Form 6-K BARRICK GOLD CORP For: May 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2021

Commission File Number: 1-9059

Barrick Gold Corporation

(Registrant’s name)

Brookfield Place, TD Canada Trust Tower, Suite 3700

161 Bay Street, P.O. Box 212

Toronto, Ontario M5J 2S1 Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INCORPORATION BY REFERENCE

Exhibit 99.1 to this report on Form 6-K is furnished, not filed, and will not be incorporated by reference into any registration statement.

Exhibit 99.2 to this report on Form 6-K is hereby incorporated by reference into the Registration Statements on Form F-3 (File No. 333-206417), Form S-8 (File No. 333-224560) and Form F-10 (File No. 333-230235).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BARRICK GOLD CORPORATION | ||||||

| Date: May 5, 2021 | By: /s/ Richie Haddock | |||||

| Name: Richie Haddock | ||||||

| Title: General Counsel | ||||||

EXHIBIT INDEX

| Exhibits | Description | |

| 99.1 | 2021 Q1 Report Press Release dated May 5, 2021 | |

| 99.2 | Barrick Gold Corporation’s Comparative Unaudited Financial Statements prepared in accordance with International Financial Reporting Standards and the notes thereto for the three months ended March 31, 2021 and Management’s Discussion and Analysis for the same period. | |

Exhibit 99.1

ROBUST Q1 PERFORMANCE BY CORE MINES

SETS BARRICK ON COURSE

FOR ANNUAL TARGET

| All amounts expressed in US dollars

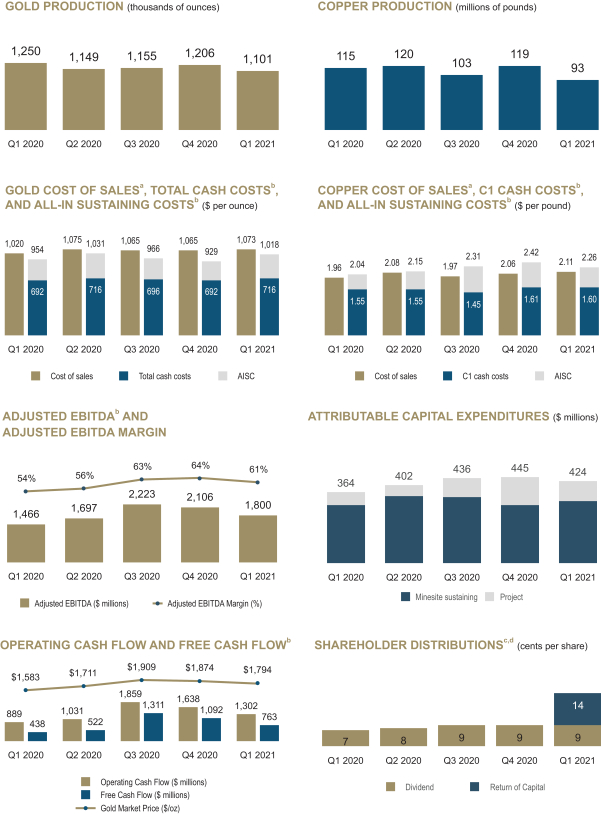

Toronto, May 5, 2021 — Barrick Gold Corporation (NYSE: GOLD)(TSX: ABX) today reported its results for the first quarter of 2021, noting that with gold and copper production on plan, it was well positioned to achieve its annual guidance.

Production in the latter half of the year is expected to be higher than the first, mainly due to mine sequencing at Nevada Gold Mines, the commissioning of the new leach pad facility at Veladero in Argentina, the ramp-up of underground mining at Bulyanhulu and higher anticipated grades at Lumwana in Zambia.

Barrick’s Tier One1 gold mines all delivered strong financial performances in Q1 while revenue from its copper mines rose by 31% due to higher copper prices. Net cash2 increased by $0.5 billion despite an advanced tax payment to the state of Nevada on the back of operating cash flow of $1.3 billion and free cash flow3 of $0.8 billion.

The company announced a 9 cents per share quarterly dividend, which will be topped up by a three-tranche return of capital distribution totaling $750 million through the course of the year. This would take the per share yield based on yesterday’s closing share price to 3.5% for 2021.4,5 |

| |

|

CONTINUED ON PAGE 3 |

* Quarter on quarter ** Distribution per share amount is based on issued and outstanding shares as of March 31, 2021, and is subject to change |

Key Performance Indicators

Financial and Operating Highlights

| BARRICK FIRST QUARTER 2021 | 2 | PRESS RELEASE |

CONTINUED FROM PAGE 1

BARRICK ANNOUNCES FIRST $250 MILLION RETURN OF CAPITAL TRANCHE AND QUARTERLY DIVIDEND

Barrick today announced that the first $250 million ($0.14 per share)15 tranche of a return of capital distribution totaling $750 million will be paid on June 15, 2021 to shareholders of record at the close of business on May 28, 2021.

| BARRICK FIRST QUARTER 2021 | 3 | PRESS RELEASE |

INTEGRATION OF EXPLORATION, MINERAL RESOURCE MANAGEMENT AND PLANNING UNLOCKS VALUE

Built on its core strategy of continuing exploration success, Barrick’s 10-year plan has been bolstered further by significant advances in resource replacement and prospect development during the first quarter of the year.

BIODIVERSITY ACTION PLANS PROTECT ECOSYSTEMS,

PROMOTE CONSERVATION AROUND BARRICK MINES

Barrick has implemented biodiversity action plans at all its operational sites to manage their impact on sensitive ecosystems as well as to support conservation efforts in the wilderness areas around some of its mines.

| BARRICK FIRST QUARTER 2021 | 4 | PRESS RELEASE |

|

The recent collaring of an elephant in Garamba National Park in the DRC. Since 2014, the Kibali mine has partnered with the park to promote conservation and combat poaching. |

ESG IN ACTION: TANZANIA SHOWS THE WAY

When Barrick took over operational control of its Tanzanian assets under two years ago, it faced daunting challenges: a government that was actively hostile to the mining industry in general and the former operator in particular; serious environmental issues which had halted production at North Mara; long-standing land disputes; allegations of human rights abuses; and a non-existent social licence to operate.

| BARRICK FIRST QUARTER 2021 | 5 | PRESS RELEASE |

NEVADA GOLD MINES:

WORLD CLASS ASSETS AND A GREAT FUTURE

Nevada Gold Mines, the joint venture formed in July 2019 by industry leaders Barrick and Newmont, is maturing rapidly, with a high-confidence 10-year plan in place and the focus shifting to a 15-year plan. The world’s largest gold mining complex, NGM is majority-owned and operated by Barrick.

PARTNERSHIP AND PERSEVERANCE PAY OFF

AT PORGERA

The Porgera gold mine is set to resume operations later this year after the Papua New Guinea (PNG) government and Barrick Niugini Limited (BNL) agreed on a partnership for its future ownership and operation.

| BARRICK FIRST QUARTER 2021 | 6 | PRESS RELEASE |

PUEBLO VIEJO MAINTAINS MAJOR CONTRIBUTION

TO DOMINICAN ECONOMY

Pueblo Viejo paid $228 million in direct cash taxes and royalties in the first four months of this year, bringing its total tax and royalty payments to the government to more than $2.6 billion since production started in 2013.

|

Pueblo Viejo |

Kibali |

KIBALI MAKES STRONG START TO 2021,

CONTINUES TO REDUCE CARBON FOOTPRINT

The Barrick operated Kibali mine in the DRC produced 191,612 ounces of gold17 in the first quarter of 2021, keeping it on plan and on track to achieve its full year target, president and chief executive Mark Bristow told local media and stakeholders at a recent briefing in Kinshasa.

| BARRICK FIRST QUARTER 2021 | 7 | PRESS RELEASE |

LOULO-GOUNKOTO’S THIRD UNDERGROUND MINE

ON TRACK TO START PRODUCTION

Barrick’s giant Loulo-Gounkoto gold complex’s third underground mine has reached its first mining level and is scheduled to start delivering ore tonnes to the plant during the second quarter, president and chief executive Mark Bristow told a media briefing in Bamako recently.

| BARRICK FIRST QUARTER 2021 | 8 | PRESS RELEASE |

Appendix 1

2021 Operating and Capital Expenditure Guidance

| GOLD PRODUCTION AND COSTS | ||||||||

| 2021 forecast attributable production (000s oz) |

2021 forecast cost of sales11 ($/oz) |

2021 forecast total cash costs12 ($/oz) |

2021 forecast all-in oz) | |||||

| Carlin (61.5%)18 |

940 - 1,000 | 920 - 970 | 740 - 790 | 1,050 - 1,100 | ||||

| Cortez (61.5%)19 |

500 - 550 | 1,000 - 1,050 | 700 - 750 | 940 - 990 | ||||

| Turquoise Ridge (61.5%) |

390 - 440 | 950 - 1,000 | 620 - 670 | 810 - 860 | ||||

| Phoenix (61.5%) |

100 - 120 | 1,800 - 1,850 | 725 - 775 | 970 - 1,020 | ||||

| Long Canyon (61.5%) |

140 - 160 | 800 - 850 | 180 - 230 | 240 - 290 | ||||

| Nevada Gold Mines (61.5%) |

2,100 - 2,250 | 980 - 1,030 | 660 - 710 | 910 - 960 | ||||

| Hemlo |

200 - 220 | 1,200 - 1,250 | 950 - 1,000 | 1,280 - 1,330 | ||||

| North America |

2,300 - 2,450 | 990 - 1,040 | 690 - 740 | 940 - 990 | ||||

| Pueblo Viejo (60%) |

470 - 510 | 880 - 930 | 520 - 570 | 760 - 810 | ||||

| Veladero (50%) |

130 - 150 | 1,510 - 1,560 | 820 - 870 | 1,720 - 1,770 | ||||

| Porgera (47.5%)20 |

— | — | — | — | ||||

| Latin America & Asia Pacific |

600 - 660 | 1,050 - 1,100 | 600 - 650 | 1,000 - 1,050 | ||||

| Loulo-Gounkoto (80%) |

510 - 560 | 980 - 1,030 | 630 - 680 | 930 - 980 | ||||

| Kibali (45%) |

350 - 380 | 990 - 1,040 | 590 - 640 | 800 - 850 | ||||

| North Mara (84%) |

240 - 270 | 970 - 1,020 | 740 - 790 | 960 - 1,010 | ||||

| Tongon (89.7%) |

180 - 200 | 1,470 - 1,520 | 1,000 - 1,050 | 1,140 - 1,190 | ||||

| Bulyanhulu (84%) |

170 - 200 | 980 - 1,030 | 580 - 630 | 810 - 860 | ||||

| Buzwagi (84%) |

30 - 40 | 1,360 - 1,410 | 1,250 - 1,300 | 1,230 - 1,280 | ||||

| Africa & Middle East |

1,500 - 1,600 | 1,050 - 1,100 | 690 - 740 | 920 - 970 | ||||

| Total Attributable to Barrick21,22,23 |

4,400 - 4,700 | 1,020 - 1,070 | 680 - 730 | 970 - 1,020 | ||||

| COPPER PRODUCTION AND COSTS | ||||||||

| 2021 forecast attributable production (Mlbs) |

2021 forecast cost of sales13 ($/lb) |

2021 forecast C1 cash costs14 ($/lb) |

2021 forecast all-in sustaining costs14 ($/lb) | |||||

| Lumwana |

250 - 280 | 1.85 - 2.05 | 1.45 - 1.65 | 2.25 - 2.45 | ||||

| Zaldívar (50%) |

90 - 110 | 2.30 - 2.50 | 1.65 - 1.85 | 1.90 - 2.10 | ||||

| Jabal Sayid (50%) |

70 - 80 | 1.40 - 1.60 | 1.10 - 1.30 | 1.30 - 1.50 | ||||

| Total Attributable to Barrick22 |

410 - 460 | 1.90 - 2.10 | 1.40 - 1.60 | 2.00 - 2.20 | ||||

| ATTRIBUTABLE CAPITAL EXPENDITURES |

| |||

| ($ millions) | ||||

| Attributable minesite sustaining |

1,250 - 1,450 | |||

| Attributable project |

550 - 650 | |||

| Total attributable capital expenditures |

1,800 - 2,100 | |||

2021 OUTLOOK ASSUMPTIONS AND ECONOMIC SENSITIVITY ANALYSIS24

| 2021 Guidance Assumption |

Hypothetical Change | Impact on EBITDA25 (millions) |

Impact on TCC/C1 Cash Costs and AISC12,14 | |||||

| Gold price sensitivity |

$1,700/oz | +/- $100/oz | +/- $620 | +/-$4/oz | ||||

| Copper price sensitivity |

$2.75/lb | +/- $0.25/lb | +/- $60 | +/- $0.01/lb | ||||

| BARRICK FIRST QUARTER 2021 | 9 | PRESS RELEASE |

Appendix 2

Production and Cost Summary - Gold

| For the three months ended | ||||||||||||||||

| 3/31/21 | 12/31/20 | % Change | 3/31/20 | % Change | ||||||||||||

| Nevada Gold Mines LLC (61.5%)a |

||||||||||||||||

| Gold produced (000s oz attributable basis) |

485 | 546 | (11)% | 526 | (8)% | |||||||||||

| Gold produced (000s oz 100% basis) |

789 | 885 | (11)% | 855 | (8)% | |||||||||||

| Cost of sales ($/oz) |

1,047 | 1,008 | 4 % | 995 | 5 % | |||||||||||

| Total cash costs ($/oz)b |

686 | 667 | 3 % | 690 | (1)% | |||||||||||

| All-in sustaining costs ($/oz)b |

932 | 873 | 7 % | 952 | (2)% | |||||||||||

| Carlin (61.5%)c |

||||||||||||||||

| Gold produced (000s oz attributable basis) |

229 | 260 | (12)% | 253 | (9)% | |||||||||||

| Gold produced (000s oz 100% basis) |

373 | 422 | (12)% | 411 | (9)% | |||||||||||

| Cost of sales ($/oz) |

950 | 917 | 4 % | 970 | (2)% | |||||||||||

| Total cash costs ($/oz)b |

766 | 740 | 4 % | 776 | (1)% | |||||||||||

| All-in sustaining costs ($/oz)b |

1,045 | 1,005 | 4 % | 1,007 | 4 % | |||||||||||

| Cortez (61.5%)d |

||||||||||||||||

| Gold produced (000s oz attributable basis) |

100 | 118 | (15)% | 128 | (22)% | |||||||||||

| Gold produced (000s oz 100% basis) |

163 | 191 | (15)% | 208 | (22)% | |||||||||||

| Cost of sales ($/oz) |

1,251 | 1,043 | 20 % | 878 | 42 % | |||||||||||

| Total cash costs ($/oz)b |

860 | 738 | 17 % | 614 | 40 % | |||||||||||

| All-in sustaining costs ($/oz)b |

1,203 | 906 | 33 % | 1,009 | 19 % | |||||||||||

| Turquoise Ridge (61.5%) |

||||||||||||||||

| Gold produced (000s oz attributable basis) |

92 | 91 | 1 % | 84 | 9 % | |||||||||||

| Gold produced (000s oz 100% basis) |

149 | 147 | 1 % | 137 | 9 % | |||||||||||

| Cost of sales ($/oz) |

1,007 | 1,064 | (5)% | 1,032 | (2)% | |||||||||||

| Total cash costs ($/oz)b |

647 | 687 | (6)% | 668 | (3)% | |||||||||||

| All-in sustaining costs ($/oz)b |

741 | 757 | (2)% | 806 | (8)% | |||||||||||

| Phoenix (61.5%) |

||||||||||||||||

| Gold produced (000s oz attributable basis) |

25 | 26 | (3)% | 35 | (28)% | |||||||||||

| Gold produced (000s oz 100% basis) |

41 | 42 | (3)% | 57 | (28)% | |||||||||||

| Cost of sales ($/oz) |

2,051 | 2,054 | — % | 1,583 | 30 % | |||||||||||

| Total cash costs ($/oz)b |

346 | 590 | (41)% | 737 | (53)% | |||||||||||

| All-in sustaining costs ($/oz)b |

530 | 670 | (21)% | 914 | (42)% | |||||||||||

| Long Canyon (61.5%) |

||||||||||||||||

| Gold produced (000s oz attributable basis) |

39 | 51 | (24)% | 26 | 50 % | |||||||||||

| Gold produced (000s oz 100% basis) |

63 | 83 | (24)% | 42 | 50 % | |||||||||||

| Cost of sales ($/oz) |

511 | 674 | (24)% | 1,025 | (50)% | |||||||||||

| Total cash costs ($/oz)b |

79 | 145 | (46)% | 345 | (77)% | |||||||||||

| All-in sustaining costs ($/oz)b |

156 | 324 | (52)% | 561 | (72)% | |||||||||||

| Pueblo Viejo (60%) |

||||||||||||||||

| Gold produced (000s oz attributable basis) |

137 | 159 | (14)% | 143 | (4)% | |||||||||||

| Gold produced (000s oz 100% basis) |

229 | 265 | (14)% | 238 | (4)% | |||||||||||

| Cost of sales ($/oz) |

816 | 803 | 2 % | 767 | 6 % | |||||||||||

| Total cash costs ($/oz)b |

507 | 493 | 3 % | 502 | 1 % | |||||||||||

| All-in sustaining costs ($/oz)b |

689 | 689 | — % | 626 | 10 % | |||||||||||

| BARRICK FIRST QUARTER 2021 | 10 | PRESS RELEASE |

Production and Cost Summary - Gold (continued)

| For the three months ended | ||||||||||||||||||||

| 3/31/21 | 12/31/20 | % Change | 3/31/20 | % Change | ||||||||||||||||

| Loulo-Gounkoto (80%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

154 | 123 | 26 % | 141 | 9 % | |||||||||||||||

| Gold produced (000s oz 100% basis) |

193 | 153 | 26 % | 177 | 9 % | |||||||||||||||

| Cost of sales ($/oz) |

974 | 1,149 | (15)% | 1,002 | (3)% | |||||||||||||||

| Total cash costs ($/oz)b |

608 | 734 | (17)% | 614 | (1)% | |||||||||||||||

| All-in sustaining costs ($/oz)b |

920 | 923 | — % | 891 | 3 % | |||||||||||||||

| Kibali (45%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

86 | 92 | (6)% | 91 | (5)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

192 | 205 | (6)% | 201 | (5)% | |||||||||||||||

| Cost of sales ($/oz) |

1,065 | 1,163 | (8)% | 1,045 | 2 % | |||||||||||||||

| Total cash costs ($/oz)b |

691 | 616 | 12 % | 582 | 19 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

856 | 783 | 9 % | 773 | 11 % | |||||||||||||||

| Veladero (50%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

32 | 58 | (45)% | 75 | (57)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

64 | 116 | (45)% | 150 | (57)% | |||||||||||||||

| Cost of sales ($/oz) |

1,151 | 1,074 | 7 % | 1,182 | (3)% | |||||||||||||||

| Total cash costs ($/oz)b |

736 | 698 | 5 % | 788 | (7)% | |||||||||||||||

| All-in sustaining costs ($/oz)b |

2,104 | 1,428 | 47 % | 1,266 | 66 % | |||||||||||||||

| Porgera (47.5%)e |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

— | — | 62 | (100)% | ||||||||||||||||

| Gold produced (000s oz 100% basis) |

— | — | 131 | (100)% | ||||||||||||||||

| Cost of sales ($/oz) |

— | — | 1,097 | (100)% | ||||||||||||||||

| Total cash costs ($/oz)b |

— | — | 941 | (100)% | ||||||||||||||||

| All-in sustaining costs ($/oz)b |

— | — | 1,089 | (100)% | ||||||||||||||||

| Tongon (89.7%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

48 | 66 | (26)% | 61 | (21)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

54 | 73 | (26)% | 68 | (21)% | |||||||||||||||

| Cost of sales ($/oz) |

1,510 | 1,371 | 10 % | 1,368 | 10 % | |||||||||||||||

| Total cash costs ($/oz)b |

995 | 810 | 23 % | 762 | 31 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,062 | 853 | 25 % | 788 | 35 % | |||||||||||||||

| Hemlo |

||||||||||||||||||||

| Gold produced (000s oz) |

47 | 57 | (18)% | 57 | (18)% | |||||||||||||||

| Cost of sales ($/oz) |

1,610 | 1,379 | 17 % | 1,119 | 44 % | |||||||||||||||

| Total cash costs ($/oz)b |

1,324 | 1,104 | 20 % | 945 | 40 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,840 | 1,464 | 26 % | 1,281 | 44 % | |||||||||||||||

| North Mara (84%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

62 | 61 | 1 % | 65 | (4)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

74 | 73 | 1 % | 77 | (4)% | |||||||||||||||

| Cost of sales ($/oz) |

1,061 | 1,073 | (1)% | 959 | 11 % | |||||||||||||||

| Total cash costs ($/oz)b |

832 | 799 | 4 % | 646 | 29 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,038 | 989 | 5 % | 816 | 27 % | |||||||||||||||

| BARRICK FIRST QUARTER 2021 | 11 | PRESS RELEASE |

Production and Cost Summary - Gold (continued)

| For the three months ended | ||||||||||||||||||||

| 3/31/21 | 12/31/20 | % Change | 3/31/20 | % Change | ||||||||||||||||

| Buzwagi (84%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

17 | 21 | (20)% | 22 | (25)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

20 | 25 | (20)% | 27 | (25)% | |||||||||||||||

| Cost of sales ($/oz) |

1,486 | 1,314 | 13 % | 1,373 | 8 % | |||||||||||||||

| Total cash costs ($/oz)b |

1,450 | 1,267 | 14 % | 1,275 | 14 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,467 | 1,283 | 14 % | 1,288 | 14 % | |||||||||||||||

| Bulyanhulu (84%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

33 | 23 | 44 % | 7 | 352 % | |||||||||||||||

| Gold produced (000s oz 100% basis) |

39 | 27 | 44 % | 9 | 352 % | |||||||||||||||

| Cost of sales ($/oz) |

1,211 | 1,181 | 3 % | 1,685 | (28)% | |||||||||||||||

| Total cash costs ($/oz)b |

865 | 610 | 42 % | 686 | 26 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

957 | 664 | 44 % | 906 | 6 % | |||||||||||||||

| Total Attributable to Barrickf |

||||||||||||||||||||

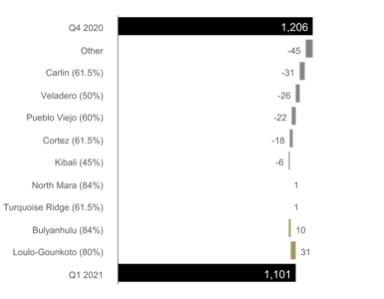

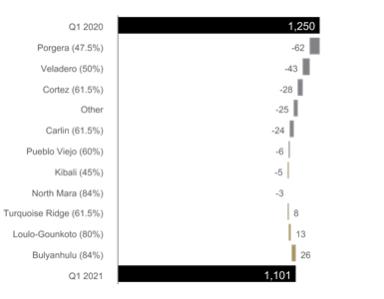

| Gold produced (000s oz) |

1,101 | 1,206 | (9)% | 1,250 | (12)% | |||||||||||||||

| Cost of sales ($/oz)g |

1,073 | 1,065 | 1 % | 1,020 | 5 % | |||||||||||||||

| Total cash costs ($/oz)b |

716 | 692 | 3 % | 692 | 3 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,018 | 929 | 10 % | 954 | 7 % | |||||||||||||||

| a. | These results represent our 61.5% interest in Carlin (including NGM’s 60% interest in South Arturo), Cortez, Turquoise Ridge, Phoenix and Long Canyon. |

| b. | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the press release to the most directly comparable IFRS measure, please see the endnotes to this press release. |

| c. | Included within our 61.5% interest in Carlin is NGM’s 60% interest in South Arturo. |

| d. | Starting in the first quarter of 2021, Goldrush is reported as part of Cortez as it is operated by Cortez management. Comparative periods have been restated to include Goldrush. |

| e. | As Porgera was placed on care and maintenance on April 25, 2020, no operating data or per ounce data is provided. |

| f. | Excludes Pierina, Lagunas Norte, Golden Sunlight, and Morila (40%) up until its divestiture in November 2020, as these assets are producing incidental ounces while in closure or care and maintenance. |

| g. | Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in care and maintenance) divided by ounces sold (both on an attributable basis using Barrick’s ownership share). |

| BARRICK FIRST QUARTER 2021 | 12 | PRESS RELEASE |

Production and Cost Summary - Copper

| For the three months ended | ||||||||||||||||

| 3/31/21 | 12/31/20 | % Change | 3/31/20 | % Change | ||||||||||||

| Lumwana |

||||||||||||||||

| Copper production (Mlbs) |

51 | 78 | (35)% | 64 | (20)% | |||||||||||

| Cost of sales ($/lb) |

1.97 | 1.96 | 1 % | 1.94 | 2 % | |||||||||||

| C1 cash costs ($/lb)a |

1.48 | 1.58 | (6)% | 1.63 | (9)% | |||||||||||

| All-in sustaining costs ($/lb)a |

2.37 | 2.60 | (9)% | 2.26 | 5 % | |||||||||||

| Zaldívar (50%) |

||||||||||||||||

| Copper production (Mlbs attributable basis) |

24 | 23 | 4 % | 31 | (23)% | |||||||||||

| Copper production (Mlbs 100% basis) |

48 | 46 | 4 % | 62 | (23)% | |||||||||||

| Cost of sales ($/lb) |

3.03 | 2.68 | 13 % | 2.39 | 27 % | |||||||||||

| C1 cash costs ($/lb)a |

2.25 | 2.01 | 12 % | 1.71 | 32 % | |||||||||||

| All-in sustaining costs ($/lb)a |

2.47 | 2.70 | (9)% | 1.99 | 24 % | |||||||||||

| Jabal Sayid (50%) |

||||||||||||||||

| Copper production (Mlbs attributable basis) |

18 | 18 | 0 % | 20 | (10)% | |||||||||||

| Copper production (Mlbs 100% basis) |

36 | 36 | 0 % | 40 | (10)% | |||||||||||

| Cost of sales ($/lb) |

1.21 | 1.53 | (21)% | 1.28 | (5)% | |||||||||||

| C1 cash costs ($/lb)a |

1.06 | 1.15 | (8)% | 0.97 | 9 % | |||||||||||

| All-in sustaining costs ($/lb)a |

1.22 | 1.27 | (4)% | 1.11 | 10 % | |||||||||||

| Total Attributable to Barrick |

||||||||||||||||

| Copper production (Mlbs attributable basis) |

93 | 119 | (22)% | 115 | (19)% | |||||||||||

| Cost of sales ($/lb)b |

2.11 | 2.06 | 2 % | 1.96 | 8 % | |||||||||||

| C1 cash costs ($/lb)a |

1.60 | 1.61 | (1)% | 1.55 | 3 % | |||||||||||

| All-in sustaining costs ($/lb)a |

2.26 | 2.42 | (7)% | 2.04 | 11 % | |||||||||||

| a. | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the press release to the most directly comparable IFRS measure, please see the endnotes to this press release. |

| b. | Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick’s ownership share). |

| BARRICK FIRST QUARTER 2021 | 13 | PRESS RELEASE |

Technical Information

The scientific and technical information contained in this press release has been reviewed and approved by Steven Yopps, MMSA, Manager of Growth Projects, Nevada Gold Mines; Craig Fiddes, SME-RM, Manager – Resource Modeling, Nevada Gold Mines; Chad Yuhasz, P.Geo, Mineral Resource Manager, Latin America & Asia Pacific; Simon Bottoms, CGeol, MGeol, FGS, FAusIMM, Mineral Resources Manager: Africa & Middle East; Rodney Quick, MSc, Pr. Sci.Nat, Mineral Resource Management and Evaluation Executive; John Steele, CIM, Metallurgy, Engineering and Capital Projects Executive; and Rob Krcmarov, FAusIMM, Executive Vice President, Exploration and Growth – each a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Endnotes

Endnote 1

A Tier One Gold Asset is an asset with a reserve potential to deliver a minimum 10-year life, annual production of at least 500,000 ounces of gold and total cash costs per ounce over the mine life that are in the lower half of the industry cost curve.

Endnote 2

Calculated as cash ($5,672 million) less debt ($5,153 million).

Endnote 3

“Free cash flow” is a non-GAAP financial performance measure that deducts capital expenditures from net cash provided by operating activities. Barrick believes this to be a useful indicator of our ability to operate without reliance on additional borrowing or usage of existing cash. Free cash flow is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other companies. Free cash flow should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on this non-GAAP measure are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow

| ($ millions) | For the three months ended | |||||||||||

| 3/31/21 | 12/31/20 | 3/31/20 | ||||||||||

| Net cash provided by operating activities |

1,302 | 1,638 | 889 | |||||||||

| Capital expenditures |

(539 | ) | (546 | ) | (451 | ) | ||||||

| Free cash flow |

763 | 1,092 | 438 | |||||||||

Endnote 4

The declaration and payment of dividends is at the discretion of the Board of Directors, and will depend on the company’s financial results, cash requirements, future prospects and other factors deemed relevant by the Board.

Endnote 5

Forecast yield for 2021 is based on the current quarterly dividend rate ($0.09 per share) and a return of capital distribution per share ($0.42) calculated based on our issued and outstanding shares as of March 31, 2021, which is subject to change.

Endnote 6

“Adjusted net earnings” and “adjusted net earnings per share” are non-GAAP financial performance measures. Adjusted net earnings excludes the following from net earnings: certain impairment charges (reversals) related to intangibles, goodwill, property, plant and equipment, and investments; gains (losses) and other one-time costs relating to acquisitions or dispositions; foreign currency translation gains (losses); significant tax adjustments not related to current period earnings; and the tax effect and non-controlling interest of these items. The Company uses this measure internally to evaluate our underlying operating performance for the reporting periods presented and to assist with the planning and forecasting of future operating results. Barrick believes that adjusted net earnings is a useful measure of our performance because these adjusting items do not reflect the underlying operating performance of our core mining business and are not necessarily indicative of future operating results. Adjusted net earnings and adjusted net earnings per share are intended to provide additional information only and do not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other companies. They should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

| BARRICK FIRST QUARTER 2021 | 14 | PRESS RELEASE |

Reconciliation of Net Earnings to Net Earnings per Share, Adjusted Net Earnings and Adjusted Net Earnings per Share

| ($ millions, except per share amounts in dollars) | For the three months ended | |||||||||||

| 3/31/21 | 12/31/20 | 3/31/20 | ||||||||||

| Net earnings attributable to equity holders of the Company |

538 | 685 | 400 | |||||||||

| Impairment charges (reversals) related to intangibles, goodwill, property, plant and equipment, and investmentsa |

(89 | ) | 40 | (336 | ) | |||||||

| Acquisition/disposition (gains) lossesb |

(3 | ) | (126 | ) | (60 | ) | ||||||

| Loss (gain) on currency translation |

4 | 16 | 16 | |||||||||

| Significant tax adjustmentsc |

47 | (2 | ) | (44 | ) | |||||||

| Other expense adjustmentsd |

11 | 15 | 98 | |||||||||

| Tax effect and non-controlling intereste |

(1 | ) | (12 | ) | 211 | |||||||

| Adjusted net earnings |

507 | 616 | 285 | |||||||||

| Net earnings per sharef |

0.30 | 0.39 | 0.22 | |||||||||

| Adjusted net earnings per sharef |

0.29 | 0.35 | 0.16 | |||||||||

| a. | For the three month period ended March 31, 2021, net impairment reversals primarily relate to non-current asset reversals at Lagunas Norte. Net impairment charges (reversals) for the three month periods ended December 31, 2020 and March 31, 2020 mainly relate to non-current assets at our Tanzanian assets. |

| b. | Acquisition/disposition gains for the three month period ended December 31, 2020 primarily relate to the gain on the sale of Eskay Creek, Morila and Bullfrog. For the three months ended March 31, 2020, acquisition/disposition gains mainly relate to the gain on the sale of Massawa. |

| c. | Significant tax adjustments for the three month period ended March 31, 2021 mainly relates to the remeasurement of deferred tax balances for changes in foreign currency rates and the recognition/derecognition of our deferred taxes in various jurisdictions. For the three months ended March 31, 2020, significant tax adjustments primarily relate to deferred tax recoveries as a result of tax reform measures in Argentina and adjustments made in recognition of the net settlement of all outstanding disputes with the Government of Tanzania. |

| d. | Other expense adjustments for the three month periods ended March 31, 2021 and December 31, 2020 mainly relate to care and maintenance expenses at Porgera. For the three months ended March 31, 2020, other expense adjustments primarily relate to the impact of changes in the discount rate assumptions on our closed mine rehabilitation provision and losses on debt extinguishment. |

| e. | Tax effect and non-controlling interest for the three month period ended March 31, 2020 primarily relates to the net impairment reversals related to long-lived assets and acquisition gains. |

| f. | Calculated using weighted average number of shares outstanding under the basic method of earnings per share. |

Endnote 7

“Realized price” is a non-GAAP financial measure which excludes from sales: unrealized gains and losses on non-hedge derivative contracts; unrealized mark-to-market gains and losses on provisional pricing from copper and gold sales contracts; sales attributable to ore purchase arrangements; treatment and refining charges; export duties; and cumulative catch-up adjustments to revenue relating to our streaming arrangements. This measure is intended to enable Management to better understand the price realized in each reporting period for gold and copper sales because unrealized mark-to-market values of non-hedge gold and copper derivatives are subject to change each period due to changes in market factors such as market and forward gold and copper prices, so that prices ultimately realized may differ from those recorded. The exclusion of such unrealized mark-to-market gains and losses from the presentation of this performance measure enables investors to understand performance based on the realized proceeds of selling gold and copper production. The realized price measure is intended to provide additional information and does not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Reconciliation of Sales to Realized Price per ounce/pound

| ($ millions, except per ounce/pound information in dollars) | Gold | Copper | ||||||||||||||||||||||

| For the three months ended | ||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 3/31/20 | 3/31/21 | 12/31/20 | 3/31/20 | |||||||||||||||||||

| Sales |

2,641 | 3,028 | 2,593 | 256 | 195 | 99 | ||||||||||||||||||

| Sales applicable to non-controlling interests |

(814 | ) | (934 | ) | (770 | ) | 0 | 0 | 0 | |||||||||||||||

| Sales applicable to equity method investmentsa,b |

154 | 168 | 147 | 170 | 135 | 107 | ||||||||||||||||||

| Realized non-hedge gold/copper derivative (losses) gains |

0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||

| Sales applicable to sites in care and maintenancec |

(41 | ) | (41 | ) | (46 | ) | 0 | 0 | 0 | |||||||||||||||

| Treatment and refinement charges |

0 | 1 | 0 | 41 | 39 | 39 | ||||||||||||||||||

| Otherd |

0 | (1 | ) | 15 | 0 | 0 | 0 | |||||||||||||||||

| Revenues – as adjusted |

1,940 | 2,221 | 1,939 | 467 | 369 | 245 | ||||||||||||||||||

| Ounces/pounds sold (000s ounces/millions pounds)c |

1,093 | 1,186 | 1,220 | 113 | 108 | 110 | ||||||||||||||||||

| Realized gold/copper price per ounce/pounde |

1,777 | 1,871 | 1,589 | 4.12 | 3.39 | 2.23 | ||||||||||||||||||

| a. | Represents sales of $154 million for the three month period ended March 31, 2021 (December 31, 2020: $168 million and March 31, 2020: $140 million) applicable to our 45% equity method investment in Kibali for gold. Represents sales of $109 million for the three months ended March 31, 2021 (December 31, 2020: $82 million and March 31, 2020: $72 million) applicable to our 50% equity method investment in Zaldívar and $65 million (December 31, 2020: $59 million and March 31, 2020: $40 million) applicable to our 50% equity method investment in Jabal Sayid for copper. |

| b. | Sales applicable to equity method investments are net of treatment and refinement charges. |

| c. | Figures exclude: Pierina, Lagunas Norte, Golden Sunlight, and Morila up until its divestiture in November 2020 from the calculation of realized price per ounce. These assets are producing incidental ounces. |

| BARRICK FIRST QUARTER 2021 | 15 | PRESS RELEASE |

| d. | Represents a cumulative catch-up adjustment to revenue relating to our streaming arrangements. Refer to note 2f of the 2020 Annual Financial Statements for more information. |

| e. | Realized price per ounce/pound may not calculate based on amounts presented in this table due to rounding. |

Endnote 8

On an attributable basis.

Endnote 9

Net earnings represents net earnings attributable to the equity holders of the Company.

Endnote 10

These amounts are presented on the same basis as our guidance.

Endnote 11

Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in care and maintenance) divided by ounces sold (both on an attributable basis using Barrick’s ownership share). Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick’s ownership share).

Endnote 12

“Total cash costs” per ounce, “All-in sustaining costs” per ounce and “All-in costs” per ounce are non-GAAP financial performance measures. “Total cash costs” per ounce starts with cost of sales related to gold production and removes depreciation, the non-controlling interest of cost of sales, and includes by product credits. “All-in sustaining costs” per ounce start with “Total cash costs” per ounce and add further costs which reflect the expenditures made to maintain current production levels, primarily sustaining capital expenditures, sustaining leases, general & administrative costs, minesite exploration and evaluation costs, and reclamation cost accretion and amortization. “All-in costs” per ounce starts with “All-in sustaining costs” per ounce and adds additional costs that reflect the varying costs of producing gold over the life-cycle of a mine, including: project capital expenditures and other non-sustaining costs. Barrick believes that the use of “Total cash costs” per ounce, “All-in sustaining costs” per ounce and “All-in costs” per ounce will assist investors, analysts and other stakeholders in understanding the costs associated with producing gold, understanding the economics of gold mining, assessing our operating performance and also our ability to generate free cash flow from current operations and to generate free cash flow on an overall Company basis. “Total cash costs” per ounce, “All-in sustaining costs” per ounce and “All-in costs” per ounce are intended to provide additional information only and do not have any standardized meaning under IFRS. Although a standardized definition of all-in sustaining costs was published in 2013 by the World Gold Council (a market development organization for the gold industry comprised of and funded by gold mining companies from around the world, including Barrick), it is not a regulatory organization, and other companies may calculate this measure differently. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

| BARRICK FIRST QUARTER 2021 | 16 | PRESS RELEASE |

Reconciliation of Gold Cost of Sales to Total cash costs, All-in sustaining costs and All-in costs, including on a per ounce basis

| ($ millions, except per ounce information in dollars) | For the three months ended | |||||||||||||||

| Footnote | 3/31/21 | 12/31/20 | 3/31/20 | |||||||||||||

| Cost of sales applicable to gold production |

1,571 | 1,681 | 1,643 | |||||||||||||

| Depreciation |

(454 | ) | (495 | ) | (474 | ) | ||||||||||

| Cash cost of sales applicable to equity method investments |

59 | 69 | 52 | |||||||||||||

| By-product credits |

(59 | ) | (56 | ) | (29 | ) | ||||||||||

| Realized (gains) losses on hedge and non-hedge derivatives |

a | 0 | (1 | ) | 0 | |||||||||||

| Non-recurring items |

b | 0 | 1 | 0 | ||||||||||||

| Other |

c | (33 | ) | (55 | ) | (27 | ) | |||||||||

| Non-controlling interests |

d | (302 | ) | (323 | ) | (316 | ) | |||||||||

| Total cash costs |

782 | 821 | 849 | |||||||||||||

| General & administrative costs |

38 | 24 | 40 | |||||||||||||

| Minesite exploration and evaluation costs |

e | 16 | 22 | 15 | ||||||||||||

| Minesite sustaining capital expenditures |

f | 405 | 354 | 370 | ||||||||||||

| Sustaining leases |

13 | 12 | 0 | |||||||||||||

| Rehabilitation - accretion and amortization (operating sites) |

g | 11 | 11 | 14 | ||||||||||||

| Non-controlling interest, copper operations and other |

h | (154 | ) | (142 | ) | (125 | ) | |||||||||

| All-in sustaining costs |

1,111 | 1,102 | 1,163 | |||||||||||||

| Project exploration and evaluation and project costs |

e | 45 | 52 | 56 | ||||||||||||

| Community relations costs not related to current operations |

0 | 0 | 1 | |||||||||||||

| Project capital expenditures |

f | 131 | 184 | 76 | ||||||||||||

| Non-sustaining leases |

0 | 4 | 0 | |||||||||||||

| Rehabilitation - accretion and amortization (non-operating sites) |

g | 3 | 4 | 2 | ||||||||||||

| Non-controlling interest and copper operations and other |

h | (42 | ) | (61 | ) | (33 | ) | |||||||||

| All-in costs |

1,248 | 1,285 | 1,265 | |||||||||||||

| Ounces sold - equity basis (000s ounces) |

i | 1,093 | 1,186 | 1,220 | ||||||||||||

| Cost of sales per ounce |

j,k | 1,073 | 1,065 | 1,020 | ||||||||||||

| Total cash costs per ounce |

k | 716 | 692 | 692 | ||||||||||||

| Total cash costs per ounce (on a co-product basis) |

k,l | 746 | 718 | 705 | ||||||||||||

| All-in sustaining costs per ounce |

k | 1,018 | 929 | 954 | ||||||||||||

| All-in sustaining costs per ounce (on a co-product basis) |

k,l | 1,048 | 955 | 967 | ||||||||||||

| All-in costs per ounce |

k | 1,144 | 1,083 | 1,035 | ||||||||||||

| All-in costs per ounce (on a co-product basis) |

k,l | 1,174 | 1,109 | 1,048 | ||||||||||||

| a. | Realized (gains) losses on hedge and non-hedge derivatives |

Includes realized hedge losses of $nil for the three month period ended March 31, 2021 (December 31, 2020: $nil and March 31, 2020: $nil), and realized non-hedge losses of $nil for the three month period ended March 31, 2021 (December 31, 2020: gains of $1 million and March 31, 2020: $nil). Refer to Note 5 to the Financial Statements for further information.

| b. | Non-recurring items |

These costs are not indicative of our cost of production and have been excluded from the calculation of total cash costs.

| c. | Other |

Other adjustments for the three month period ended March 31, 2021 include the removal of total cash costs and by-product credits associated with Pierina, Lagunas Norte, Golden Sunlight and Morila up until its divestiture in November 2020, which all are producing incidental ounces, of $24 million (December 31, 2020: $26 million; March 31, 2020: $25 million).

| d. | Non-controlling interests |

Non-controlling interests include non-controlling interests related to gold production of $462 million for the three month period ended March 31, 2021 (December 31, 2020: $490 million and March 31, 2020: $466 million). Non-controlling interests include Nevada Gold Mines, Pueblo Viejo, Loulo-Gounkoto, Tongon, North Mara, Bulyanhulu, Buzwagi. Refer to Note 5 to the Financial Statements for further information.

| e. | Exploration and evaluation costs |

Exploration, evaluation and project expenses are presented as minesite sustaining if it supports current mine operations and project if it relates to future projects. Refer to page 68 of the Q1 2021 MD&A.

| f. | Capital expenditures |

Capital expenditures are related to our gold sites only and are split between minesite sustaining and project capital expenditures. Project capital expenditures are distinct projects designed to increase the net present value of the mine and are not related to current production. Significant projects in the current year are the expansion project at Pueblo Viejo and construction of the Third Shaft at Turquoise Ridge. Refer to page 67 of the Q1 2021 MD&A.

| g. | Rehabilitation—accretion and amortization |

Includes depreciation on the assets related to rehabilitation provisions of our gold operations and accretion on the rehabilitation provision of our gold operations, split between operating and non-operating sites.

| h. | Non-controlling interest and copper operations |

| BARRICK FIRST QUARTER 2021 | 17 | PRESS RELEASE |

Removes general & administrative costs related to non-controlling interests and copper based on a percentage allocation of revenue. Also removes exploration, evaluation and project expenses, rehabilitation costs and capital expenditures incurred by our copper sites and the non-controlling interest of Nevada Gold Mines (including South Arturo), Pueblo Viejo, Loulo-Gounkoto, Tongon, North Mara, Bulyanhulu, and Buzwagi operating segments. It also includes capital expenditures applicable to our equity method investment in Kibali. Figures remove the impact of Pierina, Lagunas Norte and Golden Sunlight. The impact is summarized as the following:

| ($ millions) | For the three months ended | |||||||||||

| Non-controlling interest, copper operations and other | 3/31/21 | 12/31/20 | 3/31/20 | |||||||||

| General & administrative costs |

(6 | ) | (5 | ) | (6 | ) | ||||||

| Minesite exploration and evaluation expenses |

(7 | ) | (9 | ) | (3 | ) | ||||||

| Rehabilitation - accretion and amortization (operating sites) |

(3 | ) | (3 | ) | (4 | ) | ||||||

| Minesite sustaining capital expenditures |

(138 | ) | (125 | ) | (112 | ) | ||||||

| All-in sustaining costs total |

(154 | ) | (142 | ) | (125 | ) | ||||||

| Project exploration and evaluation and project costs |

(1 | ) | (6 | ) | (19 | ) | ||||||

| Project capital expenditures |

(41 | ) | (55 | ) | (14 | ) | ||||||

| All-in costs total |

(42 | ) | (61 | ) | (33 | ) | ||||||

| i. | Ounces sold - equity basis |

Figures remove the impact of: Pierina, Lagunas Norte, Golden Sunlight, and Morila up until its divestiture in November 2020, which are producing incidental ounces.

| j. | Cost of sales per ounce |

Figures remove the cost of sales impact of: Pierina of $5 million for the three month period ended March 31, 2021 (December 31, 2020: $4 million and March 31, 2020: $6 million); Golden Sunlight of $nil for the three month period ended March 31, 2021 (December 31, 2020: $nil and March 31, 2020: $nil); up until its divestiture in November of 2020, Morila, of $nil for the three month period ended March 31, 2021 (December 31, 2020: $2 million and March 31, 2020: $6 million); and Lagunas Norte of $23 million for the three month period ended March 31, 2021 (December 31, 2020: $26 million and March 31, 2020: $21 million), which are producing incidental ounces. Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in care and maintenance) divided by ounces sold (both on an attributable basis using Barrick’s ownership share).

| k. | Per ounce figures |

Cost of sales per ounce, total cash costs per ounce, all-in sustaining costs per ounce and all-in costs per ounce may not calculate based on amounts presented in this table due to rounding.

| l. | Co-product costs per ounce |

Total cash costs per ounce, all-in sustaining costs per ounce and all-in costs per ounce presented on a co-product basis removes the impact of by-product credits of our gold production (net of non-controlling interest) calculated as:

| ($ millions) | For the three months ended | |||||||||||

| 3/31/21 | 12/31/20 | 3/31/20 | ||||||||||

| By-product credits |

59 | 56 | 29 | |||||||||

| Non-controlling interest |

(26 | ) | (27 | ) | (15 | ) | ||||||

| By-product credits (net of non-controlling interest) |

33 | 29 | 14 | |||||||||

Endnote 13

Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick’s ownership share).

Endnote 14

“C1 cash costs” per pound and “All-in sustaining costs” per pound are non-GAAP financial performance measures. “C1 cash costs” per pound is based on cost of sales but excludes the impact of depreciation and royalties and production taxes and includes treatment and refinement charges. “All-in sustaining costs” per pound begins with “C1 cash costs” per pound and adds further costs which reflect the additional costs of operating a mine, primarily sustaining capital expenditures, general & administrative costs and royalties and production taxes. Barrick believes that the use of “C1 cash costs” per pound and “all-in sustaining costs” per pound will assist investors, analysts, and other stakeholders in understanding the costs associated with producing copper, understanding the economics of copper mining, assessing our operating performance, and also our ability to generate free cash flow from current operations and to generate free cash flow on an overall Company basis. “C1 cash costs” per pound and “All-in sustaining costs” per pound are intended to provide additional information only, do not have any standardized meaning under IFRS, and may not be comparable to similar measures of performance presented by other companies. These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

| BARRICK FIRST QUARTER 2021 | 18 | PRESS RELEASE |

Reconciliation of Copper Cost of Sales to C1 cash costs and All-in sustaining costs, including on a per pound basis

| ($ millions, except per pound information in dollars) | For the three months ended | |||||||||||

|

|

3/31/21

|

|

|

12/31/20

|

|

|

3/31/20

|

| ||||

| Cost of sales |

136 | 125 | 124 | |||||||||

| Depreciation/amortization |

(48 | ) | (41 | ) | (43 | ) | ||||||

| Treatment and refinement charges |

41 | 39 | 39 | |||||||||

| Cash cost of sales applicable to equity method investments |

79 | 72 | 66 | |||||||||

| Less: royalties and production taxesa |

(23 | ) | (16 | ) | (11 | ) | ||||||

| By-product credits |

(4 | ) | (5 | ) | (3 | ) | ||||||

| Other |

0 | 0 | 0 | |||||||||

| C1 cash costs |

181 | 174 | 172 | |||||||||

| General & administrative costs |

4 | 5 | 3 | |||||||||

| Rehabilitation - accretion and amortization |

1 | 1 | 3 | |||||||||

| Royalties and production taxesa |

23 | 16 | 11 | |||||||||

| Minesite exploration and evaluation costs |

2 | 1 | 1 | |||||||||

| Minesite sustaining capital expenditures |

42 | 65 | 32 | |||||||||

| Sustaining leases |

2 | 2 | 3 | |||||||||

| All-in sustaining costs |

255 | 264 | 225 | |||||||||

| Pounds sold - consolidated basis (millions pounds) |

113 | 108 | 110 | |||||||||

| Cost of sales per poundb,c |

2.11 | 2.06 | 1.96 | |||||||||

| C1 cash cost per poundb |

1.60 | 1.61 | 1.55 | |||||||||

| All-in sustaining costs per poundb |

2.26 | 2.42 | 2.04 | |||||||||

| a. | For the three month period ended March 31, 2021, royalties and production taxes include royalties of $23 million (December 31, 2020: $16 million and March 31, 2020: $11 million). |

| b. | Cost of sales per pound, C1 cash costs per pound and all-in sustaining costs per pound may not calculate based on amounts presented in this table due to rounding. |

| c. | Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick’s ownership share). |

Endnote 15

Return of capital distribution per share amounts are based on issued and outstanding Barrick shares as of March 31, 2021 and are subject to change.

Endnote 16

Source: Mining Intelligence and Company Reports. Based on 2020 production.

Endnote 17

On a 100% basis.

Endnote 18

Included within our 61.5% interest in Carlin is NGM’s 60% interest in South Arturo.

Endnote 19

Includes Goldrush.

Endnote 20

Porgera was placed on temporary care and maintenance in April 2020 and remains excluded from our 2021 guidance. On April 9, 2021, the Government of Papua New Guinea and BNL, the operator of the Porgera joint venture, signed a binding Framework Agreement in which they agreed on a partnership for Porgera’s future ownership and operation. We expect to update our guidance to include Porgera following both the execution of definitive agreements to implement the Framework Agreement and the finalization of a timeline for the resumption of full mine operations.

Endnote 21

Total cash costs and all-in sustaining costs per ounce include the impact of hedges and/or costs allocated to non-operating sites.

Endnote 22

Operating division guidance ranges reflect expectations at each individual operating division, and may not add up to the company-wide guidance range total. Guidance ranges exclude Pierina, Lagunas Norte, and Golden Sunlight, which are producing incidental ounces while in closure or care and maintenance.

| BARRICK FIRST QUARTER 2021 | 19 | PRESS RELEASE |

Endnote 23

Includes corporate administration costs.

Endnote 24

Reflects the impact of the full year.

Endnote 25

EBITDA is a non-GAAP financial measure, which excludes the following from net earnings: income tax expense; finance costs; finance income; and depreciation. Management believes that EBITDA is a valuable indicator of our ability to generate liquidity by producing operating cash flow to fund working capital needs, service debt obligations, and fund capital expenditures. Management uses EBITDA for this purpose. Adjusted EBITDA removes the effect of impairment charges; acquisition/disposition gains/losses; foreign currency translation gains/losses; other expense adjustments; and the impact of the income tax expense, finance costs, finance income and depreciation incurred in our equity method accounted investments. We believe these items provide a greater level of consistency with the adjusting items included in our Adjusted Net Earnings reconciliation, with the exception that these amounts are adjusted to remove any impact on finance costs/income, income tax expense and/or depreciation as they do not affect EBITDA. We believe this additional information will assist analysts, investors and other stakeholders of Barrick in better understanding our ability to generate liquidity from our full business, including equity method investments, by excluding these amounts from the calculation as they are not indicative of the performance of our core mining business and not necessarily reflective of the underlying operating results for the periods presented. EBITDA and adjusted EBITDA are intended to provide additional information only and do not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other companies. They should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Reconciliation of Net Earnings to EBITDA and Adjusted EBITDA

| ($ millions) | For the three months ended | |||||||||||

|

|

3/31/21

|

|

|

12/31/20

|

|

|

3/31/20

|

| ||||

| Net earnings |

830 | 1,058 | 663 | |||||||||

| Income tax expense |

374 | 404 | 386 | |||||||||

| Finance costs, neta |

77 | 72 | 88 | |||||||||

| Depreciation |

507 | 544 | 524 | |||||||||

| EBITDA |

1,788 | 2,078 | 1,661 | |||||||||

| Impairment charges (reversals) of long-lived assetsb |

(89 | ) | 40 | (336 | ) | |||||||

| Acquisition/disposition (gains) lossesc |

(3 | ) | (126 | ) | (60 | ) | ||||||

| Loss on currency translation |

4 | 16 | 16 | |||||||||

| Other expense (income) adjustmentsd |

11 | 15 | 98 | |||||||||

| Income tax expense, net finance costs, and depreciation from equity investees |

89 | 83 | 87 | |||||||||

| Adjusted EBITDA |

1,800 | 2,106 | 1,466 | |||||||||

| a. | Finance costs exclude accretion. |

| b. | For the three month period ended March 31, 2021, net impairment reversals primarily relate to non-current asset reversals at Lagunas Norte. Net impairment charges (reversals) for the three month periods ended December 31, 2020 and March 31, 2020 mainly relate to non-current assets at our Tanzanian assets. |

| c. | Acquisition/disposition gains for the three month period ended December 31, 2020 primarily relate to the gain on the sale of Eskay Creek, Morila and Bullfrog. For the three months ended March 31, 2020, acquisition/disposition gains mainly relate to the gain on the sale of Massawa. |

| d. | Other expense adjustments for the three month periods ended March 31, 2021 and December 31, 2020 mainly relate to care and maintenance expenses at Porgera. For the three months ended March 31, 2020, other expense adjustments primarily relate to the impact of changes in the discount rate assumptions on our closed mine rehabilitation provision and losses on debt extinguishment. |

| BARRICK FIRST QUARTER 2021 | 20 | PRESS RELEASE |

Cautionary Statement on Forward-Looking Information

Exhibit 99.2

Management’s Discussion and Analysis (“MD&A”)

Quarterly Report on the First Quarter of 2021

Cautionary Statement on Forward-Looking Information

| BARRICK FIRST QUARTER 2021 | 21 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2021 | 22 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2021 | 23 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Overview

Financial and Operating Highlights

| For the three months ended | ||||||||||||

| 3/31/21 | 12/31/20 | % Change | 3/31/20 | % Change | ||||||||

| Financial Results ($ millions) |

||||||||||||

| Revenues |

2,956 | 3,279 | (10)% | 2,721 | 9 % | |||||||

| Cost of sales |

1,712 | 1,814 | (6)% | 1,776 | (4)% | |||||||

| Net earningsa |

538 | 685 | (21)% | 400 | 35 % | |||||||

| Adjusted net earningsb |

507 | 616 | (18)% | 285 | 78 % | |||||||

| Adjusted EBITDAb |

1,800 | 2,106 | (15)% | 1,466 | 23 % | |||||||

| Adjusted EBITDA marginc |

61% | 64% | (5)% | 54% | 13 % | |||||||

| Minesite sustaining capital expendituresd |

405 | 354 | 14 % | 370 | 9 % | |||||||

| Project capital expendituresd |

131 | 184 | (29)% | 76 | 72 % | |||||||

| Total consolidated capital expendituresd,e |

539 | 546 | (1)% | 451 | 20 % | |||||||

| Net cash provided by operating activities |

1,302 | 1,638 | (21)% | 889 | 46 % | |||||||

| Net cash provided by operating activities marginf |

44% | 50% | (12)% | 33% | 33 % | |||||||

| Free cash flowb |

763 | 1,092 | (30)% | 438 | 74 % | |||||||

| Net earnings per share (basic and diluted) |

0.30 | 0.39 | (23)% | 0.22 | 36 % | |||||||

| Adjusted net earnings (basic)b per share |

0.29 | 0.35 | (17)% | 0.16 | 81 % | |||||||

| Weighted average diluted common shares (millions of shares) |

1,778 | 1,778 | 0 % | 1,778 | 0 % | |||||||

| Operating Results |

||||||||||||

| Gold production (thousands of ounces)g |

1,101 | 1,206 | (9)% | 1,250 | (12)% | |||||||

| Gold sold (thousands of ounces)g |

1,093 | 1,186 | (8)% | 1,220 | (10)% | |||||||

| Market gold price ($/oz) |

1,794 | 1,874 | (4)% | 1,583 | 13 % | |||||||

| Realized gold priceb,g ($/oz) |

1,777 | 1,871 | (5)% | 1,589 | 12 % | |||||||

| Gold cost of sales (Barrick’s share)g,h ($/oz) |

1,073 | 1,065 | 1 % | 1,020 | 5 % | |||||||

| Gold total cash costsb,g ($/oz) |

716 | 692 | 3 % | 692 | 3 % | |||||||

| Gold all-in sustaining costsb,g ($/oz) |

1,018 | 929 | 10 % | 954 | 7 % | |||||||

| Copper production (millions of pounds)g |

93 | 119 | (22)% | 115 | (19)% | |||||||

| Copper sold (millions of pounds)g |

113 | 108 | 5 % | 110 | 3 % | |||||||

| Market copper price ($/lb) |

3.86 | 3.25 | 19 % | 2.56 | 51 % | |||||||

| Realized copper priceb,g ($/lb) |

4.12 | 3.39 | 22 % | 2.23 | 85 % | |||||||

| Copper cost of sales (Barrick’s share)g,i ($/lb) |

2.11 | 2.06 | 2 % | 1.96 | 8 % | |||||||

| Copper C1 cash costsb,g ($/lb) |

1.60 | 1.61 | (1)% | 1.55 | 3 % | |||||||

| Copper all-in sustaining costsb,g ($/lb) |

2.26 | 2.42 | (7)% | 2.04 | 11 % | |||||||

| |

As at 3/31/21 |

|

As at 12/31/20 |

% Change | As at 3/31/20 |

% Change | ||||||

| Financial Position ($ millions) |

||||||||||||

| Debt (current and long-term) |

5,153 | 5,155 | 0 % | 5,179 | (1)% | |||||||

| Cash and equivalents |

5,672 | 5,188 | 9 % | 3,327 | 70 % | |||||||

| Debt, net of cash |

(519) | (33) | 1,473 % | 1,852 | (128)% | |||||||

| a. | Net earnings represents net earnings attributable to the equity holders of the Company. |

| b. | Adjusted net earnings, adjusted EBITDA, free cash flow, adjusted net earnings per share, realized gold price, all-in sustaining costs, total cash costs, C1 cash costs and realized copper price are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure to the most directly comparable IFRS measure, please see pages 74 to 92 of this MD&A. |

| c. | Represents adjusted EBITDA divided by revenue. |

| d. | Amounts presented on a consolidated cash basis. Project capital expenditures are included in our calculation of all-in costs, but not included in our calculation of all-in sustaining costs. |

| e. | Total consolidated capital expenditures also includes capitalized interest of $3 million for the three month periods ended March 31, 2021 (December 31, 2020: $8 million and March 31, 2020: $5 million). |

| f. | Represents net cash provided by operating activities divided by revenue. |

| g. | On an attributable basis. |

| h. | Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in care and maintenance) divided by ounces sold (both on an attributable basis using Barrick’s ownership share). |

| i. | Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick’s ownership share). |

| BARRICK FIRST QUARTER 2021 | 24 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| a. | Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in care and maintenance) divided by ounces sold (both on an attributable basis using Barrick’s ownership share). Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick’s ownership share). |

| b. | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure to the most directly comparable IFRS measure, please see pages 74 to 92 of this MD&A. |

| c. | Dividend per share declared in respect of the stated period. Return of capital distribution to be paid contemporaneously with respective dividend. |

| d. | Return of capital distribution per share is an estimate based on issued and outstanding shares as of March 31, 2021, and is subject to change. |

| BARRICK FIRST QUARTER 2021 | 25 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Numerical annotations throughout the text of this document refer to the endnotes found on page 93.

| BARRICK FIRST QUARTER 2021 | 26 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2021 | 27 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2021 | 28 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2021 | 29 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2021 | 30 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2021 | 31 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Operating Division Guidance

Our 2021 forecast gold and copper production, cost of salesa, total cash costsb, all-in sustaining costsb, and C1 cash costsb ranges by operating division are as follows:

| Operating Division |

|

2021 forecast attributable production (000s ozs) |

|

|

2021 forecast cost of salesa ($/oz) |

|

|

2021 forecast total cash costsb ($/oz) |

|

|

2021 forecast all-in sustaining costsb ($/oz) |

| ||||

| Gold |

||||||||||||||||

| Carlin (61.5%)c |

940 - 1,000 | 920 - 970 | 740 - 790 | 1,050 - 1,100 | ||||||||||||

| Cortez (61.5%)d |

500 - 550 | 1,000 - 1,050 | 700 - 750 | 940 - 990 | ||||||||||||

| Turquoise Ridge (61.5%) |

390 - 440 | 950 - 1,000 | 620 - 670 | 810 - 860 | ||||||||||||

| Phoenix (61.5%) |

100 - 120 | 1,800 - 1,850 | 725 - 775 | 970 - 1,020 | ||||||||||||

| Long Canyon (61.5%) |

140 - 160 | 800 - 850 | 180 - 230 | 240 - 290 | ||||||||||||

| Nevada Gold Mines (61.5%) |

2,100 - 2,250 | 980 - 1,030 | 660 - 710 | 910 - 960 | ||||||||||||

| Hemlo |

200 - 220 | 1,200 - 1,250 | 950 - 1,000 | 1,280 - 1,330 | ||||||||||||

| North America |

2,300 - 2,450 | 990 - 1,040 | 690 - 740 | 940 - 990 | ||||||||||||

| Pueblo Viejo (60%) |

470 - 510 | 880 - 930 | 520 - 570 | 760 - 810 | ||||||||||||

| Veladero (50%) |

130 - 150 | 1,510 - 1,560 | 820 - 870 | 1,720 - 1,770 | ||||||||||||

| Porgera (47.5%)e |

— | — | — | — | ||||||||||||

| Latin America & Asia Pacific |

600 - 660 | 1,050 - 1,100 | 600 - 650 | 1,000 - 1,050 | ||||||||||||

| Loulo-Gounkoto (80%) |

510 - 560 | 980 - 1,030 | 630 - 680 | 930 - 980 | ||||||||||||

| Kibali (45%) |

350 - 380 | 990 - 1,040 | 590 - 640 | 800 - 850 | ||||||||||||

| North Mara (84%) |

240 - 270 | 970 - 1,020 | 740 - 790 | 960 - 1,010 | ||||||||||||

| Tongon (89.7%) |

180 - 200 | 1,470 - 1,520 | 1,000 - 1,050 | 1,140 - 1,190 | ||||||||||||

| Bulyanhulu (84%) |

170 - 200 | 980 - 1,030 | 580 - 630 | 810 - 860 | ||||||||||||

| Buzwagi (84%) |

30 - 40 | 1,360 - 1,410 | 1,250 - 1,300 | 1,230 - 1,280 | ||||||||||||

| Africa & Middle East |

1,500 - 1,600 | 1,050 - 1,100 | 690 - 740 | 920 - 970 | ||||||||||||

| Total Attributable to Barrickf,g,h |

4,400 - 4,700 | 1,020 - 1,070 | 680 - 730 | 970 - 1,020 | ||||||||||||

| |

2021 forecast attributable production (M lbs) |

|

|

2021 forecast cost of salesa ($/lb) |

|

|

2021 forecast C1 cash costsb ($/lb) |

|

|

2021 forecast all-in sustaining costsb ($/lb) |

| |||||

| Copper |

||||||||||||||||

| Lumwana |

250 - 280 | 1.85 - 2.05 | 1.45 - 1.65 | 2.25 - 2.45 | ||||||||||||

| Zaldívar (50%) |

90 - 110 | 2.30 - 2.50 | 1.65 - 1.85 | 1.90 - 2.10 | ||||||||||||

| Jabal Sayid (50%) |

70 - 80 | 1.40 - 1.60 | 1.10 - 1.30 | 1.30 - 1.50 | ||||||||||||

| Total Copperg |

410 - 460 | 1.90 - 2.10 | 1.40 - 1.60 | 2.00 - 2.20 | ||||||||||||

| a. | Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in care and maintenance) divided by ounces sold (both on an attributable basis using Barrick’s ownership share). Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick’s ownership share). |

| b. | Total cash costs, all-in sustaining costs and C1 cash costs are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of the non-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measures, please see pages 74 to 92 of this MD&A. |

| c. | Included within our 61.5% interest in Carlin is NGM’s 60% interest in South Arturo. |

| d. | Includes Goldrush. |

| e. | Porgera was placed on temporary care and maintenance in April 2020 and remains excluded from our 2021 guidance. On April 9, 2021, the Government of Papua New Guinea and BNL, the operator of the Porgera joint venture, signed a binding Framework Agreement in which they agreed on a partnership for Porgera’s future ownership and operation. We expect to update our guidance to include Porgera following both the execution of definitive agreements to implement the Framework Agreement and the finalization of a timeline for the resumption of full mine operations. |

| f. | Total cash costs and all-in sustaining costs per ounce include the impact of hedges and/or costs allocated to non-operating sites. |

| g. | Operating division guidance ranges reflect expectations at each individual operating division, and may not add up to the company-wide guidance range total. Guidance ranges exclude Pierina, Lagunas Norte, and Golden Sunlight, which are producing incidental ounces while in closure or care and maintenance. |

| h. | Includes corporate administration costs. |

| BARRICK FIRST QUARTER 2021 | 32 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Production and Cost Summary - Gold

| For the three months ended | ||||||||||||

| 3/31/21 | 12/31/20 | % Change | 3/31/20 | % Change | ||||||||

| Nevada Gold Mines LLC (61.5%)a |

||||||||||||

| Gold produced (000s oz) |

485 | 546 | (11)% | 526 | (8)% | |||||||

| Cost of sales ($/oz) |

1,047 | 1,008 | 4 % | 995 | 5 % | |||||||

| Total cash costs ($/oz)b |

686 | 667 | 3 % | 690 | (1)% | |||||||

| All-in sustaining costs ($/oz)b |

932 | 873 | 7 % | 952 | (2)% | |||||||

| Carlin (61.5%)c |

||||||||||||

| Gold produced (000s oz) |

229 | 260 | (12)% | 253 | (9)% | |||||||

| Cost of sales ($/oz) |

950 | 917 | 4 % | 970 | (2)% | |||||||

| Total cash costs ($/oz)b |

766 | 740 | 4 % | 776 | (1)% | |||||||

| All-in sustaining costs ($/oz)b |

1,045 | 1,005 | 4 % | 1,007 | 4 % | |||||||

| Cortez (61.5%)d |

||||||||||||

| Gold produced (000s oz) |

100 | 118 | (15)% | 128 | (22)% | |||||||

| Cost of sales ($/oz) |

1,251 | 1,043 | 20 % | 878 | 42 % | |||||||

| Total cash costs ($/oz)b |

860 | 738 | 17 % | 614 | 40 % | |||||||

| All-in sustaining costs ($/oz)b |

1,203 | 906 | 33 % | 1,009 | 19 % | |||||||

| Turquoise Ridge (61.5%) |

||||||||||||

| Gold produced (000s oz) |

92 | 91 | 1 % | 84 | 10 % | |||||||

| Cost of sales ($/oz) |

1,007 | 1,064 | (5)% | 1,032 | (2)% | |||||||

| Total cash costs ($/oz)b |

647 | 687 | (6)% | 668 | (3)% | |||||||

| All-in sustaining costs ($/oz)b |

741 | 757 | (2)% | 806 | (8)% | |||||||

| Phoenix (61.5%) |

||||||||||||

| Gold produced (000s oz) |

25 | 26 | (4)% | 35 | (29)% | |||||||

| Cost of sales ($/oz) |

2,051 | 2,054 | 0 % | 1,583 | 30 % | |||||||

| Total cash costs ($/oz)b |

346 | 590 | (41)% | 737 | (53)% | |||||||

| All-in sustaining costs ($/oz)b |

530 | 670 | (21)% | 914 | (42)% | |||||||

| Long Canyon (61.5%) |

||||||||||||

| Gold produced (000s oz) |

39 | 51 | (24)% | 26 | 50% | |||||||

| Cost of sales ($/oz) |

511 | 674 | (24)% | 1,025 | (50)% | |||||||

| Total cash costs ($/oz)b |

79 | 145 | (46)% | 345 | (77)% | |||||||

| All-in sustaining costs ($/oz)b |

156 | 324 | (52)% | 561 | (72)% | |||||||

| Pueblo Viejo (60%) |

||||||||||||

| Gold produced (000s oz) |

137 | 159 | (14)% | 143 | (4)% | |||||||

| Cost of sales ($/oz) |

816 | 803 | 2 % | 767 | 6 % | |||||||

| Total cash costs ($/oz)b |

507 | 493 | 3 % | 502 | 1 % | |||||||

| All-in sustaining costs ($/oz)b |

689 | 689 | 0 % | 626 | 10 % | |||||||

| Loulo-Gounkoto (80%) |

||||||||||||

| Gold produced (000s oz) |

154 | 123 | 25 % | 141 | 9 % | |||||||

| Cost of sales ($/oz) |

974 | 1,149 | (15)% | 1,002 | (3)% | |||||||

| Total cash costs ($/oz)b |

608 | 734 | (17)% | 614 | (1)% | |||||||

| All-in sustaining costs ($/oz)b |

920 | 923 | 0 % | 891 | 3 % | |||||||

| Kibali (45%) |

||||||||||||

| Gold produced (000s oz) |

86 | 92 | (7)% | 91 | (5)% | |||||||

| Cost of sales ($/oz) |

1,065 | 1,163 | (8)% | 1,045 | 2 % | |||||||

| Total cash costs ($/oz)b |

691 | 616 | 12 % | 582 | 19 % | |||||||

| All-in sustaining costs ($/oz)b |

856 | 783 | 9 % | 773 | 11 % | |||||||

| Veladero (50%) |

||||||||||||

| Gold produced (000s oz) |

32 | 58 | (45)% | 75 | (57)% | |||||||

| Cost of sales ($/oz) |

1,151 | 1,074 | 7 % | 1,182 | (3)% | |||||||

| Total cash costs ($/oz)b |

736 | 698 | 5 % | 788 | (7)% | |||||||

| All-in sustaining costs ($/oz)b |

2,104 | 1,428 | 47 % | 1,266 | 66 % | |||||||

| Porgera (47.5%)e |

||||||||||||

| Gold produced (000s oz) |

— | — | — % | 62 | — % | |||||||

| Cost of sales ($/oz) |

— | — | — % | 1,097 | — % | |||||||

| Total cash costs ($/oz)b |

— | — | — % | 941 | — % | |||||||

| All-in sustaining costs ($/oz)b |

— | — | — % | 1,089 | — % | |||||||

| BARRICK FIRST QUARTER 2021 | 33 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Production and Cost Summary - Gold (continued)

| For the three months ended | ||||||||||||

| 3/31/21 | 12/31/20 | % Change | 3/31/20 | % Change | ||||||||

| Tongon (89.7%) |

||||||||||||

| Gold produced (000s oz) |

48 | 66 | (27)% | 61 | (21)% | |||||||

| Cost of sales ($/oz) |

1,510 | 1,371 | 10 % | 1,368 | 10 % | |||||||

| Total cash costs ($/oz)b |

995 | 810 | 23 % | 762 | 31 % | |||||||

| All-in sustaining costs ($/oz)b |

1,062 | 853 | 25 % | 788 | 35 % | |||||||

| Hemlo |

||||||||||||

| Gold produced (000s oz) |

47 | 57 | (18)% | 57 | (18)% | |||||||

| Cost of sales ($/oz) |

1,610 | 1,379 | 17 % | 1,119 | 44 % | |||||||

| Total cash costs ($/oz)b |

1,324 | 1,104 | 20 % | 945 | 40 % | |||||||

| All-in sustaining costs ($/oz)b |

1,840 | 1,464 | 26 % | 1,281 | 44 % | |||||||

| North Mara (84%) |

||||||||||||

| Gold produced (000s oz) |

62 | 61 | 2 % | 65 | (5)% | |||||||

| Cost of sales ($/oz) |

1,061 | 1,073 | (1)% | 959 | 11 % | |||||||

| Total cash costs ($/oz)b |

832 | 799 | 4 % | 646 | 29 % | |||||||

| All-in sustaining costs ($/oz)b |

1,038 | 989 | 5 % | 816 | 27 % | |||||||

| Buzwagi (84%) |

||||||||||||

| Gold produced (000s oz) |

17 | 21 | (19)% | 22 | (23)% | |||||||

| Cost of sales ($/oz) |

1,486 | 1,314 | 13 % | 1,373 | 8 % | |||||||

| Total cash costs ($/oz)b |

1,450 | 1,267 | 14 % | 1,275 | 14 % | |||||||

| All-in sustaining costs ($/oz)b |

1,467 | 1,283 | 14 % | 1,288 | 14 % | |||||||

| Bulyanhulu (84%) |

||||||||||||

| Gold produced (000s oz) |

33 | 23 | 43 % | 7 | 371 % | |||||||

| Cost of sales ($/oz) |

1,211 | 1,181 | 3 % | 1,685 | (28)% | |||||||

| Total cash costs ($/oz)b |

865 | 610 | 42 % | 686 | 26 % | |||||||

| All-in sustaining costs ($/oz)b |

957 | 664 | 44 % | 906 | 6 % | |||||||

| Total Attributable to Barrickf |

||||||||||||

| Gold produced (000s oz) |

1,101 | 1,206 | (9)% | 1,250 | (12)% | |||||||

| Cost of sales ($/oz)g |

1,073 | 1,065 | 1 % | 1,020 | 5 % | |||||||

| Total cash costs ($/oz)b |

716 | 692 | 3 % | 692 | 3 % | |||||||

| All-in sustaining costs ($/oz)b |

1,018 | 929 | 10 % | 954 | 7 % | |||||||

| a. | These results represent our 61.5% interest in Carlin (including NGM’s 60% interest in South Arturo), Cortez, Turquoise Ridge, Phoenix and Long Canyon. |

| b. | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 74 to 92 of this MD&A. |

| c. | Included within our 61.5% interest in Carlin is NGM’s 60% interest in South Arturo. |

| d. | Starting in the first quarter of 2021, Goldrush is reported as part of Cortez as it is operated by Cortez management. Comparative periods have been restated to include Goldrush. |

| e. | As Porgera was placed on care and maintenance on April 25, 2020, no operating data or per ounce data is provided. |

| f. | Excludes Pierina, Lagunas Norte, Golden Sunlight, and Morila (40%) up until its divestiture in November 2020, as these assets are producing incidental ounces while in closure or care and maintenance. |

| g. | Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in care and maintenance) divided by ounces sold (both on an attributable basis using Barrick’s ownership share). |

| BARRICK FIRST QUARTER 2021 | 34 | MANAGEMENT’S DISCUSSION AND ANALYSIS |