Form 6-K RIO TINTO LTD For: Mar 08 Filed by: RIO TINTO PLC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

March 8, 2021

| Commission file number: 001-10533 | Commission file number: 001-34121 | ||||

| Rio Tinto plc | Rio Tinto Limited | ||||

| ABN 96 004 458 404 | |||||

| (Translation of registrant’s name into English) | (Translation of registrant’s name into English) | ||||

| 6 St. James’s Square | Level 7, 360 Collins Street | ||||

| London, SW1Y 4AD, United Kingdom | Melbourne, Victoria 3000, Australia | ||||

| (Address of principal executive offices) | (Address of principal executive offices) | ||||

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to

Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If "Yes" is marked, indicate below the file number assigned to the registrant in connection

with Rule 12g3-2(b): 82- ________

EXHIBIT 99

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorised.

| Rio Tinto plc | Rio Tinto Limited | ||||||||||

| (Registrant) | (Registrant) | ||||||||||

| By | /s/ Steve Allen | By | /s/ Steve Allen | ||||||||

| Name | Steve Allen | Name | Steve Allen | ||||||||

| Title | Company Secretary | Title | Joint Company Secretary | ||||||||

| Date | 8 March 2021 | Date | 8 March 2021 | ||||||||

Notice to ASX/LSE Page 1 of 2 Notices of 2021 annual general meetings 8 March 2021 Rio Tinto will today issue notices for the 2021 annual general meetings of Rio Tinto plc and Rio Tinto Limited. The notices will be available at www.riotinto.com/invest/shareholder-information/annual-general-meetings. Rio Tinto Limited’s notice of meeting will also be released to the ASX. Rio Tinto plc will hold its 2021 annual general meeting in London on 9 April 2021. Due to the UK government restrictions on public gatherings to contain the COVID-19 pandemic, and mindful of public health concerns, shareholders will not be permitted to attend the annual general meeting in person. Shareholders can instead participate in the annual general meeting virtually via a live webcast, and will be able to vote and ask questions. Details on how to attend the Rio Tinto plc annual general meeting virtually are set out in the notice of meeting. Rio Tinto Limited will hold its 2021 annual general meeting in Perth, Australia on 6 May 2021. Shareholders who are unable to attend in person can participate in the meeting via a live webcast, and will be able to vote and ask questions. Details on how to participate online in the Rio Tinto Limited annual general meeting are set out in the notice of meeting. If it becomes necessary or appropriate as a result of the evolving COVID-19 situation in Australia to make any changes to the proposed meeting arrangements, shareholders will be given as much notice as possible. Information relating to alternate arrangements will be communicated to shareholders by way of announcement to ASX and published at www.riotinto.com/invest/shareholder-information/annual-general- meetings. Exhibit 99.1

Page 2 of 2 Contacts [email protected] riotinto.com Follow @RioTinto on Twitter Media Relations, United Kingdom Illtud Harri M +44 7920 503 600 David Outhwaite T +44 20 7781 1623 M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Media Relations, Asia Grant Donald T +65 6679 9290 M +65 9722 6028 Media Relations, Australia Jonathan Rose T +61 3 9283 3088 M +61 447 028 913 Matt Chambers T +61 3 9283 3087 M +61 433 525 739 Jesse Riseborough T +61 8 6211 6013 M +61 436 653 412 Investor Relations, United Kingdom Menno Sanderse T: +44 20 7781 1517 M: +44 7825 195 178 David Ovington T +44 20 7781 2051 M +44 7920 010 978 Clare Peever M: +44 7788 967 877 Investor Relations, Australia Natalie Worley T +61 3 9283 3063 M +61 409 210 462 Amar Jambaa T +61 3 9283 3627 M +61 472 865 948 Group Company Secretary Steve Allen Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Joint Company Secretary Tim Paine Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary.

2021 Notice of annual general meeting The annual general meeting of Rio Tinto plc will be held at 11:00am on Friday, 9 April 2021 at 6 St James’s Square, London, SW1Y 4AD. Due to the UK government restrictions on public gatherings to contain the COVID-19 pandemic, and mindful of public health concerns, shareholders will not be permitted to attend the annual general meeting in person. Shareholders can instead participate in the annual general meeting virtually via a live webcast, where they will be able to vote and ask questions. Details of how to attend virtually can be found on pages 12-13. To vote ahead of the annual general meeting, please complete and submit a proxy form in line with the instructions set out in this notice. We are closely monitoring the evolving COVID-19 situation and will continue to have regard to all developments in advance of the meeting. If circumstances should change materially before the date of the meeting, we may adapt our proposed arrangements, working always in accordance with UK government guidelines and mindful of public health concerns. If the arrangements do change, we will notify any changes as early as possible before the date of the meeting. Shareholders should continue to monitor Rio Tinto’s website (at www.riotinto.com/invest/shareholder-information/annual- general-meetings) and our announcements for any updates in relation to the meeting. This document is important and requires your immediate attention. If you have any doubts about the action you should take, contact your stockbroker, solicitor, accountant or other professional adviser, immediately. If you have sold or transferred all of your shares in Rio Tinto plc, please send this document, together with the accompanying documents, at once to the purchaser or transferee or to the stockbroker, bank or other agent through whom the sale or transfer was effected, for transmission to the purchaser or transferee. A copy of this notice and other information required by section 311A of the Companies Act 2006 can be found by visiting www.riotinto.com/invest/shareholder-information/annual-general-meetings. Rio Tinto plc Registered office: 6 St James’s Square London SW1Y 4AD (Registered in England, No: 719885) Exhibit 99.2

Dear shareholders, I am pleased to invite you to participate in Rio Tinto plc’s annual general meeting, which will be held at 11:00am on Friday, 9 April 2021. In view of the public safety measures currently imposed by the UK government on public gatherings to contain the COVID-19 pandemic, the annual general meeting will be run as a hybrid meeting. Shareholders and proxies (other than the directors at the meeting) will not be permitted to attend the meeting in person. Instead, shareholders can participate in the annual general meeting virtually via a live webcast, where they will be able to vote and ask questions. Details of how to attend virtually can be found on pages 12-13. The company will, however, ensure that the legal requirements to hold the meeting are met by the attendance in person of a minimum number of shareholders to form a quorum. This notice of meeting describes the business that will be proposed at the meeting and sets out the procedures for your participation and voting. Your participation in the annual general meeting is important to Rio Tinto and a valuable opportunity for the Board to consider with shareholders the performance of the Group in 2020 and the early part of 2021. Please note that only shareholders, proxy holders and corporate representatives participating in the meeting will be eligible to ask questions of the directors. In January 2021, Jakob Stausholm was appointed Chief Executive. Jakob’s collaborative leadership style, strong values and personal commitment to the role of business in promoting sustainability made him the ideal choice to lead us forward. I am delighted that Jakob has moved quickly to announce his new Executive team and to identify his priorities for the Group, focused on becoming the best operator, having impeccable environmental, social and governance (ESG) credentials, excelling in development, and improving the Group’s social licence by rebuilding trust – particularly in Australia. During 2020, we welcomed three new non-executive directors: Hinda Gharbi, Jennifer Nason and Ngaire Woods. The Board has already benefited from their insights and expertise in natural resources, finance, technology, governance, public policy, diversity and inclusion. I would like to thank David Constable for his significant contribution to Rio Tinto. David stepped down as a non-executive director in December 2020 to concentrate on his appointment as the chief executive of Fluor Corporation. After careful consideration following significant surgery in February, Michael L’Estrange will also be retiring at the conclusion of the 2021 annual general meetings. The entire board wishes Michael a full and speedy recovery and will greatly miss his insights and wise counsel. A search for their replacements is underway as we seek to ensure appropriate representation on the Board from our key countries of operation. As announced on 3 March 2021, while I will be seeking re-election this year, I have decided not to stand for re-election at the 2022 annual general meetings. I am proud of Rio Tinto’s achievements in 2020, including our outstanding response to the COVID-19 pandemic, a second successive fatality-free year, significant progress with our climate change strategy, and strong shareholder returns. However, these successes were overshadowed by the destruction of the Juukan Gorge rock shelters at the Brockman 4 operations in Australia and, as Chairman, I am ultimately accountable for the failings that led to this tragic event. In standing for re-election this year my intention is to provide an important period of stability and support for Jakob and the new executive team ahead of the AGMs in 2022. This will also allow an orderly process for the appointment of our new Chair and other key Board members. Sam Laidlaw and Simon McKeon, as senior independent directors of Rio Tinto plc and Rio Tinto Limited respectively, will now jointly lead the search for my successor as Chair. This year, the business of the meeting will include a number of resolutions relating to remuneration. The first is the approval of the Remuneration Policy (the Policy), set out on pages 152-158 of the 2020 Annual Report (resolution 2). The current remuneration policy was approved by shareholders at the 2018 annual general meeting and is now due for renewal. The Policy sets out the Group’s new policy on remuneration and potential payments to directors going forward. It seeks to simplify a number of aspects and align others more closely with shareholder and broader stakeholder expectations. A key change proposed to our current policy is the introduction of ESG measures into the short-term incentive plan by reclassifying half of the individual performance component. The ESG measures represent a package of targets related to our climate change initiatives, diversity and inclusion metrics, as well as governance of our cultural heritage management and other risk-related areas. In addition to the Policy resolution, we have the annual remuneration- related resolutions relating to the approval of the Directors’ 2020 Remuneration Report (resolutions 3 and 4) in accordance with UK and Australian law respectively. Finally, we are seeking shareholder approval to renew and amend the rules of two of our share plans. The first relates to the Rio Tinto Global Employee Share Plan (myShare) (resolution 17), which has been in place since 2012, and for which existing shareholder approval will expire in 2022. The plan has been instrumental in promoting employee share ownership and engagement and is an important part of our employee value proposition (EVP). Participation globally stands at around 50%, with high levels of participation especially in developing countries such as Mongolia and South Africa. The purpose of the resolution is to renew myShare for another ten-year term and make largely minor changes to the rules to aid the plan’s administration. As part of the renewal, we are seeking to increase the annual participation limit per employee, which has remained unchanged since the plan was put in place in 2012, by 5%. Secondly, we are also seeking shareholder approval to renew the rules of the Rio Tinto UK Share Plan (the SIP) (resolution 18), for which existing shareholder approval expires in April 2021, and to amend the SIP rules to make largely administrative changes in line with current market practice. Your directors are unanimously of the opinion that all of the resolutions proposed in this notice are in the best interests of shareholders and of Rio Tinto as a whole. Accordingly, they recommend that you vote in favour of all of the resolutions, except resolution 17 in relation to which, in accordance with corporate governance best practice, the directors are not permitted to make a recommendation. Please refer to the explanatory notes for further information regarding this. As shareholders will not be permitted to attend the annual general meeting in person this year, shareholders are strongly encouraged to complete and submit a proxy form by no later than 11:00am on Wednesday, 7 April 2021 in line with the instructions on page 14. Submitting a proxy form will ensure your vote is recorded, but does not prevent you from participating and voting at the meeting yourself, if you would like to do so online as described on page 13. The corresponding Rio Tinto Limited annual general meeting is expected to take place in Perth on Thursday, 6 May 2021. The result of the votes on resolutions 1 to 17 (inclusive), which are also being proposed to the Rio Tinto Limited annual general meeting, will be determined when the relevant polls are closed at the end of the Rio Tinto Limited meeting. The overall results will be announced to the relevant stock exchanges and posted on our website after that date. The result of the votes on resolutions 18 to 22 (inclusive), which only apply to Rio Tinto plc, will be released as soon as possible after the Rio Tinto plc annual general meeting. We look forward to your participation in the annual general meeting and thank you for your continued support. Yours sincerely Simon Thompson Chairman 8 March 2021 2 Notice of annual general meeting 2021 | riotinto.com Letter from the Chairman Letter from the Chairman

Notice is given that the annual general meeting of Rio Tinto plc (the company) will be held at 6 St James’s Square, London, SW1Y 4AD at 11:00am on Friday, 9 April 2021, for the following purposes: Resolution 1 Receipt of the 2020 Annual Report To receive the financial statements, strategic report and the reports of the directors and auditors for the year ended 31 December 2020. Resolution 2 Approval of the Remuneration Policy To approve the Remuneration Policy set out in the 2020 Annual Report on pages 152-158, such policy to take effect immediately after the conclusion of the meeting. This resolution is binding, and is required for UK law purposes. Resolution 3 Approval of the Directors’ Remuneration Report: Implementation Report To receive and approve the Directors’ Remuneration Report: Implementation Report for the year ended 31 December 2020, as set out in the 2020 Annual Report on pages 140-143 and 159-185, comprising the Annual Statement by the Remuneration Committee Chairman and the Implementation Report (together, the Implementation Report). This resolution is advisory, and is required for UK law purposes. Resolution 4 Approval of the Directors’ Remuneration Report To approve the Directors’ Remuneration Report for the year ended 31 December 2020, as set out in the 2020 Annual Report on pages 140-185. This resolution is advisory, and is required for Australian law purposes. Resolution 5 To re-elect Megan Clark AC as a director Resolution 6 To re-elect Hinda Gharbi as a director Resolution 7 To re-elect Simon Henry as a director Resolution 8 To re-elect Sam Laidlaw as a director Resolution 9 To re-elect Simon McKeon AO as a director Resolution 10 To re-elect Jennifer Nason as a director Resolution 11 To re-elect Jakob Stausholm as a director Resolution 12 To re-elect Simon Thompson as a director Resolution 13 To re-elect Ngaire Woods CBE as a director Resolution 14 Re-appointment of auditors To re-appoint KPMG LLP as auditors of the company to hold office until the conclusion of Rio Tinto’s 2022 annual general meetings. Resolution 15 Remuneration of auditors To authorise the Audit Committee to determine the auditors’ remuneration. Resolution 16 Authority to make political donations To authorise Rio Tinto plc, and any company which is a subsidiary of Rio Tinto plc at the time this resolution is passed or becomes a subsidiary of Rio Tinto plc at any time during the period for which this resolution has effect, to: (a) make donations to political parties and independent election candidates; (b) make donations to political organisations other than political parties; and (c) incur political expenditure, provided that in each case any such donations or expenditure made by Rio Tinto plc or a subsidiary of Rio Tinto plc shall not exceed £50,000 per company, and that the total amount of all such donations and expenditure made by all companies to which this authority relates shall not exceed £100,000. This authority shall expire at the close of the annual general meeting of Rio Tinto Limited held in 2022 (or, if earlier, at the close of business on 8 July 2022). Resolution 17 Renewal of and amendment to the Rio Tinto Global Employee Share Plan To consider, and, if thought fit, pass the following resolution: That: (a) the rules of the Rio Tinto Global Employee Share Plan (myShare), in the form described in the explanatory notes which accompany this notice, and a copy of which is produced to the annual general meeting (and is for the purpose of identification marked “A” and initialled by the Chairman), be approved, and the directors be authorised to do all things necessary to operate myShare, including making such modifications as the directors consider appropriate to take account of any applicable regulatory requirements and best practice; and (b) the directors be authorised to establish and do all things necessary to operate such further plans for the benefit of employees in different jurisdictions based on myShare, subject to such modifications as may be necessary or desirable to take account of overseas securities laws, exchange control and tax legislation, provided that any ordinary shares of the company made available under such further plans are treated as counting against any limits on individual or overall participation in myShare. 3Notice of annual general meeting 2021 | riotinto.com Notice of annual general meeting Notice of annual general meeting

Resolution 18 Renewal of and amendment to the Rio Tinto UK Share Plan To consider, and, if thought fit, pass the following resolution: That: (a) the renewal of and amendments to the rules of the Rio Tinto UK Share Plan (the SIP), as set out in the documents which have been produced for the meeting (and are for the purpose of identification marked “B” and initialled by the Chairman), be approved, and the directors be authorised to do all things necessary to operate the SIP, including making such modifications as the directors consider appropriate to continue operating it in line with Her Majesty’s Revenue & Customs requirements and to take account of the requirements of the Financial Conduct Authority and best practice; and (b) the directors be authorised to establish such further plans for the benefit of employees overseas based on the SIP, subject to such modifications as may be necessary or desirable to take account of applicable securities laws, exchange control and tax legislation, provided that any ordinary shares of the company made available under such further plans are treated as counting against any limits on individual or overall participation in the SIP. Resolution 19 General authority to allot shares To authorise the directors, pursuant to and in accordance with section 551 of the UK Companies Act 2006 (the Companies Act), to exercise all the powers of the company to allot, or to grant rights to subscribe for or convert any securities into, shares in the company up to an aggregate nominal amount of £41,589,396. Such authority to apply in substitution for all previous authorities pursuant to section 551 of the Companies Act (but without prejudice to any allotment of shares or grant of rights pursuant to an offer or agreement made before the expiry of the authority pursuant to which such offer or agreement was made) and to expire (unless previously renewed, varied or revoked by the company in general meeting) at the end of the annual general meeting of the company held in 2022 (or, if earlier, at the close of business on 8 July 2022) but, so that the company may make offers and enter into agreements during this period, which would, or might, require shares to be allotted or rights to subscribe for or to convert any security into shares to be granted after the authority ends and the directors may allot shares and grant rights in pursuance of that offer or agreement as if this authority had not expired. Resolution 20 Disapplication of pre-emption rights To pass the following resolution as a special resolution: To authorise the directors, pursuant to section 570 and section 573 of the Companies Act, if resolution 19 above is passed, to allot equity securities (as defined in the Companies Act) for cash under the authority given by that resolution and/or to sell ordinary shares held by the company as treasury shares for cash as if section 561 of the Companies Act did not apply to any such allotment or sale, such authority to be limited: (a) to the allotment of equity securities or sale of treasury shares in connection with a pre-emptive offer; and (b) to the allotment of equity securities or sale of treasury shares (otherwise than under paragraph (a) above) up to an aggregate nominal amount of £8,094,490. Such authority to apply in substitution for all existing authorities pursuant to section 570 and section 573 of the Companies Act (but without prejudice to any allotment of equity securities or sale of treasury shares pursuant to an offer or agreement made before the expiry of the authority pursuant to which such offer or agreement was made) and such authority to expire (unless previously renewed, varied or revoked by the company) at the end of the next annual general meeting of the company to be held in 2022 (or, if earlier, at the close of business on 8 July 2022) but, in each case, prior to its expiry the company may make offers, and enter into agreements, which would, or might, require equity securities to be allotted (and treasury shares to be sold) after the authority expires and the directors may allot equity securities (and sell treasury shares) under any such offer or agreement as if the authority had not expired. For the purposes of this resolution: (a) “pre-emptive offer” means an offer of equity securities, open for acceptance for a period fixed by the directors, to: (i) holders (other than the company) on the register on a record date fixed by the directors of ordinary shares in proportion (as nearly as may be practicable) to their respective holdings; and (ii) other persons so entitled by virtue of the rights attaching to any other equity securities held by them, but subject in both cases to such exclusions or other arrangements as the directors may deem necessary or expedient in relation to treasury shares, fractional entitlements, record dates or legal, regulatory or practical problems in, or under the laws of, any territory or any other matter; and (b) the nominal amount of any securities shall be taken to be, in the case of rights to subscribe for or convert any securities into shares of the company, the nominal amount of such shares that may be allotted pursuant to such rights. 4 Notice of annual general meeting 2021 | riotinto.com Notice of annual general meeting

Resolution 21 Authority to purchase Rio Tinto plc shares To pass the following resolution as a special resolution: That: (a) Rio Tinto plc, Rio Tinto Limited and/or any subsidiaries of Rio Tinto Limited be generally and unconditionally authorised to purchase ordinary shares issued by the company (RTP Ordinary Shares), such purchases to be made in the case of the company by way of market purchase (as defined in section 693 of the Companies Act), provided that this authority shall be limited: (i) so as to expire at the end of the annual general meeting of the company held in 2022 (or, if earlier, at the close of business on 8 July 2022), unless such authority is renewed, varied or revoked prior to that time (except in relation to a purchase of RTP Ordinary Shares, the contract for which was concluded before the expiry of such authority and which might be executed wholly or partly after such expiry); (ii) so that the number of RTP Ordinary Shares, which may be purchased pursuant to this authority, shall not exceed 124,768,190; (iii) so that the maximum price (exclusive of expenses) payable for each such RTP Ordinary Share is an amount equal to the higher of: (a) 5% above the average of the middle market quotations for an RTP Ordinary Share as derived from the London Stock Exchange Daily Official List during the period of five business days immediately preceding the day on which such share is contracted to be purchased; and (b) the higher of the price of the last independent trade of an RTP Ordinary Share and the highest current independent bid for an RTP Ordinary Share on the trading venue where the purchase is carried out; and (iv) so that the minimum price (exclusive of expenses) payable for each such RTP Ordinary Share shall be its nominal value; and (b) the company be authorised for the purpose of section 694 of the Companies Act to purchase off-market from Rio Tinto Limited and/or any of its subsidiaries any RTP Ordinary Shares acquired under the authority set out under (a) above pursuant to one or more contracts between the company and Rio Tinto Limited and/or any of its subsidiaries on the terms of the form of contract which has been produced to the meeting (and is for the purpose of identification marked “C” and initialled by the Company Secretary) (each, a Contract) and such Contracts be approved, provided that: (i) such authorisation shall expire at the end of the annual general meeting of the company held in 2022 (or, if earlier, at the close of business on 8 July 2022); (ii) the maximum total number of RTP Ordinary Shares to be purchased pursuant to such Contracts shall be 124,768,190; and (iii) the price of RTP Ordinary Shares purchased pursuant to a Contract shall be equal to the average of the middle market quotations for an RTP Ordinary Share as derived from the London Stock Exchange Daily Official List during the period of five business days immediately preceding the day on which such share is contracted to be purchased multiplied by the number of RTP Ordinary Shares the subject of the Contract, or such lower price as may be agreed between the company and Rio Tinto Limited, being not less than one penny. Resolution 22 Notice period for general meetings other than annual general meetings To pass the following resolution as a special resolution: That a general meeting other than an annual general meeting may be called on not less than 14 clear days’ notice. Note: In accordance with Rio Tinto’s Dual Listed Companies (DLC) structure, as Joint Decision Matters, resolutions 1 to 17 (inclusive) will be voted on by Rio Tinto plc and Rio Tinto Limited shareholders as a joint electorate. Resolutions 18 to 22 (inclusive) will be voted on by Rio Tinto plc’s shareholders only. Resolutions 1 to 19 (inclusive) will be proposed as ordinary resolutions. Resolutions 20 to 22 (inclusive) will be proposed as special resolutions. By order of the Board Steve Allen Group Company Secretary 6 St James’s Square London SW1Y 4AD 8 March 2021 5Notice of annual general meeting 2021 | riotinto.com Notice of annual general meeting

Resolution 1 Receipt of the 2020 Annual Report The directors are required by company law to present the 2020 Annual Report comprising the 2020 financial statements, the strategic report, the Directors’ report and the Auditors’ report to the annual general meeting. These can be accessed on the Rio Tinto website: www.riotinto.com/invest/ reports/annual-report. Resolution 2 Approval of the Remuneration Policy The current Remuneration Policy was put to, and approved by, shareholders of both Rio Tinto Limited and Rio Tinto plc at the 2018 annual general meetings but expires at the conclusion of the 2021 annual general meetings. The proposed Remuneration Policy (the Policy) is provided on pages 152-158 of the 2020 Annual Report. It sets out the Group’s policy on remuneration and potential payments to directors going forward. In accordance with UK law, the Policy must be approved by a binding shareholder vote (by means of a separate resolution) at least once every three years. Approving the Policy is considered a matter that affects the Group as a whole and will therefore be considered by shareholders of both Rio Tinto Limited and Rio Tinto plc. Once the Policy is approved, the Group will not be able to make a payment to a current director that is outside the terms of the Policy, unless an amendment to the Policy has been approved by shareholders. The resolution is binding on Rio Tinto. If it is passed, the Policy will take effect immediately. If the resolution is not passed, Rio Tinto would seek shareholder approval for a revised policy at or before the 2022 annual general meetings and in the meantime, the current policy would continue in effect. A remuneration policy will be put to shareholders again no later than the 2024 annual general meeting. Resolution 3 Approval of the Directors’ Remuneration Report: Implementation Report The Implementation Report for the year ended 31 December 2020, comprising the Annual Statement by the Remuneration Committee Chairman and the Implementation Report, is set out on pages 140-143 and 159-185 of the 2020 Annual Report. The Implementation Report describes the remuneration arrangements in place for each executive director, other members of the Executive Committee and the non-executive directors (including the Chairman) during 2020. The Annual Statement from the Remuneration Committee Chairman provides context to the 2020 remuneration outcomes, together with information to help shareholders understand what the executives were paid in relation to the financial year of 2020. This vote is advisory and is required for UK law purposes. Resolution 4 Approval of the Directors’ Remuneration Report The Directors’ Remuneration Report for the year ended 31 December 2020 consists of the Annual statement by the Remuneration Committee Chairman, the Remuneration at a Glance, the Remuneration Policy and the Implementation Report. The Remuneration Report is set out on pages 140-185 of the 2020 Annual Report. This vote is advisory and is required for Australian law purposes. Resolutions 5-13 Re-election of directors The Board has adopted a policy, whereby all directors are required to seek re-election by shareholders on an annual basis. All of the directors seeking re-election have been subject to a formal performance evaluation, as described in the Governance report in the 2020 Annual Report. Based on that evaluation, it is considered that each director continues to be effective and their contribution supports the long-term sustainable success of Rio Tinto. Each director demonstrates the level of commitment required in connection with their role and the needs of the business (including making sufficient time available for Board and committee meetings and other duties). The skills and experience of each director, which can be found below and on pages 116-117 of the 2020 Annual Report, demonstrate why their contribution is, and continues to be, important to Rio Tinto’s long-term sustainable success. The Board has also adopted a framework on directors’ independence and is satisfied that each non-executive director standing for re-election at the meeting is independent in accordance with this framework. Biographical details in support of each director’s re-election are provided below. In addition, the committees on which each of the non-executive directors serve are shown on pages 116-117 of the 2020 Annual Report. Megan Clark AC Independent non-executive director, BSc, PhD. Age 62. Appointed November 2014. Chairman of the Sustainability Committee. Skills and experience: Megan combines experience in the mining and metals industry with leadership in science, research and technology, and brings valuable insights on sustainable development and innovation to the Board. She was Head of the Australian Space Agency from 2018 to 2020 and Chief Executive of the Commonwealth Scientific and Industrial Research Organisation (CSIRO) from 2009 to 2014. Following mining and exploration roles with Western Mining Corporation, Megan was a director at N M Rothschild and Sons (Australia), and a Vice President Technology at BHP. Megan received the Australian Academy of Science Medal in 2019. Current external appointments: Non-executive director of CSL Limited since 2016, Chair of the Advisory Board of the Australian Space Agency since January 2021. Megan is recommended for re-election. Hinda Gharbi Independent non-executive director, BSc, MSc. Age 50. Appointed March 2020. Skills and experience: Hinda is Executive Vice President of Services & Equipment at Schlumberger Limited and has some 25 years’ experience at Schlumberger, working in various field engineering, functional and line management positions, including health and safety, human resources, technology development and operations across France, Malaysia, Nigeria, Thailand, the United Kingdom and the United States. Current external appointments: None Hinda is recommended for re-election. 6 Notice of annual general meeting 2021 | riotinto.com Explanatory notes to the resolutions Explanatory notes to the resolutions

Simon Henry Independent non-executive director, MA, FCMA. Age 59. Appointed April 2017. Chairman of the Audit Committee. Skills and experience: Simon has significant experience in global finance, corporate governance, mergers and acquisitions, international relations, and strategy. He draws on over 30 years’ experience at Royal Dutch Shell plc, where his roles included Chief Financial Officer from 2009-2017. Current external appointments: Independent director of PetroChina Company Limited since June 2017. Member of the UK Defence Board. Nominated as Senior Independent Director of Harbour Energy plc from Spring 2021. Member of the Advisory Board of the Centre for European Reform and the Advisory Panel of CIMA. Simon is recommended for re-election. Sam Laidlaw Independent non-executive director, MA, MBA. Age 65. Appointed February 2017, Senior Independent Director in May 2019. Chairman of the Remuneration Committee. Skills and experience: Sam has more than 30 years’ experience of long-cycle, capital-intensive industries in which safety, the low-carbon transition and stakeholder management are critical. Previous roles include: president and chief operating officer, Amerada Hess Corporation; CEO, Enterprise Oil plc; executive vice president, Chevron Corporation; CEO, Centrica plc; and membership of the UK Prime Minister’s Business Advisory Group. Current external appointments: Chairman of Neptune Energy Group Holdings Ltd. Chairman, National Centre of Universities & Business. Board member, Oxford Saïd Business School. Advisory Board member, The Smith School of Enterprise and Environment. Sam is recommended for re-election Simon McKeon AO Independent non-executive director, BCom, LLB, FAICD. Age 65. Appointed January 2019, Senior Independent Director, Rio Tinto Limited in September 2020. Skills and experience: Simon brings insights into sectors including financial services, the law, government and charities. He practised as a solicitor before serving at Macquarie Group for 30 years, including as executive chairman of its business in Victoria, Australia. Simon served as chairman of AMP Limited, MYOB Limited and the Commonwealth Scientific and Industrial Research Organisation, (CSIRO). He was the first president of the Australian Takeovers Panel. Current external appointments: Chancellor of Monash University. Chairman of the Australian Industry Energy Transitions Initiative Steering Group. Non-executive director of National Australia Bank Limited since February 2020. Simon is recommended for re-election. Jennifer Nason Independent non-executive director, BA, BCom (Hons) (Melbourne). Age 60. Appointed March 2020. Skills and experience: Jennifer has over 30 years’ experience in corporate finance and capital markets. For the past 17 years, she has led the Technology, Media and Telecommunications global client practice at JP Morgan, based in the USA. During her time at JP Morgan, she has also worked in the metals and mining sector team in Australia. Current external appointments: Board member of the American Australian Association. Jennifer is recommended for re-election. Jakob Stausholm Chief Executive, Ms Economics. Age 52. Appointed Chief Executive from January 2021; Chief Financial Officer in September 2018. Skills and experience: As Chief Executive, Jakob brings strategic and commercial expertise and a strong focus on sustainability. He is committed to rebuilding trust with communities, Traditional Owners and stakeholders globally. As Chief Financial Officer, Jakob focused on maximising cash flow and allocating capital with discipline. He balanced investment in sustaining and high-value growth, to maintain a strong balance sheet and deliver superior shareholder returns in the short, medium and long term. Jakob has over 20 years’ experience in senior finance roles in Europe, Latin America and Asia, including in capital-intensive, long-cycle businesses, as well as in innovative technology and supply chain optimisation. Jakob spent six years with the Maersk Group, where his roles included group Chief Financial Officer and executive director of the Group’s integrated transport and logistics business. He was previously with Royal Dutch Shell plc, holding a range of finance positions, including chief internal auditor. Current external appointments: None. Jakob is recommended for re-election. Simon Thompson Chairman, MA, PhD. Age 61. Appointed April 2014; Chairman from March 2018. Skills and experience: Simon has significant global experience in mining and metals, finance and corporate governance. Among a wide range of Board appointments, Simon was an executive director of Anglo American plc, where he held the roles of Chairman and Chief Executive Officer of the Base Metals Division. He also served as chairman of Tarmac, and chairman of the Exploration Division. Earlier in his career he held various investment banking positions at S. G. Warburg and N M Rothschild. Simon chairs 3i plc and has chaired Tullow Oil plc. His experience as a non-executive director includes serving on the boards of AngloGold Ashanti Limited and Newmont Mining Corporation. Simon is also a Commissioner at the Energy Transitions Commission. Current external appointments: Chairman of 3i Group plc since 2015. Simon is recommended for re-election. Ngaire Woods CBE Independent non-executive director, BA/LLB (Auckland), D.Phil (Oxford). Age 58. Appointed September 2020. Skills and experience: Ngaire is the founding Dean of the Blavatnik School of Government, Professor of Global Economic Governance and the Founder of the Global Economic Governance Programme at Oxford University. As a recognised expert in public policy, international development and governance, she has served as an adviser to the African Development Bank, the Asian Infrastructure Investment Bank, the Center for Global Development, the International Monetary Fund and the European Union. Current external appointments: Board member of the Mo Ibrahim Foundation, the Van Leer Foundation and the Schwarzman Education Foundation. Ngaire is recommended for re-election. 7Notice of annual general meeting 2021 | riotinto.com Explanatory notes to the resolutions

Resolutions 14-15 Re-appointment and remuneration of auditors Under UK law, the shareholders are required to approve the appointment of the company’s auditor each year. The appointment runs until the conclusion of Rio Tinto’s 2022 annual general meetings. Under Rio Tinto’s DLC structure, the appointment of Rio Tinto plc’s auditors is a Joint Decision Matter and has therefore been considered by Rio Tinto Limited and Rio Tinto plc shareholders at each annual general meeting since the DLC structure was established in 1995. On recommendation of the Audit Committee, the Board proposes the re-appointment of the company’s current auditors, KPMG LLP. KPMG LLP have expressed their willingness to continue in office for a further year. In accordance with UK company law and good corporate governance practice, shareholders are also asked to authorise the Audit Committee to determine the auditors’ remuneration. Resolution 16 Authority to make political donations Under UK law there is a prohibition against making political donations without authorisation of a company’s shareholders in a general meeting. The authority being sought is not proposed or intended to alter Rio Tinto’s policy of not making political donations, within the normal meaning of that expression. However, the definitions of political donation, political expenditure and/or political organisation in the Companies Act are defined very widely. Because of this, it may be that some of Rio Tinto’s activities could fall within this definition and, without the necessary authorisation, Rio Tinto’s ability to communicate its views effectively to political audiences and to relevant interest groups could be inhibited. In particular, the definition of political organisations may extend to bodies such as those concerned with policy review, law reform, the representation of the business community and special interest groups, such as those concerned with the environment. As a result, the definition may cover legitimate business activities that would not, in the ordinary sense, be considered to be political donations or political expenditure. The authority that the Board is requesting is a precautionary measure to ensure Rio Tinto does not inadvertently breach the Companies Act. In accordance with the United States Federal Election Campaign Act, Rio Tinto provides administrative support for the Rio Tinto America Political Action Committee (PAC). The PAC was created in 1990 and encourages voluntary employee participation in the political process. All Rio Tinto America PAC employee contributions are reviewed for compliance with federal and state law and are publicly reported in accordance with US election laws. The PAC is controlled by neither Rio Tinto nor any of its subsidiaries but instead by a governing board of five employee members on a voluntary basis. In 2020, contributions to Rio Tinto America PAC by 15 employees amounted to US$8,475.45, and Rio Tinto America PAC donated US$11,500 in political contributions in 2020. The directors believe that supporting the authority sought in this resolution is in the interests of shareholders. Any expenditure that may be incurred under this authority will be disclosed in next year’s Annual Report. Details of political expenditure by Rio Tinto during the past year are set out on pages 88 and 189 in the 2020 Annual Report. Words and expressions used in resolution 16 that are defined in Part 14 of the Companies Act shall have the same meanings for the purposes of resolution 16. Resolution 17 Renewal of and amendment to the Rio Tinto Global Employee Share Plan The Rio Tinto plc Global Employee Share Plan (myShare) has been in place since 2012. myShare has been instrumental in promoting employee share ownership and engagement and is an important part of our employee value proposition (EVP). Participation in the plan globally stands at around 50%. All eligible employees are invited to participate on equal terms. The plan has a single, global framework, with local modifications made as necessary for regulatory, legal, securities or taxation reasons. Rio Tinto Limited operates a similar version of the plan (Limited myShare). The existing shareholder approval of myShare is due to expire in 2022, on the tenth anniversary of its adoption. The purpose of this resolution is to renew and to amend the myShare rules to update statutory references and to make largely administrative changes in line with current market practice. It should be noted that, if resolution 17 is passed, it will authorise the renewal and proposed amendments to myShare and the Limited myShare. A summary of the plan is set out below. Introduction Under myShare, three types of shares may be acquired by eligible employees – free, investment and matching shares. The directors in overseeing myShare have power to decide which, if any, type of shares should be offered. Currently investment and matching shares are offered under myShare. Eligibility All employees of Group companies designated by the directors as participating companies are eligible to join myShare. The directors may set such other eligibility criteria as they determine. All eligible employees are invited to participate. Investment shares myShare provides the opportunity for participants to purchase shares out of a salary up to a maximum contribution limit agreed by the directors, which is proposed to be increased to US$5,250 per year (or the local currency equivalent on any date considered appropriate by the directors), representing a 5% increase on the current maximum which has remained unchanged since the approval of myShare in 2012. Participants can stop saving at any stage. The participants’ contributions may be used to acquire investment shares on a monthly basis or the contributions may be accumulated for a period of up to 12 months before being used to acquire investment shares. Investment shares are acquired at market value at the time of acquisition. Investment shares can be withdrawn from myShare by participants at any time, but this may result in the forfeiture of any related matching shares (see below). If the participant leaves employment the investment shares will be removed from myShare. Matching shares myShare provides that, where participants acquire investment shares, they may be awarded additional shares by the company on a matching basis, up to a maximum of two matching shares for each investment share. However, the rules provide the directors with discretion to increase this matching basis. Currently one matching share is offered for each investment share acquired. An award of matching shares may take the form of a conditional right to shares or as an award of forfeitable shares. Matching shares must be held in myShare for a holding period, which is currently three years. If the participant withdraws their related investment shares during this period, the matching shares will be forfeited. An award of matching shares may be made on terms that it is forfeited if the participant leaves employment with the Group during the holding period. However, if a participant leaves employment during the holding period due to ill-health, injury, disability, retirement, the employing company or business being sold, redundancy, death or any other reason decided by the directors, the matching shares will be released to the participant. 8 Notice of annual general meeting 2021 | riotinto.com Explanatory notes to the resolutions

Free shares myShare provides for the award of free shares up to a maximum set by the directors. In the event that free shares are offered in the future, it is intended that any maximum for any year will be no more than 200% of the maximum contribution limit stated earlier. An award of free shares may take the form of a conditional right to shares or as an award of forfeitable shares. An award of free shares may be made on terms that it is forfeited if the participant leaves employment with the Group during a holding period which is expected to be three years. If a participant leaves the Group during the holding period due to ill-health, injury, disability, retirement, the employing company or business being sold, redundancy, death or any other reason decided by the directors, then the free shares will not be forfeited. Dividends and voting rights myShare provides that any dividends paid on the free, investment or matching shares may be re-invested in the purchase of additional shares. Alternatively, dividends are paid in cash. Where free and matching shares take the form of conditional awards, dividend equivalents may be paid to the participant (in cash or shares) at the end of the holding period. Participants may be offered the opportunity to direct myShare trustees on how to exercise the voting rights attached to any shares held on their behalf. Takeovers and corporate events Participants are offered the opportunity to direct myShare trustees on how to exercise the rights attached to their shares in relation to any corporate event. The trustees will not exercise these rights unless they receive the participant’s instruction. Where free and matching shares are awarded in the form of conditional awards, the awards will vest on a takeover and may vest or be adjusted, as appropriate, in the event of a corporate event such as a variation of the company’s share capital. Dilution limits Commitments to issue new shares may not, on any day, exceed 10% of the issued ordinary share capital of the company in issue immediately before that day when added to the total number of ordinary shares which have been allocated in the previous ten years under myShare and any other employee share plan operated by the company. This limit does not include rights to shares which have lapsed or been surrendered. The limit includes any shares transferred out of treasury. Amendment provisions Although the directors have the power to amend myShare in any way, the provisions relating to: eligibility; the limits on the number of shares which may be allocated or awarded under myShare; individual’s contribution limits; the basis for determining a participant’s entitlement to shares or cash under myShare; any rights relating to the shares or the adjustment of awards in the event of a variation of capital; and the amendment rule cannot be altered to the advantage of participants without prior approval of shareholders (except for minor amendments to benefit the administration of myShare or to take account of a change in legislation or to obtain or maintain favourable tax, exchange control or regulatory treatment for participants in myShare or for the company or any other members of the Rio Tinto Group). The directors may also, establish and operate further plans based on myShare, but modified to accommodate overseas regulation or legislation. Shares made available under such further plans will be treated as counting against any limits in relation to participation in myShare. General Benefits under myShare are not pensionable. This summary should not be taken as affecting the interpretation of the rules of myShare. The directors abstain from making a recommendation in relation to resolution 17 in accordance with good corporate governance practice and a potential conflict of interest (given any executive director’s eligibility to participate in myShare). The Chairman of the annual general meeting intends to vote available proxies in favour of this resolution. Resolution 18 Renewal of and amendments to the Rio Tinto UK Share Plan The Rio Tinto UK Share Plan (the SIP), which is an all employee share plan, has been operated since 2001. The existing shareholder approval of the SIP is due to expire on 14 April 2021. The purpose of this resolution is to renew the SIP and to amend the SIP rules to update statutory references and to make largely administrative changes in line with current market practice. The SIP is a tax favoured share plan in the UK that was approved by Her Majesty’s Revenue & Customs when it was first adopted. Under the SIP, four types of shares can be offered to employees based in the UK – free, partnership, matching and dividend shares. The SIP rules contain all four elements, and the directors have power to decide which, if any, of them should be implemented. Currently the company offers employees three elements–free, partnership and matching shares, as well as dividend shares. The SIP operates in conjunction with a trust, which holds shares on behalf of employees. A summary of the key features of the SIP is set out below. Eligibility Executive directors and all employees of the company and any subsidiaries designated by the directors as participating companies are eligible to join the SIP, if they are UK tax resident and have worked for the company or a participating company for a qualifying period determined by the directors, which may not exceed eighteen months (currently no qualifying period is operated). Free shares The SIP provides for the award of free shares worth up to a maximum value set by the relevant legislation (currently £3,600) to each eligible employee each year. The shares must generally be offered on similar terms, but the award may be subject to performance targets. Subject to continuing employment, free shares must be held in trust for a period of at least three years, and will be free of income tax if held in trust for five years. Free shares may be forfeited in certain circumstances within a period to be determined by the directors of not more than three years if a participant ceases to be employed by the Group. Partnership shares The SIP provides for employees to be offered the opportunity to purchase shares out of monthly savings contributions from pre-tax salary of up to the maximum value set by the relevant legislation (currently £1,800 in each tax year, or 10% of salary if less). Matching shares The SIP provides that where employees buy partnership shares, they may be awarded additional shares by the company on a matching basis, up to a current maximum of two matching shares for each partnership share purchased (currently the company provides one matching share for each partnership share purchased). If a participant withdraws their corresponding partnership shares before the trustees have held them for three years, they will forfeit the linked matching shares. If the participant ceases to be employed within the minimum three-year period (or within such shorter period as the directors may decide) other than for a specified reason such as death, retirement, redundancy, injury or disability, or their employing company or business being sold out of the Rio Tinto Group, their matching shares will be forfeited. 9Notice of annual general meeting 2021 | riotinto.com Explanatory notes to the resolutions

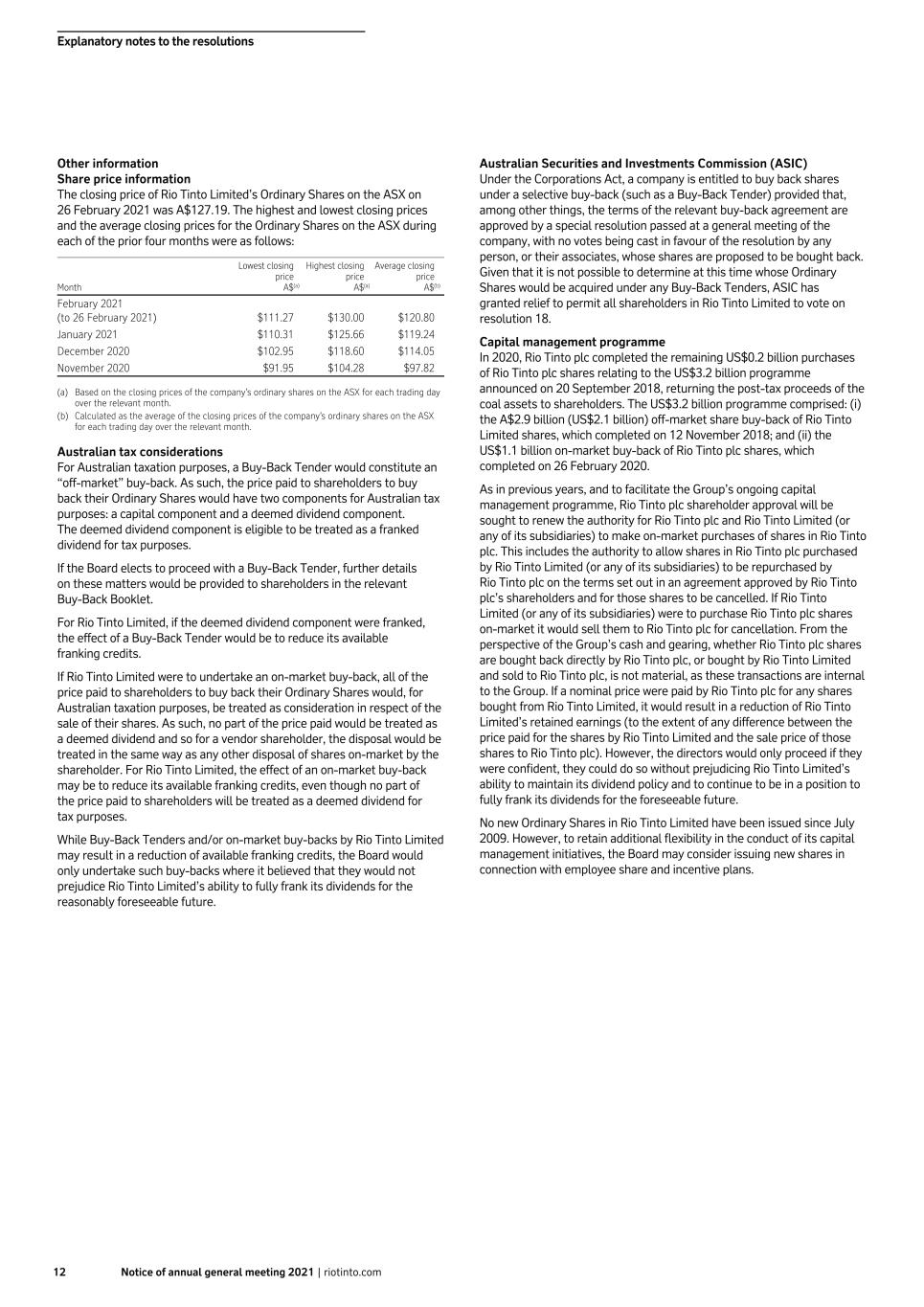

Dividends The SIP provides that directors may permit any dividends paid on the free, partnership or matching shares to be re-invested in the purchase of additional shares, which must be held in the plan for a period of three years. Voting rights Participants may direct the trustees how to exercise the voting rights attributable to the shares held on their behalf. The trustees will not exercise the voting rights unless they receive the relevant participant’s instructions. Dilution limits The directors have the power to allot up to 10% of the company’s issued share capital in any ten year period under the SIP and all other employee share schemes operated by the company. Amendment provisions Although the directors will have the power to amend the provisions of the SIP in any way, the provisions relating to: the participants; the limits on the number of shares which may be issued under the SIP; the individual limit; the basis for determining a participant’s entitlement to shares or cash under the SIP or the adjustments of awards in the event of a variation of capital; and the amendment rule, cannot be altered to the advantage of participants without prior approval of the company’s shareholders in general meeting (except for minor amendments to benefit the administration of the SIP, to take account of a change in legislation or to obtain or maintain favourable tax, exchange control or regulatory treatment for participants in the SIP or for the company or any other members of the Group). The directors may also, without further shareholder approval, establish further plans based on the SIP, but modified to take account of overseas securities laws, exchange controls or tax legislation. Shares made available under such further plans will be treated as counting against any limits on individual or overall participation in the SIP. General Benefits under the SIP are not pensionable. This summary should not be taken as affecting the interpretation of the rules of the SIP. Resolution 19 General authority to allot shares Under section 551 of the Companies Act, the directors may only allot shares or grant rights to subscribe for, or convert any security into, shares if authorised to do so by shareholders. This resolution would give the directors the authority to allot new shares, and grant rights to subscribe for, or convert other securities into shares, up to an aggregate nominal amount equal to £41,589,396 (representing 415,893,960 ordinary shares of 10p each). This amount represents not more than one third of the total issued ordinary share capital of the company, exclusive of treasury shares, as at 26 February 2021, the latest practicable date prior to publication of this notice (the Latest Practicable Date). For the avoidance of doubt and, in response to engagement with investors, this resolution does not seek authority to allot new shares in connection with a rights issue up to a further (second) one third of the total issued ordinary share capital of the company. At the Latest Practicable Date, the company held 8,082,682 treasury shares, which represents 0.65% of the total number of the company’s ordinary shares in issue, excluding treasury shares, at that date. The authority sought under this resolution, if approved, will expire at the end of the annual general meeting of the company held in 2022 (or, if earlier, at the close of business on 8 July 2022) unless renewed, varied or revoked by the company in general meeting. The directors have no present plans to exercise authority sought under this resolution, except in connection with employee share and incentive plans. The directors consider it desirable, however, to have flexibility, as permitted by corporate governance guidelines, to manage the Group’s capital resources. Resolution 20 Disapplication of pre-emption rights The directors are also seeking authority to allot new shares (and other equity securities), or sell treasury shares, for cash without first offering them to existing shareholders in proportion to their existing holdings. The authority granted under this resolution would be limited to: (a) where the company undertakes a pre-emptive offer by way of an open offer or rights issue, then the directors may make exclusions or other arrangements in order to deal with treasury shares, fractional entitlements or legal or practical problems arising under the laws of any overseas jurisdiction, or the requirements of any recognised regulatory body or stock exchange, or other matters; or (b) otherwise up to an aggregate nominal amount of £8,094,490 (representing 80,944,900 ordinary shares of 10p each). As historically agreed with the Association of British Insurers (the precursor body to the Investment Association), this aggregate amount represents not more than 5% of the combined issued ordinary share capital of the company and Rio Tinto Limited (exclusive of shares held in treasury by the company) as at the Latest Practicable Date. In respect of the authority granted under paragraph (b) of resolution 20, the directors confirm their intention to follow the provisions of the Pre-Emption Group’s Statement of Principles regarding cumulative use of authorities within a rolling three-year period. The Principles provide that usage in excess of 7.5% of the issued ordinary share capital of Rio Tinto plc and Rio Tinto Limited combined, exclusive of shares held in treasury by the company, should not take place without prior consultation with shareholders. If resolution 20 is passed, the authority will expire at the end of the annual general meeting of the company held in 2022 (or, if earlier, at the close of business on 8 July 2022) unless renewed, varied or revoked by the company in general meeting. Resolution 21 Authority to purchase Rio Tinto plc shares Consistent with its practice in prior years, the Board is seeking authority to buy back shares in the Group. The overall purpose of the buy-back resolutions of the company and Rio Tinto Limited is to provide the Group with flexibility in the conduct of its capital management initiatives, whether through on- or off-market share buy-backs in either or both of the company and/or Rio Tinto Limited. The directors have no current intention to exercise the authority conferred pursuant to resolution 21, and would only intend to do so when that would be in the best interests of the company and its shareholders. The authority conferred by the resolutions to be approved at the company’s and Rio Tinto Limited’s 2021 annual general meetings would allow buy-backs of ordinary shares in the company, either by the company on-market or by Rio Tinto Limited (or a subsidiary of Rio Tinto Limited) on-market, and buy-backs by Rio Tinto Limited of its ordinary shares, either under off-market buy-back tenders or on-market. In 2020, Rio Tinto plc completed the remaining US$0.2 billion share purchases relating to the US$3.2 billion programme announced on 20 September 2018, returning the post-tax proceeds of the coal assets to shareholders. The US$3.2 billion programme comprised: (i) the A$2.9 billion (US$2.1 billion) off-market share buy-back of Rio Tinto Limited shares, which completed on 12 November 2018; and (ii) the US$1.1 billion on-market buy-back of Rio Tinto plc shares, which completed on 26 February 2020. 10 Notice of annual general meeting 2021 | riotinto.com Explanatory notes to the resolutions

Under the DLC agreements, the approval for a buy-back of the company’s ordinary shares, whether by the company or by Rio Tinto Limited (or a subsidiary of Rio Tinto Limited), is voted on by the company’s shareholders only. Similarly, the approval for Rio Tinto Limited to buy back its ordinary shares is voted on by Rio Tinto Limited shareholders only. These approvals were most recently renewed at the 2020 annual general meetings and expire on the date of the 2021 annual general meetings. Authority is sought for the company, Rio Tinto Limited and/or any of Rio Tinto Limited’s subsidiaries, to purchase up to 10% of the issued ordinary share capital of the company during the period stated below. The authority will expire at the end of the annual general meeting of the company held in 2022 (or, if earlier, at the close of business on 8 July 2022). The authority sought would permit the company, Rio Tinto Limited and/or any of Rio Tinto Limited’s subsidiaries to purchase up to 124,768,190 of the company’s ordinary shares, representing approximately 10% of its issued ordinary share capital, excluding the shares held in treasury, as at the Latest Practicable Date. The maximum price that may be paid for an ordinary share (exclusive of expenses) is an amount equal to the higher of: (a) 5% above the average of the middle market quotations for an RTP Ordinary Share as derived from the London Stock Exchange Daily Official List during the period of five business days immediately prior to the day on which such share is contracted to be purchased; or (b) the higher of the price of the last independent trade and the highest current independent bid on the trading venue where the purchase is carried out. The minimum price that may be paid for an ordinary share (exclusive of expenses) is its nominal value. By way of illustration, the purchase of ordinary shares in the company with a total value of US$500 million at the share prices and exchange rates prevailing on 31 December 2020 would (if funded by debt), increase the Group’s net debt and reduce equity attributable to shareholders by US$500 million and, on the basis of the Group’s 2020 financial statements, would increase the ratio of net debt to total capital by 0.9 percentage points, from 1.3% to approximately 2.2%. The total number of outstanding employee share awards at the Latest Practicable Date was 5,379,740, which represents 0.43% of the issued ordinary share capital, excluding the shares held in treasury at that date. This excludes options and awards that the company intends to settle without the issue of new shares or the sale of treasury shares. If the company were to buy back the maximum number of shares permitted pursuant to this resolution, then this number of options and awards would represent 0.48% of the issued ordinary share capital, excluding the shares held in treasury. Pursuant to the Companies Act, the company can hold the ordinary shares that have been repurchased itself as treasury shares and resell them for cash, cancel them (either immediately or at a point in the future) or use them for the purposes of its employee share plans. Whenever any ordinary shares are held as treasury shares, all dividend and voting rights on these shares are suspended. Any shares purchased under the authority, if approved, would be cancelled. The authority being sought in paragraph (a) of resolution 21 extends to Rio Tinto Limited and/or any of its subsidiaries. Any purchase by the company from Rio Tinto Limited (or such subsidiaries) of the company’s ordinary shares would be an off-market purchase and the Companies Act requires the terms of any proposed contract for an off-market purchase to be approved by a special resolution of the company before the contract is entered into. Such approval is sought in paragraph (b) of resolution 21. The company is seeking the approval of shareholders for such off-market purchases from Rio Tinto Limited and/or any of its subsidiaries as may take place to be made at a price not less than one penny per parcel of shares. It is expected that such purchases would occur for nominal consideration. It is immaterial to the shareholders of either the company or Rio Tinto Limited if Rio Tinto Limited or any of Rio Tinto Limited’s subsidiaries make a gain or a loss on such transactions as they have no effect on the Group’s overall resources. The underlying purpose of these transactions would be to facilitate any capital management programme that the Group may be implementing at the relevant time, with the intention of returning surplus cash to shareholders in the most efficient manner. The DLC Merger Sharing Agreement contains the principles of equalisation, which ensure that entitlements to distributions of income and capital will be the same for all continuing shareholders regardless of whether the company’s or Rio Tinto Limited’s shares are purchased or whether the company, Rio Tinto Limited or a subsidiary of Rio Tinto Limited acts as the purchaser. Rio Tinto Limited will also seek to renew its shareholder approval to buy back its own ordinary shares at its 2021 annual general meeting on 6 May 2021. Resolution 22 Notice period for general meetings other than annual general meetings Changes made to the Companies Act by the Companies (Shareholders’ Rights) Regulations 2009 (the Regulations) increased the notice period required for general meetings of the company to 21 days, unless shareholders approve a shorter notice period, which cannot, however, be less than 14 clear days. Annual general meetings will continue to be held on at least 21 clear days’ notice. Before the Regulations came into force on 3 August 2009, the company was able to call general meetings, other than an annual general meeting, on 14 clear days’ notice without obtaining such shareholder approval. To preserve this ability, the company has sought and obtained the required shareholder approval at each annual general meeting since 2009. Resolution 22 seeks to renew this approval. The approval will be effective until the company’s annual general meeting in 2022, when it is intended that a similar resolution will be proposed. The shorter notice period would not be used as a matter of routine for such meetings but only where the flexibility is merited by the business of the meeting and is thought to be to the advantage of shareholders as a whole. 11Notice of annual general meeting 2021 | riotinto.com Explanatory notes to the resolutions

To access the meeting: (a) Visit https://web.lumiagm.com on your smartphone, tablet or computer. You will need the latest versions of Chrome, Safari, Internet Explorer 11, Edge or Firefox. Please ensure your browser is compatible. You will be prompted to enter the Meeting ID shown above. You will then be required to enter a login which is your: (b) SRN; and (c) PIN. Your personalised SRN and PIN are printed on your form of proxy. If you are unable to access your SRN and PIN, please contact the company’s registrar, Computershare, using the details set out at the bottom of the following page. Duly appointed proxies and corporate representatives: Following receipt of a valid appointment please contact Computershare before 5:30pm on 7 April 2021 on +44 (0)800 435 021 (or +44 (0)370 703 6364 if you are calling from outside the UK) for your SRN and PIN. Lines are open 8.30am to 5:30pm Monday to Friday (excluding UK public holidays). If you are viewing the meeting on a mobile device and you would like to listen to the broadcast, press the broadcast icon at the bottom of the screen. If you are viewing the meeting on a computer, the broadcast will appear at the side automatically once the meeting has started. Meeting Access Broadcast 12 Notice of annual general meeting 2021 | riotinto.com How to join the meeting virtually How to join the meeting virtually Meeting ID:190-795-803

If you are unable to access your SRN and PIN, please call Computershare Investor Services PLC (Computershare) between 8:30am and 5:30pm Monday to Friday (excluding UK public holidays) on +44 (0)800 435 021 (or +44 (0)370 703 6364 if you are calling from outside the UK). Calls from outside the UK will be charged at the applicable international rate. Different charges may apply to calls from mobile telephones. Please note that calls may be monitored or recorded and Computershare cannot provide advice on the merits of the transactions set out in the Scheme Document or give any financial, legal or tax advice. Requirements An active internet connection is required at all times in order to participate in the meeting. It is the user’s responsibility to ensure you remain connected for the duration of the meeting. Webcast The live webcast will include the question and answer sessions with shareholders. The webcast will be published on the Rio Tinto website after the meeting. Once the voting has opened at the start of the annual general meeting, the polling icon will appear on the navigation bar. From here, the resolutions and voting choices will be displayed. To vote, simply select your voting direction from the options shown on screen. A confirmation message will appear to show your vote has been received. To change your vote, simply select another direction. If you wish to cancel your vote, please press Cancel. Once the chair has opened voting, you can vote at any time during the meeting until the chair closes the voting on the resolutions. At that point your last choice will be submitted. You will still be able to send messages and view the webcast whilst the poll is open. Questions for the Board can be submitted in advance and will be addressed at the annual general meeting, or may be posed to the Board on the day through the Lumi platform. Questions on the day can be submitted either as text via the Lumi messaging function or verbally via the teleconference. Details of how to access the teleconference will be provided on the day of the annual general meeting once you are logged into the Lumi platform. Pre-submitted questions can be submitted via the Lumi platform until 11:00am (BST) 7 April 2021. Questions will be moderated before being sent to the chair. This is to avoid repetition and ensure the smooth running of the meeting. If multiple questions on the same topic are received, the chair may choose to provide a single answer to address shareholder queries on the same topic. Voting Questions 13Notice of annual general meeting 2021 | riotinto.com How to join the meeting virtually

1. Voting and proxies Entitlement to attend and vote In view of the public safety measures currently imposed by the UK government, the annual general meeting will be run as a hybrid meeting and shareholders and proxies (other than the directors at the meeting) will not be permitted to attend the meeting in person. Instead, shareholders can participate in the annual general meeting virtually via a live webcast, where they will be able to vote and ask questions. Details of how to attend virtually can be found on page 12. The company will, however, ensure that the legal requirements to hold the meeting are met by the attendance of a minimum number of shareholders to form a quorum. Including for the purposes of regulation 41 of the Uncertificated Securities Regulations 2001, the company specifies that only those shareholders registered in the register of members of the company as at 8:00pm on 7 April 2021 (the Specified Time) shall be entitled to participate and vote at the meeting in respect of the number of shares registered in their name at that time. Changes to entries on the relevant register of securities after the Specified Time shall be disregarded in determining the rights of any person to participate and vote at the meeting. If the meeting is adjourned to a time not more than 48 hours after the Specified Time applicable to the original meeting, that time will also apply for the purposes of determining the entitlement of members to participate and vote (and for the purposes of determining the number of votes they may cast) at the adjourned meeting. If, however, the meeting is adjourned for a longer period, then to be entitled to participate and vote at the meeting, members must be entered on the company’s register of members at a time that is not more than 48 hours before the time fixed for the adjourned meeting or, if the company gives notice of the adjourned meeting, at the time specified in that notice. Voting exclusions Resolutions 2, 3 and 4 Rio Tinto will disregard any votes cast on resolutions 2, 3 and 4: – by or on behalf of a member of key management personnel (KMP) (as defined in the Australian Corporations Act) named in the Remuneration Report for the year ended 31 December 2020 or their closely related parties, regardless of the capacity in which the vote is cast; or – as a proxy by a person who is a member of KMP at the date of the meeting or their closely related parties, unless the vote is cast as proxy for a person entitled to vote on resolutions 2, 3 and 4: – in accordance with a direction in the proxy form; or – by the Chairman of the meeting pursuant to an express authorisation to exercise the proxy. Resolution 17 Rio Tinto will disregard any votes cast on resolution 17 as a proxy by a person who is a member of KMP at the date of the meeting or their closely related parties, unless the vote is cast on resolution 17: – in accordance with a direction in the proxy form; or – by the Chairman of the meeting pursuant to an express authorisation to exercise the proxy. Appointment of proxies A member entitled to participate and vote at the meeting is entitled to appoint one or more persons of his/her choice, who need not be a member of the company, as his/her proxy to exercise any or all of his/her rights to participate and vote on his/her behalf at the meeting. A member may appoint more than one proxy in relation to the meeting provided that each proxy is appointed to exercise the rights attached to a different share or shares held by that member. A member may only appoint a proxy or proxies by the methods specified in this notice. As shareholders will not be permitted to attend the annual general meeting in person this year, in order to ensure their votes are counted, shareholders are strongly encouraged to appoint the chair of the meeting as their proxy. Any other person appointed as a proxy may be refused entry to the annual general meeting. Members entitled to vote will be provided with a proxy form. To be effective the proxy form and any power of attorney or other written authority under which it is executed (or a notarially certified copy of any such authority) must reach the transfer office of the company at Computershare Investor Services PLC, The Pavilions, Bridgwater Road, Bristol, BS99 6ZY by 11:00am on 7 April 2021 or not less than 48 hours before the time of the meeting or adjourned meeting or (in the case of a poll taken otherwise than at or on the same day as the meeting or adjourned meeting) the taking of the poll at which it is to be used. Completion and return of the proxy form will not prevent a member from participating and voting at the meeting themselves (and shareholders are referred to pages 12-13 for details of how to participate in the annual general meeting online). For further information please refer to your proxy form. If you do not have a proxy form and believe that you should have one, or if you require additional forms, please contact our registrar using the details set out on the final page of this notice of meeting. 14 Notice of annual general meeting 2021 | riotinto.com Further information about the meeting Further information about the meeting