Form 6-K Nomad Foods Ltd For: May 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2022

Commission File Number: 001-37669

Nomad Foods Limited

(Translation of registrant’s name in English)

No. 1 New Square

Bedfont Lakes Business Park

Feltham, Middlesex TW14 8HA

+ (44) 208 918 3200

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

2022 Annual Meeting of Shareholders

Attached hereto as Exhibit 99.1 is a copy of the proxy statement and form of proxy of Nomad Foods Limited (the “Company”) for the Company’s 2022 annual meeting of shareholders scheduled to be held on July 1, 2022, and attached hereto as Exhibit 99.2 is a copy of the Notice of Internet Availability of Proxy Materials which is being first mailed to shareholders on or about May 20, 2022.

Exhibit 99.1 is incorporated by reference into the registration statements on (i) Form S-8 filed with the Securities and Exchange Commission (the “Commission”) on May 3, 2016 (File No. 333-211095), (ii) Form F-3, initially filed with the Commission on March 30, 2017 and declared effective on May 2, 2017 (File No. 333-217044) and (iii) Form F-3 filed with the Commission on June 4, 2018, which was automatically effective upon filing with the Commission (File No. 333-225402).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NOMAD FOODS LIMITED | ||

| By: | /s/ Stéfan Descheemaeker | |

| Name: | Stéfan Descheemaeker | |

| Title: | Chief Executive Officer | |

Dated: May 20, 2022

Exhibit Index

| Exhibit Number |

Exhibit Title | |

| 99.1 | Proxy statement and form of proxy for the 2022 annual meeting of shareholders of Nomad Foods Limited. | |

| 99.2 | Notice of Internet Availability of Proxy Materials. | |

Table of Contents

Exhibit 99.1

|

No. 1 New Square Bedfont Lakes Business Park Feltham, Middlesex TW14 8HA |

Notice of Annual Meeting of Shareholders

May 20, 2022

Dear Shareholder:

It is my pleasure to invite you to attend Nomad Foods Limited’s 2022 Annual Meeting of Shareholders (the “Annual Meeting”). The meeting will be held on July 1, 2022, at 10:00 a.m. London time, at the London Headquarters of Nomad Foods Limited, No. 1 New Square, Bedfont Lakes Business Park, Feltham, Middlesex, TW14 8HA. At the meeting, you will be asked to:

| 1. | Elect ten members of the Board of Directors for a one-year term expiring at the 2023 Annual Meeting of Shareholders. |

| 2. | Ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the 2022 fiscal year. |

| 3. | Transact such other business as may properly come before the Annual Meeting and any adjournment or postponement of the Annual Meeting. |

Only shareholders of record as of the close of business on May 2, 2022 may vote at the Annual Meeting. It is important that your shares be represented at the Annual Meeting, regardless of the number of shares you may hold. Whether or not you plan to attend, we encourage you to vote as promptly as possible.

We currently intend to hold the Annual Meeting in person. However, we are actively monitoring the coronavirus, or COVID-19, and are sensitive to the public health and travel concerns that our shareholders may have, as well as protocols that local governments may impose. If it is not possible or advisable to hold the Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include switching to a virtual meeting format, or changing the time, date or location of the Annual Meeting. Any such change will be announced via press release that will be furnished on a Form 6-K to the Securities and Exchange Commission.

Shareholders of record as of May 2, 2022 are entitled to vote in one of the following ways:

|

|

By Telephone |

|

By Internet |

|

By Mail |

|

In Person | |||||||

| You can vote by calling 1-866-868-1646. You will need your control number on your proxy card or Notice of Internet Availability. | You can vote online at www.proxypush.com/NOMD. You will need your control number on your proxy card or Notice of Internet Availability. |

You can vote by marking, signing and dating your proxy card or voting instruction form and returning it in the postage- paid envelope. | You can vote in person. For instructions on attending the Annual Meeting in person, please see page 4. | |||||||||||

We look forward to seeing you on July 1, 2022.

Sincerely,

Sir Martin Ellis Franklin, KGCN

Co-Chairman of the Board of Directors

We mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access

our proxy statement and annual report on or about May 20, 2022.

Our proxy statement and annual report are available online at www.proxydocs.com/NOMD

Table of Contents

| 1 | ||

| 1 | Questions and Answers | |

| 5 | ||

| 6 | Nominees for Director | |

| 11 | ||

| 11 | Independence of Directors | |

| 11 | Board Committees | |

| 13 | Director Compensation | |

| 14 | ||

2022 Proxy Statement i

Table of Contents

The Board of Directors (the “Board”) of Nomad Foods Limited (“we,” “us,” “Nomad” or the “Company”) is soliciting proxies to be voted at the 2022 Annual Meeting of Shareholders. By using a proxy, you can vote even if you do not attend the Annual Meeting. This proxy statement describes the matters on which you are being asked to vote so you can make an informed decision.

| Q: | Why did I receive a Notice of Internet Availability of Proxy Materials in the mail instead of a paper copy of the proxy materials? |

| A: | Pursuant to the rules adopted by the United States Securities and Exchange Commission (the “SEC”), we have elected to provide shareholders access to our proxy materials over the Internet. We believe that the e-proxy process will expedite our shareholders’ receipt of proxy materials, lower the costs of distribution and reduce the environmental impact of our Annual Meeting. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, which we refer to as the “Notice,” on or about May 20, 2022 to our shareholders at the close of business on May 2, 2022 (the “Record Date”). The Notice contains instructions on how to access our proxy statement and annual report and vote online. If you received a Notice and would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions included in the Notice for requesting such materials at no charge. |

| Q: | What am I voting on? |

| A: | At the Annual Meeting, you will be asked to vote on the following proposals. Our Board recommendation for each of these proposals is set forth below. |

| Proposal | Board Recommendation | |

| 1. To elect ten members of the Board of Directors, each to hold office for a one-year term expiring at the 2023 Annual Meeting of Shareholders. |

FOR each Director Nominee | |

| 2. To ratify the selection of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the 2022 fiscal year. |

FOR | |

| We will also consider other business that properly comes before the meeting in accordance with the laws of the British Virgin Islands (“BVI law”) and our Memorandum and Articles of Association (the “Memorandum and Articles”). |

| Q: | Who can vote? |

| A: | Holders of our ordinary shares, no par value, (the “Ordinary Shares”) and of our founder preferred shares, no par value, (the “Preferred Shares”), which we sometimes collectively refer to as the “Shares”, at the close of business on the Record Date are entitled to vote their Shares at the Annual Meeting. |

| Q: | How many votes are eligible to be cast at the Annual Meeting? |

| A: | As of the Record Date, there were 172,536,436 Ordinary Shares and 1,500,000 Preferred Shares issued, outstanding and entitled to vote. Each Ordinary Share and each Preferred Share carries the right to one vote on each matter to be voted on at the Annual Meeting. |

2022 Proxy Statement 1

Table of Contents

Proxy Statement

| Q: | What rules govern our Annual Meeting and the voting process? |

| A: | We will hold our Annual Meeting in accordance with the corporate governance practices of the British Virgin Islands and our Memorandum and Articles. As we are a foreign private issuer, as defined by the rules of the SEC, we are exempt from the rules and regulations under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the New York Stock Exchange (“NYSE”) related to the furnishing and content of proxy statements. In addition, as a foreign private issuer, we are generally not required to follow the voting requirements applicable to U.S. domestic issuers under the NYSE rules. |

| Q: | What constitutes a quorum, and why is a quorum required? |

| A: | We are required to have a quorum of shareholders present to conduct business at the meeting. The presence at the meeting, in person or by proxy, of one shareholder entitled to vote on the matter to be presented will constitute a quorum, permitting us to conduct the business of the meeting. |

| Q: | What is the difference between a “shareholder of record” and a “street name” holder? |

| A: | If your Shares are registered directly in your name with our transfer agent, Computershare, you are considered a “shareholder of record” or a “registered shareholder” of those Shares. If your Shares are held in a stock brokerage account or by a bank, trust or other nominee or custodian (each, a “Broker”), you are considered the “beneficial owner” of those Shares, which are held in “street name.” The Notice has been forwarded to you by your Broker who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your nominee on how to vote your shares by following their instructions for voting by telephone or on the Internet or, if you specifically request a copy of the printed materials, you may use the voting instruction card included in such materials. |

| Q: | How do I vote? |

| A: | If you are a shareholder of record, you may vote: |

|

By Internet. The enclosed proxy card indicates the website you may access for Internet voting. The Internet voting system allows you to confirm that the system has properly recorded your votes. |

|

By Telephone. You can vote your proxy by calling 1-866-868-1646. If you vote by telephone, you do not need to return your proxy card. |

|

By Mail. If you are located in the United States and you received a paper copy of the proxy materials, you can vote by marking, dating and signing your proxy card and returning it by mail in the enclosed postage-paid envelope. If you are located outside the United States, you should add the necessary postage to the enclosed envelope to ensure delivery. In order to ensure that your vote is received on or prior to the date of the Annual Meeting, we recommend that your proxy card be returned by overnight mail. |

|

In Person at the Annual Meeting. If you attend the Annual Meeting, we will give you a ballot when you arrive. Even if you plan to attend the Annual Meeting, we encourage you to vote your Shares by proxy so that your vote will be counted if you later decide not to attend the meeting. |

| Detailed instructions for Internet and telephone voting are set forth on the Notice, which contains instructions on how to access our proxy statement and annual report online. |

| If you are a beneficial owner, you must follow the voting procedures of your Broker included with your proxy materials. If your shares are held by a Broker and you intend to vote at the meeting, please follow the instructions under “Who can attend the Annual Meeting?” |

2 Nomad Foods

Table of Contents

Proxy Statement

| Q: | What are the requirements to elect the director nominees? |

| A: | The affirmative vote of a majority of Shares present and entitled to vote at the Annual Meeting is required in order for a director to be elected. Abstentions will have the effect of a vote “AGAINST” a director nominee. |

| Q: | What are the requirements for ratification of PwC as our independent registered public accounting firm? |

| A: | The affirmative vote of a majority of Shares present and entitled to vote at the Annual Meeting is required for the ratification of PwC as our independent registered public accounting firm for the 2022 fiscal year. Abstentions will have the effect of a vote “AGAINST” the ratification proposal. |

| Q: | What if I am a beneficial owner and I do not give the nominee voting instructions? |

| A: | If you are a beneficial owner and your Ordinary Shares are held in “street name,” the Broker is bound by the rules of the NYSE regarding whether or not it can exercise discretionary voting power for any particular proposal if the Broker has not received voting instructions from you. Brokers have the authority to vote on behalf of Shares for which their customers do not provide voting instructions on certain routine matters. A broker non-vote occurs when a Broker returns a proxy but does not vote on a particular proposal because the Broker does not have discretionary authority to vote on the proposal and has not received specific voting instructions for the proposal from the beneficial owner of the Shares. Broker non-votes are included in the calculation of the number of votes considered to be present at the meeting for purposes of determining the presence of a quorum, however, as broker non-votes are deemed not entitled to vote at the meeting with regard to a proposal, they do not have any effect on the outcome of a vote, assuming a quorum is present. |

| The election of directors proposal is a non-discretionary matter and therefore a Broker may not exercise discretion to vote your Shares for or against Proposal 1 absent your voting instructions. The ratification of our independent registered public accounting firm is a discretionary matter and therefore a Broker may generally exercise discretion to vote your Shares for or against Proposal 2 absent your voting instructions. |

| Q: | What if I sign and return my proxy without making any selections? |

| A: | If you sign and return your proxy without making any selections, your Ordinary Shares or Preferred Shares will be voted “FOR” each of the director nominees and “FOR” the ratification of the appointment of PwC as our independent registered public accounting firm for the 2022 fiscal year. If other matters properly come before the meeting, the persons named as proxy holders, Stéfan Descheemaeker and Samy Zekhout, or either of them, will have the authority to vote on those matters for you at their discretion. If your Ordinary Shares are held in “street name”, see the question above on how to vote your Shares. |

| Q: | How do I change my vote? |

| A: | A shareholder of record may revoke his or her proxy by giving written notice of revocation to Computershare before the meeting, by delivering a later-dated proxy (either in writing, by telephone or over the Internet), or by voting in person at the Annual Meeting. |

| If your Ordinary Shares are held in “street name”, you may change your vote by following your Broker’s procedures for revoking or changing your proxy. |

| Q: | What shares are covered by my proxy card? |

| A: | Your proxy reflects all Ordinary Shares or Preferred Shares owned by you at the close of business on May 2, 2022. |

| Q: | What does it mean if I receive more than one proxy card? |

| A: | If you receive more than one proxy card, it means that you hold Ordinary Shares in more than one account. To ensure that all of your Ordinary Shares are voted, you should sign and return each proxy card. Alternatively, if you vote by telephone or via the Internet, you will need to vote once for each proxy card and voting instruction card you receive. |

2022 Proxy Statement 3

Table of Contents

Proxy Statement

| Q: | Who can attend the Annual Meeting? |

| A: | Only holders of Ordinary Shares or Preferred Shares and our invited guests are permitted to attend the Annual Meeting. To gain admittance, you must bring a form of government-issued identification to the meeting, where your name will be verified against our shareholder list. If a Broker holds your Ordinary Shares and you plan to attend the meeting, you should bring a brokerage statement showing your ownership of the Ordinary Shares as of the Record Date or a letter from the Broker confirming such ownership, and a form of government-issued identification. If you wish to vote your Ordinary Shares that are held by a Broker at the meeting, you must obtain a proxy from your Broker and bring such proxy to the meeting. Cameras and other recording devices will not be permitted at the Annual Meeting. |

| We currently intend to hold the Annual Meeting in person. However, we are actively monitoring the coronavirus, or COVID-19, and are sensitive to the public health and travel concerns that our shareholders may have, as well as protocols that local governments may impose. If it is not possible or advisable to hold the Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include switching to a virtual meeting format, or changing the time, date or location of the Annual Meeting. Any such change will be announced via press release that will be furnished on a Form 6-K to the Securities and Exchange Commission. |

| Q: | If I plan to attend the Annual Meeting, should I still vote by proxy? |

| A: | Yes. Casting your vote in advance does not affect your right to attend the Annual Meeting. If you send in your proxy card and also attend the meeting, you do not need to vote again at the meeting unless you are a shareholder of record (or a beneficial owner who has brought a proxy obtained from your Broker) and want to change your vote. Written ballots will be available at the Annual Meeting for shareholders of record or beneficial owners with proxies. |

| Q: | How can I access the Company’s public filings with the SEC? |

| A: | You may access any of our public filings with the SEC through the Investors—SEC Filings link on our website at www.nomadfoods.com. |

| Q: | What should I do if I have other questions? |

| A: | If you have additional questions about this proxy statement or the Annual Meeting or would like additional copies of this proxy statement, please contact: Nomad Foods Limited, No. 1 New Square, Bedfont Lakes Business Park, Feltham, Middlesex TW14 8HA, Attention: Legal Department, Telephone: +(44) 208 918 3200. |

4 Nomad Foods

Table of Contents

Proposal I — Election of Directors

Introduction

Our Memorandum and Articles provide that our Board must be composed of at least one director. Our Board currently consists of eleven directors. One of our current directors, Golnar Khosrowshahi, is not standing for re-election at the Annual Meeting, therefore, immediately following the Annual Meeting, the size of our Board will be reduced to ten directors. Pursuant to our Memorandum and Articles and a resolution of directors, our directors are appointed at the annual meeting of shareholders for a one-year term, with each director serving until the annual meeting of shareholders following his or her election.

Upon the recommendation of the Nominating and Corporate Governance Committee of our Board, our Board has nominated the following persons for election at the Annual Meeting, each for a one-year term that expires at the 2023 Annual Meeting of Shareholders: (i) Sir Martin Ellis Franklin, KGCN, (ii) Noam Gottesman, (iii) Ian G.H. Ashken, (iv) Stéfan Descheemaeker, (v) James E. Lillie, (vi) Stuart M. MacFarlane, (vii) Victoria Parry, (viii) Amit Pilowsky, (ix) Melanie Stack and (x) Samy Zekhout. Each nominee currently serves as a director of the Company and has consented to continuing his or her service if re-elected.

Nomination of Directors by Preferred Shareholders

The initial holders of 20% or more of our Preferred Shares are entitled to nominate, and the Board is required to appoint, one director to the Board. If such holder notifies the Company in writing to remove any director nominated by him or her, the other directors must remove such director, and the holder will have the right to nominate a director to fill the resulting vacancy. In the event an initial holder of the Preferred Shares ceases to be a holder of Preferred Shares or holds less than 20% of the Preferred Shares in issue, such initial holder will no longer be entitled to nominate a person as a director, and the holders of a majority of the outstanding Preferred Shares will instead be entitled to exercise that initial holder’s former rights to appoint a director. Of the outstanding Preferred Shares, 50% are held by an entity affiliated with Sir Martin and 50% are held by an entity affiliated with Mr. Gottesman. Although each of Sir Martin and Mr. Gottesman serve on the Board, neither of them has nominated any persons to serve as directors of the Company at this time.

Director Qualifications

We believe that each of our nominees has the experience, skills and qualities to fully perform his or her duties as a director and to contribute to our success. Each of our nominees is being nominated because we believe that he or she adheres to the highest standards of personal integrity and possesses excellent interpersonal and communication skills, is highly accomplished in his or her field, has an understanding of the interests and issues that are important to our shareholders and is able to dedicate sufficient time to fulfilling his or her obligations as a director. Our nominees as a group complement each other and each other’s respective experiences, skills and qualities.

Each nominee’s biographical information, including his or her principal occupation, business experience, qualifications and other information appears on the following pages.

Our Board recommends a vote FOR the election of each of the following director nominees.

2022 Proxy Statement 5

Table of Contents

Proposal — Election of Directors > Nominees for Director

|

Sir Martin Ellis Franklin, KGCN

Age: 57

Director Since:

2014

Co-Chairman of the Board

|

Sir Martin Ellis Franklin, KGCN, our co-founder and co-Chairman is the founder and CEO of Mariposa Capital, LLC, a Miami-based family investment firm focused on long-term value creation across various industries, and Chairman and controlling shareholder of Royal Oak Enterprises, LLC. Sir Martin is also the Founder and Executive Chairman of Element Solutions Inc, and co-Chairman of APi Group Corporation. Sir Martin was the co-founder and Chairman of Jarden Corporation (“Jarden”) from 2001 until April 2016 when Jarden merged with Newell Brands Inc (“Newell”). Sir Martin became Chairman and Chief Executive Officer of Jarden in 2001, and served as Chairman and Chief Executive Officer until 2011, at which time he began service as Executive Chairman. Prior to founding Jarden in 2001, Sir Martin served as the Chairman and/or Chief Executive Officer of three public companies: Benson Eyecare Corporation, Lumen Technologies, Inc., and Bollé Inc. between 1992 and 2000. In the last five years, Sir Martin served as a director of the following public companies: Newell and Restaurant Brands International Inc.

|

|

Noam Gottesman

Age: 60

Director Since:

2014

Co-Chairman of the Board

|

Noam Gottesman, our co-founder and co-Chairman is the Founder and Managing Partner of TOMS Capital LLC, which he founded in 2012. Mr. Gottesman is also co-CEO and director and founder of Go Acquisition Corp., a Delaware blank check company. Mr. Gottesman serves as a non-executive director of Radius Global Infrastructure Inc. (previously known as Digital Landscape Group, Inc. and prior to that known as Landscape Acquisition Holdings Limited), a global aggregator of real property interests underlying wireless telecommunications cell sites. Mr. Gottesman was the co-founder of GLG Partners Inc. and its predecessor entities where he served in various chief executive capacities until January 2012. Mr. Gottesman served as GLG’s chief executive officer from September 2000 until September 2005, and then as its co-chief executive officer from September 2005 until January 2012. Mr. Gottesman was also chairman of the board of GLG following its merger with Freedom Acquisition Holdings Inc. and prior to its acquisition by Man Group plc. Mr. Gottesman co-founded GLG as a division of Lehman Brothers International (Europe) in 1995 where he was a Managing Director. Prior to 1995, Mr. Gottesman was an executive director of Goldman Sachs International, where he managed global equity portfolios in the private client group.

|

6 Nomad Foods

Table of Contents

Proposal — Election of Directors > Nominees for Director

|

Ian G.H. Ashken

Age: 61

Director Since:

2016

Committees:

• Compensation (Chair)

• Nominating and Corporate Governance Committee (Chair)

|

Ian G.H. Ashken serves as a director of APi Group Corporation (since 2017) and Element Solutions Inc. (since 2013). Previously, he was the co-founder of Jarden and served as its Vice Chairman and President until the consummation of Jarden’s business combination with Newell in April 2016. Mr. Ashken was appointed to the Jarden board on June 25, 2001 and served as Vice Chairman, Chief Financial Officer and Secretary from September 24, 2001. Mr. Ashken was Secretary of Jarden until February 15, 2007 and Chief Financial Officer until June 12, 2014. Prior to Jarden, Mr. Ashken served as the Vice Chairman and/or Chief Financial Officer of three public companies, Benson Eyecare Corporation, Lumen Technologies, Inc. and Bollé Inc. between 1992 and 2000. Mr. Ashken is also a director or trustee of a number of private companies and charitable institutions. During the last five years, Mr. Ashken also previously served as a director of Newell.

|

|

Stéfan Descheemaeker

Age: 62

Director Since:

2015

|

Stéfan Descheemaeker was appointed as the Chief Executive Officer of the Company on June 1, 2015. He was previously at Delhaize Group SA, the international food retailer, where he was Chief Financial Officer between 2008 and 2011 before becoming Chief Executive Officer of its European division until October 2013. Since leaving Delhaize Group SA, Mr. Descheemaeker held board positions with Telenet Group Holdings N.V. and Group Psychologies, served as an industry advisor to Bain Capital and is currently a professor at the Université Libre de Bruxelles. Between 1996 and 2008, Mr. Descheemaeker was at Interbrew (now Anheuser-Busch InBev “ABInBev”) where he was Head of Strategy & External Growth responsible for managing M&A and strategy, during the time of the merger of Interbrew and AmBev in 2004, and prior to that he held operational management roles as Zone President in the U.S., Central and Eastern Europe, and Western Europe. Mr. Descheemaeker started his career with Cobepa, at that time the Benelux investment company of BNP-Paribas. Mr. Descheemaeker served as a Director on the Board of ABInBev, a position he has held from 2008 to 2019. Since June 2019, SDS Invest S.A represented by Mr. Descheemaeker has served as Chairman of the Board of Verlinvest.

|

2022 Proxy Statement 7

Table of Contents

Proposal — Election of Directors > Nominees for Director

|

James E. Lillie

Age: 60

Director Since:

2015

Lead Independent Director

Committees:

• Audit (Chair) • Nominating and Corporate Governance

|

James E. Lillie has served as co-Chairman of APi Group Corporation since October 2019, and previously served as its director from October 2017. He served as Jarden’s Chief Executive Officer from June 2011 until the consummation of Jarden’s business combination with Newell in April 2016. He joined Jarden in 2003 as Chief Operating Officer and was named President in 2004 and CEO in June 2011. From 2000 to 2003, Mr. Lillie served as Executive Vice President of Operations at Moore Corporation, Limited. From 1999 to 2000, he served as Executive Vice President of Operations at Walter Industries, Inc., a Kohlberg, Kravis, Roberts & Company (KKR) portfolio company. From 1990 to 1999, Mr. Lillie held a succession of senior level management positions across a variety of disciplines including human resources, manufacturing, finance and operations at World Color, Inc., another KKR portfolio company. During the last five years, Mr. Lillie also previously served as a director of Tiffany & Co.

|

|

Stuart M. MacFarlane

Age: 54

Director Since:

2019

Committees:

• Audit

• Compensation

|

Stuart M. MacFarlane joined the Whitbread Beer Company in 1992, which was later acquired by Interbrew and, subsequently ABInBev. At ABInBev, Mr. MacFarlane held various senior roles throughout the course of his career, including in Finance, Marketing, Sales and as Managing Director for the company’s business in Ireland. He was appointed President of ABInBev UK & Ireland in 2008 and in 2012 became a member of the Executive Board of Management, serving as President of Central & Eastern Europe. Mr. MacFarlane most recently served as ABInBev’s President of a combined Europe & Middle East from 2014 to May 2019. Mr. MacFarlane served as a director and member of the Corporate Governance Committee of Anadolu EFES, a brewer company, until May 28, 2019. He previously served as a director of ABI-EFES Russia & Ukraine, a joint venture of Anadolu EFES and ABInBev. Mr. MacFarlane has a degree in Business Studies from Sheffield University in the UK and is also a qualified Chartered Management Accountant.

|

8 Nomad Foods

Table of Contents

Proposal — Election of Directors > Nominees for Director

|

Victoria Parry

Age: 56

Director Since:

2016

Committees:

• Compensation

• Nominating and Corporate Governance

|

Victoria Parry was Global Head of Product Legal for Man Group plc until April 2013 and now acts as an independent non-executive director In the financial services sector. Mrs. Parry is an independent non-executive director to funds affiliated with Guardian Capital Group Limited, Pacific Capital Partners Ltd., Dimensional Holdings, Inc, and LSV Funds Plc. Prior to the merger of Man Group plc with GLG Partners, Inc. in 2010, she was Senior Legal Counsel for GLG Partners LP. Mrs. Parry joined Lehman Brothers International (Europe) in April 1996 where she was Legal Counsel with responsibility for inter alia the activities of the GLG Partners division and left Lehman Brothers in September 2000 upon the establishment of GLG Partners LP. Prior to joining Lehman Brothers in 1996 Mrs. Parry practiced as a solicitor with a leading London based firm of solicitors. Mrs. Parry graduated from University College Cardiff, with a LLB (Hons) in 1986. Mrs. Parry is a non-practicing solicitor and a member of the Law Society of England and Wales. From July 2019 to April 2022, Mrs. Parry served as a non-executive director to funds affiliated with Fiera Capital Corporation. Mrs. Parry is a director of a number of other private companies.

|

|

Amit Pilowsky

Age: 47

Director Since:

2022

|

Amit Pilowsky is the Founder and Managing Partner of Key1 Capital, a global investment firm primarily focused on Israeli and Israeli-related growth technology companies. Prior to founding Key1 Capital in January 2022, Mr. Pilowsky held various leadership roles at Goldman Sachs in its London and Tel Aviv offices from February 2005 to May 2021, including Head of the Consumer and Retail team at the Cross Markets Group in EMEA and as sector captain for Food, Beverage and Food Ingredients in EMEA. During his time at Goldman Sachs, Mr. Pilowsky led teams in numerous deals across mergers and acquisitions and capital markets transactions in the consumer and retail, food, beverage and food ingredient industries. From July 1993 to January 2004, Mr. Pilowsky served in the Israeli Air Force, retiring as a Major. Since December 2021, Mr. Pilowsky has also served as a director of Movendo Capital, a registered investment company. Mr. Pilowsky holds an MBA from INSEAD, France.

|

2022 Proxy Statement 9

Table of Contents

Proposal — Election of Directors > Nominees for Director

|

Melanie Stack

Age: 60

Director Since:

2021

Committees:

• Audit

|

Melanie Stack has served as President and Chief Executive Officer of Ideal Protein, a medically-based weight-loss company, since November 2018. Prior to joining Ideal Protein, Ms. Stack served as President EMEA of Newell Home Fragrance Division from May 2014 to September 2018. Prior to that, Ms. Stack served as a Non-Executive Director of Bromley Healthcare, a leading provider of community health services in the United Kingdom, from May 2013 to May 2014, in various roles at Weight Watchers International, a leading provider of weight management services, from December 2003 to May 2013, ran the UK-based toy, game and trading card operations for Hasbro, Inc. from January 2002 to November 2003 and served as the Vice President for WeightWatchers.com from November 2000 to January 2002. Prior to joining WeightWatchers.com, Ms. Stack was Managing Director, Hedstrom, U.K. from August 1998 to October 2000, and from July 1989 to July 1998 she held various marketing positions at Mattel UK Ltd., including Group Marketing Director. Ms. Stack is a business graduate of Manchester Metropolitan University.

|

|

Samy Zekhout

Age: 59

Director Since:

2018

|

Samy Zekhout has served as Chief Financial Officer of Nomad since April 1, 2018. Prior to joining the Company, Mr. Zekhout most recently served as CFO and Vice President of Global Grooming at Procter & Gamble since 2007. Mr. Zekhout has held various finance roles at Procter & Gamble throughout the course of his more than 30-year career at that company. From February 2021, Mr. Zekhout became a board member of Algama, a French food-tech start-up.

|

10 Nomad Foods

Table of Contents

As we are a foreign private issuer, as defined by the rules of the SEC, we are permitted to follow certain corporate governance practices of our home country, the British Virgin Islands, instead of those otherwise required for U.S. domestic issuers by both the SEC and the NYSE. While we voluntarily follow most NYSE corporate governance rules, we also take advantage of some limited exemptions, which we note in this “Corporate Governance” section.

In 2022, our Board undertook a review of director independence, which included a review of each director’s responses to questionnaires asking about any relationships with us. This review was designed to identify and evaluate any transactions or relationships between a director or any member of his or her immediate family and us, or members of our senior management or other members of our Board of Directors, and all relevant facts and circumstances regarding any such transactions or relationships.

Based on this review, our Board has affirmatively determined that each of Messrs. Ashken, Lillie, MacFarlane and Pilowsky and Mses. Parry and Stack meet the independence requirements of the NYSE’s corporate governance listing standards.

Because Mr. Gottesman and Sir Martin are affiliated with entities that receive advisory fees from us, they are not independent under NYSE corporate governance listing standards. In addition, Messrs. Descheemaeker and Zekhout are executive officers of the Company and, therefore, they are not independent.

Under BVI law, there is no requirement that our Board consist of a majority of independent directors and our independent directors are not required to hold executive sessions. Seven of our current Board members (and immediately following our Annual Meeting, six) are independent based on NYSE independence standards. While our Board’s non- management directors will meet regularly in executive session without management, our Board may not hold an executive session of only independent directors at least once a year as called for by the NYSE.

The Board has created the position of Lead Independent Director to facilitate and strengthen the Board’s independent oversight of our performance and strategy and to promote effective governance standards.

Our Board has three standing Committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee, each of which operates under a written charter adopted by the Board. Each Committee reviews its charter periodically to recommend charter changes to the Board as appropriate. A current copy of each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee charters is available through the Investors—Corporate Governance link on our website, www.nomadfoods.com.

2022 Proxy Statement 11

Table of Contents

Corporate Governance

The table below provides the current membership and chairperson for each of our Committees and identifies our current Lead Independent Director.

| Name | Audit |

Compensation |

Nominating and Corporate Governance |

Lead Independent Director | ||||

| Ian G.H. Ashken |

(Chair) |

(Chair) |

||||||

| James E. Lillie |

(Chair) |

|

| |||||

| Stuart MacFarlane |

|

|

||||||

| Victoria Parry |

|

|

||||||

| Melanie Stack |

|

|||||||

= Committee member

= Committee member

Audit Committee

Responsibilities. Our Audit Committee is primarily responsible for, among other things, assisting the Board in its oversight of the integrity of our financial statements, of our compliance with legal and regulatory requirements, and of the independence, qualifications and performance of our independent auditors. Our Audit Committee meets at least quarterly with management and the independent auditors and reports on such meetings to the Board. The responsibilities of our Audit Committee as set forth in its charter include the following:

|

overseeing our financial reporting process and systems of internal accounting and financial controls; |

|

overseeing the external audit of our financial statements; |

|

overseeing our compliance with accounting policies; |

|

overseeing our policies and procedures with respect to risk assessment and risk management; |

|

assisting the Board with oversight of the Company’s compliance with legal and regulatory matters, including whistleblowing; |

|

reviewing the Company’s public disclosures; and |

|

reviewing related party transactions. |

Independence and Financial Expertise. The Board reviewed the background, experience and independence of the current Audit Committee members and based on this review, the Board determined that each member of the Audit Committee:

|

meets the independence requirements of the NYSE’s corporate governance listing standards; |

|

meets the enhanced independence standards for audit committee members required by the SEC; and |

|

is financially literate, knowledgeable and qualified to review financial statements. |

In addition, the Board determined that Mr. Lillie qualifies as an “audit committee financial expert” under SEC rules.

12 Nomad Foods

Table of Contents

Corporate Governance

Responsibilities. The responsibilities of our Compensation Committee as set forth in its charter include the following:

|

assisting the Board in evaluating potential candidates for executive positions; |

|

determining the compensation of our chief executive officer; |

|

making recommendations to the Board with respect to the compensation of other executive officers; |

|

reviewing our incentive compensation and other equity-based plans; and |

|

reviewing, on a periodic basis, director compensation. |

Independence. The Board reviewed the background, experience and independence of the Compensation Committee members and based on this review, the Board determined that each member of the Compensation Committee meets the independence requirements of the NYSE’s corporate governance listing standards, including the heightened independence requirements specific to compensation committee members.

Nominating and Corporate Governance Committee

Responsibilities. The responsibilities of our Nominating and Corporate Governance Committee as set forth in its charter include the following:

|

identifying individuals qualified to become members of the Board, consistent with criteria approved by the Board; |

|

recommending directors to the Board to serve as members of each committee; |

|

developing and recommending a set of corporate governance principles applicable to our company and overseeing Board evaluations; and |

|

reviewing the structure, size and composition of the Board and making recommendations to the Board with regard to any changes it deems necessary. |

Independence. The Board reviewed the background, experience and independence of the Nominating and Corporate Governance Committee members, and based on this review, the Board determined that each member of the Nominating and Corporate Governance Committee meets the independence requirements of the NYSE’s corporate governance listing standards.

Director Compensation

In 2021, each of our non-executive directors (except as indicated below) received, and, in 2022 will be entitled to receive, $50,000 per year together with an annual restricted stock grant issued under the Nomad Foods Limited Amended and Restated Long-Term 2015 Incentive Plan (“LTIP”) equal to $100,000 of Ordinary Shares valued at the date of issue, which vest on the earlier of the date of the following year’s annual meeting of shareholders or 13 months from the issuance date.

Directors who are members of Board committees received in 2021, and are also entitled to receive in 2022, an additional $2,000 per year per committee. The chairman of the Audit Committee, currently James E. Lillie, is entitled to receive $10,000 per year and the chairman of the Compensation and the Nominating and Corporate Governance Committees, currently Ian G.H. Ashken, is entitled to receive $7,500 per year (per committee).

Mr. Gottesman and Sir Martin have elected not to receive a fee in relation to their service as directors.

Director fees are payable quarterly in arrears. In addition, all of the directors are entitled to be reimbursed by us for travel, hotel and other expenses incurred by them in the course of their directors’ duties.

2022 Proxy Statement 13

Table of Contents

Details regarding executive compensation for the year ended December 31, 2021, including (i) the compensation and benefits provided to our executive officers, (ii) a brief description of the bonus programs in which our executive officers participated, and (iii) the total amounts set aside for pension, retirement and similar benefits for our executive officers, as well as a description of the LTIP including a summary of the material terms of the LTIP, a description of current executive employment agreements and equity awards granted thereunder, are set forth under Item 6B – Compensation of Executive Officers and Directors in the Company’s Annual Report on Form 20-F, filed with the SEC on March 3, 2022 (the “2021 Form 20-F”).

14 Nomad Foods

Table of Contents

Proposal II — Ratification of Independent Registered Public Accounting Firm

The Audit Committee of our Board is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The Audit Committee has selected PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for 2022, and our Board hereby submits that selection for ratification by our shareholders at the Annual Meeting. PwC has acted as our independent registered public accounting firm since the Company’s inception in 2014.

The Audit Committee and the Board believe that the retention of PwC as our independent registered public accounting firm is in the best interest of the Company and our shareholders, and we are asking our shareholders to ratify the selection of PwC as our independent registered public accounting firm for 2022.

Although ratification is not required by our Memorandum and Articles or otherwise, we are submitting the selection of PwC to our shareholders for ratification because we value our shareholders’ views on our Company’s independent registered public accounting firm and as a matter of good corporate governance. The Audit Committee may consider the outcome of the shareholder vote in connection with the Audit Committee’s selection of our independent registered public accounting firm in the next fiscal year, but is not bound by the shareholders’ vote. Even if the selection is ratified, the Audit Committee may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time if it determines that a change would be in the best interests of our Company and our shareholders.

Principal Accountant Fees and Services

The table below sets out the total amount billed to us by PwC, for services performed in the years ended December 31, 2021 and 2020, and breaks down these amounts by category of service:

Audit Fees

| (€ in millions) | For the year ended December 31, 2021 |

For the year ended December 31, 2020 |

||||||

| Audit fees |

4.4 | 3.7 | ||||||

| Audit-related fees |

0.3 | — | ||||||

| Tax fees |

1.0 | 1.2 | ||||||

| All other fees |

0.1 | 0.1 | ||||||

| Total |

5.8 | 5.0 | ||||||

Audit Fees

Audit fees in the year ended December 31, 2021 and 2020 were related to the audit of our consolidated financial statements and other audit or interim review services provided in connection with statutory and regulatory filings or engagements.

Audit-Related Fees

Audit-related fees in the year ended December 31, 2021 and 2020 were related to other assurance services on capital market transactions.

Tax Fees

Tax fees in the years ended December 31, 2021 and 2020 were related to tax compliance and other tax related services.

2022 Proxy Statement 15

Table of Contents

Proposal II — Ratification of Independent Registered Public Accounting Firm

All Other Fees

Other fees in the year ended December 31, 2021 and 2020 relate to other non-audit assurance services.

Pre-Approval Policies and Procedures

The advance approval of the Audit Committee or members thereof, to whom approval authority has been delegated, is required for all audit and non-audit services provided by our auditors.

All services provided by our auditors are approved in advance by either the Audit Committee or members thereof, to whom authority has been delegated, in accordance with the Audit Committee’s pre-approval policy. No such services were approved pursuant to the procedures described in Rule 2-01(c)(7)(i)(C) of Regulation S-X, which waives the general requirement for pre-approval in certain circumstances.

Our Board recommends a vote FOR the ratification of the Audit Committee’s selection of PwC as our Independent Registered Public Accounting Firm for 2022.

16 Nomad Foods

Table of Contents

We maintain an internet website at www.nomadfoods.com. Copies of the Committee charters of each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee and of our Code of Ethics, can be found under the Investors—Corporate Governance link on our website, www.nomadfoods.com, and such information is also available in print to any shareholder who requests it through our Investor Relations department at the address below.

We will furnish without charge to each person whose proxy is being solicited, upon request of any such person, a copy of the 2021 Form 20-F as filed with the SEC, including the financial statements and schedules thereto, but not the exhibits. In addition, such report is available, free of charge, through the Investors—SEC Filings section of our internet website at www.nomadfoods.com. A request for a copy of such report should be directed to Nomad Foods Limited, No. 1 New Square, Bedfont Lakes Business Park Feltham, Middlesex TW14 8HA, Attention: Investor Relations. A copy of any exhibit to the 2021 Form 20-F will be forwarded following receipt of a written request with respect thereto addressed to Investor Relations.

We have elected to take advantage of the SEC’s rule that allows us to furnish proxy materials to you online. We believe electronic delivery will expedite shareholders’ receipt of materials, while lowering costs and reducing the environmental impact of our Annual Meeting by reducing printing and mailing of full sets of materials. We mailed the Notice containing instructions on how to access our proxy statement and annual report online on or about May 20, 2022. If you would like to receive a paper copy of the proxy materials, the Notice contains instructions on how to receive a paper copy.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder

Meeting To Be Held on July 1, 2022

This Proxy Statement and our 2021 Annual Report are available online at

www.proxydocs.com/NOMD.

2022 Proxy Statement 17

Table of Contents

Nomad Foods

Nomad Foods

P.O. BOX 8016, CARY, NC 27512-9903

YOUR VOTE IS IMPORTANT! PLEASE VOTE BY:

Nomad Foods Limited

Annual Meeting of Shareholders

For Shareholders of record as of May 02, 2022

TIME: Friday, July 1, 2022 10:00 AM, Local Time

PLACE: No. 1 New Square, Bedfont Lakes

Business Park

Feltham, Middlesex, TW14 8HA

This proxy is being solicited on

behalf of the Board of Directors

The undersigned hereby appoints Stéfan Descheemaeker and Samy Zekhout (the “Named Proxies”), and each or either

of them, as the true and lawful attorneys of the undersigned, with full power of substitution and revocation, and authorizes them, and each of them, to vote all the shares of Nomad Foods Limited which the undersigned is entitled to vote at said

meeting and any adjournment thereof upon the matters specified and upon such other matters as may be properly brought before the meeting or any adjournment thereof, conferring authority upon such true and lawful attorneys to vote in their discretion

on such other matters as may properly come before the meeting and revoking any proxy heretofore given.

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS

DIRECTED OR, IF NO DIRECTION IS GIVEN, SHARES WILL BE VOTED IDENTICAL TO THE BOARD OF DIRECTORS RECOMMENDATION. This proxy, when properly executed, will be voted in the manner directed herein. In their discretion, the Named Proxies are authorized to

vote upon such other matters that may properly come before the meeting or any adjournment or postponement thereof.

You are encouraged to specify your choice by

marking the appropriate box (SEE REVERSE SIDE) but you need not mark any box if you wish to vote in accordance with the Board of Directors’ recommendation. The Named Proxies cannot vote your shares unless you sign (on the reverse side) and

return this card.

PLEASE BE SURE TO SIGN AND DATE THIS PROXY CARD AND MARK ON THE REVERSE SIDE

INTERNET

Go To: www.proxypush.com/NOMD

Cast your vote online

Have your Proxy Card ready

Follow the simple instructions to record your vote

PHONE Call 1-866-868-1646

Use any touch-tone telephone

Have your Proxy Card ready

Follow the simple recorded instructions

MAIL

Mark, sign and date your Proxy Card

Fold and return your Proxy Card in the postage-paid

envelope provided

Table of Contents

Nomad Foods Limited

Nomad Foods Limited

Annual Meeting of Shareholders

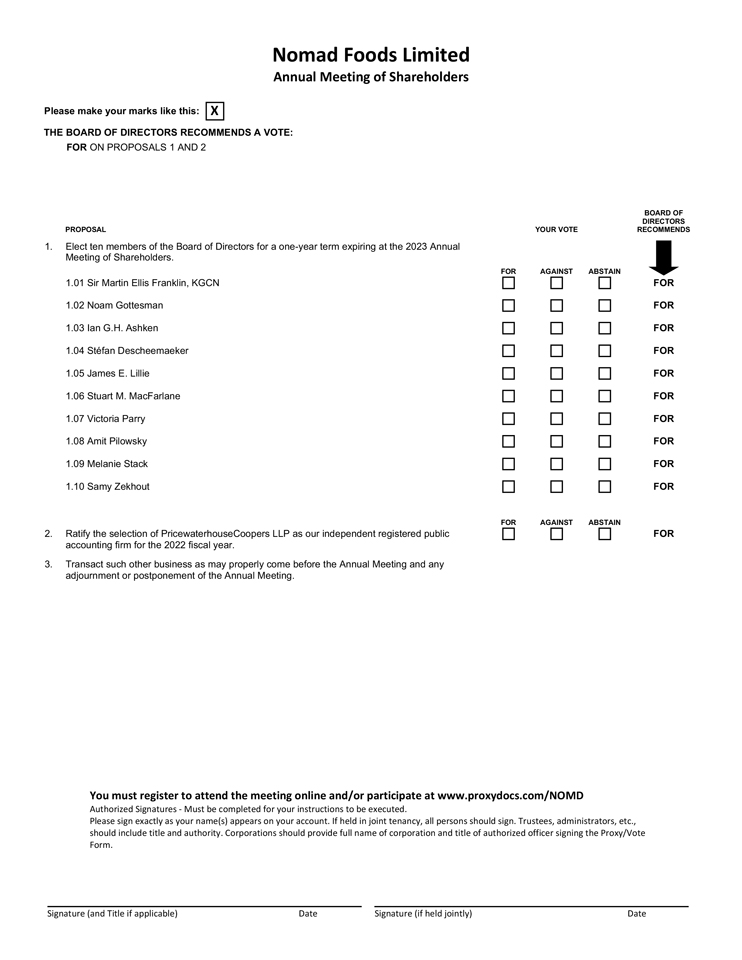

Please make your marks like this: X

THE BOARD OF DIRECTORS RECOMMENDS A VOTE:

FOR ON PROPOSALS 1 AND 2

PROPOSAL

YOUR VOTE

BOARD OF DIRECTORS RECOMMENDS

1. Elect ten members of the Board of Directors for a one-year term expiring at the 2023 Annual Meeting of Shareholders.

FOR AGAINST ABSTAIN

1.01 Sir Martin Ellis Franklin, KGCN FOR

1.02 Noam Gottesman FOR

1.03 Ian G.H. Ashken FOR

1.04 Stéfan Descheemaeker FOR

1.05 James E. Lillie FOR

1.06 Stuart M. MacFarlane FOR

1.07 Victoria Parry FOR

1.08 Amit Pilowsky FOR

1.09 Melanie Stack FOR

1.10 Samy Zekhout FOR

FOR AGAINST ABSTAIN

2. Ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the 2022 fiscal year. FOR

3. Transact such other business as may properly come before the Annual Meeting and any adjournment or postponement of the Annual Meeting.

You must register to attend the meeting online and/or participate at www.proxydocs.com/NOMD

Authorized Signatures - Must be completed for your instructions to be executed.

Please sign exactly as your name(s) appears on your account. If held in joint tenancy, all persons should sign. Trustees, administrators, etc., should include

title and authority. Corporations should provide full name of corporation and title of authorized officer signing the Proxy/Vote Form.

Signature (and Title if

applicable) Date

Signature (if held jointly) Date

Exhibit 99.2

Nomad Foods

Nomad Foods

P.O. BOX 8016, CARY, NC 27512-9903

Nomad Foods Limited

Important Notice Regarding the Availability of Proxy Materials

Shareholders Meeting to be held on July 1, 2022

For Shareholders of record as of May 02, 2022

This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. This is not a ballot. You cannot use

this notice to vote your shares. We encourage you to access and review all of the important information contained in the proxy materials before voting.

To view the

proxy materials, and to obtain directions to attend the meeting, go to: www.proxydocs.com/NOMD

To vote your proxy while visiting this site, you will need the 12

digit control number in the box below.

Under United States Securities and Exchange Commission rules, proxy materials do not have to be delivered in paper. Proxy

materials can be distributed by making them available on the internet.

For a convenient way to view proxy materials and VOTE go to www.proxydocs.com/NOMD

Have the 12 digit control number located in the shaded box above available when you access the website and follow the instructions.

If you want to receive a paper or e-mail copy of the proxy material, you must request one. There is no charge to you for requesting a copy. In order to receive a paper package in

time for this year’s meeting, you must make this request on or before June 21, 2022

To order paper materials, use one of the following methods.

INTERNET www.investorelections.com/NOMD

TELEPHONE (866) 648-8133

* E-MAIL [email protected]

When requesting via the Internet or telephone you will

need the 12 digit control number located in the shaded box above.

* If requesting material by e-mail, please send a blank e-mail with the 12 digit control number

(located above) in the subject line. No other requests, instructions OR other inquiries should be included with your e-mail requesting material.

Nomad Foods

Limited

Meeting Materials: Notice of Meeting and Proxy Statement & Annual Report

Meeting Type: Annual Meeting of Shareholders

Date: Friday, July 1, 2022

Time: 10:00 AM, Local Time

Place: No. 1 New Square, Bedfont Lakes Business Park Feltham,

Middlesex, TW14 8HA

You must register to attend the meeting online and/or participate at www.proxydocs.com/NOMD

SEE REVERSE FOR FULL AGENDA

Nomad Foods Limited

Nomad Foods Limited

Annual Meeting of Shareholders

THE BOARD OF DIRECTORS RECOMMENDS A VOTE:

FOR ON PROPOSALS 1 AND 2

PROPOSAL

1. Elect ten members of the Board of Directors for a one-year term expiring at the

2023 Annual Meeting of Shareholders.

1.01 Sir Martin Ellis Franklin, KGCN

1.02 Noam Gottesman

1.03 Ian G.H. Ashken

1.04 Stéfan Descheemaeker

1.05 James E. Lillie

1.06 Stuart M. MacFarlane

1.07 Victoria Parry

1.08 Amit Pilowsky

1.09 Melanie Stack

1.10 Samy Zekhout

2. Ratify the selection of PricewaterhouseCoopers LLP as our independent

registered public accounting firm for the 2022 fiscal year.

3. Transact such other business as may properly come before the Annual Meeting and any adjournment or

postponement of the Annual Meeting.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Nomad Foods Limited (NOMD) Announces Launch of Repricing Senior Secured Term Loan

- Dropzone AI Raises $16.85 Million Series A to Equip Cyber Defenders With 24/7 Generative AI-powered Autonomous Investigations

- Aqua Security Appoints Mike Dube as Chief Revenue Officer

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share