Form 6-K TAKEDA PHARMACEUTICAL For: Nov 01

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of November 2021

Commission File Number: 001-38757

TAKEDA PHARMACEUTICAL COMPANY LIMITED

(Translation of registrant’s name into English)

1-1, Nihonbashi-Honcho 2-Chome

Chuo-ku, Tokyo 103-8668

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Information furnished on this form:

EXHIBIT

Exhibit Number | ||||||||

| 1 | ||||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TAKEDA PHARMACEUTICAL COMPANY LIMITED | |||||||||||

| Date: November 1, 2021 | By: | /s/ Norimasa Takeda | |||||||||

Norimasa Takeda Chief Accounting Officer and Corporate Controller | |||||||||||

Corporate Governance Report

November 1, 2021

Takeda Pharmaceutical Company Limited

https://www.takeda.com

I.Basic Views on Corporate Governance and Basic Information on Capital Structure, Corporate Profile and Other Matters

1.Basic Views

The Company’s purpose is to provide “Better Health for People, Brighter Future for the World.” In line with this mission, the Company is pursuing a management framework appropriate for an R&D-driven biopharmaceutical company that operates on a global scale. We are strengthening internal controls, including thorough compliance and risk management, and establishing a structure that will allow agile decision-making that is also sound and transparent. Through these efforts, we will further improve our corporate governance, thereby maximizing corporate value.

[Reasons for Non-compliance with the Principles of the Corporate Governance Code] Update

The Company is in compliance with all of the principles of the Corporate Governance Code (effective as of June 11, 2021).

[Disclosure Based on the Principles of the Corporate Governance Code] Update

This report covers every principle that should be disclosed under the Corporate Governance Code, and addresses each principle according to its item number.

(1)Company objectives, business strategies, and business plans

a.Company objectives and business strategies…Principle 3.1 (i)

The Company’s Corporate Philosophy consisting of ‘purpose, values, vision and imperatives’ can be found on the "Corporate Philosophy" section of the Company’s website. For details on the Company’s business strategies, please look at the quarterly results and the presentation materials on the “Investor Relations” section.

Corporate Philosophy:

https://www.takeda.com/who-we-are/corporate-philosophy/

Investor Relations:

https://www.takeda.com/investors/

b.Business plans …Principle 3.1 (i)

Please refer to the quarterly results and the presentation materials on the ''Investor Relations'' page of the Company’s website (link above) for the latest information on the fiscal year 2021 Management Guidance (underlying revenue growth, underlying Core Operating Profit growth and margin, and Underlying Core EPS growth).

c.Basic views and guidelines on corporate governance… Principle 3.1 (ii)

Please refer to “Basic Views” in Part I section 1 of this report.

(2)Securing the Rights and Equal Treatment of Shareholders

d.General shareholders meeting

•The Company sends a notice of convocation of its Ordinary General Meeting of Shareholders three weeks prior to the day of the meeting and discloses it on its website so that the shareholders will have sufficient time to review the agenda of the meeting.

•The Company translates the full text of the notice of convocation into English and discloses it on its website. The Company utilizes an electronic platform for voting so that institutional and foreign investors can execute their voting rights easily.

e.Cross-Shareholdings…Principle 1.4

•The Company only holds a minimum number of shares of other companies with which it has business relationships. In relation to such shareholdings, the Company determines and assesses whether or not each shareholding contributes to the corporate value of the Company Group by considering the Company’s mid-to-long term business strategy, and comparing the benefits of such ownership (dividends, business transactions, expected returns from strategic alliance, etc.) with the Company's cost of capital. As a result of the review, the Company divests shares from shareholdings that are deemed to be of little significance after taking the financial strategy and market environment into consideration.

•The Company makes a decision on the exercise of its voting rights regarding its cross-shareholdings after comprehensively reviewing whether a relevant proposal makes a positive contribution to shareholder value as well as the value of the issuing companies. The Company will object to any proposals that are deemed detrimental to shareholder value or the corporate governance of the issuing companies.

f.Related Party Transactions…Principle 1.7

•The Company investigates the existence of related party transactions, such as transactions involving Directors and their close relatives, through various methods including seeking direct confirmation from Directors.

•The Company has procedures that comply with the provisions of the Companies Act on competitive and conflict-of-interest transactions by a Director. In addition, transactions involving the Director’s close family members and the Takeda Executive Team member (which consists of the President & CEO and the function heads of the Takeda Group who report directly to the President & CEO; the “TET”) and their close family members require the approval of the Board of Directors.

•Transactions such as investments in, and loans and guaranties provided to, subsidiaries/affiliated companies require the approval of the Business Review Committee or other decision-making bodies depending on the amount of the investment, loan, or guarantee.

•In addition to the above, the Company will investigate any unusual transaction between the Company and its affiliated companies and consider the accounting treatment and disclosure of such transaction in advance, confirm whether the value of the transaction is significant, and, where the amounts are significant, monitor the content and conditions of such transaction on a quarterly basis.

4

•As stipulated in the Financial Instruments and Exchange Act, the Company considers any shareholder who holds 10% or more of the voting rights of all shareholders (excluding those specified by the Cabinet Office Ordinance) as a “major shareholder.” Although the Company has no "major shareholders" at present, the Company will apply the above procedures to any “major shareholders” in the future.

(3)Appropriate Cooperation with Stakeholders other than Shareholders

•The Company takes into account the interests of various stakeholders including patients, healthcare professionals, employees, clients such as suppliers and vendors, creditors, local communities, and shareholders in order to improve long-term corporate value.

g.Ensuring diversity in the promotion of core human resources… Supplementary Principle 2.4.1

•The Company recognizes that the embedding of DE&I (Diversity, Equity & Inclusion) is one of the important growth strategies for a global R&D-driven biopharmaceutical company based on its values ‘putting patients at the center of everything’ which is defined in its corporate philosophy. The Company is also committed to inclusion of individual employee differences, exploring their potential, and fostering them. The same principles apply to our managers. In Japan, the ratio of female managers, non-Japanese managers, and mid-career managers is 16%, 3%, and 38%, respectively (as of July 1, 2021). We continue to strive for increasing diversity at managerial level in Japan. The company disclose other DE&I information on the following company website (Japanese site only).

https://www.takeda.com/ja-jp/recruitment/dei/

•Approximately 90% of Takeda group’s global workforce is based in countries and regions outside of Japan. In addition, the ratio of female managers in Takeda group is approximately 40%. For further information regarding DE&I, policies related to talent development, and the internal work environment to support our progress on DE&I, please refer to “Other" in Part III section 3 of this report and the Annual Integrated Report 2021 (page 42-54).

Annual Integrated Report 2021:

https://irp.cdn-website.com/a248f5d4/files/uploaded/takeda-2021-annual-integrated-report.pdf

(4)Ensuring Appropriate Information Disclosure and Transparency

•The Company makes timely and appropriate disclosures in a fair, detailed, and understandable manner to keep all shareholders informed in accordance with applicable laws, including the Companies Act, the Financial Instruments and Exchange Act and the U.S. Exchange Act, as well as the Financial Instruments Exchange rules in Japan and rules and regulations of the U.S. Securities and Exchange Commission ("SEC").

•The Company promptly discloses financial and non-financial information, including Environment, Social and Governance (ESG)-related information, beneficial to its stakeholders such as shareholders, in addition to information required to be disclosed by laws and regulations.

h.Initiatives on Sustainability… Supplementary Principle 3.1.3

•The Company defines purpose-led sustainability as focusing our core assets and capabilities as a biopharmaceutical company to solve key societal challenges in a way that respects different stakeholders’ needs and expectations to ensure the long-term performance of the Company.

•The Company recognizes that climate change may have far reaching implications for our business operations, supply chain, patients and society overall. To further our understanding and management of climate risks and opportunities that could impact our business, the Company conducted a climate scenario analysis in fiscal year 2020 of its direct business operations. This initial climate scenario analysis provided important insights into the identification, likelihood and magnitude of potential climate risks and opportunities that will be used to further inform our Company’s strategic business and financial planning. Based on this analysis, the Company plans to issue a report based on the Recommendations of the Task Force on Climate-related Financial Disclosures in fiscal year 2021.

•With regard to investment in human capital, the Company places priority on the adoption and development of top talent, and the creation of a corporate culture that fosters lifelong learning and a growth mindset, enabling employees to take on challenges without fear of failure in any way, as set forth in its Corporate Philosophy ‘People’ of ‘Imperatives and Priorities’.

•The Company proactively discloses its approach to sustainability and climate changes, investment in human capital in its Sustainability Report 2020, Annual Integrated Report 2021 and its ESG Appendix.

•Sustainability Report 2020: https://www.takeda.com/48f1a6/siteassets/system/corporate-responsibility/sustainable-value-report/takeda2020sustainabilityreport_en.pdf

•Annual Integrated Report 2021: https://irp.cdn-website.com/a248f5d4/files/uploaded/takeda-2021-annual-integrated-report.pdf

•2021 ESG appendix: https://irp.cdn-website.com/a248f5d4/files/uploaded/takeda_2021_esg_appendix.pdf

•Corporate Philosophy: https://www.takeda.com/who-we-are/corporate-philosophy/

•As for the investment in intellectual property, please refer to the Security Report and ‘Investor Relations’ section of the Company’s website that disclose the details such as the current status of its pipeline, establishment of a research platform for the future, strengthening of collaboration in research and development, major partners and the description of collaboration, and more.

•The Annual Securities Report for the 144th fiscal year:

https://www.takeda.com/49ea20/siteassets/system/investors/report/consolidated-financial-statements/asr_2021.pdf

•Investor Relations: https://www.takeda.com/investors/

5

(5)Responsibilities of the Board of Directors

i.Roles of the Board of Directors… Supplementary Principle 4.1.1

•The Board of Directors focuses on discussing and resolving strategy or particularly important matters such as the establishment of and amendments to the Company Group’s corporate philosophy, as well as important management policies and plans such as mid- to long-term strategies and corporate plans. In addition, the Board of Directors delegates the responsibilities for decision-making with respect to some of the important business decisions to management under the Company's Articles of Incorporation. The Board of Directors Charters specify the matters for resolution by the Board of Directors. In addition to the deliberation and resolution of matters, the Board of Directors is responsible for the supervision of the business executed by the Directors. The Company has disclosed Board of Directors Charter on the company website ‘Corporate governance’

Corporate Governance: https://www.takeda.com/who-we-are/corporate-governance/

•As to the aforementioned matters delegated to management, in particular, they are delegated to the Business Review Committee (which is responsible for corporate and business development matters), the Portfolio Review Committee (which is responsible for R&D and product-related matters), and the Risk, Ethics and Compliance Committee (which is responsible for risk management, business ethics and compliance matters). The Board of Directors supervises the management's execution of these matters through the reports of the aforementioned committees.

•Matters not requiring the approval of the aforementioned committees are delegated to the TET based on the Takeda Group’s Management Policy (T-MAP). The Company aims for agile and efficient decision-making across the group.

j.Composition of the Board…Supplementary Principle 4.11.1

•In order to strengthen supervisory functions and further deliver objectivity and transparency through the deliberations, Independent External Directors comprise a majority of the Board of Directors of the Company. The Company has 16 Directors (including four Directors who are Audit and Supervisory Committee Members), of which 12 are Independent External Directors (including four Independent External Directors who are Audit and Supervisory Committee Members) at the time of writing. The Board of Directors is chaired by an Independent External Director.

•The Company makes appropriate Director appointments, and constitutes the Board of Directors based on the following principles:

•Appoint individuals from inside and outside the Company, irrespective of nationality, gender, career or age, who can contribute to the balance of knowledge, experience, and capacity needed for the governance of the Company's global operations, by identifying the skills required for the Company’s business strategy. Please refer to the company website ‘Corporate governance’ : https://www.takeda.com/who-we-are/corporate-governance/

•The Board of Directors shall be of a size that allows effective and agile decision-making and appropriate supervision of management. The Company's Articles of Incorporation limit the maximum number of Directors who are not Audit and Supervisory Committee Members to 12 and Directors who are Audit and Supervisory Committee Members to four.

k.Policies and procedures nomination of candidates for Directors… Principle 3.1 (iv), (v)

•The Company nominates candidates for Directors considering, among other things, whether the candidate has appropriate experience and expertise to either complement or supplement the current capabilities in the Board of Directors, has the gravitas and reputation required for directorship of a large pharmaceutical company or high-level performance required of business managers, and has deep understanding of the Company’s corporate philosophy.

•The Board of Directors selects the candidates who will become members of the Board of Directors. The Nomination Committee (advisory committee to the Board of Directors), chaired by an External Director, with all members being External Directors, ensures the appropriateness of the candidate. Candidates for External Directors are elected based on the “Internal criteria for independence of External Directors” (Refer to “Independent Directors” in Part II section 1 of this report). Candidates for Directors who are Audit and Supervisory Committee Members are nominated by the Board of Directors, after obtaining the agreement of the Audit and Supervisory Committee.

•When giving consent to the selection of candidates for Directors who are Audit and Supervisory Committee Members and participating in the policy for the selection of candidates for Audit and Supervisory Committee Members, the Audit and Supervisory Committee carefully examines their eligibility as an Audit and Supervisory Committee Member, taking into consideration such factors as whether the candidates will be able to complete their term of office, will be independent from the managing directors, will be able to maintain a fair and impartial attitude, and will be able to make appropriate management evaluations based on their financial literacy, and others. When selecting candidates for External Directors who are Audit and Supervisory Committee Members, the Audit and Supervisory Committee considers their independence, taking into consideration their relationship with the Company, other directors and major employees etc. and the existence of any difficulties in performing their duties as Directors who are Audit and Supervisory Committee Members.

•Regarding the reappointment of Directors, the Company has internal rules that define the criteria for the non-reappointment of current Directors and if the criteria are met, the Board of Directors will determine that such Directors will not be reappointed as Directors after consultation with, and the recommendation of, the Nomination Committee. In addition, the Company will consider the dismissal of a Director if such Director has engaged in misconduct or if there is any reason that would make it difficult for such Director to perform his or her duties fully.

•The profiles and reasoning for the individual appointments of the nominated Director candidates are disclosed in the "Notice of Convocation of Ordinary General Meeting of Shareholders" and the Securities Report.

l.Remuneration of the Directors, etc. … Principle 3.1 (iii)

•Please refer to “Policies determining the amount of remuneration or the method for calculating remuneration” in Part II section 1 of this report.

6

m.Independent External Directors… Principle 4.9, Supplementary Principle 4.11.2

•The Company has established its “Internal criteria for independence of External Directors” to ensure such Directors are of a character that we believe is truly important for realizing the common interests of the shareholders.

•Please refer to "Internal Criteria for Independence of External Directors of the Company" under the title of “Independent Directors” in Part II section 1 of this report.

•The concurrent director positions of External Directors at other organizations are stated in the “Notice of Convocation of Ordinary General Meeting of Shareholders” and the Securities Report. In addition, the Company believes the concurrent holding of these positions does not prevent External Directors from allocating sufficient time and attention in their performance of the roles and duties of their offices.

n.Nomination Committee and Compensation Committee

•The Company has established the Nomination Committee and the Compensation Committee as an advisory committee to the Board of Directors. By consisting both Committees entirely of External Directors, the Company enhances their independence and objectivity. For more details, please refer to “Committee’s Name, Composition, and Attributes of the Chairperson” of Part II section 1 “[Directors]” of this report. The Company has disclosed Nomination and Compensation Committee Charters on the company website ‘Corporate governance’.

Corporate Governance: https://www.takeda.com/who-we-are/corporate-governance/

o.Director Training… Supplementary Principle 4.14.2

•The Company provides necessary information about the Company (Takeda-ism, governance, business strategies, etc.), industry trends and legal responsibilities (duty of care, duty of loyalty, etc.) to the Directors when they take office. Also, the Company continues to provide useful information and learning opportunities, etc. even after the Directors take office.

•With respect to External Directors, in addition to the above, the Company provides information about the Company and the pharmaceutical industry when they take office, and, even after that, the Company continually provides such information to them and also provides them with study sessions and site visits, as appropriate.

•The Company bears the expenses for all the foregoing training.

p.Analysis and Evaluation of Board Effectiveness… Supplementary Principle 4.11.3

•An evaluation of the performance and effectiveness of the Board of Directors is conducted once a year, in principle, by third party organizations in such a way that the individual opinions of the Directors are efficiently obtained. Each Director individually completes a questionnaire and/or is individually interviewed. Based on the results of the evaluation, the Board of Directors analyzes and evaluates their effectiveness and acts on any opportunities for improvement.

•In the fiscal year 2020, an evaluation of the performance and effectiveness of the Board of Directors was conducted by third party organizations through a questionnaire and the subsequent individual interviews of all the Directors. The questionnaire focused on the evaluation of subject items such as “Strategic Alignment & Engagement,” “Composition & Structure,” “Processes & Practices,” “Management Oversight,” “Board Culture and Dynamics,” as well as “Oversight by Audit and Supervisory Committee, Nomination Committee and Compensation Committee,” through which the Directors made self-evaluations about the effectiveness.

Following that, and after incorporating the analysis and recommendations made by the third party organizations, the review was explained by such third party organizations and discussed by all of the Directors. During the discussion, it was concluded that the Board of Directors was working effectively, confirming that (i) there was no important matter which was newly pointed out, and (ii) there exist effective leadership and good board dynamics.

In addition, the Board of Directors confirmed the necessary improvements, which focus on the important matters that were pointed out in fiscal year 2019 and remained as priorities in fiscal year 2020, such as “content of Board discussions and practice of Board meeting“, and formed a consensus on the necessity to continuously conduct further discussions on “robust strategic discussion” etc. though they confirmed the improvements thereon to some extent.

Following that, and after incorporating the analysis and recommendations made by the third party organizations, the review was explained by such third party organizations and discussed by all of the Directors. During the discussion, it was concluded that the Board of Directors was working effectively, confirming that (i) there was no important matter which was newly pointed out, and (ii) there exist effective leadership and good board dynamics.

In addition, the Board of Directors confirmed the necessary improvements, which focus on the important matters that were pointed out in fiscal year 2019 and remained as priorities in fiscal year 2020, such as “content of Board discussions and practice of Board meeting“, and formed a consensus on the necessity to continuously conduct further discussions on “robust strategic discussion” etc. though they confirmed the improvements thereon to some extent.

(6)Dialogue with Shareholders… Principle 5.1

•The Company is structured to continue a "purposeful dialogue" with its shareholders on topics including corporate governance, measures addressing environmental and social issues, corporate and financial strategy, research and development, capital policy, business performance, and business risk, each from a short-term and mid-to-long-term perspective. This dialogue is conducted with transparency, based on valid information, and in adherence to the Fair Disclosure Rules, to enable the Company to build strong relationships of trust with its shareholders, who share with the Company the common interest of realizing "sustainable growth of corporate value."

•The Chief Financial Officer (“CFO”) is responsible for the overall engagement with the shareholders, and the Global Head of Investor Relations (IR) in the Global Finance department is accountable for the operational IR activities. When planning and conducting meetings with shareholders, the Head of IR determines the meeting style and participants from management (which may include the President & CEO, the CFO, or other senior management members), taking into consideration the objectives and impact of the meeting, and the characteristics of each shareholder.

•The IR team promotes dialogue with the shareholders by collecting necessary information from various internal divisions such as finance, R&D, and commercial, and endeavors to find ways to deliver concise and effective communication to shareholders through close collaboration with these divisions.

•The Company continues to enhance the activities aiming to deepen the shareholders' understanding on topics including the Company's management policy, ESG matters, managerial and financial strategies, research and development, capital policy, financial performance, and risks. With respect to engagement with institutional investors and security analysts, in addition to one-on-one meetings, the Company holds quarterly earnings conferences and hosts multiple IR events that focus on topics of high shareholder interest. Information about these events is disclosed to individual investors through postings on the IR section of the corporate website, and the Company also holds company presentation meetings specifically for individual investors. A presentation video and a message from the President & CEO are also posted on the website to report on the Company’s management policy and financial performance.

•The senior management understand shareholders' interests and concerns, which are raised during the dialogue with the Company, and utilize them for business analysis, for business strategy planning, and for considering the optimal way of disclosing information.

•Based on feedback received from our shareholders, the Company started disclosing individual product revenues and cash flow forecasts from fiscal year 2019. The Company also started disclosing performance against KPIs and the individual compensation of Directors from fiscal year 2020.

7

•When communicating with shareholders, the Company appropriately manages insider information in compliance with internal rules and applicable regulatory requirements, and fairly and timely discloses that information. In advance of earnings announcements, the Company implements a "silent period," during which no communication with shareholders regarding earnings information is permitted.

(7)Company's measures with respect to the Corporate Pension Funds as the Managing Organization... Principle 2.6

•The Takeda Pharmaceutical Pension Association is administered by the designated or selected expert staff mainly from the areas of HR and Finance, who are knowledgeable about corporate pension and pension fund management. Insights and consulting services from external professionals are taken into consideration in the pension fund management policy, as securing long-term pension payment for employees is critically important. In addition, the pension fund investment is practically managed by external consigned institutions so that conflicts of interest which could arise between pension fund beneficiaries and companies are appropriately managed, since the Company should not be involved in directing pension fund investments or exercising voting rights. The Company is mindful of the potential impact to financial conditions, as well as of maximizing the benefits to the participants and beneficiaries of the Company’s corporate pension program, periodically monitoring the pension fund condition in the asset management committee, or flexibly changing the portfolio strategy.

•In operating the Corporate Pension Funds, the Company carefully considers the importance that the pension fund management plays in potentially impacting employees’ stable asset formation and the Company’s financial conditions. The Company continues to strengthen its systems to fulfil its responsibilities as the asset owner.

2.Capital Structure

Foreign Shareholding Ratio: More than 30% (as of end of September 2021)

[Status of Major Shareholders] Update

Name | Number of Shares Owned | Percentage (%) | ||||||

| The Master Trust Bank of Japan, Ltd. (Trust account) | 236,968,300 | 14.98 | ||||||

| Custody Bank of Japan, Ltd. (Trust account) | 83,754,900 | 5.29 | ||||||

| THE BANK OF NEW YORK MELLON AS DEPOSITARY BANK FOR DEPOSITARY RECEIPT HOLDERS | 73,028,313 | 4.62 | ||||||

| Nippon Life Insurance Company | 33,913,985 | 2.14 | ||||||

| State Street Bank West Client-Treaty 505234 | 27,513,002 | 1.74 | ||||||

| SMBC Nikko Securities Inc. | 25,655,700 | 1.62 | ||||||

| THE BANK OF NEW YORK MELLON 140042 | 19,716,001 | 1.25 | ||||||

| JP Morgan Chase Bank 385781 | 19,375,009 | 1.22 | ||||||

| Takeda Science Foundation | 17,911,856 | 1.13 | ||||||

| SSBTC CLIENT OMNIBUS ACCOUNT | 17,114,997 | 1.08 | ||||||

Controlling Shareholder (except for Parent Company): None

Parent Company: N/A

3.Corporate Attributes

| Listed Stock Market and Market Section | Tokyo 1st Section, Nagoya 1st Section, Sapporo Existing Market, Fukuoka Existing Market | ||||

| Fiscal Year-End | End of March | ||||

| Type of Business | Pharmaceuticals | ||||

| Number of Employees (consolidated) as of the End of the Previous Fiscal Year | More than 1,000 persons | ||||

| Sales (consolidated) as of the End of the Previous Fiscal Year | More than 1 trillion Yen | ||||

| Number of Consolidated Subsidiaries as of the End of the Previous Fiscal Year | More than 100 and less than 300 | ||||

4.Policy on Measures to Protect Minority Shareholders when Conducting Transactions with Controlling Shareholders

―

5.Other Special Circumstances which may have a Material Impact on Corporate Governance

―

8

II.Business Management Organization and Other Corporate Governance Systems regarding Decision-making, Execution of Business, and Oversight in Management

1. Organizational Composition and Operation

Organization Form: Company with Audit and Supervisory Committee

[Directors]

| Maximum Number of Directors Stipulated in the Articles of Incorporation | 16 persons | ||||

| Term of Office Stipulated in the Articles of Incorporation (Directors who are members of the Audit and Supervisory Committee) | 2 years | ||||

| Term of Office Stipulated in the Articles of Incorporation (Directors who are NOT members of the Audit and Supervisory Committee) | 1 year | ||||

Chair of the Board Meeting | Independent External Director | ||||

| Number of Directors | 16 persons | ||||

| Election of External Directors | Elected | ||||

Number of External Directors | 12 persons | ||||

Number of Independent Directors | 12 persons | ||||

External Directors’ Relationship with the Company (1)

| Name | Attribute | Relationship with the Company (*1) | ||||||||||||||||||||||||||||||||||||

| a | b | c | d | e | f | g | h | i | j | k | ||||||||||||||||||||||||||||

| Masahiro Sakane | Coming from another company | |||||||||||||||||||||||||||||||||||||

| Olivier Bohuon | Coming from another company | |||||||||||||||||||||||||||||||||||||

| Jean-Luc Butel | Coming from another company | |||||||||||||||||||||||||||||||||||||

| Ian Clark | Coming from another company | |||||||||||||||||||||||||||||||||||||

| Yoshiaki Fujimori | Coming from another company | |||||||||||||||||||||||||||||||||||||

| Steven Gillis | Coming from another company | |||||||||||||||||||||||||||||||||||||

| Shiro Kuniya | Attorney-at-law | X | ||||||||||||||||||||||||||||||||||||

| Toshiyuki Shiga | Coming from another company | |||||||||||||||||||||||||||||||||||||

| Koji Hatsukawa | Certified public accountant | |||||||||||||||||||||||||||||||||||||

| Emiko Higashi | Coming from another company | |||||||||||||||||||||||||||||||||||||

Masami Iijima | Coming from another company | |||||||||||||||||||||||||||||||||||||

| Michel Orsinger | Coming from another company | |||||||||||||||||||||||||||||||||||||

*1 Categories for “Relationship with the Company”:

a. Executive of the Company or its subsidiaries

b. Non-executive Director or executive of a parent company of the Company

c. Executive of a fellow subsidiary company of the Company

d. A party whose major client or supplier is the Company or an executive thereof

e. Major client or supplier of a listed company or an executive thereof

f. Consultant, accountant or legal professional who receives a large amount of monetary consideration or other property from the Company besides compensation as a Director/Auditor

g. Major shareholder of the Company (or an executive of the said major shareholder if the shareholder is a legal entity)

h. Executive of a client or supplier company of the Company (which does not correspond to any of d, e, or f) (the Director himself/herself only)

i. Executive of a company, for which the Company External Directors/Corporate Auditors are mutually appointed (the Director himself/herself only)

j. Executive of a company or organization that receives a donation from the Company (the Director himself/herself only)

k. Others

9

External Directors’ Relationship with the Company (2) Update

| Name | Designation as Independent Director | Supplementary Explanation of the Relationship | Reasons for Appointment (If designated as Independent Director, reasons for designation) | ||||||||

| Masahiro Sakane | N/A | The Company appointed Mr. Masahiro Sakane as an External Director in June 2014 based on its judgment that his deep insight and extensive experience as company top management would provide valuable contribution to the Company’s fair and appropriate decisions and sound company management. Since then, he proactively expresses his opinions at the Board of Directors meetings and with his above deep insight and extensive experience. He thereby facilitates the Board of Directors meetings and demonstrates leadership as chairperson since June 2017, and also led the discussion at the meetings by External Directors. He attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. Furthermore, as a chairperson of the Nomination Committee, he also contributes to maintain objectivity and transparency in the Director candidate selection process. His ownership of the Company’s shares is immaterial (as of June 2021), and there are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

| Olivier Bohuon | N/A | Having served as an External Director of Shire, Mr. Olivier Bohuon has sufficient expertise in Shire's portfolio and its related therapeutic areas. He also held various key positions in global healthcare companies in Europe and the U.S. and has deep insight in the management of global healthcare businesses based on such extensive experiences. Especially, he has remarkable expertise in the area of marketing in the overall healthcare business. The Company appointed Mr. Olivier Bohuon to be an External Director in January 2019 based on its judgment that his above expertise and experience would result in valuable contributions to the Company’s fair and appropriate decisions and sound company management. He attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. He also actively participates in the discussions at the Compensation Committee with his above extensive experience and expertise. He thereby contributes to maintain objectivity and transparency in the Company's compensation plan for Directors. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

10

| Jean-Luc Butel | N/A | The Company appointed Mr. Jean-Luc Butel as an External Director who is an Audit and Supervisory Committee Member in June 2016 based on its judgment that his extensive experience as top management of major western healthcare companies would result in valuable contributions to the Company’s fair and appropriate decisions and sound company management. In addition, he has been appointed as an External Director who is not an Audit and Supervisory Committee Member since June 2019. He proactively expresses his opinions at the Board of Directors meetings with his above deep insight and extensive experience. He attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. Furthermore, as a member of the Nomination Committee, he has also contributed to maintain objectivity and transparency in the Director candidate selection process. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

| Ian Clark | N/A | Having served as an External Director of Shire, Mr. Ian Clark has sufficient expertise in Shire's portfolio and related therapeutic areas. He also held various key positions in healthcare companies in Europe and the U.S. and has deep insight in the management of global healthcare businesses based on such extensive experience. Especially, he has remarkable expertise in marketing in the oncology area and operations of the science and technology division of a healthcare company. The Company appointed Mr. Ian Clark to be an External Director in January 2019 based on its judgment that his above expertise and experience would result in valuable contributions to the Company’s fair and appropriate decisions and sound company management. He attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. He also actively participates in the discussions at the Compensation Committee based on his above experience and expertise and thereby contributes to maintain objectivity and transparency in the Company's compensation plan for Directors. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

11

| Yoshiaki Fujimori | N/A | The Company appointed Mr. Yoshiaki Fujimori as an External Director in June 2016 based on its judgment that his extensive experience and knowledge as company top management of various global operating companies would result in valuable contributions to the Company’s fair and appropriate decisions and sound company management. Since then, he proactively expresses his opinions at the Board of Directors meetings with his above extensive experience and knowledge. He attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. He also actively participates in the discussions at the Compensation Committee and thereby contributes to maintain objectivity and transparency in the Company's compensation plan for Directors. His ownership of the Company’s shares is immaterial (as of June 2021), and there are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

| Steven Gillis | N/A | Having been served as an External Director of Shire, Mr. Steven Gillis has sufficient expertise in Shire's portfolio and related therapeutic areas. He also held various key positions in healthcare companies in Europe and the U.S. and has deep insight in the management of global healthcare businesses based on such extensive experience. Especially, he has remarkable expertise, with a Ph.D. in Biological Sciences, in the healthcare businesses area for immunological therapy. The Company appointed Mr. Steven Gills to be an External Director in January 2019 based on its judgment that his above extensive experience and expertise would result in valuable contributions to our fair and appropriate decisions and sound company management. He attended seven of the eight meetings of the Board of Directors in the fiscal year 2020. Furthermore, as a member of the Nomination Committee, he also contributed to maintain objectivity and transparency in the Director candidate selection process. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

12

| Shiro Kuniya | The Company receives legal advices as needed from other lawyers of Oh-Ebashi LPC & Partners, the law firm Shiro Kuniya belongs to, but the proportion of the annual transactions volume to the sales of the Company and of Oh-Ebashi LPC & Partners is less than 1% in both cases. In addition, there is no advisory contract between the Company and Oh-Ebashi LPC & Partners. | Mr. Shiro Kuniya has served as an External Corporate Auditor since June 2013. The Company appointed Mr. Shiro Kuniya as an External Director who is an Audit and Supervisory Committee Member (head of Audit and Supervisory Committee) in June 2016 based on its judgment that his strong leadership, extensive experience and expertise in corporate and international legal practice as a lawyer would provide valuable contributions to the Company’s fair and appropriate decisions and sound company management. He has also been appointed as an External Director who is not an Audit and Supervisory Committee Member since June 2019 and has proactively expressed his opinions at the Board of Directors meetings with his above wide-ranging experience and expertise. He attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. His ownership of the Company’s shares is immaterial (as of June 2021), and there are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

| Toshiyuki Shiga | N/A | The Company appointed Mr. Toshiyuki Shiga as an External Director in June 2016 based on its judgment that his extensive experience and knowledge as company top management as well as his expertise in Japan’s general industries would provide valuable contributions to the Company’s fair and appropriate decisions and sound company management. Since then, he proactively expresses his opinions at the Board of Directors meetings with his above extensive experience and knowledge. He attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. As a member of the Nomination Committee, he also contributes to maintain objectivity and transparency in the Director candidate selection process. His ownership of the Company’s shares is immaterial (as of June 2021), and there are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

13

| Koji Hatsukawa | N/A | Mr. Koji Hatsukawa has wide-ranging experience and expertise in the corporate finance and accounting practice as a certified public accountant. The Company appointed Mr. Koji Hatsukawa as an External Director who is an Audit and Supervisory Committee Member in June 2016 based on its judgment that his above extensive experience and expertise as a certified public accountant would provide valuable contributions to the Company’s fair and appropriate decisions and sound company management. He then became the head of the Audit and Supervisory Committee in June 2019 and has contributed to realize the mission of the Audit and Supervisory Committee: to ensure the sound and continuous growth of the Company, to create mid-and long-term corporate value, and to establish a good corporate governance system that accommodates society’s trust. He attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. His ownership of the Company’s shares is immaterial (as of June 2021), and there are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

| Emiko Higashi | N/A | The Company appointed Ms. Emiko Higashi as an External Director who is not an Audit and Supervisory Committee Member in June 2016 based on its judgment that her experience and wide expertise on healthcare, technology and financial industries as a top executive of various global operating companies would provide valuable contributions to the Company’s fair and appropriate decisions and sound company management. Since then, she proactively expresses her opinions at the Board of Directors meetings with her above extensive experience and expertise. She attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. As a chairperson of the Compensation Committee, she also actively led discussions at the Committee by expressing opinions based on her above experience and expertise and thereby contributed to maintain objectivity and transparency in the Company's compensation plan for Directors. Furthermore, she has served as an External Director who is an Audit and Supervisory Committee Member since June 2019 and has contributed to realize the above mission of the Audit and Supervisory Committee. There are no personnel, capital, business or other special relationships between her and the Company. The Company deemed that she is highly independent and designated her as an Independent Director of the Company because she has no conflict risk with the interests of the Company’s general shareholders in executing her duties as an External Director. | |||||||||

14

Masami Iijima | N/A | The Company appointed Mr. Masami Iijima as an External Director who is an Audit and Supervisory Committee Member in June 2021 based on its judgment that his strong leadership and extensive company management experience as top management of a global operating company would contribute to the sound business management and management governance towards sustainable development and increase the corporate value. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

| Michel Orsinger | N/A | The Company appointed Mr. Michel Orsinger as an External Director who is not an Audit and Supervisory Committee Member in June 2016 based on its judgment that his extensive experience and knowledge as top management of major western healthcare companies would contribute to the Company’s fair and appropriate decisions and sound company management. Since then, he proactively expresses his opinions at the Board of Directors meetings with his above extensive experience and knowledge. He attended eight of the eight meetings of the Board of Directors in the fiscal year 2020. As a member of the Nomination Committee, he has also contributed to maintain objectivity and transparency in the Director candidate selection process. Furthermore, he has served as an External Director who is an Audit and Supervisory Committee Member since June 2019 and has contributed to realize the above mission of the Audit and Supervisory Committee. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. | |||||||||

Voluntary Establishment of Committee(s) Corresponding to the Nomination Committee or Remuneration Committee: Established

Committee’s Name, Composition, and Attributes of the Chairperson

Nomination Committee

| Name | Nomination Committee | ||||

| Number | 5 | ||||

| Chairperson | External Director | ||||

| Member | 4 External Directors | ||||

Compensation Committee

| Name | Compensation Committee | ||||

| Number | 4 | ||||

| Chairperson | External Director | ||||

| Member | 3 External Directors | ||||

15

Supplementary Explanation

The Nomination Committee and the Compensation Committee were established as advisory bodies to the Board of Directors. The committees serve to ensure transparency and objectivity in decision-making processes and results relating to personnel matters of the Directors (appropriateness of criteria and procedures for the appointment and reappointment, and succession planning and management), as well as results relating to the compensation system (appropriateness of the levels of compensation of the Directors, performance targets within the Director bonus system and bonuses based on business results). The company delegated to the Compensation Committee, by resolution of the Board of Directors, the authority to directly make decisions on Directors who are not Audit & Supervisory Committee Members (excluding External Directors) individual compensations in order to realize the transparency in the process.

The majority of the committee members must be External Members (External Directors or external experts). Furthermore, at least one Director who is an Audit and Supervisory Committee member must be assigned to each committee and each committee must be chaired by an External Director.

In the fiscal year 2020, the Compensation Committee and the Nomination Committee held eight meetings and three meetings, respectively. The attendance rates in both committees was 100%. The Compensation Committee reviewed and discussed the goals and results of performance-linked compensation, the alignment of the compensation policy to the achievement of the Company's medium- and long-term plans and to the business environment, the amount of compensation for directors, the appropriate Corporate KPIs for STI (Short Term Incentive) and Performance Share Units (PSUs) plans, the public disclosure of compensation, etc., and the committee further provided guidance to the Board of Directors. The Nomination Committee discussed director candidates and director succession plans, and the committee further provided guidance to the Board of Directors.

Each committee consists entirely of External Directors as follows (as of 29th June, 2021):

•Nomination Committee: Masahiro Sakane (Chairperson), Jean-Luc Butel, Steven Gillis, Toshiyuki Shiga, and Michel Orsinger (Christophe Weber attends as an observer.)

•Compensation Committee: Emiko Higashi (Chairperson), Olivier Bohuon, Ian Clark, and Yoshiaki Fujimori

[Audit and Supervisory Committee]

Committee's Composition and Attributes of the Chairperson

| All Committee Members | Full-time Members | Internal Directors | External Directors | Chairperson | |||||||||||||

Audit and Supervisory Committee | 4 | 0 | 0 | 4 | External Director | ||||||||||||

| Appointment of Directors and/or Staff to Support the Audit and Supervisory Committee | Appointed | ||||

Matters Relating to the Independence of Such Directors and/or Staff from the Executive Directors

The Audit and Supervisory Committee has its own secretariat to support its operations and a sufficient number of staff devoted to the Audit and Supervisory Committee. The appointment and any personnel change in the members of the Audit and Supervisory Committee Office is handled with the agreement of the Audit and Supervisory Committee.

Cooperation among the Audit and Supervisory Committee, Accounting Auditors and Internal Audit Departments

(Cooperation between the Audit and Supervisory Committee and Accounting Auditors)

The Audit and Supervisory Committee receives reports on audit plans, the audit structure/system and audit results for each business year from the Accounting Auditors directly. In addition, the Audit and Supervisory Committee and Accounting Auditors closely cooperate with each other by exchanging information and opinions, as necessary.

(Cooperation between the Audit and Supervisory Committee and Internal Audit Division)

Based on the status of the development and operation of the internal control system, the Audit and Supervisory Committee works in close cooperation with the Internal Audit Division to which the Audit and Supervisory Committee has the authority to give instructions to, and conducts a systematic audit utilizing the information derived therefrom.

(Relationship between the Audit and Supervisory Committee and Internal Control Promoting Department)

The Audit and Supervisory Committee closely cooperates with the divisions responsible for the internal control function, such as the Global Ethics and Compliance, Global Finance, etc. and utilizes the information received from these divisions to enable the Audit and Supervisory Committee to conduct effective audit and supervision.

[Independent Directors]

Number of Independent Directors | 12 persons | ||||

Independent Directors

The Company has set the "Internal Criteria for Independence of External Directors" as follows, and elected all External Directors who meet these criteria as Independent Directors:

16

<Internal Criteria for Independence of External Directors of the Company>

The Company will judge whether an External Director has sufficient independence against the Company with the emphasis on his/her meeting the following quality requirements, on the premise that he/she meets the criteria for independence established by the financial instruments exchanges.

The Company believes that such persons will truly meet the shareholders' expectations as the External Directors of the Company, i.e., the persons who can exert strong presence among the diversified members of the Directors and of the Company by proactively continuing to inquire the nature of, to encourage improvement in and to make suggestions regarding the important matters of the Company doing pharmaceutical business globally, for the purpose of facilitating impartial and fair judgment on the Company's business and securing sound management of the Company. The Company requires such persons to meet two or more of the following four quality requirements to be an External Director:

(1)He/She has advanced insights based on the experience of corporate management;

(2)He/She has a high level of knowledge in the area requiring high expertise such as accounting and law;

(3)He/She is well versed in the pharmaceutical and/or global business; and

(4)He/She has advanced linguistic skill and/or broad experience which enable him/her to understand diverse values and to actively participate in discussion with others.

[Incentives]

| Incentive Policies for Directors | Adoption of a performance-based remuneration system | ||||

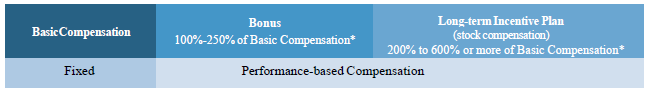

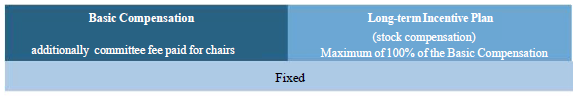

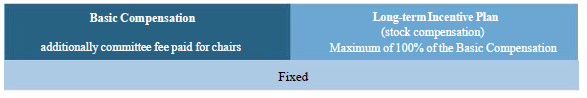

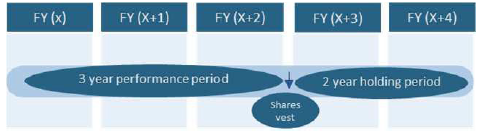

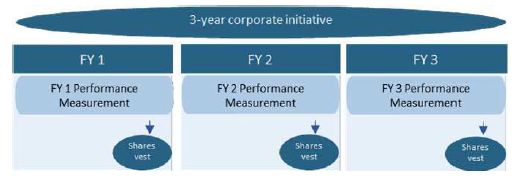

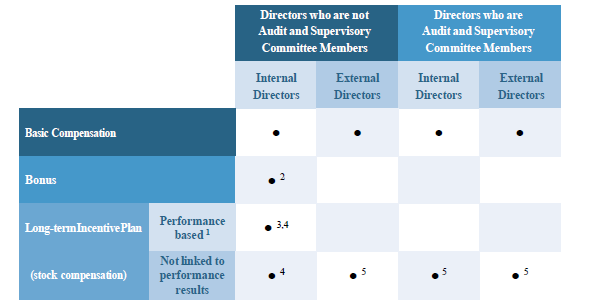

The Company introduced a short-term incentive (bonus) linked to consolidated company performance of each fiscal year and a long-term incentive plan (stock compensation) linked to three-year consolidated company performance and share price as performance-based compensation for Directors who are not Audit& Supervisory Committee Members (excluding External Directors).

Please refer to "Directors' Compensation Policy" attached at the end of this report.

[Director Remuneration]

| Disclosure of Individual Directors’ Remuneration | All disclosed individually | ||||

Means of Disclosure: Annual Securities Report of the 144th fiscal year

As for the total amount of Directors’ remuneration, the total amount of remuneration by type (cost postings relating to base salary, performance-based compensation (bonus and performance shares), and non-monetary remuneration (restricted stock)), and the amount of remuneration for each Director for the fiscal year 2020, please refer to the following report:

–The Annual Securities Report for the 144th fiscal year (page 103 to 109)

https://www.takeda.com/49ea20/siteassets/system/investors/report/consolidated-financial-statements/asr_2021.pdf

| Policies determining the amount of remuneration or the method for calculating the remuneration | Existing | ||||

Details of policies disclosed determining the amount of remuneration or the method for calculating remuneration

The Company established the "Directors’ Compensation Policy (attached at the end of the report)", which sets forth the following policies and the decision-making process and Directors' compensation level and mix are determined based on this policy.

–Policies regarding calculation formula and determination of individual remuneration for Directors

–Policies regarding Key Performance Indicators (KPI) for performance-based compensation (bonus and performance shares) and the determination of the calculation formula for such remuneration

–Policies regarding the calculation formula and the determination of non-monetary remuneration (restricted stock)

–Policies regarding the determination of remuneration mix for individual Directors

–Policies regarding the determination of conditions for payment of remuneration

–Means of the determination regarding individual remuneration for Directors

Please refer to the relevant page of the Annual Securities Report for the 144th fiscal year for more details.

The Company has also implemented an executive compensation recoupment policy (“clawback policy”). Please refer to the "Directors' Compensation Policy" to confirm the contents thereof.

[Supporting System for External Directors]

The Company provides, in a timely manner, relevant information about important management-related matters to External Directors to help them make informed decisions. Explanations of the summary of topics to be discussed at board meetings are also provided in advance. The CEO Office is responsible for the coordination with External Directors who are not Audit and Supervisory Committee Members. Information needed for activities, such as auditing in the Audit and Supervisory Committee, are shared with External Directors who are Audit and Supervisory Committee Members. To support the operation and serve as secretariat for the Audit and Supervisory Committee, the Audit and Supervisory Committee Office with dedicated staff was established.

17

[Status of persons who have retired from positions, such as Representative Director and President]

Name and details of Corporate Counselors, Advisors, etc., who formerly served in posts such as Representative Director and President, etc. of the Company

| Name | Title/ Position | Duties | Work Form/ Conditions (Full-time/ Part-time, Remunerated or not etc.) | Date of retirement as President, etc. | Term | ||||||||||||

| - | - | - | - | - | - | ||||||||||||

| Total Number of Corporate Counselors, Advisors, etc., who formerly served in posts such as Representative Director and President, etc. of the Company | 0 persons | ||||

Other Matters

•The Company abolished the advisor system in July 2017 and corporate counselor system in March 2021, respectively.

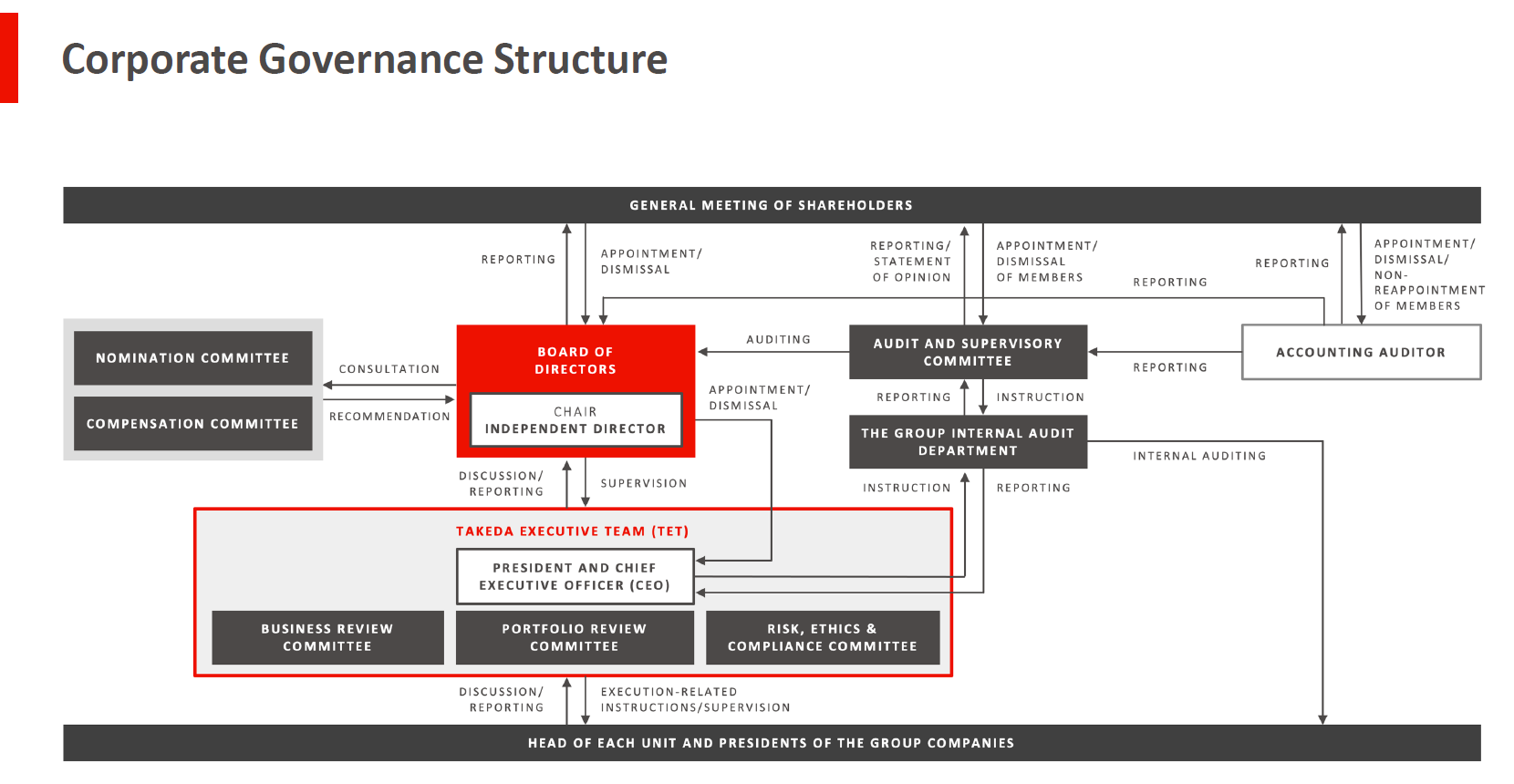

2. Matters on Functions of Business Execution, Auditing, Oversight, Nomination and Remuneration Decisions (Overview of Current Corporate Governance System) Update

At the Company, the Board of Directors determines the fundamental policies for the group, and the TET executes the management and business operations in accordance with such decisions. The external director of the Board are all qualified individually and with a diverse and relevant experience as a group. The Audit and Supervisory Committee is an independent committee which mission to monitor and verify a performance of duties by directors, and contributes proper governance and decision-making of the Board. Moreover, in order to respond to management tasks that continue to diversify, the Company has established the TET, and has also established the Business Review Committee (which is responsible for corporate and business development matters), the Portfolio Review Committee (which is responsible for R&D and products related matters), and the Risk, Ethics & Compliance Committee (which is responsible for risk management, business ethics and compliance matters), which review important matters to ensure the agility and flexibility of business execution and deeper cooperation among the various functions. Matters not requiring the approval of the aforementioned committees are delegated to the TET based on the Takeda Group’s Management Policy (T-MAP). The Company aims for agile and efficient decision-making across the group.

Board of Directors

The Company has given its Board of Directors the primary functions of observing and overseeing business execution as well as decision-making for strategic or particularly important matters regarding company management. The Board of Directors consists of 16 Directors (including one female), including 12 External Directors, eight Japanese and eight non-Japanese, and meets in principle eight times per year to make resolutions and receive reports on important matters regarding management. Eight Board of Directors meetings were held in fiscal year 2020 and all Internal Directors who took office at the end of fiscal year 2020 attended all meetings. (please refer to the Table “External Directors’ Relationship with the Company (2)” in [Directors], Part II, section 1 of this report about the attendance of External Directors.) The Board of Directors is chaired by an Independent External Director to increase the independence of the Board of Directors. To ensure the validity and transparency of the decision-making process for the election of Director candidates and compensation of Directors, the Company established a Nomination Committee and a Compensation Committee, all the members of which are External Directors and both of which are chaired by External Directors, as advisory committees to the Board of Directors.

Audit by the Audit and Supervisory Committee

The Audit and Supervisory Committee ensures its independence and effectiveness in line with the “Audit and Supervisory Committee Charter” and Internal Guidelines on Audit and Supervision of Audit and Supervisory Committee. The Committee conducts audits of the Directors’ performance of duties and performs any other duties stipulated under laws and regulations and the Articles of Incorporation.

From June 2021, the Audit and Supervisory Committee has consisted only of External Directors to further enhance the independence of the Committee.

The Company has disclosed Audit and Supervisory Committee Charter on the company website ‘Corporate governance’

Corporate Governance: https://www.takeda.com/who-we-are/corporate-governance/

Internal Audit

The Group Internal Audit department, comprising 55 members, the Corporate Environment, Health and Safety (EHS) department in the Global Manufacturing & Supply division, and Global Quality conduct regular internal audits of their areas of focus for the Company’s organization using their respective guiding documents, the “Group Internal Audit Charter”, the "Global EHS Policy." and the "Global Quality Policy."

Takeda Executive Team (TET)

The TET consists of the President & CEO and function heads of the Takeda Group who report directly to the President & CEO. Please refer to the Corporate website’s Executive Leadership page.

Takeda Executive Team:

https://www.takeda.com/who-we-are/company-information/executive-leadership/

Business Review Committee

The Business Review Committee consists of TET members. In principle, it holds a meeting twice a month to discuss and make decisions on important execution matters relating to corporate and business development.

18

Portfolio Review Committee

The Portfolio Review Committee consists of TET members and the heads of the R&D core functions. In principle, it holds a meeting two to three times a month. The Portfolio Review Committee is responsible for ensuring that the Company’s portfolio is optimized to achieve the organization’s strategic objectives, and determines the composition of the portfolio by reviewing and approving R&D investments in portfolio assets. In addition to determining which assets and projects will be funded, the Portfolio Review Committee defines how investments will be resourced.

Risk, Ethics & Compliance Committee

The Risk, Ethics & Compliance Committee consists of TET members. In principle, it holds a meeting once every quarter to discuss and make decisions on important matters concerning risk management, business ethics and compliance matters, and the risk mitigation measures.

Accounting Audit

KPMG AZSA LLC was appointed as the Accounting Auditor of the Company at the Company’s general shareholders meeting, consecutive auditing period of 14 years. The Company’s accounting was audited by the following three certified public accountants from KPMG AZSA LLC: Mr. Masahiro Mekada (consecutive auditing period: two years), Mr. Kotetsu Nonaka (consecutive auditing period: three years) and Mr. Hiroaki Namba (consecutive auditing period: one year). These three certified public accountants were supported by 28 other certified public accountants and 70 other individuals.

The Audit and Supervisory Committee makes the decision on the reappointment or non-reappointment of the Accounting Auditor after assessing the audit quality, quality control and independence of the Accounting Auditor.

Liability Limitation Agreement

The Company has executed agreements with Non-Executive Directors stating that the maximum amount of their liabilities for damages as set forth in Article 423, Paragraph 1 of the Companies Act shall be the amount provided by law.

3. Reasons for the Adoption of the Current Corporate Governance System

The Company became a Company with Audit and Supervisory Committee based on the resolution at the Ordinary General Meeting of Shareholders held on June 29, 2016. We are aiming for the increased transparency and independence of the Board of Directors, and further enhancement of the corporate governance, by establishing systems of audit and supervision conducted by the Audit and Supervisory Committee and increasing the proportion of the number of External Directors and the diversity of the Board of Directors. The governance structure also enables us to enhance the separation of business execution and supervision by delegating decision-making authority to the Directors, which allows further agility in decision-making and helps the Board of Directors focus more on discussions of business strategies and, particularly, important business matters.

III.Implementation of Measures for Shareholders and Other Stakeholders

1.Measures to Vitalize the General Shareholders Meetings and Ensure the Smooth Exercise of Voting Rights Update

| Early Notification of General Shareholders Meeting | The notice is dispatched 3 weeks prior to the day of the meeting, in principle. In addition, the Company strives to release the notice earlier than the dispatch on the Company website and other websites, including in the website of the administrator of the shareholder’s register, Mitsubishi UFJ Trust and Banking Corporation. | ||||

| Scheduling Annual General Shareholders Meetings and Avoiding Peak Days | The Company tries to avoid holding its Ordinary General Meeting of Shareholders on a date that is chosen by many Japanese companies. Nevertheless, the meeting date is eventually decided based on the availability of the venue as well as the administrative schedule. | ||||

| Allowing Electronic Exercise of Voting Rights | The Company’s shareholders have been able to exercise their voting rights by electronic means since the Ordinary General Meeting of Shareholders held in June 2007. | ||||

| Participation in the Electronic Voting Platform | The Company has been utilizing the electronic voting platform operated by Investors Communications Japan, Inc. (ICJ) since the Ordinary General Meeting of Shareholders held in June 2007. | ||||

19

| Providing Convocation Notice in English | To encourage shareholders to vote, the Company publishes the Japanese and English versions of the notice of convocation on its website and other websites, including in the website of the administrator of the shareholder’s register, Mitsubishi UFJ Trust and Banking Corporation. | ||||

| Other | The Company organizes the Ordinary General Meeting of Shareholders using presentation materials displayed in a format that is easy for shareholders to understand, including the use of slide and video presentations by the President & CEO to explain performance and business policies. Also, the Company has held the hybrid participation-type virtual General Meeting of Shareholders since 2020. In addition. the Company has the provisions in the Articles of Incorporation that a General Meeting of Shareholders may be held without specifying a venue when the Board of Directors decides that, considering the interests of shareholders, it is not appropriate to hold the General Meeting of Shareholders with a specified venue in situations such as the spread of an infectious disease or the occurrence of a natural disaster. The Company has disclosed Article of Incorporation and Company Share Policy on the company website ‘Corporate governance’ Corporate Governance: https://www.takeda.com/who-we-are/corporate-governance/ | ||||

2.IR Activities

| Supplementary Explanation | Presentation made by senior management | |||||||

| Preparation and Publication of Disclosure Policy | The disclosure of year-end and quarterly financial results requires the approval of the Board of Directors, and the other disclosure materials require the approval of the Business Review Committee. The approval authority for certain disclosures is delegated by the Business Review Committee to the CFO and the Chief Global Corporate Affairs Officer (“CGCAO”). The Disclosure Committee comprehensively reviews the requirements for timely disclosures to the Tokyo Stock Exchange and SEC, and reports and proposes its conclusions to the CFO and the CGCAO. The “Standard Operating Procedure for Timely Disclosure and Disclosure Committee Review” was established as a rule for the Disclosure Committee. Furthermore, the Company established an “External Engagement Guideline” as a guideline for external engagement, and a "Global Press Release and Statement Standard Operating Procedure" that specifies the functions within the Company with responsibility for press releases and statement disclosures, and the relevant communication channels and procedures, respectively. | |||||||

| Regular Investor Briefings for Individual Investors | During fiscal year 2020, the Company department responsible for IR organized company presentations aimed at retail investors. Such presentation was held once in Japan with the support from securities companies and the securities exchange. | No | ||||||

| Regular Investor Briefings for Analysts and Institutional Investors | In principle, the Company holds earnings release conferences (conference calls and video meetings) on the same days as each quarterly results announcement. These events include financial results and Q&A session in which participants can address questions directly to senior management. Additionally, the Company held IR events in June, September and December of 2020 and February, March, April, and June of 2021, which focused on explaining topics including the Company’s products, its pipeline, and its businesses in growth and emerging markets. Conference calls for earnings announcements and IR events are held in Japanese and English so that both Japan domestic and overseas investors are able to join. The Company posts on-demand webcasts to its website for those investors who are unable to join live and wish to learn the contents of the events. | Yes | ||||||

20

| Regular Investor Briefings for Overseas Investors | All earnings release conferences (conference calls and video meetings) and IR events are held in Japanese and English to provide information to both Japan domestic and overseas investors simultaneously. For overseas investors, the Company also holds additional conference calls in consideration of time zone differences. | Yes | ||||||

| Posting of IR Materials on the Website | URL:1TUhttps://www.takeda.com/1T Materials available on the website: Quarterly financial statements, Databook, presentation materials used in earnings release conferences, sustainability reports, annual integrated reports, notices of convocation of Ordinary General Meetings of shareholders, IR conference materials, notices of resolutions, video messages from senior management, and others. | |||||||

| Establishment of Department and/or Manager in Charge of IR | Department responsible for IR: Global Finance, IR | |||||||

3.Measures to Ensure Due Respect for Stakeholders

| Supplemental Explanation | |||||

| Stipulation of Internal Rules for Respecting the Position of Stakeholders | The Company’s purpose is to provide “Better Health for People, Brighter Future for the World.” This expresses the Company’s commitment to make a positive contribution to patients and healthcare professionals through our core business pharmaceuticals. Our Values, Takeda-ism, incorporates our Values of Integrity, Honesty, Fairness and Perseverance. The Company has established four priorities, ‘Patient (putting the patient first) -Trust (building trust with society) – Reputation (reinforcing our reputation) and Business (developing a sustainable business).’ as its action guideline, and implements its Values by following such action guidelines. Together, they represent who we are and how we act, helping us make decisions we can be proud of today, and in the future. They clearly indicate the Company’s emphasis on the importance of addressing the needs of a variety of its stakeholders, including patients. In addition, the Company implements measures to instill its Values internally, such as the “Value Ambassadors Program”, an initiative to encourage employees to instill and continuously practice the Values, and the “Global Induction Forum” (hosted by the President and CEO) aimed at cultivating the understanding of the Company including its Values and a sense of responsibility among senior leaders who have joined the Company from other companies. Moreover, the Takeda Global Code of Conduct provides ethical guidelines for employees to respect the perspectives of stakeholders. | ||||

21