Form 6-K Cellectis S.A. For: May 19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date of Report: May 19, 2021

Commission File Number: 001-36891

Cellectis S.A.

(Exact Name of registrant as specified in its charter)

8, rue de la Croix Jarry

75013 Paris, France

+33 1 81 69 16 00

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

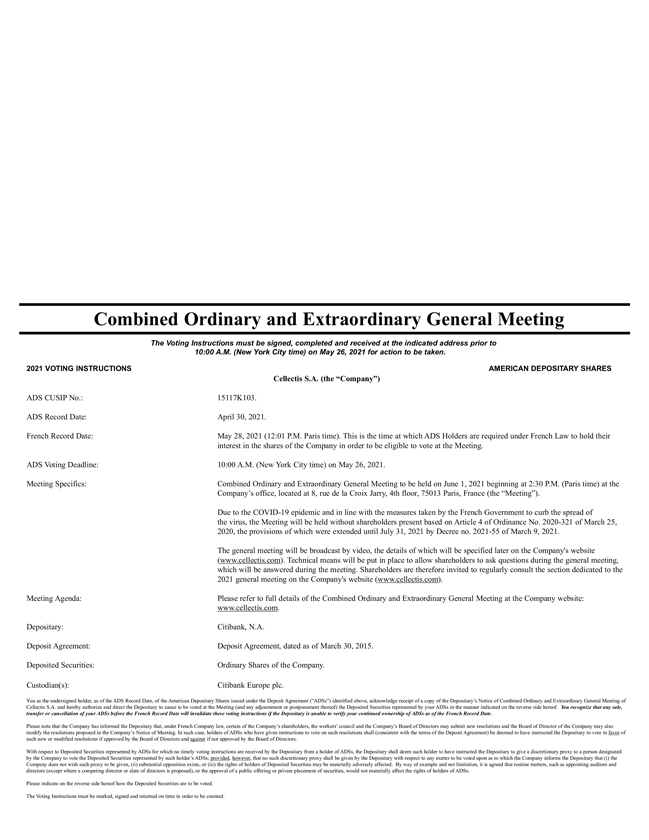

Combined Shareholders’ Meeting

Cellectis S.A. (the “Company”) previously announced that a Combined Ordinary and Extraordinary General Meeting (the “Meeting”) will be held on June 1, 2021 beginning at 2:30 p.m. (Paris time) at 8, rue de la Croix Jarry, 4th floor, 75013 Paris, France.

In connection with the Meeting, the following documents, which are attached as exhibits hereto, are being provided to the Company’s shareholders and holders of the Company’s American Depositary Shares, as applicable, and are incorporated by reference herein:

EXHIBIT INDEX

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CELLECTIS S.A. | ||||||

| (Registrant) | ||||||

| May 19, 2021 | By: | /s/ André Choulika | ||||

| André Choulika | ||||||

| Chief Executive Officer | ||||||

Exhibit 99.1

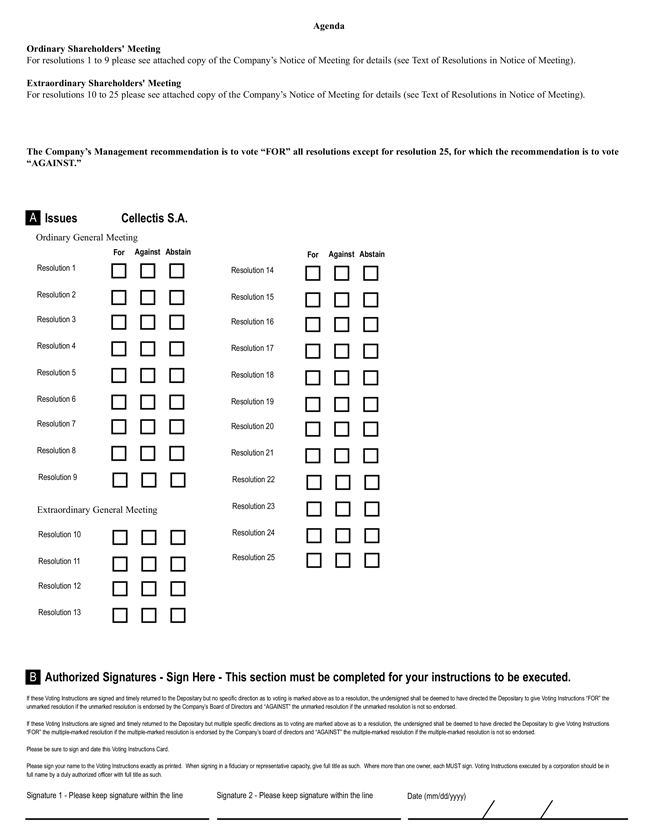

Non binding, unofficial English translation for information purposes only. Original in French. CELLECTIS A French limited liability company (société anonyme) with share capital of €2,273,065,50 Registered Office: 8, rue de la Croix Jarry—75013 Paris Paris Trade and Companies Register No. 428 859 052 (the “Company”) As shareholder of Cellectis, you are invited to attend the combined shareholder’s meeting to be held on June 1st, 2021 at 2:30 p.m., at Cellectis’ premises, located at 8, rue de la Croix Jarry, 4th floor, 75013 Paris, France. In the context of the Covid-19 pandemic and in accordance with Ordinance no. 2020-321 of March 25, 2020, the provisions of which were extended until July 31, 2021 by Decree no. 2021-255 of March 9, 2021, this general meeting will be held in closed session, i.e. without the physical presence of the shareholders and persons who are usually able to attend. The shareholders will therefore not be able to attend the said meeting in person, but will be able to be represented and vote under the conditions specified below. The general meeting will be broadcast by video, the details of which will be specified later on the Company’s website (www.cellectis.com). Technical means will be put in place to allow shareholders to ask questions during the general meeting, which will be answered during the meeting. Shareholders are therefore invited to regularly consult the section dedicated to the 2021 general meeting on the Company’s website (www.cellectis.com). The shareholder’s meeting is called to deliberate on the following agenda: Agenda of the ordinary shareholders’ meeting - management report of the board of directors, including the report on corporate governance, and presentation by the board of the annual financial statements for the financial year ended December 31, 2020, —statutory auditors’ reports on the annual financial statements and the agreements referred to in article L. 225-38 of the French commercial code, —approval of the annual financial statements for the financial year ended December 31, 2020, —statutory auditors’ reports on the consolidated financial statements for the financial year ended December 31, 2020, —group management report and presentation of the consolidated financial statements for the financial year ended December 31, 2020 by the board, —approval of the consolidated financial statements for the financial year ended December 31, 2020, —earnings allocation for the financial year ended December 31, 2020, 1 / 40

1 / 40

Non binding, unofficial English translation for information purposes only. Original in French. - review of the agreements referred to in articles L. 225-38 et seq. of the French commercial code,—setting of the amount of the total compensation to be granted to the non-executive directors, —renewal of the appointment of Mr. André Choulika as a member of the board of directors,—renewal of the appointment of Mr. David Sourdive as a member of the board of directors,—renewal of the appointment of Mr. Alain-Paul Godard as a member of the board of directors,—authorization to be given to the board of directors to buy back Company shares, Agenda of the extraordinary shareholders’ meeting - authorization to be granted to the board of directors to reduce the Company’s share capital by cancelling shares in the context of the authorization granted to the board of directors to buy back Company shares, —delegation of authority to be granted to the board of directors to increase the share capital by issuing ordinary shares or any securities, with cancellation of the shareholders’ preferential subscription rights, in favor of a category of persons meeting specified characteristics (investors having experience in the health or biotechnology sector), —delegation of authority to be granted to the board of directors to increase the share capital by issuing ordinary shares or any securities, with cancellation of the shareholders’ preferential subscription rights, in favor of a category of persons meeting specified characteristics (credit institution, investment services provider or syndicate member guaranteeing the completion of the considered issuance), —delegation of authority to be granted to the board of directors to increase the share capital by issuing ordinary shares or any securities, with cancellation of the shareholders’ preferential subscription rights, in favor of a category of persons meeting specified characteristics (industrial companies, institutions or entities active in the health or biotechnology sector), - delegation of authority to be granted to the board of directors to increase the share capital by issuing ordinary shares or any securities, with cancellation of the shareholders’ preferential subscription rights, in favor of a category of persons meeting specified characteristics, in the context of equity or bond financing, —delegation of authority to be granted to the board of directors to increase the share capital immediately or in the future by issuing ordinary shares or any securities giving access to the share capital, while preserving the shareholders’ preferential subscription rights, —delegation of authority to be granted to the board of directors to increase the share capital immediately or in the future by issuing ordinary shares or any securities giving access to the share capital, with cancellation of the shareholders’ preferential subscription rights, through a public offer (excluding offers referred to in paragraph 1° of article L. 411-2 of the French monetary and financial code), —delegation of authority to be granted to the board of directors to increase the share capital by issuing ordinary shares or any securities, with cancellation of the shareholders’ preferential subscription rights, through an offer referred to in paragraph 1° of article L. 411-2 of the French monetary and financial code, —delegation to be granted to the board of directors in order to increase the number of securities to be issued as a result of a share capital increase with or without preferential subscription rights performed pursuant to the aforementioned delegations, 2 / 40

2 / 40

Non binding, unofficial English translation for information purposes only. Original in French. - overall limitations to the amount of the share capital increases that could be completed pursuant to the aforementioned delegations, —delegation of authority to be granted to the board of directors to increase the share capital by way of incorporation of premiums, reserves, profits or others, —authorization to be granted to the board of directors to grant options to subscribe or purchase ordinary shares of Company shares, entailing a waiver by the shareholders of their preferential subscription rights, —authorization to be granted to the board of directors to grant free shares of the Company to employees and/or corporate officers of the Company and of its subsidiaries, entailing a waiver by the shareholders of their preferential subscription rights, —overall limitations to the amount of the share capital increases that could be completed pursuant to the above authorizations, —amendment of Article 18 of the by-laws relating to shareholders meetings (clarification of voting procedures) —delegation to be granted to the board of directors to increase the Company’s share capital for the benefit of employees who are members of a company savings plan(s) (plan d’épargne d’entreprise) implemented pursuant to articles L. 3332-1 and following of the French labor code. ooOoo Conditions for attending the General Meeting Any shareholder, regardless of the number of shares owned, may attend this General Meeting. Any shareholder may justify his right to participate in the shareholders’ meeting through the recording of the shares in the name of the shareholder or of the intermediary registered on his behalf, on May 28, 2021, at midnight, Paris time, either in the nominative securities’ accounts held by Société Générale, or in bearer accounts held by an authorized intermediary. The registration of shares in the bearer accounts held by an authorized intermediary is evidenced by a certificate of participation issued by the latter, attached to the remote voting form or proxy form or on behalf of the shareholder represented by the registered intermediary. In the context of the Covid-19 pandemic, this general meeting will take place in closed session, the shareholders will therefore not be able to attend meeting in person. Under these conditions, shareholders are invited to vote remotely, prior to the general meeting, by giving a proxy to the chairman or to any other natural or legal entity of their choice, or by returning the postal voting form. The shareholder has several ways in which to participate in the General Meeting. He may (1) personally attend the General Meeting or (2) participate remotely by giving a proxy to the Chairman or any other individual or legal entity of his choice, or by returning the postal voting form. Exceptionally, we invite you not to give a proxy to a third party to represent you at the meeting insofar as the meeting will be held without the physical presence of the shareholders and therefore of any third-party proxies, and to give preference to voting by mail or to give a proxy to the chairman. Given the uncertainty surrounding postal deadlines in the current circumstances, it is recommended that shareholders use, whenever possible, electronic means of communication in connection with their actions and communications relating to this general meeting. 3 / 40

3 / 40

Non binding, unofficial English translation for information purposes only. Original in French. Shareholders wishing to vote by mail or to give proxy to the chairman for registered shareholders: return the single voting form by post or by proxy, which will be sent to him with the convening notice, either by ordinary mail using the prepaid envelope attached to the convening notice or by e-mail to the following address: [email protected] by May 28, 2021 at the latest; for the holders of bearer shares: request this form from the intermediary who manages their shares, as from the date of notice of the meeting. The single voting form by post or by proxy must be accompanied by a certificate of participation issued by the financial intermediary and returned by the latter either by mail to the following address: Société Générale—Service assemblées – 32 Rue du Champ de Tir, CS 30812, 44308 Nantes Cedex 3 or by e-mail to the following address: [email protected] no later than May 28, 2021. Requests for the voting forms must reach Société Générale via the shareholder’s financial intermediary at one of the addresses indicated above, at least six days before the date of the meeting, i.e May 26, 2021. Only duly completed voting forms that are received at Société Générale at one the addresses indicated above at least three days before the scheduled date of the meeting, i.e. no later than May 28 2021, and accompanied by the certificate of participation issued by the authorized intermediaries for bearer shares will be taken into account. Shareholders wishing to give proxy to a third party: In accordance with the provisions of Article R.22-10-24 of the French Commercial Code, the notification of the appointment and revocation of a proxy representative can be made by electronic means, as follows: for registered shareholders: the shareholder must send an email to the following address: [email protected] specifying the full name, address and Societe Generale identifier for directly registered shareholders (information available at the top left of the account statement) or his or her identifier with his or her financial intermediary if he or she is a holder of administered registered shares and the full name and address of the appointed or revoked proxy; for holders of bearer shares: the shareholder must send an email to the following address: [email protected] specifying the full name, address and bank details as well as the full name and address of the appointed or revoked proxy. The shareholder must then imperatively ask the financial intermediary that manages his or her account to send written confirmation to Société Générale, Service Assemblées, 32 Rue du Champ de Tir, CS 30812, 44308 Nantes Cedex 3. In order for the duly signed and completed appointments or revocations of proxies to be validly taken into account, they must reach the Company or Société Générale no later than the day before the meeting, i.e. May 31, 2021, for both notifications made by post or by electronic means. The proxy holder sends his voting instructions for the exercise of his mandates in the form of a scanned copy of the single form, to Société Générale, by email to the following address: [email protected] The form must bear the surname, first name and address of the proxy, the words “As a proxy holder” The form must be dated and signed. Voting directions are indicated in the box “I vote by correspondence” of the form. The proxy must attach a copy of his or her identity card and, where appropriate, a power of attorney from the legal entity that he or she represents. To be taken into account, the electronic message must reach Société Générale no later than the fourth day before the date of the meeting, i.e. on May 28, 2021. 4 / 40

4 / 40

Non binding, unofficial English translation for information purposes only. Original in French. In addition, for its own voting rights, the proxy sends its voting instructions according to the usual procedures. It is stipulated that any shareholder having already cast a vote or sent a proxy: —notwithstanding Article III of Article R. 22-10-28 of the French Commercial Code and in accordance with Article 7 of Decree no. 2020-418 of April 10, 2020, as extended by Decree no. 2021-255 of March 9, 2021, any shareholder who has already cast a postal vote, sent a proxy or requested an admission card or a certificate of participation may choose another method of participation in the shareholders’ meeting, provided that his or her new instruction to this effect reaches Société Générale within the time limits specified in this notice. To this end, registered shareholders who wish to change their mode of participation are requested to send their new voting instruction by returning the single form, duly completed and signed, by e-mail to the following address: [email protected] (any other instruction sent to this address will not be taken into account). The form must indicate the shareholder’s identifier, name, first name and address, the words “New instruction—cancels and replaces” and be dated and signed. Registered shareholders must attach a copy of their identity card and, if applicable, a power of attorney from the legal entity they represent. Bearer shareholders are requested to contact their account-holding establishment, which will send the new instruction to Societe Generale, together with a certificate of participation proving their status as shareholders. —may at any time transfer all or part of its shares. If the transfer takes place before May 28, 2021 at midnight Paris time, the Company shall invalidate or amend, as appropriate, the vote cast by mail, the proxy, or the certificate of participation. For this purpose, the authorized intermediary holding the account shall notify the Company or its agent of the transfer and provide it with the necessary information. Written questions Pursuant to Articles L. 225-108 and R. 225-84 of the French commercial code, any shareholder may also submit written questions. These questions should be addressed by email to the following address: [email protected] or by registered letter with acknowledgement of receipt, addressed to the chairman of the board of directors, at the registered office: 8, rue de la Croix Jarry—75013 Paris. In accordance with Article 8-2 of Decree no. 2020-418 of April 10, 2020 as amended by Decree no. 2020-1614 of December 18, 2020, in order to be taken into account, written questions must be received before the end of the second business day preceding the date of the shareholders’ meeting, i.e. before midnight on May 28, 2021. These questions must be accompanied by a certificate of account registration. Furthermore, insofar as the general meeting is held without the physical presence of the shareholders, it is recalled that shareholders will not be able to propose new resolutions during the general assembly. Technical means will be put in place to enable shareholders to ask questions during the general meeting, which will be answered during the meeting. Shareholders are therefore invited to consult the section dedicated to the 2021 general meeting on the Company’s website on a regular basis. In accordance with the law, all documents that must be communicated in the context of general meetings are available to shareholders at the registered office and can be consulted on the Company’s website www.cellectis.com. __________ The board of directors 5 / 40

5 / 40

Non binding, unofficial English translation for information purposes only. Original in French. COMBINED SHAREHOLDERS’ MEETING OF JUNE 1, 2021 TEXT OF RESOLUTIONS FIRST RESOLUTION Approval of the annual financial statements for the financial year ended December 31, 2020 The shareholders’ meeting, voting under the quorum and majority conditions required for ordinary shareholders’ meetings, having reviewed the management report of the board of directors, including the report on corporate governance report, for the financial year ended December 31, 2020, as well as the statutory auditors’ reports on the annual financial statements and corporate governance, approves the annual financial statements for the financial year ended December 31, 2020 in the form in which they have been presented, which show a loss of € 35,081,836 as well as the transactions reflected in these financial statements and summarized in these reports, as well as the statutory auditors’ report thereon acknowledges that the financial statements do not show any expenses or charges referred to in article 39-4 of the French general tax code nor any excess depreciation. SECOND RESOLUTION Approval of the consolidated financial statements for the financial year ended December 31, 2020 The shareholders’ meeting, voting under the quorum and majority conditions required for ordinary shareholders’ meetings, having reviewed the report on the group management for the financial year ended December 31, 2020 and on the consolidated financial statements of said financial year, which show a loss of 97,483 thousand US dollars as well as the transactions reflected in these financial statements and summarized in these reports, as well as the statutory auditors’ report thereon, approves the consolidated financial statements for the financial year ended December 31, 2020 n the form in which they have been presented, as well as the transactions reflected in these financial statements and summarized in these reports. THIRD RESOLUTION Earnings allocation for the financial year ended December 31, 2020 The shareholders’ meeting, voting under the quorum and majority conditions required for ordinary shareholders’ meetings, having reviewed the management report of the board of directors, acknowledges that the loss for the financial year ended December 31, 2020 amounts to € 35,081,836, resolves to allocate the aforementioned loss to the “retained earnings” debit account that shall thereafter show an amount of € 249,661,440. 6 / 40

6 / 40

Non binding, unofficial English translation for information purposes only. Original in French. In accordance with article 243 bis of the French general tax code, no dividend has been distributed for the last three financial years. FOURTH RESOLUTION Review of the agreements referred to in articles L. 225-38 et seq. of the French commercial code The shareholders’ meeting, voting under the quorum and majority conditions required for ordinary shareholders’ meetings, having reviewed the statutory auditors’ special report on the agreements referred to in articles L. 225-38 et seq. of the French commercial code, approves the renewal of the consulting contract entered into between the Company and the SARL Godard & Co, of which Alain Godard, a member of the board of directors, is also the manager and sole partner, as described in the statutory auditors’ special report. FIFTH RESOLUTION Setting of the amount of the total compensation to be granted to the non-executive directors The shareholders’ meeting, voting under the quorum and majority conditions required for ordinary shareholders’ meetings, having reviewed the report of the board of directors, resolves, in accordance with the provisions of Article L. 225-45 of the French commercial code, to set at 750,000 euros the total sum allocated to non-executive members of the board of directors (i.e., those who are neither employees nor operational managers of the Company or a group company) as compensation for their activity for the financial year 2021, as well as for each subsequent financial year, until the ordinary shareholders’ meeting decides otherwise. SIXTH RESOLUTION Renewal of the appointment of Mr. André Choulika as a member of the board of directors The shareholders’ meeting, voting under the quorum and majority conditions required for ordinary shareholders’ meetings, having reviewed the report of the board of directors, having noted that Mr. André Choulika’s term of office expires at the end of this shareholders’ meeting, resolves to renew Mr. André Choulika’s appointment as a member of the board of directors for a three (3) year period, expiring at the ordinary shareholders’ meeting to be held to vote on the financial statements for the year ending December 31, 2023. Mr. André Choulika has already accepted the renewal of his appointment as a member of the board of directors. 7 / 40

7 / 40

Non binding, unofficial English translation for information purposes only. Original in French. SEVENTH RESOLUTION Renewal of the appointment of Mr. David Sourdive as a member of the board of directors The shareholders’ meeting, voting under the quorum and majority conditions required for ordinary shareholders’ meetings, having reviewed the report of the board of directors, having noted that Mr. David Sourdive’s term of office expires at the end of this shareholders’ meeting, resolves to renew Mr. David Sourdive’s appointment as a member of the board of directors for a three (3) year period, expiring at the ordinary shareholders’ meeting to be held to vote on the financial statements for the year ending December 31, 2023. Mr. David Sourdive has already accepted the renewal of his appointment as a member of the board of directors. EIGHTH RESOLUTION Renewal of the appointment of Mr. Alain-Paul Godard as a member of the board of directors The shareholders’ meeting, voting under the quorum and majority conditions required for ordinary shareholders’ meetings, having reviewed the report of the board of directors, having noted that Mr. Alain-Paul Godard’s term of office expires at the end of this shareholders’ meeting, resolves to renew Mr. Alain-Paul Godard’s appointment as a member of the board of directors for a three (3) year period, expiring at the ordinary shareholders’ meeting to be held to vote on the financial statements for the year ending December 31, 2023. Mr. Alain-Paul Godard has already accepted the renewal of his appointment as a member of the board of directors. NINTH RESOLUTION Authorization to be granted to the board of directors to buy back Company shares The shareholders’ meeting, voting under the quorum and majority conditions required for ordinary shareholders’ meetings, having reviewed the report of the board of directors, authorizes the board of directors to acquire Company shares, in accordance with the terms and conditions set out in articles L. 22-10-62 et seq. of the French commercial code, resolves that the acquisition, sale or transfer of these shares may be carried out by any means, on one or more occasions, in particular on the market or over the counter, including by acquisitions or sales, public offers, through the use of derivatives or option-based instruments, under the conditions provided for by the market authorities and in compliance with applicable regulations, hereby resolves that the authorization may be used for the purpose of: —ensuring the liquidity of the Company’s shares in the context of a liquidity agreement with an investment services provider, in compliance with the market practice accepted by the French 8 / 40

8 / 40

Non binding, unofficial English translation for information purposes only. Original in French. Financial Markets Authority (Autorité des Marchés Financiers) regarding share liquidity agreements, - meeting obligations related to stock option plans, the granting of free shares, employee savings plans or other share allocation programs for employees and officers of the Company or its affiliates, —delivering shares upon the exercise of rights attached to securities giving access to the share capital, —purchasing shares to be held and subsequently used in exchange or as payment in connection with any external growth transactions, in accordance with market practices permitted by the French Financial Markets Authority (AMF), —canceling all or part of the shares thus purchased, and —more generally, operating for any purpose that may be authorized by law or any market practice that may be admitted by the market authorities, it being specified that, in such a case, the Company would inform its shareholders by means of a press release. resolves to set the maximum unit price per share (excluding fees and commissions) at €100, with an overall ceiling of €100,000,000, it being specified that this purchase price will be subject to any adjustments that may be necessary to take into account transactions affecting the share capital (in particular in the event of incorporation of reserves and free allocation of shares, stock split or reverse stock split) that may occur during the period of validity of this authorization, notes that the maximum number of shares that may be purchased pursuant to this resolution may not at any time exceed 10% of the total number of shares, it being specified that (i) when the shares are acquired for the purpose of promoting the liquidity of the Company’s shares, the number of shares taken into account for the calculation of this limit shall be equal to the number of shares purchased less the number of shares resold during the term of this authorization and (ii) when they are acquired to be held and subsequently tendered in payment or in exchange as part of a merger, spin-off or asset contribution, the number of shares acquired may not exceed 5% of the total number of shares, grants full powers to the board of directors, with the option to sub-delegate such powers under the conditions provided for by law, to implement this authorization, place any stock market orders, enter into any agreements under the conditions permitted by law, to carry out any and all formalities, take any and all steps and make any and all declarations to the French Financial Market Authority (Autorité des Marchés Financiers) and any other competent authorities and, in general, do whatever is necessary. This authorization is granted for a period of eighteen (18) months from the date of this meeting and terminates any previous authorization having the same purpose. TENTH RESOLUTION Authorization to be granted to the board of directors to reduce the Company’s share capital by cancelling shares in the context of the authorization granted to the board of directors to buy back Company shares The shareholders’ meeting, voting under the quorum and majority conditions required for extraordinary shareholders’ meetings, having reviewed the report of the board of directors and the statutory auditors’ special report, authorizes the board of directors, in accordance with article L. 22-10-62 of the French commercial code, for a period of eighteen (18) months from the date of this meeting, to cancel, on one in one or several steps, up a maximum limit of 10% of the total share capital per twenty-four (24) month period, all or part of the shares acquired by the Company and to reduce the share capital accordingly, it being 9 / 40

9 / 40

Non binding, unofficial English translation for information purposes only. Original in French. specified that this limit applies to an amount of the share capital that shall be adjusted, if necessary, to take into account any transactions impacting it subsequent to the date of this meeting, resolves that any excess of the purchase price of the shares above their par value shall be charged against to the share, merger or contribution premium account or to any available reserve account, including the legal reserves, up to the limit of 10% of the capital reduction carried out, grants full powers to the board of directors, with the option to sub-delegate such powers under the conditions provided for by law, to carry out any and all acts, formalities or declarations in order to finalize any capital reductions that may be carried out under this authorization and to amend the Company’s bylaws accordingly. This authorization is granted for a period of eighteen (18) months from the date of this general meeting and terminates any previous authorization having the same purpose. ELEVENTH RESOLUTION Delegation of authority to be granted to the board of directors to increase the share capital by issuing ordinary shares or any securities, with cancellation of the shareholders’ preferential subscription rights, in favor of a category of persons meeting specified characteristics (investors having experience in the health or biotechnology sector) The shareholders’ meeting, voting under the quorum and majority conditions required for extraordinary shareholders’ meetings, having reviewed the report of the board of directors and the statutory auditors’ report, in accordance with the provisions of articles L. 225-129 et seq. of the French commercial code, and, in particular, articles L. 225-129-2, L. 22-10-49, L. 225-135, L. 225-138 and L. 228-91 et seq. of the French commercial code, delegates to the board of directors, with the option to sub-delegate such powers under the conditions provided for by law, its authority to decide, on one or more occasions, in the proportions and at the times it sees fit, in France and abroad, to issue ordinary shares of the Company as well as any securities, which are equity securities giving access to other equity securities or giving the right to the allocation of debt securities, and/or securities giving access to equity securities (including, in particular, share subscription warrants or share issuance rights), resolves that the securities thus issued may consist of debt securities, be linked to the issuance of such securities or enable the issuance of such securities as intermediate securities, resolves that the aggregate par value of the capital increases that may be carried out, immediately or in the future, pursuant to this resolution, shall be set at € 681.822 or its equivalent in foreign currency, to which shall be added, where applicable, the par value of any additional shares or securities to be issued, in order to preserve, in accordance with the law and, where applicable, applicable contractual provisions, the rights of the holders of securities and other rights giving access to the share capital, resolves that this amount shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, resolves that the total nominal amount of the issuances of debt securities giving access to the share capital that may thus be issued may not exceed [€ 300,000,000] (or the equivalent of this amount in the event of an issuance in another currency), it being specified that: —this amount shall be increased, where applicable, by any redemption premium above the par value, —this amount shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, 10 / 40

10 / 40

Non binding, unofficial English translation for information purposes only. Original in French. - this ceiling shall not apply to debt securities referred to in articles L. 228-40, L. 228-36-A and L. 228-92 sub paragraph 3 of the French commercial code, the issuance of which would be decided or authorized by the board of directors in accordance with article L. 228-40 of the French commercial code, or in other cases, under the conditions determined by the Company in accordance with article L. 228-36-A of the French commercial code, resolves to cancel shareholders’ preferential subscription rights to the Company’s ordinary shares and/or any securities and/or debt securities to be issued in favor of the following category of beneficiaries: —individuals or legal entities (including any company), trusts, and investment funds, or other investment vehicles, regardless of their form (including, without limitation, any investment fund or venture capital company (société de capital-risque), in particular any FPCI, FCPI or FIP), incorporated under French or foreign law, whether or not they are shareholders of the Company, investing on a regular basis or having invested at least 5 million euros over the past 36 months in the healthcare or biotechnology sector, specifies, where applicable, that pursuant to article L. 225-132 of the French commercial code, the decision to issue securities giving access to the share capital also entails the waiver by the shareholders of their preferential subscription rights to the equity securities to which the securities issued will entitle them, resolves that the sum due, or to be due, to the Company for each of the shares issued pursuant to the aforementioned delegation shall be at least equal to the par value of these shares on the date of issuance and further resolves that the issuance price of the new shares which may be issued pursuant to this delegation shall be at least equal to the average of the weighted-volume average price of a share on the Euronext Growth market (or in the absence of a listing on this market, on any other market on which the Company’s shares would then be listed) over the last three trading days prior to the setting of the issuance price, possibly reduced by a maximum discount of 20%, taking into account, where applicable, the date from which they begin to bear dividend rights, it being specified that (i) in the event that securities giving access to the share capital are issued, the issuance price of ordinary shares that may result from their exercise, conversion or exchange may, where applicable, be determined, at the board’s discretion, by reference to a calculation formula defined by the board and applicable following the issuance of these securities (for example, upon exercise, conversion or exchange), in which case the aforementioned maximum discount may be assessed, if the board deems it appropriate, on the date of application of such formula (and not on the date of determination of the issuance price), and (ii) the issuance price of any securities giving access to the share capital issued under this resolution shall be such that the amount, if any, received immediately by the Company, plus any amount that may be received by it on exercise or conversion of said securities, shall be, for each share issued as a result of the issuance of said securities, at least equal to the aforementioned minimum amount, resolves that the board of directors, under the conditions provided for by law, shall have full powers to implement this delegation in particular, but not limited to, for the purpose of: —deciding the amount of the share capital increase, the issuance price (it being specified that it shall be determined in accordance with the conditions set out above) and the amount of the premium that may, where applicable, be required on issuance, —setting the dates, terms and conditions for any issuance as well as the form and characteristics of the shares or securities giving access to the capital to be issued, —setting the date, which may be retroactive, from which the shares or securities giving access to the share capital to be issued will bear dividend rights and the manner in which they will be paid up, —drawing up the list of beneficiaries within aforementioned category of persons and the number of shares to be allocated to each of them, 11 / 40

11 / 40

Non binding, unofficial English translation for information purposes only. Original in French. - at its own discretion and when it deems appropriate, charging the expenses, fees and expenses incurred in connection with the capital increases carried out pursuant to the delegation granted under this resolution against the amount of the premiums related to such transactions and deducting from the amount of such premiums the sums necessary to increase the legal reserve to one-tenth of the new amount of the share capital after each transaction, —duly recording the completion of each capital increase and amending the Company’s bylaws accordingly, —more generally, entering into any and all agreements, in particular in order to successfully complete the planned issuances, taking any and all measures and carrying out any and all formalities necessary for the issuance, listing and financial administration of the shares issued under this delegation, as well as for the exercise of the rights attached thereto, —taking any decision with a view to the admission of the shares and securities thus issued to any market on which the Company’s shares may be admitted for trading, specifies that the delegation thus granted to the board of directors is valid for a period of eighteen (18) months from the date of this meeting and terminates any previous delegation having the same purpose, acknowledges the fact that, should the board of directors make use of the delegation of authority it was granted pursuant to this resolution, the board of directors shall report on the use made of the authorizations granted in this resolution to the next ordinary shareholders’ meeting, in accordance with the legal and regulatory provisions. TWELFTH RESOLUTION Delegation of authority to be granted to the board of directors to increase the share capital by issuing ordinary shares or any securities, with cancellation of the shareholders’ preferential subscription rights, in favor of a category of persons meeting specified characteristics (credit institution, investment services provider or syndicate member guaranteeing the completion of the considered issuance) The shareholders’ meeting, voting under the quorum and majority conditions required for extraordinary shareholders’ meetings, having reviewed the report of the board of directors and the statutory auditors’ report, in accordance with the provisions of articles L. 225-129 et seq. of the French commercial code, and, in particular, articles L. 225-129-2, L. 22-10-49, L. 225-135, L. 225-138 and L. 228-91 et seq. of the French commercial code, delegates to the board of directors, with the option to sub-delegate such powers under the conditions provided for by law, its authority to decide, on one or more occasions, in the proportions and at the times it sees fit, in France and abroad, to issue ordinary shares of the Company as well as any securities, which are equity securities giving access to other equity securities or giving the right to the allocation of debt securities, and/or securities giving access to equity securities (including, in particular, share subscription warrants or share issuance rights), resolves that the securities thus issued may consist of debt securities, be linked to the issuance of such securities or enable the issuance of such securities as intermediate securities, resolves that the aggregate par value of the capital increases that may be carried out, immediately or in the future, pursuant to this resolution, shall be set at € 681.822 or its equivalent in foreign currency, to which shall be added, where applicable, the par value of any additional shares or securities to be issued, in order to preserve, in accordance with the law and, where applicable, applicable contractual provisions, the rights of the holders of securities and other rights giving access to the share capital, 12 / 40

12 / 40

Non binding, unofficial English translation for information purposes only. Original in French. resolves that this amount shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, resolves that the total nominal amount of the issuances of debt securities giving access to the share capital that may thus be issued may not exceed € 300,000,000 (or the equivalent of this amount in the event of an issuance in another currency), it being specified that: —this amount shall be increased, where applicable, by any redemption premium above the par value, —this amount shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, —this ceiling shall not apply to debt securities referred to in articles L. 228-40, L. 228-36-A and L. 228-92 sub paragraph 3 of the French commercial code, the issuance of which would be decided or authorized by the board of directors in accordance with article L. 228-40 of the French commercial code, or in other cases, under the conditions determined by the Company in accordance with article L. 228-36-A of the French commercial code, resolves to cancel shareholders’ preferential subscription rights to the Company’s ordinary shares and/or any securities and/or debt securities to be issued in favor of the following category of beneficiaries: —any credit institution, investment services provider or investment syndicate member, whether French or foreign, undertaking to guarantee the completion of the share capital increase or any issuance likely to result in a future capital increase that may be carried out pursuant to this delegation, specifies, where applicable, that pursuant to article L. 225-132 of the French commercial code, the decision to issue securities giving access to the share capital also entails the waiver by the shareholders of their preferential subscription rights to the equity securities to which the securities issued will entitle them, resolves that the sum due, or to be due, to the Company for each of the shares issued pursuant to the aforementioned delegation shall be at least equal to the par value of these shares on the date of issuance and further resolves that the issuance price of the new shares which may be issued pursuant to this delegation shall be at least equal to the average of the weighted-volume average price of a share on the Euronext Growth market (or in the absence of a listing on this market, on any other market on which the Company’s shares would then be listed) over the last three trading days prior to the setting of the issuance price, possibly reduced by a maximum discount of 20%, taking into account, where applicable, the date from which they begin to bear dividend rights, it being specified that (i) in the event that securities giving access to the share capital are issued, the issuance price of ordinary shares that may result from their exercise, conversion or exchange may, where applicable, be determined, at the board’s discretion, by reference to a calculation formula defined by the board and applicable following the issuance of these securities (for example, upon exercise, conversion or exchange), in which case the aforementioned maximum discount may be assessed, if the board deems it appropriate, on the date of application of such formula (and not on the date of determination of the issuance price), and (ii) the issuance price of any securities giving access to the share capital issued under this resolution shall be such that the amount, if any, received immediately by the Company, plus any amount that may be received by it on exercise or conversion of said securities, shall be, for each share issued as a result of the issuance of said securities, at least equal to the aforementioned minimum amount, resolves that the board of directors, under the conditions provided for by law, shall have full powers to implement this delegation in particular, but not limited to, for the purpose of: —deciding the amount of the share capital increase, the issuance price (it being specified that it shall be determined in accordance with the conditions set out above) and the amount of the premium that may, where applicable, be required on issuance, 13 / 40

13 / 40

Non binding, unofficial English translation for information purposes only. Original in French. - setting the dates, terms and conditions for any issuance as well as the form and characteristics of the shares or securities giving access to the capital to be issued, —setting the date, which may be retroactive, from which the shares or securities giving access to the share capital to be issued will bear dividend rights and the manner in which they will be paid up, —drawing up the list of beneficiaries within aforementioned category of persons and the number of shares to be allocated to each of them, —at its own discretion and when it deems appropriate, charging the expenses, fees and expenses incurred in connection with the capital increases carried out pursuant to the delegation granted under this resolution against the amount of the premiums related to such transactions and deducting from the amount of such premiums the sums necessary to increase the legal reserve to one-tenth of the new amount of the share capital after each transaction, —duly recording the completion of each capital increase and amending the Company’s bylaws accordingly, —more generally, entering into any and all agreements, in particular in order to successfully complete the planned issuances, taking any and all measures and carrying out any and all formalities necessary for the issuance, listing and financial administration of the shares issued under this delegation, as well as for the exercise of the rights attached thereto, —taking any decision with a view to the admission of the shares and securities thus issued to any market on which the Company’s shares may be admitted for trading, specifies that the delegation thus granted to the board of directors is valid for a period of eighteen (18) months from the date of this meeting and terminates any previous delegation having the same purpose, acknowledges the fact that, should the board of directors make use of the delegation of authority it was granted pursuant to this resolution, the board of directors shall report on the use made of the authorizations granted in this resolution to the next ordinary shareholders’ meeting, in accordance with the legal and regulatory provisions. THIRTEENTH RESOLUTION Delegation of authority to be granted to the board of directors to increase the share capital by issuing ordinary shares or any securities, with cancellation of the shareholders’ preferential subscription rights, in favor of a category of persons meeting specified characteristics (industrial companies, institutions or entities active in the health or biotechnology sector) The shareholders’ meeting, voting under the quorum and majority conditions required for extraordinary shareholders’ meetings, having reviewed the report of the board of directors and the statutory auditors’ report, in accordance with the provisions of articles L. 225-129 et seq. of the French commercial code, and, in particular, articles L. 225-129-2, L. 22-10-49, L. 225-135, L. 225-138 and L. 228-91 et seq. of the French commercial code, delegates to the board of directors, with the option to sub-delegate such powers under the conditions provided for by law, its authority to decide, on one or more occasions, in the proportions and at the times it sees fit, in France and abroad, to issue ordinary shares of the Company as well as any securities, which are equity securities giving access to other equity securities or giving the right to the allocation of debt securities, and/or securities giving access to equity securities (including, in particular, share subscription warrants or share issuance rights), 14 / 40

14 / 40

Non binding, unofficial English translation for information purposes only. Original in French. resolves that the securities thus issued may consist of debt securities, be linked to the issuance of such securities or enable the issuance of such securities as intermediate securities, resolves that the aggregate par value of the capital increases that may be carried out, immediately or in the future, pursuant to this resolution, shall be set at € 681.822 or its equivalent in foreign currency, to which shall be added, where applicable, the par value of any additional shares or securities to be issued, in order to preserve, in accordance with the law and, where applicable, applicable contractual provisions, the rights of the holders of securities and other rights giving access to the share capital, resolves that this amount shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, resolves that the total nominal amount of the issuances of debt securities giving access to the share capital that may thus be issued may not exceed € 300,000,000 (or the equivalent of this amount in the event of an issuance in another currency), it being specified that: —this amount shall be increased, where applicable, by any redemption premium above the par value, —this amount shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, —this ceiling shall not apply to debt securities referred to in articles L. 228-40, L. 228-36-A and L. 228-92 sub paragraph 3 of the French commercial code, the issuance of which would be decided or authorized by the board of directors in accordance with article L. 228-40 of the French commercial code, or in other cases, under the conditions determined by the Company in accordance with article L. 228-36-A of the French commercial code, resolves to cancel shareholders’ preferential subscription rights to the shares and securities to be thus issued and to restrict the subscription of the shares and securities referred to in this resolution to the following category of beneficiaries: —industrial companies, institutions or entities of any form, whether French or foreign, active in the healthcare or biotechnology sector, directly or through a company controlled or by which they are controlled within the meaning of Article L. 233-3 I of the French Commercial Code, including, where applicable, upon the conclusion of a commercial agreement or partnership with the Company, specifies, where applicable, that pursuant to article L. 225-132 of the French commercial code, the decision to issue securities giving access to the share capital also entails the waiver by the shareholders of their preferential subscription rights to the equity securities to which the securities issued will entitle them, 15 / 40

15 / 40

Non binding, unofficial English translation for information purposes only. Original in French. resolves that the sum due, or to be due, to the Company for each of the shares issued pursuant to the aforementioned delegation shall be at least equal to the par value of these shares on the date of issuance and further resolves that the issuance price of the new shares which may be issued pursuant to this delegation shall be at least equal to the average of the weighted-volume average price of a share on the Euronext Growth market (or in the absence of a listing on this market, on any other market on which the Company’s shares would then be listed) over the last three trading days prior to the setting of the issuance price, possibly reduced by a maximum discount of 15%, taking into account, where applicable, the date from which they begin to bear dividend rights, it being specified that (i) in the event that securities giving access to the share capital are issued, the issuance price of ordinary shares that may result from their exercise, conversion or exchange may, where applicable, be determined, at the board’s discretion, by reference to a calculation formula defined by the board and applicable following the issuance of these securities (for example, upon exercise, conversion or exchange), in which case the aforementioned maximum discount may be assessed, if the board deems it appropriate, on the date of application of such formula (and not on the date of determination of the issuance price), and (ii) the issuance price of any securities giving access to the share capital issued under this resolution shall be such that the amount, if any, received immediately by the Company, plus any amount that may be received by it on exercise or conversion of said securities, shall be, for each share issued as a result of the issuance of said securities, at least equal to the aforementioned minimum amount, resolves that the board of directors, under the conditions provided for by law, shall have full powers to implement this delegation in particular, but not limited to, for the purpose of: —deciding the amount of the share capital increase, the issuance price (it being specified that it shall be determined in accordance with the conditions set out above) and the amount of the premium that may, where applicable, be required on issuance, —setting the dates, terms and conditions for any issuance as well as the form and characteristics of the shares or securities giving access to the capital to be issued, —setting the date, which may be retroactive, from which the shares or securities giving access to the share capital to be issued will bear dividend rights and the manner in which they will be paid up, —drawing up the list of beneficiaries within aforementioned category of persons and the number of shares to be allocated to each of them, —at its own discretion and when it deems appropriate, charging the expenses, fees and expenses incurred in connection with the capital increases carried out pursuant to the delegation granted under this resolution against the amount of the premiums related to such transactions and deducting from the amount of such premiums the sums necessary to increase the legal reserve to one-tenth of the new amount of the share capital after each transaction, —duly recording the completion of each capital increase and amending the Company’s bylaws accordingly, —more generally, entering into any and all agreements, in particular in order to successfully complete the planned issuances, taking any and all measures and carrying out any and all formalities necessary for the issuance, listing and financial administration of the shares issued under this delegation, as well as for the exercise of the rights attached thereto, —taking any decision with a view to the admission of the shares and securities thus issued to any market on which the Company’s shares may be admitted for trading, specifies that the delegation thus granted to the board of directors is valid for a period of eighteen (18) months from the date of this meeting and terminates any previous delegation having the same purpose, acknowledges the fact that, should the board of directors make use of the delegation of authority it was granted pursuant to this resolution, the board of directors shall report on the use made of the 16 / 40

16 / 40

Original in French. authorizations granted in this resolution to the next ordinary shareholders’ meeting, in accordance with the legal and regulatory provisions. FOURTEENTH RESOLUTION Delegation of authority to be granted to the board of directors to increase the share capital by issuing ordinary shares or any securities, with cancellation of the shareholders’ preferential subscription rights, in favor of a category of persons meeting specified characteristics, in the context of equity or bond financing The shareholders’ meeting, voting under the quorum and majority conditions required for extraordinary shareholders’ meetings, having reviewed the report of the board of directors and the statutory auditors’ report, in accordance with the provisions of articles L. 225-129 et seq. of the French commercial code, and, in particular, articles L. 225-129-2, L. 22-10-49, L. 225-135, L. 225-138 and L. 228-91 et seq. of the French commercial code, delegates to the board of directors its authority to decide, on one or more occasions, in the proportions and at the times it sees fit, in France or abroad, to issue ordinary shares of the Company or equity securities giving access to other equity securities or giving the right to the allocation of debt securities, and/or securities (including, in particular, debt securities) giving access to shares, said securities being issuable in euros, in any foreign currency or in any monetary unit established by reference to several currencies at the discretion of the board of directors, resolves that the securities thus issued may consist of debt securities, be linked to the issuance of such securities (including share subscription warrants attached to bonds or issued for the benefit of the subscribers of such bonds) or enable the issuance of such securities as intermediate securities, resolves to cancel shareholders’ preferential subscription rights to the shares and securities to be thus issued and to restrict the subscription of the shares and securities referred to in this resolution to the following category of beneficiaries: —any credit institution, investment services provider, investment fund or company that undertakes to subscribe for or guarantee the completion of the capital increase or any issue of securities likely to result in a future capital increase (including, in particular, through the exercise of share warrants) that may be carried out pursuant to this delegation in the context of the implementation of an equity or bond financing contract, acknowledges, where applicable, that the decision to issue securities giving access to the share capital also entails the waiver by the shareholders of their preferential subscription rights to the equity securities to which the securities issued will entitle them, resolves that the aggregate par value of the capital increases that may be carried out, immediately and/or in the future, pursuant to this delegation, shall not be superior to € 681.822 or its equivalent in foreign currency, to which shall be added, where applicable, the additional amount of any additional shares to be issued, in order to preserve, in accordance with applicable laws and regulations and, where applicable, applicable contractual provisions, the rights of the holders of securities and other rights giving access to the share capital, resolves that this amount shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, resolves that the total nominal amount of the issuances of debt securities giving access to the share capital that may thus be issued may not exceed € 300,000,000 (or the equivalent of this amount in the event of an issuance in another currency), it being specified that: 17 / 40

17 / 40

Non binding, unofficial English translation for information purposes only. Original in French. - this amount shall be increased, where applicable, by any redemption premium above the par value, —this amount shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, —this ceiling shall not apply to debt securities referred to in articles L. 228-40, L. 228-36-A and L. 228-92 sub paragraph 3 of the French commercial code, the issuance of which would be decided or authorized by the board of directors in accordance with article L. 228-40 of the French commercial code, or in other cases, under the conditions determined by the Company in accordance with article L. 228-36-A of the French commercial code, resolves that the sum due, or to be due, to the Company for each of the shares issued pursuant to the aforementioned delegation shall be at least equal to the par value of these shares on the date of issuance and further resolves that the issuance price of the new shares which may be issued pursuant to this delegation shall be at least equal to the average of the weighted-volume average price of a share on the Euronext Growth market (or in the absence of a listing on this market, on any other market on which the Company’s shares would then be listed) over the last three trading days prior to the setting of the issuance price, possibly reduced by a maximum discount of 20%, taking into account, where applicable, the date from which they begin to bear dividend rights, it being specified that (i) in the event that securities giving access to the share capital are issued, the issuance price of ordinary shares that may result from their exercise, conversion or exchange may, where applicable, be determined, at the board’s discretion, by reference to a calculation formula defined by the board and applicable following the issuance of these securities (for example, upon exercise, conversion or exchange), in which case the aforementioned maximum discount may be assessed, if the board deems it appropriate, on the date of application of such formula (and not on the date of determination of the issuance price), and (ii) the issuance price of any securities giving access to the share capital issued under this resolution shall be such that the amount, if any, received immediately by the Company, plus any amount that may be received by it on exercise or conversion of said securities, shall be, for each share issued as a result of the issuance of said securities, at least equal to the aforementioned minimum amount, specifies that the delegation thus granted to the board of directors is valid for a period of eighteen (18) months from the date of this meeting and terminates any previous delegation having the same purpose, resolves that the board of directors, with the option to sub-delegate such powers under the conditions provided for by law, shall have full powers to implement this delegation in particular for the purpose of: —deciding the amount of the share capital increase, the issuance price (it being specified that it shall be determined in accordance with the conditions set out above) and the amount of the premium that may, where applicable, be required on issuance, —setting the dates, terms and conditions for any issuance as well as the form and characteristics of the shares or securities giving access to the capital to be issued, —setting the date, which may be retroactive, from which the shares or securities giving access to the share capital to be issued will bear dividend rights and the manner in which they will be paid up, —drawing up the list of beneficiaries within aforementioned category of persons and the number of shares to be allocated to each of them, —at its own discretion and when it deems appropriate, charging the expenses, fees and expenses incurred in connection with the capital increases carried out pursuant to the delegation granted under this resolution against the amount of the premiums related to such transactions and deducting from the amount of such premiums the sums necessary to increase the legal reserve to one-tenth of the new amount of the share capital after each transaction, —duly recording the completion of each capital increase and amending the Company’s bylaws accordingly, 18 / 40

18 / 40

Non binding, unofficial English translation for information purposes only. Original in French. - more generally, entering into any and all agreements, in particular in order to successfully complete the planned issuances, taking any and all measures and carrying out any and all formalities necessary for the issuance, listing and financial administration of the shares issued under this delegation, as well as for the exercise of the rights attached thereto, —taking any decision with a view to the admission of the shares and securities thus issued to any market on which the Company’s shares may be admitted for trading, acknowledges the fact that, should the board of directors make use of the delegation of authority it was granted pursuant to this resolution, the board of directors shall report on the use made of the authorizations granted in this resolution to the next ordinary shareholders’ meeting, in accordance with the legal and regulatory provisions. FIFTEENTH RESOLUTION Delegation of authority to be granted to the board of directors to increase the share capital immediately or in the future by issuing ordinary shares or any securities giving access to the share capital, while preserving the shareholders’ preferential subscription rights The shareholders’ meeting, voting under the quorum and majority conditions required for extraordinary shareholders’ meetings, having reviewed the report of the board of directors and the statutory auditors’ report, in accordance with the provisions of articles L. 225-129 et seq. of the French commercial code, and, in particular, articles L. 225-129 to L. 225-129-6, L. 22-10-49, L. 225-132, L. 225-133, L. 225-134, L. 228-91, L. 228-92 and L. 228-93 of the French commercial code, delegates to the board of directors with the option to sub-delegate such powers under the conditions provided for by law, its authority to decide, in the proportions and at the times it sees fit, in France or abroad, to issue ordinary shares of the Company or equity securities giving access to other equity securities or giving the right to the allocation of debt securities, and/or securities (including, in particular, debt securities) giving access to shares of the Company or of any company that directly or indirectly owns more than half of its capital or of which it directly or indirectly owns more than half of the capital, it being specified that these securities may be issuable in euros, in any foreign currency or in any monetary unit established by reference to several currencies at the discretion of the board of directors, and may be paid up in cash, including by offsetting claims, resolves that the securities thus issued may consist of debt securities, be linked to the issuance of such securities or enable the issuance of such securities as intermediate securities, resolves that the shareholders have, in proportion to the amount of their shares, preferential subscription rights to the ordinary shares or securities that may be issued pursuant to this delegation, grants the board of directors the powers to grant shareholders the right to subscribe for a greater number of shares or securities than they would be entitled to subscribe for on an irreducible basis, in proportion to the rights they hold and, in any event, within the limit of their request, resolves that the aggregate par value of the capital increases that may be carried out, immediately and/or in the future, pursuant to this delegation, shall not be superior to € 681.822,15 (or its equivalent in foreign currency), it being specified that: —the maximum nominal amount of the share capital increases that may be carried out, immediately or in future, under this delegation shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, —to this ceiling shall be added, where applicable, the par value of any additional shares to be issued, in order to preserve, in accordance with the law and, where applicable, applicable 19 / 40

19 / 40

Non binding, unofficial English translation for information purposes only. Original in French. contractual provisions, the rights of the holders of securities and other rights giving access to the share capital, resolves that the total nominal amount of the issuances of debt securities giving access to the share capital that may thus be issued may not exceed € 300,000,000 (or the equivalent of this amount in the event of an issuance in another currency), it being specified that: —this amount shall be increased, where applicable, by any redemption premium above the par value, —this amount shall be deducted from the overall ceiling referred to in the Nineteenth resolution below, —this ceiling shall not apply to debt securities referred to in articles L. 228-40, L. 228-36-A and L. 228-92 sub paragraph 3 of the French commercial code, the issuance of which would be decided or authorized by the board of directors in accordance with article L. 228-40 of the French commercial code, or in other cases, under the conditions determined by the Company in accordance with article L. 228-36-A of the French commercial code, resolves that, if the subscriptions have not absorbed the totality of such an issuance, the board of directors may use, in the order of its choice, one or the other of the following powers: —limit the issuance to the amount of subscriptions, provided that the subscriptions reach at least three-quarters of the issuance initially decided, —freely allocate all or part of the issued unsubscribed securities among the persons of its choice, and —offer to the public, on the French or international market, all or part of the unsubscribed issued securities, resolves that the issuance of share subscription warrants of the Company may be carried out by way of a subscription offer, but also by way of their free allocation to the owners of existing shares, resolves that in the event of a free allocation of warrants, the board of directors shall have the power to decide that fractional allocation rights are not negotiable and that the corresponding securities shall be sold, acknowledges, where applicable, that the decision to issue securities giving access to the share capital also entails the waiver by the shareholders of their preferential subscription rights to the equity securities to which the securities issued will entitle them, resolves that the board of directors, with the option to sub-delegate such powers under the conditions provided for by law, shall have full powers to implement this delegation under the conditions provided for by law and the Company’s bylaws, in particular for the purpose of: —setting the dates, terms and conditions for any issuance as well as the form and characteristics of the shares or securities giving access to the capital to be issued, with or without a premium, —setting the amounts to be issued, the date, which may be retroactive, from which the shares or securities giving access to the share capital to be issued will bear dividend rights and the manner in which they will be paid up, and, where applicable, the terms and conditions for exercising rights to exchange, convert, redeem or otherwise allocate shares or securities giving access to the capital, —making any adjustments required by law or regulation and, as the case may be, by applicable contractual provisions, to protect the rights of holders of securities and other rights giving access to the Company’s share capital; and

20 / 40

20 / 40 Non binding, unofficial English translation for information purposes only. Original in French. - suspending, where applicable, the exercise of rights attached to these securities during a maximum period of three months, resolves that the board of directors may: —at its own discretion and when it deems appropriate, charging the expenses, fees and expenses incurred in connection with the capital increases carried out pursuant to the delegation granted under this resolution against the amount of the premiums related to such transactions and deducting from the amount of such premiums the sums necessary to increase the legal reserve to one-tenth of the new amount of the share capital after each transaction,—take any and all measures and decisions and carry out any and all formalities necessary for the admission of the securities thus issued to trading on the Euronext Growth Paris market and any other market on which the Company’s shares may then be listed, —take any and all measures, enter into any and all agreements and carry out any and all formalities necessary for the successful completion of the issuance and for the purpose of finalizing the resulting capital increase, and make the corresponding amendments to the Company’s bylaws, acknowledges the fact that, should the board of directors make use of the delegation of authority it was granted pursuant to this resolution, the board of directors shall report on the use made of the authorizations granted in this resolution to the next ordinary shareholders’ meeting, in accordance with the legal and regulatory provisions, specifies that the delegation thus granted to the board of directors is valid for a period of twenty-six (26) months from the date of this meeting and terminates any previous delegation having the same purpose. SIXTEENTH RESOLUTION Delegation of authority to be granted to the board of directors to increase the share capital immediately or in the future by issuing ordinary shares or any securities giving access to the share capital, with cancellation of the shareholders’ preferential subscription rights, through a public offer (excluding offers referred to in paragraph 1° of article L. 411-2 of the French monetary and financial code) The shareholders’ meeting, voting under the quorum and majority conditions required for extraordinary shareholders’ meetings, having reviewed the report of the board of directors and the statutory auditors’ report, in accordance with the provisions of articles L. 225-129 et seq. of the French commercial code, and, in particular, articles L. 225-129 to L. 225-129-6, L. 22-10-49, L. 225-132, L. 225-133, L. 225-134, L. 228-91, L. 228-92 and L. 228-93 of the French commercial code, delegates to the board of directors with the option to sub-delegate such powers under the conditions provided for by law, its authority to decide, in the proportions and at the times it sees fit, in France or abroad, to decide, by way of an offer to the public, excluding the offers referred to in paragraph 1° of Article L. 411-2 of the French monetary and financial code, to issue, on one or more occasions, ordinary shares of the Company (including, as the case may be, represented by American Depositary Shares or American Depositary Receipts) or equity securities giving access to other equity securities or giving the right to the allocation of debt securities, and/or securities (including, in particular, debt securities) giving access to shares of the Company or of any company that directly or indirectly owns more than half of its capital or of which it directly or indirectly owns more than half of the capital, it being specified that these securities may be issuable in euros, in any foreign currency or in any monetary unit established by reference to several currencies at the discretion of the board of directors, and may be paid up in cash, including by offsetting claims, resolves that the securities thus issued may consist of debt securities, be linked to the issuance of such securities or enable the issuance of such securities as intermediate securities, 21 / 40

21 / 40