Form 497K GOLDMAN SACHS TRUST

Class A: GSFAX Class C: GSFCX Institutional: GSNIX Service: GSNSX Investor: GSNTX Class R: GSNRX

Class R6: GSFUX Class T: GBNTX

Before you invest, you may want to review the Goldman Sachs Bond Fund’s (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund, including the Statement of Additional Information (“SAI”) and most recent annual reports to shareholders, online at www.gsamfunds.com/mutualfunds. You can also get this information at no cost by calling 800-621-2550 for Institutional, Service and Class R6 shareholders, 800-526-7384 for all other shareholders or by sending an e-mail request to [email protected]. The Fund’s Prospectus and SAI, both dated July 30, 2018, as supplemented to date, are incorporated by reference into this Summary Prospectus.

| INVESTMENT OBJECTIVE |

The Fund seeks a total return consisting of capital appreciation and income that exceeds the total return of the Bloomberg Barclays U.S. Aggregate Bond Index (the “Index”).

| FEES AND EXPENSES OF THE FUND |

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of Class A or Class T Shares if you invest at least $100,000 or $250,000, respectively, in Goldman Sachs Funds. More information about these and other discounts is available from your financial professional and in “Shareholder Guide—Common Questions Applicable to the Purchase of Class A Shares” beginning on page 50 and “Shareholder Guide—Common Questions Applicable to the Purchase of Class T Shares” beginning on page 55 and in Appendix C—Additional Information About Sales Charge Variations, Waivers and Discounts on page 92 of the Prospectus and “Other Information Regarding Maximum Sales Charge, Purchases, Redemptions, Exchanges and Dividends” beginning on page B-146 of the Fund’s SAI.

SHAREHOLDER FEES (fees paid directly from your investment)

| Class A | Class C | Institutional | Service | Investor | Class R | Class R6 | Class T | |||||||||||||||

| Maximum Sales Charge (Load) Imposed on |

3.75 | % | None | None | None | None | None | None | 2.50 | % | ||||||||||||

| Maximum Deferred Sales Charge (Load) (as a |

None | 1.00 | % | None | None | None | None | None | None | |||||||||||||

2 SUMMARY PROSPECTUS — GOLDMAN SACHS BOND FUND

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | Institutional | Service | Investor | Class R | Class R6 | Class T | |||||||||||||||||||||||||

| Management Fees |

0.41 | % | 0.41 | % | 0.41 | % | 0.41 | % | 0.41 | % | 0.41 | % | 0.41 | % | 0.41 | % | ||||||||||||||||

| Distribution and/or Service (12b-1) Fees |

0.25 | % | 0.75 | % | None | 0.25 | % | None | 0.50 | % | None | 0.25 | % | |||||||||||||||||||

| Other Expenses2 |

0.26 | % | 0.51 | % | 0.17 | % | 0.42 | % | 0.26 | % | 0.26 | % | 0.16 | % | 0.26 | % | ||||||||||||||||

| Service Fees |

No | ne | 0.2 | 5% | No | ne | No | ne | No | ne | No | ne | No | ne | No | ne | ||||||||||||||||

| Shareholder Administration Fees |

No | ne | No | ne | No | ne | 0.2 | 5% | No | ne | No | ne | No | ne | No | ne | ||||||||||||||||

| All Other Expenses |

0.2 | 6% | 0.2 | 6% | 0.1 | 7% | 0.1 | 7% | 0.2 | 6% | 0.2 | 6% | 0.1 | 6% | 0.2 | 6% | ||||||||||||||||

| Acquired Fund Fees and Expenses |

0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | ||||||||||||||||

| Total Annual Fund Operating Expenses3 |

0.93 | % | 1.68 | % | 0.59 | % | 1.09 | % | 0.68 | % | 1.18 | % | 0.58 | % | 0.93 | % | ||||||||||||||||

| Fee Waiver and Expense Limitation4 |

(0.14 | )% | (0.14 | )% | (0.14 | )% | (0.14 | )% | (0.14 | )% | (0.14 | )% | (0.14 | )% | (0.14 | )% | ||||||||||||||||

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation3 |

0.79 | % | 1.54 | % | 0.45 | % | 0.95 | % | 0.54 | % | 1.04 | % | 0.44 | % | 0.79 | % | ||||||||||||||||

| 1 | A contingent deferred sales charge (“CDSC”) of 1% is imposed on Class C Shares redeemed within 12 months of purchase. |

| 2 | The “Other Expenses” for Class T Shares have been estimated to reflect expenses expected to be incurred during the current fiscal year. |

| 3 | The “Total Annual Fund Operating Expenses” and “Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation” do not correlate to the ratios of net and total expenses to average net assets provided in the Financial Highlights, which reflect the operating expenses of the Fund and do not include “Acquired Fund Fees and Expenses.” |

| 4 | The Investment Adviser has agreed to (i) waive a portion of its management fee payable by the Fund in an amount equal to any management fees it earns as an investment adviser to any of the affiliated funds in which the Fund invests; and (ii) reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees, shareholder administration fees, taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and extraordinary expenses) to 0.004% of the Fund’s average daily net assets. These arrangements will remain in effect through at least July 29, 2019, and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Board of Trustees. |

| EXPENSE EXAMPLE |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in Class A, Class C, Institutional, Service, Investor, Class R, Class R6 and/or Class T Shares of the Fund for the time periods indicated and then redeem all of your Class A, Class C, Institutional, Service, Investor, Class R, Class R6 and/or Class T Shares at the end of those periods, unless otherwise stated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (except that the Example incorporates the fee waiver and expense limitation arrangements for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class A Shares |

$ | 453 | $ | 647 | $ | 857 | $ | 1,463 | ||||||||

| Class C Shares |

||||||||||||||||

| — Assuming complete redemption at end of period |

$ | 257 | $ | 516 | $ | 899 | $ | 1,975 | ||||||||

| — Assuming no redemption |

$ | 157 | $ | 516 | $ | 899 | $ | 1,975 | ||||||||

| Institutional Shares |

$ | 46 | $ | 175 | $ | 315 | $ | 725 | ||||||||

| Service Shares |

$ | 97 | $ | 333 | $ | 587 | $ | 1,316 | ||||||||

| Investor Shares |

$ | 55 | $ | 203 | $ | 365 | $ | 833 | ||||||||

| Class R Shares |

$ | 106 | $ | 361 | $ | 636 | $ | 1,419 | ||||||||

| Class R6 Shares |

$ | 45 | $ | 172 | $ | 310 | $ | 712 | ||||||||

| Class T Shares |

$ | 329 | $ | 525 | $ | 738 | $ | 1,352 | ||||||||

| PORTFOLIO TURNOVER |

The Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in the annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal year ended March 31, 2018 was 372% of the average value of its portfolio.

| PRINCIPAL STRATEGY |

The Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase) (“Net Assets”) in bonds and other fixed income securities, including securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises (“U.S. Government Securities”), corporate debt securities, collateralized loan obligations, privately issued adjustable rate and fixed rate mortgage loans or other mortgage-related securities (“Mortgage-Backed Securities”), asset-backed securities, high yield non-investment grade securities (securities rated BB+, Ba1 or below by a nationally recognized statistical rating organization (“NRSRO”) or, if unrated, determined by the Investment Adviser to be of comparable credit quality). The Fund may also invest in custodial receipts, fixed income securities issued by or on behalf of states, territories, and possessions of the United States (including the District of Columbia) (“Municipal Securities”) and convertible securities. The Fund may also engage in forward foreign currency transactions for both hedging and non-hedging purposes. The Fund also intends to invest in derivatives, including (but not limited to) forwards, interest rate futures, interest rate swaps and credit default swaps, which are used primarily to hedge the Fund’s portfolio risks, manage the Fund’s duration and/or gain exposure to certain fixed income securities or indices. The

3 SUMMARY PROSPECTUS — GOLDMAN SACHS BOND FUND

Fund may invest in obligations of domestic and foreign issuers which are denominated in currencies other than the U.S. dollar. The Fund may invest up to 15% of its total assets measured at the time of purchase (“Total Assets”) in sovereign and corporate debt securities and other instruments of issuers in emerging market countries (“emerging countries debt”). In pursuing its investment objective, the Fund uses the Index as its performance benchmark, but the Fund will not attempt to replicate the Index. The Fund may, therefore, invest in securities that are not included in the Index. The Fund may also purchase securities of issuers in default.

The Fund’s investments in non-investment grade securities (i.e., junk bonds) will not exceed 25% of its Total Assets at the time of purchase. Otherwise, the Fund invests in fixed income securities rated at least BBB- or Baa3 at the time of purchase. Securities will either be rated by an NRSRO or, if unrated, determined by the Investment Adviser to be of comparable credit quality.

The Fund’s target duration range under normal interest rate conditions is expected to approximate that of the Index, plus or minus 2.5 years, and over the last five years ended June 30, 2018, the duration of the Index has ranged between 5.37 and 6.17 years. “Duration” is a measure of a debt security’s price sensitivity to changes in interest rates. The longer the duration of the Fund (or an individual debt security), the more sensitive its market price to changes in interest rates. For example, if market interest rates increase by 1%, the market price of a debt security with a positive duration of 3 will generally decrease by approximately 3%. Conversely, a 1% decline in market interest rates will generally result in an increase of approximately 3% of that security’s market price.

The Fund’s benchmark index is the Bloomberg Barclays U.S. Aggregate Bond Index.

| PRINCIPAL RISKS OF THE FUND |

Loss of money is a risk of investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. Investments in the Fund involve substantial risks which prospective investors should consider carefully before investing.

Credit/Default Risk. An issuer or guarantor of fixed income securities or instruments held by the Fund (which may have low credit ratings) may default on its obligation to pay interest and repay principal or default on any other obligation. Additionally, the credit quality of securities may deteriorate rapidly, which may impair the Fund’s liquidity and cause significant deterioration in net asset value (“NAV”). These risks are more pronounced in connection with the Fund’s investments in non-investment grade fixed income securities.

Derivatives Risk. The Fund’s use of forwards, interest rate futures, interest rate swaps, credit default swaps and other derivative instruments may result in losses. These instruments, which may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other instruments, may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of underlying instruments may produce disproportionate losses to the Fund. Certain derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments.

Foreign and Emerging Countries Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. The imposition of exchange controls (including repatriation restrictions), sanctions, confiscations, trade restrictions (including tariffs) and other government restrictions by the United States and other governments, or from problems in share registration, settlement or custody, may also result in losses. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. These risks may be more pronounced in connection with the Fund’s investments in securities of issuers located in emerging countries.

Interest Rate Risk. When interest rates increase, fixed income securities or instruments held by the Fund will generally decline in value. Long-term fixed income securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments. The risks associated with changing interest rates may have unpredictable effects on the markets and the Fund’s investments. Fluctuations in interest rates may also affect the yield and liquidity of fixed income securities and instruments held by the Fund.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s NAV and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio.

Mortgage-Backed and Other Asset-Backed Securities Risk. Mortgage-related and other asset-backed securities are subject to certain additional risks, including “extension risk” (i.e., in periods of rising interest rates, issuers may pay principal later than expected) and “prepayment risk” (i.e., in periods of declining interest rates, issuers may pay principal more quickly

4 SUMMARY PROSPECTUS — GOLDMAN SACHS BOND FUND

than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). Mortgage-backed securities offered by non-governmental issuers are subject to other risks as well, including failures of private insurers to meet their obligations and unexpectedly high rates of default on the mortgages backing the securities. Other asset-backed securities are subject to risks similar to those associated with mortgage-backed securities, as well as risks associated with the nature and servicing of the assets backing the securities. Asset-backed securities may not have the benefit of a security interest in collateral comparable to that of mortgage assets, resulting in additional credit risk.

Non-Investment Grade Fixed Income Securities Risk. Non-investment grade fixed income securities and unrated securities of comparable credit quality (commonly known as “junk bonds”) are considered speculative and are subject to the increased risk of an issuer’s inability to meet principal and interest payment obligations. These securities may be subject to greater price volatility due to such factors as specific issuer developments, interest rate sensitivity, negative perceptions of the junk bond markets generally and less liquidity.

Portfolio Turnover Rate Risk. A high rate of portfolio turnover (300% or more) may involve correspondingly greater expenses which must be borne by the Fund and its shareholders, and is also likely to result in short-term capital gains taxable to shareholders.

U.S. Government Securities Risk. The U.S. government may not provide financial support to U.S. government agencies, instrumentalities or sponsored enterprises if it is not obligated to do so by law. U.S. Government Securities issued by the Federal National Mortgage Association (“Fannie Mae”), Federal Home Loan Mortgage Corporation (“Freddie Mac”) and the Federal Home Loan Banks are neither issued nor guaranteed by the U.S. Treasury and, therefore, are not backed by the full faith and credit of the United States. The maximum potential liability of the issuers of some U.S. Government Securities held by the Fund may greatly exceed their current resources, including their legal right to support from the U.S. Treasury. It is possible that issuers of U.S. Government Securities will not have the funds to meet their payment obligations in the future.

| PERFORMANCE |

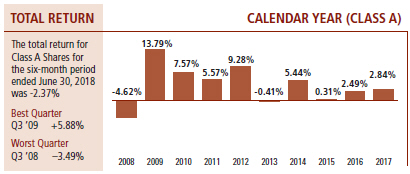

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Class A Shares from year to year; and (b) how the average annual total returns of the Fund’s Class A, Class C, Institutional, Service, Investor, Class R, Class R6 and Class T Shares compare to those of a broad-based securities market index. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone number on the back cover of the Prospectus.

The bar chart (including “Best Quarter” and “Worst Quarter” information) does not reflect the sales loads applicable to Class A Shares. If the sales loads were reflected, returns would be less. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown.

5 SUMMARY PROSPECTUS — GOLDMAN SACHS BOND FUND

AVERAGE ANNUAL TOTAL RETURN

| For the period ended December 31, 2017 |

1 Year | 5 Years | 10 Years | Since Inception |

||||||||||||

| Class A Shares (Inception 11/30/06) |

||||||||||||||||

| Returns Before Taxes |

-0.98% | 1.34% | 3.71% | 3.89% | ||||||||||||

| Returns After Taxes on Distributions |

-1.93% | 0.13% | 2.24% | 2.39% | ||||||||||||

| Returns After Taxes on Distributions and Sale of Fund Shares |

-0.56% | 0.49% | 2.30% | 2.43% | ||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees or expenses) |

3.54% | 2.10% | 4.00% | 4.18% | ||||||||||||

| Class C Shares (Inception 11/30/06) |

||||||||||||||||

| Returns Before Taxes |

1.06% | 1.35% | 3.33% | 3.47% | * | |||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees or expenses) |

3.54% | 2.10% | 4.00% | 4.18% | ||||||||||||

| Institutional Shares (Inception 11/30/06) |

||||||||||||||||

| Returns Before Taxes |

3.09% | 2.44% | 4.45% | 4.60% | ||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees or expenses) |

3.54% | 2.10% | 4.00% | 4.18% | ||||||||||||

| Service Shares (Inception 6/20/07) |

||||||||||||||||

| Returns Before Taxes |

2.67% | 1.95% | 3.95% | 4.33% | ||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees or expenses) |

3.54% | 2.10% | 4.00% | 4.41% | ||||||||||||

| Investor Shares (Inception 11/30/07) |

||||||||||||||||

| Returns Before Taxes |

3.00% | 2.35% | 4.32% | 4.33% | ||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees or expenses) |

3.54% | 2.10% | 4.00% | 4.00% | ||||||||||||

| Class R Shares (Inception 11/30/07) |

||||||||||||||||

| Returns |

2.58% | 1.86% | 3.84% | 3.85% | ||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees or expenses) |

3.54% | 2.10% | 4.00% | 4.00% | ||||||||||||

| Class R6 Shares (Inception 7/31/15)** |

||||||||||||||||

| Returns Before Taxes |

3.10% | 2.44% | 4.45% | 4.60% | ||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees or expenses) |

3.54% | 2.10% | 4.00% | 4.18% | ||||||||||||

| Class T Shares*** |

||||||||||||||||

| Returns Before Taxes |

-0.98% | 1.34% | 3.71% | 3.89% | ||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees or expenses) |

3.54% | 2.10% | 4.00% | 4.18% | ||||||||||||

| * | Effective July 30, 2018, Class C Shares will automatically convert into Class A Shares ten years after the purchase date. The Since Inception performance for Class C Shares does not reflect the conversion to Class A Shares after the first ten years of performance. |

| ** | Class R6 Shares commenced operations on July 31, 2015. Prior to that date, the performance of Class R6 Shares shown in the table above is that of Institutional Shares, including since inception performance as of Institutional Shares’ inception date. Performance has not been adjusted to reflect the lower expenses of Class R6 Shares. Class R6 Shares would have had higher returns because: (i) Institutional Shares and Class R6 Shares represent interests in the same portfolio of securities; and (ii) Class R6 Shares have lower expenses. |

| *** | As of the date of the Prospectus, Class T Shares have not commenced operations. Performance of Class T Shares shown in the table above is that of Class A Shares, including since inception performance as of Class A Shares’ inception date. Performance has not been adjusted to reflect the lower maximum sales charge (load) imposed on purchases of Class T Shares. Class T Shares would have had higher returns because: (i) Class A Shares and Class T Shares represent interests in the same portfolio of securities; and (ii) Class T Shares impose a lower maximum sales charge (load) on purchases. |

The after-tax returns are for Class A Shares only. The after-tax returns for Class C, Institutional, Service, Investor , Class R6 and Class T Shares, and returns for Class R Shares (which are offered exclusively to employee benefit plans), will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

6 SUMMARY PROSPECTUS — GOLDMAN SACHS BOND FUND

| PORTFOLIO MANAGEMENT |

Goldman Sachs Asset Management, L.P. is the investment adviser for the Fund (the “Investment Adviser” or “GSAM”).

Portfolio Managers: Ashish Shah, Managing Director, Co-Chief Investment Officer of Global Fixed Income, has managed the Fund since 2019; and Michael Swell, Managing Director, Co-Head Global Lead Portfolio Management, has managed the Fund since 2009.

| BUYING AND SELLING FUND SHARES |

The minimum initial investment for Class A and Class C Shares is, generally, $1,000. The minimum initial investment for Institutional Shares is, generally, $1,000,000 for individual or certain institutional investors, alone or in combination with other assets under the management of the Investment Adviser and its affiliates. There is no minimum for initial purchases of Investor, Class R, Class R6 and Class T Shares, except for certain institutional investors who purchase Class R6 Shares directly with the Fund’s transfer agent for which the minimum initial investment is $5,000,000. Those share classes with a minimum initial investment requirement do not impose it on certain employee benefit plans, and Institutional Shares do not impose it on certain investment advisers investing on behalf of other accounts.

The minimum subsequent investment for Class A and Class C shareholders is $50, except for certain employee benefit plans, for which there is no minimum. There is no minimum subsequent investment for Institutional, Investor, Class R, Class R6 or Class T shareholders.

The Fund does not impose minimum purchase requirements for initial or subsequent investments in Service Shares, although an Intermediary (as defined below) may impose such minimums and/or establish other requirements such as a minimum account balance.

You may purchase and redeem (sell) shares of the Fund on any business day through certain intermediaries that have a relationship with Goldman Sachs & Co. LLC (“Goldman Sachs”), including banks, trust companies, brokers, registered investment advisers and other financial institutions (“Intermediaries”).

| TAX INFORMATION |

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Investments through tax-deferred arrangements may become taxable upon withdrawal from such arrangements.

| PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES |

If you purchase the Fund through an Intermediary, the Fund and/or its related companies may pay the Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your Intermediary’s website for more information.

7 SUMMARY PROSPECTUS — GOLDMAN SACHS BOND FUND

[THIS PAGE LEFT INTENTIONALLY BLANK]

8 SUMMARY PROSPECTUS — GOLDMAN SACHS BOND FUND

MSFISUM2-18V2

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Visa (V) stock rises as Q2 earnings, revenue come ahead of estimates

- Texas Instruments (TXN) jumps on first above-consensus guide in seven years

- Centessa Pharmaceuticals (CNTA) Announces Pricing of $100 Million Public Offering of American Depositary Shares

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Goldman SachsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share