Form 6-K BCE INC For: Apr 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

| For the month of: April 2021 | Commission File Number: 1-8481 |

BCE Inc.

(Translation of Registrant’s name into English)

1, Carrefour Alexander-Graham-Bell, Verdun, Québec, Canada H3E 3B3,

(514) 870-8777

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

| Form 20-F | Form 40-F X | |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

| Yes | No X | |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

Only the BCE Inc. Management’s Discussion and Analysis for the quarter ended March 31, 2021 and the BCE Inc. unaudited consolidated interim financial statements for the quarter ended March 31, 2021, included in the BCE Inc. 2021 First Quarter Shareholder Report furnished with this Form 6-K as Exhibit 99.1, the Bell Canada Unaudited Selected Summary Financial Information for the quarter ended March 31, 2021 furnished with this Form 6-K as Exhibit 99.5, and the Exhibit to 2021 First Quarter Financial Statements – Earnings Coverage furnished with this Form 6-K as Exhibit 99.6 are incorporated by reference in the registration statements filed by BCE Inc. with the Securities and Exchange Commission on Form F-3 (Registration Statement No. 333-12130), Form S-8 (Registration Statement No. 333-12780), Form S-8 (Registration Statement No. 333-12802) and Form F-10 (Registration Statement No. 333-249962). Except for the foregoing, no other document or portion of document furnished with this Form 6-K is incorporated by reference in BCE Inc.’s registration statements. Notwithstanding any reference to BCE Inc.’s Web site on the World Wide Web in the documents attached hereto, the information contained in BCE Inc.’s site or any other site on the World Wide Web referred to in BCE Inc.’s site is not a part of this Form 6-K and, therefore, is not furnished to the Securities and Exchange Commission.

Page 1

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BCE Inc. | ||

| (signed) Glen LeBlanc

| ||

| Glen LeBlanc Executive Vice-President and Chief Financial Officer | ||

| April 29, 2021 | ||

Page 2

EXHIBIT INDEX

| 99.1 | BCE Inc. 2021 First Quarter Shareholder Report | |

| 99.2 | Supplementary Financial Information – First Quarter 2021 | |

| 99.3 | CEO/CFO Certifications | |

| 99.4 | News Release | |

| 99.5 | Bell Canada Unaudited Selected Summary Financial Information | |

| 99.6 | Exhibit to 2021 First Quarter Financial Statements – Earnings Coverage |

Page 3

Table of Contents

Exhibit 99.1

BCE 2021 FIRST QUARTER SHAREHOLDER REPORT APRIL 28, 2021 Q1

Table of Contents

Table of contents

| 1 | ||||||

| 1 | ||||||

| 1 |

3 | |||||

| 4 | ||||||

| 6 | ||||||

| 1.3 Assumptions |

7 | |||||

| 2 |

8 | |||||

| 8 | ||||||

| 9 | ||||||

| 10 | ||||||

| 2.4 Operating costs |

10 | |||||

| 2.5 Net earnings |

11 | |||||

| 2.6 Adjusted EBITDA |

11 | |||||

| 11 | ||||||

| 12 | ||||||

| 2.9 Finance costs |

12 | |||||

| 12 | ||||||

| 2.11 Income taxes |

12 | |||||

| 2.12 Net earnings attributable to common shareholders and EPS |

12 | |||||

| 3 |

13 | |||||

| 3.1 Bell Wireless |

13 | |||||

| 3.2 Bell Wireline |

17 | |||||

| 3.3 Bell Media |

21 | |||||

| 4 |

23 | |||||

| 4.1 Net debt |

23 | |||||

| 23 | ||||||

| 4.3 Cash flows |

24 | |||||

| 25 | ||||||

| 25 | ||||||

| 4.6 Credit ratings |

27 | |||||

| 4.7 Liquidity |

27 | |||||

| 5 |

28 | |||||

| 6 |

29 | |||||

| 7 |

30 | |||||

| 30 | ||||||

| 7.2 Non-GAAP financial measures and key performance indicators (KPIs) |

30 | |||||

| 33 | ||||||

| 34 | ||||||

| 34 | ||||||

| 35 | ||||||

| 36 | ||||||

| 37 | ||||||

| 38 | ||||||

| 39 | ||||||

| Note 1 |

39 | |||||

| Note 2 |

39 | |||||

| Note 3 |

40 | |||||

| Note 4 |

41 | |||||

| Note 5 |

41 | |||||

| Note 6 |

42 | |||||

| Note 7 |

42 | |||||

| Note 8 |

42 | |||||

| Note 9 |

42 | |||||

| Note 10 |

43 | |||||

| Note 11 |

44 | |||||

| Note 12 |

45 | |||||

| Note 13 |

46 | |||||

| Note 14 |

46 | |||||

Table of Contents

MD&A

Management’s discussion and analysis

In this management’s discussion and analysis (MD&A), we, us, our, BCE and the company mean, as the context may require, either BCE Inc. or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates. Bell means, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates.

All amounts in this MD&A are in millions of Canadian dollars, except where noted. Please refer to section 7.2, Non-GAAP financial measures and key performance indicators (KPIs) on pages 30 to 32 for a list of defined non-GAAP financial measures and KPIs.

Please refer to BCE’s unaudited consolidated financial statements for the first quarter of 2021 (Q1 2021 Financial Statements) when reading this MD&A. We also encourage you to read BCE’s MD&A for the year ended December 31, 2020 dated March 4, 2021 (BCE 2020 Annual MD&A). In preparing this MD&A, we have taken into account information available to us up to April 28, 2021, the date of this MD&A, unless otherwise stated.

You will find additional information relating to BCE, including BCE’s annual information form for the year ended December 31, 2020 dated March 4, 2021 (BCE 2020 AIF) and recent financial reports, including the BCE 2020 Annual MD&A, on BCE’s website at BCE.ca, on SEDAR at sedar.com and on EDGAR at sec.gov.

Documents and other information contained in BCE’s website or in any other site referred to in BCE’s website or in this MD&A are not part of this MD&A and are not incorporated by reference herein.

This MD&A comments on our business operations, performance, financial position and other matters for the three months (Q1) ended March 31, 2021 and 2020.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This MD&A and, in particular, but without limitation, the introduction to section 1, Overview, section 1.2, Key corporate and business developments, the section and sub-sections entitled Assumptions, section 3.1, Bell Wireless – Key business developments, section 3.2, Bell Wireline – Key business developments, section 4.3, Cash flows and section 4.7, Liquidity, contain forward-looking statements. These forward-looking statements include, without limitation, statements relating to the potential impacts on our business, financial condition, liquidity and financial results of the COVID-19 pandemic, BCE’s 2021 annualized common share dividend, our network deployment and capital investment plans, the sources of liquidity we expect to use to meet our anticipated cash requirements for the remainder of 2021, BCE’s business outlook, objectives, plans and strategic priorities, and other statements that do not refer to historical facts. A statement we make is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements are typically identified by the words assumption, goal, guidance, objective, outlook, project, strategy, target, and other similar expressions or future or conditional verbs such as aim, anticipate, believe, could, expect, intend, may, plan, seek, should, strive and will. All such forward-looking statements are made pursuant to the safe harbour provisions of applicable Canadian securities laws and of the United States (U.S.) Private Securities Litigation Reform Act of 1995.

Unless otherwise indicated by us, forward-looking statements in this MD&A describe our expectations as at April 28, 2021 and, accordingly, are subject to change after that date. Except as may be required by applicable securities laws, we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions, both general and specific, which give rise to the possibility that actual results or events could differ materially from our expectations expressed in, or implied by, such forward-looking statements and that our business outlook, objectives, plans and strategic priorities may not be achieved. These statements are not guarantees of future performance or events, and we caution you against relying on any of these forward-looking statements. Forward-looking statements are presented in this MD&A for the purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook as well as our anticipated operating environment. Readers are cautioned, however, that such information may not be appropriate for other purposes.

We have made certain economic, market and operational assumptions in preparing the forward-looking statements contained in this MD&A and, in particular, but without limitation, the forward-looking statements contained in the previously mentioned sections of this MD&A. These assumptions include, without limitation, the assumptions described in the section and sub-sections of this MD&A entitled Assumptions, which section and sub-sections are incorporated by reference in this cautionary statement. Subject to various factors including, without limitation, the future impacts of the COVID-19 pandemic, which are difficult to predict, we believe that our assumptions were reasonable at April 28, 2021. If our assumptions turn out to be inaccurate, our actual results could be materially different from what we expect.

Important risk factors that could cause actual results or events to differ materially from those expressed in, or implied by, the previously-mentioned forward-looking statements and other forward-looking statements contained in this MD&A, include, but are not limited to: the COVID-19 pandemic and the adverse effects from the emergency measures implemented or to be implemented as a result thereof, as well as other pandemics, epidemics and other health risks; adverse economic and financial market conditions, a declining level of retail and commercial activity, and the resulting negative impact on the demand for, and prices of, our products and services; the intensity of competitive activity including from new and emerging competitors; the level of technological substitution and the presence of alternative service providers contributing to the acceleration of disruptions and disintermediation in each of our business segments; changing viewer habits and the expansion of over-the-top (OTT) television (TV) and other alternative service providers, as well as the fragmentation of, and changes in, the advertising market; rising content costs and challenges in our ability to acquire or develop key content; the proliferation of content piracy; higher Canadian smartphone penetration and reduced or slower immigration flow; regulatory initiatives, proceedings and decisions, government consultations and government positions that affect us and influence our business; the inability to protect our physical and non-physical assets from events such as information security attacks, unauthorized access or entry, fire and natural disasters; the failure to transform our operations, enabling a truly customer-centric service experience, while lowering our cost structure; the failure to continue investment in next-generation capabilities in a disciplined and strategic manner; the inability to drive a positive customer experience; the complexity in our operations; the failure to maintain operational networks in the context of significant increases in capacity demands; the risk that we may need to incur significant capital expenditures to provide additional capacity and reduce network congestion; the failure to implement or maintain highly effective information

BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT | 1

Table of Contents

MD&A

technology (IT) systems; the failure to generate anticipated benefits from our corporate restructurings, system replacements and upgrades, process redesigns, staff reductions and the integration of business acquisitions; events affecting the functionality of, and our ability to protect, test, maintain, replace and upgrade, our networks, IT systems, equipment and other facilities; in-orbit and other operational risks to which the satellites used to provide our satellite TV services are subject; the failure to attract and retain employees with the appropriate skill sets and to drive their performance in a safe environment; labour disruptions and shortages; our dependence on third-party suppliers, outsourcers and consultants to provide an uninterrupted supply of the products and services we need to operate our business; the failure of our vendor selection, governance and oversight processes; security and data leakage exposure if security control protocols affecting our suppliers are bypassed; the quality of our products and services and the extent to which they may be subject to manufacturing defects or fail to comply with applicable government regulations and standards; the inability to access adequate sources of capital and generate sufficient cash flows from operating activities to meet our cash requirements, fund capital expenditures and provide for planned growth; uncertainty as to whether dividends will be declared by BCE’s board of directors or whether the dividend on common shares will be increased; the inability to manage various credit, liquidity and market risks; pension obligation volatility and increased contributions to post-employment benefit plans; new or higher taxes due to new tax laws or changes thereto or in the interpretation thereof, and the inability to predict the outcome of government audits; the failure to reduce costs, as well as unexpected increases in costs; the failure to evolve practices to effectively monitor and control fraudulent activities; unfavourable resolution of legal proceedings and, in particular, class actions; new or unfavourable changes in applicable laws and the failure to proactively address our legal and regulatory obligations; the failure to recognize and adequately respond to climate change concerns or stakeholder and governmental changing expectations on environmental matters; and health concerns about radiofrequency emissions from wireless communication devices and equipment.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also materially adversely affect us. Please see section 9, Business risks of the BCE 2020 Annual MD&A for a more complete description of the above-mentioned and other risks, which section, and the other sections of the BCE 2020 Annual MD&A referred to therein, are incorporated by reference in this cautionary statement. In addition, please also see section 6, Regulatory environment in this MD&A for updates to the regulatory initiatives and proceedings described in the BCE 2020 Annual MD&A, which section 6 is incorporated by reference in this cautionary statement. Any of those risks could cause actual results or events to differ materially from our expectations expressed in, or implied by, the forward-looking statements set out in this MD&A. Except for the updates set out in section 6, Regulatory environment of this MD&A, the risks described in the BCE 2020 Annual MD&A remain substantially unchanged.

We caution readers that the risk factors described above are not the only ones that could affect us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our business, financial condition, liquidity, financial results or reputation. From time to time, we consider potential acquisitions, dispositions, mergers, business combinations, investments, monetizations, joint ventures and other transactions, some of which may be significant. Except as otherwise indicated by us, forward-looking statements do not reflect the potential impact of any such transactions or of special items that may be announced or that may occur after April 28, 2021. The financial impact of these transactions and special items can be complex and depends on facts particular to each of them. We therefore cannot describe the expected impact in a meaningful way, or in the same way we present known risks affecting our business.

2 | BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT

Table of Contents

1 MD&A Overview

The COVID-19 pandemic continued to unfavourably impact our financial and operating performance in the first quarter of 2021 as emergency measures were first introduced in the second half of March 2020. It has been over a year since the pandemic began affecting our performance and we have been adapting to operate our business in this environment. Our Bell Wireless and Bell Media segments continued to be adversely affected in the quarter due to reduced commercial activity compared to Q1 2020 as a result of the government restrictions put in place to combat the pandemic. Certain emergency measures were gradually eased during the quarter, which allowed many businesses to resume some level of, or increase, commercial activities. However, by the end of March 2021, an increasing number of cases and the rise of new COVID-19 variants led to the further tightening of government restrictions and reintroduction of emergency measures in certain areas.

The COVID-19 pandemic had the following principal consequences on our business and financial results in the first quarter of 2021 compared to the first quarter of 2020:

| • | Lower advertising revenues from our Bell Media segment mainly in out-of-home (OOH) due to non-essential service restrictions (including restaurants, arenas and bars) and reduced airport and transit traffic, along with lower radio advertising revenues from decreased audience levels attributable to changes in audience listening habits as a result of the work-from-home measures |

| • | Decreased service revenues in our Bell Wireless segment primarily due to lower outbound roaming revenues resulting from reduced customer travel |

Due to uncertainties relating to the severity and duration of the COVID-19 pandemic, including the current resurgence and possible future resurgences in the number of COVID-19 cases, and various potential outcomes, it is difficult at this time to estimate the impacts of the COVID-19 pandemic on our business or future financial results and related assumptions. Our business and financial results could continue to be significantly and negatively impacted in future periods. The extent to which the COVID-19 pandemic will continue to adversely impact us will depend on future developments that are difficult to predict, including the prevalence of COVID-19 variants that are more contagious and may lead to increased health risks, the timely distribution of effective vaccines and treatments, and the potential development and distribution of new vaccines and treatments, as well as new information which may emerge concerning the severity, duration and resurgences of the COVID-19 pandemic and the actions required to contain the coronavirus or remedy its impacts, among others. Any of the risks referred to in this MD&A, including, in particular, in the section Caution regarding forward-looking statements at the beginning of this MD&A, and others arising from the COVID-19 pandemic, could have a material adverse effect on our business, financial condition, liquidity, financial results or reputation.

BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT | 3

Table of Contents

1 MD&A Overview

BCE Q1 2021 SELECTED QUARTERLY INFORMATION

| Operating revenues | Net earnings | Adjusted EBITDA (1) | ||

| $5,706 | $687 | $2,429 | ||

| million | million | million | ||

| +1.2% vs. Q1 2020 | (6.3%) vs. Q1 2020 | +0.5% vs. Q1 2020 |

| Net earnings attributable | Adjusted net earnings (1) | Cash flows from | Free cash flow (1) | |||

| to common shareholders | operating activities | |||||

| $642 | $704 | $1,992 | $940 | |||

| million | million | million | million | |||

| (5.6%) vs. Q1 2020 | (1.4%) vs. Q1 2020 | +37.3% vs. Q1 2020 | +53.8% vs. Q1 2020 | |||

|

BCE CUSTOMER CONNECTIONS

| ||||||

| Wireless | Retail high-speed | Retail TV (4) | Retail residential network | |||

| Total mobile phones(2) | Internet (3) | access services (NAS) lines | ||||

| +2.2% | +4.3% | (1.1%) | (7.7%) | |||

| 9.2 million subscribers | 3.7 million subscribers | 2.7 million subscribers | 2.4 million subscribers | |||

| at March 31, 2021 | at March 31, 2021 | at March 31, 2021 | at March 31, 2021 | |||

| (1) | Adjusted EBITDA, adjusted net earnings and free cash flow are non-GAAP financial measures and do not have any standardized meaning under International Financial Reporting Standards (IFRS). Therefore, they are unlikely to be comparable to similar measures presented by other issuers. See section 7.2, Non-GAAP financial measures and key performance indicators (KPIs) – Adjusted EBITDA and adjusted EBITDA margin, Adjusted net earnings and adjusted EPS and Free cash flow and dividend payout ratio, in this MD&A for more details, including reconciliations to the most comparable IFRS financial measure. |

| (2) | Effective January 1, 2021, we changed our wireless operating metrics to reflect our revised approach to reporting wireless subscriber units. Consequently, we are now reporting in two categories, mobile phone subscriber units and mobile connected device subscriber units (e.g. tablets, wearables and mobile Internet devices). Additionally, mobile connected device subscribers now include previously undisclosed Internet of Things (IoT) units (e.g. connected telematics services, monitoring devices, connected cars and fleet management solutions). These changes are consistent with the way we manage our business, reflect our focus on mobile phone subscribers and align to industry peers. As a result, previously reported 2020 subscribers and associated operating metrics (gross and net activations (losses), average billing per user (ABPU) and churn) have been restated for comparability. See section 7.2, Non-GAAP financial measures and key performance indicators (KPIs) – KPIs, in this MD&A for more details. |

| (3) | At the beginning of Q1 2021, our retail high-speed Internet subscriber base was increased by 4,778 subscribers due to the transfer of fixed wireless Internet subscribers from our mobile connected devices subscriber base. |

| (4) | At the beginning of Q1 2021, we adjusted our satellite TV subscriber base to remove 6,125 non-revenue generating units. |

4 | BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT

Table of Contents

1 MD&A Overview

BCE INCOME STATEMENTS – SELECTED INFORMATION

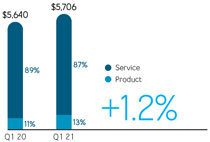

| Q1 2021 | Q1 2020 | $ CHANGE | % CHANGE | |||||||||||||

| Operating revenues |

||||||||||||||||

| Service |

4,968 | 5,018 | (50 | ) | (1.0%) | |||||||||||

| Product |

738 | 622 | 116 | 18.6% | ||||||||||||

| Total operating revenues |

5,706 | 5,640 | 66 | 1.2% | ||||||||||||

| Operating costs |

(3,277 | ) | (3,222 | ) | (55 | ) | (1.7%) | |||||||||

| Adjusted EBITDA |

2,429 | 2,418 | 11 | 0.5% | ||||||||||||

| Adjusted EBITDA margin (1) |

42.6 | % | 42.9 | % | (0.3) | pts | ||||||||||

| Net earnings from continuing operations attributable to: |

||||||||||||||||

| Common shareholders |

642 | 675 | (33 | ) | (4.9%) | |||||||||||

| Preferred shareholders |

32 | 38 | (6 | ) | (15.8%) | |||||||||||

| Non-controlling interest |

13 | 15 | (2 | ) | (13.3%) | |||||||||||

| Net earnings from continuing operations |

687 | 728 | (41 | ) | (5.6%) | |||||||||||

| Net earnings from discontinued operations |

– | 5 | (5 | ) | (100.0%) | |||||||||||

| Net earnings |

687 | 733 | (46 | ) | (6.3%) | |||||||||||

| Net earnings attributable to: |

||||||||||||||||

| Common shareholders |

642 | 680 | (38 | ) | (5.6%) | |||||||||||

| Preferred shareholders |

32 | 38 | (6 | ) | (15.8%) | |||||||||||

| Non-controlling interest |

13 | 15 | (2 | ) | (13.3%) | |||||||||||

| Net earnings |

687 | 733 | (46 | ) | (6.3%) | |||||||||||

| Adjusted net earnings |

704 | 714 | (10 | ) | (1.4%) | |||||||||||

| Net earnings from continuing operations per common share |

0.71 | 0.74 | (0.03 | ) | (4.1%) | |||||||||||

| Net earnings from discontinued operations per common share |

– | 0.01 | (0.01 | ) | (100.0%) | |||||||||||

| Net earnings per common share (EPS) |

0.71 | 0.75 | (0.04 | ) | (5.3%) | |||||||||||

| Adjusted EPS (1) |

0.78 | 0.79 | (0.01 | ) | (1.3%) | |||||||||||

|

(1) Adjusted EBITDA margin and adjusted EPS are non-GAAP financial measures and do not have any standardized meaning under IFRS. Therefore, they are unlikely to be comparable to similar measures presented by other issuers. See section 7.2, Non-GAAP financial measures and key performance indicators (KPIs) – Adjusted EBITDA and adjusted EBITDA margin and Adjusted net earnings and adjusted EPS, in this MD&A for more details, including reconciliations to the most comparable IFRS financial measure. |

| |||||||||||||||

| BCE STATEMENTS OF CASH FLOWS – SELECTED INFORMATION

|

| |||||||||||||||

| Q1 2021 | Q1 2020 | $ CHANGE | % CHANGE | |||||||||||||

| Cash flows from operating activities |

1,992 | 1,451 | 541 | 37.3% | ||||||||||||

| Capital expenditures |

(1,012 | ) | (777 | ) | (235 | ) | (30.2%) | |||||||||

| Free cash flow |

940 | 611 | 329 | 53.8% | ||||||||||||

Q1 2021 FINANCIAL HIGHLIGHTS

BCE revenue growth of 1.2% in Q1 2021, compared to the same period last year, represented an improvement over the 2.8% year-over-year decline experienced in Q4 2020, due to the moderating impacts of the COVID-19 pandemic earlier in the quarter. The growth in Q1 2021 revenues was driven by higher year-over-year product revenues of 18.6%, primarily due to greater sales of wireless premium mobile phones, along with higher equipment sales to large enterprise customers attributable to increased demand, mainly from the government sector. This growth was moderated by lower year-over-year service revenues of 1.0%, due to the ongoing erosion in our voice, satellite TV and legacy data revenues along with reduced media advertising revenues and lower wireless service revenues mainly from lower outbound roaming, driven by the continuing impacts of the COVID-19 pandemic. This was partly offset by the ongoing growth of our mobile phones, retail Internet, and Internet protocol TV (IPTV) subscriber bases, combined with the flow-through of rate increases.

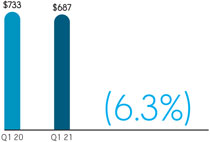

Net earnings decreased by $46 million in the first quarter of 2021, compared to the same period last year, mainly due to higher severance, acquisition and other costs and higher depreciation and amortization, partly offset by higher other income and higher adjusted EBITDA.

BCE’s adjusted EBITDA increased by 0.5% in Q1 2021, compared to the same period last year. This represented an improvement over the 3.2% year-over-year decline experienced in Q4 2020, due to the moderating impacts of the COVID-19 pandemic earlier in the quarter. The year-over-year increase in Q1 2021 adjusted EBITDA was driven by higher revenues, moderated by increased operating costs. This resulted in an adjusted EBITDA margin of 42.6% in Q1 2021, which declined by 0.3 pts, compared to Q1 2020, primarily from the flow-through impact of lower year-over-year service revenue and greater low-margin product sales in our total revenue base.

BCE’s EPS of $0.71 in Q1 2021 decreased by $0.04 compared to the same period last year.

BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT | 5

Table of Contents

1 MD&A Overview

Excluding the impact of severance, acquisition and other costs, net mark-to-market gains (losses) on derivatives used to economically hedge equity settled share-based compensation plans, net gains (losses) on investments, early debt redemption costs, impairment of assets and discontinued operations, net of tax and non-controlling interest (NCI), adjusted net earnings in the first quarter of 2021 was $704 million, or $0.78 per common share, compared to $714 million, or $0.79 per common share, for the same period last year.

Cash flows from operating activities in the first quarter of 2021 increased by $541 million, compared to the same period last year, mainly due to higher cash from working capital, in part from a slowdown experienced in Q1 2020 due to the COVID-19 pandemic and timing of supplier payments, and lower income taxes paid due to timing of installments.

Free cash flow in Q1 2021 increased by $329 million, compared to the same period last year, mainly due to higher cash flows from operating activities, excluding cash from discontinued operations and acquisition and other costs paid, partly offset by higher capital expenditures.

1.2 Key corporate and business developments

This section contains forward-looking statements, including relating to BCE’s 2021 annualized common share dividend and our objectives and plans. Refer to the section Caution regarding forward-looking statements at the beginning of this MD&A.

COMMON SHARE DIVIDEND INCREASE

On February 3, 2021, BCE’s board of directors approved a 5.1%, or 17 cents per share, increase in the annualized common share dividend from $3.33 per share to $3.50 per share, effective with BCE’s 2021 first quarter dividend paid on April 15, 2021 to common shareholders of record on March 15, 2021. This dividend increase represents BCE’s 17th increase to its annual common share dividend since 2009, representing a total increase of 140%.

PUBLIC DEBT OFFERINGS AND REDEMPTION

On March 17, 2021, Bell Canada completed a public offering in Canada of Cdn $1.55 billion of medium term notes (MTN) debentures in two series pursuant to its MTN program. The Cdn $1 billion Series M-54 MTN debentures will mature on March 17, 2031 and carry an annual interest rate of 3.00%. The Cdn $550 million Series M-55 MTN debentures will mature on March 17, 2051 and carry an annual interest rate of 4.05%. The MTN debentures are fully and unconditionally guaranteed by BCE Inc.

On the same date, Bell Canada also completed a public offering in the U.S. of US $1.1 billion of notes in two series (collectively, the Notes). The US $600 million Series US-3 Notes will mature on March 17, 2024 and carry an annual interest rate of 0.75%. The US $500 million Series US-4 Notes will mature on March 17, 2051 and carry an annual interest rate of 3.65%. The Notes are fully and unconditionally guaranteed by BCE Inc.

The net proceeds of the offerings were used to fund the early redemption in April 2021 of Bell Canada’s $1.7 billion principal amount of 3.00% Series M-40 MTN debentures due October 3, 2022 and to repay short-term debt.

BELL PLANNING FOR CARBON NEUTRAL OPERATIONS IN 2025

On March 11 2021, Bell announced its objective to be carbon neutral for its operational emissions starting in 2025. In 2020, Bell surpassed its greenhouse gas (GHG) emissions reduction target for the year, reducing the ratio of its operational emissions to its network usage by 34% from 2019 levels, and plans to further reduce the ratio of its operational GHG emissions to its network usage by 40% of 2019 levels by the end of 2021.

Bell also celebrated its status as the first North American communications company to achieve ISO 50001 certification for its energy management system. The international ISO 50001 standard requires companies to adopt a strict set of energy management objectives, guidelines and practices that enable energy efficiency and reductions in GHG emissions. ISO 50001 status is the latest example of Bell’s world-class sustainability practices; we were also the first Canadian telecommunications company to achieve ISO 14001 environmental certification.

In 2021, Bell was named one of Canada’s Greenest Employers for the fifth consecutive year, recognizing the company’s focus on minimizing environmental impact, energy management system leadership, and success in ongoing initiatives to reduce waste and save energy.

SERVICE IMPROVEMENTS HIGHLIGHTED IN CCTS REPORT

Bell’s investments in championing the customer experience helped drive a 17% reduction in the number of customer complaints accepted by the Commission for Complaints for Telecom-television Services (CCTS) according to the federal agency’s mid-year report. Bell’s improvement was the best performance among national carriers for the sixth year in a row. The CCTS report, which covers the period from August 1, 2020 to January 31, 2021, reflects a timeframe when Canadians everywhere were relying on communications services and networks like never before, especially for remote work and learning connections. Bell responded by accelerating broadband network buildouts in urban and rural locations alike, investing in network capacity and redundancy to manage unprecedented usage levels, and in service enhancements ranging from remote product installation by video to enhanced digital self-serve platforms that enable customers to control their service experience.

BELL NAMED ONE OF CANADA’S BEST DIVERSITY EMPLOYERS

For the fifth year in a row, Bell has been named one of Canada’s Best Diversity Employers in Mediacorp’s 2021 report on workplace diversity and inclusion. The award recognizes Bell’s commitment to an inclusive and accessible workplace that reflects Canada’s diversity and our ongoing action to combat systemic racism.

6 | BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT

Table of Contents

1 MD&A Overview

As at the date of this MD&A, our forward-looking statements set out in the BCE 2020 Annual MD&A, as updated or supplemented in this MD&A, are based on certain assumptions including, without limitation, the following economic and market assumptions as well as the various assumptions referred to under the sub-sections entitled Assumptions set out in section 3, Business segment analysis of this MD&A.

ASSUMPTIONS ABOUT THE CANADIAN ECONOMY

We have made certain assumptions concerning the Canadian economy, which in turn depend on important assumptions about how the COVID-19 pandemic will evolve, including the progress of the global vaccination rollout. Notably, it is assumed that broad immunity is achieved by mid-2021 in the U.S.; later in 2021 in Canada, other advanced economies and China; and in 2022 in other emerging-market economies. In particular, we have assumed:

| • | Strong rebound in economic growth as the economy recovers from the significant impacts of the COVID-19 pandemic, given the Bank of Canada’s most recent estimated growth in Canadian gross domestic product of around 6.5% on average in 2021, representing an increase from the earlier estimate of around 4% |

| • | Improving consumer confidence as vaccinations roll out and restrictions are eased |

| • | Strengthening business investment outside the oil and gas sector as uncertainty recedes |

| • | Employment gains expected in 2021, despite ongoing challenges in some sectors |

| • | Accelerating trend toward e-commerce |

| • | Low immigration levels until international travel and/or health-related restrictions are lifted |

| • | Prevailing low interest rates expected to remain at or near current levels for the foreseeable future |

| • | Canadian dollar expected to remain at or near current levels. Further movements may be impacted by the degree of strength of the U.S. dollar, interest rates and changes in commodity prices. |

MARKET ASSUMPTIONS

| • | A consistently high level of wireline and wireless competition in consumer, business and wholesale markets |

| • | Higher, but slowing, wireless industry penetration |

| • | A shrinking data and voice connectivity market as business customers migrate to lower-priced traditional telecommunications solutions or alternative OTT competitors |

| • | While the advertising market continues to be adversely impacted by cancelled or delayed advertising campaigns from many sectors due to the economic downturn during the COVID-19 pandemic, we do expect gradual recovery in 2021 |

| • | Declines in broadcasting distribution undertakings (BDU) subscribers driven by increasing competition from the continued rollout of subscription video on demand streaming services together with further scaling of OTT aggregators |

BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT | 7

Table of Contents

2 MD&A Consolidated financial analysis

2 Consolidated financial analysis

This section provides detailed information and analysis about BCE’s performance in Q1 2021 compared with Q1 2020. It focuses on BCE’s consolidated operating results and provides financial information for our Bell Wireless, Bell Wireline and Bell Media business segments. For further discussion and analysis of our business segments, refer to section 3, Business segment analysis.

2.1 BCE consolidated income statements

| Q1 2021 | Q1 2020 | $ CHANGE | % CHANGE | |||||||||||||

| Operating revenues |

||||||||||||||||

| Service |

4,968 | 5,018 | (50 | ) | (1.0%) | |||||||||||

| Product |

738 | 622 | 116 | 18.6% | ||||||||||||

| Total operating revenues |

5,706 | 5,640 | 66 | 1.2% | ||||||||||||

| Operating costs |

(3,277 | ) | (3,222 | ) | (55 | ) | (1.7%) | |||||||||

| Adjusted EBITDA |

2,429 | 2,418 | 11 | 0.5% | ||||||||||||

| Adjusted EBITDA margin |

42.6 | % | 42.9 | % | (0.3) pts | |||||||||||

| Severance, acquisition and other costs |

(89 | ) | (16 | ) | (73 | ) | n.m. | |||||||||

| Depreciation |

(895 | ) | (858 | ) | (37 | ) | (4.3%) | |||||||||

| Amortization |

(238 | ) | (230 | ) | (8 | ) | (3.5%) | |||||||||

| Finance costs |

||||||||||||||||

| Interest expense |

(267 | ) | (277 | ) | 10 | 3.6% | ||||||||||

| Interest on post-employment benefit obligations |

(5 | ) | (12 | ) | 7 | 58.3% | ||||||||||

| Impairment of assets |

(3 | ) | (7 | ) | 4 | 57.1% | ||||||||||

| Other income (expense) |

8 | (47 | ) | 55 | n.m. | |||||||||||

| Income taxes |

(253 | ) | (243 | ) | (10 | ) | (4.1%) | |||||||||

| Net earnings from continuing operations |

687 | 728 | (41 | ) | (5.6%) | |||||||||||

| Net earnings from discontinued operations |

– | 5 | (5 | ) | (100.0%) | |||||||||||

| Net earnings |

687 | 733 | (46 | ) | (6.3%) | |||||||||||

| Net earnings from continuing operations attributable to: |

||||||||||||||||

| Common shareholders |

642 | 675 | (33 | ) | (4.9%) | |||||||||||

| Preferred shareholders |

32 | 38 | (6 | ) | (15.8%) | |||||||||||

| Non-controlling interest |

13 | 15 | (2 | ) | (13.3%) | |||||||||||

| Net earnings from continuing operations |

687 | 728 | (41 | ) | (5.6%) | |||||||||||

| Net earnings attributable to: |

||||||||||||||||

| Common shareholders |

642 | 680 | (38 | ) | (5.6%) | |||||||||||

| Preferred shareholders |

32 | 38 | (6 | ) | (15.8%) | |||||||||||

| Non-controlling interest |

13 | 15 | (2 | ) | (13.3%) | |||||||||||

| Net earnings |

687 | 733 | (46 | ) | (6.3%) | |||||||||||

| Adjusted net earnings |

704 | 714 | (10 | ) | (1.4%) | |||||||||||

| EPS |

||||||||||||||||

| Continuing operations |

0.71 | 0.74 | (0.03 | ) | (4.1%) | |||||||||||

| Discontinued operations |

– | 0.01 | (0.01 | ) | (100.0%) | |||||||||||

| Net earnings per common share |

0.71 | 0.75 | (0.04 | ) | (5.3%) | |||||||||||

| Adjusted EPS |

0.78 | 0.79 | (0.01 | ) | (1.3%) | |||||||||||

|

n.m.: not meaningful |

||||||||||||||||

8 | BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT

Table of Contents

2 MD&A Consolidated financial analysis

BCE NET ACTIVATIONS (LOSSES)

| Q1 2021 | Q1 2020 | % CHANGE | ||||||||||||||

| Wireless mobile phone subscribers net activations (losses)(1) |

2,405 | (2,496 | ) | n.m. | ||||||||||||

| Postpaid |

32,925 | 1,559 | n.m. | |||||||||||||

| Prepaid |

(30,520 | ) | (4,055 | ) | n.m. | |||||||||||

| Wireless mobile connected devices net activations (1) |

74,159 | 48,964 | 51.5% | |||||||||||||

| Wireline retail high-speed Internet subscribers net activations |

21,208 | 22,595 | (6.1%) | |||||||||||||

| Wireline retail TV subscribers net (losses) activations |

(9,112 | ) | (18,555 | ) | 50.9% | |||||||||||

| IPTV |

10,696 | 2,852 | n.m. | |||||||||||||

| Satellite |

(19,808 | ) | (21,407 | ) | 7.5% | |||||||||||

| Wireline retail residential NAS lines net losses |

(51,069 | ) | (61,595 | ) | 17.1% | |||||||||||

| Total services net activations (losses) |

37,591 | (11,087 | ) | n.m. | ||||||||||||

|

n.m.: not meaningful

TOTAL BCE CUSTOMER CONNECTIONS

|

||||||||||||||||

| Q1 2021 | Q1 2020 | % CHANGE | ||||||||||||||

| Wireless mobile phone subscribers (1) |

9,166,748 | 8,971,172 | 2.2% | |||||||||||||

| Postpaid |

8,361,264 | 8,177,205 | 2.3% | |||||||||||||

| Prepaid |

805,484 | 793,967 | 1.5% | |||||||||||||

| Wireless mobile connected devices subscribers (1) |

2,130,312 | 1,877,136 | 13.5% | |||||||||||||

| Wireline retail high-speed Internet subscribers (2) |

3,730,576 | 3,578,196 | 4.3% | |||||||||||||

| Wireline retail TV subscribers (3) |

2,723,368 | 2,753,909 | (1.1%) | |||||||||||||

| IPTV |

1,817,069 | 1,770,034 | 2.7% | |||||||||||||

| Satellite (3) |

906,299 | 983,875 | (7.9%) | |||||||||||||

| Wireline retail residential NAS lines |

2,432,863 | 2,635,888 | (7.7%) | |||||||||||||

| Total services subscribers |

20,183,867 | 19,816,301 | 1.9% | |||||||||||||

| (1) | Effective January 1, 2021, we changed our wireless operating metrics to reflect our revised approach to reporting wireless subscriber units. Consequently, we are now reporting in two categories, mobile phone subscriber units and mobile connected device subscriber units (e.g. tablets, wearables and mobile Internet devices). Additionally, mobile connected device subscribers now include previously undisclosed IoT units (e.g. connected telematics services, monitoring devices, connected cars and fleet management solutions). These changes are consistent with the way we manage our business, reflect our focus on mobile phone subscribers and align to industry peers. As a result, previously reported 2020 subscribers and associated operating metrics (gross and net activations (losses), ABPU and churn) have been restated for comparability. See section 7.2, Non-GAAP financial measures and key performance indicators (KPIs) – KPIs, in this MD&A for more details. |

| (2) | At the beginning of Q1 2021, our retail high-speed Internet subscriber base was increased by 4,778 subscribers due to the transfer of fixed wireless Internet subscribers from our mobile connected devices subscriber base. |

| (3) | At the beginning of Q1 2021, we adjusted our satellite TV subscriber base to remove 6,125 non-revenue generating units. |

BCE added 37,591 net retail customer activations in Q1 2021, increasing by 48,678 compared to the same period last year. The net retail customer activations in Q1 2021 consisted of:

| • | 2,405 wireless mobile phone net customer activations, along with 74,159 wireless mobile connected devices net customer activations |

| • | 21,208 retail high-speed Internet net customer activations |

| • | 9,112 retail TV net customer losses comprised of 19,808 retail satellite TV net customer losses, moderated by 10,696 retail IPTV net customer activations |

| • | 51,069 retail residential NAS net losses |

At March 31, 2021, BCE’s retail customer connections totaled 20,183,867, up 1.9% year over year, and consisted of the following:

| • | 9,166,748 wireless mobile phone subscribers, up 2.2% compared to Q1 2020, as well as 2,130,312 wireless mobile connected devices subscribers, up 13.5% year over year |

| • | 3,730,576 retail high-speed Internet subscribers, 4.3% higher than last year |

| • | 2,723,368 total retail TV subscribers, down 1.1% compared to Q1 2020, comprised of 1,817,069 retail IPTV subscribers, up 2.7% year over year, and 906,299 retail satellite TV subscribers, down 7.9% year over year |

| • | 2,432,863 retail residential NAS lines, a decline of 7.7% compared to Q1 2020 |

BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT | 9

Table of Contents

2 MD&A Consolidated financial analysis

BCE

Revenues

(in $ millions)

|

|

||||||||||||||||||

| Q1 2021 | Q1 2020 | $ CHANGE | % CHANGE | |||||||||||||||

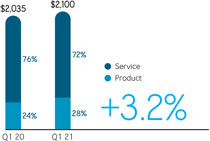

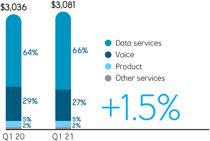

| Bell Wireless |

2,100 | 2,035 | 65 | 3.2% | ||||||||||||||

| Bell Wireline |

3,081 | 3,036 | 45 | 1.5% | ||||||||||||||

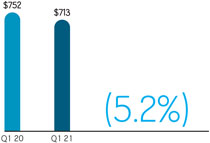

| Bell Media |

713 | 752 | (39 | ) | (5.2%) | |||||||||||||

| Inter-segment eliminations |

(188 | ) | (183 | ) | (5 | ) | (2.7%) | |||||||||||

| Total BCE operating revenues |

5,706 | 5,640 | 66 | 1.2% | ||||||||||||||

BCE

Total operating revenues at BCE increased by 1.2% in Q1 2021, compared to the same period last year, representing an improvement over the 2.8% year-over-year decline experienced in Q4 2020, from the moderating impacts of the COVID-19 pandemic earlier in the quarter. The year-over-year increase was attributable to growth in our Bell Wireless and Bell Wireline segments, offset in part by a decline in our Bell Media segment. BCE service revenues of $4,968 million in Q1 2021 declined by 1.0% year over year, whereas product revenues of $738 million in Q1 2021 increased by 18.6% year over year. Wireless operating revenues grew by 3.2% due to higher product revenues of 20.1%, offset in part by reduced service revenues of 2.1%, which continued to be unfavourably impacted by lower outbound roaming revenues as a result of the COVID-19 pandemic. Wireline operating revenues increased by 1.5% in Q1 2021, over the same period last year, driven by higher services revenues of 0.9%, from greater data and other services revenues, offset in part by reduced voice revenues, coupled with greater product revenues of 14.1%. Bell Media operating revenues declined by 5.2% year over year in Q1 2021, as advertising revenues continued to be adversely impacted by the COVID-19 pandemic.

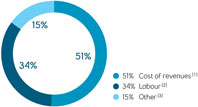

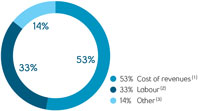

| BCE | BCE | |||

| Operating cost profile | Operating cost profile | |||

| Q1 2020 | Q1 2021 | |||

|

|

|

|||

| Q1 2021 | Q1 2020 | $ CHANGE | % CHANGE | |||||||||||||

| Bell Wireless |

(1,177 | ) | (1,107 | ) | (70 | ) | (6.3%) | |||||||||

| Bell Wireline |

(1,718 | ) | (1,701 | ) | (17 | ) | (1.0%) | |||||||||

| Bell Media |

(570 | ) | (597 | ) | 27 | 4.5% | ||||||||||

| Inter-segment eliminations |

188 | 183 | 5 | 2.7% | ||||||||||||

| Total BCE operating costs |

(3,277 | ) | (3,222 | ) | (55 | ) | (1.7%) | |||||||||

| (1) | Cost of revenues includes costs of wireless devices and other equipment sold, network and content costs, and payments to other carriers. |

| (2) | Labour costs (net of capitalized costs) include wages, salaries and related taxes and benefits, post-employment benefit plans service cost, and other labour costs, including contractor and outsourcing costs. |

| (3) | Other operating costs include marketing, advertising and sales commission costs, bad debt expense, taxes other than income taxes, IT costs, professional service fees and rent. |

BCE

Total BCE operating costs increased by 1.7% in Q1 2021, compared to last year, driven by greater costs in Bell Wireless of 6.3% and Bell Wireline of 1.0%, offset in part by reduced expenses in Bell Media of 4.5%. The increase in operating expenses was primarily driven by higher costs associated with the revenue growth.

10 | BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT

Table of Contents

2 MD&A Consolidated financial analysis

| BCE Net earnings (in $ millions)

|

Net earnings decreased by $46 million in the first quarter of 2021, compared to the same period last year, mainly due to higher severance, acquisition and other costs and higher depreciation and amortization, partly offset by higher other income and higher adjusted EBITDA. |

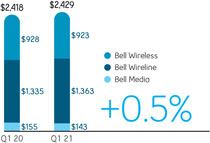

BCE

Adjusted EBITDA

(in $ millions)

|

|

||||||||||||||||||

| Q1 2021 | Q1 2020 | $CHANGE | % CHANGE | |||||||||||||||

| Bell Wireless |

923 | 928 | (5 | ) | (0.5%) | |||||||||||||

| Bell Wireline |

1,363 | 1,335 | 28 | 2.1% | ||||||||||||||

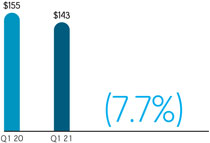

| Bell Media |

143 | 155 | (12 | ) | (7.7%) | |||||||||||||

| Total BCE adjusted EBITDA |

2,429 | 2,418 | 11 | 0.5% | ||||||||||||||

BCE

BCE’s adjusted EBITDA grew by 0.5% in Q1 2021, compared to the same period last year. This represented an improvement over the 3.2% year-over-year decline experienced in Q4 2020 due to the moderating impacts of the COVID-19 pandemic earlier in the quarter. The increase in adjusted EBITDA in Q1 2021 was driven by higher revenues, moderated by greater operating costs. Adjusted EBITDA margin of 42.6% in Q1 2021 declined by 0.3 pts over the same period last year, mainly resulting from the flow-through impact of lower year-over-year service revenue and higher low-margin product sales in our total revenue base.

2.7 Severance, acquisition and other costs

2021

Severance, acquisition and other costs of $89 million in the first quarter of 2021 included:

| • | Severance costs of $97 million related to involuntary and voluntary employee terminations |

| • | Acquisition and other costs recovery of $8 million |

2020

Severance, acquisition and other costs of $16 million in the first quarter of 2020 included:

| • | Severance costs of $8 million related to involuntary and voluntary employee terminations |

| • | Acquisition and other costs of $8 million |

BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT | 11

Table of Contents

2 MD&A Consolidated financial analysis

2.8 Depreciation and amortization

DEPRECIATION

Depreciation in Q1 2021 increased by $37 million, compared to Q1 2020, in part due to a higher asset base as we continued to invest in our broadband and wireless networks as well as our IPTV services.

AMORTIZATION

Amortization in Q1 2021 increased by $8 million, compared to Q1 2020, mainly due to a higher asset base.

INTEREST EXPENSE

Interest expense in the first quarter of 2021 decreased by $10 million, compared to the same period last year, mainly due to lower average debt levels and lower interest rates.

INTEREST ON POST-EMPLOYMENT BENEFIT OBLIGATIONS

Interest on our post-employment benefit obligations is based on market conditions that existed at the beginning of the year. On January 1, 2021, the discount rate was 2.6% compared to 3.1% on January 1, 2020.

In the first quarter of 2021, interest expense on post-employment benefit obligations decreased by $7 million, compared to the same period last year, due to a lower discount rate and a lower net post-employment benefit obligation at the beginning of the year.

The impacts of changes in market conditions during the year are recognized in other comprehensive income (OCI).

2021

Other income of $8 million in the first quarter of 2021 included net mark-to-market gains on derivatives used to economically hedge equity settled share-based compensation plans, partly offset by early debt redemption costs.

2020

Other expense of $47 million in the first quarter of 2020 included net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans and early debt redemption costs.

Income taxes in the first quarter of 2021 increased by $10 million, compared to the same period last year.

2.12 Net earnings attributable to common shareholders and EPS

Net earnings attributable to common shareholders of $642 million in the first quarter of 2021 decreased by $38 million, compared to the same period last year, mainly due to higher severance, acquisition and other costs and higher depreciation and amortization, partly offset by higher other income and higher adjusted EBITDA.

BCE’s EPS of $0.71 in Q1 2021 decreased by $0.04 compared to the same period last year.

Excluding the impact of severance, acquisition and other costs, net mark-to-market gains (losses) on derivatives used to economically hedge equity settled share-based compensation plans, net gains (losses) on investments, early debt redemption costs, impairment of assets and discontinued operations, net of tax and NCI, adjusted net earnings in the first quarter of 2021 was $704 million, or $0.78 per common share, compared to $714 million, or $0.79 per common share, for the same period last year.

12 | BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT

Table of Contents

3 MD&A Business segment analysis - Bell Wireless

KEY BUSINESS DEVELOPMENTS

LAUNCH OF TSN 5G VIEW / VISION 5G RDS

TSN and RDS launched TSN 5G View / Vision 5G RDS, an exclusive in-app feature that leverages Bell’s Fifth Generation (5G) network to offer fans interactive new ways to watch sports. Introduced in Montréal on March 19, 2021 and in Toronto on April 15, 2021, this innovative 5G-enabled technology lets Montreal Canadiens and Toronto Maple Leafs fans control how they view every angle of the game on their smartphones, getting up close to every goal, pass, hit and penalty with zoom, pause, rewind and slow motion capabilities made possible with Bell’s superfast, high-capacity 5G mobile network. In addition to the immersive mobile experience, the new 5G technology also allows viewers of TSN and RDS regional home game broadcasts to get closer to the action, featuring views from never-before-seen camera angles during in-game commentary, analysis, replays, and post-game recaps. TSN and RDS subscribers on the Bell 5G network with a 5G device can sign in to their TSN and RDS apps to take advantage of the new technology live in action. TSN 5G View / Vision 5G RDS will continue to expand to more sports events, teams and venues over time.

CONNECTED CAR PARTNERSHIP WITH HONDA CANADA

On March 11, 2021, Bell and Honda Canada announced that new Honda and Acura vehicles are now equipped with built-in Wi-Fi hotspots that enable drivers and their passengers to stay fully connected online, safely and hands-free, while on the open road. Ideal for mobile workers, commuters and families, Bell Connected Car seamlessly supports browsing, streaming and sharing on up to 7 compatible devices with the built-in Wi-Fi hotspot powered by Canada’s largest Fourth Generation (4G) Long-term evolution (LTE) wireless network. The hotspot supports real-time email and text access, enables on-the-go video streaming, gaming and web browsing for passengers, and keeps customers’ devices connected up to 50 feet away from the vehicle.

FINANCIAL PERFORMANCE ANALYSIS

Effective January 1, 2021, we changed our wireless operating metrics to reflect our revised approach to reporting wireless subscriber units. Consequently, we are now reporting in two categories, mobile phone subscriber units and mobile connected device subscriber units (e.g. tablets, wearables and mobile Internet devices). Additionally, mobile connected device subscribers now include previously undisclosed IoT units (e.g. connected telematics services, monitoring devices, connected cars and fleet management solutions). These changes are consistent with the way we manage our business, reflect our focus on mobile phone subscribers and align to industry peers. As a result, previously reported 2020 subscribers and associated operating metrics (gross and net activations (losses), ABPU and churn) have been restated for comparability. See section 7.2, Non-GAAP financial measures and key performance indicators (KPIs) – KPIs, in this MD&A for more details.

Q1 2021 PERFORMANCE HIGHLIGHTS

| Bell Wireless | Bell Wireless | |

| Revenues | Adjusted EBITDA | |

| (in $ millions) | (in $ millions) | |

| (% adjusted EBITDA margin) | ||

|

|

BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT | 13

Table of Contents

3 MD&A Business segment analysis - Bell Wireless

| Total mobile phones subscriber growth |

Mobile phones postpaid net activations |

Mobile phones prepaid net losses | ||

| +2.2% | 32,925 | (30,520) | ||

| Q1 2021 vs. Q1 2020 | in Q1 2021 | in Q1 2021 |

| Mobile phones postpaid churn in Q1 2021 |

Mobile phones blended ABPU per month | |

| 0.89% | (3.4%) | |

| Stable vs. Q1 2020 | Q1 2021: $70.34 Q1 2020: $72.78 |

BELL WIRELESS RESULTS

REVENUES

| Q1 2021 | Q1 2020 | $ CHANGE | % CHANGE | |||||||||||||

| External service revenues |

1,503 | 1,535 | (32 | ) | (2.1%) | |||||||||||

| Inter-segment service revenues |

11 | 12 | (1 | ) | (8.3%) | |||||||||||

| Total operating service revenues |

1,514 | 1,547 | (33 | ) | (2.1%) | |||||||||||

| External product revenues |

584 | 487 | 97 | 19.9% | ||||||||||||

| Inter-segment product revenues |

2 | 1 | 1 | 100.0% | ||||||||||||

| Total operating product revenues |

586 | 488 | 98 | 20.1% | ||||||||||||

| Total Bell Wireless revenues |

2,100 | 2,035 | 65 | 3.2% | ||||||||||||

|

Bell Wireless operating revenues grew by 3.2% in Q1 2021, compared to Q1 2020, reflecting quarterly sequential improvements from both service and product revenues. The increase in year-over-year operating revenues was driven by greater product revenues, offset in part by lower service revenues.

Service revenues declined by 2.1% in the current quarter, compared to Q1 2020, due to lower postpaid revenues, offset in part by higher prepaid revenues, reflecting the following:

• Decreased outbound roaming revenues mainly from reduced customer travel as a result of the COVID-19 pandemic

• Lower data overages driven by greater customer adoption of monthly plans with higher data thresholds, including unlimited and shareable plans

These factors were partly offset by:

• Continued growth in our mobile phone subscriber base

• The flow-through of rate increases

Product revenues increased by 20.1% in Q1 2021, compared to the same period last year, due to greater sales mix of premium mobile phones and higher handset prices, along with increased consumer electronic sales at The Source (Bell) Electronics Inc. (The Source), primarily in e-commerce, reflecting the shift in consumer behavior to online shopping driven by the COVID-19 pandemic.

OPERATING COSTS AND ADJUSTED EBITDA

|

| |||||||||||||||

| Q1 2021 | Q1 2020 | $ CHANGE | % CHANGE | |||||||||||||

| Operating costs |

(1,177 | ) | (1,107 | ) | (70 | ) | (6.3 | %) | ||||||||

| Adjusted EBITDA |

923 | 928 | (5 | ) | (0.5 | %) | ||||||||||

| Total adjusted EBITDA margin |

44.0 | % | 45.6 | % | (1.6 | ) pts | ||||||||||

Bell Wireless operating costs increased by 6.3% in Q1 2021, compared to Q1 2020, driven by:

| • | Increased cost of goods sold due to the greater sales mix of premium mobile phones and higher handset costs |

These factors were partly offset by:

| • | Reduced payments to other carriers associated with the decline in roaming revenues as a result of the COVID-19 pandemic |

| • | Lower labour costs due to store closures and reduced store operating hours driven by the government restrictions as a result of the COVID-19 pandemic, partly offset by increased call volumes to our customer service centres |

Bell Wireless adjusted EBITDA decreased by 0.5% in Q1 2021, compared to Q1 2020, mainly attributable to the flow-through of the service revenue decline and higher operating costs. Adjusted EBITDA margin, based on wireless operating revenues, of 44.0% in Q1 2021 declined by 1.6 pts year over year, driven by a greater proportion of low-margin product sales in our total revenue base and the flow-through of the service revenue decline.

14 | BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT

Table of Contents

3 MD&A Business segment analysis - Bell Wireless

BELL WIRELESS OPERATING METRICS

| Q1 2021 | Q1 2020 | CHANGE | % CHANGE | |||||||||||||

| Mobile phones |

||||||||||||||||

| Blended ABPU ($/month) |

70.34 | 72.78 | (2.44 | ) | (3.4 | %) | ||||||||||

| Gross activations |

340,127 | 333,557 | 6,570 | 2.0 | % | |||||||||||

| Postpaid |

248,990 | 209,550 | 39,440 | 18.8 | % | |||||||||||

| Prepaid |

91,137 | 124,007 | (32,870 | ) | (26.5 | %) | ||||||||||

| Net activations (losses) |

2,405 | (2,496 | ) | 4,901 | n.m. | |||||||||||

| Postpaid |

32,925 | 1,559 | 31,366 | n.m. | ||||||||||||

| Prepaid |

(30,520 | ) | (4,055 | ) | (26,465 | ) | n.m. | |||||||||

| Blended churn % (average per month) |

1.23 | % | 1.26 | % | 0.03 | pts | ||||||||||

| Postpaid |

0.89 | % | 0.89 | % | – | |||||||||||

| Prepaid |

4.68 | % | 5.03 | % | 0.35 | pts | ||||||||||

| Subscribers |

9,166,748 | 8,971,172 | 195,576 | 2.2 | % | |||||||||||

| Postpaid |

8,361,264 | 8,177,205 | 184,059 | 2.3 | % | |||||||||||

| Prepaid |

805,484 | 793,967 | 11,517 | 1.5 | % | |||||||||||

| Mobile connected devices |

||||||||||||||||

| Net activations |

74,159 | 48,964 | 25,195 | 51.5 | % | |||||||||||

| Subscribers |

2,130,312 | 1,877,136 | 253,176 | 13.5 | % | |||||||||||

n.m.: not meaningful

Mobile phone blended ABPU of $70.34 decreased by 3.4% in Q1 2021, compared to Q1 2020, driven by:

| • | Decreased outbound roaming revenues from reduced customer travel due to the COVID-19 pandemic |

| • | Lower data overages driven by greater customer adoption of monthly plans with higher data thresholds, including unlimited and shareable plans |

These factors were partly offset by:

| • | Higher monthly billings related to increased adoption of mobile phone device financing plans |

| • | The flow-through of rate increases |

Mobile phone gross activations increased by 2.0% in Q1 2021, compared to Q1 2020, due to higher postpaid gross activations, partly offset by lower prepaid gross activations.

| • | Mobile phone postpaid gross activations increased by 18.8% in the quarter, compared to the same period last year, due to our focus on growing higher-valued mobile phone subscribers, greater promotional offers and reflected the benefit from the enhancements to our online capabilities |

| • | Mobile phone prepaid gross activations decreased by 26.5% in the quarter, compared to Q1 2020, driven by lower market activity from fewer visitors to Canada, reduced immigration and the temporary closure of our retail distribution channels as a result of the COVID-19 pandemic |

Mobile phone net activations increased by 4,901 in Q1 2021, compared to Q1 2020, due to higher postpaid net activations, offset in part by lower prepaid net activations.

| • | Mobile phone postpaid net activations increased by 31,366 in Q1 2021, compared to the same period last year, driven by higher gross activations, offset in part by greater customer deactivations |

| • | Mobile phone prepaid net activations decreased by 26,465 in the quarter, compared to the same period last year, due to lower gross activations, offset in part by reduced customer deactivations |

Mobile phone blended churn of 1.23% improved by 0.03 pts in Q1 2021, compared to Q1 2020.

| • | Mobile phone postpaid churn of 0.89% this quarter remained relatively stable, compared to the same period last year |

| • | Mobile phone prepaid churn of 4.68% in Q1 2021 improved by 0.35 pts, compared to the same period last year, due to lower market activity as a result of the COVID-19 pandemic |

Mobile phone subscribers at March 31, 2021 totaled 9,166,748, an increase of 2.2% from 8,971,172 subscribers at the end of Q1 2020. This consisted of 8,361,264 postpaid subscribers and 805,484 prepaid subscribers, an increase of 2.3% and 1.5%, respectively, year over year.

Mobile connected device net activations increased by 51.5% in Q1 2021, compared to Q1 2020, driven by greater IoT net activations, offset in part by lower data devices, primarily less tablet activations.

Mobile connected device subscribers at March 31, 2021 totaled 2,130,312, an increase of 13.5% from 1,877,136 subscribers at the end of Q1 2020.

BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT | 15

Table of Contents

3 MD&A Business segment analysis - Bell Wireless

ASSUMPTIONS

As at the date of this MD&A, our forward-looking statements set out in the BCE 2020 Annual MD&A, as updated or supplemented in this MD&A, are based on certain assumptions including, without limitation, the following assumptions and the assumptions referred to in each of the other business segment discussions set out in this section 3, Business segment analysis, as well as the economic and market assumptions referred to in section 1.3, Assumptions, of this MD&A.

| • | Maintain our market share of national operators’ wireless postpaid net additions |

| • | Continued growth of our prepaid subscriber base |

| • | Continued adoption of smartphone devices, tablets and data applications, as well as the introduction of more 5G, 4G LTE and LTE Advanced devices and new data services |

| • | Continued deployment of 5G wireless network offering coverage that is competitive with other national operators in centres across Canada |

| • | Improvement in subscriber acquisition and retention spending, enabled by increasing adoption of device financing plans |

| • | Unfavourable impact on mobile phone blended ABPU, driven by reduced outbound roaming revenue due to travel restrictions as a result of the COVID-19 pandemic, reduced data overage revenue due to continued adoption of unlimited plans and the impact of a higher prepaid mix in our overall subscriber base |

| • | Increased adoption of unlimited data plans and device financing plans |

| • | No material financial, operational or competitive consequences of changes in regulations affecting our wireless business |

16 | BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT

Table of Contents

3 MD&A Business segment analysis - Bell Wireline

This section contains forward-looking statements, including relating to our network deployment and capital investment plans. Refer to the section Caution regarding forward-looking statements at the beginning of this MD&A.

KEY BUSINESS DEVELOPMENTS

HIGH-SPEED INTERNET DEPLOYMENT IN QUÉBEC

On March 18, 2021, Bell reaffirmed its plan to respond quickly to requests for access to its communications support structures in anticipation of an increase in the volume of requests over the coming months, underscoring its focus on accelerating the deployment of high-speed Internet as part of the federal and Québec governments’ “Operation High Speed” initiative to connect all Québecers by September 2022. By establishing common priorities and working closely with partners like Hydro-Québec and suppliers including engineering firms specializing in aerial structures, the measures Bell is implementing have already significantly accelerated the issuance of permits for many service providers and sped up deployment of several key projects.

On March 22, 2021, Bell announced that it will roll out high-speed Internet services to several unserved areas of Québec in partnership with the governments of Canada and Québec as part of the “Operation High Speed” initiative. The Bell projects will provide 100% fibre Internet connections to approximately 31,000 homes and businesses in nearly 100 Québec communities.

PARTNERSHIP WITH SCALE AI ON ARTIFICIAL INTELLIGENCE INNOVATION

Bell Business Markets partnered with SCALE AI, a Montréal-based investment and innovation hub, to reduce installation time for new fibre connections using artificial intelligence (AI). By accelerating several steps in the supply chain with AI, the new initiative will increase prediction accuracy for the order completion date, automate email interactions with internal and external participants in the supply chain process, reduce waste and accelerate supply chain fulfillment, enabling us to dynamically forecast workload to ensure consistent and high-level service. The initiative is part of a $16.6 million investment announced by SCALE AI to accelerate the rapid adoption and integration of AI solutions in Canada.

FINANCIAL PERFORMANCE ANALYSIS

Q1 2021 PERFORMANCE HIGHLIGHTS

| Bell Wireline | Bell Wireline | |

| Revenues | Adjusted EBITDA | |

| (in $ millions) | (in $ millions) | |

| (% adjusted EBITDA margin) | ||

|

|

| Retail high-speed Internet (1) | Retail high-speed Internet | Retail TV (2) | ||

| +4.3% | 21,208 | (1.1%) | ||

| Subscriber growth | Total net subscriber activations | Subscriber decline | ||

| Q1 2021 vs. Q1 2020 | in Q1 2021 | Q1 2021 vs. Q1 2020 | ||

| Retail IPTV | Retail residential NAS lines | |

| 10,696 | (7.7%) | |

| Total net subscriber activations in Q1 2021 |

Subscriber decline Q1 2021 vs. Q1 2020 |

| (1) | At the beginning of Q1 2021, our retail high-speed Internet subscriber base was increased by 4,778 subscribers due to the transfer of fixed wireless Internet subscribers from our mobile connected devices subscriber base. |

| (2) | At the beginning of Q1 2021, we adjusted our satellite TV subscriber base to remove 6,125 non-revenue generating units. |

BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT | 17

Table of Contents

3 MD&A Business segment analysis - Bell Wireline

BELL WIRELINE RESULTS

REVENUES

| Q1 2021 | Q1 2020 | $ CHANGE | % CHANGE | |||||||||||||

| Data |

1,965 | 1,891 | 74 | 3.9% | ||||||||||||

| Voice |

803 | 872 | (69 | ) | (7.9% | ) | ||||||||||

| Other services |

74 | 62 | 12 | 19.4% | ||||||||||||

| Total external service revenues |

2,842 | 2,825 | 17 | 0.6% | ||||||||||||

| Inter-segment service revenues |

85 | 76 | 9 | 11.8% | ||||||||||||

| Total operating service revenues |

2,927 | 2,901 | 26 | 0.9% | ||||||||||||

| Data |

144 | 123 | 21 | 17.1% | ||||||||||||

| Equipment and other |

10 | 12 | (2 | ) | (16.7% | ) | ||||||||||

| Total external product revenues |

154 | 135 | 19 | 14.1% | ||||||||||||

| Total operating product revenues |

154 | 135 | 19 | 14.1% | ||||||||||||

| Total Bell Wireline revenues |

3,081 | 3,036 | 45 | 1.5% | ||||||||||||

Bell Wireline operating revenues increased by 1.5% in Q1 2021, compared to the same period last year, reflecting an improvement over the decline experienced in Q4 2020. The year-over-year growth was driven by higher data service revenues, increased product sales and greater other services revenues, moderated by the continued erosion in voice revenues.

Bell Wireline operating service revenues grew by 0.9% in Q1 2021, compared to the same period last year.

| • | Data revenues increased by 3.9% in Q1 2021, compared to the same period last year, driven by: |

| • | Higher retail Internet and IPTV subscribers combined with the flow-through of pricing changes |

| • | Lower seasonal suspension of residential services as more customers maintained their services due to the COVID-19 pandemic |

| • | Greater sales of maintenance contracts on data equipment sold to business customers |

These factors were partly offset by:

| • | Continued decline in our satellite TV subscriber base |

| • | Ongoing legacy data erosion |

| • | Voice revenues declined by 7.9% in the first quarter of 2021, compared to Q1 2020, driven by lower local and access and long distance revenues due to: |

| • | NAS line erosion from technological substitution to wireless and Internet based services |

| • | Lower usage of conferencing services as business customers have adopted cheaper solutions since the onset of the COVID-19 pandemic |

| • | Large business customer conversions to Internet protocol (IP) and Internet-based data services |

| • | Other services revenue increased by 19.4% in Q1 2021, compared to Q1 2020, from the acquisition in December 2020 of Environics Analytics Group Ltd., a Canadian data and analytics company |

Bell Wireline operating product revenues increased by 14.1% in Q1 2021, compared to the same period last year, driven by higher demand in our business markets, primarily from greater sales to the government sector, along with the impact in Q1 2020 of vendor delays relating to equipment purchases as a result of the COVID-19 pandemic.

OPERATING COSTS AND ADJUSTED EBITDA

| Q1 2021 | Q1 2020 | $ CHANGE | % CHANGE | |||||||||||||

| Operating costs |

(1,718 | ) | (1,701 | ) | (17 | ) | (1.0%) | |||||||||

| Adjusted EBITDA |

1,363 | 1,335 | 28 | 2.1% | ||||||||||||

| Adjusted EBITDA margin |

44.2 | % | 44.0 | % | 0.2 pts | |||||||||||

Bell Wireline operating costs increased by 1.0% in Q1 2021, compared to the same period last year, due to:

| • | Higher cost of goods sold and maintenance contract expenses attributable to the growth in revenues |

| • | Greater expenses associated with the acquisition of Environics Analytics Group Ltd. |

| • | Higher labour costs from greater project requirements, along with increased call volumes to our customer service centres, moderated by vendor contract savings |

These factors were partly offset by:

| • | Reduced payments to other carriers and TV programming and content costs driven by lower associated revenues |

Bell Wireline adjusted EBITDA increased by 2.1% in Q1 2021, compared to the same period last year, driven by higher revenues, offset in part by greater operating expenses. This reflected an improvement over the Q4 2020 year-over-year decline of 2.7%. Adjusted EBITDA margin of 44.2% in Q1 2021 increased by 0.2 pts compared to the 44.0% achieved in Q1 2020, attributable to higher service revenue flow-through, offset in part by greater low-margin product sales in our total revenue base.

18 | BCE INC. 2021 FIRST QUARTER SHAREHOLDER REPORT

Table of Contents

3 MD&A Business segment analysis - Bell Wireline

BELL WIRELINE OPERATING METRICS

DATA

Retail high-speed Internet

| Q1 2021 | Q1 2020 | CHANGE | % CHANGE | |||||||||||||

| Retail net activations |

21,208 | 22,595 | (1,387 | ) | (6.1%) | |||||||||||

| Retail subscribers (1) |

3,730,576 | 3,578,196 | 152,380 | 4.3% | ||||||||||||

|

(1) At the beginning of Q1 2021, our retail high-speed Internet subscriber base was increased by 4,778 subscribers due to the transfer of fixed wireless Internet subscribers from our mobile connected devices subscriber base.

Retail high-speed Internet subscriber net activations decreased by 6.1% in Q1 2021, compared to Q1 2020, driven by lower retail residential net additions due to fewer promotional offers, lower door-to-door sales and slower growth of new households from lower immigration, as a result of the COVID-19 pandemic, as well as greater competitive intensity. This was offset in part by fewer deactivations due to the COVID-19 pandemic, along with increased activations in our fibre-to-the-premise (FTTP) and wireless-to-the-premise (WTTP) footprints.

Retail high-speed Internet subscribers totaled 3,730,576 at March 31, 2021, up 4.3% from the same period last year. At the beginning of Q1 2021, our retail high-speed Internet subscriber base was increased by 4,778 subscribers due to the transfer of fixed wireless Internet subscribers from our mobile connected devices subscriber base.

Retail TV

|

| |||||||||||||||

| Q1 2021 | Q1 2020 | CHANGE | % CHANGE | |||||||||||||

| Retail net subscriber (losses) activations |

(9,112 | ) | (18,555 | ) | 9,443 | 50.9% | ||||||||||

| IPTV |

10,696 | 2,852 | 7,844 | n.m. | ||||||||||||

| Satellite |

(19,808 | ) | (21,407 | ) | 1,599 | 7.5% | ||||||||||

| Total retail subscribers (1) |

2,723,368 | 2,753,909 | (30,541 | ) | (1.1% | ) | ||||||||||

| IPTV |

1,817,069 | 1,770,034 | 47,035 | 2.7% | ||||||||||||

| Satellite (1) |

906,299 | 983,875 | (77,576 | ) | (7.9% | ) | ||||||||||

n.m.: not meaningful

| (1) | At the beginning of Q1 2021, we adjusted our satellite TV subscriber base to remove 6,125 non-revenue generating units. |