Form 485BPOS NORTHERN FUNDS

As filed with the Securities and Exchange Commission on January 7, 2019

Securities Act of 1933 Registration No. 33-73404

Investment Company Act of 1940 Registration No. 811-08236

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT

UNDER

| THE SECURITIES ACT OF 1933 | ☒ | |||

| Pre-Effective Amendment No. | ☐ | |||

| Post-Effective Amendment No. 150 | ☒ |

and/or

REGISTRATION STATEMENT

UNDER

| THE INVESTMENT COMPANY ACT OF 1940 | ☒ | |||

| Amendment No. 152 | ☒ | |||

| (Check appropriate box or boxes) |

NORTHERN FUNDS

(Exact Name of Registrant as Specified in Charter)

50 South LaSalle Street

Chicago, Illinois 60603

(Address of Principal Executive Offices)

800-595-9111

(Registrant’s Telephone Number, including Area Code)

| Name and Address of Agent for Service: | with a copy to: | |

| Diana E. McCarthy Drinker Biddle & Reath LLP One Logan Square Suite 2000 Philadelphia, Pennsylvania 19103 |

Jose J. Del Real Kevin P. O’Rourke The Northern Trust Company 50 South LaSalle Street Chicago, Illinois 60603 |

It Is Proposed That This Filing Become Effective (Check Appropriate Box):

| ☐ | immediately upon filing pursuant to paragraph (b) |

| ☒ | on January 8, 2019 pursuant to paragraph (b) |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) |

| ☐ | On (date) pursuant to paragraph (a)(1) |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) |

| ☐ | On (date) pursuant to paragraph (a)(2) of Rule 485 |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

ULTRA-SHORT FIXED INCOME FUND

NORTHERN FUNDS PROSPECTUS

ULTRA-SHORT FIXED INCOME FUND (NUSFX)

Prospectus dated January 8, 2019

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”), any other government agency, or The Northern Trust Company, its affiliates, subsidiaries or any other bank. An investment in the Fund involves investment risks, including possible loss of principal.

The Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

| NORTHERN FUNDS PROSPECTUS | 1 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

| 3 | ||||||||

| 3 | ||||||||

| 8 | ||||||||

| 9 | ||||||||

| 10 | ||||||||

| 11 | ||||||||

| 12 | ||||||||

| 13 | ||||||||

| 13 | ||||||||

| 13 | ||||||||

| 15 | ||||||||

| 17 | ||||||||

| 24 | ||||||||

| 25 | ||||||||

| 27 | ||||||||

| 27 | ADDITIONAL INFORMATION ON INVESTMENT OBJECTIVES, PRINCIPAL INVESTMENT STRATEGIES AND RELATED RISKS, DESCRIPTION OF SECURITIES AND COMMON INVESTMENT TECHNIQUES | |||||||

| 44 | DISCLAIMERS | |||||||

| 45 | ||||||||

| 48 | ||||||||

| ULTRA-SHORT FIXED INCOME FUND | 2 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

INVESTMENT OBJECTIVE

The Fund seeks to maximize total return (capital appreciation and income) to the extent consistent with preservation of principal.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| Shareholder Fees (fees paid directly from your investment) | ||||

| None |

||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

||||

| Management Fees |

0.23% | |||

| Other Expenses |

0.03% | |||

| Transfer Agent Fees |

0.02% | |||

| Other Operating Expenses |

0.01% | |||

| Total Annual Fund Operating Expenses(1) |

0.26% | |||

| Expense Reimbursement(2) |

(0.01)% | |||

| Total Annual Fund Operating Expenses After Expense Reimbursement(1) |

0.25% | |||

| (1) | The Total Annual Fund Operating Expenses and Total Annual Fund Operating Expenses After Expense Reimbursement will not correlate to the Fund’s ratios of average net assets to (1) expenses before reimbursements and credits and (2) expenses net of reimbursements and credits, respectively, included in the Fund’s Financial Highlights in the Fund’s complete Prospectus, which do not reflect indirect expenses, such as Acquired Fund Fees and Expenses. |

| (2) | Northern Trust Investments, Inc. has contractually agreed to reimburse a portion of the operating expenses of the Fund (other than certain excepted expenses, i.e., Acquired Fund Fees and Expenses, the compensation paid to each Independent Trustee of the Trust, expenses of third party consultants engaged by the Board of Trustees, membership dues paid to the Investment Company Institute and Mutual Fund Directors Forum, expenses in connection with the negotiation and renewal of the revolving credit facility, extraordinary expenses and interest) to the extent the “Total Annual Fund Operating Expenses” exceed 0.25%. The “Total Annual Fund Operating Expenses After Expense Reimbursement” may be higher than the contractual limitation as a result of the excepted expenses, including but not limited to Acquired Fund Fees and Expenses, that are not reimbursed. This contractual limitation will remain in effect for at least one year from the effective date of this Prospectus, and may not be terminated before that time without the approval of the Board of Trustees. |

EXAMPLE

The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $26 | $83 | $145 | $330 |

PORTFOLIO TURNOVER. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual portfolio operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 58.41% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund will, under normal circumstances, invest primarily (and not less than 80% of its net assets) in fixed-income securities. These include:

| ∎ | Obligations of the U.S. government or its agencies, instrumentalities or sponsored enterprises; |

| ∎ | Obligations of state, local and foreign governments; |

| ∎ | Commercial paper and other obligations of domestic and foreign banks and corporations; |

| ∎ | Zero coupon bonds, debentures, preferred stock and convertible securities; |

| ∎ | Mortgage and other asset-backed securities; and |

| ∎ | Repurchase agreements relating to the above instruments. |

Under normal market conditions, the Fund will invest at least 25% of its total assets in securities issued by companies in the financial services group of industries. Companies in the financial services group of industries include but are not limited to U.S. and non-U.S. companies involved in banking, mortgage, consumer or specialized finance, investment banking, securities brokerage, asset management and custody,

| NORTHERN FUNDS PROSPECTUS | 3 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

FUND SUMMARY

insurance, financial investment, real estate and mortgage finance and financial conglomerates, and related asset-backed securities. The Fund may, however, for temporary defensive purposes, invest less than 25% of its total assets in the financial services industry if warranted due to adverse economic conditions or if investing less than 25% of its total assets in the financial services industry appears to be in the best interest of shareholders.

The Fund invests in investment grade domestic debt obligations (i.e., obligations rated within the top four rating categories by a Nationally Recognized Statistical Rating Organization (“NRSRO”) or of comparable quality as determined by the Fund’s investment adviser). The Fund’s average portfolio is expected to be “A” or better. The Fund will focus primarily on U.S. securities, but may invest in fixed-income securities of foreign issuers. The Fund’s investments in foreign securities will consist only of U.S. dollar-denominated securities.

The Fund is not a money market fund, and its share price will fluctuate.

In buying and selling securities for the Fund, the Fund’s investment adviser uses a relative value approach. This approach involves an analysis of general economic and market conditions. It also involves the use of models that analyze and compare expected returns and assumed risks. Under the relative value approach, the Fund’s investment adviser will emphasize particular securities and types of securities (such as treasury, agency, asset-backed, mortgage-backed and corporate securities) that the team believes will provide a favorable return in light of these risks.

The Fund’s dollar-weighted average maturity, under normal circumstances, will range between six and eighteen months. Under normal circumstances, the Fund will invest only in securities with a duration of three years or less. The Fund’s investment adviser may adjust the Fund’s holdings based on actual or anticipated changes in interest rates or credit quality, and may shorten the Fund’s duration below six months based on the Fund’s investment adviser’s interest rate outlook or adverse market conditions.

PRINCIPAL RISKS

ASSET-BACKED SECURITIES RISK. Asset-backed securities represent interests in pools of assets such as mortgages, automobile loans, credit card receivables and other financial assets. Asset-backed securities are subject to credit, interest rate, prepayment, extension, valuation and liquidity risk. These securities, in most cases, are not backed by the full faith and credit of the U.S. government and are subject to the risk of default on the underlying asset or loan, particularly during periods of economic downturn. Small movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain asset-backed securities.

COMMERCIAL PAPER RISK. Investments in commercial paper are subject to the risk that the issuer cannot issue enough new commercial paper to satisfy its obligations with respect to its outstanding commercial paper, also known as rollover risk. Commercial paper is also susceptible to changes in the issuer’s financial condition or credit quality. In addition, under certain circumstances commercial paper may become illiquid or may suffer from reduced liquidity. Commercial paper is generally unsecured, which increases the credit risk associated with this type of investment.

CREDIT (OR DEFAULT) RISK is the risk that the inability or unwillingness of an issuer or guarantor of a fixed-income security, or a counterparty to a repurchase or other transaction, to meet its payment or other financial obligations will adversely affect the value of the Fund’s investments and its returns. Changes in the credit rating of a debt security held by the Fund could have a similar effect.

CURRENCY RISK is the risk that foreign currencies, securities that trade in or receive revenues in foreign currencies, or derivatives that provide exposure to foreign currencies will fluctuate in value relative to the U.S. dollar, adversely affecting the value of the Fund’s investments and its returns. Because the Fund’s net asset value (“NAV”) is determined on the basis of U.S. dollars, you may lose money if the local currency of a foreign market depreciates against the U.S. dollar, even if the market value of the Fund’s holdings appreciates. In addition, fluctuations in the exchange values of currencies could affect the economy or particular business operations of companies in a geographic region in which the Fund invests, causing an adverse impact on the Fund’s investments in the affected region.

CYBERSECURITY RISK is the risk of an unauthorized breach and access to fund assets, customer data (including private shareholder information), or proprietary information, or the risk of an incident occurring that causes the Fund, the investment adviser, custodian, transfer agent, distributor and other service providers and financial intermediaries to suffer data breaches, data corruption or lose operational functionality. Successful cyber-attacks or other cyber-failures or events affecting the Fund or its service providers may adversely impact the Fund or its shareholders.

DEBT EXTENSION RISK is the risk that an issuer will exercise its right to pay principal on an obligation held by the Fund (such as a mortgage-backed security) later than expected. This may happen during a period of rising interest rates. Under these

| ULTRA-SHORT FIXED INCOME FUND | 4 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

FUND SUMMARY

circumstances, the value of the obligation will decrease and the Fund will suffer from the inability to invest in higher yielding securities.

FINANCIAL SERVICES INDUSTRY RISK is the risk that, because the Fund will invest under normal market conditions at least 25% of its total assets in the financial services industry, the Fund will be subject to greater risk of loss by economic, business, political or other developments which generally affect this industry. Changes in government regulation and interest rates and economic downturns can have a significant negative effect on issuers in the financial services sector, including the price of their securities or their ability to meet their payment obligations.

FOREIGN SECURITIES RISK is the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies, due to less liquid markets and adverse economic, political, diplomatic, financial, and regulatory factors. Foreign governments also may impose limits on investment and repatriation and impose taxes. Any of these events could cause the value of the Fund’s investments to decline.

INFLATION RISK is the risk that interest payments on inflation-indexed securities can be unpredictable and will vary as the principal and/or interest is periodically adjusted based on the rate of inflation. If the index measuring inflation falls, the interest payable on these securities will be reduced.

INTEREST RATE RISK is the risk that during periods of rising interest rates, the Fund’s yield (and the market value of its securities) will tend to be lower than prevailing market rates; in periods of falling interest rates, the Fund’s yield (and the market value of its securities) will tend to be higher. Securities with longer maturities tend to be more sensitive to changes in interest rates, causing them to be more volatile than securities with shorter maturities. Securities with shorter maturities tend to provide lower returns and be less volatile than securities with longer maturities. If interest rates rise, the Fund’s yield may not increase proportionately, and the maturities of fixed income securities that have the ability to be prepaid or called by the issuer may be extended. The risks associated with increasing interest rates are heightened given that interest rates are near historic lows, but are expected to increase in the future with unpredictable effects on the markets and the Fund’s investments. A general rise in interest rates may cause investors to move out of fixed income securities on a large scale, which could adversely affect the price and liquidity of fixed income securities and could also result in increased redemptions from the Fund. A low or declining interest rate environment poses additional risks to the Fund’s performance, including the risk that proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. Fluctuations in interest rates may also affect the liquidity of fixed income securities and instruments held by the Fund.

LIQUIDITY RISK is the risk that the Fund will not be able to pay redemption proceeds in a timely manner because of unusual market conditions, an unusually high volume of redemption requests, legal restrictions impairing its ability to sell particular securities or close derivative positions at an advantageous market price or other reasons. Certain securities may be less liquid than others, which may make them difficult or impossible to sell at the time and the price that the Fund would like and the Fund may have to lower the price, sell other securities instead or forgo an investment opportunity. In addition, less liquid securities may be more difficult to value and markets may become less liquid when there are fewer interested buyers or sellers or when dealers are unwilling or unable to make a market for certain securities. Recently, dealers have generally been less willing to make markets for fixed income securities. All of these risks may increase during periods of market turmoil and could have a negative effect on the Fund’s performance.

MANAGEMENT RISK is the risk that a strategy used by the Fund’s investment adviser may fail to produce the intended results or that imperfections, errors or limitations in the tools and data used by the investment adviser may cause unintended results.

MARKET RISK is the risk that general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment could cause the value of your investment in the Fund, or its yield, to decline. The market value of the securities in which the Fund invests may go up or down in response to the prospects of particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets.

PREPAYMENT (OR CALL) RISK is the risk that prepayment of the underlying mortgages or other collateral of some fixed-income securities may result in a decreased rate of return and a decline in value of those securities.

U.S. GOVERNMENT SECURITIES RISK is the risk that the U.S. government will not provide financial support to its agencies, instrumentalities or sponsored enterprises if it is not obligated to do so by law. Certain U.S. government securities purchased by the Fund are neither issued nor guaranteed by the U.S. Treasury and, therefore, may not be backed by the full faith and credit of the United States. It is possible that the issuers of such securities will not have the funds to meet their payment obligations in the future.

| NORTHERN FUNDS PROSPECTUS | 5 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

FUND SUMMARY

VALUATION RISK is the risk that the sale price the Fund could receive for a portfolio security may differ from the Fund’s valuation of the security, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. In addition, the value of the securities in the Fund’s portfolio may change on days when shareholders will not be able to purchase or sell the Fund’s shares.

As with any mutual fund, it is possible to lose money on an investment in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation, any other government agency, or The Northern Trust Company, its affiliates, subsidiaries or any other bank.

FUND PERFORMANCE

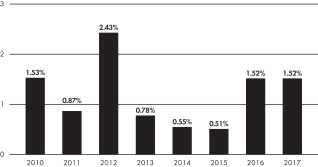

The bar chart and table that follow provide an indication of the risks of investing in the Fund by showing (A) changes in the performance of the Fund from year to year, and (B) how the average annual total returns of the Fund compare to those of a broad-based securities market index.

The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

Updated performance information for the Fund is available and may be obtained on the Fund’s website at northerntrust.com/funds or by calling 800-595-9111.

CALENDAR YEAR TOTAL RETURN*

* Year to date total return for the nine months ended September 30, 2018 is 1.22%. For the periods shown in the bar chart above, the highest quarterly return was 1.20% in the first quarter of 2012, and the lowest quarterly return was (0.32)% in the third quarter of 2011.

AVERAGE ANNUAL TOTAL RETURN

(For the periods ended December 31, 2017)

| Inception Date |

1-Year | 5-Year | Since Inception |

|||||||||||||

| Ultra-Short Fixed Income Fund |

06/18/09 | |||||||||||||||

| Returns before taxes |

1.52 | % | 0.97 | % | 1.30 | % | ||||||||||

| Returns after taxes on distributions |

0.91 | % | 0.54 | % | 0.88 | % | ||||||||||

| Returns after taxes on distributions and sale of Fund shares |

0.86 | % | 0.55 | % | 0.83 | % | ||||||||||

| ICE BofAML 1-Year U.S. Treasury Note Index (reflects no deduction for fees, expenses, or taxes) |

0.57 | % | 0.38 | % | 0.47 | % | ||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

In calculating the federal income taxes due on redemptions, capital gains taxes resulting from redemptions are subtracted from the redemption proceeds and the tax benefits from capital losses resulting from the redemptions are added to the redemption proceeds. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Returns after taxes on distributions and sale of Fund shares to be greater than the Returns after taxes on distributions or even the Returns before taxes.

MANAGEMENT

INVESTMENT ADVISER AND PORTFOLIO MANAGERS. Northern Trust Investments, Inc., an indirect subsidiary of Northern Trust Corporation, serves as the investment adviser of the Ultra-Short Fixed Income Fund. Morten Olsen, Vice President of Northern Trust Investments, Inc., and Bilal Memon, Vice President of Northern Trust Investments, Inc., have been the managers of the Fund since July 2016, and October 2018, respectively. The Northern Trust Company, an affiliate of Northern Trust Investments, Inc., serves as transfer agent, custodian and sub-administrator to the Fund.

PURCHASE AND SALE OF FUND SHARES

You may open an account directly with Northern Funds (the “Trust”) with a minimum initial investment of $2,500 in the Fund ($500 for an IRA; $250 under the Automatic Investment Plan; and $500 for employees of Northern Trust and its affiliates). The minimum subsequent investment is $50 (except for reinvestments of distributions for which there is no minimum). The Fund reserves the right to waive these minimums. You may also purchase Fund shares through your account at Northern Trust (or an affiliate) or an authorized intermediary.

| ULTRA-SHORT FIXED INCOME FUND | 6 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

FUND SUMMARY

On any business day, you may sell (redeem) or exchange shares through your account by contacting your Northern Trust account representative or authorized intermediary. If you purchase shares directly from the Trust, you may sell (redeem) or exchange your shares in one of the following ways:

| ∎ | By Mail – Send a written request to: Northern Funds, P.O. Box 75986, Chicago, Illinois 60675-5986. |

| ∎ | By Telephone – Authorize the telephone privilege on your New Account Application. Call 800-595-9111 to use the telephone privilege. |

| ∎ | By Wire – Authorize wire redemptions on your New Account Application and have proceeds sent by federal wire transfer to a previously designated bank account (the minimum redemption amount by this method is $250). You will be charged $15 for each wire redemption unless the designated bank account is maintained at Northern Trust or an affiliated bank. Call 800-595-9111 for instructions. |

| ∎ | By Systematic Withdrawal – If you own shares of the Fund with a minimum value of $10,000, you may elect to have a fixed sum redeemed at regular intervals and distributed in cash or reinvested in one or more other funds of the Trust. Call 800-595-9111 for an application form and additional information. The minimum amount is $250 per withdrawal. |

| ∎ | By Exchange – Complete the Exchange Privilege section of your New Account Application to exchange shares of one fund in the Trust for shares of another fund in the Trust. Shares being exchanged must have a value of at least $1,000 ($2,500 if a new account is being established by the exchange, $500 if the new account is an IRA). Call 800-595-9111 for more information. |

| ∎ | By Internet – You may initiate transactions between Northern Trust banking and Fund accounts by using Northern Trust Private Passport. For details and to sign up for this service, go to northerntrust.com/funds or contact your Relationship Manager. |

TAX INFORMATION

The Fund’s distributions are generally taxable to you as ordinary income, capital gains, or a combination of the two, unless you are investing through a tax-exempt or tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Distributions may be taxable upon withdrawal from tax-deferred accounts.

PAYMENTS TO BROKERS-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| NORTHERN FUNDS PROSPECTUS | 7 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

BROAD-BASED SECURITIES MARKET INDEX

THE ICE BofAML 1-YEAR U.S. TREASURY NOTE INDEX is composed of a single issue: the outstanding Treasury note that matures closest to, but not beyond, one year from each monthly rebalancing date.

| ULTRA-SHORT FIXED INCOME FUND | 8 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

This Prospectus describes one fixed income fund (the “Fund”), which is currently offered by Northern Funds (the “Trust”).

Northern Trust Investments, Inc. (“NTI” or the “Investment Adviser”), an indirect subsidiary of Northern Trust Corporation, serves as the Investment Adviser of the Fund. NTI is located at 50 South LaSalle Street, Chicago, Illinois 60603.

NTI is an Illinois State Banking Corporation and an investment adviser registered under the Investment Advisers Act of 1940, as amended. It primarily manages assets for institutional and individual separately managed accounts, investment companies and bank common and collective funds. Northern Trust Corporation is regulated by the Board of Governors of the Federal Reserve System as a financial holding company under the U.S. Bank Holding Company Act of 1956, as amended.

As of September 30, 2018, Northern Trust Corporation, through its affiliates, had assets under custody of $8.19 trillion, and assets under investment management of $1.17 trillion.

Under the Management Agreement with the Trust, the Investment Adviser, subject to the general supervision of the Trust’s Board of Trustees, is responsible for making investment decisions for the Fund and for placing purchase and sale orders for portfolio securities, as well as for providing administration services to the Fund.

| NORTHERN FUNDS PROSPECTUS | 9 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

As compensation for advisory services and administration services and the assumption of related expenses, NTI is entitled to a management fee, computed daily and payable monthly, at annual rates set forth in the table below (expressed as a percentage of the Fund’s average daily net assets). The table also reflects the management fees paid by the Fund for the fiscal year ended March 31, 2018 (expressed as a percentage of the Fund’s average daily net assets).

NTI has contractually agreed to reimburse a portion of the operating expenses of the Fund (other than certain fees and expenses shown in the table under the caption “Fees and Expenses of the Fund in the Fund’s Fund Summary) so that “Total Annual Fund Operating Expenses After Expense Reimbursement” does not exceed the amount shown in the footnote to the table under the caption “Fees and Expenses of the Fund” in the Fund’s Fund Summary. The “Total Annual Fund Operating Expenses After Expense Reimbursement” for the Fund may be higher than the contractual limitation for the Fund as a result of certain excepted expenses that are not reimbursed. The contractual expense reimbursement arrangement is expected to continue for at least one year from the effective date of this Prospectus. The contractual expense reimbursement arrangement will continue automatically thereafter for periods of one year (each such one-year period, a “Renewal Year”). The arrangement may be terminated as to any succeeding Renewal Year, by NTI or the Fund upon 60 days’ written notice prior to the end of the current Renewal Year. The Board of Trustees may terminate the arrangement at any time with respect to the Fund if it determines that it is in the best interest of the Fund and its shareholders.

NTI may reimburse additional expenses or waive all or a portion of the management fees of the Fund. Any such additional expense reimbursement or fee waiver would be voluntary and could be implemented, increased or decreased, or discontinued at any time.

A discussion regarding the Board of Trustees’ basis for its most recent approval of the Fund’s Management Agreement is available in the Fund’s semi-annual report to shareholders for the six-month period ending September 30, 2018.

| Contractual Management Fee Rate | Management Fees Paid for Fiscal Year Ended 3/31/2018 |

|||||||||||||||

| Fund | First $1.5 Billion | Next $1 Billion | Over $2.5 Billion | |||||||||||||

| ULTRA-SHORT FIXED INCOME |

0.23% | 0.223% | 0.216% | 0.23% | ||||||||||||

| ULTRA-SHORT FIXED INCOME FUND | 10 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

BELOW IS INFORMATION REGARDING THE MANAGEMENT OF THE FUND.

Each of the Fund’s portfolio managers has full and joint responsibility for managing the Fund with no restrictions or limitations on such manager’s role.

The managers for the Fund are Morten Olsen, Vice President of NTI, and Bilal Memon, Vice President of NTI. Mr. Olsen and Mr. Memon have been managers of the Fund since July 2016 and October 2018, respectively. Mr. Olsen joined NTI in 2009 and is a Director of the Ultra-Short Fixed Income Group. Mr. Memon joined NTI in 2007 and is a portfolio manager of the Short Duration Fixed Income Group.

Additional information about the Fund Managers’ compensation, other accounts managed by the Fund Managers and the Fund Managers’ ownership of securities in the Fund is available in the Statement of Additional Information (“SAI”).

| NORTHERN FUNDS PROSPECTUS | 11 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

The Northern Trust Company (“TNTC,” together with NTI, referred to as “Northern Trust”) serves as Transfer Agent and Custodian for the Fund. The Transfer Agent performs various shareholder servicing functions, and any shareholder inquiries should be directed to it. TNTC also performs certain administrative services for the Fund pursuant to a sub-administration agreement with NTI. NTI pays TNTC for its sub-administration services out of its management fees, which do not represent additional expenses to the Fund.

TNTC, as Transfer Agent, is entitled to transfer agent fees at an annual rate of 0.015% of the average daily net assets of the Fund. TNTC, as Custodian, receives an amount based on a pre-determined schedule of charges approved by the Trust’s Board of Trustees.

Pursuant to an exemptive order issued by the SEC, TNTC also may render securities lending services to the Fund. For such services, TNTC would receive a percentage of securities lending revenue generated for the Fund. In addition, cash collateral received by the Fund in connection with a securities loan may be invested in shares of other registered or unregistered funds that pay investment advisory or other fees to NTI, TNTC or an affiliate.

The Fund may invest its uninvested cash in a money market fund advised by the Investment Adviser or its affiliates. Accordingly, the Fund will bear indirectly a proportionate share of that money market fund’s operating expenses. These operating expenses include the management, transfer agent and custody fees that the money market fund pays to the Investment Adviser or its affiliates. The uninvested cash of the Fund is invested in the Northern Institutional Funds U.S. Government Portfolio. The total annual portfolio operating expenses after expense reimbursement (other than certain excepted expenses as described in the fees and expenses table of the Portfolio’s prospectus) on any assets invested in the Northern Institutional Funds U.S. Government Portfolio are at an annual rate of 0.25% of the average daily net assets value of those assets. However, to the extent of any duplicative advisory fees, the Investment Adviser will reimburse the Fund for a portion of the management fees attributable to and payable by the Fund for advisory services on any assets invested in the affiliated money market fund.

TNTC, NTI and other Northern Trust affiliates may provide other services to the Fund and receive compensation for such services, if consistent with the Investment Company Act of 1940, as amended (the “1940 Act”) and the rules, exemptive orders and no-action letters issued by the SEC thereunder. Unless required, investors in the Fund may or may not receive specific notice of such additional services and fees.

Shares of the Trust are distributed by Northern Funds Distributors, LLC (“NFD”), Three Canal Plaza, Suite 100, Portland, Maine, 04101. NFD is not affiliated with TNTC, NTI, or any other Northern Trust affiliate.

| ULTRA-SHORT FIXED INCOME FUND | 12 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

THE TRUST IS A FAMILY OF NO-LOAD MUTUAL FUNDS THAT OFFERS A SELECTION OF FUNDS TO INVESTORS, EACH WITH A DISTINCT INVESTMENT OBJECTIVE AND RISK/REWARD PROFILE.

The description in the Fund Summary may help you decide whether the Fund fits your investment needs. Keep in mind, however, that no guarantee can be made that the Fund will meet its investment objective, and the Fund should not be relied upon as a complete investment program. The Trust also offers other funds, including additional fixed income, equity, multi-manager and money market funds, which are described in separate prospectuses.

Please note that the fee and expense information shown under “Fees and Expenses of the Fund” in the Fund Summary beginning on page 3 does not reflect any charges that may be imposed by TNTC, its affiliates, financial intermediaries and other institutions on their customers. (For more information, please see “Account Policies and Other Information—Financial Intermediaries” beginning on page 21.)

You may purchase shares directly from the Trust or, if you maintain certain accounts, through Northern Trust and certain other institutions. With certain limited exceptions, the Fund is generally available only to investors residing in the United States or through a United States based financial intermediary and may not be distributed by a foreign financial intermediary. If you have any questions or need assistance in opening an investment account or purchasing shares, call 800-595-9111.

THROUGH AN AUTHORIZED INTERMEDIARY. The Trust may authorize certain institutions acting as financial intermediaries (including banks, trust companies, brokers and investment advisers) to accept purchase orders from their customers on behalf of the Fund. See “Account Policies and Other Information—Financial Intermediaries” beginning on page 21 for additional information regarding purchases of Fund shares through authorized intermediaries.

DIRECTLY FROM THE FUND. You may open a shareholder account and purchase shares directly from the Fund with a minimum initial investment per Fund of $2,500 ($500 for an IRA; $250 under the Automatic Investment Plan; and $500 for employees of Northern Trust and its affiliates). The minimum subsequent investment is $50 (except for reinvestments of distributions for which there is no minimum). The Fund reserves the right to waive these minimums.

For your convenience, there are a number of ways to invest directly in the Fund:

BY MAIL

| ∎ | Read this Prospectus carefully. |

| ∎ | Complete and sign the New Account Application. |

| ∎ | Enclose a check payable to Northern Funds. |

| ∎ | If you are investing on behalf of a corporation or other entity, your New Account Application must be accompanied by acceptable evidence of authority (if applicable). |

| ∎ | Mail your check, acceptable evidence of authority (if applicable) and completed New Account Application to: |

Northern Funds

P.O. Box 75986

Chicago, Illinois 60675-5986

| ∎ | Additional documentation may be required to fulfill the requirements of the “Customer Identification Program” described on page 21. |

| ∎ | For overnight delivery use the following address: |

Northern Funds

801 South Canal Street

Chicago, Illinois 60607

| ∎ | For subsequent investments: |

| ∎ | Enclose your check with the investment slip portion of the confirmation of your previous investment; or |

| ∎ | Indicate on your check or a separate piece of paper your name, address and account number. |

All checks must be payable in U.S. dollars and drawn on a bank located in the United States. Cash, travelers checks, money orders and third party checks are not acceptable.

BY WIRE OR AUTOMATED CLEARING HOUSE (“ACH”) TRANSFER

TO OPEN A NEW ACCOUNT:

| ∎ | For more information or instructions regarding the purchase of shares, call the Northern Funds Center at 800-595-9111. |

| NORTHERN FUNDS PROSPECTUS | 13 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

| ∎ | Complete a New Account Application and send it to: |

Northern Funds

P.O. Box 75986

Chicago, Illinois 60675-5986

TO ADD TO AN EXISTING ACCOUNT:

| ∎ | Have your bank wire federal funds or effect an ACH transfer to: |

The Northern Trust Company

Chicago, Illinois

ABA Routing No. 0710-00152

(Reference 10-Digit Fund account number, with no spaces (e.g., ##########))

(Reference Shareholder’s Name)

BY DIRECT DEPOSIT

TO PURCHASE ADDITIONAL SHARES:

| ∎ | Determine if your employer has direct deposit capabilities through the ACH. |

| ∎ | Have your employer send payments to: |

ABA Routing No. 0710-00152

(Reference 10-Digit Fund account number, with no spaces (e.g., ##########))

(Reference Shareholder’s Name)

| ∎ | The minimum periodic investment for direct deposit is $50. |

BY AUTOMATIC INVESTMENT

TO OPEN A NEW ACCOUNT:

| ∎ | Complete a New Account Application, including the Automatic Investment section. |

| ∎ | Send it to: |

Northern Funds

P.O. Box 75986

Chicago, Illinois 60675-5986

| ∎ | The minimum initial investment in the Fund is $250; $50 for monthly minimum additions. |

TO ADD TO AN EXISTING ACCOUNT:

| ∎ | Call 800-595-9111 to obtain an Automatic Investment Plan Form. |

| ∎ | The minimum for automatic investment additions is $50. |

If you discontinue participation in the plan, the Fund reserves the right to redeem your account involuntarily, upon 30 days’ written notice, if the account’s net asset value (“NAV”) is $1,000 or less. Involuntary redemptions will not be made if the value of shares in an account falls below the minimum amount solely because of a decline in the Fund’s NAV.

BY DIRECTED REINVESTMENT

You may elect to have your income dividend and capital gain distributions automatically invested in another Northern Funds account.

| ∎ | Complete the “Choose Your Dividend and Capital Gain Distributions” section on the New Account Application. |

| ∎ | Reinvestments can only be directed to an existing Northern Funds account (which must meet the minimum investment requirement). |

BY EXCHANGE

You may open a new account or add to an existing account by exchanging shares of one fund of the Trust for shares of any other fund offered by the Trust. See “Selling Shares—By Exchange.”

BY INTERNET

You may initiate transactions between Northern Trust banking and Northern Funds accounts by using Northern Trust Private Passport. For details and to sign up for this service, go to northerntrust.com/funds or contact your Relationship Manager.

THROUGH NORTHERN TRUST AND OTHER INSTITUTIONS

If you have an account with Northern Trust, you may purchase shares through Northern Trust. You also may purchase shares through other financial institutions that have entered into agreements with the Trust. To determine whether you may purchase shares through your institution, contact your institution directly or call 800-595-9111. Northern Trust and other financial institutions may impose charges against your account which will reduce the net return on an investment in the Fund. These charges may include asset allocation fees, account maintenance fees, sweep fees, compensating balance requirements or other charges based upon account transactions, assets or income.

| ULTRA-SHORT FIXED INCOME FUND | 14 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

THROUGH AN AUTHORIZED INTERMEDIARY. If you purchase shares from an authorized intermediary, you may sell (redeem) shares by contacting your financial intermediary. See “Account Policies and Other Information—Financial Intermediaries” beginning on page 21 for additional information regarding sales (redemptions) of Fund shares through authorized intermediaries.

REDEEMING AND EXCHANGING DIRECTLY FROM THE FUNDS. If you purchased shares directly from the Fund or, if you purchased your shares through an account at Northern Trust or another financial institution and you appear on Fund records as the registered holder, you may redeem all or part of your shares using one of the methods described below.

BY MAIL

SEND A WRITTEN REQUEST TO:

Northern Funds

P.O. Box 75986

Chicago, Illinois 60675-5986

THE REDEMPTION REQUEST MUST INCLUDE:

| ∎ | The number of shares or the dollar amount to be redeemed; |

| ∎ | The Fund account number; |

| ∎ | The signatures of all account owners; |

| ∎ | A signature guarantee also is required if: |

| ∎ | The proceeds are to be sent elsewhere than the address of record, or |

| ∎ | The redemption amount is greater than $100,000. |

BY WIRE

If you authorize wire redemptions on your New Account Application, you can redeem shares and have the proceeds sent by federal wire transfer to a previously designated bank account.

| ∎ | You will be charged $15 for each wire redemption unless the designated bank account is maintained at Northern Trust or an affiliated bank. |

| ∎ | Call the Transfer Agent at 800-595-9111 for instructions. |

| ∎ | The minimum amount that may be redeemed by this method is $250. |

BY SYSTEMATIC WITHDRAWAL

If you own shares of the Fund with a minimum value of $10,000, you may elect to have a fixed sum redeemed at regular intervals and distributed in cash or reinvested in one or more other funds of the Trust.

| ∎ | Call 800-595-9111 for an application form and additional information. |

| ∎ | The minimum amount is $250 per withdrawal. |

BY EXCHANGE

The Trust offers you the ability to exchange shares of one fund in the Trust for shares of another fund in the Trust.

| ∎ | When opening an account, complete the Exchange Privilege section of the New Account Application or, if your account is already opened, send a written request to: |

Northern Funds

P.O. Box 75986

Chicago, Illinois 60675-5986

| ∎ | Shares being exchanged must have a value of at least $1,000 ($2,500 if a new account is being established by the exchange, $500 if the new account is an IRA). |

| ∎ | Call 800-595-9111 for more information. |

BY TELEPHONE

If you authorize the telephone privilege on your New Account Application, you may redeem shares by telephone.

| ∎ | If your account is already opened, send a written request to: |

Northern Funds

P.O. Box 75986

Chicago, Illinois 60675-5986

| ∎ | The request must be signed by each owner of the account and must be accompanied by signature guarantees. |

| ∎ | Call 800-595-9111 to use the telephone privilege. |

| ∎ | During periods of unusual economic or market activity, telephone redemptions may be difficult to implement. In such event, shareholders should follow the procedures outlined above under “Selling Shares—By Mail” and outlined below under “Selling Shares—By Internet.” |

| NORTHERN FUNDS PROSPECTUS | 15 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

BY INTERNET

You may initiate transactions between Northern Trust banking and Northern Funds accounts by using Northern Trust Private Passport. For details and to sign up for this service, go to northerntrust.com/funds or contact your Relationship Manager.

REDEEMING AND EXCHANGING THROUGH NORTHERN TRUST AND OTHER INSTITUTIONS

If you purchased your shares through an account at Northern Trust or through another financial institution, you may redeem or exchange your shares according to the instructions pertaining to that account.

| ∎ | Although the Trust imposes no charges when you redeem shares of the Fund, when shares are purchased through an account at Northern Trust or through other financial institutions, a fee may be charged by those institutions for providing services in connection with your account. |

| ∎ | Contact your account representative at Northern Trust or at another financial institution for more information about redemptions or exchanges. |

| ULTRA-SHORT FIXED INCOME FUND | 16 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

ACCOUNT POLICIES AND OTHER INFORMATION

CALCULATING SHARE PRICE. The Trust issues shares and redeems shares at NAV. The NAV for the Fund is calculated by dividing the value of the Fund’s net assets by the number of the Fund’s outstanding shares. The NAV is calculated on each Business Day (see “Business Day” on page 21) as of 3:00 p.m. Central time for the Fund. Fund shares may be priced on days when the New York Stock Exchange (the “Exchange”) is closed if the Securities Industry and Financial Markets Association (“SIFMA”) recommends that the bond markets remain open for all or part of the day. The NAV used in determining the price of your shares is the one calculated after your purchase, exchange or redemption order is received in good order as described beginning on page 21.

Equity securities listed on a recognized U.S. securities exchange or quoted on the NASDAQ National Market System are priced at the regular trading session’s closing price on the exchange or system in which such securities are principally traded. Securities not traded on the valuation date are priced at the most recent quoted bid price.

Investments of the Fund not traded on an exchange for which market quotations are readily available will be valued using last available bid prices or current market quotations provided by dealers or prices (including evaluated prices) supplied by the Fund’s approved independent third-party pricing services, each in accordance with the valuation procedures approved by the Board of Trustees. If market quotations are not readily available, or if it is believed that such quotations do not accurately reflect fair value, the value of the Fund’s investments may be otherwise determined in good faith by NTI under procedures established by the Board of Trustees. Circumstances in which securities may be fair valued include periods when trading in a security is suspended, the exchange or market on which a security trades closes early, the trading volume in a security is limited, corporate actions and announcements take place, or regulatory news is released such as governmental approvals. Additionally, the Trust, in its discretion, may make adjustments to the prices of securities held by the Fund if an event occurs after the publication of market values normally used by the Fund but before the time as of which the Fund calculates its NAV, depending on the nature and significance of the event, consistent with applicable regulatory guidance and the Trust’s fair value procedures. This may occur particularly with respect to certain foreign securities held by the Fund, in which case the Trust may use adjustment factors obtained from an independent evaluation service that are intended to reflect more accurately the value of those securities as of the time the Fund’s NAV is calculated. Other events that can trigger fair valuing of foreign securities include, for example, significant fluctuations in general market indicators, governmental actions, or natural disasters. The use of fair valuation involves the risk that the values used by the Fund to price its investments may be higher or lower than the values used by other unaffiliated investment companies and investors to price the same investments. Short-term obligations, which are debt instruments with a maturity of 60 days or less, held by the Fund are valued at its amortized cost, which, according to the Investment Adviser, approximates fair value.

The Fund may hold foreign securities that trade on weekends or other days when the Fund does not price its shares. Therefore, the value of such securities may change on days when shareholders will not be able to purchase or redeem shares.

TIMING OF PURCHASE REQUESTS. Purchase requests received in good order and accepted by the Transfer Agent or other authorized intermediary by 3:00 p.m. Central time on any Business Day will be executed the day they are received by either the Transfer Agent or other authorized intermediary, at that day’s closing share price for the Fund, provided that one of the following occurs:

| ∎ | The Transfer Agent receives payment by 3:00 p.m. Central time on the same Business Day; or |

| ∎ | The requests are placed by a financial or authorized intermediary that has entered into a servicing agreement with the Trust or its agent and payment in federal or other immediately available funds is received by the Transfer Agent by the close of the same Business Day or on the next Business Day, depending on the terms of the Trust’s or its agent’s agreement with the intermediary. |

Purchase requests received in good order by the Transfer Agent or other authorized intermediary on a non-Business Day or after 3:00 p.m. Central time on a Business Day will be executed on the next Business Day, at that day’s closing share price for the Fund, provided that payment is made as noted above.

MISCELLANEOUS PURCHASE INFORMATION.

| ∎ | You will be responsible for all losses and expenses of the Fund, and purchase orders may be cancelled, in the event of any failure to make payment according to the procedures outlined in this Prospectus. In addition, a $20 charge will be imposed if a check does not clear. |

| ∎ | Exchanges into the Fund from another fund in the Trust may be subject to any redemption fee imposed by the other Fund. |

| ∎ | You may initiate transactions between Northern Trust banking and Northern Funds accounts by using Northern Trust Private Passport. For additional details, please go to northerntrust.com/funds or contact your Relationship Manager. |

| NORTHERN FUNDS PROSPECTUS | 17 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

| ∎ | The Trust and NFD each reserves the right, in its sole discretion, to suspend the offering of shares of the Fund or to reject any purchase order, in whole or in part, when, in the judgment of management, such suspension or rejection is in the best interests of the Fund. The Trust also reserves the right to change or discontinue any of its purchase procedures. |

| ∎ | In certain circumstances, the Trust may advance the time by which purchase orders must be received. See “Early Closings” on page 21. |

| ∎ | If the Transfer Agent cannot locate an investor for a period of time specified by appropriate state law, the investor’s account may be deemed legally abandoned and then escheated (transferred) to such state’s unclaimed property administrator in accordance with statutory requirements. |

TIMING OF REDEMPTION AND EXCHANGE REQUESTS. Redemption and exchange requests received in good order by the Transfer Agent or other authorized intermediary on a Business Day by 3:00 p.m. Central time will be executed on the same day at that day’s closing share price for the Fund.

Redemption and exchange requests received in good order by the Transfer Agent or other authorized intermediary on a non-Business Day or after 3:00 p.m. Central time on a Business Day will be executed the next Business Day, at that day’s closing share price for the Fund.

PAYMENT OF REDEMPTION PROCEEDS. If your account is held directly with the Fund, it is expected that the Fund will typically pay out redemption proceeds to shareholders by the next Business Day following receipt of a redemption request.

If your account is held through an intermediary, the length of time to pay redemption proceeds typically depends, in part, on the terms of the agreement in place between the intermediary and the Fund. For redemption proceeds that are paid either directly to you from the Fund or to your intermediary for transmittal to you, it is expected that payments will typically be made by wire, by ACH or by issuing a check by the next Business Day following receipt of a redemption request in good order from the intermediary by the Fund. Redemption requests that are processed through investment professionals that utilize the National Securities Clearing Corporation will generally settle one to three Business Days following receipt of a redemption request in good order.

However, if you have recently purchased shares with a check or through an electronic transaction, payment may be delayed as discussed below under “Miscellaneous Redemption Information.”

It is expected that payment of redemption proceeds will normally be made from uninvested cash or short-term investments, proceeds from the sale of portfolio securities, or borrowing through the Trust’s committed, unsecured credit facility (see “Credit Facility and Borrowing,” on page 29). It is possible that stressed market conditions or large shareholder redemptions may result in the need for utilization of the Fund’s ability to redeem in kind in order to meet shareholder redemption requests. The Fund reserves the right to pay all or part of your redemption proceeds in readily marketable securities instead of cash (redemption in-kind). Redemption in-kind proceeds will typically be made by delivering the selected securities to the redeeming shareholder within seven days after the receipt of the redemption request in good order by the Fund.

MISCELLANEOUS REDEMPTION INFORMATION. All redemption proceeds will be sent by check unless the Transfer Agent is directed otherwise. Redemption proceeds also may be wired. Redemptions are subject to the following restrictions:

| ∎ | The Trust may require any information from the shareholder reasonably necessary to ensure that a redemption request has been duly authorized. |

| ∎ | Redemption requests made to the Transfer Agent by mail must be signed by a person authorized by acceptable documentation on file with the Transfer Agent. |

| ∎ | The Trust reserves the right, on 30 days’ written notice, to redeem the shares held in any account if, at the time of redemption, the NAV of the remaining shares in the account falls below $1,000. Involuntary redemptions will not be made if the value of shares in an account falls below the minimum solely because of a decline in the Fund’s NAV. |

| ∎ | If you are redeeming recently purchased shares by check or electronic transaction, your redemption request may not be paid until your check or electronic transaction has cleared. This may delay your payment for up to 10 days. |

| ∎ | Subject to applicable law, the Trust and the Transfer Agent reserve the right to redeem shares held by any shareholder who provides incorrect or incomplete account information or when such involuntary redemptions are necessary to avoid adverse consequences to the Trust and its shareholders or the Transfer Agent. |

| ∎ | Subject to applicable law, the Trust, Northern Trust and their agents, reserve the right to involuntarily redeem or suspend an account at the Fund’s then current NAV, in cases of disruptive conduct, suspected fraudulent or illegal activity, inability to verify the identity of an investor, or other circumstances determined to be in the best interest of the Trust and its shareholders. |

| ∎ | The Trust, Northern Trust and their agents reserve the right, without notice, to freeze any account and/or suspend account services when: (i) notice has been received of a dispute regarding the assets in an account, or a legal claim against an |

| ULTRA-SHORT FIXED INCOME FUND | 18 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

| account; (ii) upon initial notification to Northern Trust of a shareholder’s or authorized agent’s death until Northern Trust receives required documentation in correct form; or (iii) if there is a reason to believe a fraudulent transaction may occur or has occurred. |

| ∎ | You may initiate transactions between Northern Trust banking and the Trust’s accounts by using Northern Trust Private Passport. For additional details, please go to northerntrust.com/funds or contact your Relationship Manager. |

| ∎ | The Trust reserves the right to change or discontinue any of its redemption procedures. |

| ∎ | The Trust reserves the right to defer crediting, sending or wiring redemption proceeds for up to 7 days (or such longer period permitted by the SEC) after receiving the redemption order if, in its judgment, an earlier payment could adversely affect the Fund. The processing of redemptions may be suspended, and the delivery of redemption proceeds may be delayed beyond seven days, depending on the circumstances, for any period: (i) during which the NYSE is closed (other than on holidays or weekends), or during which trading on the NYSE is restricted; (ii) when an emergency exists that makes the disposal of securities owned by the Fund or the determination of the fair value of the Fund’s net assets not reasonably practicable; or (iii) as permitted by order of the SEC for the protection of Fund shareholders. |

| ∎ | The Trust does not permit redemption proceeds to be sent by outgoing International ACH Transaction (“IAT”). An IAT is a payment transaction involving a financial institution’s office located outside U.S. territorial jurisdiction. |

| ∎ | In certain circumstances, the Trust may advance the time by which redemption and exchange orders must be received. See “Early Closings” on page 21. |

EXCHANGE PRIVILEGES. You may exchange shares of one fund in the Trust for shares of another fund in the Trust only if the registration of both accounts is identical. Both accounts must have the same owner’s name and title, if applicable. An exchange is a redemption of shares of one fund and the purchase of shares of another fund in the Trust. If the shares redeemed are held in a taxable account, an exchange is considered a taxable event and may result in a gain or loss. The Trust reserves the right to waive or modify minimum investment requirements in connection with exchanges.

The Trust reserves the right to change or discontinue the exchange privilege at any time upon 60 days’ written notice to shareholders and to reject any exchange request. Exchanges are only available in states where an exchange can legally be made. Before making an exchange, you should read the Prospectus for the shares you are acquiring.

POLICIES AND PROCEDURES ON EXCESSIVE TRADING PRACTICES. In accordance with the policy adopted by the Board of Trustees, the Trust discourages market timing and other excessive trading practices. Purchases and exchanges should be made with a view to longer-term investment purposes only. Excessive, short-term (market timing) trading practices may disrupt Fund management strategies, increase brokerage and administrative costs, harm Fund performance and result in dilution in the value of Fund shares held by long-term shareholders. The Trust and Northern Trust reserve the right to reject or restrict purchase or exchange requests from any investor. The Trust and Northern Trust will not be liable for any loss resulting from rejected purchase or exchange orders. To minimize harm to the Trust and its shareholders (or Northern Trust), the Trust (or Northern Trust) will exercise this right if, in the Trust’s (or Northern Trust’s) judgment, an investor has a history of excessive trading or if an investor’s trading, in the judgment of the Trust (or Northern Trust), has been or may be disruptive to the Fund. In making this judgment, trades executed in multiple accounts under common ownership or control may be considered together to the extent they can be identified. No waivers of the provisions of the policy established to detect and deter market timing and other excessive trading activity are permitted that would harm the Trust or its shareholders or would subordinate the interests of the Trust or its shareholders to those of Northern Trust or any affiliated person or associated person of Northern Trust.

To deter excessive shareholder trading, a shareholder is restricted to no more than two “round trips” in the Fund during a calendar quarter. A “round trip” is a redemption or exchange out of the Fund followed by a purchase or exchange into the Fund. The Trust is authorized to permit more than two “round trips” in the Fund during a calendar quarter if the Trust determines in its reasonable judgment that the Trust’s excessive trading policies would not be violated. Examples of such transactions include, but are not limited to, trades involving:

| ∎ | asset allocation programs, wrap fee programs and other investment programs offered by financial institutions where investment decisions are made on a discretionary basis by investment professionals; |

| ∎ | systematic withdrawal plans and automatic exchange plans; |

| ∎ | reinvestment of dividends, distributions or other payments; |

| ∎ | a death or post-purchase disability of the beneficial owner of the account; |

| ∎ | minimum required distributions from retirement accounts; |

| ∎ | the return of excess contributions in retirement accounts; and |

| ∎ | redemptions initiated by the Fund. |

| NORTHERN FUNDS PROSPECTUS | 19 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

As described below, it should be noted that the Trust’s ability to monitor and limit the trading activity of shareholders investing in the Fund through an omnibus account of a financial intermediary may be significantly limited or absent where the intermediary maintains the underlying shareholder accounts.

Pursuant to the policy adopted by the Board of Trustees, the Trust has developed criteria that it uses to identify trading activity that may be excessive. The Trust reviews on a regular and periodic basis available information relating to the trading activity in the Fund in order to assess the likelihood that the Fund may be the target of excessive trading. As part of its excessive trading surveillance process, the Trust, on a periodic basis, examines transactions that exceed certain monetary thresholds or numerical limits within a period of time. If, in its judgment, the Trust detects excessive, short-term trading, whether or not the shareholder has made two round trips in a calendar quarter, the Trust may reject or restrict a purchase or exchange request and may further seek to close an investor’s account with the Fund. The Trust may modify its surveillance procedures and criteria from time to time without prior notice regarding the detection of excessive trading or to address specific circumstances. The Trust will apply the criteria in a manner that, in the Trust’s judgment, will be uniform.

Fund shares may be held through omnibus arrangements maintained by intermediaries such as broker dealers, investment advisers, transfer agents, administrators and insurance companies. In addition, Fund shares may be held in omnibus 401(k) plans, retirement plans and other group accounts. Omnibus accounts include multiple investors and such accounts typically provide the Fund with a net purchase or redemption request on any given day where the purchases and redemptions of Fund shares by the investors are netted against one another. The identities of individual investors whose purchase and redemption orders are aggregated are not known by the Fund. While Northern Trust may monitor share turnover at the omnibus account level, the Fund’s ability to monitor and detect market timing by shareholders or apply any applicable redemption fee in these omnibus accounts is limited. The netting effect makes it more difficult to identify, locate and eliminate market timing activities. In addition, those investors who engage in market timing and other excessive trading activities may employ a variety of techniques to avoid detection. There can be no assurance that the Fund and Northern Trust will be able to identify all those who trade excessively or employ a market timing strategy, and curtail their trading in every instance.

If necessary, the Trust may prohibit additional purchases of Fund shares by a financial intermediary or by certain of the intermediary’s customers. Financial intermediaries may also monitor their customers’ trading activities in the Trust. Certain financial intermediaries may monitor their customers for excessive trading according to their own excessive trading policies. The Trust may rely on these financial intermediaries’ excessive trading policies in lieu of applying the Trust’s policies. The financial intermediaries’ excessive trading policies may differ from the Trust’s policies and there is no assurance that the procedures used by financial intermediaries will be able to curtail excessive trading activity in the Trust.

IN-KIND PURCHASES AND REDEMPTIONS. The Trust reserves the right to accept payment for shares in the form of securities that are permissible investments for the Fund. The Trust also reserves the right to pay redemptions by a distribution “in-kind” of securities (instead of cash) from the Fund. See the SAI for further information about the terms of these purchases and redemptions.

TELEPHONE TRANSACTIONS. All calls may be recorded or monitored. The Transfer Agent has adopted procedures in an effort to establish reasonable safeguards against fraudulent telephone transactions. If reasonable measures are taken to verify that telephone instructions are genuine, the Trust and its service providers will not be responsible for any loss resulting from fraudulent or unauthorized instructions received over the telephone. In these circumstances, shareholders will bear the risk of loss. During periods of unusual market activity, you may have trouble placing a request by telephone. In this event, consider sending your request in writing or follow the procedures found on pages 14 or 16 for initiating transactions by the Internet.

The proceeds of redemption orders received by telephone will be sent by check, wire or transfer according to proper instructions. All checks will be made payable to the shareholder of record and mailed only to the shareholder’s address of record.

The Trust reserves the right to refuse a telephone redemption subject to applicable law.

MAKING CHANGES TO YOUR ACCOUNT INFORMATION. You may make changes to wiring instructions only in writing. You may make changes to an address of record or certain other account information in writing or by telephone. Written instructions must be accompanied by acceptable evidence of authority (if applicable). A signature guarantee also may be required from an institution participating in the Stock Transfer Agency Medallion Program (“STAMP”). Additional requirements may be imposed. In accordance with SEC regulations, the Trust and Transfer Agent may charge a shareholder reasonable costs in locating a shareholder’s current address.

| ULTRA-SHORT FIXED INCOME FUND | 20 | NORTHERN FUNDS PROSPECTUS |

ULTRA-SHORT FIXED INCOME FUND

SIGNATURE GUARANTEES. If a signature guarantee is required, it must be from an institution participating in STAMP, or other acceptable evidence of authority (if applicable) must be provided. Additional requirements may be imposed by the Trust. In addition to the situations described in this Prospectus, the Trust may require signature guarantees in other circumstances based on the amount of a redemption request or other factors.

BUSINESS DAY. A “Business Day” is each Monday through Friday when the Exchange is open for business. For any given calendar year, the Fund will be closed on the following holidays or as observed: New Year’s Day, Martin Luther King, Jr. Day, Presidents’ Day, Good Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day.

GOOD ORDER. A purchase, redemption or exchange request is considered to be “in good order” when all necessary information is provided and all required documents are properly completed, signed and delivered, including acceptable evidence of authority (if applicable). Requests must include the following:

| ∎ | The account number (if issued) and Fund name; |

| ∎ | The amount of the transaction, in dollar amount or number of shares; |

| ∎ | For redemptions and exchanges (other than online, telephone or wire redemptions), the signature of all account owners exactly as they are registered on the account; |

| ∎ | Required signature guarantees, if applicable; |

| ∎ | Other supporting legal documents and certified resolutions that might be required in the case of estates, corporations, trusts and other entities or forms of ownership. Call 800-595-9111 for more information about documentation that may be required of these entities. |

Additionally, a purchase order initiating the opening of an account will not be considered to be “in good order” unless the investor has provided all information required by the Trust’s “Customer Identification Program” described below.

CUSTOMER IDENTIFICATION PROGRAM. Federal law requires the Trust to obtain, verify and record identifying information, which may include the name, residential or business street address, date of birth (for an individual), social security or taxpayer identification number or other identifying information for each investor who opens or reopens an account with the Trust. Applications without this information, or without an indication that a social security or taxpayer identification number has been applied for, may not be accepted. After acceptance, to the extent permitted by applicable law or the Trust’s customer identification program, the Trust reserves the right to: (a) place limits on account transactions until an investor’s identity is verified; (b) refuse an investment in the Trust; or (c) involuntarily redeem an investor’s shares and close an account in the event that an investor’s identity is not verified. The Trust and its agents will not be responsible for any loss in an investor’s account resulting from an investor’s delay in providing all required identifying information or from closing an account and redeeming an investor’s shares when an investor’s identity is not verified.

EARLY CLOSINGS. The Fund reserves the right to advance the time for accepting purchase, redemption or exchange orders for same Business Day credit when the Exchange and/or the bond market close early, trading on the Exchange is restricted, an emergency arises or as otherwise permitted by the SEC. In addition, on any Business Day when SIFMA recommends that the bond markets close early, the Fund reserves the right to close at or prior to the SIFMA recommended closing time. If the Fund does so, it will cease granting same Business Day credit for purchase and redemption orders received at the Fund’s closing time and credit will be given on the next Business Day.

In addition, the Board of Trustees of the Trust also may, for any Business Day, decide to change the time as of which the Fund’s NAV is calculated in response to new developments such as altered trading hours, or as otherwise permitted by the SEC.

EMERGENCY OR UNUSUAL EVENTS. In the event the Exchange does not open for business because of an emergency or unusual event, the Trust may, but is not required to, open the Fund for purchase, redemption and exchange transactions if the Federal Reserve wire payment system is open. To learn whether the Fund is open for business during an emergency situation or unusual event, please call 800-595-9111 or visit northerntrust.com/funds.

FINANCIAL INTERMEDIARIES. The Trust may authorize certain institutions acting as financial intermediaries (including banks, trust companies, brokers and investment advisers) to accept purchase, redemption and exchange orders from their customers on behalf of the Fund. These authorized intermediaries also may designate other intermediaries to accept such orders, if approved by the Trust. The Fund will be deemed to have received an order when the order is accepted by the authorized intermediary, and the order will be priced at the Fund’s per share NAV next determined, provided that the authorized intermediary forwards the order (and payment for any purchase order) to the Transfer Agent on behalf of the Trust within agreed-upon time periods. If the order (or payment for any purchase order) is not received by the Transfer Agent within such time periods, the authorized intermediary may be liable for fees and losses and the transaction may be cancelled.

| NORTHERN FUNDS PROSPECTUS | 21 | ULTRA-SHORT FIXED INCOME FUND |

ULTRA-SHORT FIXED INCOME FUND

The Trust may enter into agreements with certain financial intermediaries, including affiliates of Northern Trust that perform support services for their customers who own Fund shares (“Service Organizations”). These support services may include:

| ∎ | assisting investors in processing purchase, exchange and redemption requests; |

| ∎ | processing dividend and distribution payments from the Fund; |

| ∎ | providing information to customers showing their positions in the Fund; and |

| ∎ | providing subaccounting with respect to Fund shares beneficially owned by customers or the information necessary for subaccounting. |

For their services, Service Organizations may receive fees from the Fund at annual rates of up to 0.15% of the average daily NAV of the shares covered by their agreements. Because these fees are paid out of the Fund’s assets on an on-going basis, they will increase the cost of your investment in the Fund.

The Fund’s arrangements with Service Organizations under the agreements are governed by a Service Plan, which has been adopted by the Board of Trustees.

Northern Trust also may provide compensation to certain dealers and Service Organizations, for marketing and distribution in connection with the Trust. Northern Trust may also sponsor informational meetings, seminars and other similar programs designed to market the Trust. The amount of such compensation and payments may be made on a one-time and/or periodic basis, and may represent all or a portion of the annual fees earned by the Investment Adviser (after adjustments). The additional compensation and payments will be paid by Northern Trust or its affiliates and will not represent an additional expense to the Trust or its shareholders. Such payments may provide incentives for financial intermediaries to make shares of the Fund available to their customers, and may allow the Fund greater access to such parties and their customers than would be the case if no payments were paid.

Investors purchasing shares of the Fund through a financial intermediary should read their account agreements with the financial intermediary carefully. A financial intermediary’s requirements may differ from those listed in this Prospectus. A financial intermediary also may impose account charges, such as asset allocation fees, account maintenance fees and other charges that will reduce the net return on an investment in the Fund. If an investor has agreed with a particular financial intermediary to maintain a minimum balance and the balance falls below this minimum, the investor may be required to redeem all or a portion of the investor’s investment in the Fund.