Form 6-K Crescent Point Energy For: Apr 09

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of

April 2021

Commission File Number 001-36258

Crescent Point Energy Corp.

(Name of Registrant)

Suite 2000, 585-8th Avenue S.W.

Calgary, Alberta, T2P 1G1

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

DOCUMENTS FURNISHED AS PART OF THIS FORM 6-K:

1

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Crescent Point Energy Corp. | ||

| (Registrant) | ||

| By: | /s/ Ken Lamont | |

| Name: | Ken Lamont | |

| Title: | Chief Financial Officer | |

Date: April 9, 2021

2

EXHIBITS

| Exhibit No. | Description | |

| 99.1 | Notice of Annual General Meeting | |

| 99.2 | Management Information Circular – Proxy Statement for the Annual General Meeting of Shareholders | |

| 99.3 | Notice & Access Notification to Shareholders | |

| 99.4 | Form of Proxy | |

| 99.5 | Virtual AGM User Guide |

3

Exhibit 99.1

NOTICE OF OUR ANNUAL GENERAL MEETING

TO BE HELD ON THURSDAY, MAY 20, 2021

DUE TO THE ONGOING COVID-19 PANDEMIC THE MEETING WILL BE HELD ENTIRELY IN A VIRTUAL FORMAT.

You are entitled to vote by proxy. See the ‘Solicitation of Proxies’ section on page 4 of this information circular for information.

You are invited to our 2021 annual general meeting:

| When | Thursday, May 20, 2021 |

| 10:00 am MT | |

| Where | Live audio webcast: https://web.lumiagm.com/478426363 |

| Meeting Password | "crescent2021" (case sensitive) |

| Your vote matters | If you held Crescent Point common shares on April 8, 2021, you are entitled to receive notice of, attend, and to vote at this meeting. |

The business of the meeting is to:

| 1. | Receive and consider the financial statements for the year ended December 31, 2020, together with the auditor's report; |

| 2. | Fix the number of directors to be elected at the meeting at ten; |

| 3. | Elect directors for the coming year or until their successors are duly elected or appointed; |

| 4. | Appoint the auditors for the coming year and to authorize the Board of Directors ("Board") to fix their remuneration for 2021; |

| 5. | Adopt an advisory resolution accepting our approach to executive compensation; and |

| 6. | Transact other business as may properly be brought forward. |

To proactively address the health impact of COVID-19 and in alignment with the current restrictions on public gatherings, the meeting will be conducted in a virtual-only format. Registered shareholders, and duly appointed proxyholders, will have the opportunity to participate in the meeting by way of a live webcast. This webcast, which is intended to permit social distancing in accordance with public health restrictions, will allow registered shareholders to participate, ask questions, and vote at the meeting through an online portal. Accordingly, if you are a registered shareholder, you may choose to participate via the live webcast of the meeting through the online portal at https://web.lumiagm.com/478426363. Non-registered (or beneficial) shareholders may also listen to a live webcast of the meeting through https://web.lumiagm.com/478426363, but will not have the ability to vote virtually or ask questions through the live webcast unless they are duly appointed and registered as proxyholders.

You can access our 2020 financial statements and other documents and information online:

| www.crescentpointenergy.com | www.sedar.com (SEDAR) | www.sec.gov/edgar.shtml (EDGAR) |

By order of the Board of Directors,

/s/ Craig Bryksa

Craig Bryksa

Director, President and Chief Executive Officer

Calgary, Alberta

April 8, 2021

Exhibit 99.2

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | i

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | ii

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | iii

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | iv

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | v

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | vi

Table of Contents

| Executive Summary | |

| Executive Summary | i |

| Letter to Shareholders | |

| Letter to Shareholders | v |

| Shareholder and Voting Information | |

| Notice of Meeting | 2 |

| Meeting and Voting Information | 4 |

| Business of the Meeting | |

| Fixing Number of Directors | 9 |

| Election of Directors | 9 |

| Appointment of Auditors | 9 |

| Advisory Vote on Executive Compensation | 10 |

| Board and Governance Highlights | |

| Board and Governance Highlights | 12 |

| Director Nominees and Compensation | |

| Director Nominee Biographies | 15 |

| Director Experience and Education | 25 |

| Director Orientation and Training | 29 |

| Director Tenure and Board Renewal | 29 |

| Director Compensation Plan Description | 30 |

| Director Compensation Tables | 35 |

| Board and Committee Structure | |

| Board Mandate | 38 |

| Board Committees | 39 |

| Corporate Governance | |

| Commitment to Diversity | 48 |

| Key Policies | 49 |

| Environmental, Social and Governance | 51 |

| COVID-19 Pandemic Response | 57 |

| Executive Compensation | |

| Executive Summary | 58 |

| Executive Compensation Highlights | 61 |

| Approach to Executive Compensation | 62 |

| 2020 Corporate Performance | 69 |

| 2020 Compensation | 71 |

| 2020 NEO Compensation | 79 |

| Executive Compensation Tables | 88 |

| Termination and Change of Control Benefits | 93 |

| Other Information | |

| Other Information | 96 |

| Appendix A: Board of Directors Mandate | 101 |

| Appendix B: Deferred Share Unit Plan | 103 |

| Appendix C: Restricted Share Bonus Plan | 104 |

| Appendix D: Stock Option Plan | 107 |

| Appendix E: Performance Share Unit Plan | 110 |

| Appendix F: PSU Peer Group | 112 |

| ESG Highlights | |

| We demonstrate our purpose “Bringing energy to our world - the right way” through our ESG practices. Our ESG efforts are reflected throughout this information circular. | |

| Key highlights include: | |

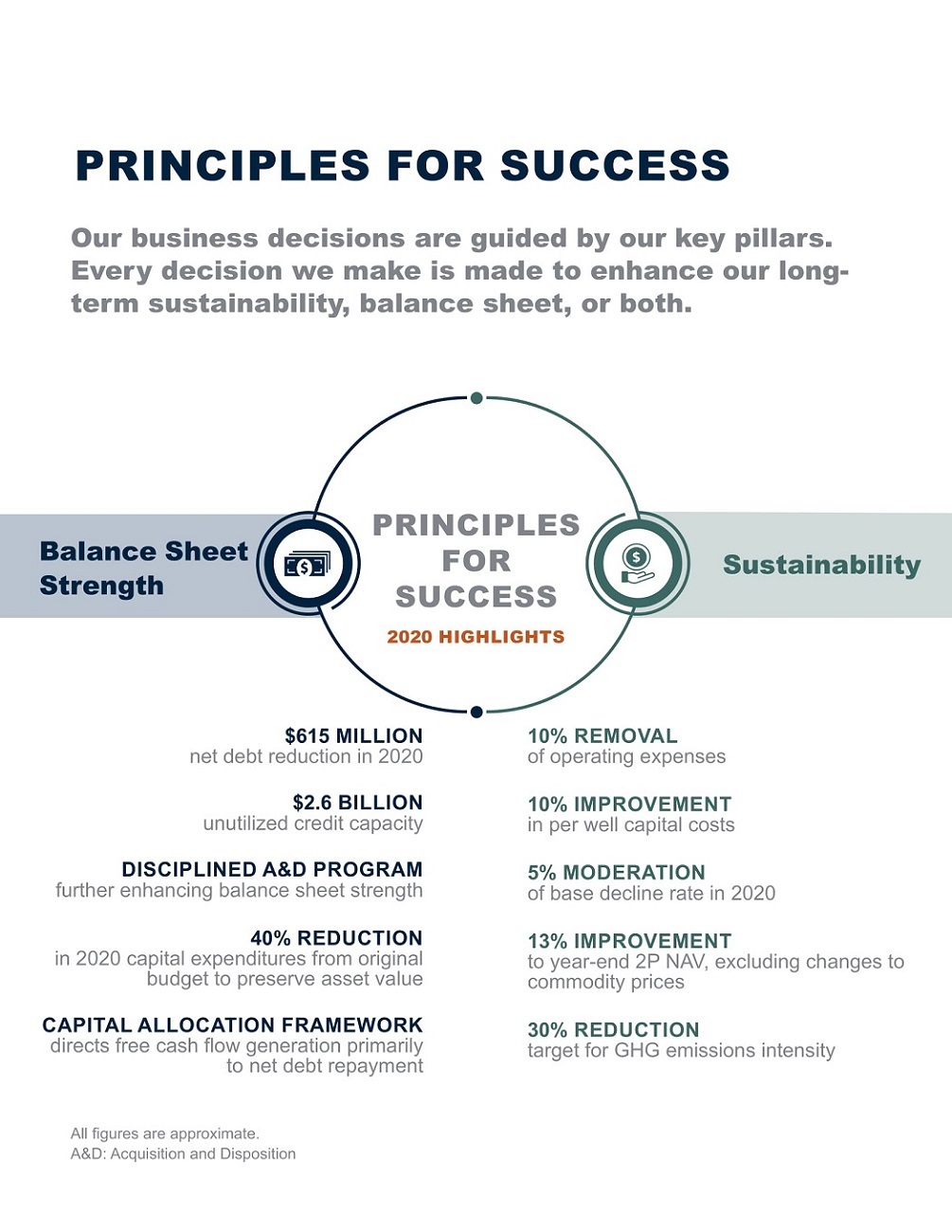

| Our Purpose and Principles for Success | i-ii |

| Risk Management in Action | iv |

| Message to Shareholders | v-vi |

| Board Skills and Continuing Education | 25 |

| ES&S Committee | 44 |

| Commitment to Diversity | 48 |

| ESG Policy and Matters | 51 |

| 2020 Corporate Performance | 69 |

| STIP Scorecard | 73 |

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 1

NOTICE OF OUR ANNUAL GENERAL MEETING

TO BE HELD ON THURSDAY, MAY 20, 2021

DUE TO THE ONGOING COVID-19 PANDEMIC THE MEETING WILL BE HELD ENTIRELY IN A VIRTUAL FORMAT.

You are entitled to vote by proxy. See the ‘Solicitation of Proxies’ section on page 4 of this information circular for information.

You are invited to our 2021 annual general meeting:

| When | Thursday, May 20, 2021 |

| 10:00 am MT | |

| Where | Live audio webcast: https://web.lumiagm.com/478426363 |

| Meeting Password | “crescent2021” (case sensitive) |

| Your vote matters | If you held Crescent Point common shares on April 8, 2021, you are entitled to receive notice of, attend, and to vote at this meeting. |

The business of the meeting is to:

| 1. | Receive and consider the financial statements for the year ended December 31, 2020, together with the auditor’s report; |

| 2. | Fix the number of directors to be elected at the meeting at ten; |

| 3. | Elect directors for the coming year or until their successors are duly elected or appointed; |

| 4. | Appoint the auditors for the coming year and to authorize the Board of Directors (“Board”) to fix their remuneration for 2021; |

| 5. | Adopt an advisory resolution accepting our approach to executive compensation; and |

| 6. | Transact other business as may properly be brought forward. |

To proactively address the health impact of COVID-19 and in alignment with the current restrictions on public gatherings, the meeting will be conducted in a virtual-only format. Registered shareholders, and duly appointed proxyholders, will have the opportunity to participate in the meeting by way of a live webcast. This webcast, which is intended to permit social distancing in accordance with public health restrictions, will allow registered shareholders to participate, ask questions, and vote at the meeting through an online portal. Accordingly, if you are a registered shareholder, you may choose to participate via the live webcast of the meeting through the online portal at https://web.lumiagm.com/478426363. Non-registered (or beneficial) shareholders may also listen to a live webcast of the meeting through https://web.lumiagm.com/478426363, but will not have the ability to vote virtually or ask questions through the live webcast unless they are duly appointed and registered as proxyholders.

You can access our 2020 financial statements and other documents and information online:

| www.crescentpointenergy.com | www.sedar.com (SEDAR) | www.sec.gov/edgar.shtml (EDGAR) |

By order of the Board of Directors,

/s/ Craig Bryksa

Craig Bryksa

Director, President and Chief Executive Officer

Calgary, Alberta

April 8, 2021

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 2

ABOUT THE TERMS IN THIS DOCUMENT

| ● | annual meeting, meeting, and AGM refer to the 2021 annual meeting of our shareholders |

| ● | Board, directors, executives, and management mean those positions of Crescent Point |

| ● | common shares mean Crescent Point’s common shares |

| ● | performance share units, or PSUs, mean performance shares granted pursuant to the company’s Performance Share Unit Plan (“PSU Plan”) |

| ● | restricted shares, or RSUs, mean restricted shares granted pursuant to the company’s Restricted Share Bonus Plan (“RSBP”) |

| ● | information circular refers to this Information Circular – Proxy Statement |

| ● | shareholders means holders of Crescent Point common shares |

| ● | we, us, our, company, and Crescent Point mean Crescent Point Energy Corp. and, where applicable, its subsidiaries and other entities controlled, directly or indirectly, by Crescent Point |

| ● | you and your refer to the shareholder |

| ● | All dollar amounts are in Canadian dollars, unless indicated otherwise |

| ● | Information is as of March 16, 2021, unless indicated otherwise |

| ● | The fair value or market value of common shares is calculated using the one-day volume-weighted average common share price on the Toronto Stock Exchange (“TSX”), unless indicated otherwise |

| ● | For additional information see ‘Non-GAAP Financial Measures’ and ‘Forward-Looking Statements and Reserves Data’ on pages 98 and 99 of this information circular. |

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 3

MEETING AND VOTING INFORMATION

Solicitation of Proxies

This information circular is supplied in connection with the solicitation of proxies by management of Crescent Point’s management for use at our AGM to be held online at https://web.lumiagm.com/478426363 for the purposes as described in the ‘Notice of Annual Meeting of our Shareholders’ section on page 2 of this information circular.

Instruments of proxy or voting instructions must be received by Crescent Point, or its agents, not less than 48 hours (excluding Saturdays, Sundays and holidays) before our meeting. Registered shareholders may submit their vote by:

|

Mail: Computershare Trust Company of Canada Attention: Proxy Department 8th floor, 100 University Avenue Toronto, Ontario M5J 2Y1 | |

|

Internet: Go to www.investorvote.com and enter the 15-digit control number printed on your form of proxy and follow the instructions on the web page to vote your shares. | |

|

Phone: Call 1-866-732-8683 (toll-free in North America) and enter the 15-digit control number printed on your form of proxy. Follow the instructions provided by the interactive voice recognition system to vote your shares. | |

|

In person via Internet Webcast: Registered shareholders and non-registered shareholders who have appointed themselves proxyholder (see Notice to Beneficial Shareholders below) have the ability to participate, ask questions, and vote at the meeting using the LUMI meeting platform. Eligible shareholders may log in at https://web.lumiagm.com/478426363, click on “I have a Control Number”, enter the 15-digit control number found on the proxy accompanying the information circular, and the password “crescent2021” (case sensitive), then click on the “Login” button. During the meeting, you must ensure you are connected to the internet at all times in order to vote when polling is commenced on the resolutions put before the meeting. It is your responsibility to ensure internet connectivity. Non-registered shareholders who are not attending the meeting in person may listen to a live webcast of the meeting by going to the same URL as above and clicking on “I am a guest”. |

Following the conclusion of the formal business to be conducted at the meeting, we will invite questions and comments from shareholders attending in person or registered shareholders participating through the LUMI meeting platform. Shareholders participating through the LUMI platform may submit questions at any time during the meeting.

To ensure the meeting is conducted in a manner that is fair to all shareholders, the Chair of the meeting may exercise discretion in responding to the questions, including the order in which the questions are answered, the grouping of the questions and the amount of time devoted to any question.

Shareholders participating through the LUMI platform will be afforded the same opportunities to participate, as if they were attending in person. The questions and answers from the Question and Answer (“Q&A”) session will be included in the replay posted on Crescent Point’s website following the meeting.

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 4

Shareholders will be able to participate in the meeting using an internet-connected device such as a laptop, computer, tablet or mobile phone. In order to run the meeting platform, you will need the latest version of Chrome, Safari, Edge or Firefox, that are running the most updated version of the applicable software plugins and that meet the minimum applicable system requirements.

If you are accessing the meeting, you must remain connected to the internet at all times during the meeting in order to vote when balloting commences. It is your responsibility to ensure internet connectivity for the duration of the meeting. Note that, if you lose connectivity once the meeting has commenced, there may be insufficient time to resolve your issue before ballot voting is completed. Even if you plan to attend the meeting, you should consider voting your shares in advance so that your vote will be counted in case you later decide not to attend the meeting or in the event that you experience any technical difficulties and are unable to access the meeting and vote for any reason.

Shareholders with questions regarding the virtual meeting portal or requiring assistance accessing the meeting website may visit the website https://www.lumiglobal.com/faq for additional information.

The deadline for deposit of proxies may be waived or extended by the Chair of the meeting at his or her discretion, without notice.

The costs incurred in the preparation and mailing of this information circular and related materials will be borne by Crescent Point. In addition to solicitation by mail, proxies may be solicited by personal meetings, telephone, or other means of communication and by directors, officers, and employees of Crescent Point, who will not be specifically compensated for such solicitations.

We have engaged Kingsdale Advisors (“Kingsdale”) to provide strategic shareholder advisory and proxy solicitation services and will pay fees of approximately $43,923 to Kingsdale for its services and additional out-of-pocket expenses. We may also reimburse brokers and other persons holding shares in their name or in the name of nominees for the costs incurred when sending proxy material to their principals in order to obtain their proxies. You can contact Kingsdale by email at [email protected] or by telephone at 1-888-518-6559 (toll-free in North America) or at 1-416-867-2272 (collect call for shareholders outside North America).

Record Date

Our Board has fixed the record date for the meeting as the close of business on April 8, 2021. If you held one or more shares on that date, you are entitled to receive notice of, attend, and vote at the meeting. Each outstanding common share on that date is entitled to one vote.

Voting by Proxy

Voting by proxy is the easiest way to vote. It means you are giving someone else (i.e. your proxyholder) the authority to attend the meeting and vote for you according to your instructions. It is your right to appoint a person or company of your choosing to represent you at the meeting and vote accordingly. Craig Bryksa, President and Chief Executive Officer (“CEO”), or failing him, Ken Lamont, Chief Financial Officer (“CFO”), each (with full power of substitution) have agreed to act as Crescent Point proxyholders to vote your shares at the meeting according to your instructions.

If you do not name a different proxyholder when you sign your form, you are authorizing Mr. Bryksa or Mr. Lamont to act as your proxyholder to vote for you at the meeting according to your instructions.

Voting recommendations:

| ● | FOR fixing the number of directors to be elected at the annual meeting at ten; |

| ● | FOR the election of the persons nominated to serve as directors; |

| ● | FOR the appointment of PricewaterhouseCoopers LLP as auditors; and |

| ● | FOR the advisory resolution to accept Crescent Point’s approach to executive compensation. |

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 5

Notice to Beneficial Holders of Common Shares

You are a beneficial holder if your shares are held in the name of a nominee. That is, your certificate was deposited with a bank, trust company, securities broker, trustee, or other institution. Only proxies deposited by registered shareholders of Crescent Point can be recognized and acted upon at the meeting. If you are a beneficial shareholder, your package includes a voting instruction form that outlines how to vote. Common shares held by brokers or their nominees can only be voted upon with the instructions of the beneficial shareholder. Without specific instructions, the Canadian broker/nominees are prohibited from voting common shares for their clients. When a broker is unable to vote on a proposal because it is non-routine and the owner of the common shares does not provide voting instructions, a “broker non-vote” occurs. Broker non-votes have no effect on the vote on such a proposal because they are not considered present and entitled to vote. Beneficial shareholders cannot be recognized at the meeting for the purposes of voting the common shares in person, via internet webcast, or by way of proxy except as outlined below.

Your broker is required by law to receive voting instructions from you before voting your shares. Every broker has their own mailing procedures and instructions for returning the completed voting instruction form, so be sure to follow the instructions provided on the form. Most brokers delegate responsibility for obtaining instructions from their clients to Broadridge Investor Communications Corporation (“Broadridge”). Broadridge mails the proxy materials and voting instruction form to beneficial shareholders, at our expense. The voting instruction form will name the same Crescent Point representatives listed above in the section ‘Voting by Proxy’ to act as Crescent Point proxyholders.

Additionally, we may use Broadridge’s QuickVoteTM service to assist beneficial shareholders with voting their shares. Beneficial shareholders may be contacted by Kingsdale to obtain voting instructions directly over the telephone. Broadridge then tabulates the results of all the instructions received and provides the appropriate instructions respecting the shares to be represented at the meeting.

If you are a beneficial shareholder and wish to participate online or vote at the meeting you must appoint yourself as proxyholder by inserting your own name in the space provided on the form of proxy or voting instruction form sent to you by your intermediary, and follow all of the applicable instructions provided by your intermediary AND, to be able to participate in the meeting online, you must also register yourself as your proxyholder, as described below. By doing so, you are instructing your intermediary to appoint you as proxyholder. Non-registered shareholders who have not appointed themselves as proxyholder (and registered as instructed below) cannot vote online during the Meeting. This is because we and our transfer agent, Computershare, do not maintain the records for non-registered shareholders and we have no knowledge of your shareholdings or entitlement to vote unless you appoint yourself as proxyholder.

Online Proxyholder Voting

After voting by proxy (mail or online), if you appointed yourself or someone else to vote at the meeting, then you MUST also visit www.computershare.com/KPYQ by 10:00 a.m. (MDT) on May 18, 2021 and provide Computershare with the required proxyholder contact information, so that Computershare may provide the proxyholder with a control number via email. Without a control number, proxyholders will not be able to attend and vote online at the Meeting.

Notice to Holders of Common Shares in the United States (“US”)

If you are a non-registered shareholder located in the United States and wish to vote at the Meeting or, if permitted, appoint a third party as your proxyholder, then you must obtain a valid legal proxy from your intermediary. Follow the instructions from your intermediary included with the legal proxy form and the voting information form sent to you, or contact your intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a valid legal proxy from your intermediary, you must then submit such legal proxy to Computershare. Requests for registration from non-registered shareholders located in the United States that wish to vote at the Meeting or, if permitted, appoint a third party as their proxyholder must be sent by e-mail or by courier to: [email protected] (if by e-mail), or Computershare, Attention: Proxy Dept., 8th Floor, 100 University Avenue, Toronto, ON M5J 2Y1, Canada (if by courier), and in both cases, must be labeled “Legal Proxy” and received no later than the voting deadline of 10:00 a.m. MDT on May 18, 2021.

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 6

Our solicitation of proxies is not subject to the requirements of Section 14(a) of the United States Securities Exchange Act of 1934, as amended (the “US Exchange Act”), by virtue of an exemption applicable to proxy solicitations by “foreign private issuers” as defined in Rule 3b-4 under the US Exchange Act. Accordingly, this information circular has been prepared in accordance with the applicable disclosure requirements in Canada. Residents of the United States of America should be aware that requirements are different than those of the US-applicable proxy statements under the US Exchange Act.

It may be difficult for you to enforce your rights and any claim you may have arising under US federal securities laws, since we are located outside the US and some or all of our officers and directors are residents of a country other than the US. You may not be able to sue or effect service of process upon a non-US entity or its officers or directors in a non-US court for violations of US securities laws. It may be difficult to compel a non-US entity and its affiliates to subject themselves to a US court’s judgment or to enforce a judgment obtained from a US court against the issuer.

This document does not address any income tax consequences of the disposition of Crescent Point shares by shareholders. Shareholders in a jurisdiction outside of Canada should be aware that the disposition of shares by them may have tax consequences both in those jurisdictions and in Canada, and are urged to consult their tax advisors with respect to their particular circumstances and the tax considerations applicable to them.

Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, and are subject to auditing and auditor independence standards in Canada. Such consequences for the Crescent Point’s shareholders who are resident in, or citizens of, the US may not be described fully in this Information Circular.

Revocability of Proxy

A submitted proxy may be revoked at any time prior to it being exercised. If you have followed the process for attending the meeting and are a registered shareholder and voting at the meeting online, voting at the meeting online will revoke your previous proxy. In addition to revocation in any other manner permitted by law, a proxy may be revoked by an instrument in writing executed by yourself (or your attorney authorized in writing) or, in the case of a shareholder that is a corporation, under the corporate seal or by a duly authorized officer or attorney. The revocation of proxy can be deposited either at Crescent Point’s head office (Suite 2000, 585 8 Avenue S.W., Calgary, Alberta, Canada) at any time up to and including the last business day preceding the day of the meeting at which the proxy is to be used, or with the Chair of the meeting on the day of the meeting, at which point the submitted proxy is revoked.

Notice-and-Access

We have elected to use the Notice-and-Access Provisions under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (the “Notice-and-Access Provisions”) for the annual meeting in respect of mailings to beneficial shareholders of common shares but not in respect of mailings to registered holders of our common shares (i.e. a shareholder whose name appears on our records). The Notice-and-Access Provisions are a set of rules developed by the Canadian Securities Administrators that reduce the volume of materials which are mailed to shareholders by allowing a reporting issuer to post online an information circular in respect of a meeting of its shareholders and related materials.

More specifically, we have elected to use procedures known as ‘stratification’ in relation to our use of the Notice-and-Access Provisions. As a result, registered shareholders will receive a paper copy of the Notice of Annual Meeting, this information circular and a form of proxy, whereas beneficial shareholders will receive a notice containing information prescribed by the Notice-and-Access Provisions and a voting instruction form. In addition, a paper copy of the Notice of Annual Meeting, this information circular, and a voting direction will be mailed to those shareholders who do not hold their common shares in their own name but who have previously requested to receive paper copies of these materials. Furthermore, a paper copy of the financial information in respect of our most recently completed financial year was mailed to those registered and beneficial shareholders who previously requested to receive such information.

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 7

We will be delivering proxy-related materials to non-objecting beneficial shareholders directly with the assistance of Broadridge. We intend to pay for intermediaries to deliver proxy-related materials to objecting beneficial shareholders.

Common Shares and Principal Holders Thereof

Crescent Point is authorized to issue an unlimited number of common shares. As at March 16, 2021, 530,366,572 common shares were issued and outstanding. To the best of the knowledge of the Board, there is no person or corporation that beneficially owns, directly or indirectly, or exercises control or direction over common shares carrying more than 10% of the voting rights attached to the issued and outstanding common shares that may be voted at the meeting. None of Crescent Point’s issued share capital consists of non-voting shares.

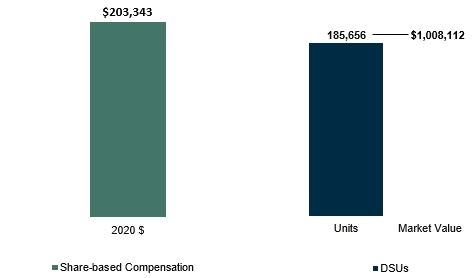

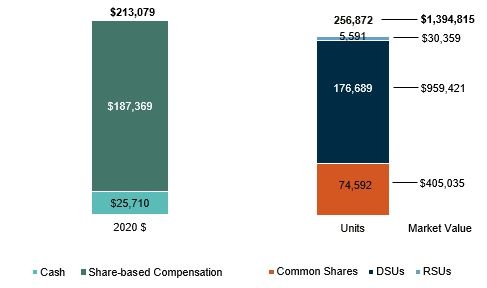

As of March 16, 2021, our directors and officers (“D&O”) owned, directly or indirectly, 1,126,336 common shares, or 0.21% of the outstanding common shares, having a market value of approximately $6.1 million, 1,313,581 Deferred Share Units (“DSUs”), having a market value of $7.1 million and 2,012,922 Restricted Share Units (“RSUs”), having a market value of approximately $10.9 million. In addition to their current ownership, officers are also aligned with common shareholders as a significant portion of their compensation is linked to share price performance (71% of President and CEO and 58% of other NEO pay mix, on average). Directors and officers are subject to a share ownership requirement policy. All directors and officers meet or exceed their ownership requirements. For more information see the ‘Director Ownership Requirements’ and ‘Executive Ownership Requirements’ sections on page 34 and 90 of this information circular.

Quorum for the Meeting

We must have a quorum for the meeting to proceed. Quorum constitutes two people present, in person, at the meeting, who are entitled to vote at the meeting and represent at least 25% of the issued and outstanding Crescent Point common shares. The two people are entitled to vote in their own right, by proxy, or as a duly authorized representative of a shareholder. For the purpose of the quorum requirements, a person attending the meeting by electronic means, telephone or other communication facility that permits all participants to hear each other or otherwise communicate with each other during the meeting, shall be deemed to be present at the meeting.

Approval Requirements

All of the matters to be considered at the meeting, except for the election of directors, are ordinary resolutions requiring approval by more than 50% of the votes cast in respect of the resolution by or on behalf of shareholders present in person or represented by proxy at the meeting. The election of directors is conducted on a “for” and “withhold” basis and pursuant to our Majority Voting Policy.

Report on Voting Results

Crescent Point will publicly disclose the results, including voting percentages, of all votes held at the meeting. In addition, the applicable voting results for the election of the directors of the company at our 2020 AGM are disclosed in the “Director Biographies” section on page 15 of this information circular.

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 8

MATTERS TO BE ACTED UPON AT THE MEETING

| 1. | Fixing Number of Directors |

We propose that the number of directors of Crescent Point to be elected at the AGM to hold office until the next meeting or until their successors are elected or appointed, subject to the Articles and By-Laws of Crescent Point, be set at ten. There are presently ten directors, and each will stand for re-election to office at the meeting.

We recommend that you vote FOR fixing the number of directors to be elected at the meeting at ten.

Unless otherwise directed, the persons named in the enclosed form of proxy intend to vote the common shares represented thereby FOR setting the number of directors to be elected at the meeting at ten.

| 2. | Election of Directors |

The Articles of Crescent Point presently provide for a minimum of one director and a maximum of 11 directors. There are currently ten directors. Shareholders are entitled to elect members to the Board by vote at a meeting of shareholders.

The ten nominees proposed for election as directors of Crescent Point are as follows:

Barbara Munroe (Chair)

Craig Bryksa

Laura A. Cillis

James E. Craddock

John P. Dielwart

Ted Goldthorpe

Mike Jackson

Jennifer F. Koury

François Langlois

Myron M. Stadnyk

Voting for the election of directors will be conducted on an individual, not a slate, basis.

We recommend that you vote FOR the election of each of the foregoing nominees as directors.

Unless otherwise directed, the persons named in the enclosed form of proxy intend to vote the common shares represented thereby FOR the election of each of these nominees unless the shareholder specifies authority to do so is withheld.

| 3. | Appointment of Auditors |

Shareholders will be asked to pass an ordinary resolution to re-appoint PricewaterhouseCoopers LLP as our auditors, to hold office until the next annual meeting of shareholders at a remuneration to be determined by the Board. PricewaterhouseCoopers LLP have acted as the auditors of Crescent Point and Crescent Point Energy Trust since September 2003.

We recommend that you vote FOR the appointment of PricewaterhouseCoopers LLP as the auditors of Crescent Point to hold office until the next annual meeting of shareholders at a remuneration to be determined by the Board.

Unless otherwise directed, the persons named in the enclosed form of proxy intend to vote FOR the appointment of PricewaterhouseCoopers LLP as auditors of Crescent Point.

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 9

| 4. | Advisory Vote on Executive Compensation |

Our Board believes that shareholders should have the opportunity to fully understand the philosophy and objectives that guide the executive compensation decisions made by the Human Resources and Compensation Committee (“HRCC”) and the Board. Executive compensation is a key component of our corporate governance and it is our intention that this shareholder advisory vote will continue to form an integral part of the Board’s shareholder engagement process around executive compensation.

While we received support through the ‘say on pay’ in the 2020 AGM, with approximately 80% of votes in favour of our 2019 approach to executive compensation, we have continued to implement compensation plan improvements in 2020. We remain committed to actively soliciting shareholder feedback on our approach to compensation and ensuring executive compensation design links pay outcomes to the execution of our business strategy.

In 2020, we made the following improvements to our compensation design:

Compensation Plan Improvements

| ✓ | Reset compensation programs around market median. |

| ✓ | Introduced a market typical Short-Term Incentive Plan (“STIP”) design, where corporate performance is evaluated between 0% to 200% of target. The 2020 STIP scorecard evaluates corporate goal achievement above and below target. The Board rigorously ensured each goal and target included stretch targets and that missing/exceeding a target would warrant a below/above target payout. |

| ✓ | Increased the focus and weighting applied to the Environmental, Social & Governance (“ESG”) goals in the STIP scorecard. |

| ✓ | Enhanced the STIP design to further drive a pay for performance culture throughout the organization and link compensation to cultural tenets, behaviors, and achievement of individual and corporate goals. |

| ✓ | Aligned savings plan contribution levels to market and introduced a matching component. |

Amendments to the RSBP

| ✓ | Added a double-trigger to the change of control provision for grants of restricted shares, in alignment with the company’s other long-term incentive plans. The officers also agreed to have the double-trigger apply retroactively to all outstanding grants to officers. |

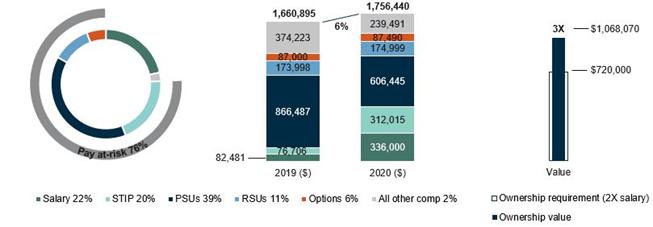

In 2020, Crescent Point’s management team continued to focus on returns, capital discipline, and cost saving initiatives, thereby significantly strengthening the balance sheet and enhancing shareholder value and sustainability despite an extremely challenging and volatile year. Although management’s performance in 2020 was strong, when determining management’s achievement the Board exercised downward discretion in order to ensure the impact of the shifting macro environment on our stakeholders was taken into account when determining NEO compensation. The following decisions were made:

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 10

Board and Executive Compensation Decisions:

| ✓ | Board compensation reductions: ● Lowered director compensation by reducing the cash component of the Board retainer by 15% effective April 1, 2020, for the remainder of the year. |

| ✓ | Executive salary reductions: ● Lowered executive compensation by reducing the CEO’s salary by 15% and all other Executive salaries by 10% effective May 1, 2020, for the remainder of the year. |

| ✓ | Reduced STIP award value: ● Reduced STIP corporate achievement component: The Board exercised downward discretion to reduce the corporate achievement multiplier under the 2020 STIP from 139% to 100%.

● Reduced STIP individual achievement component: The Board exercised downward discretion to reduce the individual achievement multiplier under the 2020 STIP for Named Executive Officers (“NEOs”), resulting in a year-over-year reduction to total direct compensation.(1)

|

Note:

| (1) | All NEO total direct compensation was reduced with the exception of Mr. Holt’s due to payments related to his relocation from the US and forgone compensation from his previous employer. |

For more information, see the ‘Executive Compensation Discussion and Analysis’ section on page 58 of this information circular.

As this is an advisory vote, the results will not be binding on the Board. Although the Board, and specifically the HRCC, will not be obligated to take any compensation actions or make any adjustments to executive compensation plans as a result of the vote, we place a great deal of importance on our shareholders’ views and we commit to take further action as deemed appropriate. We will disclose the results of the shareholder advisory vote as a part of our report on voting results for the meeting.

Form of Resolution Adopting Advisory Vote on Executive Compensation

At the meeting, shareholders will be asked to adopt the following by ordinary resolution:

“BE IT RESOLVED THAT, on an advisory basis and not to diminish the role and responsibilities of the company’s Board, the shareholders accept the company’s approach to executive compensation disclosed in the information circular of the company dated April 8, 2021.”

We recommend that you vote FOR the advisory vote on executive compensation.

Unless otherwise directed, the persons named in the enclosed form of proxy intend to vote the common shares represented thereby FOR the resolution as set out above.

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 11

| BOARD AND GOVERNANCE HIGHLIGHTS |

| Page | ||

| Board Composition and Policies | ||

| ✓ | Independent directors (nine or 90% - all except the President and CEO) | 13 |

| ✓ | Board is 100% refreshed since 2014 | 29 |

| ✓ | Every meeting has an in-camera session with independent directors | 13 |

| ✓ | Share ownership requirements for directors and officers | 33 |

| ✓ | Director orientation and continuing education | 25 |

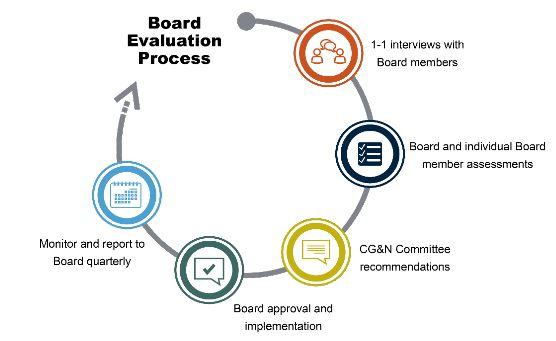

| ✓ | Formal Board evaluation process | 41 |

| ✓ | Majority Voting Policy | 13 |

| Shareholder Rights | ||

| ✓ | Annual election of directors | 9 |

| ✓ | Directors elected individually (not by slate) | 9 |

| Governance | ||

| ✓ | Separate Board Chair and President and CEO | 38 |

| ✓ | Fully independent Audit, Corporate Governance and Nominating, HRCC, and Reserves Committees | 39 |

| ✓ | Board succession planning | 41 |

| ✓ | President and CEO evaluation and management succession planning | 43 |

| ✓ | Commitment to Diversity | 48 |

| ✓ | Code of Business Conduct and Ethics Policy | 49 |

| ✓ | Anti-hedging Policy | 49 |

| Compensation | ||

| ✓ | Annual advisory vote on executive compensation | 10 |

| ✓ | Director participation restrictions | 31 |

| ✓ | Solicit feedback from third party consultants and shareholders | 64 |

| ✓ | Executive incentive compensation Clawback Policy | 93 |

| Environmental, Social and Governance Matters | ||

| ✓ | Safety Culture - Our commitment to safe operations | 52 |

| ✓ | Stakeholder Engagement - Outreach to stakeholders | 53 |

| ✓ | Community Engagement - Positively impacting our communities | 54 |

| ✓ | Employee Engagement - Annual survey to solicit feedback and effect positive change | 54 |

| ✓ | Environmental Stewardship - Responsibly enhancing environmental performance | 56 |

In addition to complying with the corporate governance guidelines applicable to all public companies in Canada set forth in National Policy 58-201 – Corporate Governance Practices (“NP 58-201”) and National Instrument 58-101 – Disclosure of Corporate Governance Practices (“NI 58-101”), we are required to comply with the provisions of the Sarbanes-Oxley Act of 2002 and the rules adopted by the US Securities and Exchange Commission (the “SEC”) pursuant to that Act, as well as the governance rules of the New York Stock Exchange (“NYSE”), in each case, as applicable to foreign private issuers like Crescent Point, and as modified by the Multijurisdictional Disclosure System for eligible Canadian companies. Crescent Point may choose to opt out of certain NYSE corporate governance practices and follow home practice rules instead, but we are required to disclose the significant differences between our corporate governance practices and the requirements applicable to US issuers. These significant differences are disclosed on our website www.crescentpointenergy.com. Except as disclosed on our website, we are in compliance with the NYSE corporate governance standards in all significant respects.

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 12

| DIRECTOR NOMINEES AND COMPENSATION |

Nominees

Our director nominees bring vast experience in areas critical to our success. The ‘Director Biographies’ section on page 15 of this information circular outlines the name, residence, and age of each of the ten individuals nominated for election as our directors, the period served as a director of Crescent Point, their principal occupation, Board meeting attendance, committee membership and attendance, the voting results of the 2020 AGM, compensation earned, common shares owned, value at-risk, including common shares, RSUs, and DSUs, ownership requirement achievement and their other public board experience.

Independence and Alignment with Shareholders

All directors, except for Mr. Bryksa, President and CEO, are independent as determined in accordance with applicable Canadian securities laws and NYSE requirements. The Board used a detailed annual questionnaire to assist in determining if a director is independent.

In addition, the directors standing for re-election meet their share ownership requirement given that non-employee directors have five years from their initial election or appointment date to comply with our share ownership policy requirements. Where an individual is appointed to Chair of the Board, he or she will be afforded an additional three years from the effective date of the appointment to reach the new Minimum Share Ownership Guideline. Where the Policy is amended to change the Minimum Share Ownership Guideline by the Board, the impacted individuals will be afforded an additional two years from the effective date of the amendment to reach the new Minimum Share Ownership Guideline.

The company’s Code of Business Conduct and Ethics contains robust conflict of interest provisions, including the obligation of directors and officers to report conflicts and potential conflicts of interest to the Board and the CFO. The company’s Corporate Sourcing and Procurement Policy and Procedure also includes detailed policies and procedures to address conflicts or potential conflicts of interest between the company and its suppliers and its potential suppliers.

Individual Voting and Majority Voting Policy

Director nominees are voted for on an individual, not a slate, basis. In addition, the Board has adopted a “majority voting” policy that meets the requirements of the TSX and requires any director nominee who receives a greater number of votes “withheld” than votes “for” his or her election to submit his or her resignation for consideration promptly after the AGM. The Board will review the results of the vote and determine whether to accept the resignation within 90 days. Absent exceptional circumstances, the Board will accept the resignation, which resignation will be effective upon acceptance. A press release, provided to the TSX in advance, will be promptly issued disclosing the Board’s decision, including, if applicable, the reason for not accepting the resignation. The policy does not apply in circumstances involving contested director elections. A director who tenders a resignation pursuant to this policy will not participate in any Board or committee meetings at which the resignation is considered.

Attendance and Sessions without Management

Crescent Point directors attended 100% of Board and committee meetings in 2020. Each Board, Audit Committee, Corporate Governance and Nominating Committee, HRCC, and Reserves Committee meeting is either held entirely without members of management present or includes an in-camera session without management present. A majority of the number of directors appointed constitutes a quorum at any meeting of directors. Notwithstanding any vacancy among the directors, a quorum of directors may exercise all the powers of the directors and no business may be transacted by the Board at a meeting of its members unless a quorum is present.

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 13

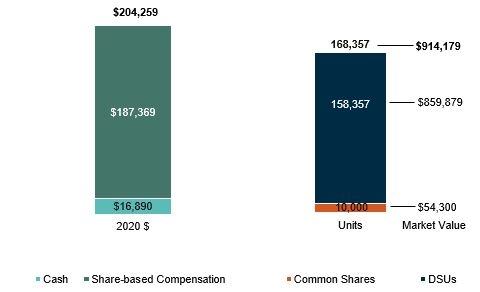

Director Compensation Adjustments

In 2020, non-employee directors were paid Board and committee membership retainers. To align with the impact the shifting macro environment had on our stakeholders and to lead by example in support of the company’s cost reduction efforts, the Board reduced the cash component of director compensation, the Board and management reduced executive salaries, and the company implemented other general and administrative (“G&A”) and cost reduction initiatives. Accordingly, the cash component of the Board retainer was reduced by 15%, effective April 1, 2020. Total fees earned in 2020 were $649,657 in aggregate compared to $1,037,771 in 2019 due to the reduction to director compensation in 2020 and changes in Board membership.

Detailed information on our director nominees, compensation and other important information can be found on the following pages:

| Topic | Page Number | |

| Director Biographies | 15 | |

| Director Experience and Education | 25 | |

| Director Compensation Plan Description | 30 | |

| Director Compensation Tables | 35 |

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 14

DIRECTOR BIOGRAPHIES

| BARBARA MUNROE | CHAIR/INDEPENDENT DIRECTOR |

Calgary, Alberta, Canada

Age: 57

Director since: 2016 |

Ms. Barbara Munroe has worked as a lawyer since being admitted to the Law Society of Alberta in 1991 and brings 28 years of legal experience and industry diversification to the Board. Prior to retiring in March 2019, Ms. Munroe served as Executive Vice President, Corporate Services and General Counsel for WestJet Airlines, a position she held since November 2016. Ms. Munroe joined WestJet in November 2011 as Vice President & General Counsel and was promoted to Senior Vice President, Corporate Services & General Counsel in June 2015. She was the Assistant General Counsel, Upstream at Imperial Oil Ltd. from 2008 to 2011, and the Senior Vice President, Legal/IP & General Counsel, Corporate Secretary for SMART Technologies Inc. from 2000 to 2008. Prior to that, Ms. Munroe practiced at a national law firm.

Ms. Munroe holds the ICD.D designation and is a member of the Institute of Corporate Directors. She holds a Bachelor of Commerce, Finance degree and a Bachelor of Law degree both from the University of Calgary.

Ms. Munroe serves on each committee in an ex officio capacity, effective January 1, 2020. |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

|

Position | Meetings | Attendance | |

| Board of Directors | Chair | 8 of 8 | 100% | |

| Meets ownership requirement:(1)(2) | Yes | |||

| Compensation | Value at Risk(3)(4) |

| |

Other Public Boards

None

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 15

| CRAIG BRYKSA | NON-INDEPENDENT DIRECTOR |

Calgary, Alberta, Canada

Age: 44

Director since: 2018 |

Mr. Bryksa is responsible for Crescent Point’s overall leadership, vision, and purpose, and in conjunction with our Board, develops the company’s strategic initiatives and the Company’s business plan. Mr. Bryksa’s responsibilities include overall accountability for operating our business while managing risk and creating long-term sustainable value for our shareholders.

Mr. Bryksa was appointed President and Chief Executive Officer on September 5, 2018, and was promoted to interim President and Chief Executive Officer on May 29, 2018. Prior to his promotion, he was Vice President, Engineering West. Mr. Bryksa has held a number of senior management roles with Crescent Point since joining the company in 2006 as an Exploitation Engineer. Through these roles, Mr. Bryksa had directly overseen the development and operations of each of Crescent Point’s core assets prior to his appointment as President and Chief Executive Officer.

Mr. Bryksa has significant experience as a professional engineer in the oil and gas industry, working for companies such as Enerplus Resources Fund and McDaniel & Associates Consultants. Mr. Bryksa is a member of the Association of Professional Engineers and Geoscientists of Alberta and Association of Professional Engineers and Geoscientists of Saskatchewan. He holds a Bachelor of Applied Science degree in petroleum engineering from the University of Regina. |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

|

Position | Meetings | Attendance | |

| Board of Directors | Member | 8 of 8 | 100% | |

| ES&S | Member | 4 of 4 | 100% | |

| Meets ownership requirement: | Yes | |||

| Compensation(5) | Value at Risk(3)(4)(6) |

Mr. Bryksa receives no compensation for his role as a director |

|

| Other Public Boards | ||

| None | ||

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 16

| LAURA A. CILLIS | INDEPENDENT DIRECTOR |

Nelson, BC, Canada

Age: 62

Director since: 2014 |

Ms. Laura A. Cillis has more than 25 years of experience working in publicly traded, primarily international, organizations and has a broad range of leadership, corporate governance and financial experience. Ms. Cillis is currently a Director and member of the Audit and the Nominating & Corporate Governance committees at Western Forest Products Inc. She is also on the Board of Shawcor Ltd. and is a member of its Compensation & Occupational Development Committee as well as Chair of its Audit Committee.

Ms. Cillis was a Director and member of the Governance and Human Resources Committee at Solium Capital Inc., as well as Audit Committee Chair until its sale in May 2019. Ms. Cillis was also a director and member of the Audit Committee of Enbridge Income Fund Holdings Inc. from July 2016 until its privatization in November 2018 and was a director and member of the Audit, Finance and Risk Committee and Chair of the Safety & Reliability Committee for the related Enbridge Income Fund group of companies. She previously served as Senior Vice President, Finance and Chief Financial Officer for Calfrac Well Services Ltd. from November 2008 to June 2013. Prior thereto, she was the Chief Financial Officer of Canadian Energy Services L.P. since January 2006. Ms. Cillis is a CPA, CA, holds the ICD.D designation granted by the Institute of Corporate Directors, and is a member of Financial Executives International. Ms. Cillis earned her Bachelor of Commerce degree from the University of Alberta. |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

|

Position | Meetings | Attendance | |

| Board of Directors | Member | 8 of 8 | 100% | |

| Audit | Chair | 4 of 4 | 100% | |

| HRCC | Member | 5 of 5 | 100% | |

| Meets ownership requirement:(1)(2) | Yes | |||

| Compensation | Value at Risk(3)(4) |

| |

| Other Public Boards: |

Shawcor Ltd.: Audit Committee (Chair), Compensation & Occupational Development Committee Western Forest Products Inc.: Audit Committee, Nominating & Corporate Governance Committee |

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 17

| JAMES E. CRADDOCK | INDEPENDENT DIRECTOR | |

Whitney, Texas, US

Age: 62

Director since: 2019 |

Mr. James E. Craddock is a seasoned upstream executive who possesses broad-based technical knowledge with over 30 years of experience. He served on Noble Energy Inc.’s board of directors since its merger with Rosetta Resources Inc. from 2015 until 2020 and served as the Chairman, Chief Executive Officer and President of Rosetta from 2013 to 2015. Previously, he was the Executive Director and Chief Operating Officer for BPI Industries Inc. and held several positions of increasing responsibility over a 20-year career at Burlington Resources Inc.

In addition to being a member of the Audit and Reserves committees, Mr. Craddock was appointed Chair of the Corporate Governance and Nominating Committee effective January 1, 2020. He holds a Bachelor of Science in Mechanical Engineering from Texas A&M University and previously served on the Boards of Templar Energy and the Texas Railroad Commission’s Eagle Ford Task Force. | |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

|

Position | Meetings | Attendance | |

| Board of Directors | Member | 8 of 8 | 100% | |

| Audit | Member | 4 of 4 | 100% | |

| CG&N | Chair | 4 of 4 | 100% | |

| Reserves | Member | 2 of 2 | 100% | |

| Meets ownership requirement:(1)(2) | Yes | |||

| Compensation | Value at Risk(3)(4) |

| |

| Other Public Boards | ||

| None | ||

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 18

| JOHN P. DIELWART | INDEPENDENT DIRECTOR |

Calgary, Alberta, Canada

Age: 68

Director since: 2019 |

Mr. John P. Dielwart brings a wealth of experience and knowledge to Crescent Point’s Board developed through his varied 40-year career in the oil and gas sector. Most notably, Mr. Dielwart is a founding member of ARC Resources Ltd., holding the position of Chief Executive Officer from 2001 to 2013. He is also a partner in ARC Financial Corp., sitting on its Investment and Governance Committees where he provides leadership support on various complex issues, including internal governance and investment decision-making. Mr. Dielwart is also Chairman of the Board of TransAlta Corporation. Prior to joining ARC in 1996, Mr. Dielwart spent 12 years with a major Calgary-based oil and natural gas engineering consulting firm, as Senior Vice-President and a director, where he gained extensive technical knowledge of oil and natural gas properties in Western Canada.

Mr. Dielwart has a Bachelor of Science degree in Civil Engineering with Distinction from the University of Calgary. He is a professional engineer, holds the ICD.D designation granted by the Institute of Corporate Directors and has served two three-year terms as a Governor of the Canadian Association of Petroleum Producers, including 18 months as Chair. |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

|

Position | Meetings | Attendance | |

| Board of Directors | Member | 8 of 8 | 100% | |

| ES&S | Chair | 4 of 4 | 100% | |

| Reserves | Member | 2 of 2 | 100% | |

| Meets ownership requirement:(1)(2) | Yes | |||

| Compensation | Value at Risk(3)(4) |

| |

| Other Public Boards | ||

| TransAlta Corporation: Board Chair | ||

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 19

| TED GOLDTHORPE | INDEPENDENT DIRECTOR |

New York, NY, US

Age: 44

Director since: 2017 |

Mr. Ted Goldthorpe is a financial professional who has been serving as Partner in charge of Global Credit Business for BC Partners since February 2017. Prior thereto, he was the President of Apollo Investment Corporation, Chief Investment Officer of Apollo Investment Management, and Senior Portfolio Manager, US Opportunistic Credit from April 2012 to August 2016. Previously, Mr. Goldthorpe was employed by Goldman Sachs & Co., where he held a variety of positions since joining the firm in 1999. Mr. Goldthorpe joined the Board of Crescent Point in May 2017 and has been serving as the CEO and Board Chairman of Mount Logan Capital Inc and Portman Ridge Finance Corporation since 2018.(7)

Mr. Goldthorpe received a B.A. in Commerce from Queen’s University and is a frequent guest lecturer at leading universities across North America. Mr. Goldthorpe currently serves on the Global Advisory Board for the Queen’s School of Business, serves on the Canadian Olympic Foundation, and serves on the board of directors for Her Justice and Capitalize for Kids. |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

|

Position | Meetings | Attendance | |

| Board of Directors | Member | 8 of 8 | 100% | |

| Audit | Member | 4 of 4 | 100% | |

| CG&N | Member | 4 of 4 | 100% | |

| Meets ownership requirement:(1)(2) | Yes | |||

| Compensation | Value at Risk(3)(4) |

| |

| Other Public Boards(7) | ||

Mount Logan: Board Chair Portman Ridge: Board Chair | ||

Note:

| (7) | Mr. Goldthorpe has been serving as the CEO and Board Chairman of Mount Logan Capital Inc and Portman Ridge Finance Corporation since 2018. Similar to other private equity funds, these two companies are simply public financing vehicles within his B.C. Partners funds specifically targeting various investor groups in multiple jurisdictions. Crescent Point remains his only external public board. |

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 20

| MIKE JACKSON | INDEPENDENT DIRECTOR |

Calgary, Alberta, Canada

Age: 59

Director since: 2016 |

Mr. Mike Jackson worked in the banking industry from 1984 to 2016 and brings more than 30 years of financial experience in corporate and investment banking. Most recently, he was Managing Director - Investment Banking, Scotiabank Global Banking and Markets, with a focus on the oil and gas industry from 2008 until his retirement in 2016. Prior to that, Mr. Jackson held several senior management roles at Scotiabank, including Managing Director, Oil & Gas Industry Head & Calgary Office Head from 1999 to 2007 and Vice President & Office Head, Corporate Banking Calgary from 1997 to 1999.

Mr. Jackson holds a Bachelor of Science degree and a Master of Business Administration, both from Dalhousie University. Additionally, Mr. Jackson completed the Executive Management Program at Queen’s University and holds the ICD.D designation granted by the Institute of Corporate Directors.

Mr. Jackson joined the Board in 2016 and chaired the HRCC from May 2017 to May 2020. |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

|

Position | Meetings | Attendance | |

| Board of Directors | Member | 8 of 8 | 100% | |

| Audit | Member | 4 of 4 | 100% | |

| CG&N | Member | 4 of 4 | 100% | |

| HRCC | Member | 5 of 5 | 100% | |

| Meets ownership requirement:(1)(2) | Yes | |||

| Compensation | Value at Risk(3)(4) |

| |

| Other Public Boards | ||

| None | ||

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 21

| JENNIFER F. KOURY | INDEPENDENT DIRECTOR |

Calgary, Alberta, Canada

Age: 60

Director since: 2019 |

Ms. Jennifer F. Koury has over 35 years of professional experience, holding various senior executive positions with BHP Billiton from 2011 to 2017. Part of her responsibilities included the development of BHP Billiton’s total rewards program for executives and employees of the Petroleum World-Wide Business. Prior to that, she was Vice President of Corporate Services for Enerplus Corp. from 2006 to 2011 and also held senior management positions with Imperial Oil/Exxon Mobil.

Ms. Koury serves as a Director and HRCC Chair for the Calgary Zoo, and Director for Women In Mining Canada in Toronto, Ontario. She holds a Bachelor of Commerce Degree from the University of Alberta and the ICD.D designation granted by the Institute of Corporate Directors. |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

|

Position | Meetings | Attendance | |

| Board of Directors | Member | 8 of 8 | 100% | |

| ES&S | Member | 4 of 4 | 100% | |

| HRCC | Chair | 5 of 5 | 100% | |

| Meets ownership requirement:(1)(2) | Yes | |||

| Compensation | Value at Risk(3)(4) |

| |

| Other Public Boards | ||

| None | ||

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 22

| FRANÇOIS LANGLOIS | INDEPENDENT DIRECTOR |

Calgary, Alberta, Canada

Age: 61

Director since: 2018 |

Mr. François Langlois is an oil and gas executive who brings more than 35 years of domestic and international experience to the Crescent Point Board, most recently from his role as Senior Vice President, Exploration & Production with Suncor Energy Inc., where he was responsible for the financial and operating performance of the group from 2011 until his retirement in 2016. Prior thereto, he was Vice President, Unconventional Gas from 2009 to 2010 and held various roles with Petro-Canada from 1982 to 2009, most recently as Vice President, Western Canada Production & North American Exploration.

Mr. Langlois holds a Bachelor of Geological Engineering from Laval University (Quebec City) and the ICD.D designation granted by the Institute of Corporate Directors. |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

|

Position | Meetings | Attendance | |

| Board of Directors | Member | 8 of 8 | 100% | |

| CG&N | Member | 4 of 4 | 100% | |

| ES&S | Member | 4 of 4 | 100% | |

| Reserves | Chair | 2 of 2 | 100% | |

| Meets ownership requirement:(1)(2) | Yes | |||

| Compensation | Value at Risk(3)(4) |

| |

| Other Public Boards | ||

| None | ||

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 23

| MYRON M. STADNYK | INDEPENDENT DIRECTOR |

Calgary, Alberta, Canada

Age: 58

Director since: 2020 |

Myron M. Stadnyk has over 35 years of oil and gas experience and is the former President and CEO of ARC Resources Ltd., retiring in 2020. Mr. Stadnyk was the first operations employee at ARC after the company’s initial public offering to progress to COO (2005), President (2009) and CEO (2013). Prior to ARC, Mr. Stadnyk worked with a major oil and gas company in both domestic and international operations.

Mr. Stadnyk holds a Bachelor of Science in Mechanical Engineering from the University of Saskatchewan and is a graduate of the Harvard Business School Advanced Management Program. He is a member of the Association of Professional Engineers and Geoscientists of Alberta and served as a Governor for the Canadian Association of Petroleum Producers for over 10 years. He also holds board positions for PrairieSky Royalty and the University of Saskatchewan Engineering Alumni Fund. |

| 2020 Voting Results | Board & Committee Membership | 2020 Attendance | ||

Appointed to Board after 2020 AGM |

Position | Meetings | Attendance | |

| Board of Directors | Member | 2 of 2 | 100% | |

| ES&S | Member | 1 of 1 | 100% | |

| HRCC | Member | 2 of 2 | 100% | |

| Reserves | Member | 1 of 1 | 100% | |

| Meets ownership requirement:(1)(2) | Yes | |||

| Compensation | Value at Risk(3)(4) |

| |

| Other Public Boards | ||

| PrairieSky: Governance and Compensation Committee (Chair), Reserves Committee | ||

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 24

| Notes: |

| (1) | Non-employee directors are required to own, within five years of the initial election, appointment to the Board Chair or appointment to the Board, at least three times their annual retainer in common shares, RSUs, and DSUs. Each director meets or exceeds this share ownership requirement as of March 16, 2021. See ‘Director Ownership Requirements’ on page 34 for details. |

| (2) | The value of RSUs and DSUs for the purpose of determining minimum ownership requirements is calculated as the greater of grant date value or current market value. Common shares are valued at the current market value as of March 16, 2021. |

| (3) | Value at risk reflects aggregate holdings (common shares, DSUs, and RSUs) and is calculated using the March 16, 2021 market value of $5.43 per share. |

| (4) | Includes holdings by associates and affiliates of directors. |

| (5) | Mr. Bryksa receives no compensation for his role as a director. All compensation he earned is related to his role as President and CEO. |

| (6) | Mr. Bryksa’s value at risk is calculated using the March 16, 2021 market value of $5.43 per share and includes RSUs and common shares. |

| (7) | Mr. Goldthorpe has been serving as the CEO and Board Chairman of Mount Logan Capital Inc and Portman Ridge Finance Corporation since 2018. Similar to other private equity funds, these two companies are simply public financing vehicles within his B.C. Partners funds specifically targeting various investor groups in multiple jurisdictions. Crescent Point remains his only external public board. |

DIRECTOR EXPERIENCE AND EDUCATION

Board Skills Matrix

The Corporate Governance and Nominating Committee (“CG&N Committee”) ensures that the Board includes members with relevant experience and expertise to ensure the Board is able to effectively fulfill its mandate. As part of our ongoing Board renewal process, we analyze this matrix as a means of identifying those potential candidates having the ideal qualifications to enhance the diversity of thought and the effectiveness of our Board. Collectively, our directors have the requisite skills and experience to oversee our ESG initiatives.

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 25

The skills matrix below shows the experience and expertise that each director nominee brings to our Board.

| Munroe (Chair) | Bryksa | Cillis | Craddock | Dielwart | Goldthorpe | Jackson | Koury | Langlois | Stadnyk | |||||||||||

| Independence | ||||||||||||||||||||

| Independent | Y | N | Y | Y | Y | Y | Y | Y | Y | Y | ||||||||||

| Demographics | ||||||||||||||||||||

| Director since | 2016 | 2018 | 2014 | 2019 | 2019 | 2017 | 2016 | 2019 | 2018 | 2020 | ||||||||||

| Age | 57 | 44 | 62 | 62 | 68 | 44 | 59 | 60 | 61 | 58 | ||||||||||

| Gender | F | M | F | M | M | M | M | F | M | M | ||||||||||

| Location | AB | AB | BC | US | AB | US | AB | AB | AB | AB | ||||||||||

| Board Membership | ||||||||||||||||||||

| Committees | Board Chair | ES&S | AU & HR | AU, CG & RE | ES&S & RE | AU & CG | AU, CG & HR | ES&S & HR | CG, ES&S & RE | ES&S, HR & RE | ||||||||||

| Attendance % | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | ||||||||||

| Ownership met | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | ||||||||||

| Voting results | 98.48% | 98.53% | 98.02% | 98.66% | 92.44% | 78.49% | 97.76% | 98.13% | 98.48% | N/A | ||||||||||

| Other public boards | — | — | 2 | — | 1 | 2(1) | — | — | — | 1 | ||||||||||

| Skills | ||||||||||||||||||||

Energy Industry Knowledge Deep understanding of the energy industry, including exploration, production and marketing aspects of the business |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

Environmental, Health and Safety Energy industry experience related to workplace health and safety, stakeholder communications, social responsibility, and the environment |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

Finance / Accounting Experience in financial reporting, accounting, and corporate finance at the management or executive level; Ability to critically assess, analyze, and interpret financial statements and projections and use them to guide strategic business decisions |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

Governance Deep understanding of corporate governance gained through experience as a senior executive officer or board member of a public or private organization |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

Human Resources / Compensation Experience related to human resources, compensation, talent management, and succession planning at the management or executive level |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

Risk Management Deep understanding of the various risks faced by organizations, including legal and regulatory, and experience identifying, evaluating, and mitigating those risks at the management or executive level |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Senior Leadership Experience leading an organization, major business segment, or functional area of the business |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

Strategic Management Experience related to planning and executing on strategy at the management or executive level |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

| Note: |

| (1) | Mr. Goldthorpe has been serving as the CEO and Board Chairman of Mount Logan Capital Inc and Portman Ridge Finance Corporation since 2018. Similar to other private equity funds, these two companies are simply public financing vehicles within his B.C. Partners funds specifically targeting various investor groups in multiple jurisdictions. Crescent Point remains his only external public board. |

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 26

Continuing Education

Each director is responsible for keeping informed on both the company and developments in the industry. Executives and/or other members of Crescent Point’s leadership team assist the directors in their efforts by providing regular updates on technical advancements, new resource plays, regulatory changes, and economic developments facing our business. Our President and CEO, other executives, and other members of the management team also regularly communicate with members of the Board on developments in the business, progress toward achieving established goals, and other relevant topics. In addition, external parties are utilized to provide market intelligence and other expert advice. These presentations, meetings, and discussions serve to increase the Board’s knowledge of the industry, the company and our business, and assist the Board in the execution of its duties.

When new directors join the Board, they are provided with materials and an introductory orientation that describes the Board’s role, its committees and directors, as well as the business and operations of the company in detail. Crescent Point also promotes continuing education of our directors through our corporate membership in the Institute of Corporate Directors (“ICD”), an organization which fosters excellence in directors to strengthen the governance and performance of Canadian businesses.

Below is a table outlining the continuing education activities our Board members engaged in during 2020.

| Category | Topic | Month | Presented by | Directors in Attendance | ||||

| Developing Board Effectiveness | February | ICD | Munroe | |||||

| Evaluating the CEO/CEO Succession Planning | February | ICD | Munroe | |||||

| COVID-19: What Canadian Directors Need to Know | March | ICD | Cillis | |||||

| Information Technology and Cybersecurity Risk | June | ICD | Munroe | |||||

| Board Education | Leading with Agility in Pandemic | October | Harvard Business Review | Stadnyk | ||||

| The Changing Role of the CEO and Corporations in Society | October | ICD | Koury | |||||

| Politics And Political Agendas: | November | Board Ready Women | Koury, Munroe & Stadnyk | |||||

| 7 events | 9 | |||||||

| Cornerstone Program | February | Willis Towers Watson | Jackson | |||||

| Role of the Compensation Committee | February | ICD | Munroe | |||||

| Executive Compensation Trends | June | ICD | Cillis & Koury | |||||

| Compensation | Executive Pay Trends & Issues | June | Hugessen | Cillis & Koury | ||||

| Executive Compensation 2020: Topics Arising from Recent Disruptions | October | ICD | Cillis & Koury | |||||

| HR & Compensation Committee Effectiveness | November | ICD | Stadnyk | |||||

| 6 events | 9 | |||||||

| Peters & Co. January Conference | January | Peters & Co. | Bryksa | |||||

| Scotiabank CAPP Energy Symposium | April | Scotiabank & CAPP | Bryksa & Jackson | |||||

| National Conference, Next Level Governance for the New Normal | May | ICD | Cillis | |||||

| Conferences | RBC Capital Markets Global Energy and Power Conference | June | Royal Bank of Canada | Bryksa | ||||

| NBF 2020 Virtual Energy Conference | September | National Bank Financial | Bryksa | |||||

| Conference for Audit Committees | December | Chartered Professional Accountants | Cillis | |||||

| 6 events | 7 |

Crescent Point Energy Corp. | 2021 | Information Circular - Proxy Statement | 27

| Beyond Compliance - Evolving Board Leadership | February | ICD | Jackson | |||||

| The ESG & Culture Imperative | February | TSX | Stadnyk | |||||

| ESG | Business Ethics in Challenging Times | June | Financial Executives International | Cillis | ||||

| Scotiabank ESG Conference and Sustainability Summit | June | Scotiabank | Koury | |||||

| The ICD Premiers Series - Alberta 2030 | November | ICD | Jackson & Koury | |||||

| 5 events | 6 | |||||||

| Directors and Officers Liability Insurance | February | ICD | Munroe | |||||

| Managing Enterprise Risk: Spotlight on Directors’ and Officers’ Liability | February | Blake, Cassels & Graydon LLP | Munroe | |||||

| Financial | Corporate Insurance Overview | March | Iridium Risk Services Evolved | Audit Committee | ||||

| What COVID-19 Means for Audit Committees | April | Ernst & Young | Cillis | |||||

| COVID-19: Implications for Audit Committee | June | ICD | Cillis | |||||

| Enterprise Risk Management | June | ICD | Munroe | |||||

| Current Issues in Internal Controls Over Financial Reporting | December | KPMG | Jackson | |||||

| 7 events | 10 | |||||||

| Market Update | January | Tudor Pickering Holt & Co | Entire Board | |||||

| Market Update | January | Bank of Montreal | Entire Board | |||||

| Navigating Turbulent Markets | March | Scotiabank Global Banking & Markets | Cillis & Jackson | |||||

| Global Markets | Market Update | July | RBC Dominion Securities | Entire Board | ||||

| Global Business Forum, The Climb Ahead Business Symposium | September | NFP Corporation, Doug & Lois Mitchell | Koury | |||||

| Market Update | September | Tudor Pickering Holt & Co | Entire Board | |||||

| Market Perspectives | October | Bank of Montreal | Entire Board | |||||

| Shifting Ground - The Collision of Business & Government Policy | November | ICD | Cillis | |||||

| 8 events | 51 | |||||||

| Energy Overview | January | CIBC Economist | Stadnyk | |||||

| Navigating Geo-security, Liquidity and Propaganda in Oil and Gas | February | Tudor Pickering Holt & Co | Jackson & Langlois | |||||

| Energy Turmoil - No Fooling Around | April | Tudor Pickering Holt & Co | Jackson | |||||