Form 497K Pacer Funds Trust

| Pacer Pacific Asset Floating Rate High Income ETF Trading Symbol: FLRT NYSE Arca, Inc. Summary Prospectus October 25, 2021 www.paceretfs.com | ||||

Before you invest, you may want to review the Fund’s prospectus and statement of additional information (“SAI”), which contain more information about the Fund and its risks. The current prospectus and SAI dated October 19, 2021, are incorporated by reference into this summary prospectus. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund online at www.paceretfs.com/media/. You can also get this information at no cost by calling 1-800-617-0004 or by sending an e-mail request to ETF@usbank.com.

Investment Objective

The Pacer Pacific Asset Floating Rate High Income ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to provide a high level of current income.

Fees and Expenses of the Fund

The following table describes the fees and expenses you may pay if you buy, hold, and sell shares of the Fund (“Shares”). The fees are expressed as a percentage of the Fund’s average net assets. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||

| Management Fees* | 0.60% | ||||

| Distribution and/or Service (12b-1) Fees | None | ||||

| Other Expenses** | 0.00% | ||||

| Total Annual Fund Operating Expenses | 0.60% | ||||

*Restated to reflect current fees.

**Estimated for the current fiscal year.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of the Shares at the end of those periods. The example assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | ||||||||

| $61 | $192 | $335 | $750 | ||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the portfolio turnover rate for the Predecessor Fund (as defined below) was 35% of the average value of its portfolio.

1

Principal Investment Strategies of the Fund

Pacific Asset Management LLC (the “Sub-Adviser”) seeks to achieve the Fund’s investment objective by selecting a focused portfolio comprised primarily of income-producing adjustable rate securities.

Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in senior secured floating rate loans and other adjustable rate securities. Other adjustable rate securities will typically include collateralized loan obligations (“CLOs”), asset-backed securities (“ABS”), and commercial mortgage backed securities (“CMBS”) (collectively, “Adjustable Rate Securities”). The Fund is expected to invest primarily in loans and Adjustable Rate Securities that are rated below investment grade (i.e., high yield securities, sometimes called “junk bonds” or non-investment grade securities) or, if unrated, of comparable quality as determined by the Sub-Adviser.

The Fund may invest in U.S.-dollar denominated senior floating rate loans and Adjustable Rate Securities of domestic and foreign issuers. Senior floating rate loans are debt instruments that may have a right to payment that is senior to most other debts of borrowers. Borrowers may include corporations, partnerships and other entities that operate in a variety of industries and geographic regions, which may from time to time prepay their loan obligations in response, for example, to changes in interest rates. Senior loans in which the Fund may invest include secured and unsecured loans. Generally, secured floating rate loans are secured by specific assets of the borrower. An adjustable rate security includes any fixed income security that requires periodic changes in its interest rate based upon changes in a recognized index interest rate or another method of determining prevailing interest rates. The Fund invests in various types of ABS, such as auto loan and student loan ABS. The Fund is actively managed.

The Fund may invest up to 20% of its assets in certain other types of debt instruments or securities, including corporate bonds (including floating rate investment grade bonds) and secured or unsecured second lien floating rate loans. Second lien loans generally are second in line behind senior loans in terms of prepayment priority with respect to pledged collateral and therefore have a lower credit quality as compared to senior loans but may produce a higher yield to compensate for the additional risk.

The secondary market on which high yield securities are traded may be less liquid than the market for investment-grade securities. Less liquidity in the secondary trading market could adversely affect the ability of the Fund to sell a high yield security or the price at which the Fund could sell a high yield security, and could adversely affect the daily NAV of Fund shares. When secondary markets for high yield securities are less liquid than the market for investment-grade securities, it may be more difficult to value the securities because such valuation may require more research, and elements of judgment may play a greater role in the valuation because there is less reliable, objective data available. The Fund may invest up to an aggregate amount of 15% of its net assets in illiquid investments, as such term is defined by Rule 22e-4 under the Investment Company Act of 1940, as amended (the “1940 Act”).

When the Sub-Adviser believes that current market, economic, political or other conditions are unsuitable and would impair the pursuit of the Fund’s investment objectives, the Fund may invest some or all of its assets in cash or cash equivalents, including but not limited to obligations of the U.S. government, money market fund shares, commercial paper, certificates of deposit and/or bankers acceptances, as well as other interest bearing or discount obligations or debt instruments that carry an investment grade rating by a national rating agency. When the Fund takes a temporary defensive position, the Fund may not achieve its investment objectives. The Fund may invest from time to time more heavily in one or more sectors of the economy than in other sectors.

Principal Risks of Investing in the Fund

You can lose money on your investment in the Fund. The Fund is subject to the risks summarized below. Some or all of these risks may adversely affect the Fund’s net asset value per share (“NAV”), trading price, yield, total return and/or ability to meet its objectives. For more information about the risks of investing in the Fund, see the section in the Fund’s prospectus entitled “Additional Information about the Principal Risks of Investing in the Fund.”

2

•Floating Rate Loan Risk. Floating rate loans (or bank loans) are usually rated below investment grade. The market for floating rate loans may be subject to irregular trading activity, wide bid/ask spreads, and extended trade settlement periods. Investments in floating rate loans are typically in the form of an assignment or participation. Investors in a loan participation assume the credit risk associated with the borrower and may assume the credit risk associated with an interposed financial intermediary. Accordingly, if a lead lender becomes insolvent or a loan is foreclosed, the Fund could experience delays in receiving payments or suffer a loss. In an assignment, the Fund effectively becomes a lender under the loan agreement with the same rights and obligations as the assigning bank or other financial intermediary. Accordingly, if the loan is foreclosed, the Fund could become part owner of any collateral, and would bear the costs and liabilities associated with owning and disposing of the collateral. In addition, the floating rate feature of loans means that floating rate loans will not generally experience capital appreciation in a declining interest rate environment. Declines in interest rates may also increase prepayments of debt obligations and require the Fund to invest assets at lower yields. Floating rate loans are also subject to prepayment risk. Such loans may not be considered securities and, therefore, may not be afforded the protections of the federal securities laws.

◦Senior Loans Risk. The risks associated with senior loans are similar to the risks of junk bonds, although senior loans typically are senior and secured, whereas junk bonds often are subordinated and unsecured. Investments in senior loans typically are below investment grade and are considered speculative because of the credit risk of their issuers. Such companies are more likely to default on their payments of interest and principal owed, and such defaults could reduce the Fund’s NAV and income distributions. An economic downturn generally leads to a higher nonpayment rate, and a senior loan may lose significant value before a default occurs. There is no assurance that the liquidation of the collateral would satisfy the claims of the borrower’s obligations in the event of the non-payment of scheduled interest or principal, or that the collateral could be readily liquidated. Economic and other events (whether real or perceived) can reduce the demand for certain senior loans or senior loans generally, which may reduce market prices. Senior loans and other debt securities also are subject to the risk of price declines and to increases in prevailing interest rates, although floating-rate debt instruments such as senior loans in which the Fund may be expected to invest are substantially less exposed to this risk than fixed-rate debt instruments. No active trading market may exist for certain senior loans, which may impair the ability of the Fund to realize full value in the event of the need to liquidate such assets. Adverse market conditions may impair the liquidity of some actively traded senior loans. Longer interest rate reset periods generally increase fluctuations in value as a result of changes in market interest rates.

◦Covenant-Lite Loan Risk. Covenant-lite loans contain fewer maintenance covenants, or no maintenance covenants at all, than traditional loans and may not include terms that allow the lender to monitor the financial performance of the borrower and declare a default if certain criteria are breached. This may hinder the Fund’s ability to reprice credit risk associated with the borrower and reduce the Fund’s ability to restructure a problematic loan and mitigate potential loss. As a result, the Fund’s exposure to losses on such investments is increased, especially during a downturn in the credit cycle. A significant portion of floating rate loans may be “covenant-lite” loans.

◦Loan Participation Risk. The Fund may not have a readily available market for loan participation interests and, in some cases, the Fund may have to dispose of such securities at a substantial discount from face value. Loan participations also involve the credit risk associated with the underlying corporate borrower.

•CLO Risk. CLOs are typically collateralized by a pool of loans, which may include, among others, domestic and foreign senior secured loans, senior unsecured loans, and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans. The cash flows from CLOs are split into two or more portions, called tranches, varying in risk and yield. CLO tranches can experience substantial losses due to actual defaults, increased sensitivity to defaults due to collateral default and disappearance of protecting tranches as well as market anticipation of defaults.

•Asset-Backed Securities Risk. Asset-backed securities represent interests in “pools” of assets, including consumer loans or receivables. Movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain types of asset-backed securities. Although certain asset-backed securities

3

are guaranteed as to timely payment of interest and principal by a government entity, the market price for such securities is not guaranteed and will fluctuate. The purchase of asset-backed securities issued by non-government entities may entail greater risk than such securities that are issued or guaranteed by a government entity. Asset-backed securities issued by non-government entities may offer higher yields than those issued by government entities, but may also be subject to greater volatility than government issues and can also be subject to greater credit risk and the risk of default on the underlying assets. Investments in asset-backed securities are subject to both extension risk, where borrowers pay off their debt obligations more slowly in times of rising interest rates, and prepayment risk, where borrowers pay off their debt obligations sooner than expected in times of declining interest rates.

•CMBS Risk. The Fund may invest in CMBS. CMBS are not backed by the full faith and credit of the U.S. government and are subject to risk of default on the underlying mortgages. The value of the collateral securing CMBS may decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate. As a result, CMBS may not be fully collateralized and may decline significantly in value. In addition, commercial mortgage loans are secured by commercial property and are subject to risks of delinquency and foreclosure, and risks of loss. In the event of any default under a mortgage, the Fund will bear a risk of loss of principal to the extent of any deficiency between the value of the collateral and the principal and accrued interest of the commercial mortgage loan. Stressed conditions in the markets for CMBS and mortgage-related assets as well as the broader financial markets have in the past resulted in a temporary but significant contraction in liquidity for CMBS. To the extent that the market for CMBS suffers such a contraction, securities that were previously considered liquid could become temporarily illiquid, and the Adviser may experience delays or difficulty in selling assets at the prices at which the Fund carries such assets, which may result in a loss to the Fund.

•High Yield Securities Risk. High yield debt obligations (commonly known as “junk bonds”) are speculative investments and entail greater risk of loss of principal than securities and loans that are investment grade rated because of their greater exposure to credit risk. The high yield market at times is subject to substantial volatility and high yield debt obligations may be less liquid than higher quality securities. As a result, the value of the Fund may be subject to greater volatility than other funds, and the Fund may be exposed to greater tracking risk (described below) than other funds.

•Fixed Income Risk. The value of the Fund’s direct or indirect investments in fixed income securities will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. On the other hand, if rates fall, the value of the fixed income securities generally increases. The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. In general, the market price of fixed income securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities. The value of the Fund’s direct or indirect investments in fixed income securities may be affected by the inability of issuers to repay principal and interest or illiquidity in debt securities markets.

◦Call Risk. During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or repay the security prior to its stated maturity, and the Fund may have to reinvest the proceeds at lower interest rates, resulting in a decline in the Fund’s income.

◦Credit Risk. Credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of an investment in that issuer. Credit risk is heightened to the extent the Fund invests in non-investment grade securities.

◦Event Risk. Event risk is the risk that corporate issuers may undergo restructurings, such as mergers, leveraged buyouts, takeovers, or similar events financed by increased debt. As a result of the added debt, the credit quality and market value of a company’s bonds and/or other debt securities may decline significantly.

◦Extension Risk. When interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these securities to fall.

4

◦Interest Rate Risk. Generally, the value of fixed income securities will change inversely with changes in interest rates. As interest rates rise, the market value of fixed income securities tends to decrease. Conversely, as interest rates fall, the market value of fixed income securities tends to increase. This risk will be greater for long-term securities than for short-term securities. Changes in government intervention may have adverse effects on investments, volatility, and illiquidity in debt markets.

◦Prepayment Risk. When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and the proceeds may have to be invested in securities with lower yields. The Fund investing in such securities will be forced to reinvest this money at lower yields, which can reduce the Fund’s returns.

◦Income Risk. The income from the Fund’s investments may decline because of falling market interest rates. This can result when the Fund invests the proceeds from new share sales, or from matured or called bonds, at market interest rates that are below the Fund’s portfolio current earnings rate.

•LIBOR Risk. Instruments in which the Fund invests may pay interest at floating rates based on the London Inter-Bank Offered Rate (“LIBOR”) or may be subject to interest caps or floors based on LIBOR. The Fund and issuers of instruments in which the Fund invests may also obtain financing at floating rates based on LIBOR. Plans are underway to phase out the use of LIBOR between December 31, 2021 and June 30, 2023. There is currently no definitive information regarding the future utilization of LIBOR or of any particular replacement rate. Abandonment of or modifications to LIBOR may affect the value, liquidity or return on certain Fund investments that reference LIBOR without including fallback provisions and may result in costs incurred in connection with closing out positions and entering into new trades. Any pricing adjustments to the Fund’s investments resulting from a substitute reference rate may also adversely affect the Fund’s performance and/or NAV. The effect of a phase out of LIBOR on instruments in which the Fund may invest is currently unclear.

•Foreign Securities Risk. Investments in non-U.S. securities involve certain risks that may not be present with investments in U.S. securities. For example, investments in non-U.S. securities may be subject to risk of loss due to foreign currency fluctuations or to political or economic instability. Investments in non-U.S. securities also may be subject to withholding or other taxes and may be subject to additional trading, settlement, custodial, and operational risks. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. Markets and economies throughout the world are becoming increasingly interconnected, and conditions or events in one market, country or region may adversely impact investments or issuers in another market, country or region.

•Market Risk. An investment in the Fund involves risks similar to those of investing in any fund of equity securities, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in securities prices. The values of equity securities could decline generally or could underperform other investments. Different types of equity securities tend to go through cycles of out-performance and under-performance in comparison to the general securities markets. In addition, securities may decline in value due to factors affecting the securities markets generally or a specific issuer or market. The Fund is subject to the risk that its investment strategy, the implementation of which is subject to a number of constraints, may not produce the intended results. Market risk refers to the possibility that the market values of securities or other investments that the Fund holds will fall, sometimes rapidly or unpredictably, or fail to rise. Security values may fall or fail to rise because of a variety of actual or perceived factors affecting an issuer (e.g., an unfavorable earnings report), the industry or sector in which it operates, or the market as a whole, which may reduce the value of an investment in the Fund. Accordingly, an investment in the Fund could lose money over short or long periods. The market values of the securities the Fund holds can be affected by changes or perceived changes in U.S. or foreign economies and financial markets, and the liquidity of these securities, among other factors. Although equity securities generally tend to have greater price volatility than debt securities, under certain market conditions, debt securities may have comparable or greater price volatility. In addition, stock prices may be sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase.

5

•ETF Risks. The Fund is an ETF and, as a result of an ETF’s structure, is exposed to the following risks:

◦Authorized Participants (“APs”), Market Makers, and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as APs. In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, shares of the Fund may trade at a material discount to NAV and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

◦Costs of Buying or Selling Shares of the Fund. Due to the costs of buying or selling shares of the Fund, including brokerage commissions imposed by brokers and bid/ask spreads, frequent trading of shares of the Fund may significantly reduce investment results and an investment in shares of the Fund may not be advisable for investors who anticipate regularly making small investments.

◦Shares of the Fund May Trade at Prices Other Than NAV. As with all ETFs, shares of the Fund may be bought and sold in the secondary market at market prices. The price of shares of the Fund, like the price of all traded securities, will be subject to factors such as supply and demand, as well as the current value of the Fund’s portfolio holdings. Although it is expected that the market price of the shares of the Fund will approximate the Fund’s NAV, there may be times when the market price of the shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount). This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for shares in the secondary market, in which case such premiums or discounts may be significant. Certain securities held by the Fund may trade on foreign exchanges that are closed when the Fund’s primary listing exchange is open, and the Fund may experience premiums and discounts greater than those of ETFs that hold securities that are traded only in the United States.

◦Trading. Although shares of the Fund are listed for trading on a national securities exchange, such as NYSE Arca, Inc. (the “Exchange”), and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that shares of the Fund will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of shares of the Fund may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than shares of the Fund.

•Liquidity Risk. Liquidity risk exists when particular investments are difficult to purchase or sell. This can reduce the Fund’s returns because the Fund may be unable to transact at advantageous times or prices. Trading opportunities are more limited for Adjustable Rate Securities that have complex terms or that are not widely held. These features may make it more difficult to sell or buy a security at a favorable price or time. Infrequent trading of securities may also lead to an increase in their price volatility.

•Privately Issued Securities Risk. The Fund may invest in privately-issued securities, including those that may be resold only in accordance with Rule 144A or Regulation S under the 1933 Act (“Restricted Securities”). Restricted Securities are not publicly traded and are subject to a variety of restrictions, which limit a purchaser’s ability to acquire or resell such securities. Delay or difficulty in selling such securities may result in a loss to the Fund.

•Management Risk. The Fund is subject to management risk because it is an actively managed portfolio. In managing the Fund’s investment portfolio, the portfolio managers will apply investment techniques and risk analyses that may not produce the desired result. There can be no guarantee that the Fund will meet its investment objective.

•Sector Risk. Sector risk is the possibility that securities within the same group of industries will decline in price due to sector-specific market or economic developments. If the Fund invests more heavily in a particular sector, the value of its shares may be especially sensitive to factors and economic risks that specifically affect that sector. As a result, the Fund’s share price may fluctuate more widely than the value of shares of a fund that invests in a broader range of industries.

6

◦Consumer Discretionary Sector Risk. The Fund may invest in companies in the consumer discretionary sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. The success of consumer product manufacturers and retailers is tied closely to the performance of domestic and international economies, interest rates, exchange rates, competition, consumer confidence, changes in demographics and consumer preferences. Companies in the consumer discretionary sector depend heavily on disposable household income and consumer spending, and may be strongly affected by social trends and marketing campaigns. These companies may be subject to severe competition, which may have an adverse impact on their profitability.

◦Industrials Sector Risk. The Fund may invest in companies in the industrials sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. The industrials sector may be affected by changes in the supply of and demand for products and services, product obsolescence, claims for environmental damage or product liability and general economic conditions, among other factors.

•Small Fund Risk. When the Fund’s size is small, the Fund may experience low trading volume and wide bid/ask spreads. In addition, the Fund may face the risk of being delisted if the Fund does not meet certain conditions of the listing exchange. Any resulting liquidation of the Fund could cause the Fund to incur elevated transaction costs for the Fund and negative tax consequences for its shareholders.

Fund Performance

The Fund is the successor to the Pacific Global Senior Loan ETF, a series of Pacific Global ETF Trust, as a result of the reorganization of the Predecessor Fund into the Fund at the close of business on October 22, 2021. In addition, the Pacific Global Senior Loan ETF was the successor to the investment performance of AdvisorShares Pacific Asset Enhanced Floating Rate ETF, a series of AdvisorShares Trust, as a result of the reorganization of the series of AdvisorShares Trust into a series of Pacific Global ETF that occurred on December 27, 2019 (together, the “Predecessor Fund”).

Accordingly, any performance information for periods prior to October 22, 2021 is that of the series of Pacific Global ETF Trust; any performance for periods prior to December 27, 2019 is that of the series of AdvisorShares Trust. While the Predecessor Fund had the same investment objective as the Fund, the Fund’s investment strategies and policies changed after the reorganization. From the Predecessor Fund’s inception to October 22, the Predecessor Fund invested at least 80% of its net assets (plus any borrowings for investment purposes) in senior secured floating rate loans. After the reorganization, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in senior secured floating rate loans and other adjustable rate securities. As part of the Fund’s 80% policy, other adjustable rate securities will typically include CLOs, ABS, and CMBS (collectively, “Adjustable Rate Securities”). Other than each Fund’s respective 80% policy and the associated risks with investing in Adjustable Rate Securities, the Funds had similar investment objectives, strategies, and policies.

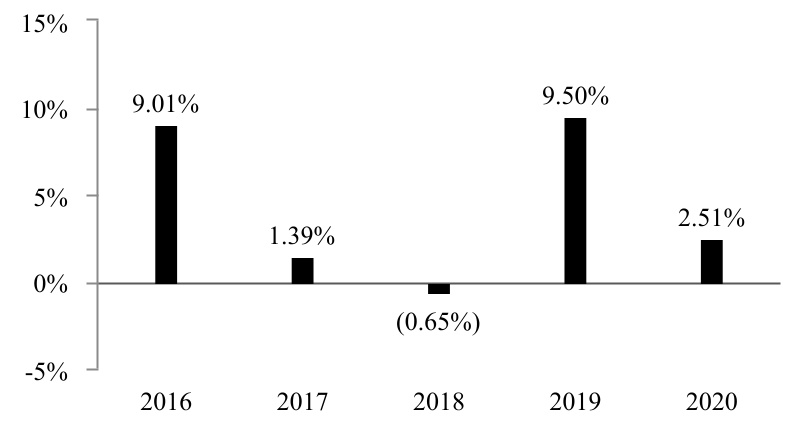

The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Predecessor Fund’s performance for calendar years ended December 31. The table illustrates how the Predecessor Fund’s average annual returns for the one-year, five-year, and since inception periods compare to (i) the S&P 500 Index, which is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks and (ii) the S&P/LSTA U.S. Leveraged Loan 100 Index, which is an index designed to track the market-weighted performance of the largest institutional leveraged loans based on market weightings, spreads and interest payments. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is also available on the Fund’s website at www.PacerETFs.com.

7

Calendar Year Total Return

During the period of time shown in the bar chart, the Predecessor Fund’s highest quarterly return was 5.83% for the quarter ended June 30, 2020 and the lowest quarterly return was -9.07% for the quarter ended March 31, 2020. The Predecessor Fund’s calendar year-to-date return as of September 30, 2021 was 2.80%.

Average Annual Total Returns

For the Periods Ended December 31, 2020

| Pacer Pacific Asset Floating Rate High Income ETF | 1 Year | 5 Year | Since Inception (2/18/15) | ||||||||||||||

| Return Before Taxes | 2.51% | 4.27% | 3.25% | ||||||||||||||

| Return After Taxes on Distributions | 1.00% | 2.68% | 1.68% | ||||||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 1.44% | 2.57% | 1.78% | ||||||||||||||

S&P 500® Index (reflects no deduction for fees, expenses, or taxes) | 18.40% | 15.22% | 12.67% | ||||||||||||||

S&P/LSTA U.S. Leveraged Loan 100 Index (reflects no deduction for fees, expenses, or taxes) | 2.84% | 5.31% | 3.77% | ||||||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred arrangements such as an individual retirement account (“IRA”) or other tax-advantaged accounts.

Management

Investment Adviser

Pacer Advisors, Inc. (the “Adviser”) serves as investment adviser to the Fund.

Investment Sub-Adviser

Pacific Asset Management LLC (the “Sub-Adviser” or “Pacific Asset Management”) serves as investment sub-adviser to the Fund.

Portfolio Managers

Bob Boyd, Portfolio Manager and Managing Director of the Sub-Adviser, and Ying Qiu, CFA, Portfolio Manager and Managing Director of the Sub-Adviser, are the primary persons responsible for the day-to-day management of the Fund. Mr. Boyd has served as the Sub-Adviser’s portfolio manager for the Fund since the Predecessor Fund’s inception in February 2015. Ms. Qiu has served as the Sub-Adviser’s portfolio manager for the Fund since October 2021.

8

Buying and Selling Fund Shares

The Fund is an ETF. This means that individual Shares of the Fund may only be purchased and sold in the secondary market through brokers at market prices, rather than NAV. Because Shares trade at market prices rather than NAV, Shares may trade at a price greater than NAV (premium) or less than NAV (discount).

The Fund generally issues and redeems shares at NAV only in large blocks of shares known as “Creation Units,” which only institutions or large investors may purchase or redeem. The Fund generally issues and redeems Creation Units in exchange for a portfolio of securities (the “Deposit Securities”) and/or a designated amount of U.S. cash that the Fund specifies each day.

Investors may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid-ask spread”). Recent information about the Fund, including its net asset value, market price, premiums and discounts, and bid-ask spreads is available on the Fund’s website at www.PacerETFs.com.

Tax Information

Fund distributions are generally taxable as ordinary income, qualified dividend income, or capital gains (or a combination), unless your investment is in an IRA or other tax-advantaged retirement account. Distributions may be taxable upon withdrawal from tax-deferred accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker or other financial intermediary (such as a bank), the Adviser, the Sub-Adviser, and their related companies may pay the intermediary for activities related to the marketing and promotion of the Fund. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

9

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Daniel Karpovič steps down as Head of B2B at Telia Lietuva

- i3 Energy PLC Announces 2024 Capital Budget and Production Guidance

- Pre-Investor Call Presentation available to shareholders

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share