Form 6-K Pyxis Tankers Inc. For: May 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month May 2022

Commission File Number: 001-37611

Pyxis Tankers Inc.

59 K. Karamanli Street

Maroussi 15125 Greece

+30 210 638 0200

(Address of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

Reverse Stock Split

A reverse stock split (the “Reverse Stock Split”) of the common stock, par value $0.001 (the “Common Stock”) of Pyxis Tankers Inc. (the “Company”) became effective on May 13, 2022 (the “Effective Date”). Pursuant to the Reverse Stock Split, every four shares of Common Stock issued on the Effective Date was combined into one share of Common Stock, without any change to the par value per share, and the number of authorized shares of Common Stock was reduced from 42,455,857 to 10,613,424 following the payment of cash in exchange for fractional shares resulting from the Reverse Stock Split. After the Reverse Stock Split, the Company’s Common Stock will have the same proportional voting rights and will be identical in all other respects to the Common Stock prior to the effectiveness of the Reverse Stock Split. The number of authorized preferred shares will remain unchanged at 50,000,000. No new securities were issued or registered in connection with the Reverse Stock Split.

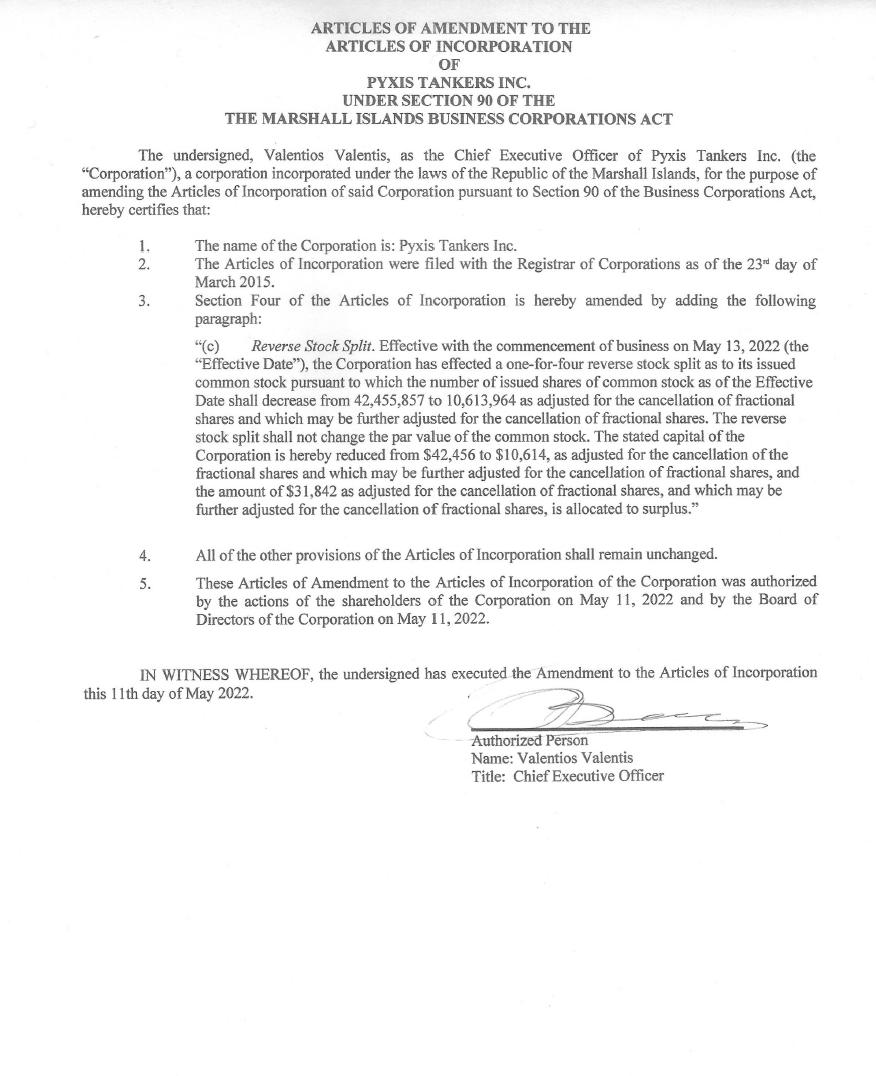

The foregoing summary of the Reverse Stock Split is not complete and is qualified in its entirety by reference to the full text of the Articles of Amendment to the Articles of Incorporation of the Company attached hereto as Exhibit 3.1 and the Articles of Incorporation, which were included as Exhibit 1.1 to the Company’s Annual Report on Form 20-F for the year ended December 31, 2021 that was filed with the U.S. Securities and Exchange Commission (the “Commission”) on April 1, 2022 and is incorporated herein by reference.

Notice to Holders of the Company’s 7.75% Series A Cumulative Convertible Preferred Shares

In connection with the Reverse Stock Split, effective May 13, 2020, the Conversion Price (as such term is defined in the Certificate of Designation (the “Certificate of Designation”) of the Company’s 7.75% Series A Cumulative Convertible Preferred Shares, Series A Preferred Shares (NASDAQ Cap Mkts: PXSAP) (the “Preferred Shares”)) was adjusted from $1.40 to $5.60, without any changes to the Certificate of Designation. The Conversion Price adjustment was made pursuant to section 5(a)(ii) of the Certificate of Designation.

Notice to Holders of the Company’s Warrant to Purchase Common Shares

In connection with the Reverse Stock Split, effective May 13, 2020, the Exercise Price (as such term is defined in the Company’s Warrant to Purchase Common Shares (NASDAQ Cap Mkts: PXSAW), dated October 13, 2020 (the “Warrant”)) was adjusted from $1.40 to $5.60, with a proportionate adjustment downwards to the Warrant Shares, as defined in the Warrant, and without any changes to the Warrant. The Exercise Price adjustment was made pursuant to section 3(a) of the Warrant.

Attachments

Attached to this Report on Form 6-K (“Report”) as Exhibit 3.1 is a copy of the Articles of Amendment to the Articles of Incorporation of the Company filed with the Registrar of Corporations of the Republic of the Marshall Islands on May 11, 2022, to effect the Reverse Stock Split.

Attached to this Report as Exhibit 4.1 is a form of share certificate for the Company’s post-Reverse Stock Split shares of Common Stock.

Attached as Exhibit 99.1 to this Report is a copy of the press release issued by the Company, dated May 11, 2022, entitled “Pyxis Tankers Announces Results of its 2022 Annual Meeting of Shareholders & Implementation of Common Stock Reverse Split, Effective May 13, 2022.”

The information contained in this Report is hereby incorporated by reference into the Company’s registration statement on Form F-3 (File No. 333-256167), filed with the Commission on May 14, 2021.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| PYXIS TANKERS INC. | ||

| By: | /s/ Henry Williams | |

| Name: | Henry Williams | |

| Title: | Chief Financial Officer | |

Date: May 17, 2022

Exhibit Index

Exhibit 3.1

Exhibit 4.1

SPECIMEN COMMON STOCK CERTIFICATE

| NUMBER | SHARES |

CS- _________

PYXIS TANKERS, INC.

INCORPORATED UNDER THE LAWS OF THE REPUBLIC OF THE MARSHALL ISLANDS

COMMON STOCK

SEE REVERSE FOR

CERTAIN DEFINITIONS

| THIS CERTIFIES THAT | CUSIP Y71726130 |

IS THE OWNER OF

FULLY PAID AND NON-ASSESSABLE SHARES OF THE PAR VALUE OF

$.001 PER SHARE, OF THE COMMON STOCK OF

Pyxis Tankers, Inc. (the “Corporation”) transferable on the books of the Corporation in person or by duly authorized attorney upon surrender of this certificate properly endorsed. This certificate, and the shares represented hereby, are issued and shall be held subject to all of the provisions of the Articles of Incorporation, as amended, and the By-laws, as amended, of the Corporation (copies of which are on file with the Corporation and the Transfer Agent), to all of which each holder, by acceptance hereof, assents. This certificate is not valid unless countersigned and registered by the Transfer Agent and Registrar.

Dated:

COUNTERSIGNED AND REGISTERED:

VSTOCK TRANSFER, LLC

TRANSFER AGENT AND REGISTRAR

| By:_______________________________ | President:______________________________ | |

| AUTHORIZED OFFICER | ||

| Secretary:_______________________________ |

(Reverse of Certificate)

PYXIS TANKERS, INC.

THE CORPORATION WILL FURNISH WITHOUT CHARGE TO EACH SHAREHOLDER WHO SO REQUESTS, A SUMMARY OF THE POWERS, DESIGNATIONS, PREFERENCES AND RELATIVE, PARTICIPATING, OPTIONAL OR OTHER SPECIAL RIGHTS OF EACH CLASS OF STOCK OF THE CORPORATION AND THE QUALIFICATIONS, LIMITATIONS OR RESTRICTIONS OF SUCH PREFERENCES AND RIGHTS, AND THE VARIATIONS IN RIGHTS, PREFERENCES AND LIMITATIONS DETERMINED FOR EACH SERIES, WHICH ARE FIXED BY THE ARTICLES OF INCORPORATION OF THE CORPORATION, AS AMENDED, AND THE RESOLUTIONS OF THE BOARD OF DIRECTORS OF THE CORPORATION, AND THE AUTHORITY OF THE BOARD OF DIRECTORS TO DETERMINE VARIATIONS FOR FUTURE SERIES. SUCH REQUEST MAY BE MADE TO THE OFFICE OF THE SECRETARY OF THE CORPORATION OR TO THE TRANSFER AGENT. THE BOARD OF DIRECTORS MAY REQUIRE THE OWNER OF A LOST OR DESTROYED STOCK CERTIFICATE, OR HIS LEGAL REPRESENTATIVES, TO GIVE THE CORPORATION A BOND TO INDEMNIFY IT AND ITS TRANSFER AGENTS AND REGISTRARS AGAINST ANY CLAIM THAT MAY BE MADE AGAINST THEM ON ACCOUNT OF THE ALLEGED LOSS OR DESTRUCTION OF ANY SUCH CERTIFICATE.

The following abbreviations, when used in the inscription on the face of this Certificate, shall be construed as though they were written out in full according to applicable laws or regulations:

TEN COM — as tenants in common

TEN ENT — as tenants by the entireties

JT TEN — as joint tenants with right of survivorship and not as tenants in common

| UNIF GIFT MIN ACT — ......................... | Custodian......................... |

| (Cust) | (Minor) |

| Under Uniform Gifts to Minors |

| Act.............................................................. |

| (State) |

Additional abbreviations may also be used though not in the above list.

For value received______________________________________________________, hereby sell(s), assign(s) and transfer(s) unto

PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE(S)

_______________________________________________________________________________

(PLEASE PRINT OR TYPEWRITE NAME(S) AND ADDRESS(ES), INCLUDING ZIP CODE, OF ASSIGNEE(S))

_______________________________________________________________________________

_______________________________________________________________________________shares of the capital stock represented by the within Certificate, and do hereby irrevocably constitutes and appoints

_______________________________________________________________________________Attorney to transfer the said stock on the books of the within named Company with full power of substitution in the premises.

Dated:

________________________________________________________________________________

NOTICE: THE SIGNATURE(S) TO THIS ASSIGNMENT MUST CORRESPOND WITH THE NAME AS WRITTEN UPON THE FACE OF THE CERTIFICATE IN EVERY PARTICULAR, WITHOUT ALTERATION OR ENLARGEMENT OR ANY CHANGE WHATEVER.

| Signature(s) Guaranteed: |

| By ______________________________________________________________________________ |

Exhibit 99.1

Pyxis Tankers Announces Results of its 2022 Annual Meeting of Shareholders &

Implementation of Common Stock Reverse Split, Effective May 13, 2022

Maroussi, Greece, May 11, 2022 – Pyxis Tankers Inc. (NASDAQ Cap Mkts: PXS), (the “Company”), an international pure play product tanker company, today announced that its 2022 Annual Meeting of Shareholders (the “AMS”) was duly held on May 11, 2022 in London, U.K. At the AMS, the following proposals were approved and adopted:

| 1) | The re-election of Mr. Aristides J. Pittas to serve as the Company’s Class II Director until the 2025 Annual Meeting of Shareholders, and |

| 2) | To amend the Company’s Articles of Incorporation to effect one or more reverse stock splits of the Company’s issued common stock, par value $0.001 (the “Common Shares”), at a ratio of not less than one-for-four and not more than one-for-ten and in the aggregate at a ratio of not more than one-for-ten, inclusive, with the exact ratio to be set at a whole number within this range to be determined by the Company’s board of directors (the “Board”), or any duly constituted committee thereof, in its discretion, and to authorize the Board to implement any such reverse stock split by filing any such amendment to the Company’s Articles of Incorporation with the Registrar of Corporations of the Republic of the Marshall Islands (each an “Amendment”) at any time following such approval (the “Reverse Stock Split”). |

Following the AMS, the Board approved the filing of an Amendment to effect a Reverse Stock Split in the ratio of one for four outstanding Common Shares, to take effect on Friday, May 13, 2022. Beginning on such date, the Company’s Common Shares will trade on a split-adjusted basis on the Nasdaq Capital Markets with a new assigned CUSIP number of Y71726130.

When the reverse stock split becomes effective, every four of the Company’s issued and outstanding Common Shares will be combined into one issued and outstanding Common Share, without any change to the par value of $0.001 per share or any shareholder’s ownership percentage of the Common Shares. This will reduce the number of outstanding Common Shares from 42,455,857 shares to 10,613,964.

No fractional shares will be issued in connection with the Reverse Stock Split. Shareholders who would otherwise receive a fraction of a Common Share of the Company will receive a cash payment in lieu thereof.

The Reverse Stock Split is undertaken with the objective of meeting the minimum $1.00 per share requirement for maintaining the listing of the Common Shares on Nasdaq.

Furthermore, following the Reverse Stock Split, (a) the Conversion Price, as defined in the Certification of Designation of the Company’s 7.75% Series A Cumulative Convertible Preferred Shares (NASDAQ Cap Mkts: PXSAP) (the “Series A Preferred”), of the Series A Preferred will be adjusted from $1.40 to $5.60 and (b) the Exercise Price, as defined in the Company’s Warrants to purchase Common Shares (NASDAQ Cap Mkts: PXSAW) (the “Warrant”) will be adjusted from $1.40 to $5.60.

Additional information about the reverse stock split can be found in the Company’s proxy statement furnished to the Securities and Exchange Commission on April 21, 2022, a copy of which is available at www.sec.gov. or the Company’s website- www.pyxistankers.com.

| 1 |

About Pyxis Tankers Inc.

We currently own a modern fleet of five tankers engaged in seaborne transportation of refined petroleum products and other bulk liquids. We are focused on growing our fleet of medium range product tankers, which provide operational flexibility and enhanced earnings potential due to their “eco” features and modifications. We are positioned to opportunistically expand and maximize our fleet due to competitive cost structure, strong customer relationships and an experienced management team whose interests are aligned with those of its shareholders. For more information, visit: http://www.pyxistankers.com.

Forward Looking Statements

This press release includes “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995 in order to encourage companies to provide prospective information about their business. These statements include statements about our plans, strategies, goals financial performance, prospects or future events or performance and involve known and unknown risks that are difficult to predict. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expects,” “seeks,” “predict,” “schedule,” “projects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “targets,” “continue,” “contemplate,” “possible,” “likely,” “might,” “will,” “should,” “would,” “potential,” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. All statements that are not statements of either historical or current facts, including among other things, our expected financial performance, expectations or objectives regarding future and market charter rate expectations and, in particular, the effects of COVID-19 on our financial condition and operations and the product tanker industry, in general, are forward-looking statements. Such forward-looking statements are necessarily based upon estimates and assumptions. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond the Company’s control, the Company cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. The Company’s actual results may differ, possibly materially, from those anticipated in these forward-looking statements as a result of certain factors, including changes in the Company’s financial resources and operational capabilities and as a result of certain other factors listed from time to time in the Company’s filings with the U.S. Securities and Exchange Commission. For more information about risks and uncertainties associated with our business, please refer to our filings with the U.S. Securities and Exchange Commission, including without limitation, under the caption “Risk Factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2021. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this press release. We undertake no obligation to update publicly any information in this press release, including forward-looking statements, to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws.

| 2 |

Company

Pyxis Tankers Inc.

59 K. Karamanli Street

Maroussi 15125 Greece

Visit our website at www.pyxistankers.com

Company Contact

Henry Williams

Chief Financial Officer

Tel: +30 (210) 638 0200 / +1 (516) 455-0106

Email: [email protected]

Source: Pyxis Tankers Inc.

| 3 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- A category innovation: Pure Sunfarms introduces Hi-Def Pre-Rolls

- Patelco Credit Union selects the Empower LOS to streamline and bolster home loan and home-equity origination

- World Champion Track Standout Gabby Thomas and Pug Rico Race to the Top with Nulo's 'Fuel Incredible’

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share