Form 6-K Great Panther Silver For: May 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2019

Commission File Number: 001-35043

GREAT PANTHER MINING LIMITED

(Translation of registrant's name into English)

1330 – 200 Granville Street

Vancouver, British Columbia, V6C 1S4, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [X] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

| 99.1 | Form 51-101 F4 - Business Acquisition Report |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GREAT PANTHER MINING LIMITED | |

| /s/ Jim A. Zadra | |

| Jim A. Zadra | |

| Chief Financial Officer & Corporate Secretary | |

Date: May 17, 2019

Exhibit 99.1

GREAT PANTHER MINING LIMITED

FORM 51-102 F4

BUSINESS ACQUISITION REPORT

| Item 1 | IDENTITY OF COMPANY |

| 1.1 | Name and Address of Company |

Great Panther Mining Limited (“Great Panther” or the “Company”)

Suite 1330 - 200 Granville Street

Vancouver, BC

V6C 1S4

| 1.2 | Executive Officer |

Jim Zadra

Chief Financial Officer

(604) 608-1766

| Item 2 | DETAILS OF ACQUISITION |

| 2.1 | Nature of Business Acquired |

On March 5, 2019, the Company completed the previously announced acquisition of all of the issued and outstanding ordinary shares of Beadell Resources Ltd. (“Beadell”) by means of a Scheme of Arrangement (the “Scheme”) under the Australian Corporations Act 2001 (the “Transaction”). The Scheme was completed pursuant to a Scheme Implementation Deed, dated September 23, 2018, between the Company and Beadell (the “Implementation Deed”).

Upon completion of the Transaction, the Company changed its name from “Great Panther Silver Limited” to “Great Panther Mining Limited”.

Under the terms of the Scheme, Beadell shareholders received 0.0619 common shares of the Company (each whole common share, a “Company Share”) for each ordinary share of Beadell (the “Exchange Ratio”) resulting in the issuance of 103,593,043 Company Shares. Under the terms of the Implementation Deed, each Beadell warrantholder received a number of Company warrants equal to the number of their Beadell warrants multiplied by the Exchange Ratio at a price determined as the original exercise price divided by the Exchange Ratio and their Beadell warrants were cancelled. In the aggregate, warrants to purchase up to 9,749,727 Company Shares were issued in exchange for outstanding Beadell warrants.

In connection with the completion of the Acquisition, the Company made an offer (the “Offer”) to purchase for cash Beadell’s outstanding US$10,000,000 principal amount of 6.00% convertible senior secured debentures maturing on June 30, 2023 (the “Debentures”) at a price equal to 105% of the principal amount, plus accrued and unpaid interest. The Offer was accepted by the holders of all Debentures and the Company completed the purchase of the Debentures on April 3, 2019.

The business of Beadell is described in the information on Beadell included in the attached Schedule A, which was part of the information included by Great Panther on Beadell in its information circular dated December 21, 2018 issued in connection with the meeting of the shareholders of Great Panther to approve the Transaction held on February 11, 2019.

| 1 | ||

| 2.2 | Date of Acquisition |

Great Panther completed the acquisition on March 5, 2019.

| 2.3 | Consideration |

Under the terms of the Scheme, Beadell shareholders received 0.0619 common shares of the Company (each whole common share, a “Company Share”) for each ordinary share of Beadell (the “Exchange Ratio”) resulting in the issuance of 103,593,043 Company Shares. Under the terms of the Implementation Deed, each Beadell warrantholder received a number of Company warrants equal to the number of their Beadell warrants multiplied by the Exchange Ratio at a price determined as the original exercise price divided by the Exchange Ratio and their Beadell warrants were cancelled. In the aggregate, warrants to purchase up to 9,749,727 Company Shares were issued in exchange for outstanding Beadell warrants.

| 2.4 | Effect of Financial Position |

Upon completion of the acquisition, Beadell became a wholly-owned subsidiary of Great Panther. The business and operations of Beadell have been combined with those of Great Panther and are managed concurrently.

Except as disclosed in this business acquisition report and the Material Change Report, Great Panther does not have any current plans for material changes in the business or affairs of Beadell which may have a significant effect on the results of the operations and financial position of Great Panther.

For details on the pro forma effect of the acquisition on Great Panther, see Item 3 and the condensed interim consolidated financial statements of Great Panther as at and for the three months ended March 31, 2019, which were filed on www.sedar.com on May 15, 2019.

The information set out above is a summary only and is qualified in its entirety by the information contained in the pro forma financial statements attached to this Business Acquisition Report.

| 2.5 | Prior Valuations |

To the best knowledge of Great Panther, there have not been any valuation opinions obtained within the last twelve months by Beadell or Great Panther as required by securities legislation or a Canadian exchange or market to support the consideration paid by Great Panther in connection with the acquisition.

| 2.6 | Parties to Transaction |

The acquisition was not with an informed person, associate or affiliate of Great Panther as defined in Section 1.1 of National Instrument 51-102 - Continuous Disclosure Obligations.

| 2.7 | Date of Report |

May 17, 2019.

| 2 | ||

| Item 3 | FINANCIAL STATEMENTS |

The following are provided in the Appendices:

| Appendix | Financial Statements |

| Appendix A |

Annual Financial Report of Beadell, including the financial statements as at and for the years ended December 31, 2018 and 2017. Independent Auditor’s Report on the audit of the Financial Statements of Beadell as at December 31, 2018 and for the year then ended. The auditors have not given their consent to include their audit report in this Business Acquisition Report. |

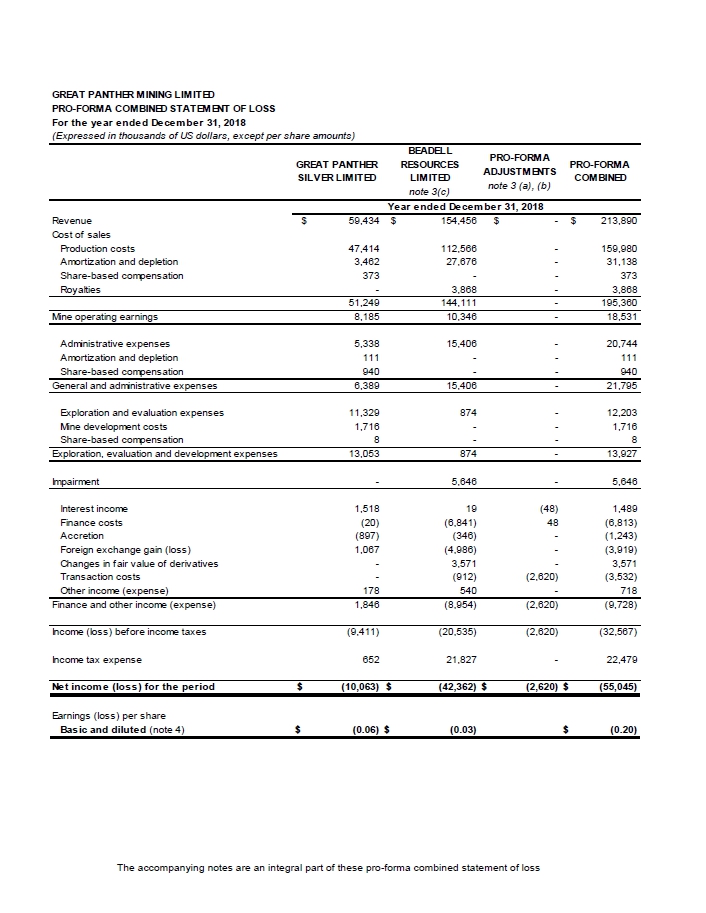

| Appendix B | Unaudited pro forma combined statement of loss for the year ended December 31, 2018 |

| 3 | ||

APPENDIX A

Annual Financial Report of Beadell, including the financial statements as at and for the years ended December 31, 2018 and 2017

and

Independent Auditor’s Report on the audit of the Financial Statements of Beadell as at December 31, 2018 and for the year then ended

Beadell Resources Limited

ABN 50 125 222 291

Annual Financial Report

31 December 2018

Contents

| Page | |

| Consolidated statement of financial position | 3 |

| Consolidated statement of profit or loss and other comprehensive income | 4 |

| Consolidated statement of changes in equity | 5 |

| Consolidated statement of cash flows | 7 |

| Notes to the consolidated financial statements | 8 |

| Directors’ declaration | 42 |

| Auditor’s independence declaration | 43 |

| Independent auditor’s report | 44 |

| 2 |

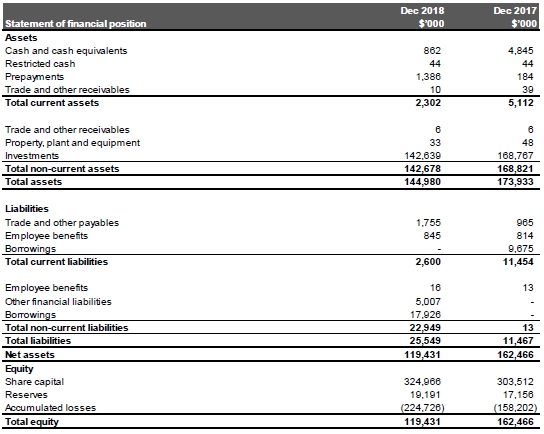

Consolidated Financial Statements

Consolidated statement of financial position

As at 31 December 2018

The notes are an integral part of these consolidated financial statements.

| 3 |

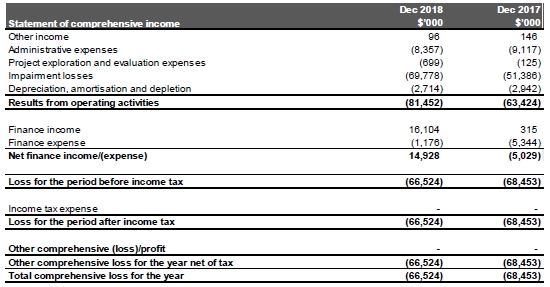

Consolidated Financial Statements

Consolidated statement of profit or loss and other comprehensive income

For the year ended 31 December 2018

The notes are an integral part of these consolidated financial statements.

| 4 |

Consolidated Financial Statements

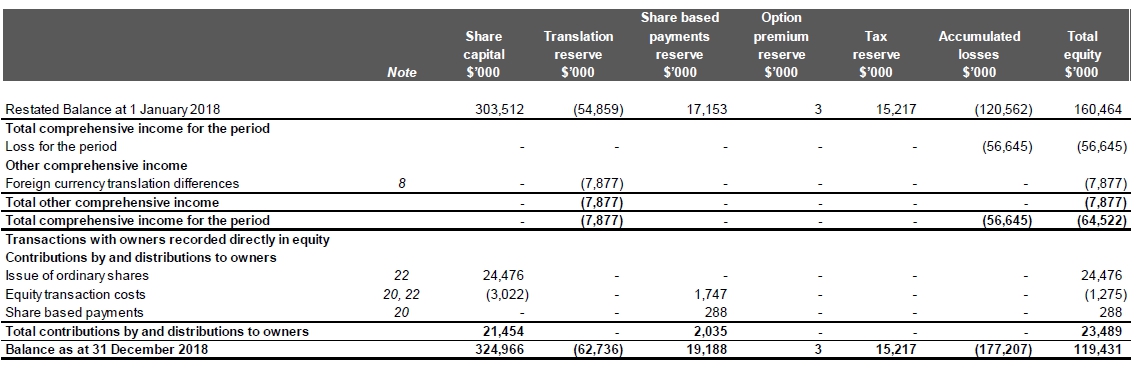

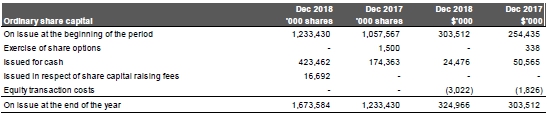

Consolidated statement of changes in equity

For the year ended 31 December 2018

The notes are an integral part of these consolidated financial statements.

| 5 |

Consolidated Financial Statements

Consolidated statement of changes in equity

For the year ended 31 December 2017

The notes are an integral part of these consolidated financial statements.

| 6 |

Consolidated financial statements

Consolidated statement of cash flows

For the year ended 31 December 2018

The notes are an integral part of these consolidated financial statements.

| 7 |

Notes to the consolidated financial statements

| 1. | Reporting entity |

Beadell Resources Limited (the Company) is a for profit company limited by shares and incorporated in Australia, whose shares were publicly traded on the Australian Stock Exchange (ASX). On 5 March 2019, the Company became a wholly owned subsidiary of Great Panther following the implementation of a Scheme of Arrangement. At the close of trading 6 March 2019 Beadell was removed from the Official List of the ASX (refer note 27).

The address of the Company’s registered office is Level 2, 16 Ord Street, West Perth, Western Australia.

The consolidated financial statements of the Company as at and for the period from 1 January 2018 to 31 December 2018 comprise the Company and its subsidiaries (together referred to as the “Group” and individually as “Group Entities”).

| 2. | Basis of preparation |

| (a) | Statement of compliance |

The financial report is a general purpose financial report which has been prepared in accordance with Australian Accounting Standards (AASBs) (including Australian Interpretations) adopted by the Australian Accounting Standards Board (AASB) and the Corporations Act 2001. The consolidated financial report of the Group complies with International Financial Reporting Standards (IFRSs) and interpretations adopted by the International Accounting Standards Board (IASB).

The financial statements were approved by the Board of Directors on 30 April 2019.

| (b) | Basis of measurement |

The consolidated financial statements have been prepared on the historical cost basis.

| (c) | Functional and presentation currency |

These consolidated financial statements are presented in Australian dollars, which is the Company’s functional currency. The Group’s functional currencies are the Brazilian Real and the Australian dollar.

The Company is of a kind referred to in ASIC Instrument 2016/191 and in accordance with that Instrument, amounts in the financial report have been rounded off to the nearest thousand dollars, unless otherwise stated.

| (d) | Use of estimates and judgements |

Set out below is information about:

| • | critical judgements in applying accounting policies that have the most significant effect on the amounts recognised in the financial statements; and |

| • | assumptions and estimation uncertainties that have a significant risk of resulting in a material adjustment within the next financial year. |

Critical judgements

Going concern

The consolidated financial report has been prepared on a going concern basis, which contemplates the continuity of normal business activity and the realisation of assets and the settlement of liabilities in the normal course of business.

Beadell Resources Limited (the Group) held cash on hand and on deposit as at 31 December 2018 of $9.4 million and has a net working capital deficit, inclusive of provisions, of $25.5 million. For the year ended 31 December 2018 the Group incurred a loss after income tax of $56.6 million including impairments of $7.6 million. Cash inflows from operating activities were $1.0 million and cash outflows from investing activities were $23.7 million.

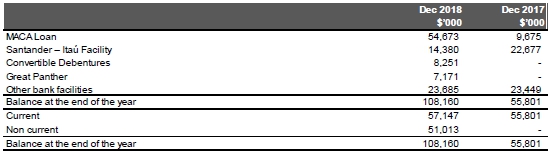

On 22 June 2018, the Group announced the MACA Termination Agreement. All amounts owing to MACA were consolidated into one $61 million loan. The outstanding loan amount at 31 December 2018 was $54.7 million.

The Group’s Santander - Itaú Facility was scheduled to be repaid in full by April 2019. The Group repaid the scheduled amount of US$5 million in January 2019. The final repayment of US$5 million was rescheduled subsequent to year end from April 2019 to June 2019.

Scheme of Arrangement

On 12 February 2019 a Scheme Meeting was held at which Beadell shareholders agreed to the acquisition of the Group by Great Panther. Under the Scheme, Beadell shareholders would receive 0.0619 of a Great Panther common share for each Beadell Share.

On 5 March 2019, the Scheme was implemented and Beadell became a 100% owned subsidiary of Great Panther. At the close of trading 6 March 2019 Beadell was removed from the Official List of ASX Limited.

The implementation of the Scheme constituted a “Change of Control” for certain borrowings of the Group. The Santander - Itaú Facility, certain other bank facilities (Banco Bradesco S.A.), Convertible Debentures and the MACA Termination Agreement contain various Change of Control clauses. Prior to the implementation of the Scheme, the Group obtained all necessary waivers and consents from Santander - Itaú, Banco Bradesco S.A. and MACA in respect of their change of control clauses.

In accordance with the terms of the Debenture Indenture, upon the occurrence of a Change of Control, Beadell is required to make an offer (the Change of Control Purchase Offer) to purchase all Beadell Convertible Debentures (the Repurchase) on issue at a price per Beadell Convertible Debenture equal to 105% of the principal amount, plus accrued and unpaid interest. All holders of Beadell Convertible Debentures agreed in writing to accept the Change of Control Purchase Offer and the Repurchase was completed on 3 April 2019.

| 8 |

Notes to the consolidated financial statements

Following the Implementation of the Scheme, the original terms of the MACA Termination Agreement has been amended. The material amended terms of the MACA Termination Agreement are as follows;

| a) | Advancement of the 31 March 2019 principal repayment of $3 million to 30 days following the Completion Date (March 2019) and advancement of monthly principal repayments of $1.5 million to 30 April 2019 from 31 July 2019, resulting in total principal repayments during 2019 increasing from $12 million to $16.5 million; |

| b) | Great Panther has guaranteed the first $6 million of principal repayments; |

| c) | MACA have a right to convert $15 million of the remaining loan outstanding to shares in Great Panther, subject to: |

| • | a limit of $5 million in each quarter following the Completion Date at a 5% discount to the 20-day volume weighted average price; |

| • | any principal amount of the loan which is converted to Great Panther shares will reduce the outstanding balance of the loan, with 50% to be applied to reduce the remaining monthly repayments on a pro-rata basis; and |

| d) | Require that 10% (reduced from 30%) is provided as a repayment to MACA of net proceeds from any debt, equity financing or exercise of warrants in the consolidated Great Panther Group |

Additionally, MACA exercised its right to a conversion of $5 million of the remaining loan outstanding to shares in Great Panther in April 2019 and repayments totalling $4.5 million were made in April 2019. The balance of the MACA Termination Agreement is currently $45.2 million.

Great Panther financial support

On 7 December 2018, the Group announced a US$5 million non-revolving term loan from Great Panther. This loan was interest bearing at 14% per annum and had a maturity date of 15 January 2019. On 14 January 2019, the Group announced that Great Panther has agreed to accept a partial repayment of US$3 million of the principal loan amount, plus interest and fees accrued to date with no repayment date for the remaining US$2 million.

Following the implementation of the Scheme, additional non-interest bearing funding has been provided to the Company of $28.9 million, with no fixed repayment date.

Funding has also been provided to the Company in the form of an uncommitted Gold Prepayment Facility. To date the prepayments with respect to 11,310 outstanding ounces of gold total US$14.3 million ($20.1 million).

Cash flows

The directors consider the going concern basis of preparation to be appropriate based on forecast cash flows and the financial support from Great Panther, for the Group to meet its obligations.

The cash flow forecast depends on successful ramp up of mining operations, processing activities and the completion of capital projects in accordance with management’s schedule and cost assumptions, and achieving forecast gold price and foreign exchange assumptions. The forecasts include the successful operation of the recently completed plant upgrade to allow for the processing of increased sulphide ore as planned. Critical to achieving forecast cash flows is the Group’s ability to achieve forecast ore material movement and gold production. The Group has a reasonable expectation that such production forecasts will be achieved through a combination of improved material movement and recoveries following the plant upgrade and accessing higher grade ore reserves.

The cash flow forecast also depends on the successful rolling of unsecured bank facilities of US$14.9 million ($20.6 million) (as at the date of these Financial Statements) and the expected refund of Brazilian Federal VAT credits (PIS/COFINS) of approximately $5.2 million in the next 12 months. The unsecured bank facilities have a successful history of being rolled and the directors expect this to continue. On 19 January 2019, the Group announced the receipt $13.9 million of PIS/COFINS. The directors have received advice that supports the timing of the additional refund of PIS/COFINS.

The forecast cash flows indicates the Group will require additional funding in the form of debt or equity from Great Panther in the current quarter and for the next 12 months. Great Panther has provided a legally binding letter of financial support confirming it is aware the Group will depend on continued financial support to meet their obligations as they fall due. Great Panther has undertaken to continue to provide such financial support to the Group for the period of at least 12 months from the date on which the financial statements for the year ended 31 December 2018 are approved by the Directors and confirm that the Group will rely on this letter in order to continue to trade. Great Panther also confirm it will not seek repayment of any outstanding loan balances as at the date of this report (refer to note 27), unless the Group is in a position to pay.

The Directors of the Group have a reasonable expectation that additional funding will be received from Great Panther, as required.

| 9 |

Notes to the consolidated financial statements

Should the Group not successfully achieve its cash flow forecast, or should Great Panther not take the necessary steps to be in a position to provide additional funding within the required timeframe to continue to support the Group, there is a material uncertainty as to whether the Group will be able to continue as a going concern and, therefore, whether it will realise its assets and discharge its liabilities in the normal course of business, and at the amounts stated in the financial report.

Estimates and assumptions

Restoration obligations

Significant estimation is required in determining the provision for site restoration as there are many factors that may affect the timing and ultimate cost to rehabilitate sites where construction, mining and/or exploration activities have taken place. These factors include future development and exploration activities, changes in the cost of goods and services required for restoration activities and changes to the legal and regulatory framework governing restoration obligations. These factors may result in future actual expenditure differing from amounts currently provided.

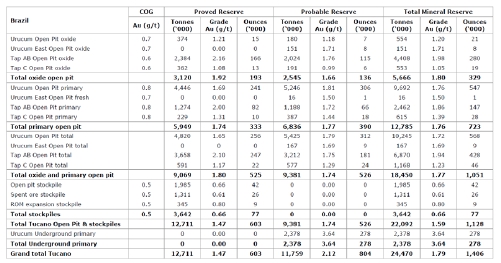

Ore Reserves

Economically recoverable ore reserves represent the estimated quantity of product in an area of interest that can be expected to be profitably extracted, processed and sold under current and foreseeable economic conditions. The Group determines and reports ore reserves under the standards incorporated in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). The determination of ore reserves includes estimates and assumptions about a range of geological, technical and economic factors, including: quantities, grades, production techniques, recovery rates, production costs, transport costs, commodity demand, commodity prices, and exchange rates. Changes in ore reserves impact the assessment of recoverability of exploration and evaluation assets, provisions for site restoration, the carrying amount of assets depreciated on units of production basis and the recognition of deferred taxes, including tax losses.

Recognition of tax losses

A deferred tax asset is recognised for unused tax losses only if it is probable that future taxable profits will be available to utilise those losses. Determination of future taxable profits requires estimates and assumptions as to future events and circumstances, in particular, whether successful development and commercial exploitation, or alternatively sale, of the respective area of interest will be achieved. This includes estimates and judgements about commodity prices, ore reserves, exchange rates, future capital requirements, future operational performance and the timing of estimated cash flows. Changes in these estimates and assumptions could impact on the amount and probability of estimated taxable profits and accordingly the recoverability of deferred tax assets.

Impairment of assets

The recoverable amount of each non-financial asset or cash generating unit (CGU) is determined as the higher of the value in use and fair value less costs to sell. Determination of the recoverable amount of an asset or CGU based on a discounted cash flow model requires the use of estimates and assumptions, including: the appropriate rate at which to discount cash flows, timing of cash flows, the expected life of the area of interest, commodity prices, exchange rates, ore reserves, future capital requirements and operational performance. Changes in these estimates and assumptions impact the recoverable amount of the asset or CGU and accordingly could result in an adjustment to the carrying amount of that asset or CGU.

Ore stockpiles

Net realisable value tests are performed at each reporting date and represent the estimated future sales price of the product based on prevailing spot metals prices at the reporting date, less estimated costs to complete and bring the product to sale. Stockpiles are measured by estimating the number of tonnes added and removed from the stockpile, the number of contained gold ounces based on assay data, and the estimated recovery percentage. Stockpile tonnages are verified by periodic surveys.

| 3. | Significant accounting policies |

The accounting policies set out below have been applied consistently to all periods presented in these consolidated financial statements, and have been applied consistently by Group entities. The Group has not elected to early adopt any accounting standards or amendments.

| (a) | Changes in significant accounting policies |

The Group has initially applied AASB 9 and AASB 15 from 1 January 2018.

AASB 9 - Financial instruments

The Group has adopted AASB 9 Financial Instruments, which replaces the existing guidance in IAS 39 Financial Instruments: Recognition and Measurement. AASB 9 includes revised guidance on the classification and measurement of financial instruments, a new expected credit loss model for calculating impairment on financial assets, and new general hedge accounting requirements. It also carries forward the guidance on recognition and de-recognition of financial instruments from IAS 39. AASB 9 is effective for annual reporting periods beginning on or after 1 January 2018, with early adoption permitted. The adoption of this new standard has not had a material impact on the financial statements.

| 10 |

Notes to the consolidated financial statements

AASB 15 - Revenue from contracts with customers

The Group has adopted AASB 15 Revenue from Contracts with Customers effective 1 January 2018 retrospectively using the practical expedient in paragraph C5(c) of IFRS 15, under which the Group does not disclose the amount of consideration allocated to the remaining performance obligations or an explanation of when the Group expects to recognise the amount as revenue for all reporting periods presented before the date of initial application - i.e. 1 January 2018. The details and quantitative impact of the changes in accounting policies are discussed below.

| (i) | Gold sales |

Previously, the Group recognised revenue from gold sales when all risks and rewards transferred; no further processing was required by the Group; the quality and quantity of the gold had been determined; and the sale was probable. Under AASB 15, the Group recognises revenue when control has passed to the buyer; the Company has no significant continuing involvement; and the amount of revenue and costs incurred or costs to be incurred in respect of the transaction can be measured reliably. The Group’s assessment is that this occurs when the refined gold has been physically delivered, which is also the date when title has passed to the buyer and the Company has issued an invoice pursuant to a transaction confirmation that fixes the quantity and price of the gold for each delivery.

The impact of the change in accounting policy is that gold bullion awaiting settlement (which represented gold that has not been turned out by the Group’s refiner prior to period end) is no longer recognised as revenue. Revenue recognition will now be delayed until the refined gold has been physically delivered and title has passed to the buyer.

In 2018 had the previous accounting treatment under AASB 118 Revenue from Contracts with Customers been applied, revenue of $209.2 million (2017: $211.1 million) would have been generated from the sale of 124,007 ounces (2017: 128,342). At balance date, gold bullion waiting settlement would have been $12.4 million (2017: $9.5 million) and comprised 7,282 ounces (2017: 5,746 ounces).

| 11 |

Notes to the consolidated financial statements

| (ii) | Impacts on the financial statements |

Consolidated statement of financial position

| 12 |

Notes to the consolidated financial statements

Consolidated statement of profit or loss and OCI

There is no material impact on the Group’s basic or diluted earnings per share for the 12 months ended 31 December 2017.

| 13 |

Notes to the consolidated financial statements

Consolidated statement of cash flows

| (b) | Basis of consolidation |

| (i) | Subsidiaries |

Subsidiaries are entities controlled by the Group. The Group controls an entity when it is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity. The financial statements of subsidiaries are included in the consolidated financial statements from the date on which control commences until the date on which control ceases.

| (ii) | Transactions and balances eliminated on consolidation |

Intra-group balances, and any unrealised income and expenses arising from intra-group transactions, are eliminated in preparing the consolidated financial statements.

| (iii) | Business combinations |

For every business combination, the Group identifies the acquirer, which is the combining entity that obtains control of the other combining entities or businesses. Control is the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities. In assessing control, the Group takes into consideration potential voting rights that currently are exercisable.

The acquisition date is the date on which control is transferred to the acquirer. Judgement is applied in determining the acquisition date and determining whether control is transferred from one party to another.

Measuring goodwill or discount in a business combination

The Group measures goodwill as the fair value of the consideration transferred including the recognised amount of any non-controlling interest in the acquiree, less the net recognised amount (generally fair value) of the identifiable assets acquired and liabilities assumed, all measured as of the acquisition date. Where the net amount of identifiable assets exceeds fair value of consideration transferred, a discount on acquisition has arisen and the resultant gain is recognised in the Group’s profit or loss. Provisional accounting for fair values is used where the Group has not completed final valuations. Where provisional accounting has been used, the Group completes final valuations within a year of acquisition.

| 14 |

Notes to the consolidated financial statements

Consideration transferred includes the fair values of the assets transferred, liabilities incurred by the Group to the previous owners of the acquiree, and entity interests issued by the Group. Consideration transferred also includes the fair value of any contingent consideration and share-based payment awards of the acquiree that are replaced mandatorily in the business combination.

Contingent liabilities

A contingent liability of the acquiree is assumed in a business combination only if such a liability represents a present obligation and arises from a past event, and its fair value can be measured reliably.

Non-controlling interest

The Group measures any non-controlling interest at its proportionate interest in the identifiable net assets of the acquiree.

Transaction costs

Transaction costs that the Group incurs in connection with a business combination, such as finder’s fees, legal fees, due diligence fees, and other professional and consulting fees, are expensed as incurred.

| (c) | Foreign currency |

Foreign currency transactions

Transactions in foreign currencies are translated to the functional currency of the operation at exchange rates at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies at balance sheet date are translated to the presentation currency at the balance date at the exchange rate at that date. The foreign currency gain or loss on monetary items is the difference between amortised cost in the functional currency at the beginning of the period, adjusted for the effective interest and payments during the period, and the amortised cost in foreign currency translated at the exchange rate at the end of the period.

Non-monetary assets and liabilities denominated in foreign currencies that are measured at fair value are retranslated to the functional currency at the exchange rate at the date that the fair value was determined. Non-monetary items in a foreign currency that are measured in terms of historical cost are measured using the exchange rate at the date of the transaction.

Foreign currency differences arising on retranslation are recognised in profit or loss, except for qualifying cash flow hedges which are recognised in the other comprehensive income to the extent the hedge is effective.

Foreign operations

The assets and liabilities of foreign operations, including goodwill and fair value adjustments arising on acquisition, are translated to Australian dollars at exchange rates at reporting date. The income and expenses of foreign operations are translated to Australian dollars at average exchange rates prevailing during the period. Foreign currency differences are recognised in the foreign currency translation reserve. When a foreign operation is disposed of, in part or in full, the relevant amount in the foreign currency translation reserve is transferred to the income statement.

| (d) | Financial instruments |

| (i) | Derivative financial instruments |

Embedded derivatives

Derivatives embedded in other financial instruments or non-financial contracts (the host contract) are accounted for separately at fair value as derivatives when the risks and characteristics of the embedded derivatives are not closely related to those of their host contract, and the host contract is not designated as fair value through profit or loss. These embedded derivatives are measured at fair value with changes in fair value recognised in the consolidated statement of profit or loss and other comprehensive income.

| (ii) | Non-derivative financial instruments |

Non-derivative financial instruments comprise trade and other receivables, cash and cash equivalents, restricted cash, borrowings and trade and other payables.

Non-derivative financial instruments are recognised initially at fair value plus, for instruments not at fair value through profit or loss, any directly attributable transaction costs. Subsequent to initial recognition non-derivative financial instruments are measured at amortised cost, less any impairment charges.

A financial instrument is recognised if the Group becomes a party to the contractual provisions of the instrument. Financial assets are derecognised if the Group’s contractual rights to the cash flows from the financial assets expire or if the Group transfers the financial asset to another party without retaining control or substantially all risks and rewards of the asset. Regular way purchases and sales of financial assets are accounted for at trade date, i.e., the date that the Group commits itself to purchase or sell the asset. Financial liabilities are derecognised if the Group’s obligations specified in the contract expire or are discharged or cancelled.

| 15 |

Notes to the consolidated financial statements

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank, cash on hand and short term deposits at call. Short term deposits have original maturities of 3 months or less that are readily convertible to known amounts of cash and are subject to insignificant risk of changes in fair value.

Restricted cash

Restricted cash comprises cash at bank and short term deposits that have been given as security in relation to the Group’s borrowings. As the Group has given security over these balances they are not eligible for recognition as cash and cash equivalents.

Trade and other receivables

Receivables are initially recorded at fair value and subsequently measured at amortised cost, less provision for impairment. Loss allowances for trade receivables are measured at lifetime expected credit losses (ECLs).

Trade and other payables

Trade and other payables are carried at amortised cost. The amounts are unsecured and typically settled in 30 to 60 days of recognition. Due to their short term nature, balances are generally not discounted.

Borrowings

Borrowings are initially recognised at fair value, net of transaction costs incurred. Subsequent to initial measurement, borrowings are recorded at amortised cost using the effective interest rate method. Fees paid on the establishment of loan facilities, which are not an incremental cost relating to the actual drawdown of the facility, are amortised on a straight line basis over the term of the facility.

Borrowings are classified as current liabilities unless the Group has an unconditional right to defer settlement of the liability for at least 12 months after the reporting date.

| (iii) | Share capital |

Ordinary shares

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction, net of tax, from the proceeds.

Dividends

Dividends are recognised as a liability in the period in which they are declared.

| (e) | Revenue |

Revenue is recognised when control has passed to the buyer; the Company has no significant continuing involvement; and the amount of revenue and costs incurred or costs to be incurred in respect of the transaction can be measure reliably.

| (i) | Gold sales |

Gold sales revenue is recognised when the refined gold has been physically delivered, which is also the date when title has passed to the buyer and the Company has issued an invoice pursuant to a transaction confirmation that fixes the quantity and price of the gold for each delivery.

| (ii) | Rental income |

Rental income is recognised in profit or loss on a straight-line basis over the term of the lease.

| (f) | Royalties |

Royalty obligations based on quantity produced or as a percentage of revenue that do not have the characteristics of income tax, are included in costs of sales.

| (g) | Exploration and evaluation expenditure |

Exploration and evaluation costs, excluding acquisition costs, are expensed as incurred. Acquisition costs are accumulated in respect of each separate area of interest.

Exploration and evaluation assets are only recognised if the rights to the area are current and either:

| (i) | the acquisition costs are expected to be recouped through successful development and exploitation of the area of interest; or |

| (ii) | activities in the area of interest have not at the reporting date, reached a state which permits a reasonable assessment of the existence or otherwise of economically recoverable reserves and active and significant operations in, or in relation to, the area of interest are continuing. |

Exploration and evaluation assets are assessed for impairment if:

| (i) | sufficient data exists to determine technical feasibility and commercial viability; and |

| (ii) | facts and circumstances suggest the carrying amount exceeds the recoverable amount. |

| 16 |

Notes to the consolidated financial statements

For the purposes of impairment testing, exploration and evaluation assets are allocated to CGU’s to which the exploration activity relates. The CGU shall not be larger than the area of interest.

Once technical feasibility and commercial viability of the extraction of mineral resources in an area of interest are demonstrable, exploration and evaluation assets attributable to that area of interest are first tested for impairment and then reclassified to mine property assets within property, plant and equipment.

In the event that an area of interest is abandoned or if the directors consider the exploration and evaluation assets attributable to the area of interest to be of reduced value, the exploration and evaluation assets are impaired in the period in which the assessment is made. Each area of interest is reviewed at each reporting period and accumulated costs are written off to the extent that they will not be recoverable in the future.

| (h) | Mineral properties |

Mineral properties represents expenditure in respect of capitalised exploration, evaluation, feasibility and other capitalised expenditure previously accumulated and carried forward as mineral properties under development in relation to areas of interest in which gold production has now commenced. Mine properties are stated at cost, less accumulated amortisation and accumulated impairment losses.

Mine properties are amortised on a unit-of-production basis over the economically recoverable reserves of the mine concerned, resulting in an amortisation charge proportional to the depletion of the economically recoverable mineral resources. Amortisation begins at the commencement of commercial production.

| (i) | Deferred stripping |

The Group defers stripping costs during the production phase of its surface mining operations. Stripping costs that generate a benefit of improved access to future components of an ore body and meet the definition of an asset are recognised as stripping activity assets. Stripping activity assets are depreciated on a units of production basis over the useful life of the identifiable component of the ore body that becomes more accessible as a result of the stripping activity. Stripping activity assets form part of property, plant and equipment.

| (j) | Property, plant and equipment |

Recognition and measurement

Items of property, plant and equipment are measured at cost less accumulated depreciation and impairment losses. Cost includes expenditure that is directly attributable to the acquisition of the asset.

When parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate items (major components) of property, plant and equipment.

Gains and losses on disposal of an item of property, plant and equipment are determined by comparing the proceeds from disposal with the carrying amount of property, plant and equipment and are recognised net within other income or other expenses in profit or loss. When re-valued assets are sold, the amounts included in the revaluation reserve are transferred to retained earnings.

Subsequent costs

The cost of replacing part of an item of property, plant and equipment is recognised in the carrying amount of the item if it is probable that the future economic benefits embodied within the part will flow to the Group and its cost can be measured reliably.

The carrying amount of the replaced part is derecognised. The costs of the day-to-day servicing of property, plant and equipment are recognised in profit or loss as incurred.

Depreciation

Depreciation of mine specific plant and equipment and buildings and infrastructure is charged to the statement of profit and loss and other comprehensive income on a units of production basis over the economically recoverable reserves of the mine concerned, except in the case of assets whose useful life is shorter than the life of mine, in which case the straight line method is used. The unit of account is ore milled.

Depreciation of non-mine specific plant and equipment is charged to the statement of profit and loss and other comprehensive income on a straight line basis over the estimated useful lives of each asset.

In the current and comparative periods useful lives are as follows:

| • | plant and equipment 2 - 20 years |

| • | fixtures and fittings 5 - 10 years |

Depreciation methods, useful lives and residual values are reviewed at each reporting date.

| (k) | Leased assets |

Leases in terms of which the Group assumes substantially all the risks and rewards of ownership are classified as finance leases. Upon initial recognition the leased asset is measured at an amount equal to the lower of its fair value and the present value of the minimum lease payments. Subsequent to initial recognition, the asset is accounted for in accordance with the accounting policy applicable to that asset.

| 17 |

Notes to the consolidated financial statements

Other leases are operating leases and the leased assets are not recognised on the Group’s statement of financial position.

| (l) | Leases |

Lease payments

Payments made under operating leases are recognised in profit or loss on a straight-line basis over the term of the lease. Lease incentives received are recognised as an integral part of the total lease expense, over the term of the lease.

Determining whether an arrangement contains a lease

At inception of an arrangement, the Group determines whether the arrangement is or contains a lease. This will be the case if the following criteria are met:

| • | the fulfilment of the arrangement is dependent on the use of a specific asset(s); and |

| • | the arrangement contains the right to use the asset(s). |

At inception or upon reassessment of the arrangement, the Group separates payments and other consideration required by such an arrangement into those for the lease and those for other elements on the basis of their relative fair values. If the Group concludes for a finance lease that it is impracticable to separate the payments reliably, an asset and a liability are recognised at an amount equal to the fair value of the underlying asset. Subsequently the liability is reduced as payments are made and an imputed finance charge on the liability is recognised using the Group’s incremental borrowing rate.

| (m) | Impairment |

Financial assets

A financial asset is assessed at each reporting date to determine whether there is an indication that it is impaired. When an indication of impairment exists, a formal estimate of the recoverable amount is made. Where the carrying amount of an asset exceeds it recoverable amount the asset is considered impaired and is written down to its recoverable value.

The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use. The present value of the estimated future cash flows discounted at a pre-tax discount rate is used to assess value in use. All impairment losses are recognised in profit or loss and any subsequent reversals of impairment losses are also recognised in profit or loss. An impairment loss is reversed if the reversal can be related objectively to an event occurring after the impairment loss was recognised.

Individually significant financial assets are tested for impairment on an individual basis. The remaining financial assets are assessed collectively in groups at the lowest levels for which they are separately identifiable cash inflows which are largely independent of the cash flows from other assets or group of assets (cash generating units).

Non-financial assets

The carrying amounts of the Group’s non-financial assets (excluding deferred tax assets and inventories) are reviewed at each reporting date to determine whether there is any indication of impairment. If any such indication exists then the asset’s recoverable amount is estimated. The recoverable amount of an asset or CGU is the greater of its value in use and its fair value less costs to sell. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. For the purpose of impairment testing, assets are grouped together into the smallest group of assets that generates cash inflows from continuing use that are largely independent of the cash inflows of other assets or groups of assets, known as CGU’s.

An impairment loss is recognised if the carrying amount of an asset or its CGU exceeds its recoverable amount. Impairment losses are recognised in profit or loss. Impairment losses recognised in respect of CGU’s are allocated to reduce the carrying amount of assets in the unit (group of units) on a pro rata basis.

An impairment loss is reversed if there has been a change in the estimates used to determine the recoverable amount. An impairment loss is reversed only to the extent that the asset’s carrying amount does not exceed the carrying amount that would have been determined, net of depreciation or amortisation, if no impairment loss had been recognised.

| (n) | Employee benefits |

Defined contribution plans

A defined contribution plan is a post-employment benefit plan under which an entity pays fixed contributions into a separate entity and will have no legal or constructive obligation to pay further amounts. Obligations for contributions to defined contribution plans are recognised as a personnel expense in profit or loss when they are due. Prepaid contributions are recognised as an asset to the extent that a cash refund or a reduction in future payments is available.

| 18 |

Notes to the consolidated financial statements

Short-term benefits

Short-term employee benefits are expensed as the related service is provided. A liability is recognised for the amount expected to be paid if the Group has a present legal or constructive obligation to pay this amount as a result of past service provided by the employee and the obligation can be estimated reliably.

Long-term benefits

The Group’s net obligation in respect of long-term employee benefits is the amount of future benefit that employees have earned in return for their service in the current and, where applicable, prior periods plus related on costs; that benefit is discounted to determine its present value and the fair value of any related assets is deducted. The discount rate is the yield at the reporting date on corporate bonds that have maturity dates approximating the terms of the Group’s obligations.

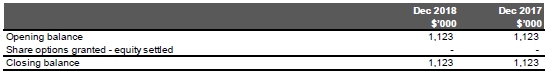

Share-based payment transactions

The Group operates equity-settled share-based payment employee share and option schemes. The fair value of the equity to which employees become entitled is measured at grant date and recognised as an expense over the vesting period, with a corresponding increase to share based payments reserve. The fair value of options and performance rights is ascertained using a recognised pricing model which incorporates all market vesting conditions.

The fair value of options is measured using the Black-Scholes formula and the fair value of the Performance Rights is measured using a combination of the Monte Carlo and/or Trinomial Lattice pricing models.

Measurement inputs include share price on measurement date, exercise price of the instrument, expected volatility (based on weighted average historic volatility adjusted for changes expected due to publicly available information), weighted average expected life of the instruments (based on historical experience and general option holder behaviour), expected dividends, and the risk-free interest rate (based on government bonds). Service and non-market performance conditions attached to the transactions are not taken into account in determining fair value.

The cost of share based payment transactions is recognised, together with a corresponding increase in equity, over the period in which the performance conditions are fulfilled, ending on the date on which the relevant employees become fully entitled to the award (vesting date). The cumulative expense recognised for share based payment transactions at each reporting date until vesting date reflects (i) the extent to which the vesting period has expired and (ii) the number of awards that, in the opinion of the directors of the Company, will ultimately vest. This opinion is formed based on the best available information at balance date. No adjustment is made for the likelihood of market performance conditions being met as the effect of these conditions is included in the determination of fair value at grant date.

No expense is recognised for awards that do not ultimately vest, except for awards where vesting is conditional upon a market condition. Where an equity-settled award is cancelled, it is treated as if it had vested on the date of cancellation, and any expense not yet recognised for the award is recognised immediately. However, if a new award is substituted for the cancelled award, and designated as a replacement award on the date that it is granted, the cancelled and new award are treated as if they were a modification of the original award.

| (o) | Income tax |

Income tax expense comprises current and deferred tax. Income tax expense is recognised in profit or loss except to the extent that it relates to items recognised directly in equity, in which case it is recognised in equity.

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted or substantively enacted at the reporting date, and any adjustment to tax payable in respect of previous years.

Deferred tax is recognised in respect of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred tax is not recognised for the following temporary differences: the initial recognition of assets or liabilities in a transaction that is not a business combination and that affects neither accounting nor taxable profit, and differences relating to investments in subsidiaries to the extent that it is probable that they will not reverse in the foreseeable future. Deferred tax is measured at the tax rates that are expected to be applied to the temporary differences when they reverse, based on the laws that have been enacted or substantively enacted by the reporting date.

Deferred tax assets and liabilities are offset if there is a legally enforceable right to offset current tax liabilities and assets and they relate to income taxes levied by the same tax authority on the same taxable entity, or on different tax entities, but they intend to settle current tax liabilities and assets on a net basis or their tax assets and liabilities will be realised simultaneously.

A deferred tax asset is recognised to the extent that it is probable that future taxable profits will be available against which the temporary difference can be utilised. Deferred tax assets are reviewed at each reporting date and are reduced to the extent that it is no longer probable that the related tax benefit will be realised.

| 19 |

Notes to the consolidated financial statements

| (p) | Finance income and expense |

Finance income comprises interest income, ineffective portion of changes in fair value of cash flow hedges and changes in fair value of derivatives not designated as cash flow hedges.

Finance expense comprises impairment losses recognised on financial assets and borrowing costs recognised using the effective interest method that are not directly attributable to the acquisition, construction or production of a qualifying asset and transaction costs not eligible for capitalisation.

Foreign currency gains and losses are reported on a net basis.

Borrowing costs

Borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset are capitalised as part of the cost of the asset, all other borrowing costs are expensed as incurred. Borrowing costs consist of interest and other costs that the Group incurs in connection with the borrowing of funds.

| (q) | Provisions |

A provision is recognised if, as a result of a past event, the Group has a present legal or constructive obligation that can be estimated reliably, and it is probable that an outflow of economic benefits will be required to settle the obligation. Provisions are determined by discounting the expected future cash flows at a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the liability.

Site restoration

Mine closure and restoration costs include the costs of dismantling and demolition of infrastructure or decommissioning, the removal of residual material and the remediation of disturbed areas specific to the site. Provisions are recognised at the time that the environmental disturbance occurs.

The provision is the best estimate of the present value of the future cash flows required to settle the restoration obligation at the reporting date, based on current legal requirements and technology. Future restoration costs are reviewed annually and any changes are reflected in the present value of the restoration provision at the end of the financial year.

The amount of the provision for future restoration costs is capitalised as an asset and recognised in Mineral Properties and is depreciated over the useful life of the mineral resource. The unwinding of the effect of discounting on the provision is recognised as a finance cost. Restoration expenditure is capitalised to the extent that it is probable that the future economic benefits associated with restoration expenditure will flow to the Group.

| (r) | Value Added Taxes (VAT) |

Revenue, expenses and assets are recognised net of the amount of goods and services tax and equivalent indirect taxes, except where the amount of tax incurred is not recoverable from the taxation authority. In these circumstances, the tax is recognised as part of the cost of acquisition of the asset or as part of the expense. Receivables and payables are stated with the amount of tax included. The net amount of tax recoverable from, or payable to, the taxation authority is included as a current asset or liability in the balance sheet. To the extent a VAT receivable is not expected to be received within 12 months of balance date, the Group classifies the VAT receivable as a non-current asset. Cash flows are included in the statement of cash flows on a gross basis. The tax components of cash flows arising from investing and financing activities which are recoverable from, or payable to, the taxation authority are classified as operating cash flows.

| (s) | Earnings per share |

The Group presents basic and diluted earnings per share (EPS) data for its ordinary shares. Basic EPS is calculated by dividing the profit or loss attributable to ordinary shareholders of the Company by the weighted average number of ordinary shares outstanding during the period. Diluted EPS is determined by adjusting the profit or loss attributable to ordinary shareholders and the weighted average number of ordinary shares outstanding for the effects of all dilutive potential ordinary shares.

| (t) | Operating segments |

The Group determines and presents operating segments based on the information that is provided to the Managing Director, who is the Group’s chief operating decision maker.

An operating segment is a component of the Group that engages in business activities from which it may earn revenues and incur expenses, including revenues and expenses that relate to transactions with any of the Group’s other components. An operating segment’s operating results are reviewed regularly by the Board to make decisions about the allocation of resources to the segment and to assess its performance, and for which discrete financial information is available.

Segment results that are reported to the Board include items directly attributable to a segment as well as those that can be allocated on a reasonable basis. Unallocated items comprise predominantly of administrative expenses. Segment capital expenditure is the total cost incurred during the period to acquire property, plant and equipment, and intangible assets other than goodwill.

| 20 |

Notes to the consolidated financial statements

| (u) | Inventories |

Gold bullion that has not been dispatched to the Group’s refiner, gold in circuit and ore stockpiles are physically measured or estimated at the lower of cost and net realisable value. Net realisable value is the estimated selling price in the ordinary course of business less estimated costs of completion and costs of selling the final product.

Cost is determined by the weighted average method and comprises direct purchase costs and an appropriate portion of fixed and variable overhead costs, including depreciation and amortisation incurred in converting gold ore to bullion.

Consumable stores are valued at the lower of cost and net realisable value.

| (v) | New accounting standards |

A number of new standards, amendments to standards and interpretations are effective for annual periods beginning after 1 January 2019, and have not been applied in preparing these consolidated financial statements. Those which may be relevant to the Group are set out below. The Group does not plan to adopt these standards early.

AASB 16 Leases will result in almost all leases being recognised on the balance sheet, as the distinction between operating and finance lease have been removed. The new standard requires a lessee to recognise assets (the right to use the leased item) and liabilities (obligations to make lease repayments). Short term leases (less than 12 months) and leases of low value assets are exempt from the lease accounting requirements. Lessor accounting remains similar to current practice. AASB 16 is effective for annual reporting periods beginning on or after 1 January 2019, with early adoption permitted. The Group is still assessing the impact of this standard.

| 4. | Financial risk management |

Overview

This note presents information about the Group’s exposure to credit, liquidity and market risks, objectives, policies and processes for measuring and managing risk and the management of capital.

The Group has established a Risk Management Policy and Risk Management Strategy. The Group’s Risk Management Policy and Strategy address the Group’s exposure to and management of credit, market and liquidity risks.

The Board of Directors has overall responsibility for the establishment and oversight of the Risk Management Strategy. The design, implementation and day to day responsibilities of the risk management strategy and internal control system rest with management. The Audit and Risk Management Committee is responsible for reviewing the Group’s risk management systems and internal financial control systems.

Credit risk

Credit risk is the risk of financial loss to the Group if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises principally from the Group’s gold bullion awaiting settlement, cash and cash equivalents and restricted cash.

Cash, cash equivalents

Cash and cash equivalents comprise cash on hand and demand deposits. The Group limits its credit risk by holding cash balances and demand deposits with reputable counterparties with acceptable credit ratings.

Restricted cash

Restricted cash comprises cash balances used as security for operating leases. Cash balances used as security are held with reputable counterparties with acceptable credit ratings.

Trade and other receivables

The Group’s trade and other receivables at balance date principally comprise VAT receivables. At 31 December 2018, the ageing of trade and other receivables, other than VAT receivables, which were not impaired, was as follows:

| 21 |

Notes to the consolidated financial statements

Exposure to credit risk

The carrying amounts of the Group’s financial assets represent maximum exposure to credit risk, by region and in total as set out below;

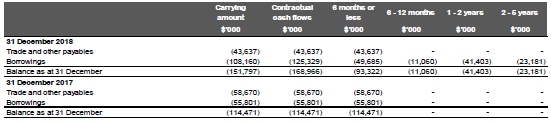

Liquidity risk

Liquidity risk is the risk that the Group will not be able to meet its financial obligations as they fall due. The Group’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity to meet its liabilities when due, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the Group’s reputation.

At least annually the Group prepares detailed cash flow models as part of its system of budget planning, against which monthly actual cash flows are reported, additionally, actual cash flows are reported daily and a rolling 3 month cash flow forecast is prepared each month. Production activities are monitored and reported daily and monthly against budget and forecast amounts. These systems are used in conjunction to predict cash flow requirements and manage liquidity risk.

As at balance date, the following are the contractual maturities of financial liabilities, including estimated interest payments:

As at 31 December 2017, the Group was in breach of a Santander - Itaú Facility financial covenant. As a result of the breach, contractual cash flows in relation to that Facility have been presented above as payable in 6 months or less as required by accounting standards.

Subsequent to year end the loan repayment profile has changed as a result of the acquisition of Beadell by Great Panther. See notes 2(d) and 27 for further information.

Market risk

Market risk is the risk that changes in market prices, such as foreign exchange rates, interest rates and equity prices will affect the Group’s income or the value of its holdings of financial instruments. The objective of market risk management is to manage and control market risk exposures within acceptable parameters, while optimising the return.

The Group is exposed to fluctuations in foreign currency rates, interest rates and metals prices. In each case, future operational cash flows and ability to service current and future borrowings are affected by these fluctuations. At 31 December 2018, the Group has no hedging instruments with respect to gold prices, interest rates or foreign currency.

Currency risk

Currency risk arises from investments and borrowings that are denominated in a currency other than the respective functional currencies of Group entities.

| 22 |

Notes to the consolidated financial statements

Exposure

The Group is exposed to foreign currency risk in the form of financial instruments denominated in currencies other than the respective functional currencies of the Group. The Group’s functional currencies are the Brazilian Real and the Australian Dollar.

The table following demonstrates the Group’s exposure to foreign currency risk at the end of the year;

Sensitivity analysis

Assuming all other variables remain constant, a 10% strengthening of the Brazilian Real at 31 December 2018 against the United States Dollar would have resulted in a reduced loss of $4.7 million (2017: $3.6 million reduced loss). A 10% weakening of the Brazilian Real would have had the equal but opposite effect, assuming all other variables remain constant.

Assuming all other variables remain constant, a 10% strengthening of the Brazilian Real at 31 December 2018 against the Australian Dollar would have resulted in a reduced loss of $4.5 million. A 10% weakening of the Brazilian Real would have had the equal but opposite effect, assuming all other variables remain constant.

This analysis is based on exchange rate variances the Group considered to be reasonably possible at the end of the period.

The following significant exchange rates applied to the Group’s financial instruments during the year:

Interest rate risk

Interest rate risk is the risk that a financial instrument’s value will fluctuate as a result of changes in the market interest rates on interest-bearing financial instruments. The Group is exposed to interest rate risk on cash and cash equivalents, restricted cash and its borrowings. The Group does not use derivatives to mitigate these exposures.

Cash and cash equivalents and restricted cash are held at variable and fixed interest rates. Cash in term deposits are held for fixed terms at fixed interest rates maturing in periods less than twelve months. The Group’s other cash balances are held in deposit accounts at variable rates with no fixed term.

Interest rates on the Group’s borrowings are fixed for terms of 3 to 12 months.

Profile

At the reporting date the interest rate profile of the Group’s interest-bearing financial instruments was:

Subsequent to year end the loan repayment profile has changed as a result of the acquisition of Beadell by Great Panther. See note 27 for further information.

Fair value sensitivity analysis for fixed rate instruments

The Group does not account for any fixed rate financial assets and liabilities at fair value through profit or loss. Therefore a change in interest rates at the reporting date would not affect profit or loss.

Cash flow sensitivity analysis - interest rates

A change in interest rates of 100 basis points at the reporting date would have increased/(decreased) the Group’s profit before tax by the amounts shown below. This analysis assumes that all other variables remain constant.

| 23 |

Notes to the consolidated financial statements

Subsequent to year end the loan repayment profile has changed as a result of the acquisition of Beadell by Great Panther. See note 27 for further information.

Fair values versus carrying amounts

Carrying amounts of financial assets and liabilities equate to their corresponding fair values.

When measuring the fair value of an asset and liability, the Group uses observable market data as far as possible. Fair values are categorised into different levels in a fair value hierarchy based on inputs used in the valuation techniques as follows:

| • | Level 1: quoted prices (unadjusted) in active markets for identical assets and liabilities |

| • | Level 2: inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly (i.e. price) or indirectly (i.e. derived from prices). |

| • | Level 3: inputs for the asset or liability that are not based on observable market data (unobservable inputs) |

If the inputs used to measure the fair value of an asset or a liability fall into the different levels of the fair value hierarchy, then the fair value measurement is categorised in its entirety in the same level of the fair value hierarchy as the lowest level input that is significant to the ensure measurement.

The fair value of Convertible Debentures and Warrants (refer to note 16) are determined using a binomial option pricing model. The key drives of this value include the Company’s own share price and the foreign exchange rate. The implementation of the Scheme subsequent to the end of the year has impacted the Group’s Convertible Debentures and Warrants. Refer note 27 for further information.

Other market price risk

The Group’s financial assets and liabilities are not exposed to any other market price risk.

Commodity price risk

The Group is exposed to the risk of fluctuations in the prevailing market gold price produced from the Tucano gold mine.

Capital management

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue as a going concern, so as to maintain a capital base (comprising equity plus borrowings) sufficient to allow future operation and development of the Group’s projects.

The Group has raised capital through the issue of equity and borrowings to fund its activities. In determining the funding mix of debt and equity, consideration is given to the ability of the Group to service loan interest and repayment schedules, lending facility compliance ratios and amount of free cash flow desired.

The Group manages its capital requirements by monitoring budget to actual performance and lending compliance ratios. The Group is subject to externally imposed capital requirements in relation to its Santander - Itaú Facility, whereby it is required that;

| • | a minimum net debt to EBITDA ratio be maintained, |

| • | a minimum net gearing ratio be maintained, |

| • | a minimum forward debt service cover ratio be maintained, and |

| • | a minimum ore reserve to expected ore reserve after final repayment of the borrowing ratio be maintained. |

Please refer to going concern in note 2(d) for further information.

| 24 |

Notes to the consolidated financial statements

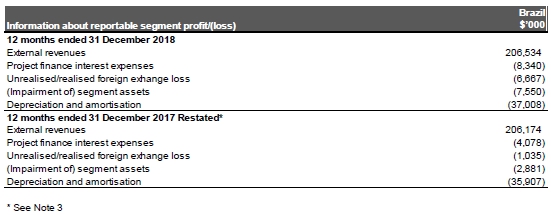

| 5. | Operating segments |

The Group has one reportable segment, ‘Brazilian operations and exploration’, which is the Group’s strategic business unit.

Revenue from one major customer of the Group was approximately $207 million during the year ended 31 December 2018 (2017: $206 million).

| 25 |

Notes to the consolidated financial statements

Geographical segments

In presenting information on the basis of geographical segments, segment revenue is based on the geographical location of production. Segment assets are based on the geographical location of assets.

| 6. | Cost of sales |

Costs of production include a net realisable value adjustment in respect of low grade ore stockpiles of $nil (2017: $63.8 million). Refer to note 11 for further information.

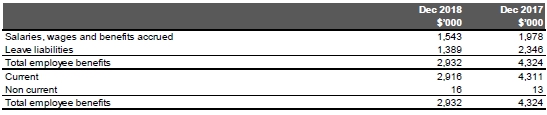

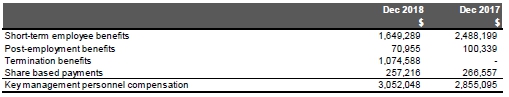

| 7. | Personnel expenses |

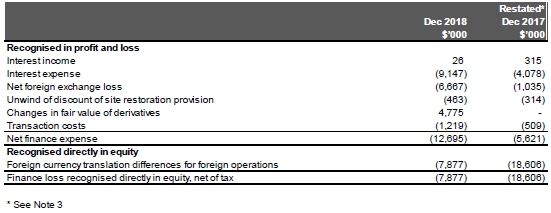

| 8. | Finance income and expense |

| 26 |

Notes to the consolidated financial statements

| 9. | Impairment losses |

VAT receivables

The Group incurred impairment losses of $3.8 million (2017: $2.9 million) in respect of Brazilian state VAT (ICMS) levied on the Group’s purchases that, at balance date, are not considered recoverable.

Recoverability of ICMS is dependent on the Group generating domestic Brazilian sales which would accrue an ICMS liability which the Group can offset against ICMS assets. At balance date, significant Brazilian domestic sales are not considered probable.

Property, plant and equipment

In accordance with the terms of the MACA Termination Agreement executed in June 2018, the Group acquired $3.8 million (R$10.2 million) in plant and equipment from MACA, which the Group has impaired in full.

| 10. | Income tax |

Current income tax

SUDAM

While current tax expense is calculated at the Brazilian corporate tax rate of 34%, any tax liabilities are determined after the application of the Group’s tax incentive program (SUDAM), which reduces the Group’s effective tax rate to 15.25%.

Deferred income tax

Recognised deferred tax balances

| 27 |

Notes to the consolidated financial statements

At 31 December 2017, the Group recognised deferred tax assets on temporary differences and tax losses in Brazil, on the basis that the Company believed that it was probable future taxable profits will be available against which the deferred tax assets can be utilised, noting, the Group had produced taxable profits from its sole production asset, the Tucano Gold Mine in Brazil, in several years following the recommencement of commercial production activities in 2013.

After incurring a further tax loss in 2018, and revisiting future cash flows based on production expectations and macro-economic data, the directors have reassessed that it is no longer probable that future taxable profits will be available against which the deferred tax assets can be utilised, from the Group’s Tucano Gold Mine in Brazil. Accordingly, the Group has de-recognised its previously recognised deferred tax assets at 31 December 2018.

| 11. | Inventories |

Net realisable value

In 2017 the Group’s low grade ore stockpiles were valued at net realisable value (NRV), resulting in the recognition of a write-down to NRV of $63.8 million. The NRV write-down was recognised in cost of goods sold.

NRV is estimated by modelling using assumptions with respect to planned usage, future processing costs and forecast gold prices. Accordingly, periodic adjustments to the carrying value of ore stockpiles will occur over time depending on the assumptions used at each reporting date. These adjustments may result in a write-down or write-back depending on assumptions used.

In 2017 the Group’s low grade ore inventory was impaired to nil and as of 1 January 2018 the Group no longer recognises low grade ore mined as inventory.

All other inventories are held at cost at reporting date.

| 28 |

Notes to the consolidated financial statements

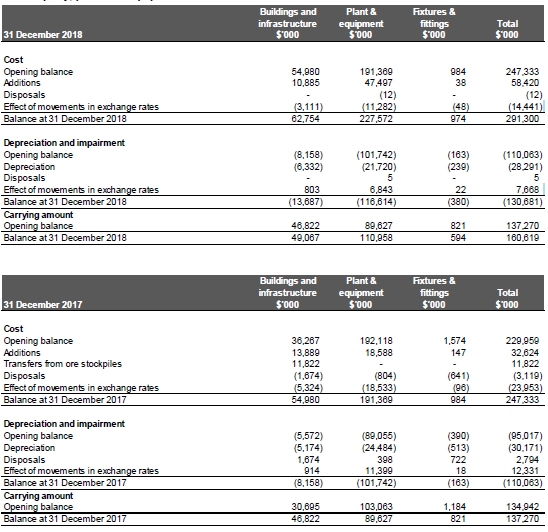

| 12. | Property, plant and equipment |

| 13. | Mineral properties |

| 29 |

Notes to the consolidated financial statements

| 14. | Trade and other receivables |

Other receivables

The Company is disputing a change by the State of Amapá to the calculation of a gold royalty and has made an application to the Federal Supreme Court of Brazil for the matter to be heard.

In connection with the application, the Company has made a Judicial Deposit with the State Supreme Court, for an amount of $4.4 million (R$12.03 million) to prevent the addition of any fines or penalties, pending the outcome of a Federal Supreme Court decision.

The Company and its Brazilian counsel are confident of a ruling in the Company’s favour and expect that the Judicial Deposit will be returned in full at the conclusion of the case.

VAT receivables

The Group’s recoverable VAT receivables are represented by PIS/COFINS, which are a Brazilian federal VAT levied on some of the Groups purchases. The Group has commenced proceedings for the refund of its PIS/COFINS assets. In December 2018 the COFINS first instalment of R$3.8 million ($1.4 million) was received. Subsequent to the end of the year, the Group has received an additional instalment of R$37.9 million ($13.9 million). Refer to note 27 for further information.

Impairment losses

The Group incurred impairment losses during the period of $3.8 million (2017: $2.9 million) in respect of Brazilian state VAT (ICMS) levied on the Group’s purchases that, at balance date, are not considered recoverable.

Recoverability of ICMS is dependent on the Group generating domestic Brazilian sales which would accrue an ICMS liability which the Group can offset against ICMS assets. At balance date, significant Brazilian domestic sales are not considered probable.

| 15. | Cash and cash equivalents |

| 16. | Other financial liabilities |

Convertible Debentures

On 7 May 2018 and 28 June 2018, the Company issued a total of US$10 million ($13.4 million) of senior secured Convertible Debentures totalling US$10 million due 30 June 2023. An embedded derivative liability has been recognised upon initial recognition of the Convertible Debentures as the debenture holders have the option to convert at a fixed price of US$0.0815 per share which is different from the Company’s Australian dollar functional currency. The fair value of the embedded derivatives on issue of the Convertible Debentures was estimated to be $5.6 million. The embedded derivative liability was revalued at 31 December 2018 to $2.9 million with the change in fair value recognised in the statement of profit or loss. Refer to note 17 for further information.

The implementation of the Scheme subsequent to the end of the year has impacted the Group’s Convertible Debentures. Refer note 27 for further information.

Warrants