Form 6-K VEON Ltd. For: Feb 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of February 2019

Commission File Number 1-34694

VEON Ltd.

(formerly VimpelCom Ltd.)

(Translation of registrant’s name into English)

The Rock Building, Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1): o.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): o.

Information Contained in this Report

On February 25, 2019, the Registrant issued a press release, presentation materials, and supplemental factbook, copies of which are furnished hereto as Exhibits 99.1, 99.2, and 99.3.

EXHIBIT INDEX

Exhibit No. | Description of Exhibit |

99.1 | |

99.2 | |

99.3 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

VEON LTD. | ||

(Registrant) | ||

Date: February 25, 2019 | ||

By: | /s/ Scott Dresser | |

Name: | Scott Dresser | |

Title: | Group General Counsel | |

25 F E B R U A R Y 2 0 1 9 V E O N R E P O R T S G O O D F U L L Y E A R 2 0 1 8 R E S U L T S F Y 2 0 1 8 F I N A N C I A L T A R G E T S A C H I E V E D F I N A L D I V I D E N D O F US 17 C E N T S D E C L A R E D

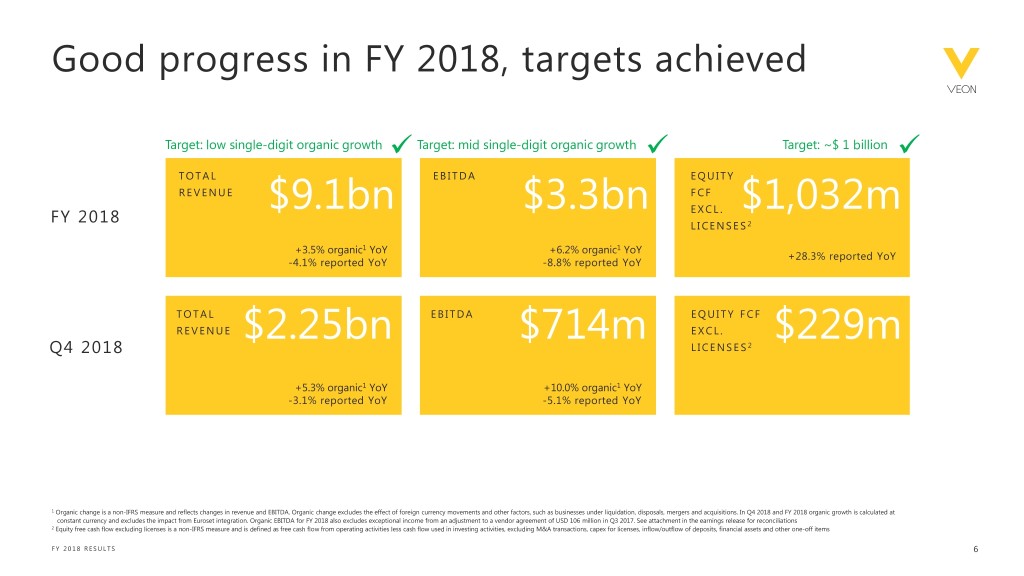

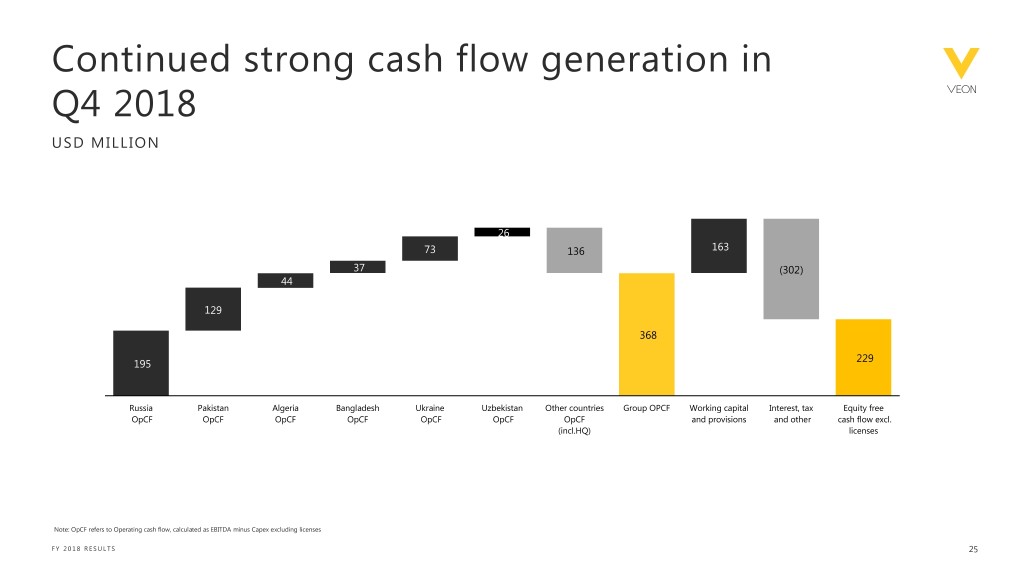

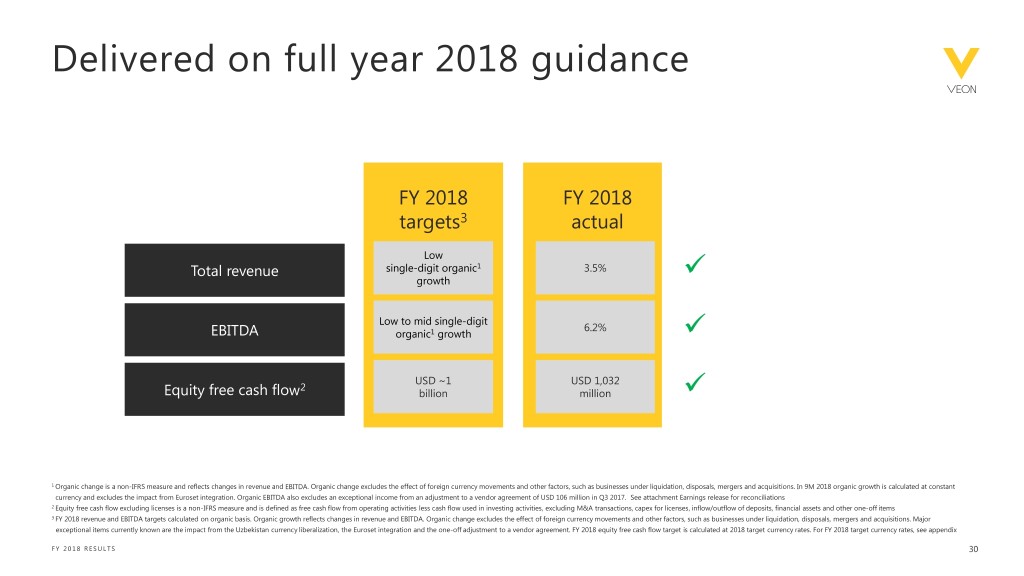

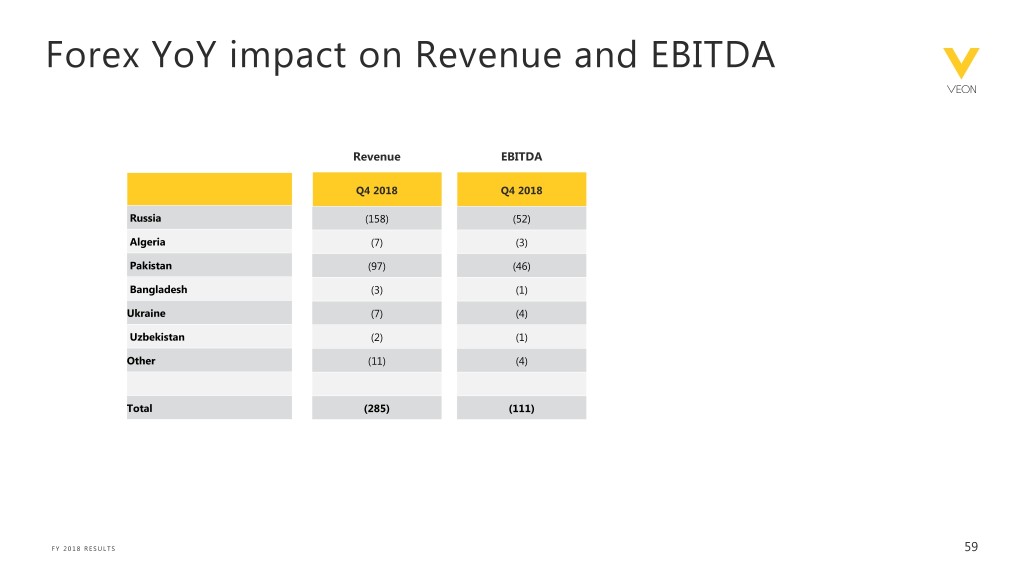

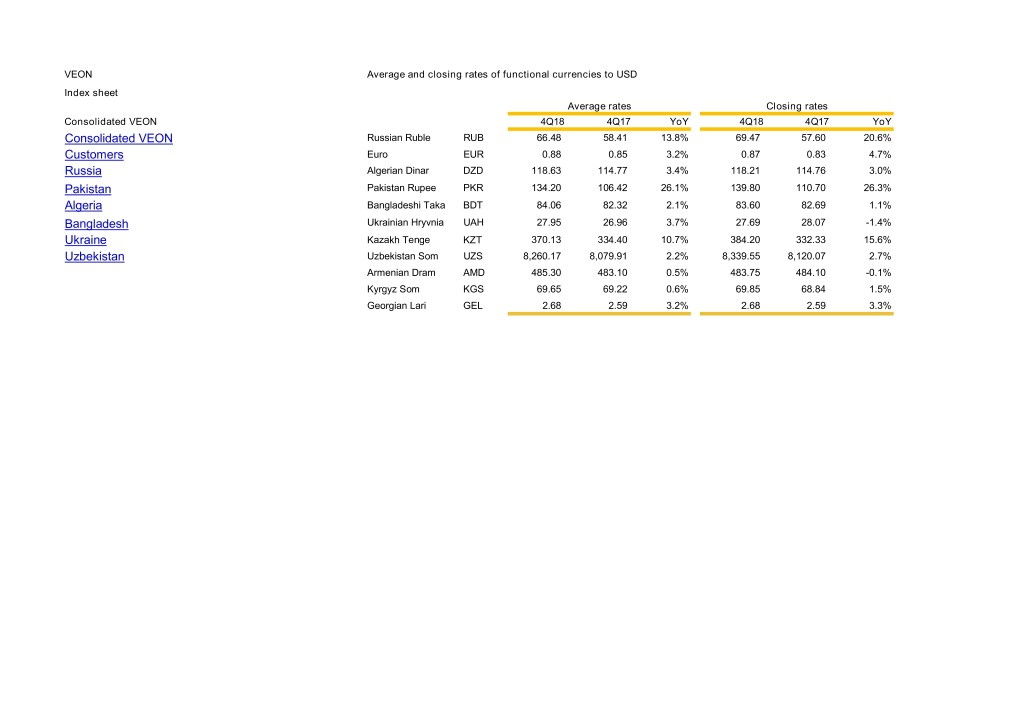

Amsterdam (25 February 2019) – VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a leading global provider of connectivity and internet services, today announces financial and operating results for the quarter and year ended 31 December 2018. KEY Q4 2018 RESULTS 1 • Solid organic2 revenue growth in Q4 2018: total revenue increased organically by 5.3% year on year to USD 2,249 million, led by strength in Russia, Pakistan and Ukraine • Strong data revenue growth across VEON’s emerging markets: data revenue continued to grow strongly, rising by 30.2% organically year on year in the quarter, with Ukraine (84.5%), Pakistan (86.7%) and Algeria (67.1%) delivering large increases year on year following investment in 4G/LTE networks • Double-digit organic2 growth in EBITDA of 10.0% during the quarter, helped by good operational performance in Pakistan and Ukraine • Currency movements negatively impacted total revenue and EBITDA: total revenue decreased by 3.1% to USD 2,249 million, due to currency headwinds of USD 285 million. EBITDA decreased by 5.1% to USD 714 million, impacted by currency headwinds of USD 111 million • EBITDA margin of 31.8% was down 0.7 percentage points year on year in Q4 2018, owing mainly to the change in revenue mix in Russia towards increased sales of equipment and accessories as a consequence of the move to monobrand stores (an impact of 1.3 percentage points) • Corporate costs were USD 135 million in Q4 2018, including USD 52 million of severance costs, down 34% year on year excluding severance. FY 2018 corporate costs were USD 359 million, delivering on the target to reduce corporate costs by approximately 20% from USD 431 million in FY 2017 • Strong equity free cash flow excluding licenses3 generated during the quarter, which at USD 229 million in Q4 and USD 1,032 million in FY 2018 are in line with the Group’s target of around USD 1 billion for FY 2018 KEY DEVELOPMENTS • FY 2018 targets achieved: VEON met or exceeded FY 2018 guidance on all key metrics: • Revenue for FY 2018 increased 3.5% organically, delivering on the target of low single-digit organic growth • EBITDA increased organically by 6.2%, exceeding the target of low to mid single-digit organic growth • Equity free cash flow excluding licenses increased 28.3% year on year to USD 1,032 million, from USD 804 million in FY 2017, exceeding the FY 2018 target of around USD 1 billion • Final dividend of US 17 cents declared, bringing total FY 2018 dividend to US 29 cents per share, up from US 28 cents in FY 2017, in line with the Group’s progressive dividend policy • In Q4 2018, VEON used approximately USD 1.3 billion in proceeds from the sale of its Italy joint venture to reduce gross debt • VEON submitted a mandatory tender offer in relation to Global Telecom Holding (“GTH”) • Ursula Burns appointed as Chairman and Chief Executive Officer; Alex Kazbegi appointed as Chief Strategy Officer • VEON announced that it expects a one-time payment of USD 350 million in H1 2019 in connection with a revised vendor agreement OUTLOOK • VEON has established financial targets for FY 20194: Guidance for total revenue is low single-digit organic growth and for EBITDA is low to mid single-digit organic2 growth • The target for equity free cash flow excluding licenses is approximately at the same level as FY 2018 (around USD 1 billion), based on currency rates as at 20 February 2019. This assumes increased capital expenditure, including additional Yarovaya-related expenses, and additional severance payments. These are expected to be partially offset by business improvements in 2019, while 2018 benefitted from specific non-recurring working capital effects. FY 2019 target will benefit from a one-time payment of USD 350 million in connection with a revised vendor agreement. • VEON has committed to reduce the Group’s cost intensity ratio5 by at least 1 percentage point organically per annum between 2019 and 2021, from 61.8% reported in FY 2018 • All targets exclude the impact of the introduction of IFRS 16 in FY 2019 FY 2018 2

URSULA BURNS, CHIEF EXECUTIVE OFFICER, COMMENTS: “2018 was a landmark year for VEON during which we delivered on our financial targets, strengthened our financial foundations and repositioned our business for emerging markets growth. Our leaner operating model is delivering cost and efficiency benefits whilst enabling us to maintain robust compliance and internal controls across our businesses. As the Group enters 2019, we remain committed to further simplifying our corporate structure, reducing costs and investing in best-in-class technologies and services in order to capture the exciting growth opportunities afforded by digital adoption across our emerging markets.” 1 Key results compare to prior year results unless stated otherwise 2 Organic change is a non-IFRS measure and reflects changes in revenue and EBITDA. Organic change excludes the effect of foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. In Q4 2018, organic growth is calculated at constant currency and excludes the impact from Euroset integration while for FY 2018, it also excludes the effect of a vendor agreement adjustment in Q3 2017 of USD 106 million. See Attachment E for reconciliations. 3 Equity free cash flow excluding licenses is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities, excluding M&A transactions, capex for licenses, inflow/outflow of deposits, financial assets and other one-off items. See attachment E for reconciliations 4 FY 2019 targets exclude the impact of the introduction of IFRS 16 in FY 2019 5 Cost intensity is defined as service costs plus selling, general and administrative costs, less other revenue, divided by total service revenue. Based on FY 2018, in USD million [(3,697+1,701-133)/8,526] FY 2018 3

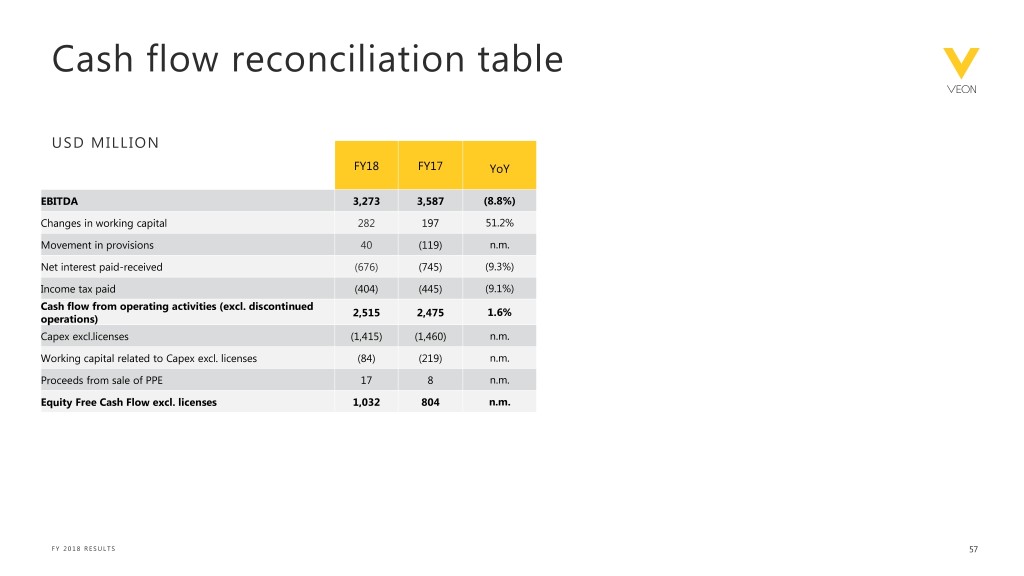

KEY RESULTS: CONSOLIDATED FINANCIAL AND OPERATING HIGHLIGHTS Organic USD million 4Q18 4Q17 Reported YoY YoY 1 Total revenue, of which 2,249 2,320 (3.1%) 5.3% mobile and fixed service revenue 2,083 2,214 (5.9%) 4.6% mobile data revenue 550 473 16.3% 30.2% EBITDA 714 753 (5.1%) 10.0% EBITDA margin (EBITDA/total revenue) 31.8% 32.4% (0.7p.p.) (Loss)/Profit from continued operations 33 (243) n.m. Profit/(Loss) from discontinued operations (0) (156) n.m. Profit for the period attributable to VEON shareholders 33 (399) n.m. Equity free cash flow excl. licenses 2 229 13 n.m. Capital expenditures excl. licenses 347 466 (25.6%) LTM capex excl. licenses/revenue 15.6% 15.4% 0.2p.p. Net debt 5,469 9,732 (43.8%) Net debt/LTM EBITDA 1.7 2.7 n.m. Total mobile customer (millions) 210 211 (0.3%) Total fixed-line broadband customers (millions) 3.8 3.4 10.8% Organic USD million FY18 FY17 Reported YoY YoY 1 Total revenue, of which 9,086 9,474 (4.1%) 3.5% mobile and fixed service revenue 8,526 9,105 (6.4%) 2.7% mobile data revenue 2,120 1,856 14.2% 26.6% EBITDA 3,273 3,587 (8.8%) 6.2% EBITDA margin (EBITDA/total revenue) 36.0% 37.9% (1.9p.p.) (Loss)/Profit from continued operations (617) (144) n.m. Profit/(Loss) from discontinued operations 979 (390) n.m. Profit/(Loss) for the period attributable to VEON shareholders 362 (534) n.m. Equity free cash flow excl. licenses 2 1,032 804 28.3% Capital expenditures excl. licenses 1,415 1,460 (3.1%) LTM capex excl. licenses/revenue 15.6% 15.4% 0.2p.p. Net debt 5,469 9,732 (43.8%) Net debt/LTM EBITDA 1.7 2.7 n.m. Total mobile customer (millions) 210 211 (0.3%) Total fixed-line broadband customers (millions) 3.8 3.4 10.8% 1 Organic change is a non-IFRS measure and reflects changes in revenue and EBITDA. Organic change excludes the effect of foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. In Q4 2018, organic growth is calculated at constant currency and excludes the impact from Euroset integration while for FY 2018 it also excludes the effect of a vendor agreement adjustment in Q3 2017 of USD 106 million. See Attachment E for reconciliations 2 Equity free cash flow excluding licenses is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities, excluding M&A transactions, capex for licenses, inflow/outflow of deposits, financial assets and other one-off items. See attachment E for reconciliations FY 2018 4

CONTENTS MAIN EVENTS .............................................................................................. 6 GROUP PERFORMANCE .................................................................................. 8 COUNTRY PERFORMANCE .............................................................................. 1 3 CONFERENCE CALL INFORMATION .................................................................... 2 0 ATTACHMENTS ........................................................................................... 2 3 PRESENTATION OF FINANCIAL RESULTS VEON’s results presented in this earnings release are based on IFRS and have not been audited. Certain amounts and percentages that appear in this earnings release have been subject to rounding adjustments. As a result, certain numerical figures shown as totals, including those in tables, may not be an exact arithmetic aggregation of the figures that precede or follow them. All non-IFRS measures disclosed in the document, i.e. EBITDA, EBITDA margin, EBIT, net debt, equity free cash flow excluding licenses, organic growth, capital expenditures excluding licenses, last twelve months (LTM) Capex excluding licenses/revenue, are reconciled to the comparable IFRS measures in Attachment E. Following classification of the Italy Joint Venture as a disposal group held for sale on 30 June 2018, the Company ceased equity method of accounting for the investment in the Italy Joint Venture. The sale of VEON´s stake in Wind Tre was completed in September 2018. As a result of the termination of the agreement to sell its Pakistan tower business, the Company amended prior periods presented in the interim consolidated financial statements to retrospectively recognize the depreciation charge of USD 37 million that would have been recognized, had the disposal group not been classified as held for sale. All forward looking targets exclude the impact of the introduction of IFRS 16 in FY 2019. All comparisons are on a year on year basis unless otherwise stated. FY 2018 5

MAIN EVENTS FY 2018 FINANCIAL TARGETS ACHIEVED VEON achieved its financial targets in FY 2018. Total revenue increased 3.5% organically in FY 2018, fulfilling the target of low single-digit organic growth, as a result of strong performances in Russia, Pakistan, Ukraine and Uzbekistan. EBITDA increased organically by 6.2% for the year, exceeding the target of low to mid-single digit organic growth, driven by good operational performances in Russia, Pakistan and Ukraine and by a 17% year on year reduction in corporate costs. FY 2018 equity free cash flow excluding licenses increased 28.3% year on year to USD 1,032 million from USD 804 million in FY 2017, reaching the FY 2018 target of around USD 1 billion. BOARD OF DIRECTORS APPROVED A FINAL 2018 DIVIDEND OF US 17 CENTS PER SHARE VEON’s Board of Directors approved a final dividend of US 17 cents per share, bringing total 2018 dividends to US 29 cents per share, in line with the Group’s progressive dividend policy. The record date for the Company’s shareholders entitled to receive the final dividend payment has been set for 8 March 2019. It is expected that the final dividend will be paid on 20 March 2019. The Company will make appropriate tax withholdings of up to 15% when the dividend is paid to the Company’s share depositary, The Bank of New York Mellon. For ordinary shareholders via Euronext Amsterdam, the final dividend of US 17 cents will be paid in euros. VEON is committed to paying a sustainable and progressive dividend. A continuation of this progressive dividend policy is dependent on the evolution of the Group’s equity free cash flow, including development of the US dollar exchange rate against VEON’s functional currencies. URSULA BURNS APPOINTED AS CHAIRMAN AND CHIEF EXECUTIVE OFFICER Ursula Burns was appointed as Chairman and CEO of VEON on 13 December 2018. Ms. Burns has served as Chairman of the VEON Board of Directors since July 2017 and as Executive Chairman since March 2018, during which time she has successfully introduced a simplified corporate structure, including a leaner operating model along with an increased focus on emerging markets. MANAGEMENT CHANGES VEON appointed Alex Kazbegi as Chief Strategy Officer, effective from 18 February 2019. Alex will join VEON’s Group Executive Committee and report to the Chairman and CEO, Ursula Burns. VEON announced the promotion of Evgeniy Nastradin to CEO of Beeline Kazakhstan, effective from 1 February 2019, following the appointment of his predecessor Aleksandr Komarov as CEO of Kyivstar, VEON’s brand in Ukraine, on 6 December 2018. Sergey Afonin was promoted to CEO of Beeline Uzbekistan, effective from 1 March 2019. REVISED TECHNOLOGY INFRASTRUCTURE PARTNERSHIP WITH ERICSSON VEON announced a revised arrangement with Ericsson to upgrade its core IT systems in several countries in the coming years and to release Ericsson from the development and delivery of the Full Stack Revenue Manager Solution. The parties have signed binding terms to vary the existing agreements and as a result VEON will receive USD 350 million during the first half of 2019. This revised arrangement enables VEON to continue upgrading its IT infrastructure with new digital business support systems (DBSS) using existing software from Ericsson which is already deployed in certain operating companies within VEON. This upgrade is expected to support the creation of a more personalized, richer experience of VEON’s services for customers and, over time, reduce overall operating costs. FY 2018 REPORTED REVENUE AND EBITDA NEGATIVELY IMPACTED BY CURRENCY WEAKNESS AND EUROSET INTEGRATION FY 2018 total revenue decreased by 4.1% year on year, or USD 388 million, due to currency weakness of USD 928 million, which diluted organic growth of 3.5% and the positive revenue impact from Euroset of 2.3%. FY 2018 EBITDA declined by 8.8%, or USD 314 million, primarily as a result of currency headwinds (USD 386 million), the financial impact of Euroset integration (USD 35 million) and the base effect of an adjustment to a vendor agreement (USD 106 million) in Q3 2017. VEON SUBMITTED MANDATORY TENDER OFFER IN RELATION TO GLOBAL TELECOM HOLDING (“GTH”) On 10 February 2019, VEON submitted a public mandatory cash tender offer (“MTO”) with the Egyptian Financial Regulatory Authority for the purchase of up to 1,997,639,608 shares, representing 42.31% of GTH’s issued shares, at a FY 2018 6

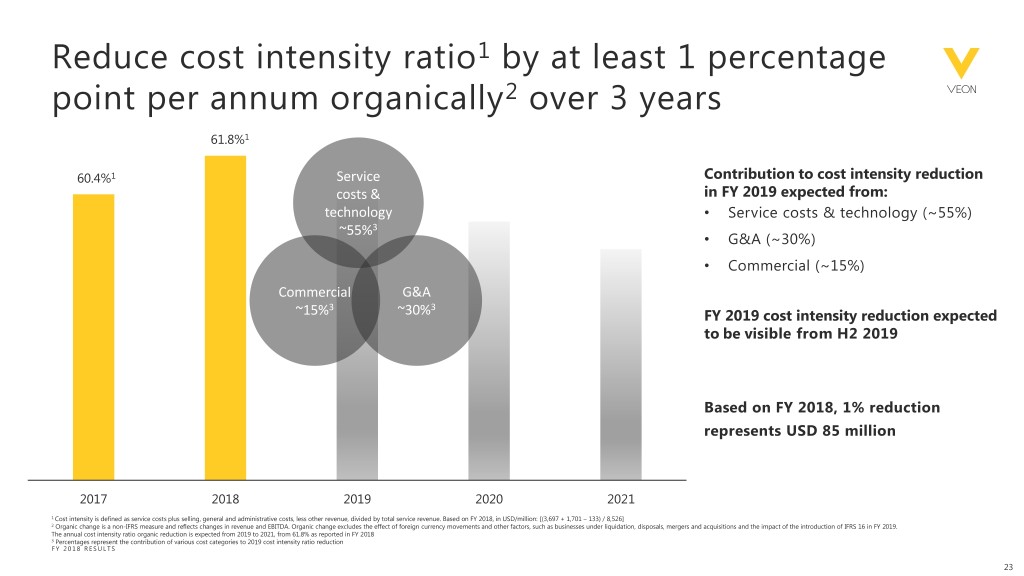

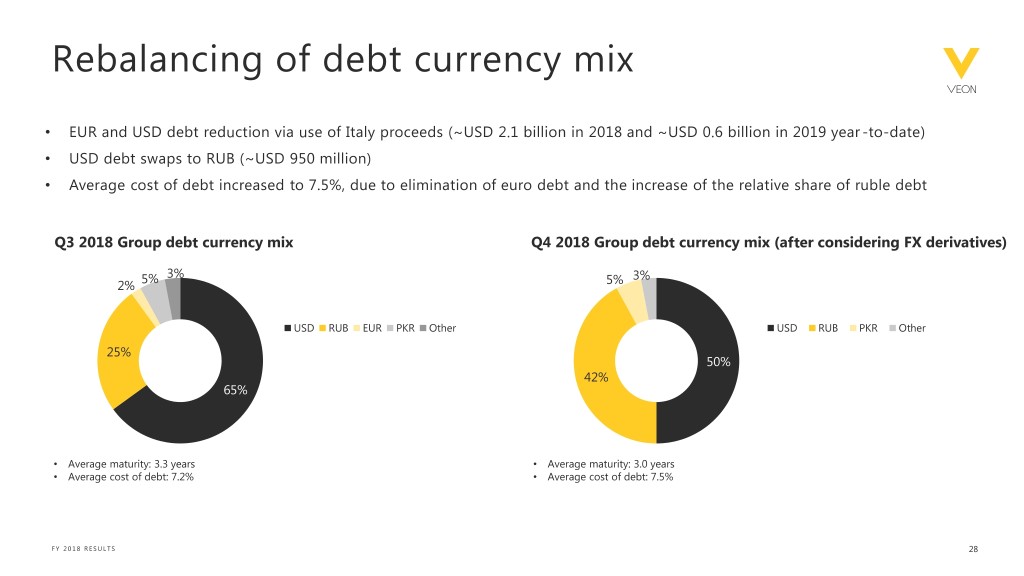

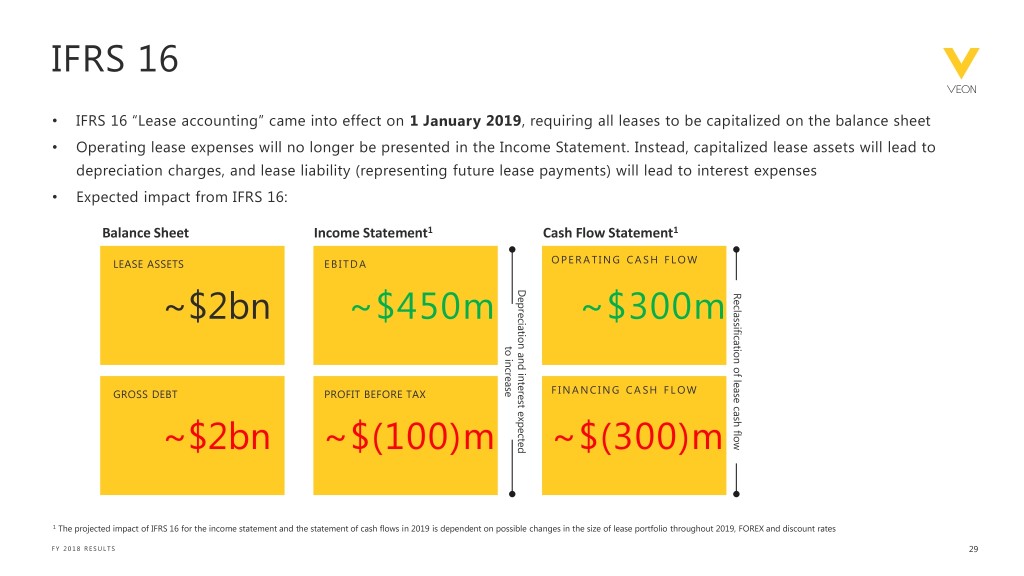

price of EGP 5.30 per share. The proposed offer price represents a 45.8% premium over GTH’s average three months share price and 50.5% premium over GTH’s average six months share price, respectively, to February 7, 2019. As previously announced, VEON intends to take GTH private following the MTO. DEBT REPAYMENTS In Q4 2018, VEON used approximately USD 1.3 billion in proceeds from the sale of its Italy joint venture, Wind Tre, to buy back and cancel VEON Holdings and PJSC VimpelCom USD bonds (USD 1,147 million) and to pre-pay all outstanding amounts under its CCB euro loan (USD 116 million). These debt repayments and currency swaps in Q3 2018 and Q4 2018 allowed VEON to significantly improve its currency mix of debt by reducing its exposure to EUR debt to zero and increasing its RUB debt exposure. IFRS 16 IMPACT IFRS 16 replaces the IAS 17 Leases and became effective on 1 January 2019. The new lease standard requires assets leased by the Company to be recognized on the statement of financial position of the Company with a corresponding lease liability. The Company estimates the opening balance of the lease asset and lease liability to amount to approximately USD 2 billion with no material impact on opening equity (i.e. an equal increase in assets and liabilities). The amount will be recorded in January 2019. The impact on income statement 2019 will depend on the development in VEON’s lease portfolio throughout 2019, foreign exchange rates, and discount rates that are used to discount future lease payments. As a rule, lease expenses will no longer be recorded in the income statement from 1 January 2019. Instead, new depreciation and interest expenses will be recorded stemming from the newly recognized lease assets and lease liabilities. In addition, leasing expenses will no longer be presented as operating cash outflows in the statement of cash flows, but will be included as part of the financing cash outflow. Interest expenses from the newly recognized lease liability will be presented in the cash flow from operating activities. The expected impact on the Group’s 2019 income statement is projected to be approximately USD 450 million positive in EBITDA and approximately USD 100 million negative in profit before tax. The expected impact on the Group’s 2019 statement of cash flows is projected to be approximately USD 300 million positive in operating cash flow and approximately USD 300 million negative in financing cash flow. The impacts on income statement and cash flow assume no changes to leasing portfolio and no changes to foreign exchange and discount rates. FY 2019 TARGETS The Company has formulated targets for FY 2019. Guidance for total revenue is low single-digit organic growth and EBITDA is low to mid-single digit organic1 growth. Organic growth reflects changes in revenue and EBITDA, excluding foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions and other exceptional items. The target for equity free cash flow excluding licenses is approximately at the same level as FY 2018 (around USD 1 billion), based on currency rates as at 20 February 2019. This assumes increased capital expenditure, including additional Yarovaya-related expenses, and additional severance payments. These are expected to be partially offset by business improvements in 2019, while 2018 benefitted from specific non-recurring working capital effects. FY 2019 target will benefit from a one-time payment of USD 350 million in connection with a revised vendor agreement. Equity free cash flow run-rate is expected to be broadly stable at approximately USD 800 million going forward, underpinned by ongoing initiatives to improve our cost intensity across the Group. This assumes, among other factors, stable currencies. Equity free cash flow excluding licenses is defined as free cash flow from operating activities less cash flow for net capex, excluding capex for licenses. FY 2019 equity free cash flow excluding licenses target is calculated at 2019 guidance currency rates and excludes the impact of the introduction of IFRS 16 in FY 2019. For the FY 2019 guidance currency rates, see attachment E. COST INTENSITY VEON has committed to reduce the Group’s cost intensity ratio by at least 1 percentage point organically1 per annum between 2019 and 2021, from 61.8% as reported in FY 2018. Efficiency initiatives will be focused on service costs and technology, commercial, general and administrative expenses. We anticipate the cost intensity ratio improvement to be visible starting from the second half of 2019. The main contributor for 2019 is expected to be further reduction in our corporate costs. Cost intensity is defined as service costs plus selling, general and administrative costs less other revenue divided by total service revenue. Based on FY 2018, 1% cost intensity reduction represents around USD 85 million. 1 Organic change is a non-IFRS measure and reflects changes in revenue and EBITDA. Organic change excludes the effect of foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions and the impact of the introduction of IFRS 16 in FY 2019 FY 2018 7

GROUP PERFORMANCE FINANCIALS BY COUNTRY Reported Organic1 Reported Organic1 USD million 4Q18 4Q17 FY18 FY17 YoY YoY YoY YoY Total revenue 2,249 2,320 (3.1%) 5.3% 9,086 9,474 (4.1%) 3.5% Russia 1,142 1,206 (5.3%) 1.2% 4,654 4,729 (1.6%) 2.3% Pakistan 368 379 (2.9%) 22.7% 1,494 1,525 (2.0%) 13.1% Algeria 204 214 (4.9%) (1.7%) 813 915 (11.2%) (6.6%) Bangladesh 130 131 (0.8%) 1.3% 521 574 (9.2%) (6.1%) Ukraine 179 159 12.4% 16.6% 688 622 10.6% 13.2% Uzbekistan 77 77 (1.0%) 1.2% 315 513 (38.7%) 8.4% HQ - - - - - - - - Other and eliminations 149 154 (2.3%) (38.6%) 601 596 1.1% (21.9%) Service revenue 2,083 2,214 (5.9%) 4.6% 8,526 9,105 (6.4%) 2.7% Russia 1,016 1,140 (10.9%) 0.0% 4,244 4,516 (6.0%) 0.9% Pakistan 344 350 (1.9%) 24.0% 1,391 1,418 (1.9%) 13.3% Algeria 195 210 (6.8%) (3.7%) 801 898 (10.8%) (6.2%) Bangladesh 127 127 0.5% 2.6% 504 557 (9.5%) (6.3%) Ukraine 178 158 12.5% 16.6% 685 620 10.5% 13.1% Uzbekistan 77 77 (0.8%) 1.4% 314 513 (38.7%) 8.4% HQ - - - - - - - - Other and eliminations 146 151 (3.5%) (36.4%) 586 583 0.5% (19.7%) EBITDA 714 753 (5.1%) 10.0% 3,273 3,587 (8.8%) 6.2% Russia 374 429 (12.9%) 0.1% 1,677 1,788 (6.2%) 2.8% Pakistan 173 174 (0.3%) 26.0% 714 703 1.5% 17.2% Algeria 92 92 1.4% 4.9% 363 426 (14.6%) (10.1%) Bangladesh 44 47 (5.7%) (3.7%) 183 233 (21.4%) (18.5%) Ukraine 100 93 8.2% 12.0% 387 347 11.6% 14.2% Uzbekistan 30 33 (6.8%) (4.7%) 136 261 (47.8%) (5.4%) HQ (135) (125) 8.0% (359) (325) 10.4% Other and eliminations 36 11 231.0% 170 154 10.6% EBITDA margin 31.8% 32.4% (0.7p.p.) 1.5p.p. 36.0% 37.9% (1.8p.p.) 1.0p.p. 1 Organic change is a non-IFRS measure and reflects changes in revenue and EBITDA. Organic change excludes the effect of foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. In FY 2018 and Q4 2018 organic growth is calculated at constant currency and excludes the impact from Euroset integration for the group and the effect of a vendor agreement adjustment in Q3 2017 of USD 106 million. In FY 2018 and Q4 2018 the organic change in Russia exclude the impact of Euroset and the impact of transit traffic revenue. Transit traffic revenue were partially centralized at VEON Wholesale Services. See Attachment E for reconciliations, including reconciliation for EBITDA Total revenue decreased 3.1% year on year in Q4 2018 to USD 2.2 billion, mainly driven by currency headwinds totalling USD 285 million as a consequence of currency weakness in Russia, Pakistan and Uzbekistan. Total revenue increased by 5.3% organically as a result of revenue growth in Russia, Pakistan, Bangladesh, Ukraine and Uzbekistan, offset by continued pressure on revenue in Algeria. The total revenue trend was supported by good organic growth in mobile data revenue, which increased 30.2% for the quarter. Reported mobile data revenue was impacted by currency headwinds of approximately USD 66 million and increased by 16.2%. Mobile customers were stable year on year at 210 million at the end of Q4 2018, as customer growth in Pakistan, Algeria and Bangladesh was offset by a decrease in the customer bases of Russia and Uzbekistan. Total revenue for FY 2018 decreased 4.1% to USD 9.1 billion, mainly driven by currency headwinds totalling USD 928 million in Russia, Pakistan and Uzbekistan. Total revenue increased 3.5% organically, delivering on the FY 2018 target of low single-digit organic growth, as a result of strong performances in Russia, Pakistan, Ukraine and Uzbekistan, partially offset by decreased performance in Algeria and Bangladesh. Mobile data revenue for the year showed strong organic growth of 26.6%, while on a reported basis, it increased by 14.2% reflecting the impact of adverse currency movements totalling USD 230 million. FY 2018 8

EBITDA decreased 5.1% to USD 714 million in Q4 2018, primarily due to currency headwinds amounting to USD 111 million in Russia, Pakistan and Uzbekistan, and the financial impact of Euroset integration totalling USD 3 million. EBITDA increased organically by 10.0% in Q4 2018, driven by good operational performances in Russia, Pakistan and Ukraine. EBITDA for FY 2018 decreased by 8.8% to USD 3,273 million, primarily due to currency headwinds amounting to USD 386 million. EBITDA increased organically by 6.2% for the year, exceeding the FY 2018 target of low to mid-single digit organic growth, driven by good operational performances in Russia, Pakistan and Ukraine, as well as a reduction of 17% year on year in corporate costs, partially offset by EBITDA pressure in Algeria, Bangladesh and Uzbekistan. FY 2018 equity free cash flow excluding licenses increased 28.3% year on year to USD 1,032 million, exceeding the FY 2018 target of around USD 1 billion. In the discussion of each country’s individual performances during Q4 2018 below, all trends are expressed in local currency. In Russia, total revenue in Q4 2018 increased by 7.8%, driven by an increase in mobile service revenue and strong growth in sales of equipment and accessories of 138%, which was attributable to the additional monobrand stores following the Euroset integration and rebranding, which began in Q1 2018. Mobile service revenue improved compared to Q3 2018, increasing by 3.1%, driven by growth in VAS and mobile data revenue of 4.0% year on year. Fixed-line service revenue declined 8.5% due to a decrease of approximately RUB 0.8 billion in transit traffic service revenue which was centralized at VEON Wholesale Services, excluding which fixed-line revenue would have decreased by 0.3%. The stabilization in fixed-line revenue was driven by continued positive dynamics in both B2C and B2B segments. EBITDA decreased by 0.9% in Q4 2018. The decrease in EBITDA was mainly driven by the increase in annual spectrum fees of RUB 0.9 billion and the impact of the Euroset integration costs of approximately RUB 0.4 billion. In Q3 2018, a 30% increase in annual spectrum fees was introduced retrospectively for FY2018, leading to an increase of 87% year on year during the quarter. The annual spectrum fees were reduced to previous levels from January 2019. The EBITDA margin decreased by 2.9 percentage points to 32.8% and was further impacted by the change in revenue mix as a result of the strong growth in sales of equipment and accessories which are characterized by lower margins. The impact of the change in revenue mix on EBITDA margin in Q4 2018 was approximately 2.1 percentage points. The Euroset integration is an important milestone in executing on Beeline´s monobrand strategy. Now that the rebranding and integration of the Euroset stores is complete, Beeline expects a positive effect on revenue going forward while EBITDA is expected to be positively impacted from 2019 onwards, driven by acceleration in device sales and distribution channel mix improvement. In Pakistan, total revenue growth (+22.7% year on year) accelerated sequentially. 9.9 percentage points of this growth came from business performance and 12.8 percentage points were driven by higher usage by customers, mainly due to suspension of taxes collected from customers by mobile operators, which continued in Q4 2018 and provided the whole market with additional revenue growth. Mobile data revenue growth accelerated sequentially to 86.7% year on year, helped by an increase in data customers and data usage through higher bundle penetration and continued data network expansion. Total customer base increased by 4.8% year on year and was broadly flat quarter on quarter, driven by data network expansion and growth in data subscribers (+15.9% year on year). EBITDA posted a healthy growth of 26.0% and EBITDA margin was 47.0%; an increase of 1.2 percentage points year on year. Excluding tax-related factors for both Q4 2017 and 2018, EBITDA growth would have been 19.8% and EBITDA margin would have increased by 3.9 percentage points year on year. In Algeria, operating trends stabilized further during Q4 2018, with the customer base growing quarter on quarter. Total revenue decreased by 1.7% year on year, a slower pace of decline compared to Q3 2018, as a result of both operational stabilization with sequential customer growth and favourable adjustments mostly related to the reversal of a liability towards a vendor of approximately DZD 0.7 billion. Excluding the favourable adjustments, revenue would have decreased by 4.5% year on year, a lower rate of decline compared to 6.7% in Q3 2018. Price competition in both voice and data caused a continued reduction in ARPU, which declined by 7.4% year on year. Djezzy’s Q4 2018 service revenue reported a 3.7% year on year decline, while data revenue growth was 67.1%, due to higher usage and a substantial increase in data customers as a result of the 3G and 4G/LTE network roll-out acceleration. The net customer additions trend, which was still positive during Q4 2018, led to customer growth of 1.3% quarter on quarter and 5.7% year on year. The quarter on quarter growth was driven by continued positive uptake of new offers launched earlier in FY 2018 9

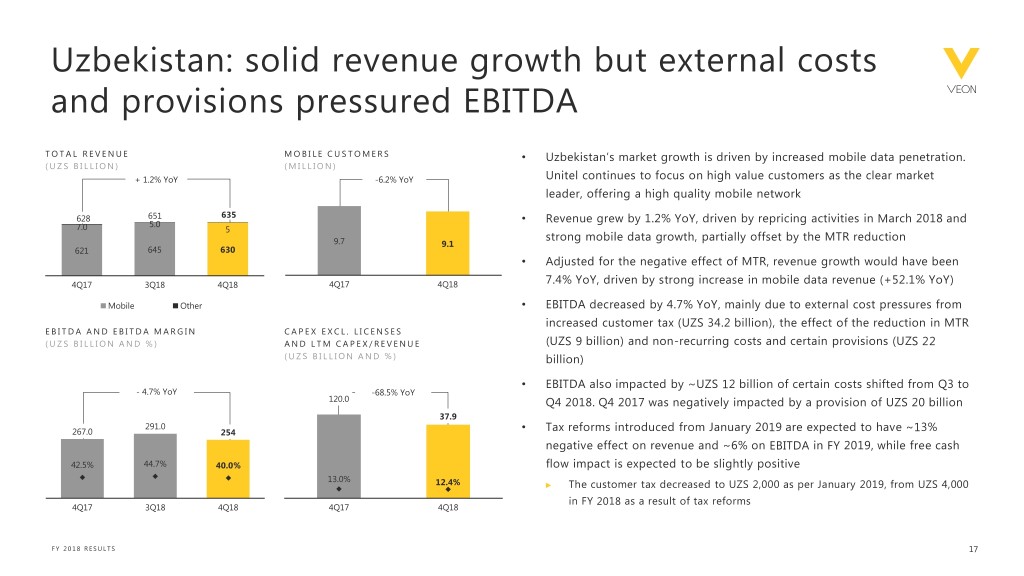

the year. EBITDA increased by 4.9% year on year. The decline in revenues, coupled with increased taxation, an increase of technology costs and additional channel incentives were more than offset by the favourable revenue adjustments and the release of certain provisions totalling DZD 1.3 billion in Q4 2018. Excluding the revenue adjustments and the release of certain provisions, EBITDA would have decreased by 7.7% year on year and the EBITDA margin would have been at 41.4%. In Bangladesh, total revenue grew by 1.3% year on year in Q4 2018, driven by service revenues which increased by 2.6% year on year. This increase represents a stabilization of the revenue trend after two years of quarterly year on year decline and was achieved despite Banglalink’s 3G network coverage gap compared to competitors. Service revenue was broadly flat quarter on quarter in Q4 2018; an improvement compared to last year, when Q4 was lower than Q3. The revenue increase was mainly driven by an acceleration of data revenue growth resulting from network improvement during the quarter following spectrum acquisition in Q1 2018 and enhanced network availability, along with the continued expansion of Banglalink’s distribution footprint. The customer base grew by 3.1% year on year and was stable quarter on quarter, supported by improved distribution and network availability, notwithstanding the intense pricing pressure in the market. Banglalink’s EBITDA in Q4 2018 decreased by 3.7%, mainly as a result of an increase of structural opex due to 4G/LTE network expansion, more than offsetting the positive revenue impact. EBITDA margin was 34.3% against 36.1% in Q4 2017 as a consequence. In Ukraine, Kyivstar continued its strong performance in Q4 2018, with total revenue increasing by 16.6%. Mobile service revenue grew by 17.2%, mainly driven by continued strong growth in mobile data revenue of 84.5% and the success of marketing activities. Successful repricing activities helped achieve an ARPU increase of 18.2% year on year. Kyivstar´s mobile customer base declined slightly by 0.5% to 26.4 million. Kyivstar continued its strong growth trajectory in data penetration with data customers growing 18.2%, leading to data usage more than doubling compared to Q4 2017, while 4G/LTE user penetration is still low at around 11% of total customers. Fixed-line service revenue grew by 9.1% year on year, driven by an increase of the fixed broadband customer base of 11.0% year on year, while fixed broadband ARPU increased by 1.1% year on year. EBITDA increased by 12.0% year on year, generating an EBITDA margin of 55.8%. Strong EBITDA growth was driven by revenue growth, partially offset by higher structural costs and the shift of commercial costs from Q3 2018 to Q4 2018. In Q4 2017, EBITDA was positively impacted by a release of regulatory provision of UAH 213 million, excluding which the year on year increase in EBITDA and EBITDA margin would have been 22% and 2.7 percentage points year on year respectively. In Uzbekistan, total revenue for the quarter increased by 1.2% year on year and mobile service revenue increased by 1.4%, driven by a repricing initiative which helped offset the negative impact of the reduction in mobile termination rates. Mobile data traffic more than doubled and mobile data revenue increased by 52.1% year on year, supported by the continued roll-out of high-speed data networks, increased smartphone penetration and the increased penetration of bundled offerings in Unitel´s customer base to 49% in Q4 2018. EBITDA decreased by 4.7% and the EBITDA margin was 40.0% in Q4 2018 compared to 42.5% in Q4 2017, mainly due to external factors such as the increase in customer tax (approximately UZS 34.2 billion) and the negative impact of the reduction in mobile termination rates (approximately UZS 9 billion). Furthermore, EBITDA was negatively impacted by non-recurring costs and certain provisions of UZS 22 billion in Q4 2018, while Q4 2017 was negatively impacted by a provision of UZS 20 billion. Quarter on quarter, approximately UZS 12 billion of certain costs were shifted from Q3 to Q4 2018. VEON’s HQ segment consists largely of the costs of VEON’s headquarters in Amsterdam and London. Corporate costs were USD 135 million in Q4 2018, including USD 52 million of severance costs, down 34% year on year excluding severance. FY 2018 corporate costs were USD 359 million, a decrease of 17% (USD 72 million) year on year after the positive income of USD 106 million related to an adjustment to a vendor agreement in Q3 2017, delivering on the target to reduce corporate costs by approximately 20% from USD 431 million in FY 2017. VEON targets a further reduction of 25% in corporate costs in FY 2019 from FY 2018 and maintains the mid-term ambition to halve the run-rate of corporate costs between FY 2017 (USD 431 million) and year-end 2019. “Other” in Q4 2018 includes the results of Kazakhstan, Kyrgyzstan, Armenia, Georgia, other global operations and services and intercompany eliminations. FY 2018 10

INCOME STATEMENT & CAPITAL EXPENDITURES Reported Reported USD million 4Q18 4Q17 FY18 FY17 YoY YoY Total revenue 2,249 2,320 (3.1%) 9,086 9,474 (4.1%) Service revenue 2,083 2,214 (5.9%) 8,526 9,105 (6.4%) EBITDA 714 753 (5.1%) 3,273 3,587 (8.8%) EBITDA margin 31.8% 32.4% (0.7p.p.) 36.0% 37.9% (1.8p.p.) Depreciation, amortization, impairments and other (506) (564) 10.2% (2,719) (2,120) (28.3%) EBIT (Operating Profit) 208 189 10.2% 554 1,467 (62.3%) Financial income and expenses (159) (237) 33.0% (749) (840) 10.9% Net foreign exchange (loss)/gain and others 8 (102) n.m. (53) (299) n.m. Share of (loss)/profit of joint ventures and associates 0 0 0.0% 0 (22) n.m. Impairment of JV and associates - - 0.0% - (110) n.m. (Loss)/Profit before tax 57 (150) n.m. (248) 328 n.m. Income tax expense (24) (93) (73.8%) (369) (472) (21.8%) (Loss)/Profit from continued operations 33 (243) n.m. (617) (144) n.m. (Loss)/Profit from discontinued operations (0) (156) n.m. 979 (390) n.m. (Loss)/Profit for the period attributable to VEON shareholders 33 (399) n.m. 362 (534) n.m. Reported Reported 4Q18 4Q17 FY18 FY17 YoY YoY Capex 369 473 (22.0%) 1,934 1,789 8.1% Capex excl. licenses 347 466 (25.6%) 1,415 1,460 (3.1%) Capex excl. licenses/revenue 15.4% 20.1% (4.7p.p.) 15.6% 15.4% 0.2p.p. LTM capex excl. licenses/revenue 15.6% 15.4% 0.2p.p. 15.6% 15.4% 0.2p.p. Note: Prior year comparatives are restated following the classification of Italy Joint Venture as a discontinued operation and retrospective recognition of depreciation and amortization charges in respect of Deodar Q4 2018 ANALYSIS EBITDA decreased year on year by USD 39 million to USD 714 million, mainly due to currency headwinds (USD 111 million) in Russia, Pakistan and Uzbekistan and the impact of the Euroset integration (USD 3 million). Operating profit for the quarter increased by USD 20 million to USD 208 million, mainly due to lower depreciation in Russia and Pakistan as a result of currency weakness year on year. Profit before tax was USD 57 million in Q4 2018, compared to a loss before tax of USD 150 million in Q4 2017. The year on year decrease in finance income and expenses was mostly driven by lower debt levels during the quarter as a result of use of proceeds of the sale of 50% of Italy JV. Net foreign exchange gain and other increased year on year to USD 8 million from a loss of USD 102 million, as Q4 2017 was negatively impacted by the FX loss related to the depreciation of the Uzbek som, while Q4 2018 was further supported by a higher FX gain related to the Warid non-controlling interest put option liability. In addition, net foreign exchange gain and other was impacted by the payment of early redemption fees related to the bond tender. Income tax expenses decreased to USD 24 million in Q4 2018 from USD 93 million, driven by the reversal of tax provision on future dividends in Pakistan and lower profit in Russia, partially offset by a higher withholding tax provision on future dividends in other countries. In Q4 2018, the company recorded a net profit for the period attributable to VEON´s shareholders of USD 33 million, driven by lower financial costs and tax expenses. Capex excluding licenses decreased to USD 347 million in Q4 2018, due to a more equal quarterly distribution of expenditures compared to last year. The full year 2018 ratio of capex excluding licenses to revenue was 15.6%, broadly stable year on year. FY 2018 11

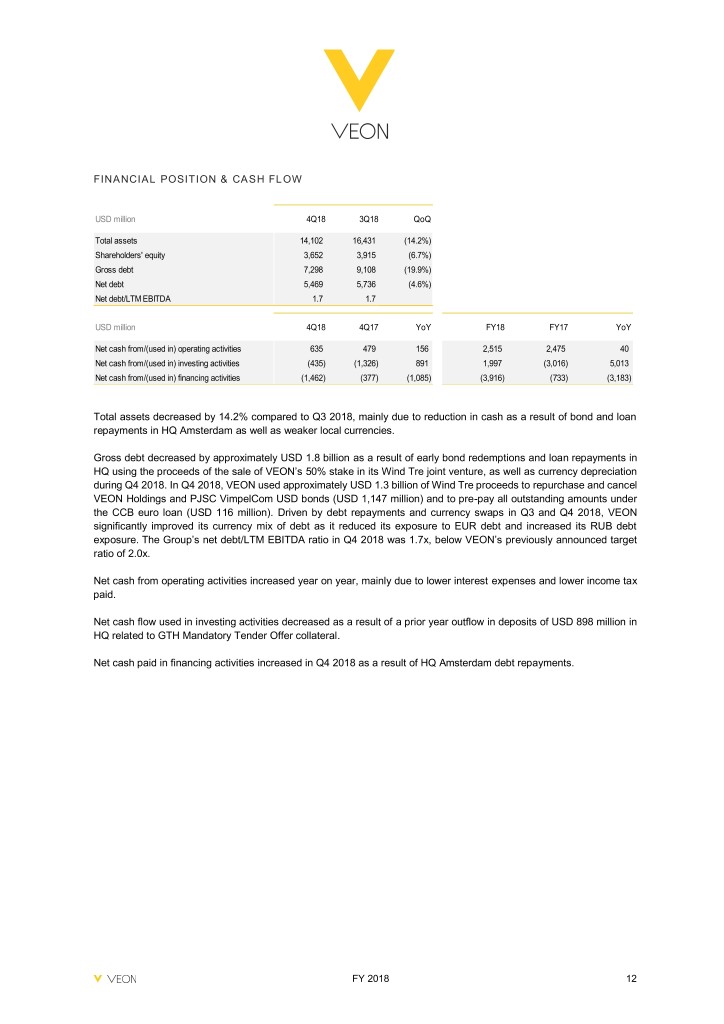

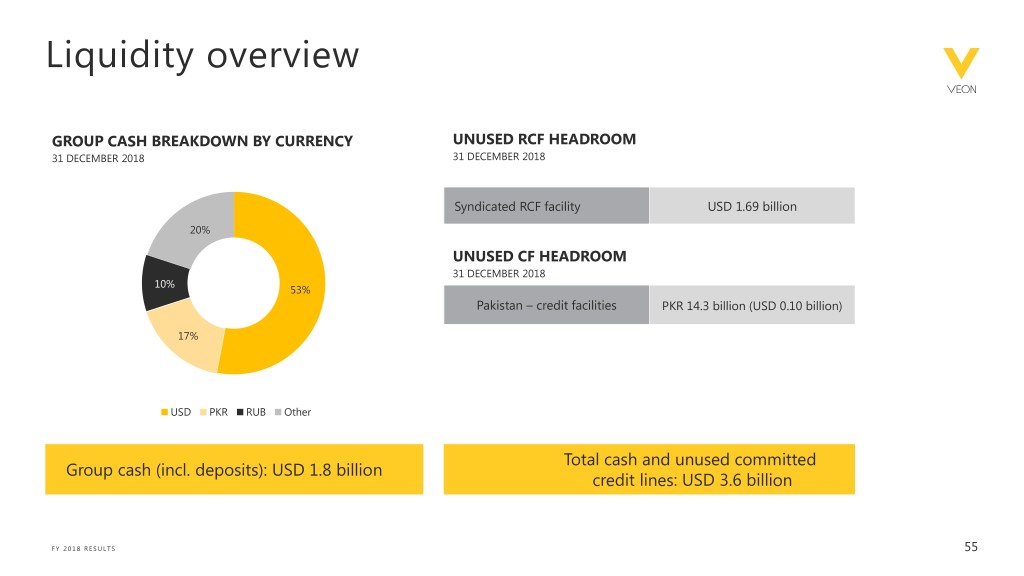

FINANCIAL POSITION & CASH FLOW USD million 4Q18 3Q18 QoQ Total assets 14,102 16,431 (14.2%) Shareholders' equity 3,652 3,915 (6.7%) Gross debt 7,298 9,108 (19.9%) Net debt 5,469 5,736 (4.6%) Net debt/LTM EBITDA 1.7 1.7 USD million 4Q18 4Q17 YoY FY18 FY17 YoY Net cash from/(used in) operating activities 635 479 156 2,515 2,475 40 Net cash from/(used in) investing activities (435) (1,326) 891 1,997 (3,016) 5,013 Net cash from/(used in) financing activities (1,462) (377) (1,085) (3,916) (733) (3,183) Total assets decreased by 14.2% compared to Q3 2018, mainly due to reduction in cash as a result of bond and loan repayments in HQ Amsterdam as well as weaker local currencies. Gross debt decreased by approximately USD 1.8 billion as a result of early bond redemptions and loan repayments in HQ using the proceeds of the sale of VEON’s 50% stake in its Wind Tre joint venture, as well as currency depreciation during Q4 2018. In Q4 2018, VEON used approximately USD 1.3 billion of Wind Tre proceeds to repurchase and cancel VEON Holdings and PJSC VimpelCom USD bonds (USD 1,147 million) and to pre-pay all outstanding amounts under the CCB euro loan (USD 116 million). Driven by debt repayments and currency swaps in Q3 and Q4 2018, VEON significantly improved its currency mix of debt as it reduced its exposure to EUR debt and increased its RUB debt exposure. The Group’s net debt/LTM EBITDA ratio in Q4 2018 was 1.7x, below VEON’s previously announced target ratio of 2.0x. Net cash from operating activities increased year on year, mainly due to lower interest expenses and lower income tax paid. Net cash flow used in investing activities decreased as a result of a prior year outflow in deposits of USD 898 million in HQ related to GTH Mandatory Tender Offer collateral. Net cash paid in financing activities increased in Q4 2018 as a result of HQ Amsterdam debt repayments. FY 2018 12

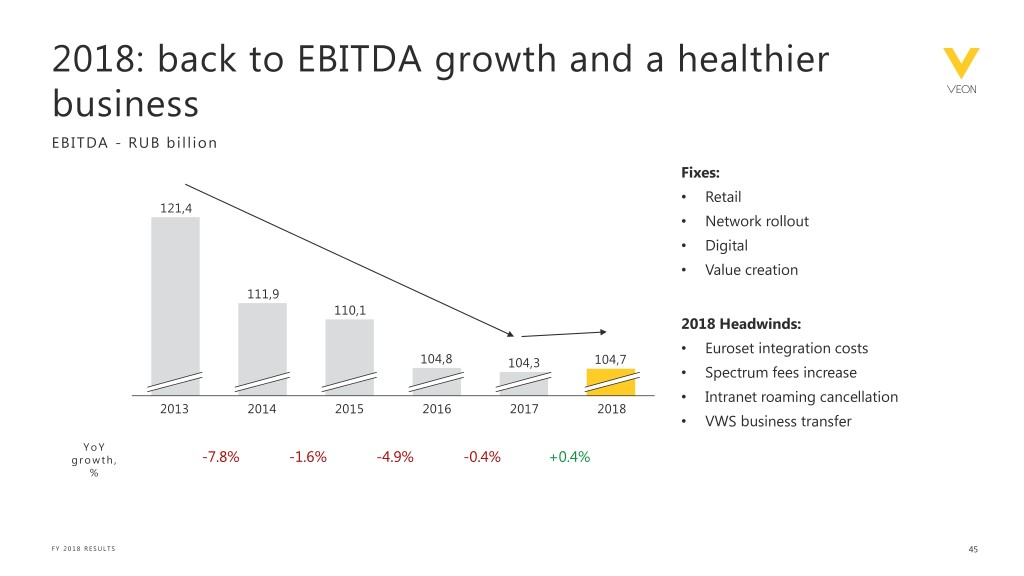

COUNTRY PERFORMANCE • Russia • Pakistan • Algeria • Bangladesh • Ukraine • Uzbekistan RUSSIA RUB million 4Q18 4Q17 YoY FY18 FY17 YoY Total revenue 75,895 70,415 7.8% 291,539 275,887 5.7% Mobile service revenue 58,761 57,001 3.1% 230,123 224,186 2.6% Fixed-line service revenue 8,790 9,608 (8.5%) 35,295 39,271 (10.1%) EBITDA 24,894 25,108 (0.9%) 104,717 104,342 0.4% EBITDA margin 32.8% 35.7% (2.9p.p.) 35.9% 37.8% (1.9p.p.) Capex excl. licenses 11,966 13,435 (10.9%) 46,604 38,918 19.8% LTM Capex excl. licenses /revenue 16.0% 14.1% 1.9p.p. 16.0% 14.1% 1.9p.p. Mobile Total revenue 67,004 60,771 10.3% 256,008 236,501 8.2% - of which mobile data 15,955 15,344 4.0% 62,259 59,041 5.4% Customers (mln) 55.3 58.2 (5.0%) 55.3 58.2 (5.0%) - of which data users (mln) 36.8 38.4 (4.2%) 36.8 38.4 (4.2%) ARPU (RUB) 350 324 8.1% 336 319 5.4% MOU (min) 317 323 (1.8%) 314 327 (3.9%) Data usage (MB/user) 4,285 3,047 40.6% 3,630 2,809 29.2% Fixed-line Total revenue 8,891 9,644 (7.8%) 35,530 39,386 (9.8%) Broadband revenue 2,699 2,508 7.6% 10,338 10,269 0.7% Broadband customers (mln) 2.4 2.2 6.4% 2.4 2.2 6.4% Broadband ARPU (RUB) 377 373 1.1% 375 389 (3.7%) In Russia, Beeline reported solid total revenue growth of 5.7% during FY 2018, mainly as a result of the successful completion of the Euroset stores integration and positive ARPU dynamics. EBITDA increased slightly during FY 2018, the first time since FY 2013, driven by the growth in revenue, which offset the negative effect on EBITDA of the integration of Euroset stores and increased annual spectrum fees during FY 2018. The cancellation of national roaming had limited impact on revenue and EBITDA, as the negative effect was offset by increased usage. EBITDA margin for FY 2018 was 35.9%. Total revenue in Q4 2018 increased by 7.8% year on year to RUB 75.9 billion, driven by an increase in mobile service revenue and strong growth in sales of equipment and accessories of 138% to RUB 8.3 billion, which were attributable to the additional monobrand stores following the Euroset integration and rebranding, which began in Q1 2018. Mobile service revenue improved compared to Q3 2018, increasing by 3.1% to RUB 58.8 billion, driven by growth in VAS and mobile data revenue of 4.0% year on year to RUB 16.0 billion. Mobile customers decreased 5.0% to 55.3 million, mainly due to a reduction in gross sales through alternative distribution channels after the integration and rebranding of Euroset stores into Beeline monobrand stores, leading to an improvement in churn of 3.8% year on year. The increased quality of the customer base as a result of change in distribution channel mix and the repricing activities during 2018 drove ARPU higher by 8.1% year on year in Q4 2018. Fixed-line revenue, adjusted for the centralization of transit services revenue in VEON Wholesale Services, stabilized in Q4 2018, driven by further improvements in the B2C and B2B segments. VEON Wholesale Services is a Group division based in Amsterdam centrally managing arrangements of VEON Group companies with international carriers and reported in revenue of the Group’s segment as “other”. The Fixed Mobile Convergence (“FMC”) proposition continues to play an important role in the turnaround of the fixed-line business for Beeline. The FMC customer base grew by 22.7% FY 2018 13

year on year in Q4 2018 to more than 1.1 million, which represents a 45% FMC customer penetration in the broadband customer base, supporting improvements in broadband customer churn. Reported fixed-line service revenue declined 8.5%, due to a decrease of approximately RUB 0.8 billion in transit traffic service revenue, excluding which fixed-line revenue would have decreased by 0.3%. EBITDA decreased by 0.9% to RUB 24.9 billion in Q4 2018, mainly driven by the increase in annual spectrum fees of RUB 0.9 billion and the impact of the Euroset integration costs of approximately RUB 0.4 billion. In Q3 2018, a 30% increase in annual spectrum fees was introduced retrospectively for FY2018, leading to an increase of 87% year on year during the quarter. The annual spectrum fees were reduced to previous levels from January 2019. The EBITDA margin decreased by 2.9 percentage points to 32.8% and was additionally impacted by the change in revenue mix as a result of the strong growth in sales of equipment and accessories, which are characterized by lower margins. The impact of the change in revenue mix on EBITDA margin in Q4 2018 was approximately 2.1 percentage points. The Euroset integration was successfully completed in August 2018 with 1,540 Euroset stores integrated and rebranded into Beeline monobrand stores. The integration impact on EBITDA, which reflects the timing difference between costs for the stores and their revenue benefits, was RUB 0.4 billion in Q4 2018 and totalled RUB 2.5 billion for FY 2018 as a whole. The Euroset integration is an important milestone in executing on Beeline´s monobrand strategy. Now that the rebranding and integration of the Euroset stores is complete, Beeline expects a positive effect on future revenue while EBITDA is expected to be positively impacted from 2019 onwards, driven by acceleration in device sales and distribution channel mix improvement. Capex excluding licenses decreased by 10.9% year on year during the quarter, mainly as a result of improved capex planning, with capex more evenly spread over the quarters. Beeline continues to invest in network development to ensure it has the best quality infrastructure that is ready to integrate new technologies. The capex (excluding licenses) to revenue ratio for FY 2018 was 16.0%. Yarovaya Law-related investment plans are progressing in alignment with legal requirements. FY 2018 14

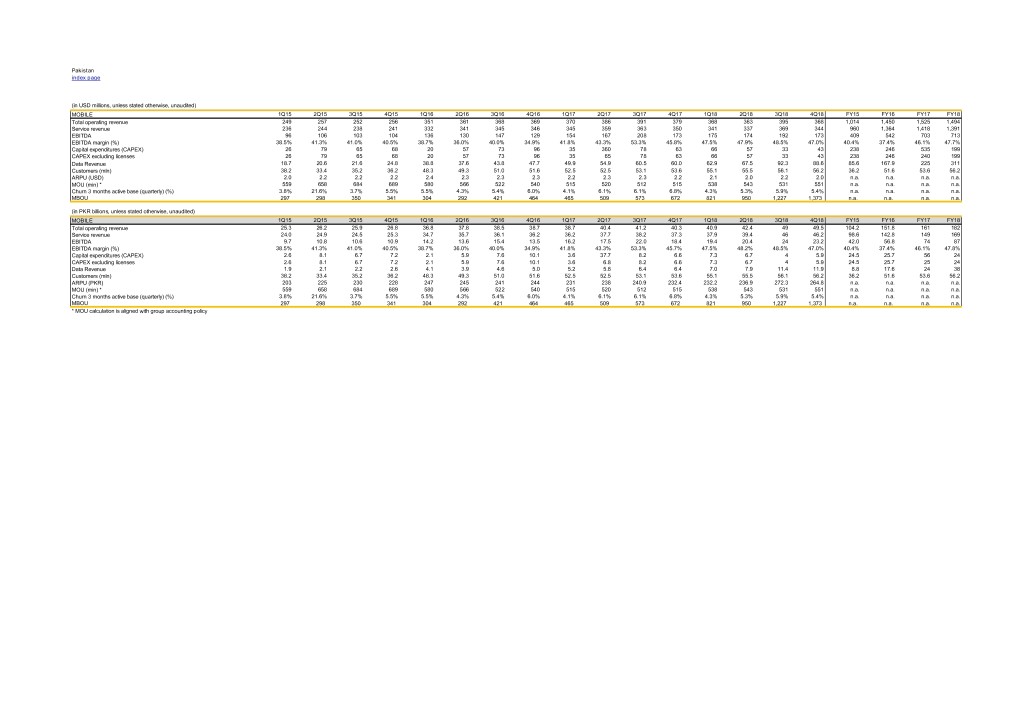

PAKISTAN PKR billion 4Q18 4Q17 YoY FY18 FY17 YoY Total revenue 49.5 40.3 22.7% 181.7 160.7 13.1% Mobile service revenue 46.2 37.3 24.0% 169.3 149.4 13.3% of which mobile data 11.9 6.4 86.7% 38.2 23.7 61.0% EBITDA 23.2 18.4 26.0% 86.8 74.1 17.2% EBITDA margin 47.0% 45.7% 1.2p.p. 47.8% 46.1% 1.7p.p. Capex excl. licenses 5.9 6.6 (11.6%) 23.9 25.3 (5.3%) LTM capex excl. licenses/revenue 13.2% 15.7% (2.6p.p.) 13.2% 15.7% (2.6p.p.) Mobile Customers (mln) 56.2 53.6 4.8% - of which data users (mln) 33.0 28.5 15.9% ARPU (PKR) 264.8 232.4 14.0% MOU (min) 551 515 6.8% Data usage (MB/user) 1373 672 104.3% The Pakistan market remained competitive in Q4 2018, particularly in data and social network offers, aimed at offering new services to drive growth. However, the overall pricing environment was generally rational and Jazz maintained its price premium positioning. Jazz continued to show growth in both revenue and customers despite these competitive market conditions. In Q4 2018, total revenue growth (+22.7% year on year) accelerated sequentially; 9.9 percentage points of this growth came from business performance and 12.8 percentage points was driven by higher usage by customers, mainly due to suspension of taxes collected from customers by mobile operators, which continued in Q4 2018 and provided the whole market with additional revenue growth. Mobile data revenue growth accelerated sequentially to 86.7% year on year, helped by an increase in data customers and data usage through higher bundle penetration and continued data network expansion. The customer base was broadly flat quarter on quarter and increased by 4.8% year on year, driven by data network expansion and growth in data subscribers which increased by 15.9% year on year. The quarter on quarter customer trend is resulting from the commercial strategy to focus on high quality customers aimed at further improving the new sale customer mix, underpinned by the best network in terms of quality of service. EBITDA posted healthy growth of 26.0% and EBITDA margin was 47.0%, an increase of 1.2 percentage points year on year. Excluding tax-related factors for both Q4 2017 and 2018, EBITDA growth would have been 19.8% and EBITDA margin would have increased by 3.9 percentage points year on year. Capex excluding licenses decreased year on year to PKR 5.9 billion in Q4 2018, due to a more balanced quarterly distribution in 2018 and lower year on year 3G and 4G/LTE roll-out activity in Q4 2018. The FY 2018 capex (excluding licenses) to revenue ratio was 13.2%. At the end of the Q4 2018, 3G was offered in more than 368 cities while 4G/LTE was offered in 167 cities (defined as cities with at least three base stations). At the end of Q4 2018, population coverage of Jazz’s 3G and 4G/LTE networks was 52% and 35% respectively. FY 2018 15

ALGERIA DZD billion 4Q18 4Q17 YoY FY18 FY17 YoY Total revenue 24.1 24.5 (1.7%) 94.8 101.5 (6.6%) Mobile service revenue 23.2 24.1 (3.7%) 93.4 99.6 (6.2%) of which mobile data 5.5 3.3 67.1% 22.0 12.6 74.6% EBITDA 11.0 10.5 4.9% 42.4 47.2 (10.1%) EBITDA margin 45.7% 42.9% 2.9p.p. 44.7% 46.5% (1.7p.p.) Capex excl. licenses 5.8 4.0 46.6% 12.6 14.6 (13.9%) LTM capex excl. licenses/revenue 13.3% 14.4% (1.1p.p.) 13.3% 14.4% (1.1p.p.) Mobile Customers (mln) 15.8 15.0 5.7% - of which mobile data customers (mln) 9.2 7.2 28.3% ARPU (DZD) 489 528 (7.4%) MOU (min) 437 430 1.7% Data usage (MB/user) 2,191 561 290.5% In Algeria, operating trends further stabilized during Q4 2018, with the customer base growing quarter on quarter. The market remains challenging with intense price competition, especially in channel related incentives, and a regulatory and macro-economic environment which remains characterized by inflationary pressures and import restrictions on certain goods. In addition, a complementary law to the Finance Law introduced on 15 July 2018 further increased the tax on recharge transfer between operators and distributors from 0.5% to 1.5%, with financial impact in both Q3 and Q4 2018. Against an overall context of economic slowdown and growing inflation, market competition on both voice and data, evident in the first nine months of 2018, further accelerated into Q4 2018, putting strong pressure on prices and ARPU. Djezzy kept its focus on both prepaid and post-paid with a segmented approach, aiming to drive up value while protecting and sequentially improving its customer base with competitive offers on data. Total revenue decreased by 1.7% year on year, a slower pace of decline compared to Q3 2018, as a result of both operational stabilization with sequential customer growth and favourable adjustments mostly related to the reversal of a liability towards a vendor of approximately DZD 0.7 billion. Excluding the favourable adjustments, revenue would have decreased by 4.5% year on year, a lower rate of decline compared to 6.7% in Q3. Price competition, in both voice and data, caused a continued reduction in ARPU, which declined by 7.4% year on year. Djezzy’s Q4 2018 service revenue was DZD 23.2 billion, a 3.7% year on year decline, while data revenue growth was 67.1%, due to higher usage and a substantial increase in data customers as a result of the acceleration in 3G and 4G/LTE network roll-out. This data revenue growth is still supported by the change towards a more aggressive data pricing strategy that has been in place since the beginning of 2018. The net customer additions trend, which was still positive during Q4 2018, led to customer growth of 1.3% quarter on quarter and 5.7% year on year. The quarter on quarter growth was driven by continued positive uptake of new offers launched earlier in the year. In June 2018, Djezzy migrated to its new DBSS platform, resulting in a slight increase in technology opex. This new platform offers Djezzy simplification, agility and a faster time to market for new services, coupled with improved customer service. Going forward, DBSS, as a cornerstone of Djezzy’s digitization, will allow the development of bespoke offers to customers via automatized customer value management tools. In Q4 2018, EBITDA increased by 4.9% year on year. The decline in revenues, coupled with increased taxation, an increase of technology costs and additional channel incentives were more than offset by the favourable revenue adjustments and the release of certain provisions totalling DZD 1.3 billion in Q4 2018. Excluding the revenue adjustments and the release of certain provisions, EBITDA would have decreased by 7.7% year on year and the EBITDA margin would have been 41.4%. FY 2018 16

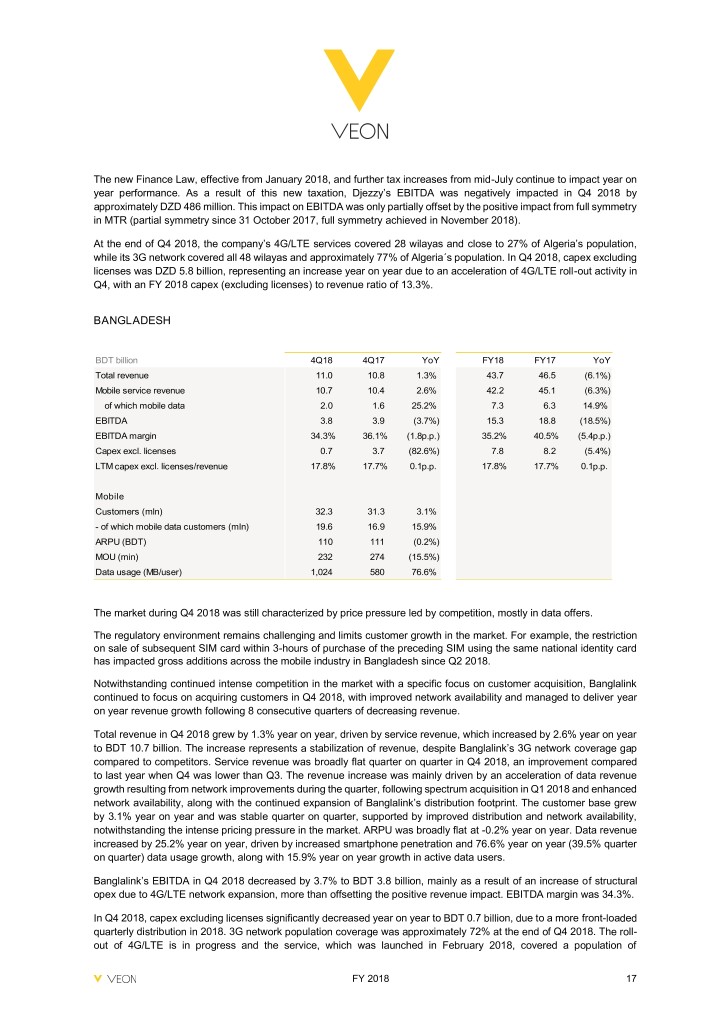

The new Finance Law, effective from January 2018, and further tax increases from mid-July continue to impact year on year performance. As a result of this new taxation, Djezzy’s EBITDA was negatively impacted in Q4 2018 by approximately DZD 486 million. This impact on EBITDA was only partially offset by the positive impact from full symmetry in MTR (partial symmetry since 31 October 2017, full symmetry achieved in November 2018). At the end of Q4 2018, the company’s 4G/LTE services covered 28 wilayas and close to 27% of Algeria’s population, while its 3G network covered all 48 wilayas and approximately 77% of Algeria´s population. In Q4 2018, capex excluding licenses was DZD 5.8 billion, representing an increase year on year due to an acceleration of 4G/LTE roll-out activity in Q4, with an FY 2018 capex (excluding licenses) to revenue ratio of 13.3%. BANGLADESH BDT billion 4Q18 4Q17 YoY FY18 FY17 YoY Total revenue 11.0 10.8 1.3% 43.7 46.5 (6.1%) Mobile service revenue 10.7 10.4 2.6% 42.2 45.1 (6.3%) of which mobile data 2.0 1.6 25.2% 7.3 6.3 14.9% EBITDA 3.8 3.9 (3.7%) 15.3 18.8 (18.5%) EBITDA margin 34.3% 36.1% (1.8p.p.) 35.2% 40.5% (5.4p.p.) Capex excl. licenses 0.7 3.7 (82.6%) 7.8 8.2 (5.4%) LTM capex excl. licenses/revenue 17.8% 17.7% 0.1p.p. 17.8% 17.7% 0.1p.p. Mobile Customers (mln) 32.3 31.3 3.1% - of which mobile data customers (mln) 19.6 16.9 15.9% ARPU (BDT) 110 111 (0.2%) MOU (min) 232 274 (15.5%) Data usage (MB/user) 1,024 580 76.6% The market during Q4 2018 was still characterized by price pressure led by competition, mostly in data offers. The regulatory environment remains challenging and limits customer growth in the market. For example, the restriction on sale of subsequent SIM card within 3-hours of purchase of the preceding SIM using the same national identity card has impacted gross additions across the mobile industry in Bangladesh since Q2 2018. Notwithstanding continued intense competition in the market with a specific focus on customer acquisition, Banglalink continued to focus on acquiring customers in Q4 2018, with improved network availability and managed to deliver year on year revenue growth following 8 consecutive quarters of decreasing revenue. Total revenue in Q4 2018 grew by 1.3% year on year, driven by service revenue, which increased by 2.6% year on year to BDT 10.7 billion. The increase represents a stabilization of revenue, despite Banglalink’s 3G network coverage gap compared to competitors. Service revenue was broadly flat quarter on quarter in Q4 2018, an improvement compared to last year when Q4 was lower than Q3. The revenue increase was mainly driven by an acceleration of data revenue growth resulting from network improvements during the quarter, following spectrum acquisition in Q1 2018 and enhanced network availability, along with the continued expansion of Banglalink’s distribution footprint. The customer base grew by 3.1% year on year and was stable quarter on quarter, supported by improved distribution and network availability, notwithstanding the intense pricing pressure in the market. ARPU was broadly flat at -0.2% year on year. Data revenue increased by 25.2% year on year, driven by increased smartphone penetration and 76.6% year on year (39.5% quarter on quarter) data usage growth, along with 15.9% year on year growth in active data users. Banglalink’s EBITDA in Q4 2018 decreased by 3.7% to BDT 3.8 billion, mainly as a result of an increase of structural opex due to 4G/LTE network expansion, more than offsetting the positive revenue impact. EBITDA margin was 34.3%. In Q4 2018, capex excluding licenses significantly decreased year on year to BDT 0.7 billion, due to a more front-loaded quarterly distribution in 2018. 3G network population coverage was approximately 72% at the end of Q4 2018. The roll- out of 4G/LTE is in progress and the service, which was launched in February 2018, covered a population of FY 2018 17

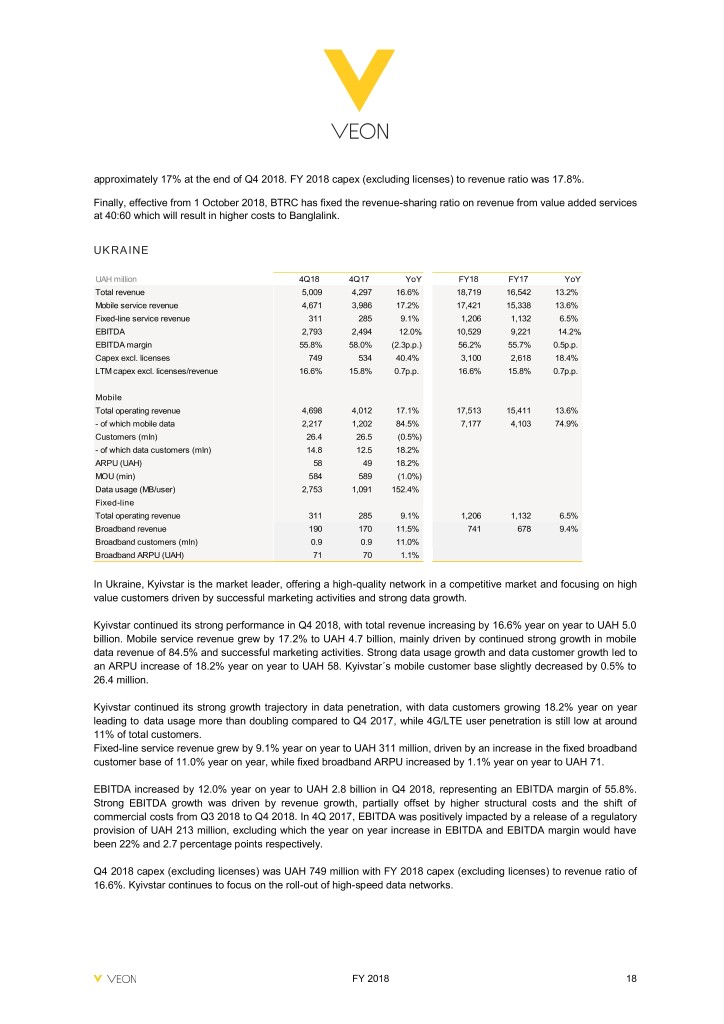

approximately 17% at the end of Q4 2018. FY 2018 capex (excluding licenses) to revenue ratio was 17.8%. Finally, effective from 1 October 2018, BTRC has fixed the revenue-sharing ratio on revenue from value added services at 40:60 which will result in higher costs to Banglalink. UKRAINE UAH million 4Q18 4Q17 YoY FY18 FY17 YoY Total revenue 5,009 4,297 16.6% 18,719 16,542 13.2% Mobile service revenue 4,671 3,986 17.2% 17,421 15,338 13.6% Fixed-line service revenue 311 285 9.1% 1,206 1,132 6.5% EBITDA 2,793 2,494 12.0% 10,529 9,221 14.2% EBITDA margin 55.8% 58.0% (2.3p.p.) 56.2% 55.7% 0.5p.p. Capex excl. licenses 749 534 40.4% 3,100 2,618 18.4% LTM capex excl. licenses/revenue 16.6% 15.8% 0.7p.p. 16.6% 15.8% 0.7p.p. Mobile Total operating revenue 4,698 4,012 17.1% 17,513 15,411 13.6% - of which mobile data 2,217 1,202 84.5% 7,177 4,103 74.9% Customers (mln) 26.4 26.5 (0.5%) - of which data customers (mln) 14.8 12.5 18.2% ARPU (UAH) 58 49 18.2% MOU (min) 584 589 (1.0%) Data usage (MB/user) 2,753 1,091 152.4% Fixed-line Total operating revenue 311 285 9.1% 1,206 1,132 6.5% Broadband revenue 190 170 11.5% 741 678 9.4% Broadband customers (mln) 0.9 0.9 11.0% Broadband ARPU (UAH) 71 70 1.1% In Ukraine, Kyivstar is the market leader, offering a high-quality network in a competitive market and focusing on high value customers driven by successful marketing activities and strong data growth. Kyivstar continued its strong performance in Q4 2018, with total revenue increasing by 16.6% year on year to UAH 5.0 billion. Mobile service revenue grew by 17.2% to UAH 4.7 billion, mainly driven by continued strong growth in mobile data revenue of 84.5% and successful marketing activities. Strong data usage growth and data customer growth led to an ARPU increase of 18.2% year on year to UAH 58. Kyivstar´s mobile customer base slightly decreased by 0.5% to 26.4 million. Kyivstar continued its strong growth trajectory in data penetration, with data customers growing 18.2% year on year leading to data usage more than doubling compared to Q4 2017, while 4G/LTE user penetration is still low at around 11% of total customers. Fixed-line service revenue grew by 9.1% year on year to UAH 311 million, driven by an increase in the fixed broadband customer base of 11.0% year on year, while fixed broadband ARPU increased by 1.1% year on year to UAH 71. EBITDA increased by 12.0% year on year to UAH 2.8 billion in Q4 2018, representing an EBITDA margin of 55.8%. Strong EBITDA growth was driven by revenue growth, partially offset by higher structural costs and the shift of commercial costs from Q3 2018 to Q4 2018. In 4Q 2017, EBITDA was positively impacted by a release of a regulatory provision of UAH 213 million, excluding which the year on year increase in EBITDA and EBITDA margin would have been 22% and 2.7 percentage points respectively. Q4 2018 capex (excluding licenses) was UAH 749 million with FY 2018 capex (excluding licenses) to revenue ratio of 16.6%. Kyivstar continues to focus on the roll-out of high-speed data networks. FY 2018 18

UZBEKISTAN UZS bln 4Q18 4Q17 YoY FY18 FY17 YoY Total revenue 635 628 1.2% 2,538 2,342 8.4% Mobile service revenue 630 621 1.4% 2,517 2,323 8.3% - of which mobile data 247 162 52.1% 872 585 49.0% Fixed-line service revenue 3.8 4.0 (4.0%) 17 15 15.7% EBITDA 254 267 (4.7%) 1,098 1,160 (5.4%) EBITDA margin 40.0% 42.5% (2.5p.p.) 43.3% 49.5% (6.3p.p.) Capex excl. licenses 37.9 120.1 (68.5%) 315 304 3.6% LTM Capex excl. licenses/revenue 12.4% 13.0% (0.6p.p.) 12.4% 13.0% (0.6p.p.) Mobile Customers (mln) 9.1 9.7 (6.0%) - of which mobile data customers (mln) 5.5 5.0 9.6% ARPU (UZS) 22,917 21,672 5.7% MOU (min) 608 574 5.9% Data usage (MB/user) 1,457 649 124.7% In Uzbekistan, market growth is driven by increased data penetration as operators expand their 4G/LTE networks. As the clear market leader, Unitel continues to focus on high value customers, offering a high quality mobile network. The company continued to report revenue growth in Q4 2018, driven by repricing initiatives introduced in March 2018, concentrating on upselling customers to higher price plans with increased allowances. However, this increase was more than offset by external cost pressures on the EBITDA level, such as the increased customer tax and the effect of the MTR reduction in Q3 2018. Total revenue for the quarter increased by 1.2% year on year and mobile service revenue increased by 1.4% to UZS 635 billion, driven by the repricing initiatives, notwithstanding the negative impact from the reduction in mobile termination rates. Adjusted for the negative effect of the MTR reduction, revenue growth would have been 7.4% year on year. Mobile data traffic more than doubled and mobile data revenue increased by 52.1% year on year, supported by the continued roll-out of high-speed data networks, increased smartphone penetration and the increased penetration of bundled offerings in Unitel´s customer base to 49.0% in Q4 2018. EBITDA decreased by 4.7% to UZS 254 billion and the EBITDA margin was 40.0% in Q4 2018, mainly due to external factors such as the increase in customer tax (approximately UZS 34.2 billion) and the negative impact of the reduction in mobile termination rates (approximately UZS 9 billion). Furthermore, EBITDA was negatively impacted by non- recurring costs and certain provisions of UZS 22 billion in Q4 2018, while Q4 2017 was negatively impacted by a provision of UZS 20 billion. Quarter on quarter, approximately UZS 12 billion of certain costs were shifted from Q3 to Q4 2018. Capex excluding licenses totalled UZS 37.9 billion and the FY 2018 capex excluding licenses to revenue ratio was 12.4%. The company continued to invest in its high-speed data networks, improving the 4G/LTE coverage to 24.5% and increasing the number of nationwide 3G sites by 11.0% year on year. Improvements to the high-speed data networks will continue to be a priority for Unitel for 2019 and the authorities in Uzbekistan have stated that connectivity of the domestic internet channel should be liberalized from January 2020. In Q4 2018, VEON’s subsidiary PJSC VimpelCom further successfully repatriated cash from Uzbekistan. The repatriation of cash was executed at the market rate and brings the total amount repatriated in FY 2018 to USD 111 million. From January 2019, new tax reforms were introduced, with the aim to simplify taxation in Uzbekistan. The tax authorities reduced the corporate tax, cancelled the revenue tax of 3.2%, while an excise tax of 15% over customer charges was introduced. Furthermore, the customer tax was reduced to UZS 2,000 in FY 2019 from UZS 4,000 in FY 2018. Overall, as a result of these changes, revenue is expected to be negatively impacted by approximately 13%, EBITDA is expected to be negatively impacted by approximately 6%, while free cash flow impact is expected to be slightly positive in FY 2019. FY 2018 19

CONFERENCE CALL INFORMATION On 25 February 2019, VEON will host a live presentation with senior management at 10:00 am CET (9:00 am GMT) in London, which will be made available through video webcast on its website and through the following dial-in numbers. The call and slide presentation may be accessed at http://www.veon.com 10:00 CET investor and analyst conference call US call-in number: +1 (646) 7871226 Confirmation Code: 5125307 International call-in number: +44 (0) 203 0095709 Confirmation Code: 5125307 The conference call replay and the slide presentation webcast will be available until 28 February 2019. The slide presentation will also be available for download from VEON's website. Investor and analyst call replay US Replay Number: +1 (917) 677 7532 Confirmation Code: 5125307 UK Replay Number: 0800 238 0667 Confirmation Code: 5125307 CONTACT INFORMATION INVESTOR RELATIONS CORPORATE COMMUNICATIONS Richard James Kieran Toohey [email protected] [email protected] FY 2018 20

DISCLAIMER This press release contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward- looking statements may be identified by words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” and other similar words. Forward-looking statements include statements relating to, among other things, VEON’s plans to implement its strategic priorities, including operating model and development plans, among others; anticipated performance and guidance for 2019, including VEON’s ability to generate sufficient cash flow; future market developments and trends; operational and network development and network investment, including expectations regarding the roll-out and benefits of 3G/4G/LTE networks, as applicable; the effect of the acquisition of additional spectrum on customer experience; VEON’s ability to realize the acquisition and disposition of any of its businesses and assets; VEON’S ability to realize financial improvements, including an expected reduction of net pro-forma leverage ratio following the successful completion of certain dispositions and acquisitions; and VEON’s ability to realize its targets and strategic initiatives in its various countries of operation. The forward-looking statements included in this press release are based on management’s best assessment of VEON’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of demand for and market acceptance of VEON’s products and services; continued volatility in the economies in VEON’s markets; unforeseen developments from competition; governmental regulation of the telecommunications industries; general political uncertainties in VEON’s markets; government investigations or other regulatory actions; litigation or disputes with third parties or other negative developments regarding such parties; risks associated with data protection or cyber security, other risks beyond the parties’ control or a failure to meet expectations regarding various strategic priorities, the effect of foreign currency fluctuations, increased competition in the markets in which VEON operates and the effect of consumer taxes on the purchasing activities of consumers of VEON´s services. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VEON’s Annual Report on Form 20-F for the year ended December 31, 2017 filed with the U.S. Securities and Exchange Commission (the “SEC”) and other public filings made by VEON with the SEC. Other unknown or unpredictable factors also could harm our future results. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Under no circumstances should the inclusion of such forward-looking statements in this press release be regarded as a representation or warranty by us or any other person with respect to the achievement of results set out in such statements or that the underlying assumptions used will in fact be the case. Therefore, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements speak only as of the date hereof. We cannot assure you that any projected results or events will be achieved. Except to the extent required by law, we disclaim any obligation to update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made, or to reflect the occurrence of unanticipated events. Non-IFRS measures are reconciled to comparable IFRS measures in VEON Ltd.’s earnings release published on its website on the date hereof. Furthermore, elements of this press release contain or may contain, “inside information” as defined under the Market Abuse Regulation (EU) No. 596/2014. All non-IFRS measures disclosed further in this press release (including, without limitation, EBITDA, EBITDA margin, EBT, net debt, equity free cash flow, organic growth, capital expenditures excluding licenses and LTM (last twelve months) capex excluding licenses/revenue) are reconciled to comparable IFRS measures in Attachment E (Reconciliation tables). In addition, we present certain information on a forward-looking basis (including, without limitation, the expected impact on revenue, EBITDA and equity free cash flow from the consolidation of the Euroset stores after completing the transaction ending the Euroset joint venture). We are not able to, without unreasonable efforts, provide a full reconciliation to IFRS due to potentially high variability, complexity and low visibility as to the items that would be excluded from the comparable IFRS measure in the relevant future period, including, but not limited to, depreciation and amortization, impairment loss, loss on disposal of non-current assets, financial income and expenses, foreign currency exchange losses and gains, income tax expense and performance transformation costs, cash and cash equivalents, long—term and short-term deposits, interest accrued related to financial liabilities, other unamortized adjustments to financial liabilities, derivatives, and other financial liabilities. FY 2018 21

ABOUT VEON VEON is a NASDAQ and Euronext Amsterdam-listed global provider of connectivity and internet services. Follow us: go to our website @ http://www.veon.com CONTENT OF THE ATTACHMENTS Attachment A VEON financial schedules 23 Attachment B Debt overview 26 Attachment C Customers 27 Attachment D Definitions 27 Attachment E Reconciliation tables 29 Average rates and target rates of functional currencies to USD For more information on financial and operating data for specific countries, please refer to the supplementary file Factbook4Q2018.xls on VEON’s website at http://veon.com/Investor-relations/Reports--results/Results/. FY 2018 22

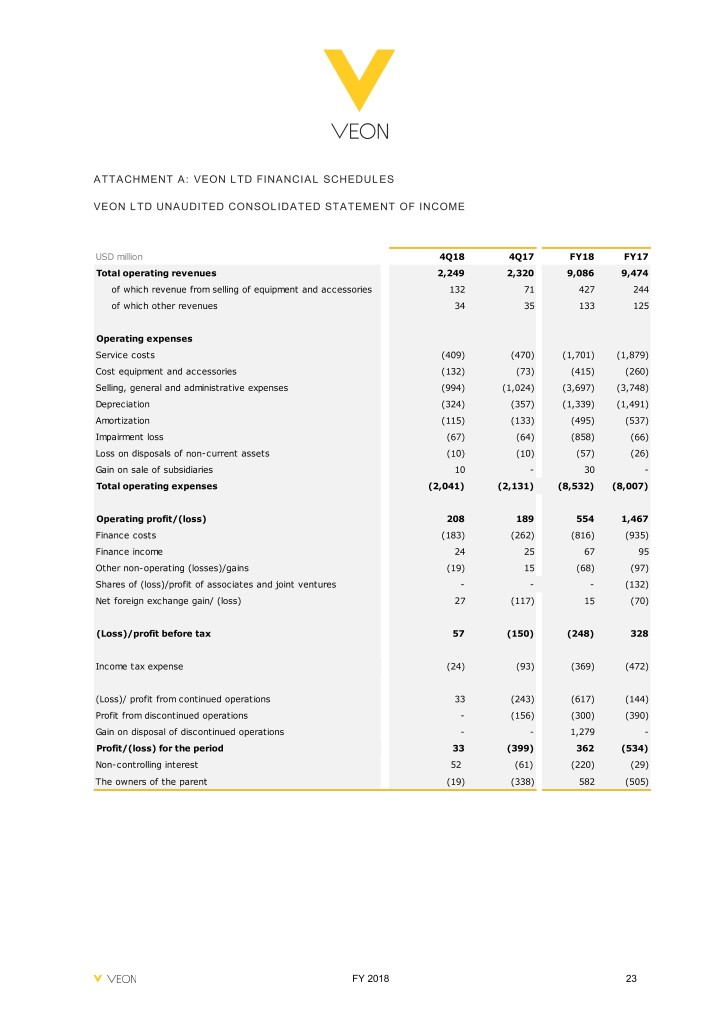

ATTACHMENT A: VEON LTD FINANCIAL SCHEDULES VEON LTD UNAUDITED CONSOLIDATED STATEMENT OF INCOME USD million 4Q18 4Q17 FY18 FY17 Total operating revenues 2,249 2,320 9,086 9,474 of which revenue from selling of equipment and accessories 132 71 427 244 of which other revenues 34 35 133 125 Operating expenses Service costs (409) (470) (1,701) (1,879) Cost equipment and accessories (132) (73) (415) (260) Selling, general and administrative expenses (994) (1,024) (3,697) (3,748) Depreciation (324) (357) (1,339) (1,491) Amortization (115) (133) (495) (537) Impairment loss (67) (64) (858) (66) Loss on disposals of non-current assets (10) (10) (57) (26) Gain on sale of subsidiaries 10 - 30 - Total operating expenses (2,041) (2,131) (8,532) (8,007) Operating profit/(loss) 208 189 554 1,467 Finance costs (183) (262) (816) (935) Finance income 24 25 67 95 Other non-operating (losses)/gains (19) 15 (68) (97) Shares of (loss)/profit of associates and joint ventures - - - (132) Net foreign exchange gain/ (loss) 27 (117) 15 (70) (Loss)/profit before tax 57 (150) (248) 328 Income tax expense (24) (93) (369) (472) (Loss)/ profit from continued operations 33 (243) (617) (144) Profit from discontinued operations - (156) (300) (390) Gain on disposal of discontinued operations - - 1,279 - Profit/(loss) for the period 33 (399) 362 (534) Non-controlling interest 52 (61) (220) (29) The owners of the parent (19) (338) 582 (505) FY 2018 23

VEON LTD UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION USD million 31 December 2018 30 September 2018 Assets Non-current assets Property and equipment 4,932 5,279 Intangible assets 1,854 2,010 Goodwill 3,816 3,996 Investments in associates and joint ventures - - Deferred tax asset 197 236 Income Tax advances, non-current 32 34 Financial assets 58 19 Other assets 103 108 Total non-current assets 10,992 11,682 Current assets Inventories 141 184 Trade and other receivables 577 628 Other assets 367 380 Current income tax asset 112 115 Other financial assets 88 72 Cash and cash equivalents 1,808 3,370 Total current assets 3,093 4,749 Assets classified as held for sale 17 - Total assets 14,102 16,431 Equity and liabilities Equity Equity attributable to equity owners of the parent 3,670 3,915 Non-controlling interests - 891 - 885 Total equity 2,779 3,030 Non-current liabilities Debt 6,567 8,170 Provisions 110 124 Other liabilities 53 53 Deferred tax liability 180 231 Total non-current liabilities 6,910 8,578 Current liabilities Trade and other payables 1,432 1,607 Other liabilities 1,258 1,219 Other financial liabilities 1,289 1,560 Current income tax payable 32 65 Provisions 398 372 Total current liabilities 4,409 4,823 Liabilities associated with assets held for sale 4 - Total equity and liabilities 14,102 16,431 FY 2018 24

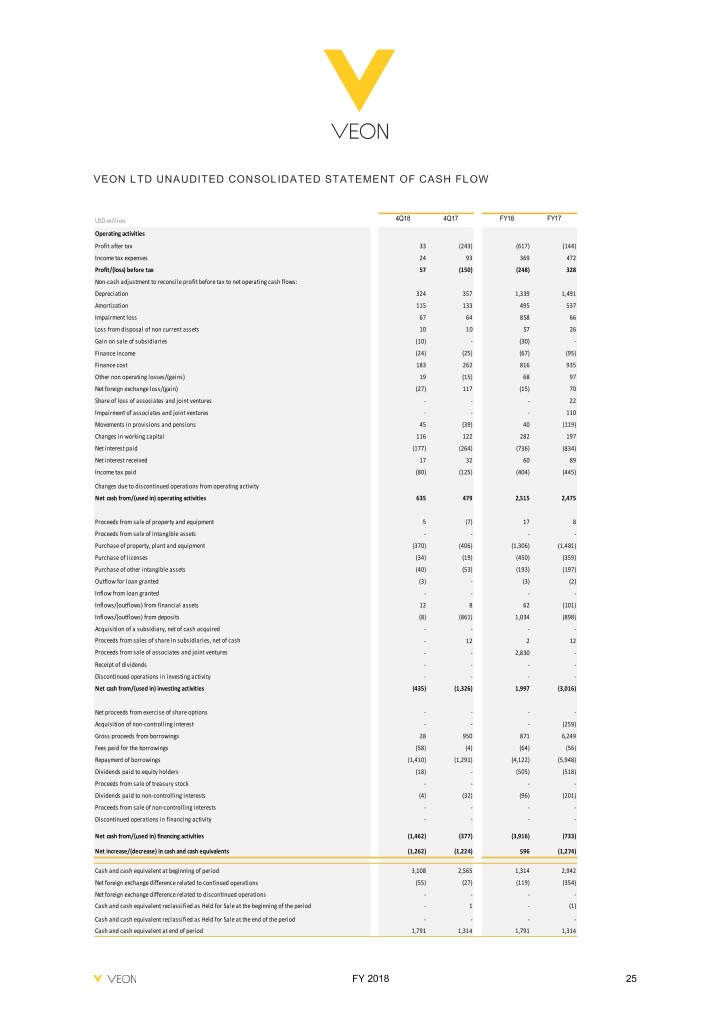

VEON LTD UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOW USD million 4Q18 4Q17 FY18 FY17 Operating activities Profit after tax 33 (243) (617) (144) Income tax expenses 24 93 369 472 Profit/(loss) before tax 57 (150) (248) 328 Non-cash adjustment to reconcile profit before tax to net operating cash flows: Depreciation 324 357 1,339 1,491 Amortization 115 133 495 537 Impairment loss 67 64 858 66 Loss from disposal of non current assets 10 10 57 26 Gain on sale of subsidiaries (10) - (30) - Finance income (24) (25) (67) (95) Finance cost 183 262 816 935 Other non operating losses/(gains) 19 (15) 68 97 Net foreign exchange loss/(gain) (27) 117 (15) 70 Share of loss of associates and joint ventures - - - 22 Impairment of associates and joint ventures - - - 110 Movements in provisions and pensions 45 (39) 40 (119) Changes in working capital 116 122 282 197 Net interest paid (177) (264) (736) (834) Net interest received 17 32 60 89 Income tax paid (80) (125) (404) (445) Changes due to discontinued operations from operating activity Net cash from/(used in) operating activities 635 479 2,515 2,475 Proceeds from sale of property and equipment 5 (7) 17 8 Proceeds from sale of intangible assets - - - - Purchase of property, plant and equipment (370) (406) (1,306) (1,481) Purchase of licenses (34) (19) (450) (359) Purchase of other intangible assets (40) (53) (193) (197) Outflow for loan granted (3) - (3) (2) Inflow from loan granted - - - - Inflows/(outflows) from financial assets 12 8 62 (101) Inflows/(outflows) from deposits (8) (861) 1,034 (898) Acquisition of a subsidiary, net of cash acquired - - - - Proceeds from sales of share in subsidiaries, net of cash - 12 2 12 Proceeds from sale of associates and joint ventures - - 2,830 - Receipt of dividends - - - - Discontinued operations in investing activity - - - - Net cash from/(used in) investing activities (435) (1,326) 1,997 (3,016) Net proceeds from exercise of share options - - - - Acquisition of non-controlling interest - - - (259) Gross proceeds from borrowings 28 950 871 6,249 Fees paid for the borrowings (58) (4) (64) (56) Repayment of borrowings (1,410) (1,291) (4,122) (5,948) Dividends paid to equity holders (18) - (505) (518) Proceeds from sale of treasury stock - - - - Dividends paid to non-controlling interests (4) (32) (96) (201) Proceeds from sale of non-controlling interests - - - - Discontinued operations in financing activity - - - - Net cash from/(used in) financing activities (1,462) (377) (3,916) (733) Net increase/(decrease) in cash and cash equivalents (1,262) (1,224) 596 (1,274) Cash and cash equivalent at beginning of period 3,108 2,565 1,314 2,942 Net foreign exchange difference related to continued operations (55) (27) (119) (354) Net foreign exchange difference related to discontinued operations - - - - Cash and cash equivalent reclassified as Held for Sale at the beginning of the period - 1 - (1) Cash and cash equivalent reclassified as Held for Sale at the end of the period - - - - Cash and cash equivalent at end of period 1,791 1,314 1,791 1,314 FY 2018 25