Form 6-K TEXTAINER GROUP HOLDINGS For: Apr 23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

April 23, 2018

Commission File Number 001-33725

Textainer Group Holdings Limited

(Translation of registrant’s name into English)

Century House

16 Par-La-Ville Road

Hamilton HM 08

Bermuda

(441) 296-2500

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On or about April 23, 2018, Textainer Group Holdings Limited (the “Company”) caused copies of the following documents to be mailed to the Company’s shareholders of record: (1) the Company’s 2017 Annual Report to Shareholders and (2) the Company’s Notice of 2018 Annual General Meeting of Shareholders to be held on May 23, 2018, together with the accompanying Proxy Statement and accompanying Form of Proxy Card.

The Company’s 2017 Annual Report to Shareholders includes the Company’s financial highlights, letter to shareholders and Annual Report on Form 20-F for the fiscal year ended December 31, 2017. The following documents, filed as exhibits to this Form 6-K, are incorporated by reference as part of this Form 6-K:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 23, 2018

| Textainer Group Holdings Limited |

| /s/ PHILIP K. BREWER |

| Philip K. Brewer |

| President and Chief Executive Officer |

EXHIBIT INDEX

| Exhibit Number |

Description of Document | |

| 99.1 | Textainer Group Holdings Limited 2017 Annual Report to Shareholders | |

| 99.2 | Textainer Group Holdings Limited Notice of 2018 Annual General Meeting of Shareholders to be Held May 23, 2018, Proxy Statement and Form of Proxy Card | |

Exhibit 99.1

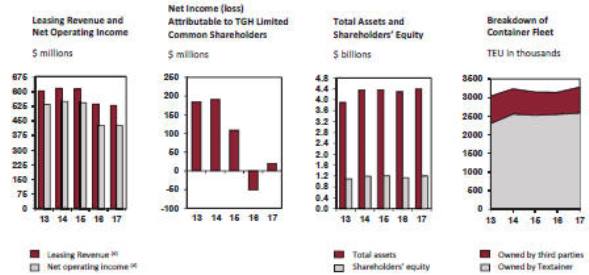

FINANCIAL HIGHLIGHTS

(All figures in millions of U.S. dollars except for per share data and percentage calculations)

| 2017 | 2016 | 2015 | ||||||||||

| Consolidated Operating Results |

||||||||||||

| Total revenue (a) |

$ | 490.9 | $ | 496.2 | $ | 544.3 | ||||||

| Income from operations |

$ | 143.9 | $ | 26.2 | $ | 211.8 | ||||||

| Income (loss) before income tax and noncontrolling interests |

$ | 22.4 | $ | (61.3 | ) | $ | 120.7 | |||||

| Net income (loss) attributable to TGH Limited common shareholders |

$ | 19.4 | $ | (52.5 | ) | $ | 108.4 | |||||

| Basic net income (loss) per share |

$ | 0.34 | $ | (0.93 | ) | $ | 1.90 | |||||

| Diluted net income (loss) per share |

$ | 0.34 | $ | (0.93 | ) | $ | 1.90 | |||||

| Dividend per share |

$ | — | $ | 0.51 | $ | 1.65 | ||||||

| Return on average shareholders’ equity |

1.7 | % | -4.5 | % | 9.1 | % | ||||||

| Return on average assets (b) |

1.9 | % | -5.3 | % | 2.6 | % | ||||||

| Leverage ratio (c) |

247 | % | 256 | % | 237 | % | ||||||

| Consolidated Financial Position |

||||||||||||

| Total assets |

$ | 4,380.3 | $ | 4,294.0 | $ | 4,365.3 | ||||||

| Long-term debt (including current portion) |

$ | 2,990.3 | $ | 3,038.3 | $ | 3,003.6 | ||||||

| Total shareholders’ equity (exclude noncontrolling interest) |

$ | 1,152.5 | $ | 1,125.9 | $ | 1,201.6 | ||||||

| Total shareholders’ equity per share |

$ | 20.19 | $ | 19.83 | $ | 21.26 | ||||||

Additional information is available on the investor relations website – http://investor.textainer.com/

Notes:

| (a) | Does not include leasing revenue for containers managed but not owned by Textainer. |

| (b) | Includes noncontrolling interest. |

| (c) | Equity includes noncontrolling interest. |

| (d) | Leasing revenue and net operating income includes all managed containers, including containers not owned by Textainer. |

To Our Shareholders:

As we noted in this letter last year, container leasing is a cyclical business. Textainer has been leasing containers since 1979 to shipping lines throughout the world. Over that time, we have successfully navigated both strong and weak markets. During the last year, we have seen a strengthening of the positive market conditions that emerged in the fourth quarter of 2016. Each quarter of 2017 our performance improved. We returned to profitability and purchased over 300,000 TEU which have already been leased out on excellent terms.

We entered 2017 with new and used container prices, lease-out demand, and new and depot container lease rates at levels that were significantly higher than those that prevailed prior to Hanjin Shipping Co.’s bankruptcy in August 2016 (Hanjin). And these rates further improved during the year. Additionally, last year we saw solid growth in container trade, a trend that has continued into 2018. Building on these positive trends and our focus on operational discipline and prudent investment policy, we expect continued improvement in our financial performance during 2018.

Year in Review

Container leasing market conditions at the start of 2017 were very favorable. New container prices had increased almost $1000 over the lowest prices of 2016. Disposal container prices also improved greatly from 2016’s lows and climbed a further 70% by year-end. These higher new and used container prices, coupled with limited depot container inventories, caused lease rates to reach levels that were more than double those prevailing in 2016. Although these rates moderated towards the end of the year, they remain at attractive levels which support new investment. Of equal importance, recent lease agreements require a high percentage of containers to be returned in China and other locations in Asia where we anticipate there will be demand.

The strong market conditions last year resulted in higher utilization, increased lease-outs of depot containers, reduced downward pressure on the repricing of maturing term leases and increased gains on sales of used containers. Lease rental income increased each quarter of the year. We were not profitable during the first half of the year because of the ongoing costs of recovering, repairing and repositioning containers from Hanjin, the loss of revenue from these units, the costs of restructuring and refinancing debt facilities to address covenant issues, and ongoing but declining container impairments. We returned to profitability in the second half of 2017 due to continued lease revenue growth, further increases in utilization, reduced costs related to Hanjin, gains from disposal container sales and the elimination of material container impairments. We also invested heavily in new containers during the second half of the year, ending 2017 as the second largest investor among container lessors.

Container trade grew approximately 5.5% in 2017, 1.7 times the rate of growth in global GDP. During 2016, container trade growth lagged global GDP growth, making the increase during 2017 even more impressive. In addition to benefiting container lessors, the growth in container trade resulted in most shipping lines experiencing dramatic improvements in their performance. They also benefited from continued consolidation, increased operating efficiencies, lower fuel prices and higher freight rates. Notwithstanding their improved financial results, shipping lines generally preferred to lease instead of buy containers. More than 60% of new container production in 2017 was purchased by lessors.

TEXTAINER GROUP HOLDINGS LIMITED 2017 ANNUAL REPORT | 1

TO OUR SHAREHOLDERS (continued)

New container rental rates peaked in the first half of the year as a limited number of lessors purchased containers. While rates have declined somewhat since then, they remain among the highest levels we have experienced since 2012, supported by strong demand, low depot container inventories, moderate interest rate increases and stable new container prices. Depot container rental rates also rose significantly last year and are currently double the lowest levels for new containers in 2016.

New container prices were very stable during 2017, generally $2200 +/- $50 per CEU, a significant change from the preceding years when wide price fluctuations occurred. The container manufacturers, in the face of increases in iron ore and steel prices and increased costs resulting from the use of waterborne paint, became more disciplined in their approach to production and pricing. Approximately 3.5 million TEU were built in 2017, a significant increase from the 2 million produced in 2016 and only the third time since 2009 that more than three million TEU were produced. With strong trade growth and minimal depot inventories, new production was the primary source of containers to satisfy demand.

Prices for used containers increased in tandem with the increases in new container prices. The used container price increase was due not just to higher new container prices but also to the limited inventory of sales containers as a result of high utilization and reduced returns of on-lease containers. Higher used container prices reversed the significant container impairments of 2016 and resulted in over $26 million in gains on sale last year. These gains arose even though we sold fewer containers in 2017, than in the previous year.

Increased used container prices led us to change our residual values at the start of the third quarter of 2017. We increased the residual value for 20’ standard, 40’ standard, and 40’ high cube containers from $950, $1,150, and $1,300 to $1,000, $1,200, and $1,350, respectively. These changes resulted in an ongoing decrease in quarterly depreciation expense of $3.6 million.

We invested $625 million to purchase more than 300,000 TEU of new and used containers in 2017, the second most of any container lessor. 94% of our investments were for our own fleet. We also assumed the management of 182,000 TEU of dry freight and refrigerated containers from Magellan Maritime Services GmbH. At year-end, our fleet totaled 3.3 million TEU. We own 79% of our fleet.

Utilization increased during the year from 94.2% at the beginning of the year to 97.7% at year-end. Utilization has subsequently increased and is currently 97.9%.

Our adjusted net income for the year was $23.2 million, or $0.41 per diluted common share, a substantial turnaround from the $58.0 million adjusted loss in 2016.

We continue to maintain a strong balance sheet. During 2017, we completed $2.7 billion in debt financings, including raising new funds and refinancing existing facilities. In several facilities we were able to improve pricing and increase our advance rate. We finished the year with approximately $900 million of available liquidity. Our debt-to-equity ratio at 2.4:1 remains the lowest among our publicly listed peers.

Outlook

Global GDP is expected to grow 3.9% in 2018. Global trade grew 1.7 times the growth of global GDP during 2017. Even if the multiplier declines from this level, the projections for container trade growth of 5-6% in 2018 appear realistic. We continue to see strong demand for new and depot containers from our shipping line customers. Additionally, due to high utilization and low depot inventory, shipping lines have reduced returns of on-lease containers.

TEXTAINER GROUP HOLDINGS LIMITED 2017 ANNUAL REPORT | 2

TO OUR SHAREHOLDERS (continued)

We expect container production in 2018 to be similar to the 3.5 million TEU produced last year. Due to the similar conditions that led to higher prices in 2017 - increases in component costs, a strengthening Renminbi and increased discipline among manufacturers - we expect new container prices to remain in the range of $2150-2250. The rate of increase in used container prices has moderated recently. Given the level of new container prices, high utilization and limited depot supply we expect used container prices to remain around their current levels. Factory inventory currently is around 700,000 TEU, of which approximately 66% TEU belongs to lessors, much of which is already committed to lease. With all lessors enjoying high utilization and low depot inventories, there is no surplus of containers and the market can support another year of strong container production.

Rental rates remain at levels that provide attractive returns and are two or more times the lows of 2016. Perhaps more importantly, new container rental rates are above both our fleetwide average rate and the average rate of term leases maturing this year. This provides the opportunity to increase revenue from containers subject to maturing term leases. Since the average rental rate on our maturing leases declines each year going forward to a low of $0.37 in 2021, we expect to benefit from upwards repricing for several years. Furthermore, the full impact of higher new container rental rates will grow over time as containers reprice and new containers are put on lease.

Most major shipping lines saw improved financial performance in 2017 as industry profitability exceeded $7 billion. This improved performance should continue into 2018 as shipping lines continue to consolidate and the three major alliances improve their operating efficiency. The critical question, as in every year, is what will happen to freight rates? Deliveries of new ships combined with limited scrapping are expected to result in containership capacity growth exceeding demand growth both this year and next. Freight rates weakened during the fourth quarter of 2017 and the start of 2018 while vessel utilization declined and fuel costs remained elevated. Several lines have plans to increase freight rates but excess vessel capacity may undermine these efforts.

We expect the positive trends benefitting container lessors to continue this year. The outlook for container trade is positive and container prices seem likely to remain at their current level or increase. While current rental rates provide attractive returns on equity, higher interest rates, competition among lessors and the increased supply of capital to our industry will impact lease rates and could negatively affect the performance of all container lessors. Serious trade disputes, were they to arise, could have a similar impact. Nonetheless, we expect our financial results to improve as we move through 2018.

As noted at the beginning of this letter, our industry is and always has been cyclical. We have been in business for almost 40 years and have successfully managed through many business cycles. We are extremely gratified by our performance in 2017 after a very challenging 2016 and look forward to continued growth and improved results this year.

TEXTAINER GROUP HOLDINGS LIMITED 2017 ANNUAL REPORT | 3

TO OUR SHAREHOLDERS (continued)

To our shareholders, customers, suppliers and employees, thank you for your trust in and support of Textainer. You are the reason we are here.

|

| |||

| Hyman Shwiel CHAIRMAN OF THE BOARD |

Philip K. Brewer PRESIDENT AND CHIEF EXECUTIVE OFFICER | |||

This Annual Report contains forward-looking statements within the meaning of U.S. securities laws. Forward-looking statements include statements that are not statements of historical facts and include, without limitation, statements regarding our belief that our financial performance will continue to improve during 2018, that China and other locations in Asia will continue as high demand locations for containers, that global GDP will grow 3.8% in 2018 and trade growth may be 5-6% in 2018, our expectation that container production in 2018 will be similar to the 3.5 million TEU in 2017, our expectations that new container prices will range between $2150 and $2250 in 2018, our belief that used container prices will remain near their current level in 2018, our expectation of benefits from increases in rental rates on expiring leases in future years and our expectation that this benefit will increase over time, our expectation that shipping line improved profitability will continue in 2018, and our expectation that positive trends for container lessors will continue in 2018. Readers are cautioned that these forward-looking statements involve risks and uncertainties, are only predictions and may differ materially from actual future events or results. For a discussion of such risks and uncertainties, see Item 3, “Key Information—Risk Factors” in Textainer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on March 14, 2018.

Textainer’s views, estimates, plans and outlook as described within this Annual Report may change subsequent to the release of this Annual Report, Textainer is under no obligation to modify or update any or all the statements it has made herein despite any subsequent changes Textainer may make in its views, estimates, plans or outlook for the future.

This Annual Report contains market data and industry forecasts that were obtained from industry publications, third-party market research and publicly available information. These publications generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed.

TEXTAINER GROUP HOLDINGS LIMITED 2017 ANNUAL REPORT | 4

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number 001-33725

Textainer Group Holdings Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Bermuda

(Jurisdiction of incorporation or organization)

Century House

16 Par-La-Ville Road

Hamilton HM 08

Bermuda

(Address of principal executive offices)

Michael J. Harvey

Textainer Group Holdings Limited

Century House

16 Par-La-Ville Road

Hamilton HM 08

Bermuda

(441) 296-2500

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

Name of each exchange on which registered | |

| Common Shares, $0.01 par value | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

57,097,220 Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definitions of “accelerated filer”, “large accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

TABLE OF CONTENTS

In this Annual Report on Form 20-F, unless indicated otherwise, references to: (1) “Textainer,” “TGH,” “the Company,” “we,” “us” and “our” refer, as the context requires, to Textainer Group Holdings Limited, which is the registrant and the issuer of the class of common shares that has been registered pursuant to Section 12(b) of the Securities Exchange Act of 1934, as amended, or Textainer Group Holdings Limited and its subsidiaries; (2) “TEU” refers to a “Twenty-Foot Equivalent Unit,” which is a unit of measurement used in the container shipping industry to compare shipping containers of various lengths to a standard 20’ dry freight container, thus a 20’ container is one TEU and a 40’ container is two TEU; (3) “CEU” refers to a Cost Equivalent Unit, which is a unit of measurement based on the approximate cost of a container relative to the cost of a standard 20’ dry freight container, so the cost of a standard 20’ dry freight container is one CEU; the cost of a 40’ dry freight container is 1.6 CEU; the cost of a 40’ high cube dry freight container (9’6” high) is 1.7 CEU; and the cost of a 40’ high cube refrigerated container is 8.0 CEU; (4) “our owned fleet” means the containers we own; (5) “our managed fleet” means the containers we manage that are owned by other container investors; (6) “our fleet” and “our total fleet” mean our owned fleet plus our managed fleet plus any containers we lease from other lessors; (7) “container investors” means the owners of the containers in our managed fleet; and (8) “Trencor” refers to Trencor Ltd., a public South African investment holding company, listed on the JSE Limited in Johannesburg, South Africa, which, indirectly owns approximately 47.8% of our common shares (such interest, “beneficiary interest”) through its wholly-owned subsidiary. See Item 4, “Information on the Company” for an explanation of the relationship between Trencor and us.

Dollar amounts in this Annual Report on Form 20-F are expressed in thousands, unless otherwise indicated.

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS; CAUTIONARY LANGUAGE

This Annual Report on Form 20-F, including the sections entitled Item 3, “Key Information — Risk Factors,” and Item 5, “Operating and Financial Review and Prospects,” contains forward-looking statements within the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not statements of historical facts and may relate to, but are not limited to, expectations or estimates of future operating results or financial performance, capital expenditures, introduction of new products, regulatory compliance, plans for growth and future operations, as well as assumptions relating to the foregoing. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “continue” or the negative of these terms or other similar terminology. Forward-looking statements include, among others, statements regarding: (i) our expectation that the favorable market conditions driven by solid trade growth, shipping lines preference to lease and minimal depot inventory to continue into 2018; (ii) our belief that the container trade grows at an even faster rate than the around 4% 2018 forecasted GDP; (iii) our expectation that new container prices to remain stable given the recent increase in steel prices and ongoing demand; (iv) our expectation that resale prices to remain high given the level of new container prices and the limited supply of containers placed on sale as a result of near full utilization; and (v) our expectation that new lease returns to remain at attractive levels assuming disciplined ordering by lessors and shipping lines .

Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy, and actual results may differ materially from those we anticipated due to a number of uncertainties, many of which cannot be foreseen. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including, among others, the risks we face that are described in the section entitled Item 3, “Key Information — Risk Factors” and elsewhere in this Annual Report on Form 20-F.

We believe that it is important to communicate our future expectations to potential investors, shareholders and other readers. However, there may be events in the future that we are not able to accurately predict or control and that may cause actual events or results to differ materially from the expectations expressed in or implied by our forward-looking statements. The risk factors listed in Item 3, “Key Information — Risk Factors,” as well as any cautionary language in this Annual Report on Form 20-F, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Before you decide to buy, hold or sell our common shares, you should be aware that the occurrence of the events described in Item 3, “Key Information — Risk Factors” and elsewhere in this Annual Report on Form 20-F could negatively impact our business, cash flows, results of operations, financial condition and share price. Potential investors, shareholders and other readers should not place undue reliance on our forward-looking statements.

Forward-looking statements regarding our present plans or expectations involve risks and uncertainties relative to return expectations and related allocation of resources, and changing economic or competitive conditions which could cause actual results to differ from present plans or expectations, and such differences could be material. Similarly, forward-looking statements regarding our present expectations for operating results and cash flow involve risks and uncertainties related to factors such as utilization rates, per diem rates, container prices, demand for containers by container shipping lines, supply and other factors discussed under Item 3, “Key Information — Risk Factors” or elsewhere in this Annual Report on Form 20-F, which could also cause actual results to differ from present plans. Such differences could be material.

All future written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. New risks and uncertainties arise from time to time, and we cannot predict those events or how they may affect us. We assume no obligation to, and do not plan to, update any forward-looking statements after the date of this Annual Report on Form 20-F as a result of new information, future events or developments, except as required by federal securities laws. You should read this Annual Report on Form 20-F and the documents that we reference and have filed as exhibits with the understanding that we cannot guarantee future results, levels of activity, performance or achievements and that actual results may differ materially from what we expect.

Industry data and other statistical information used in this Annual Report on Form 20-F are based on independent publications, reports by market research firms or other published independent sources. Some data are also based on our good faith estimates, derived from our review of internal surveys and the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information.

1

In this Annual Report on Form 20-F, unless otherwise specified, all monetary amounts are in U.S. dollars. To the extent that any monetary amounts are not denominated in U.S. dollars, they have been translated into U.S. dollars in accordance with our accounting policies as described in Item 18, “Financial Statements” in this Annual Report on Form 20-F.

2

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | Selected Financial Data |

The selected financial data presented below under the heading “Statement of Income Data” for the years ended December 31, 2017, 2016 and 2015 and under the heading “Balance Sheet Data” as of December 31, 2017 and 2016 have been derived from our audited consolidated financial statements included in Item 18, “Financial Statements” in this Annual Report on Form 20-F. The selected financial data presented below under the heading “Statement of Income Data” for the years ended December 31, 2014 and 2013 and under the heading “Balance Sheet Data” as of December 31, 2015, 2014 and 2013 are audited and have been derived from our audited consolidated financial statements not included in this Annual Report on Form 20-F. The data presented below under the heading “Other Financial and Operating Data” have not been audited. Historical results are not necessarily indicative of the results of operations to be expected in future periods. You should read the selected consolidated financial data and operating data presented below in conjunction with Item 5, “Operating and Financial Review and Prospects” and with Item 18, “Financial Statements” in this Annual Report on Form 20-F.

| Fiscal Years Ended December 31, | ||||||||||||||||||||

| 2017 | 2016 (1) | 2015 | 2014 | 2013 | ||||||||||||||||

| (Dollars in thousands, except per share data) | ||||||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Lease rental income |

$ | 444,888 | $ | 460,427 | $ | 512,544 | $ | 506,538 | $ | 470,332 | ||||||||||

| Management fees |

14,994 | 13,420 | 15,610 | 17,408 | 19,921 | |||||||||||||||

| Trading container sales proceeds |

4,758 | 15,628 | 12,670 | 27,989 | 12,980 | |||||||||||||||

| Gain on sale of containers, net |

26,210 | 6,761 | 3,454 | 13,070 | 27,340 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

490,850 | 496,236 | 544,278 | 565,005 | 530,573 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses: |

||||||||||||||||||||

| Direct container expense |

60,321 | 62,596 | 47,342 | 47,446 | 43,062 | |||||||||||||||

| Cost of trading containers sold |

3,302 | 15,904 | 12,475 | 27,465 | 11,910 | |||||||||||||||

| Depreciation expense |

231,043 | 236,144 | 191,930 | 164,209 | 140,414 | |||||||||||||||

| Container impairment |

8,072 | 94,623 | 35,345 | 13,108 | 8,891 | |||||||||||||||

| Amortization expense |

4,092 | 5,053 | 4,741 | 4,010 | 4,226 | |||||||||||||||

| General and administrative expense |

30,697 | 26,311 | 27,645 | 25,778 | 24,922 | |||||||||||||||

| Short-term incentive compensation expense |

3,481 | 2,242 | 913 | 4,075 | 1,779 | |||||||||||||||

| Long-term incentive compensation expense |

5,499 | 5,987 | 7,040 | 6,639 | 4,961 | |||||||||||||||

| Bad debt expense (recovery), net |

477 | 21,166 | 5,028 | (474 | ) | 8,084 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

346,984 | 470,026 | 332,459 | 292,256 | 248,249 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations |

143,866 | 26,210 | 211,819 | 272,749 | 282,324 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

3

| Fiscal Years Ended December 31, | ||||||||||||||||||||

| 2017 | 2016 (1) | 2015 | 2014 | 2013 | ||||||||||||||||

| (Dollars in thousands, except per share data) | ||||||||||||||||||||

| Other (expense) income: |

||||||||||||||||||||

| Interest expense (2) |

(117,475 | ) | (85,215 | ) | (76,063 | ) | (79,117 | ) | (84,279 | ) | ||||||||||

| Write-off of unamortized deferred debt (2) costs and bond discounts |

(7,550 | ) | — | (458 | ) | (6,814 | ) | (895 | ) | |||||||||||

| Interest income |

613 | 408 | 125 | 119 | 122 | |||||||||||||||

| Realized losses on interest rate swaps, collars and caps, net |

(1,191 | ) | (8,928 | ) | (12,823 | ) | (10,293 | ) | (8,409 | ) | ||||||||||

| Unrealized gains (losses) on interest rate swaps, collars and caps, net |

4,094 | 6,210 | (1,947 | ) | 1,512 | 8,656 | ||||||||||||||

| Other, net |

3 | (8 | ) | 26 | 23 | (45 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net other expense |

(121,506 | ) | (87,533 | ) | (91,140 | ) | (94,570 | ) | (84,850 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income tax and noncontrolling interest |

22,360 | (61,323 | ) | 120,679 | 178,179 | 197,474 | ||||||||||||||

| Income tax benefit (expense) |

(1,618 | ) | 3,447 | (6,695 | ) | 18,068 | (6,831 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

20,742 | (57,876 | ) | 113,984 | 196,247 | 190,643 | ||||||||||||||

| Less: Net (income) loss attributable to the noncontrolling interests |

(1,377 | ) | 5,393 | (5,576 | ) | (5,692 | ) | (6,565 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to Textainer Group Holdings Limited common shareholders |

$ | 19,365 | $ | (52,483 | ) | $ | 108,408 | $ | 190,555 | $ | 184,078 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to Textainer Group Holdings Limited common shareholders per share: |

||||||||||||||||||||

| Basic |

$ | 0.34 | $ | (0.93 | ) | $ | 1.90 | $ | 3.36 | $ | 3.27 | |||||||||

| Diluted |

$ | 0.34 | $ | (0.93 | ) | $ | 1.90 | $ | 3.34 | $ | 3.24 | |||||||||

| Weighted average shares outstanding (in thousands): |

||||||||||||||||||||

| Basic |

56,845 | 56,608 | 56,953 | 56,719 | 56,317 | |||||||||||||||

| Diluted |

57,159 | 56,608 | 57,093 | 57,079 | 56,862 | |||||||||||||||

| Other Financial and Operating Data (unaudited): |

||||||||||||||||||||

| Cash dividends declared per common share |

$ | — | $ | 0.51 | $ | 1.65 | $ | 1.88 | $ | 1.85 | ||||||||||

| Purchase of containers and fixed assets |

$ | 300,125 | $ | 505,528 | $ | 533,306 | $ | 818,451 | $ | 765,418 | ||||||||||

| Utilization rate (3) |

96.40 | % | 94.70 | % | 96.80 | % | 96.10 | % | 94.90 | % | ||||||||||

| Total fleet in TEU (as of the end of the period) |

3,279,892 | 3,142,556 | 3,147,690 | 3,233,364 | 3,040,454 | |||||||||||||||

| Balance Sheet Data (as of the end of the period): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 137,894 | $ | 84,045 | $ | 115,594 | $ | 107,067 | $ | 120,223 | ||||||||||

| Containers, net |

3,791,610 | 3,717,542 | 3,696,311 | 3,635,314 | 3,244,956 | |||||||||||||||

| Net investment in direct financing and sales-type leases (current and long-term) |

182,624 | 237,234 | 331,792 | 361,010 | 266,540 | |||||||||||||||

| Total assets |

4,380,342 | 4,294,026 | 4,365,312 | 4,334,748 | 3,879,193 | |||||||||||||||

| Long-term debt (including current portion) |

2,990,308 | 3,038,297 | 3,003,648 | 2,974,311 | 2,641,250 | |||||||||||||||

| Total liabilities |

3,170,060 | 3,109,241 | 3,099,427 | 3,084,946 | 2,737,455 | |||||||||||||||

| Total Textainer Group Holdings Limited shareholders’ equity |

1,152,542 | 1,125,926 | 1,201,633 | 1,189,982 | 1,094,067 | |||||||||||||||

| Noncontrolling interest |

57,740 | 58,859 | 64,252 | 59,820 | 47,671 | |||||||||||||||

| (1) | Certain previously reported information has been revised for the effect of immaterial corrections of identified errors pertaining to the calculation of gain on sale of containers, net and to properly account for lease concessions. See Note 2 “Immaterial Correction of Errors in Prior Periods” to our consolidated financial statements in Item 18, “Financial Statements” in this Annual Report on Form 20-F. |

4

| (2) | Amount for years ended 2013 to 2016 has been restated to reclassify the write-off of unamortized deferred debt costs and bond discounts out of interest expense to conform with the 2017 presentation. |

| (3) | We measure the utilization rate on the basis of CEU on lease, using the actual number of days on-hire, expressed as a percentage of CEU available for lease, using the actual days available for lease. CEU available for lease excludes CEU that have been manufactured for us but have not been delivered yet to a lessee and CEU designated as held-for-sale units. |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

An investment in our common shares involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained elsewhere in this Annual Report on Form 20-F, including our financial statements and the related notes thereto, before you decide to buy, hold or sell our common shares. Any of the risk factors we describe below could adversely affect our business, cash flows, results of operations and financial condition. The market price of our common shares could decline and you may lose some or all of your investment if one or more of these risks and uncertainties develop into actual events.

Risks Related to Our Business and Industry

The demand and pricing for leased containers depends on many factors beyond our control.

Substantially all of our revenue derives from activities related to the leasing, managing and selling of containers. Our ability to continue successfully leasing containers to container shipping lines, earning management fees on leased containers, selling used containers and sourcing capital required to purchase new and used containers depends, in part, upon the continued demand to lease new and used and purchase used containers.

Demand for leased containers depends largely on the rate of growth of world trade and economic growth, with worldwide consumer demand being the most critical factor affecting this growth. Demand for leased containers is also driven by our customers’ “lease vs. buy” decisions. In the past economic downturns in the U.S., Europe, Asia and countries with consumer-oriented economies have resulted in a reduction in the rate of growth of world trade and demand by container shipping lines for leased containers and it is likely that any future downturns would have similar results. Thus, a decrease in world trade can and has adversely affected our utilization and per diem rates and lead to reduced revenue and increased operating expenses (such as storage and repositioning costs), and can have an adverse effect on our financial performance. We cannot predict whether, or when, such downturns will occur. Other material factors affecting demand for leased containers, utilization and per diem rates include the following:

| • | prices of new and used containers; |

| • | economic conditions, profitability, competitive pressures and consolidation in the container shipping and container leasing industry; |

| • | shifting trends and patterns of cargo traffic; |

| • | fluctuations in demand for containerized goods outside their area of production; |

5

| • | the availability and terms of container financing for us and for our competitors and customers; |

| • | fluctuations in interest rates and currency exchange rates; |

| • | overcapacity, undercapacity and consolidation of container manufacturers; |

| • | the lead times required to purchase containers; |

| • | the number of containers purchased in the current year and prior years by competitors and container lessees; |

| • | container ship fleet overcapacity or undercapacity; |

| • | repositioning by container shipping lines of their own empty containers to higher demand locations in lieu of leasing containers; |

| • | port congestion and the efficient movement of containers as affected by labor disputes, work stoppages, increased vessel size, shipping line alliances or other factors that reduce or increase the speed at which containers are handled; |

| • | consolidation, withdrawal or insolvency of individual container shipping lines, such as the bankruptcy of Hanjin Shipping Co. in August 2016 which is discussed below; |

| • | import/export tariffs and restrictions; |

| • | customs procedures, foreign exchange controls and other governmental regulations; |

| • | natural disasters that are severe enough to affect local and global economies or interfere with trade, such as the 2011 earthquake and tsunami in Japan; and |

| • | other political and economic factors. |

Many of these and other factors affecting the container industry are inherently unpredictable and beyond our control. These factors will vary over time, often quickly and unpredictably, and any change in one or more of these factors may have a material adverse effect on our business and results of operations. In addition, many of these factors also influence the decision by container shipping lines to lease or buy containers. Should one or more of these factors influence container shipping lines to buy a larger percentage of the containers they operate, our utilization rate and/or per diems could decrease, resulting in decreased revenue and increased storage and repositioning costs, which would harm our business, results of operations and financial condition.

The bankruptcy of Hanjin Shipping Co. in August 2016 substantially impacted us.

On August 31, 2016 Hanjin’s filed for bankruptcy protection in South Korea. In the following months its services ceased operation. The insolvency of Hanjin severely disrupted container trade and the container shipping industry. At the time of the insolvency, containers leased to Hanjin with ownership interests attributable to Textainer represented approximately 4.8% of the total owned and managed fleet in TEU. We incurred substantial costs from the Hanjin insolvency, arising from container recovery expenses, unpaid current and future rental income from Hanjin, container repair expenses, container repositioning expenses, re-leasing expenses and the loss of unreturned containers. Additionally, many containers formerly leased to Hanjin were re-leased at substantially lower lease rates than the rates in the leases with Hanjin and other containers were disposed, often at prices below the book value for the containers. We have recovered 93% of the containers formerly leased to Hanjin, with the balance of the containers uneconomic or impossible to recover. We maintain insurance that covers certain costs and losses from customer defaults. At the time of the Hanjin default our policy provided for $80 million of coverage after a $5 million deductible was met. We have collected $50 million of our insurance claim and are working with our insurance companies to finalize the remaining payout amount up to our $80 million coverage limit However even if we receive the full amount of our insurance, it will be insufficient to cover all of our losses and disruptions related to Hanjin. At the time of its insolvency Hanjin was the 7th largest container shipping line in the world and the bankruptcy of Hanjin substantially impacted us, including as follows:

| • | A material portion of the losses we reported for 2016 were attributable to Hanjin’s default and the expenses caused by the default and these expenses related to the default continued in 2017 and were not fully covered by insurance; |

6

| • | As a result of the Hanjin default, lower container lease rates and lower used container sales prices, our cash flow was substantially reduced in the second half of 2016 and the first half of 2017 and this impacted our ability to comply with financial covenants in certain debt facilities and to invest in new containers in 2016 and the first half of 2017; we obtained waivers and amendments from lenders to address these issues and subsequently refinanced the majority of our debt; |

| • | We established an insurance receivable in anticipation of the receipt of insurance proceeds to cover certain Hanjin related losses; however, there can be no assurance that the insurers will pay our claim in full or without dispute; additionally, our insurance is insufficient to cover all the Hanjin related losses and disruptions; |

| • | Customer default insurance may not be available in the future to us or may not be affordable; we have renewed our insurance twice after the Hanjin default; however, the policy and coverage terms are not as favorable as before the Hanjin default and the premium has substantially increased; and |

| • | The Hanjin bankruptcy has led to further consolidation in the shipping line industry, increasing our reliance on a limited number of customers; as a result of the Hanjin default shippers have heightened concern about the shipping line that carries their cargo and this may impact the container shipping industry in ways we are unable to anticipate and which may adversely impact us. |

Global economic weakness has in the past and may in the future materially and negatively impact our business, results of operations, cash flows, financial condition and future prospects.

While domestic and global economic growth resumed and has continued following the global financial crisis in 2008 and 2009, the continued sustainability of the US and international growth is uncertain. Any slowdown or reversal of the US and global economic recoveries and trade growth could heighten a number of material risks to our business, results of operations, cash flows and financial condition, as well as our future prospects, including the following:

| • | Containerized cargo volume growth — A contraction or slowdown in containerized cargo volume growth would likely create lower utilization, higher direct costs, weaker shipping lines going out of business, pressure for us to offer lease concessions and lead to a reduction in the size of our customers’ container fleets. |

| • | Credit availability and access to equity markets — Issues involving liquidity and capital adequacy affecting lenders could affect our ability to fully access our credit facilities or obtain additional debt and could affect the ability of our lenders to meet their funding requirements when we need to borrow. Further, a high level of volatility in the equity markets could make it difficult for us to access the equity markets for additional capital at attractive prices, if at all. If we are unable to obtain credit or access the capital markets, our business could be negatively impacted. In several of the years prior to 2017 the returns provided from lease transactions were lower due to increased competition in part caused by increased debt financing access for the container leasing industry. At the end of 2016, lower container returns coupled with the impact of Hanjin’s bankruptcy and lower residual values impacted our ability to meet the financial covenants in our lending facilities, required covenant amendments and limited our ability to access funds for investment in additional new containers. |

Lease and/or utilization rates may decrease, which could adversely affect our business, results of operations and financial condition.

We compete mostly on the pricing and the availability of containers. Lease rates for our containers depend on a large number of factors, including the following:

| • | the supply of, and demand for, containers available; |

| • | the price of new containers (which is positively correlated with the price of steel); |

7

| • | the type and length of the lease; |

| • | interest rates and the availability of financing for leasing companies and shipping lines; |

| • | assumptions regarding residual value and future lease pricing; |

| • | the type and age of the container; |

| • | the location of the container being leased; |

| • | the quantity of containers available for lease by our competitors; and |

| • | lease rates offered by our competitors. |

Most of these factors are beyond our control. In particular the price of steel declined materially in 2015 and continued to decline in the beginning of 2016 and this was a significant factor in the decline in new container prices and lease rates at that time. New container prices and lease rates reached historically low levels in the beginning of 2016, but starting in the second half of 2016 and continuing during 2017 steel prices, container prices and lease rates all increased materially. In addition, lease rates can be negatively impacted by, among other things, the entrance of new leasing companies, overproduction of new containers by factories and the over-buying by shipping lines, leasing companies and tax-driven container investors. In 2012 and continuing in 2013 and 2014, container leasing companies, including us, raised substantial amounts of new funds in the debt and equity markets and were able to repeatedly refinance existing debt on ever more favorable terms. This increased availability and reduced cost of debt, which given a limited demand for containers, contributed to downward pressure on lease rates. The impact on us of the decline in lease rates that ended in the second half of 2016 has been more severe than past rate decreases due to the substantial growth in our owned fleet in the past few years and the relatively high prices paid for new containers in the period from 2010 to 2012 that were initially leased at historically high rates on leases that matured during this period of low lease rates. If future market lease rates again decrease or return to historically low levels, revenues generated by our fleet will be adversely affected, which will harm our business, results of operations, cash flows and financial condition.

We face risks associated with re-leasing containers after their initial long term lease.

We estimate the useful lives of our non-refrigerated containers other than open-top and flat-rack containers to be 13 to 14 years, open-top and flat-rack containers to be 14 to 16 years, refrigerated containers to be 12 years and tank containers to be 20 years. When we purchase newly produced containers, we typically lease them out under long-term leases with terms of three to five years at a lease rate that is correlated to the price paid for the container and prevailing interest rates. As containers leased under term leases are not leased out for their full economic life, we face risks associated with re-leasing containers after their initial long term lease at a rate that continues to provide a reasonable economic return based on the initial purchase price of the container. For leases that are currently expiring we might be re-leasing the containers at lower lease per diems as prevailing container lease rates have declined from the lease rates available three to five years ago when these containers were initially leased. If prevailing container lease rates decline significantly between the time a container is initially leased out and when its initial long term lease expires, or if overall demand for containers declines, we may be unable to earn a similar lease rate from the re-leasing of containers when their initial term leases expire which could materially adversely impact our results and financial performance. Additionally, for containers purchased new in 2015 and 2016, many of these containers are on long term leases with low per diems that are below current lease rates. Our ability to improve our financial performance depends in part on the ability to renew or re-lease these containers at the time of the expiration of their initial leases at higher rates than the per diems these containers were originally leased out. If container lease rates decline and we are unable to renew these leases at higher rates our financial results will be adversely impacted.

8

Gains and losses associated with the disposition or trading of used equipment may fluctuate and adversely affect our business, results of operations and financial condition.

We regularly sell used containers at the end of their useful lives in marine service or when we believe it maximizes the projected financial return, considering the location, sale price, cost of repair, possible repositioning expenses, earnings prospects and remaining useful life. The realized residual value of these containers affects our profitability. The volatility of the residual values of used containers may be significant. These values depend upon, among other factors, demand for used containers for secondary purposes, comparable new container costs, used container availability, condition and location of the containers, and market conditions. Most of these factors are outside of our control. Additionally, if shipping lines or our leasing company competitors determine to sell their used containers at a younger age than we believe to be the useful life of our equipment, our containers may be more difficult to sell or may sell for less than containers that were more recently manufactured.

Gains or losses on the disposition of used container equipment and the sales fees earned on the disposition of managed containers fluctuate and may be significant if we sell large quantities of used containers. In 2016, we incurred approximately $67 million of container impairments due to the fact that when we determined to dispose of containers their book value exceeded the fair market value. Low disposal prices and the high volume of containers being disposed of can cause an elevated level of container impairments to occur. Continued low disposal prices and/or disposal volumes could harm our business, results of operations and financial condition. See Item 5, “Operating and Financial Review and Prospects” for a discussion of our gains or losses on the disposition of used container equipment.

In addition to disposing of our fleet’s used containers at the end of their useful life, we opportunistically purchase used containers for resale from our shipping line customers and other sellers. Shipping lines either enter into trading deals with us at the time they are ready to dispose of older containers or enter into purchase leaseback transactions with us where they sell us older containers and then lease them back until the shipping line is ready to dispose of the containers. We face resale price risk with both transactions since by the time the container is provided to us from the shipping line the prevailing prices for older containers may have declined from the value we assumed at the time of purchase.

If the supply of trading equipment becomes limited because these sellers develop other means for disposing of their equipment or develop their own sales network, our equipment trading revenues and our profitability could be negatively impacted. If selling prices rapidly deteriorate and we are holding a large inventory that was purchased when prices for trading equipment were higher or if prices decline over the life of our purchase leaseback transactions, then our gross margins from trading and the sale of containers acquired through purchase leaseback transactions will decline or become negative. Low resale prices coupled with the higher prices paid for purchase leaseback transactions completed several years ago have caused some purchase leaseback transactions to be unprofitable.

Reductions in the prices of new containers would harm our business, results of operations and financial condition.

Lease rates for new containers are positively correlated to the price of new containers, which is positively correlated with the price of steel, a major component used in the manufacture of new containers. In the past five years, prices for new standard 20’ dry freight containers have moved in a wide range, with prices ranging between approximately $1,185 and $2,425 during this time. Our average new container cost per CEU increased 56% during 2017 compared to 2016. Container prices have substantially increased since late 2016, but if new container prices return to very low levels, the lease rates of older, off-lease containers will also decrease and the prices obtained for containers sold at the end of their useful lives will also decrease. Since the beginning of 2013 until the second half of 2016 we saw new container pricing and the sale prices of our containers sold at the end of their useful lives decline. Low new container prices cause low market lease rates and low resale values for containers, which have and may in the future adversely affect our business, results of operations and financial condition, even if low new container prices allow us to purchase new containers at a lower cost. Our future financial performance and profitability depends in part on the lease rates increasing for current leases that expire during the next three years as many of these leases were concluded with low initial lease rates. A reversal in the current recovery of new container prices and lease rates would increase the difficulty of raising lease rates on long term container leases that expire in the future.

9

Lessee defaults have and may continue to harm our business, results of operations and financial condition by decreasing revenue and increasing storage, repositioning, collection, insurance and recovery expenses.

Our containers are leased to numerous container lessees. Lessees are required to pay rent and to indemnify us for damage to or loss of containers. Lessees may default in paying rent and performing other obligations under their leases. A delay or diminution in amounts received under the leases (including leases on our managed containers), or a default in the performance of maintenance or other lessee obligations under the leases could adversely affect our business, results of operations and financial condition and our ability to make payments on our debt.

We experienced several lessee defaults in 2016, including the default of Hanjin discussed above, which severely negatively impacted our financial performance and we believe that there is the continued risk of lessee defaults in the future. During the last several years shipping lines have made a number of efforts to raise freight rates on the major trade lanes, however rate increases have generally not been sustainable for long periods of time. Excess vessel capacity due to new ship production, including the production of very large ships, and the re-activation of previously laid up vessels will continue to be a factor in the future, especially if older vessels are not scrapped. Major shipping lines are expected to be profitable overall for 2017, however reliable information about the financial position and resources of many shipping lines can be difficult to obtain. While containerized trade grew in 2017, it was not sufficient to fully utilize vessel capacity and major shipping lines both took delivery of, and resumed ordering, large vessels. Existing excess vessel capacity and continued new vessel deliveries, especially the delivery of very large vessels, are expected to continue to pressure freight rates for some time. As a result, we continue to face heightened risk that our financial performance and cash flow could be severely affected by defaults by our customers.

When lessees default, we may fail to recover all of our containers, and the containers that we do recover may be recovered in locations where we will not be able to quickly re-lease or sell them on commercially acceptable terms. In recovery actions we must locate the containers and often need to pay accrued storage and handling charges to depots and terminals, which may include debts incurred by the defaulting shipping line. We also may have to reposition these containers to other places where we can re-lease or sell them, which could be expensive, depending on the locations and distances involved. Following repositioning, we may need to repair the containers and pay container depots for storage until the containers are re-leased. These recovery, repair and repositioning costs generally are reflected in our financial statements under direct container expense. Accordingly, the amount of our bad debt expense may not capture the total adverse financial impact on us from a shipping line’s default. For our owned containers, these costs directly reduce our income and for our managed containers, lessee defaults decrease rental revenue and increase operating expenses, and thus reduce our management fee revenue. While we maintain insurance to cover some defaults, it is subject to large deductible amounts and significant exclusions and, therefore, may not be sufficient to prevent us from suffering material losses. In 2015 and 2016 we filed significant insurance claims for lessee defaults we experienced. As a result of these insurance claims, potential future insurance claims or changes in the perceived risk of providing default insurance, such insurance might not be available to us in the future on commercially reasonable terms or at all. In the renewals of our default insurance following the Hanjin bankruptcy, the policy premium was significantly increased and coverage was reduced. In any insurance claim our insurers may not agree with our determination that we have suffered an insured loss or our calculation of the amount of the insured loss. Any such future defaults could harm our business, results of operations and financial condition.

Historically we have recovered a very high percentage of the containers from defaulted lessees. However, in the last five years we encountered defaults from several smaller lessees and lessees in locations where recoveries did not track to our historical experience and significant losses were incurred. These losses were due to a number of containers being unrecoverable as the containers were not in the control of the lessee or the containers were detained by depots or terminals that demanded storage charges in excess of the value of the detained containers after accounting for repair and repositioning costs. If a material amount of future recoveries from defaulted lessees continue to deviate from our historical recovery experience, our financial performance and cash flow could be severely adversely affected.

10

Certain liens may arise on our containers.

Depot operators, manufacturers, repairmen, terminals, and transporters do come into possession of our containers from time to time and have amounts due to them from the lessees or sublessees of the containers. In the event of nonpayment of those charges by the lessees or sublessees, we may be delayed in, or entirely barred from, repossessing the containers, or be required to make payments or incur expenses to discharge such liens on our containers.

We derive a substantial portion of our lease billings from a limited number of container lessees, and the loss of, or reduction in business by, any of these container lessees could harm our business, results of operations and financial condition.

We have derived, and believe that we will continue to derive, a significant portion of lease billings and cash flow from a limited number of container lessees. Lease billings from our 20 largest container lessees represented $429.7 million or 80.0% of the total fleet billings during 2017, with lease billings from our single largest container lessee accounting for $80.2 million, or 15.1% of container lease billings during such fiscal year. Due to the ongoing consolidation in the shipping line industry, our 20 largest container lessees are becoming an increasing percentage of our total revenue, with correspondingly increased concentration of credit risk. Given the high concentration of our customer base, a default by any of our largest customers would result in a major reduction in leasing revenue, large repossession expenses, potentially large lost equipment charges and a material adverse impact on our performance and financial condition. Our experience with the Hanjin bankruptcy that commenced on August 31, 2016 is an example of the occurrence of these materially adverse events.

The introduction of very large container ships (18,000 TEU+) on the major trade lanes may lead to further industry consolidation and shipping line alliance participation, and even greater reliance by us on our largest customers, and negatively impact the performance of smaller and mid-size shipping lines. Several of the largest shipping lines have invested heavily in these very large ships and reportedly have achieved meaningful unit cost advantages and increased market shares on the major trade lanes. In response, some smaller shipping lines have started to exit the major trade lanes, while others are seeking to form closer operating partnerships.

Consolidation, shipping line alliances, and concentration in the container shipping industry could decrease the demand for leased containers.

We primarily lease containers to container shipping lines. The container shipping lines have historically relied on a large number of leased containers to satisfy their needs. The shipping industry has been consolidating for a number of years, and further consolidation is expected. In recent years two major German shipping lines have each acquired different South American shipping lines, a French shipping line acquired a Singaporean shipping line, two large Chinese shipping lines merged, a German shipping line merged with a Middle Eastern shipping line and a Danish shipping line acquired a German shipping line. Three major Japanese shipping lines will also complete their merger in April 2018. Additionally, Hanjin declared bankruptcy in August 2016, further reducing the number of large shipping lines. Historically, shipping lines have also formed a number of alliances to share vessel space and the creation of new alliances and changes in the membership of each alliance is ongoing. Consolidation of major container shipping lines and growth of alliances could create efficiencies and decrease the demand that container shipping lines have for leased containers because they may be able to fulfill a larger portion of their needs through their owned container fleets. Consolidation could also create concentration of credit risk if the number of our container lessees decreases. If shipping line alliances are effective at making shipping lines more efficient, this could reduce the demand for containers. The growth of alliances may add pressure to those shipping lines that do not join an alliance as they may find it more difficult to cost effectively serve shippers needs and/or shippers may choose to only ship cargo with alliances due to solvency concerns or otherwise. Additionally, large container shipping lines with significant resources could choose to manufacture or purchase their own containers, which would decrease their demand for leased containers and could harm our business, results of operations and financial condition.

11

Our indebtedness reduces our financial flexibility and could impede our ability to operate.

We have historically operated with, and anticipate continuing to operate with, a significant amount of debt. As of December 31, 2017, we had outstanding indebtedness of $3,014.4 million under our debt facilities. All of our outstanding indebtedness is secured debt collateralized by our container assets. There is no assurance that we will be able to refinance our outstanding indebtedness on terms that we can afford or at all. If we are unable to refinance our outstanding indebtedness, or if we are unable to increase the amount of our borrowing capacity, it could limit our ability to grow our business.

The amount of our indebtedness, and the terms of the related indebtedness (including interest rates and covenants), could have important consequences for us, including the following:

| • | require us to dedicate a substantial portion of our cash flows from operations to make payments on our debt, thereby reducing funds available for operations, investments, dividends, and future business opportunities and other purposes; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | reduce our ability to make acquisitions or expand our business; |

| • | make it more difficult for us to satisfy our current or future debt obligations; |

| • | any failure to comply with our debt obligations, including financial and other restrictive covenants, could result in an event of default under the agreements governing such indebtedness, which could lead to, among other things, an acceleration of our indebtedness or foreclosure on the assets securing our indebtedness and have a material adverse effect on our business or financial condition; |

| • | limit our ability to borrow additional funds or to sell assets to raise funds, if needed, for working capital, capital expenditures, acquisitions or other purposes; and |

| • | increase our vulnerability to general adverse economic and industry conditions, including changes in interest rates. |

We may not generate sufficient cash flow from operations to service and repay our debt and related obligations and have sufficient funds left over to achieve or sustain profitability in our operations, meet our working capital and capital expenditure needs and/or compete successfully in our industry. An uncured event of default in some or all of our debt facilities could cause some or all of our entities to be declared bankrupt or liquidated.

We will require a significant amount of cash to service and repay our outstanding indebtedness, fund future capital expenditures, and our ability to generate cash depends on many factors beyond our control.

Our ability to make payments on and repay our indebtedness and to fund planned capital expenditures will depend on our ability to generate cash in the future. Our business primarily generates cash from our container assets. Our lenders, rating agencies and the investors in our asset-backed debt securities look to the historical and anticipated performance of our container assets when deciding whether to lend to us and the terms for such lending. It is possible that:

| • | our business will not generate sufficient cash flow from operations to service and repay our debt and to fund working capital requirements and future capital expenditures; |

| • | future borrowings will not be available under our current or future credit facilities in an amount sufficient to enable us to refinance our debt; or |

| • | we will not be able to refinance any of our debt on commercially reasonable terms or at all due to declining historical or anticipated financial performance of our assets or for other reasons. |

12

The terms of our debt facilities impose, and the terms of any future indebtedness may impose, significant operating, financial and other restrictions on us and our subsidiaries.

Restrictions imposed by our secured debt facilities, revolving credit facilities, term loan and bonds may limit or prohibit, among other things, our ability to:

| • | incur additional indebtedness; |

| • | pay dividends on or redeem or repurchase our common shares; |

| • | enter into new lines of business; |

| • | issue capital stock of our subsidiaries; |

| • | make loans and certain types of investments; |

| • | incur liens; |

| • | sell certain assets or merge with or into other companies or acquire other companies; |

| • | enter into certain transactions with shareholders and affiliates; and |

| • | restrict dividends, distributions or other payments from our subsidiaries. |

We are also required to comply with certain financial ratio covenants. These restrictions could adversely affect our ability to finance our future operations or capital needs and pursue available business opportunities. A breach of any of these financial covenants and restrictions, due to weaker financial performance, reduced asset values or otherwise could result in a default in respect of the related indebtedness. If a default occurs, the relevant lenders could elect to declare the indebtedness, together with accrued interest and fees, to be immediately due and payable and proceed against any collateral securing that indebtedness, which will constitute substantially all of our container assets. As a result of the Hanjin bankruptcy, coupled with the lower container returns provided in recent years due to increased competition and lower realized used container prices, in 2016 and 2017 we experienced difficulty in meeting certain of the financial covenants on our lending facilities. We obtained various covenant amendments and waivers to address this situation and subsequently refinanced the majority of our debt with revised covenants. If needed in the future we may be unable to obtain covenant amendments and waivers from our lenders and some or all of our indebtedness could be in default. Additionally, covenant amendments and waivers may limit our ability to access additional funds for container investment and the cost and expense of covenant amendments, waivers and/or refinancing may limit our available funds for container investment.

If we are unable to enter into interest rate swaps, collars and caps on reasonable commercial terms or if a counterparty under our interest rate swap, collar and cap agreements defaults, our exposure associated with our variable rate debt could increase.