Form 497 JANUS ASPEN SERIES

| Service Shares Ticker | |

| Global & International | |

Janus Henderson Global Research Portfolio | N/A |

Janus Henderson Overseas Portfolio | N/A |

| Growth & Core | |

Janus Henderson Balanced Portfolio | N/A |

Janus Henderson Research Portfolio | N/A |

| Mathematical | |

Janus Henderson U.S. Low Volatility Portfolio | N/A |

Janus Aspen Series

Prospectus

The Securities

and Exchange Commission has not approved or disapproved of these securities or passed on the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Beginning on

January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the insurance company that offers your variable life insurance contract or variable annuity contract, may determine that

it will no longer send you paper copies of each Portfolio’s shareholder reports, unless you specifically request paper copies of the reports. Beginning on January 1, 2021, for shareholders who are not insurance

contract holders, paper copies of a Portfolio’s shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports. Instead, the reports will be made available on a

website, and your insurance company or plan sponsor, broker-dealer, or financial intermediary will notify you by mail each time a report is posted and provide you with a website link to access the report. Instructions

for requesting paper copies will be provided by your insurance company or plan sponsor, broker-dealer, or financial intermediary.

If you already

elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Portfolio

electronically by contacting your insurance company or plan sponsor, broker-dealer, or other financial intermediary.

You may elect to

receive all future reports in paper free of charge by contacting your insurance company or plan sponsor, broker-dealer or other financial intermediary. Your election to receive reports in paper will apply to all funds

held in your account with your insurance company or plan sponsor, broker-dealer or other financial intermediary.

This Prospectus describes

five series (each, a “Portfolio” and collectively, the “Portfolios”) of Janus Aspen Series (the “Trust”). Janus Capital Management LLC (“Janus Capital”) serves as

investment adviser to each Portfolio. Janus Henderson U.S. Low Volatility Portfolio is subadvised by Intech Investment Management LLC (“Intech”).

Each Portfolio currently

offers one or more classes of shares. The Service Shares (the “Shares”) are offered by this Prospectus in connection with investment in and payments under variable annuity contracts and variable life

insurance contracts (collectively, “variable insurance contracts”), as well as certain qualified retirement plans.

This Prospectus contains

information that a prospective purchaser of a variable insurance contract or plan participant should consider in conjunction with the accompanying separate account prospectus of the specific insurance company product

before allocating purchase payments or premiums to the Portfolios. Each variable insurance contract involves fees and expenses that are not described in this Prospectus. Certain Portfolios may not be available in

connection with a particular contract, and certain contracts may limit allocations among the Portfolios. Refer to the accompanying contract prospectus for information regarding contract fees and expenses and any

restrictions on purchases or allocations.

Table of contents

| Portfolio summary | |

Janus Henderson Global Research Portfolio | 2 |

Janus Henderson Overseas Portfolio | 7 |

Janus Henderson Balanced Portfolio | 13 |

Janus Henderson Research Portfolio | 19 |

Janus Henderson U.S. Low Volatility Portfolio | 23 |

| Additional information about the Portfolios | |

Fees and expenses | 27 |

Additional investment strategies and general portfolio policies | 27 |

Risks of the Portfolios | 34 |

| Management of the Portfolios | |

Investment adviser | 45 |

Management expenses | 45 |

Subadviser | 48 |

Investment personnel | 48 |

Other information | 51 |

Distributions and taxes | 52 |

| Shareholder’s guide | |

Pricing of portfolio shares | 53 |

Distribution, servicing, and administrative fees | 54 |

Payments to financial intermediaries by Janus Capital or its affiliates | 54 |

Purchases | 55 |

Redemptions | 56 |

Excessive trading | 57 |

Shareholder communications | 59 |

Financial highlights | 60 |

Glossary of investment terms | 65 |

| 1 | Janus Aspen Series |

Portfolio

summary

Janus

Henderson Global Research Portfolio

| Ticker: | N/A | Service Shares |

| Investment Objective |

Janus

Henderson Global Research Portfolio (“Global Research Portfolio”) seeks long-term growth of capital.

| Fees and Expenses of the Portfolio |

This

table describes the fees and expenses that you may pay if you buy and hold Shares of the Portfolio. Owners of variable insurance contracts that invest in the Shares should refer to the variable insurance contract prospectus for a description of fees and expenses, as the following table and

examples do not reflect deductions at the separate account level or contract level for any charges that may be incurred under a contract. Inclusion of these charges would increase the fees and expenses described

below.

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||

| Management Fees(1) | 0.69% | |

| Distribution/Service (12b-1) Fees | 0.25% | |

| Other Expenses | 0.10% | |

| Total Annual Fund Operating Expenses | 1.04% |

| (1) | This fee may adjust up or down monthly based on the Portfolio’s performance relative to its benchmark index over the performance measurement period. For more information regarding performance-based advisory fees, refer to “Management Expenses” in the Portfolio’s Prospectus. |

EXAMPLE:

The Example is

intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated,

reinvest all dividends and distributions, and then redeem all of your Shares at the end of each period. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating

expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Service Shares | $ 106 | $ 331 | $ 574 | $ 1,271 |

Portfolio Turnover: The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may

indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the

Portfolio’s turnover rate was 36% of the average value of its portfolio.

| Principal investment strategies |

The

Portfolio pursues its investment objective by investing primarily in common stocks selected for their growth potential. The Portfolio may invest in companies of any size located anywhere in the world, from larger,

well-established companies to smaller, emerging growth companies. The Portfolio typically invests at least 40% of its net assets in securities of issuers or companies that are economically tied to different countries

throughout the world, excluding the United States. The Portfolio may have significant exposure to emerging markets. Because the Portfolio’s investments in foreign securities are partially based on the

composition of the Portfolio’s benchmark index, the MSCI World Indexsm, the Portfolio’s exposure to foreign markets may fluctuate in connection with variations in the foreign exposure

of the benchmark index. The Portfolio may also invest in foreign equity securities.

Janus

Capital’s equity research analysts, overseen by the Portfolio Oversight Team led by Janus Capital’s Director of Centralized Equity Research Matthew Peron (the “Research Team”), select

investments for the Portfolio that represent the Research Team’s high-conviction investment ideas in all market capitalizations, styles, and geographies. The Research Team, comprised of sector specialists,

conducts fundamental analysis with a focus on “bottom up” research, quantitative modeling,

| 2 | Janus Henderson Global Research Portfolio |

and valuation

analysis. Using this research process, analysts rate their stocks based upon attractiveness. Stocks considered to be attractive may have all or some of the following characteristics: (i) good and preferably growing

free cash flow, (ii) strong and defensible market position, (iii) healthy risk/return profile, (iv) exemplary governance, and (v) attractive valuation. Analysts bring their high-conviction ideas to their respective

sector teams. Sector teams compare the appreciation and risk potential of each of the team’s high-conviction ideas and construct a sector portfolio that is intended to maximize the best risk-reward

opportunities.

Positions may be sold when, among other things, there is no longer high conviction in the return potential of the investment or if the risk characteristics have caused a re-evaluation of the opportunity. This may

occur if the stock has appreciated and reflects the anticipated value, if another company represents a better risk-reward opportunity, or if the investment’s fundamental characteristics deteriorate. Securities

may also be sold from the portfolio to rebalance sector weightings.

Mr.

Peron oversees the investment process and is responsible for the day-to-day management of the Portfolio. It is expected that the Portfolio will be broadly diversified among a variety of industry sectors. The Portfolio

intends to be fully invested under normal circumstances. However, under unusual circumstances, if the Research Team does not have high conviction in enough investment opportunities, the Portfolio’s uninvested

assets may be held in cash or similar instruments.

The

Portfolio may also invest its assets in derivatives, which are instruments that have a value derived from, or directly linked to, an underlying asset, such as equity securities, fixed-income securities, commodities,

currencies, interest rates, or market indices. The types of derivatives in which the Portfolio may invest include options, forward currency contracts, and swaps. The Portfolio may use derivatives to manage the

Portfolio’s equity exposure, to offset risks associated with an investment, currency exposure, or market conditions, to hedge currency exposure relative to the Portfolio’s benchmark index, and to gain

access to markets where direct investment may be restricted or unavailable. The Portfolio may also hold derivatives, such as warrants, in connection with corporate actions.

The

Portfolio may lend portfolio securities on a short-term or long-term basis, in an amount equal to up to one-third of its total assets as determined at the time of the loan origination.

| Principal investment risks |

The

biggest risk is that the Portfolio’s returns will vary, and you could lose money. The Portfolio is designed for long-term investors seeking an equity portfolio, including common stocks. Common stocks tend to be

more volatile than many other investment choices.

Foreign

Exposure Risk. The Portfolio normally has significant exposure to foreign markets as a result of its investments in foreign securities, including investments in emerging markets,

which can be more volatile than the U.S. markets. As a result, its returns and net asset value may be affected to a large degree by fluctuations in currency exchange rates or political or economic conditions in a

particular country. In some foreign markets, there may not be protection against failure by other parties to complete transactions. It may not be possible for the Portfolio to repatriate capital, dividends, interest,

and other income from a particular country or governmental entity. In addition, a market swing in one or more countries or regions where the Portfolio has invested a significant amount of its assets may have a greater

effect on the Portfolio’s performance than it would in a more geographically diversified portfolio. Some of the risks of investing directly in foreign securities may be reduced when the Portfolio invests

indirectly in such securities through various other investment vehicles including derivatives, but such investments also involve other risks, as noted in the Portfolio Summary. The Portfolio’s investments in

emerging market countries may involve risks greater than, or in addition to, the risks of investing in more developed countries.

Emerging

Markets Risk. The risks of foreign investing are heightened when investing in emerging markets. Emerging markets securities involve a number of additional risks, which may result

from less government supervision and regulation of business and industry practices (including the potential lack of strict finance and accounting controls and standards), stock exchanges, brokers, and listed

companies, making these investments potentially more volatile in price and less liquid than investments in developed securities markets, resulting in greater risk to investors. There is a risk in developing countries

that a future economic or political crisis could lead to price controls, forced mergers of companies, expropriation or confiscatory taxation, imposition or enforcement of foreign ownership limits, seizure,

nationalization, sanctions or imposition of restrictions by various governmental entities on investment and trading, or creation of government monopolies, any of which may have a detrimental effect on the

Portfolio’s investments. In addition, the Portfolio’s investments may be denominated in foreign currencies and therefore, changes in the value of a country’s currency compared to the U.S. dollar may

affect the value

| 3 | Janus Henderson Global Research Portfolio |

of the

Portfolio’s investments. To the extent that the Portfolio invests a significant portion of its assets in the securities of emerging markets issuers in or companies of a single country or region, it is more

likely to be impacted by events or conditions affecting that country or region, which could have a negative impact on the Portfolio’s performance. Some of the risks of investing directly in emerging market

securities may be reduced when the Portfolio invests indirectly in such securities through various other investment vehicles including derivatives, but such investments also involve other risks, as noted in the

Portfolio Summary. As of December 31, 2019, approximately 7.2% of the Portfolio’s investments were in emerging markets (i.e., countries included in the MSCI Emerging Markets Indexsm).

Market

Risk. The value of the Portfolio’s holdings may decrease if the value of an individual company or security, or multiple companies or securities, in the Portfolio

decreases or if the investment personnel’s belief about a company’s intrinsic worth is incorrect. Further, regardless of how well individual companies or securities perform, the value of the

Portfolio’s holdings could also decrease if there are deteriorating economic or market conditions. It is important to understand that the value of your investment may fall, sometimes sharply, in response to

changes in the market, and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole. Market risk may be magnified if certain social, political, economic, and

other conditions and events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy and financial markets.

Growth

Securities Risk. The Portfolio invests in companies that the investment personnel believe have growth potential. Securities of companies perceived to be “growth”

companies may be more volatile than other stocks and may involve special risks. If the investment personnel’s perception of a company’s growth potential is not realized, the securities purchased may not

perform as expected, reducing the Portfolio’s returns. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “growth” stocks

may perform differently from the market as a whole and other types of securities.

Mid-Sized Companies Risk. The Portfolio’s investments in securities issued by mid-sized companies may involve greater risks than are customarily associated with larger, more

established companies. Securities issued by mid-sized companies tend to be more volatile than securities issued by larger or more established companies and may underperform as compared to the securities of larger or

more established companies.

Derivatives Risk. Derivatives can be highly volatile and involve risks in addition to the risks of the underlying referenced securities or asset. Gains or losses from a derivative

investment can be substantially greater than the derivative’s original cost, and can therefore involve leverage. Leverage may cause the Portfolio to be more volatile than if it had not used leverage. Derivatives

can be less liquid than other types of investments and entail the risk that the counterparty will default on its payment obligations. The Portfolio may use derivatives for hedging purposes. Hedging with derivatives may increase expenses, and there is no guarantee that a hedging strategy will work. While hedging can reduce or eliminate losses, it can also

reduce or eliminate gains or cause losses if the market moves in a manner different from that anticipated by the investment personnel or if the cost of the derivative outweighs the benefit of the hedge.

Securities Lending Risk. The Portfolio may seek to earn additional income through lending its securities to certain qualified broker-dealers and institutions. There is the risk that when

portfolio securities are lent, the securities may not be returned on a timely basis, and the Portfolio may experience delays and costs in recovering the security or gaining access to the collateral provided to the

Portfolio to collateralize the loan. If the Portfolio is unable to recover a security on loan, the Portfolio may use the collateral to purchase replacement securities in the market. There is a risk that the value of

the collateral could decrease below the cost of the replacement security by the time the replacement investment is made, resulting in a loss to the Portfolio.

Management Risk. The Portfolio is an actively managed investment portfolio and is therefore subject to the risk that the investment strategies employed for the Portfolio may fail to

produce the intended results. The Portfolio may underperform its benchmark index or other mutual funds with similar investment objectives.

An

investment in the Portfolio is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| 4 | Janus Henderson Global Research Portfolio |

| Performance information |

The

following information provides some indication of the risks of investing in the Portfolio by showing how the Portfolio’s performance has varied over time. The Portfolio’s Service Shares commenced

operations on December 31, 1999. The returns shown for the Service Shares for periods prior to December 31, 1999 reflect the historical performance of a different class of shares (the Institutional Shares), restated

based on the Service Shares’ estimated fees and expenses (ignoring any fee and expense limitations). The bar chart depicts the change in performance from year to year during the periods indicated, but does not

include charges or expenses attributable to any insurance product, which would lower the performance illustrated. The Portfolio does not impose any sales or other charges that would affect total return computations.

Total return figures include the effect of the Portfolio’s expenses. The table compares the average annual returns for the Service Shares of the Portfolio for the periods indicated to broad-based securities

market indices. All figures assume reinvestment of dividends and distributions. For certain periods, the Portfolio’s performance reflects the effect of expense waivers. Without the effect of these expense

waivers, the performance shown would have been lower.

The

Portfolio’s past performance does not necessarily indicate how it will perform in the future. Updated performance information is available at janushenderson.com/VITperformance or by calling 1-877-335-2687.

| Annual Total Returns for Service Shares (calendar year-end) |

|

| Best Quarter: 1st Quarter 2012 15.02% | Worst Quarter: 3rd Quarter 2011 – 19.88% |

| Average Annual Total Returns (periods ended 12/31/19) | ||||

| 1 Year | 5 Years | 10 Years | Since Inception (9/13/93) | |

| Global Research Portfolio | ||||

| Service Shares | 28.71% | 8.50% | 9.41% | 8.24% |

| MSCI World Index (reflects no deduction for fees, expenses, or taxes, except foreign withholding taxes) | 27.67% | 8.74% | 9.47% | 7.24% |

| MSCI All Country World Indexsm (reflects no deduction for fees, expenses, or taxes, except foreign withholding taxes) | 26.60% | 8.41% | 8.79% | N/A |

The

Portfolio’s primary benchmark index is the MSCI World Index. The Portfolio also compares its performance to the MSCI All Country World Index. The MSCI World Index is used to calculate the Portfolio’s

performance fee adjustment. The indices are described below.

| • | The MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed market countries in North America, Europe, and the Asia/Pacific Region. The index includes reinvestment of dividends, net of foreign withholding taxes. |

| • | The MSCI All Country World Index is an unmanaged, free float-adjusted, market capitalization-weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. The index includes reinvestment of dividends, net of foreign withholding taxes. |

| 5 | Janus Henderson Global Research Portfolio |

| Management |

Investment Adviser: Janus Capital Management LLC

Portfolio Management: Matthew Peron, Janus Capital’s Director of Centralized Equity Research, provides general oversight of the Research Team and has done so since April 2020.

| Purchase and sale of Portfolio shares |

Purchases of Shares may be made only by the separate accounts of insurance companies for the purpose of funding variable insurance contracts or by certain qualified retirement plans. Redemptions, like purchases, may

be effected only through the separate accounts of participating insurance companies or through qualified retirement plans. Requests are duly processed at the NAV next calculated after your order is received in good

order by the Portfolio or its agents. Refer to the appropriate separate account prospectus or plan documents for details.

| Tax information |

Because Shares of the Portfolio may be purchased only through variable insurance contracts and certain qualified retirement plans, it is anticipated that any income dividends or net capital gains distributions made

by the Portfolio will be exempt from current federal income taxation if left to accumulate within the variable insurance contract or qualified retirement plan. The federal income tax status of your investment depends

on the features of your qualified retirement plan or variable insurance contract.

| Payments to Insurers, Broker-Dealers, and other financial intermediaries |

Portfolio shares are generally available only through an insurer’s variable contracts, or through certain employer or other retirement plans (Retirement Products). Retirement Products are generally purchased

through a broker-dealer or other financial intermediary. The Portfolio or its distributor (and/or their related companies) may make payments to the insurer and/or its related companies for distribution and/or other

services; some of the payments may go to broker-dealers and other financial intermediaries. These payments may create a conflict of interest for an intermediary, or be a factor in the insurer’s decision to

include the Portfolio as an underlying investment option in a variable contract. Ask your financial advisor, visit your intermediary’s website, or consult your insurance contract prospectus for more

information.

| 6 | Janus Henderson Global Research Portfolio |

Portfolio

summary

Janus

Henderson Overseas Portfolio

| Ticker: | N/A | Service Shares |

| Investment Objective |

Janus

Henderson Overseas Portfolio (“Overseas Portfolio”) seeks long-term growth of capital.

| Fees and Expenses of the Portfolio |

This

table describes the fees and expenses that you may pay if you buy and hold Shares of the Portfolio. Owners of variable insurance contracts that invest in the Shares should refer to the variable insurance contract prospectus for a description of fees and expenses, as the following table and

examples do not reflect deductions at the separate account level or contract level for any charges that may be incurred under a contract. Inclusion of these charges would increase the fees and expenses described

below.

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||

| Management Fees(1) | 0.64% | |

| Distribution/Service (12b-1) Fees | 0.25% | |

| Other Expenses | 0.10% | |

| Total Annual Fund Operating Expenses | 0.99% |

| (1) | This fee may adjust up or down monthly based on the Portfolio’s performance relative to its benchmark index over the performance measurement period. For more information regarding performance-based advisory fees, refer to “Management Expenses” in the Portfolio’s Prospectus. |

EXAMPLE:

The Example is

intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated,

reinvest all dividends and distributions, and then redeem all of your Shares at the end of each period. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating

expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Service Shares | $ 101 | $ 315 | $ 547 | $ 1,213 |

Portfolio Turnover: The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may

indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the

Portfolio’s turnover rate was 23% of the average value of its portfolio.

| Principal investment strategies |

The

Portfolio pursues its investment objective by investing, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in securities of issuers or companies from countries

outside of the United States. The Portfolio normally invests in securities of issuers from several different countries, excluding the United States. Although the Portfolio typically invests 80% or more of its assets

in issuers that are economically tied to countries outside the United States, it also may invest up to 20% of its net assets, measured at the time of purchase, in U.S. issuers, and it may, under unusual circumstances,

invest all or substantially all of its assets in a single country. The Portfolio may have significant exposure to emerging markets. The Portfolio typically invests in equity securities (such as stocks or any other

security representing an ownership interest) in all market capitalizations but may also invest in U.S. and foreign debt securities.

The

portfolio managers apply a “bottom up” approach in choosing investments. In other words, the portfolio managers look at companies one at a time to determine if a company is an attractive investment

opportunity and if it is consistent with the Portfolio’s investment policies.

| 7 | Janus Henderson Overseas Portfolio |

The

Portfolio may invest in equity and debt securities of real estate-related companies. Such companies may include those in the real estate industry or real estate-related industries. These securities may include common

stocks, preferred stocks, and other securities, including, but not limited to, mortgage-backed securities, real estate-backed securities, securities of real estate investment trusts (“REITs”) and similar

REIT-like entities. A REIT is a trust that invests in real estate-related projects, such as properties, mortgage loans, and construction loans. REITs are generally categorized as equity, mortgage, or hybrid REITs. A

REIT may be listed on an exchange or traded over-the-counter.

The

Portfolio may take long or short positions in derivatives, which are instruments that have a value derived from, or directly linked to, an underlying asset, such as equity securities, fixed-income securities,

commodities, currencies, interest rates, or market indices. For purposes of meeting its 80% investment policy, the Portfolio may include derivatives that have characteristics similar to the securities in which the

Portfolio may directly invest. The types of derivatives in which the Portfolio may invest include options, futures, swaps, warrants, and forward currency contracts. The Portfolio may use derivatives to hedge, to earn

income or enhance returns, as a substitute for securities in which the Portfolio invests, to increase or decrease the Portfolio’s exposure to a particular market, to adjust the Portfolio’s currency

exposure relative to its benchmark index, to gain access to foreign markets where direct investment may be restricted or unavailable, or to manage the Portfolio’s risk profile.

The

Portfolio may lend portfolio securities on a short-term or long-term basis, in an amount equal to up to one-third of its total assets as determined at the time of the loan origination.

| Principal investment risks |

The

biggest risk is that the Portfolio’s returns will vary, and you could lose money. The Portfolio is designed for long-term investors seeking an equity portfolio, including common stocks. Common stocks tend to be

more volatile than many other investment choices.

Market

Risk. The value of the Portfolio’s holdings may decrease if the value of an individual company or security, or multiple companies or securities, in the Portfolio

decreases or if the portfolio managers’ belief about a company’s intrinsic worth is incorrect. Further, regardless of how well individual companies or securities perform, the value of the Portfolio’s

holdings could also decrease if there are deteriorating economic or market conditions. It is important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market,

and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole. Market risk may be magnified if certain social, political, economic, and other conditions and

events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy and financial markets.

Foreign

Exposure Risk. The Portfolio normally has significant exposure to foreign markets as a result of its investments in foreign securities, including investments in emerging markets,

which can be more volatile than the U.S. markets. As a result, its returns and net asset value may be affected to a large degree by fluctuations in currency exchange rates or political or economic conditions in a

particular country. In some foreign markets, there may not be protection against failure by other parties to complete transactions. It may not be possible for the Portfolio to repatriate capital, dividends, interest,

and other income from a particular country or governmental entity. In addition, a market swing in one or more countries or regions where the Portfolio has invested a significant amount of its assets may have a greater

effect on the Portfolio’s performance than it would in a more geographically diversified portfolio. To the extent the Portfolio invests in foreign debt securities, such investments are sensitive to changes in

interest rates. Additionally, investments in securities of foreign governments involve the risk that a foreign government may not be willing or able to pay interest or repay principal when due. Some of the risks of

investing directly in foreign securities may be reduced when the Portfolio invests indirectly in such securities through various other investment vehicles including derivatives, but such investments also involve other

risks, as noted in the Portfolio Summary. The Portfolio’s investments in emerging market countries may involve risks greater than, or in addition to, the risks of investing in more developed countries.

Emerging

Markets Risk. The risks of foreign investing are heightened when investing in emerging markets. Emerging markets securities involve a number of additional risks, which may result

from less government supervision and regulation of business and industry practices (including the potential lack of strict finance and accounting controls and standards), stock exchanges, brokers, and listed

companies, making these investments potentially more volatile in price and less liquid than investments in developed securities markets, resulting in greater risk to investors. There is a risk in developing countries

that a future economic or political crisis could lead to price controls, forced mergers of companies, expropriation or confiscatory

| 8 | Janus Henderson Overseas Portfolio |

taxation, imposition

or enforcement of foreign ownership limits, seizure, nationalization, sanctions or imposition of restrictions by various governmental entities on investment and trading, or creation of government monopolies, any of

which may have a detrimental effect on the Portfolio’s investments. In addition, the Portfolio’s investments may be denominated in foreign currencies and therefore, changes in the value of a

country’s currency compared to the U.S. dollar may affect the value of the Portfolio’s investments. To the extent that the Portfolio invests a significant portion of its assets in the securities of

emerging markets issuers in or companies of a single country or region, it is more likely to be impacted by events or conditions affecting that country or region, which could have a negative impact on the

Portfolio’s performance. Additionally, foreign and emerging market risks, including but not limited to price controls, expropriation or confiscatory taxation, imposition or enforcement of foreign ownership

limits, nationalization, and restrictions on repatriation of assets may be heightened to the extent the Portfolio invests in Chinese local market securities. Some of the risks of investing directly in emerging market

securities may be reduced when the Portfolio invests indirectly in such securities through various other investment vehicles including derivatives, but such investments also involve other risks, as noted in the

Portfolio Summary. As of December 31, 2019, approximately 20.5% of the Portfolio’s investments were in emerging markets (i.e., countries included in the MSCI Emerging Markets Indexsm).

Small-

and Mid-Sized Companies Risk. The Portfolio’s investments in securities issued by small- and mid-sized companies, which can include smaller, start-up companies offering emerging products

or services, may involve greater risks than are customarily associated with larger, more established companies. Securities issued by small- and mid-sized companies tend to be more volatile and somewhat more

speculative than securities issued by larger or more established companies and may underperform as compared to the securities of larger or more established companies.

Industry

and Sector Risk. Although the Portfolio does not concentrate its investments in specific industries or industry sectors, it may have a significant portion of its assets invested in

securities of companies conducting similar business or business within the same economic sector. Companies in the same industry or economic sector may be similarly affected by economic or market events, making the

Portfolio more vulnerable to unfavorable developments than funds that invest more broadly. As the Portfolio’s holdings become more concentrated, the Portfolio is less able to spread risk and potentially reduce

the risk of loss and volatility. In addition, the Portfolio may be overweight or underweight in certain industries or sectors relative to its benchmark index, which may cause the Portfolio’s performance to be

more or less sensitive to developments affecting those sectors.

Geographic Concentration Risk. To the extent the Portfolio invests a substantial amount of its assets in issuers located in a single country or region, the economic, political, social,

regulatory, or other developments or conditions within such country or region will generally have a greater effect on the Portfolio than they would on a more geographically diversified fund, which may result in

greater losses and volatility. Adverse developments in certain regions could also adversely affect securities of other countries whose economies appear to be unrelated and could have a negative impact on the

Portfolio’s performance.

Growth

Securities Risk. The Portfolio invests in companies that the portfolio managers believe have growth potential. Securities of companies perceived to be “growth” companies

may be more volatile than other stocks and may involve special risks. If the portfolio managers’ perception of a company’s growth potential is not realized, the securities purchased may not perform as

expected, reducing the Portfolio’s returns. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “growth” stocks may perform

differently from the market as a whole and other types of securities.

Value

Investing Risk. Because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “value” stocks may perform differently

than other types of stocks and from the market as a whole, and can continue to be undervalued by the market for long periods of time. It is also possible that a value stock will never appreciate to the extent expected

by the portfolio managers.

Fixed-Income Securities Risk. The Portfolio may hold debt and other fixed-income securities. Typically, the values of fixed-income securities change inversely with prevailing interest rates.

Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that the value of such securities will generally decline as prevailing interest rates rise, which may cause the

Portfolio’s net asset value to likewise decrease. The Portfolio may be subject to heightened interest rate risk in times of monetary policy change and uncertainty, such as when the Federal Reserve Board ends a

quantitative easing program and/or raises interest rates. The conclusion of quantitative easing and/or rising interest rates may expose fixed-income markets to increased volatility and may reduce the liquidity of

certain Portfolio investments. These developments could cause the Portfolio’s net asset value to fluctuate or make it more difficult for the Portfolio to accurately value its

| 9 | Janus Henderson Overseas Portfolio |

securities.

Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, extension risk, and liquidity risk. Credit risk is the risk that the credit strength of an issuer of a fixed-income security

will weaken and/or that the issuer will be unable to make timely principal and interest payments and that the security may go into default. Prepayment risk is the risk that during periods of falling interest rates,

certain fixed-income securities with higher interest rates, such as mortgage- and asset-backed securities, may be prepaid by their issuers thereby reducing the amount of interest payments. Valuation risk is the risk

that one or more of the fixed-income securities in which the Portfolio invests are priced differently than the value realized upon such security’s sale. In times of market instability, valuation may be more

difficult. Extension risk is the risk that borrowers may pay off their debt obligations more slowly in times of rising interest rates, which will lengthen the duration of the portfolio. Liquidity risk is the risk that

fixed-income securities may be difficult or impossible to sell at the time that the portfolio managers would like or at the price the portfolio managers believe the security is currently worth.

Real

Estate Securities Risk. The Portfolio’s performance may be affected by the risks associated with investments in real estate-related companies. The value of real estate-related

companies’ securities is sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and

creditworthiness of the company. Investments in REITs involve the same risks as other real estate investments. In addition, a REIT could fail to qualify for tax-free pass-through of its income under the Internal

Revenue Code of 1986, as amended (the “Internal Revenue Code”) or fail to maintain its exemption from registration under the Investment Company Act of 1940, as amended, which could produce adverse economic

consequences for the REIT and its investors, including the Portfolio.

United

Kingdom Risk. The Portfolio is subject to certain risks related to the United Kingdom. Investments in British issuers may subject the Portfolio to regulatory, political,

currency, security, and economic risk specific to the United Kingdom. The United Kingdom has one of the largest economies in Europe, and the United States and other European countries are substantial trading partners

of the United Kingdom. As a result, the British economy may be impacted by changes to the economic health of the United States and other European countries. The risk of investing in British issuers may also be

heightened due to the withdrawal agreement, which came into force in January 2020, in which the United Kingdom ended its membership in the European Union (“EU”) (commonly known as “Brexit”) and

entered an 11-month transition period. There is considerable uncertainty relating to the consequences of the exit and how negotiations for new trade agreements will be conducted or whether a new trade deal will be

reached by the end of the transition period. During this period of uncertainty, the negative impact on not only the United Kingdom and European economies, but the broader global economy, could be significant,

potentially resulting in increased volatility and illiquidity and lower economic growth for companies that rely significantly on the United Kingdom and/or Europe for their business activities and revenues. Any further

exits from the EU, or an increase in the belief that such exits are likely or possible, would likely cause additional market disruption globally and introduce new legal and regulatory uncertainties.

Liquidity Risk. The Portfolio may invest in securities or instruments that do not trade actively or in large volumes, and may make investments that are less liquid than other

investments. Also, the Portfolio may make investments that may become less liquid in response to market developments or adverse investor perceptions. Investments that are illiquid or that trade in lower volumes may be

more difficult to value. When there is no willing buyer and investments cannot be readily sold at the desired time or price, the Portfolio may have to accept a lower price or may not be able to sell the security or

instrument at all. Investments in foreign securities, particularly those of issuers located in emerging market countries, tend to have greater exposure to liquidity risk than domestic securities. In unusual market

conditions, even normally liquid securities may be affected by a degree of liquidity risk (i.e., if the number and capacity of traditional market participants is reduced). An inability to sell one or more portfolio

positions can adversely affect the Portfolio’s value or prevent the Portfolio from being able to take advantage of other investment opportunities.

Derivatives Risk. Derivatives can be highly volatile and involve risks in addition to the risks of the underlying referenced securities or asset. Gains or losses from a derivative

investment can be substantially greater than the derivative’s original cost, and can therefore involve leverage. Leverage may cause the Portfolio to be more volatile than if it had not used leverage. Derivatives

can be complex instruments and may involve analysis that differs from that required for other investment types used by the Portfolio. If the value of a derivative does not correlate well with the particular market or

other asset class to which the derivative is intended to provide exposure, the derivative may not produce the anticipated result. Derivatives can also reduce the opportunity for gain or result in losses by offsetting

positive returns in other investments. Derivatives can be less liquid than other types of investments and entail the risk that the counterparty will default on its payment obligations. If the counterparty to a

derivative transaction defaults, the Portfolio would risk the loss of the net amount of the payments that

| 10 | Janus Henderson Overseas Portfolio |

it contractually is

entitled to receive. To the extent the Portfolio enters into short derivative positions, the Portfolio may be exposed to risks similar to those associated with short sales, including the risk that the

Portfolio’s losses are theoretically unlimited. The Portfolio may use derivatives, including forward currency contracts, for hedging purposes. Hedging with derivatives may increase expenses, and there is no

guarantee that a hedging strategy will work. While hedging can reduce or eliminate losses, it can also reduce or eliminate gains or cause losses if the market moves in a manner different from that anticipated by the

portfolio managers or if the cost of the derivative outweighs the benefit of the hedge.

Securities Lending Risk. The Portfolio may seek to earn additional income through lending its securities to certain qualified broker-dealers and institutions. There is the risk that when

portfolio securities are lent, the securities may not be returned on a timely basis, and the Portfolio may experience delays and costs in recovering the security or gaining access to the collateral provided to the

Portfolio to collateralize the loan. If the Portfolio is unable to recover a security on loan, the Portfolio may use the collateral to purchase replacement securities in the market. There is a risk that the value of

the collateral could decrease below the cost of the replacement security by the time the replacement investment is made, resulting in a loss to the Portfolio.

Management Risk. The Portfolio is an actively managed investment portfolio and is therefore subject to the risk that the investment strategies employed for the Portfolio may fail to

produce the intended results. The Portfolio may underperform its benchmark index or other mutual funds with similar investment objectives.

An

investment in the Portfolio is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| Performance information |

The

following information provides some indication of the risks of investing in the Portfolio by showing how the Portfolio’s performance has varied over time. The Portfolio’s Service Shares commenced

operations on December 31, 1999. The returns shown for the Service Shares for periods prior to December 31, 1999 reflect the historical performance of a different class of shares (the Institutional Shares), restated

based on the Service Shares’ estimated fees and expenses (ignoring any fee and expense limitations). The bar chart depicts the change in performance from year to year during the periods indicated, but does not

include charges or expenses attributable to any insurance product, which would lower the performance illustrated. The Portfolio does not impose any sales or other charges that would affect total return computations.

Total return figures include the effect of the Portfolio’s expenses. The table compares the average annual returns for the Service Shares of the Portfolio for the periods indicated to a broad-based securities

market index. All figures assume reinvestment of dividends and distributions.

The

Portfolio’s past performance does not necessarily indicate how it will perform in the future. Updated performance information is available at janushenderson.com/VITperformance or by calling 1-877-335-2687.

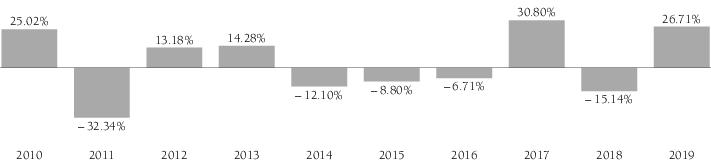

| Annual Total Returns for Service Shares (calendar year-end) |

|

| Best Quarter: 1st Quarter 2012 19.32% | Worst Quarter: 3rd Quarter 2011 – 26.68% |

| 11 | Janus Henderson Overseas Portfolio |

| Average Annual Total Returns (periods ended 12/31/19) | ||||

| 1 Year | 5 Years | 10 Years | Since Inception (5/2/94) | |

| Overseas Portfolio | ||||

| Service Shares | 26.71% | 3.66% | 1.42% | 8.26% |

| MSCI All Country World ex-U.S. Indexsm (reflects no deduction for fees, expenses, or taxes, except foreign withholding taxes) | 21.51% | 5.51% | 4.97% | N/A |

The

Portfolio’s primary benchmark index is the MSCI All Country World ex-U.S. Index. The MSCI All Country World ex-U.S. Index is used to calculate the Portfolio’s performance fee adjustment. The index is

described below.

| • | The MSCI All Country World ex-U.S. Index is an unmanaged, free float-adjusted, market capitalization-weighted index composed of stocks of companies located in countries throughout the world, excluding the United States. It is designed to measure equity market performance in global developed and emerging markets outside the United States. The index includes reinvestment of dividends, net of foreign withholding taxes. |

| Management |

Investment Adviser: Janus Capital Management LLC

Portfolio Managers: George P. Maris, CFA, is Executive Vice President and Co-Portfolio Manager of the Portfolio, which he has managed or co-managed since January 2016. Julian McManus is Executive Vice President and Co-Portfolio Manager of the Portfolio, which he has co-managed since January 2018. Garth Yettick, CFA, is Executive Vice President and Co-Portfolio Manager of the Portfolio, which he has co-managed since January 2018.

| Purchase and sale of Portfolio shares |

Purchases of Shares may be made only by the separate accounts of insurance companies for the purpose of funding variable insurance contracts or by certain qualified retirement plans. Redemptions, like purchases, may

be effected only through the separate accounts of participating insurance companies or through qualified retirement plans. Requests are duly processed at the NAV next calculated after your order is received in good

order by the Portfolio or its agents. Refer to the appropriate separate account prospectus or plan documents for details.

| Tax information |

Because Shares of the Portfolio may be purchased only through variable insurance contracts and certain qualified retirement plans, it is anticipated that any income dividends or net capital gains distributions made

by the Portfolio will be exempt from current federal income taxation if left to accumulate within the variable insurance contract or qualified retirement plan. The federal income tax status of your investment depends

on the features of your qualified retirement plan or variable insurance contract.

| Payments to Insurers, Broker-Dealers, and other financial intermediaries |

Portfolio shares are generally available only through an insurer’s variable contracts, or through certain employer or other retirement plans (Retirement Products). Retirement Products are generally purchased

through a broker-dealer or other financial intermediary. The Portfolio or its distributor (and/or their related companies) may make payments to the insurer and/or its related companies for distribution and/or other

services; some of the payments may go to broker-dealers and other financial intermediaries. These payments may create a conflict of interest for an intermediary, or be a factor in the insurer’s decision to

include the Portfolio as an underlying investment option in a variable contract. Ask your financial advisor, visit your intermediary’s website, or consult your insurance contract prospectus for more

information.

| 12 | Janus Henderson Overseas Portfolio |

Portfolio

summary

Janus

Henderson Balanced Portfolio

| Ticker: | N/A | Service Shares |

| Investment Objective |

Janus

Henderson Balanced Portfolio (“Balanced Portfolio”) seeks long-term capital growth, consistent with preservation of capital and balanced by current income.

| Fees and Expenses of the Portfolio |

This

table describes the fees and expenses that you may pay if you buy and hold Shares of the Portfolio. Owners of variable insurance contracts that invest in the Shares should refer to the variable insurance contract prospectus for a description of fees and expenses, as the following table and

examples do not reflect deductions at the separate account level or contract level for any charges that may be incurred under a contract. Inclusion of these charges would increase the fees and expenses described

below.

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||

| Management Fees | 0.55% | |

| Distribution/Service (12b-1) Fees | 0.25% | |

| Other Expenses | 0.07% | |

| Total Annual Fund Operating Expenses | 0.87% |

EXAMPLE:

The Example is

intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated,

reinvest all dividends and distributions, and then redeem all of your Shares at the end of each period. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating

expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Service Shares | $ 89 | $ 278 | $ 482 | $ 1,073 |

Portfolio Turnover: The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may

indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the

Portfolio’s turnover rate was 79% of the average value of its portfolio.

| Principal investment strategies |

The

Portfolio pursues its investment objective by normally investing 35-65% of its assets in equity securities and the remaining assets in fixed-income securities and cash equivalents. The Portfolio normally invests at

least 25% of its assets in fixed-income senior securities. The Portfolio’s fixed-income investments may reflect a broad range of credit qualities and may include corporate debt securities, U.S. Government

obligations, non-U.S. government securities, mortgage-backed securities and other mortgage-related products, and short-term securities. In addition, the Portfolio may invest up to 35% of the fixed-income portion of

its net assets in high-yield/high-risk bonds, also known as “junk” bonds. The Portfolio may enter into “to be announced” or “TBA” commitments when purchasing mortgage-backed

securities or other securities. The Portfolio may also invest in foreign securities, which may include investments in emerging markets. As of December 31, 2019, approximately 61.76% of the Portfolio’s assets

were held in equity securities, including common stocks and preferred stocks and 37.65% of the Portfolio’s assets were held in fixed-income securities and cash equivalents.

In

choosing investments for the Portfolio, the portfolio managers apply a “bottom up” approach with two portfolio managers focusing on the equity portion of the Portfolio and the other two portfolio managers

focusing on the fixed-income portion of

| 13 | Janus Henderson Balanced Portfolio |

the Portfolio. With

respect to corporate issuers, the portfolio managers look at companies one at a time to determine if a company is an attractive investment opportunity and if it is consistent with the Portfolio’s investment

policies. The portfolio managers may also consider economic factors, such as the effect of interest rates on certain of the Portfolio’s fixed-income investments. The portfolio managers share day-to-day

responsibility for the Portfolio’s investments.

The

Portfolio may also invest its assets in derivatives, which are instruments that have a value derived from, or directly linked to, an underlying asset, such as equity securities, fixed-income securities, commodities,

currencies, interest rates, or market indices. In particular, the Portfolio may use forward currency contracts to offset risks associated with an investment, currency exposure, or market conditions and may use

futures, including exchange-traded and Treasury futures, to hedge the Portfolio’s interest rate exposure. The Portfolio may also use index credit default swaps for hedging purposes (to offset risks associated

with an investment exposure, or market conditions), to increase or decrease the Portfolio’s exposure to a particular market, to manage or adjust the risk profile of the Portfolio relative to its benchmark index,

and to earn income, enhance returns, or preserve capital.

| Principal investment risks |

The

biggest risk is that the Portfolio’s returns will vary, and you could lose money. The Portfolio is designed for long-term investors seeking a balanced portfolio, including common stocks and bonds. Common stocks

tend to be more volatile than many other investment choices.

Market

Risk. The value of the Portfolio’s holdings may decrease if the value of an individual company or security, or multiple companies or securities, in the Portfolio

decreases or if the portfolio managers’ belief about a company’s intrinsic worth is incorrect. Further, regardless of how well individual companies or securities perform, the value of the Portfolio’s

holdings could also decrease if there are deteriorating economic or market conditions. It is important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market,

and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole. Market risk may be magnified if certain social, political, economic, and other conditions and

events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy and financial markets.

Growth

Securities Risk. The Portfolio invests in companies that the portfolio managers believe have growth potential. Securities of companies perceived to be “growth” companies

may be more volatile than other stocks and may involve special risks. If the portfolio managers’ perception of a company’s growth potential is not realized, the securities purchased may not perform as

expected, reducing the Portfolio’s returns. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “growth” stocks may perform

differently from the market as a whole and other types of securities.

Dividend-Oriented Stocks Risk. Companies that have paid regular dividends to shareholders may decrease or eliminate dividend payments in the future. A decrease in dividend payments by an issuer

may result in a decrease in the value of the security held by the Portfolio or the Portfolio receiving less income.

Fixed-Income Securities Risk. The Portfolio holds debt and other fixed-income securities. Typically, the values of fixed-income securities change inversely with prevailing interest rates.

Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that the value of such securities will generally decline as prevailing interest rates rise, which may cause the

Portfolio’s net asset value to likewise decrease. For example, while securities with longer maturities and durations tend to produce higher yields, they also tend to be more sensitive to changes in prevailing

interest rates and are therefore more volatile than shorter-term securities and are subject to greater market fluctuations as a result of changes in interest rates. Investments in fixed-income securities with very low

or negative interest rates may diminish the Portfolio’s yield and performance. The Portfolio may be subject to heightened interest rate risk in times of monetary policy change and uncertainty, such as when the

Federal Reserve Board ends a quantitative easing program and/or raises interest rates. The conclusion of quantitative easing and/or rising interest rates may expose fixed-income markets to increased volatility and may

reduce the liquidity of certain Portfolio investments. These developments could cause the Portfolio’s net asset value to fluctuate or make it more difficult for the Portfolio to accurately value its securities.

If rising interest rates cause the Portfolio to lose enough value, the Portfolio could also face increased shareholder redemptions, which may lead to increased portfolio turnover and transaction costs. An increase in

shareholder redemptions could also force the Portfolio to liquidate investments at disadvantageous times or prices, therefore adversely affecting the Portfolio as well as the value of your investment. The amount of

assets deemed illiquid remaining within the Portfolio may also increase, making it more difficult to meet

| 14 | Janus Henderson Balanced Portfolio |

shareholder

redemptions and further adversely affecting the value of the Portfolio. How specific fixed-income securities may react to changes in interest rates will depend on the specific characteristics of each security.

Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, extension risk, and liquidity risk. Credit risk is the risk that the credit strength of an issuer of a fixed-income security

will weaken and/or that the issuer will be unable to make timely principal and interest payments and that the security may go into default. Prepayment risk is the risk that during periods of falling interest rates,

certain fixed-income securities with higher interest rates, such as mortgage- and asset-backed securities, may be prepaid by their issuers thereby reducing the amount of interest payments. Valuation risk is the risk

that one or more of the fixed-income securities in which the Portfolio invests are priced differently than the value realized upon such security’s sale. In times of market instability, valuation may be more

difficult. Extension risk is the risk that borrowers may pay off their debt obligations more slowly in times of rising interest rates, which will lengthen the duration of the portfolio. Liquidity risk is the risk that

fixed-income securities may be difficult or impossible to sell at the time that the portfolio managers would like or at the price the portfolio managers believe the security is currently worth.

High-Yield/High-Risk Bond Risk. High-yield/high-risk bonds are considered speculative and may be more sensitive than other types of bonds to economic changes, political changes, or adverse

developments specific to the company that issued the bond, which may adversely affect their value.

Mortgage- and Asset-Backed Securities Risk. Mortgage- and asset-backed securities represent interests in “pools” of commercial or residential mortgages or other assets, including consumer loans or

receivables. Mortgage- and asset-backed securities tend to be more sensitive to changes in interest rates than other types of debt securities. Investments in mortgage- and asset-backed securities are subject to both

extension risk, where borrowers pay off their debt obligations more slowly in times of rising interest rates, and prepayment risk, where borrowers pay off their debt obligations sooner than expected in times of

declining interest rates. These risks may reduce the Portfolio’s returns. In addition, investments in mortgage- and asset-backed securities, including those comprised of subprime mortgages, may be subject to a

higher degree of credit risk, valuation risk, and liquidity risk than various other types of fixed-income securities.

TBA

Commitments Risk. The Portfolio may enter into “to be announced” or “TBA” commitments. Although the particular TBA securities must meet industry-accepted

“good delivery” standards, there can be no assurance that a security purchased on a forward commitment basis will ultimately be issued or delivered by the counterparty. If the counterparty to a transaction

fails to deliver the securities, the Portfolio could suffer a loss. Because TBA commitments do not require the purchase and sale of identical securities, the characteristics of the security delivered to the Portfolio

may be less favorable than the security delivered to the dealer. Accordingly, there is a risk that the security that the Portfolio buys will lose value between the purchase and settlement dates.

Derivatives Risk. Derivatives can be highly volatile and involve risks in addition to the risks of the underlying referenced securities or asset. Gains or losses from a derivative

investment can be substantially greater than the derivative’s original cost, and can therefore involve leverage. Leverage may cause the Portfolio to be more volatile than if it had not used leverage. Derivatives

can be less liquid than other types of investments and entail the risk that the counterparty will default on its payment obligations. The Portfolio may use derivatives, including forward currency contracts and exchange-traded and Treasury futures, for hedging purposes. Hedging with derivatives may

increase expenses, and there is no guarantee that a hedging strategy will work. While hedging can reduce or eliminate losses, it can also reduce or eliminate gains or cause losses if the market moves in a manner

different from that anticipated by the portfolio managers or if the cost of the derivative outweighs the benefit of the hedge.

Liquidity Risk. The Portfolio may invest in securities or instruments that do not trade actively or in large volumes, and may make investments that are less liquid than other

investments. Also, the Portfolio may make investments that may become less liquid in response to market developments or adverse investor perceptions. Investments that are illiquid or that trade in lower volumes may be

more difficult to value. When there is no willing buyer and investments cannot be readily sold at the desired time or price, the Portfolio may have to accept a lower price or may not be able to sell the security or

instrument at all. Investments in foreign securities, particularly those of issuers located in emerging market countries, tend to have greater exposure to liquidity risk than domestic securities. In unusual market

conditions, even normally liquid securities may be affected by a degree of liquidity risk (i.e., if the number and capacity of traditional market participants is reduced). An inability to sell one or more portfolio

positions can adversely affect the Portfolio’s value or prevent the Portfolio from being able to take advantage of other investment opportunities.

| 15 | Janus Henderson Balanced Portfolio |

Foreign

Exposure Risk. The Portfolio may have exposure to foreign markets as a result of its investments in foreign securities, including investments in emerging markets, which can be

more volatile than the U.S. markets. As a result, its returns and net asset value may be affected to a large degree by fluctuations in currency exchange rates or political or economic conditions in a particular

country. In some foreign markets, there may not be protection against failure by other parties to complete transactions. It may not be possible for the Portfolio to repatriate capital, dividends, interest, and other

income from a particular country or governmental entity. In addition, a market swing in one or more countries or regions where the Portfolio has invested a significant amount of its assets may have a greater effect on

the Portfolio’s performance than it would in a more geographically diversified portfolio. To the extent the Portfolio invests in foreign debt securities, such investments are sensitive to changes in interest

rates. Additionally, investments in securities of foreign governments involve the risk that a foreign government may not be willing or able to pay interest or repay principal when due. Some of the risks of investing

directly in foreign securities may be reduced when the Portfolio invests indirectly in such securities through various other investment vehicles including derivatives, but such investments also involve other risks, as

noted in the Portfolio Summary. The Portfolio’s investments in emerging market countries may involve risks greater than, or in addition to, the risks of investing in more developed

countries.

Sovereign Debt Risk. The Portfolio may invest in U.S. and non-U.S. government debt securities (“sovereign debt”). Some investments in sovereign debt, such as U.S. sovereign

debt, are considered low risk. However, investments in sovereign debt, especially the debt of less developed countries, can involve a high degree of risk, including the risk that the governmental entity that controls

the repayment of sovereign debt may not be willing or able to repay the principal and/or to pay the interest on its sovereign debt in a timely manner. A sovereign debtor’s willingness or ability to satisfy its

debt obligation may be affected by various factors including, but not limited to, its cash flow situation, the extent of its foreign currency reserves, the availability of foreign exchange when a payment is due, and

the relative size of its debt position in relation to its economy as a whole. In the event of default, there may be limited or no legal remedies for collecting sovereign debt and there may be no bankruptcy proceedings

through which the Portfolio may collect all or part of the sovereign debt that a governmental entity has not repaid. In addition, to the extent the Portfolio invests in non-U.S. sovereign debt, it may be subject to

currency risk.

Management Risk. The Portfolio is an actively managed investment portfolio and is therefore subject to the risk that the investment strategies employed for the Portfolio may fail to

produce the intended results. The Portfolio may underperform its benchmark index or other mutual funds with similar investment objectives.

An

investment in the Portfolio is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| Performance information |

The

following information provides some indication of the risks of investing in the Portfolio by showing how the Portfolio’s performance has varied over time. The Portfolio’s Service Shares commenced

operations on December 31, 1999. The returns shown for the Service Shares for periods prior to December 31, 1999 reflect the historical performance of a different class of shares (the Institutional Shares), restated

based on the Service Shares’ estimated fees and expenses (ignoring any fee and expense limitations). The bar chart depicts the change in performance from year to year during the periods indicated, but does not

include charges or expenses attributable to any insurance product, which would lower the performance illustrated. The Portfolio does not impose any sales or other charges that would affect total return computations.

Total return figures include the effect of the Portfolio’s expenses. The table compares the average annual returns for the Service Shares of the Portfolio for the periods indicated to broad-based securities

market indices. All figures assume reinvestment of dividends and distributions.

The

Portfolio’s past performance does not necessarily indicate how it will perform in the future. Updated performance information is available at janushenderson.com/VITperformance or by calling 1-877-335-2687.

| 16 | Janus Henderson Balanced Portfolio |

| Annual Total Returns for Service Shares (calendar year-end) |

|

| Best Quarter: 1st Quarter 2012 9.48% | Worst Quarter: 3rd Quarter 2011 – 11.06% |

| Average Annual Total Returns (periods ended 12/31/19) | ||||

| 1 Year | 5 Years | 10 Years | Since Inception (9/13/93) | |

| Balanced Portfolio | ||||

| Service Shares | 22.27% | 8.73% | 9.37% | 9.84% |

| S&P 500® Index (reflects no deduction for fees, expenses, or taxes) | 31.49% | 11.70% | 13.56% | 9.82% |

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 8.72% | 3.05% | 3.75% | 5.15% |

| Balanced Index (reflects no deduction for fees, expenses, or taxes) | 21.03% | 7.94% | 9.28% | 7.96% |

The

Portfolio’s primary benchmark index is the S&P 500 Index. The Portfolio also compares its performance to the Bloomberg Barclays U.S. Aggregate Bond Index and the Balanced Index. The indices are described

below.

| • | The S&P 500 Index is a commonly recognized, market capitalization-weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance. |

| • | The Bloomberg Barclays U.S. Aggregate Bond Index is made up of the Bloomberg Barclays U.S. Government/Corporate Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index, including securities that are of investment grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $100 million. |

| • | The Balanced Index is an internally-calculated, hypothetical combination of unmanaged indices that combines total returns from the S&P 500 Index (55%) and the Bloomberg Barclays U.S. Aggregate Bond Index (45%). |

| Management |

Investment Adviser: Janus Capital Management LLC

Portfolio Managers: Jeremiah Buckley, CFA, is Executive Vice President and Co-Portfolio Manager of the Portfolio, which he has co-managed since December 2015. Michael Keough is Executive Vice President and Co-Portfolio Manager of the Portfolio, which he has co-managed since December 2019. Marc Pinto, CFA, is Executive Vice President and Co-Portfolio Manager of the Portfolio, which he has co-managed since May 2005. Greg Wilensky, CFA, is Executive Vice President and Co-Portfolio Manager of the Portfolio, which he has co-managed since February 2020.

| 17 | Janus Henderson Balanced Portfolio |

| Purchase and sale of Portfolio shares |

Purchases of Shares may be made only by the separate accounts of insurance companies for the purpose of funding variable insurance contracts or by certain qualified retirement plans. Redemptions, like purchases, may

be effected only through the separate accounts of participating insurance companies or through qualified retirement plans. Requests are duly processed at the NAV next calculated after your order is received in good

order by the Portfolio or its agents. Refer to the appropriate separate account prospectus or plan documents for details.

| Tax information |