Form 6-K Piedmont Lithium Ltd For: Aug 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF

1934

For the month of August, 2019

Commission File Number: 001-38427

Piedmont Lithium Limited

(Translation of registrant’s name into English)

Level 9, BGC Centre, 28 The Esplanade

Perth, WA, 6000 Australia

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F.

Form 20-F ☒ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): □

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): □

EXHIBIT INDEX

The following exhibits are filed as part of this Form 6-K:

|

Exhibit

|

Description

|

|

Press Release

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

Piedmont Lithium Limited

|

|

|

(registrant)

|

|

|

|

|

Date: August 7, 2019

|

By: /s/ Bruce Czachor

|

|

|

Name: Bruce Czachor

|

|

|

Title: Vice President and General Counsel

|

ASX RELEASE | August 7, 2019 | ASX:PLL; NASDAQ:PLL

UPDATED SCOPING STUDY EXTENDS PROJECT LIFE AND ENHANCES EXCEPTIONAL ECONOMICS

Piedmont Lithium Limited

(“Piedmont” or “Company”) is pleased to report the results of the Company’s updated Scoping Study (“Scoping Study”) for its vertically

integrated Piedmont Lithium Project (“Project”) located within the Carolina Tin-Spodumene Belt (“TSB”) in North Carolina, USA.

The Project includes a lithium hydroxide chemical plant (“Chemical Plant”) supplied with spodumene concentrate from an open pit mine and concentrator (“Mine” or

“Mine/Concentrator”).

The Project has compelling projected economics due to attractive capital and operating costs, long mine life, significant

by-product credits, short transportation distances, minimal royalties and low corporate income taxes.

This updated Scoping Study incorporates the expanded Mineral Resource update published in June 2019 which has extended

the overall project life to 25 years.

|

Updated Scoping Study Parameters – Cautionary Statements

The updated Scoping Study referred to in this announcement has been undertaken to determine the potential viability of an open pit

mine, spodumene concentrator and lithium hydroxide plant constructed in North Carolina, USA and to reach a decision to proceed with more definitive studies. The Mine/Concentrator portion of the Scoping Study has been prepared to an accuracy

level of ±25% and the Lithium Chemical Plant to an accuracy of ±35%. The results should not be considered a profit forecast or production forecast.

The updated Scoping Study is a preliminary technical and economic study of the potential viability of the vertically-integrated

Piedmont Lithium Project. In accordance with the ASX Listing Rules, the Company advises it is based on low-level technical and economic assessments that are not sufficient to support the estimation of Ore Reserves. Further evaluation work

including infill drilling and appropriate studies are required before Piedmont will be able to estimate any Ore Reserves or to provide any assurance of an economic development case.

Approximately 53% of the total production targets are in the Indicated Mineral Resource category with 47% in the Inferred Mineral

Resource category. 100% of the production target in years 1-3 is in the Indicated Mineral Resource category. The Company has concluded that it has reasonable grounds for disclosing a production target which includes an amount of Inferred

material. However, there is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work (including infill drilling) on the Piedmont deposit will result in the

determination of additional Indicated Mineral Resources or that the production target itself will be realized.

The updated Scoping Study is based on the material assumptions outlined elsewhere in this announcement. These include assumptions

about the availability of funding. While Piedmont considers all the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the Scoping

Study will be achieved.

To achieve the range outcomes indicated in the updated Scoping Study, additional funding will likely be required. Investors should

note that there is no certainty that Piedmont will be able to raise funding when needed. It is also possible that such funding may only be available on terms that dilute or otherwise affect the value of the Piedmont’s existing shares. It is

also possible that Piedmont could pursue other ‘value realization’ strategies such as sale, partial sale, or joint venture of the Project. If it does, this could materially reduce Piedmont’s proportionate ownership of the Project.

The Company has concluded it has a reasonable basis for providing the forward-looking statements included in this announcement and

believes that it has a reasonable basis to expect it will be able to fund the development of the Project. Given the uncertainties involved, investors should not make any investment decisions based solely on the results of the Scoping Study.

|

1

EXECUTIVE SUMMARY

Piedmont is pleased to report the results of the updated Scoping Study for its vertically integrated lithium hydroxide

chemical project located in North Carolina, USA. The Scoping Study includes a steady-state 22,700 tonnes per year (“t/y”) lithium hydroxide (“LiOH”) Chemical Plant supported by a Mine/Concentrator producing 160,000t/y of 6% Li2O spodumene concentrate (“Concentrate” or “SC6.0”). By-products quartz, feldspar, and

mica will provide credits to the cost of lithium production. The Scoping Study features:

|

·

|

Integrated project to produce 22,700t/y of LiOH

|

|

·

|

25-year project life with 2 years of concentrate-only sales and 23 years of

integrated operations

|

|

o

|

More than 100% increase in life-of-project LiOH production compared with

prior studies

|

|

·

|

1st quartile operating costs

|

|

o

|

Lithium hydroxide

cash costs of US$3,105/t (AISC of US$3,565/t)

|

|

o

|

Spodumene concentrate cash costs of

US$199/t (AISC of US$238/t)

|

|

·

|

Exceptional project economics

|

|

o

|

NPV8% of

US$1.45B

|

|

o

|

After-tax IRR of 34%

|

|

o

|

Steady-state annual average EBITDA of US$298M

|

|

·

|

Mine/Concentrator engineering and metallurgical testwork completed to

PFS-level

|

|

·

|

Conventional technology selection in all project aspects

|

The integrated Piedmont project is projected to have an average life of project all-in sustaining cost (“AISC”) of approximately $3,565/t, including royalties and net of by-product credits, positioning Piedmont as the industry’s lowest-cost producer as reflected in the 2028

lithium hydroxide cost curve1 (see Figure 1).

1 - AISC includes all direct and indirect operating costs including feedstock costs (internal AISC or

external supply), refining, on-site G&A costs and selling expenses. It does not include costs associated with corporate-level G&A.

2

In comparison to the prior Scoping Study published September 12, 2018, every year of additional project life is a year of

‘integrated operation’, resulting in higher levels of cash flow than in the early ‘concentrate only’ years. Life-of-project LiOH production has thus more than doubled vs. the prior study, and EBITDA and NPV have correspondingly increased

significantly. The project IRR has declined largely due to a more conservative assumption about the timing of initial capital spending and production ramp-up at the Mine/Concentrator. Operating costs have remained in the first quartile after

detailed scrutiny at a PFS-level, while capital expenditures at the Mine/Concentrator have increased by ~$38M to reflect the increased scale of the Company’s land position and more rigorous assessment of the Project’s infrastructure requirements.

|

Unit

|

2019 Study

|

2018 Study

|

|

|

Mineral Resource Estimate

|

27.9Mt @ 1.11% Li2O

|

16.2Mt @ 1.12% Li2O

|

|

|

Project Life

|

years

|

25

|

13

|

|

After-Tax Net Present Value (NPV8)

|

US$M

|

$1,447

|

$888

|

|

Average Steady State EBITDA

|

US$M/y

|

$298

|

$235

|

|

Internal Rate of Return (IRR)

|

%

|

34

|

46

|

|

Initial Capex – Mine/Concentrator

|

US$M

|

168

|

130

|

|

Lithium Hydroxide Cash Costs

|

US$/t

|

3,105

|

3,112

|

|

Life-of-Project Lithium Hydroxide Produced

|

kt

|

489

|

216

|

|

Life-of-Project Spodumene Concentrate Produced

|

kt

|

3,810

|

1,960

|

Conclusions and Next Steps

The Scoping Study demonstrates the integrated Project’s strong commercial potential, and now puts Piedmont in a strong

position to engage in discussions around future financing of the Project, including with prospective strategic and off-take partners. The Company will now concentrate on the following initiatives to create additional value in the Project:

|

·

|

Continue Phase 4 drilling and expansion of the Company’s land position in the TSB;

|

|

·

|

Secure the necessary permits and approvals for the Mine/Concentrator;

|

|

·

|

Commence metallurgical testwork for the production of LiOH from Piedmont spodumene concentrate;

|

|

·

|

Accelerate the development of the Company’s proposed lithium hydroxide chemical plant;

|

|

·

|

Commence a detailed market study of the important US quartz, feldspar and mica markets; and

|

|

·

|

Formalize our dialogue with a number of prospective strategic, technical and offtake partners.

|

Keith D. Phillips, President and Chief Executive Officer, said:

“We are very pleased with the results of the updated Scoping Study, which reflect

the benefits of a 25-year mine life, a refined concentrator flow sheet and PFS-level engineering and metallurgy. The economic benefit of developing an integrated lithium chemical business in North Carolina, USA is clear, driven by the exceptional

infrastructure and human resource advantages of our location, as well as the competitive royalty and tax regime offered in the United States.

“Recent corporate transactions (i.e. Wesfarmers/Kidman and Albemarle/Wodgina) have

reinforced the wisdom of the Company’s integrated business strategy. We will continue to progress our Mine/Concentrator through the permitting and feasibility processes, but we will now redouble our efforts on the strategic front by accelerating

our lithium hydroxide testwork and intensifying the initial strategic discussions we have had with a broad array of potential strategic, offtake and financial partners”.

For further information, contact:

|

Keith D. Phillips

|

|

Anastasios (Taso) Arima

|

|

President & CEO

|

|

Executive Director

|

|

T: +1 973 809 0505

|

|

T: +1 347 899 1522

|

|

|

3

Scoping Study Results

The Scoping Study is based on the updated Mineral Resource Estimate for the Piedmont Lithium Project reported in June

2019, of 27.9Mt at a grade of 1.11% Li2O and the By-Product Mineral Resource Estimates comprising 7.4Mt of quartz, 11.1Mt of feldspar and 1.1Mt of mica reported in July 2019.

The Scoping Study contemplates a 25-year project life, with the downstream lithium hydroxide chemical plant commencing in

year 3 of mining operations. The ramp up period for Chemical Plant operations is estimated to achieve nameplate capacity after a 3 year ramp up period. The mining production target is approximately 25.6M at an average run of mine grade of 1.11%

Li2O (undiluted) over the 25-year project life. Table 2 provides a summary of production and cost figures for the integrated project.

|

Unit

|

Estimated Value

|

|

|

PHYSICAL – MINE/CONCENTRATOR

|

||

|

Mine life

|

years

|

25

|

|

Steady-state annual spodumene concentrate production

|

t/y

|

160,000

|

|

LOM spodumene concentrate production

|

t

|

3,805,000

|

|

LOM quartz by-product production

|

t

|

1,920,000

|

|

LOM feldspar by-product production

|

t

|

2,795,000

|

|

LOM mica by-product production

|

t

|

275,000

|

|

LOM feed grade (excluding dilution)

|

%

|

1.11

|

|

LOM average concentrate grade

|

%

|

6.0

|

|

LOM average process recovery

|

%

|

85

|

|

LOM average strip ratio

|

waste:ore

|

10.4:1

|

|

PHYSICAL – LITHIUM CHEMICAL PLANT

|

||

|

Steady-state annual lithium hydroxide production

|

t/y

|

22,700

|

|

LOM lithium hydroxide production

|

t

|

489,000

|

|

LOM concentrate supplied from Piedmont mining operations

|

t

|

3,100,000

|

|

Chemical Plant life

|

years

|

23

|

|

Commencement of lithium hydroxide chemical production

|

year

|

3

|

|

OPERATING AND CAPITAL COSTS – INTEGRATED PROJECT

|

||

|

Average LiOH production cash costs using self-supplied concentrate

|

US$/t

|

$3,105

|

|

Mine/Concentrator – Direct development capital

|

US$M

|

$106.2

|

|

Mine/Concentrator – Owner’s costs

|

US$M

|

$11.3

|

|

Mine/Concentrator – Land acquisition costs

|

US$M

|

$28.3

|

|

Mine/Concentrator – Contingency

|

US$M

|

$22.1

|

|

Mine/Concentrator – Sustaining and deferred capital

|

US$M

|

$147.9

|

|

Mine/Concentrator – Working Capital

|

US$M

|

$20.0

|

|

Chemical Plant - Direct development capital

|

US$M

|

$252.6

|

|

Chemical Plant – Owner’s costs

|

US$M

|

$12.1

|

|

Chemical Plant – Contingency

|

US$M

|

$79.4

|

|

Chemical Plant – Sustaining and deferred capital

|

US$M

|

$86.5

|

|

FINANCIAL PERFORMANCE – INTEGRATED PROJECT – LIFE OF PROJECT

|

||

|

Annual steady state EBITDA

|

US$M/y

|

$240-$340

|

|

Annual steady state after-tax cash flow

|

US$M/y

|

$195-$260

|

|

Net operating cash flow after tax

|

US$M

|

$5,370

|

|

Free cash flow after capital costs

|

US$M

|

$4,630

|

|

After tax Net Present Value (NPV) @ 8% discount rate

|

US$M

|

$1,447

|

|

After tax Internal Rate of Return (IRR)

|

%

|

34

|

4

Project Overview

Piedmont Lithium Limited (ASX: PLL; Nasdaq: PLL) holds a 100% interest in the Piedmont Lithium Project located within the

TSB and along trend to the Hallman Beam and Kings Mountain mines, which historically provided most of the western world’s lithium between the 1950s and the 1980s. The TSB has been described as one of the largest lithium regions in the world and is

located approximately 25 miles west of Charlotte, North Carolina.

Portions of the Project were originally explored by Lithium Corporation of America which was eventually acquired by FMC

Corporation (now Livent Corporation). A Canadian exploration company, North Arrow Minerals, completed a 19-drill hole, 2,544 meter exploration drill program on the property in 2009-2010.

The Company has undertaken four drill campaigns on the project totaling 333 drill holes and 52,441 meters of drilling.

Piedmont, through its 100% owned U.S. subsidiary, Piedmont Lithium Inc., has entered into exclusive option and land

acquisition agreements with local landowners which, upon exercise, allow the Company to purchase (or in some cases long-term lease) approximately 2,206 acres of surface property and the associated mineral rights. The Company also controls a

60-acre parcel in Kings Mountain, North Carolina for the site of the Company’s planned Chemical Plant.

`

Figure 2 -

Piedmont Lithium Project located within the TSB

5

Scoping Study Consultants

The Scoping Study uses information and assumptions provided by a range of independent consultants,

including the following consultants who have contributed to key components of the Scoping Study.

|

Table 3: Piedmont Lithium Project

Scoping Study Consultants

|

|

|

Consultant

|

Scope of Work

|

|

Primero Group Limited

|

Process engineering and infrastructure

|

|

SGS Lakefield

|

Metallurgical testwork

|

|

Marshall Miller and Associates

|

Mine design and scheduling

|

|

CSA Global Pty Ltd

|

Resource estimation

|

|

HDR Engineering, Inc. of the Carolinas

|

Permitting, environment, and social studies

|

|

Johnston, Allison, and Hord

|

Land title and legal

|

|

Roskill

|

Lithium Products Marketability

|

|

CSA Global Pty Ltd

|

By-Products Marketability

|

Mineral Resource Estimates

On June 25, 2019 the Company announced an updated Mineral Resource Estimate prepared by independent consultants CSA

Global Pty Ltd (“CSA Global”) in accordance with JORC Code (2012 Edition). The total Mineral Resources for the Project are 27.9Mt grading at

1.11% Li2O.

|

Table 4: Project Wide Mineral Resource

Estimate for the Piedmont Lithium Project (0.4% cut-off)

|

||||||||

|

Resource Category

|

Core property

|

Central property

|

Total

|

|||||

|

Tonnes (Mt)

|

Grade (Li2O%)

|

Tonnes (Mt)

|

Grade (Li2O%)

|

Tonnes (Mt)

|

Grade (Li2O%)

|

Li2O

(t)

|

LCE

(t)

|

|

|

Indicated

|

12.5

|

1.13

|

1.41

|

1.38

|

13.9

|

1.16

|

161,000

|

398,000

|

|

Inferred

|

12.6

|

1.04

|

1.39

|

1.29

|

14.0

|

1.06

|

148,000

|

366,000

|

|

Total

|

25.1

|

1.09

|

2.80

|

1.34

|

27.9

|

1.11

|

309,000

|

764,000

|

An important feature of the Core MRE, is that 74% or 18.6 Mt is located within 100 meters of surface.

Table 5 shows the details of the MRE with regards to depth from surface.

|

Depth (from surface) (m)

|

Tonnes (Mt)

|

Percentage of Resource (%)

|

Cumulative Tonnes (Mt)

|

Cumulative % of Resource

|

|

0 - 50

|

8.7

|

35

|

8.7

|

35

|

|

50 - 100

|

9.9

|

39

|

18.6

|

74

|

|

100 - 150

|

5.7

|

23

|

24.3

|

97

|

|

150 +

|

0.8

|

3

|

25.1

|

100

|

On July 31, 2019 the Company announced updated Mineral Resource Estimates for by-products quartz,

feldspar and mica. The results are shown in Table 6. The by-product Mineral Resource estimates have been prepared by independent consultants, CSA Global and are reported in accordance with the JORC Code (2012 Edition). The economic

extraction of by-product minerals is contingent on the economic extraction of lithium mineral resources at the project. Accordingly, the by-product Mineral Resource Estimates are reported at a 0.4% Li2O cut-off grade, consistent with the

lithium MRE for the Project.

6

|

Category

|

Tonnes (Mt)

|

Li2O

|

Quartz

|

Feldspar

|

Mica

|

||||

|

Grade

(%) |

Tonnes

(t) |

Grade

(%) |

Tonnes (Mt)

|

Grade

(%) |

Tonnes (Mt)

|

Grade

(%) |

Tonnes (Mt)

|

||

|

Indicated

|

12.5

|

1.13

|

141,000

|

30.0

|

3.75

|

44.4

|

5.55

|

4.5

|

0.56

|

|

Inferred

|

12.6

|

1.04

|

131,000

|

28.7

|

3.61

|

44.4

|

5.58

|

4.4

|

0.56

|

|

Total

|

25.1

|

1.09

|

272,000

|

29.3

|

7.36

|

44.4

|

11.13

|

4.5

|

1.12

|

Figure 3 shows the relative position of the Core and Central resources, resource constraining

shells, and exploration targets.

7

Mining and Production Target

Independent consultants Marshall Miller and Associates used SimSched™ software to generate a series of

economic pit shells using the updated Mineral Resource block model and input parameters as agreed by Piedmont. Overall slope angles in rock were estimated following a preliminary geotechnical analysis that utilized fracture orientation data from

oriented core and downhole geophysics (Acoustic Televiewer), as well as laboratory analysis of intact rock strength. The preliminary geotechnical assessment involved both kinematic and overall slope analyses utilizing Rocscience™

modeling software.

Overall slope angles of 45 degrees were assumed for overburden and oxide material. Overall slope angles of 53 degrees

were estimated for fresh material which includes a ramp width of 30 meters. Production schedules were prepared for the Project based on the following parameters:

|

·

|

A targeted run-of-mine production of 1.15Mt/y targeting a process plant output of about

160,000t/y of 6.0% Li2O spodumene concentrate from the Core property

|

|

·

|

The Central property production target was based on a process plant throughput of about

900,000t/y to produce about 160,000t/y of 6.0% Li2O spodumene concentrate

|

|

·

|

By-product output of 86kt of quartz, 125kt of feldspar, and 13kt of mica concentrate annually

|

|

·

|

About 75% of average annual production realized in the first year of operations accounting

for commissioning and ramp up

|

|

·

|

Mining dilution of 5%

|

|

·

|

Mine recovery of 95%

|

|

·

|

Processing recovery of 85%

|

|

·

|

A mining sequence targeting maximized utilization of Indicated Mineral Resources at the front

end of the schedule

|

Pit optimizations were completed by Marshall Miller to produce a production schedule on an annual basis, resulting in a

total production target of approximately 3.8Mt of spodumene concentrate, averaging approximately 160,000t/y of spodumene concentrate over the 25-year mine life. This equates to an average of 1.15Mt/y of ore processed, totaling approximately 25.6Mt

of run-of-mine (“ROM”) ore at an average ROM grade of 1.11% Li2O (undiluted) over the 25-year mine life.

The results reported are based upon a scenario which maximizes extraction of Indicated Resources in the early years of

production. Indicated resources represent 100% of the tonnes processed in years 1-3 of operations. The results shown assume that the Core property is mined from year 1-20 with Central property operations commencing in year 21. Table 7

shows the production target.

|

Property

|

ROM Tonnes

Processed

(kt)

|

Waste

Tonnes Mined

(kt)

|

Stripping

Ratio

(W:O t:t)

|

ROM Li2O Diluted Grade

(% )

|

Production Years

|

Tonnes of

Concentrate

(kt)

|

|

Core

|

22,616

|

227,200

|

10.0

|

1.03

|

1-20

|

3,284

|

|

Central

|

2,951

|

38,790

|

13.1

|

1.25

|

21-25

|

521

|

|

Total

|

25,567

|

265,990

|

10.40

|

1.05

|

1-25

|

3,805

|

The Scoping Study assumes a lithium Chemical Plant production life of 23 years, commencing in year 3 of

mining operations. Of the total production target of 3.8Mt of concentrate, approximately 0.7Mt will be sold to third parties during years 1 to 5 of mining operations and approximately 3.1Mt will be supplied to Piedmont’s Chemical Plant for

conversion into lithium hydroxide during years 3 to 25 of operations, resulting in a total production target of approximately 489,000t of lithium hydroxide, averaging approximately 21,260t/y of lithium hydroxide over the 23-year production life.

The Scoping Study assumes that approximately one-third of the by-product potential will be converted to

product based on processing spodumene flotation tailings with approximately two-thirds of potential by-products reporting to waste via dense medium separation tailings. This results in production targets of 1.9Mt of quartz concentrate, 2.7Mt of

feldspar concentrate, and 0.3Mt of mica concentrate over the life of mine. If

8

market conditions support additional sales potential then Piedmont will evaluate reprocessing of dense

medium separation tailings to produce additional byproduct concentrates.

There remains significant opportunity to increase the mine life beyond 25 years or to increase annual capacity of the

Project by discovery of additional resources within the TSB within a reasonable trucking or conveying distance to the proposed concentrator.

The mine design is based on an open pit concept assuming the following wall design configuration for

oxide and overburden material in this Scoping Study:

|

·

|

Batter face angle of 45 degrees

|

|

·

|

Batter height of 10 vertical meters

|

|

·

|

Berm width of 0 meters

|

|

·

|

Overall slope angle of 45 degrees

|

The following wall design configuration was used for fresh material in this Scoping Study:

|

·

|

Batter face angle of 75 degrees

|

|

·

|

Batter height of 24 vertical meters (80 ft.) for final wall

|

|

·

|

Berm width of 9.5 meters (30 ft.) for final wall

|

|

·

|

Overall slope angle of 53 degrees for final wall, which includes a ramp width of 30 meters (98 ft.)

|

Figure 4 – Representation of the Piedmont pit wall design based on wall design

configuration estimates

The pit wall design parameters indicated above are based on the results of a preliminary geotechnical assessment that

utilized available fracture orientation measurements from exploration drilling and downhole geophysical logging, along with laboratory results for intact rock strength. The preliminary geotechnical analysis focused on assessment of fresh rock

material. The pit wall dimensions indicated above are based on a final wall configuration. Working benches during mining are expected to be on the order of 12 meters high and 8 meters wide, with a batter angle of 75-degrees. The current mine

plan takes into consideration the nature of the ore deposit and allows for smaller internal bench dimensions. The current pit wall dimensions are considered representative of average conditions. More detailed pit wall geotechnical assessment in

specific areas is to be completed during a future definitive feasibility study (“DFS”).

9

Waste Management

Mine operations will commence in the east pit with waste hauled to the central waste dump. East pit will be used as a

future backfill pit for waste from the west and south pits. Generally waste disposal has been designed in 50 ft. (15.2m) lifts on 2:1 slopes with 20 ft. (6.1m) safety benches.

Waste disposal areas on the Project have been designed to a detail sufficient for permit approvals. Geochemical analysis

results of the waste rock and tailings does not indicate the potential for acid drainage.

Figure 5 – Waste rock disposal areas have been designed to sufficient detail for

permit applications and approvals

Mineralogy

Piedmont has completed mineralogical testing, comprising semi-quantitative and quantitative x-ray diffraction (“XRD”) analysis, on samples of mineralized pegmatites and composite samples from Piedmont’s Core, Central, and Sunnyside Properties. All testwork to

date effectively demonstrate that lithium occurs almost exclusively in spodumene in Piedmont’s Mineral Resources. Mineralogy results were previously announced on June 18, 2019.

10

Certain hard rock lithium projects are understood to contain multiple lithium-bearing minerals

(petalite, lepidolite, zinnwaldite, etc. as well as spodumene). Piedmont has been advised that the relatively pure spodumene character of its ore body is unusual and highly positive, allowing for a simplified flowsheet to produce strong lithium

recoveries as achieved in the Company’s most recent metallurgical testwork program.

Metallurgy

Piedmont engaged SGS laboratories in Lakefield, Ontario to undertake testwork on variability and composite samples.

Dense Medium Separation (“DMS”)

and flotation Locked-Cycle Tests (“LCT”) test work results showed high quality spodumene concentrate product with a grade above 6.0% Li2O,

iron oxide below 1.0%, and low impurities from composite samples. Table 8 shows the results of composite tests on the preferred flowsheet which were previously announced on July 17, 2019.

|

Sample

|

Feed Grade Li2O (%)

|

Concentrate Grade Li2O (%)

|

Fe2O3 (%)

|

Na2O (%)

|

K2O (%)

|

CaO+ MgO +

MnO (%) |

P2O5 (%)

|

|

Dense Medium Separation

|

6.42

|

0.97

|

0.56

|

0.45

|

0.51

|

0.12

|

|

|

Locked Cycle Test

|

6.31

|

0.90

|

0.68

|

0.52

|

1.25

|

0.46

|

|

|

Piedmont Composite Sample 1

|

1.11

|

6.35

|

0.93

|

0.63

|

0.49

|

0.96

|

0.32

|

The composite samples were prepared to approximate the average grade of the Project’s ore body.

Overall lithium recovery during testwork for the preferred flowsheet was 77% at a grade of 6.35% Li2O. Simulations based on the testwork results support an overall plant design recovery of 85% when targeting a 6.0% Li2O

spodumene concentrate product. Further optimization will be undertaken in a future feasibility level pilot testwork program.

Figure 6 shows photographs of the coarse and fine DMS concentrates produced using the preferred

process flow diagram. Piedmont spodumene concentrate is generally light green to white colored.

By-Product Metallurgy

Piedmont engaged North Carolina State University’s Minerals Research Laboratory (“MRL”) to conduct a comprehensive bench-scale testwork and optimization program on samples obtained from the Company’s Core land area for byproducts quartz, feldspar, and

mica. The objective of the testwork program was to develop optimized conditions for spodumene flotation and magnetic separation for both grade and recovery which would then be applied to future testwork.

11

Likely product specifications for the Piedmont deposit are supported by the results of the bench-scale metallurgical test

work program undertaken by Piedmont Lithium in 2018 at MRL.

Figure 7 - Examples of quartz, feldspar and mica concentrates from the Piedmont Project

Quartz Results

Quartz data in three (3) samples showed results which may be favorable for the glass or optical glass markets (Table 9).

|

Parameter

|

Sample B

|

Sample F

|

Sample G

|

|

% SiO2

|

99.8

|

99.7

|

99.7

|

|

% Al2O3

|

0.10

|

0.10

|

0.14

|

|

% Other

|

0.14

|

0.015

|

0.14

|

Typical market specifications for quartz of various grades are shown in the table below for comparative

purposes.

|

Table 10: Specialty Silica Sand and

Quartz Specifications by Market1

|

|||

|

Specification

|

SiO2 Min. %

|

Other Elements Max %

|

Other Elements Max ppm

|

|

Clear glass-grade sand

|

99.5

|

0.5

|

5,000

|

|

Semiconductor filler, LCD and optical glass

|

99.8

|

0.2

|

2,000

|

|

“Low Grade” HPQ

|

99.95

|

0.05

|

500

|

1Source – Modified from Richard Flook and the December 2013 Issue of

Industrial Minerals Magazine (p25)

12

Feldspar Results

Feldspar data in three (3) samples are reported in Table 11.

|

Parameter

|

Sample B

|

Sample F

|

Sample G

|

|

% SiO2

|

68.9

|

68.8

|

68.8

|

|

% Al2O3

|

18.5

|

18.6

|

18.6

|

|

% K2O

|

3.99

|

3.81

|

3.84

|

|

% Na2O

|

8.35

|

8.45

|

8.49

|

|

Total Na2O+K2O

|

12.34

|

12.26

|

12.33

|

|

% Fe2O3

|

0.02

|

0.01

|

0.02

|

|

% CaO

|

0.07

|

0.12

|

0.08

|

Table 12 shows representative feldspar market specifications for reference.

|

Product

|

Source

|

Al2O3

|

Fe2O3

|

CaO

|

K2O

|

Na2O

|

K2O+Na2O

|

|

K-spar

|

North Carolina

|

18.0

|

0.07

|

0.14

|

10.1

|

3.6

|

13.7

|

|

Na-spar

|

North Carolina

|

19.0

|

0.07

|

1.6

|

4.0

|

7.0

|

11.0

|

3 Source: Harben (2002) Industrial Minerals Handbook. ISBN 1 904333 04 4

Mica Results

Mica quality is measured by its physical properties including bulk density, grit, color/brightness, and particle size.

The bulk density of mica by-product generated from Piedmont composite samples was in the range of 0.680-0.682 g/cm3.

The National Gypsum Grit test is used mostly for minus 100-mesh mica which issued as joint cement compound and textured

mica paint. The specification for total grit for mica is 1.0%. Piedmont sample grit results were in the range of 0.70-0.76.

Color/brightness is usually determined on minus 100-mesh material. Several instruments are used for this determination

including the Hunter meter, Technedyne and the Photovoltmeter. The green reflectance is often reported for micas and talcs. Piedmont Green Reflectance results were in the range of 11.2-11.6.

Process Design

The concentrator process design is based on SGS composite testwork. The flowsheet will be optimized during future DFS

level pilot testwork. The basic process flow is shown schematically in Figure 8. Notably, DMS tailings and flotation tailings will be processed separately with the DMS and flotation process water circulated separately within the

concentrator.

13

14

Quartz, feldspar and mica will be recovered via a series of flotation and magnetic separation circuits as shown in Figure

9.

After review of multiple conventional and novel lithium conversion techniques, Piedmont proposes to use

a direct-to-hydroxide conversion approach in its Chemical Plant. The process is commonplace among Chinese lithium chemical plants operated by producers including Albemarle, Ganfeng, Tianqi, General Lithium and Yahua.

Piedmont selected the direct-to-hydroxide process based on an analysis of various process alternatives taking into

consideration capital and operating costs, total economic return, technology risk, and other factors.

The Chemical Plant will focus on the maximization of production of battery grade quality lithium hydroxide monohydrate

but will maintain future optionality to produce lithium carbonate products.

15

Figure 10 – Proposed Lithium Hydroxide Chemical Plant Flowsheet

Site Plans

Mining Operations

A preliminary integrated site plan including mining operations, waste disposal, and concentrator was developed by

Marshall Miller and Primero Group during the course of this Scoping Study. The site plan has been developed to a pre-feasibility level of detail and with sufficient definition to acquire permits (Figure 11).

Concentrator Site

The concentrator is located to the northwest of the planned open pits. The location of the

concentrator has been updated based on the results of condemnation drilling and preliminary geotechnical investigation. (Figure 12).

Chemical Plant Site

Piedmont has secured a 60.6-acre property in King’s Mountain, North Carolina as a proposed site for the Chemical Plant.

The site is a 20 mile truck haul from the planned mine site and is accessible by a combination of NC state highways, US-highways, and US Interstate.

An indicative site plan for the Chemical Plant was developed as part of the Scoping Study (Figure 13).

16

17

Figure 12 – Piedmont Lithium Concentrator Plot Plan

18

Figure 14 – Indicative Site Plan of Piedmont’s Proposed 22,700 t/y Lithium Hydroxide Plant

Infrastructure

The Piedmont Lithium Project holds a superior infrastructure position relative to most lithium projects globally. The

proposed mine site is approximately 25 miles west of Charlotte, North Carolina. The mine site is directly accessible by multiple state highways and is in close proximity to US Highway 321 and US Interstate I-85.

The project has close access to Class I railroads Norfolk Southern and CSX Transportation. These are the two largest

rail operators in the Eastern United States and have main lines which are 20 miles and 4 miles from the mine site, respectively. The Mine/Concentrator and Chemical Plant sites are in proximity to four (4) major US ports:

|

·

|

Charleston, SC

-197 miles

|

|

·

|

Wilmington, NC

-208 miles

|

|

·

|

Savannah, GA

-226 miles

|

|

·

|

Norfolk, VA

-296 miles

|

Charlotte-Douglas International Airport is 20 miles from the mine site and 32 miles from the proposed Chemical Plant

site. It is the 6th largest airport in the United States and has direct international routes to Canada, the Caribbean, South America, and Europe.

Temporary or permanent camp facilities will not be required as part of the project. Furthermore, Livent Corporation and

Albemarle Corporation operate lithium chemical plants in close proximity to the proposed Piedmont operations, and the local region is well serviced by fabrication, maintenance, and technical service contractors experienced in the sector.

19

Logistics

Most spodumene concentrate produced by Piedmont will be consumed by the Piedmont Chemical Plant. A US$6.00/t cost is

included in the financial model for the 20-mile transport between the Mine/Concentrator and Chemical Plant. For third-party spodumene concentrate sales Piedmont has assumed a US$75/t freight cost from mine gate to CIF China delivery.

North Carolina is a significant producer of quartz, feldspar and mica. Piedmont has assumed current by-product pricing

based on FOB mine gate terms, and that given Piedmont’s location within the mid-Atlantic industrial corridor and existing industrial mineral consumers that by-products can be delivered by truck or rail on a cost-competitive basis to regional

customers.

Environmental and Social Impact Assessment

HDR Engineering has been retained by Piedmont to support permitting activities on the project. In December 2018 the

Company submitted a Section 404 Standard Individual Permit application to the US Army Corps of Engineers (USACE) for the Project.

The Company also concurrently submitted an application for a Section 401 Individual Water Quality Certification to the

North Carolina Division of Water Resources (NCDWR). The Section 404 and 401 permits are typical requirements for the type of operation proposed by Piedmont Lithium.

Piedmont has received comments from agencies and the public for these permit applications and provided written responses

in Q2 2019. Approval of both applications is expected within 2019.

A mining permit application and rezoning application will be submitted to the state of North Carolina and Gaston County,

respectively, in the coming months.

Background studies undertaken in support of permit applications have been constructive, and the conclusions reached in

each individual study to date have met the requirements which would normally support permit approval.

The following environmental, field investigation and social studies have been concluded on the project:

|

·

|

Threatened and endangered species surveys, which concluded that no federally protected species occur on the

Project site

|

|

·

|

A detailed cultural resources survey including a comprehensive archaeological investigation of the

Mine/Concentrator site was undertaken. Cultural resources surveys which concluded that no properties listed in or eligible for listing in the National Register of Historic Places would be adversely affected by the Project.

|

|

·

|

Hydrogeological modeling

|

|

·

|

Ground and surface water monitoring which will continue for a minimum of 12 months prior to the start of

construction on the Project

|

|

·

|

Waste rock characterization including acid/base accounting and neutralization potential which indicated that

the waste rock from the project does not have the potential to be acid forming

|

|

·

|

Traffic analysis

|

HDR performed a fatal flaw analysis of the proposed Chemical Plant site including a preliminary site survey. The

proposed site is already zoned heavy-industrial.

Piedmont maintains an active community engagement program including local, state, and federal elected officials,

community groups, private individuals, and local media. Community engagement will continue through the permitting, development, and operations phases of the Project.

In 2019, United States Senator Lisa Murkowski (chair of the Senate Committee on Energy and Natural Resources) introduced

bipartisan legislation aimed at improving United States critical minerals security through reduction in dependence on foreign suppliers. The Senate Energy and Natural Resource Committee approved this legislation in July 2019.

20

Marketing

Lithium Demand and Supply Outlook

Lithium demand is expected to grow rapidly due to increasing requirements for lithium-ion batteries used in electric

vehicles (“EVs”) and in energy storage applications. Approximately 60% of lithium is currently consumed in batteries for EVs and consumer products, with the remainder being used in traditional applications in ceramics, glass, grease and other

industrial applications. Many industry observers expect EV penetration to grow from approximately 2% in 2018 to 8%-10% in 2025, driving lithium demand from approximately 280,000t in 2018 to over 1,000,000t by 2025-2028. Roskill, a leading

international consultancy, projects EV sales to increase by 26% per year in the years to 2028, with global plug-in vehicle sales (BEV and PHEV) expected to reach 32 million annual units by 2028 and continuing to grow rapidly in subsequent years.

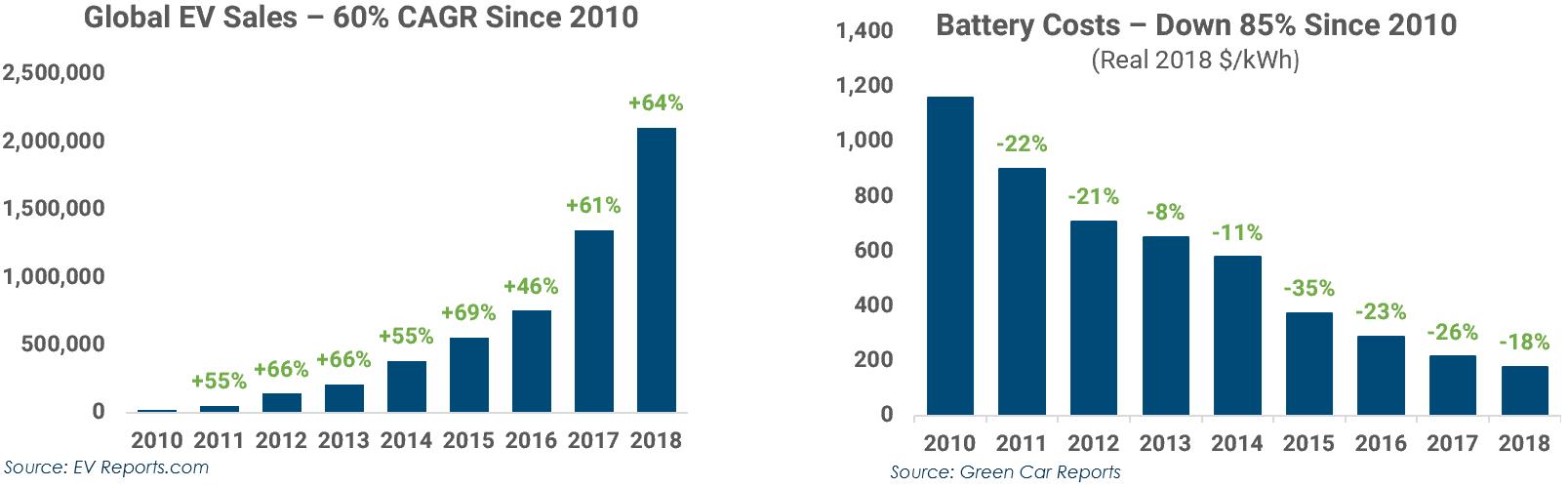

EV demand has grown approximately 60% in the years since 2010, driven in part by the dramatic reduction in the cost of lithium-ion batteries over that time period.

Figure 15 – Global EV Sales Growth Compared with Battery Costs (Real Basis)

2010-2018

Lithium supply has thus far grown to keep up with demand, with three new Australian spodumene projects commencing

operation in 2018 along with organic growth at certain incumbent hard-rock and brine producers. Lithium chemical conversion capacity has also grown, particularly amongst the leading Chinese producers. This supply response has led to a renewed

supply-demand balance such that lithium prices have retreated from the all-time highs of 2017-2018 to what some observers consider the ‘new normal’ prices being experienced currently.

Longer-term, while there are numerous lithium development projects at different stages of evaluation, many industry

observers expect ore quality, economic, permitting and financing considerations will lead to a shortage of lithium production, particularly of battery quality, in the years most relevant to the Project.

Figure 16 – Forecast Refined Lithium Output and Demand 2019-2035 (Benchmark Minerals Intelligence)

21

Marketing Strategy

Piedmont is focused on establishing strategic partnerships with customers of both high quality spodumene concentrate and

battery grade lithium hydroxide. Piedmont will concentrate this effort on the growing North American EV supply chain, particularly in light of the growing commitments to US battery manufacturing by groups such as Tesla, SK Innovation, LG, Daimler

and others.

Product Pricing

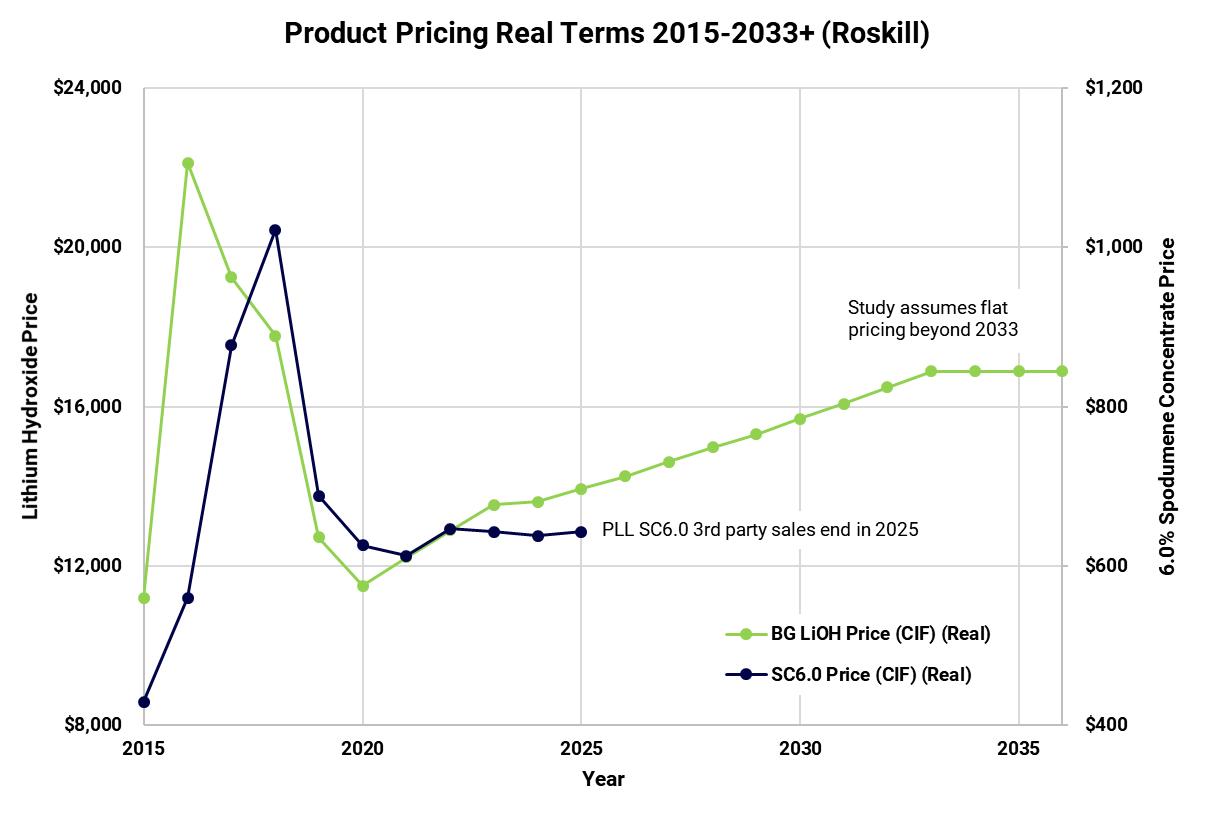

Piedmont has used Roskill’s long-term price forecasts as the basis for this Scoping Study. Roskill is a leading chemical

industry consultancy, and their price forecasts have been used in public filings over the past twelve months by industry participants including Tianqi, Livent, Kidman, Pilbara and Ioneer. Roskill’s (real) price forecasts for 6.0% Li2O

spodumene concentrate for the relevant years of spodumene sales in this Scoping Study and Roskill’s (real) pricing for battery grade lithium hydroxide for the life of the Piedmont project are depicted in Figure 17.

Notably, and despite Roskill’s expectations of a long-term lithium supply deficit in, the long-term prices used in the

Scoping Study do not reach the peak pricing experienced in the 2016-2018 period.

Piedmont proposes to produce quartz, feldspar and mica as by-products of spodumene concentration. CSA Global evaluated

Piedmont’s by-product metallurgical testwork results, planned production volumes, and potential market applications. Table 13 illustrates summary market opportunities for Piedmont Lithium’s by-product output.

22

|

By-product

|

Annual Volume (t/y)

|

Assumed Average Sales Price (US$/t)

|

CSA Global Indicative Price Range

(US$/t)

|

Markets

|

|

Quartz

|

99,000

|

$100

|

$70-$100

|

Low-iron glass including solar panel cover glass and others, industrial ceramics.

|

|

Feldspar

|

125,000

|

$75

|

$75-$85 (chips); $130 (powder)

|

Glass, frit, and industrial ceramics.

|

|

Mica

|

15,500

|

$50

|

$270-$350

|

Specialty paints including automotive, filler uses, joint compound.

|

Based on the results of bench-scale testwork, by-products from Piedmont’s lithium operations are expected to have

low-iron content, which will be desirable in many industrial applications.

Economics

Operating Costs

Piedmont forecasts operating costs for lithium hydroxide based on a self-supply of spodumene concentrate during the life

of mining operations. Excess spodumene concentrate sales during ramp-up of chemical operations are applied as a co-product credit to lithium hydroxide cash costs. Early spodumene sales prior to Chemical Plant commissioning are excluded from the

by-product credits (Figure 18).

Figure 19 shows the breakdown of lithium hydroxide conversion cash costs, excluding spodumene concentrate supply, by major cost

center.

23

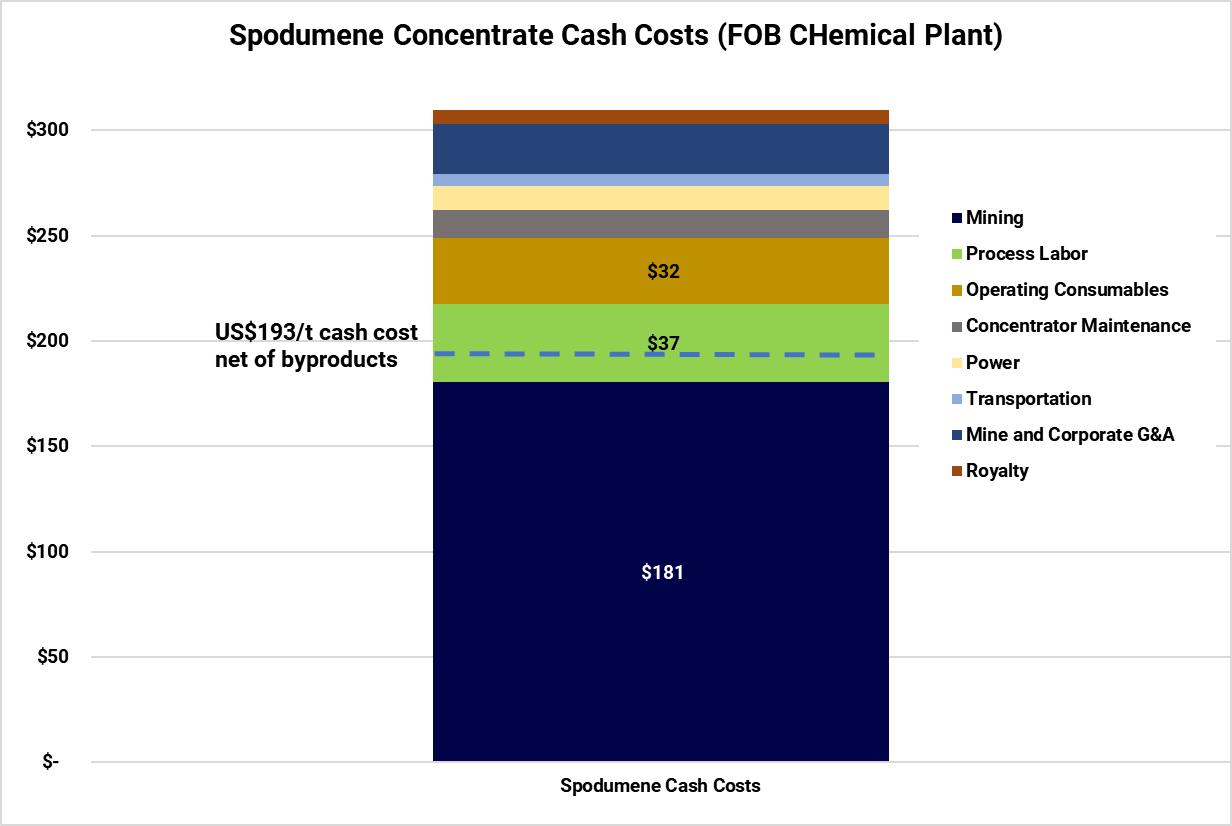

Cash operating costs for spodumene mining and concentration were estimated at an average of US$ 199/t

net of by-product credits delivered to the Chemical Plant site in King’s Mountain. The estimated cost is inclusive of G&A associated with mining operations, royalties and transportation. A breakdown of spodumene mining and concentration costs

is shown in Figure 20.

24

Capital Costs

Piedmont estimates the capital cost to construct the mine and concentrator at US$106.2M, excluding contingency, land

expenses, owner’s costs, and working capital. The sustaining capital includes the costs for financed mobile equipment including rebuild and replacement costs through the 25-year mine life.

Table 14 highlights the total estimated capital expenditures for the Mine/Concentrator. A

20% contingency has generally been carried on costs in the economic modelling of the Mine/Concentrator project except where contracted values, such as land expenses, have been defined.

|

Cost Center

|

Life-of-mine total (US$ million)

|

|

Site establishment and bulk earthworks

|

$13.8

|

|

Pre-stripping expenses

|

$8.0

|

|

Process plant

|

$63.3

|

|

Non-process infrastructure

|

$3.9

|

|

Engineering, procurement, construction management (EPCM)

|

$13.4

|

|

Construction indirects

|

$2.3

|

|

Spares and commissioning

|

$1.5

|

|

Total

|

$106.2

|

|

Land acquisition

|

$28.3

|

|

Owner’s costs

|

$11.3

|

|

Total Initial Capital (Excluding Contingency)

|

$145.8

|

|

Contingency

|

$22.1

|

|

Total Development Capital

|

$167.9

|

|

Deferred and sustaining capital (including contingency)

|

$147.9

|

|

Working capital (including contingency)

|

$20.0

|

Piedmont estimates the capital cost to construct the Chemical Plant at

US$253M before owner’s costs and contingency. A contingency of 30% has been carried in the economic modelling of the Chemical Plant project. Approximately US$141M of free cash flow is expected to be generated prior to

completion of construction of the Chemical Plant from sales of spodumene concentrate in early years.

|

Table 15: Lithium Hydroxide Chemical Plant Estimated Capital Costs

|

|

|

Cost Centre

|

Life-of-mine total (US$ million)

|

|

Contractor directs – Chemical Plant

|

$208.4

|

|

Contractor indirects

|

$37.5

|

|

Spares and commissioning

|

$6.7

|

|

Total

|

$252.6

|

|

Owner’s Costs

|

$12.1

|

|

Contingency

|

$79.4

|

|

Total Development Capital

|

$344.1

|

|

Development Capital to be funded from free cash flows

|

$141.0

|

|

Development Capital to be funded from additional sources

|

$203.1

|

|

Deferred and sustaining capital (including contingency)

|

$86.5

|

25

Royalties, Taxes, Depreciation, and Depletion

The Scoping Study project economics include the following key parameters related to royalties, tax, depreciation, and

depletion allowances.

|

·

|

Royalties of US$1.00 per ROM tonne based on the average land option agreement

|

|

·

|

North Carolina state corporate taxes are 2.5%

|

|

·

|

Federal tax rate of 21% is applied and state corporate taxes are deductible from this rate

|

|

·

|

Effective base tax rate of 22.975%

|

|

·

|

Depletion allowance of 22% is applied to the spodumene concentrate sales price

|

|

·

|

Depletion allowances for quartz, feldspar, and mica concentrates are 14%, 14% and 22%,

respectively

|

|

·

|

Depreciation is assumed as 80% within the first year of operations and 50% of the remaining

balance in each subsequent year, with a 5% premium occurring in year 2

|

Financial Modelling

A comprehensive economic model has been prepared which fully integrates Piedmont’s Chemical Plant with its

Mine/Concentrator. The Scoping Study assumes a Chemical Plant production life of 23 years commencing in year 3 of mining operations. The mining production target is approximately 25.6Mt at an average run of mine grade of 1.11% Li2O (undiluted)

over a 25-year mine life. The overall project life is 25 years. Table 16 provides a summary of production and cost figures for the integrated project.

The current economic model assumes that 100% of initial capital costs for the Mine/Concentrator are incurred in the year

prior to commissioning (Year 0), and that 50% of initial capital costs for the Chemical Plant are incurred in the year prior to commissioning, and 50% are incurred in the year of commissioning. The Mine/Concentrator is assumed to ramp to full

production over a one-year period while the Chemical Plant is assumed to ramp to full production over a three-year period.

|

Unit

|

Estimated Value

|

|

|

PHYSICAL – MINE/CONCENTRATOR

|

||

|

Mine/Concentrator Life

|

years

|

25

|

|

Steady-state annual spodumene concentrate production

|

t/y

|

160,000

|

|

LOM spodumene concentrate production

|

t

|

3,805,000

|

|

LOM quartz by-product production

|

t

|

1,865,000

|

|

LOM feldspar by-product production

|

t

|

2,710,000

|

|

LOM mica by-product production

|

t

|

267,000

|

|

LOM feed grade (excluding dilution)

|

%

|

1.11

|

|

LOM average concentrate grade

|

%

|

6.0

|

|

LOM average process recovery

|

%

|

85

|

|

LOM average strip ratio

|

waste:ore

|

10.4:1

|

|

PHYSICAL – LITHIUM CHEMICAL PLANT

|

||

|

Steady-state annual lithium hydroxide production

|

t/y

|

22,700

|

|

LOM lithium hydroxide production

|

t

|

489,000

|

|

LOM concentrate supplied from Piedmont mining operations

|

t

|

3,100,000

|

|

Third party concentrate used in lithium hydroxide production

|

t

|

Nil

|

|

Chemical Plant Life

|

years

|

23

|

|

Commencement of lithium hydroxide chemical production

|

year

|

3

|

26

|

Table 16: Piedmont Lithium Project –

Life of Mine Integrated Project

|

Unit

|

Estimated Value

|

|

OPERATING AND CAPITAL COSTS – INTEGRATED PROJECT

|

||

|

Average LiOH production cash costs using self-supplied concentrate

|

US$/t

|

$3,105

|

|

Mine/Concentrator - Direct development capital

|

US$M

|

$106.2

|

|

Mine/Concentrator - Owner’s costs

|

US$M

|

$11.3

|

|

Mine/Concentrator – Land Acquisition Costs

|

US$M

|

$28.3

|

|

Mine/Concentrator – Contingency1

|

US$M

|

$22.1

|

|

Mine/Concentrator – Sustaining and deferred capital (inc. contingency)

|

US$M

|

$147.9

|

|

Chemical Plant - Direct development capital

|

US$M

|

$252.6

|

|

Chemical Plant – Owner’s Costs

|

US$M

|

$12.1

|

|

Chemical Plant – Contingency1

|

US$M

|

$79.4

|

|

Chemical Plant – Sustaining and deferred capital

|

US$M

|

$86.5

|

|

FINANCIAL PERFORMANCE – INTEGRATED PROJECT – LIFE OF PROJECT

|

||

|

Annual Steady State EBITDA

|

US$M/y

|

$240-$340

|

|

Annual Steady State After-Tax Cash Flow

|

US$M/y

|

$190-$260

|

|

Net operating cash flow after tax

|

US$M

|

$5,370

|

|

Free cash flow after capital costs

|

US$M

|

$4,630

|

|

After Tax Internal Rate of Return (IRR)

|

%

|

34

|

|

After Tax Net Present Value (NPV) @ 8% discount rate

|

US$M

|

$1,447

|

| 1. |

Contingency was applied to all direct and indirect costs at a rate of 20% (Mine/Concentrator) and 30% (Chemical Plant).

|

Payback Period

Payback periods for the Mine/Concentrator and Chemical Plant are approximately 2.4 years and 2.3 years, respectively.

The payback periods are based on free-cash flow, after taxes.

Sensitivity Analyses

The Mine/Concentrator component of the Scoping Study has been designed to a PFS level of detail with an accuracy of

± 25%. The Chemical Plant component of the Scoping Study was prepared at a ± 35% level of accuracy to investigate the technical and economic parameters of a fully-integrated lithium chemical operation located within the TSB. Key inputs into the

Scoping Study have been tested by the following sensitivities (Figure 21 and Figure 22).

27

28

Next Steps

The Company has identified the following near-term opportunities to add value to the Project:

|

·

|

Continue Phase 4 drilling and expansion of the Company’s land position in the Carolina

Tin-Spodumene Belt with a view to further enhancing the scale of the Project;

|

|

·

|

Complete permit applications and secure the necessary permits and approvals to commence mining

and processing operations at the Project;

|

|

·

|

Accelerate the development of the Company’s proposed lithium hydroxide chemical plant

including metallurgical testwork for the conversion of spodumene concentrate produced from Piedmont ore;

|

|

·

|

Commence a detailed market study of the important US quartz, feldspar and mica markets;

|

|

·

|

Formalize our dialogue with a number of prospective strategic, technical and offtake partners.

|

Conclusions

Piedmont is pleased to present a Scoping Study that clearly demonstrates the advantages of locating a

vertically-integrated lithium business in North Carolina, USA. The Scoping Study supports the Company’s first-mover position to restart hard rock lithium mining operations in the historic Carolina Tin-Spodumene Belt where the access to

infrastructure, labor, low costs, and favorable tax and royalty regimes contribute to robust Project economics.

As the only conventional lithium project under development in the United States, Piedmont Lithium has the potential to

offer the market diversification from current lithium supply sources. The Project meets an important strategic need for domestic US lithium production and will confer substantial economic benefits to the local region.

The addition of by-product credits to the Project’s economics are made possible by Piedmont’s location within the

industrial heartland of the mid-Atlantic United States. The benefits which by-product credits convey onto the project will ensure Piedmont’s highly competitive cost position within the growing lithium chemical industry.

The update of the concentrator process flow diagram to include dense medium separation as well as flotation provides

improvement in concentrator operator costs and potentially derisks commissioning and ramp up of the Mine and Concentrator.

29

Forward Looking Statements

This announcement may include forward-looking statements. These forward-looking statements are based on

Piedmont’s expectations and beliefs concerning future events. Forward looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Piedmont, which could cause actual results to

differ materially from such statements. Piedmont makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of that announcement.

Cautionary Note to United States Investors Concerning Estimates

of Measured, Indicated and Inferred Mineral Resources

The information contained herein has been prepared in accordance with the requirements of the

securities laws in effect in Australia, which differ from the requirements of United States securities laws. The terms "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are Australian

mining terms defined in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the “JORC Code”). However, these terms are not defined in Industry Guide 7 ("SEC Industry

Guide 7") under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"), and are normally not permitted to be used in reports and filings with the U.S. Securities and Exchange Commission (“SEC”). Accordingly, information contained

herein that describes Piedmont’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations

thereunder. U.S. investors are urged to consider closely the disclosure in Piedmont’s Form 20-F, a copy of which may be obtained from Piedmont or from the EDGAR system on the SEC’s website at http://www.sec.gov/.

Competent

Persons Statements

The information in this report that relates to Exploration Results is based on, and fairly represents, information

compiled or reviewed by Mr. Lamont Leatherman, a Competent Person who is a Registered Member of the ‘Society for Mining, Metallurgy and Exploration’, a ‘Recognized Professional Organization’ (RPO). Mr. Leatherman is a consultant to the Company. Mr.

Leatherman has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian

Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Leatherman consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Exploration Targets and Mineral Resources is based on, and fairly

represents, information compiled or reviewed by Mr. Leon McGarry, a Competent Person who is a Professional Geoscientist (P.Geo.) and registered member of the ‘Association of Professional Geoscientists of Ontario’ (APGO no. 2348), a ‘Recognized

Professional Organization’ (RPO). Mr. McGarry is a Senior Resource Geologist and full-time employee at CSA Global Geoscience Canada Ltd. Mr. McGarry has sufficient experience which is relevant to the style of mineralization and type of deposit

under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Mineral Resources and Ore Reserves’. Mr. McGarry consents to the inclusion in

this report of the results of the matters based on his information in the form and context in which it appears.

The information in this announcement that relates to Metallurgical Testwork Results, Process Design, Process Plant

Capital Costs, and Process Plant Operating Costs is based on, and fairly represents, information compiled or reviewed by Mr. Kiedock Kim, a Competent Person who is a Registered Member of ‘Professional Engineers Ontario’, a ‘Recognized Professional

Organization’ (RPO). Mr. Kim is full-time employee of Primero Group. Mr. Kim has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a

Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Mineral Resources and Ore Reserves’. Mr. Kim consents to the inclusion in this report of the matters based on his information in the form and context in

which it appears.

The information in this announcement that relates to Mining Engineering and Mining Schedule is based on information

compiled by Mr. Chris Scott and reviewed by Dr. Steven Keim, both of whom are employees of Marshall Miller and Associates (MM&A). Dr. Keim takes overall responsibility as Competent Person for the portions of the work completed by MM&A. Dr.

Steven Keim is a Competent Person who is a Registered Member of the ‘Society for Mining, Metallurgy & Exploration Society’, a ‘Recognized Professional Organization’ (RPO). Dr. Keim has sufficient experience, which is relevant to the style of

mineral extraction under consideration, and to the activity he is undertaking, to qualify as Competent Person in terms of the JORC Code (2012 Edition). Dr. Keim has reviewed this document and consents to the inclusion in this report of the matters

based on his information in the form and context within which it appears.

30

SUMMARY OF MODIFYING FACTORS AND MATERIAL ASSUMPTIONS

The Modifying Factors included in the JORC Code (2012) have been assessed as part of the Scoping Study, including mining,

processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and government factors. The Company has received advice from appropriate experts when assessing each Modifying Factor.

A summary assessment of each relevant Modifying Factor is provided below.

|

Mining

|

Refer to section entitled ‘Mining and Production Target’ in the Announcement.

The Company engaged independent engineers Marshall Miller to carry out pit optimizations, mine design, scheduling, and waste

disposal. Modelling and pit sequencing were compiled by Mr. Chris Scott, a Senior Engineer with Marshall Miller.

The mine design is based on an open pit design assuming the following wall design configuration for oxide and overburden material in

this Scoping Study:

•Batter face angle of 45 degrees

•Batter height of 10 vertical meters

•Berm width of 0 meters

•Overall slope angle of 45 degrees.

The following wall design configuration was used for fresh material in this Scoping Study:

•Batter face angle of 75 degrees

•Batter height of 24 vertical meters

•Berm width of 9.5 meters

•Overall slope angle of 52 degrees, which includes a ramp width of 30 meters.

The pit wall design parameters indicated above are based on the results of a preliminary geotechnical assessment that utilized

available fracture orientation measurements from exploration drilling and downhole geophysical logging, along with laboratory results for intact rock strength.

Production schedules have been prepared for the Piedmont Lithium Project based on the following parameters:

•Target a process plant output of 160 kt/y of 6% Li2O concentrate

•Plant throughput of 1.15 Mt/y

•Approximately 70% of production will be achieved in Year 1 of operations

•Mine dilution of 5%

•Mine recovery of 95%

•Processing recovery of 85%

•A mining sequence targeting maximized utilization of Indicated resources at

the front end of the schedule

•Annual scheduling periods.

It is planned that conventional drill and blast, load and haul open pit mining will be used to extract the mineralized material. ROM

feed will be defined by grade control procedures in the pit and delivered by truck to the ROM pad located next to the processing facility.

It is planned that site development and pre-strip activities will be carried out by an experienced earthmoving contractor.

Costs carried in the Scoping Study assume an owner-performed mining operation with an OEM financed mine fleet.

|

31

|

No alternative mining methods were considered in this Scoping Study.

Concentrator tailings will be co-disposed with waste rock from mining operations. The disposal method will not require the

construction of a tailings impoundment.

No other tailings disposal methods were considered in this Scoping Study.

The initial production target is approximately 160,000t of 6.0% (Li2O) or greater spodumene concentrate which will convert

to 22,700t of lithium hydroxide monohydrate. This equates to approximately 1.15Mt of ore processed per year totaling 25.6Mt grading at 1.05% (fully diluted) Li2O over 25 years. The production target was derived from selection

of the SimSched shell which provided the best estimate NPV.

The Company has concluded that it has reasonable grounds for disclosing a production target which includes an amount of Inferred

material. Approximately 47% of the total life-of-mine plan relates to Inferred material, however 0% of the mine plan relates to Inferred material in years 1-3.

Based on the advice from the relevant Competent Persons, the Company has a high degree of confidence that the Inferred Mineral

Resources for the Project will upgrade to Indicated Mineral Resources with further infill drilling. As support for this, the Company’s Indicated Mineral Resources have already increased by 5.4Mt (or 64%) from 8.5Mt @ 1.15% Li2O

(in June 2018) to 13.9Mt @ 1.16 Li2O (in June 2019), such increase resulting from a large proportion of previously Inferred Mineral Resources being upgraded to Indicated Mineral Resources from infill drilling. In the unlikely

event that the remaining Inferred Mineral Resources are not able to be upgraded, the Project’s viability is not affected.

The Project is located within the TSB and along trend to the Hallman Beam and Kings Mountain mines, which historically provided most

of the western world’s lithium between the 1950s and the 1980s. The TSB has been described as one of the largest lithium regions in the world. The TSB was the most important lithium producing region in the western world prior to the

establishment of the brine operations in Chile and Argentina in the 1990s. Livent and Albemarle both historically mined the lithium bearing spodumene pegmatites from the TSB, with the historic Kings Mountain lithium mine being described as

one of the richest spodumene deposits in the world by Albemarle.

The lithium chemical plant mass balance assumes that 144,960t/y of 6.0% spodumene concentrate is required to achieve the production

target. Excess concentrate produced each year after the lithium chemical plant achieves full capacity will be carried in inventory and consumed at the end of life-of-mine

|

||||

|

Processing

(including Metallurgical)

|

Refer to sections entitled ‘Metallurgy’ and ‘Process Design’ in the Announcement.

The Company engaged SGS laboratories in Lakefield, Ontario to complete variability and composite testwork on various flowsheet

options using a combination of Dense Medium Separation (DMS) and flotation processing techniques.

The summary results for the preferred flowsheet alternative are shown. Details of the testwork program and results were previously

announced on July 17, 2019.

|

|||

|

Parameter

|

DMS Results

|

Locked Cycle Test Results

|

Composite Sample Results

|

|

|

Feed Grade Li2O (%)

|

1.11

|

|||

|

Concentrate Grade Li2O (%)

|

6.42

|

6.31

|

6.35

|

|

|

Fe2O3 (%)

|

0.97

|

0.90

|

0.93

|

|

|

Na2O (%)

|

0.56

|

0.68

|

0.63

|

|

|

K2O (%)

|

0.45

|

0.52

|

0.49

|

|

|

CaO+ MgO + MnO (%)

|

0.51

|

1.25

|

0.96

|

|

|

P2O5 (%)

|

0.12

|

0.46

|

0.32

|

|

32

|

The composite samples were prepared to approximate the average grade of the Project’s ore body. Overall lithium recovery during

testwork for the preferred flowsheet was 77% at a grade of 6.35% Li2O. Simulations based on the testwork results support an overall plant design recovery of 85% when targeting a 6.0% Li2O spodumene concentrate product

Overall Li2O recovery of 85% is used in the Scoping Study. It is acknowledged that laboratory scale testwork will not