Form 497K VanEck ETF Trust

| VANECK® GREEN BOND ETF | ||||

Ticker: GRNB®

Principal U.S. Listing Exchange: NYSE Arca, Inc.

SUMMARY PROSPECTUS

SEPTEMBER 1, 2022

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at https://www.vaneck.com/resources/documents/income-etfs-literature/. You can also get this information at no cost by calling 800.826.2333, or by sending an email request to info@vaneck.com. The Fund’s prospectus and statement of additional information, both dated September 1, 2022, as may be supplemented from time to time, are incorporated by reference into this summary prospectus. | ||

INVESTMENT OBJECTIVE

VanEck® Green Bond ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the S&P Green Bond U.S. Dollar Select Index (the “Green Bond Index”).

FUND FEES AND EXPENSES

The following tables describe the fees and expenses that you may pay if you buy, hold and sell shares of the Fund (“Shares”). You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees (fees paid directly from your investment) | None | ||||

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Management Fee | 0.20 | % | |||||||||

Other Expenses(a) | 0.00 | % | |||||||||

Total Annual Fund Operating Expenses(a) | 0.20 | % | |||||||||

(a)Van Eck Associates Corporation (the “Adviser”) will pay all expenses of the Fund, except for the fee payment under the investment management agreement, acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses. Notwithstanding the foregoing, the Adviser has agreed to pay the offering costs until at least September 1, 2023.

EXPENSE EXAMPLE

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. This example does not take into account brokerage commissions that you pay when purchasing or selling Shares of the Fund.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell or hold all of your Shares at the end of those periods. The example also assumes that your investment has a 5% annual return and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| YEAR | EXPENSES | ||||||||||

| 1 | $20 | ||||||||||

| 3 | $64 | ||||||||||

| 5 | $113 | ||||||||||

| 10 | $255 | ||||||||||

PORTFOLIO TURNOVER

The Fund will pay transaction costs, such as commissions, when it purchases and sells securities (or “turns over” its portfolio). A higher portfolio turnover will cause the Fund to incur additional transaction costs and may result in higher taxes when Fund Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example,

| vaneck.com | 1 | ||||

may affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 19% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund normally invests at least 80% of its total assets in securities that comprise the Fund’s benchmark index. The Green Bond Index is comprised of bonds issued for qualified “green” purposes and seeks to measure the performance of U.S. dollar denominated “green”-labeled bonds issued globally. The Green Bond Index is sponsored by S&P Dow Jones Indices LLC, which is not affiliated with or sponsored by the Fund or the Adviser. “Green” bonds are bonds whose proceeds are used principally for climate change mitigation, climate adaptation or other environmentally beneficial projects, such as, but not limited to, the development of clean, sustainable or renewable energy sources, commercial and industrial energy efficiency, or conservation of natural resources. For a bond to be eligible for inclusion in the Green Bond Index, the issuer of the bond must indicate the bond’s “green” label and the rationale behind it, such as the intended use of proceeds. As an additional filter, the bond must be flagged as “green” by Climate Bonds Initiative (“CBI”), an international not-for-profit working to mobilize the bond market for climate change solutions, to be eligible for inclusion in the Green Bond Index. The Green Bond Index is market value-weighted and includes supranational, corporate, government-related, sovereign and securitized “green” bonds issued throughout the world (including emerging market countries), and may include both investment grade and below investment grade securities (commonly referred to as high yield securities or “junk bonds”). “Securitized green bonds” are securities typically collateralized by a specified pool of assets, such as mortgages, automobile loans or other consumer receivables. All bonds must be rated by at least one credit rating agency, except that up to 10% of the Green Bond Index can be invested in unrated bonds that are issued or guaranteed by a government-sponsored enterprise. The maximum weight of below investment grade bonds (excluding any unrated bonds that are issued or guaranteed by a government-sponsored enterprise) in the Green Bond Index is capped at 20%. No more than 10% of the Green Bond Index can be invested in a single issuer. Qualifying securities must have a maturity of at least 12 months at the time of issuance and at least one month remaining until maturity at each rebalancing date.

As of June 30, 2022, the Green Bond Index consisted of 383 bonds issued by 242 issuers and the weighted average maturity of the Green Bond Index was approximately 7.45 years. As of the same date, approximately 6.65% of the Green Bond Index was comprised of Regulation S securities and 28.49% of the Green Bond Index was comprised of Rule 144A securities. The S&P Green Bond Index is rebalanced monthly. The Fund’s 80% investment policy is non-fundamental and may be changed without shareholder approval upon 60 days’ prior written notice to shareholders.

The Fund, using a “passive” or indexing investment approach, attempts to approximate the investment performance of the Green Bond Index. Unlike many investment companies that try to “beat” the performance of a benchmark index, the Fund does not try to “beat” the Green Bond Index and does not take temporary defensive positions that are inconsistent with its investment objective of seeking to replicate the Green Bond Index. Because of the practical difficulties and expense of purchasing all of the securities in the Green Bond Index, the Fund does not purchase all of the securities in the Green Bond Index. Instead, the Adviser utilizes a “sampling” methodology in seeking to achieve the Fund’s objective. As such, the Fund may purchase a subset of the securities in the Green Bond Index in an effort to hold a portfolio of bonds with generally the same risk and return characteristics of the Green Bond Index.

The Fund may concentrate its investments in a particular industry or group of industries to the extent that the Green Bond Index concentrates in an industry or group of industries. As of April 30, 2022, each of the financials and utilities sectors represented a significant portion of the Fund.

PRINCIPAL RISKS OF INVESTING IN THE FUND

Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund’s Shares and the possibility of significant losses. An investment in the Fund involves a substantial degree of risk. An investment in the Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Therefore, you should consider carefully the following risks before investing in the Fund, each of which could significantly and adversely affect the value of an investment in the Fund.

Risk of Investing in “Green” Bonds. Investments in “green” bonds include bonds whose proceeds are used principally for climate mitigation, climate adaptation or other environmentally beneficial projects, such as, but not limited to, the development of clean, sustainable or renewable energy sources, commercial and industrial energy efficiency, or conservation of natural resources. Investing in “green” bonds carries the risk that, under certain market conditions, the Fund may underperform as compared to funds that invest in a broader range of investments. In addition, some “green” investments may be dependent on government tax incentives and subsidies and on political support for certain environmental technologies and companies. Investing primarily in “green” investments may affect the Fund’s exposure to certain sectors or types of investments and will impact the Fund’s relative investment performance depending on whether such sectors or investments are in or out of favor in the market. The “green” sector may also have challenges such as a limited number of issuers, limited liquidity in the market and limited supply of bonds that merit “green” status, each of which may adversely affect the Fund.

Special Risk Considerations of Investing in Asian Issuers. Investments in securities of Asian issuers involve risks and special considerations not typically associated with investments in the U.S. securities markets. Certain Asian economies have experienced over-extension of credit, currency devaluations and restrictions, high unemployment, high inflation, decreased exports and economic recessions. Economic events in any one Asian country can have a significant effect on the entire Asian region as well as on major trading partners outside Asia, and any adverse effect on some or all of the Asian countries and regions in which the Fund invests. The securities markets in some Asian economies are relatively underdeveloped and may subject the Fund to higher action

2 | vaneck.com | ||||

costs or greater uncertainty than investments in more developed securities markets. Such risks may adversely affect the value of the Fund’s investments.

Special Risk Considerations of Investing in Chinese Issuers. Investments in securities of Chinese issuers, including issuers located outside of China that generate significant revenues from China, involve certain risks and considerations not typically associated with investments in the U.S. securities markets. These risks include, among others, (i) more frequent (and potentially widespread) trading suspensions and government interventions with respect to Chinese issuers resulting in lack of liquidity and in price volatility, (ii) currency revaluations and other currency exchange rate fluctuations or blockage, (iii) the nature and extent of intervention by the Chinese government in the Chinese securities markets, whether such intervention will continue and the impact of such intervention or its discontinuation, (iv) the risk of nationalization or expropriation of assets, (v) the risk that the Chinese government may decide not to continue to support economic reform programs, (vi) limitations on the use of brokers, (vii) higher rates of inflation, (viii) greater political, economic and social uncertainty, (ix) market volatility caused by any potential regional or territorial conflicts or natural disasters and (x) the risk of increased trade tariffs, embargoes, sanctions, investment restrictions and other trade limitations. Certain securities are, or may in the future become restricted, and the Fund may be forced to sell such restricted securities and incur a loss as a result. In addition, the economy of China differs, often unfavorably, from the U.S. economy in such respects as structure, general development, government involvement, wealth distribution, rate of inflation, growth rate, interest rates, allocation of resources and capital reinvestment, among others. The Chinese central government has historically exercised substantial control over virtually every sector of the Chinese economy through administrative regulation and/or state ownership and actions of the Chinese central and local government authorities continue to have a substantial effect on economic conditions in China. In addition, previously the Chinese government has from time to time taken actions that influence the prices at which certain goods may be sold, encourage companies to invest or concentrate in particular industries, induce mergers between companies in certain industries and induce private companies to publicly offer their securities to increase or continue the rate of economic growth, control the rate of inflation or otherwise regulate economic expansion. The Chinese government may do so in the future as well, potentially having a significant adverse effect on economic conditions in China.

Special Risk Considerations of Investing in European Issuers. Investments in securities of European issuers involve risks and special considerations not typically associated with investments in the U.S. securities markets. The Economic and Monetary Union (“EMU”) of the European Union (“EU”) requires member countries to comply with restrictions on inflation rates, deficits, interest rates, debt levels and fiscal and monetary controls, each of which may significantly affect every country in Europe. Decreasing imports or exports, changes in governmental or EU regulations on trade, changes in the exchange rate of the euro, the default or threat of default by an EU member country on its sovereign debt, and/or an economic recession in an EU member country may have a significant adverse effect on the economies of other EU countries and on major trading partners outside Europe. The European financial markets have previously experienced, and may continue to experience, volatility and have been adversely affected, and may in the future be affected, by concerns about economic downturns, credit rating downgrades, rising government debt levels and possible default on or restructuring of government debt in several European countries. These events have adversely affected, and may in the future affect, the value and exchange rate of the euro and may continue to significantly affect the economies of every country in Europe, including EU member countries that do not use the euro and non-EU member countries. In a referendum held on June 23, 2016, voters in the United Kingdom (“UK”) voted to leave the EU, creating economic and political uncertainty in its wake. On January 31, 2020, the UK officially withdrew from the EU and the UK entered a transition period which ended on December 31, 2020. On December 30, 2020, the EU and UK signed the EU-UK Trade and Cooperation Agreement (“TCA”), an agreement on the terms governing certain aspects of the EU's and the UK's relationship following the end of the transition period. Notwithstanding the TCA, following the transition period, there is likely to be considerable uncertainty as to the UK's post-transition framework.

Risk of Investing in Foreign Securities. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. These additional risks include greater market volatility, the availability of less reliable financial information, higher transactional and custody costs, taxation by foreign governments, decreased market liquidity and political instability. Because certain foreign securities markets may be limited in size, the activity of large traders may have an undue influence on the prices of securities that trade in such markets. The Fund invests in securities of issuers located in countries whose economies are heavily dependent upon trading with key partners. Any reduction in this trading may have an adverse impact on the Fund’s investments.

Risk of Investing in Emerging Market Issuers. Investments in securities of emerging market issuers are exposed to a number of risks that may make these investments volatile in price or difficult to trade. Emerging markets are more likely than developed markets to experience problems with the clearing and settling of trades, as well as the holding of securities by local banks, agents and depositories. Political risks may include unstable governments, nationalization, restrictions on foreign ownership, laws that prevent investors from getting their money out of a country and legal systems that do not protect property rights as well as the laws of the United States. Market risks may include economies that concentrate in only a few industries, securities issues that are held by only a few investors, liquidity issues and limited trading capacity in local exchanges and the possibility that markets or issues may be manipulated by foreign nationals who have inside information. The frequency, availability and quality of financial information about investments in emerging markets varies. The Fund has limited rights and few practical remedies in emerging markets and the ability of U.S. authorities to bring enforcement actions in emerging markets may be limited, and the Fund's passive investment approach does not take account of these risks. All of these factors can make emerging market securities more volatile and potentially less liquid than securities issued in more developed markets.

| vaneck.com | 3 | ||||

Foreign Currency Risk. Because all or a portion of the income received by the Fund from its investments and/or the revenues received by the underlying issuer will generally be denominated in foreign currencies, the Fund’s exposure to foreign currencies and changes in the value of foreign currencies versus the U.S. dollar may result in reduced returns for the Fund, and the value of certain foreign currencies may be subject to a high degree of fluctuation. Moreover, the Fund may incur costs in connection with conversions between U.S. dollars and foreign currencies.

Credit Risk. Bonds are subject to credit risk. Credit risk refers to the possibility that the issuer or guarantor of a security will be unable and/or unwilling to make timely interest payments and/or repay the principal on its debt or to otherwise honor its obligations and/or default completely. Bonds are subject to varying degrees of credit risk, depending on the issuer’s financial condition and on the terms of the securities, which may be reflected in credit ratings. There is a possibility that the credit rating of a bond may be downgraded after purchase or the perception of an issuer’s credit worthiness may decline, which may adversely affect the value of the security.

Interest Rate Risk. Debt securities, such as bonds, are subject to interest rate risk. Interest rate risk refers to fluctuations in the value of a bond resulting from changes in the general level of interest rates. When the general level of interest rates goes up, the prices of most debt securities go down. When the general level of interest rates goes down, the prices of most debt securities go up. Many factors can cause interest rates to rise, including central bank monetary policy, rising inflation rates and general economic conditions. The prevailing historically low interest rate environment increases the risks associated with rising interest rates, including the potential for periods of volatility and increased redemptions. In addition, debt securities with longer durations tend to be more sensitive to interest rate changes, usually making them more volatile than debt securities with shorter durations. In response to the COVID-19 pandemic, as with other serious economic disruptions, governmental authorities and regulators are enacting significant fiscal and monetary policy changes, including providing direct capital infusions into companies, creating new monetary programs and lowering interest rates. These actions present heightened risks to debt instruments, and such risks could increase if these actions are unexpectedly or suddenly reversed or are ineffective in achieving their desired outcomes.

Floating Rate Risk. The Fund invests in floating-rate securities. A floating-rate security is an instrument in which the interest rate payable on the obligation fluctuates on a periodic basis based upon changes in an interest rate benchmark. As a result, the yield on such a security will generally decline in a falling interest rate environment, causing the Fund to experience a reduction in the income it receives from such securities.

Floating Rate LIBOR Risk. Certain of the floating-rate securities pay interest based on the London Inter-bank Offered Rate ("LIBOR"). Due to the uncertainty regarding the future utilization of LIBOR and the nature of any replacement rate, the potential effect of a transition away from LIBOR on the Fund or the financial instruments in which the Fund invests cannot yet be fully determined. The discontinuation of LIBOR could have adverse impacts on newly issued and existing financial instruments that reference LIBOR. While some instruments may provide for an alternative rate setting methodology in the event LIBOR is no longer available, not all instruments may have such provisions and there is uncertainty regarding the effectiveness of any alternative methodology. In addition, the discontinuation and/or replacement of LIBOR may affect the value, liquidity or return on certain Fund investments and may result in costs incurred in connection with closing out positions and entering into new trades.

High Yield Securities Risk. Securities rated below investment grade are commonly referred to as high yield securities or “junk bonds.” High yield securities are often issued by issuers that are restructuring, are smaller or less creditworthy than other issuers, or are more highly indebted than other issuers. High yield securities are subject to greater risk of loss of income and principal than higher rated securities and are considered speculative. The prices of high yield securities are likely to be more sensitive to adverse economic changes or individual issuer developments than higher rated securities. During an economic downturn or substantial period of rising interest rates, high yield security issuers may experience financial stress that would adversely affect their ability to service their principal and interest payment obligations, to meet their projected business goals or to obtain additional financing. In the event of a default, the Fund may incur additional expenses to seek recovery. The secondary market for securities that are high yield securities may be less liquid than the markets for higher quality securities, and high yield securities issued by non-corporate issuers may be less liquid than high yield securities issued by corporate issuers, which, in either instance, may have an adverse effect on the market prices of and the Fund’s ability to arrive at a fair value for certain securities. The illiquidity of the market also could make it difficult for the Fund to sell certain securities in connection with a rebalancing of the Green Bond Index. In addition, periods of economic uncertainty and change may result in an increased volatility of market prices of high yield securities and a corresponding volatility in the Fund’s net asset value (“NAV”).

Supranational Bond Risk. Investments in supranational bonds are subject to the overall condition of the supranational entities that issue such bonds. Certain securities in which the Fund may invest are obligations issued or backed by supranational entities, such as the European Investment Bank. Obligations of supranational organizations are subject to the risk that the governments on whose support the entity depends for its financial backing or repayment may be unable or unwilling to provide that support. If an issuer of supranational bonds defaults on payments of principal and/or interest, the Fund may have limited recourse against the issuer. A supranational entity’s willingness or ability to repay principal and pay interest in a timely manner may be affected by, among other factors, its cash flow situation, the extent of its reserves, the relative size of the debt service burden to the entity as a whole and the political constraints to which a supranational entity may be subject. During periods of economic uncertainty, the market prices of supranational bonds, and the Fund’s NAV, may be more volatile than prices of corporate bonds, which may result in losses. Obligations of a supranational organization that are denominated in foreign currencies will also be subject to the risks associated with investment in foreign currencies.

4 | vaneck.com | ||||

Government-Related Bond Risk. Investments in government-related bonds involve special risks not present in corporate bonds. The governmental authority or government-related entity that controls the repayment of the bond may be unable or unwilling to make interest payments and/or repay the principal on its debt or to otherwise honor its obligations. If an issuer of government-related bonds defaults on payments of principal and/or interest, the Fund may have limited recourse against the issuer. A government-related debtor’s willingness or ability to repay principal and pay interest in a timely manner may be affected by, among other factors, its cash flow situation, the extent of its foreign currency reserves, the availability of sufficient foreign exchange on the date a payment is due, the relative size of the debt service burden to the economy as a whole, the government-related debtor’s policy toward international lenders, and the political constraints to which a government-related debtor may be subject. During periods of economic uncertainty, the market prices of government-related bonds, and the Fund’s NAV, may be more volatile than prices of corporate bonds, which may result in losses. In the past, certain governments of emerging market countries have declared themselves unable to meet their financial obligations on a timely basis, which has resulted in losses for holders of government-related bonds.

Restricted Securities Risk. Regulation S and Rule 144A securities are restricted securities. Restricted securities are securities that are not registered under the Securities Act of 1933, as amended (the “Securities Act”). They may be less liquid and more difficult to value than other investments because such securities may not be readily marketable. The Fund may not be able to purchase or sell a restricted security promptly or at a reasonable time or price. Although there may be a substantial institutional market for these securities, it is not possible to predict exactly how the market for such securities will develop or whether it will continue to exist. A restricted security that was liquid at the time of purchase may subsequently become illiquid and its value may decline as a result. In addition, transaction costs may be higher for restricted securities than for more liquid securities. The Fund may have to bear the expense of registering restricted securities for resale and the risk of substantial delays in effecting the registration.

Securitized/Asset-Backed Securities Risk. Investments in asset-backed securities, including collateralized mortgage obligations, are subject to the risk of significant credit downgrades, dramatic changes in liquidity, and defaults to a greater extent than many other types of fixed-income investments. During periods of falling interest rates, asset-backed securities may be called or prepaid, which may result in the Fund having to reinvest proceeds in other investments at a lower interest rate. During periods of rising interest rates, the average life of asset-backed securities may extend, which may lock in a below-market interest rate, increase the security’s duration and interest rate sensitivity, and reduce the value of the security. The Fund may invest in asset-backed securities issued or backed by federal agencies or government sponsored enterprises or that are part of a government-sponsored program, which may subject the Fund to the risks noted above. The values of assets or collateral underlying asset-backed securities may decline and, therefore, may not be adequate to cover underlying obligations. Enforcing rights against the underlying assets or collateral may be difficult, and the underlying assets or collateral may be insufficient if the issuer defaults.

Risk of Investing in the Financials Sector. The Fund will be sensitive to, and its performance will depend to a greater extent on, the overall condition of the financials sector. Companies in the financials sector may be subject to extensive government regulation that affects the scope of their activities, the prices they can charge and the amount of capital they must maintain. The profitability of companies in the financials sector may be adversely affected by increases in interest rates, by loan losses, which usually increase in economic downturns, and by credit rating downgrades. In addition, the financials sector is undergoing numerous changes, including continuing consolidations, development of new products and structures and changes to its regulatory framework. Furthermore, some companies in the financials sector perceived as benefitting from government intervention in the past may be subject to future government-imposed restrictions on their businesses or face increased government involvement in their operations. Increased government involvement in the financials sector, including measures such as taking ownership positions in financial institutions, could result in a dilution of the Fund’s investments in financial institutions.

Risk of Investing in the Utilities Sector. The Fund will be sensitive to, and its performance will depend to a greater extent on, the overall condition of the utilities sector. The utilities sector comprises companies that provide basic amenities, such as electricity, water, sewage services, dams, and natural gas to residential, industrial, commercial, and government customers. Companies in the utilities sector may be adversely affected by changes in exchange rates, domestic and international competition, difficulty in raising adequate amounts of capital and governmental limitation on rates charged to customers.

Market Risk. The prices of the securities in the Fund are subject to the risks associated with investing in the securities market, including general economic conditions, sudden and unpredictable drops in value, exchange trading suspensions and closures and public health risks. These risks may be magnified if certain social, political, economic and other conditions and events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy; in these and other circumstances, such events or developments might affect companies world-wide. An investment in the Fund may lose money.

Operational Risk. The Fund is exposed to operational risk arising from a number of factors, including, but not limited to, human error, processing and communication errors, errors of the Fund’s service providers, counterparties or other third parties, failed or inadequate processes and technology or system failures.

Call Risk. The Fund may invest in callable bonds. If interest rates fall, it is possible that issuers of callable securities will “call” (or prepay) their bonds before their maturity date. If a call were exercised by the issuer during or following a period of declining interest rates, the Fund is likely to have to replace such called security with a lower yielding security or securities with greater risks or other less favorable features. If that were to happen, it would decrease the Fund’s net investment income.

| vaneck.com | 5 | ||||

Sampling Risk. The Fund’s use of a representative sampling approach will result in its holding a smaller number of securities than are in the Green Bond Index. As a result, an adverse development respecting an issuer of securities held by the Fund could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the Green Bond Index. Conversely, a positive development relating to an issuer of securities in the Green Bond Index that is not held by the Fund could cause the Fund to underperform the Green Bond Index. To the extent the assets in the Fund are smaller, these risks will be greater.

Index Tracking Risk. The Fund’s return may not match the return of the Green Bond Index for a number of reasons. For example, the Fund incurs a number of operating expenses, including taxes, not applicable to the Green Bond Index and incurs costs associated with buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of the Green Bond Index or (to the extent the Fund effects creations and redemptions for cash) raising cash to meet redemptions or deploying cash in connection with newly created Creation Units (defined herein), which are not factored into the return of the Green Bond Index. Transaction costs, including brokerage costs, will decrease the Fund’s NAV to the extent not offset by the transaction fee payable by an Authorized Participant (“AP”). Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Green Bond Index. Errors in the Green Bond Index data, the Green Bond Index computations and/or the construction of the Green Bond Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Green Bond Index provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Shareholders should understand that any gains from the Green Bond Index provider's errors will be kept by the Fund and its shareholders and any losses or costs resulting from the Green Bond Index provider's errors will be borne by the Fund and its shareholders. When the Green Bond Index is rebalanced and the Fund in turn rebalances its portfolio to attempt to increase the correlation between the Fund’s portfolio and the Green Bond Index, any transaction costs and market exposure arising from such portfolio rebalancing will be borne directly by the Fund and its shareholders. Apart from scheduled rebalances, the Green Bond Index provider or its agents may carry out additional ad hoc rebalances to the Green Bond Index. Therefore, errors and additional ad hoc rebalances carried out by the Green Bond Index provider or its agents to the Green Bond Index may increase the costs to and the tracking error risk of the Fund. In addition, the Fund's use of a representative sampling approach may cause the Fund to not be as well correlated with the return of the Green Bond Index as would be the case if the Fund purchased all of the securities in the Green Bond Index, or invested in them in the exact proportions in which they are represented in the Green Bond Index. The Fund may value certain of its investments, underlying securities and/or currencies based on fair value prices. The Fund’s performance may also deviate from the return of the Green Bond Index due to legal restrictions or limitations imposed by the governments of certain countries, certain listing standards of the Fund’s listing exchange (the “Exchange”), a lack of liquidity on stock exchanges in which such securities trade, potential adverse tax consequences or other regulatory reasons (such as diversification requirements). To the extent the Fund calculates its NAV based on fair value prices and the value of the Green Bond Index is based on securities’ closing prices on local foreign markets (i.e., the value of the Green Bond Index is not based on fair value prices), the Fund’s ability to track the Green Bond Index may be adversely affected. When markets are volatile, the ability to sell securities at fair value prices may be adversely impacted and may result in additional trading costs and/or increase the index tracking risk. The Fund may also need to rely on borrowings to meet redemptions, which may lead to increased expenses. For tax efficiency purposes, the Fund may sell certain securities, and such sale may cause the Fund to realize a loss and deviate from the performance of the Green Bond Index. The performance of a “green” bond issuer may cause its securities to no longer merit “green” status, and such securities would no longer be eligible for inclusion in the Green Bond Index. This could cause the Fund to temporarily hold securities that are not in the Green Bond Index, which may adversely affect the Fund and its investments and may increase the risk of Green Bond Index tracking error. Additionally, there may also be a limited supply of bonds that merit "green" status, which may increase the risk of index tracking error. In light of the factors discussed above, the Fund’s return may deviate significantly from the return of the Green Bond Index. Changes to the composition of the Green Bond Index in connection with a rebalancing or reconstitution of the Green Bond Index may cause the Fund to experience increased volatility, during which time the Fund’s index tracking risk may be heightened.

Authorized Participant Concentration Risk. The Fund may have a limited number of financial institutions that act as APs, none of which are obligated to engage in creation and/or redemption transactions. To the extent that those APs exit the business, or are unable to or choose not to process creation and/or redemption orders, and no other AP is able to step forward to create and redeem, there may be a significantly diminished trading market for Shares or Shares may trade like closed-end funds at a greater discount (or premium) to NAV and possibly face trading halts and/or de-listing. The AP concentration risk may be heightened in scenarios where APs have limited or diminished access to the capital required to post collateral.

No Guarantee of Active Trading Market. While Shares are listed on the Exchange, there can be no assurance that an active trading market for the Shares will be maintained. Further, secondary markets may be subject to irregular trading activity, wide bid/ask spreads and extended trade settlement periods in times of market stress because market makers and APs may step away from making a market in the Shares and in executing creation and redemption orders, which could cause a material deviation in the Fund’s market price from its NAV.

Trading Issues. Trading in Shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in Shares inadvisable. In addition, trading in Shares on the Exchange is subject to trading halts caused by extraordinary market volatility pursuant to the Exchange’s “circuit breaker” rules. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged.

6 | vaneck.com | ||||

Passive Management Risk. An investment in the Fund involves risks similar to those of investing in any fund invested in bonds, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in security prices. However, because the Fund is not “actively” managed, unless a specific security is removed from the Green Bond Index, the Fund generally would not sell a security because the security’s issuer was in financial trouble. Additionally, unusual market conditions may cause the Green Bond Index provider to postpone a scheduled rebalance or reconstitution, which could cause the Green Bond Index to vary from its normal or expected composition. Therefore, the Fund’s performance could be lower than funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline or a decline in the value of one or more issuers.

Fund Shares Trading, Premium/Discount Risk and Liquidity of Fund Shares. The market price of the Shares may fluctuate in response to the Fund’s NAV, the intraday value of the Fund’s holdings and supply and demand for Shares. The Adviser cannot predict whether Shares will trade above, below, or at their most recent NAV. Disruptions to creations and redemptions, the existence of market volatility or potential lack of an active trading market for Shares (including through a trading halt), as well as other factors, may result in Shares trading at a significant premium or discount to NAV or to the intraday value of the Fund’s holdings. If a shareholder purchases Shares at a time when the market price is at a premium to the NAV or sells Shares at a time when the market price is at a discount to the NAV, the shareholder may pay significantly more or receive significantly less than the underlying value of the Shares that were bought or sold or the shareholder may be unable to sell his or her Shares. The securities held by the Fund may be traded in markets that close at a different time than the Exchange. Liquidity in those securities may be reduced after the applicable closing times. Accordingly, during the time when the Exchange is open but after the applicable market closing, fixing or settlement times, bid/ask spreads on the Exchange and the resulting premium or discount to the Shares’ NAV may widen. Additionally, in stressed market conditions, the market for the Fund’s Shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings. There are various methods by which investors can purchase and sell Shares. Investors should consult their financial intermediaries before purchasing or selling Shares of the Fund.

Concentration Risk. The Fund’s assets may be concentrated in a particular sector or sectors or industry or group of industries to the extent the Green Bond Index concentrates in a particular sector or sectors or industry or group of industries. To the extent that the Fund is concentrated in a particular sector or sectors or industry or group of industries, the Fund will be subject to the risk that economic, political or other conditions that have a negative effect on those sectors and/or industries may negatively impact the Fund to a greater extent than if the Fund’s assets were invested in a wider variety of sectors or industries.

PERFORMANCE

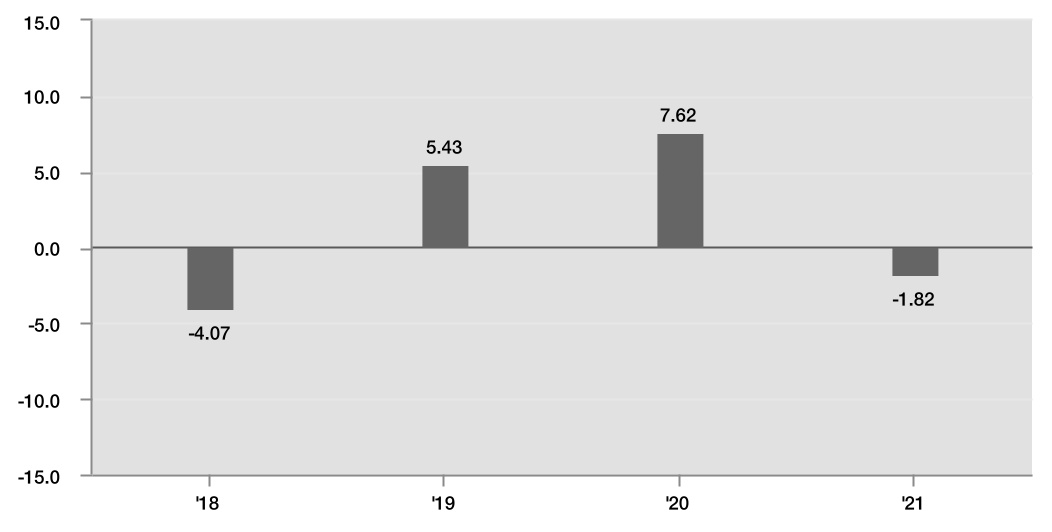

The bar chart that follows shows how the Fund performed for the calendar year shown. The table below the bar chart shows the Fund’s average annual returns (before and after taxes). The bar chart and table provide an indication of the risks of investing in the Fund by comparing the Fund’s performance from year to year and by showing how the Fund’s average annual returns for the one year, five year, ten year and/or since inception periods, as applicable, compared with the Fund’s benchmark index and a broad measure of market performance. Prior to September 1, 2019, the Fund sought to replicate as closely as possible, before fees and expenses, the price and yield performance of the S&P Green Bond Select Index (the “Prior Index”). Therefore, performance information prior to September 1, 2019 reflects the performance of the Fund while seeking to track the Prior Index. All returns assume reinvestment of dividends and distributions. The Fund’s past performance (before and after taxes) is not necessarily indicative of how the Fund will perform in the future. Updated performance information is available online at www.vaneck.com.

| vaneck.com | 7 | ||||

Annual Total Returns (%)—Calendar Years

The year-to-date total return as of June 30, 2022 was -10.82%.

| Best Quarter: | 5.28% | 2Q 2020 | ||||||

| Worst Quarter: | -3.51% | 2Q 2018 | ||||||

Average Annual Total Returns for the Periods Ended December 31, 2021

The after-tax returns presented in the table below are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown below. After-tax returns are not relevant to investors who hold Shares of the Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

| Past One Year | Since Inception (3/2/2017) | ||||||||||

| VanEck Green Bond ETF (return before taxes) | -1.82% | 3.36% | |||||||||

| VanEck Green Bond ETF (return after taxes on distributions) | -2.66% | 2.68% | |||||||||

| VanEck Green Bond ETF (return after taxes on distributions and sale of Fund Shares) | -1.07% | 2.30% | |||||||||

S&P Green Bond U.S. Dollar Select Index* (reflects no deduction for fees, expenses or taxes) | -1.56% | 3.96% | |||||||||

| Bloomberg US Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | -1.54% | 3.65% | |||||||||

ICE BofA Broad US Market Index1 (reflects no deduction for fees, expenses or taxes) | -1.58% | 3.70% | |||||||||

* Prior to September 1, 2019, the Fund sought to replicate as closely as possible, before fees and expenses, the price and yield performance of the Prior Index. Therefore, performance information prior to September 1, 2019 reflects the performance of the Fund while seeking to track the Prior Index. Prior to September 1, 2019, index data reflects that of the Prior Index. From September 1, 2019, the index data reflects that of the Green Bond Index.

1 On September 1, 2022, the ICE BofA Broad US Market Index replaced the Bloomberg US Aggregate Bond Index as the Fund's broad-based benchmark index as the Adviser believes it is more representative of broad bond market exposure.

8 | vaneck.com | ||||

PORTFOLIO MANAGEMENT

Investment Adviser. Van Eck Associates Corporation.

Portfolio Manager. The following individual is primarily responsible for the day-to-day management of the Fund’s portfolio:

| Name | Title with Adviser | Date Began Managing the Fund | ||||||||||||

| Francis G. Rodilosso | Portfolio Manager | March 2017 | ||||||||||||

PURCHASE AND SALE OF FUND SHARES

Individual Shares of the Fund may only be purchased and sold in secondary market transactions through a broker or dealer at a market price. Shares of the Fund is listed on the Exchange, and because Shares trade at market prices rather than NAV, Shares of the Fund may trade at a price greater than NAV (i.e., a "premium") or less than NAV (i.e., a "discount").

An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares of the Fund (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid/ask spread”).

Recent information, including information about the Fund’s NAV, market price, premiums and discounts, and bid/ask spreads, is included on the Fund’s website at www.vaneck.com.

TAX INFORMATION

The Fund’s distributions are taxable and will generally be taxed as ordinary income or capital gains.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

The Adviser and its related companies may pay broker-dealers or other financial intermediaries (such as a bank) for the sale of the Fund Shares and related services. These payments may create a conflict of interest by influencing your broker-dealer or other intermediary or its employees or associated persons to recommend the Fund over another investment. Ask your financial adviser or visit your financial intermediary’s website for more information.

| vaneck.com | 9 | ||||

[THIS PAGE INTENTIONALLY LEFT BLANK]

| 800.826.2333 vaneck.com | |||||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- GoNetspeed to host first annual Massachusetts Broadband Legislative Summit May 13

- Marymount University and Placemakr Introduce Amazon's Just Walk Out Technology at Marymount Ballston Property

- AlayaCare Partners with Corus Health to Enhance Family-Centered Care in New Mexico

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share