Form 6-K HEXO Corp. For: Jun 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2021

Commission File Number: 001-38781

HEXO Corp.

(Translation of registrant’s name into English)

3000 Solandt Road

Ottawa, Ontario, Canada K2K 2X2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXPLANATORY NOTE

Exhibits 99.1 and 99.2 included with this Report on Form 6-K are hereby incorporated by reference into (i) the Registration Statement on Form F-10 of HEXO Corp. and HEXO Operations Inc. (File No. 333-256131), and (ii) the Registration Statement on Form F-10 of HEXO Corp. (File No. 333-255264).

| Exhibit |

Description | |

| 99.1 |

Condensed interim consolidated financial statements for the three and nine months ended April 30, 2021 and 2020 | |

| 99.2 |

Management’s Discussion and Analysis for the three and nine months ended April 30, 2021 | |

| 99.3 |

Form 52-109F2 — Certification of Interim Filings - CEO | |

| 99.4 |

Form 52-109F2 — Certification of Interim Filings - CFO | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| HEXO Corp. | ||||||

| Date: June 14, 2021 | /s/ Sébastien St-Louis | |||||

| President and Chief Executive Officer | ||||||

Exhibit 99.1

HEXO Corp. Condensed Interim Consolidated Financial Statements For the three and nine months ended April 30, 2021 and 2020

Table of Contents

| Condensed Interim Consolidated Statements of Financial Position | 1 | |||

| Condensed Interim Consolidated Statements of Net Loss and Comprehensive Loss | 2 | |||

| Condensed Interim Consolidated Statements of Changes in Shareholders’ Equity | 3 | |||

| Condensed Interim Consolidated Statements of Cash Flows | 4 | |||

| Notes to the Condensed Interim Consolidated Financial Statements: | ||||

| 1. Description of Business | 5 | |||

| 2. Basis of Preparation | 5 | |||

| 3. New Accounting Policies and Pronouncements | 5 | |||

| 4. Restricted Funds | 6 | |||

| 5. Commodity Taxes Recoverable and Other Receivables | 6 | |||

| 6. Inventory | 6 | |||

| 7. Biological Assets | 7 | |||

| 8. Investments in Associates & Joint Ventures | 7 | |||

| 9. Long-term Investments | 8 | |||

| 10. Property, Plant and Equipment | 8 | |||

| 11. Intangible Assets | 9 | |||

| 12. Convertible Debenture Receivable | 9 | |||

| 13. Warrant Liabilities | 9 | |||

| 14. Convertible Debentures | 10 | |||

| 15. Lease Liabilities | 10 | |||

| 16. Term Loan | 11 | |||

| 17. Share Capital | 11 | |||

| 18. Common Share Purchase Warrants | 12 | |||

| 19. Share-based Compensation | 13 | |||

| 20. Net Loss per Share | 15 | |||

| 21. Financial Instruments | 15 | |||

| 22. Operating Expenses by Nature | 17 | |||

| 23. Other Income and Losses | 17 | |||

| 24. Related Party Disclosure | 18 | |||

| 25. Capital Management | 18 | |||

| 26. Commitments and Contingencies | 19 | |||

| 27. Fair Value of Financial Instruments | 20 | |||

| 28. Non-Controlling Interest | 20 | |||

| 29. Revenue from Sale of Goods | 21 | |||

| 30. Segmented Information | 21 | |||

| 31. Operating Cash Flow | 21 | |||

| 32. Comparative Information | 22 | |||

| 33. Income Taxes | 22 | |||

| 34. Subsequent Events | 22 | |||

Condensed Interim Consolidated Statements of Financial Position

(Unaudited, expressed in thousands of Canadian Dollars)

| As at |

Note | April 30, 2021 | July 31, 2020 | |||||||||

| Assets |

||||||||||||

| Current assets |

||||||||||||

| Cash and cash equivalents |

$ | 81,038 | $ | 184,173 | ||||||||

| Restricted funds |

4 | 32,551 | 8,261 | |||||||||

| Trade receivables |

19,049 | 19,426 | ||||||||||

| Commodity taxes recoverable and other receivables |

5 | 10,202 | 16,733 | |||||||||

| Prepaid expenses |

4,386 | 4,606 | ||||||||||

| Inventory |

6 | 95,223 | 64,933 | |||||||||

| Biological assets |

7 | 9,222 | 7,571 | |||||||||

|

|

|

|

|

|||||||||

| 251,671 | 305,703 | |||||||||||

|

|

|

|

|

|||||||||

| Non-current assets |

||||||||||||

| Property, plant and equipment |

10 | 280,183 | 285,366 | |||||||||

| Intangible assets |

11 | 16,412 | 16,008 | |||||||||

| Convertible debenture receivable |

12 | 20,246 | — | |||||||||

| Investment in associate and joint ventures |

8 | 73,379 | 76,306 | |||||||||

| Lease receivable |

3,795 | 3,865 | ||||||||||

| License and prepaid royalty |

— | 1,020 | ||||||||||

| Long-term investments |

9 | 4,402 | 3,209 | |||||||||

| Prepaid expenses |

3,101 | 1,392 | ||||||||||

|

|

|

|

|

|||||||||

| 653,189 | 692,869 | |||||||||||

|

|

|

|

|

|||||||||

| Liabilities |

||||||||||||

| Current liabilities |

||||||||||||

| Accounts payable and accrued liabilities |

42,968 | 32,451 | ||||||||||

| Excise taxes payable |

4,315 | 7,121 | ||||||||||

| Warrant liabilities |

13 | 13,037 | 3,450 | |||||||||

| Lease liability |

15 | 4,659 | 4,772 | |||||||||

| Term loan |

16 | — | 29,930 | |||||||||

| Onerous contract |

26 | 4,763 | 4,763 | |||||||||

|

|

|

|

|

|||||||||

| 69,742 | 82,487 | |||||||||||

|

|

|

|

|

|||||||||

| Non-current liabilities |

||||||||||||

| Lease liability |

15 | 22,566 | 24,344 | |||||||||

| Convertible debentures |

14 | 31,951 | 28,969 | |||||||||

| Other long-term liabilities |

1,805 | 393 | ||||||||||

|

|

|

|

|

|||||||||

| 126,064 | 136,193 | |||||||||||

|

|

|

|

|

|||||||||

| Shareholders’ equity |

||||||||||||

| Share capital |

17 | 1,031,525 | 1,023,788 | |||||||||

| Share-based payment reserve |

19 | 66,381 | 65,746 | |||||||||

| Warrant reserve |

18 | 93,429 | 95,617 | |||||||||

| Contributed surplus |

37,386 | 27,377 | ||||||||||

| Accumulated deficit |

(704,978 | ) | (659,231 | ) | ||||||||

| Accumulated other comprehensive income |

3 | — | ||||||||||

| Non-controlling interest |

28 | 3,379 | 3,379 | |||||||||

|

|

|

|

|

|||||||||

| 527,125 | 556,676 | |||||||||||

|

|

|

|

|

|||||||||

| 653,189 | 692,869 | |||||||||||

|

|

|

|

|

|||||||||

| Commitments and contingencies (Note 26) | ||||||

| Subsequent events (Note 34) |

Approved by the Board of Directors

/s/ Jason Ewart, Director

/s/ Michael Munzar, Director

1

Condensed Interim Consolidated Statements of Net Loss and Comprehensive Loss

(Unaudited, expressed in thousands of Canadian Dollars, except per share data)

| For the three months ended | For the nine months ended | |||||||||||||||||||

| Note | April 30, 2021 |

April 30, 2020 |

April 30, 2021 |

April 30, 2020 |

||||||||||||||||

| Revenue from sale of goods |

29 | 33,082 | 30,895 | 120,059 | 74,009 | |||||||||||||||

| Excise taxes |

(10,482 | ) | (8,817 | ) | (35,219 | ) | (20,516 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net revenue from sale of goods |

22,600 | 22,078 | 84,840 | 53,493 | ||||||||||||||||

| Ancillary revenue |

60 | 54 | 168 | 145 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net revenue |

22,660 | 22,132 | 85,008 | 53,638 | ||||||||||||||||

| Cost of goods sold |

6,22 | 18,281 | 13,530 | 57,391 | 76,914 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit/(loss) before fair value adjustments |

4,379 | 8,602 | 27,617 | (23,276 | ) | |||||||||||||||

| Realized fair value amounts on inventory sold |

6 | 6,426 | 9,251 | 17,619 | 21,362 | |||||||||||||||

| Unrealized gain on changes in fair value of biological assets |

7 | (10,863 | ) | (6,379 | ) | (35,616 | ) | (21,378 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit/(loss) |

8,816 | 5,730 | 45,614 | (23,260 | ) | |||||||||||||||

| Operating expenses |

||||||||||||||||||||

| Selling, general and administrative |

22 | 14,822 | 11,238 | 39,039 | 40,833 | |||||||||||||||

| Marketing and promotion |

2,452 | 2,131 | 6,682 | 9,621 | ||||||||||||||||

| Share-based compensation |

22 | 2,715 | 6,171 | 10,904 | 22,237 | |||||||||||||||

| Research and development |

730 | 1,017 | 2,901 | 3,962 | ||||||||||||||||

| Depreciation of property, plant and equipment |

10 | 1,612 | 1,566 | 4,369 | 4,890 | |||||||||||||||

| Amortization of intangible assets |

11 | 371 | 341 | 1,043 | 3,690 | |||||||||||||||

| Restructuring costs |

336 | 865 | 1,721 | 4,846 | ||||||||||||||||

| Impairment of property, plant and equipment |

10 | 16 | 220 | 881 | 33,004 | |||||||||||||||

| Impairment of intangible assets |

11 | — | — | — | 106,189 | |||||||||||||||

| Impairment of goodwill |

— | — | — | 111,877 | ||||||||||||||||

| Recognition of onerous contract |

— | — | — | 3,000 | ||||||||||||||||

| Disposal of long-lived assets |

— | — | 1,294 | — | ||||||||||||||||

| Loss/(gain) on disposal of property, plant and equipment |

(19 | ) | 3,237 | 45 | 3,734 | |||||||||||||||

| Acquisition and transaction costs |

1,871 | — | 2,307 | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| 24,906 | 26,786 | 71,186 | 347,883 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loss from operations |

(16,090 | ) | (21,056 | ) | (25,572 | ) | (371,143 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Finance income (expense), net |

23 | (2,947 | ) | (2,926 | ) | (7,311 | ) | (6,073 | ) | |||||||||||

| Non-operating income (expense), net |

23 | (1,674 | ) | 4,463 | (12,864 | ) | (6,717 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loss and comprehensive loss attributable to shareholders before tax |

(20,711 | ) | (19,519 | ) | (45,747 | ) | (383,933 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income tax recovery |

— | — | — | 6,023 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other comprehensive income |

||||||||||||||||||||

| Foreign currency translation |

3 | — | 3 | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss and comprehensive loss |

(20,708 | ) | (19,519 | ) | (45,744 | ) | (377,910 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Comprehensive loss attributable to: |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Shareholders of HEXO Corp. |

(20,708 | ) | (19,519 | ) | (45,744 | ) | (377,910 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-controlling interest |

— | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| (20,708 | ) | (19,519 | ) | (45,744 | ) | (377,910 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss per share, basic and diluted |

(0.17 | ) | (0.26 | ) | (0.38 | ) | (5.56 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Weighted average number of outstanding shares |

||||||||||||||||||||

| Basic and diluted |

20 | 122,397,731 | 73,852,844 | 121,749,456 | 67,936,412 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

2

Condensed Interim Consolidated Statements of Changes in Shareholders’ Equity

(Unaudited, expressed in thousands of Canadian Dollars, except per share data)

| For the nine months ended |

Note | Number of common shares |

Share capital |

Share-based payment reserve |

Warrant reserve |

Contributed surplus |

Non-controlling interest |

Other comprehensive Income |

Accumulated deficit |

Shareholders’ equity |

||||||||||||||||||||||||||||||

| Balance at July 31, 2019 |

64,245,438 | 799,706 | 40,315 | 60,433 | — | 1,000 | — | (112,742 | ) | 788,712 | ||||||||||||||||||||||||||||||

| April 2020 underwritten offering |

14,950,000 | 25,864 | — | 20,182 | — | — | — | — | 46,046 | |||||||||||||||||||||||||||||||

| $70m private placement unsecured convertible debentures |

— | — | — | — | 23,902 | — | — | — | 23,902 | |||||||||||||||||||||||||||||||

| USD$25m registered offering |

3,742,516 | 26,782 | — | — | — | — | — | — | 26,782 | |||||||||||||||||||||||||||||||

| USD$20m registered offering |

2,994,012 | 22,323 | — | — | — | — | — | — | 22,323 | |||||||||||||||||||||||||||||||

| Issuance fees |

— | (5,570 | ) | — | — | (27 | ) | — | — | — | (5,597 | ) | ||||||||||||||||||||||||||||

| Expiry of warrants |

— | — | — | (7,141 | ) | 7,141 | — | — | — | — | ||||||||||||||||||||||||||||||

| Exercise of warrants |

17,856 | 177 | — | — | — | — | — | — | 177 | |||||||||||||||||||||||||||||||

| Exercise of stock options |

19 | 29,133 | 223 | (88 | ) | — | — | — | — | — | 135 | |||||||||||||||||||||||||||||

| Expiry of stock options |

— | — | (312 | ) | — | 312 | — | — | — | — | ||||||||||||||||||||||||||||||

| Equity-settled share-based payments |

19,22 | — | — | 27,326 | — | — | — | — | — | 27,326 | ||||||||||||||||||||||||||||||

| Net loss and comprehensive loss |

— | — | — | — | — | — | — | (377,910 | ) | (377,910 | ) | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Balance at April 30, 2020 |

85,978,955 | 869,505 | 67,241 | 73,474 | 31,328 | 1,000 | — | (490,652 | ) | 551,896 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Balance at July 31, 2020 |

120,616,441 | 1,023,788 | 65,746 | 95,617 | 27,377 | 3,379 | — | (659,231 | ) | 556,676 | ||||||||||||||||||||||||||||||

| June 2020 at the market offering |

17 | 244,875 | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Issuance fees |

— | (192 | ) | — | — | — | — | — | — | (192 | ) | |||||||||||||||||||||||||||||

| Exercise of stock options |

19 | 82,083 | 499 | (195 | ) | — | — | — | — | — | 304 | |||||||||||||||||||||||||||||

| Expiry of stock options |

— | — | (9,507 | ) | — | 9,507 | — | — | — | — | ||||||||||||||||||||||||||||||

| Exercise of warrants |

1,522,139 | 7,430 | — | (2,188 | ) | 131 | — | — | — | 5,373 | ||||||||||||||||||||||||||||||

| Expiry of warrants |

— | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||

| Equity-settled share-based payments |

19,22 | — | — | 10,337 | — | — | — | — | — | 10,337 | ||||||||||||||||||||||||||||||

| Other comprehensive income |

— | — | — | — | — | — | 3 | — | 3 | |||||||||||||||||||||||||||||||

| Non-controlling interest |

28 | — | — | — | — | 371 | — | — | — | 371 | ||||||||||||||||||||||||||||||

| Net loss and comprehensive loss |

— | — | — | — | — | — | — | (45,747 | ) | (45,747 | ) | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Balance at April 30, 2021 |

122,465,538 | 1,031,525 | 66,381 | 93,429 | 37,386 | 3,379 | 3 | (704,978 | ) | 527,125 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3

Condensed Interim Consolidated Statements of Cash Flows

(Unaudited, expressed in thousands of Canadian Dollars)

| For the nine months ended |

Note | April 30, 2021 | April 30, 2020 | |||||||||

| Operating activities |

||||||||||||

| Total net loss |

$ | (45,744 | ) | $ | (377,910 | ) | ||||||

| Items not affecting cash |

31 | 24,102 | 343,929 | |||||||||

| Changes in non-cash operating working capital items |

31 | 4,804 | (59,650 | ) | ||||||||

|

|

|

|

|

|||||||||

| Cash used in operating activities |

(16,838 | ) | (93,631 | ) | ||||||||

|

|

|

|

|

|||||||||

| Financing activities |

||||||||||||

| Issuance of common shares |

883 | 104,748 | ||||||||||

| Issuance fees |

(192 | ) | (5,773 | ) | ||||||||

| Proceeds from the exercise of stock options |

19 | 304 | 135 | |||||||||

| Proceeds from the exercise of warrants |

18 | 5,373 | 71 | |||||||||

| Payments on term loan |

16 | (30,625 | ) | (2,625 | ) | |||||||

| Lease payments |

15 | (3,476 | ) | (3,196 | ) | |||||||

| Issuance of unsecured convertible debentures |

14 | — | 70,000 | |||||||||

| Interest paid on unsecured convertible debentures |

14 | (2,409 | ) | (1,804 | ) | |||||||

|

|

|

|

|

|||||||||

| Cash used financing activities |

(30,142 | ) | 161,556 | |||||||||

|

|

|

|

|

|||||||||

| Investing activities |

||||||||||||

| Settlement of short-term investments |

— | 24,726 | ||||||||||

| Proceeds from sale of investments |

— | 8,258 | ||||||||||

| Restricted cash |

4 | (24,290 | ) | 4,967 | ||||||||

| Issuance of convertible debenture receivable |

12 | (19,500 | ) | — | ||||||||

| Proceeds from sale of property, plant and equipment |

102 | 716 | ||||||||||

| Acquisition of property, plant and equipment |

(8,045 | ) | (95,998 | ) | ||||||||

| Purchase of intangible assets |

(1,447 | ) | (617 | ) | ||||||||

| Investment in associate and joint ventures |

8 | (2,975 | ) | (29,220 | ) | |||||||

|

|

|

|

|

|||||||||

| Cash used in investing activities |

(56,155 | ) | (87,168 | ) | ||||||||

|

|

|

|

|

|||||||||

| Cash used |

(103,135 | ) | (19,243 | ) | ||||||||

| Cash and cash equivalents, beginning of period |

184,173 | 113,568 | ||||||||||

|

|

|

|

|

|||||||||

| Cash and cash equivalents, end of period |

81,038 | 94,325 | ||||||||||

|

|

|

|

|

|||||||||

|

Supplemental cashflow information in Note 31. | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

Notes to the Consolidated Financial Statements

For the three and nine months ended April 30, 2021 and 2020

(Unaudited, expressed in thousands of Canadian Dollars, except share amounts or where otherwise stated)

1. Description of Business

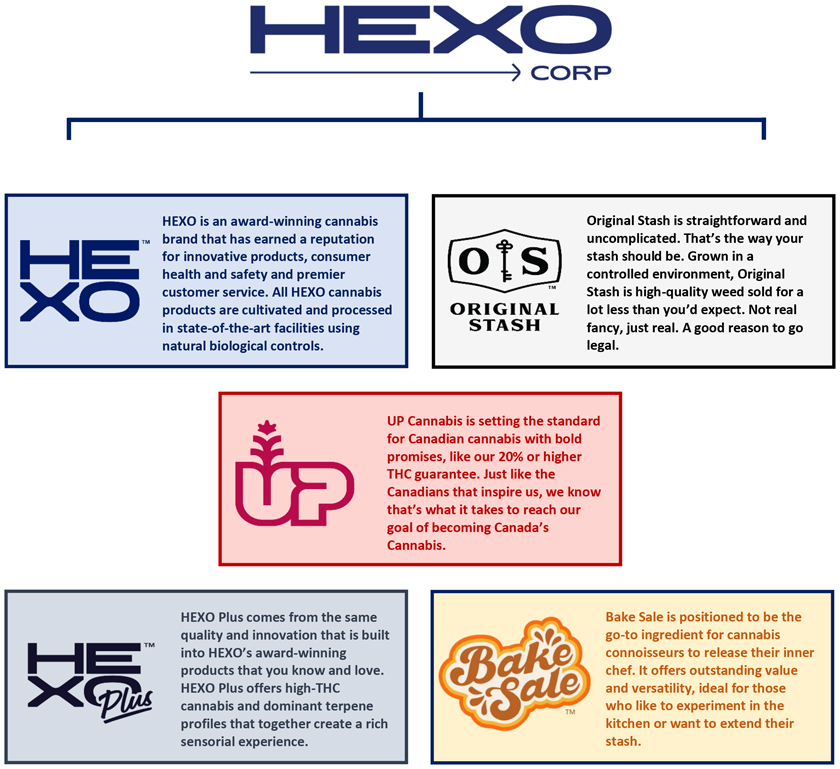

HEXO Corp. (the “Company”), is a publicly traded corporation, incorporated in Ontario. HEXO is licensed to produce and sell cannabis and cannabis products under the Cannabis Act. Its head office is located at 3000 Solandt Road Ottawa, Canada. The Company’s common shares are listed on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”), both under the trading symbol “HEXO”.

COVID-19

In March 2020, the World Health Organization declared the outbreak of COVID-19 a global pandemic. In response to the outbreak, governmental authorities in Canada and internationally have introduced various recommendations and measures to try to limit the pandemic, including travel restrictions, border closures, non- essential business closures, quarantines, self-isolations, shelters-in-place and social distancing. These measures are continuously monitored and modified by the applicable governmental authorities in Canada and remained in effect as at April 30, 2021. The production and sale of cannabis in Canada was deemed an essential service throughout the three and nine months ended April 30, 2021.

The Company regularly monitors the impact of the ongoing pandemic on all aspects of its business and operations and as of April 30, 2021, we have not observed any material changes.

2. Basis of Preparation

Statement of Compliance

These condensed interim consolidated financial statements (“interim consolidated financial statements”) have been prepared in accordance with International Accounting Standard 34, Interim Financial Reporting (“IAS 34”), using accounting policies consistent with International Financial Reporting Standards as issued by the International Accounting Standards Board and IFRS Interpretations Committee (“IFRS”). These interim consolidated financial statements do not contain all the disclosures required in annual consolidated financial statements and should be read in conjunction with the amended and restated annual consolidated financial statements of the Company for the year ended July 31, 2020, prepared in accordance with IFRS.

The interim consolidated financial statements have been prepared using accounting policies consistent with those described in the annual consolidated financial statements for the year ended July 31, 2020.

These interim consolidated financial statements were approved and authorized for issue by the Board of Directors on June 14, 2021.

3. New Accounting Policies and Pronouncements

New Accounting Policy

CAPTIVE INSURANCE

Insurance coverage for the Company’s directors and officers has been secured through a Captive Cell program (“the Captive Program”). The Captive Program was effected by entering into a participation agreement with a registered insurer for the purposes of holding and managing the Company’s coverage funds through a separate cell account (the “Cell Captive”). The Company applies IFRS 10 Consolidated Financial Statements in its assessment of control as it relates to the Cell Captive. The Company’s accounting policy is to consolidate the Cell Captive. Currently the Captive Program funds are held as cash in the Cell Captive with the possibility of reinvestment into short-term investments and/or marketable securities in the future. As the funds cannot be transferred to other parts of the group without providing 6 month notice, the funds are disclosed as Restricted cash. The Company recognizes gains and losses from, interest, foreign exchange activity and/or fair market value adjustments through the Statement of Loss and Comprehensive Loss.

New Accounting Procurement Not Yet Effective

AMENDMENTS TO IAS 37: ONEROUS CONTRACTS AND THE COST OF FULFILLING A CONTRACT

The amendment specifies that the ‘cost of fulfilling’ a contract comprises the ‘costs that relate directly to the contract’. Costs that relate directly to a contract consist of both the incremental costs of fulfilling that contract or an allocation of other costs that relate directly to fulfilling contracts. The amendment is effective for annual periods beginning on or after January 1, 2022 with early application permitted. The Company is currently evaluating the potential impact of these amendments on the Company’s consolidated financial statements.

5

4. Restricted Funds

| April 30, 2021 | July 31, 2020 | |||||||

| $ | $ | |||||||

| Debt service reserve account – term loan (Note 16) | — | 8,191 | ||||||

| Letters of credit, collateral and guarantees for purchases |

2,552 | 70 | ||||||

| Captive insurance |

29,999 | — | ||||||

|

|

|

|

|

|||||

| Total |

32,551 | 8,261 | ||||||

|

|

|

|

|

|||||

5. Commodity Taxes Recoverable and Other Receivables

| April 30, 2021 | July 31, 2020 | |||||||

| Commodity taxes recoverable |

$ | 3,167 | $ | 12,821 | ||||

| Lease receivable – current1 |

630 | 630 | ||||||

| Other receivables |

6,405 | 3,282 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 10,202 | $ | 16,733 | ||||

|

|

|

|

|

|||||

| 1 | A related party capital lease receivable related to Truss Limited Partnership (Note 24). |

6. Inventory

| As at April 30, 2021 | ||||||||||||

| Capitalized cost |

Biological asset fair value adjustment |

Total | ||||||||||

| Dried cannabis |

$ | 46,707 | $ | 28,309 | $ | 75,016 | ||||||

| Purchased dried cannabis |

1,666 | — | 1,666 | |||||||||

| Extracts |

10,688 | 96 | 10,784 | |||||||||

| Purchased extracts |

856 | — | 856 | |||||||||

| Hemp derived distillate |

49 | — | 49 | |||||||||

| Packaging and supplies |

6,852 | — | 6,852 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 66,818 | $ | 28,405 | $ | 95,223 | |||||||

|

|

|

|

|

|

|

|||||||

| As at July 31, 2020 | ||||||||||||

| Capitalized cost |

Biological asset fair value adjustment |

Total | ||||||||||

| Dried cannabis |

$ | 29,702 | $ | 16,981 | $ | 46,683 | ||||||

| Purchased dried cannabis |

1,956 | — | 1,956 | |||||||||

| Extracts |

4,828 | 385 | 5,213 | |||||||||

| Purchased extracts |

5,977 | — | 5,977 | |||||||||

| Hemp derived distillate |

566 | — | 566 | |||||||||

| Packaging and supplies |

4,538 | — | 4,538 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 47,567 | $ | 17,366 | $ | 64,933 | |||||||

|

|

|

|

|

|

|

|||||||

Capitalized costs relating to inventory expensed and included in Cost of goods sold were $17,654 and $57,934 for the three and nine months ended April 30, 2021, respectively (April 30, 2020 – $13,349 and $34,765). The unrealized fair value gain on biological asset fair value adjustments on the consolidated statement of loss for the three and nine months ended April 30, 2021 were $10,863 and $35,616, respectively (April 30, 2020 – $6,379 and $21,378). The realized fair value amounts on inventory sold on the consolidated statement of loss was $6,426 and $17,619 for the three and nine months ended April 30, 2021, respectively (April 30, 2020 – $9,251 and $21,362). During the three and nine months ended April 30, 2021, the Company reversed certain prior period inventory write downs of $nil and $1,543, respectively (April 30, 2020 – $nil and $nil) recorded in costs of sales on the consolidated statement of loss and $nil and $688 (April 30, 2020 – $nil and $nil) of fair value recorded in fair value amounts on inventory sold.

Total share-based compensation capitalized to inventory in the nine months ended April 30, 2021 was $1,283 (April 30, 2020 –$5,089). Total depreciation capitalized to inventory in the nine months ended April 30, 2021 was $10,850 (April 30, 2020 – $8,221).

6

7. Biological Assets

The Company’s biological assets consist of cannabis plants throughout the growth cycle, from mother plants to plants in propagation, vegetative and flowering stages. The changes in the carrying value of biological assets are as follows:

| For the nine months ended April 30, 2021 |

For the year ended July 31, 2020 |

|||||||

| $ | $ | |||||||

| Balance, beginning of year |

7,571 | 7,371 | ||||||

| Production costs capitalized |

23,819 | 38,638 | ||||||

| Net increase in fair value due to biological transformation and estimates |

35,616 | 29,356 | ||||||

| Transferred to inventory upon harvest |

(57,784 | ) | (67,131 | ) | ||||

| Disposal of biological assets |

— | (663 | ) | |||||

|

|

|

|

|

|||||

| Balance, end of period |

9,222 | 7,571 | ||||||

|

|

|

|

|

|||||

The valuation of biological assets is based on an income approach (Level 3) in which the fair value at the point of harvesting is estimated based on selling prices less the costs to sell. For in process biological assets, the fair value at the point of harvest is adjusted based on the stage of growth at period-end.

The significant estimates used in determining the fair value of cannabis plants are as follows:

| • | yield per plant; |

| • | stage of growth percentage estimated as costs incurred as a percentage of total cost as applied to the estimated total fair value per gram (less fulfilment costs) to arrive at an in-process fair value for estimated biological assets, which have not yet been harvested; |

| • | percentage of costs incurred for each stage of plant growth. |

| • | fair value selling price per gram less cost to complete and cost to sell. |

| • | destruction/wastage of plants during the harvesting and processing process. |

Management’s identified significant unobservable inputs, their range of values and sensitivity analysis are presented in the tables below.

| Input values | An increase or decrease of 5% applied to the unobservable input would result in a change to the fair value of approximately | |||||||

| Unobservable inputs |

April 30, 2021 | July 31, 2020 | April 30, 2021 | July 31, 2020 | ||||

| Weighted average selling price Derived from actual retail prices on a per product basis using the expected Flower and Trim yields per plant. |

$2.81 per dried gram |

$3.23 per dried gram |

$746 | $550 | ||||

| Yield per plant Derived from historical harvest cycle results on a per strain basis. |

80 – 113 grams per plant |

46 – 135 grams per plant |

$746 | $376 | ||||

| Stage of growth Derived from the estimates of stage of completion within the harvest cycle. |

Average of 50% completion |

Average of 43% completion |

$460 | $376 | ||||

| Waste Derived from the estimates of planned removal and naturally occurring waste within the cultivation and production cycle. |

0%–21% dependent upon |

0%–21% dependent upon |

No material variance | No material variance | ||||

8. Investments in Associates & Joint Ventures

| For the nine months ended April 30, 2021 | For the year ended July 31, 2020 | |||||||||||||||||||||||

| Truss LP | Other | Total | Truss LP | Other | Total | |||||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| Opening Balance |

74,966 | 1,340 | 76,306 | 51,786 | 1,063 | 52,849 | ||||||||||||||||||

| Cash contributed to investment |

2,975 | — | 2,975 | 29,155 | 1,231 | 30,386 | ||||||||||||||||||

| Capitalized transaction costs |

— | — | — | — | 109 | 109 | ||||||||||||||||||

| Share of net (loss) |

(5,638 | ) | (264 | ) | (5,902 | ) | (5,975 | ) | (356 | ) | (6,331 | ) | ||||||||||||

| Impairment |

— | — | — | — | (707 | ) | (707 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ending Balance |

72,303 | 1,076 | 73,379 | 74,966 | 1,340 | 76,306 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

7

Truss LP

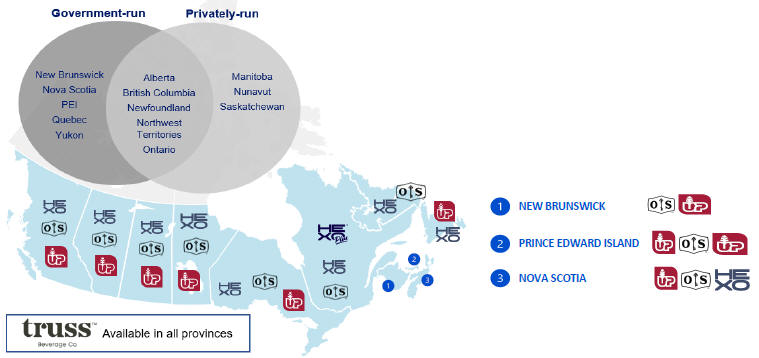

The Truss Limited Partnership (“Truss LP”) is a joint arrangement between the Company and Molson Coors Canada (the “Partner”) and is a standalone entity, incorporated in Canada, with its own board of directors and an independent management team. The Partner holds 57,500 common shares representing 57.5% controlling interest in Truss with the Company holding 42,500 common shares and representing the remaining 42.5%. Truss is a private limited partnership and its principal operating activities consist of pursuing opportunities to develop non-alcoholic, cannabis-infused beverages (Note 24). During the nine months ended April 30, 2021 the Company contributed $2,975 of additional capital to Truss as required under the shareholders agreement.

9. Long-term Investments

| Units | Fair value July 31, 2020 |

Divestiture | Change in fair value |

Fair value April 30, 2021 |

||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||

| Level 1 Investments |

||||||||||||||||||||

| Fire and Flower common shares |

1,319,377 | 1,292 | — | 171 | 1,463 | |||||||||||||||

| Inner Spirit common shares |

8,994,500 | 1,260 | — | 1,033 | 2,293 | |||||||||||||||

| Other long-term investments |

n/a | 517 | (11 | ) | — | 506 | ||||||||||||||

| Level 3 Investments |

||||||||||||||||||||

| Segra International Corp. |

400,000 | 140 | — | — | 140 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

3,209 | (11 | ) | 1,204 | 4,402 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

10. Property, Plant and Equipment

| Cost |

Land | Buildings | Leasehold improvements |

Cultivation and production equipment |

Furniture, computers, vehicles and equipment |

Construction in progress |

Right-of-Use assets |

Total | ||||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| At July 31, 2019 |

5,339 | 150,834 | 627 | 42,029 | 10,368 | 57,550 | — | 266,747 | ||||||||||||||||||||||||

| Additions |

— | 24,432 | 1,395 | 14,969 | 9,404 | 66,246 | 24,405 | 140,851 | ||||||||||||||||||||||||

| Disposals |

(3,683 | ) | (18,260 | ) | — | (13,402 | ) | (909 | ) | (5,428 | ) | — | (41,682 | ) | ||||||||||||||||||

| Transfers |

— | 7,943 | 22,417 | (10,135 | ) | 8 | (20,233 | ) | — | — | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| At July 31, 2020 |

1,656 | 164,949 | 24,439 | 33,461 | 18,871 | 98,135 | 24,405 | 365,916 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Additions |

— | 873 | 63 | 2,014 | 234 | 7,978 | — | 11,162 | ||||||||||||||||||||||||

| Disposals |

— | (5 | ) | — | (51 | ) | — | — | (1,055 | ) | (1,111 | ) | ||||||||||||||||||||

| Transfers |

— | 3,929 | 15,685 | 764 | 888 | (21,089 | ) | — | 177 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| At April 30, 2021 |

1,656 | 169,746 | 40,187 | 36,188 | 19,993 | 85,024 | 23,350 | 376,144 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Accumulated depreciation and impairments |

|

|||||||||||||||||||||||||||||||

| At July 31, 2019 |

— | 4,392 | 130 | 2,216 | 1,216 | — | — | 7,954 | ||||||||||||||||||||||||

| Depreciation |

— | 7,395 | 879 | 3,702 | 3,562 | — | 2,522 | 18,060 | ||||||||||||||||||||||||

| Transfers |

— | — | — | 271 | (271 | ) | — | — | — | |||||||||||||||||||||||

| Disposals |

— | (17,081 | ) | — | (7,435 | ) | (366 | ) | — | — | (24,882 | ) | ||||||||||||||||||||

| Impairments |

307 | 19,006 | — | 9,937 | — | 48,990 | 1,178 | 79,418 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| At July 31, 2020 |

307 | 13,712 | 1,009 | 8,691 | 4,141 | 48,990 | 3,700 | 80,550 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Depreciation |

— | 5,529 | 1,525 | 3,481 | 2,865 | — | 1,819 | 15,219 | ||||||||||||||||||||||||

| Transfers |

— | 454 | (16 | ) | 27 | (190 | ) | — | — | 275 | ||||||||||||||||||||||

| Disposals |

— | — | — | — | — | — | (964 | ) | (964 | ) | ||||||||||||||||||||||

| Impairments |

— | — | 85 | (20 | ) | 61 | (6 | ) | 761 | 881 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| At April 30, 2021 |

307 | 19,695 | 2,603 | 12,179 | 6,877 | 48,984 | 5,316 | 95,961 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net book value |

|

|||||||||||||||||||||||||||||||

| At July 31, 2019 |

5,339 | 146,442 | 497 | 39,813 | 9,152 | 57,550 | — | 258,793 | ||||||||||||||||||||||||

| At July 31, 2020 |

1,349 | 151,237 | 23,430 | 24,770 | 14,730 | 49,145 | 20,705 | 285,366 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| At April 30, 2021 |

1,349 | 150,051 | 37,584 | 24,009 | 13,116 | 36,040 | 18,034 | 280,183 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

In the nine months ended April 30, 2021, the Company capitalized $10,850 (July 31, 2020 — $11,988) of depreciation to inventory. During the three and nine months ended April 30, 2021, depreciation expensed to the consolidated statement of loss and comprehensive loss was $1,612 and $4,369 (April 30, 2020 — $1,566 and $4,890).

Capitalized borrowing costs to buildings in the nine months ended April 30, 2021 were $1,269 (July 31, 2020 — $2,385) at an average interest rate of 5.6% (July 31, 2020 — 7.22%).

8

11. Intangible Assets

| Cost |

Cultivating and processing license |

Brand | Software | Domain names |

Patents | Total | ||||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| At July 31, 2019 |

116,433 | 8,440 | 3,558 | 585 | 1,231 | 130,247 | ||||||||||||||||||

| Additions |

— | — | 702 | — | 875 | 1,577 | ||||||||||||||||||

| Disposals |

— | — | (550 | ) | — | (173 | ) | (723 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At July 31, 2020 |

116,433 | 8,440 | 3,710 | 585 | 1,933 | 131,101 | ||||||||||||||||||

| Additions |

— | — | 896 | — | 551 | 1,447 | ||||||||||||||||||

| Disposals |

— | — | (872 | ) | — | — | (872 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At April 30, 2021 |

116,433 | 8,440 | 3,734 | 585 | 2,484 | 131,676 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Accumulated amortization |

||||||||||||||||||||||||

| At July 31, 2019 |

1,601 | — | 1,269 | 66 | 29 | 2,965 | ||||||||||||||||||

| Amortization |

3,167 | — | 697 | 59 | 16 | 3,939 | ||||||||||||||||||

| Impairment |

106,189 | 2,000 | — | — | — | 108,189 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At July 31, 2020 |

110,957 | 2,000 | 1,966 | 125 | 45 | 115,093 | ||||||||||||||||||

| Amortization |

384 | — | 521 | 44 | 94 | 1,043 | ||||||||||||||||||

| Disposals |

— | — | (872 | ) | — | — | (872 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At April 30, 2021 |

111,341 | 2,000 | 1,615 | 169 | 139 | 115,264 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net book value |

||||||||||||||||||||||||

| At July 31, 2019 |

114,832 | 8,440 | 2,289 | 519 | 1,202 | 127,282 | ||||||||||||||||||

| At July 31, 2020 |

5,476 | 6,440 | 1,744 | 460 | 1,888 | 16,008 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At April 30, 2021 |

5,092 | 6,440 | 2,119 | 416 | 2,345 | 16,412 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Research and development expenses in the three and nine months ended April 30, 2021 were $730 and $2,901, respectively (April 30, 2020 - $1,017 and $3,962, respectively).

12. Convertible Debenture Receivable

On February 15, 2021 Zenabis entered into an agreement with HEXO for the issuance of an unsecured convertible debenture to the Company in a principal amount of $19,500. On this date, HEXO advanced Zenabis $12,500 in cash and converted the previous supply prepayment of $7,000 to a convertible debenture receivable. The debenture is convertible into common shares of Zenabis at a conversion price equal to the 5-day volume weighted average price (“VWAP”) of the Zenabis common shares on TSX for the five trading days prior to the date of conversion. The debenture may be prepaid by Zenabis, at its option and without penalty or premium. The unsecured convertible debenture bears interest at a rate of 8% per annum and matures on February 15, 2023.

Upon initial recognition of the $19,500 face value convertible debenture receivable (Level 2) on February 16, 2021, the fair value was derived using the calculated 5-day VWAP of $0.1724 and the closing market price of $0.18. The estimated fair value upon recognition was $20,360.

The fair value of the convertible debenture receivable as at April 30, 2021 was estimated using the calculated 5-day VWAP of $0.1174 and the closing market price of $0.12. The estimated fair value as at April 30, 2021 was $20,246. The gain on revaluation of the instrument was $434.

13. Warrant Liabilities

| USD$25,000 Registered Direct Offering |

USD$20,000 Registered Direct Offering |

Total | ||||||||||

| $ | $ | $ | ||||||||||

| Balance as at July 31, 2020 |

1,917 | 1,533 | 3,450 | |||||||||

| Loss on revaluation of financial instruments |

5,326 | 4,261 | 9,587 | |||||||||

|

|

|

|

|

|

|

|||||||

| Balance as at April 30, 2021 |

7,243 | 5,794 | 13,037 | |||||||||

|

|

|

|

|

|

|

|||||||

The warrants are classified as a liability because the exercise price is denominated in US dollars, which is different to the functional currency of the Company.

The warrant liabilities were revalued on April 30, 2021 using the Black-Scholes-Merton option pricing model (Level 2) using the following assumptions:

| • | stock price of USD$6.70; |

| • | expected life of 2.5 years; |

| • | $nil dividends; |

| • | 96.54% volatility based upon historical data; |

| • | risk-free interest rate of 0.29%; and |

| • | USD/CAD exchange rate of 1.2285. |

9

USD$20,000 Registered Direct Offering – Warrants

On April 30, 2021 the Company had 1,497,007 common share purchase warrants outstanding (Note 18) with an exercise price of USD$9.80 per share with a five year-term.

The loss/(gain) on the revaluation of the warrant liability during the three and nine months ended April 30, 2021 was $170 and $4,261, respectively (April 30, 2020 – ($4,261) and ($3,071), respectively) which is recorded in Other income and losses on the consolidated statements of loss and comprehensive loss.

USD$25,000 Registered Direct Offering – Warrants

On April 30th, 2021 the Company had 1,871,259 common share purchase warrants outstanding (Note 18) with an exercise price of USD$9.80 per share with a five year- term.

The loss/(gain) on the revaluation of the warrant liability during the three and nine months ended April 30, 2021 was $212 and $5,326, respectively (April 30, 2020 – ($2,752) and ($4,508), respectively) which is recorded in Other income and losses on the consolidated statements of loss and comprehensive loss.

14. Convertible Debentures

| Balance as at July 31, 2020 |

$ | 28,969 | ||

| Interest expense |

5,391 | |||

| Interest paid |

(2,409 | ) | ||

|

|

|

|||

| Balance as at April 30, 2021 |

$ | 31,951 | ||

|

|

|

On December 5, 2019, the Company closed a $70,000 private placement of convertible debentures. The Company issued a total of $70,000 principal amount of 8.0% unsecured convertible debentures maturing on December 5, 2022 (the “Debentures”). The Debentures are convertible at the option of the holder at any time after December 7, 2020 and prior to maturity at a conversion price of $12.64 per share (the “Conversion Price”), subject to adjustment in certain events. The Company may force the conversion of all of the then outstanding Debentures at the Conversion Price at any time after December 7, 2020 and prior to maturity on 30 days’ notice if the daily volume weighted average trading price of the common shares of the Company is greater than $30.00 for any 15 consecutive trading days.

The Company had the option to at any time on or before December 4, 2020, to repay all, but not less than all, of the principal amount of the Debentures, plus accrued and unpaid interest. Upon maturity, the holders of the Debentures have the right to require the Company to repay any principal amount of their Debentures through the issuance of common shares of the Company in satisfaction of such amounts at a price equal to the volume weighted average trading price of the common shares on the TSX for the five trading days immediately preceding the payment date.

In May 2020, the Company provided notice to all holders of the Debentures of an option to voluntarily convert their Debentures into units of the Company (the “Conversion Units”) at a discounted early conversion price of $0.80 (the “Early Conversion Price”) calculated based on the 5-day volume weighted average HEXO Corp. market prices (the “VWAP”) preceding the announcement. The VWAP unitized data from both the TSX and NYSE. Each Conversion Unit will provide the holder one common share and one half common share purchase warrant (with an exercise price of $4.00 and term of three years). The early conversion occurred in two phases, the first being on June 10, 2020 followed by the second and final phase June 30, 2020. During phases one and two, $23,595 principal amount, or approximately 34%, and $6,265 principal amount, or approximately 9% of the Debentures were converted under the Early Conversion Price into 7,373,438 and 1,957,813 common shares and 3,686,719 and 978,906 common share purchase warrants of HEXO Corp, respectively.

On April 30, 2021, there remains $40,140 in principal debentures, the net present value of the debt was $26,600 and the remaining balance of $13,540, was allocated to the conversion feature.

The accrued and unpaid interest as at April 30, 2020 was $483.

15. Lease Liabilities

The following is a continuity schedule of lease liabilities for the nine months ended April 30, 2021:

| $ | ||||

| Balance as at July 31, 2020 |

29,116 | |||

| Lease disposals |

(789 | ) | ||

| Lease payments |

(3,476 | ) | ||

| Interest expense on lease liabilities |

2,374 | |||

|

|

|

|||

| Balance as at April 30, 2021 |

27,225 | |||

|

|

|

|||

| Current portion |

4,659 | |||

|

|

|

|||

| Long-term portion |

22,566 | |||

|

|

|

|||

10

The Company’s leases consist of administrative real estate leases and a production real estate property. Effective August 1, 2020, the Company exited two real estate leases and the corresponding liability was written off for a realized a gain $181 recognized in Other income and losses on the consolidated statements of loss. The Company expensed variable lease payments of $815 and $2,412, respectively for the three and nine months ended April 30, 2021 (April 30, 2020 – $895 and $2,818, respectively).

The following table is the Company’s lease obligations over the next five fiscal years and thereafter as at April 30, 2021:

| Fiscal year |

2021 | 2022 – 2023 | 2024 – 2025 | Thereafter | Total | |||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Lease obligations |

1,143 | 9,186 | 8,749 | 31,082 | 50,160 | |||||||||||||||

16. Term Loan

Term Loan

On February 14, 2019, the Company entered into a syndicated credit facility with Canadian Imperial Bank of Commerce (“CIBC”) as Sole Bookrunner, Co-Lead Arranger and Administrative Agent and Bank of Montreal as Co-Lead Arranger and Syndication Agent (together “the Lenders”). The Lenders provided the Company with up to $65,000 in secured debt financing at a rate of interest that is expected to average in the mid-to-high 5% per annum range. The credit facility consisted of an up to $50,000 term loan (“Term Loan”) and up to a $15,000 in a revolving credit facility which is limited to the Company’s working capital assets available to support funded balances. The credit facility had a maturity date of February 14, 2022 and was secured against the Company’s property, plant and equipment. The Company was to repay at minimum 2.5% of the initial amount drawn each quarter per the terms of the credit facility agreement. On February 14, 2019, the Company received $35,000 on the Term Loan and incurred financing costs of $1,347.

Under the terms of the credit facility the Company was able to repay the loan without penalty, at any time and did so, in full, on April 30, 2021.

On July 31, 2020 the Company was not in compliance with an administrative banking covenant which mandated that the Company does not utilize a Canadian dollar operating bank account with any institution other than the Lenders. The Company was subject to the covenant 90 days after entering the syndicated credit facility on February 14, 2019. The Company received an amendment on October 29, 2020 allowing it to rectify this administrative breach by April 27, 2021. Due to the amendment being received after July 31, 2020 and within the three months ended October 31, 2020 the Company classified its Term Loan as a current liability on July 31, 2020. On April 30, 2021, the Company repaid the credit facility in full and therefore is no longer subject to the credit facilities financial or administrative covenants. The credit facility has therefore been terminated and is no longer available to the Company.

In the nine months ended April 30, 2021, total interest expenses were $990 (April 30, 2020 - $567) and total interest capitalized was $419 (April 30, 2020 - $752). The non- cash interest expense relating to the amortization of deferred financing costs was $793 for the nine months ended April 30, 2021 (April 30, 2020 - $364).

The following table illustrates the continuity schedule of the term loan as at April 30, 2021 and July 31, 2020:

| April 30, 2021 | July 31, 2020 | |||||||

| $ | $ | |||||||

| Term loan |

||||||||

| Opening balance |

30,625 | 34,125 | ||||||

| Repayments |

(30,625 | ) | (3,500 | ) | ||||

|

|

|

|

|

|||||

| Ending balance |

— | 30,625 | ||||||

|

|

|

|

|

|||||

| Deferred financing costs |

$ | $ | ||||||

| Opening balance |

(695 | ) | (751 | ) | ||||

| Additions |

(98 | ) | (445 | ) | ||||

| Amortization of deferred finance costs |

793 | 501 | ||||||

|

|

|

|

|

|||||

| Ending balance |

— | (695 | ) | |||||

|

|

|

|

|

|||||

| Total term loan |

— | 29,930 | ||||||

|

|

|

|

|

|||||

| Current portion |

— | 29,930 | ||||||

|

|

|

|

|

|||||

| Long-term portion |

— | — | ||||||

|

|

|

|

|

|||||

17. Share Capital

(a) Authorized

An unlimited number of common shares and an unlimited number of special shares, issuable in series.

(b) Consolidation Announcement

The Company finalized the share consolidation on the basis of four pre-consolidation common shares for one post-consolidation common share (4:1) by way of shareholder approval at the annual and special meeting of shareholders held December 11, 2020 (the “Consolidation”). The Consolidation was effected by the filing of articles of amendment to the Company’s articles under the Business Corporations Act (Ontario) on December 18, 2020. The purpose of the proposed share consolidation is to increase the Company’s

11

common share price to regain compliance with the USD$1.00 minimum share price continued listing standard of the New York Stock Exchange.

All balances of common shares, common share purchase warrants, stock options and restricted share units herein are reflective of the Consolidation.

(c) Issued and Outstanding

As at April 30, 2021, a total of 122,465,538 (July 31, 2020 – 120,616,441) common shares were issued and outstanding. No special shares have been issued or are outstanding.

| Number of shares | Share Capital | |||||||||||

| Balance at July 31, 2020 |

120,616,441 | $ | 1,023,788 | |||||||||

| June 2020 at the market offering |

(i | ) | 244,875 | — | ||||||||

| Exercise of warrants |

1,522,139 | 7,430 | ||||||||||

| Exercise of stock options |

82,083 | 499 | ||||||||||

| Issuance fees |

— | (192 | ) | |||||||||

|

|

|

|

|

|||||||||

| Balance at April 30, 2021 |

122,465,538 | $ | 1,031,525 | |||||||||

|

|

|

|

|

|||||||||

| (i) | June 2020 At-the-market (“ATM”) Offering |

On June 16, 2020, the Company established an ATM equity program allowing the Company to issue up to $34,500 (or its U.S. dollar equivalent) of common shares to the public. The common shares sold through the ATM program were sold through the TSX, the NYSE and other marketplaces on which the common shares were listed, quoted or otherwise traded, at the prevailing market price at the time of sale. The program closed on July 31, 2020 and a total of approximately $34,551 (after foreign exchange gains) was generated through the issuance of 8,235,620 common shares in the year ended July 31, 2020. On July 31, 2020 a receivable of $883 remained for irrevocable sales which occurred prior to year end and subsequently settled on August 5, 2020, at which time the remaining 244,875 shares were issued.

18. Common Share Purchase Warrants

The following table summarizes warrant activity during the nine months ended April 30, 2021 and year ended July 31, 2020.

| April 30, 2021 | July 31, 2020 | |||||||||||||||

| Number of | Weighted average | Number of | Weighted average | |||||||||||||

| warrants | exercise price1 | warrants | exercise price1 | |||||||||||||

| Outstanding, beginning of year |

33,379,408 | $ | 7.60 | 7,396,359 | $ | 39.80 | ||||||||||

| Expired |

(97,123 | ) | 3.92 | (3,889,871 | ) | 49.00 | ||||||||||

| Issued |

— | — | 30,976,389 | 4.96 | ||||||||||||

| Exercised |

(1,522,139 | ) | 3.85 | (1,103,469 | ) | 3.88 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Outstanding, end of year |

31,760,146 | $ | 7.66 | 33,379,408 | $ | 7.60 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1 | USD denominated warrant’s exercise price have been converted to the CAD equivalent as at the period end for presentation purposes. |

The 97,123 expired and cancelled warrants during the nine months ended April 30, 2021 were due to cashless exercises of the Company’s April 2020 and May 2020 warrants. In lieu of cash equal to the number of warrants exercised multiplied by the exercise price, the warrant holder forgoes the corresponding number of warrants which are effectively cancelled.

The following is a consolidated summary of warrants outstanding as at April 30, 2021 and July 31, 2020.

| April 30, 2021 | July 31, 2020 | |||||||||||||||

| Number outstanding |

Book value | Number outstanding |

Book value | |||||||||||||

| Classified as Equity |

$ | $ | ||||||||||||||

| June 2019 financing warrants |

||||||||||||||||

| Exercise price of $63.16 expiring June 19, 2023 |

546,135 | 10,022 | 546,135 | 10,022 | ||||||||||||

| April 2020 underwritten public offering warrants |

||||||||||||||||

| Exercise price of $3.84 expiring April 13, 2025 |

12,459,750 | 16,821 | 14,004,375 | 18,906 | ||||||||||||

| May 2020 underwritten public offering warrants |

||||||||||||||||

| Exercise price of $4.20 expiring May 21, 2025 |

7,777,876 | 10,702 | 7,852,513 | 10,805 | ||||||||||||

| Conversion Unit warrants |

||||||||||||||||

| Exercise price of $4.00 expiring June 10, 2023 |

3,686,721 | 11,426 | 3,686,721 | 11,426 | ||||||||||||

| Exercise price of $4.00 expiring June 30, 2023 |

978,907 | 1,928 | 978,907 | 1,928 | ||||||||||||

| Broker / Consultant warrants |

||||||||||||||||

| Exercise price of $3.00 expiring November 3, 2021 |

43,905 | 78 | 43,905 | 78 | ||||||||||||

| Exercise price of $3.00 expiring March 14, 2022 |

23,571 | 66 | 23,571 | 66 | ||||||||||||

| Exercise price of $63.16 expiring June 19, 2023 |

15 | — | 15 | — | ||||||||||||

| Molson warrants |

||||||||||||||||

12

| April 30, 2021 | July 31, 2020 | |||||||||||||||

| Number outstanding |

Book value | Number outstanding |

Book value | |||||||||||||

| Exercise price of $24.00 expiring October 4, 2021 |

2,875,000 | 42,386 | 2,875,000 | 42,386 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 28,391,880 | 93,429 | 30,011,142 | 95,617 | |||||||||||||

| Classified as Liability |

||||||||||||||||

| USD$25m Registered Direct Offering Warrants |

||||||||||||||||

| Exercise price of USD$9.80 expiring December 31, 2024 |

1,871,259 | 7,243 | 1,871,259 | 1,917 | ||||||||||||

| USD$20m Registered Direct Offering Warrants |

||||||||||||||||

| Exercise price of USD$9.80 expiring January 22, 2025 |

1,497,007 | 5,794 | 1,497,007 | 1,533 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 3,368,266 | 13,037 | 3,368,266 | 3,450 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 31,760,146 | 106,466 | 33,379,408 | 99,067 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

19. Share-based Compensation

Stock Options

The following table summarizes stock option activity during the nine months ended April 30, 2021 and the year ended July 31, 2020.

| April 30, 2021 | July 31, 2020 | |||||||||||||||

| Number of options |

Weighted average exercise price |

Number of options |

Weighted average exercise price |

|||||||||||||

| Opening balance |

7,503,689 | $ | 16.30 | 6,072,243 | $ | 23.48 | ||||||||||

| Granted |

2,091,172 | 5.03 | 2,986,507 | 6.48 | ||||||||||||

| Forfeited |

(593,408 | ) | 13.03 | (1,145,610 | ) | 22.20 | ||||||||||

| Expired |

(462,550 | ) | 27.82 | (380,318 | ) | 26.64 | ||||||||||

| Exercised |

(82,083 | ) | 3.70 | (29,133 | ) | 4.60 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Closing balance |

8,456,820 | $ | 13.23 | 7,503,689 | $ | 16.30 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table summarizes the stock option grants during the nine months ended April 30, 2021.

| Options granted | ||||||||||||||||||||||||

| Grant date |

Exercise price ($) |

Executives and directors |

Non-executive employees |

Total | Vesting terms | Expiry period | ||||||||||||||||||

| October 30, 2020 |

3.88 | 349,652 | 315,358 | 665,010 | Terms A | 10 years | ||||||||||||||||||

| December 22, 2020 |

5.44 | 380,673 | 960,100 | 1,340,773 | Terms A | 10 years | ||||||||||||||||||

| April 28, 2021 |

7.54 | — | 85,389 | 85,389 | Terms A | 10 years | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

730,325 | 1,360,847 | 2,091,172 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

Vesting terms A – One-third of the options will vest on each of the one-year anniversaries of the date of grant over a three-year period.

The following table summarizes information concerning stock options outstanding as at April 30, 2021.

| Exercise price |

Number outstanding |

Weighted average remaining life (years) |

Number exercisable |

Weighted average remaining life (years) |

||||||||||||

| $2.32–$10.76 |

4,566,444 | 8.86 | 943,941 | 6.78 | ||||||||||||

| $15.56–$26.16 |

1,664,895 | 8.00 | 1,051,887 | 7.78 | ||||||||||||

| $28.52–$34.00 |

2,220,732 | 7.65 | 1,205,879 | 7.53 | ||||||||||||

| $47.36–$66.96 |

4,749 | 0.41 | 4,749 | 0.41 | ||||||||||||

|

|

|

|

|

|||||||||||||

| 8,456,820 | 3,206,456 | |||||||||||||||

|

|

|

|

|

|||||||||||||

Restricted Share Units (“RSUs”)

Under the Omnibus Plan, the Board of Directors is authorized to issue RSUs up to 10% of the issued and outstanding common shares, inclusive of the outstanding stock options. At the time of issuance, the Board of Directors establishes conversion values and expiry dates, which are up to 10 years from the date of issuance. The restriction criteria of the units are at the discretion of the Board of Directors and from time to time may be inclusive of Company based performance restrictions, employee-based performance restrictions or no restrictions to the units.

The following table summarizes RSU activity during the nine months ended April 30, 2021 and the year ended July 31, 2020.

13

| April 30, 2021 | July 31, 2020 | |||||||||||||||

| Value of units on | Value of units on | |||||||||||||||

| Units | grant date | Units | grant date | |||||||||||||

| Opening balance |

587,108 | $ | 8.41 | — | $ | — | ||||||||||

| Granted |

7,161 | 3.16 | 609,636 | 8.52 | ||||||||||||

| Exercised |

(25,483 | ) | 8.60 | — | — | |||||||||||

| Forfeited |

(34,801 | ) | 11.76 | (22,528 | ) | 11.76 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Closing balance |

533,985 | $ | 7.96 | 587,108 | $ | 8.41 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table summarizes the RSUs granted during the nine months ended April 30, 2021.

| RSUs granted | ||||||||||||||||||||

| Grant date |

Unit value | Executive and directors |

Non-executive employees |

Vesting terms |

Expiry period |

|||||||||||||||

| October 30, 2020 |

$ | 3.16 | 7,161 | — | Terms A | 10 years | ||||||||||||||

|

|

|

|||||||||||||||||||

| Total |

7,161 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

Vesting terms A – One-third of the units vest on each of the one-year anniversaries for the first three years after the grant date.

Share-based Compensation

Share-based compensation is measured at fair value at the date of grant and are expensed over the vesting period (See Note 22 for share-based compensation allocation by expense group). In determining the amount of share-based compensation, the Company used the Black-Scholes-Merton option pricing model to establish the fair value of stock options and RSUs granted at grant date by applying the following assumptions:

| April 30, 2021 | July 31, 2020 | |||||||

| Exercise price (weighted average) |

$ | 17.97 | $ | 26.04 | ||||

| Market price (weighted average) |

$ | 18.16 | $ | 26.44 | ||||

| Risk-free interest rate (weighted average) |

1.30 | % | 1.79 | % | ||||

| Expected life (years) of options (weighted average) |

5 | 5 | ||||||

| Expected annualized volatility (weighted average) |

83 | % | 75 | % | ||||

Volatility was estimated using the average historical volatility of the Company and comparable companies in the industry that have trading history and volatility history.

For the three and nine months ended April 30, 2021, the Company allocated to inventory $444 and $1,284, respectively (April 30, 2020 – $1,358 and $5,088) of share-based compensation applicable to direct and indirect labour in the cultivation and production process..

The cash-settled share-based compensation liability is presented in Other liabilities. The following table summarizes the Company’s equity-settled and cash-settled share- based payments for the nine months ended April 30, 2021 and 2020.

| April 30, 2021 | April 30, 2020 | |||||||

| $ | $ | |||||||

| Stock option share-based compensation |

10,337 | 18,599 | ||||||

| RSU share-based compensation |

— | — | ||||||

|

|

|

|

|

|||||

| Total equity-settled share-based compensation |

10,337 | 18,599 | ||||||

|

|

|

|

|

|||||

| RSU share-based compensation |

1,850 | — | ||||||

|

|

|

|

|

|||||

| Total cash-settled share-based compensation |

1,850 | — | ||||||

|

|

|

|

|

|||||

14

20. Net Loss per Share

The following securities could potentially dilute basic net loss per share in the future but have not been included in diluted loss per share because their effect was anti-dilutive:

| Instrument |

April 30, 2021 | July 31, 2020 | ||||||

| Stock Options |

8,456,820 | 7,503,690 | ||||||

| RSUs |

533,985 | 587,108 | ||||||

| 2019 June financing warrants |

546,135 | 546,135 | ||||||

| USD$25m registered direct offering warrants |

1,871,259 | 1,871,259 | ||||||

| USD$20m registered direct offering warrants |

1,497,007 | 1,497,007 | ||||||

| 2020 April underwritten public offering warrants |

12,459,750 | 14,004,375 | ||||||

| 2020 May underwritten public offering warrants |

7,777,876 | 7,852,513 | ||||||

| Warrants issued under conversion of debentures |

4,665,628 | 4,665,628 | ||||||

| Joint venture and Inner Spirit issued warrants |

2,875,000 | 2,875,000 | ||||||

| Convertible debenture broker/finder warrants |

67,491 | 67,491 | ||||||

|

|

|

|

|

|||||

| 40,750,951 | 41,470,206 | |||||||

|

|

|

|

|

|||||

21. Financial Instruments

Market Risk

Interest Risk

The Company has minimal exposure to interest rate risk related to any investments of cash and cash equivalents. The Company may invest cash in highly liquid investments with short terms to maturity that would accumulate interest at prevailing rates for such investments. As at April 30, 2021, the Company had no term loans (July 31, 2020 – $29,930) (Note 16).

Price Risk

Price risk is the risk of variability in fair value due to movements in equity or market prices. The Company’s level 1 and 2 investments are susceptible to price risk arising from uncertainties about their future outlook, future values and the impact of market conditions. The fair value of marketable securities and derivatives held in publicly traded entities is based on quoted market prices, which the shares of the investments can be exchanged for. The Company elected an early conversion option in the year ended July 31, 2020 in which $29,860 of the aggregate principal amount of its 8% unsecured convertible debentures (Note 14) were converted, which partially mitigates the Company’s Price Risk.

There would be no material impact (July 31, 2020 – no material impact) if the fair value of these financial assets were to increase or decrease by 10% as of April 30, 2021. The price risk exposure as at April 30, 2021 and July 31, 2020 is presented in the table below.

| April 30, 2021 | July 31, 2020 | |||||||

| $ | $ | |||||||

| Financial assets |

4,402 | 2,692 | ||||||

| Financial liabilities |

(13,037 | ) | (3,450 | ) | ||||

|

|

|

|

|

|||||

| Total exposure |

(8,635 | ) | (758 | ) | ||||

|

|

|

|

|

|||||

Credit Risk

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises principally from the Company’s trade receivables and convertible debentures receivable. As at April 30, 2021, the Company was exposed to credit related losses in the event of non-performance by the counterparties.

The Company provides credit to its customers in the normal course of business and has established credit evaluation and monitoring processes to mitigate credit risk. Since the majority of the medical sales are transacted with clients that are covered under various insurance programs, and adult use sales are transacted with crown corporations, the Company has limited credit risk.

Cash and cash equivalents, certain restricted funds and short-term investments are held with four Canadian commercial banks that hold Dun and Bradstreet credit ratings of AA (July 31, 2020 – AA) and $111 is held with a credit union that does not have a publicly available credit rating. Certain restricted funds in the amount of $30,000 are managed by an insurer and are held as a cell captive within a Bermuda based private institution which does not have a publicly available credit rating; however the utilized custodian is Citibank which holds a credit rating of A+. The majority of the trade receivables balance is held with crown corporations of Quebec, Ontario and Alberta. Creditworthiness of a counterparty is evaluated prior to the granting of credit. The Company has estimated the expected credit loss using a lifetime credit loss approach. The current expected credit loss for the nine months ended April 30, 2021 is $36 (July 31, 2020 - $35).

15

In measuring the expected credit losses, the adult-use cannabis trade receivables have been assessed on a per customer basis as they consist of a low number of material contracts. Medical trade receivables have been assessed collectively as they have similar credit risk characteristics. They have been grouped based on the days past due.

Credit risk from the convertible debenture receivable arises from the possibility that principal and/or interest due may become uncollectible. The Company mitigates this risk by managing and monitoring the underlying business relationship.

The carrying amount of cash and cash equivalents, restricted cash and trade receivables represents the maximum exposure to credit risk and as at April 30, 2021; this amounted to$132,638 (July 31, 2020 – $211,860).

The following table summarizes the Company’s aging of trade receivables as at April 30, 2021 and July 31, 2020:

| April 30, 2021 |

July 31, 2020 |

|||||||

| $ | $ | |||||||

| 0–30 days |

14,830 | 15,253 | ||||||

| 31–60 days |

2,407 | 2,972 | ||||||

| 61–90 days |

375 | 412 | ||||||

| Over 90 days |

1,437 | 789 | ||||||

|

|

|

|

|

|||||

| Total |

19,049 | 19,426 | ||||||

|

|

|

|

|

|||||

Economic Dependence Risk

Economic dependence risk is the risk of reliance upon a select number of customers, which significantly impacts the financial performance of the Company. For the three months ended April 30, 2021, the Company’s recorded sales to the crown corporations; Société québécoise du cannabis (“SQDC”) the Ontario Cannabis Store (“OCS”) and the Alberta Gaming, Liquor and Cannabis agency (“ALGC”) representing 44%, 26% and 15%, respectively (April 30, 2020 – one crown corporation representing 83%) of total applicable periods gross cannabis sales.

For the nine months ended April 30, 2021, the Company’s recorded sales to the crown corporations; Société québécoise du cannabis (“SQDC”) the Ontario Cannabis Store (“OCS”) and the Alberta Gaming, Liquor and Cannabis agency (“ALGC”) representing 50%, 20% and 17%, respectively (April 30, 2020 – one crown corporation representing 75%) of total applicable periods gross cannabis sales.

The Company holds trade receivables from the crown corporations SQDC, OCS and the AGLC representing 30%, 35% and 14%, respectively, of total trade receivable, respectively as at April 30, 2021 (July 31, 2020 – two crown corps SQDC and OCS representing 47% and 25% of total trade receivables, respectively).

Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they come due. The Company manages its liquidity risk by reviewing on an ongoing basis its capital requirements. As at April 30, 2021, the Company had $81,038 (July 31, 2020 –$184,173) of cash and cash equivalents and $19,049 (July 31, 2020 –$19,426) in trade receivables.

The Company has current liabilities of $69,742 and contractual commitments of $9,472 due before July 31, 2022. The Company’s existing cash and cash equivalents and trade receivables are expected to provide sufficient liquidity to meet cash outflow requirements over the next twelve months.