Form 6-K UNILEVER PLC For: Mar 22

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2021

Commission File

Number: 001-04546

UNILEVER PLC

(Translation of registrant’s name into English)

UNILEVER HOUSE, BLACKFRIARS, LONDON, ENGLAND

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ☐

Table of Contents

CAUTIONARY STATEMENT

This document may contain forward-looking statements, including ‘forward-looking statements’ within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as ‘will’, ‘aim’, ‘expects’, ‘anticipates’, ‘intends’, ‘looks’, ‘believes’, ‘vision’, or the negative of these terms and other similar expressions of future performance or results, and their negatives, are intended to identify such forward-looking statements. These forward-looking statements are based upon current expectations and assumptions regarding anticipated developments and other factors affecting the Unilever Group (the ‘Group’). They are not historical facts, nor are they guarantees of future performance.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Among other risks and uncertainties, the material or principal factors which could cause actual results to differ materially are: Unilever’s global brands not meeting consumer references; Unilever’s ability to innovate and remain competitive; Unilever’s investment choices in its portfolio management; the effect of climate change on Unilever’s business; Unilever’s ability to find sustainable solutions to its plastic packaging; significant changes or deterioration in customer relationships; the recruitment and retention of talented employees; disruptions in our supply chain and distribution; increases or volatility in the cost of raw materials and commodities; the production of safe and high quality products; secure and reliable IT infrastructure; execution of acquisitions, divestitures and business transformation projects; economic, social and political risks and natural disasters; financial risks; failure to meet high and ethical standards; and managing regulatory, tax and legal matters. A number of these risks have increased as a result of the current Covid-19 pandemic.

These forward-looking statements speak only as of the date of this document. Except as required by any applicable law or regulation, the Group expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Group’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Further details of potential risks and uncertainties affecting the Group are described in the Group’s filings with the London Stock Exchange, Euronext Amsterdam and the US Securities and Exchange Commission, including in the Annual Report on Form 20-F 2020 and the Unilever Annual Report and Accounts 2020.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| UNILEVER PLC

|

| /s/ R. Sotamaa |

| By R. SOTAMAA, |

| Chief Legal Officer and Group Secretary |

Date: 22 March 2021

Table of Contents

| Exhibit Number |

Exhibit Description | |

| 99.1 | Unilever PLC Chairman’s Letter and Notice of Meeting | |

| 99.2 | Unilever PLC Proxy Form | |

Exhibit 99.1

Making

Sustainable Living

Commonplace

| Chairman’s letter and Notice of Meeting Annual General Meeting London 5 May 2021 |

|

Unilever House, 100 Victoria Embankment, London EC4Y 0DY

Telephone 020 7822 5252

This document is important and requires your immediate attention. If you are in any doubt as to what action you should take, you are recommended to consult your stockbroker, bank manager, solicitor, accountant or other professional adviser under the Financial Services and Markets Act 2000 as soon as possible. If you have sold or otherwise transferred all of your shares, please pass this document to the purchaser or transferee, or to the person who arranged the sale or transfer so they can pass this document to the person who now holds the shares.

|

Nils Andersen Chairman |

22 March 2021 |

Dear shareholder,

Unilever PLC

Registered in England and Wales No 41424. Registered office: Port Sunlight, Wirral, Merseyside CH62 4ZD, United Kingdom

| Unilever Chairman’s Letter and Notice of Meeting 2021 | 2 |

Unilever PLC Notice of Meeting 2021

| 3 | Unilever Chairman’s Letter and Notice of Meeting 2021 |

Unilever PLC Notice of Meeting 2021 continued

| Unilever Chairman’s Letter and Notice of Meeting 2021 | 4 |

Explanatory notes to the resolutions

| 5 | Unilever Chairman’s Letter and Notice of Meeting 2021 |

Explanatory notes to the resolutions continued

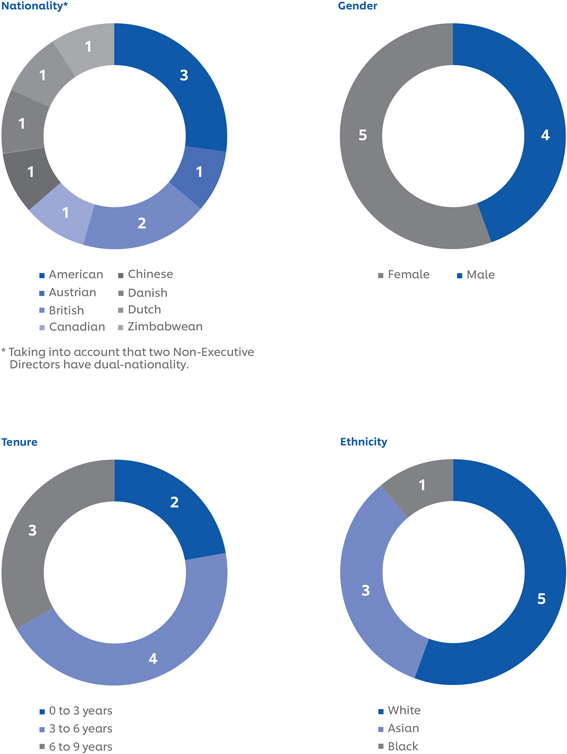

The tables below set out the diversity of our Non-Executive Directors standing for re-election at the AGM.

| Unilever Chairman’s Letter and Notice of Meeting 2021 | 6 |

Explanatory notes to the resolutions continued

| 7 | Unilever Chairman’s Letter and Notice of Meeting 2021 |

Explanatory notes to the resolutions continued

| Unilever Chairman’s Letter and Notice of Meeting 2021 | 8 |

Explanatory notes to the resolutions continued

| 9 | Unilever Chairman’s Letter and Notice of Meeting 2021 |

Appendix 1

| Unilever Chairman’s Letter and Notice of Meeting 2021 | 10 |

Appendix 1 continued

| 11 | Unilever Chairman’s Letter and Notice of Meeting 2021 |

Appendix 2

| Unilever Chairman’s Letter and Notice of Meeting 2021 | 12 |

Notes to the Notice of Meeting 2021

| 13 | Unilever Chairman’s Letter and Notice of Meeting 2021 |

Notes to the Notice of Meeting 2021 continued

| Unilever Chairman’s Letter and Notice of Meeting 2021 | 14 |

| Unilever PLC

Head Office 100 Victoria Embankment London EC4Y 0DY United Kingdom T +44 (0)20 7822 5252

Registered Office Unilever PLC Port Sunlight Wirral Merseyside CH62 4ZD United Kingdom

Registered in England and Wales Company Number: 41424 |

For further information about Unilever please visit our website:

www.unilever.com | |||

Exhibit 99.2

Annual General Meeting of Unilever PLC: Proxy Form for voting

When you have completed and signed this form, please return it to Computershare in the enclosed envelope. No stamp is required if you are resident in the UK. To be valid, this form must be signed and received by no later than 2.30pm on Monday 3 May 2021.

For further information on completing your Proxy Form, including how to send it using the internet, see the reverse.

Please complete using black ink as this form will be scanned.

I/We, the undersigned, being a shareholder/shareholders of Unilever PLC, hereby appoint the Chairperson of the Annual General Meeting or the following person

| * | ** |

Please put an ‘X’ in this box to indicate that this Proxy appointment is one of multiple appointments being made. |

* Please leave this box blank if you have selected the Chairperson. Do not insert your own name(s).

** For the reasons set out in question 1 overleaf we recommend that you only appoint the Chairperson of the AGM as your proxy.

as my/our Proxy to vote on my/our behalf at the Annual General Meeting of the Company to be held at 2.30pm on Wednesday 5 May 2021 and at any adjournments of that Meeting. I/We direct that my/our vote(s) be cast or withheld on the Resolutions as set out in the Notice of Annual General Meeting as indicated by an ‘X’ in the appropriate box below and, in respect of any Resolutions where no such indication is made and/or on any other business which may properly come before the Annual General Meeting, in such manner as my/our Proxy thinks fit.

Resolutions

Please indicate your voting instructions to your Proxy with an ‘X’ in the appropriate box below. The full text of each Resolution is set out in the Notice of Meeting.

| For | Against | Vote withheld |

For | Against | Vote withheld | |||||||||

| 1. To receive the Report and Accounts for the year ended 31 December 2020 |

|

|

|

14. To re-elect Mr J Rishton as a Non-Executive Director |

|

|

| |||||||

| 2. To approve the Directors’ Remuneration Report |

|

|

|

15. To re-elect Mr F Sijbesma as a Non-Executive Director |

|

|

| |||||||

| 3. To approve the Directors’ Remuneration Policy |

|

|

|

16. To reappoint KPMG LLP as Auditors of the Company |

|

|

| |||||||

| 4. To approve the Climate Transition Action Plan |

|

|

|

17. To authorise the Directors to fix the remuneration of the Auditor |

|

|

| |||||||

| 5. To re-elect Mr N Andersen as a Non-Executive Director |

|

|

|

18. To authorise Political Donations and expenditure |

|

|

| |||||||

| 6. To re-elect Mrs L Cha as a Non-Executive Director |

|

|

|

19. To approve the SHARES Plan |

|

|

| |||||||

| 7. To re-elect Dr J Hartmann as a Non-Executive Director |

|

|

|

20. To renew the authority to Directors to issue shares |

|

|

| |||||||

| 8. To re-elect Mr A Jope as an Executive Director |

|

|

|

21. To renew the authority to Directors to disapply pre-emption rights |

|

|

| |||||||

| 9. To re-elect Ms A Jung as a Non-Executive Director |

|

|

|

22. To renew the authority to Directors to disapply pre-emption rights for the purposes of acquisitions or capital investments |

|

|

| |||||||

| 10. To re-elect Ms S Kilsby as a Non-Executive Director |

|

|

|

23. To renew the authority to the Company to purchase its own shares |

|

|

| |||||||

| 11. To re-elect Mr S Masiyiwa as a Non-Executive Director |

|

|

|

24. To shorten the notice period for General Meetings |

|

|

| |||||||

| 12. To re-elect Professor Y Moon as a Non-Executive Director |

|

|

|

25. To adopt new Articles of Association |

|

|

| |||||||

| 13. To re-elect Mr G Pitkethly as an Executive Director |

|

|

|

26. To reduce the share premium account |

|

|

|

A ‘Vote withheld’ is not a vote in law and will not be counted in the calculation of the proportion of the votes ‘For’ and ‘Against’ a Resolution.

| Go online! Turn over to find out how to send your Proxy voting instructions electronically. Institutional investors: see overleaf for details of CREST Proxy voting. | Please put an ‘X’ in this box if signing on behalf of the shareholder under Power of Attorney or other authority. | |||||

| EXT0634 | Note: please do not use this form for changes of address or other matters relating to your shareholding. | |||||

|

Signature

SRN: PIN: |

||

| Date |

2021

| |

| CONTROL NUMBER: 916945 |

|

Kindly note: This form is issued only to the addressee(s) and is specific to the class of security and the unique designated account printed hereon. This personalised form is not transferable between different (i) account holders (ii) classes of security or (iii) uniquely designated accounts. Unilever PLC and Computershare accept no liability for any instruction that does not comply with these conditions. |

|

COMPLETING YOUR PROXY FORM FOR THE ANNUAL GENERAL MEETING:

QUESTIONS AND ANSWERS

|

| |||||||

| Proxy and Voting card

Annual General Meeting

At 2.30pm on Wednesday 5 May 2021. 100 Victoria Embankment, London EC4Y 0DY. |

In order to comply with restrictions on gatherings as a result of the Covid-19 pandemic, you will not be able to attend the Annual General Meeting on 5 May 2021. We strongly encourage you to complete this card in advance of the Annual General Meeting and appoint the chairperson of the meeting as your proxy so your vote is counted. |

|

||||||

|

||||||

| Notice of availability – Annual Report and Accounts 2020 | ||||||

|

You can now access the Unilever Annual Report and Accounts 2020 by visiting the website: www.unilever.com/ara. |

||||||

| We are holding an online webcast and Q & A Session at 3.00pm on 5 May 2021 after the conclusion of the Annual General Meeting to provide our shareholders the opportunity to ask the Board questions.

In order to participate in the webcast and Q & A Session, you will need to visit meetings.computershare. com/MSL7TQL on your device operating a compatible browser using the latest version of Chrome, Firefox, Edge or Safari. Please note that Internet Explorer is not supported. It is highly recommended that you check your system capabilities in advance of the session on 5 May 2021.

All shareholders have the right to attend and participate in the webcast and Q & A Session. If you are a shareholder, you can use your unique Shareholder Reference Number and PIN as displayed below and on your Form of Proxy. These details are unique to you and will only allow access to the webcast and Q & A Session.

If you would like to delegate your attendance at the webcast and Q & A Session to a third party or a corporate representative then please contact Computershare Investor Services PLC by email at [email protected] or alternatively call 0370 600 3977, providing details of your proxy appointment including their email address so that unique credentials can be issued to allow the proxy to access the electronic meeting. This instruction must be received by Computershare by 2.30pm on 3 May 2021. Access credentials will be emailed to the appointee one working day prior to the meeting conditional on evidence of your delegation having been received and accepted. Lines are open 8.30am to 5.30pm Monday to Friday (excluding bank holidays). This delegation relates to attendance at the webcast and Q & A Session only and will not impact your proxy appointment for voting purposes.

Access to the webcast and Q & A Session via meetings.computershare.com/MSL7TQL will be available from 2.45pm on 5 May 2021. It is your responsibility to ensure connectivity for the duration of the webcast and Q & A Session. Further assistance on access can be located on www.unilever.com/agm. Please note shareholders can also submit questions in advance of the webcast and Q & A Session at [email protected]. |

|

|||||

| SRN: | PIN: | |||||

|

| |||||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Salesforce talks to buy Informatica fall through- reports

- UGE Announces Financial Results Release Date and Webinar

- Aurania Announces Increase in Size of Debt Settlement to C$2.07 Million

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share