Form 6-K NexGen Energy Ltd. For: May 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2018

Commission File Number 001-38072

NexGen Energy Ltd.

(Translation of registrant's name into English)

Suite 3150, 1021 – West Hastings Street

Vancouver, B.C., Canada V6E 0C3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ¨ Form 40-F þ

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ¨

DOCUMENTS FILED AS PART OF THIS FORM 6-K

See the Exhibit Index hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on May 2, 2018.

| NEXGEN ENERGY LTD. | ||

| By: | /s/Bruce Sprague | |

| Name: Bruce Sprague | ||

| Title: CFO and Corporate Secretary | ||

EXHIBIT INDEX

| Exhibit | Description | |

| 99.1 | Notice of Annual Meeting of Shareholders | |

| 99.2 | Management Information Circular | |

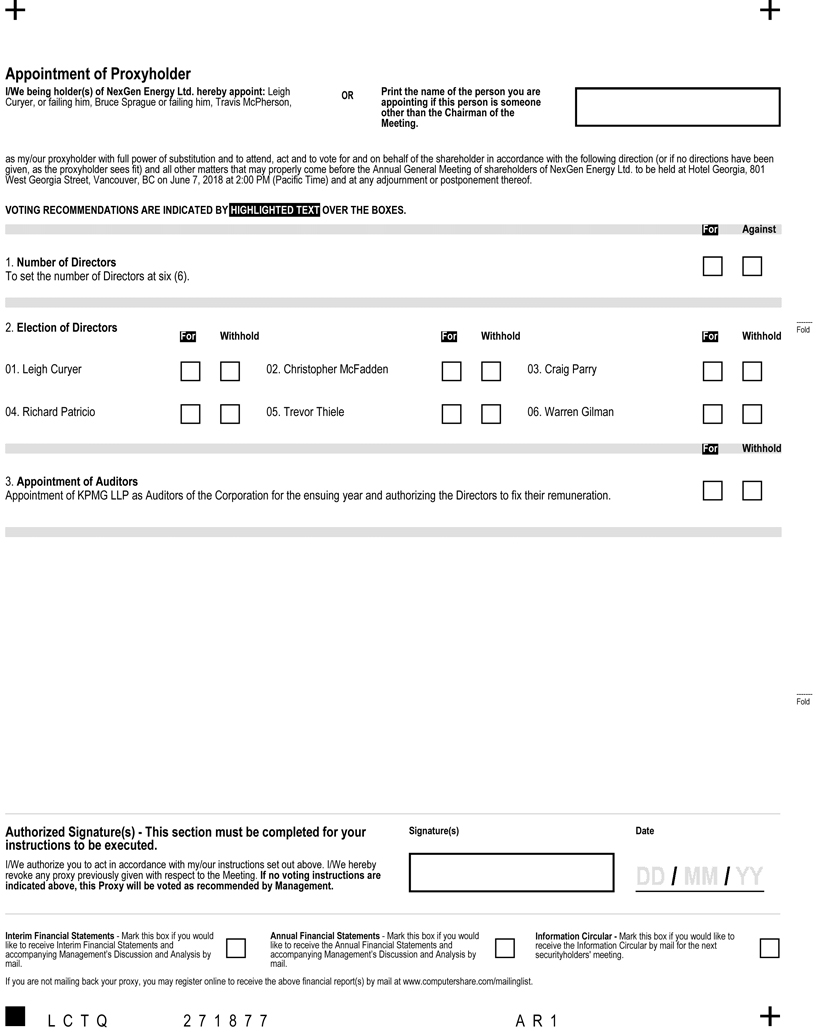

| 99.3 | Form of Proxy | |

| 99.4 | Notice & Access Notification |

Exhibit 99.1

NEXGEN ENERGY LTD.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting (the “Meeting”) of shareholders of NexGen Energy Ltd. (the “Corporation” or “NexGen”) will be held on Thursday, June 7, 2018 at 2:00 p.m. (Vancouver time) at the Rosewood Hotel Georgia Bowden Room located at 801 West Georgia Street, Vancouver, British Columbia, V6C 1P7, for the following purposes:

| 1. | to receive the audited consolidated financial statements of the Corporation for the financial year ended December 31, 2017 together with the report of the independent auditors thereon; |

| 2. | to elect the directors of the Corporation for the ensuing year; |

| 3. | to re-appoint KPMG LLP as independent auditor of the Corporation for the 2018 financial year and to authorize the directors to fix their remuneration; and |

| 4. | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The nature of the business to be transacted at the Meeting is described in further detail in the accompanying management information circular, which is deemed to form part of this notice of meeting. Please read the management information circular carefully before you vote on the matters being transacted at the Meeting.

Your vote is important regardless of the number of NexGen shares you own. Registered NexGen shareholders who are unable to attend the Meeting or any postponement or adjournment thereof in person are requested to complete, date, sign and return the enclosed form of proxy or, alternatively, to vote by telephone, or over the Internet, in each case in accordance with the enclosed instructions. To be used at the Meeting, the completed proxy form must be deposited at the office of Computershare Investor Services Inc., by fax within North America at 1-866-249-7775 or outside North America at (416) 263-9524 or by mail or hand delivery to the 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 not later than 2:00 p.m. (Vancouver time) on June 5, 2018 or, if the Meeting is adjourned or postponed, not later than 48 hours (excluding Saturdays, Sundays and statutory holidays in the Province of British Columbia) prior to the time set for the adjourned or postponed meeting.

Non-registered NexGen shareholders who receive these materials through their broker or other intermediary should complete and send the form of proxy or voting instruction form in accordance with the instructions provided by their broker or intermediary.

Late proxies may be accepted or rejected by the Chair of the Meeting at his or her discretion.

DATED at Vancouver, British Columbia, this 23rd day of April, 2018.

| BY ORDER OF THE BOARD | |

| “Leigh Curyer” | |

|

Leigh Curyer President & Chief Executive Officer |

Exhibit 99.2

MANAGEMENT INFORMATION CIRCULAR

AND

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OF

NEXGEN ENERGY LTD.

TO BE HELD ON JUNE 7, 2018

These materials are important and require your immediate attention.

If you have questions or require assistance with voting your shares,

you may contact the NexGen's proxy solicitation agent:

Laurel Hill Advisory Group

North American Toll-Free Number: 1-877-452-7184

Collect Calls Outside North America: 1-416-304-0211

Email: [email protected]

NEXGEN ENERGY LTD.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting (the “Meeting”) of shareholders of NexGen Energy Ltd. (the “Corporation” or “NexGen”) will be held on Thursday, June 7, 2018 at 2:00 p.m. (Vancouver time) at the Rosewood Hotel Georgia Bowden Room located at 801 West Georgia Street, Vancouver, British Columbia, V6C 1P7, for the following purposes:

| 1. | to receive the audited consolidated financial statements of the Corporation for the financial year ended December 31, 2017 together with the report of the independent auditors thereon; |

| 2. | to elect the directors of the Corporation for the ensuing year; |

| 3. | to re-appoint KPMG LLP as independent auditor of the Corporation for the 2018 financial year and to authorize the directors to fix their remuneration; and |

| 4. | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The nature of the business to be transacted at the Meeting is described in further detail in the accompanying management information circular, which is deemed to form part of this notice of meeting. Please read the management information circular carefully before you vote on the matters being transacted at the Meeting.

Your vote is important regardless of the number of NexGen shares you own. Registered NexGen shareholders who are unable to attend the Meeting or any postponement or adjournment thereof in person are requested to complete, date, sign and return the enclosed form of proxy or, alternatively, to vote by telephone, or over the Internet, in each case in accordance with the enclosed instructions. To be used at the Meeting, the completed proxy form must be deposited at the office of Computershare Investor Services Inc., by fax within North America at 1-866-249-7775 or outside North America at (416) 263-9524 or by mail or hand delivery to the 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 not later than 2:00 p.m. (Vancouver time) on June 5, 2018 or, if the Meeting is adjourned or postponed, not later than 48 hours (excluding Saturdays, Sundays and statutory holidays in the Province of British Columbia) prior to the time set for the adjourned or postponed meeting.

Non-registered NexGen shareholders who receive these materials through their broker or other intermediary should complete and send the form of proxy or voting instruction form in accordance with the instructions provided by their broker or intermediary.

Late proxies may be accepted or rejected by the Chair of the Meeting at his or her discretion.

DATED at Vancouver, British Columbia, this 23rd day of April, 2018.

| BY ORDER OF THE BOARD | |

| “Leigh Curyer” | |

|

Leigh Curyer President & Chief Executive Officer |

MANAGEMENT INFORMATION CIRCULAR

This management information circular (the “Circular”) is furnished in connection with the solicitation of proxies by the management of NexGen Energy Ltd. (the “Corporation” or “NexGen”) for use at the annual meeting (the “Meeting”) of its shareholders to be held on Thursday, June 7, 2018 at the time and place and for the purposes set forth in the accompanying notice of annual meeting of shareholders (the “Notice of Meeting”). Unless otherwise stated, this Circular contains information as at April 23, 2018. References in this Circular to the Meeting include any adjournment or postponement thereof and, unless otherwise indicated, in this Circular all references to “$” are to Canadian dollars.

The Corporation holds approximately 60.02% of the issued and outstanding common shares of IsoEnergy Ltd. (TSXV: ISO) (“IsoEnergy”). IsoEnergy is a reporting issuer subject to Canadian securities laws, including disclosure regarding compensation of its directors and named executive officers. All directors, other than Warren Gilman, are also directors of IsoEnergy and receive director fees from IsoEnergy in such capacities and hold stock options and common shares of IsoEnergy. In addition, Craig Parry, a director of the Corporation, is the President and Chief Executive Officer of IsoEnergy and receives compensation from IsoEnergy in that capacity. Further information regarding the compensation paid by IsoEnergy and stock options and common shares held by those common directors and officers will be available in its management information circular which will be filed under its profile on www.sedar.com.

GENERAL PROXY INFORMATION

Solicitation of Proxies

It is expected that proxies will be solicited primarily by mail, but proxies may also be solicited personally, by telephone, email or by other means of electronic communication, by directors, officers or employees of the Corporation, to whom no additional compensation will be paid. All costs of solicitation will be borne by NexGen. In addition, the Corporation shall, upon request, reimburse brokerage firms and other custodians for their reasonable expenses in forwarding proxies and related material to beneficial owners of common shares of the Corporation.

NexGen has also retained Laurel Hill Advisory Group (“Laurel Hill”) to assist with communicating with shareholders. In connection with these services, Laurel Hill is expected to receive a fee of approximately $35,000, plus out-of-pocket expenses. The Company will bear all costs of this solicitation.

Notice-and-Access

The Corporation has decided to use the notice and access mechanism (the “Notice-and-Access Provisions”) under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) for the delivery of this Circular to shareholders for the Meeting.

Under the Notice-and-Access Provisions, instead of receiving printed copies of this Circular, shareholders will receive a notice (“Notice”) with information on the Meeting as well as information on how they may access this Circular electronically and how they may vote.

The Corporation will not use the procedures known as “stratification” in relation to the use of Notice-and-Access Provisions meaning that all shareholders will receive a Notice in accordance with the Notice-and-Access Provisions.

Shareholders can request that printed copies of this Circular be sent to them by postal delivery, at no cost to them, up to one year after the date this Circular was filed on SEDAR by calling toll-free (in Canada and the United States) 1-800-841-5821 or by emailing [email protected]. See under the heading “How to Obtain Paper Copies of the Circular” in the accompanying Notice and Access Notification to Shareholders.

Appointment of Proxyholders

The persons named in the enclosed form of proxy are executive officers of the Corporation. You have the right to appoint someone other than the persons designated in the enclosed form of proxy, who need not be a shareholder, to attend and act on your behalf at the Meeting by printing the name of the person you want in the blank space provided or by completing and delivering another suitable form of proxy.

Voting by Proxyholder

On any ballot, the nominees named in the accompanying proxy form will vote, or withhold from voting or vote against (as applicable), your common shares in accordance with your instructions. In respect of any matter for which a choice is not specified, the persons named in the accompanying proxy form will vote at their own discretion, except where management recommends that shareholders vote in favour of a matter, in which case the nominees will vote FOR the approval of such matter.

The form of proxy confers discretionary authority upon the nominees named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting.

As of the date of this Circular, management of NexGen knows of no such amendment, variation or other matter that may come before the Meeting. However, if any amendment, variation or other matter should properly come before the Meeting, each nominee named in the accompanying proxy form intends to vote thereon in accordance with the nominee’s best judgment or as stated above.

Registered Shareholders

Registered NexGen shareholders who are unable to attend the Meeting or any postponement or adjournment thereof in person are requested to complete, date, sign and return the enclosed form of proxy or, alternatively, to vote by telephone, or over the Internet, in each case in accordance with the enclosed instructions.

To vote by telephone, NexGen shareholders should call Computershare Investor Services Inc. at 1-866-732-VOTE (8683). NexGen shareholders will need to enter the 15-digit control number provided on the form of proxy to identify themselves as shareholders on the telephone voting system.

To vote over the Internet, NexGen shareholders should go to www.investorvote.com. NexGen shareholders will need to enter the 15-digit control number provided on the form of proxy to identify themselves as shareholders on the voting website.

To be used at the Meeting, the completed form of proxy must be deposited at the office of Computershare Investor Services Inc., by fax within North America at 1-866-249-7775 or outside North America at (416) 263-9524 or by mail or hand delivery to the 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 not later than 2:00 p.m. (Vancouver time) on June 5, 2018 or, if the Meeting is adjourned or postponed, not later than 48 hours (excluding Saturdays, Sundays and statutory holidays in either the Province of Ontario or the Province of British Columbia) prior to the time set for the adjourned or postponed meeting.

Late proxies may be accepted or rejected by the Chair of the Meeting in his or her discretion.

Non-Registered Shareholders

Most shareholders of the Corporation are “non-registered” shareholders (“Non-Registered Shareholders”) because the common shares they own are not registered in their name but are registered in the name of an intermediary such as a bank, trust company, securities dealer or broker, trustee or administrator, of a self-administered RRSP, RRIF, or RESP or a clearing agency (such as CDS Clearing and Depositary Services Inc.) of which the intermediary is a participant.

| - 2 - |

Applicable regulatory policy requires intermediaries/brokers to whom meeting materials have been sent to seek voting instructions from Non-Registered Shareholders in advance of shareholders’ meetings. Every intermediary has its own mailing procedures and provides its own return instructions, which should be carefully followed in order to ensure that the Non-Registered Shareholder’s common shares are voted at the Meeting.

The majority of brokers now delegate responsibility for obtaining instructions from Non-Registered Shareholders to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically mails a scannable voting instruction form (“VIF”), instead of the form of proxy. Non-Registered Shareholders are requested to complete and return the VIF to Broadridge. Alternatively, Non-Registered Shareholders can call a toll-free telephone number or access Broadridge’s dedicated voting website www.proxyvote.com.

The VIF must be returned as directed by Broadridge well in advance of the Meeting in order to have the common shares voted. Non-Registered Shareholders who receive forms of proxies or voting materials from organizations other than Broadridge should complete and return such forms of proxies or voting materials in accordance with the instructions on such materials in order to properly vote their common shares at the Meeting.

NexGen may utilize the Broadridge QuickVoteTM service to assist Non-Registered Shareholders vote their shares. Those shareholders who have not objected to the NexGen knowing who they are (non-objecting beneficial owners) may be contacted by Laurel Hill to conveniently obtain a vote directly over the phone.

Non-Registered Shareholders are not entitled, as such, to vote at the Meeting in person or to deliver a form of proxy. If you are a Non-Registered Shareholder and wish to appoint yourself as proxyholder to vote in person at the Meeting or appoint someone else to attend the Meeting and vote on your behalf, please see the voting instructions you received or contact your intermediary/broker well in advance of the Meeting to determine how you can do so.

Non-Registered Shareholders should carefully follow the voting instructions they receive, including those on how and when voting instructions are to be provided, in order to have their common shares voted at the Meeting.

The materials for the Meeting are being sent to both registered and Non-Registered Shareholders. If you are a Non-Registered Shareholder, and the Corporation or its agent has sent these materials directly to you, your name and address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf.

By choosing to send these materials to you directly, the Corporation (and not the intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you; and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

Revocation of Proxies

Only a registered NexGen shareholder who has submitted a proxy may revoke it at any time prior to the exercise thereof. In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the NexGen shareholder or such shareholder’s legal representative, or if the NexGen shareholder is a corporation, by its duly authorized legal, and deposited at the Corporation’s registered office: Suite 2500, 700 West Georgia Street, Vancouver, BC V7Y 1B3 at any time up to and including the last business day preceding the day of the Meeting at which the proxy is to be used, or with the Chair of the Meeting on the day of the Meeting prior to voting and, upon either of such deposits, the proxy is revoked.

Non-Registered Shareholders who wish to change their vote must, in sufficient time in advance of the Meeting, arrange for their respective intermediaries to change their vote and if necessary revoke the proxy on their behalf.

| - 3 - |

VOTING SHARES AND PRINCIPAL SHAREHOLDERS

Record Date

The board of directors of NexGen (the “Board”) has fixed April 23, 2018 as the record date, being the date for the determination of the holders of the Corporation’s common shares entitled to notice of, and to vote at, the Meeting and any adjournment or postponement thereof.

Shares Outstanding and Principal Holders

As of April 23, 2018, there were a total of 343,352,690 NexGen common shares issued and outstanding. The holders of the common shares are entitled to receive notice of, and to attend, all meetings of NexGen shareholders and to have one vote for each common share held.

To the knowledge of the directors and executive officers of the Corporation, as of the date of this Circular, no person beneficially owns, or controls or directs, directly or indirectly, 10% or more of the Corporation’s outstanding common shares.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

The Corporation is unaware of any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, of any person who has been a director or executive officer of the Corporation at any time since the beginning of the Corporation’s last financial year, or is a proposed nominee for election as a director (or an associate or affiliate of such director, executive officer or director nominee) in any matter to be acted upon at the Meeting, other than the election of directors.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

The Corporation is unaware of any material interest, direct or indirect, of any informed person or any proposed nominee for election as a director of the Corporation (or an associate or affiliate of such informed person or director nominee) in any transaction since the beginning of the Corporation’s last financial year or any proposed transaction, which has materially affected or would materially affect the Corporation or any of its subsidiaries.

BUSINESS TO BE TRANSACTED AT THE MEETING

Financial Statements

The audited consolidated financial statements of the Corporation for the financial year ended December 31, 2017 and the report of the independent auditors thereon will be presented at the Meeting. These consolidated financial statements and the related management’s discussion and analysis were sent to all shareholders who have requested a copy. The Corporation’s consolidated financial statements and related management’s discussion and analysis for the financial year ended December 31, 2017 are also available under the Corporation’s profile on SEDAR (www.sedar.com) and on the Corporation’s website (www.nexgenenergy.ca).

Election of Directors

The directors of the Corporation are elected annually and hold office until the next annual general meeting of the shareholders or until their successors are elected or appointed. Management proposes to nominate the persons listed below for election as directors of the Corporation to serve until their successors are elected or appointed. All six (6) nominees are currently directors of the Corporation.

Unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the common shares represented by such form of proxy FOR the election of the six (6) director nominees listed in this Circular. Management does not contemplate that any of the nominees will be unable to serve as a director.

| - 4 - |

The following table provides information on the six (6) director nominees, including: (i) their province or state and country of residence; (ii) the date when they were appointed a director; (iii) whether they are considered to be independent; (iv) their membership on committees of the Board; (v) their principal occupation, business or employment presently and over the preceding five (5) years; and (vi) the number of common shares and stock options of the Corporation (does not include common shares or stock options of IsoEnergy for the common directors) beneficially owned, controlled, or directed, directly or indirectly.

|

Leigh Curyer British Columbia, Canada

Director since: April 19, 2013

Not Independent (1) |

Mr. Curyer has over 20 years’ experience in the resources and corporate sector. Mr. Curyer currently serves as the Corporation’s President and Chief Executive Officer. Mr. Curyer was previously the Chief Financial Officer and head of corporate development of Southern Cross Resources Inc. (now Uranium One Inc.). In addition, from 2008 to 2011, Mr. Curyer was Head of Corporate Development for Accord Nuclear Resources Management, assessing uranium projects worldwide for First Reserve Corporation, a global energy-focused private equity and infrastructure investment firm.

Mr. Curyer’s uranium project assessment experience has been focused on assets located in Canada, Australia, USA, Africa, Central Asia and Europe, including operating mines, advanced development projects and exploration prospects. Mr. Curyer has a Bachelor of Arts in Accountancy from the University of South Australia and is a member of Chartered Accountants Australia and New Zealand.

| |

| Board Committees | ||

| Nil | ||

| Principal Occupation | ||

| President and Chief Executive Officer of NexGen Energy Ltd. | ||

| Options and Common Shares (as at April 23, 2018) | ||

| Options | Common Shares | |

| 8,800,000 | 1,956,250 | |

| (1) | Mr. Curyer is not independent on the basis that he is an executive officer of the Corporation. |

|

Christopher McFadden Victoria, Australia

Director since: April 19, 2013

Independent |

Mr. McFadden is a lawyer with 22 years of experience in exploration and mining and currently serves as the President and Chief Executive Officer of NxGold Ltd. Previously, Mr. McFadden was the Manager, Business Development at Newcrest Mining Limited and, before that, the Head of Commercial, Strategy and Corporate Development for Tigers Realm Coal Limited, which is listed on the Australian Stock Exchange. Additionally, Mr. McFadden was General Manager, Business Development of Tigers Realm Minerals Pty Ltd. Prior to commencing with the Tigers Realm Group in 2010, Mr. McFadden was a Commercial General Manager with Rio Tinto’s exploration division with responsibility for gaining entry into new projects through negotiation with government or joint venture partners, or through acquisition.

Mr. McFadden has extensive international experience in managing large and complex transactions and has a broad knowledge of all aspects of project evaluation and negotiation in challenging and varied environments. Mr. McFadden holds a combined law/commerce degree from Melbourne University and an MBA from Monash University.

| |

| Board Committees | ||

| Chairman of the Board; Audit Committee; Nomination and Governance Committee | ||

| Principal Occupation | ||

| President and Chief Executive Officer of NxGold Ltd. | ||

| Options and Common Shares (as at April 23, 2018) | ||

| Options | Common Shares | |

| 2,300,000 | 500,000 | |

| - 5 - |

|

Warren Gilman (1) Hong Kong, HK

Director since: July 21, 2017

Independent |

Mr. Gilman was appointed as a Director of NexGen on July 21, 2017. He was appointed Chairman and CEO of CEF Holdings Limited in 2011. Prior to that he was Vice Chairman of CIBC World Markets. He was previously Managing Director and Head of Asia Pacific Region for CIBC for 10 years where he was responsible for all of CIBC's activities across Asia. Mr. Gilman is a mining engineer who co-founded CIBC's Global Mining Group in 1988. During his 26 years with CIBC he ran the mining team in Canada, Australia and Asia and worked in the Toronto, Sydney, Perth, Shanghai and Hong Kong offices of CIBC. He has acted as advisor to the largest mining companies in the world including BHP, Rio Tinto, Anglo American, Noranda, Falconbridge, Meridian Gold, China Minmetals, Jinchuan and Zijin and has been responsible for some of the largest equity capital markets financings in Canadian mining history.

Mr. Gilman obtained his B.Sc. in Mining Engineering at Queen's University and his MBA from the Ivey Business School at Western University. He is Chairman of the International Advisory Board of Western University and a member of the Dean's Advisory board of Laurentian University.

| |

| Board Committees | ||

| Nil | ||

| Principal Occupation | ||

| Chairman and CEO of CEF Holdings Limited | ||

| Options and Common Shares (as at April 23, 2018) | ||

| Options | Common Shares | |

| 250,000 | Nil | |

| (1) | Mr. Gilman is the director nominee of CEF Holdings Limited. See “Corporate Governance Disclosure – Nomination of Directors – Investor Rights Agreement”. |

|

Craig Parry British Columbia, Canada

Director since: May 22, 2014

Not Independent (1) |

Mr. Parry is currently the President and Chief Executive Officer of IsoEnergy Ltd., a 70%-owned subsidiary of NexGen. Mr. Parry was a founding member of the Tigers Realm Group and was appointed to the Board of Tigers Realm Minerals Pty Ltd., Tigers Realm Metals and NexGen Energy Ltd. in 2011. Mr. Parry was appointed Chief Executive Officer of Tigers Realm Coal Limited in 2012 and acted in that capacity until 2015.

Mr. Parry is a geologist and has been responsible for the business development activities of the Tigers Realm Group since inception in 2008. Prior to joining the Tigers Realm Group, Mr. Parry was the Business Development Manager for G-Resources Limited, responsible for mergers and acquisitions, and Principal Geologist - New Business at Oxiana Limited, responsible for strategy and business development initiatives in bulk and energy commodities. Mr. Parry also previously led exploration programs for iron ore, copper, diamonds, coal and bauxite at Rio Tinto in Australia, Asia and South America and was the principal geologist for the Kintyre Uranium project pre-feasibility study. Mr. Parry holds an Honours Degree in Geology and is a Member of the Australian Institute of Mining and Metallurgy.

| |

| Board Committees | ||

| Nil | ||

| Principal Occupation | ||

| President and Chief Executive Officer of IsoEnergy Ltd. | ||

| Options and Common Shares (as at April 23, 2018) | ||

| Options | Common Shares | |

| 2,100,000 | 210,244 | |

| (1) | Mr. Parry is not independent on the basis that he is an executive officer of an affiliate of the Corporation. |

| - 6 - |

|

Richard Patricio Ontario, Canada

Director since: April 19, 2013

Independent |

Mr. Patricio is the President and Chief Executive Officer of Mega Uranium Ltd., having previously been its Executive Vice President from 2005 to 2015.

Until April 2016, Mr. Patricio was also the Chief Executive Officer of Pinetree Capital Ltd. (“Pinetree”). Mr. Patricio joined Pinetree in November 2005 as Vice President, Corporate and Legal Affairs. Mr. Patricio was previously general counsel for Teknion Corp., a senior TSX-listed manufacturing company. Prior to that, Mr. Patricio practiced law at Osler LLP in Toronto where he focused on mergers and acquisitions, securities law and general corporate transactions.

Mr. Patricio has built a number of mining companies with global operations and holds senior officer and director positions in several companies listed on stock exchanges in Toronto, Australia, London and New York. Mr. Patricio received his law degree from Osgoode Hall and was called to the Ontario bar in 2000.

| |

| Board Committees | ||

| Nomination and Governance Committee (Chair); Audit Committee; Compensation Committee (Chair) | ||

| Principal Occupation | ||

| President and Chief Executive Officer of Mega Uranium Ltd. | ||

| Options and Common Shares (as at April 23, 2018) | ||

| Options | Common Shares | |

| 2,200,000 | 400,000 (1) | |

| (1) | In addition, Mega Uranium Ltd. holds 19,376,265 common shares of NexGen. Mr. Patricio is the President and Chief Executive Officer of Mega Uranium Ltd. The common shares of Mega Uranium Ltd. are listed on the TSX. |

|

Trevor Thiele South Australia, Australia

Director since: April 19, 2013

Independent |

Mr. Thiele has over 30 years’ experience in senior finance roles in medium to large Australian listed companies. Mr. Thiele has also been Chief Financial Officer for companies involved in the agribusiness sector (Elders and ABB Grain Ltd., Rural Services Division) and the biotechnology sector (Bionomics Limited). In these roles he combined his technical, accounting and financial skills with commercial expertise thereby substantially contributing to the growth of each of these businesses. During this time, Mr. Thiele was actively involved in initial public offerings, capital raisings, corporate restructures, mergers and acquisitions, refinancing and joint ventures.

Mr. Thiele is currently a non-executive director of a number of non-listed Australian entities, and acts as Chairman of one of these entities.

Mr. Thiele holds a Bachelor of Arts in Accountancy from the University of South Australia and is a member of Chartered Accountants of Australia and New Zealand.

| |

| Board Committees | ||

| Audit Committee (Chair); Compensation and Governance Committee; Nominating Committee | ||

| Principal Occupation | ||

| Corporate Director | ||

| Options and Common Shares (as at April 23, 2018) | ||

| Options | Common Shares | |

| 2,150,000 | Nil | |

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

To the knowledge of management, no proposed director:

| (a) | is, as of the date of this Circular, or has been, within ten (10) years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including the Corporation) that, |

| (i) | while that person was acting in that capacity, was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant issuer access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days (an "Order"); or |

| - 7 - |

| (ii) | was subject to an Order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity of director, chief executive officer or chief financial officer; or |

| (b) | is, at the date of this Circular, or has been within ten (10) years before the date of this Circular, a director or an executive officer of any company (including the Corporation) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (c) | has within ten (10) years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director. |

In addition, to the knowledge of management, no proposed director has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority or been subject to any other penalties or sanctions imposed by a court, or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

Appointment of Auditor

At the Meeting, shareholders will be asked to re-appoint KPMG LLP, 777 Dunsmuir Street, PO Box 10426, Vancouver BC, Canada, as independent auditor of the Corporation for the ensuing year at such remuneration to be fixed by the Board.

Unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the common shares represented by such form of proxy FOR the re-appointment of KPMG LLP as the Corporation’s independent auditor to hold office for the ensuing year with remuneration to be fixed by the Board.

EXECUTIVE COMPENSATION

In accordance with the requirements of applicable securities legislation in Canada, the following executive compensation disclosure is provided in respect of each person who served as the Corporation’s Chief Executive Officer (the “CEO”) or Chief Financial Officer (the “CFO”) during the financial year ended December 31, 2017 and each of the three (3) other most highly compensated executive officers of the Corporation for the financial year ended December 31, 2017, whose annual aggregate compensation exceeded $150,000.

Compensation and Governance Committee

The Board is responsible for overseeing the Corporation’s compensation program. The Board has however delegated certain oversight responsibilities in this regard to the Corporation’s Compensation and Governance Committee (the “Compensation Committee”), but retains final authority over the Corporation’s compensation program and process.

| - 8 - |

The Compensation Committee is comprised of two (2) independent members of the Board: Richard Patricio (Chair) and Trevor Thiele. The Compensation Committee has a written mandate which was approved by the Board in 2017.

By virtue of their respective experience as executives and their exposure to capital markets, corporate governance and regulatory matters, each member possesses the relevant decision-making skills that make them suitable members of the Compensation Committee. A general description of the education and experience of each Compensation Committee member which is relevant to the performance of his responsibilities as a Compensation Committee member is contained in their respective biographies set out under “Election of Directors” in this Circular. In particular, Mr. Patricio has extensive experience as an officer and/or director of several mining companies including as a member of the compensation committee thereof and Mr. Thiele has extensive financial experience. In addition, each of Messrs. Patricio and Thiele have been involved with the Corporation since inception and hence are intimately familiar with its operations and senior management team. As a result, each of them is qualified to make decisions on the suitability of the Corporation’s compensation policies and practices.

The responsibilities, powers and operation of the Compensation Committee are set out in its written charter. The Compensation Committee is generally responsible for, among other things:

| · | establishing the Corporation’s general compensation philosophy and overseeing the development and implementation of the Corporation’s compensation programs; |

| · | reviewing and approving corporate goals and objectives relevant to the compensation of the CEO, evaluating the performance of the CEO in light of those goals and objectives, and setting the CEO’s compensation level based on this evaluation, subject to the approval of the Board; |

| · | reviewing and approving compensation, incentive plans and equity-based plans for all other senior officers of the Corporation after considering recommendations of the CEO, all within the compensation policies and guidelines approved by the Board; and |

| · | reviewing the adequacy and form of the compensation of directors and ensuring that the compensation realistically reflects the responsibilities and risks involved. |

Compensation Discussion and Analysis

Objectives

The objective of the Corporation’s executive compensation program is to provide total compensation that:

| (i) | ensures external competitiveness by developing and maintaining compensation levels that reflect current market rates; |

| (ii) | rewards consistently high performance levels; |

| (iii) | attracts, retains and motivates qualified and experienced executives; |

| (iv) | aligns the interests of executives with the interests of the Corporation’s shareholders; and |

| (v) | reflects the respective duties and responsibilities of senior executives. |

The Corporation’s executive compensation program is based on a pay-for-performance philosophy. It is designed to retain, encourage, compensate and reward executives on the basis of individual and corporate performance, both in the short-term and long-term. More specifically, the Corporation’s program is designed to provide the Corporation with maximum flexibility in determining executive compensation and allows it to ensure that a material percentage of total compensation is based on performance (as opposed to base salary) thereby aligning the interests of executive officers with shareholders and ensuring compensation is merit based, while conserving the Corporation’s cash by not committing to significant base salaries.

| - 9 - |

In addition and in particular, the Corporation’s compensation program reflects the fact that, notwithstanding the Corporation’s rapid growth, its staffing complement at the executive level during the financial year ended December 31, 2017 had not increased and remained comparatively small. The Corporation believes that compensating its executive officers during this transitional growth period with cash bonuses (as opposed to substantial increases in base salary) was in the best interests of the Corporation’s financial resources and permits a measured and strategic approach to hiring additional senior management while motivating and rewarding the additional commitment and effort required of its senior management team. Moreover, the Corporation believes that its compensation program for the financial year ended December 31, 2017 (and prior thereto) reflected the stage of the Corporation’s business and the relative size and experience of its senior management team.

The Corporation has recently increased size and changed the composition of its senior management team to reflect the Corporation’s focus on pre-development activities and will be assessing its compensation philosophy and practices as a result.

Elements of Executive Compensation

During the financial year ended December 31, 2017, compensation of the Corporation’s executive officers consisted of a base salary, annual incentive compensation in the form of a discretionary performance bonus and/or special bonus and a longer term incentive in the form of stock options, all of which is intended to be competitive in the aggregate while delivering an appropriate balance between annual compensation (base salary and cash bonuses) and long-term compensation (stock options).

Base salaries are based on a number of factors and designed to best position the Corporation to compete for, and retain, executives critical to the Corporation’s long-term success. Performance bonuses and special bonuses (in the form of cash bonuses) are directly tied to corporate and individual performance. Long-term incentive awards consist of stock options and are designed to align the interests of executive officers with the longer term interests of shareholders.

During the financial year ended December 31, 2017, the Chairman of the Compensation Committee met with the Chief Executive Officer periodically to discuss corporate goals and performance and to discuss the performance of executive officers individually. The Compensation Committee works in conjunction with the Chief Executive Officer to set compensation, including proposed salary adjustments, performance and/or special bonuses and stock option awards for executive officers.

The Compensation Committee made recommendations relating to the compensation of executive officers to the Board. Based on these recommendations, the Board makes decisions concerning the nature and scope of the compensation to be paid to the Corporation’s executive officers. The Compensation Committee based its recommendations to the Board on its compensation philosophy and the Compensation Committee’s assessment of corporate and individual performance, recruiting and retention needs.

For the 2017 fiscal year, aggregate compensation was based, in part, on a report prepared by the Harlon Group in September 2015, pending completion of an evaluation commencing in 2017 by Lane Caputo Compensation Inc., the results of which were implemented for the 2018 fiscal year, which included an evaluation against peer group comparators (see below). The comparator group consisted of the following companies:

| Aureus Mining Inc. | Peninsula Energy Limited |

| Dalradian Resources Inc. | Platinum Group Metals |

| Denison Mines Corp. | PolyMet Mining Corp. |

| Energy Fuels, Inc. | Seabridge Gold Inc. |

| Gold Resource Corporation | Taseko Mines Limited |

| Golden Star Resources Ltd. | Ur-Energy Inc. |

| Kaminak Gold Corporation | Uranium Energy Corp. |

| Largo Resources Ltd. | Toro Energy Limited |

| Nautilus Minerals Inc. |

| - 10 - |

In establishing base salaries, the Compensation Committee considered factors such as experience, individual performance, changes to roles and responsibilities, corporate growth, length of service, contribution towards the achievement of corporate objectives and compensation compared to other employment opportunities for executives. Base salaries are also intended to be internally equitable. Salaries are reviewed annually by the Board based on recommendations of the Compensation Committee.

Bonuses are based on the achievement of pre-determined, measurable corporate and/or individual performance objectives. During the financial year ended December 31, 2017, bonuses were either based on performance over the year (a “Performance Bonus”) and/or based on the achievement of a particular and extraordinary corporate transaction or other milestone (a “Special Bonus”).

A maximum Performance Bonus was determined for each executive officer as a percentage of salary. The maximum performance bonus for 2017 was 75% of base salary for the CEO and 50% for all other executive officers. The key performance indicators and maximum bonus percentage are determined by the Compensation Committee (after discussion with the CEO) annually for the ensuing financial year and recommended to the Board for approval, on an individual basis for each executive officer.

The corporate performance objectives for 2017 included share appreciation, completion of a financing or other similar transaction, management of operations within budget, and the Corporation’s health and safety record. Individual performance objectives relate to the particular executive’s role and expected contribution to the Corporation and its objectives and a discretionary assessment of overall job performance.

Special Bonuses were awarded on an ad hoc basis during the year based on the completion of material corporate transactions and/or other milestones. Special Bonuses are not based on pre-determined objectives and are intended to award extraordinary effort and achievement without financial incentive. Special Bonuses are determined by the Compensation Committee based on discussions, to the extent appropriate, with the CEO.

Stock options are granted on a discretionary basis, based on the Board and the Compensation Committee’s assessments of responsibilities and achievements, recognizing that at the earlier stage of development stock option awards can help preserve cash resources. Generally, the number of stock options granted to any executive officer is a function of the level of authority and responsibility of the executive officer, the contribution of the executive officer to the business and affairs of the Corporation, the number of stock options the Corporation has already granted to the executive officer, and such other factors as the Compensation Committee may consider relevant.

Stock options are governed by the Corporation’s amended and restated incentive stock option plan (the “Option Plan”), and awards are generally made annually in the month of December. Existing stock options have a five year term and are exercisable at the price determined by the Board, subject to applicable regulatory requirements at the time of grant.

Risk Management

The Compensation Committee is responsible for identifying any risks associated with the Corporation’s compensation policies and practices and considering the implications of any such risks and then ensuring such risks are mitigated, particularly those arising from policies and practices that encourage or may encourage excessive risk-taking by executive officers. Given the current stage of development, at this time, the Board has not formally assessed the implications of the risk associated with its compensation policies and practices. However, the Compensation Committee maintains sufficient discretion and flexibility in implementing compensation decisions such that unintended consequences in remuneration can be minimized, while still allowing the Compensation Committee to be responsive to market conditions.

| - 11 - |

Hedging

Pursuant to the Corporation’s Code of Business Ethics, the Corporation’s executive officers and directors are not permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the executive officer or director.

Outside Consultants

During the financial year ended December 31, 2017, the Compensation Committee engaged Lane Caputo Compensation Inc. (“Lane Caputo”) to advise the Compensation Committee and the Board on executive and director compensation, including benchmarking and other equity compensation structures such as restricted share units and performance share units.

The results of the report prepared by Lane Caputo have been assessed and will continue to be implemented as appropriate.

Performance Graph

The Corporation first commenced trading on the TSXV as “Clermont Capital Inc.”, a “capital pool company” within the meaning of Policy 2.4 – Capital Pool Companies (the “CPC Policy”) of the TSXV, on August 29, 2012 under the symbol “XYZ.P”. On April 19, 2013, the Corporation completed its “qualifying transaction” and in connection therewith consolidated its common shares on a 2.35:1 basis and changed its name to “NexGen Energy Ltd.” On April 22, 2013, the Corporation’s common shares commenced trading on the TSXV under the symbol “NXE”. On July 15, 2016, the Corporation commenced trading on the TSX under the symbol “NXE”.

The following graph compares the Corporation’s cumulative total shareholder return to the capital markets over the five most recently completed financial years ending December 31, 2017. It shows the change in value of $100 invested in common shares of the Corporation on December 31, 2013 to December 31, 2017 compared to $100 invested in the S&P/TSX Composite Index or the S&P/TSX Global Mining Index for the same time period, assuming the reinvestment of all dividends (if applicable).

| Dec. 31, 2013 | Dec. 31, 2014 | Dec. 31, 2015 | Dec. 31, 2016 | Dec. 31, 2017 | ||||||||||||||||

| NexGen Energy Ltd. | $ | 100 | $ | 129 | $ | 244 | $ | 790 | $ | 1,088 | ||||||||||

| S&P/TSX Global Mining Index | $ | 100 | $ | 85 | $ | 61 | $ | 87 | $ | 99 | ||||||||||

| S&P/TSX Composite Index | $ | 100 | $ | 220 | $ | 200 | $ | 240 | $ | 260 | ||||||||||

The trend shown in the above graph does not necessarily correspond to the Corporation’s compensation to its executive officers for the financial year ended December 31, 2017 or for any prior fiscal periods. The Corporation’s executive compensation is based on a number of factors including, but not limited to, the demand for and supply of skilled professionals in the resource industry generally, individual performance, the Corporation’s performance (which is not necessarily tied exclusively to the trading price of the common shares on the TSX) and other factors discussed above. The trading price of the common shares on the TSX is subject to fluctuation based on several factors, many of which are beyond the control of the Corporation and its executive officers. These include, among other things, market perception of the Corporation’s ability to achieve planned growth or results, trading volume in the Corporation’s common shares, and changes in general conditions in the economy and financial markets. In general, executive cash compensation has increased significantly less than the price of the Corporation’s common shares over that same period. The Corporation’s philosophy is to reward the achievement of tangible objectives, not capital market speculation which may or may not be related to the performance of the executive officer.

| - 12 - |

Summary Compensation Table

For the financial year ended December 31, 2017, the Corporation had five (5) named executive officers: Leigh Curyer, Bruce Sprague, Grace Marosits, Garrett Ainsworth and Joanna Cameron (collectively, the “Named Executive Officers”). The following table sets forth the compensation paid to each of the Named Executive Officers for each of the Corporation’s three (3) most recently completed financial years (2015, 2016 and 2017).

| Non-equity incentive plan compensation ($) |

||||||||||||||||||||||||||

| Name and principal position |

Year | Salary ($) |

Share- based awards ($) |

Option- ($) (1) |

Annual ($) (2) |

Long-term incentive plans ($) |

Pension value ($) |

All other compensation ($) |

Total compensation ($) |

|||||||||||||||||

| Leigh Curyer | ||||||||||||||||||||||||||

| President, Chief | 2017 | 500,000 | Nil | 2,588,969 | 967,600 | (7) | Nil | Nil | Nil | 4,056,569 | ||||||||||||||||

| Executive Officer & | 2016 | 400,000 | Nil | 2,802,393 | 950,000 | Nil | Nil | Nil | 4,152,393 | |||||||||||||||||

| Director (3) | 2015 | 300,000 | Nil | 675,555 | 200,000 | Nil | Nil | Nil | 1,175,555 | |||||||||||||||||

| Bruce Sprague | 2017 | 56,618 | Nil | 778,335 | Nil | Nil | Nil | Nil | 834,953 | |||||||||||||||||

| Chief Financial Officer (4) | 2016 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

| 2015 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||||||||||||

| Grace Marosits | 2017 | 150,000 | Nil | 223,267 | 65,000 | (8) | Nil | Nil | Nil | 438,267 | ||||||||||||||||

| Former Chief Financial | 2016 | 135,000 | Nil | 322,961 | 50,000 | Nil | Nil | Nil | 507,961 | |||||||||||||||||

| Officer (5) | 2015 | 120,000 | Nil | 99,195 | 30,000 | Nil | Nil | Nil | 249,195 | |||||||||||||||||

| Garrett Ainsworth | 2017 | 250,000 | Nil | 604,890 | 309,625 | (9) | Nil | Nil | Nil | 1,164,515 | ||||||||||||||||

| Former Vice President, | 2016 | 250,000 | Nil | 652,862 | 350,000 | Nil | Nil | Nil | 1,252,862 | |||||||||||||||||

| Exploration & Development | 2015 | 180,000 | Nil | 426,313 | 85,000 | Nil | Nil | Nil | 691,313 | |||||||||||||||||

| Joanna Cameron | ||||||||||||||||||||||||||

| Former Vice President, | 2017 | 200,000 | Nil | 289,942 | 167,500 | (10) | Nil | Nil | Nil | 657,442 | ||||||||||||||||

| Legal & General | 2016 | 200,000 | Nil | 377,382 | 100,000 | Nil | Nil | Nil | 677,382 | |||||||||||||||||

| Counsel (6) | 2015 | 51,644 | Nil | 115,113 | 15,000 | Nil | Nil | Nil | 181,757 | |||||||||||||||||

| Notes: |

| (1) | Option-based compensation is valued using the Black-Scholes option pricing model. This model was selected as it is widely used in estimating option based compensation values by Canadian public companies. The Black-Scholes model resulted in a value of an option on each of the following dates as follows: |

December 14, 2017: $2.20; November 13, 2017: $1.95; December 15, 2016: $1.50; June 23, 2016: $1.80; December 16, 2015: $0.42; September 22, 2015: $0.43; May 27, 2015: $0.35.

| (2) | Includes bonus amounts paid to Named Executive Officers by the end of each financial year, comprising a Performance Bonus and/or Special Bonus. |

| (3) | Mr. Curyer did not receive any remuneration in his role as a Director of NexGen. |

| (4) | Mr. Sprague was appointed as Chief Financial Officer on November 13, 2017. |

| (5) | Ms. Marosits acted as Chief Financial Officer from November 24, 2014 to November 13, 2017. |

| (6) | Ms. Cameron commenced as Vice President, Legal & General Counsel on September 28, 2015. |

| (7) | Represents aggregate bonus amounts paid during 2017 and consists of an annual Performance Bonus ($238,100) for meeting or exceeding pre-determined performance goals (including share price performance) and a Special Bonus in respect of the announcement of an updated resource estimate at the Rook 1 Project and completion of a US$110,000,000 financing. There is no assurance that one or more Special Bonuses will be paid in the future. |

| (8) | Represents aggregate bonus amounts paid during 2017 and consists of an annual Performance Bonus ($30,000) for meeting or exceeding pre-determined performance goals and a Special Bonus in respect of the completion of a US$110,000,000 financing. There is no assurance that one or more Special Bonuses will be paid in the future. |

| (9) | Represents aggregate bonus amounts paid during 2017 and consists of an annual Performance Bonus ($209,625) for meeting or exceeding pre-determined performance goals and a Special Bonus in respect of the announcement of an updated resource estimate at the Rook 1 Project. There is no assurance that one or more Special Bonuses will be paid in the future. |

| (10) | Represents aggregate bonus amounts paid during 2017 and consists of an annual Performance Bonus ($30,000) for meeting or exceeding pre-determined performance goals and a Special Bonus in respect of the completion of a US$110,000,000 financing. There is no assurance that one or more Special Bonuses will be paid in the future. |

| - 13 - |

Incentive Plan Awards

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth all share-based and option-based awards outstanding at December 31, 2017 for each Named Executive Officer. All option-based awards vest in one-third increments annually, based on the anniversary of the date of grant and have five (5) year terms.

| Option-based Awards | Share-based Awards | |||||||||||||||||

| Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share- based awards that have not vested ($) | ||||||||||||

| Leigh Curyer | 300,000 | 0.40 | 30-Jul-18 | 843,000 | Nil | Nil | ||||||||||||

| 200,000 | 0.30 | 19-Dec-18 | 582,000 | Nil | Nil | |||||||||||||

| 500,000 | 0.40 | 23-May-19 | 1,405,000 | Nil | Nil | |||||||||||||

| 1,500,000 | 0.46 | 24-Dec-19 | 4,125,000 | Nil | Nil | |||||||||||||

| 1,000,000 | 0.50 | 27-May-20 | 2,710,000 | Nil | Nil | |||||||||||||

| 1,500,000 | 0.64 | 16-Dec-20 | 3,855,000 | Nil | Nil | |||||||||||||

| 1,800,000 | 2.65 | 23-Jun-21 | 1,008,000 | Nil | Nil | |||||||||||||

| 1,000,000 | 2.24 | 15-Dec-21 | 970,000 | Nil | Nil | |||||||||||||

| 1,000,000 | 3.39 | 14-Dec-22 | Nil | Nil | Nil | |||||||||||||

| Bruce Sprague | 1,000,000 | 2.93 | 13-Nov-22 | 280,000 | Nil | Nil | ||||||||||||

| Grace Marosits | 250,000 | 0.46 | 24-Dec-19 | 687,500 | Nil | Nil | ||||||||||||

| 250,000 | 0.50 | 27-May-20 | 677,500 | Nil | Nil | |||||||||||||

| 100,000 | 0.64 | 16-Dec-20 | 257,000 | Nil | Nil | |||||||||||||

| 250,000 | 2.65 | 23-Jun-21 | 140,000 | Nil | Nil | |||||||||||||

| 25,000 | 2.24 | 15-Dec-21 | 24,250 | Nil | Nil | |||||||||||||

| 75,000 | 3.39 | 14-Dec-22 | Nil | Nil | Nil | |||||||||||||

| Garrett Ainsworth | 750,000 | 0.40 | 03-Jun-19 | 2,107,500 | Nil | Nil | ||||||||||||

| 750,000 | 0.46 | 24-Dec-19 | 2,062,500 | Nil | Nil | |||||||||||||

| 750,000 | 0.50 | 27-May-20 | 2,032,500 | Nil | Nil | |||||||||||||

| 750,000 | 0.64 | 16-Dec-20 | 1,927,500 | Nil | Nil | |||||||||||||

| 250,000 | 2.65 | 23-Jun-21 | Nil | Nil | Nil | |||||||||||||

| 300,000 | 2.24 | 15-Dec-21 | 291,000 | Nil | Nil | |||||||||||||

| 250,000 | 3.39 | 14-Dec-22 | Nil | Nil | Nil | |||||||||||||

| Joanna Cameron | 500,000 | 0.62 | 22-Sep-20 | 1,295,000 | Nil | Nil | ||||||||||||

| 100,000 | 0.64 | 16-Dec-20 | 257,000 | Nil | Nil | |||||||||||||

| 250,000 | 2.65 | 23-Jun-21 | 140,000 | Nil | Nil | |||||||||||||

| 100,000 | 2.24 | 15-Dec-21 | 97,000 | Nil | Nil | |||||||||||||

| 75,000 | 3.39 | 14-Dec-22 | Nil | Nil | Nil | |||||||||||||

Notes:

| (1) | The value of unexercised in-the-money options is calculated by multiplying the difference between the December 29, 2017 closing price of the common shares on the TSX of $3.21 and the option exercise price, by the number of outstanding options. Where the difference is negative, the options are not in-the-money and no value is reported. These stock options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the common shares on the date of exercise. |

Incentive Plan Awards – Value Vested or Earned During the Year

During the financial year ended December 31, 2017, no incentive plan awards vested or were earned for the Named Executive Officers except as follows:

| - 14 - |

| Name | Option-based awards - Value ($) | Shared-based awards - Value vested during the year ($) |

Non-equity incentive plan compensation - Value earned during the year ($) | ||||||

| Leigh Curyer | 2,796,336 | Nil | Nil | ||||||

| Bruce Sprague | Nil | Nil | Nil | ||||||

| Grace Marosits (2) | 331,750 | Nil | Nil | ||||||

| Garrett Ainsworth (2) | 1,504,167 | Nil | Nil | ||||||

| Joanna Cameron (2) | 518,000 | Nil | Nil | ||||||

| Notes: |

| (1) | The aggregate dollar value that would have been realized if the options under the option-based award had been exercised on the vesting date. |

| (2) | Employment ended effective April 12, 2018. |

Termination and Change of Control Benefits

Each of the Named Executive Officers (other than Ms. Cameron, Ms. Marosits and Mr. Ainsworth) is party to an employment agreement with the Corporation (each, an “Executive Employment Agreement”).

The Executive Employment Agreements establish base compensation comprised of base salary and eligibility for an annual performance-based cash incentive. Named Executive Officers are also eligible to participate in the Corporation’s equity-based long-term incentive compensation plans in the form of stock options, at the discretion of the Board. The Executive Employment Agreements are effective until such time as they are terminated in accordance with their terms.

The Executive Employment Agreements also provide for termination payments in the event that (i) the Named Executive Officer’s employment is terminated without cause (including constructive dismissal), or (ii) within 12 months of a “change of control”, the Named Executive Officer is terminated without cause or resigns.

In each case, the terminated Named Executive Officer is entitled to a termination payment equal to the product by multiplying: (i) the sum of (a) his or her annual base salary; and (b) his or her highest bonus (including both Performance Bonuses and Special Bonuses) paid or payable in the preceding three years, in each case, calculated on a monthly basis, by (ii) a period of between three (3) and 36 months, with longer periods being applicable only in the case of a change of control (the “Severance Period”). The Named Executive Officer is also entitled to the continuation of benefits during the Severance Period, or in the event the Corporation is unable to continue such benefits, payment in lieu equal to the cost of such benefits to the Corporation.

In addition, the terminated Named Executive Officer is entitled to a payment equal to the sum of: (i) all earned but unpaid salary, earned but unpaid bonus, outstanding but untaken vacation pay, and outstanding expenses; and (ii) the terminated Named Executive Officer’s highest Performance Bonus and Special Bonus over the preceding three (3) years, prorated to the date of termination (the “Final Wages”).

All outstanding options held by the terminated Named Executive Officer would also vest immediately and continue to be exercisable until the earlier of the expiry of their term or such period imposed by an applicable regulatory body.

The estimated incremental payments (excluding the Final Wages) payable by the Corporation to each Named Executive Officer upon termination without cause or related to a change of control, assuming the triggering event occurred on December 31, 2017, are as follows.

| Name | Triggering Event | Estimated Incremental Payment ($) | ||||

| Leigh Curyer (1) | Termination Without Cause | 2,201,400 | ||||

| President & Chief Executive Officer | Change of Control | 4,402,800 | ||||

Bruce Sprague (2) Chief Financial Officer | Termination Without Cause Change of Control | 212,500 850,000 | ||||

| - 15 - |

| Notes: |

| (1) | Mr. Curyer holds an aggregate of 8,800,000 stock options, having an aggregate in-the-money value, as of December 31, 2017, of $15,498,000. |

| (2) | Mr. Sprague holds an aggregate of 1,000,000 stock options, having an aggregate in-the-money value, as of December 31, 2017, of $280,000. |

There are no significant conditions or obligations that apply to the receipt of the foregoing incremental payments.

Director Compensation

The following table sets forth the compensation provided to the directors of the Corporation for the financial year ended December 31, 2017.

Compensation paid to Leigh Curyer for the financial year ended December 31, 2017 is set out above under the heading “Summary Compensation Table”. Mr. Curyer did not receive any remuneration in his role as a director of the Corporation.

| Name | Fees earned ($) | Share- based awards ($) | Option-based awards ($) (1) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation ($) | Total ($) | |||||||||||||

| Christopher McFadden | 80,000 | Nil | 587,140 | Nil | Nil | Nil | 667,140 | |||||||||||||

| Warren Gilman | 24,511 | Nil | 195,547 | Nil | Nil | Nil | 220,058 | |||||||||||||

| Craig Parry | 56,250 | Nil | 587,140 | Nil | Nil | Nil | 643,390 | |||||||||||||

| Richard Patricio | 65,000 | Nil | 587,140 | Nil | Nil | Nil | 652,140 | |||||||||||||

| Trevor Thiele | 73,750 | Nil | 587,140 | Nil | Nil | Nil | 660,890 | |||||||||||||

| Note: |

| (1) | Option-based compensation is valued using the Black-Scholes option pricing model. This model was selected as it is widely used in estimating option-based compensation values by Canadian public companies. The Black-Scholes model resulted in the following option value on each of the following dates: |

December 14, 2017: $2.20; November 13, 2017: $1.95; December 15, 2016: $1.50; November 8, 2016: $0.96; June 23, 2016: $1.80; December 16, 2015: $0.42; May 27, 2015: $0.35.

| - 16 - |

Incentive Plan Awards

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth all share-based and option-based awards outstanding at December 31, 2017 for each of the Corporation’s directors. All option-based awards vest in one-third increments annually, based on the anniversary of the date of grant and have five (5) year terms.

| Option-based Awards | Share-based Awards | |||||||||||||||||

| Name | Number of (#) | Option ($) | Option expiration | Value of unexercised in- ($) | Number of (#) | Market or ($) | ||||||||||||

| Christopher McFadden | 250,000 | 3.39 | 14-Dec-22 | Nil | Nil | Nil | ||||||||||||

| 250,000 | 2.24 | 15-Dec-21 | 242,500 | Nil | Nil | |||||||||||||

| 350,000 | 2.65 | 23-Jun-21 | 196,000 | Nil | Nil | |||||||||||||

| 250,000 | 0.64 | 16-Dec-20 | 642,500 | Nil | Nil | |||||||||||||

| 300,000 | 0.50 | 27-May-20 | 813,000 | Nil | Nil | |||||||||||||

| 300,000 | 0.46 | 24-Dec-19 | 825,000 | Nil | Nil | |||||||||||||

| 350,000 | 0.40 | 23-May-19 | 983,500 | Nil | Nil | |||||||||||||

| 250,000 | 0.40 | 30-Jul-18 | 702,500 | Nil | Nil | |||||||||||||

| Warren Gilman | 250,000 | 3.39 | 14-Dec-22 | Nil | Nil | Nil | ||||||||||||

| Craig Parry | 250,000 | 3.39 | 14-Dec-22 | Nil | Nil | Nil | ||||||||||||

| 250,000 | 2.24 | 15-Dec-21 | 242,500 | Nil | Nil | |||||||||||||

| 350,000 | 2.65 | 23-Jun-21 | 196,000 | Nil | Nil | |||||||||||||

| 250,000 | 0.64 | 16-Dec-20 | 642,500 | Nil | Nil | |||||||||||||

| 300,000 | 0.50 | 27-May-20 | 813,000 | Nil | Nil | |||||||||||||

| 200,000 | 0.46 | 24-Dec-19 | 550,000 | Nil | Nil | |||||||||||||

| 500,000 | 0.40 | 23-May-19 | 1,405,000 | Nil | Nil | |||||||||||||

| Richard Patricio | 250,000 | 3.39 | 14-Dec-22 | Nil | Nil | Nil | ||||||||||||

| 250,000 | 2.24 | 15-Dec-21 | 242,500 | Nil | Nil | |||||||||||||

| 350,000 | 2.65 | 23-Jun-21 | 196,000 | Nil | Nil | |||||||||||||

| 250,000 | 0.64 | 16-Dec-20 | 642,500 | Nil | Nil | |||||||||||||

| 300,000 | 0.50 | 27-May-20 | 813,000 | Nil | Nil | |||||||||||||

| 200,000 | 0.46 | 24-Dec-19 | 550,000 | Nil | Nil | |||||||||||||

| 350,000 | 0.40 | 23-May-19 | 983,500 | Nil | Nil | |||||||||||||

| 250,000 | 0.40 | 30-Jul-18 | 702,500 | Nil | Nil | |||||||||||||

| Trevor Thiele | 250,000 | 3.39 | 14-Dec-22 | Nil | Nil | Nil | ||||||||||||

| 250,000 | 2.24 | 15-Dec-21 | 242,500 | Nil | Nil | |||||||||||||

| 350,000 | 2.65 | 23-Jun-21 | 196,000 | Nil | Nil | |||||||||||||

| 250,000 | 0.64 | 16-Dec-20 | 642,500 | Nil | Nil | |||||||||||||

| 300,000 | 0.50 | 27-May-20 | 813,000 | Nil | Nil | |||||||||||||

| 200,000 | 0.46 | 24-Dec-19 | 550,000 | Nil | Nil | |||||||||||||

| 350,000 | 0.40 | 23-May-19 | 983,500 | Nil | Nil | |||||||||||||

| 250,000 | 0.40 | 30-Jul-18 | 702,500 | Nil | Nil | |||||||||||||

| Note: |

| (1) | The value of unexercised in-the-money options is calculated by multiplying the difference between the closing price of the common shares on the TSX on December 29, 2017, which was $3.21, and the option exercise price, by the number of outstanding options. Where the difference is negative, the options are not in-the-money and no value is reported. These stock options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the common shares on the date of exercise. |

| - 17 - |

Incentive Plan Awards – Value Vested or Earned During the Year

During the financial year ended December 31, 2017, no incentive plan awards vested or were earned for the directors except as follows:

| Name | Option-based awards - ($) | Shared-based awards - Value vested during the year ($) | Non-equity incentive plan compensation - Value earned during the year ($) | |||||

| Christopher McFadden | 621,000 | Nil | Nil | |||||

| Warren Gilman | 10,000 | Nil | Nil | |||||

| Craig Parry | 621,000 | Nil | Nil | |||||

| Richard Patricio | 621,000 | Nil | Nil | |||||

| Trevor Thiele | 621,000 | Nil | Nil | |||||

| Note: |

| (1) | The aggregate dollar value that would have been realized if the options under the option-based award had been exercised on the vesting date. |

CORPORATE GOVERNANCE DISCLOSURE

National Instrument 58-101 – Disclosure of Corporate Governance Practices (the “Disclosure Instrument”) requires that the Corporation annually disclose its corporate governance practices with reference to a series of corporate governance practices outlined in National Policy 58-201 – Corporate Governance Guidelines (the “Guidelines”).

The following is a discussion of each of the Corporation’s corporate governance practices for which disclosure is required by the Disclosure Instrument. Unless otherwise indicated, the Board believes that its corporate governance practices are consistent with those recommended by the Guidelines.

Director Independence

For the purposes of the Disclosure Instrument, a director is independent if he or she has no direct or indirect material relationship with the Corporation. A “material relationship” is one which could, in the view of the Board, reasonably be expected to interfere with his or her ability to exercise independent judgment. Certain specified relationships will, in all circumstances, be considered, for the purposes of the Disclosure Instrument, to be material relationships.

As of the date of this Circular, the Board consists of six (6) individuals, four (4) of whom are independent. It is proposed that the Board remain at six (6) members for the current fiscal year. If the Board remains at six (6) members and all of management’s nominees are elected as directors at the Meeting, the Board will consist of six (6) individuals, four (4) of whom are independent. Accordingly, a majority of the Board is independent.

The current independent directors are: Christopher McFadden, Warren Gilman, Richard Patricio and Trevor Thiele. These directors are also independent for the purposes of the NYSE American Company Guide.

Mr. McFadden has been appointed as the Chairman of the Board and is responsible for, among other things, providing leadership to ensure that the Board functions independently of management and overseeing the governance obligations of the Board and its committees generally.

Messrs. Curyer and Parry are not independent for the purposes of the Disclosure Instrument. Mr. Curyer is the Corporation’s President and Chief Executive Officer and, as of April 1, 2016, Mr. Parry was appointed as the President and Chief Executive Officer of IsoEnergy, an affiliate of the Corporation (with the Corporation holding approximately 60.02% of the outstanding shares of IsoEnergy).

| - 18 - |

In-camera sessions of the independent directors are scheduled for the conclusion of each meeting of the Board. Additional meetings for the independent directors are held as considered necessary. Moreover, the independent directors have the opportunity to hold discussions in the absence of management through their participation in the Compensation Committee and the Audit Committee. During the financial year ended December 31, 2017, no meetings of the independent directors were convened.

Other Directorships

Currently, the following directors serve as directors of the following reporting issuers or reporting issuer equivalents:

| Name of Director | Reporting Issuer(s) or Equivalent(s) | |

| Leigh Curyer |

IsoEnergy Ltd. (1) NxGold Ltd. | |

| Christopher McFadden |

IsoEnergy Ltd. (1) NxGold Ltd. | |

| Warren Gilman | Nil | |

| Craig Parry |

IsoEnergy Ltd. (1) Skeena Resources Limited | |

| Richard Patricio |

IsoEnergy Ltd. (1) Latin American Minerals Inc. NxGold Ltd. Toro Energy Limited (2) | |

| Trevor Thiele |

IsoEnergy Ltd. (1) NxGold Ltd. |

| Notes: |

| (1) | NexGen holds approximately 60.02% of the outstanding common shares of IsoEnergy. Accordingly, IsoEnergy is an affiliate of NexGen. |

| (2) | Mr. Patricio’s directorship at Toro Energy Limited is a result of his management role at Mega Uranium Ltd. Latin American Minerals Inc. and NxGold are Mr. Patricio’s only directorships which are distinct from his principal occupation. |

Attendance

The Board is committed to scheduling regular meetings of the Board and its committees and encouraging attendance by directors. The Board and its committees held the following number of meetings in the financial year ended December 31, 2017:

| Year Ended December 31, 2017 | ||

| Board | 7 | |

| Audit Committee | 4 | |

| Compensation Committee | 3 | |

| Nomination and Governance Committee | Nil |

The attendance of the current directors at such meetings was as follows:

| Director | Board Meetings Attended |

Audit Committee Meetings Attended |

Compensation Attended |

Nomination and Governance Committee Meetings Attended | ||||

| Leigh Curyer | 7 of 7 | N/A | N/A | N/A | ||||

| Christopher McFadden | 7 of 7 | 4 of 4 | N/A | N/A | ||||

| Craig Parry | 6 of 7 | N/A | N/A | N/A | ||||

| Richard Patricio | 7 of 7 | 4 of 4 | 3 of 3 | N/A | ||||

| Trevor Thiele | 7 of 7 | 4 of 4 | 3 of 3 | N/A | ||||

| Warren Gilman(1) | 4 of 4 | N/A | N/A | N/A |

| Note: |

| (1) | Mr. Gilman was appointed to the Board on July 21, 2017. |

The Corporation’s Nominating and Governance Committee was formed in May 2017 and has not yet convened a meeting. While the Compensation Committee held three (3) formal meetings, there were multiple informal meetings held throughout the year.

| - 19 - |

Charter of the Board of Directors

The Board is responsible for the overall stewardship of the Corporation. The Board discharges this responsibility directly and through delegation of selected and specific responsibilities to committees of the Board, and the Chairman of the Board, all as more particularly described in the Charter of the Board of Directors (the “Charter”) attached to this Circular as Schedule A.

Position Descriptions

The Board has adopted a written position description for the roles of the Chairman of the Board and the CEO. The Chairman of the Board’s role is set out in the Charter as being responsible for the management, development and effective performance of the Board and ensuring the Board fulfils its duties as required by law and as set forth in the Charter.

The CEO is responsible for leading the Corporation in meeting its short-term operational and long-term strategic goals. The CEO is expected to report to the Board on a regular basis concerning the Corporation’s progress towards its goals, strategies and objectives.

Although the Board has developed written mandates for each of the Board committees, the Board has not yet developed written position descriptions for the chairs of each Board committee. The written mandate of each committee however delineates the role and responsibilities of each committee chair.

Orientation and Continuing Education