Form 485BPOS TRUST FOR PROFESSIONAL

BARRETT GROWTH FUND

Ticker Symbol: BGRWX

Purchasing high-quality

growth stocks at reasonable

prices to achieve long-term capital appreciation and

to maximize after-tax returns.

PROSPECTUS

September 27, 2019

Shares of the Barrett Growth Fund are sold on a no-load basis through investment advisers, consultants, financial planners, brokers, dealers and other investment professionals.

The Securities and Exchange Commission (the “SEC”) has not approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Barrett Growth Fund

a series of Trust for Professional Managers (the “Trust”)

TABLE OF CONTENTS

Summary Section

Investment Objective

The Barrett Growth Fund (the “Fund”) seeks to achieve long-term capital appreciation and to maximize after-tax returns.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees (fees paid directly from your investment) | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

Management Fees | 1.00% |

Distribution (Rule 12b-1) Fees(1) | 0.25% |

Other Expenses | 0.71% |

Total Annual Fund Operating Expenses(2) | 1.96% |

Fee Waiver/Expense Reimbursement | -0.70% |

Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement(3) | 1.26% |

(1) | The Fund accrued 12b-1 fees in the amount of 0.11% during the prior fiscal year. |

(2) | Please note that the Total Annual Fund Operating Expenses in the table above do not correlate to the Ratio of Expenses to Average Net Assets Before Expense Reimbursement found within the “Financial Highlights” section of the prospectus, because the “Financial Highlights” section includes only the direct operating expenses incurred by the Fund and excludes Acquired Fund Fees and Expenses. |

(3) | Pursuant to an operating expense limitation agreement between Barrett Asset Management, LLC, the Fund’s investment adviser (“Barrett,” or the “Adviser”) and the Trust, on behalf of the Fund, the Adviser has agreed to waive its management fees and/or reimburse expenses of the Fund to ensure that Total Annual Fund Operating Expenses (exclusive of front-end or contingent deferred loads, taxes, leverage ( i.e. , any expenses incurred in connection with borrowings made by the Fund), interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividends or interest expenses on short positions, acquired fund fees and expenses or extraordinary expenses such as litigation (collectively, “Excluded Expenses”)) do not exceed 1.25% of the Fund’s average daily net assets through September 28, 2020. The current operating expense limitation agreement can be terminated only by, or with the consent of, the Trust’s Board of Trustees (the “Board of Trustees”). The Adviser may request recoupment of previously waived fees and paid expenses from the Fund for three years from the date such fees and expenses were waived or paid, subject to the operating expense limitation agreement, if such reimbursement will not cause the Fund to exceed the lesser of: (1) the expense limitation in place at the time of the waiver and/or expense payment; or (2) the expense limitation in place at the time of the recoupment. |

Example

This Example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The operating expense limitation agreement discussed in the table above is reflected only through September 28, 2020. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

One Year | Three Years | Five Years | Ten Years |

$128 | $547 | $992 | $2,229 |

1

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 16% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests primarily in a diversified portfolio of common stocks of large- and mid-cap U.S. companies, as well as global companies traded on a U.S. exchange, selected by the Adviser. The Fund considers mid-cap companies to be companies with market capitalizations of approximately $2 billion to $15 billion and large-cap companies to be companies with market capitalizations greater than $15 billion. The Fund may also purchase securities with an equity component, such as preferred stock, warrants, rights or other securities that are convertible into or exchangeable for shares of common stock. The Fund may invest up to 25% of its net assets in foreign securities, and will normally make such investments through the purchase of American Depositary Receipts (“ADRs”).

The Fund takes a conservative approach to growth stock investing that emphasizes “Growth at a Reasonable Price.” The Fund invests in common stocks of high-quality companies that Barrett believes have superior growth potential and stocks that can be purchased at reasonable prices. The Fund makes investments in companies that have solid long-term earnings prospects and the Fund expects to hold these investments for prolonged periods of time, thereby avoiding short-term capital gains, which are taxable to shareholders at higher rates than long-term capital gains. The Adviser focuses on identifying companies that will produce earnings and cash flow growth in excess of companies in the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500® Index”). The Adviser makes investments in companies that it believes produce superior earnings at reasonable valuations. Superior relative earnings growth is usually driven by new products and services, niche products in growth sectors and industries, open-ended global growth opportunities, and cyclical companies whose margins are benefiting from a recovery in their respective industries. Stocks are sold when there is likely to be deterioration in earnings growth or other financial metrics, including balance sheet items. Maintaining a competitive industry position and management stability are also important factors in retaining a company position. Unusually weak relative stock market performance is another signal that prompts the Adviser to immediately reevaluate a holding.

The Adviser mitigates risk in several ways. In order to invest in a specific company the Adviser carefully analyzes the company’s balance sheet and overall ability to withstand adverse economic conditions. More broadly, the Adviser diversifies the portfolio across multiple industries, economic sectors and geographic regions to reduce the risk of a particular industry’s or region’s weakness adversely affecting the total Fund. Since the Adviser focuses on buying companies at reasonable valuations, the risk of overpaying for companies with strong earnings growth is also reduced. The Fund invests in companies across the large- and mid-capitalization spectrum which provides the Fund with exposure to companies of different revenue and earnings levels. Finally, the Fund emphasizes objectivity in evaluating existing holdings and sells holdings when the fundamental outlook for a company is expected to deteriorate.

From time to time, the Fund may purchase options, futures contracts or other instruments, such as depositary receipts, that relate to a particular stock index, to allow the Fund to quickly invest excess cash in order to gain exposure to the markets until the Fund can purchase individual stocks.

Principal Risks

Before investing in the Fund, you should carefully consider your own investment goals, the amount of time you are willing to leave your money invested, and the amount of risk you are willing to take. Remember, in addition to possibly not achieving your investment goals, you could lose money by investing in the Fund. The principal risks of investing in the Fund are:

2

• | Management Risk. Investment strategies employed by the Adviser in selecting investments for the Fund may not result in an increase in the value of your investment or in overall performance equal to other investments. |

• | General Market Risk. Certain securities selected for the Fund’s portfolio may be worth less than the price originally paid for them, or less than they were worth at an earlier time. |

• | Equity Market Risk. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Preferred stock is subject to the risk that the dividend on the stock may be changed or omitted by the issuer and that participation in the growth of an issuer may be limited. |

• | Growth Stock Risk. The prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. |

• | Foreign Securities Risk. Investments in foreign companies, including ADRs, which represent an ownership in a foreign security, involve certain risks not generally associated with investments in the securities of U.S. companies, including changes in currency exchange rates, unstable political, social and economic conditions, a lack of adequate or accurate company information, differences in the way securities markets operate, less secure international banks or securities depositories than those in the U.S. and foreign controls on investment. Income earned on foreign securities may be subject to foreign withholding taxes. In addition, individual international country economies may differ favorably or unfavorably from the U.S. economy in such respects as growth of gross domestic product, rates of inflation, capital reinvestment, resources, self-sufficiency and balance of payments position. These risks may also apply to U.S. companies that have substantial foreign operations. |

• | Large-Capitalization Company Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in consumer tastes or innovative smaller competitors. Also, large-capitalization companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion. |

• | Mid-Capitalization Company Risk. The mid-capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, these mid-sized companies may pose additional risks, including liquidity risk, because these companies may have limited product lines, markets and financial resources, and may depend upon a relatively small management group. Therefore, mid-cap stocks may be more volatile than those of larger companies. |

• | Options and Futures Risk. Options and futures may be more volatile than investments in securities, involve additional costs and may involve a small initial investment relative to the risk assumed. In addition, the value of an option or future may not correlate perfectly to the underlying securities index or overall securities markets. |

• | Cybersecurity Risk. With the increased use of technologies such as the Internet to conduct business, the Fund is susceptible to operational, information security, and related risks. Cyber incidents affecting the Fund or its service providers may cause disruptions and impact business operations, potentially resulting in financial losses, interference with the Fund’s ability to calculate its NAV, impediments to trading, the inability of shareholders to transact business, violations of |

3

applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, or additional compliance costs.

Performance

The performance information demonstrates the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for one, five and ten years compare with those of a broad measure of market performance and the returns of a Lipper peer group (a group of mutual funds with characteristics similar to those of the Fund). The Fund is the successor to the Barrett Growth Fund, a series of the Barrett Funds (the “Predecessor Fund”). The performance information included herein reflects the performance of the Predecessor Fund for periods prior to the reorganization, which occurred on March 30, 2010. Remember, the Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information may be obtained by calling the Fund toll-free at 1-877-363-6333.

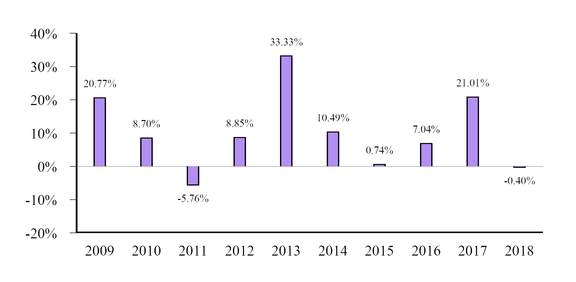

Calendar Year Returns as of December 31

The Fund’s calendar year-to-date return as of June 30, 2019 was 21.74%. During the period shown in the bar chart, the best performance for a quarter was 13.26% (for the quarter ended March 31, 2012) and the worst performance was -15.77% (for the quarter ended September 30, 2011).

Average Annual Total Returns (for the Periods Ended December 31, 2018) | |||

One Year | Five Years | Ten Years | |

Return Before Taxes | -0.40% | 7.51% | 9.94% |

Return After Taxes on Distributions | -1.21% | 7.07% | 9.70% |

Return After Taxes on Distributions and Sale of Fund Shares | 0.33% | 5.90% | 8.21% |

S&P 500® Total Return Index (reflects no deductions for fees, expenses, or taxes) | -4.38% | 8.49% | 13.12% |

Lipper Large-Cap Growth Funds Index® (reflects no deductions for fees, expenses, or taxes) | -0.47% | 8.98% | 14.09% |

After-tax returns are calculated using the historically highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who

4

hold their Fund shares through tax-deferred or other tax-advantaged arrangements such as 401(k) plans or individual retirement accounts (“IRAs”).

In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax benefit to the investor.

Management

Investment Adviser

Barrett Asset Management, LLC is the Fund’s investment adviser.

Portfolio Managers

Robert J. Milnamow, President and Chief Investment Officer, joined the Adviser in 2003, E. Wells Beck, CFA ® , Managing Director and Director of Research, joined the Adviser in 2006 and Owen W. Gilmore, CFA ® , Associate Managing Director, joined the Adviser in 2016. Mr. Milnamow has served as a portfolio manager of the Fund since 2004, Mr. Beck has served as a portfolio manager of the Fund since 2006 and Mr. Gilmore has served as a portfolio manager of the Fund since 2017.

Purchase and Sale of Fund Shares

You may purchase or redeem shares by mail (Barrett Growth Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701 (for regular mail) or 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53202 (for overnight or express mail)), or by telephone at 877-363-6333, on any day the New York Stock Exchange (“NYSE”) is open for trading. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly. The minimum initial amount of investment in the Fund is $2,500 with a subsequent investment minimum of $50. The minimum initial investment for qualified retirement accounts is $1,000 ($500 for Coverdell Education Savings Accounts) with no subsequent investment minimum.

Tax Information

The Fund’s distributions will be taxed as ordinary income or long-term capital gains, unless you are investing through a tax-deferred or other tax-advantaged arrangement, such as a 401(k) plan or an IRA. You may be taxed later upon withdrawal of monies from such tax-deferred arrangements.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and/or its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create conflicts of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

Investment Strategies, Related Risks and Disclosure of Portfolio Holdings

Investment Objective

The Fund’s investment objective is to achieve long-term capital appreciation and to maximize after-tax returns.

Changes in Investment Objective. The Fund’s investment objective in this Prospectus may be changed or modified in the future by action of the Board of Trustees without shareholder approval. However, shareholders would receive advance written notice at least 60 days prior to any such change taking effect.

Principal Investment Strategies

Types of Investments. The Fund invests primarily in common stocks of large- and mid-cap U.S. companies, as well as securities of companies that operate globally, provided that their shares are traded on U.S. stock exchanges. The Fund considers mid-cap companies to be companies with market capitalizations of approximately $2 billion to $15 billion and large-cap companies to be companies with market capitalizations greater than $15 billion. It also may purchase securities with an equity component, such as preferred stock, warrants, rights or other securities that are convertible into or exchangeable for shares of common stock. The Fund may invest up to 25% of its net assets in foreign securities, and will normally make such investments through the purchase of ADRs. ADRs are receipts issued by U.S. banks or trust companies representing ownership interests of securities issued by foreign companies.

From time to time, the Fund may purchase options, futures contracts or other instruments (such as depository receipts) that relate to a particular stock index. These investments allow the Fund to quickly invest excess cash in order to gain exposure to the markets until the Fund can purchase individual stocks. For example, the Fund may purchase Standard & Poor’s Depository Receipts®, which are receipts representing an ownership interest in a portfolio of the stocks that make up the S&P 500® Index.

Stock Selection Process. The Adviser identifies stocks for investment using its own research and analysis techniques, and supplements its internal research with the research and analysis of investment firms as well as evaluating data from other independent sources, some of which are available on the Internet. The Adviser also employs quantitative screens of various databases to identify potential companies to research on a fundamental basis. When analyzing a company’s growth prospects, the Adviser evaluates the revenue growth opportunity, the opportunity for margin expansion and the financial strength to take advantage of opportunities. In addition to companies that produce superior earnings growth, the Adviser invests primarily in companies that generate free cash flow, are leaders in their respective industries, and have records that point to management’s focus on shareholder enhancement. The Adviser uses several valuation metrics to ensure that the investment is made at a reasonable price. These metrics include price-to-earnings ratios, free cash flow yields, price-to-sales ratios and price-to-cash flow ratios.

The Fund has a long-term investment outlook and does not intend to use short-term trading as a primary means of achieving its investment objective. When the Adviser anticipates that individual stocks will be sold, it attempts to manage the liquidation process to take advantage of longer holding periods for favorable long-term capital gains tax rates in order to optimize the after-tax return to Fund shareholders. The Fund makes investments in companies that have solid long-term earnings prospects, and the Fund expects to hold these investments for prolonged periods of time, thereby avoiding short-term capital gains.

Temporary Strategies; Cash or Similar Investments. For temporary defensive purposes, the Adviser may invest up to 100% of the Fund’s total assets in high-quality, short-term debt securities and money market instruments. These short-term debt securities and money market instruments include shares of other mutual funds, commercial paper, certificates of deposit, bankers’ acceptances, U.S. Government securities and repurchase agreements. Taking a temporary defensive position may result in the Fund

6

not achieving its investment objective. Furthermore, to the extent that the Fund invests in money market mutual funds for its cash position, there will be some duplication of expenses because the Fund would bear its pro rata portion of such money market funds’ management fees and operational expenses.

Principal Risks

Before investing in the Fund, you should carefully consider your own investment goals, the amount of time you are willing to leave your money invested, and the amount of risk you are willing to take. Remember, in addition to possibly not achieving your investment goals, you could lose money by investing in the Fund. The principal risks of investing in the Fund are:

• | Management Risk. The ability of the Fund to meet its investment objective is directly related to the Adviser’s investment strategies for the Fund. The value of your investment in the Fund may vary with the effectiveness of the Adviser’s research, analysis and asset allocation among portfolio securities. If the Adviser’s investment strategies do not produce the expected results, your investment could be diminished or even lost. |

• | General Market Risk. The market value of a security may move up or down, sometimes rapidly and unpredictably. These fluctuations may cause a security to be worth less than the price originally paid for it, or less than it was worth at an earlier time. Market risk may affect a single issuer, industry, sector of the economy or the market as a whole. Global economies and financial markets are increasingly interconnected, which increases the possibilities that conditions in one country or region might adversely impact issuers in a different country or region. The securities markets have experienced substantially lower valuations, reduced liquidity, price volatility, credit downgrades, increased likelihood of default, and valuation difficulties, all of which may increase the risks of investing in securities held by the Fund. |

• | Equity Market Risk. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. These investor perceptions are based on various and unpredictable factors including: expectations regarding government, economic, monetary and fiscal policies; inflation and interest rates; economic expansion or contraction; and global or regional political, economic and banking crises. If you held common stock, or common stock equivalents, of any given issuer, you would generally be exposed to greater risk than if you held preferred stocks and debt obligations of the issuer because common stockholders, or holders of equivalent interests, generally have inferior rights to receive payments from issuers in comparison with the rights of preferred stockholders, bondholders and other creditors of such issuers. |

• | Growth Stock Risk. Growth stocks are stocks of companies believed to have above-average potential for growth in revenue and earnings. The prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may not perform as well as value stocks or the stock market in general. |

• | Foreign Securities Risk. Investing in foreign securities, including direct investments and through ADRs, which are traded on U.S. exchanges and represent an ownership in a foreign security, poses additional risks since political and economic events unique to a country or region will affect those markets and their issuers. These risks will not necessarily affect the U.S. economy or similar issuers located in the United States, but may affect the U.S. companies with significant foreign operations. In addition, changes in the value of a currency compared to the U.S. dollar may affect (positively or negatively) the value of foreign securities. These currency movements may occur separately from, and in response to, events that do not otherwise affect the value of the security in the issuer’s home country. While ADRs provide an alternative to directly purchasing the underlying foreign securities in their respective national markets and currencies, investments in |

7

ADRs continue to be subject to many of the risks associated with investing directly in foreign securities.

• | Large-Capitalization Company Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in consumer tastes or innovative smaller competitors. Also, large-capitalization companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion. |

• | Mid-Capitalization Company Risk. The mid-capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, these mid-sized companies may pose additional risks, including liquidity risk, because these companies may have limited product lines, markets and financial resources, and may depend upon a relatively small management group. Therefore, mid-cap stocks may be more volatile than those of larger companies. These securities may be traded over-the-counter or listed on an exchange. |

• | Options and Futures Risk . The Fund may invest in options and futures contracts. The Fund also may invest in so-called “synthetic options” or other derivative instruments written by broker-dealers or other financial intermediaries. Options and futures are subject to the same risks as the securities in which the Fund invests, but also may involve risks different from, and possibly greater than, the risks associated with investing directly in securities. Investments in options and futures involve additional costs, may be more volatile than other investments and may involve a small initial investment relative to the risk assumed. If the Adviser incorrectly forecasts the value of securities in using an option or futures contract, the Fund might have been in a better position if the Fund had not entered into the contract. In addition, the value of an option or futures contract may not correlate perfectly to the underlying securities index or overall securities markets. |

• | Cybersecurity Risk. With the increased use of technologies such as the Internet to conduct business, the Fund is susceptible to operational, information security, and related risks. In general, cyber incidents can result from deliberate attacks or unintentional events. Cyber attacks include, but are not limited to, gaining unauthorized access to digital systems (e.g., through “hacking” or malicious software coding) for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. Cyber attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites (i.e., efforts to make network services unavailable to intended users). Cyber incidents affecting the Fund or its service providers may cause disruptions and impact business operations, potentially resulting in financial losses, interference with the Fund’s ability to calculate its NAV, impediments to trading, the inability of shareholders to transact business, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, or additional compliance costs. Similar adverse consequences could result from cyber incidents affecting issuers of securities in which the Fund invests, counterparties with which the Fund engages in transactions, governmental and other regulatory authorities, exchange and other financial market operators, banks, brokers, dealers, insurance companies and other financial institutions (including financial intermediaries and service providers for shareholders) and other parties. In addition, substantial costs may be incurred in order to prevent any cyber incidents in the future. While the Fund’s service providers have established business continuity plans in the event of, and risk management systems to prevent, such cyber incidents, there are inherent limitations in such plans and systems including the possibility that certain risks have not been identified. Furthermore, the Fund cannot control the cybersecurity plans and systems put in place by its service providers or any other third parties whose operations may affect the Fund or its shareholders. As a result, the Fund and its shareholders could be negatively impacted. |

8

Portfolio Holdings Information

A description of the Fund’s policies and procedures with respect to the disclosure of the Fund’s portfolio holdings is available in the Fund’s Statement of Additional Information (“SAI”). Disclosure of the Fund’s holdings is required to be made quarterly within 60 days of the end of each fiscal quarter in the annual and semi-annual reports to Fund shareholders and in the quarterly holdings report on Form N-Q (through the quarter ended February 29, 2020) or Part F of Form N-PORT (beginning with filings thereafter). The annual and semi-annual reports are available by contacting Barrett Growth Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701 or calling 877-363-6333. Form N-Q or Part F of Form N-PORT, as applicable, is available on the SEC’s website at www.sec.gov.

Management of the Fund

Investment Adviser

Barrett Asset Management, LLC, located at 90 Park Avenue, New York, New York 10016, serves as the investment adviser to the Fund under an investment advisory agreement (the “Advisory Agreement”) between the Trust, on behalf of the Fund, and the Adviser. Under the Advisory Agreement, the Adviser manages the Fund’s investments subject to the supervision of the Board of Trustees. The Adviser is responsible for managing the Fund in accordance with its investment objective, strategies and policies, making decisions with respect to, and placing orders for, all purchases and sales of portfolio securities. The Adviser also maintains related records for the Fund. For the fiscal year ended May 31, 2019, the Adviser received management fees of 0.44% (net of fee waivers and expense reimbursements) of the Fund’s average daily net assets.

The Adviser is the successor firm to Barrett Associates, Inc., which was founded in 1937. As of July 31, 2019, the Adviser managed over $1.99 billion of client assets, of which approximately $1.737 billion is invested in equity securities. The firm has approximately 860 client accounts, including families, individuals, foundations and other organizations or entities. Many of the client relationships are in their third generation. The Fund was organized in order to provide investors with a cost-efficient opportunity to invest according to the Adviser’s long-term equity investing philosophy of “Growth at a Reasonable Price,” without being required to maintain a large account balance.

Fund Expenses . The Fund is responsible for its own operating expenses. Pursuant to an operating expense limitation agreement between the Adviser and the Trust, on behalf of the Fund, the Adviser has agreed to waive its management fees and/or reimburse expenses to ensure that the Fund’s total annual operating expenses (exclusive of Excluded Expenses) do not exceed 1.25% of the Fund’s average daily net assets. Any waiver of management fees or payment of expenses made by the Adviser may be reimbursed by the Fund in subsequent years if the Adviser so requests. This reimbursement may be requested if the aggregate amount actually paid by the Fund toward operating expenses for such fiscal year (taking into account the reimbursement) does not exceed the applicable limitation on Fund expenses. The Adviser may request recoupment of previously waived fees and paid expenses from the Fund for three years from the date such fees and expenses were waived or paid, if such reimbursement will not cause the Fund to exceed the lesser of: (1) the expense limitation in place at the time of the waiver and/or expense payment; or (2) the expense limitation in place at the time of the recoupment. Any such reimbursement will be reviewed and approved by the Board of Trustees. In addition, any such reimbursement from the Fund to the Adviser will be subject to the applicable limitation on the Fund’s expenses. This operating expense limitation agreement, effective through at least September 28, 2020, can be terminated only by, or with the consent of, the Board of Trustees. Thereafter, the operating expense limitation agreement may be renewed by the Adviser and the Board of Trustees.

A discussion regarding the basis of the approval by the Board of Trustees of the Advisory Agreement between the Trust, on behalf of the Fund, and the Adviser is included in the Fund’s semi-annual report to shareholders for the six-month period ended November 30, 2018.

9

The Fund, as a series of the Trust, does not hold itself out as related to any other series of the Trust for purposes of investment and investor services, nor does it share the same investment adviser with any other series of the Trust.

Portfolio Managers

The Adviser uses a team approach for security selection and decision-making. Robert J. Milnamow, E. Wells Beck and Owen W. Gilmore are the portfolio managers (the “Portfolio Managers”) of the Fund and are jointly responsible for the day-to-day investment decisions for the Fund. The Portfolio Managers regularly review Fund positions to assess changes in the investment outlook for each company in the portfolio based upon changes in each company’s business outlook as well as macroeconomic variables. The Portfolio Managers evaluate each new investment opportunity for the portfolio to assess whether it meets the investment objective of the Fund. Decisions are made jointly by the Portfolio Managers. The names and backgrounds of the portfolio management team members are as follows:

Robert J. Milnamow

President and Chief Investment Officer – Barrett Asset Management, LLC

Mr. Milnamow holds a B.A. from Pennsylvania State University and an M.B.A. from New York University. Mr. Milnamow joined Barrett in 2003 and, in addition to his research and portfolio management responsibilities, he assists in the generation of new business. Prior to joining Barrett, Mr. Milnamow was Managing Member at Thayer Pond Capital, LLC from 2001 to 2003. Mr. Milnamow was a research analyst and portfolio manager for Rockefeller & Co., where he was responsible for managing individual high net worth, foundation and endowment accounts from 1998 to 2001. Previously, he was a research analyst and portfolio manager for Phoenix Securities Group from 1989 to 1995, where he managed the Phoenix Total Return Fund and the Phoenix Variable Annuity Total Return Fund, and for Oppenheimer Funds from 1995 to 1998, where he managed the Main Street Income and Growth Fund.

E. Wells Beck, CFA®

Managing Director and Director of Research – Barrett Asset Management, LLC

Mr. Beck is a graduate of Princeton University and received his M.B.A. from New York University. Mr. Beck joined Barrett in 2006. He was previously an analyst and portfolio manager at Haven Capital Management in New York from 2001 to 2006. From 2000 to 2001, Mr. Beck was a sell-side analyst in the research department of Prudential Securities covering a number of areas, including financial services. He also has investment experience from positions he held at HSBC Investment Banking PLC in 1998 and Oppenheimer Capital International from 1994 to 1997. Mr. Beck is a CFA® Charterholder.

Owen W. Gilmore, CFA®

Associate Managing Director – Barrett Asset Management, LLC

Mr. Gilmore joined Barrett Asset Management, LLC in 2016 and is responsible for assisting the investment team with security selection and portfolio construction. Mr. Gilmore received a B.A. in Economics and Mathematical Science from Colby College in 2008 and an M.B.A. in Accounting, Financial Instruments and Markets, and Leadership & Change Management from the New York University Stern School of Business in 2016. While in business school, Owen interned as an Equity Research Summer Associate in the Healthcare Group at Manning & Napier. Prior to attending business school, Mr. Gilmore was an Investment Analyst at Boston University’s Investment Office. Mr. Gilmore is a CFA ® Charterholder.

CFA® is a registered trademark owned by the CFA Institute.

The SAI provides additional information about the Portfolio Managers’ compensation, other accounts they manage and their ownership of shares of the Fund.

Shareholder Information

10

Share Price

The price of the Fund’s shares is the Fund’s net asset value (“NAV”). The NAV is calculated by dividing the value of the Fund’s total assets, less its liabilities, by the number of its shares outstanding. In calculating the NAV, portfolio securities are valued using current market values or official closing prices, if available. The NAV is calculated at the close of regular trading on the NYSE (generally 4:00 p.m., Eastern time). The NAV will not be calculated on days on which the NYSE is closed for trading. If the NYSE closes early, the Fund will calculate its NAV at the closing time on that day. If an emergency exists as permitted by the SEC, the NAV may be calculated at a different time.

Each equity security owned by the Fund that is listed on a national securities exchange, except for portfolio securities listed on the NASDAQ Stock Market LLC (“NASDAQ”), is valued at its last sale price on that exchange on the date as of which assets are valued. If a security is listed on more than one exchange, the Fund will use the price on the exchange that the Fund generally considers to be the principal exchange on which the security is traded.

Portfolio securities listed on NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at the mean between the most recent bid and asked prices at the close of the exchange on such day or the security is valued at the latest sales price on the “composite market” for the day such security is being valued. The composite market is defined as the consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter (“OTC”) markets as published by an approved independent pricing service.

Exchange-traded options are valued at the composite price, using the National Best Bid and Offer quotes. If there are no trades for the option on a given business day composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. Option contracts on securities, currencies and other financial instruments traded in the OTC market with less than 180 days remaining until their expiration are valued at the evaluated price provided by the broker-dealer with which the option was traded. Option contracts on securities, currencies and other financial instruments traded in the OTC market with 180 days or more remaining until their expiration are valued at the prices provided by a recognized independent broker-dealer.

If market quotations are not readily available, a security or other asset will be valued at its fair value as determined under fair value pricing procedures approved by the Board of Trustees. These fair value pricing procedures will also be used to price a security when corporate events, events in the securities market or world events cause the Adviser to believe that the security’s last sale price may not reflect its actual fair market value. The intended effect of using fair value pricing procedures is to ensure that the Fund’s shares are accurately priced. The Board of Trustees will regularly evaluate whether the Fund’s fair value pricing procedures continue to be appropriate in light of the specific circumstances of the Fund and the quality of prices obtained through their application by the Trust’s valuation committee.

When fair value pricing is employed, the prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. Due to the subjective and variable nature of fair value pricing, it is possible that the fair value determined for a particular security may be materially different from the price of the security quoted or published by others, or the value when trading resumes or is realized upon sale. Therefore, if a shareholder purchases or redeems Fund shares when the Fund holds securities priced at a fair value, the number of shares purchased or redeemed may be higher or lower than it would be if the Fund were using market value pricing. The Adviser anticipates that the Fund’s portfolio holdings will be fair valued only if market quotations for those holdings are considered unreliable.

In the case of foreign securities, the occurrence of certain events after the close of foreign markets, but prior to the time the Fund’s NAV is calculated (such as a significant surge or decline in the U.S. or other

11

markets) often will result in an adjustment to the trading prices of foreign securities when foreign markets open on the following business day. If such events occur, the Fund will value foreign securities at fair value, taking into account such events, in calculating the NAV. In such cases, use of these evaluated prices can reduce an investor’s ability to seek to profit by estimating the Fund’s NAV in advance of the time the NAV is calculated. In the event the Fund holds portfolio securities that trade in foreign markets or that are primarily listed on foreign exchanges that trade on weekends or other days when the Fund does not price its shares, the Fund’s NAV may change on days when shareholders will not be able to purchase or redeem the Fund’s shares.

How to Purchase Shares

All purchase requests received in good order by the Fund’s transfer agent, U.S. Bancorp Fund Services, LLC (the “Transfer Agent”), or by an Authorized Intermediary (as defined below), before the close of the NYSE (generally 4:00 p.m., Eastern time) will be processed at that day’s NAV per share. Purchase requests received by the Transfer Agent or an Authorized Intermediary after the close of the NYSE will receive the next business day’s NAV per share. An Authorized Intermediary is a financial intermediary (or its authorized designee) that has made arrangements with the Fund to receive purchase and redemption orders on its behalf. For additional information about purchasing shares through financial intermediaries, please see “Purchasing Shares Through a Financial Intermediary,” below.

All account applications (each an “Account Application”) to purchase Fund shares are subject to acceptance by the Fund and are not binding until so accepted. It is the policy of the Fund not to accept applications under certain circumstances or in amounts considered disadvantageous to other shareholders. Your order will not be accepted until the Fund or the Transfer Agent receives a completed Account Application.

The Fund reserves the right to reject any purchase order or suspend the offering of shares if, in its discretion, it is in the Fund’s best interest to do so. For example, a purchase order may be rejected if it appears so large that it would disrupt the management of the Fund. Purchases may also be rejected from persons believed to be “market-timers,” as described under “Tools to Combat Frequent Transactions,” below. In addition, a service fee, which is currently $25, as well as any loss sustained by the Fund, will be deducted from a shareholder’s account for any payment that is returned to the Transfer Agent unpaid. The Fund and the Transfer Agent will not be responsible for any losses, liability, cost or expense resulting from rejecting any purchase order. Your order will not be accepted until a completed Account Application is received by the Fund or the Transfer Agent.

Shares of the Fund have not been registered for sale outside of the United States. The Fund generally does not sell shares to investors residing outside the United States, even if they are United States citizens or lawful permanent residents, except to investors with United States military APO or FPO addresses.

Minimum Investments. The minimum initial investment in the Fund is $2,500 and additional subsequent investments can be made at a minimum amount of $50. The minimum investment amount for qualified retirement accounts is $1,000 ($500 for Coverdell Education Savings Accounts) with no minimum amount for subsequent investments. The Fund reserves the right to change or waive its minimum initial investment or minimum subsequent investment policies at any time.

Purchase Requests Must be Received in Good Order

Your share price will be the next NAV per share calculated after the Transfer Agent or your Authorized Intermediary receives your purchase request in good order. For purchases made through the Transfer Agent, “good order” means that your purchase request includes:

• | the name of the Fund; |

• | the dollar amount of shares to be purchased; |

12

• | your Account Application or investment stub; and |

• | a check payable to “Barrett Growth Fund.” |

For information about your financial intermediary’s requirements for purchases in good order, please contact your financial intermediary.

Purchase by Mail. To purchase the Fund’s shares by mail, simply complete and sign the Account Application and mail it, together with your check made payable to the Fund, to one of the addresses below. To make additional investments once you have opened your account, write your account number on the check and send it together with the Invest by Mail form from your most recent confirmation statement received from the Transfer Agent. If you do not have the Invest by Mail form, include the Fund name and your name, address, and account number on a separate piece of paper and mail it with your check made payable to the Fund to:

Regular Mail Barrett Growth Fund c/o U.S. Bank Global Fund Services P.O. Box 701 Milwaukee, WI 53201-0701 | Overnight or Express Mail Barrett Growth Fund c/o U.S. Bank Global Fund Services 615 East Michigan Street, 3rd Floor Milwaukee, WI 53202 |

The Fund does not consider the U.S. Postal Service or other independent delivery services to be its agents. Therefore, deposit in the mail or with such services, or receipt at the Transfer Agent’s post office box, of purchase orders does not constitute receipt by the Transfer Agent. Receipt of purchase orders or redemption requests is based on when the order is received at the Transfer Agent’s offices. All purchase checks must be in U.S. dollars drawn on a domestic financial institution. The Fund will not accept payment in cash or money orders. To prevent check fraud, the Fund will not accept third party checks, Treasury checks, credit card checks, traveler’s checks or starter checks for the purchase of shares. The Fund is unable to accept post-dated checks or any conditional order or payment.

Purchase by Wire. If you are making your first investment in the Fund through a wire purchase, the Transfer Agent must have a completed Account Application before you wire funds. You can mail or use an overnight service to deliver your Account Application to the Transfer Agent at the above address. Upon receipt of your completed Account Application, the Transfer Agent will establish an account for you. Once your account has been established, you may instruct your bank to send the wire. Prior to sending the wire, please call the Transfer Agent at 877-363-6333 to advise them of the wire and to ensure proper credit upon receipt. Your bank must include the name of the Fund, your name and your account number so that monies can be correctly applied. Your bank should transmit immediately available funds by wire to:

Wire to: | U.S. Bank National Association 777 East Wisconsin Avenue Milwaukee, Wisconsin 53202 |

ABA Number: | 075000022 |

Credit: | U.S. Bancorp Fund Services, LLC |

Account: | 112-952-137 |

Further Credit: | Barrett Growth Fund (Shareholder Name/Account Registration) (Shareholder Account Number) |

13

Wired funds must be received prior to the close of the NYSE (generally 4:00 p.m., Eastern time) to be eligible for same day pricing. The Fund and U.S. Bank National Association, the Fund’s custodian, are not responsible for the consequences of delays resulting from the banking or Federal Reserve wire system, or from incomplete wiring instructions.

Investing by Telephone. Telephone purchase privileges are automatically provided unless you specifically decline the option on your Account Application. You must also have submitted a voided check or a savings deposit slip to have banking information established on your account. This option allows investors to move money from their bank account to their Fund account upon request. If your account is open for at least 7 business days, you may purchase additional shares by calling the Fund toll free at 877-363-6333. Only bank accounts held at domestic financial institutions that are Automated Clearing House (“ACH”) members may be used for telephone transactions. The minimum telephone purchase amount is $50. If your order is received by the Transfer Agent or an authorized intermediary prior to the close of the NYSE (generally 4:00 p.m., Eastern time), shares will be purchased in your account at the applicable price determined on the day your order is placed. During periods of high market activity, shareholders may encounter higher than usual call waiting times. Please allow sufficient time to place your telephone transaction.

Automatic Investment Plan. For your convenience, the Fund offers an Automatic Investment Plan (“AIP”). Under the AIP, after your initial investment, you may authorize the Fund to withdraw automatically from your personal checking or savings account an amount that you wish to invest, which must be at least $50, on a monthly, quarterly or annual basis. In order to participate in the AIP, your bank must be a member of the ACH network. If you wish to enroll in the AIP, complete the appropriate section in the Account Application. The Fund may suspend, terminate or modify this privilege at any time. You may terminate your participation in the AIP at any time by notifying the Transfer Agent five days prior to the effective date. A $25 fee will be charged if your bank does not honor the AIP draft for any reason.

Purchasing Shares Through a Financial Intermediary. Investors may be charged a fee if they effect transactions through a financial intermediary. If you are purchasing shares through a financial intermediary, you must follow the procedures established by your financial intermediary. Your financial intermediary is responsible for sending your purchase order and wiring payment to the Transfer Agent. Your financial intermediary holds the shares in your name and receives all confirmations of purchases and sales. Financial intermediaries placing orders for themselves or on behalf of their customers should call the Fund toll free at 877-363-6333, or follow the instructions listed in the sections above entitled “Investing by Telephone,” “Purchase by Mail” and “Purchase by Wire.”

If you place an order for the Fund’s shares through a financial intermediary that is not an Authorized Intermediary in accordance with such financial intermediary’s procedures, and such financial intermediary then transmits your order to the Transfer Agent in accordance with the Transfer Agent’s instructions, your purchase will be processed at the applicable price next calculated after the Transfer Agent receives your order. The financial intermediary must promise to send to the Transfer Agent immediately available funds in the amount of the purchase price in accordance with the Transfer Agent’s procedures. If payment is not received within the time specified, the Transfer Agent may rescind the transaction and the financial intermediary will be held liable for any resulting fees or losses.

In the case of Authorized Intermediaries that have made satisfactory payment or redemption arrangements with a Fund, orders will be processed at the applicable price next calculated after receipt by the Authorized Intermediary (or its authorized designee), consistent with applicable laws and regulations. An order is deemed to be received when a Fund or an Authorized Intermediary accepts the order. Authorized Intermediaries may be authorized to designate other intermediaries to receive purchase and redemption requests on behalf of the Fund.

14

For more information about your financial intermediary’s rules and procedures, whether your financial intermediary is an Authorized Intermediary, and whether your financial intermediary imposes cut-off times for the receipt of orders that are earlier than the cut-off times established by the Fund, you should contact your financial intermediary directly.

Anti-Money Laundering Program. The Trust has established an Anti-Money Laundering Compliance Program as required by the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “USA PATRIOT Act”) and related anti-money laundering laws and regulations. To ensure compliance with these laws, the Account Application asks for, among other things, the following information for all “customers” seeking to open an “account” (as those terms are defined in rules adopted pursuant to the USA PATRIOT Act):

• | full name; |

• | date of birth (individuals only); |

• | Social Security or taxpayer identification number; and |

• | permanent street address (a P.O. Box alone is not acceptable). |

If you are opening an account in the name of a certain legal entity (e.g., a partnership, limited liability company, business trust, corporation, etc.), you must also supply the identity of the beneficial owners of the legal entity. Accounts opened by entities, such as corporations, limited liability companies, partnerships or trusts will require additional documentation.

If any information listed above is missing, your Account Application will be returned and your account will not be opened. In compliance with the USA PATRIOT Act and other applicable anti-money laundering laws and regulations, the Transfer Agent will verify the information on your application. The Fund reserves the right to request additional clarifying information and may close your account and redeem your shares at the next computed NAV if such clarifying information is not received by the Fund within a reasonable time of the request or if the Fund cannot form a reasonable belief as to the true identity of a customer. If you require additional assistance when completing your application, please contact the Transfer Agent at 877-363-6333.

How to Redeem Shares

Orders to sell or “redeem” shares may be placed directly with the Fund or through a financial intermediary. If you originally purchased your shares through a financial intermediary, including an Authorized Intermediary, your redemption order must be placed with the same financial intermediary in accordance with the procedures established by that financial intermediary. Your financial intermediary is responsible for sending your order to the Transfer Agent and for crediting your account with the proceeds. You may redeem Fund shares on any business day that the Fund calculates its NAV. To redeem shares directly with the Fund, you must contact the Fund either by mail or by telephone to place a redemption request. Your redemption request must be received in good order (as discussed under “Payment of Redemption Proceeds” below) prior to the close of the regular trading session of the NYSE (generally 4:00 p.m., Eastern time) by the Transfer Agent or by your Authorized Intermediary. Redemption requests received by the Transfer Agent or an Authorized Intermediary after the close of the NYSE will be treated as though received on the next business day.

Shareholders who hold their shares through an IRA or other retirement account must indicate on their written redemption request whether or not to withhold federal income tax. Redemption requests failing to indicate an election not to have tax withheld will generally be subject to 10% withholding. Shares held in IRA accounts may be redeemed by telephone at 877-363-6333. Investors will be asked whether or not to withhold taxes from any redemption.

15

Payment of Redemption Proceeds. You may redeem your Fund shares at the NAV per share next determined after the Transfer Agent or your Authorized Intermediary receives your redemption request in good order. Your redemption request cannot be processed on days the NYSE is closed. Proceeds from redemption requests received by the Transfer Agent or your Authorized Intermediary before the close of the regular trading session of the NYSE (generally 4:00 p.m., Eastern time) will usually be sent one to three business days following the receipt of your redemption request.

A redemption request made through the Transfer Agent will be deemed in “good order” if it includes:

• | the shareholder’s name; |

• | the name of the Fund you are invested in; |

• | the account number; |

• | the share or dollar amount to be redeemed; and |

• | signatures by all shareholders on the account and signature guarantee(s), if applicable. |

The Fund reserves the right to change the requirements of “good order.” Shareholders will be given advance notice if the requirements of “good order” change. For information about your financial intermediary’s requirements for redemption requests in good order, please contact your financial intermediary.

You may receive proceeds of your sale in a check sent to the address of record, electronically via the ACH network using the previously established bank instructions or via federal wire transfer to your pre-established bank account. The Fund typically expects that it will take one to three days following the receipt of your redemption request to pay out redemption proceeds, regardless of whether the redemption proceeds are paid by check, ACH transfer or wire. Please note that wires are subject to a $15 fee. There is no charge to have proceeds sent via ACH; however, funds are typically credited to your bank within two business days after redemption. Proceeds will be processed within seven calendar days after the Fund receives your redemption request, unless the Fund has suspended your right of redemption or postponed the payment date as permitted under the federal securities laws.

The Fund typically expects it will hold cash or cash equivalents to meet redemption requests. The Fund may also use the proceeds from the sale of portfolio securities to meet redemption requests if consistent with the management of the Fund. These redemption methods will be used regularly and may also be used in stressed market conditions.

If you did not purchase your shares with a wire payment, the Transfer Agent may delay payment of your redemption proceeds for up to 12 calendar days from the date of purchase or until your payment has cleared, whichever comes first. Furthermore, there are certain times when you may be unable to sell Fund shares or receive proceeds. Specifically, the Fund may suspend the right to redeem shares or postpone the date of payment upon redemption for more than seven calendar days: (1) for any period during which the NYSE is closed (other than customary weekend or holiday closings) or trading on the NYSE is restricted; (2) for any period during which an emergency exists as a result of which disposal by the Fund of securities owned by it is not reasonably practicable or it is not reasonably practicable for the Fund to fairly determine the value of its net assets; or (3) for such other periods as the SEC may permit for the protection of shareholders. Your ability to redeem shares by telephone may be delayed or restricted after you change your address. You may change your address at any time by telephone or written request addressed to the Transfer Agent. Confirmation of an address change will be sent to both your old and new address. Redemption proceeds will be sent to the address of record. The Fund is not responsible for interest lost on redemption amounts due to lost or misdirected mail.

Redemption In-Kind. The Fund generally pays redemption proceeds in cash. However, the Trust has filed a notice of election under Rule 18f-1 under the Investment Company Act of 1940, as amended (the “1940 Act”), with the SEC, under which the Trust has reserved the right to satisfy redemption requests in-kind under certain circumstances, meaning that redemption proceeds are paid in liquid securities with

16

a market value equal to the redemption price. If the Fund pays your redemption proceeds by a distribution of securities, you could incur brokerage or other charges when converting the securities to cash. These securities redeemed in-kind remain subject to general market risks until sold. For federal income tax purposes, redemptions in-kind are taxed in the same manner as redemptions paid in cash. In addition, sales of such in-kind securities may generate taxable gains.

Redemptions in-kind are typically used to meet redemption requests that represent a large percentage of the Fund’s net assets in order to minimize the effect of large redemptions on the Fund and its remaining shareholders. Redemptions in-kind may also be used during periods of stressed market conditions. The Fund has in place a line of credit that may be used to meet redemption requests during periods of stressed market conditions.

Redemption in-kind proceeds are limited to securities that are traded on a public securities market or for which quoted bid prices are available. In the unlikely event that the Fund does redeem shares in-kind, the procedures utilized by the Fund to determine the securities to be distributed to redeeming shareholders will generally be representative of a shareholder’s interest in the Fund’s portfolio securities. However, the Fund may also redeem in-kind using individual securities as circumstances dictate.

Signature Guarantees. The Transfer Agent may require a signature guarantee for certain redemption requests. Signature guarantees can be obtained from domestic banks, brokers, dealers, credit unions, national securities exchanges, registered securities associations, clearing agencies and savings associations, as well as from participants in the New York Stock Exchange Medallion Signature Program and the Securities Transfer Agents Medallion Program (“STAMP”), but not from a notary public. A signature guarantee, from either a Medallion program member or a non-Medallion program member, of each owner is required in the following situations:

• | if ownership is being changed on your account; |

• | when redemption proceeds are payable or sent to any person, address or bank account not on record; |

• | when a redemption request is received by the Transfer Agent and the account address has changed within the last 15 calendar days; and |

• | for all redemptions in excess of $100,000 from any shareholder account. |

Non-financial transactions, including establishing or modifying certain services on an account, may require a signature guarantee, a signature verification from a Signature Validation Program member, or other acceptable form of authentication from a financial institution source.

In addition to the situations described above, the Fund and the Transfer Agent each reserve the right to require a signature guarantee or other acceptable signature verification in other instances based on the circumstances relative to the particular situation.

Redemption by Mail. You can execute most redemptions by furnishing an unconditional written request to the Fund to redeem your shares at the current NAV. Redemption requests in writing should be sent to the Transfer Agent at:

Regular Mail Barrett Growth Fund c/o U.S. Bank Global Fund Services P.O. Box 701 Milwaukee, WI 53201-0701 | Overnight or Express Mail Barrett Growth Fund c/o U.S. Bank Global Fund Services 615 East Michigan Street, 3rd Floor Milwaukee, WI 53202 |

The Fund does not consider the U.S. Postal Service or other independent delivery services to be its agents. Therefore, deposit in the mail or with such services, or receipt at U.S. Bank Global Fund Services post office box, of purchase orders or redemption requests does not constitute receipt by the Transfer

17

Agent. Receipt of purchase orders or redemption requests is based on when the order is received at the Transfer Agent’s offices.

Telephone Redemption. Telephone redemption privileges are automatically provided unless you specifically decline the option on your Account Application. You may redeem shares, in amounts of $100,000 or less, by instructing the Fund by telephone at 877-363-6333. A signature verification from a Signature Validation program member or other acceptable form of authentication from a financial institution source may be required of all shareholders in order to add or change telephone redemption privileges on an existing account. Telephone redemptions will not be made if you have notified the Transfer Agent of a change of address within 15 calendar days before the redemption request. Once a telephone transaction has been placed, it may not be cancelled or modified after the close of regular trading on the NYSE (generally 4:00 p.m., Eastern time). If an account has more than one owner or authorized person, the Fund will accept telephone instructions from any one owner or authorized person.

All telephone calls are recorded for your protection. Written confirmation will be provided for all purchase and redemption transactions initiated by telephone.

Wire Redemption. Wire transfers may be arranged to redeem shares for amounts of $1,000 or more. The Transfer Agent charges a fee, currently $15, per wire redemption against your account on dollar specific trades, and from proceeds on complete redemptions and share-specific trades. There is no charge to have proceeds sent via ACH.

Systematic Withdrawal Program. The Fund offers a systematic withdrawal program (the “SWP”) whereby shareholders or their representatives may request a redemption in a specific dollar amount be sent to them each month, calendar quarter or annually. Investors may choose to have a check sent to the address of record, or proceeds may be sent to a pre-designated bank account via the ACH network. To start this program, your account must have Fund shares with a value of at least $10,000, and the minimum payment amount is $100. This program may be terminated or modified by the Fund at any time. Any request to change or terminate your SWP should be communicated in writing or by telephone to the Transfer Agent no later than five days before the next scheduled withdrawal. A withdrawal under the SWP involves a redemption of Fund shares, and may result in a capital gain or loss for federal income tax purposes. In addition, if the amount withdrawn exceeds the amounts credited to your account, the account ultimately may be depleted. To establish the SWP, complete the SWP section of the Account Application. Please call 877-363-6333 for additional information regarding the SWP.

The Fund’s Right to Redeem an Account. The Fund reserves the right to redeem the shares of any shareholder whose account balance is less than $1,000, other than as a result of a decline in the NAV of the Fund or for market reasons. The Fund will provide shareholders with written notice 30 calendar days prior to redeeming the shareholder’s account. A redemption by the Fund may result in a taxable capital gain or loss for federal income tax purposes.

18

Tools to Combat Frequent Transactions

The Fund is intended for long-term investors. Short-term “market-timers” who engage in frequent purchases and redemptions may disrupt the Fund’s investment program and create additional transaction costs that are borne by all of the Fund’s shareholders. The Board of Trustees has adopted policies and procedures that are designed to discourage excessive, short-term trading and other abusive trading practices that may disrupt portfolio management strategies and harm performance. The Fund takes steps to reduce the frequency and effect of these activities in the Fund. These steps may include, among other things, monitoring trading activity and using fair value pricing, as determined by the Board of Trustees, when the Adviser determines current market prices are not readily available. Although these efforts are designed to discourage abusive trading practices, these tools cannot eliminate the possibility that such activity will occur. The Fund seeks to exercise its judgment in implementing these tools to the best of its ability in a manner that it believes is consistent with shareholder interests. Except as noted herein, the Fund will apply all restrictions uniformly in all applicable cases.

Monitoring Trading Practices. The Fund monitors selected trades in an effort to detect excessive short-term trading activities. If, as a result of this monitoring, the Fund believes that a shareholder has engaged in excessive short-term trading, it may, in its discretion, ask the shareholder to stop such activities or refuse to process purchases in the shareholder’s accounts. In making such judgments, the Fund seeks to act in a manner that it believes is consistent with the best interests of its shareholders. The Fund uses a variety of techniques to monitor for and detect abusive trading practices. These techniques may change from time to time as determined by the Fund in its sole discretion. To minimize harm to the Fund and its shareholders, the Fund reserves the right to reject any purchase order (but not a redemption request), in whole or in part, for any reason and without prior notice. The Fund may decide to restrict purchase and sale activity in its shares based on various factors, including whether frequent purchase and sale activity will disrupt portfolio management strategies and adversely affect Fund performance.

Fair Value Pricing. The Fund employs fair value pricing selectively to ensure greater accuracy in its daily NAVs and to prevent dilution by frequent traders or market timers who seek to take advantage of temporary market anomalies. The Board of Trustees has developed procedures which utilize fair value pricing when reliable market quotations are not readily available or the Fund’s pricing service does not provide a valuation (or provides a valuation that, in the judgment of the Adviser, does not represent the security’s fair value), or when, in the judgment of the Adviser, events have rendered the market value unreliable. Valuing securities at fair value involves reliance on judgment. Fair value determinations are made in good faith in accordance with procedures adopted by the Board of Trustees. There can be no assurance that the Fund will obtain the fair value assigned to a security if it were to sell the security at approximately the time at which the Fund determines its NAV per share. More detailed information regarding fair value pricing can be found in this Prospectus under the heading entitled “Share Price.”

Due to the complexity and subjectivity involved in identifying abusive trading activity and the volume of shareholder transactions the Fund handles, there can be no assurance that the Fund’s efforts will identify all trades or trading practices that may be considered abusive. In particular, since the Fund receives purchase and sale orders through Authorized Intermediaries that use group or omnibus accounts, the Fund cannot always detect frequent trading. However, the Fund will work with Authorized Intermediaries as necessary to discourage shareholders from engaging in abusive trading practices and to impose restrictions on excessive trades. In this regard, the Fund has entered into information sharing agreements with Authorized Intermediaries pursuant to which these intermediaries are required to provide to the Fund, at the Fund’s request, certain information relating to their customers investing in the Fund through non-disclosed or omnibus accounts. The Fund will use this information to attempt to identify abusive trading practices. Authorized Intermediaries are contractually required to follow any instructions from the Fund to restrict or prohibit future purchases from shareholders who are found to have engaged in abusive trading in violation of the Fund’s policies. However, the Fund cannot guarantee the accuracy of the information provided to it from Authorized Intermediaries and cannot ensure that it will always be able to detect abusive trading practices that occur through non-disclosed and omnibus accounts. As

19

a result, the Fund’s ability to monitor and discourage abusive trading practices in non-disclosed or omnibus accounts may be limited.

Other Fund Policies

Telephone Transactions. If you have not declined telephone privileges on the account application or in a letter to the Fund, you may be responsible for any fraudulent telephone orders as long as the Fund has taken reasonable precautions to verify your identity. In addition, once you place a telephone transaction request, it cannot be canceled or modified after the close of regular trading on the NYSE (generally 4:00 p.m., Eastern time).

During periods of significant economic or market change, telephone transactions may be difficult to complete. If you are unable to contact the Fund by telephone, you may also mail the requests to the Fund at the address listed previously in the “How to Purchase Shares” section. Neither the Fund nor the Transfer Agent are liable for any loss incurred due to failure to complete a telephone transaction prior to market close.

Telephone trades must be received by or prior to market close. During periods of high market activity, shareholders may encounter higher than usual call waiting times. Please allow sufficient time to ensure that you will be able to complete your telephone transaction prior to the close of the NYSE (generally 4:00 p.m., Eastern time). The Fund is not responsible for delays due to communications or transmission outages, subject to applicable law.

Neither the Fund nor any of its service providers will be liable for any loss or expense in acting upon instructions that are reasonably believed to be genuine, subject to applicable law. If an account has more than one owner or authorized person, the Fund will accept telephone instructions from any one owner or authorized person. To confirm that all telephone instructions are genuine, the Fund will use reasonable procedures, such as requesting:

• | that you correctly state your Fund account number; |

• | the name in which your account is registered; or |

• | the Social Security or taxpayer identification number under which the account is registered. |

Policies of Other Financial Intermediaries. An Authorized Intermediary may establish policies that differ from those of the Fund. For example, the institution may charge transaction fees, set higher minimum investments or impose certain limitations on buying or selling shares in addition to those identified in this Prospectus. Please contact your Authorized Intermediary for details.

Closure of the Fund. The Adviser retains the right to close the Fund (or partially close the Fund) to new purchases if it is determined to be in the best interest of shareholders. Based on market and Fund conditions, the Adviser may decide to close the Fund to new investors, all investors or certain classes of investors (such as Fund supermarkets) at any time. If the Fund is closed to new purchases it will continue to honor redemption requests, unless the right to redeem shares has been temporarily suspended as permitted by federal law.

Householding. In an effort to decrease costs, the Fund intends to reduce the number of duplicate prospectuses and annual and semi-annual reports you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders the Fund reasonably believes are from the same family or household. If you would like to discontinue householding for your accounts, please call toll-free at 877-363-6333 to request individual copies of these documents. Once the Fund receives notice to stop householding, the Fund will begin sending individual copies 30 days after receiving your request. This policy does not apply to account statements.

20