Form 6-K CELESTICA INC For: Apr 29

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/24/2024

March 16, 2020 1:03 PM EDT

QuickLinks

-- Click here to rapidly navigate through this document

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of March, 2020

001-14832

(Commission File Number)

CELESTICA INC.

(Translation of registrant's name into English)

5140 Yonge Street, Suite 1900

Toronto, Ontario

Canada M2N 6L7

(416) 448-5800

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

Furnished Herewith (and incorporated by reference herein)

|

|

|

|

| Exhibit No. |

|

Description |

| |

99.1 |

|

Notice of Meeting and Management Information Circular for the April 29, 2020 Annual Meeting of Shareholders |

|

99.2 |

|

Form of Proxy (Multiple Voting Shares) |

|

99.3 |

|

Form of Proxy (Subordinate Voting Shares) |

|

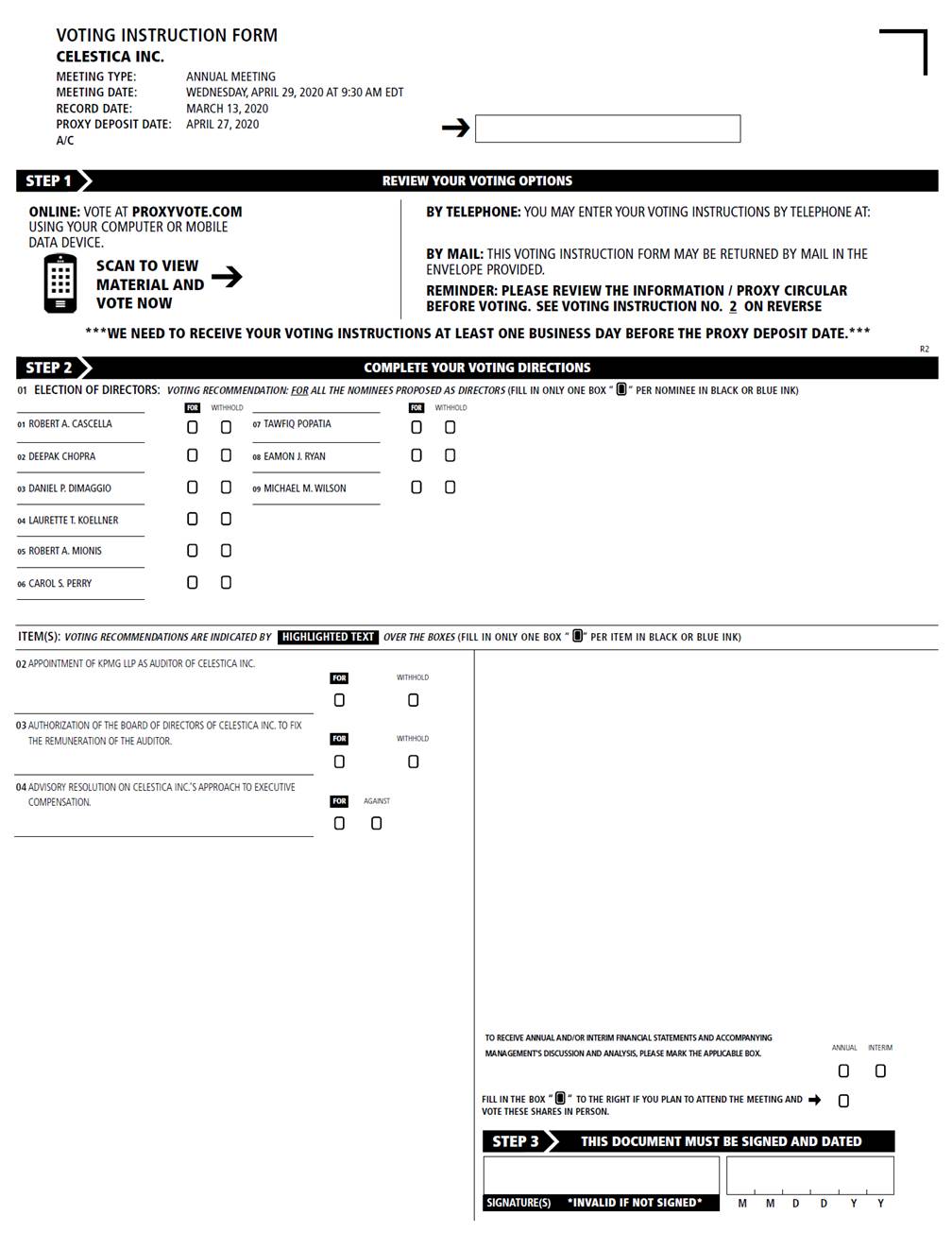

99.4 |

|

Voting Instruction Form for US beneficial holders |

|

99.5 |

|

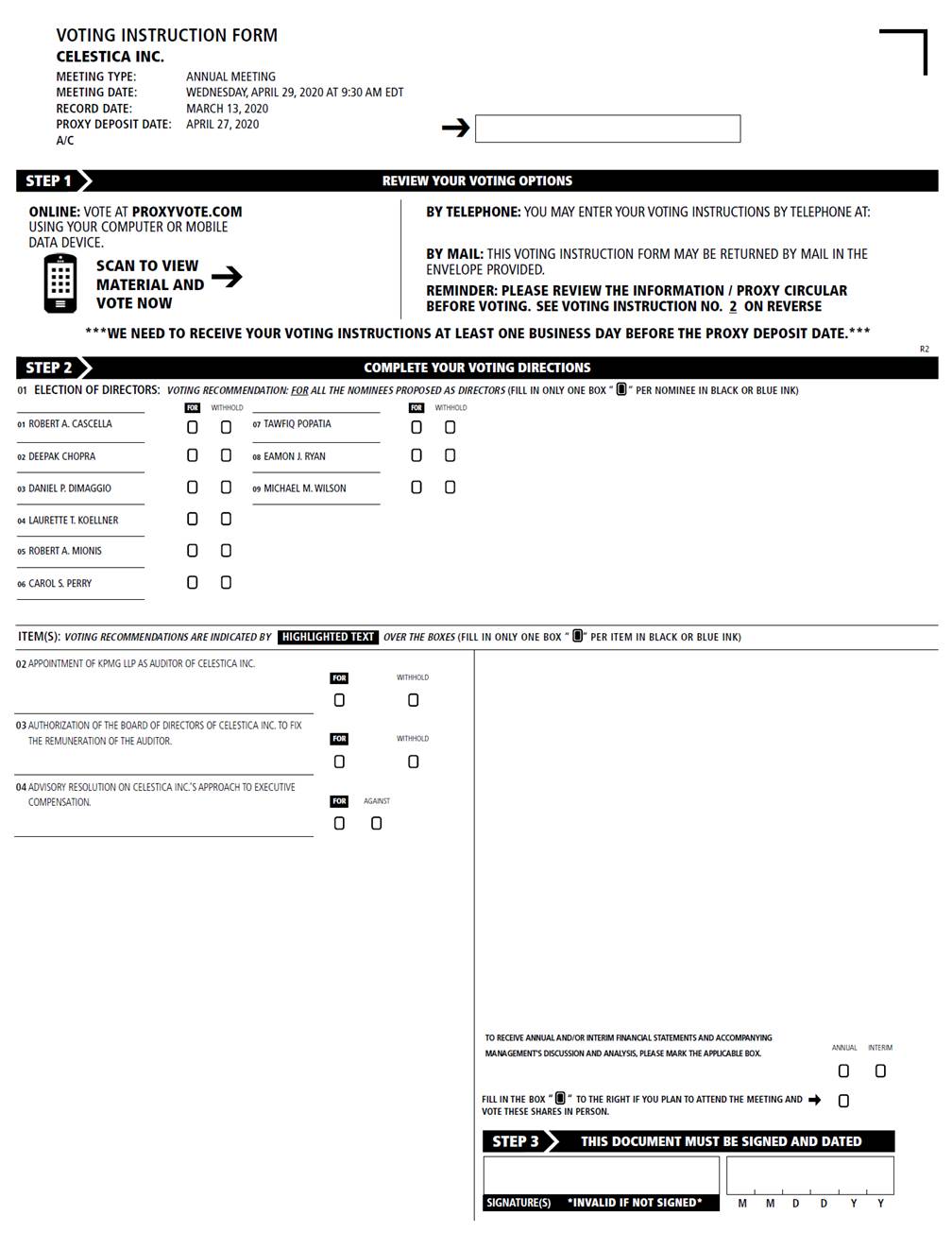

Voting Instruction Form for Canadian beneficial holders |

|

99.6 |

|

Request card for both US and Canadian registered holders |

|

99.7 |

|

2019 Letter to Shareholders |

The

information contained in this Form 6-K is not incorporated by reference into any registration statement (or into any prospectus that forms a part thereof) filed by

Celestica Inc. with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

| |

|

CELESTICA INC. |

Date: March 16, 2020 |

|

By: |

|

/s/ Elizabeth L. DelBianco

Elizabeth L. DelBianco |

| |

|

|

|

Chief Legal and Administrative Officer |

EXHIBIT INDEX

QuickLinks

Furnished Herewith (and incorporated by reference herein)

SIGNATURES

EXHIBIT INDEX

QuickLinks

-- Click here to rapidly navigate through this document

Exhibit 99.1

NOTICE OF MEETING

AND

MANAGEMENT INFORMATION

CIRCULAR

FOR THE ANNUAL MEETING

OF SHAREHOLDERS

TO BE HELD ON

APRIL 29, 2020

INVITATION TO SHAREHOLDERS

On behalf of the Board of Directors, management and employees of Celestica Inc.

(the "Corporation"), it is our pleasure to invite you to join us at the Corporation's Annual Meeting of Shareholders to be held on

Wednesday, April 29, 2020 at 9:30 a.m. EDT at the Novotel Toronto North York Hotel, 3 Park Home Avenue, North York, Ontario.

The

items of business to be considered and voted upon by shareholders at this meeting are described in the Notice of Annual Meeting and the accompanying Management Information Circular.

You

can find further information concerning the Corporation on our website: www.celestica.com. We encourage you to visit our website before attending the meeting, as it

provides useful information regarding the Corporation.

Your

participation at this meeting is important. We encourage you to exercise your right to vote, which can be done by following the instructions provided in the Management Information Circular and

accompanying form of proxy.

While

we invite you to attend the meeting, we are also actively monitoring the coronavirus disease 2019 (COVID-19) situation and are sensitive to the public health and travel concerns our shareholders

may have and the protocols that federal, provincial, and local governments may impose. In the event we determine that it is not possible or advisable for our shareholders to attend the meeting in

person, we will announce alternative arrangements as promptly as practicable. Please monitor our website at www.celestica.com for updated information. If you are planning

to attend our meeting, please check the website prior to the meeting for our most current instructions. If you have any concerns about traveling, as always our meeting is available for viewing online

through a live webcast at www.celestica.com. We encourage you to provide voting instructions prior to the meeting. PLEASE NOTE: Although management

will respond to questions following the formal proceedings, there will not be an investor presentation by management.

Yours

sincerely,

|

|

|

|

|

|

Michael M. Wilson

Chair of the Board |

|

Robert A. Mionis

President and Chief Executive Officer |

Your Vote Is Important

Registered Shareholders

You are a registered shareholder if your shares are registered directly in your name with our registrar and transfer agent, Computershare Investor Services Inc.

("Computershare"). You will have received from Computershare a form of proxy which accompanied your Management Information Circular. Complete, sign,

date and mail your form of proxy to Computershare in the envelope provided or follow the instructions provided on the form of proxy to vote by telephone or internet. For instructions regarding how to

vote in person at the meeting if you are a registered shareholder, see Questions and Answers on Voting and Proxies — How Do I Exercise My

Vote (and by When) If I am a Registered Shareholder?

Non-Registered Shareholders

You are a non-registered shareholder (or beneficial owner) if your shares are held in the name of a nominee (such as a securities broker, trustee or other financial

institution). You will have received from your nominee a request for voting instructions which accompanied your Management Information Circular. Alternatively, your nominee may have provided you with

a form of proxy. Follow the instructions on your voting instruction form or the form of proxy provided to you to vote by telephone or internet, or complete, sign, date and mail the voting instruction

form or the form of proxy provided to you in the envelope provided. For instructions regarding how to vote in person at the meeting if you are a non-registered shareholder, see Questions and Answers on Voting and

Proxies — How Do I Vote if I am a Non-Registered Shareholder?

|

|

|

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF CELESTICA INC. |

|

i |

| MANAGEMENT INFORMATION CIRCULAR |

|

1 |

| Questions and Answers on Voting and Proxies |

|

1 |

| Principal Holders of Voting Shares |

|

5 |

| Agreement for the Benefit of Holders of SVS |

|

5 |

| Information Relating to Our Directors |

|

6 |

| Election of Directors |

|

6 |

| Director Compensation |

|

14 |

| Directors' Fees Earned in 2019 |

|

15 |

| Directors' Ownership of Securities |

|

17 |

| Attendance of Directors at Board and Committee Meetings |

|

20 |

| Environmental, Social and Governance Matters |

|

21 |

| Information About Our Auditor |

|

24 |

| Say-On-Pay |

|

25 |

| 2019 Voting Results |

|

25 |

| Human Resources and Compensation Committee |

|

26 |

| Human Resources and Compensation Committee Letter to Shareholders |

|

28 |

| Compensation Discussion and Analysis |

|

32 |

| Note Regarding Non-IFRS Measures |

|

34 |

| Compensation Objectives |

|

35 |

| Anti-Hedging and Anti-Pledging Policy |

|

41 |

| "Clawback" Provisions |

|

42 |

| Compensation Elements for the Named Executive Officers |

|

42 |

| 2019 Compensation Decisions |

|

47 |

| Realized and Realizable Compensation |

|

54 |

| Compensation of Named Executive Officers |

|

56 |

| Summary Compensation Table |

|

56 |

| Option-Based and Share-Based Awards |

|

58 |

| Securities Authorized for Issuance Under Equity Compensation Plans |

|

60 |

| Equity Compensation Plans |

|

60 |

| Pension Plans |

|

63 |

| Termination of Employment and Change in Control Arrangements with Named Executive Officers |

|

64 |

| Performance Graph |

|

68 |

| Executive Share Ownership |

|

69 |

| Indebtedness of Directors and Officers |

|

70 |

| Directors, Officers and Corporation Liability Insurance |

|

70 |

| Statement of Corporate Governance Practices |

|

70 |

| Other Matters |

|

71 |

| Requests for Documents |

|

71 |

| Certificate |

|

71 |

| Schedule A — Statement of Corporate Governance Practices |

|

A-1 |

| Schedule B — Board of Directors Mandate |

|

B-1 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF CELESTICA INC.

The Annual Meeting of Shareholders (the "Meeting") of CELESTICA INC.

(the "Corporation" or "Celestica") will be held at the Novotel Toronto North York Hotel,

3 Park Home Avenue, North York, Ontario on Wednesday the 29th day of April, 2020 at 9:30 a.m. EDT for the following purposes:

- •

- to

receive and consider the financial statements of the Corporation for its financial year ended December 31, 2019, together with the report of the auditor thereon;

- •

- to

elect the directors for the ensuing year;

- •

- to

appoint the auditor for the ensuing year;

- •

- to

authorize the directors to fix the auditor's remuneration;

- •

- to

approve an advisory resolution on the Corporation's approach to executive compensation; and

- •

- to

transact such other business as may properly be brought before the Meeting and any adjournment(s) or postponement(s) thereof.

Shareholders

are invited to vote at the Meeting by completing, signing, dating and returning the accompanying form of proxy by mail or by following the instructions for voting by telephone or internet

in the accompanying form of proxy, whether or not they are able to attend personally.

Only

shareholders of record at the close of business on March 13, 2020 will be entitled to vote at the Meeting.

DATED

at Toronto, Ontario this 12th day of March, 2020.

By

Order of the Board of Directors

Elizabeth

L. DelBianco

Chief Legal and Administrative Officer

and Corporate Secretary

Note: If you are a new shareholder or a shareholder who did not elect to receive a copy of our 2019 Annual Report, you can view that report on our website at

www.celestica.com or under our profile at www.sedar.com. If you wish to receive a hard copy of the report, please contact us at

[email protected].

CELESTICA INC.

5140 Yonge Street, Suite 1900

Toronto, Ontario, Canada M2N 6L7

MANAGEMENT INFORMATION CIRCULAR

In this Management Information Circular (the "Circular"), unless otherwise noted, all information is given as of

February 19, 2020 and all dollar amounts are expressed in United States dollars. Unless stated otherwise, all references to "U.S.$" or "$" are to U.S. dollars and all references

to "C$" are to Canadian dollars. Unless otherwise indicated, any reference in this Circular to a conversion between U.S.$ and C$ is a conversion at the average of the exchange rates in effect for

2019. During that period, based on the relevant 2019 noon buying rates in New York City for cable transfers in Canadian dollars, as certified for customs purposes by the Board of Governors of

the U.S. Federal Reserve System, the average exchange rate was $1.00 = C$1.3269.

|

QUESTIONS AND ANSWERS ON VOTING AND PROXIES

|

- Q.

- WHAT DECISIONS WILL I BE ASKED TO MAKE?

- A.

- Shareholders will be voting on the following matters: the election of each individual director to the Board of Directors of the

Corporation (the "Board" or the "Board of Directors") for the ensuing year, the appointment of an

auditor for the Corporation for the ensuing year, authorization of the Board to fix the auditor's remuneration, an advisory resolution on the Corporation's approach to executive compensation, and any

other matters as may properly be brought before the Meeting.

The

Corporation's Board of Directors and management recommend that you vote in favour of each of the proposed nominees for election as directors of the

Corporation, in favour of the appointment of KPMG LLP as auditor of the Corporation, in favour of

the authorization of the Board of Directors of the Corporation to fix the remuneration to be paid to the auditor, and in favour of the advisory

resolution on the Corporation's approach to executive compensation.

- Q.

- WHO IS SOLICITING MY PROXY?

- A.

- The Corporation's management is soliciting your proxy. All associated costs of solicitation will be borne by the

Corporation. The solicitation will be primarily by mail, but proxies may also be solicited personally by regular employees of the Corporation for which no additional compensation will be paid. The

Corporation anticipates that copies of this Circular and accompanying form of proxy will be sent to registered shareholders on or about March 20, 2020.

- Q.

- WHO IS ENTITLED TO VOTE?

- A.

- Any holder of Subordinate Voting Shares ("SVS") or Multiple Voting Shares

("MVS") of the Corporation at the close of business on March 13, 2020 or such holder's duly appointed proxyholders or representatives are

entitled to vote.

As

at February 19, 2020, 110,451,453 SVS (which carry one vote per share and collectively represent approximately 19.2% of the voting power of the Corporation's securities) and

18,600,193 MVS (which carry

25 votes

per share and collectively represent approximately 80.8% of the voting power of the Corporation's securities) were issued and outstanding.

- Q.

- HOW DO I EXERCISE MY VOTE (AND BY WHEN) IF I AM A REGISTERED SHAREHOLDER?

- A.

- If you are a registered shareholder, you may exercise your right to vote by attending and voting your shares in person at the Meeting,

by mailing in the attached form of proxy or by voting by telephone or internet.

If

you vote your shares in person, your vote will be taken and counted at the Meeting.

If

you choose to vote your shares using the form of proxy, your proxy form must be received by the Corporation's registrar and transfer agent, Computershare Investor Services Inc.

("Computershare"), 100 University Avenue, 8th Floor, Toronto, Ontario, Canada M5J 2Y1, no

later than 5:00 p.m. (EDT) on Monday, April 27, 2020. If the Meeting is adjourned or postponed, Computershare must receive the form of proxy at least

48 hours, excluding Saturdays, Sundays and holidays, before the rescheduled Meeting. Alternatively, the form of proxy may be given to the Chair of the Meeting at which the form of proxy is to

be used.

If

you choose to vote your shares by telephone or internet, your vote must be received no later than 5:00 p.m. (EDT) on Monday,

April 27, 2020.

Non-registered

shareholders should refer to Questions and Answers on Voting and Proxies — How Do I Vote If I Am a Non-Registered

Shareholder?

- Q.

- WHAT IF A REGISTERED SHAREHOLDER SIGNS THE FORM OF PROXY ENCLOSED WITH THIS CIRCULAR?

- A.

- Signing the form of proxy gives authority to Mr. Michael M. Wilson or Mr. Robert A. Mionis or their designees

(the "Proxy Nominees"), to vote your shares at the Meeting, unless you give authority to another person to vote your shares by providing that

person's name on the form of proxy.

- Q.

- CAN A REGISTERED SHAREHOLDER APPOINT SOMEONE OTHER THAN THE PROXY NOMINEES TO VOTE THEIR SHARES AT THE MEETING?

- A.

- Yes, you may appoint an individual or company (such individual or authorized representative of such company shall be referred to herein as a "Designee") other

than the Proxy Nominees to represent you at the Meeting. Write the name of the Designee of your choice in the blank space provided in the form of proxy. The Designee whom you

choose need not be a shareholder.

Please

ensure that the Designee you have appointed is attending the Meeting and is aware that he or she will be voting your shares. Designees should speak to a representative of Computershare upon

arriving at the Meeting.

- Q.

- HOW WILL THE SHARES OF REGISTERED SHAREHOLDERS BE VOTED AT THE MEETING IF THEY GIVE THEIR PROXY?

- A.

- On any ballot that may be called for, the shares represented by a properly executed proxy given in favour of the Proxy Nominees in the

enclosed form of proxy will be voted for or against or withheld from voting in accordance with the instructions given on the ballot. If you specify a choice with respect to any matter to be acted

upon, such shares will be voted accordingly.

The

persons named in the form of proxy must vote for or against or withhold from voting your shares in accordance with your instructions on the form of proxy. In the absence of

such directions and unless you specify a Designee other than the Proxy Nominees to vote your shares, your shares will be voted in favour of the election to the Corporation's Board of each of the

nominees proposed by management, in favour of the appointment of KPMG LLP as the Corporation's auditor, in favour of the authorization of the Board to fix the auditor's remuneration, in favour

of the advisory resolution on the Corporation's approach to executive compensation, and as the Proxy Nominees may determine in their best judgment with respect to any other matters that may be

properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

- Q.

- IF REGISTERED SHAREHOLDERS CHANGE THEIR MIND, CAN THEY TAKE BACK THEIR PROXY ONCE IT HAS BEEN GIVEN?

- A.

- Yes, you may revoke any proxy that you have given at any time prior to its use at the Meeting for which it was given or any

adjournment(s) or postponement(s) thereof. In addition to revocation in any other manner permitted by law, you may revoke your proxy by preparing a written statement, signed by you or your attorney,

as authorized, or if the proxy is given on behalf of a corporation or other legal entity, by a duly authorized officer or attorney of such corporation or legal entity, and deposited with the Chair of

the Meeting on the day of the Meeting, or any adjournment(s) or postponement(s) thereof, prior to the proxy being voted, or by transmitting, by telephonic or electronic means, a revocation signed by

electronic signature by you or by your attorney, who is authorized in writing, to the registered office of the Corporation at any time up to and including the last business day preceding the day of

the Meeting, or any adjournment(s) or postponement(s) thereof, at which the proxy is to be used.

Note

that your participation in person in a vote by ballot at the Meeting will automatically revoke any proxy previously given by you regarding business considered by that vote.

- Q.

- WHAT IF AMENDMENTS ARE MADE TO THE SCHEDULED MATTERS OR IF OTHER MATTERS ARE BROUGHT BEFORE THE MEETING?

- A.

- The accompanying form of proxy confers discretionary authority upon the Proxy Nominees in respect of any amendments or variations to

matters identified in the Notice of Meeting or other matters that may properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

As

of the date of this Circular, the Corporation's management was not aware of any such amendments, variations or other matters to come before the Meeting. However, if any amendments, variations or

other matters that are not now known to management should properly come before the Meeting or any adjournment(s) or postponement(s) thereof, the shares represented by proxies in favour of the Proxy

Nominees will be voted on such matters in accordance with their best judgment.

- Q.

- HOW DO I VOTE IF I AM A NON-REGISTERED SHAREHOLDER?

- A.

- A shareholder is a non-registered shareholder (or beneficial owner) if (i) an intermediary (such as a bank, trust company,

securities dealer or broker, trustee or administrator of a registered retirement savings plan, registered retirement income fund, deferred profit sharing plan, registered education savings plan,

registered disability savings plan or tax-free savings account), or (ii) a clearing agency (such as CDS Clearing and Depository Services Inc. or Depository Trust and Clearing

Corporation), of which the intermediary is a participant (in each case, an "Intermediary"), holds the shareholder's shares on behalf of the

shareholder.

In

accordance with National Instrument 54-101 — Communication with Beneficial Owners of Securities of a Reporting

Issuer of the Canadian Securities Administrators ("NI 54-101"), the Corporation is distributing copies of materials

related to the Meeting to Intermediaries for distribution to non-registered shareholders and such Intermediaries are to forward the materials related to the Meeting to each non-registered shareholder

(unless the non-registered shareholder has declined to receive such materials). Such Intermediaries often use a service company (such as Broadridge Investor Communication Solutions

("Broadridge")), to permit the non-registered shareholder to direct the voting of the shares held by the Intermediary on behalf of the non-registered

shareholder. The Corporation is paying Broadridge to deliver, on behalf of the Intermediaries, a copy of the materials related to the Meeting to each "non-objecting beneficial owner" and each

"objecting beneficial owner" (as those terms are defined in NI 54-101).

If

you are a non-registered shareholder, the Intermediary holding your shares should provide a voting instruction form. In order to cast your vote, you must follow the instructions on the voting

instruction form to vote by telephone or internet, or complete, sign and return the voting instruction form in accordance with the instructions, and within the timeline (which will likely be earlier

than 5:00 p.m. (EDT) on Monday, April 27, 2020), set forth therein. This form will constitute voting instructions which the Intermediary must follow. Alternatively, the Intermediary may

provide you with a signed form of proxy. In this case, you do not need to sign the form of proxy, but should complete it and forward it directly to Computershare.

As

a non-registered holder, if your shares are held through a broker who is a member of the New York Stock Exchange (the "NYSE") and you

do not return the voting instruction form, your broker will not have the discretion to vote your shares on any "non-routine" matters, as defined under NYSE rules. Therefore, it

is important that you instruct your broker or other Intermediary how to vote your shares. If such broker doesn't receive voting instructions as to a non-routine proposal

(all proposals, other than the proposal to appoint the auditor for the ensuing year and to authorize the directors to fix the auditor's remuneration, are "non-routine" matters under NYSE

rules), a "broker non-vote" with respect to such shares occurs, and such shares will not be taken into account in determining the outcome of the non-routine proposal.

Should

you, as a non-registered shareholder, wish to attend the Meeting and vote your shares in person, or have another person attend and vote your shares on your behalf, you should fill in your own

name or the name of your appointee, as the case may be, in the space provided on the form of proxy provided by the Intermediary. An Intermediary's voting instruction form will likely provide

corresponding instructions as to how you (or your appointee) can cast your vote in person. In any case, you should carefully follow the instructions provided by the Intermediary and contact the

Intermediary promptly if you require assistance.

If

you vote and would subsequently like to change your vote (whether by revoking a voting instruction or by revoking a proxy), you should contact the Intermediary to discuss whether this is possible

and, if so, what procedures you should follow.

- Q.

- HOW CAN I CONTACT THE INDEPENDENT DIRECTORS AND CHAIR?

- A.

- You may confidentially contact the Chair of the Board or the independent directors by writing to them individually or as a group at the

Corporation's head office. Please send your letters in sealed envelopes to our head office as follows and we will deliver them to the Chair of the Board or the appropriate addressee(s), unopened:

c/o

Investor Relations

5140 Yonge Street, Suite 1900

Toronto, Ontario, Canada M2N 6L7

Phone: 416-448-2211

- Q.

- WHOM SHOULD I CONTACT IF I HAVE QUESTIONS CONCERNING THE CIRCULAR OR FORM OF PROXY?

- A.

- If you have questions concerning the information contained in this Circular you may contact Celestica Investor Relations:

Investor

Relations

5140 Yonge Street, Suite 1900

Toronto, Ontario, Canada M2N 6L7

Phone: 416-448-2211

E-mail: [email protected]

If

you require assistance in completing the form of proxy you may contact Computershare (see contact coordinates below).

- Q.

- HOW CAN I CONTACT THE TRANSFER AGENT?

- A.

- You may contact the transfer agent by mail:

Computershare

Investor Services Inc.

100 University Avenue, 8th Floor

Toronto, Ontario M5J 2Y1

or

by telephone:

within

Canada and the United States

1-800-564-6253

all other countries

514-982-7555

|

PRINCIPAL HOLDERS OF VOTING SHARES

|

As

of February 19, 2020, the only persons, corporations or legal entities who, to the knowledge of the Corporation, its directors or executive officers, beneficially own, or control or direct,

directly or indirectly, voting securities carrying 10% or more of the voting rights attached to any class of the voting securities of the Corporation are as follows:

Table 1: Principal Holders of Voting Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

|

|

Number of

Shares

|

|

|

|

Percentage of

Class

|

|

|

|

Percentage of

All Equity Shares

|

|

|

|

Percentage of

Voting Power

|

|

|

Onex Corporation(1) |

|

|

|

18,600,193 MVS

|

|

|

|

100.0%

|

|

|

|

14.4%

|

|

|

|

80.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Toronto, Ontario

Canada |

|

|

|

397,045 SVS |

|

|

|

* |

|

|

|

* |

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gerald W. Schwartz(2) |

|

|

|

18,600,193 MVS

|

|

|

|

100.0%

|

|

|

|

14.4%

|

|

|

|

80.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Toronto, Ontario

Canada |

|

|

|

517,702 SVS |

|

|

|

* |

|

|

|

* |

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Letko, Brosseau & Associates Inc.(3)

Montréal, Québec

Canada |

|

|

|

20,539,951 SVS |

|

|

|

18.6% |

|

|

|

15.9% |

|

|

|

3.6% |

|

|

- *

- Less

than 1%.

- (1)

- The

number of shares beneficially owned, controlled or directed, directly or indirectly, by Onex Corporation ("Onex")

includes 945,010 MVS held by a wholly-owned subsidiary of Onex. 814,546 of the MVS beneficially owned by Onex are subject to options granted to certain officers of Onex pursuant to certain Onex

management investment plans, which options may be exercised upon specified dispositions by Onex (directly or indirectly) of Celestica's securities, with respect to which Onex has the right to vote or

direct the vote ("MIP Options"), including 688,807 MIP Options granted to Gerald W. Schwartz (each of which MVS will, upon exercise of such

options, be automatically converted into an SVS).

- (2)

- The

number of shares beneficially owned, or controlled or directed, directly or indirectly, by Mr. Schwartz consists of 120,657 SVS owned by a company

controlled by Mr. Schwartz and all of the 18,600,193 MVS and 397,045 SVS beneficially owned, controlled or directed, directly or indirectly, by Onex as described in

footnote 1 above. Mr. Schwartz is the Chairman of the Board, President and Chief Executive Officer of Onex. In addition, he indirectly owns multiple voting shares of Onex carrying the

right to elect a majority of the Onex board of directors. Accordingly, under applicable securities laws, Mr. Schwartz is deemed to be the beneficial owner of the Celestica shares owned by Onex;

Mr. Schwartz has advised the Corporation, however, that he disclaims beneficial ownership of the shares held by Onex.

- (3)

- The

number of shares reported as held by Letko, Brosseau & Associates Inc. is based on the Schedule 13G/A it filed with the United States

Securities and Exchange Commission on January 28, 2020, reporting ownership as of December 31, 2019.

Agreement for the Benefit of Holders of SVS

Onex, which beneficially owns, controls or directs, directly or indirectly, all of the outstanding MVS, has entered into an agreement with the Corporation and

with Computershare Trust Company of Canada (as successor to the Montreal Trust Company of Canada), as trustee for the benefit of the holders of the SVS, for the purpose of ensuring that the

holders of the SVS will not be deprived of rights under applicable provincial take-over bid legislation to which they would be otherwise entitled in the event of a take-over bid (as that term

is defined in applicable securities legislation) for the MVS if the MVS had been SVS. Subject to certain permitted forms of sale, such as identical or better offers to all holders of SVS, Onex has

agreed that it, and any of its affiliates that may hold MVS from time to time, will not sell any MVS, directly or indirectly, pursuant to a take-over bid (as that term is defined under

applicable securities legislation) under circumstances in which any applicable securities legislation would have required the same offer or a follow-up offer to be made to holders of SVS if the sale

had been a sale of SVS rather than MVS, but otherwise on the same terms.

The

Restated Articles of Incorporation (the "Articles") of the Corporation provide "coat-tail" protection to the holders of the SVS by providing

that the MVS will be converted automatically into SVS upon any transfer thereof, except (a) a transfer to Onex or any affiliate of Onex, or (b) a transfer of 100% of the outstanding MVS

to a purchaser who also has offered to purchase all of the outstanding SVS for a per share consideration identical to, and otherwise on the same terms as, that offered for the MVS, and the MVS held by

such purchaser thereafter shall be subject to the provisions relating to conversion (including with respect to the provisions described in this paragraph) as if all references to Onex were references

to such purchaser. In addition, if (a) any holder of any MVS ceases to be an affiliate of Onex, or (b) Onex and its affiliates cease to have the right, in all cases, to exercise the

votes attached to, or to direct the voting of, any of the MVS held by Onex and its affiliates, such MVS shall convert automatically into SVS on a one-for-one basis. For these purposes,

(a) "Onex" includes any successor corporation resulting from an amalgamation, merger, arrangement, sale of all or substantially all of its assets, or other business combination or

reorganization involving Onex, provided that such successor corporation beneficially owns directly or indirectly all MVS beneficially owned directly or indirectly by Onex immediately prior to such

transaction and is controlled by the same person or persons as controlled Onex prior to the consummation of such transaction, (b) a corporation shall be deemed to be a subsidiary of another

corporation if, but only if (i) it is controlled by that other, or that other and one or more corporations each of which is controlled by that other, or two or more corporations each of which

is controlled by that other, or (ii) it is a subsidiary of a corporation that is that

other's subsidiary, (c) "affiliate" means a subsidiary of Onex or a corporation controlled by the same person or company that controls Onex, and (d) "control" means beneficial ownership

of, or control or direction over, securities carrying more than 50% of the votes that may be cast to elect directors if those votes, if cast, could elect more than 50% of the directors. For these

purposes, a person is deemed to beneficially own any security which is beneficially owned by a corporation controlled by such person. In addition, if at any time the number of outstanding MVS shall

represent less than 5% of the aggregate number of the outstanding MVS and SVS, all of the outstanding MVS shall be automatically converted at such time into SVS on a one-for-one basis.

|

INFORMATION RELATING TO OUR DIRECTORS

|

Election of Directors

The nine individuals listed herein are being recommended for election as directors of the Corporation, as the current term of office for each director expires

at the close of the Meeting. If elected, they will hold office until the close of the next annual meeting of shareholders or until their successors are elected or appointed, unless such office is

earlier vacated in accordance with the Corporation's by-laws. All of the proposed nominees are currently directors of the Corporation. The Articles provide for a minimum of three and a maximum of

twenty directors. The Board of Directors has the authority to set the number of directors of the Corporation to be elected at the Meeting and has set that number at nine.

The

Board has a retirement policy which provides that, unless the Board authorizes an exception, a director shall not stand for re-election after his or her 75th birthday. As previously

disclosed, an exception to such policy was authorized for Mr. Etherington in each of the past three years in light of his leadership, expertise and valuable contributions to the Board. Through

the Board's 2019 annual evaluation process, and on the recommendation of the Nominating and Corporate Governance Committee, Mr. Wilson was identified to succeed Mr. Etherington as Chair

of the Board and Chair of the Nominating and Corporate Governance Committee upon Mr. Etherington's retirement. Mr. Etherington retired on January 29, 2020 and Mr. Wilson

replaced him as Chair of the Board and Chair of the Nominating and Corporate Governance Committee as of such date. Mr. Wilson has served on the Board since 2011. See Statement of Corporate Governance

Practices — Nomination and Election of Directors and Statement of Corporate Governance Practices — Retirement Policy and Term Limits in

Schedule A

to this Circular.

Unless

authority to do so is withheld, shares represented by proxies in favour of the Proxy Nominees will be voted in favour of each of the proposed nominees listed below for election as directors.

Management of the

Corporation

does not contemplate that any of the nominees will be unable, or for any reason unwilling, to serve as a director, but if that should occur for any reason prior to their election, the

Proxy Nominees may, in their discretion, nominate and vote for another nominee.

The

Board has adopted a policy that requires, in an uncontested election of directors, that shareholders be able to vote in favour of, or to withhold from voting, separately

for each director nominee. If, with respect to any particular nominee, other than the controlling shareholder or a representative of the controlling shareholder, the number of shares withheld from

voting by shareholders other than the controlling shareholder and its associates exceeds the number of shares that are voted in favour of the nominee, by shareholders other than the controlling

shareholder and its associates, then the Board shall determine, and in so doing shall give due weight to the rights of the controlling shareholder, whether to require the nominee to resign from the

Board and, if so required, any such nominee shall immediately tender his or her resignation. A director who tenders a resignation pursuant to this policy will not participate in any meeting of the

Board at which the resignation is considered. The Board shall determine whether to accept the resignation, which, if accepted, shall be effective immediately upon such acceptance. The Board shall

accept such resignation absent exceptional circumstances. Such a determination by the Board shall be made, and promptly announced by press release (a copy of which will be provided to the

Toronto Stock Exchange ("TSX")), within 90 days after the applicable shareholders' meeting. If the Board determines not to accept a resignation,

the press release will fully state the reasons for such decision. Subject to any corporate law restrictions, the Board may leave any resultant vacancy unfilled until the next annual shareholders'

meeting or it may fill the vacancy through the appointment of a new director whom the Board considers would merit the confidence of the shareholders, or it may call a special meeting of shareholders

at which there shall be presented a nominee or nominees to fill the vacant position or positions. See Statement of Corporate Governance

Practices — Nomination and Election of Directors — Election of Directors in Schedule A

to this Circular.

Nominees for Election as Director

|

The

following tables set out certain information with respect to the nominees, including their places of residence; their ages; the year from which each has continuously

served as a director of the Corporation, if applicable; all positions and offices held by them with the Corporation or any of its significant affiliates; their present principal occupations,

businesses and employments; and other public corporations of which they are or were (during the prior five years) directors. There are no contracts, arrangements or understandings between any director

or executive officer or any other person pursuant to which any one of the nominees has been nominated.

For

a description of the deferred share units ("DSUs") and restricted share units ("RSUs") issued to the

Corporation's directors, see Information Relating to Our Directors — Directors' Ownership of Securities and Information Relating to Our

Directors — Director Compensation. In the case of options, RSUs and performance share

units ("PSUs") issued to Mr. Mionis, see Compensation Discussion and Analysis and Compensation of Named

Executive Officers — Option-Based and Share-Based

Awards. As an executive officer of the Corporation, Mr. Mionis has not received any DSUs.

Robert A. Cascella

Boca Raton, Florida

United States

Director Since: 2019

Age: 65

Status: Independent

Areas of Expertise:

• Executive Leadership

• Healthcare Technology

• Strategy & M&A

2019 Annual Meeting

Votes in Favour: 99.57%

Votes Withheld: 0.43%

Mr. Cascella is currently an Executive Vice President and Executive Committee member of Royal Philips, a public Dutch multinational healthcare company. He is

also the Chief Executive Officer ("CEO") of the Philips Precision Diagnosis business, including businesses serving Radiology, Cardiology and Oncology,

as well as Enterprise Diagnostic Informatics. He served as the President and CEO of Hologic, Inc., a public medical device and diagnostics company, from 2003 to 2013. He has also held senior

leadership positions at CFG Capital, NeoVision Corporation and Fischer Imaging Corporation. Mr. Cascella served on Hologic, Inc.'s board of directors from 2008 to 2013. He also

previously served on the board of Tegra Medical and acted as chair of the boards of Dysis Medical and Miranda Medical. He holds a Bachelor's degree in Accounting from Fairfield University.

Mr. Cascella sits on the Audit, Human Resources and Compensation, and Nominating and Corporate Governance Committees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE(1)(2) |

|

|

|

|

|

|

|

|

| |

|

ATTENDANCE |

|

TOTAL ATTENDANCE |

| Board |

|

7 of 8 |

|

Board |

|

87% |

| Audit |

|

5 of 5 |

|

Committee |

|

92% |

| Human Resources and Compensation |

|

4 of 5 |

|

|

|

|

| Nominating and Corporate Governance |

|

3 of 3 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CURRENT PUBLIC BOARD DIRECTORSHIPS |

|

|

|

|

|

|

|

|

| No other public company directorships |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE AND DSU/RSU OWNERSHIP VALUE AS OF DECEMBER 31, 2019(3) |

|

|

|

|

|

|

|

|

| Target Value: $352,500 |

|

Target Met: N/A |

| Actual Value: $132,990 |

|

|

|

|

Deepak Chopra

Toronto, Ontario

Canada

Director Since: 2018

Age: 56

Status: Independent

Areas of Expertise:

• Executive Leadership

• Logistics & e-Commerce Supply-Chain

• Global Strategic Development

2019 Annual Meeting

Votes in Favour: 99.23%

Votes Withheld: 0.77%

Mr. Chopra most recently served as President and Chief Executive Officer of Canada Post Corporation from February 2011 to March 2018. He has more

than 30 years of global experience in the financial services, technology, logistics and supply-chain industries. Mr. Chopra worked for Pitney Bowes Inc., a NYSE-traded technology

company known for postage meters, mail automation and location intelligence services, for more than 20 years. He served as President of Pitney Bowes Canada and Latin America from 2006 to 2010.

He held a number of increasingly senior executive roles internationally, including President of its new Asia Pacific and Middle East region from 2001 to 2006 and Chief Financial Officer for the

Europe, Africa and Middle East (EAME) region from 1998 to 2001. He has previously served on the boards of Canada Post Corporation, Purolator Inc., SCI Group, the Canada Post Community

Foundation, the Toronto Region Board of Trade and the Conference Board of Canada. He currently sits on the board of The North West Company Inc., a TSX-traded retailer. Mr. Chopra is a

Fellow of the Institute of Chartered Professional Accountants of Canada and has a Bachelor's degree in Commerce (Honours) and a Master's Degree in Business Management (PGDBM).

Mr. Chopra

sits on the Audit, Human Resources and Compensation, and Nominating and Corporate Governance Committees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE(2) |

|

|

|

|

|

|

|

|

| |

|

ATTENDANCE |

|

TOTAL ATTENDANCE |

| Board |

|

9 of 9 |

|

Board |

|

100% |

| Audit |

|

6 of 6 |

|

Committee |

|

100% |

| Human Resources and Compensation |

|

6 of 6 |

|

|

|

|

| Nominating and Corporate Governance |

|

4 of 4 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CURRENT PUBLIC BOARD DIRECTORSHIPS |

|

|

|

|

|

|

|

|

| The North West Company Inc. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE AND DSU/RSU OWNERSHIP VALUE AS OF DECEMBER 31, 2019(3) |

|

|

|

|

|

|

|

|

| Target Value: $352,500 |

|

Target Met: N/A |

| Actual Value: $233,437 |

|

|

|

|

Daniel P. DiMaggio

Duluth, Georgia

United States

Director Since: 2010

Age: 69

Status: Independent

Areas of Expertise:

• Executive Leadership

• Global Operations and Supply Chain

• Financial Literacy

2019 Annual Meeting

Votes in Favour: 99.23%

Votes Withheld: 0.77%

Mr. DiMaggio is a corporate director. Prior to retiring in 2006, he spent 35 years with United Parcel Services ("UPS")

(a public company), most recently as CEO of the UPS Worldwide Logistics Group. Prior to leading UPS' Worldwide Logistics Group, Mr. DiMaggio held a number of positions at UPS with

increasing responsibility, including leadership roles for the UPS International Marketing Group, as well as the Industrial Engineering function. In addition to his senior leadership roles at UPS,

Mr. DiMaggio was a member of the board of directors of Greatwide Logistics Services, Inc. and CEVA Logistics (a public company). He holds a Bachelor of Science degree from the

Lowell Technological Institute (now the University of Massachusetts Lowell).

Mr. DiMaggio

sits on the Audit, Human Resources and Compensation, and Nominating and Corporate Governance Committees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE(2) |

|

|

|

|

|

|

|

|

| |

|

ATTENDANCE |

|

TOTAL ATTENDANCE |

| Board |

|

9 of 9 |

|

Board |

|

100% |

| Audit |

|

6 of 6 |

|

Committee |

|

100% |

| Human Resources and Compensation |

|

6 of 6 |

|

|

|

|

| Nominating and Corporate Governance |

|

4 of 4 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CURRENT PUBLIC BOARD DIRECTORSHIPS |

|

|

|

|

|

|

|

|

| No other public company directorships |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE AND DSU/RSU OWNERSHIP VALUE AS OF DECEMBER 31, 2019(3) |

|

|

|

|

|

|

|

|

| Target Value: $352,500 |

|

Target Met: Yes |

| Actual Value: $1,745,408 |

|

|

|

|

Laurette T. Koellner

Merritt Island, Florida

United States

Director Since: 2009

Age: 65

Status: Independent

Areas of Expertise:

• Public Company Board Expertise

• Audit and Finance

• Human Resources

2019 Annual Meeting

Votes in Favour: 98.40%

Votes Withheld: 1.60%

Ms. Koellner is a corporate director. She most recently served as Executive Chairman of International Lease Finance Corporation, an aircraft leasing subsidiary of American

International Group, Inc. ("AIG") from 2012 until its sale in 2014. Ms. Koellner retired as President of Boeing International, a division

of The Boeing Company, in 2008. While at Boeing, she was a member of the Office of the Chairman and served as the Executive Vice President, Internal Services, Chief Human Resources and Administrative

Officer, President of Shared Services and Corporate Controller. Ms. Koellner previously served on the board of directors and was the Chair of the Audit Committee of Hillshire Brands Company

(a public company, formerly Sara Lee Corporation and now merged with Tyson Foods, Inc.) and on the board of directors of AIG (a public company). She holds a Bachelor of Science

degree in Business Management from the University of Central Florida and a Master of Business Administration from Stetson University, as well as a Certified Professional Contracts Manager designation

from the National Contracts Management Association.

Ms. Koellner

sits on the Audit (Chair), Human Resources and Compensation, and Nominating and Corporate Governance Committees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE(2) |

|

|

|

|

|

|

|

|

| |

|

ATTENDANCE |

|

TOTAL ATTENDANCE |

| Board |

|

9 of 9 |

|

Board |

|

100% |

| Audit |

|

6 of 6 |

|

Committee |

|

100% |

| Human Resources and Compensation |

|

6 of 6 |

|

|

|

|

| Nominating and Corporate Governance |

|

4 of 4 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CURRENT PUBLIC BOARD DIRECTORSHIPS |

|

|

|

|

|

|

|

|

| • Papa John's International, Inc. |

|

• Nucor Corporation |

| • The Goodyear Tire & Rubber Company |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE AND DSU/RSU OWNERSHIP VALUE AS OF DECEMBER 31, 2019(3) |

|

|

|

|

|

|

|

|

| Target Value: $352,500 |

|

Target Met: Yes |

| Actual Value: $1,902,770 |

|

|

|

|

Robert A. Mionis

Hampton, New Hampshire

United States

Director Since: 2015

Age: 56

Status: Not Independent

Areas of Expertise:

• Business Transformation and Strategy

• Operations

• Technology and Engineering

• Risk Management

2019 Annual Meeting

Votes in Favour: 99.45%

Votes Withheld: 0.55%

Mr. Mionis is President and CEO of the Corporation. From July 2013 until August 2015, he was an Operating Partner at Pamplona Capital Management

("Pamplona"), a global private equity firm focused on companies in the industrial, aerospace, healthcare and automotive industries. Before joining

Pamplona, Mr. Mionis spent over six years as the President and CEO of StandardAero, a global aerospace maintenance, repair and overhaul company. Before StandardAero, Mr. Mionis held

senior leadership roles at Honeywell, including as the head of the Integrated Supply Chain Organization for Honeywell Aerospace. Prior to Honeywell, Mr. Mionis held a variety of progressively

senior leadership roles with General Electric and Axcelis Technologies (each a public company) and AlliedSignal. Mr. Mionis has been serving on the board of directors of Shawcor Ltd., a

TSX-listed energy services company, since 2018. He holds a Bachelor of Science in Electrical Engineering from the University of Massachusetts.

Mr. Mionis does not sit on any committees of the Board of Directors of the Corporation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD ATTENDANCE(2) |

|

|

|

|

|

|

|

|

| |

|

ATTENDANCE |

|

TOTAL ATTENDANCE |

| Board |

|

9 of 9 |

|

100% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CURRENT PUBLIC BOARD DIRECTORSHIPS |

|

|

|

|

|

|

|

|

| • Shawcor Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE AND SHARE UNIT

OWNERSHIP AND VALUE

AS OF DECEMBER 31, 2019(4) |

|

EXECUTIVE SHARE OWNERSHIP

GUIDELINES(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

Shares/Units

(#)

|

|

Actual

Value

($) |

|

Target

Value

($) |

|

Target

Met |

|

Share and

Share Unit

Ownership

(Multiple of

Salary) |

|

|

|

|

|

|

|

|

|

|

|

|

|

SVS |

|

410,389 |

|

$3,393,917 |

|

|

|

|

|

|

|

RSUs |

|

540,891 |

|

$4,473,169 |

|

|

|

|

|

|

|

PSUs |

|

80,527 |

|

$665,956 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Value |

|

— |

|

$8,533,042 |

|

$4,750,000 |

|

Yes |

|

9X |

|

|

|

|

|

|

|

|

|

|

|

|

Carol S. Perry

Toronto, Ontario

Canada

Director Since: 2013

Age: 69

Status: Independent

Areas of Expertise:

• Capital Markets

• Finance and Treasury

• Corporate Governance and Securities Regulation

2019 Annual Meeting

Votes in Favour: 99.42%

Votes Withheld: 0.58%

Ms. Perry is a corporate director. She is Chair of the Independent Review Committee of the mutual funds managed by 1832 Asset Management L.P., a

mutual fund manager and wholly-owned affiliate of The Bank of Nova Scotia. She also serves as Chair of the Independent Review Committees of investment funds managed by Jarislowsky Fraser Limited and

MD Financial Management Inc., which are subsidiaries of The Bank of Nova Scotia. Previously, she was a Commissioner of the Ontario Securities Commission, and has served on adjudicative panels

and acted as a director and Chair of its Governance and Nominating Committee. With over 20 years of experience in the investment industry as an investment banker, Ms. Perry held senior

positions with leading financial services companies including RBC Capital Markets, Richardson Greenshields of Canada Limited and CIBC World Markets and later founded MaxxCap Corporate

Finance Inc., a financial advisory firm. She is a former director of Softchoice Corporation, Atomic Energy of Canada Limited and DALSA Corporation. Ms. Perry has a Bachelor of

Engineering Science (Electrical) degree from the University of Western Ontario and a Master of Business Administration degree from the University of Toronto. She also holds the professional

designation ICD.D from the Institute of Corporate Directors.

Ms. Perry

sits on the Audit, Human Resources and Compensation, and Nominating and Corporate Governance Committees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE(2) |

|

|

|

|

|

|

|

|

| |

|

ATTENDANCE |

|

TOTAL ATTENDANCE |

| Board |

|

9 of 9 |

|

Board |

|

100% |

| Audit |

|

6 of 6 |

|

Committee |

|

100% |

| Human Resources and Compensation |

|

6 of 6 |

|

|

|

|

| Nominating and Corporate Governance |

|

4 of 4 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CURRENT PUBLIC BOARD DIRECTORSHIPS |

|

|

|

|

|

|

|

|

| No other public company directorships |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE AND DSU/RSU OWNERSHIP VALUE AS OF DECEMBER 31, 2019(3) |

|

|

|

|

|

|

|

|

| Target Value: $352,500 |

|

Target Met: Yes |

| Actual Value: $1,278,137 |

|

|

|

|

Tawfiq Popatia

Toronto, Ontario

Canada

Director Since: 2017

Age: 45

Status: Not Independent

Areas of Expertise:

• Finance and Capital Markets

• Aerospace and Transportation

• Business Development

2019 Annual Meeting

Votes in Favour: 99.40%

Votes Withheld: 0.60%

Mr. Popatia has been a Managing Director of Onex since 2014 and leads its efforts in automation, aerospace and other transportation-focused industries, having joined the firm in

2007. Prior to joining Onex, Mr. Popatia worked at the private equity firm of Hellman & Friedman LLC and in the Investment Banking Division of Morgan Stanley & Co.

Mr. Popatia currently serves on the boards of Advanced Integration Technology, an aerospace automation company, and BBAM, a provider of commercial jet aircraft leasing, financing and

management. He previously served on the board of Spirit Aerosystems (a public company) and is a former Employer Trustee of the International Association of Machinists National Pension Fund.

Mr. Popatia holds a Bachelor of Science degree in Microbiology and a Bachelor of Commerce degree in Finance from the University of British Columbia.

Mr. Popatia

does not sit on any committees of the Board of Directors of the Corporation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD ATTENDANCE(2) |

|

|

|

|

|

|

|

|

| |

|

ATTENDANCE |

|

TOTAL ATTENDANCE |

| Board |

|

8 of 9 |

|

88% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CURRENT PUBLIC BOARD DIRECTORSHIPS |

|

|

|

|

|

|

|

|

| No other public company directorships |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE AND DSU/RSU OWNERSHIP VALUE AS OF DECEMBER 31, 2019(3)(5) |

|

|

|

|

|

|

|

|

| Target Value: N/A |

|

|

|

Target Met: N/A |

Actual Value: N/A

|

|

|

|

|

Eamon J. Ryan

Toronto, Ontario

Canada

Director Since: 2008

Age: 74

Status: Independent

Areas of Expertise:

• Executive Compensation

• Marketing and Sales

• Business Development

2019 Annual Meeting

Votes in Favour: 99.12%

Votes Withheld: 0.88%

Mr. Ryan is a corporate director. He is the former Vice President and General Manager, Europe, Middle East and Africa for Lexmark International Inc. (a public

company). Prior to that, he was the Vice President and General Manager, Printing Services and Solutions Manager, Europe, Middle East and Africa. Mr. Ryan joined Lexmark

International Inc. in 1991 as the President of Lexmark Canada. Prior to that, he spent 22 years at IBM Canada, where he held a number of sales and marketing roles in its Office Products

and Large Systems divisions. Mr. Ryan's last role at IBM Canada was Director of Operations for its Public Sector, a role he held from 1986 to 1990. He holds a Bachelor of Arts degree from the

University of Western Ontario.

Mr. Ryan

sits on the Audit, Human Resources and Compensation (Chair), and Nominating and Corporate Governance Committees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE(2) |

|

|

|

|

|

|

|

|

| |

|

ATTENDANCE |

|

TOTAL ATTENDANCE |

| Board |

|

9 of 9 |

|

Board |

|

100% |

| Audit |

|

6 of 6 |

|

Committee |

|

100% |

| Human Resources and Compensation |

|

6 of 6 |

|

|

|

|

| Nominating and Corporate Governance |

|

4 of 4 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CURRENT PUBLIC BOARD DIRECTORSHIPS |

|

|

|

|

|

|

|

|

| No other public company directorships |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE AND DSU/RSU OWNERSHIP VALUE AS OF DECEMBER 31, 2019(3) |

|

|

|

|

|

|

|

|

| Target Value: $352,500 |

|

Target Met: Yes |

| Actual Value: $2,308,793 |

|

|

|

|

Michael M. Wilson

Bragg Creek, Alberta

Canada

Director Since: 2011

Age: 68

Status: Independent

Areas of Expertise:

• Public Company Board Expertise

• Business Development

• Corporate Governance

2019 Annual Meeting

Votes in Favour: 99.23%

Votes Withheld: 0.77%

Mr. Wilson is a corporate director and has served on the Board since 2011. Mr. Wilson was appointed Chair of the Board effective January 29, 2020. Until his

retirement in December 2013, he was the President and CEO, and a director, of Agrium Inc. (a public agricultural crop inputs company that has subsequently merged with Potash

Corporation of Saskatchewan Inc. to form Nutrien Ltd.). He has over 30 years of international and executive management experience. Prior to joining Agrium Inc.,

Mr. Wilson served as President of Methanex Corporation (a public company) and held various senior positions in North America and Asia during his 18 years with The Dow Chemical

Company (a public company). Mr. Wilson previously served on the board of directors of Finning International Inc. (a public company) and was also the past Chair of the

Calgary Prostate Cancer Centre. He holds a degree in Chemical Engineering from the University of Waterloo.

Mr. Wilson

sits on the Audit, Human Resources and Compensation, and Nominating and Corporate Governance (Chair) Committees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE(2) |

|

|

|

|

|

|

|

|

| |

|

ATTENDANCE |

|

TOTAL ATTENDANCE |

| Board |

|

9 of 9 |

|

Board |

|

100% |

| Audit |

|

6 of 6 |

|

Committee |

|

100% |

| Human Resources and Compensation |

|

6 of 6 |

|

|

|

|

| Nominating and Corporate Governance |

|

4 of 4 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CURRENT PUBLIC BOARD DIRECTORSHIPS |

|

|

|

|

|

|

|

|

| • Air Canada |

|

• Suncor Energy Inc. (Chair) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE AND DSU/RSU OWNERSHIP VALUE AS OF DECEMBER 31, 2019(3) |

|

|

|

|

|

|

|

|

| Target Value: $352,500 |

|

Target Met: Yes |

| Actual Value: $1,837,396 |

|

|

|

|

- (1)

- Mr. Cascella

was appointed to the Board effective February 1, 2019.

- (2)

- See

Table 7: Directors' Attendance at Board and Committee Meetings for disclosure for all directors of board and

standing committee meeting attendance.

- (3)

- See — Directors' Ownership of Securities — Director Share Ownership

Guidelines for a description of the shareholding requirements for applicable directors. New directors have five years from the time of their appointment to the Board to comply

with the Director Share Ownership Guidelines (as defined below). The "Actual Value" of the shares and DSU/RSUs held as of December 31, 2019 is determined with respect to all SVS

beneficially owned, all unvested RSUs and all DSUs, the value of which was, in each case, determined using a share price of $8.27, the closing price of SVS on the NYSE on

December 31, 2019.

- (4)

- As

President and CEO of the Corporation, Mr. Mionis is subject to the Executive Share Ownership Guidelines and not the Director

Share Ownership Guidelines. See Executive Share Ownership. The "Actual Value" of the shares and share units held by Mr. Mionis as of

December 31, 2019 includes all SVS beneficially owned by Mr. Mionis, all of his unvested RSUs and his PSUs that vested on January 31, 2020. The value of such RSUs and PSUs was

determined using a share price of $8.27, the closing price of SVS on the NYSE on December 31, 2019.

- (5)

- Mr. Popatia,

as an officer of Onex, is not subject to the Director Share Ownership Guidelines.

Interlocking Directorships

|

None

of the current directors of the Corporation serve together as directors of other corporations.

Director Compensation

Director compensation is set by the Board on the recommendation of the Human Resources and Compensation Committee

(the "HRCC") and in accordance with director compensation guidelines and principles established by the Nominating and Corporate Governance

Committee. Under these guidelines and principles, the Board seeks to maintain director compensation at a level that is competitive with director compensation at comparable companies, and requires a

substantial portion of such compensation to be taken in the form of DSUs (or, at a director's election, RSUs, if the Director Share Ownership Guidelines described below have been met). The director

fee structure for 2019 is set forth in Table 2 below.

Table 2: Directors' Fees(1)

|

|

|

|

|

|

|

|

Element |

|

|

|

Director Fee Structure

for 2019(2) |

|

|

|

Annual Board Retainer(3) |

|

|

|

$360,000 — Board Chair

$235,000 — Directors |

|

|

|

|

|

|

|

|

|

|

|

Travel Fees(4) |

|

|

|

$2,500 |

|

|

|

|

|

|

|

|

|

|

|

Annual Retainer for the Audit Committee Chair |

|

|

|

$20,000 |

|

|

|

|

|

|

|

|

|

|

|

Annual Retainer for the HRCC Chair |

|

|

|

$15,000 |

|

|

|

|

|

|

|

|

|

|

|

Annual Retainer for the Nominating and Corporate Governance Committee Chair(5) |

|

|

|

— |

|

|

- (1)

- Does

not include Mr. Mionis, President and CEO of the Corporation, whose compensation is set out in Table 18 of this Circular. Does not include fees

payable to Onex for the service of Mr. Popatia as a director, which is described in footnote 10 to Table 3 of this Circular.

- (2)

- Directors

may also receive further retainers and meeting fees for participation on ad hoc committees. During 2019,

Mr. Wilson received a cash payment of $30,000 for chairing an ad hoc committee and Mses. Koellner and Perry and Mr. Ryan each received a

cash payment of $20,000 for participation on such committee. The Board has the discretion to grant supplemental equity awards to individual directors as deemed appropriate (no such discretion

was exercised in 2019).

- (3)

- Paid

on a quarterly basis.

- (4)

- Payable

only to directors who travel outside of their home state or province to attend a Board or Committee meeting.

- (5)

- The

Chair of the Board also served as the Chair of the Nominating and Corporate Governance Committee in 2019, for which no additional fee was paid.

Effective

January 1, 2019, each director must elect to receive 0%, 25% or 50% of their annual board fees, committee chair retainer fees and travel fees (collectively,

"Annual Fees") in cash, with the balance in DSUs, until such director has satisfied the requirements of the Director Share Ownership Guidelines

described (and defined) under Director Share Ownership Guidelines below. Once a director has satisfied such requirements, the director may then

elect to receive 0%, 25% or 50% of their

Annual Fees in cash, with the balance either in DSUs or RSUs. If a director does not make an election, 100% of such director's Annual Fees will be paid in DSUs.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Fee Election |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior to Satisfaction of Director

Share Ownership Guidelines |

|

|

|

After Satisfaction of Director

Share Ownership Guidelines |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option 1 |

|

|

|

Option 2 |

|

|

|

Option 1 |

|

|

|

Option 2 |

|

|

|

Option 3 |

|

|

|

100% DSUs |

|

|

|

(i) 25% Cash +

75% DSUs

or

(ii) 50% Cash +

50% DSUs |

|

|

|

(i) 100% DSUs

or

(ii) 100% RSUs |

|

|

|

(i) 25% Cash +

75% DSUs

or

(ii) 50% Cash +

50% DSUs |

|

|

|

(i) 25% Cash +

75% RSUs

or

(ii) 50% Cash +

50% RSUs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subject

to the terms of the Directors' Share Compensation Plan, each DSU represents the right to receive one SVS or an equivalent value in cash (at the Corporation's discretion) when the

director (a) ceases to be a director of the Corporation and (b) is not an employee of the Corporation or a director or employee of any corporation that does not deal at arm's-length with

the Corporation (collectively, "Retires"). RSUs granted to directors are governed by the terms of the Corporation's Long-Term Incentive Plan

("LTIP"). Each quarterly grant of RSUs will vest in instalments of one-third per year on the first, second and third anniversary dates of the grant.

Each vested RSU entitles the holder thereof to one SVS; however, if permitted by the Corporation under the terms of the grant, a director may elect to receive a payment of cash in lieu of SVS.

Unvested RSUs will vest immediately on the date that the director Retires. The date used in valuing DSUs and RSUs that vest on retirement for settlement purposes is the date that is 45 days

following the date on which the director Retires, or as soon as practicable thereafter. Such DSUs and RSUs, as applicable, are redeemed and payable on or prior to the 90th day

following the date on which the director Retires.

Grants

of DSUs and RSUs are credited quarterly in arrears. The number of DSUs and RSUs, as applicable, granted is calculated by multiplying the amount of such director's Annual Fees for the quarter by

the percentage of the Annual Fees that the director elected to receive in the form of DSUs or RSUs, as applicable, and dividing the product by the closing price of the SVS on the NYSE on the last

business day of the quarter.

Directors' Fees Earned in 2019

All compensation paid in 2019 by the Corporation to its directors is set out in Table 3, except for the compensation of Mr. Mionis, President and

CEO of the Corporation, which is set out in Table 18 of this Circular. In 2019, the Board (excluding Mr. Popatia — see footnote 10 to

Table 3) earned total Annual Fees in the amount of $2,170,000, including total grants of $1,396,250 in DSUs and $125,000 in RSUs.

Table 3: Director Fees Earned in Respect of 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

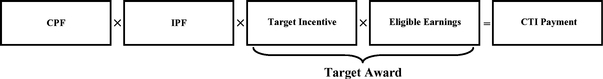

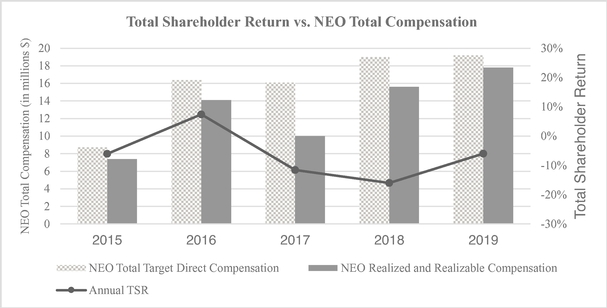

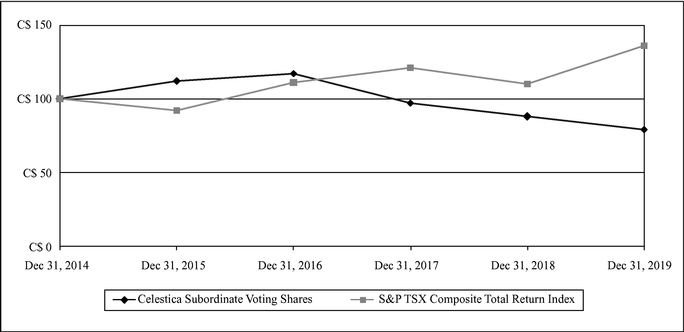

|