Form 6-K Gildan Activewear Inc. For: Jan 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For the month of: March 2021 | Commission File Number: 1-14830 | |||||||

GILDAN ACTIVEWEAR INC.

(Translation of Registrant’s name into English)

600 de Maisonneuve Boulevard West

33rd Floor

Montréal, Québec

Canada H3A 3J2

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F o | Form 40-F x | |||||||

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GILDAN ACTIVEWEAR INC. | |||||||||||

| Date: March 31, 2021 | By: | /s/ Lindsay Matthews | |||||||||

| Name: | Lindsay Matthews | ||||||||||

| Title: | Vice-President, General Counsel and Corporate Secretary | ||||||||||

| SEC 1815 (04-09) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

EXHIBIT INDEX

| Exhibit | Description of Exhibit | |||||||

| 99.1 | Management Proxy Circular | |||||||

| 99.2 | Notice of Meeting | |||||||

| 99.3 | Form of Proxy | |||||||

| 99.4 | Access Notice | |||||||

| 99.5 | AGM Guide | |||||||

NOTICE OF ANNUAL MEETING OF

SHAREHOLDERS

To the shareholders of Gildan Activewear Inc. (the “Company”):

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders (the “Meeting”) of the Company will be held via live audio webcast on Thursday, May 6, 2021 at 10:00 a.m. (Montréal time), for the purposes of:

(i)receiving the consolidated financial statements of the Company for the fiscal year ended January 3, 2021, together with the auditors’ report thereon;

(ii)electing ten directors for the ensuing year;

(iii)considering and, if deemed advisable, approving an advisory resolution (the full text of which is reproduced as Schedule “C” to the accompanying management information circular) on the Company’s approach to executive compensation;

(iv)appointing auditors for the ensuing year; and

(v)transacting such other business as may properly come before the Meeting.

Due to the ongoing impacts of the COVID 19 pandemic, this year we will once again hold the Meeting in a virtual only format, which will be conducted via live audio webcast. We are confident that hosting a virtual meeting will enable greater participation by our shareholders, by allowing those who might not otherwise be able to travel to a physical meeting to attend online. All shareholders, regardless of their geographic location, will have an equal opportunity to participate in the Meeting and engage with directors and management of the Company as well as with other shareholders. Shareholders will not be able to attend the Meeting in person. At the Meeting, shareholders will have the opportunity to ask questions and vote on a number of important matters. We encourage all shareholders to participate in the Meeting.

Registered shareholders and duly appointed proxyholders will be able to attend, participate, vote and ask questions at the Meeting online at https://web.lumiagm.com/495431045. Non-registered shareholders (being shareholders who hold their shares through a securities dealer or broker, bank, trust company or trustee, custodian, nominee or other intermediary) who have not duly appointed themselves as their proxy will be able to attend the Meeting only as guests. Guests will be able to listen to the Meeting but will not be able to vote or ask questions. Inside this document, you will find important information and detailed instructions about how to participate in the Meeting.

Dated at Montréal, Québec, Canada, March 9, 2021.

By order of the Board of Directors,

Lindsay Matthews

Vice-President, General Counsel

and Corporate Secretary

Shareholders may exercise their rights by attending the virtual Meeting online or by completing a form of proxy. If you are unable to attend the Meeting, please complete, date and sign the enclosed form of proxy and return it in the envelope provided for that purpose. A shareholder who wishes to appoint a person other than the directors and officers of the Company designated in the form of proxy or voting instruction form (the “Gildan proxyholders”) to represent such shareholder at the Meeting may do so by inserting such person’s name in the blank space provided in the form of proxy or voting instruction form and following the instructions for submitting such form of proxy or voting instruction form. This must be completed prior to registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form. If you wish that a person other than the Gildan proxyholders attend and participate in the Meeting as your proxy and vote your shares, including if you are a non-registered shareholder

and wish to appoint yourself as your proxy to attend, participate and vote at the Meeting, you MUST register such proxyholder after having submitted your form of proxy or voting instruction form identifying such proxyholder. Failure to register the proxyholder will result in the proxyholder not receiving a Control Number to participate in the Meeting. Without a Control Number, proxyholders will not be able to attend, participate or vote at the Meeting. To register a proxyholder, shareholders MUST visit http://www.computershare.com/gildan and provide Computershare Investor Services Inc. (“Computershare”), the transfer agent and registrar of the Company, with their proxyholder’s contact information, so that Computershare may provide the proxyholder with a Control Number via email.

Proxies must be received by Computershare, (100 University Avenue, 8th Floor, North Tower, Toronto, Ontario, Canada M5J 2Y1) no later than 10:00 a.m. on the second business day preceding the day of the Meeting or any adjournment thereof. Your shares will be voted in accordance with your instructions as indicated on the proxy.

If you are a registered shareholder, contact Computershare at 1-800 564 6253 (toll free in North America) or +1 (514) 982 7555 (outside North America), for any voting questions you may have.

Les actionnaires qui préféreraient recevoir la circulaire de sollicitation de procurations de la direction en français n’ont qu’à en aviser le secrétaire corporatif de Les Vêtements de Sport Gildan Inc.

MANAGEMENT INFORMATION CIRCULAR

Except as otherwise indicated, the information contained herein is given as of March 9, 2021. All dollar amounts set forth herein are expressed in U.S. dollars, the Company’s functional and reporting currency, and the symbol “$” refers to the U.S. dollar, unless otherwise indicated.

WHAT’S INSIDE

| INVITATION TO SHAREHOLDERS | Environmental Social & Governance (ESG) | |||||||||||||

| SUMMARY | Independence of Directors | |||||||||||||

| VOTING AND PROXIES | Formal Board Mandate | |||||||||||||

| BUSINESS OF THE MEETING | Formal Position Descriptions | |||||||||||||

| Election of Directors | Election of Directors | |||||||||||||

| Appointment of Auditors | Committees of the Board | |||||||||||||

| Advisory Vote on Executive Compensation | Board and Committee Meetings | |||||||||||||

| ELECTION OF DIRECTORS - NOMINEES | Board Performance Assessment | |||||||||||||

| COMPENSATION OF DIRECTORS | Director Selection | |||||||||||||

| COMPENSATION DISCUSSION AND ANALYSIS | Director Orientation and Continuing Education | |||||||||||||

| Message from the Compensation and Human Resources Committee | Director Compensation | |||||||||||||

| Determining Compensation | Audit Committee Disclosure | |||||||||||||

| Our Executive Compensation Practices | Risk Management | |||||||||||||

| Our Named Executive Officers | CEO and Executive Succession Planning | |||||||||||||

| Our Executive Compensation Program | Strategic Planning | |||||||||||||

| Executive Compensation Components | Shareholder Engagement | |||||||||||||

| Base Salary | NORMAL COURSE ISSUER BID | |||||||||||||

| Short-Term Incentives (SCORES) | OTHER INFORMATION | |||||||||||||

| Long-Term Incentives | Indebtedness of Directors and Executive Officers | |||||||||||||

| Other Compensation | Additional Information | |||||||||||||

| Executive Share Ownership Policy | Shareholder Proposals for 2021 Annual Meeting | |||||||||||||

| Risk Assessment of Executive Compensation Program | Approval of Management Information Circular | |||||||||||||

| Named Executive Officers’ Compensation | SCHEDULE “A” MANDATE OF THE BOARD OF DIRECTORS | |||||||||||||

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES | SCHEDULE “B” LONG-TERM INCENTIVES | |||||||||||||

| Code of Ethics | SCHEDULE “C” ADVISORY VOTE ON EXECUTIVE COMPENSATION | |||||||||||||

| INVITATION TO SHAREHOLDERS | ||||

INVITATION TO SHAREHOLDERS

Dear shareholders:

On behalf of the Board of Directors and management of the Company, we are pleased to invite you to attend the annual meeting of shareholders that will be held this year on Thursday, May 6, 2021 at 10:00 a.m. (Montréal time). Once again this year we have decided, given the continuing public health impact of COVID-19, to hold the annual meeting in a virtual only format. The meeting will be conducted via live audio webcast at https://web.lumiagm.com/495431045. Although shareholders will not be able to attend the meeting in person, all shareholders, regardless of their geographic location, will have an equal opportunity to participate in the meeting and engage with directors and management of the Company as well as other shareholders. A summary of the information shareholders will need to attend the meeting online is provided below in the section entitled “Voting and Proxies”.

The annual meeting is your opportunity to vote on a number of important matters as well as hear first-hand about our financial performance and strategic plans for the future. The enclosed management information circular describes the business to be conducted at the meeting and provides information on the Company’s executive compensation and corporate governance practices.

Your participation in the meeting is important to us and we value your input as shareholders. You can vote by attending the virtual meeting online, or alternatively by telephone, via the internet or by completing and returning the enclosed form of proxy or voting instruction form. If you have questions but are unable to attend the meeting online, you are always welcome to initiate communications with the Board through our Shareholder Engagement Policy, which is available on the Company’s website at www.gildancorp.com.

We look forward to welcoming you at the meeting and thank you for your continued support.

Sincerely,

|  | ||||

Donald C. Berg Chair of the Board of Directors | Glenn J. Chamandy President and Chief Executive Officer | ||||

MANAGEMENT INFORMATION CIRCULAR 1

| SUMMARY | ||||

SUMMARY

The following summary highlights some of the important information you will find in this management information circular (this “Circular”) of Gildan Activewear Inc. (the “Company” or “Gildan”).

Shareholder Voting Matters

| VOTING MATTER | BOARD VOTE RECOMMENDATION | INFORMATION | ||||||

| Election of ten directors | FOR each nominee | |||||||

| Appointment of KPMG LLP as auditors | FOR | page 9 | ||||||

| Advisory vote on executive compensation | FOR | page 10 | ||||||

Our Director Nominees

| NAME & REGION | AGE | DIRECTOR SINCE | POSITION | BOARD & COMMITTEE ATTENDANCE IN 2020 | OTHER PUBLIC BOARDS | AREAS OF EXPERTISE | |||||||||||||||||

| Donald C. Berg Florida, United States Independent |  | 65 | 2015 | President, DCB Advisory Services | 100% | 1 | –Financial Accounting/Auditing –Corporate Development –Retail Sales/Distribution –Government Relations/Public Policy | ||||||||||||||||

| Maryse Bertrand Québec, Canada Independent |  | 62 | 2018 | Corporate Director | 100% | 2 | –ESG/Health & Safety –Corporate Development –Capital Markets –Risk Management | ||||||||||||||||

| Marc Caira Ontario, Canada Independent |  | 67 | 2018 | Corporate Director | 100% | — | –International –Executive Leadership –Retail Sales/Distribution –Marketing/Advertising | ||||||||||||||||

| Glenn J., Chamandy Québec, Canada Not Independent |  | 59 | 1984 | President and Chief Executive Officer, Gildan Activewear Inc. | 100% | — | –Executive Leadership –Retail Sales/Distribution –Manufacturing/Supply Chain –ESG/Health & Safety | ||||||||||||||||

| Shirley E. Cunningham Florida, United States Independent |  | 60 | 2017 | Corporate Director | 100% | 1 | –International –Corporate Development –Human Resources –Cyber Security/Technology | ||||||||||||||||

| Russell Goodman Québec, Canada Independent |  | 67 | 2010 | Corporate Director | 100% | 2 | –Financial Accounting/Auditing –Corporate Development –International –Capital Markets | ||||||||||||||||

| Charles M. Herington Florida, United States Independent |  | 61 | 2018 | Chief Operating Officer, Vice-Chairman and President of Global Operations, Zumba Fitness LLC | 100% | 1 | –International –Corporate Development –Executive Leadership –Human Resources | ||||||||||||||||

| Luc Jobin Québec, Canada Independent |  | 61 | 2020 | Corporate Director | 95% | 1 | –Financial Accounting/Auditing –Corporate Development –Executive Leadership –Manufacturing/Supply Chain | ||||||||||||||||

MANAGEMENT INFORMATION CIRCULAR 2

| SUMMARY | ||||

| NAME & REGION | AGE | DIRECTOR SINCE | POSITION | BOARD & COMMITTEE ATTENDANCE IN 2020 | OTHER PUBLIC BOARDS | AREAS OF EXPERTISE | |||||||||||||||||

| Craig A. Leavitt New York, United States Independent |  | 60 | 2018 | Corporate Director | 100% | 1 | –Executive Leadership –International –Retail Sales/Distribution –Marketing/Advertising | ||||||||||||||||

| Anne Martin-Vachon Québec, Canada Independent |  | 59 | 2015 | Chief Retail Officer, Rogers Communications Inc. | 100% | — | –Retail Sales/Distribution –Marketing/Advertising –Strategy –Executive Leadership | ||||||||||||||||

We consider strong and transparent corporate governance practices to be an important factor in Gildan’s overall success and we are committed to adopting and adhering to the highest standards in corporate governance. Some of our best practices are:

| l | All members of the Board are independent, except the CEO | l | Director orientation and continuing education | ||||||||

| l | Independent Chair of the Board | l | Guidelines for interlocking board memberships | ||||||||

| l | Only independent directors on Board committees | l | Board Diversity Policy | ||||||||

| l | Annual election of directors (no staggered terms) | l | Formal annual Board performance assessment | ||||||||

| l | Directors elected individually (no slate voting) | l | Shareholder Engagement Policy | ||||||||

| l | Majority voting for directors | l | Code of Ethics Program | ||||||||

| l | Board tenure and term limits | l | Share ownership guidelines for Board members and executives | ||||||||

| l | Private sessions of independent directors at all Board and committee meetings | l | Risk management process | ||||||||

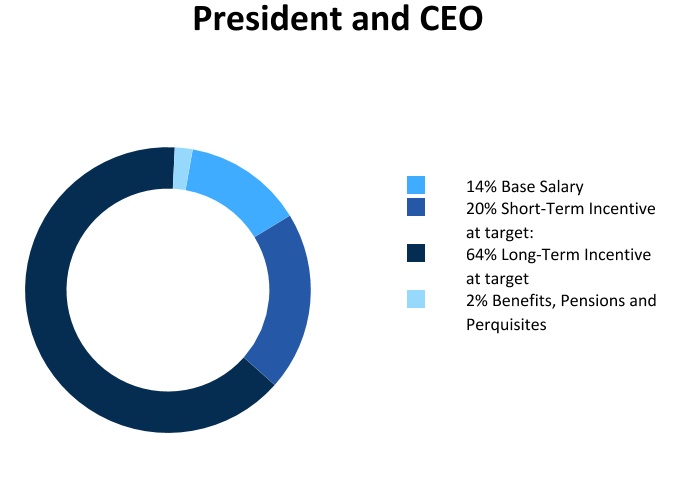

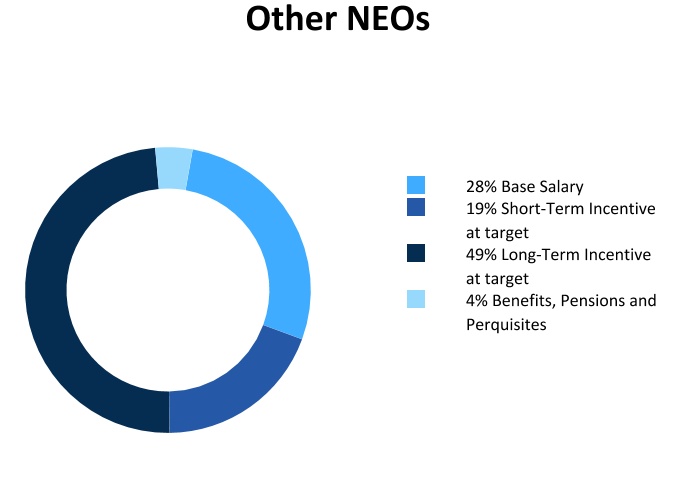

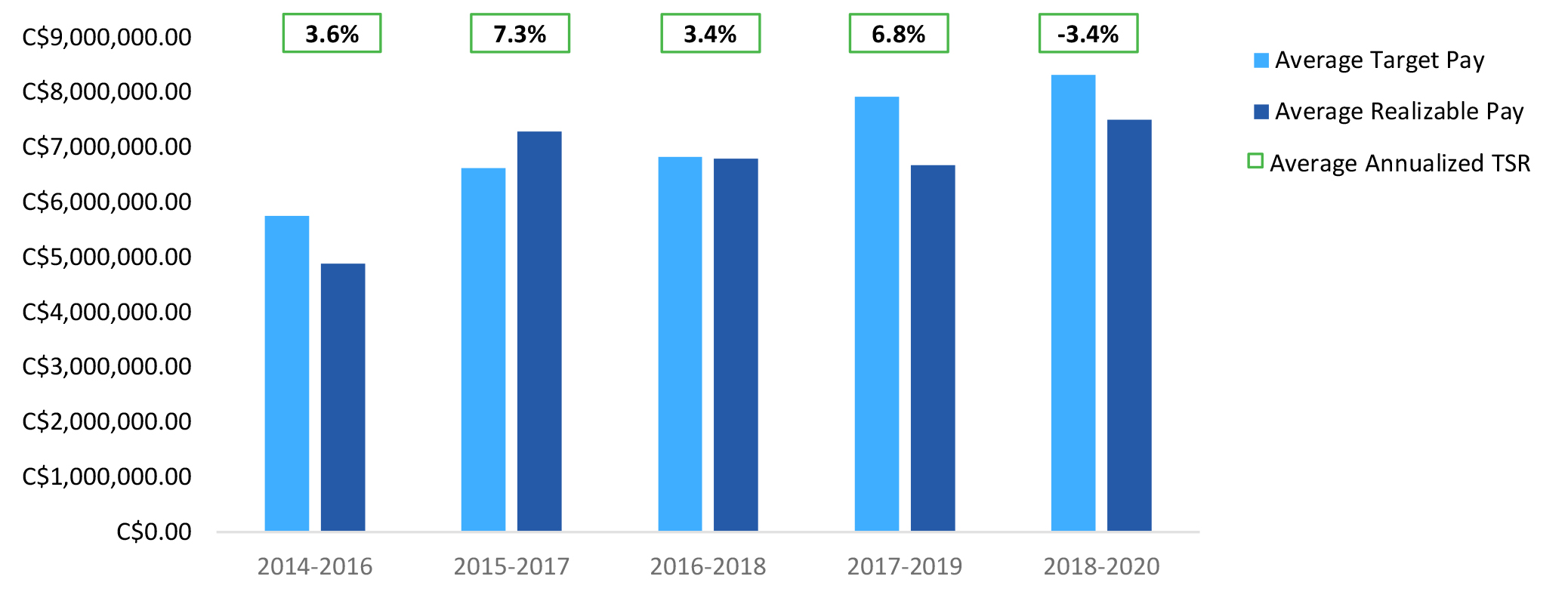

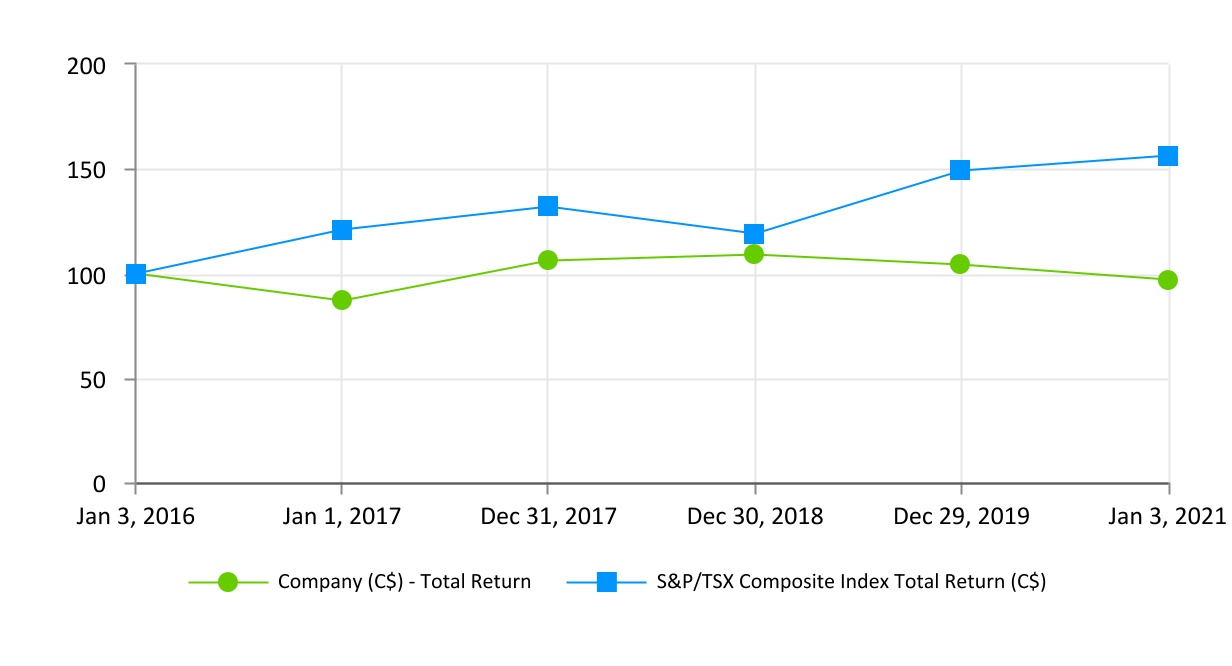

Highlights of our Executive Compensation Program

Our executive compensation program is designed to link executive pay with Gildan performance and align the interests of our executive management team with those of Gildan’s shareholders. Some of our compensation highlights are:

| l | Annual incentive awards are subject to achievement of pre-established performance goals tied to both financial and qualitative objectives | l | Use of stress-testing and back-testing to assess alignment between pay and performance | ||||||||

| l | Significant proportion of executive officers’ annual target compensation is “at-risk” | l | Performance share unit payouts under the long-term incentive plan are capped at two times target | ||||||||

| l | Amount that an executive officer can receive under the short-term incentive plan is capped at two times target | l | Use of representative and relevant peer group | ||||||||

| l | No minimum guaranteed payout under the short-term incentive plan | l | Annual advisory vote on executive compensation | ||||||||

| l | Long-term incentive plan equity awards are designed to encourage a long-term view of performance | l | Clawback Policy for senior executive incentive-based compensation | ||||||||

| l | No hedging or monetizing of equity awards by executives | l | Minimum share ownership guidelines for executives | ||||||||

| l | Use of an independent compensation consultant | l | Post-retirement share ownership guidelines for the President and Chief Executive Officer | ||||||||

| l | No excessive perquisites | l | Use of Board discretion to modify short and long-term incentive award outcomes if necessary to address potential issues | ||||||||

MANAGEMENT INFORMATION CIRCULAR 3

| VOTING AND PROXIES | ||||

VOTING AND PROXIES

Solicitation of Proxies

This Circular is sent in connection with the solicitation by the management of the Company of proxies to be used at the annual meeting of shareholders of the Company to be held on Thursday, May 6, 2021 (the “Meeting”), at 10:00 a.m. (Montréal time), in a virtual only format which will be conducted via live audio webcast at https://web.lumiagm.com/495431045, and for the purposes set forth in the Notice of Annual Meeting of Shareholders (the “Notice of Meeting”), and at any adjournment thereof. The solicitation is being made primarily by mail, but proxies may also be solicited by telephone, facsimile or other personal contact by officers or other employees of the Company. The cost of the solicitation will be borne by the Company other than the cost of solicitation of the Objecting Non-Registered Holders (see the section entitled “Non-Registered Shareholders” below).

Notice-and-Access

Notice-and-AccessThis year, as permitted by Canadian securities regulators, Gildan is using notice-and-access (as defined in National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI-54-101”)) to deliver the Meeting materials, including this Circular, to both its registered and non-registered shareholders. Gildan is also using notice-and-access to deliver its annual consolidated financial statements to its registered and non-registered shareholders. This means that the Circular and the annual consolidated financial statements of the Company are being posted online for shareholders to access, rather than being mailed out. Notice-and-access gives shareholders more choice, substantially reduces Gildan’s printing and mailing costs, and is more environmentally friendly as it reduces materials and energy consumption. Shareholders will still receive a form of proxy or a voting instruction form in the mail (unless shareholders have chosen to receive proxy materials electronically) so they can vote their shares but, instead of automatically receiving a paper copy of this Circular and the annual consolidated financial statements of the Company, shareholders will receive a notice with information about how they can access the Circular and annual consolidated financial statements of the Company electronically and how to request a paper copy. This Circular and annual consolidated financial statements of the Company are available on Gildan’s website at www.gildancorp.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Shareholders may request a paper copy of this Circular and/or the annual consolidated financial statements of the Company, at no cost, up to one year from the date this Circular was filed on SEDAR. Shareholders may make such a

request at any time prior to the meeting by contacting Gildan’s transfer agent and registrar (the “Transfer Agent”), Computershare Investor Services Inc., via their website www.investorcentre.com/service or by phone 1-866-964-0492. After the meeting, requests may be made via our website at www.gildancorp.com.

Virtual Only Meeting

Virtual Only Meeting Due to the ongoing impacts of the COVID-19 pandemic, this year we will once again hold the Meeting in a virtual only format, which will be conducted via live audio webcast. All shareholders, regardless of their geographic location, will have an equal opportunity to participate in the Meeting and engage with directors and management of the Company as well as with other shareholders.

Participation in the Meeting

Participation in the MeetingRegistered shareholders and duly appointed proxyholders who participate in the Meeting online will be able to attend, participate and vote at the Meeting, provided they are connected to the internet and comply with all of the requirements set out in the sections below entitled “How to Vote” and “Attendance and Participation in the Meeting”. Non-registered shareholders who have not duly appointed themselves as their proxies may still attend the Meeting as guests. Guests will be able to listen to the Meeting but will not be able to vote or ask questions at the Meeting. See the sections below entitled “How to Vote” and “Attendance and Participation in the Meeting” below.

Voting Information

Voting InformationPlease read this section carefully, as it contains important information regarding how to vote your shares. We have sent or caused to be sent forms of proxy to our registered shareholders and voting instruction forms to our non-registered shareholders.

Voting Shares and Principal Holders Thereof

As of March 9, 2021, there were 198,422,935 common shares of the Company (the “Common Shares”) issued and outstanding. Each Common Share entitles its holder to one vote with respect to the matters voted at the Meeting.

Holders of Common Shares whose names are registered on the lists of shareholders of the Company as at the close of business, Montréal time, on March 9, 2021, being the date fixed by the Company for determination of the registered

MANAGEMENT INFORMATION CIRCULAR 4

| VOTING AND PROXIES | ||||

holders of Common Shares who are entitled to receive notice of the Meeting, will be entitled to exercise the voting rights attached to the Common Shares in respect of which they are so registered at the Meeting, or any adjournment thereof, if present or represented by proxy thereat. As of March 9, 2021, there was an aggregate of 198,422,935 votes attached to the Common Shares entitled to be voted at the Meeting or any adjournment thereof.

To the knowledge of the directors and officers of the Company, according to the latest publicly available information, no person owns beneficially, directly or indirectly, or exercises control or direction over, voting securities carrying 10% or more of the voting rights attached to any class of voting securities of the Company, as at March 9, 2021.

Appointment of Proxy

The persons named as proxyholders in the enclosed form of proxy are directors and officers of the Company (the “Gildan proxyholders”). Each shareholder has the right to appoint a person other than the Gildan proxyholders to represent such shareholder at the Meeting. In order to appoint such other person, the shareholder should insert such person’s name in the blank space provided on the form of proxy and delete the names printed thereon or complete another proper form of proxy and, in either case, deliver the completed form of proxy to the Transfer Agent (Computershare Investor Services Inc., 100 University Avenue, 8th Floor, North Tower, Toronto, Ontario, Canada M5J 2Y1) no later than 10:00 a.m. on the second business day preceding the day of the Meeting or any adjournment thereof at which the proxy is to be used.

Exercise of Discretion by Proxies

The persons named in the enclosed form of proxy will, on any ballot that may be called for, vote (or withhold from voting) the Common Shares in respect of which they are appointed as proxies in accordance with the instructions indicated on the form of proxy. If a shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. If no instructions are given, the Common Shares will be voted FOR the election of the nominees of the board of directors of the Company (the “Board of Directors” or the “Board”) as directors, FOR the advisory resolution (as set out in Schedule “C”) on the Company’s approach to executive compensation, and FOR the appointment of KPMG LLP as auditors. A completed proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting, and with respect to other business which may properly come before the Meeting or any adjournment thereof. As of the date hereof, management of the Company knows of no such amendment, variation or

other business to come before the Meeting. If any such amendment or other business properly comes before the Meeting, or any adjournment thereof, the persons named in the enclosed form of proxy will vote on such matters in accordance with their best judgement.

Non-Registered Shareholders

You are a registered shareholder if your Common Shares are registered directly in your name with our Transfer Agent. You may hold your Common Shares in the form of a physical share certificate or through the direct registration system (DRS) on the records of our Transfer Agent in electronic form.

You are a non-registered shareholder (a “Non-Registered Holder”) if the Common Shares you beneficially own are registered either: (i) in the name of an intermediary that you deal with in respect of your Common Shares (an “Intermediary”), such as securities dealers or brokers, banks, trust companies and trustees or administrators of self-administered RRSPs, TFSAs, RRIFs, RESPs and similar plans, or (ii) in the name of a clearing agency of which the Intermediary is a participant. In accordance with NI 54-101, the Company has distributed copies of the Notice of Meeting and notice of availability of proxy materials to the clearing agencies and Intermediaries for distribution to Non-Registered Holders. Intermediaries are required to forward such notices to Non-Registered Holders, and often use a service company (such as Broadridge or Computershare in Canada) for this purpose. Non-Registered Holders cannot use a voting instruction form received from Broadridge or Computershare to vote directly at the Meeting. Only registered shareholders or the persons they appoint as their proxies are permitted to vote at the Meeting.

If you receive more than one Notice of Meeting, form of proxy or voting instruction form, it means that you have multiple accounts with brokers or other nominees or with our Transfer Agent, as applicable, through which you hold Common Shares. The voting process is different for registered shareholders and Non-Registered Holders. Please follow the instructions carefully and vote or provide voting instructions for all of the Common Shares you own. If you have questions on how to exercise voting rights carried by Common Shares held through an Intermediary, please contact your Intermediary directly.

In all cases, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when, where and by what means the voting instruction form or proxy form must be delivered.

If you are a Non-Registered Holder you may revoke voting instructions that have been given to an Intermediary at any time by written notice to the Intermediary.

MANAGEMENT INFORMATION CIRCULAR 5

| VOTING AND PROXIES | ||||

Management of the Company does not intend to pay for an Intermediary to deliver the Meeting Materials to Non-Registered Holders who have objected to their Intermediary disclosing ownership information about them to the Company (“Objecting Non-Registered Holders”). Objecting Non-Registered Holders will not receive the Meeting Materials unless the Objecting Non-Registered Holder’s Intermediary assumes the costs of delivery.

How to Vote

How to VoteGildan shareholders may vote by proxy before the Meeting or vote at the Meeting, as described below:

1. Voting by proxy before the Meeting

You may vote before the Meeting by completing your form of proxy or voting instruction form in accordance with the instructions provided therein. Non-Registered Holders should also carefully follow all instructions provided by their Intermediaries to ensure that their Common Shares are voted at the Meeting. Voting by proxy is the easiest way to vote. It means you are giving someone else the authority to attend the Meeting and vote on your behalf.

The Gildan proxyholders named in the enclosed form of proxy will vote (or withhold from voting) the Common Shares in respect of which they are appointed as proxies in accordance with your instructions, including on any ballot that may be called. If there are changes to the items of business or new items properly come before the Meeting, a proxyholder can vote as he or she sees fit.

You can appoint someone else to be your proxy. This person does not need to be a shareholder. See the section below entitled “Appointment of a Third Party as Proxy”.

There are three ways for registered shareholders to vote by proxy before the Meeting:

(a) Telephone voting - You may vote by calling the toll-free telephone number 1-866-732-VOTE (8683) Toll Free. You will be prompted to provide your Control Number printed on the form of proxy. If you vote by telephone, you may not appoint a person as your proxy other than the Gildan proxyholders named in the form of proxy or voting instruction form. Please follow the voice prompts that allow you to vote your Common Shares and confirm that your instructions have been properly recorded.

Telephone voting - You may vote by calling the toll-free telephone number 1-866-732-VOTE (8683) Toll Free. You will be prompted to provide your Control Number printed on the form of proxy. If you vote by telephone, you may not appoint a person as your proxy other than the Gildan proxyholders named in the form of proxy or voting instruction form. Please follow the voice prompts that allow you to vote your Common Shares and confirm that your instructions have been properly recorded.

Telephone voting - You may vote by calling the toll-free telephone number 1-866-732-VOTE (8683) Toll Free. You will be prompted to provide your Control Number printed on the form of proxy. If you vote by telephone, you may not appoint a person as your proxy other than the Gildan proxyholders named in the form of proxy or voting instruction form. Please follow the voice prompts that allow you to vote your Common Shares and confirm that your instructions have been properly recorded.

Telephone voting - You may vote by calling the toll-free telephone number 1-866-732-VOTE (8683) Toll Free. You will be prompted to provide your Control Number printed on the form of proxy. If you vote by telephone, you may not appoint a person as your proxy other than the Gildan proxyholders named in the form of proxy or voting instruction form. Please follow the voice prompts that allow you to vote your Common Shares and confirm that your instructions have been properly recorded.(b) Internet voting - You may vote by logging on to the website indicated on the form of proxy (www.investorvote.com). Please follow the website prompts that allow you to vote your Common Shares

Internet voting - You may vote by logging on to the website indicated on the form of proxy (www.investorvote.com). Please follow the website prompts that allow you to vote your Common Shares

Internet voting - You may vote by logging on to the website indicated on the form of proxy (www.investorvote.com). Please follow the website prompts that allow you to vote your Common Shares

Internet voting - You may vote by logging on to the website indicated on the form of proxy (www.investorvote.com). Please follow the website prompts that allow you to vote your Common Shares and confirm that your instructions have been properly recorded.

(c) Return your form of proxy by mail - You may vote by completing, signing and returning the form of proxy in the postage-paid envelope provided.

Return your form of proxy by mail - You may vote by completing, signing and returning the form of proxy in the postage-paid envelope provided.

Return your form of proxy by mail - You may vote by completing, signing and returning the form of proxy in the postage-paid envelope provided.

Return your form of proxy by mail - You may vote by completing, signing and returning the form of proxy in the postage-paid envelope provided.Proxies, whether submitted through the Internet or by telephone or mail as described above, must be received by the Transfer Agent (Computershare Investor Services Inc., 100 University Avenue, 8th Floor, North Tower, Toronto, Ontario, Canada M5J 2Y1) no later than 10:00 a.m. on the second business day preceding the day of the Meeting or any adjournment thereof. Your Common Shares will be voted in accordance with your instructions as indicated on the proxy. The time limit for the deposit of proxies may be waived or extended by the chair of the Meeting at his or her discretion without notice.

If you are a registered shareholder, contact Computershare Investor Services Inc., our Transfer Agent, at 1-800 564 6253 (toll free in North America) or +1 (514) 982 7555 (outside North America), for any voting questions.

Non-Registered Holders will receive a Notice of Meeting and notice of availability of proxy materials and voting instruction form indirectly through their Intermediary. The Notice of Meeting and notice of availability of proxy materials contains instructions on how to access our proxy materials and return your voting instructions. You should follow the voting instructions of your Intermediary. Intermediaries may set deadlines for voting that are further in advance of the Meeting than those set out in this Circular. You should contact your Intermediary for further details.

2. Voting at the Meeting

Registered shareholders may vote at the Meeting by completing a ballot online during the Meeting, as further described in the section below entitled “Attendance and Participation in the Meeting”.

Non-Registered Holders who have not duly appointed themselves as their proxy will not be able to vote at the Meeting but will be able to participate as a guest. This is because the Company and our Transfer Agent do not have a record of the Non-Registered Holders of the Company, and, as a result, will have no knowledge of your shareholdings or entitlement to vote unless you appoint yourself as your proxy. If you are a Non-Registered Holders and wish to vote at the Meeting, you have to appoint yourself as your proxy by inserting your own name in the space provided on the voting instruction form sent to you and you must follow all of the applicable instructions, including the deadline, provided by your Intermediary. See the sections below entitled “Appointment of a Third Party as Proxy” and “Attendance and Participation in the Meeting”.

MANAGEMENT INFORMATION CIRCULAR 6

| VOTING AND PROXIES | ||||

Appointment of a Third Party as Proxy

The following applies to shareholders who wish to appoint someone as their proxy other than the Gildan proxyholders named in the form of proxy or voting instruction form. This includes Non-Registered Holders who wish to appoint themselves as their proxy to attend, participate, vote or ask questions at the Meeting. Shareholders who wish to appoint someone other than the Gildan proxyholders as their proxy (including themselves) to attend the Meeting as their proxy and vote their Common Shares MUST submit their form of proxy or voting instruction form, as applicable, appointing themselves or that third party proxyholder as their proxy AND register themselves or that third party proxyholder online, as described below. Registering yourself or your third-party proxyholder is an additional step to be completed AFTER you have submitted your form of proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a Control Number that is required to vote at the Meeting and, consequently, only being able to attend the meeting as a guest.

•Step 1 - Submit your form of proxy or voting instruction form: To appoint someone other than the Gildan proxyholders as your proxy (including yourself), insert your or such person’s name in the blank space provided in the form of proxy or voting instruction form (if permitted) and follow the instructions for submitting such form of proxy or voting instruction form. This must be completed before registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form.

If you are a Non-Registered Holder and wish to vote at the Meeting, you have to insert your own name in the space provided on the voting instruction form sent to you by your Intermediary, follow all of the applicable instructions provided by your Intermediary AND register yourself as your proxy, as described below. By doing so, you are instructing your Intermediary to appoint you as your proxy. It is important that you comply with the signature and return instructions provided to you by your Intermediary. See the section below entitled “Attendance and Participation in the Meeting”.

If you are a Non-Registered Holder located in the United States and wish to vote at the Meeting or, if permitted, appoint a third party as your proxy, in addition to the steps described below in the section entitled “Attendance and Participation in the Meeting”, you must obtain a valid legal proxy from your Intermediary. Follow the instructions from your Intermediary included with the legal proxy form and the voting instruction form sent to you or contact your Intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a

valid legal proxy from your Intermediary, you must then submit such legal proxy to the Transfer Agent. Requests for registration from Non-Registered Holders located in the United States that wish to vote at the Meeting or, if permitted, appoint a third party as their proxy must be sent by e-mail or by courier to: Computershare Investor Services Inc., 100 University Avenue, 8th Floor, North Tower, Toronto, Ontario, Canada M5J 2Y1, and in both cases, must be labeled “Legal Proxy” and received no later than 10:00 a.m. on the second business day preceding the day of the Meeting or any adjournment thereof.

•Step 2 - Register your proxyholder: To register yourself or a third party proxyholder, you must visit http://www.computershare.com/gildan by 10:00 a.m. on the second business day preceding the day of the Meeting or any adjournment thereof and provide the Transfer Agent with the required proxyholder contact information so that the Transfer Agent may provide the proxyholder with a Control Number via email. Without a Control Number, proxyholders will not be able to vote or ask questions at the Meeting but will be able to attend as a guest.

Attendance and Participation in the Meeting

Attendance and Participation in the MeetingThe Company is holding the Meeting in a virtual only format, which will be conducted via live audio webcast. Shareholders will not be able to attend the Meeting in person. Attending the Meeting online enables registered shareholders and duly appointed proxyholders, including Non-Registered Holders who have duly appointed themselves as their proxy, to participate in the Meeting and ask questions. Registered shareholders and duly appointed proxyholders can vote at the appropriate times during the Meeting. Guests, including Non-Registered Holders who have not duly appointed themselves as their proxy, can log in to the Meeting as set out below. Guests can listen to the Meeting but are not able to vote or ask questions.

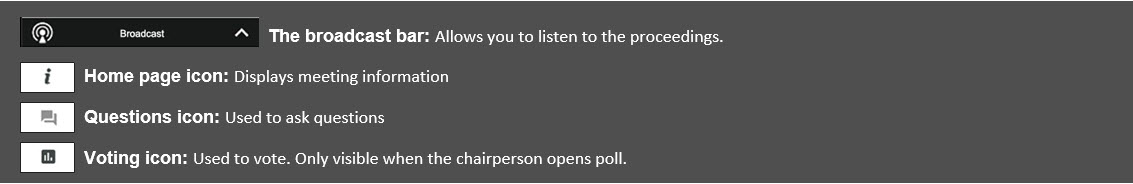

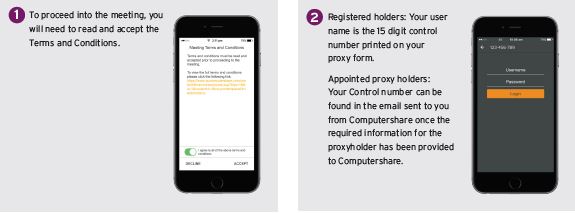

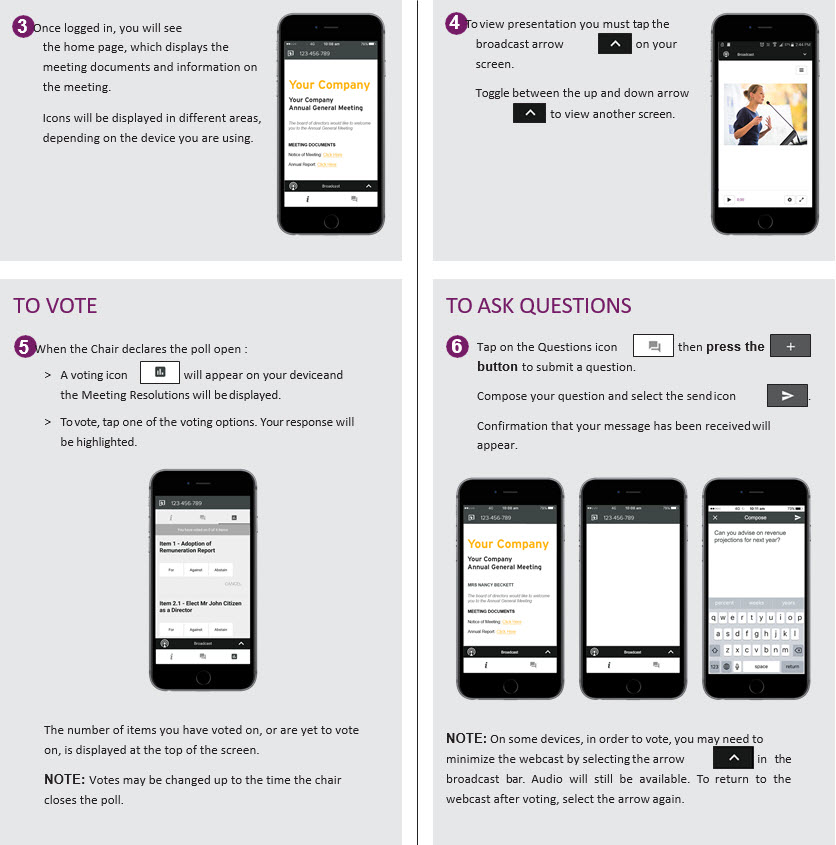

•Log in online at https://web.lumiagm.com/495431045. We recommend that you log in at least one hour before the Meeting starts. The meeting will begin promptly at 10:00 a.m. (Montréal time) on May 6, 2021, unless otherwise adjourned or postponed.

•Click “I have a Login” and then enter your Control Number (see below) and Password “gildan2021” (case sensitive).

OR

•Click "Guest" and then complete the online form.

MANAGEMENT INFORMATION CIRCULAR 7

| VOTING AND PROXIES | ||||

Registered Shareholders: The Control Number located on the form of proxy or in the email notification you received is your Control Number.

Duly appointed proxyholders: The Transfer Agent will provide the proxyholder with a Control Number by e-mail after the proxy voting deadline has passed and the proxyholder has been duly appointed AND registered as described in “Appointment of a Third Party as Proxy” above.

If you attend the Meeting online, it is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. You should allow ample time to check into the Meeting online and complete the related procedure. For any technical difficulties experienced during the check-in process or during the Meeting, please call 1-800-564-6253 (toll free in North America) or 514-982-7555 (outside North America).

Revocation of Proxy

If you are a registered shareholder, you may change a vote you made by proxy by voting again by any of the means, and by the deadlines, described in the section above entitled “1. Voting by proxy before the Meeting”. Your new instructions will revoke your earlier instructions.

If you are a registered shareholder and you voted by proxy, you can revoke your voting instructions at any time up to and including the last business day preceding the day of the Meeting or any adjournment by (i) sending us a notice in writing (from you or a person authorized to sign on your behalf). Send your notice to the Transfer Agent (Computershare Investor Services Inc., 100 University Avenue, 8th Floor, North Tower, Toronto, Ontario, Canada M5J 2Y1); or any other manner permitted by law.

If you have followed the process for attending and voting at the Meeting online, voting at the Meeting online will revoke your previous proxy.

If you are a Non-Registered Holder, contact your Intermediary to find out how to change or revoke your voting instructions and the timing requirements, or for other voting questions. Intermediaries may set deadlines for the receipt of revocation notices that are farther in advance of the Meeting than those set out above and, accordingly, any such revocation should be completed well in advance of the deadline prescribed in the proxy form or voting instruction form to ensure it is given effect at the Meeting.

Submitting Questions

Submitting Questions Following the formal portion of the Meeting, we will hold a live Q&A session to answer written questions submitted

during the Meeting by Registered Shareholders and duly appointed proxyholders participating via live audio webcast.

The chair of the Meeting reserves the right to edit or reject questions he or she deems inappropriate, or to limit the number of questions per shareholder in order to ensure that as many shareholders as possible will have the opportunity to ask questions. The chair of the Meeting has broad authority to conduct the Meeting in an orderly manner. To ensure the Meeting is conducted in a manner that is fair to all shareholders, the chair of the Meeting may exercise broad discretion in the order in which the questions are asked, and the amount of time devoted to any question.

Voting Deadline

Voting Deadline If voting by proxy, your proxy must be received by the Transfer Agent (Computershare Investor Services Inc., 100 University Avenue, 8th Floor, North Tower, Toronto, Ontario, Canada M5J 2Y1) no later than 10:00 a.m. on the second business day preceding the day of the Meeting or any adjournment thereof. The time limit for the deposit of proxies may be waived or extended by the chair of the Meeting at his or her discretion without notice.

The Company reminds shareholders that only the most recently dated voting instructions will be counted and any prior dated instructions will be disregarded.

Voting Questions

Voting Questions Registered shareholders may contact the Transfer Agent, at 1-800 564 6253 (toll free in North America) or +1 (514) 982 7555 (outside North America), for any voting questions.

MANAGEMENT INFORMATION CIRCULAR 8

| BUSINESS OF THE MEETING | ||||

BUSINESS OF THE MEETING

Election of Directors

The articles of the Company provide that the Board of Directors shall consist of not less than five and not more than twelve directors. Except where authority to vote on the election of directors is withheld, the persons named in the enclosed form of proxy or voting instruction form intend to vote FOR the election of the nominees whose names are hereinafter set forth. All of the nominees are currently members of the Board of Directors and have been members since the dates indicated below. If prior to the Meeting, any of the nominees shall be unable or, for any reason, become unwilling to serve as a director, it is intended that the discretionary power granted by the form of proxy or voting instruction form shall be used to vote for any other person or persons as directors. Each director is elected for a one-year term ending at the next annual meeting of shareholders or when his or her successor is elected, unless he or she resigns or his or her office otherwise becomes vacant. The Board of Directors and management of the Company have no reason to believe that any of the said nominees will be unable or will refuse to serve, for any reason, if elected to office.

Nomination Process

The process to nominate the Company’s directors, including the Board skills matrix and Board succession planning and renewal, is described in the section entitled “Director Selection” in the Statement of Corporate Governance Practices of this Circular.

Diversity

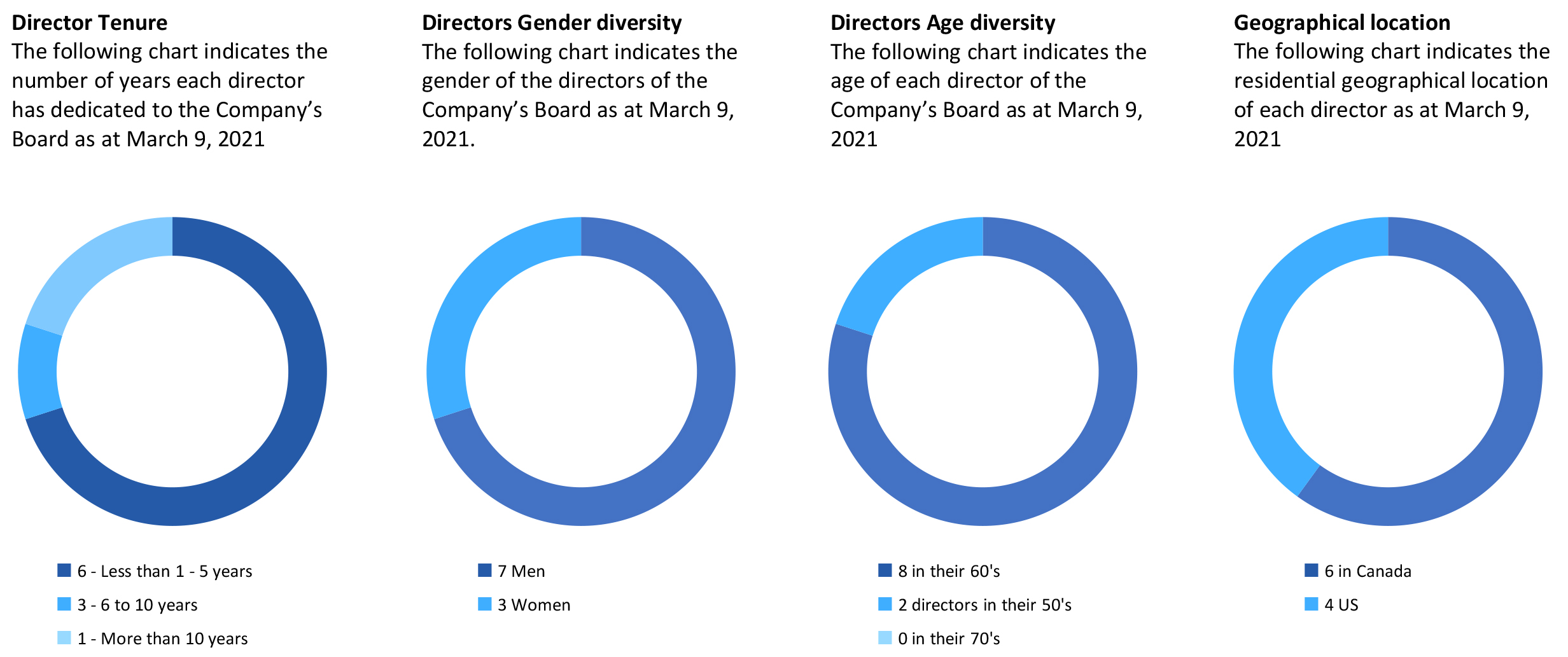

The Board is committed to diversity and inclusion at Gildan and has adopted a formal written Board Diversity Policy to support this commitment at the Board level. In that regard, the Board will consider diversity, including gender, age, ethnicity, and other personal characteristics, when reviewing qualified candidates for recommendation for appointment to the Board to ensure that the Board is comprised of a diverse membership. See the section entitled “Diversity” in the Statement of Corporate Governance Practices of this Circular. Currently, three of the ten nominees proposed for election to the Board of Directors (representing 30%) are women and one nominee self-identifies as a member of a minority group. Additionally, two of the three Board committees are chaired by women (representing 66%). These include Maryse Bertrand, who is the Chair of the Corporate Governance and Social Responsibility Committee, and Shirley E. Cunningham, who is the Chair of the Compensation and Human Resources Committee.

Nominees

The tables found in the section of this Circular entitled “Election of Directors - Nominees” provide the profile of the nominees proposed for election to the Board of Directors. Included in these tables is information relating to each nominee’s experience, qualifications, areas of expertise, attendance at Board and committee meetings, ownership of Gildan securities, as well as other public company board memberships. One of our long-standing directors, William D. Anderson, retired from the Board in February 2021 having reached his term limit and is not standing for re-election. As you will note from the enclosed form of proxy or voting instruction form, shareholders may vote for each director individually.

Majority Voting Policy

The Board of Directors has adopted a majority voting policy providing that in an uncontested election of directors, any nominee who receives a greater number of votes “withheld” than votes “for” his or her nomination will tender his or her resignation to the Board of Directors promptly following the shareholders’ meeting. The Corporate Governance and Social Responsibility Committee will consider the offer of resignation and will make a recommendation to the Board of Directors on whether to accept it. Absent exceptional circumstances, the Board will accept the resignation and it will be effective on the date of such acceptance. The Board of Directors will make its final decision and announce it in a press release within ninety days following the shareholders’ meeting giving the reasons for not accepting the resignation if such is the case. A director who tenders his or her resignation pursuant to this policy will not participate in any meeting of the Board of Directors or the Corporate Governance and Social Responsibility Committee at which the resignation is considered.

Appointment of Auditors

KPMG LLP (“KPMG”), chartered accountants, has served as auditors of the Company since fiscal 1996. In fiscal 2020, in addition to retaining KPMG to report upon the annual consolidated financial statements of the Company, the Company retained KPMG to provide various audit, audit-related, and tax services. The aggregate fees billed for professional services by KPMG for each of the last two fiscal periods were as follows:

Audit Fees - The aggregate audit fees billed by KPMG were C$2,578,750 for fiscal 2020 and C$2,459,500 for fiscal 2019. These services consisted of professional services rendered for the annual audit of the Company’s consolidated financial

MANAGEMENT INFORMATION CIRCULAR 9

| BUSINESS OF THE MEETING | ||||

statements and the quarterly reviews of the Company’s interim financial statements, and services provided in connection with statutory and regulatory filings or engagements. The fees for the annual audit of the Company’s consolidated financial statements include fees relating to KPMG’s audit of the effectiveness of the Company’s internal control over financial reporting.

Audit-Related Fees - The aggregate audit-related fees billed by KPMG were C$172,940 for fiscal 2020 and C$180,500 for fiscal 2019. These services consisted of consultation concerning financial reporting and accounting standards, and translation services in both years.

Tax Fees - The aggregate tax fees billed by KPMG were C$695,750 for fiscal 2020 and C$956,500 for fiscal 2019. These services consisted of tax compliance, including assistance with the preparation and review of tax returns, and the preparation of annual transfer pricing studies.

All fees paid and payable by the Company to KPMG in fiscal 2020 were pre-approved by the Company’s Audit and Finance Committee pursuant to the procedures and policies set forth in the Audit and Finance Committee mandate. Except where authorization to vote with respect to the appointment of auditors is withheld, the persons designated in the enclosed form of proxy or voting instruction form intend to vote FOR the reappointment of KPMG, as auditors of the Company, to hold office until the close of the next annual meeting of shareholders at such remuneration as may be recommended by the Audit and Finance Committee and fixed by the Board.

Advisory Vote on Executive Compensation

The Board of Directors, through its Compensation and Human Resources Committee, has spent considerable time and effort overseeing the implementation of Gildan’s executive compensation program and the Board is satisfied that this program is aligned with the Company’s performance, reflects competitive market practices, and is aligned with shareholder interests. The Board is also committed to maintaining an ongoing engagement process with the Company’s shareholders by adopting effective measures to receive shareholder feedback.

In this light, the Board of Directors wishes to offer Gildan’s shareholders the opportunity to cast at the Meeting an advisory vote on the Company’s approach to executive compensation as disclosed in the section entitled “Compensation Discussion and Analysis” of this Circular. This section discusses the Company’s executive compensation philosophy, objectives, policies and practices and provides important information on the key components of Gildan’s executive compensation program. It explains how Gildan’s executive compensation program is based on a pay-for-performance approach that is aligned with the long-term interests of the Company’s shareholders.

The Board recommends that shareholders indicate their support for the Company’s approach to executive compensation disclosed in this Circular by voting FOR the advisory resolution (the full text of which is reproduced at Schedule “C” to this Circular). Unless contrary instructions are indicated on the proxy form or the voting instruction form, the persons designated in the enclosed form of proxy or voting instruction form intend to vote FOR this advisory resolution.

As this is an advisory vote, the Board will not be bound by the results of the vote. However, the Board will take the results of the vote into account, together with feedback received from shareholders, when considering its approach to executive compensation in the future. Results of the vote will be disclosed in the report of voting results and related news release and in next year’s management information circular.

MANAGEMENT INFORMATION CIRCULAR 10

| ELECTION OF DIRECTORS - NOMINEES | ||||

ELECTION OF DIRECTORS - NOMINEES

The following tables include profiles of each director nominee with a description of his or her experience, qualifications, areas of expertise, participation on the Board and its committees, if applicable, ownership of Gildan securities, as well as other public company board memberships. A more detailed description of each nominee’s competencies is described in the section entitled “Skills and Experience of Directors” in the Statement of Corporate Governance Practices.

| Donald C. Berg | ||||||||||

Age 65 Lakewood Ranch, Florida, United States Director since February 2015 Independent(1) | |||||||||||

| Donald C. Berg is President of DCB Advisory Services, providing consulting services to food and beverage companies ranging from multi-national conglomerates to start-up companies. Mr. Berg retired in April 2014 as Executive Vice President, Chief Financial Officer at Brown-Forman Corporation, a U.S.-based producer and marketer of fine quality beverage alcohol brands and one of the largest companies in the global wine and spirits industry. Mr. Berg’s career at Brown-Forman Corporation spanned over 25 years, where he held various executive positions including as President of its Advancing Markets Group, President of Brown-Forman Spirits Americas, the company’s largest operating group, head of its corporate development and strategy functions, and director of its mergers and acquisitions group. Prior to joining Brown-Forman, Mr. Berg has held a wide variety of finance, sales and marketing roles with respected national and international firms after beginning his career as a certified public accountant with Ernst & Whinney. Mr. Berg is also a member of the Board of Directors of Meredith Corporation, a publicly-held media and marketing company, where he is also Chair of the Audit and Finance Committee. In addition, he is a member of the Board of Beam Suntory International, the third largest global spirits company wholly owned by Tokyo-based Suntory Holdings Group. Mr. Berg holds a Master of Business Administration from the Wharton School of Business and earned his Bachelor of Arts degree in accounting and business administration from Augustana College in Illinois. | |||||||||||

Areas of Expertise: •Financial Accounting/Auditing •Corporate Development •Retail Sales/Distribution •Government Relations/Public Policy | Board/Committee Membership and Attendance in 2020(2) | Public Board Memberships | |||||||||

Chair of the Board of Directors(7) | 100% | Meredith Corporation - Media and marketing company | |||||||||

| Voting Results | In Favour | ||||||||||

| 2020 | 99.6% | ||||||||||

| 2019 | 97.75% | ||||||||||

| Securities Held | |||||||||||||||||||||||

| As at | Common Shares(3) | DSUs(4) | Total Common Shares and DSUs | Total Market Value of Common Shares and DSUs(5) | Minimum Shareholding Requirement(6) | Meets Requirement | |||||||||||||||||

| Mar. 9, 2021 | 3,000 | 51,485 | 54,485 | $1,632,915 | $540,000 | Yes | |||||||||||||||||

| Mar. 4, 2020 | 3,000 | 34,545 | 37,545 | $928,112 | |||||||||||||||||||

| Change | Nil | 16,940 | 16,940 | $704,803 | |||||||||||||||||||

MANAGEMENT INFORMATION CIRCULAR 11

| ELECTION OF DIRECTORS - NOMINEES | ||||

| Maryse Bertrand | ||||||||||

Age 62 Westmount, Québec, Canada Director since May 2018 Independent(1) | |||||||||||

| Maryse Bertrand has had a career in law and business spanning over 35 years. Ms. Bertrand is currently an advisor in corporate governance and risk management and is a corporate director. Ms. Bertrand is a member of the Board of Directors of National Bank of Canada, Canada’s sixth largest retail and commercial bank, of PSP Investments, one of Canada’s largest pension investment managers, and of Metro Inc., a leader in the grocery and pharmaceutical distribution sectors in Canada, where she chairs the Corporate Governance and Nominating Committee. From 2016 to 2017, she was Strategic Advisor and Counsel to Borden Ladner Gervais LLP, in matters of risk and governance. From 2009 to 2015, she was Vice-President, Real Estate Services, Legal Services and General Counsel at CBC/Radio-Canada, Canada’s public broadcaster, where she also chaired the National Crisis Management Committee and the Board of Directors of ArTV, a specialty channel. Prior to 2009, Ms. Bertrand was a partner of Davies Ward Phillips and Vineberg LLP, where she specialized in M&A and corporate finance, and served on the firm’s National Management Committee. Ms. Bertrand also chairs the Board of the Institute of Corporate Directors (Québec Chapter), and is a Vice-Chair of the Board of Governors of McGill University. She was named as Advocatus emeritus (Ad. E.) in 2007 by the Québec Bar in recognition of her exceptional contribution to the legal profession. Ms. Bertrand holds a law degree from McGill University (with High Distinction) and a Masters in Risk Management from New York University, Stern School of Business. | |||||||||||

Areas of Expertise: •ESG/Health & Safety •Corporate Development •Capital Markets •Risk Management | |||||||||||

Board/Committee Membership and Attendance in 2020(2) | Public Board Memberships | ||||||||||

| Board of Directors | 100% | Metro Inc. - Grocery and pharmaceutical distribution | |||||||||

| Audit and Finance Committee | 100% | National Bank of Canada - Retail and commercial bank | |||||||||

| Chair of the Corporate Governance and Social Responsibility Committee | 100% | ||||||||||

| Voting Results | In Favour | ||||||||||

| 2020 | 98.4% | ||||||||||

| 2019 | 98.43% | ||||||||||

| Securities Held | |||||||||||||||||||||||

| As at | Common Shares(3) | DSUs(4) | Total Common Shares and DSUs | Total Market Value of Common Shares and DSUs(5) | Minimum Shareholding Requirement(6) | Meets Requirement | |||||||||||||||||

| Mar. 9, 2021 | 2,500 | 11,840 | 14,340 | $429,770 | $540,000 | No(12) | |||||||||||||||||

| Mar. 4, 2020 | 2,500 | 5,923 | 8,423 | $208,217 | |||||||||||||||||||

| Change | Nil | 5,917 | 5,917 | $221,553 | |||||||||||||||||||

| Marc Caira | ||||||||||

Age 67 Toronto, Ontario, Canada Director since May 2018 Independent(1) | |||||||||||

Marc Caira has had a career as a business leader that spans over 40 years. Mr. Caira currently serves on the Board of Directors of Minto Group, a private real estate developer, as well as the Toronto General & Western Hospital Foundation. Mr. Caira retired in 2020 from his role as the Vice-Chairman of the Board of Directors of Restaurant Brands International Inc., a multinational quick service restaurant company, a position he had held since 2014. Prior to that, Mr. Caira has held several senior executive positions, including as President and Chief Executive Officer of Tim Hortons Inc., a multinational fast food restaurant, as a member of the Executive Board of Nestlé S.A. in Switzerland, a transnational food and beverage company, as Chief Executive Officer of Nestlé Professional, as President and Chief Executive Officer of Parmalat North America, and as President, Food Services and Nescafé Beverages for Nestlé Canada. Mr. Caira holds an Advanced Diploma in Marketing Management from Seneca College, Toronto and is a graduate of the Director Program at The International Institute for Management Development, Lausanne, Switzerland. | |||||||||||

Areas of Expertise: •International •Executive Leadership •Retail Sales/Distribution •Marketing/Advertising | Board/Committee Membership and Attendance in 2020(2) | Public Board Memberships | |||||||||

| Board of Directors | 100% | None | |||||||||

| Corporate Governance and Social Responsibility Committee | 100% | ||||||||||

| Audit and Finance Committee | 100% | ||||||||||

| Voting Results | In Favour | ||||||||||

| 2020 | 98.79% | ||||||||||

| 2019 | 96.77% | ||||||||||

| Securities Held | |||||||||||||||||||||||

| As at | Common Shares(3) (15) | DSUs(4) | Total Common Shares and DSUs | Total Market Value of Common Shares and DSUs(5) | Minimum Shareholding Requirement(6) | Meets Requirement | |||||||||||||||||

| Mar. 9, 2021 | 1,560 | 21,212 | 22,772 | $682,477 | $540,000 | Yes | |||||||||||||||||

| Mar. 4, 2020 | 1,560 | 10,660 | 12,220 | $302,078 | |||||||||||||||||||

| Change | Nil | 10,552 | 10,552 | $380,399 | |||||||||||||||||||

MANAGEMENT INFORMATION CIRCULAR 12

| ELECTION OF DIRECTORS - NOMINEES | ||||

| Glenn J. Chamandy | ||||||||||

| Age 59 Westmount, Québec, Canada Director since May 1984 Not Independent (Management) | |||||||||||

| Glenn J. Chamandy is one of the founders of the Company and has devoted his entire career to building Gildan into an industry leader. Mr. Chamandy has been involved in various textile and apparel businesses for over thirty years. Prior to his appointment as President and Chief Executive Officer in 2004, the position which he currently holds, Mr. Chamandy served as a Co-Chief Executive Officer and Chief Operating Officer of Gildan. | |||||||||||

Board/Committee Membership and Attendance in 2020(8) | Public Board Memberships | ||||||||||

| Board of Directors | 100% | None | |||||||||

Areas of Expertise: •Executive Leadership •Retail Sales/Distribution •Manufacturing/Supply Chain •ESG/Health & Safety | |||||||||||

| Voting Results | In Favour | ||||||||||

| 2020 | 99.86% | ||||||||||

| 2019 | 99.91% | ||||||||||

| Securities Held | |||||||||||||||||||||||

| As at | Common Shares(3)(14) | Options Exercisable(9) | RSUs(10) | Total Market Value of Common Shares, Options Exercisable and RSUs(11) | Minimum Shareholding Requirement(6) | Meets Requirement | |||||||||||||||||

| Mar. 9, 2021 | 3,380,533 | 719,281 | 597,055 | $121,933,165 | $7,500,000 | Yes | |||||||||||||||||

| Mar. 4, 2020 | 3,219,245 | 455,000 | 616,827 | $94,919,167 | |||||||||||||||||||

| Change | 161,288 | 264,281 | (19,772) | $27,013,998 | |||||||||||||||||||

| Shirley E. Cunningham | ||||||||||

Age 60 Estero, Florida, United States Director since February 2017 Independent (1) | |||||||||||

| Shirley E. Cunningham has had a career in information technology and business management spanning over 25 years. Ms. Cunningham retired in 2018 from her position as Executive Vice-President and Chief Operating Officer, Ag Business and Enterprise Strategy, for CHS Inc., a global energy, grains and foods company. Prior to joining CHS Inc. in 2013, Ms. Cunningham was the Chief Information Officer for Monsanto Company, a global agriculture company. Ms. Cunningham currently serves on the Board of Directors of Kemira Oyj, a Finnish-based global chemicals company providing innovative and sustainable solutions for improving water, energy and raw material efficiencies. She received a Master’s degree in Business Administration from Washington University in St. Louis. | |||||||||||

Areas of Expertise: •International •Corporate Development •Human Resources •Cyber Security/Technology | Board/Committee Membership and Attendance in 2020(2) | Public Board Memberships | |||||||||

| Board of Directors | 100% | Kemira Oyj - Global chemical company | |||||||||

| Audit and Finance Committee | 100% | ||||||||||

| Chair of the Compensation and Human Resources Committee | 100% | ||||||||||

| Voting Results | In Favour | ||||||||||

| 2020 | 98.86% | ||||||||||

| 2019 | 98.28% | ||||||||||

| Securities Held | |||||||||||||||||||||||

| As at | Common Shares(3) | DSUs(4) | Total Common Shares and DSUs | Total Market Value of Common Shares and DSUs(5) | Minimum Shareholding Requirement(6) | Meets Requirement | |||||||||||||||||

| Mar. 9, 2021 | Nil | 28,194 | 28,194 | $844,974 | $540,000 | Yes | |||||||||||||||||

| Mar. 4, 2020 | Nil | 16,554 | 16,554 | $409,215 | |||||||||||||||||||

| Change | Nil | 11,640 | 11,640 | $435,759 | |||||||||||||||||||

MANAGEMENT INFORMATION CIRCULAR 13

| ELECTION OF DIRECTORS - NOMINEES | ||||

| Russell Goodman | ||||||||||

Age 67 Mont- Tremblant, Québec, Canada Director since December 2010 Independent(1) | |||||||||||

| Russell Goodman is a corporate director of public, private and not-for-profit companies. In addition to Gildan, he currently serves on the Board of Directors of Metro Inc., a leader in grocery and pharmaceutical distribution in Canada, where he is Chair of the Audit Committee and a member of the Corporate Governance and Nominating Committee, and the Board of Directors of Northland Power Inc., a leading global independent power producer, where he is Lead Independent Director, Chair of the Audit Committee and a member of the Compensation Committee. Mr. Goodman is also Chairman of the Independent Review Committee of IG Wealth Management Funds, which comprise mutual funds, ETFs and other wealth management solutions managed by entities within the Power Corporation group of companies. Mr. Goodman spent his business career at PricewaterhouseCoopers LLP until his retirement in 2011. From 1998 to 2011, he was the Managing Partner of various business units across Canada and the Americas and also held global leadership roles in the services and transportation industry sectors. Mr. Goodman is a Fellow Chartered Professional Accountant and a holder of the ICD.D designation from the Institute of Corporate Directors. He completed a Bachelor of Commerce degree from McGill University, is a recipient of the Governor General of Canada’s Sovereign’s Medal for Volunteers, and is a member of the Canadian Ski Hall of Fame. | |||||||||||

Areas of Expertise: •Financial Accounting/Auditing •Corporate Development •International •Capital Markets | Board/Committee Membership and Attendance in 2020(2) | Public Board Memberships | |||||||||

| Board of Directors | 100% | Metro Inc. - Grocery and pharmaceutical distribution | |||||||||

| Chair of the Audit and Finance Committee | 100% | Northland Power Inc. - Power producer | |||||||||

| Compensation and Human Resources Committee | 100% | ||||||||||

| Voting Results | In Favour | ||||||||||

| 2020 | 97.73% | ||||||||||

| 2019 | 97.06% | ||||||||||

| Securities Held | |||||||||||||||||||||||

| As at | Common Shares(3) (16) | DSUs(4) | Total Common Shares and DSUs | Total Market Value of Common Shares and DSUs(5) | Minimum Shareholding Requirements(6) | Meets Requirement | |||||||||||||||||

| Mar. 9, 2021 | 14,500 | 44,291 | 58,791 | $1,761,966 | $540,000 | Yes | |||||||||||||||||

| Mar. 4, 2020 | 14,500 | 37,932 | 52,432 | $1,296,119 | |||||||||||||||||||

| Change | Nil | 6,359 | 6,359 | $465,847 | |||||||||||||||||||

| Charles M. Herington | ||||||||||

Age 61 Miami, Florida, United States Director since May 2018 Independent(1) | |||||||||||

Charles M. Herington is the Chief Operating Officer, Vice-Chairman and President of Global Operations at Zumba Fitness LLC, a worldwide provider of dance fitness classes. Mr. Herington sits on the Board of Directors of Molson Coors Beverage Company, a multinational drink and brewing company. Mr. Herington is also a member of the boards of the following privately held companies: Quirch Foods, where he acts as Chairman; HyCite Enterprises; Accupac; and Klox Technologies. From 2006 to 2012, Mr. Herington served as Executive Vice-President of Developing and Emerging Markets Group at Avon Products Inc. Prior to that, he was President and Chief Executive Officer of America Online (AOLA) Latin America, and before that Division President at Pepsico Restaurants Latin America. Mr. Herington began his career in brand management at The Procter & Gamble Company. Mr. Herington received a Chemical Engineering Degree from Instituto Tecnológico y de Estudios Superiores de Monterrey. | |||||||||||

Areas of Expertise: •International •Corporate Development •Executive Leadership •Human Resources | Board/Committee Membership and Attendance in 2020(2) | Public Board Memberships | |||||||||

| Board of Directors | 100% | Molson Coors Beverage Company - Global drink and brewing company | |||||||||

| Corporate Governance and Social Responsibility Committee | 100% | ||||||||||

| Compensation and Human Resources Committee | 100% | ||||||||||

| Voting Results | In Favour | ||||||||||

| 2020 | 98.86% | ||||||||||

| 2019 | 96.7% | ||||||||||

| Securities Held | |||||||||||||||||||||||

| As at | Common Shares(3) | DSUs(4) | Total Common Shares and DSUs | Total Market Value of Common Shares and DSUs(5) | Minimum Shareholding Requirement(6) | Meets Requirement | |||||||||||||||||

| Mar. 9, 2021 | 5,200 | 21,212 | 26,412 | $791,568 | $540,000 | Yes | |||||||||||||||||

| Mar. 4, 2020 | 5,200 | 10,660 | 15,860 | $392,059 | |||||||||||||||||||

| Change | Nil | 10,552 | 10,552 | $399,509 | |||||||||||||||||||

MANAGEMENT INFORMATION CIRCULAR 14

| ELECTION OF DIRECTORS - NOMINEES | ||||

| Luc Jobin | ||||||||||

Age 61 Montréal, Québec, Canada Director since February 2020 Independent(1) | |||||||||||

Luc Jobin has had a career as a business leader in Canada spanning over 30 years. Mr. Jobin retired from Canadian National Railway Company, a leading North American transportation and logistics company, where he served as President and Chief Executive Officer from 2016 to 2018 and as Executive Vice-President and Chief Financial Officer from 2009 to 2016. Prior to that, Mr. Jobin was Executive Vice-President of Power Corporation of Canada, a Canadian multinational diversified management and holding company with interests in the financial services, asset management, sustainable and renewable energy, and other business sectors. Previously, Mr. Jobin was Chief Executive Officer of Imperial Tobacco Canada, a subsidiary of British American Tobacco p.l.c., a multinational cigarette and tobacco manufacturing company, as well as Executive Vice-President and Chief Financial Officer. Mr. Jobin currently serves on the Board of Directors of British American Tobacco p.l.c., where he has been appointed Chairman Designate and will serve as Chairman of the Board effective in April 2021. Mr. Jobin also serves on the Board of Directors of Hydro-Québec, a public utility company that manages the generation, transmission and distribution of electricity in Québec. Mr. Jobin is a Chartered Professional Accountant and he received a Graduate Diploma in Public Accounting from McGill University as well as a Bachelor of Science Degree from Nova Southeastern University. | |||||||||||

Areas of Expertise: •Financial Accounting/Auditing •Corporate Development •Executive Leadership •Manufacturing/Supply Chain | Board/Committee Membership and Attendance in 2020(2) | Public Board Memberships | |||||||||

| Board of Directors | 100% | British American Tobacco p.l.c - Global cigarette and tobacco manufacturing company | |||||||||

| Audit and Finance Committee | 100% | ||||||||||

| Compensation and Human Resources Committee | 80% | ||||||||||

| Voting Results | In Favour | ||||||||||

| 2020 | 99.53% | ||||||||||

| 2019 | Nil | ||||||||||

| Securities Held | |||||||||||||||||||||||

| As at | Common Shares(3) | DSUs(4) | Total Common Shares and DSUs | Total Market Value of Common Shares and DSUs(5) | Minimum Shareholding Requirement(6) | Meets Requirement | |||||||||||||||||

| Mar. 9, 2021 | Nil | 8,255 | 8,255 | $247,402 | $540,000 | No(13) | |||||||||||||||||

| Mar. 4, 2020 | Nil | — | — | $— | |||||||||||||||||||

| Change | Nil | 8,255 | 8,255 | $247,402 | |||||||||||||||||||

| Craig A. Leavitt | ||||||||||

Age 60 Red Hook, New York, United States Director since May 2018 Independent(1) | |||||||||||

| Craig Leavitt has had a career as a business leader in the retail sector that spans over 30 years. Mr. Leavitt most recently served as Chief Executive Officer of Kate Spade & Company, a designer and marketer of fashion accessories and apparel, from 2014 to 2017, where he oversaw all aspects of the Kate Spade New York and Jack Spade businesses and was a member of Kate Spade’s Board of Directors. He first joined Kate Spade in 2008 as Co-President and Chief Operating Officer and was named Chief Executive Officer in 2010. Mr. Leavitt led the successful $2.4 billion divestiture of Kate Spade & Company to Coach, Inc. in 2017 and integrated his team into the new company. Previously, Mr. Leavitt was President of Global Retail at Link Theory Holdings, a company that manufactures and sells contemporary clothing and accessories for men and women. At Link Theory Holdings, Mr. Leavitt was responsible for merchandising, operations, planning, allocation and real estate for the Theory and Helmut Lang retail businesses. He also spent several years at Diesel, an Italian retail clothing company, where he was most recently Executive Vice-President of Sales and Retail, and he spent 16 years at Polo Ralph Lauren, known for its clothing, marketing and distribution of products in apparel, home accessories and fragrances, where he held positions of increasing responsibility, including Executive Vice-President of Retail Concepts. Mr. Leavitt serves on the Boards of Directors of Build-A-Bear Workshop Inc., a global, interactive retail destination for creating customizable stuffed animals, where he is Non-Executive Chair, and Crate & Barrel, an industry-leading home furnishings specialty retailer. Mr. Leavitt holds a Bachelor of Arts Degree from Franklin & Marshall College. | |||||||||||

Areas of Expertise: •Executive Leadership •International •Retail Sales/Distribution •Marketing/Advertising | |||||||||||

Board/Committee Membership and Attendance in 2020(2) | Public Board Memberships | ||||||||||

| Board of Directors | 100% | Build-A-Bear Workshop, Inc. - Retailer of plush animals | |||||||||

| Audit and Finance Committee | 100% | ||||||||||

| Compensation and Human Resources Committee | 100% | ||||||||||

| Voting Results | In Favour | ||||||||||

| 2020 | 99.26% | ||||||||||

| 2019 | 98.25% | ||||||||||

| Securities Held | |||||||||||||||||||||||

| As at | Common Shares(3) | DSUs(4) | Total Common Shares and DSUs | Total Market Value of Common Shares and DSUs(5) | Minimum Shareholding Requirement(6) | Meets Requirement | |||||||||||||||||

| Mar. 9, 2021 | Nil | 12,761 | 12,761 | $382,447 | $540,000 | No(12) | |||||||||||||||||

| Mar. 4, 2020 | Nil | 5,199 | 5,199 | $128,519 | |||||||||||||||||||

| Change | Nil | 7,562 | 7,562 | $253,928 | |||||||||||||||||||

MANAGEMENT INFORMATION CIRCULAR 15

| ELECTION OF DIRECTORS - NOMINEES | ||||

| Anne Martin-Vachon | ||||||||||

Age 59 Trois-Rivières, Québec, Canada Director since February 2015 Independent(1) | |||||||||||

| Anne Martin-Vachon became the Chief Retail Officer for Rogers Communications Inc. in September 2019. Prior to that Ms. Martin-Vachon served as President of Today's Shopping Choice, a division of Rogers Media, for over three years. Before joining Rogers, Ms. Martin-Vachon held various executive positions in the consumer packaged goods and retail industry, including Chief Merchandising, Planning and Programming Officer at HSN, Inc., a leading interactive multi-channel entertainment and lifestyle retailer; Chief Marketing Officer at Nordstrom, Inc., a leading fashion specialty retailer operating 293 stores in 38 U.S. states; Chief Executive Officer at Lise Watier Cosmétiques, Inc., a Canadian-based beauty and skincare company; and Chief Marketing Officer at Bath & Body Works, LLC, which operates retail stores for personal care products. Ms. Martin-Vachon began her career at The Procter & Gamble Company, a multinational consumer goods corporation, where she spent more than 20 years in a variety of leadership positions across the company's portfolio of beauty, personal care and household brands. Ms. Martin-Vachon holds a Master of Business Administration from McGill University and earned a Bachelor of Arts degree in business administration at the University of Québec in Trois-Rivières. | |||||||||||

Areas of Expertise: •Retail Sales/Distribution •Marketing/Advertising •Strategy •Executive Leadership | Board/Committee Membership and Attendance in 2020(2) | Public Board Memberships | |||||||||

| Board of Directors | 100% | None | |||||||||