Form 6-K Li-Cycle Holdings Corp. For: Sep 09

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2021.

Commission File Number

LI-CYCLE HOLDINGS CORP.

Li-Cycle Corp.

2351 Royal Windsor Dr. Unit 10

Mississauga, ON L5J 4S7 (877) 542-9253

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)( 1): ☐

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| LI-CYCLE HOLDINGS CORP. | ||

| By: | /s/ Ajay Kochhar | |

| Name: | Ajay Kochhar | |

| Title: | Chief Executive Officer and Director | |

Date: September 9, 2021

Exhibit 99.1

Li-Cycle to Build New Lithium-Ion Battery Recycling Facility in Alabama

Li-Cycle will Add a Fourth Spoke in Alabama as the Pace of New Battery Mega-Factory Deployment Continues to Exceed Expectations

Commercial Spoke 4 will Provide an Initial Processing Capacity Increase of up to 5,000 tonnes of Manufacturing Scrap and End-of-life Batteries per year, Bringing Li-Cycle’s North American Recycling Capacity to 25,000 tonnes per year

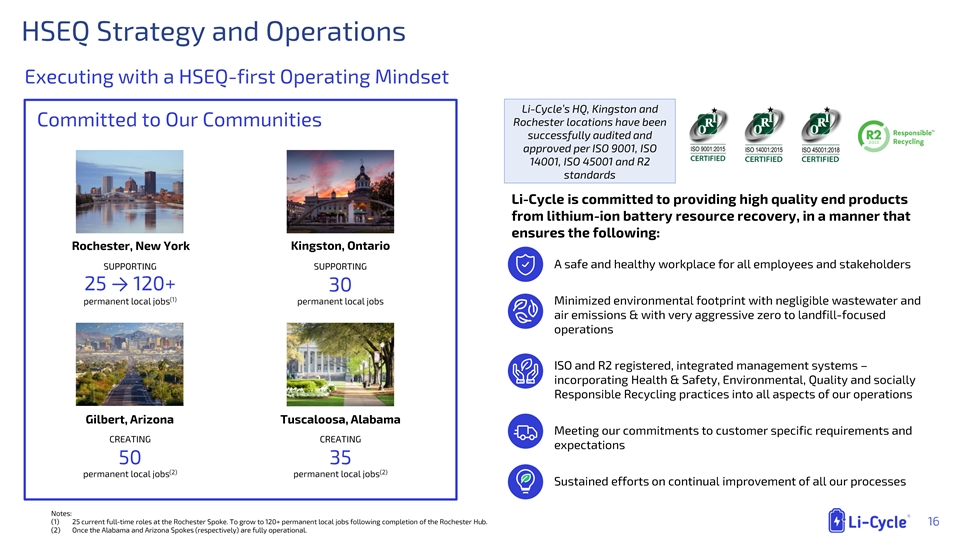

TORONTO, Ontario (September 8, 2021) – Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or “the Company”), an industry leader in lithium-ion battery resource recovery and the leading lithium-ion battery recycler in North America, today announced that the Company will build a fourth commercial lithium-ion battery recycling facility, to be located in Tuscaloosa, Alabama.

With the pace of deployment of new battery mega-factories far exceeding initial expectations, Li-Cycle will construct an additional fourth Spoke in North America (“Spoke 4”). The Company previously had a base case plan for three North American Spokes (the Kingston, Ontario and Rochester, New York Spoke facilities are commercially operational; the Gilbert, Arizona Spoke facility is in advanced execution stages).

The southeastern United States is emerging as a critical region for the lithium-ion battery supply chain, as battery manufacturers and automotive OEMs establish operations in the region, which will lead to the generation of significant quantities of battery manufacturing scrap and end-of-life batteries available for recycling. Univar Solutions Inc. will be an anchor battery feed supply customer for the new facility, following on Li-Cycle’s previously announced on-site partnership with Univar Solutions to provide waste management solutions for electric vehicle and lithium-ion battery manufacturing.

When completed, Li-Cycle’s Spoke 4 facility will have an initial capacity of up to 5,000 tonnes of battery manufacturing scrap and end-of-life batteries per year, bringing Li-Cycle’s total North American recycling capacity to 25,000 tonnes per year. The Tuscaloosa site is also being developed to accommodate a future, second 5,000 tonne processing line, which would increase capacity at the Tuscaloosa site to 10,000 tonnes per year, and Li-Cycle’s total North American recycling capacity to 30,000 tonnes per year. As Li-Cycle continues to build upon its position as a leading lithium-ion battery recycler and resource recovery company, the Alabama Spoke is projected to commence operations by mid-2022 and is expected to create an initial 30+ new jobs.

The execution of Spoke 4 is strongly supported by a range of local stakeholders, including but not limited to:

| • | Univar Solutions and their existing automotive customer base; |

| • | The Alabama Automotive Manufacturers Association (AAMA); |

| • | The State of Alabama, including the Alabama Department of Commerce; and |

| • | The Tuscaloosa County Economic Development Authority. |

1

“Our new facility in Alabama positions us well to meet the growing demand for lithium-ion battery recycling,” said Tim Johnston, Co-founder, and Executive Chairman of Li-Cycle. “Originally, we had planned on rolling out three commercial Spoke facilities in North America over the next five years, with a total recycling capacity of 20,000 tonnes per year. However, demand for lithium-ion battery recycling has continued to outperform our forecasts and we are now forecasting total recycling capacity of 30,000 tonnes per year. This facility is essential in filling a recycling gap in the southeastern United States. Like our Arizona Spoke, we expect the new facility to have the capability to process entire vehicle battery packs, without dismantling.”

“We have a responsibility to not only manufacture vehicles and batteries, but to be good corporate citizens in the choices we make to protect our environment and the community around us,” said Michael Goebel, President and CEO, Mercedes-Benz, US International, Inc. (MBUSI), which is working together with Univar Solutions on end-of-life solutions for lithium-ion batteries. “We welcome the partnership between Univar Solutions and Li-Cycle and the strong commitment of our partners here in Tuscaloosa, Alabama to push a sustainable future for mobility.”

“At Univar Solutions, we’re committed to bringing more sustainable solutions for a better world, leveraging our expertise to help our customers and suppliers make progress toward their sustainability goals. We are thrilled to work together with industry leaders like Li-Cycle and MBUSI to make a difference in lithium-ion battery recycling,” said Stephen Molica, Vice President of Services for Univar Solutions Inc. “We look forward to further assisting MBUSI with best-in-class sustainability solutions through our OnSite Services team, including supporting the addition of Li-Cycle’s new facility in Alabama.”

“Li-Cycle’s decision to locate in Alabama helps position our state on the leading edge as our industry enters the era of electric vehicle production,” said Ron Davis, President of the Alabama Automotive Manufacturers Association (AAMA). “With its innovative technology and process, Li-Cycle is bringing a capability that will offer the auto industry a solution to what will become an issue of critical importance. I am very excited to see Li-Cycle’s ground-breaking contributions to our growing Alabama automotive industry.”

“With the popularity of electric vehicles accelerating, it’s critical that old batteries are recycled — and Li-Cycle’s technologies make that possible,” Governor Kay Ivey said. “Li-Cycle’s selection of Tuscaloosa for its network of recycling facilities means not only jobs in Alabama, but also a positive for the environment.”

“With EV production set to start in Alabama in 2022, Li-Cycle’s Tuscaloosa recycling facility will ensure that Alabama plays another important role in the lifecycle of the batteries powering electric vehicles,” said Greg Canfield, Secretary of the Alabama Department of Commerce. “This project addresses the battery repurposing proposition that must also be a part of the sustainability solution that EVs offer.”

“With a strategic focus on mobility and power, West Alabama is a prime location for Li-Cycle’s Spoke facility,” said Danielle Winningham, executive director for Tuscaloosa County Economic Development Authority. “We welcome Li-Cycle’s sustainable and environmentally friendly end-of-life solution for lithium-ion batteries, which assists meeting the demand for electric vehicle battery materials.”

About Li-Cycle Holdings Corp. (NYSE: LICY)

Li-Cycle is on a mission to leverage its innovative Spoke & Hub Technologies™ to provide a customer-centric, end-of-life solution for lithium-ion batteries, while creating a secondary supply of critical battery materials. Lithium-ion rechargeable batteries are increasingly powering our world in automotive, energy storage, consumer electronics, and other industrial and household applications. The world needs improved technology and supply chain innovations to better manage battery manufacturing waste and end-of-life batteries and to meet the rapidly growing demand for critical and scarce battery-grade raw materials through a closed-loop solution. For more information, visit https://li-cycle.com/.

2

CONTACTS

Investor Relations: [email protected]

Press: [email protected]

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements contained in this communication may be considered “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1993, as amended, Section 21 of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities laws. Forward-looking statements may generally be identified by the use of words such as “will”, “continue”, “expect”, “would”, “plan”, “projected”, “future” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. These statements are based on various assumptions, whether or not identified in this communication, which Li-Cycle believe are reasonable in the circumstances. There can be no assurance that such estimates or assumptions will prove to be correct and, as a result, actual results or events may differ materially from expectations expressed in or implied by the forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Li-Cycle, and are not guarantees of future performance. Li-Cycle believes that these risks and uncertainties include, but are not limited to, the following: Li-Cycle’s inability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries; Li-Cycle’s inability to successfully implement its global growth strategy, on a timely basis or at all; Li-Cycle’s inability to manage future global growth effectively; Li-Cycle’s inability to develop the Rochester Hub, Arizona Spoke, Alabama Spoke and other future projects in a timely manner or on budget or that those projects will not meet expectations with respect to their productivity or the specifications of their end products; Li-Cycle’s failure to materially increase recycling capacity and efficiency; Li-Cycle may engage in strategic transactions, including acquisitions, that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in incurrence of debt, or prove not to be successful; one or more of Li-Cycle’s current or future facilities becoming inoperative, capacity constrained or if its operations are disrupted; additional funds required to meet Li-Cycle’s capital requirements in the future not being available to Li-Cycle on commercially reasonable terms or at all when it needs them; Li-Cycle expects to incur significant expenses and may not achieve or sustain profitability; problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations; Li-Cycle’s inability to maintain and increase feedstock supply commitments as well as securing new customers and off-take agreements; a decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies; decreases in benchmark prices for the metals contained in Li-Cycle’s products; changes in the volume or composition of feedstock materials processed at Li-Cycle’s facilities; the development of an alternative chemical make-up of lithium-ion batteries or battery alternatives; Li-Cycle’s revenues for the Rochester Hub are derived significantly from a single customer; Li-Cycle’s insurance may not cover all liabilities and damages; Li-Cycle’s heavy reliance on the experience and expertise of its management; Li-Cycle’s reliance on third-party consultants for its regulatory compliance; Li-Cycle’s inability to complete its recycling processes as quickly as customers may require; Li-Cycle’s inability to compete successfully; increases in income tax rates, changes in income tax laws or disagreements with tax authorities; significant variance in Li-Cycle’s operating and financial results from period to period due to fluctuations in its operating costs and other factors; fluctuations in foreign currency exchange rates which could result in declines in reported sales and net earnings; unfavourable economic conditions, such as consequences of the global COVID-19 pandemic; natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, boycotts and geo-political events; failure to protect Li-Cycle’s intellectual property; Li-Cycle may be subject to intellectual property rights claims by third parties; Li-Cycle’s failure to effectively remediate the material weaknesses in its internal control over financial reporting that it has identified or if it fails to develop and maintain a proper and effective internal control over financial reporting. These and other risks and uncertainties related to Li-Cycle’s business are described in greater detail in the section entitled “Risk Factors” in its final prospectus dated August 10, 2021 filed with the Ontario Securities Commission in Canada and the Form 20-F filed with the SEC. Because of these risks, uncertainties and assumptions, readers should not place undue reliance on these forward-looking statements. Actual results could differ materially from those contained in any forward-looking statement.

# # #

3

Exhibit 99.2

Li-Cycle Holdings Corp. Reports Financial Results for Third Quarter 2021

– Rochester Hub and Arizona Spoke Continue to be on Track –

– Li-Cycle will Add a Fourth Spoke in Alabama to Meet Demand; Pace of New Battery Mega-factory Deployment Far Exceeding Expectations –

– Li-Cycle Reports Third Quarter Revenue Increasing 840% Year-Over-Year to $1.7 Million –

– Subsequent to Fiscal Q3 2021, Li-Cycle Successfully Completed its Public Listing in August 2021, Resulting in Net Proceeds of $527 Million –

TORONTO, ONTARIO (September 9, 2021) – Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or the “Company”), an industry leader in lithium-ion battery resource recovery and the leading lithium-ion battery recycler in North America, today announced financial results for its third quarter ended July 31, 2021.

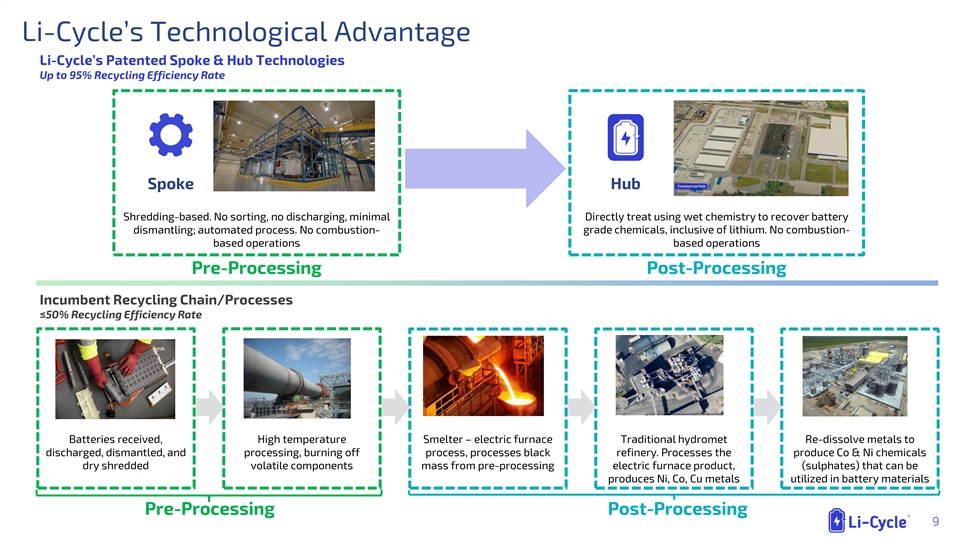

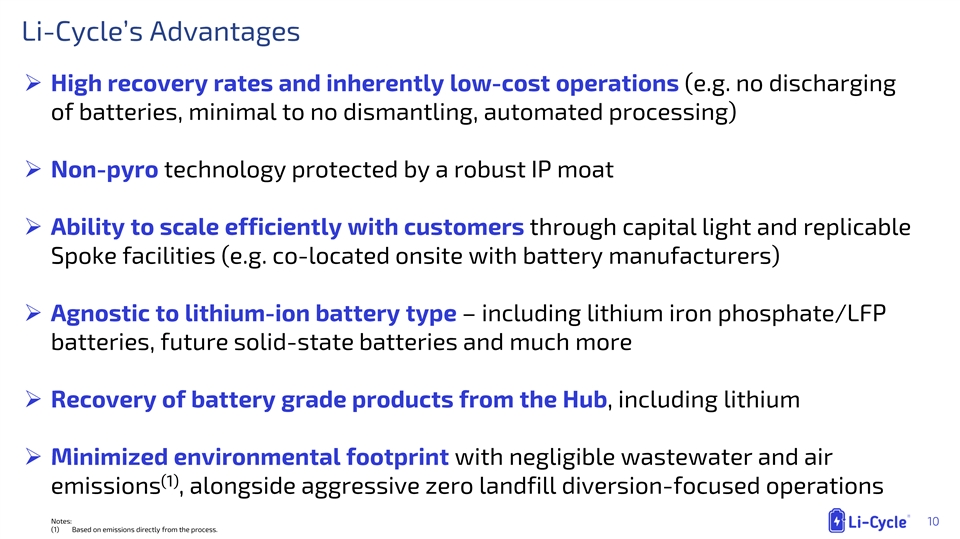

Founded in 2016, Li-Cycle utilizes its patented Spoke & Hub Technologies™ to achieve industry-leading resource recovery rates and produce the critical battery materials underpinning the global growth in electric vehicle (“EV”) proliferation. The imperative for economically and environmentally sustainable resource recycling is growing in lockstep with the exponential growth of battery manufacturing with an average of 5% to 10% of new battery production being rejected/scrapped. Li-Cycle’s two-stage battery recycling model enables customers to benefit from an economically sustainable, safe and environmentally friendly solution for the recycling of all types of lithium-ion materials.

“I am incredibly proud of what the Li-Cycle team has accomplished so far in 2021, continuing our mission to solve the global battery manufacturing scrap and end-of-life lithium-ion battery problem by creating a secondary supply of critical battery materials, while also ensuring a sustainable future for our planet. Since announcing our business combination with Peridot Acquisition Corp. in February, we signed significant commercial agreements with Ultium Cells LLC (the joint venture between General Motors and LG Energy Solution) and Univar Solutions Inc.; we began construction of our Arizona Spoke; and just yesterday, we announced plans to build an incremental fourth Spoke in Alabama. With the funds from our business combination transaction completed in August 2021, we believe that Li-Cycle is primed to capitalize on the significant growth opportunities created by the continuing mobility revolution,” said Ajay Kochhar, President and Chief Executive Officer of Li-Cycle.

1

Key Fiscal Q3 2021 Highlights

Spoke and Hub Roll-out Plans Responding to Increasing Market Demand

Demand for lithium-ion battery recycling has continued to exceed the Company’s projections and, in order to meet this growing demand, Li-Cycle plans to increase and accelerate its investment in the build-out of the Company’s recycling capacity. In addition to the Arizona Spoke project, Li-Cycle has announced the development of the Alabama Spoke, increasing its North American processing capacity beyond that of previous plans and projections. The Company is confident in its ability to scale the business to at least 100,000 tonnes per year of Spoke processing capacity and 220,000-240,000 tonnes per year of Hub processing capacity by 2025 (measured as tonnes of lithium-ion battery equivalent input per year). The Company expects to provide fiscal year 2022 guidance in conjunction with the reporting of full fiscal year 2021 results.

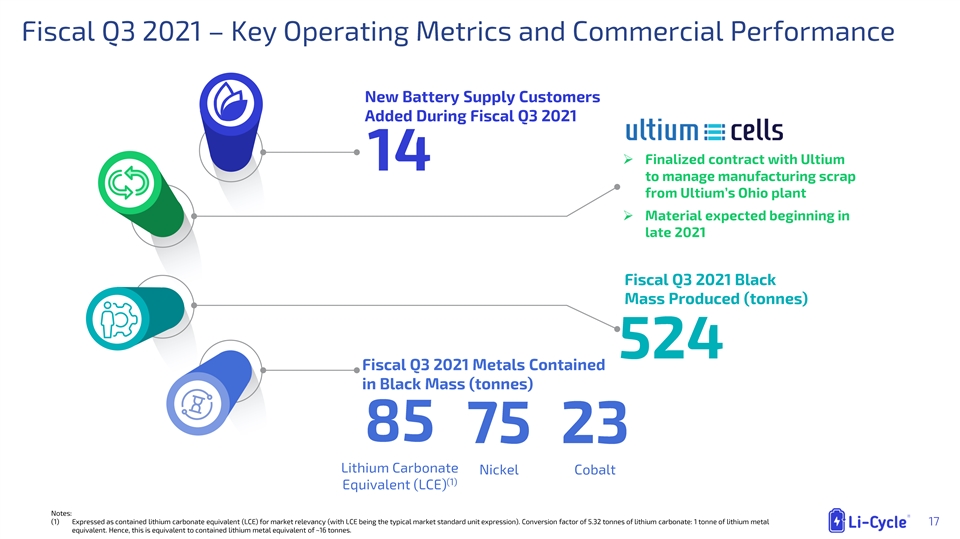

Commercial highlights

Fourteen additional battery supply customers were onboarded during fiscal Q3 2021, bringing Li-Cycle’s battery supply customer base to a new total of over 70. This demonstrates continued Li-Cycle technical and commercial validation, alongside continued market acceleration. New battery supply customers include the following (as previously announced):

| • | Agreement with Ultium Cells LLC to recycle up to 100% of the scrap generated by battery cell manufacturing at Ultium’s Lordstown, Ohio battery cell plant. |

| • | Partnership with Renewance to deliver a safe, sustainable, and cost-effective lithium-ion battery recycling solution for end-of-life energy storage systems. |

| • | Partnership with Univar Solutions OnSite Services to provide comprehensive lithium-ion battery environmental services and solutions. |

Hub capital project execution highlights

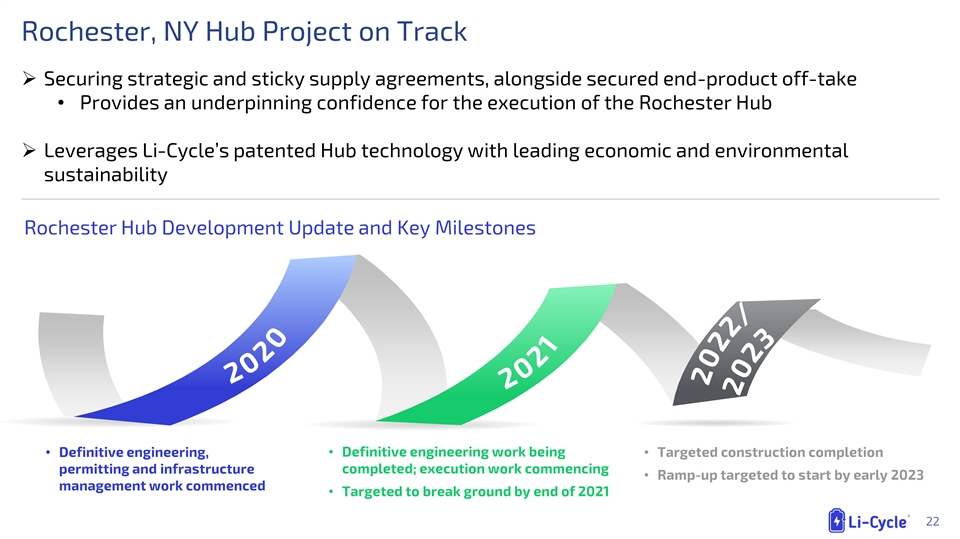

| • | Li-Cycle’s first revenue-generating Hub will be located in Rochester, New York, and is currently in late-stage development. |

| • | The Rochester Hub will leverage Li-Cycle’s patented technology, providing a leading economic and environmental sustainability profile for recycling lithium-ion battery materials. |

| • | Li-Cycle’s pre-feasibility engineering for the Rochester Hub provides that the facility will have the capacity to process 25,000 tonnes of black mass annually (equivalent to approximately 60,000 tonnes of lithium-ion battery feed equivalent annually). |

| • | Li-Cycle expects to complete the definitive engineering phase for the Rochester Hub in late 2021. |

| • | Pending the completion of definitive engineering, final project, budget and regulatory approvals, the Company expects construction at the Hub site to begin in late 2021, with operations commencing in early 2023. |

2

Spoke expansion highlights

| • | Arizona Spoke – the Arizona Spoke (in Gilbert, Arizona in the Phoenix metropolitan area) is strategically located close to Li-Cycle’s existing battery supply network in the Southwestern United States, as well as being at the nexus of where we expect there will be continued growth in the quantity of lithium-ion batteries available for recycling. The Arizona Spoke will have a recycling capacity of 10,000 tonnes of lithium-ion batteries per year (comprised of two 5,000 tonnes/year Spoke lines, built out via a staged approach). Li-Cycle expects the first processing line at its Arizona Spoke to commence operations in early 2022, with the second processing line to commence operations during 2023. |

| • | Alabama Spoke – the Alabama Spoke, a recently announced fourth Spoke, will start by servicing strategic and anchor battery supply customers that are proximal to the facility. It is also expected to benefit from the rapid pace of other newly announced battery manufacturing facilities in the Southeast USA. The Alabama Spoke is incremental to the previously planned three North American Spoke facilities and will increase Li-Cycle’s total recycling capacity to 25,000 tonnes of lithium-ion batteries per year. The Company expects to develop the Tuscaloosa site to accommodate a future second 5,000 tonne processing line, which would increase Li-Cycle’s total North American recycling capacity to 30,000 tonnes per year. The Alabama Spoke is in the definitive engineering and early works phase. The first Alabama Spoke processing line is expected to commence operations by mid-2022. |

Spoke operations highlights – Kingston Spoke and Rochester Spoke

| • | A total of 524 tonnes of black mass were produced from the Kingston and Rochester Spokes. The produced black mass contained: |

| • | 85 tonnes of lithium carbonate equivalent (equivalent to 16 tonnes of lithium metal); |

| • | 75 tonnes of nickel metal equivalent; and |

| • | 23 tonnes of cobalt metal equivalent. |

Financial Results for Third Quarter 2021

Revenues grew 840% to $1.7 million, compared to $0.2 million in the prior-year period, driven by increases in recycling services and product sales, primarily as a result of the increase in the quantities of batteries and battery scrap processed at the Rochester Spoke and the continued onboarding of new battery supply customers. Revenues from product sales were approximately $1.6 million, while revenues from recycling services were approximately $0.1 million.

Operating expenses increased to $7.9 million, compared to $1.9 million during the prior-year period driven by increased personnel costs, a ramp-up of operations at the Kingston and Rochester Spokes, increases in raw materials and supplies, increased R&D spending, and non-recurring expenses related to the business combination between Li-Cycle and Peridot Acquisition Corp. completed in August 2021 (the “Business Combination”). The year-over-year changes in R&D expenditures were primarily due to the fact that R&D expenses in 2020 were largely funded by government grants, the amortization of which offset the applicable R&D expense for accounting purposes.

3

Net loss was approximately $6.9 million, compared to approximately $1.8 million in the prior-year period.

Adjusted EBITDA (loss) was $(5.2) million, compared to $(1.3) million for the prior-year period1.

Cash flows used in operating activities were approximately $5.2 million, compared to $2.2 million during the prior-year period, primarily driven by increased personnel costs, a ramp up of operations at the Kingston Spoke and Rochester Spoke, increases in raw materials, supplies and finished goods, increased R&D spending, and consulting costs relating to the development of the Rochester Hub. Cash, cash equivalents and marketable securities were approximately $2.4 million as of July 31, 2021. Subsequent to quarter end, Li-Cycle completed the Business Combination, resulting in net proceeds of $527 million.

Shares outstanding as of August 31, 2021 were 163,179,553 common shares.

Financial Results for the Nine Months Ended July 31, 2021

Revenues grew approximately 824% to approximately $3.0 million, compared to approximately $0.3 million in the prior-year period, driven by increases in recycling services and product sales, primarily as a result of the increase in the quantities of batteries and battery scrap processed at the Kingston and Rochester Spokes and the continued onboarding of new battery supply customers. Revenues from product sales were approximately $2.7 million, while revenues from recycling services were approximately $0.3 million for the nine-month period ended July 31, 2021.

Operating expenses increased to approximately $20.8 million, compared to approximately $5.0 million during the prior-year period, driven by increased personnel costs, a ramp up of operations at the Kingston and Rochester Spokes, increases in raw materials, supplies and finished goods, increased R&D spending, and non-recurring expenses related to the Business Combination. The year-over-year changes in R&D expenditure were primarily due to the fact that R&D expenses in 2020 were largely funded by government grants, the amortization of which offset the applicable R&D expense for accounting purposes.

Net loss was approximately $21.6 million, compared to approximately $4.8 million in the prior-year period.

| 1 | Adjusted EBITDA is not a recognized measure under IFRS, does not have a standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to similar measures presented by other companies. See “Non-IFRS Financial Measures” section of this press release, including for a reconciliation of Adjusted EBITDA to net loss. |

4

Adjusted EBITDA (loss) was approximately $(12.6) million for the first nine months of 2021, compared to approximately $(3.7) million for the prior-year period.

Cash flows used in operating activities were approximately $16.6 million, compared to approximately $7.7 million during the prior-year period, primarily driven by increased personnel costs, a ramp up of operations at the Kingston Spoke and Rochester Spoke, increases in raw materials and supplies, increased R&D spending, and consulting costs relating to the development of the Rochester Hub.

Fiscal Year 2021 Outlook and Previously Disclosed Projections

Li-Cycle’s fiscal year 2021 business outlook is provided as follows:

| • | Li-Cycle is reiterating the continued ramp-up at the Kingston Spoke and Rochester Spoke during H2 2021, in-line with expectations; |

| • | The Rochester Hub procurement will begin during fiscal year 2021, enabling Li-Cycle to continue on track with project execution; |

| • | The Arizona Spoke procurement and construction will continue; |

| • | The recently announced Alabama Spoke procurement and execution will be kicked off; and |

| • | Fiscal year 2022 guidance will be provided in conjunction with fiscal year 2021 results. |

Li-Cycle included certain projected financial information in the F-4/proxy statement initially filed with the SEC on July 15, 2021 in connection with the Business Combination (as amended, the Proxy/Registration Statement).

As highlighted above, demand for lithium-ion battery recycling has continued to exceed the Company’s projections. In order to meet this growing demand, the Company plans to increase and accelerate investment in the build-out of its recycling capacity, including through the development of the Alabama Spoke, increasing its processing capacity beyond that of previous plans and projections. As a result of such developments, the assumptions underlying the projections included in the Proxy/Registration Statement, including a number regarding capital expenditures and the timing of the roll-out of new facilities, no longer reflect a reasonable basis on which to project Li-Cycle’s future results and therefore such projections should not be relied on as indicative of future results. The Company’s actual results could differ materially relative to the projected financial information contained in the Proxy/Registration Statement. The Company is confident in its ability to scale the business to at least 100,000 tonnes per year of Spoke processing capacity and 220,000-240,000 tonnes per year of Hub processing capacity by 2025 (measured as tonnes of lithium-ion battery equivalent input per year). As noted within this press release, the Company expects to provide fiscal year 2022 guidance in conjunction with the reporting of full fiscal year 2021 results.

Webcast and Conference Call Information

5

Company management will host a webcast and conference call on September 9, 2021, at 9:00 a.m. Eastern Time, to discuss the Company’s financial results.

Interested investors and other parties can listen to a webcast of the live conference call and access the Company’s first quarter update presentation by logging onto the Investor Relations section of the Company’s website at https://investors.li-cycle.com/.

The conference call can be accessed live over the phone by dialing 1-877-407-0784 (domestic) or + 1-201-689-8560 (international). A telephonic replay will be available approximately two hours after the call by dialing 1-844-512-2921 (domestic) or +1-412-317-6671 (international). The conference ID for the live call and pin number for the replay is 13722615. The replay will be available until 11:59 p.m. Eastern Time on September 21, 2021.

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is on a mission to leverage its innovative Spoke & Hub Technologies™ to provide a customer-centric, end-of-life solution for lithium-ion batteries, while creating a secondary supply of critical battery materials. Lithium-ion rechargeable batteries are increasingly powering our world in automotive, energy storage, consumer electronics, and other industrial and household applications. The world needs improved technology and supply chain innovations to better manage battery manufacturing waste and end-of-life batteries and to meet the rapidly growing demand for critical and scarce battery-grade raw materials through a closed-loop solution. For more information, visit https://li-cycle.com/.

Contacts:

Investors: [email protected]

Media: [email protected]

Non-IFRS Financial Measures

Adjusted EBITDA (loss)

The table below reconciles Adjusted EBITDA (loss) to net profit (loss):

| Three months ended | Nine months ended | |||||||||||||||

| July 31, | July 31, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| (U.S. dollar amounts in thousands) | ||||||||||||||||

| Net loss |

(6,897 | ) | (1,811 | ) | (21,591 | ) | (4,842 | ) | ||||||||

| Depreciation, gross |

698 | 328 | 1,831 | 717 | ||||||||||||

| Interest expense (income), gross |

428 | 162 | 900 | 307 | ||||||||||||

| Share-based compensation |

298 | 57 | 1,308 | 220 | ||||||||||||

6

| Three months ended July 31, |

Nine months ended July 31, |

|||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| (U.S. dollar amounts in thousands) | ||||||||||||||||

| Foreign exchange (gain) loss |

(214 | ) | (74 | ) | 536 | (109 | ) | |||||||||

| Fair value loss on restricted share units |

509 | — | 2,433 | — | ||||||||||||

| Forfeited SPAC transaction cost |

— | — | 2,000 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA loss |

(5,178 | ) | (1,338 | ) | (12,583 | ) | (3,708 | ) | ||||||||

Li-Cycle reports its financial results in accordance with the International Financial Reporting Standards (“IFRS”). The Company makes references to certain non-IFRS measures, including Adjusted EBITDA. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing a further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for the analysis of the Company’s financial information reported under IFRS.

Forward-Looking Statements

Certain statements contained in this communication may be considered “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1993, as amended, Section 21 of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities laws. Forward-looking statements may generally be identified by the use of words such as “will”, “continue”, “anticipate”, “expect”, “would”, “could”, “plan”, “future” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. Forward-looking statements in this press release include but are not limited to Li-Cycle’s ability to capitalize on growth opportunities, Li-Cycle’s ability to scale the business to at least 100,000 tonnes per year of Spoke processing capacity and 220,000-240,000 tonnes per year of Hub processing capacity by 2025; the expected recycling capacity of the Arizona Spoke and the Alabama Spoke and the development of a second processing line at the Alabama Spoke, the expected date of the commencement of operations for the first and second processing lines at the Arizona Spoke and the first processing line at the Alabama Spoke; continued increasing ramp-up at the Kingston Spoke and Rochester Spoke during H2 2021; and procurement of the Rochester Hub mechanical equipment during fiscal 2021.These statements are based on various assumptions, whether or not identified in this communication, which Li-Cycle believe are reasonable in the circumstances. There can be no assurance that such estimates or assumptions will prove to be correct and, as a result, actual results or events may differ materially from expectations expressed in or implied by the forward-looking statements.

7

These forward-looking statements are provided for the purpose of assisting readers in understanding certain key elements of Li-Cycle’s current objectives, goals, targets, strategic priorities, expectations and plans, and in obtaining a better understanding of Li-Cycle’s business and anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes and is not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Li-Cycle, and are not guarantees of future performance. Li-Cycle believes that these risks and uncertainties include, but are not limited to, the following: Li-Cycle’s inability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries; Li-Cycle’s inability to successfully implement its global growth strategy, on a timely basis or at all; Li-Cycle’s inability to manage future global growth effectively; Li-Cycle’s inability to develop the Rochester Hub, Arizona Spoke, Alabama Spoke and other future projects in a timely manner or on budget or that those projects will not meet expectations with respect to their productivity or the specifications of their end products; Li-Cycle’s failure to materially increase recycling capacity and efficiency; Li-Cycle may engage in strategic transactions, including acquisitions, that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in incurrence of debt, or prove not to be successful; one or more of Li-Cycle’s current or future facilities becoming inoperative, capacity constrained or if its operations are disrupted; additional funds required to meet Li-Cycle’s capital requirements in the future not being available to Li-Cycle on commercially reasonable terms or at all when it needs them; Li-Cycle expects to incur significant expenses and may not achieve or sustain profitability; problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations; Li-Cycle’s inability to maintain and increase feedstock supply commitments as well as securing new customers and off-take agreements; a decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies; decreases in benchmark prices for the metals contained in Li-Cycle’s products; changes in the volume or composition of feedstock materials processed at Li-Cycle’s facilities; the development of an alternative chemical make-up of lithium-ion batteries or battery alternatives; Li-Cycle’s revenues for the Rochester Hub are derived significantly from a single customer; Li-Cycle’s insurance may not cover all liabilities and damages; Li-Cycle’s heavy reliance on the experience and expertise of its management; Li-Cycle’s reliance on third-party consultants for its regulatory compliance; Li-Cycle’s inability to complete its recycling processes as quickly as customers may require; Li-Cycle’s inability to compete successfully; increases in income tax rates, changes in income tax laws or disagreements with tax authorities; significant variance in Li-Cycle’s operating and financial results from period to period due to fluctuations in its operating costs and other factors; fluctuations in foreign currency exchange rates which could result in declines in reported sales and net earnings; unfavourable economic conditions, such as consequences of the global COVID-19 pandemic; natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, boycotts and geo-political events; failure to protect Li-Cycle’s intellectual property; Li-Cycle may be subject to intellectual property rights claims by third parties; Li-Cycle’s failure to effectively remediate the material weaknesses in its internal control over financial reporting that it has identified or if it fails to develop and maintain a proper and effective internal control over financial reporting. These and other risks and uncertainties related to Li-Cycle’s business are described in greater detail in the section entitled “Risk Factors” in its final prospectus dated August 10, 2021 filed with the Ontario Securities Commission in Canada and the Form 20-F filed with the SEC. Because of these risks, uncertainties and assumptions, readers should not place undue reliance on these forward-looking statements. Actual results could differ materially from those contained in any forward-looking statement.

8

| Li-Cycle Corp. |

| Condensed consolidated interim statements of financial position |

| As at July 31, 2021 and October 31, 2020 |

| (Unaudited—expressed in U.S. dollars) |

| July 31, 2021 | October 31, 2020 | |||||||

| $ | $ | |||||||

| Assets |

||||||||

| Current assets |

||||||||

| Cash |

2,350,722 | 663,557 | ||||||

| Accounts receivable |

3,255,981 | 890,229 | ||||||

| Prepayments and deposits |

7,911,436 | 963,951 | ||||||

| Inventory |

1,502,921 | 179,994 | ||||||

|

|

|

|

|

|||||

| 15,021,060 | 2,697,731 | |||||||

|

|

|

|

|

|||||

| Non-current assets |

||||||||

| Plant and equipment |

18,113,712 | 5,602,580 | ||||||

| Right of use assets |

16,277,652 | 3,859,088 | ||||||

|

|

|

|

|

|||||

| 34,391,364 | 9,461,668 | |||||||

|

|

|

|

|

|||||

| 49,412,424 | 12,159,399 | |||||||

|

|

|

|

|

|||||

| Liabilities |

||||||||

| Current liabilities |

||||||||

| Accounts payable and accrued liabilities |

15,778,982 | 4,364,372 | ||||||

| Restricted share units |

3,259,010 | 171,849 | ||||||

| Lease liabilities |

1,190,086 | 591,355 | ||||||

| Loans payable |

1,688,853 | 1,468,668 | ||||||

|

|

|

|

|

|||||

| 21,916,931 | 6,596,244 | |||||||

|

|

|

|

|

|||||

| Non-current liabilities |

||||||||

| Lease liabilities |

15,044,408 | 3,021,815 | ||||||

| Loans payable |

9,776,681 | 779,210 | ||||||

| Restoration provisions |

332,420 | 321,400 | ||||||

|

|

|

|

|

|||||

| 25,153,509 | 4,122,425 | |||||||

|

|

|

|

|

|||||

| 47,070,440 | 10,718,669 | |||||||

|

|

|

|

|

|||||

| Shareholders’ equity |

||||||||

| Share capital |

37,805,879 | 15,441,600 | ||||||

| Contributed surplus |

952,441 | 824,683 | ||||||

| Accumulated deficit |

(36,119,724 | ) | (14,528,941 | ) | ||||

| Accumulated other comprehensive loss |

(296,612 | ) | (296,612 | ) | ||||

|

|

|

|

|

|||||

| 2,341,984 | 1,440,730 | |||||||

|

|

|

|

|

|||||

| 49,412,424 | 12,159,399 | |||||||

|

|

|

|

|

|||||

9

Li-Cycle Corp.

Condensed consolidated interim statements of loss and comprehensive loss

Three and nine months ended July 31, 2021 and 2020

(Unaudited—expressed in U.S. dollars)

| Three months ended July 31, | Nine months ended July 31, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Revenue |

||||||||||||||||

| Product sales |

1,593,563 | 107,040 | 2,682,531 | 185,156 | ||||||||||||

| Recycling services |

115,560 | 74,692 | 301,216 | 137,877 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1,709,123 | 181,732 | 2,983,747 | 323,033 | |||||||||||||

| Expenses |

||||||||||||||||

| Employee salaries and benefits, net |

2,481,939 | 547,080 | 5,358,953 | 1,415,661 | ||||||||||||

| Raw materials, supplies and finished goods |

2,261,304 | 142,161 | 4,876,561 | 344,704 | ||||||||||||

| Professional fees |

1,176,310 | 897,224 | 4,095,596 | 1,560,108 | ||||||||||||

| Research and development, net |

576,551 | (282,541 | ) | 1,928,582 | (19,357 | ) | ||||||||||

| Share-based compensation |

298,489 | 57,383 | 1,307,874 | 220,440 | ||||||||||||

| Office and administrative |

369,113 | 64,786 | 987,820 | 134,337 | ||||||||||||

| Depreciation, net |

272,724 | 327,806 | 788,830 | 717,278 | ||||||||||||

| Freight and shipping |

155,456 | (5,450 | ) | 587,953 | 57,303 | |||||||||||

| Marketing |

160,479 | 65,570 | 465,269 | 188,500 | ||||||||||||

| Plant facilities |

74,818 | 59,774 | 232,358 | 223,767 | ||||||||||||

| Travel and entertainment |

102,768 | 30,754 | 188,712 | 125,535 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 7,929,951 | 1,904,547 | 20,818,508 | 4,968,276 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(6,220,828 | ) | (1,722,815 | ) | (17,834,761 | ) | (4,645,243 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other (income) expense |

||||||||||||||||

| Foreign exchange (gain) loss |

(214,496 | ) | (73,931 | ) | 536,216 | (109,297 | ) | |||||||||

| Interest expense |

382,639 | 164,819 | 788,335 | 340,695 | ||||||||||||

| Interest income |

(503 | ) | (2,722 | ) | (1,725 | ) | (34,178 | ) | ||||||||

| Fair value loss on restricted share units |

508,850 | — | 2,433,196 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 676,490 | 88,166 | 3,756,022 | 197,220 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(6,897,318 | ) | (1,810,981 | ) | (21,590,783 | ) | (4,842,463 | ) | ||||||||

| Other comprehensive income (loss) |

||||||||||||||||

| Foreign currency translation |

— | 249,607 | — | (276,873 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss |

(6,897,318 | ) | (1,561,374 | )) | (21,590,783 | ) | (5,119,336 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss per common share—basic and diluted |

(2.88 | ) | (0.86 | ) | (9.10 | ) | (2.35 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

10

| Li-Cycle Corp. | ||||||||

| Condensed consolidated interim statements of cash flows | ||||||||

| Three and nine months ended July 31, 2021 and 2020 | ||||||||

| (Unaudited—expressed in U.S. dollars) | ||||||||

| Three months ended July 31, | Nine months ended July 31, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Operating activities |

||||||||||||||||

| Net loss for the period |

(6,897,318 | ) | (1,810,981 | ) | (21,590,783 | ) | (4,842,463 | ) | ||||||||

| Items not affecting cash |

||||||||||||||||

| Share-based compensation |

298,489 | 57,383 | 1,307,874 | 220,440 | ||||||||||||

| Depreciation |

697,604 | 327,806 | 1,830,603 | 717,278 | ||||||||||||

| Amortization of government grants |

(26,887 | ) | (1,086,133 | ) | (92,926 | ) | (2,176,041 | ) | ||||||||

| Loss on disposal of assets |

— | — | 13,399 | — | ||||||||||||

| FX (gain) loss on translation |

(152,562 | ) | 153,808 | 509,195 | (451,238 | ) | ||||||||||

| Fair value loss on restricted share units |

508,850 | — | 2,433,196 | — | ||||||||||||

| Share-based professional fees |

— | 455,055 | — | 455,055 | ||||||||||||

| Interest and accretion on convertible debt |

— | — | — | 9,931 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (5,571,824 | ) | (1,903,062 | ) | (15,589,442 | ) | (6,067,038 | ) | |||||||||

| Changes in non-cash working capital items |

||||||||||||||||

| Accounts receivable |

(1,504,376 | ) | 218,432 | (2,365,752 | ) | 327,776 | ||||||||||

| Prepayments and deposits |

(2,668,131 | ) | (631,538 | ) | (7,118,905 | ) | (1,938,325 | ) | ||||||||

| Inventory |

(719,231 | ) | (711 | ) | (1,322,927 | ) | (191,310 | ) | ||||||||

| Accounts payable and accrued liabilities |

5,218,663 | 155,725 | 9,830,211 | 214,656 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (5,244,899 | ) | (2,161,153 | ) | (16,566,815 | ) | (7,654,241 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Investing activity |

||||||||||||||||

| Purchases of plant and equipment |

(5,298,447 | ) | (836,378 | ) | (12,066,848 | ) | (1,748,271 | ) | ||||||||

| Proceeds from disposal of plant and equipment |

— | — | 16,866 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (5,298,447 | ) | (836,378 | ) | (12,049,982 | ) | (1,748,271 | ) | |||||||||

| Financing activities |

||||||||||||||||

| Proceeds from share issuance, net of share issue costs |

— | — | 21,620,000 | 6,481,381 | ||||||||||||

| Proceeds from exercise of stock options |

169,105 | — | 169,105 | — | ||||||||||||

| Proceeds from loans payable |

7,000,000 | 5,663 | 10,091,220 | 2,149,335 | ||||||||||||

| Proceeds from government grants |

26,887 | 429,537 | 92,926 | 1,131,730 | ||||||||||||

| Repayment of lease liabilities |

(204,231 | ) | (137,173 | ) | (530,953 | ) | (250,371 | ) | ||||||||

| Repayment of loans payable |

(423,595 | ) | (3,871 | ) | (1,138,336 | ) | (10,051 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 6,568,166 | 294,156 | 30,303,962 | 9,502,024 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net change in cash |

(3,975,180 | ) | (2,703,375 | ) | 1,687,165 | 99,512 | ||||||||||

| Cash, beginning of period |

6,325,902 | 6,586,336 | 663,557 | 3,783,449 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash, end of period |

2,350,722 | 3,882,961 | 2,350,722 | 3,882,961 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-cash investing activities |

||||||||||||||||

| Accrual for purchase of plant and equipment |

251,802 | — | 1,584,399 | — | ||||||||||||

| Non-cash financing activities |

||||||||||||||||

| Shares issued for non-cash costs |

— | — | 455,055 | 492,409 | ||||||||||||

11

Exhibit 99.3

Condensed consolidated interim financial statements of

Li-Cycle Corp.

Three and nine months ended July 31, 2021 and 2020

(unaudited)

| Condensed consolidated interim statements of financial position |

2 | |||

| Condensed consolidated interim statements of loss and comprehensive loss |

3 | |||

| Condensed consolidated interim statements of changes in equity |

4 | |||

| Condensed consolidated interim statements of cash flows |

5 | |||

| Notes to the condensed consolidated interim financial statements |

6–18 | |||

Li-Cycle Corp.

Condensed consolidated interim statements of financial position

As at July 31, 2021 and October 31, 2020

(Unaudited - expressed in U.S. dollars)

| Notes | July 31, 2021 $ |

October 31, 2020 $ |

||||||||||

| Assets |

||||||||||||

| Current assets |

||||||||||||

| Cash |

2,350,722 | 663,557 | ||||||||||

| Accounts receivable |

3 | 3,255,981 | 890,229 | |||||||||

| Prepayments and deposits |

4 | 7,911,436 | 963,951 | |||||||||

| Inventory |

5 | 1,502,921 | 179,994 | |||||||||

|

|

|

|

|

|||||||||

| 15,021,060 | 2,697,731 | |||||||||||

|

|

|

|

|

|||||||||

| Non-current assets |

||||||||||||

| Plant and equipment |

6 | 18,113,712 | 5,602,580 | |||||||||

| Right of use assets |

7 | 16,277,652 | 3,859,088 | |||||||||

|

|

|

|

|

|||||||||

| 34,391,364 | 9,461,668 | |||||||||||

|

|

|

|

|

|||||||||

| 49,412,424 | 12,159,399 | |||||||||||

|

|

|

|

|

|||||||||

| Liabilities |

||||||||||||

| Current liabilities |

||||||||||||

| Accounts payable and accrued liabilities |

15,778,982 | 4,364,372 | ||||||||||

| Restricted share units |

9 | 3,259,010 | 171,849 | |||||||||

| Lease liabilities |

11 | 1,190,086 | 591,355 | |||||||||

| Loans payable |

8 | 1,688,853 | 1,468,668 | |||||||||

|

|

|

|

|

|||||||||

| 21,916,931 | 6,596,244 | |||||||||||

|

|

|

|

|

|||||||||

| Non-current liabilities |

||||||||||||

| Lease liabilities |

11 | 15,044,408 | 3,021,815 | |||||||||

| Loans payable |

8 | 9,776,681 | 779,210 | |||||||||

| Restoration provisions |

332,420 | 321,400 | ||||||||||

|

|

|

|

|

|||||||||

| 25,153,509 | 4,122,425 | |||||||||||

|

|

|

|

|

|||||||||

| 47,070,440 | 10,718,669 | |||||||||||

|

|

|

|

|

|||||||||

| Shareholders’ equity |

||||||||||||

| Share capital |

9 | 37,805,879 | 15,441,600 | |||||||||

| Contributed surplus |

9 | 952,441 | 824,683 | |||||||||

| Accumulated deficit |

(36,119,724 | ) | (14,528,941 | ) | ||||||||

| Accumulated other comprehensive loss |

(296,612 | ) | (296,612 | ) | ||||||||

|

|

|

|

|

|||||||||

| 2,341,984 | 1,440,730 | |||||||||||

|

|

|

|

|

|||||||||

| 49,412,424 | 12,159,399 | |||||||||||

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of the condensed consolidated interim statements.

Page 2

Li-Cycle Corp.

Condensed consolidated interim statements of loss and comprehensive loss

Three and nine months ended July 31, 2021 and 2020

(Unaudited - expressed in U.S. dollars)

| Three months ended July 31, | Nine months ended July 31, | |||||||||||||||||||

| Notes | 2021 $ |

2020 $ |

2021 $ |

2020 $ |

||||||||||||||||

| Revenue |

||||||||||||||||||||

| Product sales |

1,593,563 | 107,040 | 2,682,531 | 185,156 | ||||||||||||||||

| Recycling services |

115,560 | 74,692 | 301,216 | 137,877 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| 1,709,123 | 181,732 | 2,983,747 | 323,033 | |||||||||||||||||

| Expenses |

||||||||||||||||||||

| Employee salaries and benefits, net |

2,481,939 | 547,080 | 5,358,953 | 1,415,661 | ||||||||||||||||

| Raw materials, supplies and finished goods |

2,261,304 | 142,161 | 4,876,561 | 344,704 | ||||||||||||||||

| Professional fees |

1,176,310 | 897,224 | 4,095,596 | 1,560,108 | ||||||||||||||||

| Research and development, net |

576,551 | (282,541 | ) | 1,928,582 | (19,357 | ) | ||||||||||||||

| Share-based compensation |

9 | 298,489 | 57,383 | 1,307,874 | 220,440 | |||||||||||||||

| Office and administrative |

369,113 | 64,786 | 987,820 | 134,337 | ||||||||||||||||

| Depreciation, net |

6,7 | 272,724 | 327,806 | 788,830 | 717,278 | |||||||||||||||

| Freight and shipping |

155,456 | (5,450 | ) | 587,953 | 57,303 | |||||||||||||||

| Marketing |

160,479 | 65,570 | 465,269 | 188,500 | ||||||||||||||||

| Plant facilities |

74,818 | 59,774 | 232,358 | 223,767 | ||||||||||||||||

| Travel and entertainment |

102,768 | 30,754 | 188,712 | 125,535 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| 7,929,951 | 1,904,547 | 20,818,508 | 4,968,276 | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Loss from operations |

|

(6,220,828 | ) | (1,722,815 | ) | (17,834,761 | ) | (4,645,243 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other (income) expense |

||||||||||||||||||||

| Foreign exchange (gain) loss |

(214,496 | ) | (73,931 | ) | 536,216 | (109,297 | ) | |||||||||||||

| Interest expense |

382,639 | 164,819 | 788,335 | 340,695 | ||||||||||||||||

| Interest income |

(503 | ) | (2,722 | ) | (1,725 | ) | (34,178 | ) | ||||||||||||

| Fair value loss on restricted share units |

508,850 | — | 2,433,196 | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| 676,490 | 88,166 | 3,756,022 | 197,220 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

|

(6,897,318 | ) | (1,810,981 | ) | (21,590,783 | ) | (4,842,463 | ) | |||||||||||

| Other comprehensive income (loss) |

||||||||||||||||||||

| Foreign currency translation |

— | 249,607 | — | (276,873 | ) | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Comprehensive loss |

|

(6,897,318 | ) | (1,561,374 | )) | (21,590,783 | ) | (5,119,336 | ) | |||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Loss per common share - basic and diluted |

13 | (2.88 | ) | (0.86 | ) | (9.10 | ) | (2.35 | ) | |||||||||||

|

|

|

|

|

|

|

|||||||||||||||

The accompanying notes are an integral part of the condensed consolidated interim financial statements.

Page 3

Li-Cycle Corp.

Condensed consolidated interim statements of changes in equity

For the six months ended July 31, 2021 and 2020

(Unaudited - expressed in U.S. dollars)

| Notes | Number of common shares |

Share capital $ |

Contributed surplus $ |

Accumulated deficit $ |

Accumulated other comprehensive income (loss) $ |

Total $ |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance, October 31, 2020 |

|

2,088,733 | 15,441,600 | 824,683 | (14,528,941 | ) | (296,612 | ) | 1,440,730 | |||||||||||||||||||

| Stock option expense |

9 | — | — | 702,932 | — | — | 702,932 | |||||||||||||||||||||

| Exercise of stock options |

9 | 25,664 | 289,224 | (120,119 | ) | — | — | 169,105 | ||||||||||||||||||||

| Shares issued for cash |

9 | 281,138 | 21,620,000 | — | — | — | 21,620,000 | |||||||||||||||||||||

| Shares issued for non-cash costs |

9 | 12,000 | 455,055 | (455,055 | ) | — | — | — | ||||||||||||||||||||

| Comprehensive loss |

— | — | — | (21,590,783 | ) | — | (21,590,783 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance, July 31, 2021 |

|

2,407,535 | 37,805,879 | 952,441 | (36,119,724 | ) | (296,612 | ) | 2,341,984 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Notes | Number of common shares |

Share capital $ |

Contributed surplus $ |

Accumulated deficit $ |

Accumulated other comprehensive income (loss) $ |

Total $ |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance, October 31, 2019 |

|

1,916,003 | 8,467,810 | 123,781 | (5,252,979 | ) | (77,886 | ) | 3,260,726 | |||||||||||||||||||

| Stock option expense |

9 | — | — | 132,568 | — | — | 132,568 | |||||||||||||||||||||

| Shares issued for cash |

9 | 159,294 | 6,481,381 | — | — | — | 6,613,949 | |||||||||||||||||||||

| Shares issuable for non-cash costs |

9 | — | — | 455,055 | — | — | 455,055 | |||||||||||||||||||||

| Conversion of convertible debt |

9 | 13,436 | 492,409 | — | — | — | 492,409 | |||||||||||||||||||||

| Comprehensive loss |

— | — | — | (4,842,463 | ) | (276,873 | ) | (5,119,336 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance, July 31, 2020 |

|

2,088,733 | 15,441,600 | 711,404 | (10,095,442 | ) | (354,759 | ) | 5,702,803 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

The accompanying notes are an integral part of the condensed consolidated interim financial statements.

Page 4

Li-Cycle Corp.

Condensed consolidated interim statements of cash flows

Three and nine months ended July 31, 2021 and 2020

(Unaudited - expressed in U.S. dollars)

| Three months ended July 31, | Nine months ended July 31, | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||

| Notes | $ | $ | $ | $ | ||||||||||||||||

| Operating activities |

||||||||||||||||||||

| Net loss for the period |

(6,897,318 | ) | (1,810,981 | ) | (21,590,783 | ) | (4,842,463 | ) | ||||||||||||

| Items not affecting cash |

||||||||||||||||||||

| Share-based compensation |

9 | 298,489 | 57,383 | 1,307,874 | 220,440 | |||||||||||||||

| Depreciation |

6, 7 | 697,604 | 327,806 | 1,830,603 | 717,278 | |||||||||||||||

| Amortization of government grants |

(26,887 | ) | (1,086,133 | ) | (92,926 | ) | (2,176,041 | ) | ||||||||||||

| Loss on disposal of assets |

— | — | 13,399 | — | ||||||||||||||||

| FX (gain) loss on translation |

(152,562 | ) | 153,808 | 509,195 | (451,238 | ) | ||||||||||||||

| Fair value loss on restricted share units |

508,850 | — | 2,433,196 | — | ||||||||||||||||

| Share-based professional fees |

9 | — | 455,055 | — | 455,055 | |||||||||||||||

| Interest and accretion on convertible debt |

— | — | — | 9,931 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| (5,571,824 | ) | (1,903,062 | ) | (15,589,442 | ) | (6,067,038 | ) | |||||||||||||

| Changes in non-cash working capital items |

||||||||||||||||||||

| Accounts receivable |

(1,504,376 | ) | 218,432 | (2,365,752 | ) | 327,776 | ||||||||||||||

| Prepayments and deposits |

(2,668,131 | ) | (631,538 | ) | (7,118,905 | ) | (1,938,325 | ) | ||||||||||||

| Inventory |

(719,231 | ) | (711 | ) | (1,322,927 | ) | (191,310 | ) | ||||||||||||

| Accounts payable and accrued liabilities |

5,218,663 | 155,725 | 9,830,211 | 214,656 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| (5,244,899 | ) | (2,161,153 | ) | (16,566,815 | ) | (7,654,241 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Investing activity |

||||||||||||||||||||

| Purchases of plant and equipment |

6 | (5,298,447 | ) | (836,378 | ) | (12,066,848 | ) | (1,748,271 | ) | |||||||||||

| Proceeds from disposal of plant and equipment |

— | — | 16,866 | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| (5,298,447 | ) | (836,378 | ) | (12,049,982 | ) | (1,748,271 | ) | |||||||||||||

| Financing activities |

||||||||||||||||||||

| Proceeds from share issuance, net of share issue costs |

9 | — | — | 21,620,000 | 6,481,381 | |||||||||||||||

| Proceeds from exercise of stock options |

9 | 169,105 | — | 169,105 | — | |||||||||||||||

| Proceeds from loans payable |

8 | 7,000,000 | 5,663 | 10,091,220 | 2,149,335 | |||||||||||||||

| Proceeds from government grants |

26,887 | 429,537 | 92,926 | 1,131,730 | ||||||||||||||||

| Repayment of lease liabilities |

(204,231 | ) | (137,173 | ) | (530,953 | ) | (250,371 | ) | ||||||||||||

| Repayment of loans payable |

(423,595 | ) | (3,871 | ) | (1,138,336 | ) | (10,051 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| 6,568,166 | 294,156 | 30,303,962 | 9,502,024 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net change in cash |

(3,975,180 | ) | (2,703,375 | ) | 1,687,165 | 99,512 | ||||||||||||||

| Cash, beginning of period |

6,325,902 | 6,586,336 | 663,557 | 3,783,449 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cash, end of period |

2,350,722 | 3,882,961 | 2,350,722 | 3,882,961 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-cash investing activities |

||||||||||||||||||||

| Accrual for purchase of plant and equipment |

251,802 | — | 1,584,399 | — | ||||||||||||||||

| Non-cash financing activities |

||||||||||||||||||||

| Equity issued for non-cash costs |

— | — | — | 947,464 | ||||||||||||||||

The accompanying notes are an integral part of the condensed consolidated interim financial statements.

Page 5

Li-Cycle Corp.

Notes to the condensed consolidated interim financial statements

Three and nine months ended July 31, 2021 and 2020

(Unaudited - expressed in U.S. dollars)

| 1. | Nature of operations and going concern |

| (i) | Li-Cycle Corp. (“Li-Cycle” or the “Company”) was incorporated under the Business Corporations Act (Ontario) on November 18, 2016. The Company’s registered address is 2351 Royal Windsor Drive, Unit 10, Mississauga, ON L5J 4S7 Canada. |

Li-Cycle’s core business model is to build, own and operate recycling plants tailored to regional needs. Li-Cycle’s Spoke and Hub Technologies™ provide an environment friendly and scalable solution that address the growing global lithium-ion battery recycling challenge and provide an economically viable resource recovery solution, supporting the global transition toward electrification.

On March 28, 2019, the Company incorporated a 100% owned subsidiary in Delaware, U.S., by the name of Li-Cycle Inc., under the General Corporation Law of the State of Delaware.

On September 2, 2020, the Company incorporated a 100% owned subsidiary in Delaware, U.S., by the name of Li-Cycle North America Hub, Inc., under the General Corporation Law of the State of Delaware.

On February 12, 2021, the Company incorporated a 100% owned subsidiary in Ontario, Canada, by the name of Li-Cycle Holdings Corp., under the Business Corporations Act (Ontario).

On February 16, 2021, the Company entered into a definitive business combination agreement with Peridot Acquisition Corp. (NYSE: PDAC) and Li-Cycle Holdings Corp. Upon closing, the combined company will be renamed Li-Cycle Holdings Corp.

On August 10, 2021, in accordance with the plan of arrangement to reorganize Li-Cycle Corp., the Company finalized the business combination with Peridot Acquisition Corp. (NYSE: PDAC). Upon closing, the combined company was renamed Li-Cycle Holdings Corp.

| (ii) | Going concern |

These condensed consolidated interim statements have been prepared by management on a going concern basis which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. For the three and nine months ended July 31, 2021, the Company had not achieved a level of revenue from its operations to be profitable and incurred a loss of $6.7 million and $21.4 million, respectively (losses of $1.8 million and $4.8 million in the three and nine months ended July 31, 2020). Cash used in operations for the three and nine months ended July 31, 2021 was $5.2 million and $16.6 million, respectively (used in operations was $2.1 million and $7.6 million in the three and nine months ended July 31, 2020).

In order to continue its long-term operations, the Company must achieve profitable operations and continue to obtain additional equity or debt financing. Until the Company achieves profitability, management plans to fund its operations and capital expenditures through borrowings and issuance of capital stock. Until the Company generates revenue at a level to support its cost structure, the Company expects to continue to incur substantial operating losses and net cash outflows.

There can be no assurance that the Company will be successful in raising additional capital or that such capital, if available, will be on terms that are acceptable to the Company. If the Company is unable to raise sufficient additional capital on acceptable terms, it may be compelled to reduce the scope of its operations and planned capital expenditures or sell certain assets, including intellectual property assets. These conditions call into question the Company’s ability to continue as a going concern.

Page 6

Li-Cycle Corp.

Notes to the condensed consolidated interim financial statements

Three and nine months ended July 31, 2021 and 2020

(Unaudited - expressed in U.S. dollars)

Subsequent to the quarter end, the Company finalized the business combination with Peridot Acquisition Corp. (NYSE: PDAC) in August 2021. The new combined company Li-Cycle Holdings Corp received $582 million of gross transaction proceeds, before deduction of $55 million of transaction costs. These funds are sufficient to fund the current operations and capital expenditures related to the Company’s expansion plans for the next 12 months. As a result, after considering all relevant information, including its actions completed to date and its future plans, management has concluded that there are no material uncertainties related to events or conditions that may cast significant doubt upon the Company’s ability to continue as a going concern for a period of 12 months from the date these condensed consolidated interim financial statements are available to be issued.

The estimates used by management in reaching this conclusion are based on information available as of the date these condensed consolidated interim financial statements were authorized for issuance and include internally generated cash flow forecasts. Accordingly, actual results could differ from these estimates and resulting variances may be material to management’s assessment.

| 2. | Significant accounting policies |

| (a) | Statement of compliance |

These condensed consolidated interim financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) under International Accounting Standard (IAS) 34 – Interim Financial Reporting. Except as described below, these financial statements were prepared using the same basis of presentation, accounting policies and methods of computation as outline in Note 2, Significant accounting policies in the Company’s consolidated financial statements for the year ended October 31, 2020. These financial statements do not include all the notes required in annual financial statements.

These condensed consolidated interim consolidated interim financial statements were approved and authorized for issue by the Board of Directors on September 8, 2021.

| (b) | Basis of consolidation |

These condensed consolidated interim financial statements include the accounts of the Company and its subsidiaries. The Company’s three subsidiaries are entities controlled by the Company. Control exists when the Company has power over an investee, when the Company is exposed, or has rights, to variable returns from the investee and when the Company has the ability to affect those returns through its power over the investee. The subsidiaries are included in the condensed consolidated interim financial results of the Company from the effective date of incorporation up to the effective date of disposition or loss of control. The Company’s principal subsidiaries and their geographic location as at July 31, 2021 was as follows:

| Company |

Location | Ownership interest | ||||

| Li-Cycle Inc. |

Delaware, U.S. | 100 | % | |||

| Li-Cycle North America Hub, Inc. |

Delaware, U.S. | 100 | % | |||

| Li-Cycle Holdings Corp. |

Ontario, Canada | 100 | % | |||

Intercompany transactions, balances and unrealized gains/losses on transactions between the Company and its subsidiary are eliminated.

| (c) | Basis of preparation |

Change in Functional Currency: Prior to November 1, 2020, the Company had determined its functional currency was the Canadian dollar on the basis that its operating expenditures, capital expenditures and financing were primarily denominated in Canadian dollars. With increasing volume of operations, new contracts with US based suppliers, commencement of

Page 7

Li-Cycle Corp.

Notes to the condensed consolidated interim financial statements

Three and nine months ended July 31, 2021 and 2020

(Unaudited - expressed in U.S. dollars)

operations at its US Spoke and increasing capital expenditures in its US facilities, the Company’s operating expenditures are becoming predominantly denominated in US dollars. Additionally, due to the increase in US dollar expenses and its expansion plans in the US, the Company has obtained, and plans to continue to seek, financing in US dollars. As a result of the increasing activities in US dollars, the Company has changed its functional currency to the U.S. dollar effective November 1, 2020.

Accordingly, beginning with the three month period ended January 31, 2021, the Company transitioned its functional and presentation currency to U.S. dollars. Transactions in currencies other than the U.S. dollar are recorded at the exchange rates on the dates of transactions. At the end of each reporting period, monetary assets and liabilities that are denominated in foreign currencies are translated at the closing rate on that date.

Comparative financial information for the 2020 fiscal periods was translated from Canadian dollars into U.S. dollars in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates:

| (i) | Assets and liabilities were translated at the closing rate at end of each reporting period; |

| (ii) | Items recognized in the statement of loss and comprehensive loss were translated at the exchange rate at the time of transaction; |

| (iii) | Equity items have been translated using the historical rate at the time of transaction; |

| (iv) | All resulting exchange differences were recognized in other comprehensive loss. |

Page 8

Li-Cycle Corp.

Notes to the condensed consolidated interim financial statements

Three and nine months ended July 31, 2021 and 2020

(Unaudited - expressed in U.S. dollars)

| 3. | Accounts receivable |

| July 31, 2021 $ |

October 31, 2020 $ |

|||||||

| Trade receivables |

2,877,970 | 571,300 | ||||||

| Harmonized Sales Taxes receivable |

378,011 | 274,998 | ||||||

| Other receivables |

— | 43,931 | ||||||

|

|

|

|

|

|||||

| 3,255,981 | 890,229 | |||||||

|

|

|

|

|

|||||

For product sales, the Company estimates the amount of consideration to which it expects to be entitled under provisional pricing arrangements. The amount of consideration for black mass and mixed copper/aluminum sales is based on the mathematical product of: (i) market prices of the constituent metals at the date of settlement, (ii) product weight, and (iii) assay results (ratio of the constituent metals initially estimated by management and subsequently trued up to customer confirmation). Certain adjustments like handling and refining charges are also made per contractual terms with customers. Depending on the contractual terms with customers, the payment of receivables may take up to 12 months from date of shipment. Product sales and the related trade accounts receivables are measured at fair value at initial recognition and are re-estimated at each reporting period end using the market prices of the constituent metals at the respective measurement dates. Changes in fair value are recognized as an adjustment to profit and loss and the related accounts receivable. For the three and nine months ended July 31, 2021, the fair value gain arising from changes in estimates was $361,141 and $529,109, respectively (three and nine months ended July 31, 2020: Nil).

An insignificant portion of the receivables relate to services revenue which are initially measured at fair value and subsequently at amortized cost. For the period ended July 31, 2021 and 2020, the Company has assessed an allowance for credit loss of $nil for service-related receivables based on its past experience, the credit ratings of its existing customers and economic trends.

| 4. | Prepayments and deposits |

| July 31, 2021 $ |

October 31, 2020 $ |

|||||||

|

|

|

|

|

|||||

| Prepaid lease deposits |

675,773 | 33,501 | ||||||

| Prepaid transaction costs |

6,176,806 | — | ||||||

| Other prepaids |

1,058,857 | 930,450 | ||||||

|

|

|

|

|

|||||

| 7,911,436 | 963,951 | |||||||

|

|

|

|

|

|||||

Prepaid transactions costs principally relate to the business combination with Peridot Acquisition Corp. (NYSE: PDAC) discussed in Note 1.

Other prepaids consist principally of prepaid insurance, environmental financial assurance, subscriptions, and parts and consumables.

| 5. | Inventory |

| July 31, 2021 $ |

October 31, 2020 $ |

|||||||

| Raw material |

342,591 | 140,419 | ||||||

| Finished goods |

1,160,330 | 39,575 | ||||||

|

|

|

|

|

|||||

| 1,502,921 | 179,994 | |||||||

|

|

|

|

|

|||||

Page 9

Li-Cycle Corp.

Notes to the condensed consolidated interim financial statements

Three and nine months ended July 31, 2021 and 2020

(Unaudited - expressed in U.S. dollars)

The cost of inventories recognized as an expense during the three and nine month ended July 31, 2021 was $2,156,737and $4,647,469, respectively (three and nine months ended July 31, 2020: $142,161 and $344,704).