SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K dated 9 June 2015

(Commission File No. 001-35053)

INTERXION HOLDING N.V.

(Translation of Registrant’s Name into English)

Tupolevlaan 24, 1119 NX

Schiphol-Rijk, The Netherlands, +31 20 880 7600

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached

annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7) ): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or

legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required

to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This

report contains Interxion Holding N.V.’s (1) press release “Interxion files 2014 Dutch Statutory Annual Report” and (2) 2014 Dutch Statutory Annual Report.

This Report on Form 6-K is incorporated by reference into the Registration Statement on Form S-8 of the Registrant originally filed with the Securities and

Exchange Commission on 23 June 2011 (File No. 333-175099) and into the Registration Statement on Form S-8 of the Registrant originally filed with the Securities and Exchange Commission on 2 June 2014 (File No. 333-196447).

|

|

|

|

Exhibit

|

|

|

|

|

| 99.1 |

|

The press release “Interxion files 2014 Dutch Statutory Annual Report”, dated 9 June 2015. |

|

|

| 99.2 |

|

2014 Dutch Statutory Annual Report. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| INTERXION HOLDING N.V. |

|

|

| By: |

|

/s/ David C. Ruberg |

| Name: |

|

David C. Ruberg |

| Title: |

|

Chief Executive Officer |

Date: 9 June 2015

Exhibit 99.1

Press release 9 June 2015

Interxion Files 2014 Dutch Statutory Annual Report

AMSTERDAM 9 June 2015. INTERXION HOLDING N.V. (NYSE: INXN), a leading European provider of carrier and cloud neutral colocation data centre

services, today announced that it has filed its 2014 Dutch Statutory Annual Report with the Securities and Exchange Commission. The 2014 Dutch Statutory Annual Report can be found under the “Annual Reports” link on the company’s

website at investors.interxion.com as well as on the SEC website at www.sec.gov. In addition, shareholders may request a hard copy of the 2014 Dutch Statutory Annual Report, which includes the company’s complete audited financial statements,

free of charge by contacting Interxion Investor Relations at Tupolevlaan 24, 1119 NX Schiphol-Rijk, The Netherlands, Attention: Investor Relations or by email at [email protected].

About Interxion

Interxion (NYSE: INXN) is a leading

provider of carrier and cloud-neutral colocation data centre services in Europe, serving a wide range of customers through 39 data centres in 11 European countries. Interxion’s uniformly designed, energy efficient data centres offer customers

extensive security and uptime for their mission-critical applications.

With over 500 connectivity providers, 20 European Internet exchanges, and most

leading cloud and digital media platforms across its footprint, Interxion has created connectivity, cloud, content and finance hubs that foster growing customer communities of interest. For more information, please visit www.interxion.com.

Contact:

Jim Huseby

Investor Relations

Interxion

Tel: +1-813-644-9399

[email protected]

Exhibit 99.2

CLOUD AND CARRIER-NEUTRAL

DATA CENTRE SERVICES

Interxion is a leading pan-European

provider of cloud and carrier-neutral data centre services. We deliver value to our customers by being responsive to their needs, and by building communities of interest that enable our customers to add value to their service offerings. Established

in 1998, we have expanded rapidly to create 39 data centres in 13 cities across 11 countries, giving us the largest reach across Europe and providing our customers with access to more than 77% of EU GDP.

FORWARD-LOOKING STATEMENTS

This

annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to all statements other than

statements of historical fact regarding our business, financial condition, results of operations and certain of our plans, objectives, assumptions, projections, expectations or beliefs with respect to these items and statements regarding other

future events or prospects. These statements include, without limitation, those concerning: our strategy and our ability to achieve it; expectations regarding sales, profitability and growth; plans for the construction of new data centres; our

possible or assumed future results of operations; research and development, capital expenditure and investment plans; adequacy of capital; and financing plans. The words “aim,” “may,” “will,” “expect,”

“anticipate,” “believe,” “future,” “continue,” “help,” “estimate,” “plan,” “schedule,” “intend,” “should,” “shall” or the negative or other

variations thereof as well as other statements regarding matters that are not historical fact, are or may constitute forward-looking statements.

In addition, this

annual report includes forward-looking statements relating to our potential exposure to various types of market risks, such as foreign exchange rate risk, interest rate risks and other risks related to financial assets and liabilities. We have based

these forward-looking statements on our management’s current view with respect to future events and financial performance. These views reflect the best judgment of our management but involve a number of risks and uncertainties which could cause

actual results to differ materially from those predicted in our forward-looking statements and from past results, performance or achievements. Although we believe that the estimates reflected in the forward-looking statements are reasonable, those

estimates may prove to be incorrect.

By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on

circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from these expressed or implied by these forward-looking statements. These factors include, among other

things:

| ● |

|

operating expenses cannot be easily reduced in the short term; |

| ● |

|

inability to utilise the capacity of newly planned data centres and data centre expansions; |

| ● |

|

significant competition; |

| ● |

|

cost and supply of electrical power; |

| ● |

|

data centre industry over-capacity; |

| ● |

|

and performance under service level agreements. |

These risks and others described under “Risk Factors” (page 32)

are not exhaustive. Other sections of this annual report describe additional factors that could adversely affect our business, financial condition or results of operations. Additionally, new risk factors can emerge from time to time, and it is not

possible for us to predict all such risk factors, nor can we assess the impact of all such risk factors to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, you should not place undue

reliance on forward-looking statements as a prediction of actual results.

All forward-looking statements included in this annual report are based on information

available to us on the date of this annual report. We undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable

law. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this annual report.

|

| 2 / INTERXION ANNUAL REPORT 2014 |

IN THIS REPORT

|

|

|

|

|

|

|

| OPERATIONAL REVIEW |

|

|

|

|

| 6 |

|

Our 2014 performance at a glance |

|

12 |

|

Our country team |

| 7 |

|

Selected financial data |

|

13 |

|

Our segment team |

| 8 |

|

What we do |

|

14 |

|

Consistent execution |

| 9 |

|

Why customers choose us |

|

15 |

|

Continued growth |

| 10 |

|

Our

people |

|

16 |

|

Market

strategy |

| FINANCIAL REVIEW |

|

|

|

|

| 20 |

|

Income statement highlights |

|

23 |

|

Cash flow highlights |

| 22

|

|

Balance sheet

highlights |

|

|

|

|

| REPORT OF THE BOARD OF

DIRECTORS |

|

|

|

|

| 26 |

|

Structure |

|

32 |

|

Shares beneficially owned |

| 26 |

|

Board of Directors |

|

32 |

|

Risk management |

| 29 |

|

Director’s insurance and

indemnification |

|

32 |

|

Risk factors |

| 30 |

|

Board committees |

|

34 |

|

Controls and procedures |

| 31

|

|

Compensation |

|

34 |

|

Dutch Corporate

Governance Code |

| CONSOLIDATED FINANCIAL

STATEMENTS |

|

|

|

|

| 38

38 |

|

Consolidated income statement

Consolidated statement of comprehensive

income |

|

40 |

|

Consolidated statement of changes in shareholders’

equity |

|

|

41 |

|

Consolidated statement of cash flows |

| 39

|

|

Consolidated

statement of financial position |

|

42 |

|

Notes to the 2014

consolidated financial statements |

| COMPANY FINANCIAL

STATEMENTS |

|

|

|

|

| 86 |

|

Company statement of financial position |

|

87 |

|

Notes to the 2014 company financial

statements |

| 87 |

|

Company income

statement |

|

|

|

|

| OTHER INFORMATION |

|

FIND OUT MORE |

| 94 |

|

Appropriation of result |

|

98 |

|

Where can I find out more? |

| 95 |

|

Independent

auditor’s report |

|

99 |

|

Follow

us |

|

| INTERXION ANNUAL REPORT 2014 / 3 |

|

| 4 / INTERXION ANNUAL REPORT 2014 |

INTERXION ANNUAL REPORT

2014 / 5

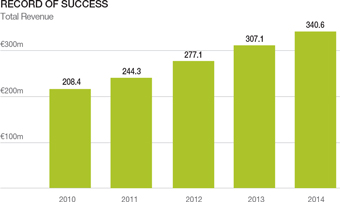

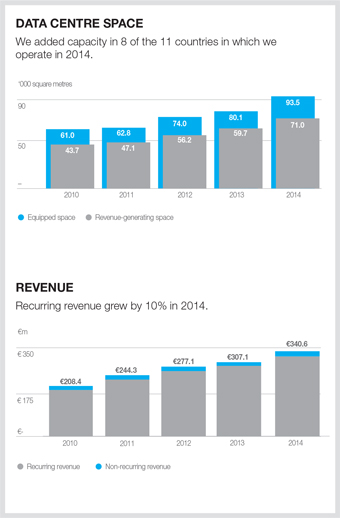

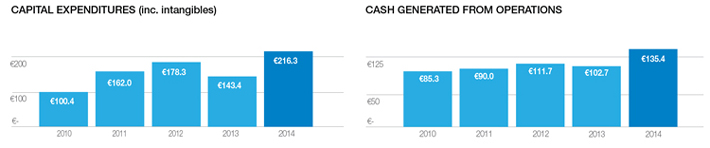

OUR 2014 PERFORMANCE AT A GLANCE

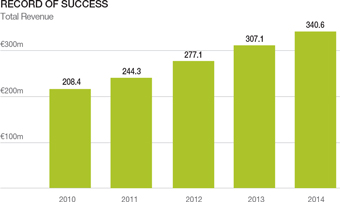

Throughout 2014 we have continued to build on the previous track record of consistent growth to achieve a strong set of financial

and operating results. We expanded our footprint, added capacity to continue to meet our customers’ needs and focused on our strategy of developing communities of interest amongst our customer base. Magnetic customers established their presence

in our Cloud Hubs across Europe, positioning Interxion to benefit as cloud adoption in Europe develops.

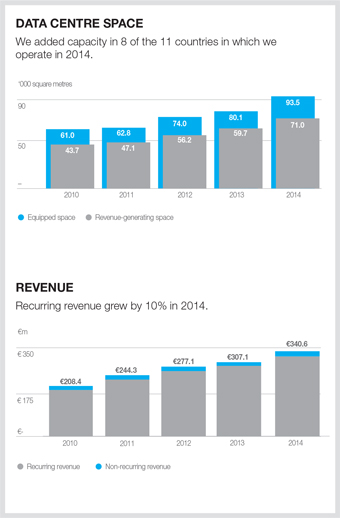

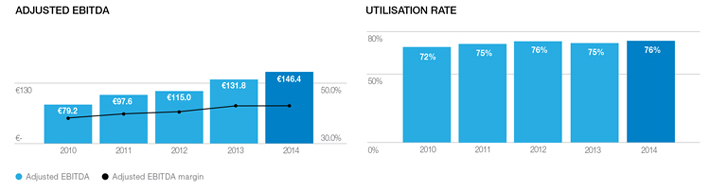

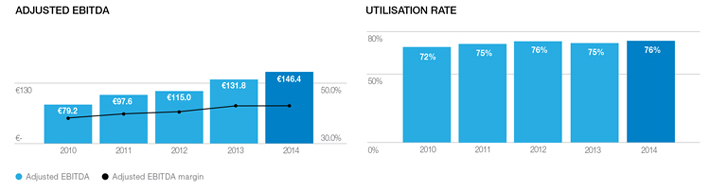

Growth across our footprint was strong, with recurring revenue growing 10% and Adjusted EBITDA growing 11% over 2013,

despite a continued challenging European economy.

We made customer-driven capital investments to open 6 new data centres and completed expansion projects in 8 of the

11 countries in which we operate. We added over 13,400 square metres of equipped space in line with customer demand and the discipline of our approach was highlighted as utilisation increased from around 75% to around 76% as more than 11,300 square

metres of revenue generating space was installed by our customers during the year.

With the purchase of the SFR Netcenter in Marseille, we are positioning Interxion

at the crossroads of connectivity between Europe, Asia, Africa and the Middle East and allowing our customers easier, cost effective access to these expanding markets.

Overall, 2014 was a year of solid progress and growth. Looking forward, the order-driven momentum that we have created and

the attractive opportunity opened up by our Marseille investment, combined with healthy industry fundamentals, leave us optimistic on our future growth prospects.

We

expect the strong customer demand to continue in 2015 and we will be investing in further capacity during the course of the year. We have already announced new data centre builds in Frankfurt and Stockholm and three expansions in Amsterdam,

Marseille and Vienna.

Subsequent to the year end, on 9th March 2015, we announced that we have entered into a definitive agreement* on an all-share merger with

Telecity Group plc. We believe that the combination of the two businesses is strategically compelling. Demand for data centre services is evolving rapidly and the additional geographic scope and financial scale of the combined business will provide

customers with even more robust connectivity choices and cloud platforms, and will be better positioned to service the needs of global data centre customers.

Finally, I would like to thank all our employees for their dedication, commitment and contribution to Interxion’s continuing success.

David Ruberg, Chief Executive Officer

28 April 2015

* Completion of the transaction will be subject to, amongst other

things, all relevant regulatory and anti-trust approvals

|

| 6 / INTERXION ANNUAL REPORT 2014 |

SELECTED FINANCIAL DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2010

|

|

|

2011

|

|

|

2012

|

|

|

2013

|

|

|

2014

|

|

| Recurring revenue |

|

|

193.0 |

|

|

|

228.3 |

|

|

|

259.2 |

|

|

|

291.3 |

|

|

|

319.2 |

|

| Non-recurring revenue |

|

|

15.4 |

|

|

|

16.0 |

|

|

|

17.9 |

|

|

|

15.8 |

|

|

|

21.4 |

|

| Revenue |

|

|

208.4 |

|

|

|

244.3 |

|

|

|

277.1 |

|

|

|

307.1 |

|

|

|

340.6 |

|

| Adjusted EBITDA |

|

|

79.2 |

|

|

|

97.6 |

|

|

|

115.0 |

|

|

|

131.8 |

|

|

|

146.4 |

|

| Adjusted EBITDA margin |

|

|

38.0% |

|

|

|

40.0% |

|

|

|

41.5% |

|

|

|

42.9% |

|

|

|

43.0% |

|

| Capital expenditures (including

intangibles) |

|

|

(100.4) |

|

|

|

(162.0) |

|

|

|

(178.3) |

|

|

|

(143.4) |

|

|

|

(216.3) |

|

| Cash generated from operations |

|

|

85.3 |

|

|

|

90.0 |

|

|

|

111.7 |

|

|

|

102.7 |

|

|

|

135.4 |

|

| Revenue-generating space |

|

|

43.7 |

|

|

|

47.1 |

|

|

|

56.2 |

|

|

|

59.7 |

|

|

|

71.0 |

|

| Equipped space |

|

|

61.0 |

|

|

|

62.8 |

|

|

|

74.0 |

|

|

|

80.1 |

|

|

|

93.5 |

|

| Utilisation rate |

|

|

72% |

|

|

|

75% |

|

|

|

76% |

|

|

|

75% |

|

|

|

76% |

|

Financial figures are expressed as millions of euros; space figures in ‘000 sqm.

|

| INTERXION ANNUAL REPORT 2014 / 7 |

WHAT WE DO

CLOUD AND CARRIER-NEUTRAL COLOCATION DATA CENTRES

With 39 cloud and carrier-neutral colocation data centres

across 11 countries and 13 cities, Interxion enables over 1,500 customers to securely deliver applications and content to their end-customers, with excellent response time and performance.

We are located in the markets where demand for data centre services is the greatest. Our footprint provides access to over 77% of

European GDP, and our data centres are home to more than 500 carriers and ISPs, as well as 20 European Internet exchanges

WHAT MAKES US DIFFERENT?

We are a provider that delivers value to customers by offering reliability and security beyond industry standards, and by creating communities of interest. Our data

centres are close to city centres, which gives our customers direct access to Europe’s leading businesses and helps them provide rapid response times to their end customers.

Organisations that colocate with us can take advantage of the security, uptime and scalability we offer without relinquishing control of their ICT infrastructure. They

can cut both capital and operational costs while improving application performance, achieving increased business flexibility, and realising the value of community membership.

CLOUD AND CARRIER-NEUTRALITY

A neutral

data centre provider like Interxion is independent of the organisations that colocate in its facilities: it doesn’t compete with any of them. All colocating organisations are free to contract directly with the cloud platforms and the

connectivity, infrastructure, managed services and other providers of their choice.

Our neutrality helps to attract a wide range of providers into our facilities,

all of whom compete to offer the best performance, service and price. Our data centres effectively constitute a marketplace within a highly connected environment, helping customers gain the flexibility, performance and cost efficiencies they need.

Customers can interconnect quickly and easily with low-latency Cross Connects that not only improve the speed and flexibility of doing business, but also reduce the

costs.

CREATING COMMUNITIES OF INTEREST

We develop strong communities of interest within our data centres to bring together companies operating in the same sector. Organisations find a ready-formed community of

potential customers, providers and partners, and can benefit from fast, low-cost interconnectivity and rapidly establish profitable business relationships.

|

|

|

|

|

|

|

|

MEETING THE SPECIFIC

NEEDS OF DIFFERENT INDUSTRY SECTORS

Our communities of interest, together with our in-house industry experts, deliver real value to our customers. We recognise that organisations in different sectors have

differing needs, which influence what they want from a data centre partner. We help:

● Service providers meet the challenges of a dynamically

growing, time-sensitive market where providing outstanding quality of service is critical

● Connectivity providers extend their reach and deploy new

services

● Digital media providers meet the demand for content, anytime,

anywhere

● Enterprises reduce costs, manage risk, develop a platform for

growth and meet their environmental objectives ● Financial services organisations trade securely at high speed and move quickly to meet their regulatory obligations

● Systems integrators grow their business and create new

business models |

|

|

|

| 8 / INTERXION ANNUAL REPORT 2014 |

WHY CUSTOMERS CHOOSE US

A FUTURE-PROOF HOME FOR OUR CUSTOMERS’ ICT INFRASTRUCTURE

Our state-of-the-art data centre design and our commitment to sustainability are among the reasons our customers choose to work with us – they also understand

the value derived from being part of a community backed by consistent, strong operational support and design excellence.

UNEQUALLED SUPPORT AND EXPERTISE

Our support teams in all the European countries where we operate speak our customers’ languages and understand the local market and regulations. Our on-site, highly

skilled engineering teams help to ensure the smooth running and availability of our customers’ ICT infrastructures.

Our European Customer Service Centre (ECSC)

is made up of experienced professionals who are available 24/7 to provide multi-lingual support via a single phone number. Customers can also use our secure portal for self-service access to real-time information.

For our larger pan-European customers, our international accounts team provides streamlined support, along with a single point of contact and a master services agreement

spanning all their locations.

INNOVATION AND TECHNICAL EXCELLENCE

For

well over a decade we have been at the forefront of data centre design and management, and we continue to focus strongly on innovation and efficiency improvements. Whether it’s evaluating the latest energy-efficiency techniques, options for

green power, or new design practices, Interxion leads the way.

Our dedicated Digital, Technology and Engineering Group (DTEG) pioneered many of today’s key data

centre design approaches, such as modular design and build, designing for power usage effectiveness (PUE), cold aisle containment and other energy efficient design innovations.

Because we have grown by organic expansion, the data centres that we have built are designed, operated and maintained in a consistent way, which contributes to high

levels of technical excellence, reliability and performance.

OUR COMMITMENT TO SUSTAINABILITY

We are

committed to environmental responsibility. We deliver efficient, cost-effective services by minimising waste and energy use, without compromising reliability and performance. Our modular data centre design – which lets us build large systems

from smaller subsystems – optimises our use of space, power and cooling and helps us continue to improve PUE.

In 2014 we reaffirmed our commitment to

sustainability with the formation of our Energy Strategy Group which works across Interxion countries to develop, implement and govern the energy strategy of the company.

This year we reached a milestone with more than 90% of power coming from sustainable sources. We implement free cooling wherever we can and recycle waste heat for other

purposes.

Our Paris operations have led the way, receiving ISO 50001 certification for energy efficiency through the development of an energy management system.

As part of our sustainability commitment we contribute to recognised industry bodies. For example, we sit on the Technical Committee and the Advisory Council of The Green

Grid (the leading energy efficiency and sustainability association for the data centre industry), and contribute to the EC Joint Research Centre on sustainability.

|

| INTERXION ANNUAL REPORT 2014 / 9 |

OUR PEOPLE

OUR SENIOR TEAM

Our people are a key part of what differentiates us, led

by a management team with considerable experience in the technology sector. The team focus on customers and on driving Interxion towards the heart of the digital economy, adding value and making it easier for our customers to do business.

|

|

|

|

|

| DAVID RUBERG |

|

|

|

|

|

|

|

David Ruberg, Chief Executive Officer

After serving for five years as Chairman, David became CEO in 2007 and continues to develop our

business as one of Europe’s leading providers of cloud and carrier-neutral data centres. In his role he combines valuable insights into the needs of our customers with his knowledge of how colocation technology can add value to such companies

and help them further develop their business. Prior to this, David was CEO and Chairman of

Intermedia Communications, a broadband communications services provider. David has also held posts at Data General and AT&T, and has served on the boards of several businesses, including Adaptix and Broadview Networks.

He holds a Masters degree from the University of Michigan in Computer and Communications Science.

|

|

|

|

|

|

|

|

| JOSH JOSHI |

|

|

|

|

|

|

|

Josh Joshi, Chief Financial Officer

Josh joined Interxion in 2007 and is responsible for our financial policy and funding strategy,

financial planning, reporting and control, and investor relations. Josh has held senior executive roles in data centre, network and infrastructure businesses for over 15 years.

Before joining Interxion, Josh worked as CFO at two publicly traded companies – Leisure and

Gaming plc and Telecity Group plc. He was one of the founders of the private equity-backed Storm Telecommunications Ltd. Early in his career Josh worked in professional practice for eight years, latterly with Arthur Andersen.

He holds a degree in Civil Engineering from Imperial College, London and is a member of the Institute

of Chartered Accountants in England and Wales. |

|

|

|

| 10 / INTERXION ANNUAL REPORT 2014 |

|

|

|

|

|

| GIULIANO

DI VITANTONIO

|

|

Giuliano Di

Vitantonio, Chief Marketing & Strategy Officer Giuliano

joined Interxion in 2015 and is responsible for our market and product strategies including product management, product marketing, segment strategy and business development. He joined from Cisco Systems where he held the position of Vice President

Marketing, Data Center & Cloud. Giuliano has over 20 years of experience in the IT

industry, including 17 years at Hewlett-Packard, where he held a broad range of positions in R&D, strategy, consulting, business development and marketing. Giuliano’s areas of expertise include IT management software, enterprise

applications, data centre infrastructure and business intelligence solutions. He has a Masters degree in EE/ Telecommunications from the University of Bologna and an MBA from the London Business School.

Giuliano has lived in five different countries and is fluent in four languages. He is based in

London. |

|

|

| |

|

|

|

|

| JAN-PIETER ANTEN

|

|

Jan-Pieter Anten,

Vice President, Human Resources Jan-Pieter joined Interxion

as VP Human Resources in 2011 and is responsible for the development and implementation of our HR strategy. His experience in human resources enables him to oversee the recruitment, development and retention of the experienced and dedicated staff

who are key to our business across Europe. He joined Interxion from global management

consulting firm Hay Group, where he held the position of Director, International Strategic Clients Europe. In previous posts, he has worked as VP Human Resources for other international organisations such as Synthon and as a senior consultant within

Hay Group. Jan-Pieter holds a degree in Pharmaceutical Sciences from the University of

Utrecht. |

|

|

| |

|

|

|

|

| JAAP

CAMMAN

|

|

Jaap Camman, Senior Vice President, Legal Jaap joined Interxion in 1999 and is

responsible for all legal and corporate affairs across the group. Jaap provides strategic legal direction, drawing on his extensive experience in corporate financing, finance restructuring, corporate governance and business design.

He joined Interxion after working in a number of roles within the Dutch government during which time

he was responsible for the development of financial sector legislation and represented the Netherlands both at European Union and United Nations level. In his latest role he served as Deputy Head of the Insurance Division at the Netherlands Ministry

of Finance. Jaap holds a Masters degree in Law from the University of Utrecht. |

|

|

|

| INTERXION ANNUAL REPORT 2014 / 11 |

OUR COUNTRY TEAM

We have strong local management, operational, sales, service delivery and assurance teams, enabling us to deliver a more efficient, consistent and personal service.

Our country leaders have the local knowledge and focus to ensure we provide outstanding service to our customers and continue to expand our data centre campuses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHAT OUR CUSTOMERS SAY ABOUT US

“When it comes to data centres, no-one does it better than Interxion. Having looked at all providers in Spain, Interxion was our first choice for quality,

reliability and scalability. They combine outstanding flexibility with a reassuring attention to detail.”

Diego Cabezudo, CEO Gigas Hosting

“With its core expertise in data centre operations, Interxion can much more efficiently and

reliably perform both installation and maintenance. We also benefit from lower initial investment costs and shorter implementation times, as well as greater scalability, flexibility and cost efficiency offered by the cloud model.”

Thomas Leidenbach,

Head of IS Infrastructure Bombardier

“We were pleased to see Interxion enter the Marseille market. It’s great to have a partner who focuses on connectivity, digital media and cloud segments, and

recognises the connectivity and business advantages of Marseille and supports us as we continue to grow our business.”

Franck Simon, Managing Director

France-IX “Interxion’s London facilities were a perfect fit to complement our

network build in key European locations, bringing us closer to potential new customers. This has also enabled us to lower the cost of our infrastructure build, improving our competitiveness – without compromising service quality.”

Clive Hamilton,

VP Network Services NTT Europe

“In the coming years we want to expand our activities in Europe by providing telecommunication services with the highest standards. We believe Interxion is the

best partner to facilitate this growth, thanks to central locations of the data centres and providing access to the Internet Exchanges and Connectivity Hubs where the biggest and fastest network connections come together.”

Bjarni Thorvardarson,

CEO Hibernia Networks |

|

|

|

| 12 / INTERXION ANNUAL REPORT 2014 |

OUR SEGMENT TEAM

Our segment strategies are led by people who understand our customers and have direct experience of the challenges they face. Our segment leaders spend time and

become familiar with their business objectives, how their technology platforms work and explore solutions available. They will continue to develop our communities of interest strategy.

|

|

|

|

|

|

|

|

|

|

|

| Bill

Fenick, Financial Services |

|

|

|

|

|

|

|

WHAT OUR CUSTOMERS SAY ABOUT US “We were impressed by Interxion’s

track record in Financial Services combined with the unrivalled range of connectivity to the entire CEE region from the Vienna data centre.”

Sean Chinnock, Director COO Data and Services,

Deutsche Börse “Working with Interxion as a European data centre partner has

proved to be a positive business decision for Zayo. We’re very happy with the partnership we have and look forward to continued collaboration and potential expansion.”

Alastair Kane,

VP for Europe, Zayo Group

“Interxion really stood out for their understanding of our target business model and the flexibility to make it a reality.”

Ruben van der Zwan,

CTO, Amsio

“The resilience and reliability of systems need to be of a very high standard. We needed to find a partner who was willing to talk through options that were not

necessarily about increased space and increased cost.” Mary

Hensher, IT Director, Cancer Research UK

“When reviewing options for our data centre expansion we were impressed with the quality, professionalism and level of connectivity from Interxion. They

demonstrated an impressive commitment to understanding our specific industry needs and have actively pursued a strategy designed to support our success and long-term growth.”

Matthew Breedlove, Technical and Data Operations, Rubicon

Project |

|

|

| Bill works to build on our financial hubs

that comprise access points to financial markets, tier 1 banks, hedge funds, prime brokers and independent software vendors. With a career spanning over 19 years in financial services, Bill has first-hand experience of large capital-intensive

infrastructure projects: developing new products and services and, ultimately, running businesses that provide cloud, data and infrastructure services to the financial services Industry.

“Interxion has rich communities of financial services companies colocated

in its data centres. Via these communities of interest, our customers implement their infrastructure and cross connect to their own clients. This all leads to an ease of doing business with us and greater return on their investment.”

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Jeff

Smith, Connectivity |

|

|

|

|

|

|

|

|

| Jeff focuses on attracting into our data

centres the connectivity providers most demanded by our customers and has over 20 years’ experience in Telecommunications across multiple roles in various markets including EMEA, Australia & NZ. As connectivity providers launch new

services and capabilities, Jeff ensures they’re made available in our data centres as early as possible. This provides our customers with a competitive advantage - access to new technologies ahead of their competitors.

“I am focused on executing a clear connectivity strategy ensuring that

Interxion is central to their European market requirements – this in turn creates a diverse community of interest that supports and drives growth amongst all our customers.”

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Vincent in’t Veld, Cloud |

|

|

|

|

|

|

|

|

| Vincent identifies and targets prospects

that will make the most magnetic and strategic additions to our cloud communities of interest, and leads the process for developing relationships with these prospects and winning their business. Vincent draws on over 19 years of experience in

international telecoms and IT, working in various roles across sales, product management and marketing.

“The migration towards cloud is a phased process. IT leaders are assessing what applications and workloads should go where. It’s key for

our service provider customers to understand from partners, like Interxion, how to best build out their cloud and networking infrastructure and lower the thresholds for enterprise customers to migrate their applications and workloads to the

cloud.” |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Ian McVey,

Enterprise and Systems Integrators |

|

|

|

|

|

|

|

|

| Ian is responsible for the go-to-market

strategy for our enterprise and system integrator segments. His target is to win “first-of-a-kind” deals for Interxion. He ensures we identify, promote and capitalise on the key trends in the market through a mix of value proposition

articulation, market-making and education. With nearly 20 years in ICT from strategy consulting to telecoms, software and outsourcing, Ian understands the pressures and the opportunities in transforming business models, and can see the resulting

opportunity for Interxion. |

|

|

|

|

|

|

|

|

| “Interxion is a key enabler of the

digital economy. As enterprises replatform to the cloud and leverage innovations in big data, Interxion is strongly positioned to enable customers to create value from their IT operations, supported by a strong community”

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Bryan Hill,

Digital Media |

|

|

|

|

|

|

|

|

|

| Bryan is responsible for our digital media

business and the strategic development and implementation of our communities of interest across video, social media, advertising, gaming and gambling. Bryan has spent 20 years in the sector and has experience of the monetisation of content and

audiences, an understanding of the complex, technical and evolving workflows that underpin the digital media value chains and the challenges our customers are facing. |

|

|

|

|

|

|

|

|

|

| “The growth in the delivery of online

content and services to consumers, the automation of advertising, the movement of media workflows to the cloud and the transformation of TV are driving new interconnected communities. It is our mission to help companies navigate and meet these

challenges” |

|

|

|

|

|

|

|

|

|

|

| INTERXION ANNUAL REPORT 2014 / 13 |

CONSISTENT EXECUTION

We offer outstanding customer service and deliver exceptional data centre performance. We embrace innovation to ensure that our data centres remain state-of-the-art,

and we strive to maintain our leadership in data centre design, construction, operation, maintenance, sustainability and management.

Continuing to deliver best-in-class service

We are focused on maximising customer satisfaction. Our European Customer Service Centre (ECSC) operates round the clock and gives our customers a single number to call

for help at any time of the day or night.

As part of our ongoing drive to deliver outstanding customer service, we introduced Cloud Connect, allowing for easy

implementation of hybrid IT environments in the data centre. Currently in operation in the UK, this will be rolled out to more countries in 2015.

Building new capacity in line with demand

We continue to invest in data centre capacity in the context of our disciplined investment

approach and prudent financial policy. Our expansion plans are based on analysis of selling patterns, pipeline and trends in existing demand, and on working with our customers to understand their future capacity requirements.

Our expansions are fully funded and take place in phases to reduce risk and improve our return on capital.

Targeting new customers

We target new customers in segments where colocation delivers the highest value, including cloud and managed services, connectivity, digital media and financial services.

Winning new customers in these markets lets us create and expand communities of interest within our data centres.

We expect the benefits of our communities of

interest to continue to attract new prospects, lowering our customer acquisition costs and reducing churn.

Making it easier to do business with us

We expanded our international accounts focus so that our customers in multiple countries can share a single point of contact. This coupled with our product

standardisation programme, means that customers can order the same product in any country to allow for scalability and agile growth.

We continue to develop tools to make our interaction with customers easier, including our Customer Portal that provides real-time

access to information. And we invest in our service delivery and assurance teams to be responsive to customers’ needs locally, in their own language.

|

| 14 / INTERXION ANNUAL REPORT 2014 |

CONTINUED GROWTH

We aim to generate strong returns on the capital we invest by adding value to our customers through the communities of interest we build, and the market-leading

connectivity, high-quality infrastructure and best-in-class customer service that we offer.

NEW CUSTOMERS

| ● |

|

ACTIV Financial, ITG and SIX Group are some of the new financial services customers that now derive value from our ultra-low latency connectivity to global liquidity venues. |

| ● |

|

Salesforce.com, Oracle and Digital Ocean joined our growing community of cloud providers, taking advantage of our wealth of industry knowledge as well as our highly secure and resilient facilities. |

| ● |

|

We welcomed new digital media providers into our customer base, including Riedel Networks and SWISS TXT, who derive value from our growing content hubs, as cloud becomes a vital part of the media workflow.

|

| ● |

|

Bombardier and Minds + Machines are two of the customers who joined our enterprise and systems Integrator communities. These companies gain from increased efficiencies through community connections, and will be well

positioned to take advantage of trends such as big data and the Internet of Things. |

| ● |

|

We also saw a rapid increase in the number of connectivity customers in our Marseille facility, a strategic location which serves as the telecom landing point serving the Middle East and Africa as well as particularly

strong growth in the CDN market with companies such as Akamai, Edgecast and CDNetworks expanding their presence across Interxion locations.

|

|

| INTERXION ANNUAL REPORT 2014 / 15 |

MARKET STRATEGY

Interxion continues to execute a proven strategic approach that anticipates how the disruptions in the ICT industry will impact the market for colocation data centre

services and successfully captures the associated customer demand.

The premise of our market strategy is that current and future demand for data centre services is largely shaped by

enterprise cloud adoption and cloud provider deployment strategies.

Our strategy is designed to enable and benefit from the evolution of Cloud, and has been

validated through our ability to attract the leading global cloud infrastructure providers to our data centres. These leading cloud service providers recognize the value of the existing communities of interests we have established and their presence

will further enhance our ability to expand our communities as the migration to Cloud continues to evolve.

Our performance throughout 2014 reinforces our belief that

neutral colocation data centres have a central role to play in addressing the Cloud opportunity and in meeting the long term needs of our customers.

CAPTURING

THE FIRST WAVE OF CLOUD DEPLOYMENTS

The first phase of Cloud adoption has been underway for a few years and consists of enterprises embracing SaaS

(Software-as-a-Service) and IaaS (Infrastructure-as-a-Service) for standalone applications.

SaaS is the most mature model, as enterprises are shifting from software

licenses to a pay-per-use model to reduce their capital investments. The adoption of IaaS is also growing rapidly and is primarily driven by the small and medium business segment and specific workloads within enterprises - such as test and

development.

This first wave of adoption is fueling the rapid growth of service build-outs by Cloud Providers, with colocation data

centres playing a critical role in their deployment strategies, especially as US-based providers establish their presence in Europe to reach the local markets.

In

2014, Interxion expanded its relationship with all the main SaaS and IaaS vendors, leading to the fast growth of this segment, which now represents 26% of our revenue. Several Cloud Providers that are present in our data centres have raised their

forecasts for capacity requirements, and are planning further expansions into current and new cities.

PREPARING FOR HYBRID CLOUD ADOPTION

The

second phase of Cloud adoption is starting with the emergence of Hybrid Cloud solutions in the United States, which we expect to spill over into Europe in the coming years.

We are supporting our customers and partners with the development of their new applications that are being deployed in a hybrid environment of public and private clouds

to get the best of both worlds: optimal response time and full control, combined with the ability to flex the usage of resources up and down.

One of the key drivers

for this phase is PaaS (Platform-as-a-Service), which is becoming a strategic priority for Cloud Providers, developers and system integrators. Cloud Providers are making significant investments in PaaS to create Cloud communities on their platforms,

while developers and system integrators are embracing this new model for Cloud native applications.

This phase is very important for the colocation industry,

because it provides a strong indication that enterprises are starting to restructure their applications with a Hybrid Cloud model in mind, which makes them ideal candidates to be colocated with Cloud Providers in a carrier neutral data centre.

|

| 16 / INTERXION ANNUAL REPORT 2014 |

ANTICIPATING THE FUTURE EVOLUTION OF CLOUD

The third phase of Cloud adoption is further out in the future, but some of our customers are already starting to consider the redesign of their business processes to

take full advantage of the flexibility that Hybrid Cloud provides from an architectural standpoint. This is the phase when all the legacy processes will be rethought and applications will be fully converted to the new model, which presents a huge

opportunity for the colocation industry.

Our strategic focus is to enable Colocated Hybrid Cloud solutions that address current demand and prepare us for these

future developments. A hybrid environment requires fast, secure data flow between the different platforms to enable migration of workloads from one platform to another when necessary. Enterprises that are colocated in Interxion’s data centres

will be able to connect to the communities of interest that we support and will find it easier to rewrite business processes and applications to meet future requirements, potentially leapfrogging their competition.

Benefits of Colocation Data Centre Services

Carrier neutral colocation is the outsourcing option that best lends itself to a Hybrid Cloud model, and we expect it to fuel further growth in the

industry.

Enterprises cannot be expected to predict the shape of their IT beyond a few years, given the constantly changing mix of applications and

services, and those that house their IT in neutral facilities will have the flexibility to adapt and will be well-placed to create value in any business scenario.

Interxion has made the right investments over the last 24-36 months to capture this opportunity and accelerate the Hybrid Cloud adoption for Enterprises.

The neutral colocation data centres designed, built and operated by Interxion provide a single secure environment where customers simultaneously

have access to:

| |

● |

|

Direct connection to the major public cloud platforms, providing greater security and better performance than internet connectivity |

| |

● |

|

A wide choice of carriers for other networking needs |

| |

● |

|

The potential to connect to other providers of IT services housed in the same data centre campus |

| |

● |

|

State-of-the-art data centres for private cloud or legacy IT deployments behind the corporate firewall |

|

| INTERXION ANNUAL REPORT 2014 / 17 |

|

| 18 / INTERXION ANNUAL REPORT 2014 |

INTERXION ANNUAL REPORT

2014 / 19

FINANCIAL REVIEW

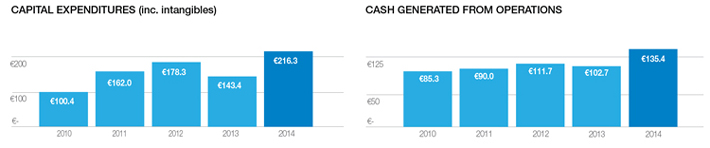

Interxion delivered a strong year of financial performance in 2014. Total revenue increased by 11% to €340.6 million

while recurring revenue, at €319.2 million, was up 10% year-on-year. Non-recurring revenues grew 35% year-on-year driven by strong customer installations. Adjusted EBITDA increased by 11%, to €146.4 million, and Adjusted EBITDA

margin increased slightly to 43.0% from 42.9% in 2013.

Net finance expense for the year was

€27.9 million, compared with €57.5 million in 2013; the decrease was primarily attributable to the €31.0 million one-off cost associated with the refinancing activities in 2013. The underlying blended interest cost of the business was 6.1%, improving 40 basis points compared to 2013. Net profit

for the year was €35.1 million, compared with €6.8 million in 2013 which was impacted by the one off refinancing costs. Underlying

adjusted net profit* for the year increased by 10%.

In April we returned to the public debt market to support growth by issuing €150 million in aggregate principal of our 6% Senior Secured Notes, due 2020, at a premium of 106.75, providing net proceeds of €157.9

million. The additional financing, combined with a new €9.2 million mortgage secured in 2014, was used to repay amounts drawn under our revolving facility and to fund further expansion

projects.

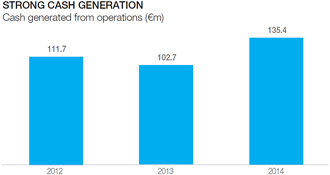

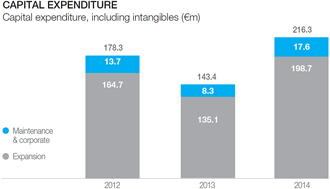

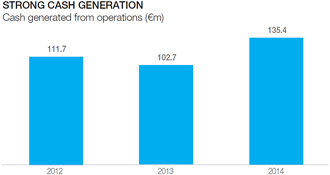

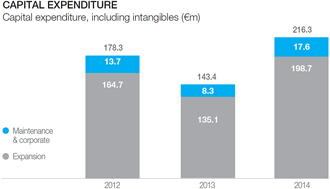

The Company continued to generate significant cash from its operations: €135.4 million in 2014.

We continue to deploy these resources in a disciplined manner, which together with the additional financing, was used to service debt, repay amounts drawn under our revolving facility and to fund further customer-driven data centre expansion: €198.7 million of the €216.3 million capital expenditure in 2014 was invested in expansion and upgrade projects to build the foundation

of future growth.

During the year, we added a record 13,400 square metres of data centre equipped space, of which more than 70% has already been committed to

customers.

Josh Joshi

Chief Financial Officer

28 April 2015

INCOME STATEMENT HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

| (€ millions) |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Total revenue |

|

|

340.6 |

|

|

|

307.1 |

|

|

|

277.1 |

|

| Recurring revenue |

|

|

94% |

|

|

|

95% |

|

|

|

94% |

|

| Gross profit |

|

|

201.5 |

|

|

|

183.0 |

|

|

|

164.0 |

|

| Gross profit margin |

|

|

59% |

|

|

|

60% |

|

|

|

59% |

|

| Adjusted EBITDA |

|

|

146.4 |

|

|

|

131.8 |

|

|

|

115.0 |

|

| Adjusted EBITDA margin |

|

|

43% |

|

|

|

43% |

|

|

|

42% |

|

| Operating profit |

|

|

78.4 |

|

|

|

70.4 |

|

|

|

65.2 |

|

| Operating profit margin |

|

|

23% |

|

|

|

23% |

|

|

|

24% |

|

| Profit for the year |

|

|

35.1 |

|

|

|

6.8 |

|

|

|

31.6 |

|

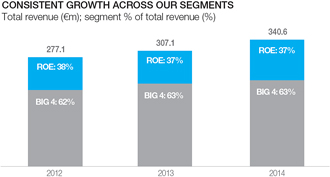

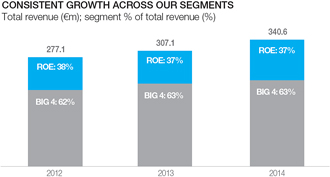

REVENUE

Interxion benefits

from a business model that has a high proportion of recurring revenue. Total revenue during the year was €340.6 million, of which

€319.2 million, or 94%, was recurring. This compares with €307.1 million in revenue for 2013, of which €291.3 million, or 95%, was recurring. The increased percentage of non-recurring revenue was driven by an expected significant increase in customer installations in the latter part of 2014, in

particular in the Netherlands, France and Austria. In the Big 4 countries – France, Germany, the Netherlands and the UK – €200.6 million or 94% of total revenue of €214.2 million was recurring which compares with €182.2 million (95%) of

€192.5 million total revenue in 2013. Recurring revenue in the Big 4 segment grew 9% organically on a constant-currency basis.

*For reconciliation see page 22

|

|

|

| 20 / INTERXION ANNUAL REPORT 2014 |

|

|

€118.6 million or 94% of

€126.4 million total revenue in the Rest of Europe countries was recurring. This compares with €109.1 million (95%) of €114.7 million total revenue in 2013. Recurring revenue in the Rest of Europe segment grew 9% organically on a constant-currency basis.

Germany and the Netherlands revenue growth was particularly strong in 2014 with Austria, Ireland and Sweden also performing very well within the Rest of Europe.

COST OF SALES

Cost of sales increased by

12% in 2014, to €139.1 million (2013: €124.1 million). Interxion’s business model not only results in a high percentage of

recurring revenue, but also delivers significant operating benefits: once data centres are in operation, a number of costs are relatively fixed contributing to operating leverage. Conversely, newly opened data centres generate comparatively higher

non-recurring installation revenues at a relatively higher cost of sales combined with nearly full operating costs at lower utilisation levels. This “expansion drag” was evident in 2014: most of the new openings occurred in the latter part

of the year and this, in turn, led to a slight decrease, to 59.2% (2013: 59.6%), in gross profit margin. The underlying inherent operating leverage of the business model remains intact.

SALES AND MARKETING COSTS

Sales and marketing costs increased by 8%, to €24.6 million (2013: €22.8 million), but were maintained at 7% of revenue. The increase was primarily a result of higher sales commissions

that resulted from increased bookings. Our marketing department continued to invest resources in understanding our customers’ needs and how best to meet them. The department continues to develop the expertise within our organisation to support

our strategy of developing customer communities of interest around magnetic customers.

These communities of interest will, we believe, result in a high-quality

customer base that benefits and grows from the businesses that our magnetic customers attract to our data centres leading to better customer satisfaction, lower churn and attractive investment returns.

GENERAL AND ADMINISTRATIVE COSTS

General and administrative costs increased

by 10% in 2014, to €98.9 million (2013: €90.1 million), and were maintained at 29% of revenue. The higher costs were primarily the

result of a €4.5 million increase, to €62.2 million (2013: €57.7 million), in

depreciation and amortisation and a €2.4 million increase in share-based payments. The higher depreciation and amortisation costs were consistent with the Company’s year-on-year

increase of equipped data centre space

and were partially offset by the full-year cost benefit arising from the adjustment in the estimated useful lives of certain assets

that had been accomplished in October 2013.

General and administrative costs, excluding depreciation, amortisation, impairments, share-based payments, M&A

transaction costs and increase/(decrease) in provision for onerous lease contracts, increased by 8% to €30.6 million compared with 2013 – an indication of the Company’s continued

tight cost control.

ADJUSTED EBITDA

Adjusted EBITDA increased 11%

during the year to €146.4 million (2013: €131.8 million). Adjusted EBITDA margin expanded by five basis points, to 43.0% (2013: 42.9%).

Adjusted EBITDA in the Big 4 countries – France, Germany, the Netherlands and the UK – totalled €113.4 million (2013: €104.4

million), a 52.9% margin (2013: 54.2%).

The decrease in Big 4 Adjusted EBITDA margin was the result of expansion drag and relatively higher sales commissions in

2014, partially offset by a positive Adjusted EBITDA performance in France. Adjusted EBITDA in the Rest of Europe totalled €67.3 million (2013:

€ 59.1 million), a 53.2% margin (2013: 51.5%). Growth in Adjusted EBITDA and Adjusted EBITDA margin was particularly strong in Belgium, Ireland, Sweden and Switzerland.

The operating leverage in the Company’s business model and cost control is manifested in its Adjusted EBITDA results, which grew faster than recurring revenue and

resulted in stable to expanding margins. Over the period, 2012–2014, Interxion’s recurring revenue increased by 23%, while Adjusted EBITDA grew by 27%.

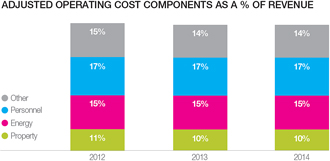

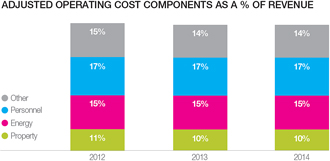

During this period, Adjusted EBITDA margins expanded by 150 basis points, from 41.5% in 2012 to 43.0% in 2014 (2013: 42.9%). The drivers behind this performance can be

understood by looking at the trends in the nature of the operating costs.

The costs of data centre installation and energy have shown a direct correlation with the

growth of revenue, whereas property and other general and administrative costs generally grow at a slower pace. In 2014, the Company employed an average of 478 full-time equivalent employees, compared to 425 in 2013. We expect this number to

increase moderately in 2015, in line with new data centre capacity becoming available and with customer requirements.

OPERATING PROFIT

Operating profit increased by 11% to €78.4 million in 2014 (2013:

€70.4 million), primarily as a result of the increased scale of the business.

|

| INTERXION ANNUAL REPORT 2014 / 21 |

NET FINANCE EXPENSE

Net

finance expense for the year decreased to €27.9 million (2013: €57.5 million), primarily as a result of a €31.0 million one-off cost associated with the refinancing in 2013. Normalised net finance expense increased by 5%, principally because of the increase in total debt financing in 2014.

INCOME TAX EXPENSE

Income tax expense in 2014 was €15.4 million (2013: €6.1 million), an increase of 154%. Our effective tax rate decreased from 47% in 2013 to 31% in 2014. The underlying 2013

effective tax rate was approximately 30% after adjusting for the impact of the €31.0 million one-off refinancing costs and the

€0.6 million deferred tax asset adjustment. The underlying year-on-year increase in the effective tax rate for 2014 was caused by the increase of non-deductible share-based payments.

NET PROFIT

Net profit, which increased to €35.1 million (2013: €6.8 million), was also affected by the one-off refinancing costs. Net profit margin increased to 10.3% in 2014 (2013:

2.2%). Net profit, adjusted for refinancing charges, transaction expenses, capitalised interest and other items, increased by 10% to €32.5 million. Adjusted net profit margin decreased by 11 bps

to 10%.

EARNINGS PER SHARE

Diluted earnings per share (EPS) were €0.50 per share in 2014 (2013: €0.10). The increase was principally a result of the one-off

€31.0 million refinancing cost in 2013. Adjusted net profit for the year increased by 9% on an earnings-per-share basis.

NET PROFIT HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (€ millions) |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Net profit - as reported |

|

|

35.1 |

|

|

|

6.8 |

|

|

|

31.6 |

|

| Add back |

|

|

|

|

|

|

|

|

|

|

|

|

| + Refinancing charges |

|

|

0.6 |

|

|

|

31.0 |

|

|

|

— |

|

| + M&A transaction costs |

|

|

0.3 |

|

|

|

— |

|

|

|

— |

|

| + Deferred tax asset adjustment |

|

|

— |

|

|

|

0.6 |

|

|

|

— |

|

| + Dutch crisis wage tax |

|

|

— |

|

|

|

0.4 |

|

|

|

1.9 |

|

| + Adjustments to onerous lease |

|

|

— |

|

|

|

— |

|

|

|

0.8 |

|

| |

|

|

0.9 |

|

|

|

32.0 |

|

|

|

2.7 |

|

| Reverse |

|

|

|

|

|

|

|

|

|

|

|

|

| – Adjustments to onerous lease |

|

|

(0.8) |

|

|

|

— |

|

|

|

— |

|

| – Interest Capitalised |

|

|

(3.6) |

|

|

|

(1.7) |

|

|

|

(9.2) |

|

| |

|

|

(4.4) |

|

|

|

(1.7) |

|

|

|

(9.2) |

|

| Tax effect of above add backs & reversals |

|

|

0.9 |

|

|

|

(7.5) |

|

|

|

1.6 |

|

| Adjusted Net profit |

|

|

32.5 |

|

|

|

29.6 |

|

|

|

26.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Reported Basic EPS: (€) |

|

|

0.51 |

|

|

|

0.10 |

|

|

|

0.47 |

|

| Reported Diluted EPS: (€) |

|

|

0.50 |

|

|

|

0.10 |

|

|

|

0.46 |

|

| Adjusted Basic EPS: (€) |

|

|

0.47 |

|

|

|

0.43 |

|

|

|

0.40 |

|

| Adjusted Diluted EPS: (€) |

|

|

0.46 |

|

|

|

0.43 |

|

|

|

0.39 |

|

BALANCE SHEET HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (€ millions) |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| PP&E and intangible assets |

|

|

914.2 |

|

|

|

716.6 |

|

|

|

639.6 |

|

| Cash and cash equivalents |

|

|

99.9 |

|

|

|

45.7 |

|

|

|

68.7 |

|

| Other current and non-current assets |

|

|

159.0 |

|

|

|

148.5 |

|

|

|

110.9 |

|

| Total assets |

|

|

1,173.1 |

|

|

|

910.8 |

|

|

|

819.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Borrowings |

|

|

561.6 |

|

|

|

364.0 |

|

|

|

288.1 |

|

| Other current and non-current liabilities |

|

|

175.4 |

|

|

|

158.9 |

|

|

|

155.6 |

|

| Total liabilities |

|

|

737.0 |

|

|

|

522.9 |

|

|

|

443.7 |

|

| Shareholders’ equity |

|

|

436.1 |

|

|

|

387.9 |

|

|

|

375.6 |

|

| Total liabilities and shareholders’ equity |

|

|

1,173.1 |

|

|

|

910.8 |

|

|

|

819.2 |

|

BALANCE SHEET

Interxion’s balance sheet

at financial year-end 2014 was strong and well capitalised, with growing assets, declining costs of capital, and increasing shareholders’ equity.

During 2014,

we invested €198.7 million for discretionary expansion and upgrade projects, including €8.5 million relating to the transaction

with Société Française du Radiotéléphone, SFR SA (“SFR”), to purchase a data centre campus in Marseille, France. The acquisition was completed in the summer of 2014. Including Marseille, we opened six new

data centres and expanded two others; we increased equipped space by 13,400 square metres. Net of depreciation, this resulted in a €196.4 million increase in property, plant and equipment.

At 31 December 2014, the total book value of the Company’s property, plant and equipment was €895.2 million.

Intangible assets, which primarily represent power grid rights and software development expenditure, increased on a net basis by

€1.1 million to end the year at €19.0 million.

The

Company’s deferred tax assets represent the temporary timing differences between the carrying amounts of assets for financial reporting purposes and the amounts for taxation purposes, and result primarily from tax loss carry-forwards. At

31 December 2014, the balance of these deferred tax assets was €30.1 million. Cash and cash equivalents increased to €99.9 million

at year-end 2014 (at year-end 2013: €45.7 million), primarily as a result of financing activities and cash generated from operations, offset by capital expenditures.

Trade and other current assets increased by 27%, to €122.4 million. The Company’s contracts typically require

that, with the exception of metered power usage which is invoiced in arrears, monthly recurring fees are invoiced quarterly in advance. Total trade payables and other liabilities increased 11% to

€158.7 million (2013: €143.6 million). Of this, 92%, or €146.5 million (2013 €132.1 million), were current liabilities. Other liabilities included deferred revenue, customer deposits, tax and social security liabilities, and accrued expenses.

22 / INTERXION ANNUAL REPORT 2014

Borrowings at year-end 2014 increased to €561.6 million (2013: €364.0 million), primarily as a result of the additional €150 million Senior Secured Notes and the new finance leases for the AMS7 and VIE

data centres, which were previously reported as operating leases.

To fund expansion, by Q1 2014, the Company had drawn

€30.0 million under the €100.0 million revolving facility. This was repaid in Q2 with the proceeds from the bond tap. The €100 million revolving facility was undrawn, providing a healthy liquidity cushion, as of 31 December 2014.

Interxion continued to be in full compliance with its debt covenants. Our net debt leverage ratio stood at 3.22 compared with a covenant of less than 4.00.

Other than the Vienna financial lease liability, which was settled in the first quarter of 2015, the Company had no significant near-term debt maturities: 94% of its debt

matures in 2019 or beyond. The €475 million 6.00% Senior Secured Notes mature in July 2020.

Shareholders’ equity increased by €48.2 million in 2014 to

€436.1 million, primarily as a result of retained net profit in 2014 and foreign currency translation differences, leading to a total comprehensive income of €38.4 million, and €9.8 million relating to new shares issued in respect of share options exercised.

CASH FLOW HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

| (€ millions) |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Cash generated from operations |

|

|

135.4 |

|

|

|

102.7 |

|

|

|

111.7 |

|

| Net cash flows from operating activities |

|

|

104.4 |

|

|

|

72.6 |

|

|

|

89.1 |

|

| Capital expenditures, including intangible assets |

|

|

(216.3) |

|

|

|

(143.4) |

|

|

|

(178.3) |

|

| Net cash flows used in investing activities |

|

|

(217.9) |

|

|

|

(143.4) |

|

|

|

(179.1) |

|

| Net cash flows from financing activities |

|

|

167.6 |

|

|

|

47.9 |

|

|

|

15.9 |

|

| Net movement in cash and cash equivalents |

|

|

54.2 |

|

|

|

(23.0) |

|

|

|

(74.0) |

|

| Cash and cash equivalents at the end of the year |

|

|

99.9 |

|

|

|

45.7 |

|

|

|

68.7 |

|

CASH FLOW

During 2014, cash generated from

operations was 32% higher, at €135.4 million (2013: €102.7 million), principally as a result of a higher operating profit and a decrease

in working capital. Movements in trade and other current liabilities, including an increase in deferred income and accrued expenses, primarily drove the decrease in working capital.

Reported cash interest paid in 2014 was €25.2 million (2013:

€22.7 million). In accordance with IFRS, Interxion is required to capitalise interest costs during construction.

The related cash interest paid reported in “purchase of property, plant and equipment” in 2014 was

€2.5 million (2013: €3.7 million).

Cash income taxes decreased by 20%, to €6.3 million (2013: €7.9 million). As a result, net cash flow from operating activities increased by 44%, to €104.4 million (2013: €72.6 million). Capital expenditure for 2014, which included the purchase of property, plant and equipment, plus the purchase of intangible assets, totalled

€216.3 million. These investments were financed through the cash generated from operations and incremental financing; €198.7 million of

this expenditure was invested in expansion and upgrade projects to fuel future growth.

Net cash flow from financing activities was €167.6 million (2013: €47.9 million). In April, net proceeds from the €150 million

bond tap at a premium of 106.75 amounted to €157.9 million. In addition, we acquired additional capital at attractive rates by securing a mortgage on our BRU1 data centre with net proceeds

amounting to €9.2 million. As a result, the blended net effective interest rate improved to approximately 6.1%.

Scheduled repayments for our mortgages totalled €2.0 million in 2014. The Company also received €3.3 million from the exercise of stock options. While the Company does not currently hedge its foreign exchange exposure, exchange rates had a small positive impact on cash balances in 2014,

compared with a small negative impact in 2013. During 2014, the Company’s cash and cash equivalents increased by €54.2 million, from

€45.7 million at the beginning of the year to €99.9 million at the year-end.

EVENTS SUBSEQUENT TO THE BALANCE SHEET DATE

On 9 March 2015, Interxion announced the signing of a definitive agreement on an all-share merger with London-based Telecity Group plc. At publication date, the

companies are working towards closing the merger transaction which is expected to complete sometime in the second half of 2015. The merger announcement does not affect the 2014 financial statements of Interxion.

INTERXION ANNUAL REPORT

2014 / 23

|

| 24 / INTERXION ANNUAL REPORT 2014 |

|

|

|

| REPORT

OF THE BOARD OF DIRECTORS |

|

|

INTERXION ANNUAL REPORT

2014 / 25

|

|

|

|

Report of the Board of Directors

|

|

|

REPORT OF THE BOARD OF DIRECTORS

STRUCTURE

Interxion Holding

N.V. (the “Company”) is a public limited liability company incorporated under the laws of the Netherlands and is the direct or indirect parent company of all companies forming the Interxion group of companies (the “Group”). Our

corporate seat is in Amsterdam, the Netherlands. Our principal office is at Tupolevlaan 24, 1119 NX, Schiphol-Rijk, the Netherlands. The Company was incorporated on 6 April 1998 as European Telecom Exchange B.V. and was renamed Interxion

Holding B.V. on 12 June 1998. On 11 January 2000, the Company was converted into a Naamloze Vennootschap. Since 28 January 2011 the Company’s shares have been listed on the New York Stock Exchange (“NYSE”).

The Company has one class of shares of which 69,317,029 had been issued and paid-up as of 31 December 2014. Of these shares 20,375,252 were issued by the Company in

2011 as part of its initial public offering.

BOARD OF DIRECTORS

BOARD POWERS AND FUNCTION

The Company has a one-tier management structure with one board of directors, currently consisting of one

Executive Director and six Non-executive Directors. Our Board is responsible for the overall conduct of our business and has the powers, authorities and duties vested in it by and pursuant to the relevant laws of the Netherlands and our Articles of

Association. In all its dealings, our Board shall be guided by the interests of our Group as a whole, including our shareholders and other stakeholders. Our Board has the final responsibility for the management, direction and performance of us and

our Group. Our Executive Director is responsible for the day-to-day management of the Company. Our Non-executive Directors supervise the Executive Director and our general affairs, and provide general advice to the Executive Director.

Our Chief Executive Officer (“CEO”), the Executive Director, is the general manager of our business, subject to the control of our Board, and is entrusted with

all of our Board’s powers, authorities and discretions (including the power to sub-delegate) delegated by the full Board from time to time by a resolution of our Board. Matters expressly delegated to our CEO are validly resolved upon by our CEO

and no further resolutions, approvals or other involvement of our Board is required. Our Board may also delegate authorities to its committees. Upon any such delegation our Board supervises the execution of its responsibilities by our CEO and/or our

Board committees. The Board remains ultimately responsible

for the fulfilment of its duties. Moreover, its members remain accountable for the actions and decision of the Board and have ultimate responsibility for the Company’s management and the

external reporting. The Board’s members are accountable to the shareholders of the Company at its Annual General Meeting.

BOARD

MEETINGS AND DECISIONS

All resolutions of our Board are adopted by a simple majority of votes cast in a meeting at which at least the majority of the

Directors are present or represented. A member of the Board may authorise another member of the Board to represent him/ her at the Board meeting and vote on his/her behalf. Each Director is entitled to one vote (provided that, for the avoidance of