Form 6-K Atento S.A. For: Mar 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of March, 2021

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant’s name into English)

Société anonyme

1 rue Hildegard Von Bingen, L-1282 Luxembourg

Grand Duchy of Luxembourg

R.C.S. Luxembourg B 185.761

(Address of principal executive and registered office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: ☒ Form 40-F: ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Extraordinary and Ordinary General Meetings of Shareholders of the Company

The combined Extraordinary General Meeting (the “EGM”) and Ordinary General Meeting of Shareholders (the “Ordinary General Meeting” and together with the EGM, the “Meetings”) of Atento S.A. (the “Company”) will be held extraordinarily starting at 9:00 a.m. Central European Time on April 2, 2021 at the offices of Maître Jacques Kesseler at 13, Route de Luxembourg, L-4761 Pétange, Grand Duchy of Luxembourg. The agenda for the Meetings is set forth on the Convening Notice to the Meetings, which is attached hereto as Exhibit 99.1. The form of proxy to be solicited by the Company and the notice of the Meetings provided to Company’s shareholders are each attached hereto as Exhibit 99.2 and Exhibit 99.3, respectively.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| ATENTO S.A. | ||||

| Date: March 15, 2021 | /s/ Carlos López-Abadía | |||

| Carlos López-Abadía | ||||

| Chief Executive Officer | ||||

Exhibit 99.1

Atento S.A.

Société Anonyme

1 rue Hildegard Von Bingen

L-1282 Luxembourg

R.C.S. Luxembourg B.185.761

March 15, 2021

By registered mail.

Dear Shareholder:

You are cordially invited to attend (i) an Extraordinary General Meeting of Shareholders (the “EGM”) of Atento S.A. (the “Company”) to be held extraordinarily at 9:00 a.m. Central European Time on April 2, 2021 at the offices of Maître Jacques Kesseler at 13, Route de Luxembourg, L-4761 Pétange, Grand Duchy of Luxembourg and (ii) an Ordinary General Meeting of Shareholders of the Company (the “Ordinary General Meeting” and together with the EGM, the “Meetings”) to be held extraordinarily starting immediately after the EGM at the offices of Maître Jacques Kesseler at 13, Route de Luxembourg, L-4761 Pétange, Grand Duchy of Luxembourg. Information concerning the matters to be considered and voted upon at the Meetings is set out in the attached Letter and Proxy Statement.

The Company has fixed the close of business on March 9, 2021 as the record date for the Meetings (the “Record Date”), and only holders of record of shares at such time will be entitled to notice of the Meetings or any adjournment or postponement thereof. Holders of record of our ordinary shares will be entitled to vote at the Meetings or any adjournment or postponement thereof.

It is important that your shares be represented at the Meetings, regardless of the number of shares you hold or whether or not you plan to attend the Meetings in person. Accordingly, please authorize a proxy to vote your shares as soon as possible in accordance with the instructions you received. This will not prevent you from voting your shares in person if you subsequently choose to attend the Meetings.

Please note that powers of attorney or proxy cards must be received by the Company or the tabulation agent (Broadridge Financial Solutions, Inc.), no later than 5:00 p.m. Central European Time on March 29, 2021 in order for such votes to be taken into account.

Thank you for your continued support.

| Sincerely, /s/ Carlos López-Abadía Authorized director, for and on behalf of the Board of Directors of the Company |

Atento S.A.

Société Anonyme

1 rue Hildegard Von Bingen

L-1282 Luxembourg

R.C.S. Luxembourg B.185.761

Convening Notice to

the Extraordinary General Meeting of Shareholders

to Be Held on April 2, 2021 at 9:00 a.m. Central European Time at the offices of Maître Jacques Kesseler at

13, Route de Luxembourg, L-4761 Pétange, Grand Duchy of Luxembourg

Convening Notice to

the Ordinary General Meeting of Shareholders

to Be Held Extraordinarily on April 2, 2021 immediately after the EGM

at the offices of Maître Jacques Kesseler at 13, Route de Luxembourg, L-4761 Pétange, Grand Duchy of

Luxembourg

Dear Shareholders,

The Board of Directors of Atento S.A. (the “Board of Directors”) is pleased to invite you to attend (i) an Extraordinary General Meeting of Shareholders (the “EGM”) of Atento S.A. (the “Company”) to be held extraordinarily at 9:00 a.m. Central European Time on April 2, 2021 at the offices of Maître Jacques Kesseler at 13, Route de Luxembourg, L-4761 Pétange, Grand Duchy of Luxembourg and (ii) an Ordinary General Meeting of Shareholders of the Company (the “Ordinary General Meeting” and together with the EGM, the “Meetings”) to be held extraordinarily starting immediately after the EGM at the offices of Maître Jacques Kesseler at 13, Route de Luxembourg, L-4761 Pétange, Grand Duchy of Luxembourg.

The agenda for the Meetings are as follows:

Agenda of the EGM

| 1. | Approval of the amendment of article thirteen (13) of the articles of association of the Company. |

Agenda of the Ordinary General Meeting

| 1. | Approval of the appointment of Deloitte Audit, Société à responsabilité limitée as independent auditor (réviseur d’entreprises agréé) of the Company with respect to the financial year ending on December 31, 2021 and, as a result, for a term which will expire after the annual general meeting of the shareholders of the Company approving the annual accounts as at December 31, 2021.; and |

| 2. | Approval of the amendment of the existing 2014 Omnibus Plan of the Company to increase the number of shares of the Company authorized to be issued and/or allocated thereunder. |

The EGM will validly deliberate on the resolution on its agenda provided that a quorum of more than 50% of the Company’s issued and outstanding shares excluding the own shares of the Company is present or represented. The resolution will be validly adopted by at least two-thirds of the votes validly cast in favor by the shareholders present or represented. If the aforementioned presence quorum is not met, the EGM may be reconvened by the Board of Directors and at the reconvened meeting no presence quorum will be required.

The Ordinary General Meeting will validly deliberate on its agenda without any presence quorum requirement. The resolutions at the Ordinary General Meeting will be adopted by a simple majority of the votes validly cast.

i

Any shareholder who holds one or more shares(s) of the Company on March 9, 2021 (the “Record Date”) will be admitted to the Meetings and may attend the Meetings in person or vote by proxy. Luxembourg law provides for criminal sanctions applicable to persons voting shares they do not own at the time of the vote, and as such shareholders should not vote their shares at the Meetings if such shares are expected to be transferred between the Record Date and the date of the Meetings.

Please review the procedures for attending the Meetings or to be represented by way of proxy included in the attached Proxy Statement. Regarding the proposed resolution for the EGM, a draft amended and restated version of the articles of association of the Company will be available at the registered office 8 days before the EGM. Please note that powers of attorney or proxy cards must be received by the Company or the tabulation agent (Broadridge Financial Solutions, Inc.) no later than 5:00 p.m. Central European Time on March 29, 2021 in order for such votes to be taken into account.

Yours faithfully,

Carlos López-Abadía

Authorized director, for and on behalf of the Board of Directors of the Company

ii

ATENTO S.A.

PROXY STATEMENT

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON April 2, 2021

ORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD EXTRAORDINARILY ON April 2, 2021

GENERAL INFORMATION

This Proxy Statement is being provided to solicit proxies on behalf of the Board of Directors of Atento S.A. (the “Company,” “Atento,” “we” or “us”) for use at (i) the Extraordinary General Meeting of Shareholders (the “EGM”) of the Company to be held extraordinarily at 9:00 a.m. Central European Time on April 2, 2021 at the offices of Maître Jacques Kesseler at 13, Route de Luxembourg, L-4761 Pétange, Grand Duchy of Luxembourg and (ii) the Ordinary General Meeting of Shareholders of the Company (the “Ordinary General Meeting” and together with the EGM, the “Meetings”) to be held extraordinarily starting immediately after the EGM at the offices of Maître Jacques Kesseler at 13, Route de Luxembourg, L-4761 Pétange, Grand Duchy of Luxembourg. We expect to mail the notice on or about March 16, 2021. On that same date, we will also mail a printed copy of this Proxy Statement.

Foreign Private Issuer

We are a “foreign private issuer” within the meaning of Rule 3b-4 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as a result, we are not required to mandatorily comply with U.S. federal proxy requirements.

Who May Vote

Only holders of record of our ordinary shares at the close of business on the Record Date will be entitled to notice of the Meetings. Holders of record of our ordinary shares at the close of business on the Record Date will be entitled to vote at the Meetings. On the Record Date, 4,427,352 ordinary shares were issued and outstanding and entitled to vote at the Meetings and 907,536 additional ordinary shares were held as treasury shares, being noted that according to Article 430-18 of the Luxembourg law dated 10 August, 1915 concerning commercial companies, as amended from time to time, voting rights in respect of the shares held by the Company shall be suspended and such repurchased shares shall not be taken into account when calculating the presence quorum and majority. Each ordinary share not held in treasury is entitled to one vote at the Meetings.

What Constitutes a Quorum

A quorum of more than 50% of the Company’s issued and outstanding shares excluding the own shares of the Company present or represented is required for any resolution to be considered at the EGM. If the aforementioned quorum is not met, the EGM may be reconvened by the Board and at the reconvened meeting no quorum will be required.

No quorum is required for any ordinary resolution to be considered at the Ordinary General Meeting.

Broker Non-Votes and Abstentions

Broker non-votes occur when brokers holding shares in street name for beneficial owners do not receive instructions from the beneficial owners about how to vote their shares and the broker is unable to vote the shares in its discretion in the absence of an instruction. An abstention occurs when a shareholder withholds such shareholder’s vote on a particular matter by checking the “ABSTAIN” box on the proxy card.

Under the current New York Stock Exchange rules as applicable to foreign private issuers, your broker will not be able to vote your shares with respect to any of the proposals or other matters considered at the Meetings, in each case unless you have provided instructions to your broker. We strongly encourage you to provide instructions to your broker to vote your shares and exercise your right as a shareholder. A vote will not be cast in cases where a broker has not received an instruction from the beneficial owner.

With respect to all of the proposals or other matters considered at the Meetings, only those votes cast “FOR” or “AGAINST” are counted for the purposes of determining the number of votes cast with respect to each such proposal. Abstentions are not considered votes cast and have no effect on the outcome of any of the proposals.

Voting Process and Revocation of Proxies

If you are a shareholder of record, and you received your proxy materials by mail, you can vote by mail by marking, dating, signing and returning the proxy card in the postage-paid envelope. Submitting your proxy by mail will not affect your ability to attend the Meetings in-person and vote at the Meetings.

If your shares are held in “street name,” meaning you are a beneficial owner with your shares held through a bank or brokerage firm, you will receive instructions from your bank or brokerage firm. You must follow the instructions of the holder of record in order for your shares to be voted.

The Company will retain an independent tabulator to receive and tabulate the proxies.

If you submit a proxy and direct how your shares will be voted, the individuals named as proxies will vote your shares in the manner you indicate. If you submit a proxy but do not direct how your shares will be voted, the individuals named as proxies will vote your shares “FOR” each of the proposals identified herein, to the extent that discretion is duly provided for by proxy in accordance with Luxembourg law.

It is not expected that any other matters will be brought before the Meetings. If, however, other matters are properly presented, the individuals named as proxies will vote in accordance with their discretion with respect to such matters, to the extent that such discretion is duly provided for by proxy in accordance with Luxembourg law.

A shareholder who has given a proxy may revoke it at any time before it is exercised at the Meetings by:

| • | attending the Meetings and voting in person; |

| • | delivering a written notice, at the address given below, bearing a date later than that indicated on the proxy card, but prior to the date of the Meetings, stating that the proxy is revoked; or |

| • | signing and delivering a subsequently dated proxy card prior to the vote at the Meetings. |

You should send any written notice or new proxy card to Atento S.A., c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, New York 11717. If you are a registered holder you may request a new proxy card by contacting our Investor Relations Department at +55 113 2935 926 or [email protected].

Any shareholder owning shares in street name may change or revoke previously given voting instructions by contacting the bank or brokerage firm holding the shares or by obtaining a legal proxy from such bank or brokerage firm and voting in person at the Meetings. Your last vote, prior to or at the Meetings is the vote that will be counted.

Attendance at the Meetings

Only shareholders or their legal proxy holders are invited to attend the Meetings. All shareholders planning to attend the Meetings in person must contact our Investor Relations Department at +55 113 2935 926 or [email protected] by March 29, 2021 to reserve a seat. For admission, shareholders should come to the Meetings check-in area no less than 15 minutes before the Meetings are scheduled to begin. To be admitted to the Meetings, you will need a form of photo identification (such as a driver’s license or passport), and if you hold your shares in street name you must also bring valid proof of ownership of your shares on the Record Date or a valid legal proxy from the holder of record. If you are a shareholder of record, you will be admitted to the Meetings only

2

if we are able to verify your shareholder status by checking your name against the list of registered shareholders on the Record Date. If you hold your shares in street name through a bank or brokerage firm, a brokerage statement reflecting your ownership as of the Record Date or a letter from a bank or broker confirming your ownership as of the Record Date is sufficient proof of ownership to be admitted to the Meetings. Registration will begin at 8:30 a.m. Central European Time, and the EGM will begin at 9:00 a.m. Central European Time and the Ordinary General meeting will start immediately thereafter.

No cameras, recording equipment, electronic devices (including cell phones) or large bags, briefcases or packages will be permitted in the Meetings. Attendees may be asked to pass through a security check prior to entering the Meetings.

Solicitation of Proxies

We will pay the cost of soliciting proxies for the Meetings. We may solicit by mail, telephone, personal contact and electronic means and arrangements are made with brokerage houses and other custodians, nominees and fiduciaries to send the Letter, and if requested, other proxy materials, to beneficial owners. Upon request, we will reimburse them for their reasonable expenses. In addition, our directors, officers and employees may solicit proxies, either in-person or by telephone, facsimile or written or electronic mail (without additional compensation). Shareholders are encouraged to return their proxies promptly.

PROPOSAL WITH RESPECT TO EGM AGENDA ITEM NO. 1:

APPROVAL OF THE AMENDMENT OF ARTICLES OF ASSOCIATION OF THE COMPANY

It is proposed to remove the condition of unanimity to change the nationality of the Company and subsequently to amend the article 13 of the articles of association of the Company to read as follows (the “Amendment”):

“Article 13 Change of nationality. The shareholders may change the nationality of the Company in the manner required for the amendment to the articles of association.”

At the EGM, the shareholders will be asked to approve the following resolution:

Resolved: The EGM hereby approves the Amendment.

Vote Required and Board Recommendation

The approval of the amendment of the articles of association requires the affirmative vote of at least two third of shares present or represented at the EGM provided that a quorum of more than 50% of the Company’s issued and outstanding shares excluding the own shares of the Company is present or represented. If the aforementioned presence quorum is not met, the EGM may be reconvened by the Board of Directors and at the reconvened meeting no presence quorum will be required.

Our Board of Directors unanimously recommends a vote “FOR” the Amendment.

3

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 1:

APPROVAL OF APPOINTMENT OF INDEPENDENT AUDITOR

At the Ordinary General Meeting, the following resolution will be put before the Ordinary General Meeting for approval:

Resolved: The Ordinary General Meeting hereby approves the appointment of Deloitte Audit, Société à responsabilité limitée, as independent auditor (réviseur d’entreprises agréé) of the Company with respect to the financial year ending on December 31, 2021 and, as a result, for a term which will expire after the annual general meeting of the shareholders of the Company approving the annual accounts as at December 31, 2021.

Vote Required and Board Recommendation

Approval of the proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by shareholders entitled to vote at the Ordinary General Meeting.

Our Board of Directors unanimously recommends a vote “FOR” the appointment of Deloitte Audit, Société à responsabilité limitée, as independent auditor (réviseur d’entreprises agréé) of the Company with respect to the financial year ending on December 31, 2021 and, as a result, for a term which will expire after the annual general meeting of the shareholders of the Company approving the annual accounts as at December 31, 2021.

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 2:

APPROVAL OF THE AMENDMENT OF THE EXISTING 2014 OMNIBUS PLAN

The Company previously adopted the 2014 Omnibus Incentive Plan, as amended from time to time (the “Incentive Plan”) for the purpose of enhancing the profitability and value of the Company for the benefit of its shareholders, by enabling the Company to offer Eligible Individuals (as defined in the Incentive Plan) cash and share-based incentives, in order to attract, retain and reward such individuals and strengthen the mutuality of interests between such individuals and the Company’s shareholders.

The provisions of the section 4.1 of the Incentive Plan establish, among others, that the aggregate number of shares of Common Stock (as defined in the Incentive Plan) that may be issued or used for reference purposes or with respect to which Awards (as defined in the Incentive Plan) may be granted under the Incentive Plan shall not exceed 17,300,000 shares, as well as that the maximum number of shares of Common Stock with respect to which Incentive Stock Options (as defined in the Incentive Plan) may be granted under the Incentive Plan shall be 17,300,000 shares (the “Share Limitation”).

The Board of Directors approved an increase of the Share Limitation, as established by the provisions of section 4.1 of the Incentive Plan, from the amount of 17,300,000 shares up to an amount of 18,800,000 shares (the “Share Limitation Increase”), and an amendment of section 4.1 of the Incentive Plan (the “Amendment of the Incentive Plan”), so that it reads as follows:

“4.1 Shares. (a) The aggregate number of shares of Common Stock that may be issued or used for reference purposes or with respect to which Awards may be granted under the Plan shall not exceed 18,800,000 shares (subject to any increase or decrease pursuant to Section 4.2) (the ’’Share Reserve”), which may be either authorized and unissued Common Stock or Common Stock held in or acquired for the treasury of the Company or both. The maximum number of shares of Common Stock with respect to which Incentive Stock Options may be granted under the Plan shall be 18,800,000 shares. With respect to Stock Appreciation Rights settled in Common Stock, upon settlement, only the number of shares of Common Stock delivered to a Participant (based on the difference between the Fair Market Value of the shares of Common Stock subject to such Stock Appreciation Right on the date such Stock Appreciation Right is exercised and the exercise price of each Stock Appreciation Right on the date such Stock Appreciation Right was awarded) shall count against the aggregate and individual share limitations set forth under Sections 4 1(a) and 4 1(b), If any Option, Stock Appreciation Right or Other Stock-Based Awards granted under the Plan expires, terminates or is canceled for any reason without having been exercised in

4

full, the number of shares of Common Stock underlying any unexercised Award shall again be available for the purpose of Awards under the Plan, If any shares of Restricted Stock, Performance Awards or Other Stock-Based Awards denominated in shares of Common Stock awarded under the Plan to a Participant are forfeited for any reason, the number of forfeited shares of Restricted Stock, Performance Awards or Other Stock-Based Awards denominated in shares of Common Stock shall again be available for purposes of Awards under the Plan If a Tandem Stock Appreciation Right or a Limited Stock Appreciation Right is granted in tandem with an Option, such grant shall only apply once against the maximum number of shares of Common Stock which may be issued under the Plan Any Award under the Plan settled in cash shall not be counted against the foregoing maximum share limitations. The maximum number of shares of Common Stock subject to any Award of Stock Options, or Stock Appreciation Rights which may be granted under the Plan during any fiscal year of the Company to any Participant shall be 160,000 shares (which shall be subject to any further increase or decrease pursuant to Section 4.2). The maximum grant date fair value of any Award granted to any director during any calendar year shall not exceed $5,000,000.”

In accordance with the provisions of section 12.1 of the Incentive Plan, establishing among others, a contractual obligation pursuant to which without the approval of the holders of the Company’s Common Stock entitled to vote in accordance with applicable law, no amendment may be made that would notably increase the aggregate number of shares of Common Stock that may be issued under the Plan.

At the Ordinary General Meeting, the shareholders will be asked to approve the following resolution:

Resolved: The Ordinary General Meeting hereby approves the Share Limitation Increase and the Amendment of the Incentive Plan.

Vote Required and Board Recommendation

Approval of the proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by shareholders entitled to vote at the Ordinary General Meeting.

Our Board of Directors unanimously recommends a vote “FOR” the approval of Share Limitation Increase and the Amendment of the Incentive Plan.

5

SHAREHOLDER COMMUNICATIONS

Shareholders and interested parties may contact any of the Company’s directors, including the non-management directors as a group, the chair of any committee of the Board of Directors or any committee of the Board of Directors by writing them as follows:

Atento S.A.

Société Anonyme

1 rue Hildegard Von Bingen

L-1282 Luxembourg

R.C.S. Luxembourg B 185.761

Attn: Legal and Regulatory Compliance Director

Concerns relating to accounting, internal controls or auditing matters should be communicated to the Company through the Legal and Regulatory Compliance Director and will be handled in accordance with the procedures established by the Audit Committee with respect to such matters.

OTHER MATTERS

Our Board of Directors has no knowledge of any other matters to be presented at the Meetings other than those described herein. If any other business properly comes before the shareholders at the Meetings, however, it is intended that the proxy holders will vote on such matters in accordance with their discretion, to the extent that such discretion is duly provided for by proxy in accordance with Luxembourg law.

6

Important Notice Regarding the Availability of Proxy Materials for the

Meetings of Shareholders to Be Held on April 2, 2021

The Notice, Proxy Statement and the Incentive Plan are available at both www.atento.com and www.proxyvote.com. Regarding the proposed resolution for the EGM, a draft amended and restated version of the articles of association of the Company is available at both websites and will also be available at the registered office 8 days before the EGM.

YOUR VOTE IS IMPORTANT. OUR BOARD OF DIRECTORS URGES YOU TO VOTE BY MARKING,

DATING, SIGNING AND RETURNING A PROXY CARD.

With respect to all of the proposals and matters considered at the Meetings, shares held through a broker or other intermediary will not be voted unless the beneficial holder notifies the broker or other intermediary through which the shares are held with instructions regarding how to vote. We strongly encourage you to provide instructions to your broker or other intermediary to vote your shares and exercise your right as a shareholder.

If you wish to attend the Meetings in person, you must reserve your seat by March 29, 2021 by contacting our Investor Relations Department at +55 113 2935 926 or [email protected]. Additional details regarding requirements for admission to the Meetings are described in the attached proxy statement under the heading “Attendance at the Meetings.”

If you are a shareholder of record as of the Record Date, you will be admitted to the Meetings upon presenting a form of photo identification. If you own ordinary shares beneficially through a bank, broker or otherwise, you will be admitted to the Meetings upon presenting a form of photo identification and proof of share ownership as of the Record Date or a valid proxy signed by the record holder. A recent brokerage statement reflecting your ownership as of the Record Date or a letter from a bank or broker confirming your ownership as of the Record Date are examples of proof of share ownership for this purpose.

If you are a holder of ordinary shares you will be entitled to vote at the Meetings or any adjournment or postponement thereof.

Regardless of whether or not you plan to attend the Meetings, please follow the instructions you received to authorize a proxy to vote your shares as soon as possible to ensure that your shares are represented at the Meetings. Any shareholder that decides to attend the Meetings in person may, if so desired, revoke the prior proxy by voting such person’s ordinary shares at the Meetings.

Luxembourg

March 15, 2021

7

Exhibit 99.2

ATENTO S.A. SOCIÉTÉ ANONYME

1 RUE

HILDEGARD VON BINGEN

L-1282 LUXEMBOURG

R.C.S. LUXEMBOURG B 185.761

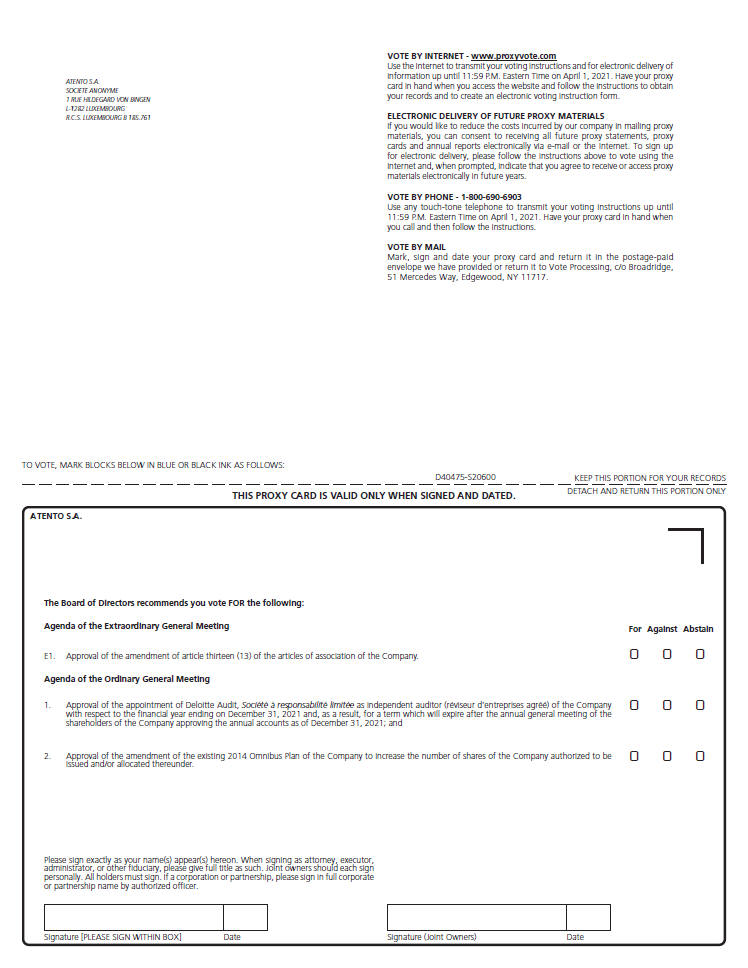

VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting

instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on April 1, 2021. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting

instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would

like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery,

please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting

instructions up until 11:59 P.M. Eastern Time on April 1, 2021. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge,

51 Mercedes Way, Edgewood, NY 11717.

ATENTO S.A.

The Board of Directors recommends you vote FOR the following:

Agenda of the Extraordinary

General Meeting For Against Abstain

E1. Approval of the amendment of article thirteen (13) of the articles of association of the Company. ! ! !

Agenda of the Ordinary General Meeting

1. Approval of the appointment of Deloitte Audit,

Société à responsabilité limitée as independent auditor (réviseur d’entreprises agréé) of the Company ! ! ! with respect to the nancial year ending on December 31, 2021 and, as a result, for a term which

will expire after the annual general meeting of the shareholders of the Company approving the annual accounts as of December 31, 2021; and

2. Approval of the

amendment of the existing 2014 Omnibus Plan of the Company to increase the number of shares of the Company authorized to be ! ! ! issued and/or allocated thereunder.

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other duciary, please give full title as such. Joint

owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized ofcer.

Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

TO

VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

D40475-S20600 KEEP THIS PORTION FOR YOUR RECORDS

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. DETACH AND RETURN THIS PORTION ONLY

Important Notice Regarding the Availability of Proxy Materials for the Extraordinary and Ordinary General Meeting:

The Notice, the Proxy Statement, the 2014 Omnibus Incentive Plan, and a proposed draft of the amended and restated articles of association of the Company are available at

www.proxyvote.com

D40476-S20600

ATENTO S.A.

Extraordinary and Ordinary General Meeting of Shareholders April 2, 2021 9:00 AM CET

This

proxy is solicited by the Board of Directors The shareholder(s) hereby appoint(s) Raphaël Collin and Flavien Carbone, or any of them, as proxies, each with the power to appoint his substitute, and hereby authorize(s) them to represent and to

vote, as designated on the reverse side of this ballot, all of the ordinary shares of ATENTO S.A. that the shareholder(s) is/are entitled to vote at the Extraordinary and Ordinary General Meeting of Shareholders to be held starting at 9:00 AM,

Central European Time on April 2, 2021, at the offices of Matre Jacques Kesseler at 13, Route de Luxembourg, L-4761 Ptange, Grand Duchy of Luxembourg, and any adjournment or postponement thereof.

This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of

Directors’ recommendations.

Continued and to be signed on reverse side

Exhibit 99.3

Your Vote Counts!

ATENTO S.A.

2021 Extraordinary and Ordinary General Meeting

Vote by April 1, 2021 11:59 PM ET

ATENTO S.A. SOCIÉTÉ ANONYME

1 RUE HILDEGARD VON BINGEN

L-1282 LUXEMBOURG

R.C.S. LUXEMBOURG B 185.761

D40488-S20600

You invested in ATENTO S.A. and it’s time to vote!

You have the right to vote on proposals being presented at the Extraordinary and Ordinary General Meeting. This is an important notice regarding the availability of proxy material

for the shareholder meeting to be held on April 2, 2021.

Get informed before you vote

View the Notice, the Proxy Statement, the 2014 Omnibus Incentive Plan, and a proposed draft of the amended and restated articles of association of the Company online OR you can

receive a free paper or email copy of the material(s) by requesting prior to March 19, 2021. If you would like to request a copy of the material(s) for this and/or future shareholder meetings, you may (1) visit www.ProxyVote.com, (2) call

1-800-579-1639 or (3) send an email to [email protected]. If sending an email, please include your control number (indicated below) in the subject line. Unless requested, you will not otherwise receive a paper or email copy.

For complete information and to vote, visit www.ProxyVote.com

Control #

Smartphone users

Point your camera here and vote without entering a control number

Vote in Person at the Meeting*

April 2, 2021

9:00 AM Central European Time

Maltre Jacques Kesseler at 13, Route de Luxembourg, L-4761

Pétange, Grand Duchy of Luxembourg

*Many shareholder meetings have attendance requirements including, but not limited to, the possession of an attendance

ticket issued by the entity holding the meeting.

Please check the meeting materials for any special requirements for meeting attendance. At the meeting, you will

need to request a ballot to vote these shares.

V1

Vote at www.ProxyVote.com

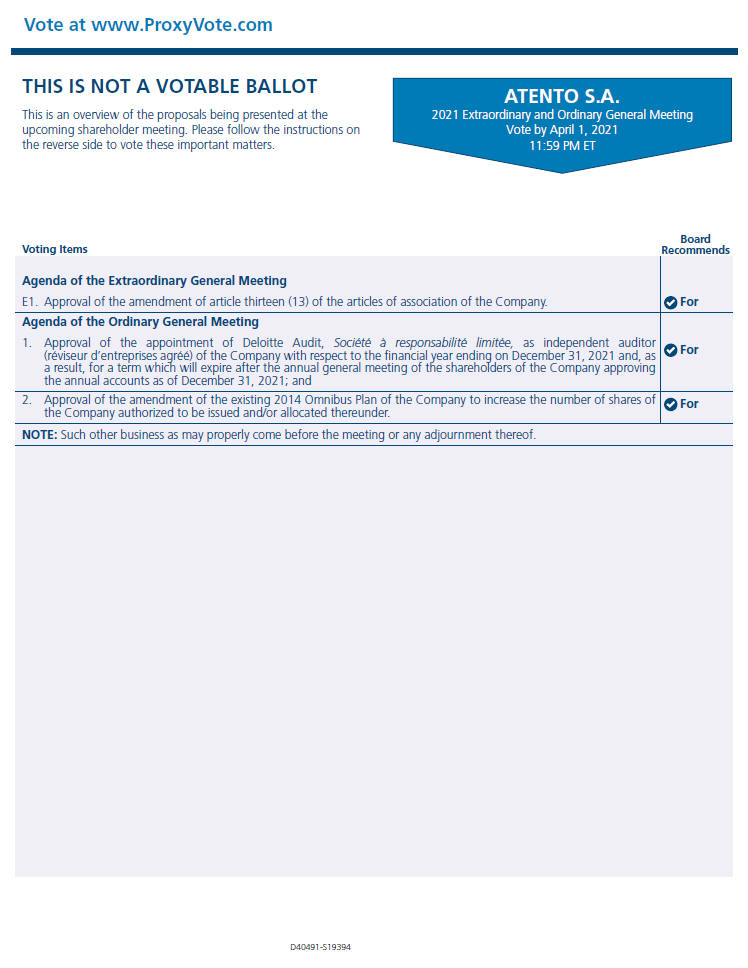

THIS IS NOT A VOTABLE

BALLOT

This is an overview of the proposals being presented at the upcoming shareholder meeting. Please follow the instructions on the reverse side to vote these

important matters.

Voting Items Board Recommends

Agenda of the Extraordinary

General Meeting

E1. Approval of the amendment of article thirteen (13) of the articles of association of the Company. For Agenda of the Ordinary General Meeting

1. Approval of the appointment of Deloitte Audit, Société à responsabilité limitée, as independent auditor (réviseur

d’entreprises agréé) of the Company with respect to the financial year ending on December 31, 2021 and, as For a result, for a term which will expire after the annual general meeting of the shareholders of the Company approving the

annual accounts as of December 31, 2021; and 2. Approval of the amendment of the existing 2014 Omnibus Plan of the Company to increase the number of shares of For the Company authorized to be issued and/or allocated thereunder.

Prefer to receive an email instead? While voting on www.ProxyVote.com, be sure to click “Sign up for E-delivery”.

D40489-S20600

Your Vote Counts!

ATENTO S.A.

2021 Extraordinary and Ordinary General Meeting

Vote by April 1, 2021 11:59 PM ET

D40490-S19394

You invested in ATENTO S.A. and it’s time to vote!

You have the right to vote on proposals being presented at the Extraordinary and Ordinary General Meeting. This is an important notice regarding the availability of proxy material

for the shareholder meeting to be held on April 2, 2021.

Get informed before you vote

View the Notice, the Proxy Statement, the 2014 Omnibus Incentive Plan, and a proposed draft of the amended and restated articles of association of the Company online OR you can

receive a free paper or email copy of the material(s) by requesting prior to March 19, 2021. If you would like to request a copy of the material(s) for this and/or future shareholder meetings, you may (1) visit www.ProxyVote.com, (2) call

1-800-579-1639 or (3) send an email to [email protected]. If sending an email, please include your control number (indicated below) in the subject line. Unless requested, you will not otherwise receive a paper or email copy. For complete

information and to vote, visit www.ProxyVote.com

Control #

Smartphone users

Point your camera here and vote without entering a control number

Vote in

Person at the Meeting*

April 2, 2021

9:00 AM Central European Time

Maltre Jacques Kesseler

at 13, Route de Luxembourg, L-4761

Pétange, Grand Duchy of Luxembourg

*If you choose to vote these shares in person at the

meeting, you must request a “legal proxy.” To do so, please follow the instructions at www.ProxyVote.com or request a paper copy of the materials, which will contain the appropriate instructions. Please check the meeting materials for any

special requirements for meeting attendance. V1

Vote at www.ProxyVote.com

THIS IS NOT A VOTABLE

BALLOT

This is an overview of the proposals being presented at the upcoming shareholder meeting. Please follow the instructions on the reverse side to vote these

important matters.

ATENTO S.A.

2021 Extraordinary and Ordinary General

Meeting

Vote by April 1, 2021

11:59 PM ET

Voting Items Board Recommends

Agenda of the Extraordinary General Meeting

E1. Approval of the amendment of article thirteen (13) of the articles of association of the Company. For Agenda of the Ordinary General Meeting

1. Approval of the appointment of Deloitte Audit, Société à responsabilité limitée, as independent auditor

For (réviseur d’entreprises agréé) of the Company with respect to the financial year ending on December 31, 2021 and, as a result, for a term which will expire

after the annual general meeting of the shareholders of the Company approving the annual accounts as of December 31, 2021; and

2. Approval of the amendment of the

existing 2014 Omnibus Plan of the Company to increase the number of shares of For the Company authorized to be issued and/or allocated thereunder.

NOTE: Such other

business as may properly come before the meeting or any adjournment thereof.

D40491-S19394

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Tenaris Announces 2024 First Quarter Results

- USCB Financial Holdings, Inc. Reports Diluted EPS of $0.23 for Q1 2024 and Announces Adoption of New 500,000 Share Repurchase Program

- Correction: Publication of 2023 Annual Report of Azerion Group N.V.

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share