Form 6-K INTERTAPE POLYMER GROUP For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 6-K

________________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March, 2021

Commission File Number 1-10928

________________________________________

INTERTAPE POLYMER GROUP INC.

________________________________________

9999 Cavendish Blvd., Suite 200, Ville St. Laurent, Québec, Canada, H4M 2X5

________________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| INTERTAPE POLYMER GROUP INC. | ||||||||||||||||||||

| March 26, 2021 | By: | /s/ Jeffrey Crystal | ||||||||||||||||||

| Jeffrey Crystal, Chief Financial Officer | ||||||||||||||||||||

INTERTAPE POLYMER GROUP INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TAKE NOTICE that an Annual Meeting of Shareholders (the “Meeting”) of INTERTAPE POLYMER GROUP INC. (the “Company”) will be held as a virtual only meeting on Wednesday, May 12, 2021 at 12:00 p.m. (EST) to:

| 1. | receive and consider the consolidated financial statements of the Company for the fiscal year ended December 31, 2020 and the auditor’s report thereon; | ||||

| 2. | elect directors of the Company to hold office until the close of the next annual meeting; | ||||

| 3. | appoint the auditor and authorize the directors to fix its remuneration; | ||||

| 4. | consider, and if deemed advisable, adopt a resolution in the form annexed as Schedule A to the accompanying Management Information Circular (the “Circular”) "say on pay", accepting, in an advisory, non-binding capacity, the Company’s approach to executive compensation disclosed under “Executive Compensation – Compensation Discussion and Analysis” in the Circular; and | ||||

| 5. | transact such other business as may properly be brought before the Meeting. | ||||

The accompanying Circular provides detailed information relating to the matters to be dealt with at the Meeting and forms part of this notice.

In an effort to safeguard the health and safety of all stakeholders and the broader community associated with the COVID-19 pandemic, the Company has opted to proceed with a virtual only format enabling shareholders to attend and vote at the Meeting via live audio webcast. Registered shareholders and duly appointed proxyholders will have the opportunity to attend the Meeting online, submit questions, and vote in real time through a web-based platform instead of attending the Meeting in person. Non-registered or beneficial shareholders who have not appointed themselves as proxyholders will be able to attend the Meeting as guests, but will not be able to vote or ask questions. Shareholders will not be able to attend the Meeting in person. See Appendix A of the Circular for more details.

Shareholders and other interested parties can attend the Meeting virtually by going to https://web.lumiagm.com/474339464 and using the following password: intertape2021 (case sensitive).

The Company has elected to use the notice-and-access rules (“Notice-and-Access”) under National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer of the Canadian Securities Administrators for distribution of the materials for the Meeting to shareholders of the Company who do not own their shares in their own names as registered shareholders (“Beneficial Shareholders”). Notice-and-Access is a set of rules that allows issuers to post electronic versions of their proxy-related materials on SEDAR and on one additional website, rather than mailing paper copies to shareholders.

Notice-and-Access is more environmentally friendly as it helps reduce paper use; it also reduces the Company’s printing and mailing costs. Further information about Notice-and-Access is contained in the Circular; Beneficial Shareholders may also contact the Company toll free at 866-202-4713 for information regarding Notice-and-Access. The Company will not be using Notice-and-Access for delivery to shareholders who hold their shares directly in their respective names (“Registered Shareholders”).

Shareholders are strongly encouraged to express their vote in advance by completing the form of proxy or voting instruction form that were provided to them. Detailed instructions on how to complete and return proxies and the voting instruction form by mail, fax or e-mail are provided starting on page 4 of the Circular. To be effective, the completed form of proxy or voting instruction form must be deposited with our transfer agent and registrar, AST Trust Company (Canada), P.O. Box 721, Agincourt, Ontario M1S 0A1, at any time prior to 12:00 p.m. (eastern time) on May 10, 2021.

1

In order to vote at the Meeting, follow the steps described below:

1. Log in to the Meeting online at https://web.lumiagm.com/474339464

2. If you are a registered shareholder: Select the “I have a control number” icon and enter your 13-digit control number as indicated on the form of proxy that you received from AST, followed by the following password: intertape2021 (case sensitive).

Note: In the event that you use your control number to log in to the Meeting, any vote you cast will thereby revoke any proxy you previously submitted. If you do not wish to revoke a proxy that you previously submitted, you should refrain from voting during the Meeting.

3. If you are a duly appointed proxyholder: Select the “I have a control number” icon then enter your 13-digit control number, followed by the following password: intertape2021 (case sensitive). Proxyholders who have been duly appointed and registered with AST in accordance with the following instructions will receive a control number via e-mail from AST after the proxy voting deadline has passed:

Shareholders or their duly appointed proxyholder must complete the online form available at https://lp.astfinancial.com/ControlNumber or call AST at 866-751-6315 (toll free in Canada and the United States) or 212-235-5754 (other countries) by 12:00 p.m. (eastern time) on May 10, 2021 and provide AST with the required proxyholder contact information and AST will provide the proxyholder with a Control Number via e-mail.

4. If you are a guest: Select the “I am a Guest” icon and complete the online form.

For additional instructions regarding the virtual platform and the navigation thereof, consult the "Virtual Annual General Meeting 2021 - LUMI Guide" on the Company's website at https://www.itape.com/annualmeetingmaterials.

Shareholders may also vote their shares by internet or telephone in advance using the procedures described in the enclosed form of proxy.

The Company may utilize the Broadridge QuickVote™ service to assist Beneficial Shareholders with voting over the telephone. Alternatively, Kingsdale Advisors may contact such Beneficial Shareholders to assist them with conveniently voting directly over the phone..

Shareholders registered at the close of business on March 26, 2021 will be entitled to receive notice of and vote at the Meeting.

Shareholders who have any questions should contact Intertape Polymer Group Inc.’s strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors, at 855-682-9437 (toll-free within North America) or 416-867-2272 (collect call outside North America) or by e-mail at contactus@kingsdaleadvisors.com.

DATED at Sarasota, Florida

March 26, 2021

BY ORDER OF THE BOARD OF DIRECTORS

(signed) Randi M. Booth

Secretary

2

INTERTAPE POLYMER GROUP INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TAKE NOTICE that an Annual Meeting of Shareholders (the “Meeting”) of INTERTAPE POLYMER GROUP INC. (the “Company”) will be held as a virtual only meeting on Wednesday, May 12, 2021 at 12:00 p.m. (EST) to:

| 1. | receive and consider the consolidated financial statements of the Company for the fiscal year ended December 31, 2020 and the auditor’s report thereon; | ||||

| 2. | elect directors of the Company to hold office until the close of the next annual meeting; | ||||

| 3. | appoint the auditor and authorize the directors to fix its remuneration; | ||||

| 4. | consider, and if deemed advisable, adopt a resolution in the form annexed as Schedule A to the accompanying Management Information Circular (the “Circular”) "say on pay", accepting, in an advisory, non-binding capacity, the Company’s approach to executive compensation disclosed under “Executive Compensation – Compensation Discussion and Analysis” in the Circular; and | ||||

| 5. | transact such other business as may properly be brought before the Meeting. | ||||

Additional information on the above matters can be found in the Circular under the heading “Business of the Meeting”.

Notice-and-Access

The Company has elected to use the notice-and-access rules (“Notice-and-Access”) under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer of the Canadian Securities Administrators for distribution of the materials for the Meeting to shareholders of the Company who do not own their shares in their own names as registered shareholders (“Beneficial Shareholders”). Notice-and-Access is a set of rules that allows issuers to post electronic versions of their proxy-related materials on SEDAR and on one additional website, rather than mailing paper copies to shareholders. Notice-and-Access is more environmentally friendly as it helps reduce paper use; it also reduces the Company’s printing and mailing costs. Beneficial Shareholders may obtain further information about Notice-and-Access by contacting the Company toll free at 866-202-4713.

The Company will not be using Notice-and-Access for delivery to shareholders who hold their shares directly in their respective names (“Registered Shareholders”); they will receive paper copies of the Circular and related materials via prepaid mail.

Websites Where Materials are Posted

The Circular, this notice of meeting, the form of proxy, voting instruction form and the Company’s 2020 annual report containing the Company’s annual audited consolidated financial statements for the year ended December 31, 2020 and the related Management’s Discussion and Analysis (collectively, the “Meeting Materials”) are available on the Company’s website at www.itape.com and under the Company’s profile on SEDAR at www.sedar.com (Canada) and at www.sec.gov (United States). All shareholders are reminded to review the Circular and other Meeting Materials before voting.

1

How to Obtain Paper Copies of Meeting Materials

Beneficial Shareholders may obtain paper copies free of charge of the Circular, other Meeting Materials and the Company’s 2020 annual report by contacting the Company toll free at 866-202-4713 or by email at Itp$info@itape.com. Any request for paper copies should be received by the Company by 5:00 p.m. (eastern time) on April 28, 2021 in order to allow sufficient time for a Beneficial Shareholder to receive the paper copy and return the voting instruction form by its due date.

Voting

The Board of Directors has fixed the close of business on March 26, 2021 as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting and at any adjournment or postponement thereof.

If you are a Beneficial Shareholder, accompanying this notice of meeting are a voting instruction form and a supplemental mailing list return card for use by shareholders who wish to receive the Company’s interim financial statements for the 2021 fiscal year. If you receive these materials through your broker or another intermediary, please complete, sign and return the materials in accordance with the instructions provided to you by such broker or other intermediary.

Registered Shareholders are encouraged to express their vote in advance by completing the form of proxy. Detailed instructions on how to complete and return proxies by mail, fax or email are provided starting on page 4 of the accompanying Circular. To be effective, the completed form of proxy must be deposited with the Company’s transfer agent and registrar, AST Trust Company (Canada), P.O. Box 721, Agincourt, Ontario M1S 0A1, at any time prior to 12:00 p.m. (eastern time) on May 10, 2021 or with the Chair of the Meeting before the commencement of the Meeting or at any adjournment thereof. Registered Shareholders may also vote their shares by internet or telephone using the procedures described in the enclosed form of proxy.

Shareholders who have any questions should contact Intertape Polymer Group Inc.’s strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors, at 855-682-9437 (toll-free within North America) or 416-867-2272 (collect call outside North America) or by e-mail at contactus@kingsdaleadvisors.com.

Dated this 26th day of March, 2021.

BY ORDER OF THE BOARD OF DIRECTORS

(signed) Randi M. Booth

Secretary

2

Management Information Circular

Notice of 2021 Annual Meeting

to be held on May 12, 2021

CHAIR'S LETTER TO SHAREHOLDERS

| Dear fellow shareholders: On behalf on the Board, please join us virtually at our annual meeting of shareholders of Intertape Polymer Group Inc. (“IPG”) to be held on May 12, 2021 at 12:00 p.m. (eastern time). After the formal proceedings, management will provide an update of our corporate progress and our growth plans. Society and commerce were faced with unprecedented challenges during the past year due to the COVID-19 pandemic. No training or management practice could adequately prepare an organization for the challenges we each faced in our own unique way. At IPG, our long-established culture of health and safety within our daily operations at the plant level underpinned our ability to not only maintain operations in the face of the pandemic, but to flourish due to the essential nature of our products in the end markets we serve. | |||||||||||||

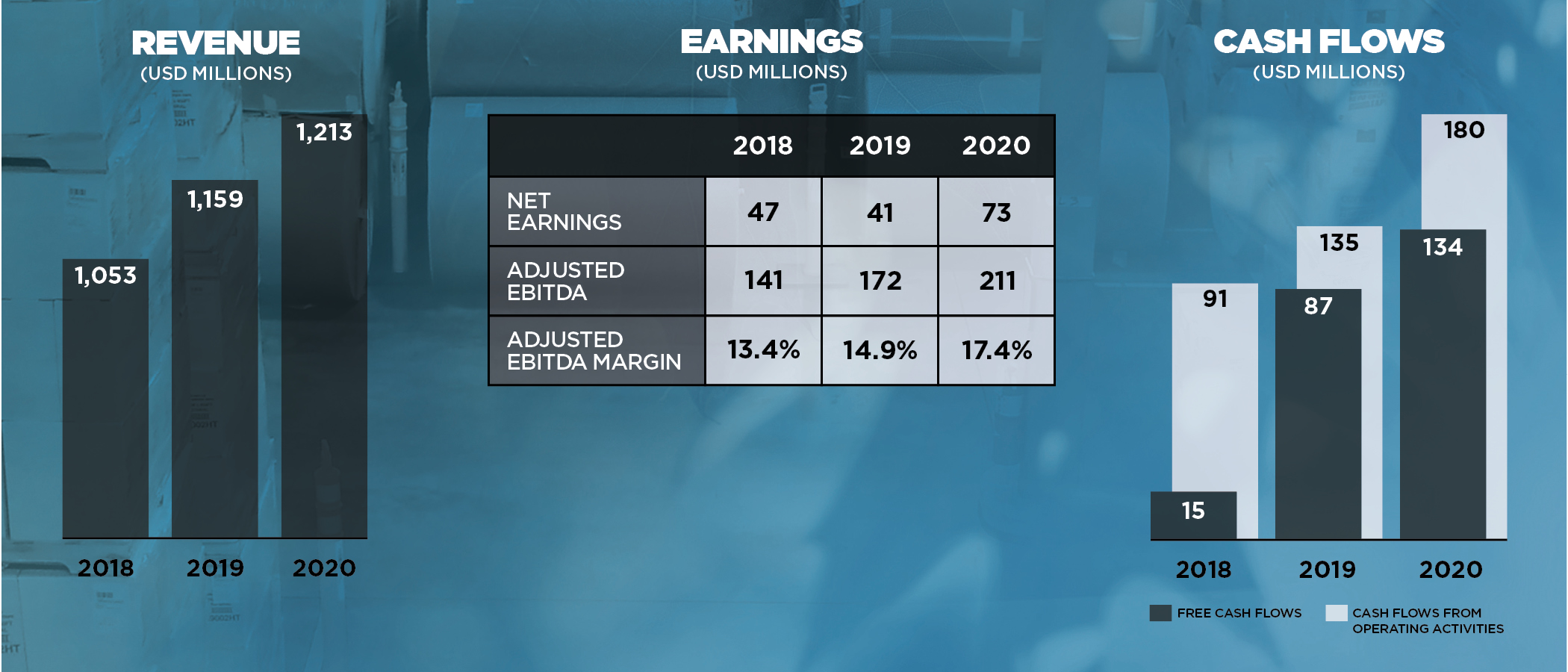

These market dynamics combined with the investments we have made over the past five years created a structural change in the business. We reported Company records for revenue of $1.2 billion and Adjusted EBITDA(1) of $211 million in fiscal 2020. This performance led to a material lift in our Adjusted EBITDA margin(1) to 17% and continued strong generation of free cash flow(1) of $134 million.

(1) Non-GAAP financial measure. For definitions and reconciliations of non-GAAP financial measures to their most directly comparable GAAP financial measures, see Appendix B.

The end markets where we saw the strongest growth this year are the same ones in which we have made recent capital investments and strategic acquisitions. Specifically, the growth in the e-commerce market where we supply water-activated tape, protective packaging, dispensing equipment and films, and the growth in the building and construction market which uses our woven products and certain industrial and retail tapes. Capital allocation is a key element of successful business strategy and our capital investments in Midland, NC and India, and our acquisitions of Polyair and Maiweave, have strengthened our product bundle and our competitive position in these end markets.

Looking ahead, we believe our customers and end users will increasingly pursue sustainable solutions and practices in their choice of packaging and protective solutions suppliers. We are committed to embracing sustainability and during 2020 we made it one of the four strategic pillars by which we manage the business for the long term. As part of this commitment, we established the Environmental, Social & Governance ("ESG") Committee of the Board of Directors and we are increasing our public disclosures so our customers and other important stakeholders can keep abreast of progress and new developments in order to make informed decisions. In July 2020, we published our second annual sustainability report, titled ‘We Package, We

Protect AND We Sustain.’ We are very proud of this year’s report as we significantly expanded the scope to discuss how we manage for sustainability in the operations of the business.

We have invested in a world-class, low cost manufacturing base that we believe is competitively positioned to perform regardless of the market cycle. Just as importantly, we have an executive team and an employee base that has clearly demonstrated their resiliency and resourcefulness during 2020 and into 2021. Their emphasis on working safely and servicing our customers has ensured an uninterrupted supply of the essential products we produce. Operating facilities safely and efficiently, growing with our existing customers and acquiring new ones, and maintaining our high standard of customer service are core capabilities of our team. Our world-class asset base and dedicated team members fortify our ability to manufacture high-quality tapes, films, protective packaging, woven products and machine systems. Once the history of this period is written, I believe 2020 will be recognized as an inflection point for IPG in building a global leader in sustainable packaging and protective solutions. We look forward to further updating you on our progress at the annual meeting.

The Management Information Circular attached to this letter provides information on the compensation for directors and executive management, our governance practices, directors to be elected at the meeting and certain other items to be voted upon as set out in the notice of meeting.

If you are unable to attend the virtual meeting, we encourage you to exercise your right to vote by completing the proxy, or if applicable, the voting instruction form and return it within the deadline indicated to ensure your vote is counted as part of the process. If you require any assistance or have questions please contact IPG’s strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors, by telephone at 855-682-9437 (toll-free within North America) or 416-867-2272 (collect call outside North America) or by email at contactus@kingsdaleadvisors.com.

On behalf of the Board and the entire organization we appreciate your continued support and we invite you to share your feedback with us by email at jpanteli@itape.com or by writing to the attention of the Chair of the Board at the following address: 800 Place Victoria, Suite 3700, Montréal, Québec H4Z 1E9, c/o Fasken Martineau Dumoulin LLP.

Sincerely,

James Pantelidis

Chair of the Board

Intertape Polymer Group Inc.

TABLE OF CONTENTS

| Solicitation of Proxies by Management | |||||

| Internet Availability of Proxy Materials | |||||

| Appointment and Revocation of Proxies | |||||

| Beneficial Shareholders | |||||

| Exercise of Discretion by Proxies | |||||

| Voting Shares | |||||

| Principal Shareholders | |||||

| Business of the Meeting | |||||

| Advisory Vote on Executive Compensation | |||||

| Election of Directors | |||||

| Directors’ and Officers’ Insurance | |||||

| Executive Compensation | |||||

| Securities Authorized for Issuance Under Equity Compensation Plans | |||||

| Indebtedness of Directors and Executive Officers | |||||

| Interest of Informed Persons in Material Transactions | |||||

| Shareholder Proposals | |||||

| Environmental, Social & Governance Practices | |||||

| Statement of Corporate Governance Practices | |||||

| Audit Committee Information | |||||

| Additional Information | |||||

| Authorization | |||||

| Schedule A — Shareholders’ Advisory, Non-Binding Resolution — Executive Compensation | |||||

| Appendix A — Virtual Meeting — Code of Procedure | |||||

| Appendix B — Non GAAP Financial Measures and Key Performance Indicators | |||||

MANAGEMENT INFORMATION CIRCULAR

SOLICITATION OF PROXIES BY MANAGEMENT

This Management Information Circular (the “Circular”) is furnished in connection with the solicitation by the management of Intertape Polymer Group Inc. ("IPG" or the “Company”) of proxies to be used at the annual meeting of shareholders (the “Meeting”) of the Company to be held at the time and place and for the purposes set out in the Notice of Meeting and all adjournments thereof. Except as otherwise stated, the information contained herein is given as of March 26, 2021 and all dollar amounts in this Circular are in US dollars. The solicitation of proxies by management will be made primarily by mail. However, directors, officers and employees of the Company may also solicit proxies by telephone, telecopier, e-mail or in person. The total cost of solicitation of proxies will be borne by the Company. The Company has also engaged Kingsdale Advisors (“Kingsdale”) as its strategic shareholder advisor and proxy solicitation agent, and will pay fees of approximately $44,100 to Kingsdale for the advisory and proxy solicitation services in addition to certain out-of-pocket expenses. Kingsdale can be reached by telephone, toll-free in North America at 855-682-9437 or at 416-867-2272 outside of North America (collect call) or by e-mail at contactus@kingsdaleadvisors.com.

INTERNET AVAILABILITY OF PROXY MATERIALS

Notice-and-Access

The Company has again this year elected to use “notice-and-access” rules (“Notice-and-Access”) under National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) for distribution of Proxy-Related Materials (as defined below) to shareholders who do not hold common shares of the Company (“Shares”) in their own names (referred to herein as “Beneficial Shareholders”). Notice-and-Access is a set of rules that allows issuers to post electronic versions of proxy-related materials on SEDAR and on one additional website, rather than mailing paper copies. “Proxy-Related Materials” refers to this Circular, the Notice of Meeting, a voting instruction form ("VIF") and the Company’s 2020 annual report containing the Company’s annual audited consolidated financial statements as of and for the year ended December 31, 2020 and the related Management’s Discussion and Analysis.

The use of Notice-and-Access is more environmentally friendly as it helps reduce paper use. It also reduces the Company’s printing and mailing costs. Beneficial Shareholders may obtain further information about Notice-and-Access by contacting AST Trust Company (Canada) toll free at 800-387-0825 (within North America) or 416-682-3860 (outside North America).

The Company is not using Notice-and-Access for delivery to shareholders who hold their Shares directly in their respective names (referred to herein as “Registered Shareholders”). Registered Shareholders will receive paper copies of this Circular and related materials via prepaid mail.

Websites Where Proxy-Related Materials are Posted

The Proxy-Related Materials are available on the Company’s website at www.itape.com and under the Company’s profile on SEDAR at www.sedar.com (Canada) and at www.sec.gov (United States). All shareholders are reminded to review the Proxy-Related Materials, including this Circular, before voting.

Notice Package

Although the Proxy-Related Materials have been posted on-line as noted above, Beneficial Shareholders will receive paper copies of a notice package (“Notice Package”) via prepaid mail containing information prescribed by NI 54-101 such as the date, time and location of the Meeting, the website addresses where the Proxy-Related Materials are posted and a VIF.

How to Obtain Paper Copies of Proxy-Related Materials

Beneficial Shareholders may obtain paper copies of this Circular, the Company’s 2020 annual report and other Proxy-Related Materials free of charge by contacting the Company toll free at 866-202-4713 or by email at Itp$info@itape.com. Any request for paper copies which are required in advance of the Meeting should be sent so that the request is received by the Company by 5:00 p.m. (eastern time) on April 28, 2021 in order to allow sufficient time for Beneficial Shareholders to receive their paper copies and to return their VIF by its due date.

4

APPOINTMENT AND REVOCATION OF PROXIES

General

As mentioned above, shareholders may be “Registered Shareholders” or “Beneficial Shareholders”. If Shares are registered in the name of an intermediary and not registered in the shareholder’s name, they are said to be owned by a “Beneficial Shareholder”. An intermediary is usually a bank, trust company, securities dealer or broker, or a clearing agency in which an intermediary participates. The instructions provided below set out the different procedures for voting Shares at the Meeting to be followed by Registered Shareholders and Beneficial Shareholders.

The persons named in the enclosed instrument appointing a proxyholder are officers or directors of the Company. Each shareholder has the right to appoint a person or company (who need not be a shareholder) to attend and act for him at the Meeting other than the persons designated in the enclosed form of proxy by inserting such other person’s name in the blank space provided in the form of proxy and signing the form of proxy or by completing and signing another proper form of proxy. Shareholders who have given a proxy also have the right to revoke it insofar as it has not been exercised. The right to appoint an alternate proxyholder and the right to revoke a proxy may be exercised by following the procedures set out below under “Registered Shareholders” or “Beneficial Shareholders”, as applicable.

If any shareholder receives more than one proxy or VIF, it is because that shareholder’s Shares are registered in more than one form. In such cases, shareholders should sign and submit all proxies or VIFs received by them in accordance with the instructions provided.

Registered Shareholders

Registered Shareholders have two methods by which they can vote their Shares; namely during the virtual Meeting or by proxy. To assure representation at the Meeting, Registered Shareholders are encouraged to return the proxy included with this Circular. Sending in a proxy will not prevent a Registered Shareholder from voting during the virtual Meeting. The vote will be taken and counted at the Meeting. Registered Shareholders who do not plan to attend the Meeting or do not wish to vote during the virtual Meeting can vote by proxy.

To be valid, the duly completed form of proxy must be deposited at the offices of AST Trust Company (Canada), P.O. Box 721, Agincourt, Ontario M1S 0A1 prior to 12:00 p.m. (eastern time) on May 10, 2021 or with the Chair of the Meeting before the commencement of the Meeting or any adjournment thereof. A Registered Shareholder may return the completed proxy as follows:

(a)by mail in the enclosed envelope;

(b)by the internet by accessing the following internet site: www.astvotemyproxy.com and entering the personalized 13-digit e-voting control number printed on the form of proxy and following the instructions on the website;

(c)by fax to 416-368-2502 or toll free in Canada and the United States to 866-781-3111;

(d)by telephone by calling 888-489-7352 as described on the enclosed proxy;

(e)by email by scanning the proxy and emailing it to proxyvote@astfinancial.com; or

(f)by registered mail, by hand or by courier to the attention of AST Trust Company (Canada), 1 Toronto Street, Suite 1200 Toronto, Ontario M5C2V6.

To exercise the right to appoint a person or company to attend and act for a Registered Shareholder at the Meeting, such shareholder must strike out the names of the persons designated on the enclosed instrument appointing a proxy and insert the name of the alternate appointee in the blank space provided for that purpose. The instrument appointing a proxyholder must be executed by the shareholder or by his attorney authorized in writing or, if the shareholder is a corporate body, by its authorized officer or officers.

In addition, the shareholder or their duly appointed proxyholder must complete the online form available at https://lp.astfinancial.com/ControlNumber or call AST at 866-751-6315 (toll free in Canada and the United States) or 212-235-5754 (other countries) prior to 12:00 p.m. (eastern time) on May 10, 2021 and provide AST with the required proxyholder contact information and AST will provide the proxyholder with a Control Number via email.

5

To exercise the right to revoke a proxy, in addition to any other manner permitted by law, a shareholder who has given a proxy may revoke it by instrument in writing, executed by the shareholder or his attorney authorized in writing, or if the shareholder is a corporation, by a duly authorized officer or attorney thereof, and deposited: (i) with AST Trust Company (Canada), P.O. Box 721, Agincourt, Ontario M1S 0A1 at any time up to and including prior to 12:00 p.m. (eastern time) on May 10, 2021, or (ii) with the Chair of the Meeting on the date of the Meeting, or at any adjournment thereof, and upon either of such deposits the proxy is revoked.

Shareholders who have any questions should contact Intertape Polymer Group Inc.’s strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors, at 855-682-9437 (toll-free within North America) or 416-867-2272 (collect call outside North America) or by e-mail at contactus@kingsdaleadvisors.com.

BENEFICIAL SHAREHOLDERS

Beneficial Shareholders who have not objected to their intermediary disclosing certain ownership information about themselves to the Company are referred to as “NOBOs”. Beneficial Shareholders who have objected to their intermediary disclosing the ownership information about themselves to the Company are referred to as “OBOs”.

As mentioned above, the Company is using Notice-and-Access to provide Proxy-Related Materials to Beneficial Shareholders. Therefore, a Notice Package will be sent indirectly to all NOBOs and OBOs through intermediaries; the Company is assuming the cost of such delivery to OBOs.Therefore, a Notice Package will be sent indirectly to all NOBOs and OBOs through their intermediaries; the Company is assuming the cost of such delivery to OBOs.

Beneficial Shareholders may vote in the following ways:

a)by the internet by going to the website at www.proxyvote.com and following the instructions on the screen. The Shareholder's voting instructions are then conveyed electronically over the internet. The Shareholder will need the 16 digit Control Number found on his or her VIF;

b)by telephone by calling the number located on such Shareholder's VIF. The Shareholder will need the 16 digit Control Number found on his or her VIF; or

c)by mail by completing the VIF as directed and returning it in the business reply envelope provided by the Shareholder's nominee's cut-off date and time.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting Shares registered in the name of his or her broker, a Beneficial Shareholder may attend the Meeting as proxyholder for the Registered Shareholder and vote the Shares in that capacity. Beneficial Shareholders who wish to attend the Meeting and indirectly vote their Shares as proxyholder for the Registered Shareholder should follow the instructions found on the VIF.

The Company may utilize the Broadridge QuickVote™ service to assist Beneficial Shareholders with voting their Shares over the telephone. Alternatively, Kingsdale Advisors may contact such Beneficial Shareholders to assist them with conveniently voting their Shares directly over the phone. Shareholders who have any questions should contact Intertape Polymer Group Inc.’s strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors, at 855-682-9437 (toll-free within North America) or 416-867-2272 (collect call outside North America) or by e-mail at contactus@kingsdaleadvisors.com.

Meeting Materials Received by OBOs from Intermediaries

The Company has distributed copies of the Notice Package to intermediaries for distribution to OBOs. Intermediaries are required to deliver the Notice Package to all OBOs of the Company who have not waived their right to receive these materials, and to seek instructions as to how to vote Shares. Often, intermediaries will use a service company (such as, for example, Broadridge Financial Solutions, Inc.) to forward the Notice Package to OBOs.

OBOs who receive the Notice Package will typically be given the ability to provide voting instructions in one of two ways:

(a)Generally, an OBO will be given a VIF which must be completed and signed by the OBO in accordance with the instructions provided by the intermediary. In this case, the mechanisms described above for Registered Shareholders cannot be used and the instructions provided by the intermediary must be followed.

(b)Occasionally, an OBO may be given a proxy that has already been signed by the intermediary. This form of proxy is restricted to the number of Shares owned by the OBO but is otherwise not completed. This form of proxy need not be

6

signed by the OBO but must be completed by the OBO and returned to AST Trust Company (Canada) in the manner described above for Registered Shareholders.

The purpose of these procedures is to allow OBOs to direct the proxy voting of the Shares that they own but that are not registered in their name. Should an OBO who receives either a form of proxy or a VIF wish to attend and vote at the virtual Meeting (or have another person attend and vote on its behalf), the OBO should strike out the persons named in the form of proxy as the proxyholder and insert the OBO’s (or such other person’s) name in the blank space provided or, in the case of a VIF, follow the corresponding instructions provided by the intermediary. In either case, OBOs who received a Notice Package from their intermediary should carefully follow the instructions provided by the intermediary.

To exercise the right to revoke a proxy, an OBO who has completed a proxy (or a VIF, as applicable) should carefully follow the instructions provided by the intermediary.

Proxies returned by intermediaries as “non-votes” because the intermediary has not received instructions from the OBO with respect to the voting of certain Shares or, under applicable stock exchange or other rules, the intermediary does not have the discretion to vote those Shares on one or more of the matters that come before the Meeting, will be treated as not entitled to vote on any such matter and will not be counted as having been voted in respect of any such matter. Shares represented by such “non-votes” will, however, be counted in determining whether there is a quorum at the Meeting.

EXERCISE OF DISCRETION BY PROXIES

Where a choice is specified, the Shares represented by proxy will be voted for, withheld from voting or voted against, as directed, on any poll or ballot that may be called. Where no choice is specified, the proxy will confer discretionary authority and will be voted in favour of all matters referred to on the form of proxy. Accordingly, in the absence of any direction to the contrary, Shares represented by properly-executed proxies in favour of the persons designated in the enclosed form of proxy will be voted FOR the: (i) election of directors, (ii) appointment of the auditor and authorization of the directors to fix its remuneration, and (iii) resolution accepting, in an advisory, non-binding capacity, the Company’s approach to executive compensation disclosed in the Circular, the whole as stated under such headings in this Circular.

The proxy also confers discretionary authority to vote for, withhold from voting or vote against amendments or variations to the matters identified in the Notice of Meeting and with respect to other matters not specifically mentioned in the Notice of Meeting but which may properly come before the Meeting. Management has no present knowledge of any amendments or variations to matters identified in the Notice of Meeting or any business that will be presented at the Meeting other than that referred to in the Notice of Meeting. However, if any other matters not known to management should properly come before the Meeting, the accompanying form of proxy confers discretionary authority upon the persons named therein and, in such case, it is their intention to vote in accordance with the recommendations of management of the Company.

VOTING SHARES

As of March 26, 2021, there were 59,027,047 Shares issued and outstanding. Each Share entitles the holder thereof to one vote. The Company has fixed March 26, 2021 as the record date (the “Record Date”) for the purpose of determining shareholders entitled to receive notice of the Meeting. Pursuant to the Canada Business Corporations Act (the “CBCA”), the Company is required to prepare, no later than ten days after the Record Date, an alphabetical list of shareholders entitled to vote as of the Record Date that shows the number of Shares held by each shareholder. A shareholder whose name appears on the list referred to above is entitled to vote the Shares shown opposite the shareholder’s name at the Meeting. The list of shareholders is available for inspection during usual business hours at the registered office of the Company, 800 Place Victoria, Suite 3700, Montreal, Québec H4Z 1E9 and at the Meeting.

PRINCIPAL SHAREHOLDERS

As of March 26, 2021, to the knowledge of the directors and executive officers of the Company, no person beneficially owned, or exercised control or direction over, directly or indirectly, more than 10% of the issued and outstanding Shares.

7

BUSINESS OF THE MEETING

The purposes of the Meeting are to:

| 1. | receive and consider the consolidated financial statements of the Company for the fiscal year ended December 31, 2020 and the auditor’s report thereon; | ||||

| 2. | elect directors of the Company to hold office until the close of the next annual meeting; | ||||

| 3. | appoint the auditor and authorize the directors to fix its remuneration; | ||||

| 4. | consider, and if deemed advisable, adopt a resolution in the form annexed as Schedule A to the accompanying Management Information Circular (the “Circular”) "say on pay", accepting, in an advisory, non-binding capacity, the Company’s approach to executive compensation disclosed under “Executive Compensation – Compensation Discussion and Analysis” in the Circular; and | ||||

| 5. | transact such other business as may properly be brought before the Meeting. | ||||

Receiving the Financial Statements

The audited consolidated financial statements of the Company as of and for the year ended December 31, 2020 and the Auditor’s Report thereon will be placed before the Meeting. These audited consolidated financial statements may be obtained from the Company upon request and will be available at the Meeting. The audited consolidated financial statements of the Company as of and for the fiscal year ended December 31, 2020 are available on the Company’s website at www.itape.com under “Investor Relations”. They have also been filed with the Canadian securities regulatory authorities as well as the United States Securities and Exchange Commission (the “SEC”) and are available under the Company’s profile on SEDAR at www.sedar.com (Canada) and at www.sec.gov (United States).

Election of Directors

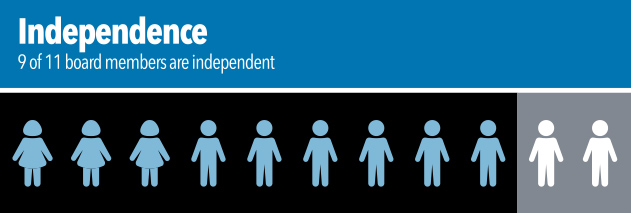

The Company’s Articles of Amalgamation provide that the Company shall have a minimum of three and a maximum of eleven directors. Eleven directors have been nominated for election to the Board of Directors for the year to come. Each director elected at the Meeting will hold office until the next annual meeting of shareholders or until the election of his successor, unless the director’s seat on the Board of Directors becomes vacant for any reason.

Unless authority to do so is withheld, the persons named in the accompanying form of proxy intend to vote FOR the election of the eleven nominees whose names appear on pages 11 to 21 hereof. Management does not expect that any of the nominees will be unable to serve as a director.

Appointment of Auditor

Management and the Board of Directors propose that Raymond Chabot Grant Thornton LLP be appointed as the Company’s auditor until the close of the next annual meeting of shareholders. Raymond Chabot Grant Thornton LLP has been the Company’s auditor for more than five years.

The Audit Committee has a policy that restricts the services that may be provided by, and the fees paid to, the auditor. All services provided by the auditor must be permitted by law and by the Audit Committee policy and be pre-approved by the Audit Committee in accordance with the policy. Fees paid to the auditor for the past two fiscal years ended December 31, 2020 and 2019 are set out below:

8

| 2020 | 2019 | |||||||||||||

| (CDN$) | (CDN$) | |||||||||||||

| Audit Fees | 993,500 | 961,000 | ||||||||||||

| Audit-Related Fees | 125,325 | 117,900 | ||||||||||||

| Tax Fees | 45,893 | 278,828 | ||||||||||||

| All Other Fees | — | — | ||||||||||||

| Total | 1,164,718 | 1,357,728 | ||||||||||||

The nature of each category of fees is described below.

Audit Fees. Audit fees were for professional services rendered for the integrated audit of the Company’s consolidated financial statements and internal control over financial reporting, assisting its Audit Committee in discharging its responsibilities for the review of the Company’s interim unaudited consolidated financial statements and services that generally only the independent auditor can reasonably provide, such as consent letters and assistance and review of documents filed with the SEC and Canadian securities regulatory authorities.

Audit-Related Fees. Audit-related fees were for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated interim unaudited financial statements and are not reported under the caption “Audit Fees” above. These services included consultations concerning financial accounting and reporting standards as well as services related to business acquisitions.

Tax Fees. Tax fees were for the preparation of the Canadian subsidiaries’ income tax returns and assistance with questions in 2020 and 2019. In addition, tax fees in 2019 were for tax advice and tax planning which included assistance with questions regarding tax audits from the various taxation authorities in Canada and tax planning relating to common forms of domestic and international taxation.

All Other Fees. The Company paid no other fees for services provided other than audit fees, audit-related fees and tax fees in 2020 and 2019 as described above.

The Audit Committee charter provides for the required pre-approvals of services to be rendered by the external auditors. The pre-approval process takes place annually and is presented by the Company’s internal accountants and the external auditors for planned activity including audit, tax and non-audit services and includes reasonable detail with respect to the services covered. The pre-approval of all non-audit services allows the Audit Committee to consider the effect of such services on the independence of the external auditor. Any such services that may arise in addition to the pre-approved plan must be presented separately to the Audit Committee for pre-approval. The charter states that this responsibility cannot be delegated to management of the Company in any way whatsoever.

Except where authorization to vote with respect to the appointment of the auditor is withheld, the persons named in the accompanying form of proxy intend to vote FOR the appointment of Raymond Chabot Grant Thornton LLP as the auditor of the Company until the next annual meeting of shareholders, at remuneration to be determined by the Board of Directors.

Advisory “Say on Pay” Vote on Executive Compensation

At the Meeting, Shareholders will be asked to consider and, if deemed advisable adopt an advisory, non-binding or “Say on Pay” resolution in the form annexed as Schedule A to the Circular, accepting the Company’s approach to executive compensation as disclosed in this Circular. See section entitled “Advisory Vote on Executive Compensation” below for information regarding the advisory, non-binding vote. The Board of Directors recommends that shareholders vote in favour of the resolution accepting, in an advisory, non-binding capacity, the Company’s approach to executive compensation disclosed in the Circular. Unless authority to do so is withheld, the persons named in the accompanying form of proxy intend to vote FOR the foregoing advisory, non-binding resolution.

Other Matters

Management has no present knowledge of any amendments or variations to matters identified in the Notice of Meeting or any business that will be presented at the Meeting other than that referred to in the Notice of Meeting. However, if any other matters not known to management should properly come before the Meeting, the accompanying form of proxy confers discretionary authority upon the persons named therein and, in such case it is their intention to vote in accordance with the recommendations of management of the Company.

9

ADVISORY VOTE ON EXECUTIVE COMPENSATION

At the Meeting, as part of the Company’s commitment to strong corporate governance practices, shareholders will have an opportunity to cast an advisory “Say on Pay” vote on the Board of Directors’ approach to executive compensation. The Company held a “Say on Pay” vote at the 2019 and 2020 annual meetings and intends to continue to hold an advisory “Say on Pay” vote at each annual meeting as part of its process of shareholder engagement. The shareholder engagement process is described in more detail in the section entitled "Shareholder Engagement" starting on page 82 of this Circular. At the 2020 annual meeting, shareholders adopted a resolution accepting, in an advisory, non-binding capacity, the Company’s approach to executive compensation as disclosed in the Company’s 2020 management information circular, with 36,775,395 Shares voted in favour of the “Say on Pay” resolution (92.0%) and 3,192,855 Shares voted against (8.0%).

The purpose of an advisory “Say on Pay” vote is to provide shareholders with an opportunity to indicate their acceptance of the Board of Directors’ overall approach to executive compensation. The Board of Directors, through its Human Resources and Compensation Committee, remains fully responsible for compensation decisions and is not relieved of these responsibilities by either a positive or negative advisory vote by shareholders. The vote by shareholders is advisory only and non-binding on the Board of Directors and the Company. However, the Board of Directors and the Human Resources and Compensation Committee will consider the outcome of the vote as part of an ongoing review of the executive compensation program of the Company together with feedback received from shareholders in the course of regular communications.

The Board of Directors diligently reviews the Company’s executive compensation plans and consults third-party experts to design the terms of these plans relative to the current marketplace. To fully understand the objectives, philosophy and principles the Board of Directors has used in its approach to executive compensation decisions, shareholders should carefully read the section of the Circular entitled “Executive Compensation” starting on page 34 of this Circular.

That section describes the Company’s compensation philosophy, the objectives and elements of the program, the measurement and assessment process used by the Company and why a large portion of the Company’s executive compensation is linked to business performance and earned over the longer term, thereby aligning the interests of the Company’s executives with those of its shareholders.

The year 2020 was extraordinary and required immediate and ongoing action to maintain essential operations in the COVID-19 environment, notwithstanding significant uncertainty and macroeconomic disruption. The Company ended the year with strong results, including Company records for revenue, adjusted EBITDA and free cash flows financial metrics, and outstanding shareholder value creation. The Board of Directors and Human Resources and Compensation Committee took management and Company performance into consideration while making compensation decisions. The Committee has aligned the Company's compensation outcomes directly with the experience of shareholders and key company accomplishments, as further discussed in the "Executive Compensation" section later in this Circular.

Shareholders are encouraged, prior to casting their votes at the Meeting, to provide any specific feedback, questions or concerns they may have regarding executive compensation directly to the Board of Directors by writing to the attention of the Chair of the Board at the following address: 800 Place Victoria, Suite 3700, Montréal, Québec H4Z 1E9, c/o Fasken Martineau Dumoulin LLP.

The Board of Directors recommends that shareholders vote FOR the advisory, non-binding resolution accepting the Company’s approach to executive compensation. Unless otherwise specified, the persons named in the accompanying form of proxy or VIF intend to vote FOR the advisory, non-binding resolution accepting the Company’s approach to executive compensation. The text of the resolution accepting the Company’s approach to executive compensation is annexed as Schedule A to this Circular.

10

ELECTION OF DIRECTORS

Number of Directors

The Board of Directors currently consists of eleven directors. The persons named in the enclosed form of proxy intend to vote for the election of the eleven nominees whose names are set out below. Each director will hold office until the next annual meeting of shareholders or until the election of his or her successor, unless the director’s seat on the Board of Directors becomes vacant for any reason.

The Nominated Directors

The following are profiles of each of the eleven persons proposed to be nominated for election as a director. Information in this Circular regarding the number of Shares held or over which control or direction is exercised by each director was provided to the Company by the respective directors.

| Robert M. Beil | Areas of Expertise: | ||||||||||||

Bob Beil worked for The Dow Chemical Company for 32 years, until September 2006. Mr. Beil held numerous positions in Sales, Marketing, Business and Executive Management at Dow Chemical, including serving as the North American Commercial Vice President for Dow’s Plastics Business. In this role, he was responsible for sales and marketing of more than $2 billion of polyethylene, polypropylene and polystyrene resins to Dow Chemical’s customers in all market segments in the United States, Canada and Mexico. In addition, he spent a portion of his career working in Dow’s Human Resources function, which was responsible for compensation design for Dow, a Fortune 500 company. Prior to his retirement, Mr. Beil was Corporate Vice President with functional oversight for all of Sales and Marketing at Dow Chemical. Principal occupation(1): Corporate Director. | Strategy/Leading Growth Risk Management Mergers & Acquisitions Manufacturing/Operations Marketing/Sales Human Resources/Compensation International Markets Packaging Industry | |||||||||||||

| Phoenix, Arizona, USA Current position with the Company: Director Director since: September 2007 Age: 68 Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

| Board of Directors Human Resources and Compensation Committee (chair) Corporate Governance and Nominating Committee (member) | ||||||||||||||

| Shares & Deferred Share Units Held | ||||||||||||||

Minimum level of ownership (2) | Number of Common Shares | Number of DSUs (3) | Total Market Value (4) | Compliance with minimum share ownership requirement (5) | ||||||||||

| $325,000 | 43,885 | 48,076 | $2,107,746 | Yes | ||||||||||

(1)Mr. Beil has held this occupation for the last five years.

(2)Minimum level of ownership is equal to five times the annual board member retainer fee.

(3)Includes related dividend amounts.

(4)Value calculated based on the closing price of the Company’s common shares on the Toronto Stock Exchange ("TSX") (being CDN$28.80, USD$22.92), shares and deferred share units ("DSUs") under the Deferred Share Unit Plan (the "DSU Plan") held on March 12, 2021.

(5)DSUs are included in determining whether the minimum share ownership requirements have been satisfied. For more information see sections entitled "Minimum Share Ownership Requirement" and "Director Compensation".

11

| Chris R. Cawston, CPA | Areas of Expertise: | ||||||||||||

Chris Cawston founded The Cawston Group, an advisory group delivering financial, strategic and operational advisory services and interim executive management with a focus on rapid growth, building leadership teams, and corporate clients who are in transition mainly in the technology, automotive and B2B segments. He was the President and Chief Executive Officer of The Cawston Group from July 2010 to March 2015 and again at present since February 2020. Mr. Cawston was the President of Sym-Tech, a leading provider of finance and insurance solutions to automobile dealers and original equipment manufacturers, from March 2015 to January 2020. He was also a member of the board of AutoServe1 from 2014 until the sale of the business in 2019. His prior roles include, President and Chief Executive Officer of SCI Marketview, Co-Founder and President of Premier Salons & Magicuts, and Director Internal Audit, Mitel Corporation. Mr. Cawston began his career with Coopers & Lybrand, now PricewaterhouseCoopers. Mr. Cawston is a Canadian Chartered Professional Accountant. Principal occupation(1): Chief Executive Officer, The Cawston Group | Strategy/Leading Growth Finance/Accounting Risk Management CEO/COO Experience Mergers & Acquisitions Manufacturing/Operations Information Technology Governance | |||||||||||||

| Toronto, Ontario, Canada Current position with the Company: Director Director since: October 2020 Age: 62 Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

| Board of Directors Audit Committee (member) | ||||||||||||||

| Shares & DSUs Held | ||||||||||||||

Minimum level of ownership (2) | Number of Common Shares | Number of DSUs (3) | Total Market Value (4) | Compliance with minimum share ownership requirement (5) | ||||||||||

| $325,000 | 6,300 | 4,135 | $239,170 | Pending | ||||||||||

(1)Mr. Cawston was previously President, Sym-Tech Dealer Services from March 2015 through January 2020 and Chief Executive Officer, Cawston Group Inc. from July 2010 through March 2015, and February 2020 to present.

(2)Minimum level of ownership is equal to five times the annual board member retainer fee.

(3)Includes related dividend amounts.

(4)Value calculated based on the closing price of the Company’s common shares on the TSX (being CDN$28.80, USD$22.92), shares and DSUs held on March 12, 2021.

(5)DSUs are included in determining whether the minimum share ownership requirements have been satisfied. For more information see sections entitled "Minimum Share Ownership Requirement" and "Director Compensation". Mr. Cawston was appointed to the Board of Directors on October 15, 2020 and has until October 15, 2025 to comply with the minimum share ownership requirement.

12

| Jane Craighead, PhD, CPA, CA | Areas of Expertise: | ||||||||||||

Jane Craighead was a Senior Vice President in Global Human Resources at Scotiabank from February 2011 until her retirement in May 2019. Her corporate experience also includes similar roles at Alcan and Rio Tinto plc, a large UK based mining conglomerate, from 2007 to 2010. Ms. Craighead has a professional background with over 30 years in business, accounting and finance. She is a Chartered Accountant and Chartered Professional Accountant and worked for many years in practice and in consulting as an Eastern Canada Business Leader at Mercer Human Resource Consulting. She holds a PhD in Management from McGill University, and has published research on executive compensation and corporate governance. Ms. Craighead was a member of the board of Clearwater Seafoods from 2015 until it was sold and taken private in January 2021. While on the board of Clearwater Seafoods, she served as the chair of the Human Resources and Development Committee and was a member of the Finance Committee. She has been a director of Jarislowsky Fraser Limited, one of Canada's leading independent investment firms, since 2018. She also sits on various investment advisory boards including the Scotiabank pension plan, Mount Allison University endowment and a private holding company. She is Vice Chair of the Board of Regents of Mount Allison University and Co-Vice Chair of the McGill University Health Centre Foundation. She has also been awarded one of Canada’s Top 100 Most Powerful Women by the Women’s Executive Network. Principal occupation(1): Corporate Director. | Strategy/Leading Growth Capital Markets Finance/Accounting Risk Management Mergers & Acquisitions Human Resources/Compensation Information Technology Governance International Markets Environmental & Social | |||||||||||||

| Elizabethtown, Ontario, Canada Current position with the Company: Director Director since: October 2020 Age: 61 Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

Board of Directors Human Resources and Compensation Committee (member) ESG Committee (member)(2) | ||||||||||||||

| Shares & DSUs Held | ||||||||||||||

Minimum level of ownership (3) | Number of Common Shares | Number of DSUs (5) | Total Market Value (5) | Compliance with minimum share ownership requirement (6) | ||||||||||

| $325,000 | 7,000 | 4,123 | $254,939 | Pending | ||||||||||

(1)Ms. Craighead was previously Senior Vice President Global Human Resources, Scotiabank, Toronto from February 2011 through April 2019.

(2)The ESG Committee was established on November 11, 2020.

(3)Minimum level of ownership is equal to five times the annual board member retainer fee.

(4)Includes related dividend amounts.

(5)Value calculated based on the closing price of the Company’s common shares on the TSX (being CDN$28.80, USD$22.92), shares and DSUs held on March 12, 2021.

(6)DSUs are included in determining whether the minimum share ownership requirements have been satisfied. For more information see sections entitled "Minimum Share Ownership Requirement" and "Director Compensation". Ms. Craighead was appointed to the Board of Directors on October 15, 2020 and has until October 15, 2025 to comply with the minimum share ownership requirement.

13

| Frank Di Tomaso, FCPA, FCA, ICD.D | Areas of Expertise: | ||||||||||||

Frank Di Tomaso has been a Canadian Chartered Professional Accountant since 1972, and an ICD.D since 2009. He was a Partner and Advisory Partner at Raymond Chabot Grant Thornton LLP from 1981 until 2012 where he held the position of Managing Partner Audit – Public Companies. He is currently serving on the boards of ADF Group Inc., Birks Group Inc., and Laurentian Pilotage Authority and has also served on the boards of National Bank Trust, National Bank Life Assurance Company, Redline Communications Inc., Yorbeau Resources Inc., Ordre des comptables agréés du Québec, Raymond Chabot Grant Thornton and Grant Thornton. Mr. Di Tomaso is engaged both in the business and the social community while being a member of many business associations and not-for-profit organizations. In that regard, he received the Award of Distinction from the John Molson School of Business – Concordia University, Montreal, Québec in 2004, in recognition of his outstanding contribution to the World of Business and the community. Principal occupation(1): Corporate Director. | Strategy/Leading Growth Finance/Accounting Risk Management Mergers & Acquisitions Human Resources/Compensation Governance Auditing Restructuring | |||||||||||||

| Montreal, Québec, Canada Current position with the Company: Director Director since: August 2014 Age: 74 Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

| Board of Directors Audit Committee (chair) Corporate Governance and Nominating Committee (member) | ADF Group Inc. Birks Group Inc. | Audit Committee (chair) Audit Committee (chair) | ||||||||||||

| Shares & DSUs Held | ||||||||||||||

Minimum level of ownership (2) | Number of Common Shares | Number of DSUs (3) | Total Market Value (4) | Compliance with minimum share ownership requirement (5) | ||||||||||

| $325,000 | 10,000 | 41,502 | $1,180,426 | Yes | ||||||||||

(1)Mr. Di Tomaso has held this occupation for the last five years.

(2)Minimum level of ownership is equal to five times the annual board member retainer fee.

(3)Includes related dividend amounts.

(4)Value calculated based on the closing price of the Company’s common shares on the TSX (being CDN$28.80, USD$22.92), shares and DSUs held on March 12, 2021.

(5)DSUs are included in determining whether the minimum share ownership requirements have been satisfied. For more information see sections entitled "Minimum Share Ownership Requirement" and "Director Compensation".

14

| Robert J. Foster | Areas of Expertise: | ||||||||||||

Robert J. Foster, B.A., M.A. (Economics), C.F.A., is Founder, President and Chief Executive Officer of Capital Canada Limited, an independent investment banking firm providing financial services to entrepreneurs and companies. Capital Canada provides negotiating and structuring for mergers and acquisitions, debt and equity financing, as well as valuation and fairness opinion services. Mr. Foster focuses on the aviation, media, entertainment and sports sectors. Mr. Foster has served on the boards of CHC Helicopters, Golf Town, Cargojet, Canada 3000 and Canadian Airlines Regional in addition to currently serving on a number of private company boards. Robert Foster has served as Chair on a broad range of not-for-profit organizations over the years including arts and culture, education and the political arena. He is currently Chair of the TO Live Theatre Board, Chair of Business for the Arts and is on the board of the Harbourfront Foundation. Notably, Mr. Foster served as Chair of Toronto’s Artscape and Lead Co-Chair for the Creative Capital Gains Report for the City of Toronto in 2011, a guiding document for Toronto’s cultural growth over the next decade. Principal occupation(1): Chief Executive Officer and President, Capital Canada Limited (investment banking firm). | Strategy/Leading Growth Capital Markets Finance/Accounting Risk Management CEO/COO Experience Mergers & Acquisitions Human Resources/Compensation Information Technology Governance Restructuring | |||||||||||||

| Toronto, Ontario, Canada Current position with the Company: Director Director since: June 2010 Age: 78 Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

| Board of Directors Executive Committee (member) Audit Committee (member) Human Resources and Compensation Committee (member) | ||||||||||||||

| Shares & DSUs Held | ||||||||||||||

Minimum level of ownership (2) | Number of Common Shares | Number of DSUs (3) | Total Market Value (4) | Compliance with minimum share ownership requirement (5) | ||||||||||

| $325,000 | 60,100 | 69,894 | $2,979,462 | Yes | ||||||||||

(1)Mr. Foster has held this occupation for the last five years.

(2)Minimum level of ownership is equal to five times the annual board member retainer fee.

(3)Includes related dividend amounts.

(4)Value calculated based on the closing price of the Company’s common shares on the TSX (being CDN$28.80, USD$22.92), shares and DSUs held on March 12, 2021.

(5)DSUs are included in determining whether the minimum share ownership requirements have been satisfied. For more information see sections entitled "Minimum Share Ownership Requirement" and "Director Compensation".

15

| Dahra Granovsky | Areas of Expertise: | ||||||||||||

Dahra Granovsky is the Chief Executive Officer of Beresford Accurate Folding Cartons, a folding carton packaging company and the Managing Director of Chem-Ecol, a lubricant company. Ms. Granovsky also serves on the Board of Directors of Hammond Power Solutions, Velan Inc. and Atlantic Packaging Product Ltd. Ms. Granovsky formerly served as a director of Redknee Solutions and as the President of Atlantic Packaging Products, a manufacturer of corrugated packaging and paper bags with paper mills and recycling services. Principal occupation(1): Chief Executive Officer, Beresford Accurate Folding Cartons and Managing Director, Chem-Ecol. | Strategy/Leading Growth Finance/Accounting Risk Management CEO/COO Experience Mergers & Acquisitions Manufacturing/Operations Marketing/Sales Human Resources/Compensation Governance Packaging Industry Environmental & Social | |||||||||||||

| Toronto, Ontario, Canada Current position with the Company: Director Director since: June 2019 Age: 50 Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

Board of Directors Human Resources and Compensation Committee (member) ESG Committee (member)(2) | Hammond Power Solutions | Corporate Governance Committee (chair); Audit and Compensation Committee (member) | ||||||||||||

| Velan Inc. | Corporate Governance and Human Resources Committee (chair); Audit Committee (member) | |||||||||||||

| Shares & DSUs Held | ||||||||||||||

Minimum level of ownership (3) | Number of Common Shares | Number of DSUs (4) | Total Market Value (5) | Compliance with minimum share ownership requirement (6) | ||||||||||

| $325,000 | 6,929 | 17,854 | $568,026 | Yes | ||||||||||

(1)Ms. Granovsky has held this occupation for the last five years.

(2)The ESG Committee was established on November 11, 2020.

(3)Minimum level of ownership is equal to five times the annual board member retainer fee.

(4)Includes related dividend amounts.

(5)Value calculated based on the closing price of the Company’s common shares on the TSX (being CDN$28.80, USD$22.92), shares and DSUs held on March 12, 2021.

(6)DSUs are included in determining whether the minimum share ownership requirements have been satisfied. For more information see sections entitled "Minimum Share Ownership Requirement" and "Director Compensation".

16

| James Pantelidis | Areas of Expertise: | ||||||||||||

James Pantelidis has more than 30 years of experience in the petroleum industry. He is Chair of the Board and Chair of the Supply and Development Committee of Parkland Corporation (marketer of petroleum products) and has served as a director thereof since 1999. Mr. Pantelidis served as a director and Chair of the Board of EnerCare Inc. from 2002 to 2018. He previously served on the Board of RONA Inc. (Chair of the Human Resources and Compensation Committee) and Industrial Alliance Insurance and Financial Services Inc. (Chair of the Investment Committee and member of Human Resources and Compensation Committee). From 2008 to 2011, Mr. Pantelidis served as a Non-Executive Director of Equinox Minerals Ltd. (Chair of the Human Resources and Compensation Committee). From 2002 to 2006, Mr. Pantelidis was on the board of FisherCast Global Company and served as Chair and Chief Executive Officer from 2004 to 2006. From 2002 to 2004, Mr. Pantelidis was President of J.P. & Associates, a strategic consulting group. Between 1999 and 2001, Mr. Pantelidis served as Chair and Chief Executive Officer for the Bata International Organization. Mr. Pantelidis has a Bachelor of Science degree and a Master of Business Administration degree, both from McGill University, Montreal, Québec. Principal occupation(1): Corporate Director. | Strategy/Leading Growth Capital Markets Finance/Accounting Risk Management Mergers & Acquisitions Manufacturing/Operations Marketing/Sales Human Resources/Compensation Information Technology Governance International Markets Restructuring | |||||||||||||

| Toronto, Ontario, Canada Current position with the Company: Chair of the Board of Directors Director since: May 2012 Age: 75 Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

| Board of Directors (chair) Executive Committee (member) Corporate Governance and Nominating Committee (chair) | Parkland Corporation | Supply and Development Committee (chair) | ||||||||||||

| Shares & DSUs Held | ||||||||||||||

Minimum level of ownership (2) | Number of Common Shares | Number of DSUs (3) | Total Market Value (4) | Compliance with minimum share ownership requirement (5) | ||||||||||

| $325,000 | 57,510 | 41,534 | $2,270,088 | Yes | ||||||||||

(1)Mr. Pantelidis has held this occupation for the last five years.

(2)Minimum level of ownership is equal to five times the annual board member retainer fee. This excludes the added retainer fee for the Chair position.

(3)Includes related dividend amounts.

(4)Value calculated based on the closing price of the Company’s common shares on the TSX (being CDN$28.80, USD$22.92), shares and DSUs held on March 12, 2021.

(5)DSUs are included in determining whether the minimum share ownership requirements have been satisfied. For more information see sections entitled "Minimum Share Ownership Requirement" and "Director Compensation".

17

| Jorge N. Quintas | Areas of Expertise: | ||||||||||||

Jorge Quintas started in 1970 as a Director in the cable industry and since 2002 has been the President of Nelson Quintas SGPS, SA, a holding company for the manufacturing of electrical and telecommunication cables, hazardous waste treatment plants, a telecommunications network in Brazil and real estate. Mr. Quintas has and continues to serve in executive capacities and/or as a director of various other private companies, most of which are based in Portugal. The companies with which Mr. Quintas serves as an executive are involved in a range of industrial activities, including the distribution and/or manufacture of natural gas, energy and telecommunications cables, fiber-optic cables, cables for the automotive industry and other types of cables. Principal occupation(2): President, Nelson Quintas SGPS, SA (holding company for manufacturer of electrical and telecommunication cables). | Strategy/Leading Growth Finance/Accounting Risk Management CEO/COO Experience Manufacturing/Operations Marketing/Sales Human Resources/Compensation International Markets Packaging Industry | |||||||||||||

Porto, Portugal Current position with the Company: Director(1) Director since: June 2009 Age: 74 Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

| Board of Directors Human Resources and Compensation Committee (member) | ||||||||||||||

| Shares & DSUs Held | ||||||||||||||

Minimum level of ownership (3) | Number of Common Shares | Number of DSUs (4) | Total Market Value (5) | Compliance with minimum share ownership requirement (6) | ||||||||||

| $325,000 | 59,608 | 73,155 | $3,042,928 | Yes | ||||||||||

(1)Mr. Quintas was also a director of the Company from May 2005 to June 2006.

(2)Mr. Quintas has held this occupation for the last five years.

(3)Minimum level of ownership is equal to five times the annual board member retainer fee.

(4)Includes related dividend amounts.

(5)Value calculated based on the closing price of the Company’s common shares on the TSX (being CDN$28.80, USD$22.92), shares and DSUs held on March 12, 2021.

(6)DSUs are included in determining whether the minimum share ownership requirements have been satisfied. For more information see sections entitled "Minimum Share Ownership Requirement" and "Director Compensation".

18

| Mary Pat Salomone | Areas of Expertise: | ||||||||||||

Mary Pat Salomone is a corporate director. From 2010 to 2013, she was Senior Vice President & Chief Operating Officer of Babcock & Wilcox Company (“B&W”), with more than 23,000 employees and 30 locations worldwide. Prior to that, Ms. Salomone held several senior positions with B&W, including Manager of Business Development and Manager of Strategic Acquisitions. From 1998 through 2007, Ms. Salomone was an officer of Marine Mechanical Company, which B&W acquired in 2007, including serving as President and Chief Executive Officer from 2001 through 2007. Ms. Salomone is currently on the Board of Directors of TC Energy Corporation (formerly TransCanada Corporation), where she is the chairperson of the Health, Safety, Sustainability and Environment Committee as well as a member of the Governance Committee. Ms. Salomone has served as a director of Herc Holdings, Inc since 2016 and is a member of the Audit and Finance Committees. She also formerly served as a trustee of the Youngstown State University Foundation. Ms. Salomone has a Bachelor of Engineering in Civil Engineering from Youngstown State University in Youngstown, Ohio and a Master of Business Administration from Baldwin Wallace College in Berea, Ohio. She completed the Advanced Management Program at Duke University’s Fuqua School of Business in 2011. Principal occupation(1): Corporate Director. | Strategy/Leading Growth Finance/Accounting Risk Management CEO/COO Experience Mergers & Acquisitions Manufacturing/Operations Human Resources/Compensation Information Technology Governance International Markets Environmental & Social Engineering Restructuring Energy/Utilities | |||||||||||||

| Naples, Florida, USA Current position with the Company: Director Director since: November 2015 Age: 60 Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

Board of Directors ESG Committee (chair)(2) Audit Committee (member) Human Resources and Compensation Committee (member)(3) | TC Energy Corporation | Health, Safety, Sustainability & Environment Committee (chair); Governance Committee (member) | ||||||||||||

| TransCanada PipeLines Limited | ||||||||||||||

| Herc Holdings, Inc. | Audit Committee (member); Finance Committee (member) | |||||||||||||

| Shares & DSUs Held | ||||||||||||||

Minimum level of ownership (4) | Number of Common Shares | Number of DSUs (5) | Total Market Value (6) | Compliance with minimum share ownership requirement (7) | ||||||||||

| $325,000 | — | 36,239 | $830,598 | Yes | ||||||||||

(1)Ms. Salomone has held this occupation for the last five years.

(2)The ESG Committee was established on November 11, 2020.

(3)Ms. Salomone is no longer a member of the committee effective January 1, 2021.

(4) Minimum level of ownership is equal to five times the annual board member retainer fee.

(5) Includes related dividend amounts.

(6) Value calculated based on the closing price of the Company’s common shares on the TSX (being CDN$28.80, USD$22.92), shares and DSUs held on March 12, 2021.

(7) DSUs are included in determining whether the minimum share ownership requirements have been satisfied. For more information see sections entitled "Minimum Share Ownership Requirement" and "Director Compensation".

19

| Melbourne F. Yull | Areas of Expertise: | ||||||||||||

Melbourne F. Yull has been an entrepreneur for most of his business career. He founded the Company in 1981 and by 2006 had grown it to approximately CDN $1 billion in revenue. He was Chief Executive Officer and Chair of the Board of the Company until his retirement in 2006. Prior to starting the Company, he was an original partner in a major Canadian paper converter and founded a plastic company that was the first to develop and commercialize the transition to plastic bags from paper in the retail market. Mr. Yull was Québec’s Entrepreneur of the Year in 1995 and serves on numerous private company boards. Principal occupation(2): President, Samanna Properties LLC and Affinity Kitchen & Bath LLC. | Strategy/Leading Growth Capital Markets Finance/Accounting Risk Management CEO/COO Experience Mergers & Acquisitions Manufacturing/Operations Marketing/Sales Governance International Markets Packaging Industry | |||||||||||||

Sarasota, Florida, USA Current position with the Company: Director Director since: June 2007(1) Age: 80 Non-Independent | ||||||||||||||

| Board/ Committee Memberships with the Company | Other Public Companies Currently Serving | |||||||||||||

| Directorships | Committees | |||||||||||||

| Board of Directors Executive Committee (chair) | ||||||||||||||

| Shares & DSUs Held | ||||||||||||||

Minimum level of ownership (3) | Number of Common Shares | Number of DSUs (4) | Total Market Value (5) | Compliance with minimum share ownership requirement (6) | ||||||||||

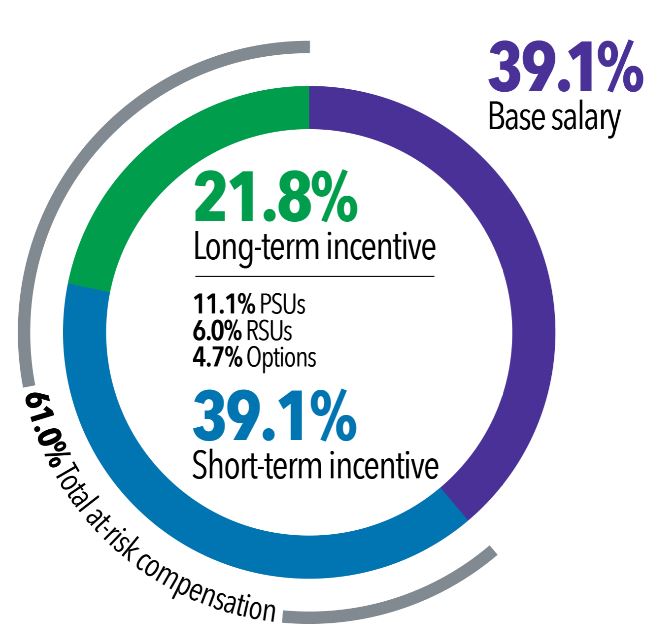

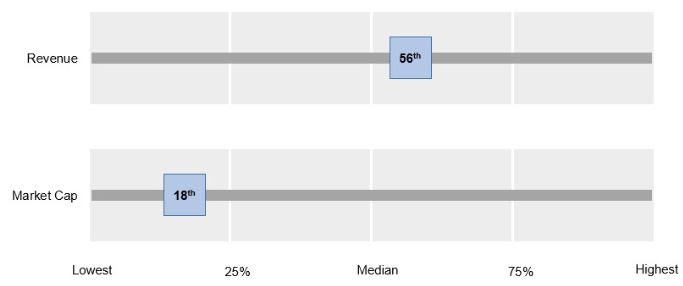

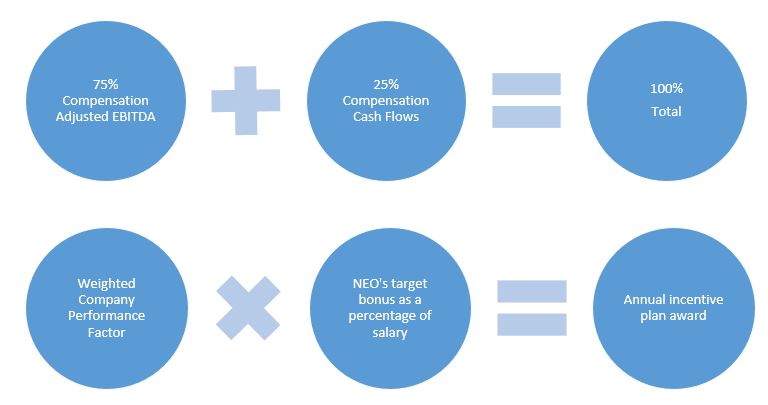

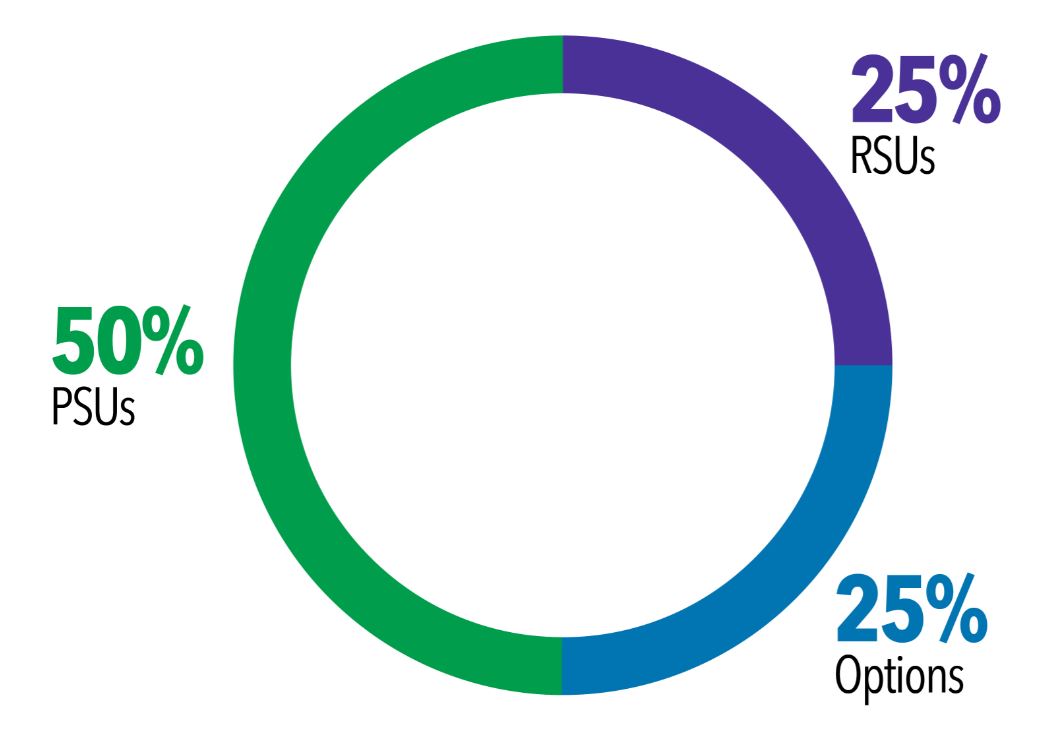

| $325,000 | 1,734,629 | 50,029 | $40,904,361 | Yes | ||||||||||