Form 6-K MorphoSys AG For: Jul 28

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/25/2024

- S&P 500 ends higher as markets weigh rising yields, upbeat corporate results

- Meta Platforms reports softer Q2 revenue guidance on plans to boost spending on AI

- IBM (IBM) announces mixed Q1 results, HashiCorp acquisition; shares down

- Equities mixed as investors eye earnings; yen on intervention watch

- ServiceNow (NOW) stock falls as refreshed subscription outlook trails estimates

- Meta Platforms (META) Tops Q1 EPS by 39c, Offers Guidance

- Hasbro (HAS) brand strength sees earnings top expectations

- IBM (IBM) announces mixed Q1 results, HashiCorp acquisition; shares down

- Seagate Technology (STX) Enters $600M Asset Purchase Agreement with Avago

- Crude Inventory Declined 6.4 Million Barrels Last Week

- After-hours movers: Meta, Ford, IBM, ServiceNow and more

- Midday movers: Tesla, Boeing rise; Uber, Old Dominion Freight fall

- After-hours movers: Tesla, Texas Instruments, Seagate, Visa and more

- Midday movers: PepsiCo, JetBlue fall; GM, Danaher and UPS rise

- After-hours movers: Cadence Design Systems, Cleveland-Cliffs, Riot Platforms, and more

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF A FOREIGN ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For July 28, 2021

Commission File Number 1-38455

MorphoSys AG

Semmelweisstrasse 7

82152 Planegg

Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If ‘‘Yes’’ is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Exhibits

| 99.1 | Half-Year Report January – June 2021 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| MORPHOSYS AG (Registrant) | ||||||

| Date: July 28, 2021 | By: | /s/ Klaus de Wall | ||||

| Name: | Klaus de Wall | |||||

| Title: | Head of Accounting & Tax | |||||

| By: | /s/ Dr. Robert Mayer | |||||

| Name: | Robert Mayer | |||||

| Title: | Director Investor Relations | |||||

Table of Contents

Exhibit 99.1

Half-Year Report

JANUARY – JUNE 2021

H1

Table of Contents

| 2 | Group Interim Statement |

MorphoSys Group:

Half-Year Report January – June 2021

| 4 | ||||

| 7 | ||||

| 7 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 28 | Consolidated Statement of Changes in Stockholder’s Equity (IFRS) | |||

| 30 | ||||

| 32 | ||||

Table of Contents

| Group Interim Statement | 3 |

Summary of the Second Quarter of 2021

Operating Highlights for the Second Quarter of 2021

| · | On April 19, 2021, MorphoSys and Incyte announced the first patient had been dosed in the placebo-controlled phase 3 inMIND study. The study is evaluating the efficacy and safety of tafasitamab in combination with lenalidomide and rituximab compared to lenalidomide and rituximab in patients with relapsed or refractory follicular lymphoma (FL) or marginal zone lymphoma (MZL). |

| · | On May 11, 2021, MorphoSys and Incyte announced the first patient had been dosed in the pivotal phase 3 frontMIND study. The study is evaluating tafasitamab and lenalidomide in addition to rituximab, cyclophosphamide, doxorubicin, vincristine and prednisone (R-CHOP) compared to R-CHOP alone as first-line treatment for high-intermediate and high-risk patients with untreated diffuse large B-cell lymphoma (DLBCL). |

| · | On June 2, 2021, MorphoSys announced its plans to acquire Constellation Pharmaceuticals to accelerate its growth strategy by adding two mid- to late-stage product candidates, pelabresib (CPI-0610) and CPI-0209 and bolster its position in hematology-oncology and expand into solid tumors. In order to fund this acquisition, MorphoSys entered into a strategic funding partnership with Royalty Pharma. |

| · | On June 4-8, 2021, MorphoSys presented new three-year follow-up data from the ongoing Phase 2 L-MIND study of tafasitamab (Monjuvi®) in combination with lenalidomide in adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) at the 2021 American Society of Clinical Oncology (ASCO) Annual Meeting. |

| · | On June 16, 2021, MorphoSys announced it had filed a tender offer, including an offer to purchase and the terms of the tender offer, with the U.S. Securities and Exchange Commission to purchase all outstanding shares of Constellation Pharmaceuticals, Inc. |

| · | On June 25, 2021, MorphoSys and Incyte announced that the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) issued a positive opinion recommending the conditional marketing authorization for tafasitamab in combination with lenalidomide, followed by tafasitamab monotherapy, for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplantation (ASCT). |

Financial Results for the First Half-Year of 2021

| · | Group revenues in the first half-year of 2021 reached € 85.4 million (H1 2020: € 269.7 million), and operating expenses amounted to € 171.2 million (H1 2020: € 118.2 million). |

| · | Cash and investments as of June 30, 2021 totaled € 1,129.2 million (December 31, 2020: € 1,244.0 million). |

| · | MorphoSys updated its financial guidance for the 2021 financial year on July 26, 2021. Group revenues changed from a range of € 150 million to € 200 million to a range of € 155 million to € 180 million. Group operating expenses, which are comprised of research and development, selling as well as general and administrative expenses, are expected to be in the range of € 435 million to € 465 million (previously € 355 million to € 385 million), which include operating expenses for Constellation Pharmaceuticals starting July 15, 2021. The revised Group operating expenses range also include one-time transaction related costs of € 36 million related to the agreements with Constellation Pharmaceuticals and Royalty Pharma. Research and Development expenses are anticipated to comprise between 52% to 57% of Group operating expenses (previously 45% to 50%), excluding the one-time transaction costs. |

| MorphoSys – II/2021 |

Table of Contents

| 4 | Group Interim Statement |

Corporate Developments

| · | The MorphoSys AG Annual General Meeting on May 19, 2021, re-elected Dr. Marc Cluzel, Sharon Curran and Krisja Vermeylen to the Company’s Supervisory Board. Due to the ongoing restrictions related to the COVID-19 pandemic, the 2021 Annual General Meeting was also held as a virtual meeting without the physical presence of shareholders or their proxies, as in the prior year, and was available to registered shareholders as a live broadcast on the Internet. |

Significant Events After the End of the Second Quarter of 2021

| · | For the detailed effects and events in connection with the Constellation Pharmaceuticals acquisition, please refer to section 13 of the notes to this half-year report. |

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 5 |

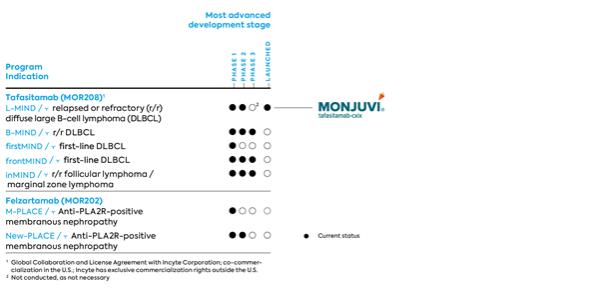

Our Clinical Pipeline as of June 30, 2021

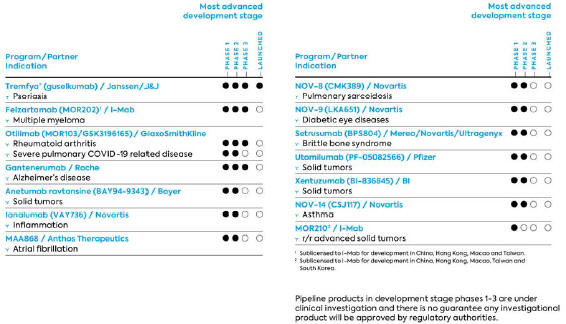

Clinical Programs Developed by Partners (Selection)

| MorphoSys – II/2021 |

Table of Contents

| 6 | Group Interim Statement |

Interim Group Management Report:

January 1 – June 30, 2021

Operating Business Performance

Acquisition of Constellation Pharmaceuticals

MorphoSys announced on June 2, 2021, its plans to acquire Constellation Pharmaceuticals, Inc. (“Constellation”) for US$ 34.00 per share in cash, which represents a total equity value of US$ 1.7 billion. The transaction was unanimously approved by the Management Board and Supervisory Board of MorphoSys as well as by the Board of Directors of Constellation. The acquisition closed on July 15, 2021.

Constellation is a clinical-stage biopharmaceutical company using its expertise in epigenetics to discover and develop novel therapeutics that address serious unmet medical needs in patients with various forms of cancer. Constellation’s two lead product candidates, pelabresib (CPI-0610), a BET inhibitor, and CPI-0209, a second-generation EZH2 inhibitor, are in late- and mid-stage clinical trials respectively and have broad therapeutic potential to offer meaningful benefits to patients with various hematological and solid tumors. Pelabresib has the potential to be a first- and best-in-class BET inhibitor and is currently in a Phase 3 clinical trial for myelofibrosis, a bone marrow cancer that disrupts the body’s normal production of blood cells. The EZH2 inhibitor CPI-0209 is currently in Phase 2 with best-in-class potential for treating hematological and solid tumors. Constellation’s pipeline also includes numerous preclinical compounds.

MorphoSys also announced that it has entered into a long-term strategic funding partnership with Royalty Pharma (Royalty Pharma plc and its subsidiaries) in conjunction with the Constellation transaction. The terms of the agreement between MorphoSys and Royalty Pharma provide for the following, under certain conditions and upon closing of the transaction with Constellation:

| · | US$ 1.425 billion upfront payment: Royalty Pharma will make a US$ 1.425 billion upfront payment to MorphoSys, supporting its growth strategy. The proceeds will be used to support the financing of the Constellation transaction and development of the combined company’s pipeline. |

| · | US$ 350 million development funding bonds: Royalty Pharma USA Inc. will provide MorphoSys with access to up to US$ 350 million in Development Funding Bonds with the flexibility to draw over a one-year period. |

| · | Milestone payments: Royalty Pharma will make additional payments of up to US$ 150 million to MorphoSys upon reaching clinical, regulatory and commercial milestones for otilimab, gantenerumab and pelabresib. |

| · | Royalties and milestones: Royalty Pharma will have the rights to receive 100% of MorphoSys’ royalties on net sales of Tremfya®, 80% of future royalties and 100% of future milestone payments on otilimab, 60% of future royalties on gantenerumab, and 3% on future net sales of Constellation’s clinical stage assets (pelabresib and CPI-0209). |

| · | Equity investment: After completion of the transaction and subject to the required approvals of the management board (Vorstand) and the supervisory board (Aufsichtsrat) of MorphoSys, Royalty Pharma is expected to invest US$ 100 million in a cash capital increase of MorphoSys under an authorization to exclude subscription rights of existing shareholders. The new MorphoSys shares will be listed on the Frankfurt Stock Exchange. |

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 7 |

An Integration Project Team headed by Barbara Krebs-Pohl, PhD, as Chief Integration Officer has started work and will organize and support the integration of Constellation. Constellation will continue to operate as an independent subsidiary of MorphoSys until further notice, and MorphoSys expects the following benefits from the acquisition:

| · | Accelerates growth strategy with exciting mid- to late-stage product candidates: The transaction accelerates MorphoSys’ strategy to grow through proprietary drug development and commercialization. Constellation’s lead product candidates, pelabresib and CPI-0209, have broad potential, with expected approvals across a range of oncology indications in the coming years. Constellation’s lead compounds fit well with MorphoSys’ proven clinical development, regulatory and commercial capabilities, and MorphoSys is well positioned to rapidly advance and unlock the potential of the Constellation portfolio. |

| · | Bolsters position in hematology-oncology and expands into solid tumors: Constellation adds an attractive, complementary pipeline of highly innovative early to late-stage cancer therapy candidates, augmenting MorphoSys’ existing pipeline in hematologic malignances and expanding into potential therapies for solid tumors. |

| · | Strengthens cutting-edge research and development organization: The transaction leverages MorphoSys’ expertise in biologics and Constellation’s expertise in epigenetics and small molecule discovery platforms to develop a broad range of oncology therapies. Constellation adds exciting, pioneering science and attractive preclinical compounds targeting epigenetic regulators. Together, MorphoSys’ and Constellation’s highly talented research and development teams will strengthen earlier stage and emerging science to bring exciting new cancer therapies to patients. |

| · | Anchored by strategic funding partnership: Royalty Pharma’s strategic funding partnership will fuel the expansion of the combined company’s capabilities to help accelerate the development, approval and commercial reach of breakthrough cancer treatments. This long-term commitment will help deliver significant value to all stakeholders. |

Consummation of the tender offer was subject to various conditions including a minimum tender of at least a majority of outstanding Constellation shares, the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and the receipt of any approvals or clearances required to be obtained under the applicable antitrust laws, and other customary conditions. The full transaction was completed on July 15, 2021.

| MorphoSys – II/2021 |

Table of Contents

| 8 | Group Interim Statement |

Development of Tafasitamab

MorphoSys’ commercial activities are currently focused on Monjuvi® (tafasitamab-cxix) in the United States. Tafasitamab is a humanized monoclonal antibody directed against the CD19 antigen. CD19 is selectively expressed on the surface of B-cells, a group of white blood cells. CD19 enhances B-cell receptor signaling, which is an important factor in B-cell survival and growth, making CD19 a potential target structure for the treatment of B-cell malignancies.

On July 31, 2020, Monjuvi® in combination with lenalidomide received accelerated FDA approval for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, and who are not eligible for autologous stem cell transplantation (ASCT). MorphoSys co-commercializes Monjuvi® with partner Incyte in the United States.

Commercial Performance of Tafasitamab

During the first half of 2021, Monjuvi® demonstrated sequential sales growth in the second quarter despite continued COVID-19 headwinds – driven by underlying double-digit demand growth as shown in vials and momentum exiting June. The company, along with partner Incyte, has in aggregate received orders from more than 700 treatment sites. Outpatient share in the community setting continues to show strong traction and now accounts for 70% of customers.

Overall, commercial performance in the first half of the year continued to be adversely impacted by COVID-19. As vaccination rates have increased there has been a gradual easing of restrictions at sites of care. This has allowed sales teams to engage in more face-to-face meetings with physicians and contributed to the positive momentum we observed in June. Many larger facilities, however, are opening at a slower pace than community health centers. As of April 1, 2021, Monjuvi® was granted a J-code, which will further simplify reimbursement for some treatment centers.

Regulatory Progress of Tafasitamab

On January 5, 2021, MorphoSys and Incyte announced that the Swiss Agency for Therapeutic Products (Swissmedic) had accepted the marketing authorization application (MAA) for tafasitamab and on January 12, 2021, MorphoSys and Incyte announced that Health Canada had accepted the New Drug Submission (NDS) for tafasitamab. Both applications are based on data from the L-MIND study of tafasitamab in combination with lenalidomide for the treatment of patients with relapsed or refractory DLBCL and data from the RE-MIND study, a retrospective observational study of relapsed or refractory DLBCL. Both applications seek approval for tafasitamab, in combination with lenalidomide, followed by tafasitamab monotherapy, for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL), including DLBCL arising from low grade lymphoma, who are not eligible for, or refuse, autologous stem cell transplantation (ASCT). Incyte has exclusive marketing rights for tafasitamab outside the U.S. and if approved, Incyte will receive marketing approval in Switzerland and Canada.

On May 20, 2020, MorphoSys and Incyte announced the validation of the European Marketing Authorization Application (MAA) for tafasitamab in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT). As in the U.S., the marketing authorization application submitted by MorphoSys was based on data from the L MIND study and supported by RE-MIND.

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 9 |

On June 25, 2021, MorphoSys and Incyte announced that the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) issued a positive opinion recommending the conditional marketing authorization for tafasitamab in combination with lenalidomide, followed by tafasitamab monotherapy, for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplantation (ASCT). The CHMP opinion to recommend the use of tafasitamab is now being reviewed by the European Commission, which has the authority to grant marketing authorization for medicinal products in the European Union (EU). If approved, tafasitamab would be commercialized in the EU under the brand name Minjuvi®. Incyte has exclusive marketing rights for tafasitamab outside the U.S., and if approved, Incyte will receive the marketing authorization in Europe.

Research and Development

The acquisition of Constellation Pharmaceuticals is anticipated to accelerate the growth of the MorphoSys pipeline with the addition of two compounds in mid- to late-stage clinical development. Pelabresib (CPI-0610) and CPI-0209 will strengthen MorphoSys’ position in hematology-oncology and enable it to expand into potential therapies for solid tumors. Constellation’s research and development capabilities are complementary to MorphoSys’ own capabilities and set the stage for the development of new cancer therapies for patients.

MorphoSys’ research and development activities are currently focused on the following clinical candidates:

| · | Tafasitamab (MOR208, formerly XmAb5574) is a humanized monoclonal antibody directed against the CD19 antigen. CD19 is selectively expressed on the surface of B-cells, which belong to a group of white blood cells. CD19 enhances B-cell receptor signaling, which is an important factor in B-cell survival and growth. CD19 is a potential target structure for the treatment of B-cell malignancies. |

| · | Felzartamab (MOR202/TJ202) is a recombinant human monoclonal HuCAL-IgG1-antibody directed against a unique epitope of the target molecule CD38. CD38 is a surface antigen broadly expressed on malignant myeloma cells as well as on antibody-producing plasmablasts and plasma cells, the latter playing an important role in the pathogenesis of antibody-mediated autoimmune diseases. |

| · | Pelabresib (CPI-0610) is a BET inhibitor with an epigenetic mechanism of action to address serious unmet medical needs in patients with various forms of cancer. |

| · | CPI-0209 is a second-generation EZH2 inhibitor with an epigenetic mechanism of action that has been designed to achieve comprehensive target coverage through extended on-target residence time. The compound has demonstrated more potent anti-tumor activity compared with first-generation EZH2 inhibitors in preclinical models of multiple cancer types. It does not induce its own metabolism, which has been an issue with other EZH2 inhibitors. |

In addition to MorphoSys’ own pipeline, the following programs, among others, are being further developed by our partners:

| · | Otilimab (formerly MOR103/GSK3196165) is a fully human HuCAL-IgG1-antibody directed against granulocyte-monocyte colony-stimulating factor (GM-CSF). Due to its diverse functions in the immune system, GM-CSF can be considered a target for a broad range of anti-inflammatory therapies such as rheumatoid arthritis (RA). Otilimab was fully out-licensed to GlaxoSmithKline (GSK) in 2013. As part of the Constellation financing agreement, Royalty Pharma will receive 80% of future royalties and 100% of future milestone payments on Otilimab. |

| · | MOR202/TJ202 (see above) is also being further developed by I-Mab Biopharma for China, Taiwan, Hong Kong and Macau where, if approved, it may also be commercialized. |

| MorphoSys – II/2021 |

Table of Contents

| 10 | Group Interim Statement |

| · | MOR210 is a human antibody directed against C5aR, derived from MorphoSys’ HuCAL library. C5aR, the receptor of complement factor C5a, is being investigated as a potential new drug target in the fields of immuno-oncology and autoimmune diseases. In November 2018, MOR210/TJ210 was out-licensed to I-Mab for China and certain other countries in Asia. |

| · | Gantenerumab, an antibody targeting amyloid-beta, is being developed by MorphoSys’ partner Roche as a potential treatment for Alzheimer’s disease. As part of the Constellation financing agreement, Royalty Pharma will receive 60% of future royalties on Gantenerumab. |

| · | In addition to the programs listed above, MorphoSys and its partners are pursuing several programs in various stages of research and clinical development. |

Proprietary Clinical Development

Studies of Tafasitamab

The clinical development of tafasitamab is focused on non-Hodgkin’s lymphoma (NHL). In DLBCL, MorphoSys is aiming at positioning tafasitamab as a backbone therapy for all patients suffering from DLBCL, regardless of treatment line or potential combination therapy. Both the L-MIND and B-MIND studies concentrate on those patients with r/r DLBCL who are not candidates for high-dose chemotherapy (HDC) and ASCT. Treatment options for this group of patients were limited prior to the U.S. approval of tafasitamab. Additionally, the firstMIND study, included patients with newly diagnosed DLBCL and paved the way for the frontMIND study, a pivotal phase 3 trial in first-line patients, which began in May 2021.

In June 2021, MorphoSys and Incyte announced new three-year follow-up data from the ongoing Phase 2 L-MIND study of tafasitamab (Monjuvi®) in combination with lenalidomide in adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL). The new results - based on an October 30, 2020 data cut-off - build on previous findings showing durable responses and a consistent safety profile of tafasitamab in combination with lenalidomide followed by tafasitamab monotherapy. A total of 80 out of 81 enrolled study patients receiving tafasitamab plus lenalidomide were included in the efficacy analysis at approximately three years follow-up (³35 months). The long-term analysis, as assessed by an independent review committee (IRC), showed that patients treated with tafasitamab plus lenalidomide had an overall response rate (ORR) of 57.5%, including a complete response (CR) rate of 40%. Additionally, the median duration of response (DoR) was 43.9 months, with a median overall survival (OS) of 33.5 months and median progression free survival (PFS) of 11.6 months.

The phase 2/3 study, B-MIND, initiated in September 2016, is evaluating the safety and efficacy of administering tafasitamab in combination with the chemotherapeutic agent bendamustine in comparison to administering the anticancer drug rituximab plus bendamustine in patients with r/r DLBCL who are not candidates for high-dose chemotherapy and autologous stem cell transplantation. The study has been in the phase 3 part since mid-2017. MorphoSys expects top-line results from the study to be available in 2022.

In addition to the previously mentioned clinical development in r/r DLBCL, MorphoSys initiated a randomized phase 1b clinical trial in first-line therapy in patients with DLBCL (firstMIND) in late 2019. The study completed enrollment earlier than anticipated and is evaluating the safety (primary endpoint) and preliminary efficacy of tafasitamab or tafasitamab plus lenalidomide in combination with R-CHOP (the current standard of care) in patients with newly diagnosed DLBCL. This study paved the way for frontMIND, a pivotal phase 3 trial of tafasitamab in first-line DLBCL. The frontMIND study dosed the first patient on May 11, 2021 and plans to enroll up to 880 patients.

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 11 |

In addition to these combination studies in DLBCL, MorphoSys has been investigating tafasitamab in a phase 2 combination study in chronic lymphocytic leukemia (CLL) or small B-cell lymphoma (SLL) since December 2016. The COSMOS study, in particular, is evaluating the safety of tafasitamab in combination with the anticancer drugs idelalisib (Cohort A) or venetoclax (Cohort B). The study enrolled patients who either did not respond to or did not tolerate prior therapy with a Bruton tyrosine kinase inhibitor. Data from the primary analysis of both cohorts were presented at the ASH conference in Orlando in December 2019.

Incyte is responsible for the initiation of a combination study of its PI3K delta inhibitor parsaclisib with tafasitamab in relapsed or refractory B-cell malignancies (TopMIND) and to initiate a pivotal phase 3 study (inMIND) in patients with relapsed or refractory follicular lymphoma (r/r FL) as well as in patients with relapsed or refractory marginal zone follicular lymphoma (MZL). This global, randomized trial of approximately 600 patients has started in April 2021 and will compare the safety and efficacy of tafasitamab in combination with rituximab and lenalidomide to the safety and efficacy of rituximab in combination with lenalidomide.

In November 2020, MorphoSys and Incyte announced a clinical collaboration agreement with Xencor to evaluate the combination of tafasitamab, lenalidomide and plamotamab – a tumor-targeted bispecific antibody from Xencor, which has both a CD20-binding domain and a cytotoxic T-cell binding domain (CD3) – in patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL), first-line DLBCL and relapsed or refractory follicular lymphoma (FL). Under the agreement, the companies plan to initiate a phase 1/2 trial evaluating the combination of tafasitamab, plamotamab and lenalidomide in patients with relapsed or refractory DLBCL. The companies are also working on plans to evaluate this combination in relapsed or refractory FL and first-line DLBCL patients in multiple phase 1b trials. MorphoSys and Incyte will provide tafasitamab for the studies, which are sponsored and funded by Xencor and planned to be conducted in North America, Europe and the Asia-Pacific region.

Studies of Felzartamab

Felzartamab is currently being evaluated by MorphoSys in autoimmune diseases. In November 2017, MorphoSys entered into a regional license agreement with I-Mab for development in China, Hong Kong, Macau and Taiwan. I-Mab is currently pursuing development in multiple myeloma.

In October 2019, MorphoSys initiated a phase 1/2 trial for the treatment of anti-PLA2R-positive membranous nephropathy, an autoimmune disease affecting the kidneys. The proof-of-concept study, called M-PLACE, is an open-label, multi-center study and will primarily evaluate the safety and tolerability of felzartamab. Secondary endpoints include the effect of felzartamab on serum antibodies to PLA2R and evaluation of the immunogenicity and pharmacokinetics of felzartamab; an exploratory objective is to determine clinical efficacy. In November 2020, the safety run-in phase of the study ended and the further enrollment phase was opened. In February 2021, MorphoSys achieved the First Treated Patient milestone in the phase 2 New-PLACE study, which in coherence with M-PLACE, is designed to identify the optimal felzartamab dosing schedule for the treatment of patients with anti-PLA2R-positive membranous nephropathy.

The following ongoing Constellation Pharmaceuticals’ clinical studies, will presumably continue after the acquisition was completed on July 15, 2021:

Studies of Pelabresib

Pelabresib is in two clinical trials for the treatment of myelofibrosis (MF), a bone marrow cancer that disrupts the normal production of blood cells in the body.

| MorphoSys – II/2021 |

Table of Contents

| 12 | Group Interim Statement |

MANIFEST, a global, multi-center, open-label phase 2 study in patients with myelofibrosis is testing pelabresib:

| · | as monotherapy in MF patients who are refractory to or intolerant of, and are no longer on, ruxolitinib (Arm 1); |

| · | as add-on to ruxolitinib in MF patients who have had a suboptimal response to ruxolitinib or have experienced disease progression (Arm 2); |

| · | in combination with ruxolitinib in MF patients who are JAK-inhibitor-naïve (Arm 3); |

| · | as monotherapy in patients with high-risk essential thrombocythemia who are intolerant of, or refractory to, hydroxyurea (Arm 4)). |

MANIFEST-2, a global, double-blind, randomized Phase 3 clinical study is evaluating pelabresib in combination with ruxolitinib versus placebo plus ruxolitinib in JAK-inhibitor-naïve patients with primary myelofibrosis or post-ET or post-PV myelofibrosis who have splenomegaly and symptoms requiring therapy.

Study of CPI-0209

Patient enrollment in a Phase 1/2 clinical trial of CPI-0209 is ongoing and patients are dosed in the Phase 1 dose escalation portion of the trial. The phase 1 portion of the trial is evaluating CPI-0209 as a monotherapy in patients with advanced solid tumors. After determining the recommended phase 2 dose for CPI-0209, which is expected in 2021, it is intended to pursue expansion arms in selected tumor indications as well as combination therapy development.

Clinical Development Through Partners

Studies of Otilimab

Otilimab (MOR103/GSK3196165), a fully human HuCAL IgG1 antibody directed against GM-CSF, was fully out-licensed to GSK in 2013. In mid-2019, GSK announced the initiation of a phase 3 program in rheumatoid arthritis (RA) called ContRAst. The program includes three pivotal studies and a long-term extension study and is evaluating the antibody in patients with moderate to severe RA. GSK also initiated a clinical trial (OSCAR) in 2020 to evaluate the efficacy and safety of otilimab in patients with severe pulmonary COVID 19-associated disease. GSK reported preliminary results of the OSCAR trial in February 2021. As these data suggest important clinical benefit in a predefined subgroup of high-risk patients and an urgent unmet medical need, GSK has amended the OSCAR study to expand this cohort and confirm these potentially significant findings. The dosing of the first patient in the expanded study triggered milestone payments to MorphoSys totaling € 16 million.

Studies of Gantenerumab

In June 2018, Roche initiated a new phase 3 development program for patients with Alzheimer’s disease. The program consists of two phase 3 trials – GRADUATE 1 and GRADUATE 2 – which are expected to enroll more than 2,000 patients in up to 350 study centers in more than 30 countries worldwide. The two multi-center, randomized, doubleblinded, placebo-controlled studies are investigating the efficacy and safety of gantenerumab in patients with early (prodromal to mild) Alzheimer’s disease. The primary endpoint for both studies is the assessment of the signs and symptoms of dementia, measured as the clinical dementia rating sum of boxes (CDR-SOB) score. Both studies have an estimated primary completion date in 2022. Patients receive a significantly higher dose of gantenerumab than in Roche’s previous trials as a subcutaneous injection.

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 13 |

Studies of Felzartamab (MOR202/TJ202)

In November of 2017, MorphoSys and I-Mab signed a regional license agreement for the development and commercialization of MOR202/TJ202 in China, Hong Kong, Taiwan and Macau. Under this agreement, I-Mab received exclusive rights in the agreed regions.

On April 27, 2020, MorphoSys and I-Mab announced the dosing of the first patient in a phase 3 clinical study in mainland China to evaluate MOR202/TJ202 in combination with lenalidomide plus dexamethasone in patients with relapsed or refractory multiple myeloma (r/r MM). The study (NCT03952091) is a randomized, open-label, controlled, multi-center study to evaluate the efficacy and safety of the combination of felzartamab, lenalidomide and dexamethasone versus the combination of lenalidomide and dexamethasone in patients with r/r MM who have received at least one prior line of treatment. This multi-center study was previously initiated in April 2019 at study sites in Taiwan and has now officially started in mainland China as part of a coordinated effort to accelerate the study. I-Mab is also evaluating felzartamab as a third-line therapy in patients with r/r MM in a phase 2 trial that began in March 2019. Both studies are considered pivotal in the region.

On June 25, 2021, I-Mab announced that the Center for Drug Evaluation (CDE) of the China National Medical Products Administration (NMPA) had approved the Investigational New Drug (IND) application to initiate a phase 1b study with felzartamab, a CD38 antibody, in patients with systemic lupus erythematosus (SLE). This new phase 1b study with felzartamab is a multi-center study to evaluate safety, tolerability, pharmacokinetics (PK) and pharmacodynamics (PD) in patients with SLE in China.

Study of MOR210/TJ210

In November 2018, MorphoSys announced that it had entered into an exclusive strategic collaboration and regional license agreement with I-Mab for exclusive rights to develop and commercialize MOR210/TJ210 in China, Hong Kong, Macau, Taiwan and South Korea.

On January 25, 2021, MorphoSys and I-Mab announced the dosing of the first patient in the United States in a phase 1 dose-finding study evaluating the safety, tolerability, pharmacokinetics (PK) and pharmacodynamics (PD) of MOR210/TJ210 as monotherapy in patients with relapsed or refractory advanced solid tumors. The phase 1 clinical trial is an open-label, multiple dose-group, dose-finding study in multiple centers across the U.S.

The acquisition of Constellation accelerates the growth strategy and expands the pipeline in hematology-oncology as outlined in the 2020 Annual Report starting on page 53. Future group management will be adjusted to reflect operations of the combined companies.

The MorphoSys AG Annual General Meeting on May 19, 2021, re-elected Dr. Marc Cluzel, Sharon Curran and Krisja Vermeylen to the Company’s Supervisory Board. Due to the ongoing restrictions related to the COVID-19 pandemic, the 2021 Annual General Meeting, as in the prior year, was also held as a virtual meeting without the physical presence of shareholders or their proxies and was available to registered shareholders as a live visual and audio broadcast on the Internet.

| MorphoSys – II/2021 |

Table of Contents

| 14 | Group Interim Statement |

For the detailed effects and events in connection with the Constellation Pharmaceuticals acquisition, please refer to section 13 of the notes to this half-year report.

General Business and Market Environment

Economic Trends

The International Monetary Fund (IMF) sees an end to the corona crisis from an economic perspective for industrialized countries. Thanks to vaccinations and stimulus packages, the global economy is projected to grow by 6% this year; 0.5 percentage points higher than assumed in January 2021. Growth in 2021 will be driven primarily by a strong recovery in the U.S., the world’s largest economy. The IMF is forecasting growth in economic output in the current year of 3.6% in Germany, and by as much as 4.4% in the eurozone. The IMF raised and updated its annual forecast for the U.S. in July to 7.0%.

Stock markets worldwide began 2021 on a note of optimism. At the end of the first half-year, the German DAX index closed 13.1% higher, followed by the MDAX index for medium-sized companies with an increase of 10.0%, and the TecDAX technology index of +9.8%. Biotech stocks benefitted as well from the gradual approval and application of vaccines against the SARS-CoV 2 virus, as demonstrated, for example, by the performance of the Nasdaq Biotech Index, which closed higher by 8.8% after the first half-year.

Sector Developments

In the first half of 2021, numerous medical conferences were held where several companies in the sector presented their research results. As a result of the travel and meeting restrictions due to the COVID-19 pandemic, these conferences were held exclusively virtually. Among other events, the world’s largest oncology conference, the American Society of Clinical Oncology (ASCO) Annual Meeting, was held on June 4-8, 2021 as a virtual conference, as was the leading European conference in the field of hematology, the Annual Meeting of the European Hematology Association (EHA), which was held on June 9-17, 2021. On June 18-22, the 16th International Conference on Malignant Lymphoma (ICML) also took place virtually. MorphoSys presented clinical results of tafasitamab at all three medical conferences. MorphoSys also participated in five investor conferences in May and June of 2021.

The shares of MorphoSys AG were not able to benefit from the economic upturn described above. After starting the 2021 trading year at € 94.02, the shares temporarily rose above € 100 at the end of January. In the following months, the share price fell and reached its low of € 63.02 on June 2, 2021, when the acquisition of Constellation Pharmaceuticals was announced. The shares closed the first half of 2021 on June 30 at € 65.42.

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 15 |

In the first six months of 2021, MorphoSys continued to consolidate and expand the patent protection of its development programs and growing technology portfolio, and thereby the Company’s key value drivers.

Currently, the Company has approximately 70 different proprietary patent families worldwide, in addition to the numerous patent families it is pursuing in collaboration with its partners.

On June 30, 2021, the MorphoSys Group had 607 employees (December 31, 2020: 615). In the first six months of 2021, the MorphoSys Group employed an average of 608 people (H1 2020: 518).

| MorphoSys – II/2021 |

Table of Contents

| 16 | Group Interim Statement |

By virtue of MorphoSys’ business model, the COVID-19 pandemic has had limited impact on MorphoSys’ net assets and financial position in the first six months of 2021. The COVID-19 pandemic, however, has had a negative impact on the results of operations in the first six months of 2021, specifically on lower than expected sales of Monjuvi®. In addition, the adherence to the time schedule of the clinical studies was associated with higher expenses. There have been no material asset impairments that have been recognized in connection with COVID-19.

MorphoSys reports the key financial figures – revenues, operating expenses and percentage of research and development expenses included therein – relevant for internal management purposes in interim statements. Their presentation is supplemented accordingly if other areas of the income statement or balance sheet during the quarter are affected by material business transactions.

As of the first quarter of 2021, the previous segment information “Proprietary Development” and “Partnered Discovery” is no longer presented as part of the reporting. For further information, please refer to Note 1.

Revenues

Group revenues in the first half-year amounted to € 85.4 million (H1 2020: € 269.7 million). The lower revenues were primarily a result of the collaboration and license agreement concluded with Incyte in 2020. A total of € 27.8 million (H1 2020: € 0 million) of the Group’s revenues were from the recognition of Monjuvi® product sales in the U.S.

Success-based payments including royalties accounted for 50% or € 43.1 million (H1 2020: 9% or € 23.1 million) of total revenues. On a regional basis, MorphoSys generated 76% or € 65.0 million of its commercial revenues from product sales and with biotechnology and pharmaceutical companies or non-profit entities in North America and 24% or € 20.4 million with partners primarily located in Europe and Asia. In the same period of the previous year, these percentages were 99% and 1%, respectively. 62% of total Group revenues were generated with customers Janssen, GSK and Incyte (H1 2020: 99% with Incyte, Janssen and I-Mab).

Cost of Sales

Cost of sales in the first six months of 2021 amounted to € 15.2 million (H1 2020: € –4.0 million) and consisted primarily of expenses related to the provision of services in the course of transferring projects to customers and to the acquisition and production costs of inventories recognized as an expense, mainly for Monjuvi®. In 2020, the impairment to net realizable value of zero on the antibody material (tafasitamab) derived from fermenter runs recognized in prior periods was reversed due to the market approval of tafasitamab. This could now be utilized for commercialization and therefore represented inventory and resulted in income. This impairment reversal was recognized in cost of sales and overcompensated for the expenses incurred in the first six months of financial year 2020, which is why cost of sales showed an income in total.

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 17 |

Operating Expenses

Research and Development Expenses

Research and development expenses amounted to € 73.8 million in the first six months of 2021 (H1 2020: € 52.4 million). Expenses in this area consisted primarily of expenses for external laboratory services of € 36.9 million (H1 2020: € 13.1million), personnel expenses of € 22.7 million (H1 2020: € 14.4 million) and expenses for amortization of intangible assets of € 2.9 million (H1 2020 € 16.2 million). The increase in research and development expenses relate mainly to the commencement of different clinical trials for tafasitamab and felzartamab. In 2020, expenses for intangible assets included a total of € 13.7 million in impairment losses related to the in-process R&D program MOR107 and to a license.

Selling Expenses

Selling expenses amounted to € 56.6 million in the first six months of 2021 (H1 2020: € 42.1 million). This item was comprised mainly of personnel expenses of € 31.2 million (H1 2020: € 20.6 million) and expenses for external services of € 23.0 million (H1 2020: € 19.8 million). Selling expenses also included all expenses for services provided by Incyte as part of the joint U.S. sales activities for Monjuvi®. Selling expenses in the first six months of 2020 included preparatory activities and thus monthly increasing expenses of both companies for the commercialization of Monjuvi®, the sales launch of which started with the market approval at the end of July 2020, which is why expenses were lower than in the first six months of 2021.

General and Administrative Expenses

Compared to the same prior-year period, general and administrative expenses increased to € 40.8 million (H1 2020: € 23.9 million). This item mainly included expenses for external services of € 22.8 million (H1 2020: € 6.4 million) and personnel expenses of € 13.7 million (H1 2020: € 14.4 million). The expenses for external services in 2021 include transaction costs in connection with the acquisition of Constellation and the closing of the related agreements with Royalty Pharma in the amount of € 18.8 million.

Other Income/Finance Income/Finance Expenses

Other income amounted to € 2.8 million in the first six months of 2021 (H1 2020: € 10.0 million) and resulted primarily from exchange rate gains from operations of € 2.7 million (H1 2020: € 9.7 million).

Finance income amounted to € 116.3 million in the first six months of 2021 (H1 2020: € 28.1 million) and resulted in a total of € 108.3 million (H1 2020: € 22.3 million) from the net effects of the measurement of financial assets and liabilities from collaborations. This included effects from the differences between actual figures and planning assumptions, currency translation of the financial assets and fair value measurement of the financial assets. Also included is finance income from the investment of cash and investments and related foreign currency translation gains of € 8.0 million (H1 2020: € 5.8 million).

| MorphoSys – II/2021 |

Table of Contents

| 18 | Group Interim Statement |

Finance expenses amounted to € 36.8 million in the first six months of 2021 (H1 2020: € 34.4 million) and resulted mainly from the effect of financial liabilities from collaborations in the amount of € 27.5 million (H1 2020: € 17.6 million) and, specifically from the application of the effective interest method and foreign currency valuation. Also included are finance expenses from the investment of cash and investments and related foreign currency translation losses of € 2.7 million (H1 2020: € 9.0 million). Furthermore, interest expenses were recognized in the amount of € 5.9 million from the convertible bond (H1 2020: € 0 million).

Income Taxes

The Group recognized total tax benefits of € 1.0 million in the first six months of 2021 (H1 2020: € 23.3 million). This amount consisted mainly of deferred tax expenses of € 13.5 million (H1 2020: deferred tax benefit € 132.1 million) on temporary differences and of € 14.7 million (H1 2020: € 0 million) relating to the recognition of deferred taxes on current period losses. Deferred taxes on temporary differences and loss carryforwards were capitalized in full due to the positive medium- to long-term business expectations for MorphoSys AG and MorphoSys US Inc. This assessment has not changed after the completion of the Constellation acquisition and the strategic financing partnership with Royalty Pharma.

Financial Position

Cash and Investments

On June 30, 2021, the Company had cash and investments, previously referred to as liquidity, of € 1,129.2 million, compared with € 1,244.0 million at December 31, 2020. The decrease in cash and investments resulted mainly from the use of cash for operating activities in the first six months of 2021.

Cash and investments are the sum of the balance sheet items “Cash and cash equivalents,” “Financial assets at fair value through profit or loss,” and current and non-current “Other financial assets at amortized cost.”

Balance Sheet

Assets

Total assets on June 30, 2021 amounted to € 1,577.4 million, a decrease of € 82.1 million compared to December 31, 2020 (€ 1,659.5 million).

The increase in current assets resulted mainly from the increase in the balance sheet item “Cash and Cash Equivalents” by € 187.5 million and from the increase in the item “Other financial assets at amortized cost” by € 73.5 million, mainly due to a shift in the composition of the investments. Furthermore, “Accounts Receivable” increased by € 13.8 million and “Prepaid Expenses and Other Current Assets” by € 17.2 million. This increase was partially offset by a decrease in the item “Financial Assets at Fair Value through Profit or Loss” in the amount of € 234.7 million.

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 19 |

In comparison to December 31, 2020, non-current assets decreased by € 131.2 million to € 321.5 million, mainly due to the decrease in the balance sheet item “Other financial assets at amortized cost, net of current portion” by € 141.2 million as a result of a shift in the composition of the investments. This decrease was partially offset by an increase in the item “In-process R&D Programs” of € 10.4 million.

Liabilities

Current liabilities increased from € 200.5 million as of December 31, 2020 to € 204.6 million as of June 30, 2021, mainly as a result of a € 6.1 million increase in the item “Accounts payable and accruals”. This increase was partly offset by a decrease of € 1.8 million in the balance sheet item “Current portion of contract liabilities”.

Non-current liabilities decreased by € 66.3 million compared to December 31, 2020, mainly due to the decrease of the item “Financial liabilities from collaborations” in the amount of € 70.5 million due to adjustments in planning assumptions. This was partially offset by the increase of the item “Convertible Bond, Net of Current Portion” by € 4.9 million.

Stockholder’s Equity

As of June 30, 2021, the Company’s common stock including treasury shares amounted to € 32,892,540 (December 31, 2020: € 32,890,046). Common stock increased by € 2,494 and 2,494 shares, as a result of the exercise of 2,494 stock options granted to the Management Board and certain employees of the Company (beneficiaries) under the 2017 Stock Option Plan (SOP Plan). The vesting period for this stock option plan expired on April 1, 2021 and offers beneficiaries a three-year period until March 31, 2024 to receive a total of 79,935 shares. The exercise price amounted to € 55.52.

As of June 30, 2021, the value of treasury shares decreased from € 4,868,744 on December 31, 2020 to € 3,783,044. The reason for this decrease was the transfer of 27,786 treasury shares from the 2017 performance-based Long-Term Incentive Plan (LTI Plan) in the amount of € 1,026,971 to the Management Board and certain employees of the Company (beneficiaries). The vesting period for this LTI Plan expired on April 1, 2021 and offers beneficiaries a six-month period until October 13, 2021 to receive a total of 45,891 shares. In addition, 1,589 treasury shares in the amount of € 58,729 from the 2019 Long-Term Incentive Plan were transferred to certain employees of MorphoSys US Inc. As a result, the number of MorphoSys shares held by the Company as of June 30, 2021, amounted to 102,039 shares (December 31, 2020: 131,414 shares).

As of June 30, 2021, additional paid-in capital amounted to € 749,283,869 (December 31, 2020: € 748,978,506). The increase totaling € 305,363 was largely a result of the allocation of personnel expenses from share-based payments in the amount of € 1,276,490 and the exercise of stock options in the amount of € 114,573 net of transaction costs of € 21,400. Part of the increase was offset by a decline that resulted from the reclassification of treasury shares related to share allocations from the 2017 Long-Term Incentive Plan in the amount of € 1,026,971 as well as from the allocation of treasury shares from the 2019 LTI Plan of MorphoSys US Inc. to selected employees of MorphoSys US Inc. in the amount of € 58,729.

| MorphoSys – II/2021 |

Table of Contents

| 20 | Group Interim Statement |

Risks and Opportunities

Through the acquisition of Constellation on July 15, 2021 and the related strategic financing partnership with Royalty Pharma, the risks and opportunities profile of MorphoSys Group changes compared to the situation described on pages 92-101 of the Annual Report 2020. The MorphoSys Group generally conducts a “risk run” twice a year, during which risks and opportunities are identified, updated and evaluated according to the defined internal processes, and appropriate countermeasures are discussed and, if necessary, initiated at the Management Board and Supervisory Board level. The effects of the transactions described are fully taken into account in the “risk run” of the second half of the year. The risks presented below therefore only address the material risks and opportunities in connection with the above transactions that were identified by the Management Board.

A detailed report on the risk and opportunity profile of MorphoSys Group, taking into account the Constellation acquisition, will therefore be provided in the Annual Report 2021.

A moderate operational risk is to ensure the progress of the development plan of Constellation’s compounds in an advanced study phase. Constellation employees have specific program knowledge as it pertains to clinical development, clinical data analysis, and other areas. In order to minimize any continuity risks, employees in key positions in the area of clinical development at Constellation were offered appropriate incentives to continue their employment.

In addition, a short-term moderate organizational risk has been identified which relates to the operational integration of Constellation into the MorphoSys Group. If MorphoSys does not succeed in integrating the acquired company into the Group structures and processes within a reasonable period of time, there is a risk that synergy potentials cannot be achieved as planned. As a risk-reducing measure, a project team consisting of experienced employees from Constellation and MorphoSys from different functions and departments has been set up to work on key aspects of the integration in different working groups.

The strategic financing partnership with Royalty Pharma provides MorphoSys with access to capital to finance the Constellation acquisition and also enhances future liquidity for research and development activities through milestone payments or access to a development funding bond.

Due to the high expected clinical development expenses and the associated liquidity requirements for the key development programs of the Constellation as well as MorphoSys compounds, a corresponding comprehensive liquidity planning was prepared, in which, among other things, the effects of different scenarios were simulated. As a measure to reduce the low financing risk, the findings of the liquidity planning are taken into account by the Management Board when prioritizing research and development projects and determining the financing requirements and the thereof resulting concrete financing activities.

In addition to the aforementioned risks, the expansion of the clinical development pipeline and possible synergies in the area of research and development as well as general administrative expenses offer potential opportunities to increase the value of the company.

The accounting treatment of the payment received by MorphoSys AG from Royalty Pharma in the third quarter of 2021 under German tax law could be challenged by the tax authorities in the context of a future tax audit which would be considered routine given the size of the payment. Based on the Company’s knowledge of the German tax law which is further informed by experts in German tax law, the Company believes it is very probable that there will not be a different tax assessment. In the event of a different tax assessment, significant effects in the form of additional tax interest payments as well as an advance of the cash outflow from income taxes would have to be expected.

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 21 |

By letter dated June 10, 2021, MorphoSys was notified by a licensor of the initiation of arbitration proceedings in the United States. The licensor alleges breach of contract and claims damages for the licensor’s argued loss of revenues. Despite the patent expiry in 2018 confirmed by the licensor at the time, this is now disputed and a significantly longer patent term is assumed. Taking into account the associated legal and consulting costs, the potential amount in dispute in the proceedings is in the low double-digit million range and also includes a currently unspecified share of royalty income. A decision by the arbitration court is expected in mid-2022. Based on the current assessment of the facts, MorphoSys believes that the arguments presented are unfounded and that the arbitration will likely be decided in MorphoSys’s favor.

| MorphoSys – II/2021 |

Table of Contents

| 22 | Group Interim Statement |

Financial Guidance

MorphoSys updated its financial guidance for the 2021 financial year on July 26, 2021. The Group expects Group revenues in the range of € 155 million to € 180 million for the 2021 financial year compared to the prior guidance range of € 150 million to € 200 million. This guidance was narrowed primarily due to Monjuvi® product sales in the U.S. in the first six months of 2021 and expectations for the remaining months of 2021. The updated guidance excludes any royalties from the potential approval of tafasitamab outside of the U.S. as well as significant milestones from development partners and/or licensing partnerships other than those that were already recorded in the first six months of 2021. The guidance is subject to a number of uncertainties, including potential fluctuations in the first full year of Monjuvi®’s launch, the limited visibility MorphoSys has with respect to the Tremfya royalties, as well as the ongoing COVID-19 pandemic and the related impact on our business as well as that of our partners.

MorphoSys expects Group operating expenses, which are comprised of research and development, selling as well as general and administrative expenses, in the range of € 435 million to € 465 million (previously € 355 million to € 385 million), which include expenses for Constellation starting July 15, 2021. The revised Group operating expenses range also include one-time transaction related costs of € 36 million related to the agreements with Constellation and Royalty Pharma. Research and development expenses now are expected to comprise 52% to 57% of Group operating expenses (previously 45% to 50%), excluding the one-time transaction-related costs.

The statements in the 2020 Annual Report on pages 88-91 concerning the strategic outlook, the expected business and human resource developments, future research and development, and the dividend policy continue to apply.

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 23 |

Consolidated Statement of Profit or Loss

(IFRS) – (unaudited)

| in € | Note

|

Q2 2021 |

Q2 2020 1 |

H1 2021 |

H1 2020 1 |

|||||||||||||||||||||||||

|

Revenues |

2 | 38,233,992 | 18,434,036 | 85,423,609 | 269,656,727 | |||||||||||||||||||||||||

| Cost of Sales |

(10,136,312 | ) | 7,227,804 | (15,184,293 | ) | 3,968,326 | ||||||||||||||||||||||||

| Gross Profit |

1 | 28,097,680 | 25,661,840 | 70,239,316 | 273,625,053 | |||||||||||||||||||||||||

|

Operating Expenses |

||||||||||||||||||||||||||||||

| Research and Development |

(40,506,812 | ) | (30,932,839 | ) | (73,823,916 | ) | (52,428,972 | ) | ||||||||||||||||||||||

|

Selling |

(28,461,138 | ) | (29,278,842 | ) | (56,627,048 | ) | (42,106,431 | ) | ||||||||||||||||||||||

| General and Administrative |

(30,493,263 | ) | (13,816,895 | ) | (40,751,085 | ) | (23,940,517 | ) | ||||||||||||||||||||||

| Total Operating Expenses |

1 | (99,461,213 | ) | (74,028,576 | ) | (171,202,049 | ) | (118,475,920 | ) | |||||||||||||||||||||

|

Operating Profit / (Loss) |

1 | (71,363,533 | ) | (48,366,736 | ) | (100,962,733 | ) | 155,149,133 | ||||||||||||||||||||||

| Other Income |

1,663,390 | (360,300 | ) | 2,838,468 | 9,969,474 | |||||||||||||||||||||||||

| Other Expenses |

(1,437,088 | ) | (1,344,435 | ) | (3,409,133 | ) | (1,629,971 | ) | ||||||||||||||||||||||

| Finance Income |

102,411,620 | 17,470,786 | 116,308,866 | 28,071,456 | ||||||||||||||||||||||||||

| Finance Expenses |

2,926,302 | (25,076,101 | ) | (36,763,703 | ) | (34,363,514 | ) | |||||||||||||||||||||||

| Income from Reversals of Impairment Losses / (Impairment Losses) on Financial Assets |

196,000 | (311,000 | ) | 285,000 | (772,000 | ) | ||||||||||||||||||||||||

| Income Tax Benefit / (Expenses) |

3 | (13,502,482 | ) | 4,899,051 | 989,211 | 23,336,280 | ||||||||||||||||||||||||

|

Consolidated Net Profit / (Loss) |

20,894,209 | (53,088,735 | ) | (20,714,024 | ) | 179,760,858 | ||||||||||||||||||||||||

| Earnings per Share, Basic and Diluted |

- | (1.62 | ) | (0.63 | ) | - | ||||||||||||||||||||||||

| Earnings per Share, Basic |

0.64 | - | - | 5.56 | ||||||||||||||||||||||||||

| Earnings per Share, diluted |

0.61 | - | - | 5.54 | ||||||||||||||||||||||||||

| Shares Used in Computing Earnings per Share, Basic and Diluted |

- | 32,696,980 | 32,772,125 | - | ||||||||||||||||||||||||||

| Shares Used in Computing Earnings per Share, Basic |

32,781,475 | - | - | 32,309,894 | ||||||||||||||||||||||||||

| Shares Used in Computing Earnings per Share, Diluted |

35,371,193 | - | - | 32,437,297 | ||||||||||||||||||||||||||

1 The consolidated statement of profit or loss has been adjusted to present comparable information for the previous year. For details we refer to the section

“Structural Changes to the Consolidated Statement of Profit or Loss” in section 1 of the notes.

| MorphoSys – II/2021 |

Table of Contents

| 24 | Group Interim Statement |

Consolidated Statement of Comprehensive Income (IFRS) – (unaudited)

| in € | Q2 2021

|

Q2 2020 |

H1 2021 |

H1 2020 |

||||||||||||||||||||

|

Consolidated Net Profit / (Loss) |

20,894,209 | (53,088,735 | ) | (20,714,024 | ) | 179,760,858 | ||||||||||||||||||

| Items that will not be reclassified to Profit or Loss |

||||||||||||||||||||||||

| Change in Fair Value of Shares through Other Comprehensive Income |

0 | (303,371 | ) | 0 | (3,565,402 | ) | ||||||||||||||||||

| Items that may be reclassified to Profit or Loss |

||||||||||||||||||||||||

| Foreign Currency Translation Differences from Consolidation |

333,222 | 1,329,973 | (594,594 | ) | 580,257 | |||||||||||||||||||

| Other Comprehensive Income |

333,222 | 1,026,602 | (594,594 | ) | (2,985,145 | ) | ||||||||||||||||||

| Total Comprehensive Income |

21,227,431 | (52,062,133 | ) | (21,308,618 | ) | 176,775,713 | ||||||||||||||||||

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 25 |

(IFRS) – (unaudited)

| in €

|

Note

|

06/30/2021

|

12/31/2020

|

|||||||||||||||

|

ASSETS |

||||||||||||||||||

| Current Assets |

||||||||||||||||||

| Cash and Cash Equivalents |

4 | 297,334,811 | 109,794,680 | |||||||||||||||

|

Financial Assets at Fair Value through Profit or Loss |

4 | 53,255,377 | 287,937,972 | |||||||||||||||

| Other Financial Assets at Amortized Cost |

4 | 723,257,031 | 649,713,342 | |||||||||||||||

| Accounts Receivable |

4 | 97,166,501 | 83,354,276 | |||||||||||||||

|

Financial Assets from Collaborations |

4 | 21,497,150 | 42,870,499 | |||||||||||||||

| Income Tax Receivables |

504,364 | 401,826 | ||||||||||||||||

| Other Receivables |

10,521,549 | 2,159,475 | ||||||||||||||||

|

Inventories, Net |

14,517,118 | 9,962,657 | ||||||||||||||||

| Prepaid Expenses and Other Current Assets |

37,853,108 | 20,621,493 | ||||||||||||||||

| Total Current Assets |

1,255,907,009 | 1,206,816,220 | ||||||||||||||||

| Non-current Assets |

||||||||||||||||||

|

Property, Plant and Equipment, Net |

6,269,951 | 6,323,753 | ||||||||||||||||

| Right-of-Use Assets, Net |

43,153,949 | 44,417,767 | ||||||||||||||||

| Patents, Net |

1,963,968 | 1,937,856 | ||||||||||||||||

|

Licenses, Net |

11,342,467 | 11,835,619 | ||||||||||||||||

| Licenses for Marketed Products |

54,329,930 | 55,485,886 | ||||||||||||||||

| In-process R&D Programs |

10,428,750 | 0 | ||||||||||||||||

|

Internally Generated Intangible Assets |

829,300 | 0 | ||||||||||||||||

|

Software, Net |

130,908 | 115,788 | ||||||||||||||||

|

Goodwill |

1,619,233 | 1,619,233 | ||||||||||||||||

| Other Financial Assets at Amortized Cost, Net of Current Portion |

4 | 55,378,227 | 196,587,542 | |||||||||||||||

| Deferred Tax Asset |

3 | 134,290,594 | 132,806,097 | |||||||||||||||

| Prepaid Expenses and Other Assets, Net of Current Portion |

4 | 1,770,095 | 1,567,259 | |||||||||||||||

| Total Non-current Assets |

321,507,372 | 452,696,800 | ||||||||||||||||

| Total Assets |

1,577,414,381 | 1,659,513,020 | ||||||||||||||||

| MorphoSys – II/2021 |

Table of Contents

| 26 | Group Interim Statement |

| in €

|

Note

|

06/30/2021

|

12/31/2020

|

|||||||||||||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||||||||||||

|

Current Liabilities |

||||||||||||||||||

| Accounts Payable and Accruals |

4 | 134,663,434 | 128,554,203 | |||||||||||||||

| Current Portion of Lease Liabilities |

4 | 3,264,506 | 3,055,608 | |||||||||||||||

| Tax Liabilities |

3 | 64,768,479 | 65,727,675 | |||||||||||||||

| Other Provisions |

658,150 | 0 | ||||||||||||||||

| Current Portion of Contract Liability |

781,925 | 2,543,903 | ||||||||||||||||

| Current Portion of Convertible Bond |

417,282 | 422,945 | ||||||||||||||||

|

Current Portion of Financial Liabilities from Collaborations |

4, 5 | 0 | 154,895 | |||||||||||||||

| Total Current Liabilities |

204,553,776 | 200,459,229 | ||||||||||||||||

| Non-current Liabilities |

||||||||||||||||||

| Lease Liabilities, Net of Current Portion |

4 | 40,593,526 | 41,963,794 | |||||||||||||||

| Other Provisions, Net of Current Portion |

2,219,544 | 1,527,756 | ||||||||||||||||

| Contract Liability, Net of Current Portion |

50,280 | 71,829 | ||||||||||||||||

| Deferred Tax Liability |

3 | 5,057,465 | 5,057,465 | |||||||||||||||

|

Convertible Bond, Net of Current Portion |

277,676,710 | 272,759,970 | ||||||||||||||||

|

Financial Liabilities from Collaborations, Net of Current Portion |

4, 5 | 445,856,124 | 516,350,960 | |||||||||||||||

| Total Non-current Liabilities |

771,453,649 | 837,731,774 | ||||||||||||||||

| Total Liabilities |

976,007,425 | 1,038,191,003 | ||||||||||||||||

|

Stockholders’ Equity |

||||||||||||||||||

|

Common Stock |

6 | 32,892,540 | 32,890,046 | |||||||||||||||

| Ordinary Shares Issued (32,892,540 and 32,890,046 for 2021 and 2020, respectively) |

||||||||||||||||||

| Ordinary Shares Outstanding (32,790,501 and 32,758,632 for 2021 and 2020, respectively) |

||||||||||||||||||

| Treasury Stock (102,039 and 131,414 shares for 2021 and 2020, respectively), at Cost |

(3,783,044 | ) | (4,868,744 | ) | ||||||||||||||

|

Additional Paid-in Capital |

6 | 749,283,869 | 748,978,506 | |||||||||||||||

| Other Comprehensive Income Reserve |

6 | 1,616,825 | 2,211,419 | |||||||||||||||

|

Accumulated Deficit |

(178,603,234 | ) | (157,889,210 | ) | ||||||||||||||

| Total Stockholders’ Equity |

601,406,956 | 621,322,017 | ||||||||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

1,577,414,381 | 1,659,513,020 | ||||||||||||||||

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 27 |

Consolidated Statement of Changes in Stockholders’ Equity (IFRS) – (unaudited)

| Common Stock | ||||||||||||||||||||||||

|

Shares

|

€

|

|||||||||||||||||||||||

| Balance as of January 1, 2020 |

31,957,958 | 31,957,958 | ||||||||||||||||||||||

| Capital Increase, Net of Issuance Cost of € 100,370 |

907,441 | 907,441 | ||||||||||||||||||||||

| Compensation Related to the Grant of Stock Options and Performance Shares |

0 | 0 | ||||||||||||||||||||||

| Exercise of Convertible Bonds Issued |

24,647 | 24,647 | ||||||||||||||||||||||

| Transfer of Treasury Stock for Long-Term Incentive Programs |

0 | 0 | ||||||||||||||||||||||

| Reserves: |

||||||||||||||||||||||||

| Change in Fair Value of Shares through Other Comprehensive Income |

0 | 0 | ||||||||||||||||||||||

| Foreign Currency Translation Differences from Consolidation |

0 | 0 | ||||||||||||||||||||||

| Consolidated Net Profit |

0 | 0 | ||||||||||||||||||||||

| Total Comprehensive Income |

0 | 0 | ||||||||||||||||||||||

| Balance as of June 30, 2020 |

32,890,046 | 32,890,046 | ||||||||||||||||||||||

| Balance as of January 1, 2021 |

32,890,046 | 32,890,046 | ||||||||||||||||||||||

| Compensation Related to the Grant of Stock Options and Performance Shares |

6, 10 | 0 | 0 | |||||||||||||||||||||

| Exercise of Stock Options Issued |

6, 7, 11 | 2,494 | 2,494 | |||||||||||||||||||||

| Transfer of Treasury Stock for Long-Term Incentive Programs |

6, 7, 11 | 0 | 0 | |||||||||||||||||||||

| Reserves: |

||||||||||||||||||||||||

| Foreign Currency Translation Differences from Consolidation |

0 | 0 | ||||||||||||||||||||||

| Consolidated Net Loss |

0 | 0 | ||||||||||||||||||||||

| Total Comprehensive Income |

0 | 0 | ||||||||||||||||||||||

| Balance as of June 30, 2021 |

32,892,540 | 32,892,540 | ||||||||||||||||||||||

| MorphoSys – II/2021 |

Table of Contents

| 28 | Group Interim Statement |

| Treasury Stock | Additional Paid-in Capital |

Other Comprehensive Income Reserve |

Accumulated Deficit |

Total Equity |

||||||||||||||||||||||||||||||||

| Shares

|

€

|

€

|

€

|

€

|

€

|

|||||||||||||||||||||||||||||||

| 225,800 | (8,357,250 | ) | 628,176,568 | (1,295,718 | ) | (255,779,786 | ) | 394,701,772 | ||||||||||||||||||||||||||||

| 0 | 0 | 79,590,657 | 0 | 0 | 80,498,098 | |||||||||||||||||||||||||||||||

| 0 | 0 | 3,751,660 | 0 | 0 | 3,751,660 | |||||||||||||||||||||||||||||||

| 0 | 0 | 760,976 | 0 | 0 | 785,623 | |||||||||||||||||||||||||||||||

| (53,392 | ) | 1,973,368 | (1,973,368 | ) | 0 | 0 | 0 | |||||||||||||||||||||||||||||

| 0 | 0 | 0 | (3,565,402 | ) | 0 | (3,565,402 | ) | |||||||||||||||||||||||||||||

| 0 | 0 | 0 | 580,257 | 0 | 580,257 | |||||||||||||||||||||||||||||||

| 0 | 0 | 0 | 0 | 179,760,858 | 179,760,858 | |||||||||||||||||||||||||||||||

| 0 | 0 | 0 | (2,985,145 | ) | 179,760,858 | 176,775,713 | ||||||||||||||||||||||||||||||

| 172,408 | (6,383,882 | ) | 710,306,493 | (4,280,863 | ) | (76,018,928 | ) | 656,512,866 | ||||||||||||||||||||||||||||

| 131,414 | (4,868,744 | ) | 748,978,506 | 2,211,419 | (157,889,210 | ) | 621,322,017 | |||||||||||||||||||||||||||||

| 0 | 0 | 1,276,490 | 0 | 0 | 1,276,490 | |||||||||||||||||||||||||||||||

| 0 | 0 | 114,573 | 0 | 0 | 117,067 | |||||||||||||||||||||||||||||||

| (29,375 | ) | 1,085,700 | (1,085,700 | ) | 0 | 0 | 0 | |||||||||||||||||||||||||||||

| 0 | 0 | 0 | (594,594 | ) | 0 | (594,594 | ) | |||||||||||||||||||||||||||||

| 0 | 0 | 0 | 0 | (20,714,024 | ) | (20,714,024 | ) | |||||||||||||||||||||||||||||

| 0 | 0 | 0 | (594,594 | ) | (20,714,024 | ) | (21,308,618 | ) | ||||||||||||||||||||||||||||

| 102,039 | (3,783,044 | ) | 749,283,869 | 1,616,825 | (178,603,234 | ) | 601,406,956 | |||||||||||||||||||||||||||||

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 29 |

Consolidated Statement of Cash Flows

(IFRS) – (unaudited)

| H1 (in € )

|

Note

|

2021

|

2020

|

|||||||||||||||

|

Operating Activities: |

||||||||||||||||||

|

Consolidated Net Profit / (Loss) |

(20,714,024 | ) | 179,760,858 | |||||||||||||||

|

Adjustments to Reconcile Consolidated Net Profit / (Loss) to Net Cash |

||||||||||||||||||

|

Impairments of Assets |

116,001 | 14,305,306 | ||||||||||||||||

|

Depreciation and Amortization of Tangible and Intangible Assets and of Right-of-Use Assets |

4,654,051 | 3,696,928 | ||||||||||||||||

| Net (Gain) / Loss of Financial Assets at Fair Value through Profit or Loss |

(615,851 | ) | 1,226,920 | |||||||||||||||

| Net (Gain) / Loss of Financial Assets at Amortized Cost |

(1,868,504 | ) | 2,751,558 | |||||||||||||||

| (Income) from Reversals of Impairments / Impairments on Financial Assets |

(285,000 | ) | 772,000 | |||||||||||||||

| Net (Gain) / Loss on Derivative Financial Instruments |

0 | 6,991,506 | ||||||||||||||||

| Non Cash Effective Net Change in Financial Assets / Liabilities from Collaborations |

(80,796,823 | ) | (4,642,257 | ) | ||||||||||||||

| Non Cash Effective Change of Financial Liabilities at Amortized Cost |

5,926,887 | 0 | ||||||||||||||||

| (Income) from Reversals of Impairments on Inventories |

0 | (15,509,559 | ) | |||||||||||||||

|

Recognition of Contract Liability |

(2,385,710 | ) | (7,987,408 | ) | ||||||||||||||

|

Share-based Payment |

10 | 1,854,488 | 4,395,357 | |||||||||||||||

| Income Tax (Benefit) / Expenses |

3 | (989,211 | ) | (23,336,280 | ) | |||||||||||||

|

Changes in Operating Assets and Liabilities: |

||||||||||||||||||

| Accounts Receivable |

(13,154,588 | ) | (18,021,317 | ) | ||||||||||||||

|

Inventories, Prepaid Expenses and Other Assets, Tax Receivables and Other Receivables |

(29,647,859 | ) | (3,980,369 | ) | ||||||||||||||

| Accounts Payable and Accruals, Lease Liabilities, Tax Liabilities and Other Provisions |

5,802,027 | (2,124,194 | ) | |||||||||||||||

| Other Liabilities |

0 | 118,489 | ||||||||||||||||

| Contract Liability |

602,182 | 11,389,563 | ||||||||||||||||

| Income Taxes Paid |

(83,363 | ) | (45,156 | ) | ||||||||||||||

| Net Cash Provided by / (Used in) Operating Activities |

(131,585,297 | ) | 149,761,945 | |||||||||||||||

| MorphoSys – II/2021 |

Table of Contents

| 30 | Group Interim Statement |

| H1 (in €)

|

Note

|

2021

|

2020

|

|||||||||||||||

|

Investing Activities: |

||||||||||||||||||

| Cash Payments to Acquire Financial Assets at Fair Value through Profit or Loss |

0 | (416,449,668 | ) | |||||||||||||||

| Cash Receipts from Sales of Financial Assets at Fair Value through Profit or Loss |

235,645,206 | 41,521,507 | ||||||||||||||||

| Cash Payments to Acquire Other Financial Assets at Amortized Cost |

(786,452,089 | ) | (476,140,326 | ) | ||||||||||||||

| Cash Receipts from Sales of Other Financial Assets at Amortized Cost |

855,799,950 | 131,190,000 | ||||||||||||||||

| Cash Receipts from (+) / Cash Payments for (-) Derivative Financial Instruments |

0 | (6,595,240 | ) | |||||||||||||||

| Cash Payments to Acquire Property, Plant and Equipment |

(971,053 | ) | (1,504,428 | ) | ||||||||||||||

| Cash Payments to Acquire Intangible Assets and for Internally Generated Intangible Assets |

(11,449,733 | ) | (11,544,656 | ) | ||||||||||||||

| Cash Receipts from Sales of Shares at Fair Value through Other Comprehensive Income |

0 | 1,103,433 | ||||||||||||||||

|

Interest Received |

155,459 | 166,591 | ||||||||||||||||

| Net Cash Provided by / (Used in) Investing Activities |

292,727,740 | (738,252,787 | ) | |||||||||||||||

|

Financing Activities: |

||||||||||||||||||

| Cash Proceeds from Issuing Shares |

0 | 80,598,468 | ||||||||||||||||

| Cash Payments for Costs from Issuing Shares |

6 | (21,400 | ) | (100,370 | ) | |||||||||||||

| Cash Proceeds in Connection with Stock Options (2021) and Convertible Bonds (2020) |

6 | 138,467 | 773,300 | |||||||||||||||

| Cash Receipts from Financing from Collaborations |

31,520,343 | 497,509,605 | ||||||||||||||||

| Cash Payments for Principal Elements of Lease Payments |

(1,560,976 | ) | (1,233,706 | ) | ||||||||||||||

| Interest Paid |

(2,219,439 | ) | (683,835 | ) | ||||||||||||||

| Net Cash Provided by / (Used in) Financing Activities |

27,856,995 | 576,863,462 | ||||||||||||||||

|

Effect of Exchange Rate Differences on Cash |

(1,459,307 | ) | 717,681 | |||||||||||||||

| Increase / (Decrease) in Cash and Cash Equivalents |

187,540,131 | (10,909,699 | ) | |||||||||||||||

| Cash and Cash Equivalents at the Beginning of the Period |

109,794,680 | 44,314,050 | ||||||||||||||||

| Cash and Cash Equivalents at the End of the Period |

297,334,811 | 33,404,351 | ||||||||||||||||

| MorphoSys – II/2021 |

Table of Contents

| Group Interim Statement | 31 |