Prospectus

October 22, 2018

State Street Institutional Funds

State Street Institutional Small-Cap Equity Fund (SIVIX)

Like all mutual funds, the State Street Institutional Funds’ shares have not been approved or disapproved by the Securities and Exchange Commission, nor has the Securities and

Exchange Commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

State Street Institutional Small-Cap Equity Fund

Investment Class SIVIX

|

| INVESTMENT OBJECTIVE |

| Long-term growth of capital. |

FEES AND EXPENSES OF THE FUND

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

|

|

|

| SHAREHOLDER FEES (fees paid directly from your investment): |

|

N/A |

|

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your

investment) |

| |

|

Investment Class |

| Management Fees1 |

|

0.88% |

| Distribution and /or Service (12b-1) Fees |

|

N/A |

| Other Expenses |

|

0.00% |

| Total Annual Fund Operating Expenses |

|

0.88% |

| 1 |

The Fund’s management fee is a “unitary” fee that includes most operating expenses payable by the Fund. The rate fluctuates based upon the average

daily net assets of the Fund, and may be higher or lower than shown above. |

EXPENSE EXAMPLE

The example below is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods or continue to

hold them. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

| Investment Class |

|

$90 |

|

$281 |

|

$488 |

|

$1,084 |

PORTFOLIO TURNOVER

The Fund

pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held

in a taxable account. These costs, which are not reflected in the Annual Fund Operating Expenses or in the Expense Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 34% of

the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund seeks to achieve its investment objective by investing at least 80% of its net assets (plus any borrowings for investment purposes) under normal circumstances in equity securities of small-cap companies, such as common and preferred stocks.

The Fund defines a small-cap company as one with a market capitalization that, at the time of investment, falls between (a) the market capitalization of the smallest company in the Russell 2000® Index and (b) either the market capitalization of the largest company in the Russell 2000® Index or $3.0 billion. As of December 31, 2017, the market capitalizations of companies in the Russell 2000® Index ranged from $14.8 million to $8.8 billion*. The portfolio managers will not sell a stock merely because the

market capitalization of a company in the portfolio moves outside of this capitalization range or because the index capitalization range changes.

| * |

The Russell 2000® Index is constructed to provide an unbiased small-cap barometer and is reconstituted annually. The capitalization range, however, may change significantly intra-year due to changes in the market capitalizations of securities that comprise the Index.

|

1

The Fund uses a multi sub-adviser investment strategy that combines growth,

value and core investment management styles. SSGA Funds Management, Inc. (“SSGA FM”), the Fund’s investment adviser, will allocate the Fund’s assets among the sub-advisers to maintain

exposure to a combination of investment styles, but may have larger allocations to certain sub-advisers based on its assessment of the potential for better performance or to address capacity constraints of a

particular sub-adviser, among other reasons. As a result, this orientation will typically produce a portfolio that does not materially favor value or growth style investing, and allows the Fund the potential

to benefit from both value and growth cycles in the marketplace. Stock selection is key to the performance of the Fund.

The portfolio managers seek to

identify securities of companies with characteristics such as:

| • |

|

high quality management focused on generating shareholder value |

| • |

|

attractive products or services |

| • |

|

appropriate capital structure |

| • |

|

strong competitive positions in their industries |

In addition, the portfolio managers of a sub-adviser with a value investment style generally will seek to identify

securities of companies with characteristics such as attractive valuation, while portfolio managers of a sub-adviser with a growth investment style generally will seek to identify securities of companies with

strong growth potential.

The portfolio managers may consider selling a security when one of these characteristics no longer applies, or when valuation

becomes excessive and more attractive alternatives are identified.

The Fund also may invest to a lesser extent in securities with capitalizations

outside the Fund’s small-cap range, debt securities and securities of foreign (non-U.S.) issuers. The portfolio managers may also use various types of derivative

instruments (primarily futures contracts) to gain or hedge exposure to certain types of securities as an alternative to investing directly in or selling such securities.

PRINCIPAL RISKS

The principal risks of investing in the Fund are:

Securities Market Risk is the risk that the value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due

to factors affecting particular companies or the securities markets generally. A general downturn in the securities markets may cause multiple asset classes to decline in value simultaneously, although equity securities generally have greater price

volatility than fixed income securities. Negative conditions and price declines may occur unexpectedly and dramatically. In addition, the Fund could be forced to sell portfolio securities at an inopportune time in order to meet unusually large or

frequent redemption requests in times of overall market turmoil or declining prices for the securities.

Small-Cap Company Risk is the risk that investing in the securities of small-cap companies may pose greater market and liquidity risks than larger, more established

companies, because of limited product lines and/or operating history, limited managerial and financial resources, limited trading markets, and the potential lack of management depth. In addition, the securities of such companies are typically more

volatile than securities of larger capitalization companies.

Growth Investing Risk is the risk of investing in growth stocks that

may be more volatile than other stocks because they are more sensitive to investor perceptions of the issuing company’s growth potential. Growth-oriented funds will typically underperform when value investing is in favor.

Value Investing Risk is the risk of investing in undervalued stocks that may not realize their perceived value for extended periods of time

or may never realize their perceived value. Value stocks may respond differently to market and other developments than other types of stocks. Value-oriented funds will typically underperform when growth investing is in favor.

Allocation Risk is the risk that SSGA FM may not allocate assets of the Fund among strategies, asset classes or investment management styles

in an optimal manner, if, among other reasons, it does not correctly assess the attractiveness of a strategy, asset class or investment style.

Foreign Investment Risk is the risk that investing in securities of foreign (non-U.S.) issuers may result in the Fund experiencing more rapid and extreme changes in

value than a fund that invests exclusively in securities of U.S. companies, due to smaller markets, differing reporting, accounting and auditing standards, increased risk of delayed settlement of portfolio transactions, and the risk of unfavorable

foreign government actions, including

2

nationalization, expropriation or confiscatory taxation, currency blockages and political changes or diplomatic developments. The costs of investing are higher in many foreign markets than in the

U.S., and securities of foreign (non-U.S.) issuers may be less liquid and more difficult to value than securities of U.S. issuers. The risk of loss and volatility have increased in recent periods and may

continue because of high levels of debt and other economic distress in various countries, including some in Europe. Attempted solutions such as austerity or stimulus measures and governmental regulation also may increase the risk of loss and

volatility in securities markets.

Currency Risk is the risk that the dollar value of foreign investments will change in response

to changes in currency exchange rates. If a foreign currency weakens against the U.S. dollar, the U.S. dollar value of an investment denominated in that currency would also decline.

Credit Risk is the risk that the issuer or guarantor of a fixed income security, or the counterparty of a derivative instrument contract or

repurchase agreement, is unable or unwilling (or is perceived to be unable or unwilling) to make timely payment of principal and/or interest, or to otherwise honor its obligations.

Interest Rate Risk is the risk that fixed income securities will decline in value because of changes in interest rates. Bond prices generally

rise when interest rates decline and generally decline when interest rates rise. Although governmental financial regulators, including the U.S. Federal Reserve, have taken steps to maintain historically low interest rates, the U.S. Federal Reserve

recently raised interest rates slightly. It is possible there will be less governmental action in the future to maintain low interest rates or that action will be taken to raise interest rates further, which may have unpredictable effects on markets

and the Fund’s investments.

Management Risk is the risk that the investment techniques and risk analyses applied by the

investment adviser or the sub-advisers, as applicable, will not produce the desired results and that legislative, regulatory or tax restrictions, policies or developments may affect the investment techniques

available to the investment adviser or the sub-advisers, as applicable, and the portfolio managers in connection with managing the Fund. There is no guarantee that the investment objective of the Fund will be

achieved.

Multi-Style Management Risk is the risk that, because portions of the Fund’s assets are managed by different sub-advisers using different investment styles, the Fund could engage in overlapping security transactions, potentially leading to the Fund holding a more concentrated position in these securities. The Fund could

also take opposite positions in securities of the same issuer, which may lead to higher transaction costs compared to a fund using a single investment style.

Derivative Instruments Risk is a combination of several risks, including the risks that: (1) an investment in a derivative instrument will not correlate well with the performance of the securities or

asset class to which the Fund seeks exposure or which the Fund seeks to hedge, and (2) a derivative instrument entailing leverage may result in a loss greater than the principal amount invested. In addition, changes in laws or regulations may

make the use of derivative instruments more costly, may limit the Fund’s ability to employ certain strategies that use derivative instruments and/or may adversely affect the value of derivative instruments and the Fund’s performance.

It is possible to lose money on an investment in the Fund, and this risk of loss may be heightened if you hold shares of the Fund for a shorter period.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency.

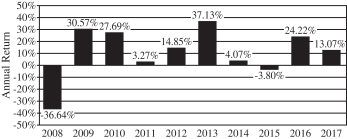

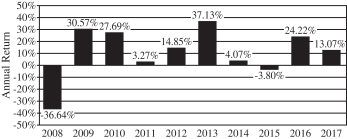

PERFORMANCE

The bar chart and the Average Annual Total Returns table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how

the Fund’s average annual returns compare with the returns of a broad-based securities market index. Past performance assumes the reinvestment of all dividend income and capital gains distributions. The Fund’s past performance is not

necessarily an indication of how the Fund will perform in the future. For updated performance information, please visit the Fund’s website at www.ssga.com/geam or call the GE Retirement Savings Plan Service Center at 1-877-554-3777.

CALENDAR YEAR TOTAL RETURNS (%)

Highest/Lowest quarterly results during this time period were:

Highest 20.58% (quarter ended June 30, 2009)

Lowest -27.40% (quarter

ended December 31, 2008)

3

AVERAGE ANNUAL TOTAL RETURNS (%) (for the periods ended December 31, 2017)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

Since Inception |

|

| Investment Class (inception 8/3/98) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return Before Taxes |

|

|

13.07% |

|

|

|

14.03% |

|

|

|

9.22% |

|

|

|

9.63% |

|

| Russell 2000®

Index (does not reflect fees, expenses or taxes) |

|

|

14.65% |

|

|

|

14.12% |

|

|

|

8.71% |

|

|

|

8.34% |

* |

PORTFOLIO

MANAGEMENT

INVESTMENT ADVISER

SSGA FM

INVESTMENT SUB-ADVISERS

Champlain Investment Partners, LLC

GlobeFlex Capital, L.P.

Kennedy Capital Management, Inc.

Palisade Capital Management, L.L.C.

SouthernSun Asset Management, LLC

PORTFOLIO MANAGERS

The primary individual portfolio managers of the Fund are:

|

|

|

|

|

| Portfolio Manager |

|

Portfolio manager experience in this Fund |

|

Primary title with Investment Adviser/Sub-Advisers |

| David Wiederecht |

|

Since 2010 |

|

Executive Vice President at State Street Global Advisors (“SSGA”) |

| Dennis Santos |

|

Since 2017 |

|

Vice President at SSGA |

| Scott Brayman, CFA |

|

Since 2008 |

|

Managing Partner and Chief Investment Officer of Small and Mid Cap Strategies of Champlain Investment Partners, LLC |

| Robert Anslow |

|

Since 2008 |

|

Partner and Chief Investment Officer of GlobeFlex Capital, L.P. |

| Frank Latuda, Jr., CFA |

|

Since 2010 |

|

Vice President, Director and Chief Investment Officer of Kennedy Capital Management, Inc. |

| Marc Shapiro |

|

Since 2012 |

|

Managing Director and Senior Portfolio Manager of Palisade Capital Management, L.L.C. |

| Michael Cook |

|

Since 2008 |

|

Chief Executive Officer and Chief Investment Officer of SouthernSun Asset Management, LLC |

PURCHASE AND SALE OF FUND SHARES

|

|

|

|

|

| |

|

Purchase Minimum |

| Eligible Investors |

|

Initial

Investment |

|

Subsequent

Investments |

| • Individuals who are plan

participants in the General Electric Retirement Savings Plan. |

|

None |

|

None |

You may purchase Fund shares or sell (redeem) all or part of your Fund shares on any business day through the following options:

| • |

|

Visit benefits.ge.com and click on My GE RSP. |

| • |

|

Call the GE RSP Service Center at

1-877-55-GERSP

(1-877-554-3777) between 8:30 a.m. and 8:30 p.m., Eastern time, on any day the New York Stock Exchange is open for trading.

|

TAX INFORMATION

Since you

are investing through a tax-deferred 401(k) plan, dividends and capital gains distributions you receive from the Fund are not subject to federal income taxes or other taxes at the time of their distribution,

but may be subject to federal income tax upon withdrawal.

4

MORE ON STRATEGIES, RISKS AND DISCLOSURE OF PORTFOLIO HOLDINGS

IMPORTANT DEFINITIONS

This

section defines important terms that may be unfamiliar to an investor reading about the Fund.

Bank deposits are cash, checks or drafts

deposited in a financial institution for credit to a customer’s account. Banks differentiate between demand deposits (checking accounts on which the customer may draw) and time deposits, which pay interest and have a specified maturity or

require 30 days’ notice before withdrawal.

Cash includes bank deposits and highly rated, liquid short-term instruments, such as

money market instruments. Certain of these instruments may be referred to as cash equivalents.

Commercial paper includes short-term

debt securities issued by banks, corporations and other borrowers.

Common stock is a class of security representing equity ownership in a

corporation. Holders of common stock have the right to elect directors and collect dividends. Common stock claims are subordinate to bondholder claims, preferred stockholders, and general creditors.

Convertible securities may be debt or equity securities that pay interest or dividends or are sold at a discount and that may be converted on

specified terms into the stock of the issuer.

Debt obligations of supranational agencies are obligations of multi-jurisdictional agencies that

operate across national borders (e.g., the World Bank).

Debt securities are bonds and other securities that are used by issuers to borrow money

from investors. Holders of debt securities have a higher priority claim to assets than do equity holders. Typically, the debt issuer pays the investor a fixed, variable or floating rate of interest and must repay the borrowed amount at

maturity. Some debt securities are sold at a discount from their face values instead of paying interest.

Depositary receipts represent

interests in an account at a bank or trust company which holds equity securities. These interests may include American Depositary Receipts (held at U.S. banks and traded in the United States) (“ADRs”), European Depositary Receipts,

Global Depositary Receipts or other similar instruments.

Derivative instruments are instruments or contracts whose values are based on the

performance of an underlying financial asset, currency or index and include futures contracts (on single stocks, on indices, currencies or bonds), options (on stocks, indices,

currencies, futures contracts or bonds), forward contracts, interest-only and principal-only debt securities and certain mortgage-backed securities like collateralized

mortgage obligations (“CMOs”).

Duration is the expected change in the value of a portfolio of fixed income securities that will result

from a 1% change in interest rates. Duration is stated in years. For example, a 5 year average portfolio duration means the portfolio would be expected to decrease in value by 5% if interest rates rise 1%. Unlike maturity, duration takes into

account interest payments that occur throughout the course of holding a fixed income security.

Equitized cash is a technique that uses futures or

other instruments (such as exchange traded funds) to gain equity market exposure for holdings of cash. The use of futures or other instruments would be subject to other applicable restrictions on the Fund’s investments.

Equity securities may include common stocks, preferred securities, depositary receipts, convertible securities, and rights

and warrants of U.S. and foreign companies. Stocks represent an ownership interest in a corporation.

Foreign debt securities are issued by

foreign corporations or governments. They may include the following:

| • |

|

Eurodollar Bonds, which are dollar-denominated securities issued outside the U.S. by foreign corporations and financial institutions and by foreign branches of

U.S. corporations and financial institutions |

| • |

|

Yankee Bonds, which are dollar-denominated securities issued by foreign issuers in the U.S. |

| • |

|

Debt securities denominated in currencies other than U.S. dollars |

Foreign securities include interests in or obligations of governments or entities located outside the United States. The determination of where an issuer of a security is located will be made by reference to

the country in which the issuer (i) is organized, (ii) derives at least 50% of its revenues or profits from goods produced or sold, investments made or services performed, (iii) has at least 50% of its assets situated, (iv) has

the principal trading market for its securities, or (v) is assessed a non-U.S. risk rating by a recognized third-party rating agency. Foreign securities may be denominated in non-U.S. currencies and traded outside the United States or may be in the form of depositary receipts.

Forward contracts involve agreements to exchange one currency for another at a future date. Forward contracts, unlike futures contracts, are

not traded on

5

exchanges and are not standardized; rather, banks and dealers act as principals in these markets, negotiating each transaction on an individual basis.

Futures contracts are agreements to buy or sell a specific amount of a commodity, financial instrument, currency or index at a particular price and future

date.

Growth investing involves buying stocks with above-average growth rates. Typically, growth stocks are the stocks of faster growing

companies in more rapidly growing sectors of the economy. Generally, growth stock valuation levels will be higher than those of value stocks and the market averages.

High yield securities are debt securities, preferred securities and convertible securities of corporations rated Ba through C by Moody’s Investors Service, Inc.

(“Moody’s”) or BB through D by S&P Global Ratings (“S&P”) (or comparably rated by another nationally recognized statistical rating organization) or, if not rated by Moody’s or S&P, are considered by

portfolio management to be of similar quality. High yield securities include bonds rated below investment-grade, sometimes called “junk bonds,” and are considered speculative with respect to their capacity to pay interest and repay

principal in accordance with their terms. High yield securities generally entail more credit risk than higher-rated securities.

Illiquid

investments are securities or other instruments that cannot be sold within seven days for a price approximately equal to the value they currently have on the Fund’s books. Illiquid investments may include repurchase agreements

maturing in more than seven days, time deposits with a notice or demand period of more than seven days, certain over-the-counter option contracts (and segregated

assets used to cover such options), participation interests in loans, and certain restricted securities.

Investment-grade debt securities

are rated Baa or better by Moody’s or BBB or better by S&P (or comparably rated by another nationally recognized statistical rating organization), or, if not rated, are considered by portfolio management to be of similar quality to such

securities. Securities rated in the fourth highest grade have some speculative elements.

Maturity represents the date on which a debt

security matures or when the issuer must pay back the principal amount of the security.

Money market instruments are short-term debt

securities of the U.S. Government, banks, corporations and other entities. The Fund may invest directly in money market instruments. The Fund may also invest indirectly in money market instruments through investments in money

market fund(s) managed by SSGA

Funds Management, Inc. (“SSGA FM” or the “Adviser”) (the “State Street Money Market Funds”).

Mortgage dollar rolls are transactions involving the sale of a mortgage-backed security with a simultaneous contract (with the purchaser) to buy similar, but not identical, securities at a future date.

Mortgage-backed securities include securities issued by the Government National Mortgage Association), the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, other government agencies and private issuers.

Options are rights to buy (i.e., a call) or sell (i.e., a put) securities or other interests for a predetermined price on or before a fixed date. A

securities index option represents the option holder’s right to obtain from the seller, in cash, a fixed multiple of the amount by which the exercise price exceeds (in the case of a put) or is less than (in the case of a call) the

closing value of the securities index on the exercise date. An option on a foreign currency represents the right to buy or sell a particular amount of that currency for a predetermined price on or before a fixed date.

Preferred securities are classes of stock that pay dividends at a specified rate. Dividends are paid on preferred stocks before they are paid on

common stocks. In addition, preferred stockholders have priority over common stockholders as to the proceeds from the liquidation of a company’s assets.

Repurchase agreements (repos) are used to invest cash on a short-term basis. A seller (bank or broker-dealer) sells securities, usually government securities, to the Fund, agreeing to buy them back at a

designated price and time — usually the next day.

Restricted securities (which include Rule 144A securities) may have

contractual restrictions on resale, or cannot be resold publicly until registered. Certain restricted securities may be illiquid. Illiquid investments may be difficult or impossible to sell when the Fund wants to sell them at a price

at which the Fund values them.

Reverse repurchase agreements involve selling securities held and concurrently agreeing to repurchase the same

securities at a specified price and future date.

Rights represent a preemptive right of stockholders to purchase additional shares of a stock at

the time of a new issuance, before the stock is offered to the general public, allowing the stockholder to retain the same ownership percentage after the new stock offering.

Rule 144A securities are restricted securities that may be sold to certain institutional purchasers pursuant to Rule 144A under the Securities Act of 1933, as amended.

6

Russell

2000® Index is a market-capitalization-weighted index consisting of 2,000 of the smallest U.S.-domiciled publicly traded common stocks that are

included in the Russell 3000® Index. The Russell 3000® Index is comprised of the 3,000 largest U.S. domiciled companies.

Short sales against the box involve selling short securities actually owned or otherwise covered at all times during the period the short position is open.

Value investing involves buying stocks that are out of favor and/or undervalued in comparison to their peers and/or their prospects for growth.

Generally, value stocks have lower valuation levels than growth stocks.

Various investment techniques are utilized by the Fund to increase or

decrease its exposure to changing security prices, interest rates, currency exchange rates, commodity prices or other factors that affect security values. These techniques may involve derivative instruments and transactions such as buying and

selling options and futures contracts and entering into forward contracts. These techniques are designed to adjust the risk and return characteristics of the Fund’s portfolio of investments and are not used for leverage.

The Fund is not under any obligation to use any of these techniques at any given time or under any particular economic condition and there can be no assurance that the utilization of such investment techniques will benefit the Fund. To the extent

that the Fund employs these techniques, the Fund would be subject to derivative instruments risk.

Warrants are securities that are usually

issued together with a bond or preferred securities, that permit the holder to buy a proportionate amount of common stock at a specified price that is usually higher than the stock price at the time of issue.

Weighted average effective maturity represents the length of time in days or years until the average security in a money market or income fund will mature or

be redeemed by its issuer, taking into account all expected prepayments, puts and adjustable coupons. The average effective maturity is weighted according to the dollar amounts invested in the various securities in the Fund. This measure indicates a

money market fund’s or an income fund’s sensitivity to changes in interest rates. In general, the longer the Fund’s weighted average effective maturity, the more its share price will fluctuate in response to changing interest

rates.

When-issued and delayed delivery securities are securities that are purchased or sold for delivery and payment at a future date,

i.e., beyond the normal settlement date.

MORE ON INVESTMENT STRATEGIES

In addition to the Fund’s principal investment strategies described earlier in this Prospectus, the Fund is permitted to invest in other securities or use

other investment strategies or techniques in pursuit of its investment objective. The Fund is not under any obligation to invest in or use any other securities, strategies or techniques at any given time or under any particular economic condition.

Certain securities, strategies and techniques may expose the Fund to other risks and considerations, which are discussed later in this Prospectus or in the State Street Institutional Funds’ (the “Trust”) Statement of Additional

Information (“SAI”).

Cash and Temporary Defensive Positions: Under normal circumstances, the Fund may hold cash:

(i) pending investment, (ii) for investment purposes, (iii) for cash management purposes, such as to meet redemptions or pay operating expenses, and (iv) during restructuring. The Fund invests in equity securities and

may equitize cash in order to gain general equity market exposure with respect to such holdings of cash.

The Fund may, from time to

time and in the discretion of SSGA FM, take temporary defensive positions when its portfolio managers believe that adverse or unstable market, economic, political or other conditions or abnormal circumstances, such as large cash inflows or

anticipated redemptions, exist. In these circumstances, the portfolio managers may hold cash without limit, or restrict the securities markets in which the Fund’s assets are invested by investing those assets in securities markets deemed

to be conservative in light of the Fund’s investment objective and strategies.

In addition, the Fund may hold cash under circumstances where

the liquidation of the Fund has been approved by the Trust’s Board of Trustees (the “Board”), and therefore investments in accordance with the Fund’s investment objective and policies would no longer be appropriate.

The Fund may invest directly in money market instruments and may also invest indirectly in money market instruments through investment in the

State Street Money Market Funds.

To the extent that the Fund holds cash for temporary defensive positions, it may be unable to pursue or achieve

its investment objective. Temporary defensive investments could reduce the benefit to the Fund from any upswing in the market.

The Fund may change its

policy of investing at least 80% of its net assets (plus any borrowings for investment purposes) in the type of investment or industry suggested by its name, as stated in the Summary Section above, subject to approval of the Board and upon 60

days’ notice to shareholders.

7

The following tables summarize some of the investment techniques that may be employed by the Fund. Certain techniques

and limitations may be changed at the discretion of SSGA FM and subject to the approval of the Board. Percentage figures refer to the percentage of the Fund’s total assets (including any borrowings) that may be invested in accordance with the

indicated technique. The percentage limitations on Fund investments listed in the Prospectus typically will apply at the time of investment. Thus, the Fund would not violate these limitations unless an excess or deficiency occurs or exists

immediately after and as a result of an investment.

|

|

|

| |

|

State Street

Institutional

Small-Cap

Equity Fund |

| Borrowing Limit |

|

33 1

/3% |

| Repurchase Agreements |

|

Yes |

| Reverse Repurchase Agreements |

|

Yes |

| Restricted Securities and Illiquid Investments |

|

Yes |

| Options |

|

Yes |

| Securities Index Options |

|

Yes |

| Futures Contracts and Options on Futures Contracts |

|

Yes |

| Forward Contracts |

|

Yes |

| Options on Foreign Currencies |

|

Yes |

| Maximum Investment in Debt Securities |

|

20% |

| Maximum Investment in Below-Investment Grade Debt Securities (High Yield

Securities) |

|

10% |

| Maximum Investment in Foreign Securities |

|

10%* |

| When-Issued and Delayed Delivery Securities |

|

Yes |

| Lending Portfolio Securities |

|

Yes |

| Rule 144A Securities |

|

Yes |

| Debt Obligations of Supranational Agencies |

|

Yes |

| Depositary Receipts |

|

Yes |

| Securities of Other Investment Funds |

|

Yes |

| Mortgage Related Securities, including CMOs |

|

Yes |

| Mortgage Dollar Rolls |

|

Yes |

| Short Sales Against the Box |

|

Yes |

| * |

This limitation excludes: ADRs; securities of a foreign issuer with a class of securities registered with the Securities and Exchange Commission

(“SEC”) and listed on a U.S. national securities exchange; and dollar-denominated securities publicly offered in the U.S. by a foreign issuer. |

MORE ON RISKS

Like all mutual funds, investing in the Fund involves risks. The Fund’s risk exposure is determined primarily by its principal investment strategies, which are described earlier in the Summary Section of this

Prospectus. Investments in the Fund are not insured against loss of principal. As with any mutual fund, there can be no assurance that the Fund will achieve its investment objective. Investing in shares of the Fund should not be considered a

complete investment program. The share value of the Fund will rise and fall.

One of your most important investment considerations should be balancing

risk and return. Different types of investments tend to respond differently to shifts in the economic and financial environment. So, diversifying your investments among different asset classes — such as stocks, bonds and cash — and within

an asset class — such as small-cap and large-cap stocks — can help you manage risk and achieve the results you need to reach your financial goals.

The principal risks of investing in the Fund are summarized below. In addition, the Fund may be subject to additional

risks other than those described in the following pages because the types of investments made by the Fund can change over time. For more information about the risks associated with the Fund, please see the SAI, which is incorporated by reference

into this Prospectus.

Allocation Risk: SSGA FM may not allocate assets of the Fund among strategies, asset classes or investment management

styles in an optimal manner, if, among other reasons, it does not correctly assess the attractiveness of a strategy, asset class or investment style.

Credit Risk: The price of a bond is affected by the issuer’s or counterparty’s credit quality. Changes in an entity’s financial condition and

general economic conditions can affect its ability to honor financial obligations and therefore its credit quality. Lower quality

8

bonds are generally more sensitive to these changes than higher quality bonds. Even within securities considered investment grade, differences exist in credit quality and some investment-grade

debt securities may have speculative characteristics. A security’s price may be adversely affected by the market’s perception of the security’s credit quality level even if the issuer or counterparty has suffered no degradation in

its ability to honor the obligation.

Derivative Instruments Risk: The Fund’s use of various investment techniques may involve

derivative instruments, such as forward contracts, futures and options on futures and options. There is no guarantee that these techniques will work. The Fund may, but is not required to, use derivative

instruments as a substitute for taking a long or short position in an underlying asset, to increase returns, or as part of a hedging strategy. Some derivative instruments have the effect of leverage on the Fund, meaning that a small

investment in derivative instruments could have a potentially large impact on the Fund’s performance and its rate of income distributions for a particular period of time. The use of derivative instruments involves risks different

from, and/or possibly greater than, the risks associated with investing directly in the underlying assets. Potential losses from certain derivative instruments are unlimited. Derivative instruments can be highly volatile, illiquid and

difficult to value. Derivative instruments not traded on an exchange may be subject to counterparty risk (i.e., the risk that a counterparty to a derivative instruments transaction may not fulfill its obligations). There is also the

risk that changes in the value of a derivative instrument held by the Fund may not correlate with the Fund’s other investments, which could impact Fund performance. The Fund may choose not to invest in derivative instruments

because of their cost, limited availability or any number of other reasons deemed relevant by SSGA FM and the portfolio managers responsible for managing the Fund. Changes in regulation relating to a mutual fund’s use of derivative

instruments could potentially limit or impact the Fund’s ability to invest in derivative instruments, limit the Fund’s ability to employ certain strategies that use derivative instruments and/or adversely affect the value

of derivative instruments and the Fund’s performance.

| |

• |

|

Forward Contracts Risk: The principals who deal in the forward markets are not required to continue to make markets in the currencies or

commodities they trade and these markets can experience periods of illiquidity, sometimes of significant duration. While the Fund may enter into forward contracts to reduce currency exchange rate risks, transactions in such contracts involve

certain other risks. Therefore,

|

| |

|

while the Fund may benefit from such transactions, unanticipated changes in currency prices may result in a poorer overall performance for the Fund than if it had not engaged in any such

transactions. Moreover, there may be imperfect correlation between the Fund’s portfolio holdings of securities quoted or denominated in a particular currency and forward contracts entered into by the Fund. Such imperfect correlation may

cause the Fund to sustain losses which will prevent the Fund from achieving a complete hedge or expose the Fund to risk of foreign exchange loss. |

| |

• |

|

Futures Contracts Risk: When the Fund uses futures contracts as a hedging technique, because perfect correlation between a futures position

and the Fund position that is intended to be hedged is impossible to achieve, the desired protection may not be obtained and the Fund may be exposed to additional risk of loss. The loss that may be incurred by entering into futures contracts

could exceed the amount invested and may be potentially unlimited. Futures markets are highly volatile and the use of futures may increase the volatility of the Fund’s net asset value (“NAV”). Additionally, because of the low

collateral deposits normally involved in futures trading, a high degree of leverage is typical of a futures trading account. As a result, a relatively small movement in the price or value of a futures contract increases the risk of losing

more than the amount initially invested by the Fund. Furthermore, exchanges may limit fluctuations in futures contract prices during a trading session by imposing a maximum permissible price movement on each futures contract. The Fund may be

disadvantaged if it is prohibited from executing a trade outside the daily permissible price movement. Futures contracts executed on foreign exchanges may not be provided the same protections as provided by U.S. exchanges.

|

| |

• |

|

Options Risk: Writing and purchasing call and put options are highly specialized activities and entail greater than ordinary investment risks.

Although options are intended to enable the Fund to manage market and interest rate risks, these investments can be highly volatile and the Fund’s use of them could result in poorer investment performance. If the Fund purchases

options, it is subject to the risk of a complete loss of the amounts paid as premiums to purchase the options. Unusual market conditions or the lack of a ready market for any particular option at a specific time may reduce the effectiveness

of the Fund’s option strategies, and for these and other reasons the Fund’s option strategies may not reduce the Fund’s volatility to the extent desired.

|

9

Foreign Investment Risk: Investing in foreign securities, including depositary receipts, or

securities of U.S. entities with significant foreign operations, involves unique and additional risks that can affect the Fund’s performance. Foreign markets, particularly emerging markets, may be less liquid, more volatile and subject to less

regulation than U.S. markets. There may be difficulties in enforcing contractual obligations, and it may take more time for transactions to clear and settle in foreign countries than in the U.S. Less information may be available about foreign

issuers. The costs of buying and selling foreign securities, including tax, brokerage and custody costs, generally are higher than those involving domestic transactions. The specific risks of investing in foreign securities include

valuation risk and:

| |

• |

|

Currency Risk: The values of foreign investments may be affected by changes in currency rates or exchange control regulations. If the local

currency gains strength against the U.S. dollar, the value of the foreign security increases in U.S. dollar terms. Conversely, if the local currency weakens against the U.S. dollar, the value of the foreign security declines in U.S. dollar terms.

U.S. dollar-denominated securities of foreign issuers, including depositary receipts, also are subject to currency risk based on their related investments. The Fund is permitted to hedge against foreign currency risk, but normally will not do

so. |

| |

• |

|

Political/Economic/Social Risk: Changes in economic, tax or foreign investment policies, government stability, war or other political,

economic or social actions may have an adverse effect on the Fund’s foreign investments. |

| |

• |

|

Regulatory Risk: Foreign companies often are not subject to uniform accounting, auditing and financial reporting standards or to other regulatory

practices and requirements common to U.S. companies. |

| |

• |

|

Additional Risks Related to Debt and Economic Conditions: The risk of loss and volatility have increased in recent periods and may continue because

of high levels of debt and other economic distress in various countries, including some in Europe. Attempted solutions such as austerity or stimulus measures and governmental regulation also may increase the risk of loss and volatility in securities

markets. The continuing uncertainty regarding the regional and global impact of the 2016 “Brexit” vote and related negotiations for the United Kingdom’s departure from the European Union may cause future volatility and disruption in

global markets. |

Initial Public Offerings Risk: The Fund may purchase shares issued as part of, or a short period after,

a

company’s initial public offering (“IPOs”), and may dispose of those shares shortly after their acquisition. The purchase of shares issued in IPOs exposes the Fund to the risks

associated with organizations that have little operating history as public companies, as well as to the risks associated with the sectors of the market in which the issuer operates. In addition, the Fund’s investment return earned during a

period of substantial investment in IPOs may not be sustained during other periods when the Fund makes more limited, or no, investments in IPOs. The market for IPO shares has been volatile, and share prices of newly-public companies have fluctuated

significantly over short periods of time.

Interest Rate Risk: Bond prices generally rise when interest rates decline and generally decline

when interest rates rise. The longer the duration of a bond, the more a change in interest rates affects the bond’s price. Short-term and long-term interest rates may not move the same amount and may not move in the same direction. Although

governmental financial regulators, including the U.S. Federal Reserve, have taken steps to maintain historically low interest rates, the U.S. Federal Reserve recently raised interest rates slightly. It is possible there will be less governmental

action in the future to maintain low interest rates, or that action will be taken to raise interest rates further, which may have unpredictable effects on markets and the Fund’s investments. Thus, the Fund currently faces a heightened level of

interest rate risk. More generally, changes in market conditions and governmental action may have adverse effects on investments, volatility, and liquidity in debt markets and any negative impact on fixed income securities could be swift and

significant, potentially increasing Fund redemptions and negatively impacting the Fund’s performance. Substantial redemptions from bond and other income funds may worsen that impact. Dividend paying and other types of equity securities also may

be adversely affected from an increase in interest rates.

Liquidity Risk: Illiquid investments may be difficult to resell at approximately

the price they are valued in the ordinary course of business within seven days. When investments cannot be sold readily at the desired time or price, the Fund may have to accept a much lower price, may not be able to sell the investment at all, or

may be forced to forego other investment opportunities, all of which may adversely impact the Fund’s returns. Illiquid investments also may be subject to valuation risk. In addition, liquidity risk refers to the risk

of unusually high redemption requests, redemption requests by certain large shareholders (such as institutional investors), or other market conditions that may make it difficult for the Fund to sell investments within the allowable time period to

meet redemptions. Meeting such redemption requests could require the Fund to sell securities at

10

reduced prices or under unfavorable conditions, which would reduce the value of the Fund.

Management Risk: SSGA FM or the sub-advisers, as applicable, and the Fund’s portfolio managers will apply

investment techniques and risk analysis in making investment decisions for the Fund but there can be no guarantee that these decisions will produce the desired results. There also can be no assurance that all of the personnel of SSGA FM or a sub-adviser will continue to be associated with SSGA FM or the sub-adviser for any length of time. The loss of services of one or more key employees of SSGA FM or a sub-adviser could have an adverse impact on the Fund’s ability to realize its investment objective. In addition, regulatory restrictions, actual or potential conflicts of interest or other considerations may

cause SSGA FM or the sub-advisers, as applicable, to restrict or prohibit participation in certain investments.

Multi-Style Management Risk: Because portions of the Fund’s assets are managed by different sub-advisers using

different investment styles, the Fund could engage in overlapping security transactions or take opposite positions in securities of the same issuer or engage in derivatives transactions that may offset each other. Overlapping transactions could lead

to multiple sub-advisers purchasing the same or similar securities at the same time, potentially leading to the Fund holding a more concentrated position in these securities. Conversely, certain sub-advisers may be purchasing securities at the same time other sub-advisers may be selling those same securities, which may lead to higher transaction costs compared to a

fund using a single investment style. To a significant extent, the Fund’s performance will depend on the success of SSGA FM in allocating the Fund’s assets among the various investment strategies and

sub-advisers.

Redemption Risk: The Fund may need to sell its holdings in order to meet shareholder

redemption requests. The Fund could experience a loss when selling securities to meet redemption requests if the redemption requests are unusually large or frequent, occur in times of overall market turmoil or declining prices for the securities

sold, or when the securities the Fund wishes to or is required to sell are illiquid. The Fund may be unable to sell illiquid securities at its desired time or price. Illiquidity can be caused by a drop in overall market trading volume, an inability

to find a ready buyer, or legal restrictions on the securities’ resale. Certain securities that were liquid when purchased may later become illiquid, particularly in times of overall economic distress.

Repurchase Agreements Risk: The Fund may suffer a loss if the other party to the repurchase agreement transaction defaults on its obligations and

could be

delayed or prevented from exercising its rights to dispose of the underlying securities. The value of the underlying securities may decline while the Fund seeks to assert its rights. The Fund

could incur additional expenses in asserting its rights or may lose all or part of the income from the agreement.

Restricted Securities Risk:

Restricted securities (including Rule 144A securities) may be subject to legal restraints on resale and, therefore, are typically less liquid than other securities. The prices received from reselling restricted securities in

privately negotiated transactions may be less than those originally paid by the Fund. Investors in restricted securities may not benefit from the same investor protection requirements as publicly traded securities.

Reverse Repurchase Agreements Risk: A reverse repurchase agreement involves the risk that the market value of the securities retained by the Fund may

decline below the price of the securities that the Fund has previously sold but is later obligated to repurchase at a higher price under the agreement.

Securities Market Risk is the risk that the value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors

affecting particular companies or the securities markets generally. A general downturn in the securities markets may cause multiple asset classes to decline in value simultaneously, although equity securities generally have greater price volatility

than fixed income securities. Negative conditions and price declines may occur unexpectedly and dramatically. In addition, the Fund could be forced to sell portfolio securities at an inopportune time in order to meet unusually large or frequent

redemption requests in times of overall market turmoil or declining prices for the securities. Securities market risk also includes the risk that geopolitical events will disrupt the economy on a national or global level. For instance, terrorism,

market manipulation, government defaults, government shutdowns, political changes or diplomatic developments, and natural/environmental disasters can all negatively impact the securities markets, which could cause the Fund to lose value. Any market

disruptions could also prevent the Fund from executing advantageous investment decisions in a timely manner.

| |

• |

|

Stock market risk is the risk that the value of equity securities may decline. Stock prices change daily, sometimes rapidly, in response to

company activity and general economic and market conditions. Certain stocks may decline in value even during periods when the prices of equity securities in general are rising, or may not perform as well as the market in general. Stock prices

may also experience greater volatility during periods of |

11

| |

|

challenging market conditions. Additional stock market risk may be introduced when a particular equity security is traded on a foreign market. For more detail on the related risks

involved in foreign markets, see Foreign Investment Risk above. |

| |

• |

|

Bond market risk includes the risk that the value and liquidity of debt securities may be reduced under certain circumstances. Bond prices

can change daily, sometimes rapidly, in response to issuer activity and general economic and credit market conditions. Bond prices can be volatile and there can be severe limitations in the ability to value or sell certain bonds, including those

that are of higher credit quality, during periods of reduced credit market liquidity. |

Style Risk: Securities with different

characteristics tend to shift in and out of favor depending upon market and economic conditions as well as investor sentiment. The Fund may outperform or underperform other funds that invest in similar asset classes but employ different investment

styles. The Fund also may employ a combination of styles that impact its risk characteristics. Examples of different styles include growth and value investing, as well as those focusing on large, medium, or small company securities.

| |

• |

|

Growth Investing Risk: Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions of the issuing

company’s growth potential. Growth-oriented funds will typically underperform when value investing is in favor. |

| |

• |

|

Value Investing Risk: Undervalued stocks may not realize their perceived value for extended periods of time or may never realize their perceived

value. Value stocks may respond differently to market and other developments than other types of stocks. Value-oriented funds will typically underperform when growth investing is in favor. |

| |

• |

|

Small-Cap Company Risk: Investing in securities of small-cap

companies may involve greater risks than investing in larger, more established companies. Smaller companies may have limited product lines, markets or financial resources. Their securities may trade less frequently and in more limited volume than

securities of larger, more established companies. In addition, smaller companies are typically subject to greater changes in earnings and business prospects than are larger companies. Consequently, the prices of small company stocks tend to rise and

fall in value more than other stocks. Although investing in small-cap companies offers potential for above-average returns, the companies may not succeed and their stock prices could

|

| |

|

decline significantly. Investments in small-cap companies may also be subject to valuation risk. |

Valuation Risk: Portfolio securities may be valued using techniques other than market quotations, under the circumstances described under “Calculating

Share Value.” The value established for a portfolio security may be different than what would be produced through the use of another methodology or if it had been priced using market quotations. Portfolio securities that are valued using

techniques other than market quotations, including “fair valued” securities, may be subject to greater fluctuation in their value from one day to the next than would be the case if market quotations were used. In addition, there is no

assurance that the Fund could sell a portfolio security for the value established for it at any time and it is possible that the Fund would incur a loss because a portfolio security is sold at a discount to its established value. Investors who

purchase or redeem Fund shares on days when the Fund is holding “fair valued” securities may receive fewer or more shares or lower or higher redemption proceeds than they would have received if the Fund had not “fair valued” the

holding(s) or had used a different valuation methodology. These risks may be magnified in a rising interest rate environment, and the Fund may be particularly susceptible to the risks associated with fair valuation if the Fund holds a significant

percentage of fair valued securities.

OTHER RISK CONSIDERATIONS

Cyber Security and Disaster Recovery Risk: Information and technology systems relied upon by the Fund, the investment adviser, the investment sub-advisers, the Fund’s service providers (including, but not limited to, Fund accountants, custodians, transfer agents, administrators, distributors and other financial intermediaries) and/or the issuers of

securities in which the Fund invests may be vulnerable to damage or interruption from computer viruses, network failures, computer and telecommunication failures, infiltration by unauthorized persons, security breaches, usage errors, power outages

and catastrophic events such as fires, tornadoes, floods, hurricanes and earthquakes. Although the investment adviser and investment sub-advisers have implemented measures to manage risks relating to these

types of events, systems failures may still occur from time to time. The failure of these systems and/or of disaster recovery plans could cause significant interruptions in the operations of the Fund, the investment adviser, the investment sub-advisers, the Fund’s service providers and/or issuers of securities in which the Fund invests and may result in a failure to maintain the security, confidentiality or privacy of sensitive data, including

personal information relating to investors (and the beneficial owners of investors). Such

12

a failure could also harm the reputation of the Fund, the investment adviser, the investment sub-advisers, the Fund’s service providers and/or issuers

of securities in which the Fund invests, subject such entities and their respective affiliates to legal claims or otherwise affect their business and financial performance.

Institutional Investor Risk: The Fund is generally held by a smaller number of institutional investors with typically larger investment amounts compared with other mutual funds. The Fund is subject to the

risk that a large investor can purchase or redeem a large percentage of Fund shares at any time. Large investor transactions may cause the Fund to sell certain assets in order to meet purchase or redemption requests, which could indirectly affect

the liquidity of the Fund’s portfolio. This could have adverse effects on the Fund’s performance if the Fund were required to sell securities at times when it otherwise would not do so. In addition, such transactions may cause the Fund to

make investment decisions at inopportune times or prices or miss attractive investment opportunities. Similarly, large purchases of Fund shares may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new

cash and is required to maintain a larger cash position than it ordinarily would. Investors may be materially affected by the actions of other large institutional investors. For example, if a large institutional investor withdraws an investment in

the Fund, the Fund could diminish in size by a substantial amount causing the remaining investors to experience higher pro rata operating expenses, resulting in lower returns for such investors. Additionally, if a large institutional investor

withdraws an investment in the Fund shortly before the ex-dividend date, other shareholders may be subject to a greater tax burden as a larger distribution will be applied to fewer shares. The purchase or

withdrawal by a large investor may result in significant portfolio trading expenses and/or tax implications that are borne by other shareholders. Moreover, the Fund is subject to the risk that other shareholders may make investment decisions based

on the choices of a large investor, which could exacerbate any potential negative effects experienced by the Fund.

DISCLOSURE OF PORTFOLIO HOLDINGS

SSGA FM has adopted policies and procedures to protect the Fund’s portfolio information and to prevent the misuse of that information by a third party. SSGA FM

limits disclosure of portfolio information to situations it believes will not result in material harm to or disadvantage investors in the Fund. The Fund will generally disclose on its website (www.ssga.com/geam) the complete list of month-end portfolio holdings for the Fund, 30 days after the end of

each month. Top 10 portfolio holdings and portfolio characteristics (such as

sector and regional weightings) are generally posted monthly for the Fund, 15 days after the end of each month. A description of the Fund’s policies and procedures relating to the disclosure

of portfolio holdings is available in the SAI.

ABOUT THE INVESTMENT ADVISER

INVESTMENT ADVISER, ADMINISTRATOR AND SUB-ADMINISTRATOR

SSGA FM serves as the investment adviser and administrator to the Fund and, subject to the supervision of the Board, is responsible for the investment management of

the Fund. The Adviser provides an investment management program for the Fund and manages the investment of the Fund’s assets. The Adviser is a wholly-owned subsidiary of State Street Global Advisors, Inc., which itself is a wholly-owned

subsidiary of State Street Corporation and is registered with the SEC under the Investment Advisers Act of 1940, as amended. Prior to June 8, 2017, SSGA FM was a wholly-owned subsidiary of State Street Corporation. The Adviser and certain other

affiliates of State Street Corporation make up SSGA. SSGA is one of the world’s largest institutional money managers and the investment management arm of State Street Corporation. As of September 30, 2017, SSGA FM managed approximately

$450.42 billion in assets and SSGA managed approximately $2.67 trillion in assets. The Adviser’s principal business address is State Street Financial Center, One Iron Street, Boston, Massachusetts 02210.

The Fund pays SSGA FM a combined fee for advisory and administrative services that is accrued daily and paid monthly. The advisory and administration fees

(“Management Fee”) for the Fund declines incrementally as Fund assets increase. This means that investors pay a reduced fee with respect to Fund assets over a certain level, or “breakpoint.” The Management Fee for the Fund, and

the relevant breakpoints, are stated in the schedule below (fees are expressed as an annual rate).

Under a separate

sub-administration agreement, SSGA FM has delegated certain administrative functions to State Street Bank and Trust Company (“State Street”), One Lincoln Street, Boston, Massachusetts 02111. State

Street is a subsidiary of State Street Corporation. Under the sub-administration agreement, State Street performs certain back office services to support SSGA FM, including among other things, furnishing

financial and performance information about the Fund for inclusion in regulatory filings and Board and shareholder reports; preparing regulatory filings, Board materials and tax returns; performing expense and budgeting functions; performing tax

compliance testing; and maintaining books and records. State Street also serves

13

as custodian and accounting agent for the Fund for a separate fee that is paid by the Fund.

SSGA

FM has retained sub-advisers to manage the Fund’s assets, subject to oversight by SSGA FM. SSGA FM pays each sub-adviser of the Fund an investment sub-advisory fee out of the Management Fee that it receives from the Fund. The investment sub-advisory fee is paid by SSGA FM monthly and is based upon the average daily net

assets of the Fund’s assets that are allocated to and managed by the sub-adviser. For their services as sub-adviser to the Fund, each of Palisade Capital

Management, L.L.C. (“Palisade”), Champlain Investment Partners, LLC (“Champlain”), GlobeFlex Capital, L.P. (“GlobeFlex”), Kennedy Capital Management, Inc. (“Kennedy”) and SouthernSun Asset Management, LLC

(“SouthernSun”) receives an investment sub-advisory fee from SSGA FM.

Management Fee:

The Fund pays SSGA FM a Management Fee. The fee is accrued daily and paid monthly at the following rates:

|

|

|

|

|

| |

|

Average Daily

Net Assets

of Fund |

|

Annual

Rate

Percentage |

| State Street Institutional |

|

First $250 million |

|

0.95% |

| Small-Cap Equity Fund |

|

Next $250 million |

|

0.90% |

|

|

Over $500 million |

|

0.85% |

For the fiscal year ended September 30, 2017, the Fund paid SSGA FM the following Management Fee as a percentage of average net

assets:

|

|

|

|

|

| State Street Institutional Small-Cap Equity Fund |

|

|

0.88% |

|

The Fund’s Management Fee is a “unitary” fee that includes all operating expenses payable by the Fund, except for

fees and expenses associated with the Trust’s independent Trustees, shareholder servicing and distribution (12b-1) fees, brokerage fees and commissions, and expenses that are not normal operating expenses

of the Fund (such as extraordinary expenses, interest and taxes). The Management Fee for the Fund fluctuates based upon the average daily net assets of the Fund.

BOARD OF TRUSTEES’ APPROVAL OF INVESTMENT ADVISORY AGREEMENTS

The

Fund’s annual report to shareholders for the fiscal year ended September 30, 2016 contains a discussion regarding the basis for the Board’s approval of all investment advisory contracts, including

sub-advisory contracts with Champlain, GlobeFlex, Kennedy, Palisade and SouthernSun.

MANAGER OF MANAGERS STRUCTURE

SSGA FM has received an exemptive order from the SEC to operate the funds it manages under a manager of managers structure that permits SSGA FM, with the

approval of the Board, including a majority of the independent Trustees, to appoint and replace sub-advisers, enter into

sub-advisory agreements, and materially amend and terminate sub-advisory agreements on behalf of the Fund without shareholder approval (the “Manager of Managers

Structure”). Under the Manager of Managers Structure, SSGA FM has responsibility, subject to oversight of the Board, for overseeing the Fund’s sub-advisers and recommending to the Board their hiring,

termination, or replacement. The SEC order does not apply to any sub-adviser that is affiliated with the Fund or SSGA FM. Notwithstanding the SEC exemptive order, adoption of the Manager of Managers Structure

by the Fund also requires prior shareholder approval, which has been obtained for the Fund.

The Manager of Managers Structure enables the Fund to

operate with greater efficiency and without incurring the expense and delays associated with obtaining shareholder approvals for matters relating to sub-advisers or

sub-advisory agreements. Operation of the Fund under the Manager of Managers Structure will not: (1) permit management fees paid by the Fund to SSGA FM to be increased without shareholder approval; or

(2) diminish SSGA FM’s responsibilities to the Fund, including SSGA FM’s overall responsibility for overseeing the portfolio management services furnished by its sub-advisers.

Shareholders will be notified of any changes made to sub-advisers or sub-advisory

agreements within 90 days of the change.

ABOUT THE PORTFOLIO MANAGERS

The Fund is managed by a team of portfolio managers, who are jointly and primarily responsible for the day-to-day management of the Fund. The portfolio managers of the Fund generally have final authority over all aspects of their portions of the Fund’s investment portfolio, including security purchase and

sale decisions, portfolio construction techniques and portfolio risk assessment. The following sets forth the roles of the primary portfolio managers of the Fund followed by biographical information for each portfolio manager.

Portfolio Management Team

The Fund is managed by David

Wiederecht and Dennis Santos, who are vested with oversight authority over the Fund’s sub-advisers that provide day-to-day

management of the assets of the Fund allocated to them. Messrs. Wiederecht and Santos have full discretion in determining the assets that are allocated to each sub-adviser. The current sub-advisers of the Fund are as follows: Palisade; Champlain; GlobeFlex; Kennedy; and SouthernSun. Additional information about each sub-adviser can be found under the section

entitled “About the Sub-Advisers” later in this Prospectus.

14

Portfolio Manager Biographies

The following sets forth biographical information for those individuals who are primarily responsible for managing the Fund’s investments. The portfolio managers may change from time to time. The SAI provides

the following additional information about each portfolio manager (including those of the sub-advisers): (i) the portfolio manager’s compensation; (ii) other accounts managed by the portfolio

manager; and (iii) the portfolio manager’s ownership of shares of the Fund, if any.

Dennis Santos is a Vice President of SSGA and the Adviser

and a Portfolio Manager in the Fundamental U.S. Equity Group. Prior to this role, Mr. Santos held positions in manager research and asset allocation where he was responsible for investment decisions in client portfolios across the spectrum

of client type from family offices to corporate defined benefit plans. In addition to the portfolio construction on institutional accounts, he was also instrumental in the construction and management of

sub-advised mutual funds. Mr. Santos has spent over 15 years in the investment industry and joined SSGA through its acquisition of GE Asset Management Incorporated (“GEAM”) in

July 2016, where he had been employed since 2012. Mr. Santos holds a Bachelor of Science in International Economics from Suffolk University and a Master of Business Administration from Bentley University where he graduated with

distinction.

David Wiederecht is an Executive Vice President of SSGA and the Adviser and Chief Investment Officer of the Outsourced Chief Investment

Officer investment platform. Mr. Wiederecht joined SSGA through its acquisition of GEAM in July 2016. Prior to joining SSGA, Mr. Wiederecht served in various senior investment roles at GEAM since 1988.

ABOUT THE SUB-ADVISERS

SSGA FM seeks to make the best managers available to Fund shareholders, whether that means accessing SSGA FM’s wealth of internal talent or using external talent

(sub-advisers). When SSGA FM deems it necessary or appropriate to access specialists outside, it investigates and engages sub-advisers with strong performance records

and styles that match the investment objective of the Fund. SSGA FM has engaged the following sub-advisers to conduct the investment program for the Fund, subject to oversight by SSGA FM.

The assets of the Fund are allocated to and managed by each of the following sub-advisers: (i) Palisade;

(ii) Champlain; (iii) GlobeFlex; (iv) Kennedy; and (v) SouthernSun. SSGA FM is responsible for allocating the Fund’s assets among the sub-advisers (“Allocated

Assets”), and for managing the Fund’s cash position. The following sets forth the information for each sub-adviser:

Palisade Capital Management, L.L.C.

One Bridge Plaza

Fort Lee, NJ 07024

Palisade has a history of managing small-cap equity portfolios and had discretionary authority over various institutional and private accounts with total assets of approximately $3.1 billion as of September 30, 2017. Palisade translates its

experience from various institutional and private accounts to mutual fund portfolios it sub-advises for SSGA FM. Palisade has managed the Fund since inception.

Palisade’s Allocated Assets are managed by Marc Shapiro and Dennison (“Dan”) Veru, members of Palisade’s Investment Policy Committee.

Messrs. Shapiro and Veru are jointly and primarily responsible for the strategy of the Allocated Assets and the day-to-day management of the Allocated Assets is

executed by Mr. Shapiro.

Marc Shapiro, Managing Director and Senior Portfolio Manager, joined Palisade in March 2004. Mr. Shapiro serves as

the portfolio manager of Palisade’s Institutional Small Cap Core Equity portfolios. Mr. Shapiro became a senior portfolio manager in March 2012, with lead research responsibility for a number of sectors, including Information Technology

and Telecom Services. Prior thereto, he served as the strategy’s Associate Portfolio Manager and as a Senior Vice President of Research for Palisade’s Small Cap Core Equity portfolio since October 2006. Prior to joining Palisade,

Mr. Shapiro was a senior equity analyst at Awad Asset Management and a small cap analyst at Schroders. Mr. Shapiro received his M.S. in Finance from Drexel University and his B.S. in Finance from the College of New Jersey.

Dennison (“Dan”) Veru, Chief Investment Officer, joined Palisade in March 2000. Since joining Palisade, Mr. Veru has been a member of Palisade’s

Investment Policy Committee and became a partner of Palisade in July 2004. Prior to joining Palisade, he was President and Director of Research at Awad Asset Management, a division of Raymond James Financial. Prior to Awad, Mr. Veru worked with

the Palisade team from 1985 through 1992. Mr. Veru graduated from Franklin & Marshall College. Mr. Veru has been a guest on CNBC, Fox Business, and Bloomberg television.

Champlain Investment Partners, LLC

180 Battery Street

Burlington, VT 05401

15

Champlain is a registered investment adviser that was formed in 2004. Champlain is an independent, employee-owned

asset management firm headquartered in Burlington, Vermont offering both domestic and emerging market investment strategies. As of September 30, 2017, Champlain had approximately $9.2 billion in assets under management. Champlain’s

Allocated Assets are managed by a team of investment professionals led by Scott Brayman, CFA, who is a co-founder of Champlain.

Scott Brayman, CFA, is a Managing Partner and Chief Investment Officer of Small and Mid-Cap Strategies at Champlain and has more than 32 years of investment management

experience. Mr. Brayman leads the investment team for both the small and mid-cap strategies at Champlain. Prior to joining Champlain in 2004, Mr. Brayman was a Senior Vice President and served as a

portfolio manager at NL Capital Management, Inc. from 2003 to 2004, and served as a portfolio manager with Sentinel Advisers, Inc. from 1996 to 2004, where he was responsible for managing the small-cap and

core mid-cap strategies. Mr. Brayman began his career as a credit analyst with the First National Bank of Maryland.

GlobeFlex Capital, L.P.

4365 Executive Drive, Suite 720

San Diego, CA 92121

GlobeFlex is a registered investment adviser that was formed in 1994 to specialize in equity

management for the institutional marketplace, with a focus on both U.S. and international growth small and mid-cap companies. As of September 30, 2017, GlobeFlex had approximately $4.3 billion in