Form 425 PARK NATIONAL CORP /OH/ Filed by: PARK NATIONAL CORP /OH/

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) | January 23, 2018 |

Park National Corporation |

(Exact name of registrant as specified in its charter) |

Ohio | 1-13006 | 31-1179518 |

(State or other jurisdiction | (Commission | (IRS Employer |

of incorporation) | File Number) | Identification No.) |

50 North Third Street, P.O. Box 3500, Newark, Ohio | 43058-3500 |

(Address of principal executive offices) | (Zip Code) |

(740) 349-8451 |

(Registrant’s telephone number, including area code) |

Not Applicable |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 - Other Events

On January 23, 2018, Park National Corporation, an Ohio corporation (the “Company” or “Park”), and NewDominion Bank, a North Carolina state-chartered bank (“NewDominion”), issued a joint press release announcing the execution of an Agreement and Plan of Merger and Reorganization, dated as of January 22, 2018, by and among the Company, The Park National Bank, a national banking association and a wholly owned subsidiary of the Company (“Park National Bank”), and NewDominion, pursuant to which NewDominion will merge with and into Park National Bank, subject to the terms and conditions set forth therein (the “Merger”). The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

On January 23, 2018, the Company also released a slide presentation regarding the Merger which management of the Company intends to make available to investors. The slide presentation is attached hereto as Exhibit 99.2 and incorporated herein by reference.

Important Information About the Merger

In connection with the proposed merger, Park will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a Proxy Statement of NewDominion and a prospectus of Park, as well as other relevant documents concerning the Merger. SHAREHOLDERS OF NEWDOMINION ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PARK, PARK NATIONAL BANK, NEWDOMINION AND THE PROPOSED TRANSACTION.

A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Park and NewDominion, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Park at the “Investor Information” section of Park's web site at www.parknationalcorp.com or from NewDominion at the “Investor Relations” section of NewDominion’s website at www.newdominionbank.com. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to Park National Corporation, 50 North Third Street, P.O. Box 3500, Newark, OH 43058-3500, Attention: Investor Relations, Telephone: (740) 322-6844 or to NewDominion Bank, PO Box 37389, Charlotte, NC 28237, Attention: Investor Relations, Telephone: (704) 943-5725.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. This communication is also not a solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise. No offer of securities or solicitation will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The communication is not a substitute for the Registration Statement that will be filed with the SEC or the Proxy Statement/Prospectus that will be sent to NewDominion shareholders.

Forward-Looking Statement

Certain statements contained in this communication which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, “would”, “should”, “could”, “might”, “can”, “may”, or similar expressions.

These forward-looking statements include, but are not limited to, statements relating to the expected timing and benefits of the Merger between Park, Park National Bank and NewDominion, including future financial and operating results, cost savings, enhanced revenues, and accretion/dilution to reported earnings that may be realized

from the Merger, as well as other statements of expectations regarding the Merger, and other statements of Park’s goals, intentions and expectations; statements regarding the Park’s business plan and growth strategies; statements regarding the asset quality of Park’s loan and investment portfolios; and estimates of Park’s risks and future costs and benefits, whether with respect to the Merger or otherwise. These forward-looking statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-looking statements, including, among other things: the risk that the businesses of Park and NewDominion will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; expected revenue synergies and cost savings from the Merger may not be fully realized or realized within the expected time frame; revenues following the Merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the Merger; the ability to obtain required governmental and shareholder approvals, and the ability to complete the Merger on the expected timeframe; possible changes in economic and business conditions; the existence or exacerbation of general geopolitical instability and uncertainty; the ability of Park to integrate recent acquisitions and attract new customers; possible changes in monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like Park’s affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; and changes in market, economic, operational, liquidity, credit and interest rate risks associated with the Park’s business. Please refer to Park’s Annual Report on Form 10-K for the year ended December 31, 2016, as well as its other filings with the SEC, for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward-looking statements.

All forward-looking statements included in this communication are made as of the date hereof and are based on information available as of the date hereof. Except as required by law, none of Park, Park National Bank or NewDominion assumes any obligation to update any forward-looking statement.

Item 9.01 - Financial Statements and Exhibits.

(a) | Not applicable |

(b) | Not applicable |

(c) | Not applicable |

(d) | Exhibits. The following exhibits are included with this Current Report on Form 8-K: |

Exhibit No. Description

99.1Press Release dated January 23, 2018

99.2Slide presentation regarding the acquisition of NewDominion Bank.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

PARK NATIONAL CORPORATION | ||

Dated: January 23, 2018 | By: | /s/ Brady T. Burt |

Brady T. Burt | ||

Chief Financial Officer, Secretary and Treasurer | ||

NEWS RELEASE

January 23, 2018

Park National Bank announces plan to welcome NewDominion Bank into organization in 2018

Charlotte-based bank to expand services through new partnership

NEWARK, Ohio and CHARLOTTE, N.C. – Park National Corporation (Park) (NYSE AMERICAN: PRK) and NewDominion Bank (NewDominion) (OTC PINK:NDMN) have signed a definitive agreement and plan of merger, in which NewDominion will become a community bank division of Park’s subsidiary The Park National Bank. The merger will allow NewDominion to strengthen its community banking success, achieve new growth goals as a company and broaden its services, such as larger and more specialized loans and wealth management capabilities. NewDominion will keep its name, local leadership and board, and maintain local decision-making and community support. NewDominion’s mission, vision and core values will continue to be at the center of every client interaction and their executive team will remain headquartered in Charlotte, North Carolina.

In November 2016, Park made a friendly investment of $3.5 million in NewDominion, giving Park 8.55 percent current ownership of NewDominion’s outstanding common stock. Yesterday, the boards of directors of both Park and NewDominion unanimously approved a merger transaction, which is expected to close mid-year of 2018.

“This is an exciting time for our company and clients. I’m so proud of the commitment and effort our teammates have made to transform our bank and look forward to seeing the even greater impact we’ll be able to make in our community and with our clients across the region,” said NewDominion Chief Executive Officer J. Blaine Jackson. “Having the strength of Park National Bank behind us is going to take us all, our clients included, to the next level.”

NewDominion holds $338 million in assets (as of December 31, 2017) and operates two banking offices, in downtown Charlotte and Mooresville, respectively. At December 31, 2017 it had $282 million in deposits and $284 million in loans. NewDominion recently announced that 2017 was its most successful year in its 13-year history. Loans grew by 14 percent and deposits grew by 9 percent.

Park is a well-capitalized organization with eleven community banking divisions. By adding operations in a metropolitan market like Charlotte, Park intends to build on its successful performance in similar areas like Columbus and Cincinnati, Ohio. “The bankers at NewDominion are a welcome addition to our organization. We have common values and principles regarding community banking and delivering extraordinary service. This partnership is an excellent opportunity to create value for both organizations,” Park Chief Executive Officer David L. Trautman said. “Blaine Jackson and his team are doing great work in a thriving city, and we can provide them new and enhanced options to offer their personal and business

clients. We share their enthusiasm and confidence, and look forward to supporting them as they continue NewDominion’s success.”

Under the terms of the merger agreement, Park will pay $76.4 million to acquire the remaining 91.45 percent of NewDominion shares and options. NewDominion shareholders can elect to receive either 0.01023 shares of Park common stock or $1.08 in cash for each share of NewDominion common stock owned, subject to proration such that the total consideration related to this transaction will consist of approximately 60 percent Park common stock and 40 percent cash. The agreement, in which NewDominion will merge with and into The Park National Bank, is subject to approval by NewDominion Bank’s shareholders, regulatory approvals and other customary closing conditions.

The Park National family of community banks consists of eleven banking divisions, each led by local professionals. The banks share operational, compliance and administrative resources, placing them in a strong position to remain competitive with sophisticated technology and service capabilities – while keeping a steadfast focus on personalized service and community involvement.

Boenning & Scattergood, Inc. is serving as financial advisor and Squire Patton Boggs US LLP is serving as legal advisor to Park.

Sandler O’Neill is serving as financial advisor and Wyrick Robbins Yates & Ponton LLP is serving as legal advisor to NewDominion.

Headquartered in Newark, Ohio, Park National Corporation had $7.5 billion in total assets (as of December 31, 2017). The Park organization principally consists of 11 community bank divisions, a non-bank subsidiary and two specialty finance companies. Park's Ohio-based banking operations are conducted through Park subsidiary The Park National Bank and its divisions, which include Fairfield National Bank Division, Richland Bank Division, Century National Bank Division, First-Knox National Bank Division, Farmers Bank Division, United Bank, N.A. Division, Second National Bank Division, Security National Bank Division, Unity National Bank Division, and The Park National Bank of Southwest Ohio & Northern Kentucky Division; and Scope Leasing, Inc. (d.b.a. Scope Aircraft Finance). The Park organization also includes Guardian Financial Services Company (d.b.a. Guardian Finance Company) and SE Property Holdings, LLC.

Park National Media Contact: Bethany Lewis, 740.349.0421, [email protected]

Park National Investor Contact: Brady Burt, 740.322.6844, [email protected]

NewDominion Bank Contact: MaryBeth Simon, 704-943-5708, [email protected]

Important Information About the Merger:

Park will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a Proxy Statement of NewDominion and a Prospectus of Park, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS OF NEWDOMINION ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE, AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PARK, PARK NATIONAL BANK, NEWDOMINION AND THE PROPOSED TRANSACTION.

A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Park and NewDominion, may be obtained at

the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Park at the “Investor Information” section of Park's web site at www.parknationalcorp.com or from NewDominion at the “Investor Relations” section of NewDominion’s website at www.newdominionbank.com. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to Park National Corporation, 50 North Third Street, P.O. Box 3500, Newark, OH 43058-3500, Attention: Investor Relations, Telephone: (740) 322 6844 or to NewDominion Bank, PO Box 37389, Charlotte, NC 28237, Attention: Investor Relations, Telephone: (704) 943-5725. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of such jurisdiction. This communication is also not a solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise. No offer of securities or solicitation will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The communication is not a substitute for the Registration Statement that will be filed with the SEC or the Proxy Statement/Prospectus that will be sent to NewDominion shareholders.

Forward –Looking Statement:

Certain statements contained in this communication which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, “would”, “should”, “could”, “might”, “can”, “may”, or similar expressions. These forward-looking statements include, but are not limited to, statements relating to the expected timing and benefits of the proposed merger (the “Merger”) between Park, The Park National Bank and NewDominion, including future financial and operating results, cost savings, enhanced revenues, and accretion/dilution to reported earnings that may be realized from the Merger, as well as other statements of expectations regarding the Merger, and other statements of Park’s goals, intentions and expectations; statements regarding the Park’s business plan and growth strategies; statements regarding the asset quality of Park’s loan and investment portfolios; and estimates of Park’s risks and future costs and benefits, whether with respect to the Merger or otherwise. These forward-looking statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-looking statements, including, among other things: the risk that the businesses of Park and NewDominion will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; expected revenue synergies and cost savings from the Merger may not be fully realized or realized within the expected time frame; revenues following the Merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the Merger; the ability to obtain required governmental and shareholder approvals, and the ability to complete the Merger on the expected timeframe; possible changes in economic and business conditions; the existence or exacerbation of general geopolitical instability and uncertainty; the ability of Park to integrate recent acquisitions and attract new customers; possible changes in monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like Park’s affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; and changes in market, economic, operational, liquidity, credit and interest rate risks associated with the Park’s business. Please refer to Park’s Annual Report on Form 10-K for the year ended December 31, 2016, as well as its other filings with the SEC, for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward-looking statements. All forward-looking statements included in this communication are made as of the date hereof and are based on information available as of the date hereof. Except as required by law, none of Park, Park National Bank or NewDominion assumes any obligation to update any forward-looking statement.

January 23, 2018 NYSE AMERICAN: PRK | OTC PINK: NDMN

and

Strategic Partnership and Expansion into North Carolina

Forward-looking Statement Disclosure

Certain statements contained in this communication which are not statements of historical fact constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often, but not always, be

identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar

expressions or future or conditional verbs such as “will”, “would”, “should”, “could”, “might”, “can”, “may”, or similar expressions.

These forward-looking statements include, but are not limited to, statements relating to the expected timing and benefits of the proposed

merger (the “Merger”) between Park National Corporation (“Park”), The Park National Bank and NewDominion Bank (“NewDominion”),

including future financial and operating results, cost savings, enhanced revenues, and accretion/dilution to reported earnings that may be

realized from the Merger, as well as other statements of expectations regarding the Merger, and other statements of Park’s goals,

intentions and expectations; statements regarding the Park’s business plan and growth strategies; statements regarding the asset quality

of Park’s loan and investment portfolios; and estimates of Park’s risks and future costs and benefits, whether with respect to the Merger or

otherwise. These forward-looking statements are subject to significant risks, assumptions and uncertainties that may cause results to

differ materially from those set forth in forward-looking statements, including, among other things: the risk that the businesses of Park and

NewDominion will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected;

expected revenue synergies and cost savings from the Merger may not be fully realized or realized within the expected time frame;

revenues following the Merger may be lower than expected; customer and employee relationships and business operations may be

disrupted by the Merger; the ability to obtain required governmental and shareholder approvals, and the ability to complete the Merger on

the expected timeframe; possible changes in economic and business conditions; the existence or exacerbation of general geopolitical

instability and uncertainty; the ability of Park to integrate recent acquisitions and attract new customers; possible changes in monetary

and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost

and other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of

collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking

legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like Park’s affiliate

bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; and changes in

market, economic, operational, liquidity, credit and interest rate risks associated with the Park’s business. Please refer to Park’s Annual

Report on Form 10-K for the year ended December 31, 2016, as well as its other filings with the Securities and Exchange Commission

(the "SEC"), for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed

in the forward-looking statements.

All forward-looking statements included in this communication are made as of the date hereof and are based on information available as

of the date hereof. Except as required by law, none of Park, Park National Bank or NewDominion assumes any obligation to update any

forward-looking statement.

1

Important Information about the Merger

In connection with the proposed merger, Park will file with the SEC a Registration Statement on Form S-4 that will include a Proxy

Statement of NewDominion and a Prospectus of Park, as well as other relevant documents concerning the proposed transaction.

SHAREHOLDERS OF NEWDOMINION ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY

STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PARK, PARK NATIONAL BANK, NEWDOMINION AND THE PROPOSED

TRANSACTION.

A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Park and NewDominion, may be

obtained at the SEC’s website (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Park at the

“Investor Information” section of Park's website at www.parknationalcorp.com or from NewDominion at the “Investor Relations” section of

NewDominion’s website at www.newdominionbank.com. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge,

by directing a request to Park National Corporation, 50 North Third Street, P.O. Box 3500, Newark, OH 43058-3500, Attention: Investor

Relations, Telephone: (740) 322-6844 or to NewDominion Bank, PO Box 37389, Charlotte, NC 28237, Attention: Investor Relations,

Telephone: (704) 943-5725.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the

securities laws of such jurisdiction. This communication is also not a solicitation of any vote in any jurisdiction pursuant to the proposed

transactions or otherwise. No offer of securities or solicitation will be made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended. The communication is not a substitute for the Registration Statement that will be

filed with the SEC or the Proxy Statement/Prospectus that will be sent to NewDominion shareholders.

2

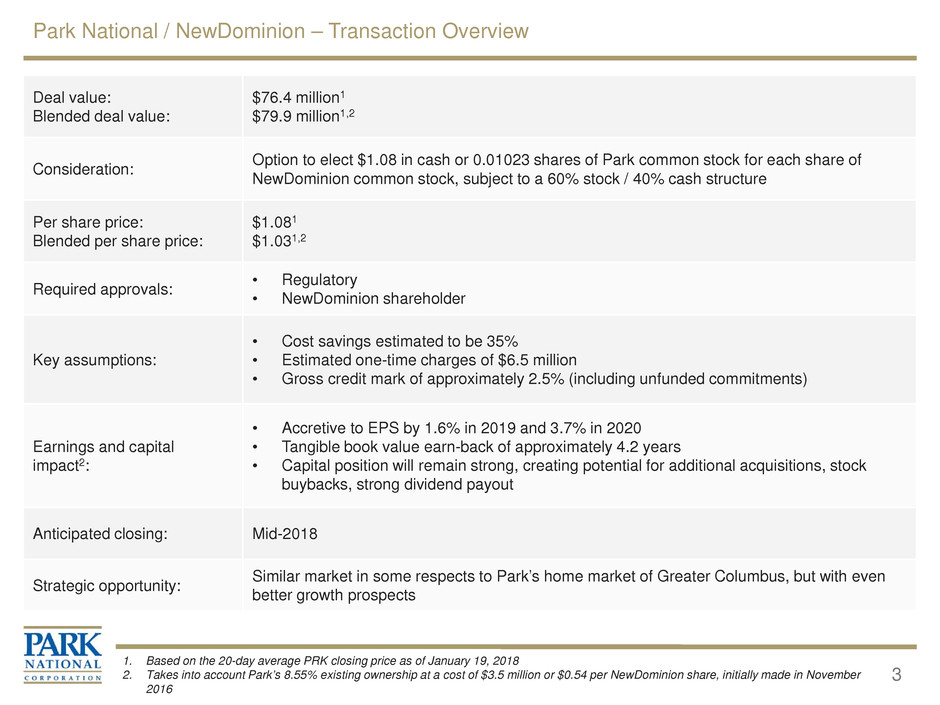

Park National / NewDominion – Transaction Overview

3

1. Based on the 20-day average PRK closing price as of January 19, 2018

2. Takes into account Park’s 8.55% existing ownership at a cost of $3.5 million or $0.54 per NewDominion share, initially made in November

2016

Deal value:

Blended deal value:

$76.4 million1

$79.9 million1,2

Consideration: Option to elect $1.08 in cash or 0.01023 shares of Park common stock for each share of NewDominion common stock, subject to a 60% stock / 40% cash structure

Per share price:

Blended per share price:

$1.081

$1.031,2

Required approvals: • Regulatory• NewDominion shareholder

Key assumptions:

• Cost savings estimated to be 35%

• Estimated one-time charges of $6.5 million

• Gross credit mark of approximately 2.5% (including unfunded commitments)

Earnings and capital

impact2:

• Accretive to EPS by 1.6% in 2019 and 3.7% in 2020

• Tangible book value earn-back of approximately 4.2 years

• Capital position will remain strong, creating potential for additional acquisitions, stock

buybacks, strong dividend payout

Anticipated closing: Mid-2018

Strategic opportunity: Similar market in some respects to Park’s home market of Greater Columbus, but with even better growth prospects

Park National / NewDominion – Selected Highlights

Pro Forma Branch Map

Transaction Metrics1

Blended price per share / TBVPS: 200.9%

Blended price per share / adj. TBVPS2: 188.1%

Blended price per share / 2019 EPS w/ synergies: 13.4x

NewDominion pro forma ownership: 2.8%

4

Park Branches (108)

NewDominion Branches (2)

NewDominion Financials

(as of and for the year ended 12/31/17)

Total assets: $338.3 million

Total gross loans: $284.4 million

Total deposits: $282.3 million

Total equity (all tangible): $39.0 million

2017 efficiency ratio: 86.5%

NPAs / assets: 1.02%

2017 NCOs (recoveries) / average loans: (0.08)%

1. Based on the 20-day average PRK closing price as of January 19, 2018 and takes into account Park’s 8.55% existing ownership

2. Reflects adjusted tangible book value per share assuming the inclusion of NewDominion’s $2.7 million off balance sheet deferred

tax asset

Park National / NewDominion – Strategic Rationale

5

Demographically accretive, given attractive Charlotte market demographics

− Charlotte’s five-year population growth rate projected to be 11x Ohio average and 2x national average (Nielsen)

− Charlotte is the largest metropolitan area in the Carolinas with over 2.5 million residents (Nielsen)

− Charlotte was rated among top 20 places to live in the U.S. (U.S. News & World Report)

− Charlotte’s tech talent pool grew faster than any other top 50 U.S. tech market (CBRE)

− Charlotte is home to six Fortune 500 companies (Fortune)

Culturally similar; Park has become very familiar with NewDominion since initially investing $3.5 million in

NewDominion in a friendly transaction in November 2016

Terrific NewDominion management team that has completed a turnaround effort and is eager to grow its

franchise as part of the Park team

Strategically important but a small and lower-risk acquisition for Park

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Park National (PRK) PT Raised to $130 at Keefe, Bruyette & Woods

- Vacation Innovations Wins 2024 ARDA Awards for Best New Product, Prestigious ACE Emerging Leader Award

- Tidal Wave Auto Spa Celebrates Grand Openings in Woodstock, IL, and Waynesboro, VA, With Free Washes

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share