Form 6-K PEMBINA PIPELINE CORP For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-

16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2022

Commission File Number: 001-35563

Pembina Pipeline Corporation

(Translation of registrant’s name into English)

4000, 585 – 8th Avenue S.W.

Calgary, Alberta, Canada T2P 1G1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ☐ Form 40-F ☑

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ☐

INCORPORATION BY REFERENCE

Exhibit 99.1 to this Report on Form 6-K is hereby incorporated by reference as an exhibit to the Registration Statement on Form F-10 (File No. 333-261207) of Pembina Pipeline Corporation.

DOCUMENTS FILED AS PART OF THIS FORM 6-K

| Exhibit | Description | |

| 99.1 | Notices of Meeting and Management Information Circular for Annual Meeting of Shareholders, to be held on May 6, 2022 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on March 31, 2022.

| PEMBINA PIPELINE CORPORATION | ||

| By: | /s/ Janet C. Loduca | |

| Name: | Janet C. Loduca | |

| Title: | Senior Vice President, External Affairs & Chief Legal and Sustainability Officer | |

EXHIBIT INDEX

| Exhibit | Description | |

| 99.1 | Notice of Meeting and Management Information Circular for Annual Meeting of Shareholders, to be held on May 6, 2022 | |

MANAGEMENT INFORMATION CIRCULAR Notice of 2022 annual meeting of shareholders March 18, 2022 WHAT’S INSIDE Message form the Chair 2 Notice of our 2022 annual meeting of shareholders 4 Management information circular 5 About voting 6 Business of the meeting 11 About the nominated directors 15 Governance 28 Compensation discussion and analysis 53 Other information 102 PEMBINA

Message from the Chair

Dear Fellow Shareholders,

| I am pleased to invite you to the 2022 annual meeting of shareholders of Pembina Pipeline Corporation (Pembina or the company) to be held on Friday, May 6, 2022 at 2:00 p.m. (Mountain time). To mitigate the risks to the health and safety of our communities, shareholders, employees and other stakeholders in light of the COVID-19 pandemic, we are holding a virtual-only meeting. The meeting will be held by live audio webcast. Every shareholder and duly appointed proxyholder, regardless |

During another year of global economic and health uncertainties and challenges, Pembina once again proved resilient and disciplined while delivering on its commitments. |

of geographic location and ownership, will have an equal opportunity to participate at the meeting and vote on the matters to be considered at the meeting. Information about how to join, vote, and ask questions at the meeting can be found in this document.

During another year of global economic and health uncertainties and challenges, Pembina once again proved resilient and disciplined while delivering on its commitments. The board of directors of the company (board) continues to provide sound strategic oversight and remains confident that Pembina’s diversified and integrated asset base, low-risk business model and enduring focus on all stakeholders, will allow it to sustain its track record of strong performance and capitalize on longer-term growth opportunities, including contributing to the longer-term transition to a lower carbon economy.

Leadership

In November, Pembina announced a leadership transition with the departure of its President and Chief Executive Officer, Mick Dilger. I want to thank Mick for his service and contribution to Pembina. During his tenure, Pembina accelerated its impressive history of innovation and growth, becoming a truly differentiated, integrated leader in the midstream industry, with a strong core business and is well positioned for the future. I am truly proud to have worked with Mick.

Selecting a CEO is one of the most important tasks a board can undertake. We approached this task thoughtfully, recognizing Pembina’s strong capabilities and future opportunities. Ultimately, the board was pleased to appoint Scott Burrows as Pembina’s new President and Chief Executive Officer.

Scott has a deep understanding of the company and the industry, with 11 years of experience at Pembina and over 18 years in energy. In his roles with Pembina in corporate development and as Chief Financial Officer, Scott has been a key architect of the company’s growth and a strong proponent of financial discipline. He has overseen over $20 billion in successful strategic acquisitions and growth investments that have reshaped Pembina over the last decade.

Scott, along with the rest of Pembina’s senior management team, has been instrumental in defining and executing the strategy that has created what Pembina is today. They have the board’s full support in continuing to advance Pembina’s strategy, driving new initiatives forward and seizing opportunities to enhance value as they present themselves.

Governance and purpose

| Pembina is committed to providing responsible energy transportation and midstream services that deliver much needed oil and gas products to market. |

Over the past few years, Pembina has actively advanced its overall ESG strategy, including integrating ESG considerations into its long-term business planning, organizational structure and corporate policies and practices, and significantly enhancing its ESG disclosure.

| |||

|

The company has also committed to being in business for all stakeholders: employees, customers, communities, and investors – that is its purpose. Strong stewardship by the board, and high standards of governance and ethics throughout the business, are essential to helping Pembina achieve its purpose and operate the business effectively. |

Over the past few years, the board has overseen Pembina as it has actively advanced its overall environmental, social and governance (ESG) strategy, including integrating ESG considerations into its long-term business planning, organizational structure and corporate policies and practices, and significantly enhancing its ESG disclosure.

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 2 |

In 2021, the board was involved in the following important areas, which you can read more about beginning on page 33 of this circular:

| ● | We approved Pembina’s commitment to a 30% greenhouse gas (GHG) emission intensity reduction target by 2030, relative to baseline 2019 emissions. The GHG reduction target will help guide business decisions and improve overall emissions intensity performance while increasing Pembina’s long-term value and ensuring Canadian energy is developed and delivered responsibly. |

| ● | We oversaw the creation of two transformational Indigenous-led partnerships, both of which are truly equal partnerships that advance meaningful Indigenous community participation in the development of Canada’s energy industry: Pembina’s partnership with the Haisla Nation to develop the proposed Cedar LNG Project, the largest First Nation-owned infrastructure project in Canada, with one of the cleanest environmental profiles in the world, and Chinook Pathways, a partnership with Western Indigenous Pipeline Group to pursue ownership of the Trans Mountain Pipeline, following completion of construction of the Trans Mountain Expansion project. Pembina was honoured to be invited as a partner on both of these exciting projects. |

| ● | We continued to advance Pembina’s equity, diversity and inclusion (EDI) strategy, including by extending our diversity focus from the board to the company overall through overseeing and approving Pembina’s new employee EDI targets. These targets support the work being done across the organization to advance ESG priorities, including to increase the representation of women and other underrepresented groups at all levels of the organization. |

| ● | We amended the company’s code of ethics to include human rights, adopted new anti-bribery and community relations policies, and updated Pembina’s Indigenous and tribal relations policy. |

| ● | We incorporated ESG performance into Pembina’s annual corporate incentive compensation for all employees. |

The board is pleased to see that these efforts are being recognized as Pembina has successfully improved or maintained its ESG scores or rankings from globally recognized agencies including Sustainalytics, MSCI, and ISS.

Looking ahead

The board remains confident in Pembina’s strategy for the long-term. The core tenets of the strategy that has underpinned Pembina’s success remain intact, and Pembina is in an excellent position to continue building on its base business and supporting long-term growth opportunities, while being a leading participant in the energy industry’s evolution to a more sustainable future. Pembina has many exciting opportunities to pursue, and the strength it needs to tackle challenges while continuing to differentiate itself as an industry leader. The board is excited about what lies ahead for the company and the energy industry.

Last year I said I would retire in 2022, but after careful consideration, the board has asked me to continue on as Chair for one more year, to oversee and facilitate the company’s leadership transition. I am honoured to continue working with a board and management team that have such a deep and unwavering commitment to values and ethics, and a company with a long-standing reputation as a reliable and responsible energy services provider. The board continues its focus on succession planning and ensuring the next Chair has the right characteristics to lead the board as Pembina evolves in the coming years.

I want to thank my fellow directors for their ongoing stewardship of Pembina. I also want to acknowledge the strong leadership of our experienced management team and their dedication to creating a leading North American energy company by continuing to execute Pembina’s strategy during a leadership transition. To Pembina’s employees, thank you for your commitment, resilience and hard work over the course of another challenging year.

Finally, thank you to all of our shareholders for your ongoing support. The board is committed to continuing to work diligently on your behalf.

Sincerely,

(signed) “Randall (Randy) Findlay”

Randall (Randy) Findlay

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 3 |

| Notice of our 2022 annual meeting of common shareholders

You are invited to our 2022 annual meeting (the meeting) of common shareholders:

When May 6, 2022 2:00 p.m. (Mountain time)

Where Virtual-only meeting live audio webcast online at https://web.lumiagm.com/431537915

We will cover six items of business – see Business of the meeting in our 2022 management information circular: 1. Receive our 2021 audited consolidated financial statements and the auditors’ report thereon. 2. Vote on electing the directors. 3. Vote on appointing the auditors. 4. Vote on the continuation of the shareholder rights plan. 5. Vote on our approach to executive compensation. 6. Vote on any other business that properly comes before the meeting.

Your vote is important

Our 2022 management information circular includes important information about the meeting and the voting process. Please read it carefully before you vote.

We mailed you a copy of our 2021 audited consolidated financial statements and the auditors’ report if you asked us to (in accordance with applicable corporate and securities laws). You can also find a copy of our financial statements on our website (www.pembina.com), on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov).

To mitigate the risks to the health and safety of our communities, shareholders, employees and other stakeholders in light of the COVID-19 pandemic, we are holding a virtual-only meeting. The meeting will be held by live audio webcast. Every shareholder and duly appointed proxyholder, regardless of geographic location and ownership, will have an equal opportunity to participate at the meeting and vote on the matters to be considered at the meeting. You will find detailed instructions about how to participate in the meeting in this notice and in the management information circular starting on page 6. There are different processes if you are a registered shareholder or a beneficial shareholder. Most of our shareholders are beneficial shareholders, meaning that they hold their shares through a bank, broker or other such institution. Closely follow the applicable instructions in this notice, the management information circular and in your voting information form or form of proxy.

By order of the board,

(signed) “Jason Metcalf”

Jason Metcalf Deputy General Counsel & Corporate Secretary Pembina Pipeline Corporation

Calgary, Alberta March 18, 2022 |

Where to get a copy of the 2022 management information circular

If you are a registered common shareholder or you have given us instructions to send you printed documents, your management information circular is attached to this notice.

We use the notice and access procedures to deliver meeting materials (this notice and the management information circular) to beneficial holders of our common shares. Notice and access are a set of rules developed by the Canadian Securities Administrators that allows companies to post meeting materials online, reducing paper and mailing costs.

If you are a beneficial common shareholder, you can view the management information circular at: www.sedar.com or https://www.pembina.com/investors/invest or-documents-filings/

If you would like us to mail you a paper copy of the management information circular instead, please contact us:

● online: www.pembina.com/lnvestor- Centre/Shareholder-information ● by phone: 1-855-880-7404 ● by email: [email protected]

We will send it free of charge, but we need your request at least five days before the proxy deposit date listed on the enclosed voting instruction form, and within one year of filing the management information circular on SEDAR.

How to vote If you are a beneficial common shareholder, complete and return your voting instruction form at least one business day before the proxy deposit date of May 4, 2022 at 2:00 p.m. (Mountain time), or as listed on the attached voting instruction form. You cannot vote by returning this notice. If you want to attend the virtual meeting and vote your shares, you must appoint yourself as a proxyholder.

Send your voting instructions to us:

● online: www.proxyvote.com ● by phone: 1-800-474-7493 (English) 1-800-474-7501 (French) 1-800-454-8683 (United States) ● by fax: 905-507-7793 ● by mail: Data Processing Centre PO Box 2800 STN LCD Malton Mississauga, Ontario L5T 2T7

If you have questions about notice and access, call us toll-free at 1-855-880-7404. |

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 4 |

Management information circular

| You have received this document because you owned Pembina shares on March 18, 2022 (the record date) and are entitled to vote at our 2022 annual meeting of common shareholders, which will be held at 2:00 p.m. (Mountain time) on May 6, 2022, or at a reconvened meeting if the meeting is postponed or adjourned. The meeting will be held in a virtual-only format, by live audio webcast. All shareholders and duly appointed proxyholders can participate. You cannot attend the meeting in person.

The full webcast of the meeting will be available on our website after the event, including any questions we receive during the meeting and our answers.

All information in this circular is provided as of March 18, 2022 and all dollar amounts are in Canadian dollars, unless we note otherwise.

You will find financial information about Pembina in our annual audited consolidated financial statements and management’s discussion and analysis of our financial and operating results (MD&A) for the year ended December 31, 2021. Contact us for a copy of these documents. You can also find these documents and other important information about Pembina on our website (www.pembina.com), on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov). |

In this document | |||

| · |

meeting means the annual meeting of common shareholders to be held as a virtual-only meeting on May 6, 2022 | |||

| · |

you, your, common shareholders and shareholders mean holders of Pembina shares | |||

| · |

we, us, our, Pembina and the company mean Pembina Pipeline Corporation and our consolidated subsidiaries | |||

| · |

common shares, shares and Pembina shares mean common shares in the capital of Pembina | |||

| · |

circular means this management information circular | |||

| · |

board means Pembina’s board of directors | |||

|

Our principal corporate and registered office Pembina Pipeline Corporation 4000, 585 – 8th Avenue S.W. Calgary, Alberta T2P 1G1 T. 403-231-7500 F. 403-237-0254

| ||||

| This circular contains forward-looking statements that are based on our current expectations, estimates, projections and assumptions in light of our experience and perception of historic trends. These forward-looking statements include statements about succession plans, our compensation programs, expected financial performance, ESG strategy and related targets, corporate strategy, operations and projects. Forward-looking statements involve known and unknown risks and actual results may differ materially from those expressed or implied by these forward-looking statements. Please see Forward-Looking Statements & Information in the MD&A for more information about the assumptions and risks involved in making the forward-looking statements. These forward-looking statements are made only as of the date of this circular. Pembina does not undertake any obligation to publicly update or revise the forward-looking statements contained in this document, except as required by law.

In this circular, we also use certain financial measures and ratios that are not defined by generally accepted accounting practices (GAAP). Please see About non-GAAP |

2021 awards and achievements | |||

| · |

2021 Canada’s Top 100 Employers | |||

| · |

2021 Alberta’s Top 70 Employers | |||

| · |

Awarded with the Disability Employment Awareness Month (DEAM) Award | |||

| · |

$5.4 million invested in our communities through charitable contributions, including a flagship partnership with Breakfast Club of Canada | |||

| · |

$1.9 million invested in Indigenous community investments across our operating areas. | |||

|

· |

$3.2 million for United Way and other charitable organizations across our organization through employee donations and company matching

| |||

measures on page 102 for more information about these measures and why they are used.

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 5 |

About voting

Who can vote?

| You can vote at our annual meeting of common shareholders if you held our common shares at the close of business on the record date of March 18, 2022, even if you sold your common shares after this date.

You are not allowed to vote at the meeting if you acquired your shares after the record date, unless you ask us to include your name in the list of voting shareholders at least two days before the meeting and provide adequate evidence that you own the shares.

Common shares

We are authorized to issue an unlimited number of common shares. As at March 17, 2022, we had 552,007,278 common shares issued and outstanding. Our common shares are listed and trade on the Toronto Stock Exchange (TSX) (TSX: PPL) and the New York Stock Exchange (NYSE) (NYSE: PBA). |

|

Quorum

According to our articles and by-laws, at least two persons holding or representing at least 25% of our outstanding common shares must be present for the annual meeting to take place, or the meeting will be adjourned to a set time and place and no business will be transacted until the adjourned meeting.

About voting results

We will post the voting results on our website (www.pembina.com) and file them on SEDAR (www.sedar.com) and EDGAR (www.sec.gov) as soon as possible following the meeting. |

| To the best of the knowledge of the company’s directors and officers, no person beneficially owns, or controls or directs, directly or indirectly, more than 10% of our common shares.

Proxy solicitation |

|

Where to go with questions If you have any questions about the meeting or need help voting your shares, please contact our investor relations group at:

· 1-855-880-7404

|

Management is soliciting your proxy for the meeting. Management may use the service of external proxy solicitors and you may be contacted by Pembina employees or Kingsdale Advisors, our strategic shareholder advisor and proxy solicitation agent, by mail, by telephone or by personal interview. This year, Kingsdale Advisors is providing governance, strategic shareholder advisory services to the company and may also provide proxy solicitation services in connection with the meeting. We have paid them approximately $45,000 for this work and we may also pay them customary fees for contacting shareholders in connection with voting at the meeting. Pembina pays all costs related to producing and mailing this circular and other meeting materials, and for soliciting your proxy.

About the virtual meeting

To continue to mitigate the risks to the health and safety of our communities, shareholders, employees and other stakeholders in light of the COVID-19 pandemic, we are holding a virtual-only meeting this year as a live audio webcast. Every shareholder and duly appointed proxyholder, regardless of geographic location and ownership, will have an equal opportunity to participate at the meeting and vote on the matters to be considered at the meeting. You cannot attend the meeting in person. The full webcast will be available on our website after the event, including any questions we receive from shareholders and their answers.

Attending as a guest

All shareholders can attend the meeting as a guest by logging in online at https://web.lumiagm.com/431537915, selecting “I am a guest” and completing the required form. If you attend the meeting as a guest, you will not be permitted to vote during the meeting. Guests can, however, ask questions after the formal part of the meeting is over, during the live question and answer session.

Asking questions at the virtual meeting

Questions may be submitted at any time through the chat thread on the live webcast; however, during the formal part of the meeting, only questions from registered shareholders and duly appointed proxyholders that relate to the business of the meeting will be addressed.

Pembina will host a live question and answer session after the meeting, where we will answer other questions submitted during the meeting. Registered shareholders, duly appointed proxyholders (including beneficial shareholders that have duly appointed themselves as proxyholders) and guests can submit questions during the live question and answer session.

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 6 |

To make sure we can answer as many questions as possible, please keep your questions brief and concise, and make each question addresses only one topic. If there are questions from several shareholders or proxyholders on the same topic or that are otherwise related, we may group, summarize and answer them together. While all shareholder questions are welcome, we do not intend to address questions that are not related to the business of the meeting or Pembina’s operations, are repetitive or have been asked by another shareholder, are personal in nature or in furtherance of a shareholder’s personal or business interest, are related to material non-public information, are considered derogatory or otherwise offensive or are out of order or otherwise not appropriate.

To ensure the meeting is conducted in a way that is fair to all shareholders, the chair of the meeting may exercise discretion in responding to questions, including the order the questions are answered in, the grouping or editing of questions and the amount of time devoted to any question.

Technical difficulties

If you participate in the virtual meeting, it is important that you stay connected to the internet at all times during the meeting in order to vote. It is your responsibility to ensure connectivity for the duration of the virtual meeting. You should allow ample time to log into the virtual meeting and complete the above procedure.

All meeting participants must use the latest versions of Chrome, Safari, Microsoft Edge, or Firefox. Please do not use Internet Explorer. We recommend that you log in at least 30-60 minutes before the meeting starts as this will allow you to check compatibility and complete the related procedures required to log in to the meeting.

Caution: Internal network security protocols including firewalls and virtual private network (VPN) connections may block your access to the meeting. If you are experiencing any difficulty connecting to or watching the meeting, ensure your VPN setting is disabled or use a computer or other device on a network that is not restricted by any particular security settings.

If you have any questions about the virtual meeting portal or requiring assistance accessing the meeting website, please go to https://www.lumiglobal.com/faq for information.

How to vote

You can vote your shares by proxy (by appointing someone – a proxyholder – to represent you), or by attending the virtual meeting and voting. The rules for voting depend on whether you are a registered shareholder or a beneficial shareholder.

Beneficial shareholders

You are a beneficial shareholder if your shares are registered in the name of a nominee, such as a bank, trust company, securities broker, trustee or other institution. The majority of our shares are held by beneficial shareholders. Beneficial shareholders can vote their shares during the virtual meeting, or by proxy before the meeting:

Vote during the virtual meeting:

Before the meeting:

| 1. | Appoint yourself as the duly appointed proxyholder by printing your own name in the blank space provided for the proxyholder on the proxy or voting instruction form. Then return the form in the envelope provided (or by following the instruction on the form). Do not complete the rest of the form or mark your voting instructions on the form, because your vote will be taken at the meeting. |

| 2. | Register online with Computershare Trust Company of Canada (Computershare) online by going to www.computershare.com/pembina before 2:00 p.m. (Mountain time) on May 4, 2022 and input your name and contact information. |

Computershare will email you a username. You will need it to log in to the meeting and vote. Without a username, you will not be able to vote at the meeting but will be able to participate as a guest.

On the day of the meeting:

| 1. | Log in online at https://web.lumiagm.com/431537915. We recommend visiting the site before the meeting starts to make sure it works on your computer or device. You must stay connected to the internet for the entire meeting. |

| 2. | Select “I have a Control Number/Username” and enter the username Computershare provided by email. |

| 3. | Enter the password (case sensitive): pembina2022 |

| 4. | Complete the ballot online during the meeting. |

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 7 |

Beneficial shareholders who have not appointed themselves as proxyholder will not be able to vote online during the virtual meeting but will be able to participate as a guest.

Vote by proxy before the meeting by following the instructions on your proxy or voting instruction form

If you are a beneficial shareholder, you must send your voting instructions to your nominee who will vote for you. You will receive a request for voting instructions for the number of shares held for your benefit. Follow the instructions on the voting instruction form and send your voting instructions to your nominee. You likely have an earlier deadline for returning your voting instruction form to your nominee, so be sure to send the form early, to allow enough time for your nominee to receive your voting instructions and then send them to Pembina before the proxy cut-off time.

Most nominees delegate responsibility for obtaining voting instructions from their clients to Broadridge Financial Solutions Inc. (Broadridge). Broad ridge usually mails a scanable voting instruction form that is to be completed and returned to them by mail or fax. You can also call a toll-free phone number or access Broad ridge’s dedicated voting website to submit your voting instructions. Broadridge tabulates the results of all the instructions it receives and presents this information at the meeting. Kingsdale Advisors may contact beneficial shareholders to help you vote your shares directly over the phone, using the Broadridge QuickVote™ service, if available.

If you received voting materials from a company other than Broadridge, you need to complete and return the form following the instructions they have provided.

We use Broad ridge to send proxy-related materials to non-objecting beneficial owners of our shares. We intend to pay for intermediaries to deliver proxy-related materials to objecting beneficial owners of our shares.

Beneficial shareholders located in the United States

If you are a beneficial shareholder located in the United States and wish to vote at the meeting or, if permitted, appoint a third party as your proxyholder, in addition to the steps described above, you must obtain a valid legal proxy from your intermediary. Follow the instructions from your intermediary included with the legal proxy form or contact your intermediary to request a legal proxy form if you have not received one. After obtaining a valid legal proxy from your intermediary, you must then submit such legal proxy to Computershare. Requests for registration from beneficial located in the United States that wish to vote at the meeting or, if permitted, appoint third parties as their proxyholders must be sent by e-mail or by courier to: [email protected] (if by e-mail); or Computershare Trust Company of Canada, Attention: Proxy Department, 8th Floor, 100 University Avenue, Toronto, ON M5J 2Y1, Canada (if by courier), and in both cases, must be labeled “Legal Proxy” and received before 2:00 p.m. (Mountain time) on May 4, 2022. You will receive a confirmation of your registration by email once Computershare receives your registration materials.

Registered shareholders

You are a registered shareholder if you hold your shares in certificate form through the Direct Registration System. Registered holders can vote their shares during the virtual meeting, or by proxy before the meeting.

Vote during the virtual meeting

On the day of the meeting:

| 1. | Log in online at https://web.lumiagm.com/431537915. We recommend visiting the site before the meeting starts to make sure it works on your computer or device. You must stay connected to the internet during the meeting. |

| 2. | Select “I have a Control Number/Username” and enter your 15-digit control number (this is your username and you will find it on the bottom left corner of the first page of the enclosed proxy form). |

| 3. | Enter the password (case sensitive): pembina2022 |

| 4. | Complete the ballot online during the meeting. |

Vote by proxy before the meeting in one of the following three ways

| 1. | Online: Go to www.investorvote.com. You will need to enter your 15-digit control number (located on the bottom left corner of the first page of the enclosed proxy form) to identify yourself as a shareholder on the voting website; |

| 2. | By phone: Call 1-866-732-VOTE (8683) toll-free and follow the instructions. You will need to enter your 15-digit control number (located on the bottom left corner of the first page of the enclosed proxy form) to identify yourself as a shareholder on the telephone voting system; or |

| 3. | By mail: Complete the enclosed proxy form, sign and date it and return it in the enclosed envelope. |

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 8 |

Computershare is our transfer agent. Computershare must receive your completed proxy form at least 48 hours before the meeting (not including Saturdays, Sundays or holidays). The chair of the meeting can waive or extend the time limit for receiving proxy forms without notice, at his or her discretion.

About your proxyholder

The officers named on the proxy form and voting instruction form have agreed to serve as your proxyholder and will vote your shares according to your instructions. If you do not specify your voting instructions, they will vote your shares for each item of business at the meeting. If there are changes to the items of business or other matters that are properly brought before the meeting, your proxyholder can use their discretion and vote as they see fit. As of the date of this circular, we do not anticipate any changes to the items of business or other matters to be brought before the meeting.

Choosing someone else to be your proxyholder

You have the right to appoint someone else to be your proxyholder and act on your behalf at the virtual meeting. The person you appoint does not have to be a Pembina shareholder. Make sure this person knows he or she has been appointed to attend the virtual meeting and vote on your behalf. Your proxyholder must vote (or withhold from voting) your shares according to your instructions. If you appoint someone else to be your proxyholder and do not give them specific voting instructions, your proxyholder has the discretion to vote as they see fit.

To nominate someone other than the officers named in the form as your proxyholder:

| 1. | Appoint your proxyholder as a duly appointed proxyholder by printing his or her name in the blank space provided on your proxy or voting instruction form. Then return the form in the envelope provided (or by following the instructions on the form). |

| 2. | Register your proxyholder online with Computershare by going to www.computershare.com/pembina before 2:00 p.m. (Mountain time) on May 4, 2022 and inputting their name and contact information. |

Computershare will email your proxyholder a username, which they will need to log in to the meeting and vote. Without a username, your proxyholder will not be able to vote at the meeting but will be able to participate as a guest.

On the day of the meeting, your proxyholder will:

| 1. | Log in online at https://web.lumiagm.com/431537915. We recommend visiting the site before the meeting starts to make sure it works on the computer or device the proxyholder is using. Your proxyholder must stay connected to the internet for the entire meeting. |

| 2. | Select “I have a Control Number/Username” and enter the username Computershare provided by email. |

| 3. | Enter the password (case sensitive): pembina2022 |

| 4. | Complete the ballot online during the meeting. |

Changing your vote

If you are a registered shareholder, you can revoke a proxy form you previously submitted by:

| · | voting again at the meeting; |

| · | voting again by internet, telephone or fax before 4:30 p.m. (Mountain time) on the last business day before the meeting; |

| · | delivering a revocation notice in writing executed by the registered shareholder or by an authorized officer or attorney (duly authorized in writing) to: (i) our head office before 4:30 p.m. (Mountain time) on the last business day before the meeting; or (ii) with the chair of the meeting prior to the start time of the meeting; or |

| · | in any other manner permitted by law. |

If you are a beneficial shareholder, you can revoke voting instructions you previously submitted by contacting your nominee.

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 9 |

|

Shareholder proposals If you want to present a shareholder proposal at our 2023 annual meeting, you must submit it by February 6, 2023 to be considered for inclusion in next year’s management information circular.

Send your shareholder proposals to: Corporate Secretary Pembina Pipeline Corporation 4000, 585-8 Avenue SW Calgary, AB T2P 1G1

|

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 10 |

Business of the meeting

Our 2022 annual meeting of common shareholders will cover the six items of business listed below.

1. Receive our 2021 audited consolidated financial statements and auditors’ report

You have received our audited consolidated financial statements for the year ended December 31, 2021 and the auditors’ report thereon, which are included in our 2021 annual report, if you requested a copy. Copies are available on our website (www.pembina.com), on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov), or you can request a copy from our Investor Relations department.

2. Elect the directors

|

Our articles state that the board must have between five and 13 directors. In accordance with our by-laws, the board has fixed the number of directors to be elected at the meeting at 12.

The following 12 directors are nominated for election to the board:

· Randall J. Findlay (chair) · Maureen E. Howe · Anne-Marie N. Ainsworth · Gordon J. Kerr · J. Scott Burrows · David M.B. LeGresley · Cynthia Carroll · Leslie A ..O’ Donoghue · Ana Dutra · Bruce D. Rubin · Robert G. Gwin · Henry W. Sykes

11 of the nominated directors currently serve on our board, while Ms. Dutra is being nominated for the first time. Turn to the director profiles starting on page 15 for detailed information about each director.

Directors will serve until the next annual meeting of common shareholders, or until their successors are elected or appointed.

The proxy form allows you to vote for all the nominated directors, vote for some of them and withhold your vote for others, or withhold your vote for all of them. Unless instructed otherwise, the Pembina officers named in the proxy form will vote for all our nominated directors. |

Our policy on majority voting

Each director must receive a majority of the votes cast for their election, or they must resign immediately following the meeting.

The governance, nominating and corporate social responsibility committee will consider the resignation and recommend to the board the action to be taken. The director who resigned does not participate in these discussions.

The board will consider the committee’s recommendation and, within 90 days of the meeting, will accept the resignation unless there are exceptional circumstances. The resignation will be effective when it is accepted by the board. The board will announce its decision in a news release.

If the board accepts the resignation, it can appoint a new director, call a meeting of shareholders to vote for other candidates or leave the position vacant until the next annual meeting.

Our majority voting policy does not apply if a director election is contested. |

3. Appoint our auditors

You will vote on appointing our external auditors. The audit committee and the board propose that KPMG LLP (KPMG), Chartered Professional Accountants, be appointed as auditors and serve until the next annual meeting of common shareholders. The audit committee will recommend KPMG’s compensation to the board for its review and approval.

KPMG have been Pembina’s auditors since September 1997. Pembina’s audit committee and management conduct a comprehensive review of the external auditor at least every five years. A comprehensive review was last completed in 2020 for the five-year period from 2015 to 2019. The results of this review supported the continuation of the audit engagement. The following table shows the fees paid or payable to KPMG for the fiscal years ended December 31, 2020 and 2021.

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 11 |

|

Fee category |

2020 ($)

|

2021 ($)

|

||||||

|

Audit fees Fees for auditing our annual financial statements, reviewing our quarterly financial statements, and services related to statutory and regulatory filings or engagements. · 2021 fees also include expenses for: the short form base shelf prospectus related to the offer and issue from time to time of common shares, preferred shares, warrants, debt securities, subscriptions receipts and units, the short form base shelf prospectus related to the offer and issue from time to time of medium-term notes, pricing supplements in relation to the sale and issue of medium-term notes, series 17 and series 18 in December 2021 and the restatement of Pembina’s financial statements, MD&A and annual information form for the year ended December 31, 2020. · 2020 fees also include expenses for: pricing supplements related to the issue and sale of the medium-term notes, series 7 and series 16 in May 2020, the short form base shelf prospectus related to the offer and issue from time to time of debt securities and Class A preferred shares and prospectus supplements relating to the issue and sale of 4.80% Fixed-to-Fixed Rate Subordinated Notes, Series 1 in January 2021.

|

|

2,197,500 |

|

|

2,724,500 |

| ||

|

Audit-related fees Fees for assurance and related services, including French translations in connection with statutory and regulatory filings, reasonably related to the performance of the audit or review of Pembina’s financial statements and not reported under Audit fees above. · In 2021, these fees included audit fees for the pension plan and Younger facility pension plan audits of $25,000 and $18,000, respectively. · In 2020, these fees included audit fees for the pension plan and Younger facility pension plan audits of $30,000 and $30,000, respectively.

|

|

128,500 |

|

|

119,000 |

| ||

|

Tax fees Fees for non-audit tax services provided by KPMG’s tax division, including $2,850 (2020: $2,700) for tax compliance and $47,650 (2020: $92,300) for tax advice and tax planning. Fees in both years also include tax consultation and compliance fees for preparing and filing tax returns for our subsidiaries.

|

|

95,000 |

|

|

120,305 |

| ||

|

All other fees Fees for other products and services provided by the auditors not described above, which included fees related to advice and assistance with assurance and advisory services over GHG emissions and ESG sustainability reporting.

|

|

31,750 |

|

|

199,250 |

| ||

|

Total fees |

2,452,750 | 3,163,055 | ||||||

The board recommends you vote for appointing KPMG as our auditors until the close of our next annual meeting of common shareholders. Unless instructed otherwise, the Pembina officers named in the proxy form will vote for the appointment of KPMG as our auditors.

4. Approve our shareholder rights plan

You will vote on continuing our shareholder rights plan agreement.

As described in more detail below, our shareholder rights plan (rights plan) is designed to make sure shareholders are treated fairly if there is a takeover bid for a controlling position of the company by a shareholder or a group of shareholders acting together. The purpose of the rights plan is to give the board more time to find an alternative value enhancing transaction and to ensure the equal treatment of all shareholders.

See Appendix A for a summary of our rights plan. You can also find the full text of our rights plan on our website (www.pembina.com), on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov).

Background

When we converted from an income trust to a corporation on October 1, 2010, we adopted a rights plan in the form of a shareholder rights plan agreement with Computershare as rights agent.

Unitholders of Pembina Pipeline Income Fund approved the rights plan when they approved the corporate conversion on May 7, 2010, and it became effective October 1, 2010. Our rights plan must be approved by shareholders every three years. Shareholders last approved the rights plan on May 3, 2019, which means the rights plan will expire at the end of this year’s meeting unless shareholders ratify its continuance.

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 12 |

On February 24, 2022, the board unanimously determined that it was appropriate and in the best interests of shareholders that the rights plan be approved to continue for another three years.

At the meeting, common shareholders will vote on ratifying the continuance of the rights plan for another three-year period.

Why we have a shareholder rights plan

Takeover bids can be discriminatory. Exemptions to takeover bid legislation can allow a shareholder (or shareholders) to gain control of a company without making a formal takeover bid to all of the shareholders (for example, through transactions outside Canada, by making private agreements with a small group of shareholders or by slowly accumulating shares over time through stock exchange trading). This could result in a shareholder or group of shareholders acquiring control without paying fair value to all shareholders (this is sometimes called a creeping bid).

Our rights plan is designed to discourage this kind of takeover bid. When there is a takeover bid that is not a permitted bid (as described below), our rights plan gives shareholders contingent rights to acquire common shares at a significant discount to the prevailing market price. In certain circumstances, these rights become exercisable by all shareholders except the offeror in a takeover bid (and its associates, affiliates and joint actors), with the potential to significantly dilute the value of the offeror’s shares.

The rights plan does not prevent or discourage takeover bids but rather it addresses the concerns noted above by requiring offerors to:

| · | make permitted bids under the rights plan, which give shareholders an opportunity to participate in the transaction – a permitted bid meets specific conditions, including that it must be made to all shareholders and remain open for acceptance for at least 105 days or the minimum period that a formal take-over bid is required to remain open for in the relevant circumstances under Canadian law, if less than 105 days; or |

| · | negotiate an offer directly with the board, giving the board the opportunity to bargain for terms it believes will be in the best interests of shareholders. |

If the offeror does not take either of these approaches, they could trigger the dilution provisions in our rights plan, which are described above.

Management has reviewed the terms of our rights plan and confirmed that they continue to comply with current Canadian securities laws and to conform in all material respects to the shareholder rights plans of other public corporations in Canada.

We may amend the rights plan before shareholders approve it based on comments we may receive from regulatory authorities, or as any of our executive officers or directors consider necessary.

Resolution

Common shareholders will be asked to consider and, if deemed advisable, approve the following binding resolution:

RESOLVED, as an ordinary resolution, that:

| 1. | the shareholder rights plan of Pembina Pipeline Corporation (Pembina) be continued and the amended and restated shareholder rights plan agreement made as of May 12, 2016 between Pembina and Computershare Trust Company of Canada, as rights agent, which amended and restated the shareholder rights plan agreement dated effective October 1, 2010, as amended and restated May 10, 2013, and continued the rights issued thereunder, be and is hereby ratified, confirmed and approved; and |

| 2. | any one director or officer of Pembina is hereby authorized to execute and deliver, whether under corporate seal or otherwise, the agreement referred to above and any other agreements, instruments, notices, consents, acknowledgements, certificates and other documents (including any documents required under applicable laws or regulatory policies) and to perform and do all such other acts and things, as such director or officer may consider to be necessary or advisable from time to time in order to give effect to this resolution. |

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 13 |

To be approved, this resolution must be passed by at least 50 percent plus one of the votes cast by:

| · | the independent shareholders (as defined in the rights plan, but generally meaning any shareholder other than an acquiring person as defined in the rights plan, or a person making a takeover bid for Pembina and their associates and affiliates); and |

| · | all common shareholders present in person or by proxy at the meeting. |

This resolution is not in response to, or in anticipation of, any pending, threatened or proposed acquisition or takeover bid, and is not intended as a means to prevent a takeover of Pembina, as a strategy to retain management or the board, or to deter fair offers for Pembina shares.

We are not aware of any shareholder whose votes would not be eligible to be counted for this resolution, or of any shareholders who would not qualify as independent shareholders.

The board recommends common shareholders vote for this ordinary resolution. Unless instructed otherwise, the Pembina officers named in the proxy form will vote for the ordinary resolution authorizing the continuation of our rights plan.

5. Vote on our approach to executive compensation

You will vote on our approach to executive compensation.

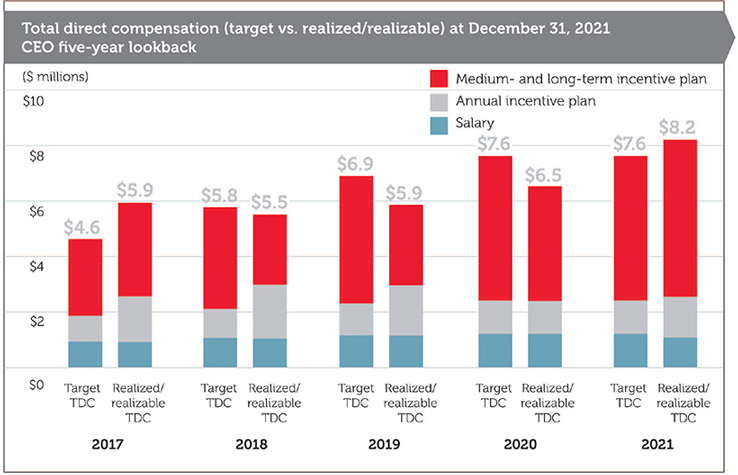

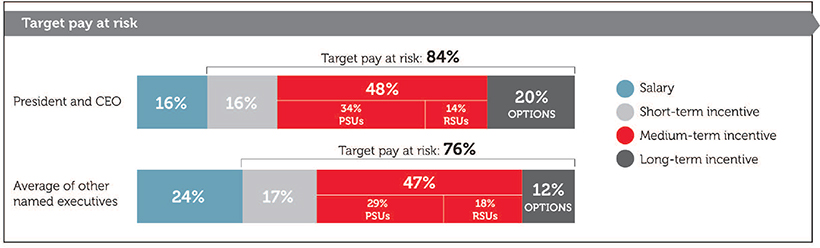

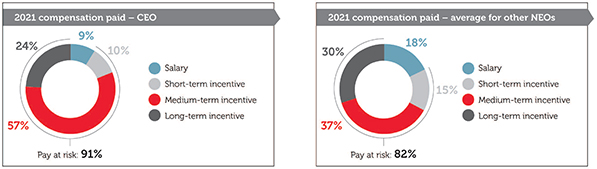

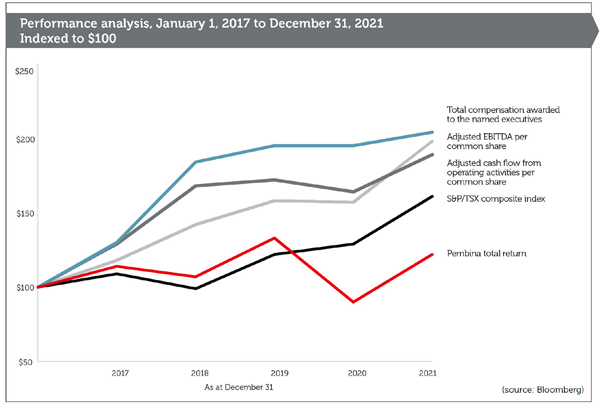

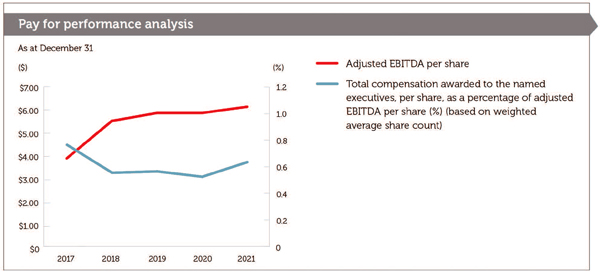

| A key principle underlying executive compensation at Pembina is ‘pay for performance’. We believe that linking compensation to strategy and corporate performance helps us attract and retain excellent people and motivates them to focus on our success. You will find a detailed discussion of our executive compensation program beginning on page 66 of this circular. |

Say on pay votes In 2021, our executive compensation approach was supported by 93.75% of shareholder votes for our say on pay resolution.

|

The board gives common shareholders the opportunity every year to vote for or against our approach to executive compensation (to have a say on pay). This is an advisory vote, so the results will not be binding on the board. The board will, however, consider the outcome of the vote as part of its ongoing review of executive compensation. If a significant number of shareholders oppose the “say on pay” resolution, the board will consult with shareholders to understand their concerns, and then review our approach to executive compensation with their concerns in mind.

You will be asked to consider and, if deemed advisable, approve the following non-binding resolution:

RESOLVED, on an advisory basis and not to diminish the role and responsibilities of the board of directors of Pembina Pipeline Corporation (Pembina), that the common shareholders of Pembina (shareholders) accept the approach to executive compensation disclosed in Pembina’s management information circular delivered in advance of the 2022 annual meeting of shareholders.

This resolution conforms to the language of the resolution recommended by the Canadian Coalition for Good Governance. The board recommends you vote for this resolution. Unless instructed otherwise, the Pembina officers named in the proxy form will vote for our approach to executive compensation as described in this circular.

6. Other business

You will vote on any other items of business that may be properly brought before the meeting. As of the date of this circular, we are not aware of any other matters to be brought before the meeting.

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 14 |

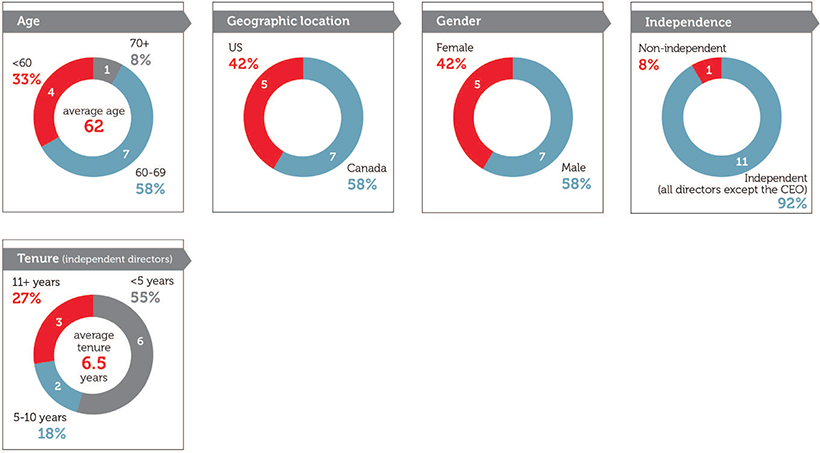

About the nominated directors

To ensure strong stewardship, the board needs to operate independently, have a prudent mix of relevant skills and experience, including industry knowledge and experience, a mix of age ranges and tenure, sufficiently diverse backgrounds and opinions to support balanced discussion and debate, and a manageable board size to facilitate productive discussion and decision-making. We believe this year’s group of 12 nominated directors meets all of these requirements.

The profiles on the following pages tell you about each nominated director’s background and experience, independence, meeting attendance, share ownership, other public company boards they serve on and voting results from our 2021 annual meeting (as applicable). All director information is provided as of March 18, 2022, unless indicated otherwise. Each of the nominated directors is willing and able to serve on the board until the next annual meeting of common shareholders.

All of the nominated directors are independent except Mr. Burrows, who is our President and Chief Executive Officer (CEO). The board has reviewed the independence and qualifications of the non-management directors and has recommended their nomination.

An overview of the nominated directors

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 15 |

|

Chair

Director since March 2007

Calgary, Alberta Canada |

Randall J. Findlay (71) | Independent3 2021 voting results: 97.22% for, 2.78% withheld

Mr. Findlay was the President of Provident Energy Trust (Provident) from 2001 until his retirement in 2006. He was a director of Provident from 2001 to 2012. Before that he held various executive positions in the oil and gas industry over 30 years, including senior positions at NOVA Corporation and TransCanada Pipelines Limited.

Mr. Findlay has been a director of over 15 public and private companies. He has also chaired the board of a number of not-for-profit organizations and campaigns. He is the past chair of the Alberta Children’s Hospital Foundation and the current chair of the Alberta Children’s Hospital Research Institute Strategic Advisory Board.

Mr. Findlay is a professional engineer and has a Bachelor of Applied Science in chemical engineering from the University of British Columbia. He is a graduate of the Institute of Corporate Directors Education Program and holds the ICD.D designation.

| |||||||||||

| Board and committee membership and attendance | ||||||||||||

| Board of directors (chair) | 14 of 14 meetings | 100% | ||||||||||

| Governance, nominating and corporate social responsibility committee | 4 of 4 meetings | 100% | ||||||||||

| Other public company boards and committee memberships 1 | ||||||||||||

| Superior Plus Corp. | TSX | Governance and nominating; audit | |||||||||||

|

1 Mr. Findlay was a director of Spyglass Resources Corp. (a TSX listed company) from March 2013 until May 13, 2015. Spyglass Resources Corp., an intermediate oil and gas exploration and production company, was placed into receivership by a syndicate of its lenders on November 26, 2015.

| ||||||||||||

| Securities held as of March 18, 2022 | ||||||||

| Common

shares |

Deferred share

units |

Total value2 | Meets share ownership guidelines

(including 50% common shares) | |||||

| 138,321 | 37,178 | $8,022,063 | yes | |||||

|

2 Based on $45.71, the closing price of our common shares on the TSX on March 18, 2022. Deferred share units for directors include units issued under our deferred share unit plan and units accrued as dividend equivalents (see Director compensation on page 63 for more information). | ||||||||

| 3 | Directors ordinarily retire from our board and do not stand for re-election once they have turned 72. Mr. Findlay will turn 72 between the date of mailing the circular and the meeting date. After careful consideration, the board has determined, following a recommendation by the governance, nominating and corporate social responsibility committee, that it is in the best interests of the company for Mr. Findlay to remain on the board for one more year, as chair, to provide assistance and guidance to the board in overseeing the leadership transition and has asked him to stand for re-election at the meeting – see page 41. |

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 16 |

|

Director since October 2014

Houston, Texas U.S. |

Anne-Marie N. Ainsworth (65) | Independent 2021 voting results: 90.61% for, 9.39% withheld

Ms. Ainsworth served as President and Chief Executive Officer of Oiltanking Partners, L.P. and Oiltanking Holding Americas, Inc. from November 2012 to March 2014. She is currently on the boards of Kirby Corporation, HollyFrontier Corporation and Archrock, Inc. Ms. Ainsworth has extensive experience in the oil industry and has held several senior management positions throughout her career.

Ms. Ainsworth was Senior Vice President of Refining at Sunoco Inc. (2009 to 2012) and previously was the General Manager of the Motiva Enterprises, LLC (Motiva) refinery in Norco, Louisiana (2006 to 2009). Before she joined Motiva, Ms. Ainsworth was director of process safety management systems and business improvement leader at Shell Oil Products U.S. (2003 to 2006) and Vice President of Technical Assurance at Shell Deer Park Refining Company (2000 to 2003).

| |||||

| Ms. Ainsworth graduated cum laude from the University of Toledo with a Bachelor of Science in chemical engineering. She holds a Master of Business Administration from Rice University, where she also served as an adjunct professor (2000 to 2009). She is a graduate of the Institute of Corporate Directors Education Program and holds the ICD.D designation.

| ||||||

| Board and committee membership and attendance | ||||

| Board of directors | 14 of 14 meetings | 100% | ||

| Human resources, health and compensation committee | 4 of 4 meetings | 100% | ||

| Safety, environment and operational excellence committee | 5 of 5 meetings | 100% | ||

| Other public company boards and committee memberships | ||||||||||

| Archrock, Inc. | NYSE | Governance and nominating (chair); audit | |||||||||

| HollyFrontier Corporation | NYSE | Health, safety and environment (chair);finance | |||||||||

| Kirby Corporation | NYSE | Audit; nominating and corporate governance | |||||||||

| Securities held as of March 18, 2022 | ||||||||

| Common shares | Deferred

share units |

Total value1 | Meets share ownership guidelines

(including 50% common shares) | |||||

| 23,830 | 25,214 | $2,243,151 | yes | |||||

|

1 Based on US$36.21, the closing price of our common shares on the NYSE on March 17, 2022 and the Reuters noon U.S. Canadian dollar foreign exchange rate of 1.2639 as at March 17, 2022. Deferred share units for directors include units issued under our deferred share unit plan and units accrued as dividend equivalents (see Director compensation on page 63 for more information) and their value is based on $45.71, the closing price of our common shares on the TSX on March 17, 2022. | ||||||||

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 17 |

|

Director since February 2022

Calgary, Alberta Canada |

Scott Burrows (42) | Non-independent

Mr. Burrows was appointed President and Chief Executive Officer in February 2022. Mr. Burrows is responsible to all Pembina stakeholders for delivering on Pembina’s overall purpose: to be the leader in delivering integrated infrastructure solutions connecting global markets.

Prior to his current role, Mr. Burrows was named interim President and Chief Executive Officer in November 2021. Prior thereto, he served as Senior Vice President and Chief Financial Officer, where he oversaw Pembina’s financial, treasury, accounting, tax, risk, investor relations, capital markets, corporate development and planning functions. In his prior role, he was a trusted and highly valued advisor to the CEO to help drive the strategic growth agenda and ensure continued profitability and a conservative balance sheet.

Mr. Burrows joined Pembina in November 2010 and held various leadership positions until January 1, 2015, when he was appointed Vice President, Finance and Chief Financial Officer. On July 1, 2017, he was appointed Senior Vice President and Chief Financial Officer and held that position until he was appointed interim President and Chief Executive Officer in November 2021.

Before joining Pembina, Mr. Burrows spent seven years in energy-focused investment banking where he provided advice related to mergers and acquisitions, dispositions, joint ventures and equity and debt financings. He has considerable experience in most aspects of the energy industry, including petroleum, natural gas and other product pipelines and related infrastructure facilities.

Mr. Burrows has a Bachelor of Commerce from the University of British Columbia, is a CFA Charterholder and was named one of Canada’s top 40 under 40. Mr. Burrows also sits on the Board of Rundle College Society.

| |||||||||

| Board and committee membership and attendance | ||||||||||

| Board of directors

|

n/a n/a

| |||||||||

| Other public company boards and committee memberships | ||||||||||

| None | ||||||||||

| Securities held as of March 18, 2022 | ||||||||||

| Common

shares |

Restricted and

performance

share units |

Total value1 | Meets share ownership guidelines

(including 50% common shares) 2 | |||||||

| 20,022 | 259,080 | $12,757,745 | On track3 | |||||||

|

1 Based on $45.71, the closing price of our common shares on the TSX on March 17, 2022. Mr. Burrows is not entitled to deferred share units issued under our deferred share unit plan. Restricted and performance share units include units issued under our share unit plan and units accrued as dividend equivalents (see Executive compensation on page 66 for more information).

2 Not including the value of PSUs.

3 Mr. Burrows has five years from the date of his appointment on February 22, 2022 to meet the share ownership guidelines. | ||||||||||

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 18 |

|

Director since May 2020

Naples, Florida U.S. |

Cynthia Carroll (65) | Independent 2021 voting results: 98.11% for, 1.89% withheld

Ms. Carroll began her career as an exploration geologist at Amoco Production Company in Denver, Colorado before joining Alcan Aluminum Corporation (Alcan). She held various executive roles at Alcan including President of Bauxite, Alumina and Specialty Chemicals and Chief Executive Officer of the Primary Metal Group, Alcan’s core business. From 2007 to 2013, Ms. Carroll served as the Chief Executive Officer of Anglo American plc, which was, at the time, one of the largest and most diversified mining companies in the world.

Ms. Carroll is currently a non-executive director of Hitachi Ltd., Baker Hughes Company, Glencore plc and of Prince International Corporation, a subsidiary of American Securities LLC, where she sits on the Advisory Board. She previously chaired the boards of Anglo American Platinum Ltd., De Beers Société Anonyme, Vedanta Resources Holdings Ltd., and the World Economic Forum, Mining and Metals Industry group. She has also served on the boards of BP, the International Council on Mining and Metals, the International Aluminum Institute, The American Aluminum Association, Sara Lee Corporation and Century Aluminum Company.

Ms. Carroll holds a bachelor’s degree in Geology from Skidmore College, a Master of Science degree in Geology from the University of Kansas, and a Master of Business Administration from Harvard University. She was awarded an Honorary Doctorate of Science from the University of Exeter, Honorary Doctorate of Laws from Skidmore College and an Honorary Doctorate of Economics from the University of Limerick. She is a fellow of the Royal Academy of Engineers and a Fellow of the Institute of Materials, Minerals and Mining. Ms. Carroll is a member of the Institute of Corporate Directors.

| |||||||||||||||

| Board and committee membership and attendance |

|

|||||||||||||||

| Board of directors |

|

14 of 14 meetings | 100% | |||||||||||||

| Human resources, health and compensation committee |

|

4 of 4 meetings | 100% | |||||||||||||

| Safety, environment and operational excellence committee (chair) |

|

5 of 5 meeting | 100% | |||||||||||||

| Other public company boards and committee memberships | ||||||||

| Baker Hughes Company | NYSE | Audit; compensation | |||||||

| Hitachi Ltd. | TYO | Nominations | |||||||

| Glencore plc | LON | Remuneration (chair); nomination; safety, environment and communities |

|||||||

| Securities held as of March 18, 2022 | ||||||||||||

| Common

shares |

Deferred share

units |

Total value1 | Meets share ownership guidelines (including 50% common shares) | |||||||||

| - | 4,871 | $222,647 | On track2 | |||||||||

|

1 Deferred share units for directors include units issued under our deferred share unit plan and units accrued as dividend equivalents (see Director compensation on page 63 for more information) and their value is based on $45.71, the closing price of our common shares on the TSX on March 17, 2022. | ||||||||||||

|

2 Ms. Carroll has five years from the date of her appointment on May 8, 2020 to meet the share ownership guidelines. | ||||||||||||

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 19 |

|

Director nominee

Chicago, Illinois U.S. |

Ana Dutra (57) | Independent 2021 voting results: N/A

Ms. Dutra is an experienced corporate director and executive with over 30 years of global experience in profit and loss management, technology, business growth and C-Level business advisory. She has held various executive positions and board memberships with a number of public and private corporations across numerous industries, including fin-tech, renewable energy, banking, and healthcare. She has expertise in many areas, including ESG, mergers and acquisitions, technology, executive compensation and corporate governance. Most recently, Ms. Dutra was the President and Chief Executive Officer of The Executives’ Club of Chicago (2014 – 2018) and was previously the Proxy Officer and Chief Executive Officer of Korn Ferry Consulting (2008 – 2013). In her role as Global Senior Managing Partner at Accenture, she oversaw the creation and growth of Accenture’s organization strategy consulting business line, including the innovation, mergers and acquisitions and culture transformation practices.

Ms. Dutra is currently a non-executive director of CME Group, First Internet Bankcorp, Amyris Inc., Carparts, Inc., and the M. Holland Company (a private corporation).

Ms. Dutra has a Bachelor in Economics from the Universidade Federal do Rio de Janeiro, a Juris Doctor from the Universidade do Estado do Rio de Janeiro and a Master in Economics from Pontificia Universidade Catolica do Rio de Janeiro. In addition, Ms. Dutra also holds a Master of Business Administration from Kellogg School of Management at Northwestern University, where she continues to serve as a lecturer in the areas of strategy and innovation, leadership development and globalization.

| |||||||||

| Board and committee membership and attendance | ||||||||||

| n/a | ||||||||||

| Other public company boards and committee memberships1 | ||||||

| CME Group Inc. | Nasdaq | Compensation; risk; market regulation oversight; diversity | |||||

| First Internet Bankcorp | Nasdaq | Audit; nominating and governance | |||||

| Amyris, Inc. | Nasdaq | ||||||

| Carparts, Inc. | Nasdaq | ||||||

|

1 If elected, Ms. Dutra will have until the end of 2022 to meet the recommended number of outside directorships under our governance guidelines – see page 44 for details.

| ||||||

| Securities held as of March 18, 2022 | ||||||||

| Common

shares |

Deferred share

units |

Total value2 | Meets share ownership guidelines

(including 50% common shares) | |||||

| - | - | - | n/a3 | |||||

|

2 Deferred share units for directors include units issued under our deferred share unit plan and units accrued as dividend equivalents (see Director compensation on page 63 for more information).

3 If elected, Ms. Dutra will have five years from the date of her election to meet the share ownership guidelines. | ||||||||

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 20 |

|

Director since May 2020

Houston, Texas U.S. |

Robert G. Gwin (58) | Independent 2021 voting results: 98.72% for, 1.28% withheld

Mr. Gwin was President of Anadarko Petroleum Corporation (Anadarko), one of the world’s largest independent oil and natural gas exploration and production companies, until its acquisition by Occidental Petroleum Corporation in late 2019. He previously was Executive Vice President, Finance and Chief Financial Officer of Anadarko from 2009 to 2018. Mr. Gwin joined Anadarko in 2006 and was a member of Anadarko’s executive committee since 2008. Concurrently, he also served as Chairman of the Board of Western Gas Partners, LP (WES), a large U.S. oil and natural gas midstream company, from 2010 to 2018, and previously as WES’s President and CEO from 2007 to 2010.

Earlier in his career, Mr. Gwin held various positions in corporate finance and executive management.

Mr. Gwin currently is also on the board of directors of Crescent Energy Company.

Mr. Gwin served as a director of WES from 2007 to 2019, as a director of LyondellBasell Industries, N.V. from 2011 to 2018, including serving as its Chairman from 2013 to 2018, and as a director of Enable Midstream Partners, LP from 2020 through 2021, including serving as its Chairman. He has also served as a director of several non-public entities throughout his career. He holds a Bachelor of Science degree from the University of Southern California and a Master of Business Administration degree from the Fuqua School of Business at Duke University. He also earned the Chartered Financial Analyst (CFA) designation from the CFA Institute. He is a member of the Institute of Corporate Directors.

| |||||||||

| Board and committee membership and attendance | ||||||||

| Board of directors | 14 of 14 meetings | 100% | ||||||

| Human resources, health and compensation committee | 4 of 4 meetings | 100% | ||||||

| Governance, nominating and corporate social responsibility committee (chair) |

4 of 4 meetings | 100% | ||||||

| Other public company boards and committee memberships | ||||||||

| Crescent Energy Company | NYSE - |

||||||||

| Securities held as of March 18, 2022 | ||||||||||||

| Common

shares |

Deferred share

units |

Total value1 | Meets share ownership guidelines

(including 50% common shares) | |||||||||

| - | 4,871 | $222,647 | On track2 | |||||||||

|

1Deferred share units include units issued under our deferred share unit plan and units accrued as dividend equivalents (see Director compensation on page 63 for more information) and their value is based on $45.71, the closing price of our common shares on the TSX on March 17, 2022.

2 Mr. Gwin has five years from the date of his appointment to the board on May 8, 2020 to meet the guidelines. | ||||||||||||

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 21 |

|

Director since October 2017

Vancouver, British Columbia Canada |

Maureen E. Howe (64) | Independent 2021 voting results: 99.07% for, 0.93% withheld

Ms. Howe was a Research Analyst and Managing Director at RBC Capital Markets in equity research from 1996 until 2008. She specialized in the area of energy infrastructure, which included power generation, transmission and distribution, oil and gas transmission and distribution, gas processing, and alternative energy. Prior to joining RBC Capital Markets, Ms. Howe held various positions in the area of capital markets, including investment banking, portfolio management, and corporate finance.

Ms. Howe is a director of Methanex Corporation and Freehold Royalties Ltd. She is also the Chairperson of the University of British Columbia Phillips, Hager & North Centre for Financial Research.

Ms. Howe has a Bachelor of Commerce (Honours) from the University of Manitoba and a Ph.D. in Finance from the University of British Columbia. She is a member of the Institute of Corporate Directors.

| |||||

| Board and committee membership and attendance | ||||

| Board of directors | 14 of 14 meetings | 100% | ||

| Audit committee (chair) | 6 of 6 meetings | 100% | ||

| Governance, nominating and corporate social responsibility committee |

4 of 4 meetings | 100% | ||

| Other public company boards and committee memberships | ||||

| Methanex Corporation | TSX, NASDAQ Governance (chair); audit | ||||

| Freehold Royalties Ltd. | TSX Audit | ||||

| Securities held as of March 18, 2022 | ||||||

| Common

shares |

Deferred share

units |

Total value1 | Meets share ownership guidelines

(including 50% common shares) | |||

| 25,000 | 13,048 | $1,739,190 | yes | |||

|

1 Based on $45.71, the closing price of our common shares on the TSX on March 17, 2022. Deferred share units for directors include units issued under our deferred share unit plan and units accrued as dividend equivalents (see Director compensation on page 63 for more information). | ||||||

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 22 |

|

Director since January 2015

Calgary, Alberta Canada |

Gordon J. Kerr (68) | Independent 2021 voting results: 98.11% for, 1.89% withheld

Mr. Kerr was President and Chief Executive Officer and director of Enerplus Corporation (a TSX and NYSE-listed company) from May 2001 until July 2013. He is a past Chairman of the Canadian Association of Petroleum Producers, a former director of Deer Creek Energy Limited and Laricina Energy Ltd., a past member of the Canadian Council of Chief Executives and of the Management Advisory Council of the Haskayne School of Business at the University of Calgary.

He has gained extensive management experience in leadership positions at various oil and gas companies since launching his career in 1979. He started his employment with Enerplus Corporation and its predecessor firms in 1996, and held positions of increasing responsibility, including the positions of Chief Financial Officer and Executive Vice President.

| |

| He has a Bachelor of Commerce from the University of Calgary. Mr. Kerr received his Chartered Accountant designation in 1979 and is a fellow of the Institute of Chartered Accountants of Alberta. Mr. Kerr is a graduate of the Institute of Corporate Directors Education Program and holds the ICD.D designation and is a member of the executive of the Calgary Chapter of the Institute of Corporate Directors. |

| Board and committee membership and attendance | ||||||||

| Board of directors | 14 of 14 meetings | 100% | ||||||

| Audit committee | 6 of 6 meetings | 100% | ||||||

| Governance, nominating and corporate social responsibility committee |

4 of 4 meetings | 100% | ||||||

|

| ||||||||

| Other public company boards and committee memberships1 | ||||||||

| None | ||||||||

| 1 Mr. Kerr was a director of Laricina Energy Ltd., a private company, until February 5, 2016. Laricina Energy Ltd. was subject to proceedings under the Companies’ Creditors Arrangement Act (Canada) in 2015. On February 1, 2016, the proceedings were conditionally discharged. | ||||||||

| Securities held as of March 18, 2022 | ||||||||

| Common

shares |

Deferred

share units |

Total value2 | Meets share ownership guidelines

(including 50% common shares) | |||||

| 10,400 | 37,851 | $2,205,563 | yes | |||||

| Class A preferred shares | ||||||

| Series 7 | 6,000 |

|

2 Based on $45.71, the closing price of our common shares on the TSX on March 17, 2022. Deferred share units for directors include units issued under our deferred share unit plan and units accrued as dividend equivalents (see Director compensation on page 63 for more information). | ||||||||

| Pembina Pipeline Corporation ● 2022 Management Information Circular | 23 |

|

Director since August 2010

Toronto, Ontario Canada

|

David M.B. LeGresley (63) | Independent 2021 voting results: 98.45% for, 1.55% withheld

Mr. LeGresley is an experienced Canadian corporate director having served on a number of public and private boards, both large and small cap since 2008. He has extensive experience in the financial services industry, including as a senior executive at National Bank Financial for 12 years, in several roles, including Head of Corporate and Investment Banking, and most recently Vice Chair. Before that, he held investment banking positions at Salomon Brothers Canada and CIBC Wood Gundy.