Form 497K Cushing Mutual Funds

NXG FUNDS

CUSHING® MUTUAL FUNDS TRUST

March 30, 2023

Summary Prospectus

NXG NextGen Infrastructure Fund

Class A Shares (NXGAX)

Class I Shares (NXGNX)

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information, reports to shareholders, and other information about the Fund online at https://www.cushingfunds.com/nxg-nextgen-infrastructure-fund/. You may also obtain this information at no cost by calling (888) 878-4080 or by sending an email to contact fundinfo@nxgim.com. The Fund’s Prospectus and Statement of Additional Information, both dated March 30, 2023, are incorporated by reference into this Summary Prospectus.

Paper copies will no longer be mailed. Instead, the Fund will send a notice, either by mail or e-mail, each time your fund’s updated report is available on our website (www.cushingfunds.com).

As with all mutual funds, the SEC has not approved or disapproved of the Fund’s shares or determined whether this Prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Investment Objective

NXG NextGen Infrastructure Fund (formerly, Cushing NextGen Infrastructure Fund) seeks current income and capital appreciation. In seeking current income, the Fund intends to pay current cash distributions to shareholders, regardless of the character of such distributions for tax or accounting purposes.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and examples below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund. More information about these and other discounts is available from your financial professional and in “How to Decide Which Class of Shares to Buy” beginning on page 39 of the Prospectus.

| Class A Shares | Class I Shares | |||||||

Shareholder Fees (fee paid directly from your investment) | ||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 5.50% | None | ||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or redemption proceeds) | None(a) | None | ||||||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends | None | None | ||||||

| Redemption Fee (as a percentage of amount redeemed) | None | None | ||||||

| Wire Transfer Fee | $15 | $15 | ||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||

| Management Fees | 0.85% | 0.85% | ||||||

| Distribution (12b-1) and/or Service Fees | 0.25% | None | ||||||

| Other Expenses(b) | 1.45% | 1.45% | ||||||

| Total Annual Fund Operating Expenses | 2.55% | 2.30% | ||||||

| Expense Waiver/Reimbursement(b) | -1.05% | -1.05% | ||||||

| Total Annual Fund Operating Expenses (After Expense Waiver/Reimbursement) | 1.50% | 1.25% | ||||||

(a) Investors who purchase more than $1,000,000 of Class A Shares may be assessed a contingent deferred sales charge of 1.00% upon redemptions made within twelve (12) months of purchase.

(b) The Investment Adviser has agreed to waive or reimburse the Fund for certain Fund operating expenses, such that total annual Fund operating expenses (including the management fee, but exclusive of any front-end load, deferred sales charge, 12b-1 fees, taxes, brokerage commissions, expenses incurred in connection with any merger or reorganization, acquired fund fees and expenses, or extraordinary expenses such as litigation) will not exceed 1.25% for each of Class A and Class I Shares, subject to possible recoupment from the Fund in future years on a rolling three year basis (within the three years after the date that such expenses have been waived or reimbursed); provided, however, that such recoupment will not cause the Fund’s expense ratio, after recoupment has been taken into account, to exceed the lesser of the expense cap in effect at the time of the waiver or the expense cap in effect at the time of recoupment. Such waiver or reimbursement may not be terminated without the consent of the Board of Trustees of the Trust (the “Board”) before March 31, 2024 and may be modified or terminated by the Investment Adviser at any time thereafter.

Example:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses (giving effect to the expense limitation only during the first year) remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| Class A Shares | $694 | $1,205 | $1,742 | $3,202 | ||||||||||

| Class I Shares | $127 | $618 | $1,135 | $2,554 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes payable by the Fund. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. The portfolio turnover rate of the Fund for its most recent fiscal year was 241.02% of the average value of its portfolio.

Principal Investment Strategies of the Fund

Under normal market conditions, the Fund invests at least 80% of its assets (net assets plus any borrowings for investment purposes) in a portfolio of equity and debt securities of infrastructure companies, including energy infrastructure companies, industrial infrastructure companies, sustainable infrastructure companies and technology and communication infrastructure companies. The Fund is diversified and it may invest in companies of any market capitalization size.

The infrastructure investment landscape is rapidly evolving due to technological advancement and obsolescence. While some energy and industrial infrastructure companies (sometimes referred to as “traditional” infrastructure companies) are now in their maturity phase, many traditional infrastructure companies have become leaders in implementing technological innovations. The Fund’s next generation focus within the infrastructure investment landscape consists of these innovative infrastructure companies along with sustainable infrastructure companies and technology and communication infrastructure companies. Similar to traditional infrastructure assets, which provide the underlying foundation of basic services, facilities and institutions and are often said to form the “backbone” of the economy, technology and communication infrastructure assets provide the underlying foundation of the data that drives the modern knowledge economy.

The Fund considers an infrastructure company to be any company that has at least 50% of its assets, income, revenue, sales or profits committed to or derived from the ownership, operation, management, construction, development, servicing or financing of infrastructure assets. Infrastructure assets include energy infrastructure assets, industrial infrastructure assets, sustainable infrastructure assets and technology and communication infrastructure assets. Each are described as follows:

•Energy infrastructure assets are physical structures and networks for the transportation, storage and transmission of energy. Examples of energy infrastructure assets include: electricity transmission and distribution lines and facilities used in gathering, treating, processing, fractionation, transportation and storage of hydrocarbon products.

•Industrial infrastructure assets are structures that allow transportation of goods and people, logistics assets, assets that improve productivity and automation of existing capacity, and materials critical to establish these networks. Examples of industrial infrastructure assets include: toll roads; bridges and tunnels; airports; seaports; railroads; water and sewage treatment facilities and distribution pipelines; communication towers, cables, and satellites; and security systems related to the foregoing assets.

•Sustainable infrastructure assets consist of renewable energy infrastructure assets. Examples of sustainable infrastructure assets include: power generation from renewable and other clean energy sources, including utility scale and distributed solar power, wind, hydroelectric and geothermal power, renewable energy storage and electric vehicle charging networks, as well as waste collection and recycling, water purification and desalinization.

2

•Technology and communication infrastructure assets consist of assets, systems and technologies that collect, enable, analyze, optimize, automate, transmit and secure the data that allows businesses and other organizations to operate. Examples of technology and communications infrastructure assets include: data centers, cloud, hosting, and database systems, transactional and financial back-end systems, customer relationship management systems, smart city technologies, network security and cybersecurity, automation systems, human resource and workforce management and industry specific infrastructure software.

The Fund will invest at least 25% of its assets in companies operating in the energy and energy infrastructure sectors.

The Fund may invest in non-U.S. securities, including securities of issuers in emerging markets. The Fund’s investments may include non-U.S. securities represented by American Depositary Receipts or “ADRs.”

The Fund will not invest more than 25% of its total assets in master limited partnerships or “MLPs” that are treated as Qualified Publicly Traded Partnerships for U.S. federal income tax purposes. MLPs are generally treated as partnerships for U.S. federal income tax purposes and are generally organized under state law as limited partnerships or limited liability companies. To be treated as a partnership for U.S. federal income tax purposes, an MLP must derive at least 90% of its gross income for each taxable year from qualifying sources, including natural resources-based activities such as the exploration, development, mining, production, processing, refining, transportation, storage and certain marketing of mineral or natural resources.

The Fund may invest in debt securities of any maturity or duration (a measure of the price sensitivity of a fixed-income investment to changes in interest rates, expressed as a number of years). Debt securities rated below investment grade (that is, rated Ba or lower by Moody’s Investors Service, Inc. (“Moody’s”), BB or lower by Standard & Poor’s (“S&P”) or Fitch Ratings (“Fitch”), comparably rated by another statistical rating organization, or, if unrated, as determined by the Investment Adviser to be of comparable credit quality) are commonly known as “junk bonds” and are regarded as predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal in accordance with the terms of the obligations, and involve major risk exposure to adverse conditions. The Fund may invest in below investment grade securities, however, the Fund will not invest more than 5% of its total assets in debt securities that are rated, at the time of investment, below B3 by Moody’s or B- by S&P or Fitch or comparably rated by another rating agency or, if unrated, as determined by the Investment Adviser to be of comparable credit quality.

Principal Risks of Investing in the Fund

The value of the Fund’s investments may increase or decrease, which will cause the value of the Fund’s shares to increase or decrease. As a result, you may lose money on your investment in the Fund, and there can be no assurance that the Fund will achieve its investment objective. See “Additional Information About the Funds” in the Prospectus for more information about these and other risks of investing in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Market Risk. The value of the Fund’s investments may fluctuate because of changes in the markets in which the Fund invests, which could cause the Fund to underperform other funds with similar objectives. Changes in these markets may be rapid and unpredictable, particularly under current economic, financial, labor, and health conditions. From time to time, markets may experience periods of stress for potentially prolonged periods that may result in: (i) increased market volatility; (ii) reduced market liquidity; and (iii) increased redemptions. Such conditions may add significantly to the risk of volatility in the net asset value of the Fund’s shares.

Issuer Risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s products or services.

Concentration Risk. Because the Fund will be concentrated in the group of industries constituting the energy and energy infrastructure sectors, it will be more susceptible to the risks associated with those sectors than if it were more broadly diversified over numerous industries and sectors of the economy. Companies in the energy and energy infrastructure sectors may be affected by fluctuations in the prices of energy commodities. The highly cyclical nature of the industries in which companies in the energy and energy infrastructure sectors operate may adversely affect the earnings or operating cash flows of such companies or the ability of such companies to borrow money or

3

raise capital needed to fund their continued operations. A significant decrease in the production of energy commodities could reduce the revenue, operating income and operating cash flows of certain companies in the energy and energy infrastructure sectors and, therefore, their ability to make distributions or pay dividends. A sustained decline in demand for energy commodities could adversely affect the revenues and cash flows of certain companies in the energy and energy infrastructure sectors. General changes in market sentiment towards the energy and energy infrastructure sectors may adversely affect the Fund, and the performance of investments in the energy and energy infrastructure sectors may lag behind the broader market as a whole. The energy markets have experienced significant volatility in recent periods, including as a result of the COVID-19 pandemic, during which demand for energy commodities fell sharply and energy commodity prices reached historic lows, and may continue to experience relatively high volatility for a prolonged period. In addition, the consequences of the Russian invasion of Ukraine, including international sanctions and increased disruption to supply chains, have contributed to increased volatility in the energy markets. Such conditions may negatively impact the Fund and its shareholders. The Investment Adviser may take measures to navigate the conditions of the energy markets, but there is no guarantee that such efforts will be effective or that the Fund’s performance will correlate with any increase in oil and gas prices.

Infrastructure Companies Risk. Infrastructure companies may be subject to a variety of factors that may adversely affect their business or operations, including high interest costs in connection with capital construction and improvement programs, high leverage, costs associated with environmental and other regulations, the effects of economic slowdown, surplus capacity, increased competition from other providers of services, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies and other factors. Infrastructure companies may also be affected by or subject to difficulty in raising capital in adequate amounts on reasonable terms in periods of high inflation and unsettled capital markets; inexperience with and potential losses resulting from a developing de-regulatory environment; costs associated with compliance with and changes in environmental and other regulations; regulation or adverse actions by various government authorities; government regulation of rates charged to customers; service interruption due to environmental, operational or other mishaps; the imposition of special tariffs and changes in tax laws, regulatory policies and accounting standards; technological innovations that may render existing plants, equipment or products obsolete; and general changes in market sentiment towards infrastructure assets. Recently imposed tariffs on imports to the United States could affect operating or construction costs for a number of companies in which the Fund invests.

Sustainable infrastructure investments are subject to certain additional risks including high dependency upon government policies that support renewable power generation and enhance the economic viability of owning renewable electric generation assets; adverse impacts from the reduction or discontinuation of tax benefits and other similar subsidies that benefit sustainable infrastructure companies; dependency on suitable weather condition and risk of damage to components used in the generation of renewable energy by severe weather; adverse changes and volatility in the wholesale market price for electricity in the markets served; the use of newly developed, less proven, technologies and the risk of failure of new technology to perform as anticipated; and dependence on a limited number of suppliers of system components and the occurrence of shortages, delays or component price changes. There is a risk that regulations that provide incentives for renewable energy could change or expire in a manner that adversely impacts the market for sustainable infrastructure companies generally.

Technology and communications infrastructure investments are subject to certain additional risks including rapidly changing technologies and existing product obsolescence; short product life cycles; fierce competition; high research and development costs; aggressive pricing and reduced profit margins; the loss of patent, copyright and trademark protections; cyclical market patterns; evolving industry standards; frequent new product introductions and new market entrants; cyber security risks that include, among other things, theft, unauthorized monitoring, release, misuse, loss, destruction or corruption of confidential and highly restricted data, denial of service attacks, unauthorized access to relevant systems, compromises to networks or devices that the information infrastructure companies use, or operational disruption or failures in the physical infrastructure or operating systems, potentially resulting in, among other things, financial losses, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs and/or additional compliance costs.

Equity Securities Risk. Equity securities can be affected by macroeconomic, political, global and other factors affecting the stock market in general, expectations of interest rates, investor sentiment towards the issuer or the industry or sector in which such issuer operates, changes in a particular issuer’s financial condition, or unfavorable or unanticipated poor performance of a particular issuer.

4

Debt Securities Risk. The risks of investing in debt or fixed-income securities include: (i) credit risk, e.g., the issuer or guarantor of a debt security may be unable or unwilling (or be perceived as unable or unwilling) to make timely principal and/or interest payments or otherwise honor its obligations; (ii) maturity/duration risk, e.g., a debt security with a longer maturity or duration (a measure of the price sensitivity of a fixed-income investment to changes in interest rates, expressed as a number of years) may fluctuate in value more than one with a shorter maturity; (iii) market risk, e.g., low demand for debt securities may negatively impact their price; (iv) interest rate risk, e.g., when interest rates go up, the value of a debt security generally goes down, and when interest rates go down, the value of a debt security generally goes up (long-term debt securities are generally more susceptible to interest rate risk than short-term debt securities); and (v) call risk, e.g., during a period of falling interest rates, the issuer may redeem a security by repaying it early, which may reduce the Fund’s income if the proceeds are reinvested at lower interest rates.

While interest rates were historically low in recent years, the Board of Governors of the Federal Reserve System (the “Federal Reserve”) has recently been increasing the Federal Funds rate in an effort to address inflation. Rising interest rates or lack of market participants may lead to decreased liquidity and increased volatility in the debt securities markets, making it more difficult for the Fund to sell its debt securities holdings at a time when the Investment Adviser might wish to sell. Decreased liquidity in the debt securities markets also may make it more difficult to value some or all of the Fund’s debt securities holdings. The risk of interest rates rising is more pronounced in the current market environment because of recent monetary policy measures and the low interest rate environment in recent years.

Below investment grade debt securities are considered to have speculative characteristics and some may be commonly referred to as “junk bonds.” Junk bonds entail default and other risks greater than those associated with higher-rated securities.

Master Limited Partnership Risk. Holders of MLP units are subject to certain risks inherent in the structure of MLPs, including (i) tax risks; (ii) the limited ability to elect or remove management or the general partner or managing member; (iii) limited voting rights, except with respect to extraordinary transactions; and (iv) conflicts of interest between the general partner or managing member and its affiliates, on the one hand, and the limited partners or members, on the other hand, including those arising from incentive distribution payments or corporate opportunities.

Risks Associated with an Investment in Non-U.S. Companies. Generally, foreign securities are issued by companies organized outside the U.S. and are traded primarily in markets outside the U.S., but foreign debt securities may be traded on bond markets or over-the-counter markets in the U.S. Foreign securities may be more difficult to sell than U.S. securities. Investments in foreign securities may involve difficulties in receiving or interpreting financial and economic information, possible imposition of taxes, higher brokerage and custodian fees, possible currency exchange controls or other government restrictions, including possible seizure or nationalization of foreign deposits or assets. Foreign securities may also be less liquid and more volatile than U.S. securities. There may also be difficulty in invoking legal protections across borders. In addition, investments in emerging market countries present risks to a greater degree than those presented by investments in countries with developed securities markets and more advanced regulatory systems.

Some of the foreign securities in which the Fund invests will be denominated in a foreign currency. Changes in foreign currency exchange rates will affect the value of securities denominated or quoted in foreign currencies. Exchange rate movements can be large and can endure for extended periods of time, affecting either favorably or unfavorably the value of the Fund’s assets. However, the Fund may engage in foreign currency transactions to attempt to protect itself against fluctuations in currency exchange rates in relation to the U.S. dollar.

Market Capitalization Risk. To the extent the Fund invests in the securities issued by small-, mid-, or large-cap companies, the Fund will be subject to the risks associated with securities issued by companies of the applicable market capitalization. Securities of small-cap and mid-cap companies may be subject to greater price volatility, significantly lower trading volumes, cyclical, static or moderate growth prospects and greater spreads between their bid and ask prices than securities of larger companies. Smaller capitalization companies frequently rely on narrower product lines and niche markets and may be more vulnerable to adverse business or market developments. Securities issued by larger companies may have less growth potential and may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods. In addition, larger companies may be less capable of responding quickly to competitive challenges and industry changes, including those resulting

5

from improvements in technology, and may suffer sharper price declines as a result of earnings disappointments. There is a risk that the securities issued by companies of a certain market capitalization may underperform the broader market at any given time.

Liquidity and Valuation Risk. Market prices may not be readily available for certain of the Fund’s investments, and the value of such investments will ordinarily be determined based on fair valuations determined by the Investment Adviser pursuant to procedures adopted by the Board and the Investment Adviser as valuation designee.

Securities purchased by the Fund may be illiquid at the time of purchase or liquid at the time of purchase and subsequently become illiquid due to, among other things, events relating to the issuer of the securities, market events, operational issues, economic conditions, investor perceptions or lack of market participants. The lack of an active trading market may make it difficult to sell or obtain an accurate price for a security. If market conditions or issuer specific developments make it difficult to value securities, the Fund may value these securities using more subjective methods, such as fair value pricing. In such cases, the value determined for a security could be different than the value realized upon such security’s sale. As a result, an investor could pay more than the market value when buying Fund shares or receive less than the market value when selling Fund shares. This could affect the proceeds of any redemption or the number of shares an investor receives upon purchase. Liquidity risk may also refer to the risk that the Fund may not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, unusually high volume of redemptions, or other reasons. To meet redemption requests or to raise cash to pursue other investment opportunities, the Fund may be forced to sell securities at an unfavorable time and/or under unfavorable conditions, which may adversely affect the Fund.

Management Risk. The Fund’s portfolio is subject to investment management risk because it will be actively managed. The Investment Adviser will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that they will produce the desired results. The decisions with respect to the management of the Fund are made exclusively by the Investment Adviser, subject to the oversight of the Board. Investors have no right or power to take part in the management of the Fund. The Investment Adviser also is responsible for all of the trading and investment decisions of the Fund. In the event of the withdrawal or bankruptcy of the Investment Adviser, generally the affairs of the Fund will be wound-up and its assets will be liquidated.

Portfolio Turnover Risk. The Fund may have a high turnover of the securities held in its portfolio. Increased portfolio turnover causes the Fund to incur higher brokerage costs, which may adversely affect the Fund’s performance and may produce increased taxable distributions. Portfolio turnover is not a principal consideration in investment decisions for the Trust, and the Trust is not subject to any limit on the frequency with which portfolio securities may be purchased or sold.

Initial Public Offerings (IPO) Risk. The Fund may invest in IPO securities. The prices of IPO securities often fluctuate more than prices of securities of companies with longer trading histories and sometimes experience significant price drops shortly after their initial issuance. In addition, companies offering securities in IPOs may have less experienced management or limited operating histories.

Performance

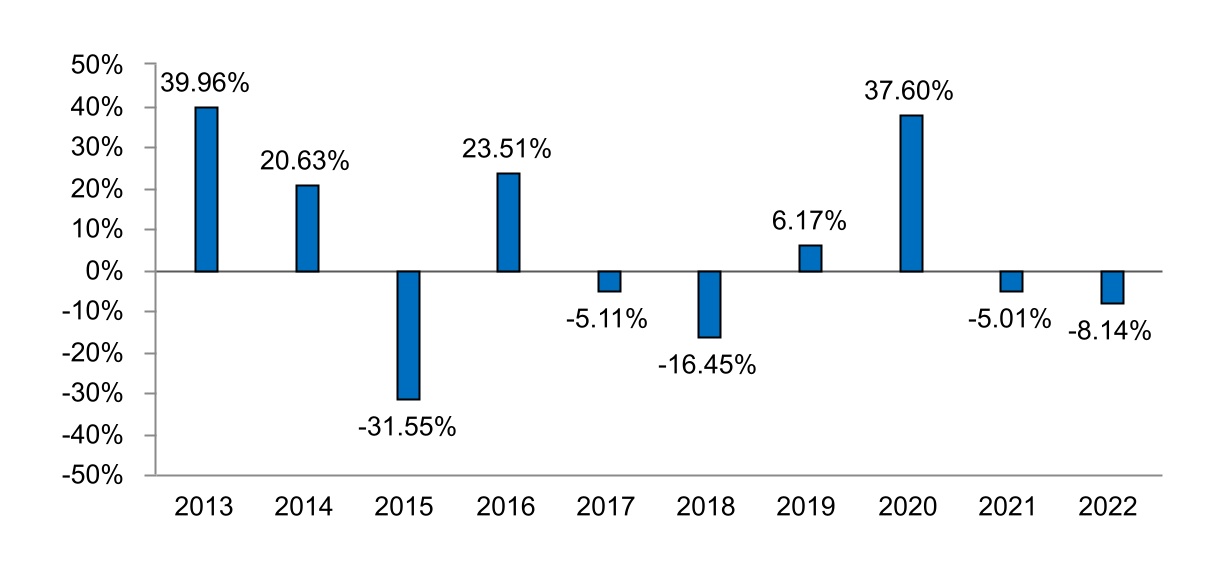

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for the 1-year, five-year and since inception periods compare with various broad-based benchmarks. Past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. The returns in the bar chart and best/worst quarter are for Class I Shares and do not reflect a sales charge. If the Class A sales charge was reflected, the returns would be lower. The performance of other share classes will differ due to their different expense structures. Updated performance is available on the Fund’s website www.cushingfunds.com and by calling (888) 777-2346.

On December 15, 2017, the Fund acquired the assets and assumed the liabilities of The Cushing® MLP Infrastructure Fund I, a closed-end fund (the “Predecessor Fund”). Class I Shares of the Fund have assumed the performance, financial and other historical information of the Predecessor Fund’s common units of beneficial interest.

6

1.The performance of Class I Shares of the Fund for periods prior to December 15, 2017 reflects the performance of the Predecessor Fund. Performance has not been restated to reflect the estimated annual operating expenses of Class I Shares.

2.The performance of Class A Shares of the Fund for periods prior to December 15, 2017 reflects the performance of common units of the Predecessor Fund and is calculated using the fees and expenses of Class A Shares of the Fund.

Performance of the Fund may differ from the Predecessor Fund, as the Predecessor Fund differed from the Fund in important ways, including its principal investment strategies, its structure as a closed-end fund, its status as a partnership for U.S. federal income tax purposes and its operation during certain periods within a master-feeder structure.

In addition, the Fund adopted certain changes to its non-fundamental investment policies effective as of December 1, 2019. As a result, performance of the Fund may differ from the Fund’s performance for periods prior to December 1, 2019.

Annual Total Returns for Class I Shares (calendar year-end)

Best Quarter: | 2nd Quarter 2020 | 27.44% | Worst Quarter: | 3rd Quarter 2015 | -25.30% | |||||||||||||||

7

Average Annual Total Returns (for Periods Ended December 31, 2022)

One Year | Five Year | 10 Year | Since Inception (March 1, 2010) | |||||||||||

| Class I Shares | ||||||||||||||

| Returns before taxes | -8.14% | 1.27% | 3.73% | 6.66% | ||||||||||

| Returns After Taxes on Distributions | -8.14% | 0.25% | 2.01% | 4.96% | ||||||||||

| Returns After Taxes on Distributions and Sale of Fund Shares | -4.82% | 0.62% | 2.18% | 4.65% | ||||||||||

| Class A Shares | ||||||||||||||

| Returns before taxes | -13.49% | -0.19% | 2.89% | 5.93% | ||||||||||

S&P 500® Index | -19.44% | 7.51% | 10.41% | 10.11% | ||||||||||

| (reflects no deduction for fees, expenses or taxes) | ||||||||||||||

| S&P Global Infrastructure Index (Net Total Return) | -0.99% | 2.99% | 5.61% | 5.84% | ||||||||||

After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for Class I shares only. After-tax returns for Class A shares will vary. The returns in the table above reflect the sales loads for Class A shares.

In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax benefit to the investor.

The bar chart and table assume that all distributions have been reinvested. Performance reflects fee waivers, if any, in effect during the periods presented. If any such waivers were not in place, returns would be reduced.

Investment Adviser

Cushing® Asset Management, LP, doing business as NXG Investment Management (“NXG”), is the Fund’s investment adviser.

Portfolio Managers

Saket Kumar, Portfolio Manager and Co-Chief Investment Officer, Global Equities of the Investment Adviser, Alex Palma, Portfolio Manager and Senior Research Analyst of the Investment Adviser and Hari Kusumakar, Portfolio Manager and Senior Research Analyst of the Investment Adviser, are primarily responsible for the day-to-day management of the Fund’s portfolio. Messrs. Kumar, Palma and Kusumakar have been portfolio managers of the Fund since 2019.

Purchase and Sale of Fund Shares

You may purchase or redeem Fund shares by mail (NXG NextGen Infrastructure Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701 (for regular mail) or 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53202 (for overnight or express mail), or by telephone at (888) 878-4080. You may also exchange shares of the Fund for shares of another Fund in the Cushing® Mutual Funds Trust. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly. The minimum initial investment amount for Class A Shares is $2,000 ($250 for IRAs). For corporate sponsored retirement

8

plans, there is no minimum initial investment. The minimum initial investment amount for Class I Shares is $250,000. The minimum subsequent investment for all share classes is $100.

Tax Information

The Fund’s distributions may be taxable to you as ordinary income or capital gains, or a combination of the two, except when your investment is held in an IRA, 401(k) or other tax-advantaged account. Investments through tax-advantaged accounts may become taxable upon withdrawal from such accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

9

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- SCAD Names Bob Weis Executive in Residence

- AMA New York Announces Inductees to 2024 Marketing Hall of Fame

- Shopoff Realty Investments Promotes Christy Hutchison to Senior Vice President, National Accounts

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share