Form 6-K RIO TINTO LTD For: Apr 30 Filed by: RIO TINTO PLC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Month of April 2021

| Commission file number: 001-10533 | Commission file number: 001-34121 | ||||

| Rio Tinto plc | Rio Tinto Limited | ||||

| ABN 96 004 458 404 | |||||

| (Translation of registrant’s name into English) | (Translation of registrant’s name into English) | ||||

| 6 St. James’s Square | Level 7, 360 Collins Street | ||||

| London, SW1Y 4AD, United Kingdom | Melbourne, Victoria 3000, Australia | ||||

| (Address of principal executive offices) | (Address of principal executive offices) | ||||

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to

Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If "Yes" is marked, indicate below the file number assigned to the registrant in connection

with Rule 12g3-2(b): 82- ________

EXHIBIT 99

7.Stock Exchange announcement dated 20 April 2021 entitled ‘Resolutions requisitioned by shareholders’

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorised.

| Rio Tinto plc | Rio Tinto Limited | ||||||||||

| (Registrant) | (Registrant) | ||||||||||

| By | /s/ Steve Allen | By | /s/ Steve Allen | ||||||||

| Name | Steve Allen | Name | Steve Allen | ||||||||

| Title | Company Secretary | Title | Joint Company Secretary | ||||||||

| Date | 3 May 2021 | Date | 3 May 2021 | ||||||||

EXHIBIT 99.1

Notice to ASX/LSE

Total voting rights and issued capital

1 April 2021

In accordance with the Financial Conduct Authority’s (FCA) Disclosure Guidance and Transparency Rule 5.6.1R, Rio Tinto plc notifies the market that as of 31 March 2021:

1.Rio Tinto plc’s issued share capital comprised 1,255,764,724 Ordinary shares of 10p each, each with one vote.

2.8,082,034 Ordinary shares of 10p each are held in treasury. These shares are not taken into consideration in relation to the payment of dividends and voting at shareholder meetings.

Accordingly the total number of voting rights in Rio Tinto plc is 1,247,682,690. This figure may be used by shareholders (and others with notification obligations) as the denominator for the calculation by which they will determine if they are required to notify their interest in, or a change to their interest in, Rio Tinto plc under the FCA’s Disclosure Guidance and Transparency Rules.

Note:

As at the date of this announcement:

(a)Rio Tinto plc has also issued one Special Voting Share of 10p and one DLC Dividend Share of 10p in connection with its dual listed companies (‘DLC’) merger with Rio Tinto Limited which was designed to place the shareholders of both companies in substantially the same position as if they held shares in a single enterprise owning all of the assets of both companies;

(b)the Special Voting Share facilitates joint voting by shareholders of Rio Tinto plc and Rio Tinto Limited on joint electorate resolutions; and

(c)there are 371,216,214 publicly held Rio Tinto Limited shares in issue which do not form part of the share capital of Rio Tinto plc.

LEI: 213800YOEO5OQ72G2R82

Classification: 2.5 Total number of voting rights and capital disclosed under article 15 of the Transparency Directive

This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary.

Steve Allen Group Company Secretary | |||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2058 Registered in England No. 719885 | |||||

EXHIBIT 99.2

Media release

Rio Tinto achieves battery grade lithium production at Boron plant

07 April 2021

BORON, Calif.--(BUSINESS WIRE)-- Rio Tinto has commenced production of battery-grade lithium from waste rock at a lithium demonstration plant at the Boron mine site in California, United States.

The demonstration plant is the next step in scaling up a breakthrough lithium production process developed at Boron, to recover the critical mineral and extract additional value out of waste piles from over 90 years of mining at the operation.

An initial small-scale trial in 2019 successfully proved the process of roasting and leaching waste rock to recover high grades of lithium.

The demonstration plant has a design capacity of 10 tonnes per year of battery grade lithium. It will be run throughout 2021 to optimise the process and inform Rio Tinto’s feasibility assessment for progressing to a production scale plant with an initial capacity of at least 5,000 tonnes per year, or enough to make batteries for approximately 70,000 electric vehicles.

Rio Tinto Minerals chief executive Sinead Kaufman said “This is a valuable next step in scaling up our production of lithium at the Boron site, all from using waste material without the need for further mining. It shows the innovative thinking we are applying across our business to find new ways to meet the demand for emerging commodities like lithium, which are part of the transition to a low-carbon future.”

Rio Tinto’s lithium pipeline includes the Jadar lithium-borate project in Serbia, for which a feasibility study is expected to complete by the end of 2021.

Development of the lithium project at Boron draws on Rio Tinto’s long standing partnership with the U.S. Department of Energy’s Critical Materials Institute (CMI), which is focussed on discovering ways to economically recover critical mineral by-products from existing refining and smelting processes. CMI experts worked alongside Rio Tinto technical leads to help solve a number of key processing challenges to produce battery grade lithium at Boron.

riotinto.com

Follow @RioTinto on Twitter

View source version on businesswire.com: https://www.businesswire.com/news/home/20210407005321/en/

View source version on businesswire.com: https://www.businesswire.com/news/home/20210407005321/en/Contacts

media.enquiries@riotinto.com

Media Relations, United Kingdom

Illtud Harri

M +44 7920 503 600

David Outhwaite

T +44 20 7781 1623

M +44 7787 597 493

Media Relations, Americas

Matthew Klar

T +1 514 608 4429

Media Relations, Asia

Grant Donald

T +65 6679 9290

M +65 9722 6028

Media Relations, Australia

Jonathan Rose

T +61 3 9283 3088

M +61 447 028 913

Matt Chambers

T +61 3 9283 3087

M +61 433 525 739

Jesse Riseborough

T +61 8 6211 6013

M +61 436 653 412

Investor Relations, United Kingdom

Menno Sanderse

T: +44 20 7781 1517

M: +44 7825 195 178

David Ovington

T +44 20 7781 2051

M +44 7920 010 978

Clare Peever

M: +44 7788 967 877

Investor Relations, Australia

Natalie Worley

T +61 3 9283 3063

M +61 409 210 462

Amar Jambaa

T +61 3 9283 3627

M +61 472 865 948

Group Company Secretary

Steve Allen

Joint Company Secretary

Tim Paine

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

Rio Tinto Limited

Level 7, 360 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

EXHIBIT 99.3

Media release

Rio Tinto details $47 billion 2020 economic contribution, including $8.4 billion of taxes and royalties

08 April 2021

MELBOURNE, Australia--(BUSINESS WIRE)-- Rio Tinto today released its 2020 Taxes paid: Our economic contribution report, which shows the company made a total direct economic contribution of $47 billion in the countries and communities where it operates, including $8.4 billion of taxes and royalties.

Despite the widespread challenges of COVID-19 in 2020, the contribution was up from the previous year, when Rio Tinto made a total direct economic contribution of $45.1 billion in the countries and communities where it operates, including $7.6 billion of taxes and royalties.

Most of Rio Tinto’s taxes and royalties were paid in Australia ($6.8 billion, or AUD9.8 billion, including $4.6 billion of corporate tax), home to the largest part of Rio Tinto’s business. The company also made significant payments in Canada ($651 million or CAD872 million), Mongolia ($277 million), Chile ($246 million), UK ($132 million), United States ($111 million), and South Africa ($61 million).

Rio Tinto’s $47 billion direct economic contribution in 2020 took the company’s total direct economic contribution since 2016 to $220 billion.

Rio Tinto interim chief financial officer Peter Cunningham said “As the COVID-19 virus threatened lives and livelihoods around the world, our entire company mobilised to safeguard our employees, contractors and local communities, and to keep our operations running safely and smoothly.

“The strength and resilience of our business, along with the commitment and flexibility of our employees, customers, communities and host governments, enabled us to protect thousands of jobs across our supply chain and continue to pay taxes and royalties to governments when many other companies were forced to cut back.”

More than a decade ago, Rio Tinto was the first company in the resources industry to voluntarily disclose its payments to governments in detail, and has continued to report on taxes and royalties paid, and economic contribution, in increasing detail ever since. In the past 10 years, Rio Tinto has paid $71.5 billion in taxes and royalties to governments around the world, including $54.4 billion paid in Australia.

Rio Tinto is a founding member of the Extractive Industries Transparency Initiative and a signatory to the B Team Tax Principles, a not-for-profit initiative formed by a group of cross-sector, cross-regional companies to help define what leadership in responsible tax looks like.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210407005970/en/

media.enquiries@riotinto.com

riotinto.com

Follow @RioTinto on Twitter

Media Relations, United Kingdom

Illtud Harri

M +44 7920 503 600

David Outhwaite

T +44 20 7781 1623

M +44 7787 597 493

Media Relations, Americas

Matthew Klar

T +1 514 608 4429

Media Relations, Asia

Grant Donald

T +65 6679 9290

M +65 9722 6028

Media Relations, Australia

Jonathan Rose

T +61 3 9283 3088

M +61 447 028 913

Matt Chambers

T +61 3 9283 3087

M +61 433 525 739

Jesse Riseborough

T +61 8 6211 6013

M +61 436 653 412

Investor Relations, United Kingdom

Menno Sanderse

T: +44 20 7781 1517

M: +44 7825 195 178

David Ovington

T +44 20 7781 2051

M +44 7920 010 978

Clare Peever

M: +44 7788 967 877

Investor Relations, Australia

Natalie Worley

T +61 3 9283 3063

M +61 409 210 462

Amar Jambaa

T +61 3 9283 3627

M +61 4 7286 5948

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

Rio Tinto Limited

Level 7, 360 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

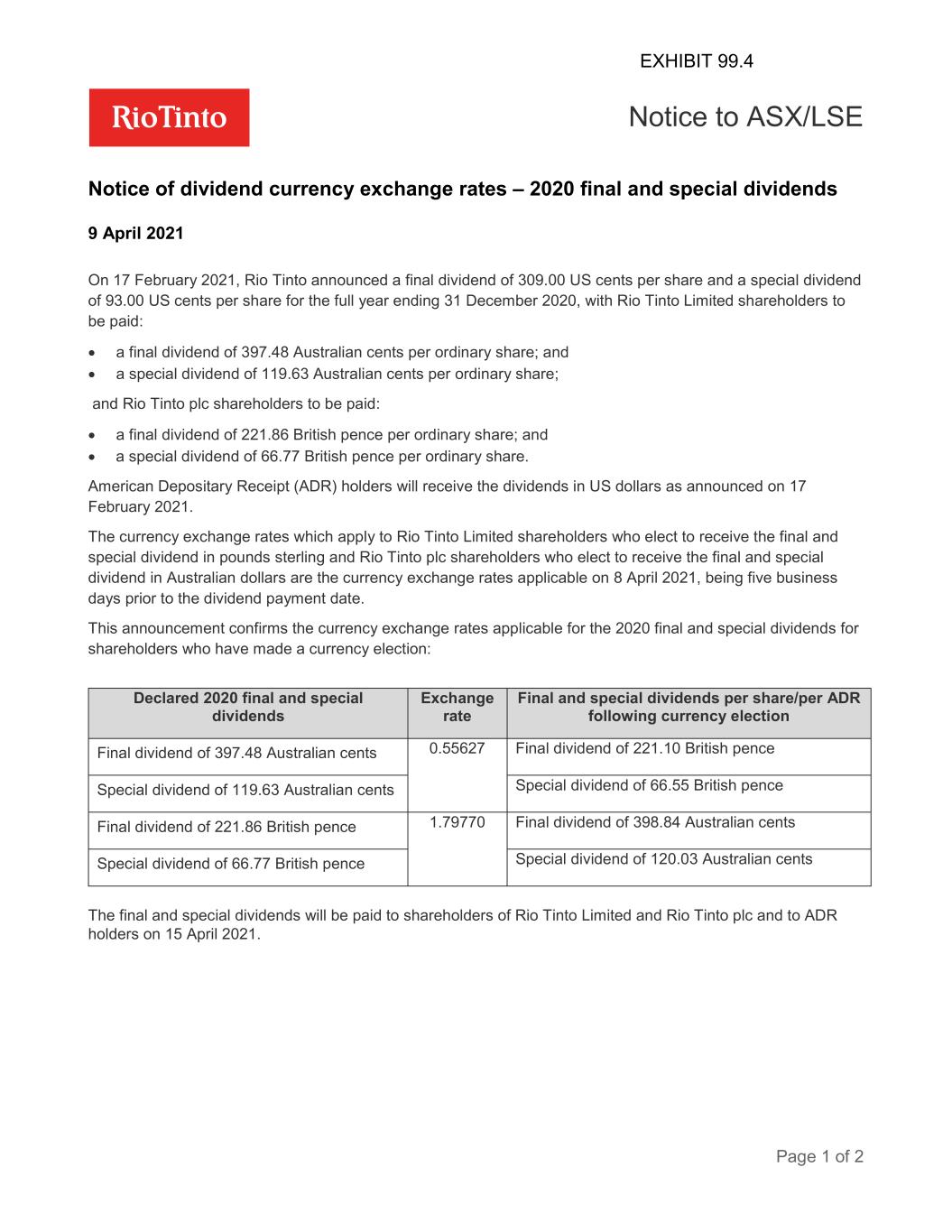

Notice to ASX/LSE Page 1 of 2 Notice of dividend currency exchange rates – 2020 final and special dividends 9 April 2021 On 17 February 2021, Rio Tinto announced a final dividend of 309.00 US cents per share and a special dividend of 93.00 US cents per share for the full year ending 31 December 2020, with Rio Tinto Limited shareholders to be paid: • a final dividend of 397.48 Australian cents per ordinary share; and • a special dividend of 119.63 Australian cents per ordinary share; and Rio Tinto plc shareholders to be paid: • a final dividend of 221.86 British pence per ordinary share; and • a special dividend of 66.77 British pence per ordinary share. American Depositary Receipt (ADR) holders will receive the dividends in US dollars as announced on 17 February 2021. The currency exchange rates which apply to Rio Tinto Limited shareholders who elect to receive the final and special dividend in pounds sterling and Rio Tinto plc shareholders who elect to receive the final and special dividend in Australian dollars are the currency exchange rates applicable on 8 April 2021, being five business days prior to the dividend payment date. This announcement confirms the currency exchange rates applicable for the 2020 final and special dividends for shareholders who have made a currency election: Declared 2020 final and special dividends Exchange rate Final and special dividends per share/per ADR following currency election Final dividend of 397.48 Australian cents 0.55627 Final dividend of 221.10 British pence Special dividend of 119.63 Australian cents Special dividend of 66.55 British pence Final dividend of 221.86 British pence 1.79770 Final dividend of 398.84 Australian cents Special dividend of 66.77 British pence Special dividend of 120.03 Australian cents The final and special dividends will be paid to shareholders of Rio Tinto Limited and Rio Tinto plc and to ADR holders on 15 April 2021. EXHIBIT 99.4

Page 2 of 2 Contacts [email protected] riotinto.com Follow @RioTinto on Twitter Media Relations, United Kingdom Illtud Harri M +44 7920 503 600 David Outhwaite T +44 20 7781 1623 M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Media Relations, Asia Grant Donald T +65 6679 9290 M +65 9722 6028 Media Relations, Australia Jonathan Rose T +61 3 9283 3088 M +61 447 028 913 Matt Chambers T +61 3 9283 3087 M +61 433 525 739 Jesse Riseborough T +61 8 6211 6013 M +61 436 653 412 Investor Relations, United Kingdom Menno Sanderse T: +44 20 7781 1517 M: +44 7825 195 178 David Ovington T +44 20 7781 2051 M +44 7920 010 978 Clare Peever M: +44 7788 967 877 Investor Relations, Australia Natalie Worley T +61 3 9283 3063 M +61 409 210 462 Amar Jambaa T +61 3 9283 3627 M +61 472 865 948 Group Company Secretary Steve Allen Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Joint Company Secretary Tim Paine Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary.

EXHIBIT 99.5

Notice to ASX/LSE

Shareholdings of persons discharging managerial responsibility (PDMR) / Key Management Personnel (KMP)

13 April 2021

As part of its dual listed company structure, Rio Tinto notifies dealings in Rio Tinto plc and Rio Tinto Limited securities by PDMRs/KMPs to both the Australian Securities Exchange (ASX) and the London Stock Exchange (LSE).

On 12 April 2021, the Company was notified that Simon Trott, a PDMR/KMP, had transferred 23,437

Rio Tinto Limited ordinary shares of AUD1.00 each to Carnwrath Pty Ltd, a person closely associated (PCA). The transfer took place on 12 April 2021.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

This announcement is authorised for release to the market by Rio Tinto's Group Company Secretary.

Steve Allen

Group Company Secretary

Tim Paine

Joint Company Secretary

Rio Tinto plc

6 St James's Square London SW1Y 4AD United Kingdom

T +44 20 7781 2000

Registered in England No. 719885

Rio Tinto Limited

360 Collins Street

Melbourne 3000 Australia

T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404

EXHIBIT 99.6

Media release

ELYSIS selects Alma smelter for commercial size 450 kA inert anode prototype cells

20 April 2021

MONTREAL, Canada - ELYSIS today announced it has selected the Alma smelter, operated by Rio Tinto in Saguenay-Lac-Saint-Jean, Quebec, for the first installation and demonstration of its inert anode technology at a commercial size of 450 kiloamperes (kA), which is a common capacity for modern, full-scale smelters.

ELYSIS is a joint venture company, led by Rio Tinto and Alcoa, that is working to commercialize a new technology to make aluminum that eliminates all direct greenhouse gases (GHGs) from the traditional smelting process and instead produces oxygen.

As part of its technology development and scale-up, ELYSIS will install industrial inert anode prototype cells at the end of an existing potline at the Alma smelter to demonstrate the technology’s effectiveness at a commercial scale in an industrial operating environment. This will build on ongoing work at the nearby ELYSIS Industrial Research and Development Centre, also located in the Saguenay region of Quebec.

ELYSIS plans to commercialise its breakthrough technology in 2024, for use in retrofitting existing smelters and installation in new facilities.

Investment by the Government of Quebec

The 450 kA cells at Alma will be supported by a $20 million CAD investment from the Government of Quebec to help bring forward the start of work at the site and to further strengthen the capability of manufacturing businesses in the region to supply specialized equipment required for the ELYSIS technology.

The technology at a glance

•The ELYSIS technology addresses the global trend towards producing low carbon footprint products, from mobile phones to cars, planes and building materials.

•The new process will reduce operating costs of aluminium smelters while increasing production capacity. It could be used in both new and existing aluminium smelters.

•In Canada alone, the ELYSIS technology has the potential to reduce GHG emissions by 7 million tons, the equivalent of removing 1.8 million cars from the roads.

•ELYSIS will also sell next-generation anode and cathode materials, which will last more than 30 times longer than traditional components.

ELYSIS continues to work closely with the Rio Tinto technology design team in France and Alcoa's Technical Center, where the zero-carbon smelting technology was invented.

The Rio Tinto technology team in France is creating commercial scale designs for the ELYSIS technology. Alcoa's Technical Center supports ELYSIS in the manufacture of proprietary materials for the new anodes and cathodes that are essential to the ELYSIS process.

Quotes

“The road ahead is seeing the technology scaled up at our facilities in Québec, where we already use clean hydropower to deliver some of the world’s lowest carbon aluminum. Putting this hydropower together with the ELYSIS technology can take aluminum to the next level as a sustainable material, and help cut the carbon footprint of everything from cars to smartphones, buildings and food and beverage packaging.”

- Samir Cairae, Rio Tinto Aluminium managing director Atlantic Operations

“Our team is thrilled to be taking a significant step forward in the development of technology that will position ELYSIS as a leader of tomorrow’s aluminium industry technology. We would like to thank our provincial government for their support in our breakthrough technology. We look forward to using the new 450 kA inert anode cells to demonstrate to the industry that decarbonizing aluminium production while improving its competitiveness is not just a mere dream.”

- Vincent Christ, Chief Executive Officer, ELYSIS

“Innovation is a key enabler to help the global aluminum industry further decarbonize, and we are proud to see the technology that Alcoa first developed advance further with a potential retrofit solution. The ELYSIS technology offers the opportunity to improve the competitiveness of existing smelters, not only eliminating all greenhouse gas emissions, but also boosting productivity and improving costs.”

- Ben Kahrs, Alcoa Executive Vice President and Chief Innovation Officer

Notes to editors

ELYSIS is a technology company that was created thanks to a ground-breaking partnership between two global industry leaders – Alcoa and Rio Tinto. ELYSIS’ goal is

to revolutionize the way aluminium is produced across the globe. Our process eliminates all direct greenhouse gases from aluminium smelting, and instead produces pure oxygen. Alcoa, Rio Tinto, the Government of Canada and the Government of Quebec provided a combined investment of $188 million (CAD) to create ELYSIS and to see this technology reach commercial maturity in 2024. Learn more at www.elysis.com.

| Contacts | Please direct all enquiries to media.enquiries@riotinto.com | ||||

Media Relations, UK Illtud Harri M +44 7920 503 600 David Outhwaite M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Investor Relations, UK Menno Sanderse M: +44 7825 195 178 David Ovington M +44 7920 010 978 Clare Peever M +44 7788 967 877 | Media Relations, Australia Jonathan Rose M +61 447 028 913 Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Investor Relations, Australia Natalie Worley M +61 409 210 462 Amar Jambaa M +61 472 865 948 | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

Notice to ASX 20 April 2021 Resolutions requisitioned by shareholders In accordance with ASX Listing Rule 3.17A.1, Rio Tinto advises that it has received two proposed resolutions under section 249N of the Corporations Act 2001 for consideration at the 2022 Rio Tinto Limited Annual General Meeting, to be held in over 12 months’ time. The first resolution proposes an amendment to the company’s constitution to permit the company’s members in general meeting to pass advisory resolutions. The second resolution requests disclosure by the company in relation to its risk threshold to Scope 3 emissions and the measures it will take to reduce this exposure. The resolutions have been submitted for consideration at the 2022 Rio Tinto Limited Annual General Meeting by Market Forces as agent for 103 shareholders representing approximately 0.016% of the shares on issue in Rio Tinto Limited. These resolutions are not for consideration by shareholders at the 2021 Rio Tinto Limited Annual General Meeting on 6 May 2021. Rio Tinto continues to engage with Market Forces to try to understand the rationale for submitting these resolutions more than one year head of the 2022 Annual General Meeting, during which time Rio Tinto will produce its fourth Climate Change Report in compliance with the recommendations of the Taskforce on Climate-related Financial Disclosure, which it has committed to submit for a non-binding ‘say on climate’ advisory vote at the same Annual General Meeting. EXHIBIT 99.7

Notice to ASX Page 2 of 2 Contacts Please direct all enquiries to [email protected] Media Relations, UK Illtud Harri M +44 7920 503 600 David Outhwaite M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Investor Relations, UK Menno Sanderse M: +44 7825 195 178 David Ovington M +44 7920 010 978 Clare Peever M +44 7788 967 877 Media Relations, Australia Jonathan Rose M +61 447 028 913 Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Investor Relations, Australia Natalie Worley M +61 409 210 462 Amar Jambaa M +61 472 865 948 Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary. riotinto.com

EXHIBIT 99.8

Notice to ASX/LSE

Shareholdings of directors and persons discharging managerial responsibility (PDMR) / Key Management Personnel (KMP)

Rio Tinto plc notifies the London Stock Exchange (LSE) of PDMR interests in securities of Rio Tinto plc, in compliance with the EU Market Abuse Regulation. As part of its dual listed company structure, Rio Tinto voluntarily notifies the Australian Securities Exchange (ASX) of material dealings in Rio Tinto plc shares by PDMR/KMP and both the ASX and the LSE of material dealings by PDMR/KMP in Rio Tinto Limited securities.

On 20 April 2021, the following PDMR/KMP sold shares as follows:

| Security | Name of PDMR/KMP | Number of shares sold | Price per share GBP | ||||||||

Rio Tinto plc | Alfredo Barrios | 81,500 | 59.707670 | ||||||||

FCA notifications in accordance with the EU Market Abuse Regulation have been issued to the London Stock Exchange contemporaneously with this release.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

| Contacts | Please direct all enquiries to media.enquiries@riotinto.com | ||||

Media Relations, UK Illtud Harri M +44 7920 503 600 David Outhwaite M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Investor Relations, UK Menno Sanderse M: +44 7825 195 178 David Ovington M +44 7920 010 978 Clare Peever M +44 7788 967 877 | Media Relations, Australia Jonathan Rose M +61 447 028 913 Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Investor Relations, Australia Natalie Worley M +61 409 210 462 Amar Jambaa M +61 472 865 948 | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

Notice to ASX/LSE Page 2 of 3 | ||

EXHIBIT 99.9

Notice to ASX/LSE

Shareholdings of persons discharging managerial responsibility (PDMR) / Key Management Personnel (KMP)

As part of its dual listed company structure, Rio Tinto notifies dealings in Rio Tinto plc and Rio Tinto Limited securities by PDMRs to both the Australian Securities Exchange (ASX) and the London Stock Exchange (LSE).

Global Employee Share Plan (myShare)

Under myShare employees are able to purchase, on a quarterly basis, Rio Tinto plc ordinary shares of 10p each or Rio Tinto Limited ordinary shares (‘shares’). Shares are purchased out of monthly deductions from salary, and participants are allocated an equivalent number of shares free of charge (‘matching shares’), conditional upon satisfying the terms of myShare.

The following PDMRs acquired Rio Tinto shares under myShare and were allocated the same number of matching share awards as follows:

| Security | Name of PDMR | Number of shares | Matching shares | Price per share | Date of transaction | ||||||||||||

Rio Tinto plc shares | Baatar, Bold | 6.1784 | 6.1784 | 60.69488 GBP | 19/04/2021 | ||||||||||||

Rio Tinto plc shares | Barrios, Alfredo | 12.0782 | 12.0782 | 60.69488 GBP | 19/04/2021 | ||||||||||||

Rio Tinto plc shares | Cunningham, Peter | 6.1784 | 6.1784 | 60.69488 GBP | 19/04/2021 | ||||||||||||

Rio Tinto Limited shares | Kaufman, Sinead | 11.6152 | 11.6152 | 120.36 AUD | 19/04/2021 | ||||||||||||

Rio Tinto plc shares | Stausholm, Jakob | 6.1784 | 6.1784 | 60.69488 GBP | 19/04/2021 | ||||||||||||

Rio Tinto plc shares | Toth, Peter | 6.1784 | 6.1784 | 60.69488 GBP | 19/04/2021 | ||||||||||||

Rio Tinto Limited shares | Vella, Ivan | 6.6467 | 6.6467 | 120.36 AUD | 19/04/2021 | ||||||||||||

UK Share Plan (UKSP)

The UKSP is an HMRC approved Share Incentive Plan under which qualifying UK employees are able to purchase, on a quarterly basis, Rio Tinto plc shares. Rio Tinto plc shares are purchased out of monthly deductions from salary, and participants are allocated an equivalent number of shares free of charge (UKSP matching shares). Qualifying UK employees are also awarded Free Shares once a year.

The following PDMRs purchased Rio Tinto plc shares under the UKSP and were allocated the same number of matching shares as follows:

| Security | Name of PDMR | Number of Shares Acquired | Matching shares | Price per Share GBP | Date of transaction | ||||||||||||

Rio Tinto plc shares | Baatar, Bold | 6 | 6 | 60.69488 | 19/04/2021 | ||||||||||||

Rio Tinto plc shares | Stausholm, Jakob | 6 | 6 | 60.69488 | 19/04/2021 | ||||||||||||

Rio Tinto plc shares | Toth, Peter | 6 | 6 | 60.69488 | 19/04/2021 | ||||||||||||

FCA notifications in accordance with the EU Market Abuse Regulation have been issued to the London Stock Exchange contemporaneously with this release.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

Notice to ASX/LSE Page 2 of 3 | ||

| Contacts | Please direct all enquiries to media.enquiries@riotinto.com | ||||

Media Relations, UK Illtud Harri M +44 7920 503 600 David Outhwaite M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Investor Relations, UK Menno Sanderse M: +44 7825 195 178 David Ovington M +44 7920 010 978 Clare Peever M +44 7788 967 877 | Media Relations, Australia Jonathan Rose M +61 447 028 913 Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Investor Relations, Australia Natalie Worley M +61 409 210 462 Amar Jambaa M +61 472 865 948 | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

Notice to ASX/LSE Page 3 of 3 | ||

EXHIBIT 99.10

Notice to ASX/LSE

Shareholdings of persons discharging managerial responsibility (PDMR) / Key Management Personnel (KMP)

21 April 2021

Dividend Reinvestment

As part of its dual listed company structure, Rio Tinto notifies dealings in Rio Tinto plc and Rio Tinto Limited securities by PDM/KMP to both the Australian Securities Exchange (ASX) and the London Stock Exchange (LSE).

Vested Share Account (VSA)

Rio Tinto plc ordinary shares of 10p each and Rio Tinto Limited ordinary shares (‘Shares’) held in a VSA are subject to dividend reinvestment whereby cash dividends are used to buy Shares in the market.

On 16 April 2021 the following PDMR/KMP acquired shares in Rio Tinto plc by way of reinvestment of dividends received on shares held in a VSA.

| Security | Name of PDMR/KMP | Number of Shares Acquired | Price per Share GBP | ||||||||

| Rio Tinto plc shares | Barrios, Alfredo | 5,053.4995 | 59.828703 | ||||||||

| Rio Tinto plc shares | Cunningham, Peter | 622.1427 | 59.828703 | ||||||||

| Rio Tinto plc shares | Toth, Peter | 4.57842 | 59.828703 | ||||||||

| Rio Tinto plc shares | Trott, Simon | 74.3563 | 59.828703 | ||||||||

On 16 April 2021 the following PDMR/KMP acquired shares in Rio Tinto Limited by way of reinvestment of dividends received on shares held in a VSA.

| Security | Name of PDMR/KMP | Number of Shares Acquired | Price per Share AUD | ||||||||

| Rio Tinto Limited shares | Kaufman, Sinead | 653.47899 | 118.79 | ||||||||

| Rio Tinto Limited shares | Trott, Simon | 323.25699 | 118.79 | ||||||||

UK Share Plan (UKSP)

The UKSP is an HMRC approved Share Incentive Plan under which qualifying UK employees are able to purchase, on a quarterly basis, Rio Tinto plc shares. Rio Tinto plc shares are purchased out of monthly deductions from salary, and participants are allocated an equivalent number of shares free of charge (UKSP matching shares). Qualifying UK employees are also awarded Free Shares once a year.

Rio Tinto plc shares held in the UKSP are subject to dividend reinvestment whereby cash dividends are used to buy Rio Tinto plc shares in the market.

On 16 April 2021 the following PDMR/KMP acquired shares in Rio Tinto plc by way of reinvestment of dividends received on shares held in a UKSP.

| Security | Name of PDMR/KMP | Number of Shares Acquired | Price per Share GBP | ||||||||

| Rio Tinto plc shares | Baatar, Bold | 19 | 59.828703 | ||||||||

| Rio Tinto plc shares | Cunningham, Peter | 140 | 59.828703 | ||||||||

| Rio Tinto plc shares | Stausholm, Jakob | 11 | 59.828703 | ||||||||

| Rio Tinto plc shares | Toth, Peter | 71 | 59.828703 | ||||||||

Global Employee Share Plan (myShare)

Under myShare employees are able to purchase, on a quarterly basis, Rio Tinto plc ordinary shares of 10p each, Rio Tinto plc ADRs or Rio Tinto Limited ordinary shares (‘Shares’). Shares are purchased out of monthly deductions from salary and participants are allocated an equivalent number of shares or ADRs free of charge (‘matching shares’ and ‘matching ADRs’), conditional upon satisfying the terms of myShare. The matching shares or matching ADRs are subject to a three year holding period, and vest after this period.

Rio Tinto Shares held in myShare are subject to dividend reinvestment whereby cash dividends are used to buy Shares in the market under the terms of myShare.

On 16 April 2021 the following PDMR/KMP acquired Rio Tinto plc shares by way of reinvestment of dividends received on shares held in myShare.

| Security | Name of PDMR/KMP | Number of Shares Acquired | Price per Share GBP | ||||||||

| Rio Tinto plc shares | Baatar, Bold | 24.3762 | 59.828703 | ||||||||

| Rio Tinto plc shares | Barrios, Alfredo | 9.9641 | 59.828703 | ||||||||

| Rio Tinto plc shares | Cunningham, Peter | 33.6532 | 59.828703 | ||||||||

| Rio Tinto plc shares | Stausholm, Jakob | 2.865 | 59.828703 | ||||||||

| Rio Tinto plc shares | Toth, Peter | 23.4482 | 59.828703 | ||||||||

| Rio Tinto plc shares | Trott, Simon | 8.7872 | 59.828703 | ||||||||

On 16 April 2021 the following PDMR/KMP acquired Rio Tinto Limited shares by way of reinvestment of dividends received on shares held in myShare.

| Security | Name of PDMR/KMP | Number of Shares Acquired | Price per Share AUD | ||||||||

| Rio Tinto Limited shares | Kaufman, Sinead | 24.0164 | 118.79 | ||||||||

| Rio Tinto Limited shares | Trott, Simon | 57.1661 | 118.79 | ||||||||

| Rio Tinto Limited shares | Vella, Ivan | 6.8684 | 118.79 | ||||||||

FCA notifications in accordance with the EU Market Abuse Regulation have been issued to the London Stock Exchange contemporaneously with this release.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

Notice to ASX/LSE Page 2 of 3 | ||

| Contacts | Please direct all enquiries to media.enquiries@riotinto.com | ||||

Media Relations, UK Illtud Harri M +44 7920 503 600 David Outhwaite M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Investor Relations, UK Menno Sanderse M: +44 7825 195 178 David Ovington M +44 7920 010 978 Clare Peever M +44 7788 967 877 | Media Relations, Australia Jonathan Rose M +61 447 028 913 Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Investor Relations, Australia Natalie Worley M +61 409 210 462 Amar Jambaa M +61 472 865 948 | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

Notice to ASX/LSE Page 3 of 3 | ||

EXHIBIT 99.11

Notice to ASX/LSE

Shareholdings of persons discharging managerial responsibility (PDMR) / Key Management Personnel (KMP)

As part of its dual listed company structure, Rio Tinto notifies dealings in Rio Tinto plc and Rio Tinto Limited securities by PDMR/KMP to both the Australian Securities Exchange (ASX) and the London Stock Exchange (LSE).

Global Employee Share Plan (myShare)

Under myShare employees are able to purchase, on a quarterly basis, Rio Tinto plc ordinary shares of 10p each or Rio Tinto Limited ordinary shares (‘shares’). Shares are purchased out of monthly deductions from salary and participants are allocated an equivalent number of shares free of charge (‘matching shares’), conditional upon satisfying the terms of myShare. The matching shares are subject to a three year holding period, and vest after this period.

Upon vesting, on 19 April 2021, the following PDMR/KMP received matching shares under myShare, of which sufficient were sold on 20 April 2021 to pay applicable withholding tax and other deductions.

| Security | Name of PDMR/KMP | No: of Matching Shares Granted | No: of Shares Vested* | No: of Shares Sold | Price per Share Sold | No: of Shares Retained | ||||||||||||||

Rio Tinto plc shares | Baatar, Bold | 20.0177 | 24.1951 | 10.1621 | 60.18885 | 14.0330 | ||||||||||||||

Rio Tinto plc shares | Barrios, Alfredo | 19.1519 | 23.1487 | 9.3538 | 60.18885 | 13.7949 | ||||||||||||||

Rio Tinto plc shares | Cunningham, Peter | 10.0088 | 12.0972 | 5.0811 | 60.18885 | 7.0161 | ||||||||||||||

| Rio Tinto Limited shares | Kaufman, Sinead | 17.9599 | 21.3838 | 0 | - | 21.3838 | ||||||||||||||

Rio Tinto plc shares | Toth, Peter | 10.0088 | 12.0972 | 5.0811 | 60.18885 | 7.0161 | ||||||||||||||

| Rio Tinto plc shares | Trott, Simon | 24.6298 | 29.77 | 6.5496 | 60.18885 | 23.2204 | ||||||||||||||

| Rio Tinto Limited shares | Vella, Ivan | 15.4162 | 18.3551 | 0 | - | 18.3551 | ||||||||||||||

*The number of shares vested includes additional shares calculated to reflect dividends declared during the vesting period on the original shares granted, in accordance with the plan rules.

FCA notifications in accordance with the EU Market Abuse Regulation have been issued to the London Stock Exchange contemporaneously with this release.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

| Contacts | Please direct all enquiries to media.enquiries@riotinto.com | ||||

Media Relations, UK Illtud Harri M +44 7920 503 600 David Outhwaite M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Investor Relations, UK Menno Sanderse M: +44 7825 195 178 David Ovington M +44 7920 010 978 Clare Peever M +44 7788 967 877 | Media Relations, Australia Jonathan Rose M +61 447 028 913 Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Investor Relations, Australia Natalie Worley M +61 409 210 462 Amar Jambaa M +61 472 865 948 | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

Notice to ASX/LSE Page 2 | ||

This appendix is not available as an online form Please fill in and submit as a PDF announcement +Rule 3.10.3A, 3.10.3B, 3.10.3C + See chapter 19 for defined terms 31 January 2020 Page 1 Appendix 3G Notification of issue, conversion or payment up of equity +securities Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public. If you are an entity incorporated outside Australia and you are issuing a new class of +securities other than CDIs, you will need to obtain and provide an International Securities Identification Number (ISIN) for that class. Further information on the requirement for the notification of an ISIN is available from the Create Online Forms page. ASX is unable to create the new ISIN for non-Australian issuers. *Denotes minimum information required for first lodgement of this form, with exceptions provided in specific notes for certain questions. The balance of the information, where applicable, must be provided as soon as reasonably practicable by the entity. Part 1 – Entity and announcement details Question no Question Answer 1.1 *Name of entity We (the entity here named) give notice of the issue, conversion or payment up of the following unquoted +securities. Rio Tinto Limited 1.2 *Registration type and number Please supply your ABN, ARSN, ARBN, ACN or another registration type and number (if you supply another registration type, please specify both the type of registration and the registration number). 96 004 458 404 1.3 *ASX issuer code RIO 1.4 *This announcement is Tick whichever is applicable. ☒ A new announcement ☐ An update/amendment to a previous announcement ☐ A cancellation of a previous announcement 1.5 *Date of this announcement 26 April 2021 EXHIBIT 99.12

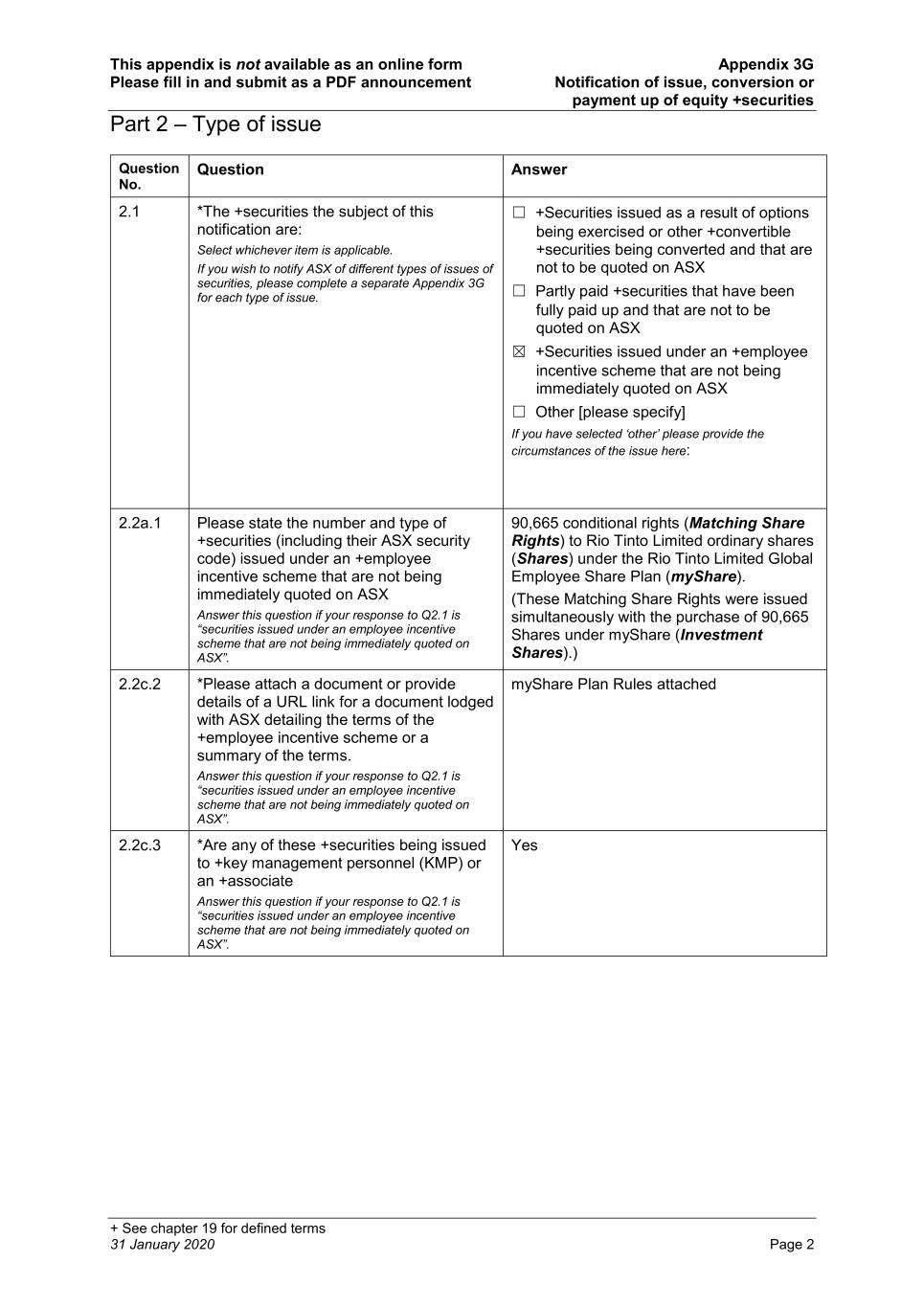

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities + See chapter 19 for defined terms 31 January 2020 Page 2 Part 2 – Type of issue Question No. Question Answer 2.1 *The +securities the subject of this notification are: Select whichever item is applicable. If you wish to notify ASX of different types of issues of securities, please complete a separate Appendix 3G for each type of issue. ☐ +Securities issued as a result of options being exercised or other +convertible +securities being converted and that are not to be quoted on ASX ☐ Partly paid +securities that have been fully paid up and that are not to be quoted on ASX ☒ +Securities issued under an +employee incentive scheme that are not being immediately quoted on ASX ☐ Other [please specify] If you have selected ‘other’ please provide the circumstances of the issue here: 2.2a.1 Please state the number and type of +securities (including their ASX security code) issued under an +employee incentive scheme that are not being immediately quoted on ASX Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. 90,665 conditional rights (Matching Share Rights) to Rio Tinto Limited ordinary shares (Shares) under the Rio Tinto Limited Global Employee Share Plan (myShare). (These Matching Share Rights were issued simultaneously with the purchase of 90,665 Shares under myShare (Investment Shares).) 2.2c.2 *Please attach a document or provide details of a URL link for a document lodged with ASX detailing the terms of the +employee incentive scheme or a summary of the terms. Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. myShare Plan Rules attached 2.2c.3 *Are any of these +securities being issued to +key management personnel (KMP) or an +associate Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. Yes

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities + See chapter 19 for defined terms 31 January 2020 Page 3 2.2c.3.a *Provide details of the recipients and the number of +securities issued to each of them. Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX” and your response to Q2.2c.3 is “Yes”. Repeat the detail in the table below for each KMP involved in the issue. If the securities are being issued to the KMP, repeat the name of the KMP or insert “Same” in “Name of registered holder”. If the securities are being issued to an associate of a KMP, insert the name of the associate in “Name of registered holder”. Name of KMP Name of registered holder Number of +securities Ivan Vella Computershare Trustees (Jersey) Limited on behalf of Mr Vella 6.6467 Matching Share Rights under myShare (These Matching Share Rights were issued simultaneously with the purchase of 6.6467 Investment Shares under myShare.) Sinead Kaufman Computershare Trustees (Jersey) Limited on behalf of Ms Kaufman 11.6152 Matching Share Rights under myShare (These Matching Share Rights were issued simultaneously with the purchase of 11.6152 Investment Shares under myShare.) 2.3 *The +securities being issued are: Tick whichever is applicable ☒ Additional +securities in an existing unquoted class that is already recorded by ASX ("existing class") ☐ New +securities in an unquoted class that is not yet recorded by ASX ("new class") Part 3A – number and type of +securities being issued (existing class) Answer the questions in this part if your response to Q2.3 is “existing class”. Question No. Question Answer 3A.1 *ASX security code & description RIOAL 3A.2 *Number of +securities being issued 90,665 Matching Share Rights under myShare - (These Matching Share Rights were issued simultaneously with the purchase of 90,665 Investment Shares under myShare.) 3A.3a *Will the +securities being issued rank equally in all respects from their issue date with the existing issued +securities in that class? Yes

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities + See chapter 19 for defined terms 31 January 2020 Page 4 Part 4 – Issue details Question No. Question Answer 4.1 *Have the +securities been issued yet? Yes 4.1a *What was their date of issue? Answer this question if your response to Q4.1 is “Yes”. 19 April 2021 4.2 *Are the +securities being issued for a cash consideration? If the securities are being issued for nil cash consideration, answer this question “No”. No 4.2c Please describe the consideration being provided for the +securities Answer this question if your response to Q4.2 is “No”. Nil consideration under the terms of myShare

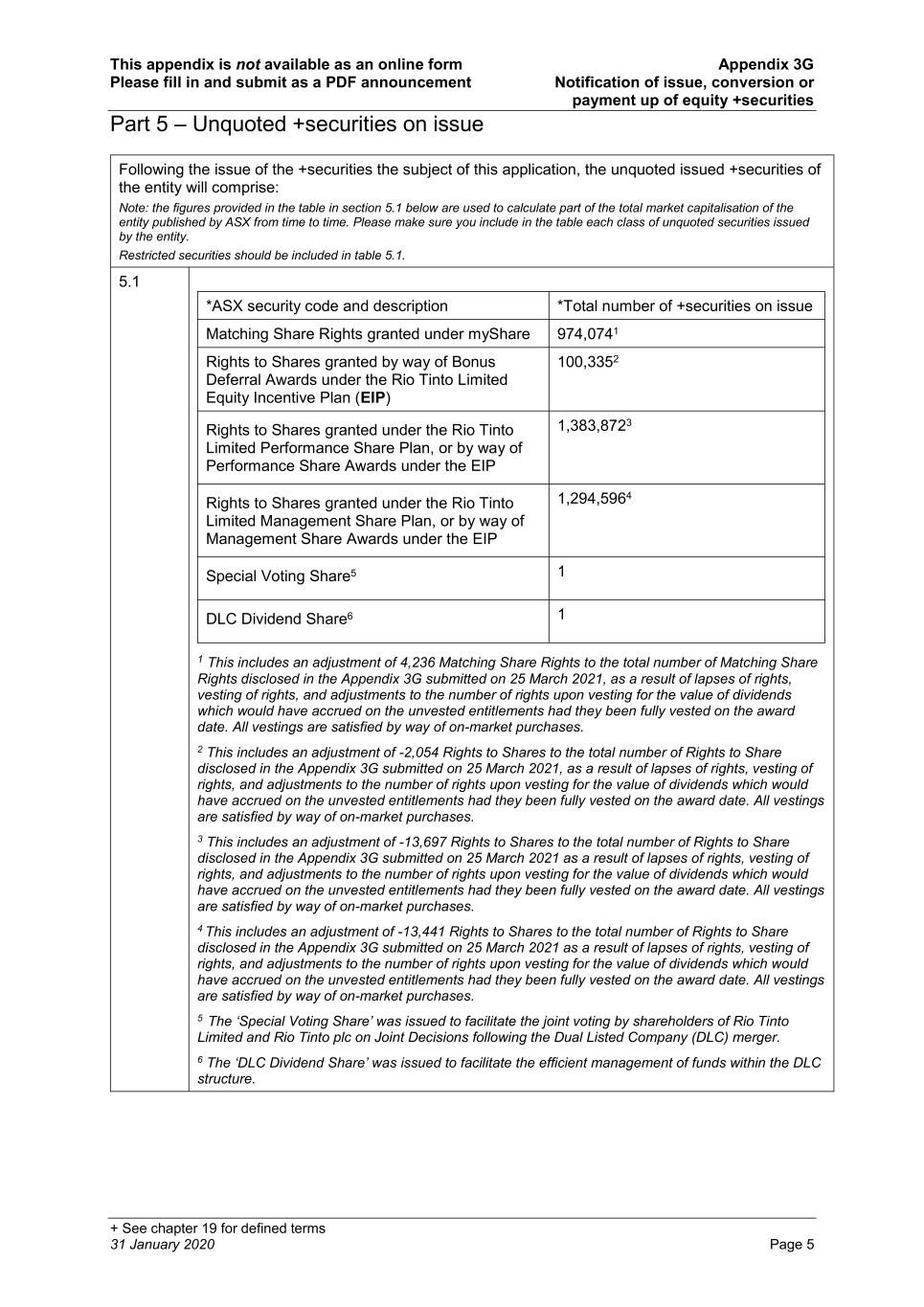

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities + See chapter 19 for defined terms 31 January 2020 Page 5 Part 5 – Unquoted +securities on issue Following the issue of the +securities the subject of this application, the unquoted issued +securities of the entity will comprise: Note: the figures provided in the table in section 5.1 below are used to calculate part of the total market capitalisation of the entity published by ASX from time to time. Please make sure you include in the table each class of unquoted securities issued by the entity. Restricted securities should be included in table 5.1. 5.1 *ASX security code and description *Total number of +securities on issue Matching Share Rights granted under myShare 974,0741 Rights to Shares granted by way of Bonus Deferral Awards under the Rio Tinto Limited Equity Incentive Plan (EIP) 100,3352 Rights to Shares granted under the Rio Tinto Limited Performance Share Plan, or by way of Performance Share Awards under the EIP 1,383,8723 Rights to Shares granted under the Rio Tinto Limited Management Share Plan, or by way of Management Share Awards under the EIP 1,294,5964 Special Voting Share5 1 DLC Dividend Share6 1 1 This includes an adjustment of 4,236 Matching Share Rights to the total number of Matching Share Rights disclosed in the Appendix 3G submitted on 25 March 2021, as a result of lapses of rights, vesting of rights, and adjustments to the number of rights upon vesting for the value of dividends which would have accrued on the unvested entitlements had they been fully vested on the award date. All vestings are satisfied by way of on-market purchases. 2 This includes an adjustment of -2,054 Rights to Shares to the total number of Rights to Share disclosed in the Appendix 3G submitted on 25 March 2021, as a result of lapses of rights, vesting of rights, and adjustments to the number of rights upon vesting for the value of dividends which would have accrued on the unvested entitlements had they been fully vested on the award date. All vestings are satisfied by way of on-market purchases. 3 This includes an adjustment of -13,697 Rights to Shares to the total number of Rights to Share disclosed in the Appendix 3G submitted on 25 March 2021 as a result of lapses of rights, vesting of rights, and adjustments to the number of rights upon vesting for the value of dividends which would have accrued on the unvested entitlements had they been fully vested on the award date. All vestings are satisfied by way of on-market purchases. 4 This includes an adjustment of -13,441 Rights to Shares to the total number of Rights to Share disclosed in the Appendix 3G submitted on 25 March 2021 as a result of lapses of rights, vesting of rights, and adjustments to the number of rights upon vesting for the value of dividends which would have accrued on the unvested entitlements had they been fully vested on the award date. All vestings are satisfied by way of on-market purchases. 5 The ‘Special Voting Share’ was issued to facilitate the joint voting by shareholders of Rio Tinto Limited and Rio Tinto plc on Joint Decisions following the Dual Listed Company (DLC) merger. 6 The ‘DLC Dividend Share’ was issued to facilitate the efficient management of funds within the DLC structure.

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities + See chapter 19 for defined terms 31 January 2020 Page 6 Part 6 – Other Listing Rule requirements The questions in this Part should only be answered if you are an ASX Listing (ASX Foreign Exempt Listings and ASX Debt Listings do not need to complete this Part) and: - your response to Q2.1 is “+securities issued under an +employee incentive scheme that are not being immediately quoted on ASX”; or - your response to Q2.1 is “Other” Question No. Question Answer 6.1 *Are the securities being issued under Listing Rule 7.2 exception 131 and therefore the issue does not need any security holder approval under Listing Rule 7.1? Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. No 6.2 *Has the entity obtained, or is it obtaining, +security holder approval for the issue under listing rule 7.1? Answer this question if the response to Q6.1 is “No”. No 6.2b *Are any of the +securities being issued without +security holder approval using the entity’s 15% placement capacity under listing rule 7.1? Answer this question if the response to Q6.1 is “No” and the response to Q6.2 is “No”. Yes 1 Exception 13 An issue of securities under an employee incentive scheme if within 3 years before the issue date: (a) in the case of a scheme established before the entity was listed – a summary of the terms of the scheme and the maximum number of equity securities proposed to be issued under the scheme were set out in the prospectus, PDS or information memorandum lodged with ASX under rule 1.1 condition 3; or (b) the holders of the entity’s ordinary securities have approved the issue of equity securities under the scheme as an exception to this rule. The notice of meeting must have included: • a summary of the terms of the scheme. • the number of securities issued under the scheme since the entity was listed or the date of the last approval under this rule; • the maximum number of +equity securities proposed to be issued under the scheme following the approval; and • a voting exclusion statement. Exception 13 is only available if and to the extent that the number of +equity securities issued under the scheme does not exceed the maximum number set out in the entity’s prospectus, PDS or information memorandum (in the case of (a) above) or in the notice of meeting (in the case of (b) above). Exception 13 ceases to be available if there is a material change to the terms of the scheme from those set out in the entity’s prospectus, PDS or information memorandum (in the case of (a) above) or in the notice of meeting (in the case of (b) above).

EXHIBIT 99.13

Notice to ASX/LSE

Block Listing Six Monthly Return

29 April 2021

| Name of applicant: | Rio Tinto plc | ||||

| Name of scheme: | Rio Tinto plc Performance Share Plan | ||||

| Period of return: | 23 October 2020 to 28 April 2021 | ||||

| Balance of unallotted securities under scheme(s) from previous return: | 358,183 | ||||

Plus: The amount by which the block scheme(s) has been increased since the date of the last return (if any increase has been applied for): | 0 | ||||

Less: Number of securities issued/allotted under scheme(s) during period: | 0 | ||||

| Equals: Balance under scheme(s) not yet issued/allotted at end of period: | 358,183 | ||||

| Name of applicant: | Rio Tinto plc | ||||

| Name of scheme: | Rio Tinto plc Global Employee Share Plan | ||||

| Period of return: | 23 October 2020 to 28 April 2021 | ||||

| Balance of unallotted securities under scheme(s) from previous return: | 42,262 | ||||

Plus: The amount by which the block scheme(s) has been increased since the date of the last return (if any increase has been applied for): | 0 | ||||

Less: Number of securities issued/allotted under scheme(s) during period: | 26,349 | ||||

| Equals: Balance under scheme(s) not yet issued/allotted at end of period: | 15,913 | ||||

| Name of contact: | Steve Allen | ||||

| Telephone number of contact: | 0207 781 2000 | ||||

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Additional regulated information required to be disclosed under the laws of a Member State.

EXHIBIT 99.14

Notice to ASX/LSE

Shareholdings of directors and persons discharging managerial responsibility (PDMR) / Key Management Personnel (KMP)

Rio Tinto plc notifies the London Stock Exchange (LSE) of PDMR interests in securities of Rio Tinto plc, in compliance with the EU Market Abuse Regulation. As part of its dual listed company structure, Rio Tinto voluntarily notifies the Australian Securities Exchange (ASX) of material dealings in Rio Tinto plc shares by PDMR/KMP and both the ASX and the LSE of material dealings by PDMR/KMP in Rio Tinto Limited securities.

On 29 April 2021, the following PDMR/KMP sold shares as follows:

| Security | Name of PDMR/KMP | Number of shares sold | Price per share AUD$ | ||||||||

Rio Tinto Limited | Simon Trott | 7,748 | 123.103950 | ||||||||

This announcement is authorised for release to the market by Rio Tinto's Group Company Secretary.

Steve Allen Group Company Secretary | Tim Paine Joint Company Secretary | ||||

Rio Tinto plc 6 St James's Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

EXHIBIT 99.15

Media release

Rio Tinto updates details of tailings facilities

30 April 2021

LONDON--(BUSINESS WIRE)-- Rio Tinto today released updated information in relation to its global tailings facilities to align with the requirements of the Global Industry Standard for Tailings Management (GISTM) released in August 2020, an initiative co-convened by the International Council on Mining and Metals, United Nations Environment Programme and the Principles for Responsible Investment.

The latest disclosure at http://www.riotinto.com/tailings builds on previously disclosed information on each of Rio Tinto’s global tailings facilities released in June 2019 and the publication of Rio Tinto’s Group Procedure and updated Standard for 'Management of tailings and water storage facilities' in February 2019. The changes to existing data are in line with guidance contained in GISTM including updating information previously disclosed.

As per the June 2019 disclosure, all facilities have been awarded a consequence classification in accordance with the regulatory or industry body that oversees tailings in each region or jurisdiction. Additional technical data from recently updated downstream impact assessments required under the GISTM and Rio Tinto’s own internal Tailings standard have resulted in a modification to hazard classifications of some facilities within the company’s global operations. Consequence classifications are not a rating of the condition of a facility or the likelihood of failure but on the potential consequence if there were to be a failure.

All Rio Tinto managed facilities are subject to three levels of governance and assurance:

•First level of assurance takes place at the asset itself with the main tenets being effective facility design, comprehensive operational controls and regular reviews. Independent reviews of the operations must be conducted at least every two years

•Second level is assurance to the Rio Tinto Standard through periodic Business Conformance Audits and Technical Reviews, supported by Rio Tinto's Surface Mining Centre of Excellence

•Third level of assurance is independent of site management and normally conducted by third parties. In addition, all Rio Tinto managed facilities, whether active or inactive, have an external engineer of record or design engineer.

Full details of all Rio Tinto tailings and water storage facilities are available at https://www.riotinto.com/tailings.

riotinto.com

Category: General

View source version on businesswire.com: https://www.businesswire.com/news/home/20210430005187/en/

Please direct all enquiries to media.enquiries@riotinto.com

Media Relations, UK

Illtud Harri

M +44 7920 503 600

David Outhwaite

M +44 7787 597 493

Media Relations, Americas

Matthew Klar

T +1 514 608 4429

Investor Relations, UK

Menno Sanderse

M: +44 7825 195 178

David Ovington

M +44 7920 010 978

Clare Peever

M +44 7788 967 877

Media Relations, Australia

Jonathan Rose

M +61 447 028 913

Matt Chambers

M +61 433 525 739

Jesse Riseborough

M +61 436 653 412

Investor Relations, Australia

Natalie Worley

M +61 409 210 462

Amar Jambaa

M +61 472 865 948

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

Rio Tinto Limited

Level 7, 360 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

Source: Rio Tinto

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Rio Tinto donates $1.5 million to support the people and community of Grindavík in Iceland

- SHAREHOLDER ACTION ALERT: The Schall Law Firm Encourages Investors in Autodesk, Inc. with Losses to Contact the Firm

- Orion Group’s Facilities Maintenance Business Enters Lock, Door, Safe, and Access Control Market Through Partnership with Academy Locksmith

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share