Form 425 ULTRATECH INC Filed by: ULTRATECH INC

Veeco Instruments to Acquire Ultratech February 2, 2017 Filed by Ultratech, Inc. Pursuant to Rule 425 Under the Securities Act of 1933 And Deemed Filed Pursuant to Rule 14a-12 Under the Securities Exchange Act of 1934 Subject Company: Ultratech, Inc. Commission File No. 000-22248

Cautionary Statements Forward-looking Statements This written communication contains forward-looking statements that involve risks and uncertainties concerning the Company’s proposed acquisition of Ultratech, Ultratech’s and the Company’s expected financial performance, as well as Ultratech’s and the Company’s strategic and operational plans. Actual events or results may differ materially from those described in this written communication due to a number of risks and uncertainties. The potential risks and uncertainties include, among others, the possibility that Ultratech may be unable to obtain required stockholder approval or that other conditions to closing the transaction may not be satisfied, such that the transaction will not close or that the closing may be delayed; the reaction of customers to the transaction; general economic conditions; the transaction may involve unexpected costs, liabilities or delays; risks that the transaction disrupts current plans and operations of the parties to the transaction; the ability to recognize the benefits of the transaction; the amount of the costs, fees, expenses and charges related to the transaction and the actual terms of any financings that will be obtained for the transaction; the outcome of any legal proceedings related to the transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement. In addition, please refer to the documents that the Company and Ultratech file with the SEC on Forms 10-K, 10-Q and 8-K. The filings by the Company and Ultratech identify and address other important factors that could cause its financial and operational results to differ materially from those contained in the forward-looking statements set forth in this written communication. All forward-looking statements speak only as of the date of this written communication nor, in the case of any document incorporated by reference, the date of that document. Neither the Company nor Ultratech is under any duty to update any of the forward-looking statements after the date of this written communication to conform to actual results.

Cautionary Statements Additional Information and Where to Find It In connection with the proposed acquisition of Ultratech (“Ultratech”) by Veeco (the “Company”) pursuant to the terms of an Agreement and Plan of Merger by and among Ultratech, the Company and Ultratech, the Company will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 (the “Form S-4”) that will contain a proxy statement of Ultratech and a prospectus of the Company, which proxy statement/prospectus will be mailed or otherwise disseminated to Ultratech’s stockholders when it becomes available. Investors are urged to read the proxy statement/prospectus (including all amendments and supplements) because they will contain important information. Investors may obtain free copies of the proxy statement/prospectus when it becomes available, as well as other filings containing information about the Company and Ultratech, without charge, at the SEC’s Internet site (http://www.sec.gov). Copies of these documents may also be obtained for free from the companies’ web sites at www.Veeco.com or www.Ultratech.com. Participants in Solicitation The Company, Ultratech and their respective officers and directors may be deemed to be participants in the solicitation of proxies from the stockholders of Ultratech in connection with the proposed transaction. Information about the Company’s executive officers and directors is set forth in its Annual Report on Form 10-K, which was filed with the SEC on February 25, 2016 and its proxy statement for its 2016 annual meeting of stockholders, which was filed with the SEC on March 22, 2016. Information about Ultratech’ executive officers and directors is set forth in its Annual Report on Form 10-K, which was filed with the SEC on February 26, 2016, Amendment No. 1 to its Annual Report on Form 10-K, which was filed with the SEC on April 22, 2016, and the proxy statements for its 2016 annual meeting of stockholders, which were filed with the SEC on June 10 and June 13, 2016. Investors may obtain more detailed information regarding the direct and indirect interests of the Company, Ultratech and their respective executive officers and directors in the acquisition by reading the preliminary and definitive proxy statement/prospectus regarding the transaction, which will be filed with the SEC.

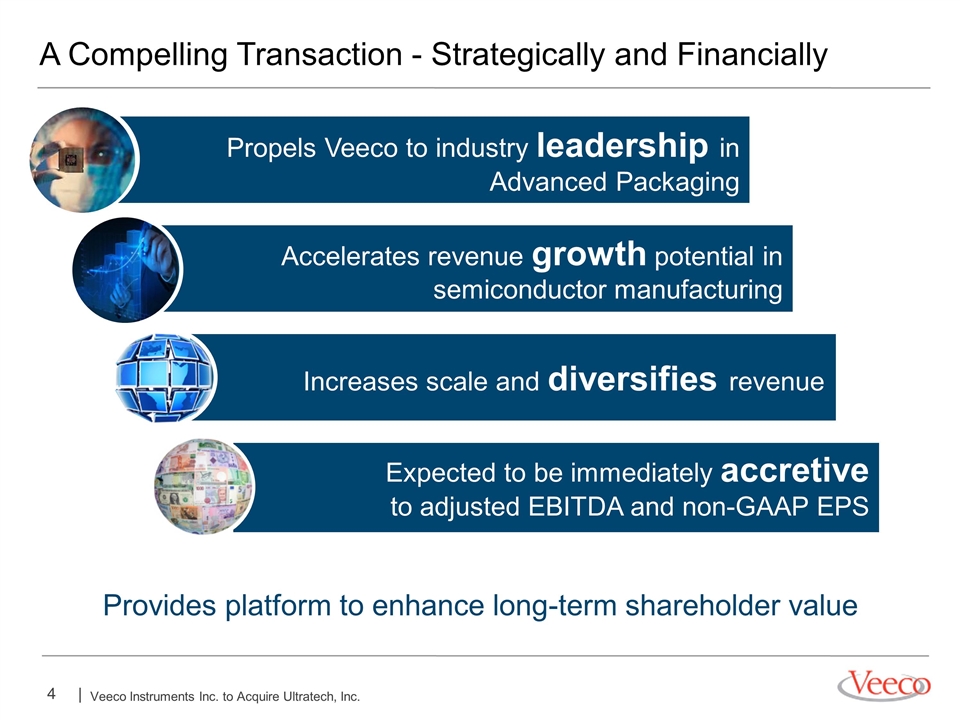

A Compelling Transaction - Strategically and Financially Propels Veeco to industry leadership in Advanced Packaging Accelerates revenue growth potential in semiconductor manufacturing Enhances revenue growth Expected to be immediately accretive to adjusted EBITDA and non-GAAP EPS Provides platform to enhance long-term shareholder value Increases scale and diversifies revenue

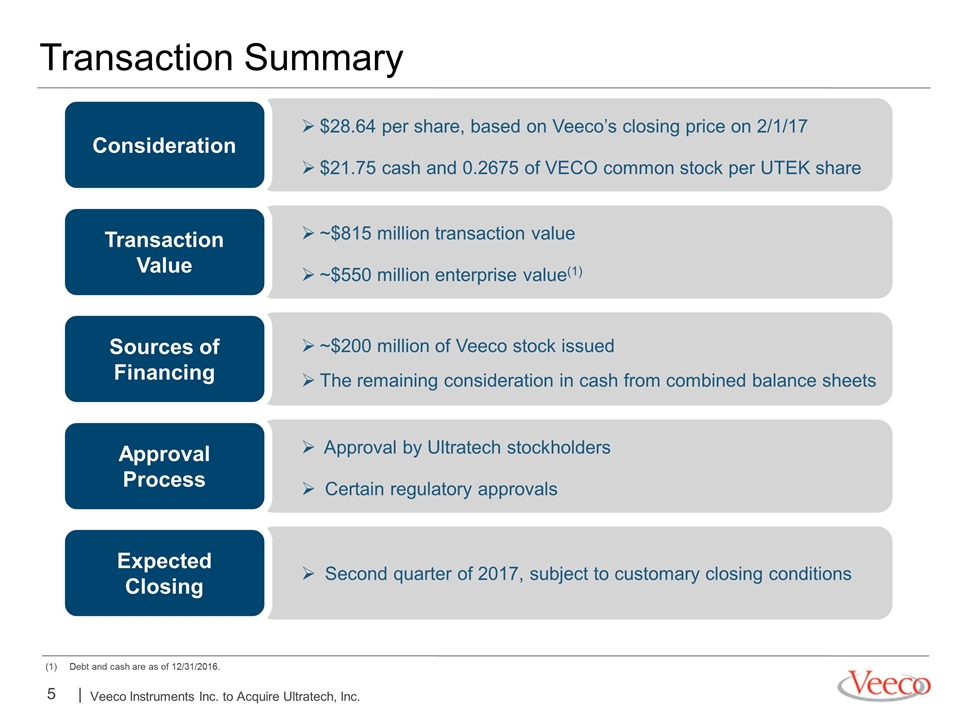

$28.64 per share, based on Veeco’s closing price on 2/1/17 $21.75 cash and 0.2675 of VECO common stock per UTEK share ~$815 million transaction value ~$550 million enterprise value(1) ~$200 million of Veeco stock issued The remaining consideration in cash from combined balance sheets Approval by Ultratech stockholders Certain regulatory approvals Second quarter of 2017, subject to customary closing conditions Transaction Summary Consideration Transaction Value Sources of Financing Approval Process Expected Closing Debt and cash are as of 12/31/2016.

Advanced Packaging Semiconductor Foundry Logic Memory Ultratech At a Glance Ultratech Business Overview Deep rooted history of innovation Founded in 1979 Headquartered in San Jose, CA ~312 Global employees Strong patent portfolio, >1,000 patents Track record of technology leadership Advanced Packaging Lithography Semiconductor Laser Annealing Solid financial performance 2016 revenue of $194M, up 30% Y/Y Expanded gross margin to 46%, in 2016 Addressing Growth Markets Blue-chip customer base LEDs

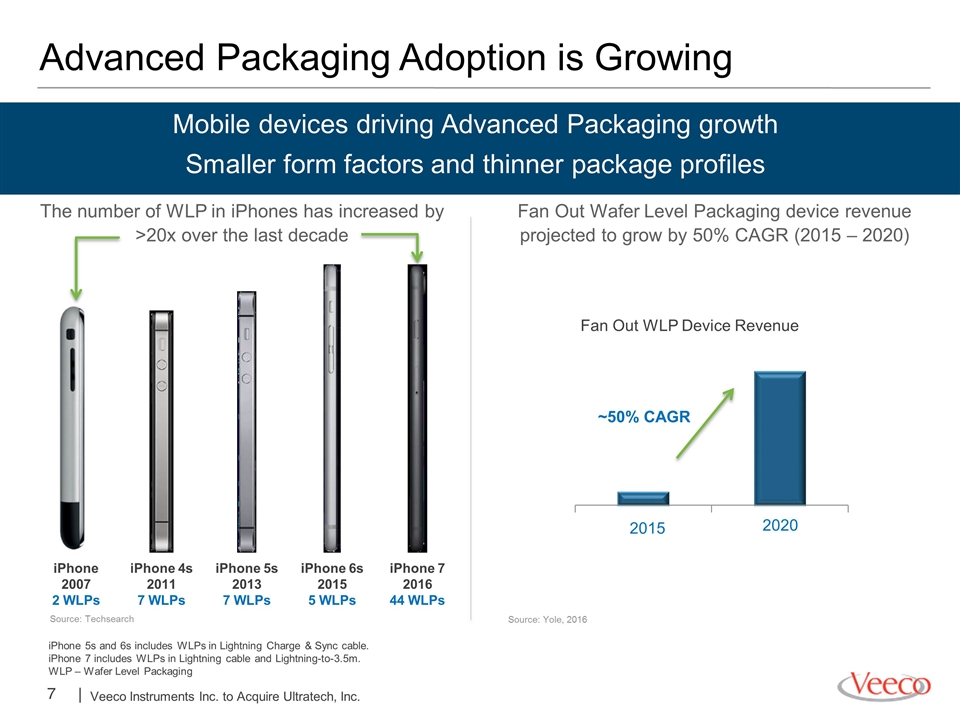

Advanced Packaging Adoption is Growing iPhone 4s 2011 7 WLPs iPhone 5s 2013 7 WLPs iPhone 7 2016 44 WLPs iPhone 2007 2 WLPs iPhone 6s 2015 5 WLPs ~50% CAGR Fan Out WLP Device Revenue Source: Yole, 2016 Mobile devices driving Advanced Packaging growth Smaller form factors and thinner package profiles iPhone 5s and 6s includes WLPs in Lightning Charge & Sync cable. iPhone 7 includes WLPs in Lightning cable and Lightning-to-3.5m. WLP – Wafer Level Packaging Source: Techsearch The number of WLP in iPhones has increased by >20x over the last decade Fan Out Wafer Level Packaging device revenue projected to grow by 50% CAGR (2015 – 2020)

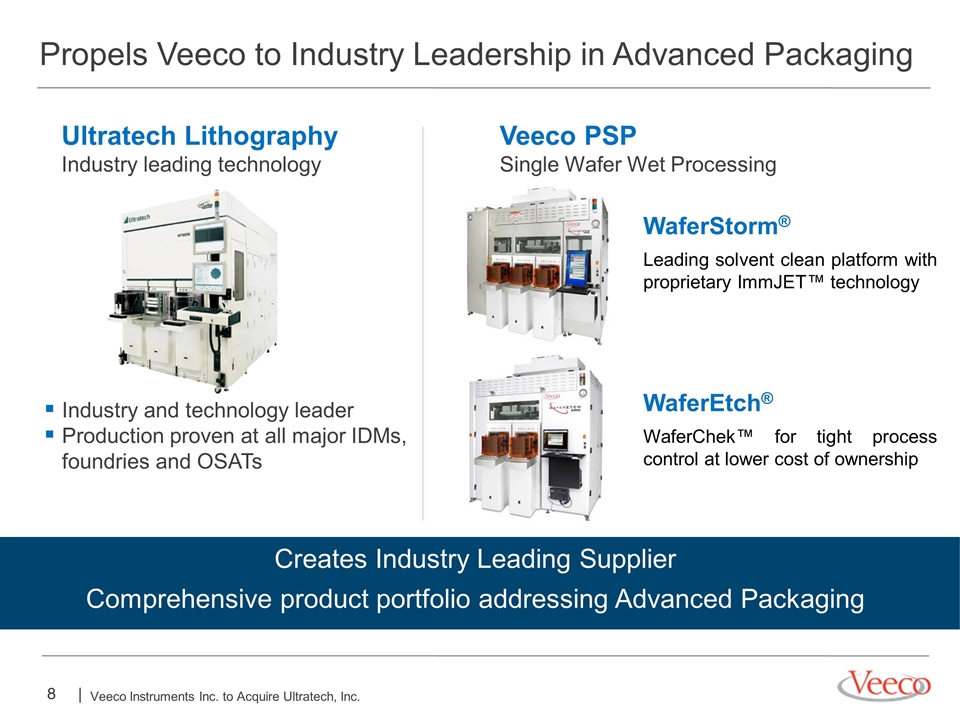

Propels Veeco to Industry Leadership in Advanced Packaging WaferStorm® Leading solvent clean platform with proprietary ImmJET™ technology WaferEtch® WaferChek™ for tight process control at lower cost of ownership Veeco PSP Single Wafer Wet Processing Ultratech Lithography Industry leading technology Industry and technology leader Production proven at all major IDMs, foundries and OSATs Creates Industry Leading Supplier Comprehensive product portfolio addressing Advanced Packaging

Expands Presence in Semiconductor Manufacturing Laser Spike Anneal Ion Beam Deposition EUV Mask Blanks Enabling Moore’s Law with defect free EUV mask blanks Leader in millisecond anneal; required for logic applications 28nm and below Superfast 3D Inspection Increasingly important for advanced logic and memory Ion Beam Etch MRAM development Winning development opportunities with magnetic materials processing expertise

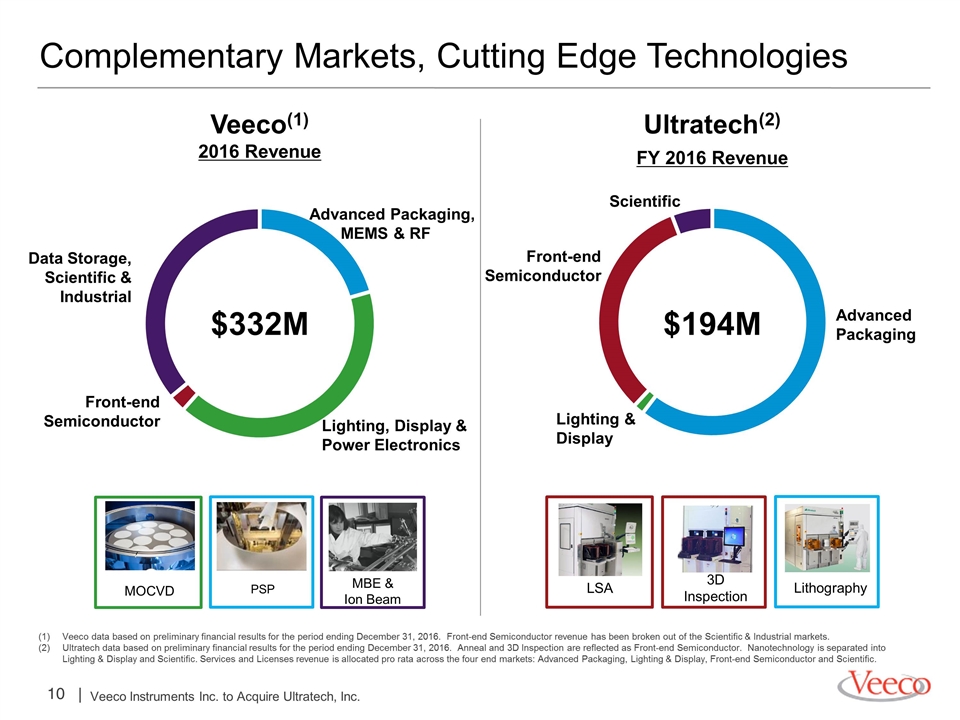

Complementary Markets, Cutting Edge Technologies MBE & Ion Beam MOCVD PSP Advanced Packaging, MEMS & RF Data Storage, Scientific & Industrial Lighting, Display & Power Electronics Advanced Packaging Scientific Lighting & Display Veeco(1) 2016 Revenue Ultratech(2) FY 2016 Revenue Lithography LSA 3D Inspection $194M $332M Veeco data based on preliminary financial results for the period ending December 31, 2016. Front-end Semiconductor revenue has been broken out of the Scientific & Industrial markets. Ultratech data based on preliminary financial results for the period ending December 31, 2016. Anneal and 3D Inspection are reflected as Front-end Semiconductor. Nanotechnology is separated into Lighting & Display and Scientific. Services and Licenses revenue is allocated pro rata across the four end markets: Advanced Packaging, Lighting & Display, Front-end Semiconductor and Scientific. Front-end Semiconductor Front-end Semiconductor

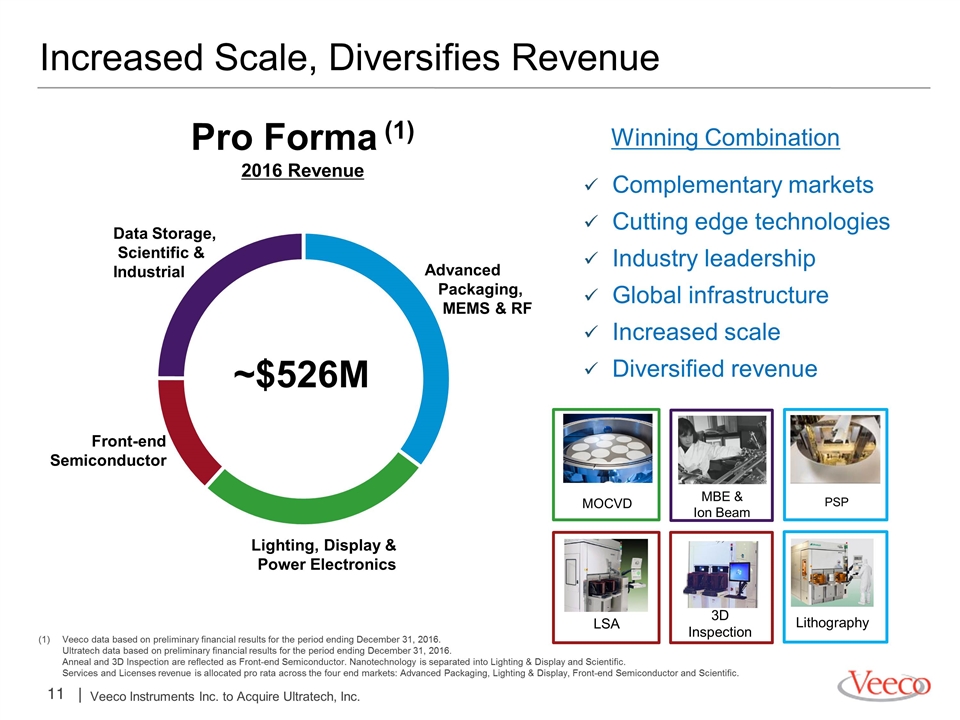

Increased Scale, Diversifies Revenue Complementary markets Cutting edge technologies Industry leadership Global infrastructure Increased scale Diversified revenue Pro Forma (1) 2016 Revenue Advanced Packaging, MEMS & RF Data Storage, Scientific & Industrial Lighting, Display & Power Electronics ~$526M Lithography MOCVD PSP LSA 3D Inspection MBE & Ion Beam Winning Combination Veeco data based on preliminary financial results for the period ending December 31, 2016. Ultratech data based on preliminary financial results for the period ending December 31, 2016. Anneal and 3D Inspection are reflected as Front-end Semiconductor. Nanotechnology is separated into Lighting & Display and Scientific. Services and Licenses revenue is allocated pro rata across the four end markets: Advanced Packaging, Lighting & Display, Front-end Semiconductor and Scientific. Front-end Semiconductor

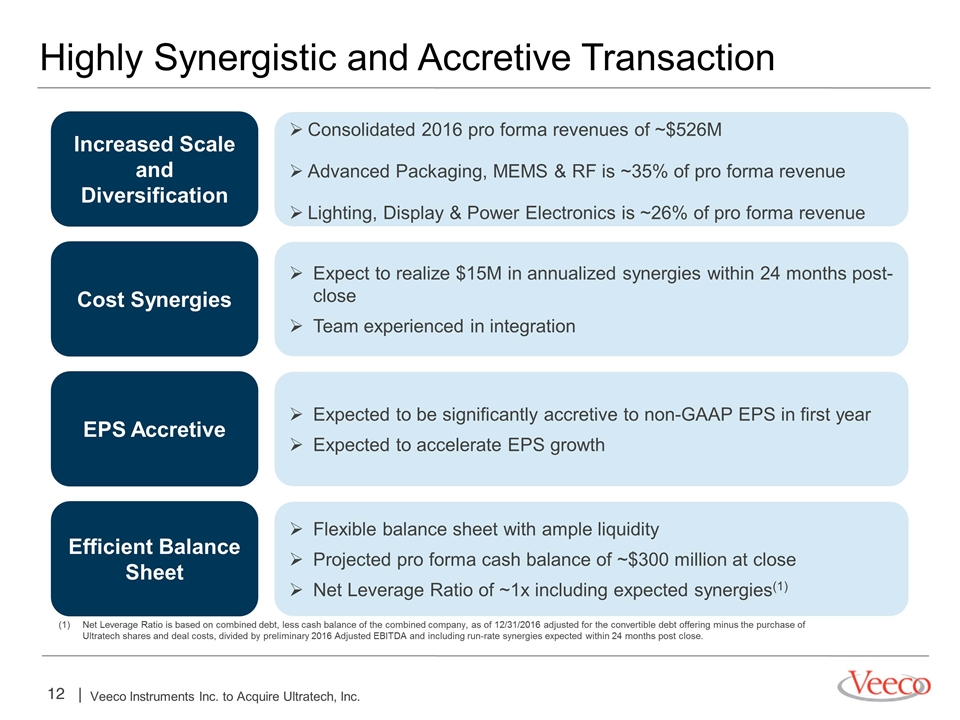

Highly Synergistic and Accretive Transaction Increased Scale and Diversification Cost Synergies EPS Accretive Efficient Balance Sheet Net Leverage Ratio is based on combined debt, less cash balance of the combined company, as of 12/31/2016 adjusted for the convertible debt offering minus the purchase of Ultratech shares and deal costs, divided by preliminary 2016 Adjusted EBITDA and including run-rate synergies expected within 24 months post close. Consolidated 2016 pro forma revenues of ~$526M Advanced Packaging, MEMS & RF is ~35% of pro forma revenue Lighting, Display & Power Electronics is ~26% of pro forma revenue Expect to realize $15M in annualized synergies within 24 months post-close Team experienced in integration Expected to be significantly accretive to non-GAAP EPS in first year Expected to accelerate EPS growth Flexible balance sheet with ample liquidity Projected pro forma cash balance of ~$300 million at close Net Leverage Ratio of ~1x including expected synergies(1)

A Compelling Combination for All Stakeholders Stockholders Customers Employees Better positioned for long term growth and profitability Expected to be significantly accretive to non-GAAP EPS in 2017 and 2018 Expected annualized cost savings of ~$15 million within 24 months post-close Better positioned to continue addressing customers’ critical needs Global manufacturing, sales and service presence Complementary skills to deliver innovative and cost-effective solutions Creates premier, industry leading platform to attract talent Like cultures with focus on innovation Increased scale provides opportunities for achievement and professional growth

Thank You

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- W3WC Dubai Event: Where Visionaries Unite for Web3’s Tomorrow

- Nykode Therapeutics Initiates Phase 2 Trial of VB10.16 in Second Line HPV16-Positive Cervical Cancer

- Sodexo - Financial report for First half Fiscal 2024 available

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share