Form 425 Monocle Acquisition Corp Filed by: Monocle Acquisition Corp

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 8, 2019

MONOCLE ACQUISITION CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 001-38801 | 82-1751907 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

750 Lexington Avenue, Suite 1501

New York, NY 10022

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (212) 446-6981

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| Units, each consisting of one share of Common Stock and one redeemable Warrant |

MNCLU | The Nasdaq Stock Market LLC | ||

| Common Stock, par value $0.0001 per share | MNCL | The Nasdaq Stock Market LLC | ||

| Redeemable warrants, each warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

MNCLW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company. x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

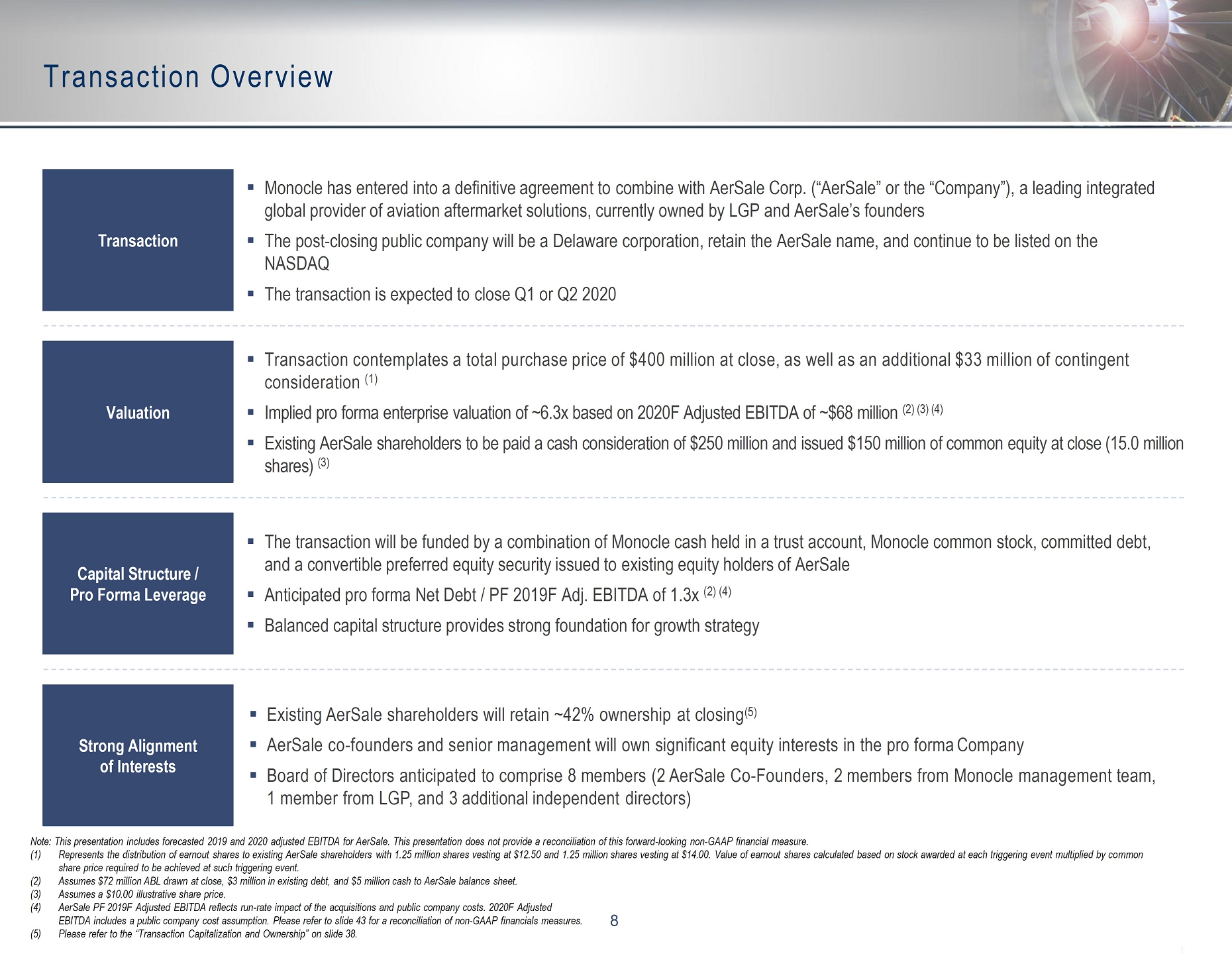

Agreement and Plan of Merger

On December 8, 2019, Monocle Acquisition Corporation (“Monocle”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Monocle Holdings Inc., a Delaware corporation and wholly-owned direct subsidiary of Monocle (“NewCo”), Monocle Merger Sub 1 Inc., a Delaware corporation and wholly-owned direct subsidiary of NewCo (“Merger Sub 1”), Monocle Merger Sub 2 LLC, a Delaware limited liability company and wholly-owned indirect subsidiary of NewCo (“Merger Sub 2” and together with Monocle, NewCo and Merger Sub 1, the “Monocle Parties”), AerSale Corp., a Delaware corporation (“AerSale”), and solely in its capacity as the initial Holder Representative, Leonard Green & Partners, L.P., a Delaware limited partnership.

Pursuant to the Merger Agreement, (a) Merger Sub 1 will be merged with and into Monocle, with Monocle surviving the merger as a wholly-owned direct subsidiary of NewCo (the “First Merger”), and (b) Merger Sub 2 will be merged with and into AerSale, with AerSale surviving the merger as a wholly-owned indirect subsidiary of NewCo (the “Second Merger”). The First Merger, the Second Merger and the other transactions contemplated in the Merger Agreement are referred to herein as the “Business Combination.” In connection with the Business Combination, Monocle and AerSale will become direct or indirect wholly-owned subsidiaries of NewCo, the new public company after the closing of the Business Combination (the “Closing”).

Merger Consideration

Under the Merger Agreement and pursuant to the First Merger, (i) all of the issued and outstanding shares of common stock of Monocle, par value $0.0001 per share (“Monocle Common Stock”), will be exchanged on a one-for-one basis for shares of common stock of NewCo, par value $0.0001 per share (“NewCo Common Stock”), (ii) each outstanding and unexercised warrant to purchase Monocle Common Stock will be exchanged on a one-for-one basis for a warrant to purchase NewCo Common Stock, in the same form and on the same terms and conditions as such warrants to purchase Monocle Common Stock, and (iii) each issued and outstanding shares of common stock of Merger Sub 1 will be canceled and converted into and become, on a one-for-one basis, a share of Monocle Common Stock.

Under the Merger Agreement and pursuant to the Second Merger, the holders of issued and outstanding shares of capital stock of AerSale and AerSale in-the-money stock appreciation rights (“SARs”) will receive aggregate consideration equal to $400 million, consisting of (i) $250 million payable in cash (the “Aggregate Cash Consideration”) and (ii) 15,000,000 shares of NewCo Common Stock, valued at $10 per share (i.e., $150 million in the aggregate) (the “Aggregate Common Stock Consideration”). Under certain circumstances, the cash consideration payable at closing may be reduced to not less than $200 million in exchange for the issuance of up to $50 million of 5.00% Series A Convertible Preferred Stock of NewCo, par value $0.0001 per share (“NewCo Convertible Preferred Stock”) to the AerSale stockholders and holders of SARs.

Holders of AerSale common stock, par value $0.01 per share, and SARs will also receive as consideration a contingent right to receive up to 2,500,000 additional shares of NewCo Common Stock in the aggregate, half of which will be issued at such time as the NewCo Common Stock price is greater than $12.50 per share for any period of twenty (20) trading days out of thirty (30) consecutive trading days on or prior to the fifth anniversary of the date of the Closing (the “Closing Date”) and the other half of which will be issued at such time as the NewCo Common Stock price is greater than $14.00 per share for any period of twenty (20) trading days out of thirty (30) consecutive trading days on or prior to the fifth anniversary of the Closing Date (collectively, the “Earnout Shares”). The Earnout Shares will also be issued upon the occurrence of a Liquidity Event (as defined in the Merger Agreement), solely to the extent the Liquidity Event Consideration (as defined in the Merger Agreement) is greater than $12.50, in which case half of the Earnout Shares will be issued, or $14.00, in which case the other half of the Earnout Shares will also be issued. Earnout Shares that have not been issued on or prior to the fifth anniversary of the Closing Date will be cancelled.

Representations and Warranties

The Merger Agreement contains customary representations and warranties by the parties thereto. Except for any claim based upon Fraud (as defined in the Merger Agreement), the representations and warranties made by AerSale and Monocle to each other in the Merger Agreement will not survive the consummation of the Business Combination. Monocle has obtained customary representations and warranties insurance coverage in the event of breaches of the representations and warranties by AerSale.

Covenants

The Merger Agreement contains customary covenants of the parties thereto with respect to operation of their respective businesses prior to the Closing and efforts required to satisfy conditions precedent to the consummation of the Business Combination.

Mutual Conditions to the Closing

The Closing is subject to certain mutual conditions, including, among others, (i) the approval of the Business Combination and certain related matters by the requisite vote of holders of Monocle Common Stock, (ii) that the amount by which Necessary Cash (as more particularly defined in the Merger Agreement, but generally the amount of cash necessary to pay the Aggregate Cash Consideration plus each party’s transaction expenses and certain other amounts) exceeds Available Cash (as more particularly defined in the Merger Agreement, but generally the amount of the cash available from Monocle’s trust account after redemptions of Monocle Common Stock pursuant to Monocle’s amended and restated certificate of incorporation plus cash received from the debt financing and certain other amounts) is not more than $50 million, (iii) the expiration or termination of all applicable waiting periods (and any extensions thereof) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), (iv) no law or order prohibiting the consummation of the Business Combination being in force, (v) the execution and delivery of a customary registration rights agreement and lock-up agreement by the parties thereto, (vi) in the event that any NewCo Convertible Preferred Stock is issued, that the NewCo Certificate of Designation (as defined in the Merger Agreement) has been properly filed and is in effect prior to the Closing, and (vii) other customary closing conditions.

AerSale’s Conditions to the Closing

The obligation of AerSale to consummate the Business Combination is also conditioned upon, among other things: (i) the accuracy of the representations and warranties of the Monocle Parties (subject to customary materiality qualifiers) and (ii) the Monocle Parties performing in all material respects each of the covenants to be performed by it as of or prior to the Closing.

Monocle’s Conditions to the Closing

The obligation of Monocle to consummate the Business Combination is also conditioned upon, among other things: (i) the accuracy of the representations and warranties of AerSale (subject to customary materiality qualifiers except for certain fundamental representations), (ii) AerSale performing in all material respects each of the covenants to be performed by it as of or prior to the Closing and (iii) no Material Adverse Effect (as defined in the Merger Agreement) having occurred or continuing from the date of the Merger Agreement.

Termination

The Merger Agreement may be terminated under certain circumstances, including, among others: (i) by written consent of AerSale and Monocle; (ii) by AerSale or Monocle if the Closing has not occurred on or prior to August 31, 2020 (the “Termination Date”); provided, that either party may extend the Termination Date by one additional three (3) month-period if all of the conditions to Closing have been satisfied or waived as of the Termination Date, except for the condition related to the expiration or termination of the HSR Act waiting period; (iii) by either AerSale or Monocle if the other party has materially breached any of its representations, warranties, covenants or agreements set forth in the Merger Agreement such that the applicable condition to Closing would not be satisfied and has not cured such breach by the earlier of (a) 30 days of a written notice of such breach or (b) the Termination Date; (iv) by written notice of either party if the consummation of the Business Combination is permanently enjoined or prohibited by a final, non-appealable governmental order or (v) by either AerSale or Monocle if the Monocle Stockholder Approval (as defined in the Merger Agreement) is not obtained or if Necessary Cash exceeds Available Cash by more than $50 million.

Trust Account Waiver

AerSale has agreed that it and its stockholders and affiliates will not have any right, title, interest or claim of any kind in or to any monies in Monocle’s trust account held for its public shareholders, and has agreed not to, and has waived any right to, make any claim against the trust account (including any distributions therefrom) directly or indirectly to Monocle’s public shareholders.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Merger Agreement, a copy of which is attached as Exhibit 2.1 hereto and is incorporated by reference herein. The Merger Agreement has been attached to provide investors with information regarding its terms. The representations, warranties, covenants and agreements contained in the Merger Agreement, which were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties (including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts) and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors and reports and documents filed with the U.S. Securities and Exchange Commission (the “SEC”). Investors should not rely on the representations, warranties, covenants and agreements, or any descriptions thereof, as characterizations of the actual state of facts or condition of any party to the Merger Agreement. In addition, the representations, warranties, covenants and agreements and other terms of the Merger Agreement may be subject to subsequent waiver or modification. Moreover, information concerning the subject matter of the representations and warranties and other terms may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in Monocle’s public disclosures.

Debt Financing

In order to finance a portion of the Aggregate Cash Consideration payable in the Business Combination and the costs and expenses incurred in connection therewith, Monocle and NewCo entered into a debt commitment letter with Wells Fargo Bank, N.A. and PNC Bank, N.A., dated December 8, 2019 (the “Debt Commitment Letter”), in connection with a $150 million senior secured asset-based revolving credit facility (the “ABL Facility”).

The foregoing description of the Debt Commitment Letter does not purport to be complete and is qualified in its entirety by the terms and conditions of the Debt Commitment Letter, a copy of which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

Related Agreements

Support and Release Agreement

Concurrently with the execution of the Merger Agreement, NewCo, Monocle and the AerSale stockholders entered into a support and release agreement (the “Support and Release Agreement”), pursuant to which (i) the AerSale stockholders have agreed not to transfer any shares of AerSale capital stock prior to the Closing, (ii) the AerSale stockholders have made certain representations as to their ownership of AerSale capital stock, (iii) the AerSale stockholders have agreed to customary releases in favor of NewCo, Monocle and their respective affiliates related to activity on or prior to the Closing, and (iv) NewCo and Monocle, on behalf of themselves and the other Monocle Parties and their respective affiliates, have agreed to customary releases in favor of the AerSale stockholders and their respective affiliates related to activity on or prior to the Closing.

The foregoing description of the Support and Release Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Support and Release Agreement, a copy of which is filed as Exhibit 10.2 hereto and incorporated by reference herein.

Founder Shares Agreement

Concurrently with the execution of the Merger Agreement, the founders of Monocle entered into a founder shares agreement (the “Founder Shares Agreement”), pursuant to which they have agreed to defer the vesting of an aggregate of 1,293,750 shares of Monocle Common Stock held by the Founders (representing 30% of the Founder Shares (as defined in the Merger Agreement)) (the “Unvested Founder Shares”), half of which will vest at such time as the NewCo Common Stock price is greater than $12.50 per share for any period of twenty (20) trading days out of thirty (30) consecutive trading days and the other half of which will vest at such time as the NewCo Common Stock price is greater than $14.00 per share for any period of twenty (20) trading days out of thirty (30) consecutive trading days. The Unvested Founder Shares will also vest upon the occurrence of a Liquidity Event on or prior to the fifth anniversary of the date of the Founder Shares Agreement, solely to the extent the Liquidity Event Consideration is greater than $12.50, in which case half of the Unvested Founder Shares which will vest, or $14.00, in which case the other half of the Unvested Founder Shares will also vest. Unvested Founder Shares that have not vested on or prior to the fifth anniversary of the Closing Date will be forfeited.

The foregoing description of the Founder Shares Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Founder Shares Agreement, a copy of which is filed as Exhibit 10.3 hereto and incorporated by reference herein.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K with respect to the issuance of NewCo Common Stock and the potential issuance of NewCo Convertible Preferred Stock (the “Securities”) to the AerSale stockholders and SAR holders is incorporated by reference herein. The issuance of the Securities will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

| Item 7.01 | Regulation FD Disclosure. |

On December 9, 2019, Monocle issued a press release announcing the execution of the Merger Agreement. A copy of the press release is furnished as Exhibit 99.1 hereto.

Furnished as Exhibit 99.2 is a copy of an investor presentation to be used by Monocle in connection with the Business Combination.

Monocle and AerSale will also host a teleconference at 10:30 a.m. Eastern Time. The teleconference and accompanying investor presentation can be accessed by visiting https://event.on24.com/wcc/r/2154390-1/A2D2AFD31A767E1FF8CF3D45AE919BA8. The teleconference can also be accessed by dialing +1 (866) 342 8591 or +1 (203) 518 9713 and providing the conference ID 120919 or asking for the Monocle/AerSale teleconference.

A replay will be available from December 9, 2019 at 12:30 p.m. Eastern Time. The replay can be accessed by visiting the same link.

The information in this Item 7.01 and Exhibits 99.1 and 99.2 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Important Information About the Business Combination and Where to Find It

In connection with the proposed Business Combination, Monocle intends to file a Registration Statement on Form S-4, which will include a preliminary proxy statement/prospectus of Monocle. Monocle will mail a definitive proxy statement/prospectus and other relevant documents to its stockholders. MONOCLES STOCKHOLDERS AND OTHER INTERESTED PERSONS ARE ADVISED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT/PROSPECTUS AND THE AMENDMENTS THERETO AND THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND DOCUMENTS INCORPORATED BY REFERENCE THEREIN FILED IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION, AS THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT AERSALE, MONOCLE AND THE PROPOSED BUSINESS COMBINATION. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to stockholders of Monocle as of a record date to be established for voting on the proposed Business Combination. Stockholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s web site at www.sec.gov.

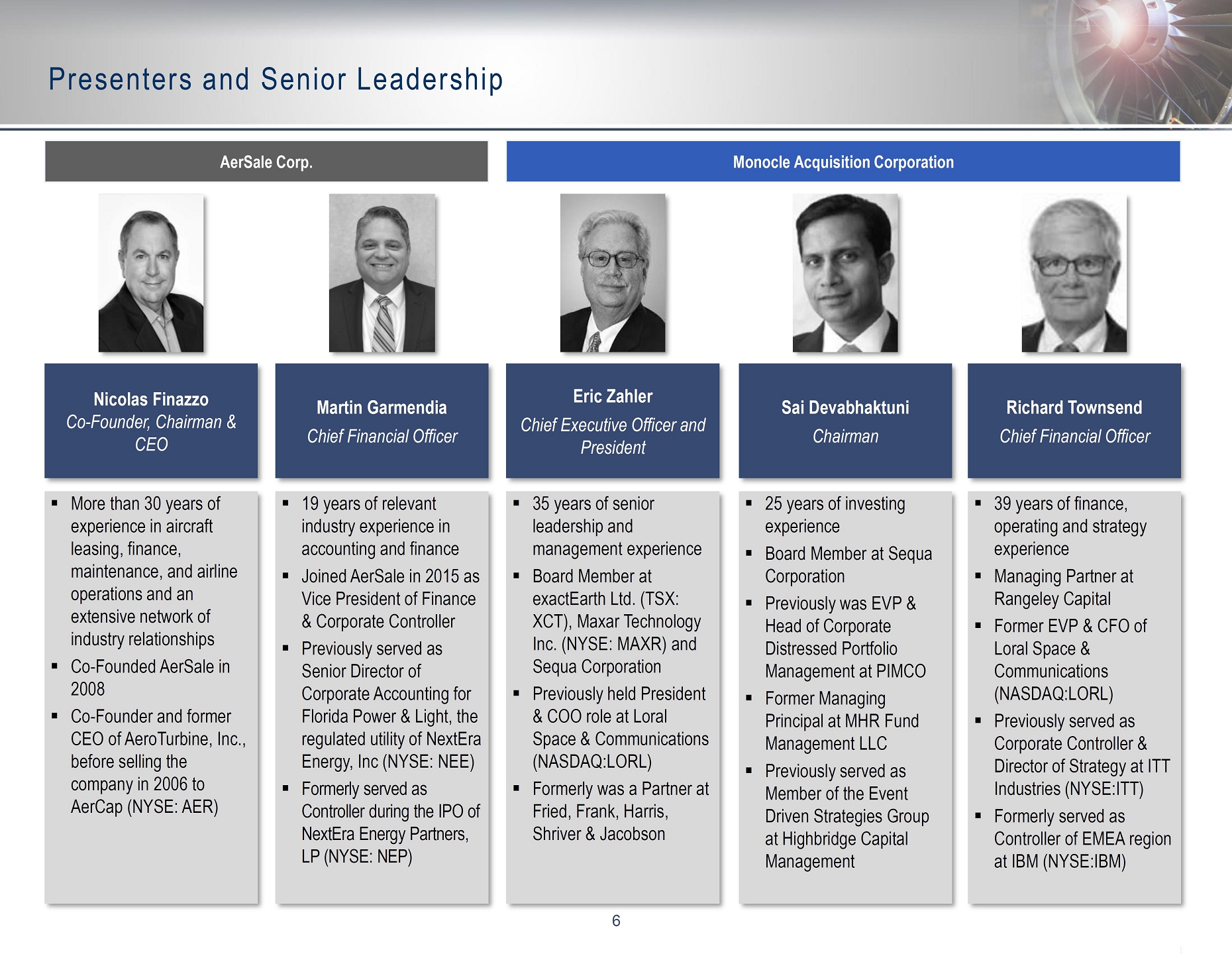

Participants in the Solicitation

Monocle and AerSale and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of Monocle’s stockholders in connection with the proposed Business Combination. Investors and security holders may obtain more detailed information regarding the names and interests in the proposed Business Combination of Monocle’s directors and officers in Monocle’s filings with the SEC, including Monocle’s Form S-1 registration statement, which was declared effective by the SEC on February 6, 2019. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Monocle’s stockholders in connection with the proposed Business Combination will be set forth in the proxy statement/prospectus for the proposed Business Combination when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed Business Combination will be included in the registration statement that the parties intend to file with the SEC.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Monocle’s and AerSale’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, Monocle’s and AerSale’s expectations with respect to future performance and anticipated financial impacts of the Business Combination, the satisfaction of the closing conditions to the Business Combination and the timing of the completion of the Business Combination. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside Monocle’s and AerSale’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement or could otherwise cause the Business Combination to fail to close; (2) the outcome of any legal proceedings that may be instituted against Monocle and AerSale following the announcement of the Merger Agreement and the Business Combination; (3) the inability to complete the Business Combination, including due to failure to obtain approvals from the stockholders of Monocle and AerSale or other conditions to closing in the Merger Agreement; (4) the inability to obtain or maintain the listing of the shares of common stock of the post-acquisition company on The Nasdaq Stock Market following the Business Combination; (5) the risk that the Business Combination disrupts current plans and operations as a result of the announcement and consummation of the Business Combination; (6) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably and retain its key employees; (7) costs related to the Business Combination; (8) changes in applicable laws or regulations; (9) the possibility that AerSale or the combined company may be adversely affected by other economic, business, and/or competitive factors; and (10) other risks and uncertainties indicated from time to time in the proxy statement/prospectus relating to the Business Combination, including those under “Risk Factors” therein, and in Monocle’s other filings with the SEC. Monocle cautions that the foregoing list of factors is not exclusive. Monocle further cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Monocle does not undertake to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based unless required to do so under applicable law.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination and shall not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| * | Certain exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). Monocle agrees to furnish supplementally a copy of any omitted exhibit or schedule to the SEC upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| MONOCLE ACQUISITION CORPORATION | ||

| By: | /s/ Eric J. Zahler | |

| Name: Eric J. Zahler | ||

| Title: President and Chief Executive Officer | ||

| Dated: December 9, 2019 | ||

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

by and among

MONOCLE ACQUISITION CORPORATION,

as Monocle,

MONOCLE MERGER SUB 1 INC.,

as Merger Sub 1,

MONOCLE HOLDINGS INC.,

as NewCo,

MONOCLE MERGER SUB 2 LLC,

as Merger Sub 2,

AERSALE CORP.,

as the Company,

and

solely in its capacity as the Holder Representative,

LEONARD GREEN & PARTNERS, L.P.

dated as of December 8, 2019

TABLE OF CONTENTS

Page

| Article I. CERTAIN DEFINITIONS | 2 |

| 1.1 Definitions | 2 |

| 1.2 Construction | 19 |

| 1.3 Knowledge | 20 |

| Article II. FIRST MERGER | 20 |

| 2.1 First Merger | 20 |

| 2.2 Effects of the First Merger | 21 |

| 2.3 First Merger Closing; First Merger Effective Time | 21 |

| 2.4 Certificate of Incorporation and Bylaws of Monocle and NewCo | 21 |

| 2.5 Directors and Officers of the Surviving Corporation | 22 |

| 2.6 Effects of the First Merger on the Capital Stock of Monocle | 22 |

| 2.7 Exchange of Certificates | 23 |

| Article III. SECOND MERGER; CLOSING | 24 |

| 3.1 Second Merger | 24 |

| 3.2 Effects of the Second Merger | 24 |

| 3.3 Closing; Effective Time | 25 |

| 3.4 Certificate of Incorporation and Bylaws of the Surviving Corporation | 25 |

| 3.5 Directors and Officers of the Surviving Corporation | 25 |

| Article IV. EFFECTS OF THE SECOND MERGER ON THE CAPITAL STOCK | 25 |

| 4.1 Conversion of Shares of Preferred Stock, Shares of Common Stock and SARs | 25 |

| 4.2 Merger Sub 2 Interests | 28 |

| 4.3 Payment; Exchange of Certificates; Letter of Transmittal | 28 |

| 4.4 Repayment of Funded Debt | 30 |

| 4.5 Exchange Agent | 30 |

| 4.6 Lost Certificate | 31 |

| 4.7 No Liability; Withholding | 31 |

| 4.8 Earnout | 31 |

| Article V. REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 34 |

| 5.1 Corporate Organization of the Company | 34 |

| 5.2 Subsidiaries | 34 |

| 5.3 Due Authorization | 35 |

| 5.4 No Conflict | 35 |

| 5.5 Governmental Authorities; Consents | 36 |

i

| 5.6 Capitalization | 36 |

| 5.7 Financial Statements | 37 |

| 5.8 Undisclosed Liabilities | 38 |

| 5.9 AerLine Financial Statements; Undisclosed Liabilities | 38 |

| 5.10 Litigation and Proceedings | 39 |

| 5.11 Compliance with Laws | 39 |

| 5.12 Product Warranty; Aviation Regulation Compliance | 40 |

| 5.13 Contracts; No Defaults | 41 |

| 5.14 Company Benefit Plans | 43 |

| 5.15 Labor Matters | 45 |

| 5.16 Taxes | 46 |

| 5.17 Brokers’ Fees | 48 |

| 5.18 Insurance | 48 |

| 5.19 Real Property; Assets | 48 |

| 5.20 Environmental Matters | 49 |

| 5.21 Absence of Changes | 50 |

| 5.22 Affiliate Agreements | 50 |

| 5.23 Intellectual Property | 50 |

| 5.24 Permits | 51 |

| 5.25 Customers and Vendors | 52 |

| 5.26 Certain Business Practices; Anti-Corruption | 52 |

| 5.27 Sanctions and Trade Control | 53 |

| 5.28 Company Transaction Expenses | 53 |

| 5.29 Registration Statement and Proxy Statement | 54 |

| 5.30 No Additional Representations and Warranties; No Outside Reliance | 54 |

| Article VI. REPRESENTATIONS AND WARRANTIES OF THE MONOCLE PARTIES | 55 |

| 6.1 Corporate Organization | 55 |

| 6.2 Due Authorization | 55 |

| 6.3 No Conflict | 56 |

| 6.4 Litigation and Proceedings | 56 |

| 6.5 Governmental Authorities; Consents | 56 |

| 6.6 Monocle Capitalization | 57 |

| 6.7 Business Activities | 57 |

| 6.8 Monocle SEC Documents; Controls | 58 |

| 6.9 Listing | 59 |

| 6.10 Registration Statement and Proxy Statement | 59 |

| 6.11 Financial Ability | 60 |

| 6.12 Brokers’ Fees | 60 |

| 6.13 Solvency; Surviving Corporation After the Second Merger | 61 |

| 6.14 Trust Account | 61 |

| 6.15 Outstanding Monocle Expenses | 61 |

| 6.16 No Outside Reliance | 62 |

| 6.17 Investment Intent | 63 |

ii

| Article VII. COVENANTS OF THE COMPANY | 63 |

| 7.1 Conduct of Business | 63 |

| 7.2 Inspection | 66 |

| 7.3 HSR Act and Regulatory Approvals | 67 |

| 7.4 Cooperation with Financing | 67 |

| 7.5 Representation and Warranty Insurance | 71 |

| 7.6 Termination of Certain Agreements | 71 |

| 7.7 Company Real Property Certificate | 71 |

| 7.8 No Shop | 71 |

| 7.9 Trust Account Waiver | 72 |

| 7.10 Section 280G | 73 |

| 7.11 Notification of Certain Matters; Information Updates | 73 |

| 7.12 Expense Report; Company Transaction Expenses | 73 |

| Article VIII. COVENANTS OF MONOCLE | 74 |

| 8.1 Conduct of Business | 74 |

| 8.2 HSR Act and Regulatory Approvals | 75 |

| 8.3 Indemnification and Insurance | 77 |

| 8.4 Financing | 78 |

| 8.5 Post-Closing Access; Preservation of Records | 79 |

| 8.6 Monocle Public Filings | 79 |

| 8.7 Nasdaq Listing | 79 |

| 8.8 Additional Covenants | 79 |

| Article IX. JOINT COVENANTS | 80 |

| 9.1 Support of Transaction | 80 |

| 9.2 Tax Matters | 81 |

| 9.3 Proxy Statement; Registration Statement | 81 |

| 9.4 Monocle Stockholder Approval | 83 |

| 9.5 NewCo Board of Directors | 84 |

| 9.6 Trust Account | 84 |

| Article X. CONDITIONS TO OBLIGATIONS | 84 |

| 10.1 Conditions to Obligations of the Monocle Parties and the Company | 84 |

| 10.2 Conditions to Obligations of the Monocle Parties | 85 |

| 10.3 Conditions to the Obligations of the Company | 86 |

| 10.4 Satisfaction of Conditions | 86 |

| Article XI. TERMINATION/EFFECTIVENESS | 86 |

| 11.1 Termination | 86 |

| 11.2 Effect of Termination | 88 |

iii

| Article XII. HOLDER REPRESENTATIVE | 88 |

| 12.1 Designation and Replacement of Holder Representative | 88 |

| 12.2 Authority and Rights of the Holder Representative; Limitations on Liability | 89 |

| Article XIII. MISCELLANEOUS | 89 |

| 13.1 Non-Survival of Representations, Warranties and Covenants | 89 |

| 13.2 Waiver | 90 |

| 13.3 Notices | 90 |

| 13.4 Assignment | 92 |

| 13.5 Rights of Third Parties | 92 |

| 13.6 Expenses | 92 |

| 13.7 Governing Law | 92 |

| 13.8 Captions; Counterparts | 93 |

| 13.9 Schedules and Annexes | 93 |

| 13.10 Entire Agreement | 93 |

| 13.11 Amendments | 93 |

| 13.12 Publicity | 93 |

| 13.13 Severability | 94 |

| 13.14 Jurisdiction; WAIVER OF TRIAL BY JURY | 94 |

| 13.15 Enforcement | 95 |

| 13.16 Non-Recourse | 95 |

| 13.17 Acknowledgement and Waiver | 96 |

ANNEXES

Annex A – Amended and Restated Registration Rights Agreement

Annex B – Lock-Up Agreement

Annex C – Founder Shares Agreement

Annex D – Company Stockholder Approval

Annex E – Letter of Transmittal

Annex F – NewCo Certificate of Designation

Annex G – First Certificate of Merger

Annex H – Second Certificate of Merger

iv

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of December 8, 2019, is entered into by and among Monocle Acquisition Corporation, a Delaware corporation (“Monocle”), Monocle Holdings Inc., a Delaware corporation and a wholly-owned direct Subsidiary of Monocle (“NewCo”), Monocle Merger Sub 1 Inc., a Delaware corporation and a wholly-owned direct Subsidiary of NewCo (“Merger Sub 1”), Monocle Merger Sub 2 LLC, a Delaware limited liability company and a wholly-owned indirect Subsidiary of NewCo (“Merger Sub 2” and together with Monocle, NewCo and Merger Sub 1, the “Monocle Parties” and each individually, a “Monocle Party”), AerSale Corp., a Delaware corporation (the “Company”), and Leonard Green & Partners, L.P., a Delaware limited partnership, solely in its capacity as the initial Holder Representative (as defined below) hereunder. The Company, Merger Sub 1, Merger Sub 2, NewCo, Monocle and the Holder Representative are referred to herein, collectively, as the “Parties” and, individually, each a “Party.”

RECITALS

WHEREAS, the respective boards of directors or managers, as applicable, of each of the Monocle Parties and the board of directors of the Company have unanimously approved and declared advisable the Mergers (as defined below) upon the terms and subject to the conditions of this Agreement and in accordance with the DGCL (as defined below) or the LLC Act (as defined below), as applicable;

WHEREAS, Monocle Parent LLC, a Delaware limited liability company and wholly-owned direct Subsidiary of NewCo (“Parent”), has, in its capacity as the sole member of Merger Sub 2, approved and declared advisable the Second Merger (as defined below) upon the terms and subject to the conditions of this Agreement and in accordance with the DGCL and the LLC Act;

WHEREAS, prior to the Mergers, Monocle shall provide an opportunity to its stockholders to have their issued and outstanding shares of Monocle common stock, par value $0.0001 per share (“Monocle Common Stock”), redeemed on the terms and subject to the conditions set forth in the Amended and Restated Certificate of Incorporation of Monocle, dated February 6, 2019, as may be amended from time to time (the “Monocle Certificate of Incorporation”), and the Monocle Bylaws, dated August 31, 2018, as may be amended from time to time (together with the Monocle Certificate of Incorporation, the “Monocle Governing Documents”) in connection with the transactions contemplated by this Agreement;

WHEREAS, concurrently with the execution and delivery of this Agreement, and as an inducement to Monocle’s willingness to enter into this Agreement, each of the Company Stockholders (as defined below) and Monocle have entered into a Support and Release Agreement (the “Support and Release Agreement”);

WHEREAS, promptly following the date hereof (and in any event within twenty-four (24) hours of the execution of this Agreement), the Company shall obtain the Company Stockholder Approval and deliver a copy of the Company Stockholder Approval to Monocle;

1

WHEREAS, concurrently with the consummation of the transactions contemplated by this Agreement, Monocle shall cause the Registration Rights Agreement, dated February 6, 2019, to be amended and restated in the form of the Amended and Restated Registration Rights Agreement attached as Annex A hereto (the “Amended and Restated Registration Rights Agreement”);

WHEREAS, concurrently with the consummation of the transactions contemplated by this Agreement, the Company Stockholders and NewCo shall enter into a Lock-Up Agreement substantially in the form attached as Annex B hereto (the “Lock-Up Agreement”), related to, among other things, the NewCo Common Stock that the Company Stockholders receive as consideration in the Second Merger;

WHEREAS, concurrently with the execution and delivery of this Agreement, the Company, Newco, Monocle and certain holders of Founder Shares (as defined below) have entered into a Founder Shares Agreement substantially in the form attached as Annex C hereto (the “Founder Shares Agreement”);

WHEREAS, for U.S. federal income Tax purposes, the Mergers, when taken together, are intended to qualify as transfers of property to a corporation that meet the requirements of Section 351 of the Code (the “Intended Tax Treatment”); and

WHEREAS, for certain limited purposes, and subject to the terms set forth herein, the Holder Representative shall serve as a representative of the holders of Preferred Stock, Common Stock and SARs.

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth in this Agreement, and intending to be legally bound hereby, NewCo, Monocle, Merger Sub 1, Merger Sub 2, the Company and the Holder Representative agree as follows:

Article

I.

CERTAIN DEFINITIONS

1.1 Definitions. As used herein, the following terms shall have the following meanings:

“Acquisition Transaction” has the meaning specified in Section 7.8.

“Action” means any claim, action, suit, assessment, arbitration, or proceeding, in each case that is by or before any Governmental Authority.

“AerLine” means AerLine Holdings, Inc., a Delaware corporation.

“AerLine Financial Statements” has the meaning specified in Section 5.9(a).

“AerLine Interim Financial Statements” has the meaning specified in Section 5.9(a).

2

“AerSale” means AerSale, Inc., a Florida corporation and wholly-owned subsidiary of the Company.

“Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is controlled by, or is under common control with, such specified Person, through one or more intermediaries or otherwise.

“Affiliate Agreement” has the meaning specified in Section 5.22.

“Affiliated Group” means a group of Persons that elects, is required to, or otherwise files a Tax Return or pays a Tax as an affiliated group, consolidated group, combined group, unitary group, or other group recognized by applicable Tax Law.

“Aggregate Cash Consideration” means an amount in cash equal to two hundred fifty million dollars ($250,000,000).

“Aggregate Common Stock Consideration” means fifteen million shares of NewCo Common Stock (i.e., the number of shares of NewCo Common Stock equal to the quotient of (i) one hundred fifty million dollars ($150,000,000) divided by (ii) ten dollars ($10)).

“Aggregate Fully-Diluted Common Shares” means the aggregate number of issued and outstanding Common Shares (for the avoidance of doubt, excluding Cancelled Common Shares) held by all Holders immediately prior to the Effective Time.

“Aggregate Preferred Consideration” means a number of shares of NewCo Convertible Preferred Stock equal to the quotient of (i) the Available Cash Shortfall Amount divided by (ii) one hundred dollars ($100).

“Agreement” has the meaning specified in the preamble hereto.

“Alternative Financing” has the meaning specified in Section 8.4(b).

“Amended and Restated Registration Rights Agreement” has the meaning specified in the Recitals.

“Amended and Restated Stockholders Agreement” means the Amended and Restated Stockholders Agreement, dated as of May 26, 2010, by and among the Company, Green Equity Investors V, L.P., Green Equity Investors Side V, L.P., LGP Parts Coinvest LLC, Florida Growth Fund LLC, Nicholas Finazzo, Robert B. Nicholas, Enarey, LP, a Nevada limited partnership, and ThoughtValley Limited Partnership, a Nevada limited partnership.

“Anti-Corruption Laws” means any applicable national, state, local or international Laws relating to anti-bribery or anti-corruption (governmental or commercial), including Laws that prohibit the corrupt payment, offer, promise, or authorization of the payment or transfer of anything of value (including gifts or entertainment), directly or indirectly, to any representative of a foreign Governmental Authority or commercial entity to obtain a business advantage, including, without limitation, the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act of 2010, all national and international Laws enacted to implement the OECD Convention on Combating Bribery of Foreign Officials in International Business Transactions or any other applicable Law relating to anti-corruption or anti-bribery, each as may be amended or supplemented from time to time.

3

“Approved Stock Exchange” means the Nasdaq Stock Market (“Nasdaq”) or any other national securities exchange that may be agreed upon by the Parties.

“Audited Financial Statements” has the meaning specified in Section 5.7(a).

“Available Cash” means, as of immediately prior to the Closing, an aggregate amount equal to the result of (without duplication) (i) the cash available to be released from the Trust Account, minus (ii) the aggregate amount of all payments to be made as a result of the completion of all Monocle Share Redemptions, plus (iii) the amount of cash proceeds actually received by Monocle pursuant to the Debt Financing, plus (iv) the cash and cash equivalents of the Company and its Subsidiaries in immediately available funds (excluding (x) the aggregate amount of outstanding and unpaid checks issued by or on behalf of the Company or its Subsidiaries as of such time and (y) any cash or cash equivalents of the Company or its Subsidiaries not freely usable by the Company or its Subsidiaries because it is subject to restrictions, limitations or Taxes on use or distribution by Law, Contract or otherwise).

“Available Cash Shortfall Amount” means, as of immediately prior to the Closing, the amount by which the Necessary Cash exceeds Available Cash.

“Aviation Regulations” has the meaning specified in Section 5.12(b).

“Borrowers” means, with respect to any specified Funded Debt, AerSale and its Subsidiaries identified as borrowers, co-borrowers, issuers or co-issuers under the First Lien Credit Documents or the Senior Note Credit Documents, as applicable, in their capacity as co-borrowers or co-issuers, as applicable, of such Funded Debt.

“Business Combination” has the meaning given to such term in the Monocle Certificate of Incorporation.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or required by Law to close.

“CAA” has the meaning specified in Section 9.1.

“Cancelled Common Shares” has the meaning specified in Section 4.1(a)(ii).

“Cash Consideration Percentage” means (i) in the event that Available Cash equals or exceeds Necessary Cash, 62.5%, or (ii) in the event that Necessary Cash exceeds Available Cash and the Available Cash Shortfall Amount equals or is less than $50,000,000, a fraction (expressed as a percentage), (A) the numerator of which is (x) the Aggregate Cash Consideration, minus, (y) the Available Cash Shortfall Amount, and (B) the denominator of which is 400,000,000.

“Cash Per Fully-Diluted Common Share” has the meaning specified in Section 4.1(b)(iv).

4

“Certificate of Designation” means the Certificate of Designation of the Company, as filed with the Secretary of State of the State of Delaware on January 11, 2010.

“Certificates” has the meaning specified in Section 4.3(b).

“Change in Control Payments” means any amounts payable by the Company or any of its Subsidiaries (i) to any director, employee or officer of the Company or any of its Subsidiaries or (ii) to any other party under a Contract to which the Company or any of its Subsidiaries is a party, in each case of clauses (i) and (ii), solely as a result of the Second Merger or any of the transactions contemplated by this Agreement, including any change in control or similar payments and all payroll and employer Taxes payable by the Company or any of its Subsidiaries with respect to any such payment; provided, however, that “Change in Control Payments” shall not include any payments made in respect of the SARs (other than payment of any employer Taxes associated therewith in connection with the transactions contemplated by Section 4.1, which shall constitute “Change in Control Payments”).

“Closing” has the meaning specified in Section 3.3.

“Closing Date” has the meaning specified in Section 3.3.

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Share” has the meaning specified in Section 4.1(a)(ii).

“Common Stock” means the Company’s common stock, par value $0.01 per share.

“Common Stock Consideration Percentage” means 37.5%.

“Common Stock Per Fully-Diluted Common Share” has the meaning specified in Section 4.1(b)(vi).

“Company” has the meaning specified in the preamble hereto.

“Company Benefit Plan” has the meaning specified in Section 5.14(a).

“Company Board” means the board of directors of the Company.

“Company Cure Period” has the meaning specified in Section 11.1(b)(i).

“Company IT Systems” has the meaning specified in Section 5.23(e).

“Company Related Parties” means the Company’s and its Affiliates’ former, current or future representatives, in each case in their capacities as such, other than the Company and its Subsidiaries.

“Company Stockholder Approval” means the approval by stockholders of the Company representing one hundred percent (100%) of the outstanding shares of Common Stock of this Agreement, in the form attached hereto as Annex D.

5

“Company Stockholders” means the parties listed on Schedule 5.6(a).

“Company Transaction Expenses” means the following fees and expenses incurred by the Company in connection with the preparation, negotiation and execution of this Agreement and the consummation of the transactions contemplated hereby: (i) the reasonable and documented fees and disbursements of outside counsel to the Company or its Affiliates; (ii) the reasonable and documented fees and expenses of any other agents, advisors, consultants, experts and financial advisors employed by the Company or its Affiliates; (iii) Change in Control Payments, if any; and (iv) solely to the extent not already reflected in “Company Transaction Expenses”, all reasonable and documented fees and expenses incurred by or on behalf of the Company related to assistance provided in connection with the arrangements of the Debt Financing (including expenses incurred pursuant to Section 7.4), in each case of clauses (i) through (iv) solely to the extent such fees and expenses are incurred and unpaid as of 11:59 p.m. (Eastern time) on the Business Day immediately preceding the Closing Date; provided, however, that “Company Transaction Expenses” shall not include fees, disbursements or expenses payable to LGP or to third party advisors incurred in connection with work performed solely for the benefit of LGP or any of its limited or general partners that is outside of the ordinary scope of work customarily performed in connection with a sale by a private equity sponsor of one of its portfolio companies.

“Confidentiality Agreement” has the meaning specified in Section 13.10.

“Contracts” means any contract, agreement, subcontract, lease, sublease, conditional sales contract, purchase or service order, license, indenture, note, bond, loan, understanding, undertaking, commitment or other arrangement or instrument, in each case that is legally binding.

“Credit Agreements” means the First Lien Credit Agreement and the Senior Note Purchase Agreement.

“Credit Documents” means the First Lien Credit Documents and the Senior Note Credit Documents.

“Credit Facilities” means (i) the revolving credit facility available to the Borrowers and their respective Subsidiaries under the First Lien Credit Agreement and (ii) the promissory notes issued and outstanding under the Senior Note Credit Documents, in each case immediately prior to the Effective Time.

“CW&T” has the meaning specified in Section 13.5.

“Damages” means all fines, losses, damages, liabilities, penalties, judgments settlements, assessments and other reasonable costs and expenses (including reasonable legal, attorneys’ and other experts’ fees).

“Data Breach” means any unauthorized access, use, disclosure, acquisition, or modification of Personal Information requiring notification to affected persons or regulators under applicable Laws.

“Debt Commitment Letter” has the meaning specified in Section 6.11(a).

6

“Debt Financing” means any debt financing incurred or intended to be incurred by Merger Sub 2 pursuant to the Debt Commitment Letter.

“Debt Financing Parties” means (a) the Debt Financing Sources and their respective Affiliates and (b) the former, current or future general or limited partners, shareholders, managers, members, directors, officers, employees, agents and representatives of the Persons identified in clause (a), in each case, in their respective capacities as such.

“Debt Financing Sources” means the Persons that are party to the Debt Commitment Letter (including any amendments thereto) that have committed to provide or arrange or otherwise entered into agreements in connection with all or any part of the Debt Financing or other financings in connection with the transactions contemplated hereby, including the parties to any joinder agreements, indentures or credit agreements entered pursuant thereto or relating thereto. For the avoidance of doubt, the term “Debt Financing Sources” excludes the agents and lenders under the Credit Facilities and the other parties to the Credit Documents, in each case in their capacity as such.

“DGCL” has the meaning specified in Section 2.1(b).

“Earnout Holders” has the meaning specified in Section 4.8(a).

“Earnout Per Fully-Diluted Common Share and SAR” has the meaning specified in Section 4.8(g).

“Earnout Period” has the meaning specified in Section 4.8(a).

“Earnout Shares” has the meaning specified in Section 4.8(a).

“EASA” has the meaning specified in Section 9.1.

“Effective Time” has the meaning specified in Section 3.3.

“Environmental Laws” means any and all applicable Laws relating to pollution or the protection of the environment, including those related to the use, generation, treatment, storage, handling, emission, transportation, disposal or Release of Hazardous Materials, each as in effect on and as interpreted as of the date of this Agreement.

“Equity Financing” has the meaning specified in Section 7.4(k).

“ERISA” has the meaning specified in Section 5.14(a).

“Exchange Act” has the meaning specified in Section 6.8(a).

“Exchange Agent” has the meaning specified in Section 2.7(a).

“FAA” has the meaning specified in Section 5.12(b).

“Filing Party” has the meaning specified in Section 9.2(a).

7

“Financial Statements” has the meaning specified in Section 5.7(a).

“Financing” means the Debt Financing, and if applicable, the Alternative Financing.

“Financing Agreements” has the meaning specified in Section 8.4(a).

“First Certificate of Merger” has the meaning specified in Section 2.1(a).

“First Lien Credit Agreement” means that certain Amended and Restated Credit Agreement, dated as of July 20, 2018, by and among the Borrowers, as borrowers, the Company, Wells Fargo Bank, N.A., as administrative agent, lead arranger and book runner, and the lenders and other persons from time to time party thereto, as amended, restated, amended and restated, supplemented or otherwise modified from time to time, including any such modifications after the date hereof in accordance with Article VII of this Agreement.

“First Lien Credit Documents” means the First Lien Credit Agreement and the Loan Documents (as defined in the First Lien Credit Agreement).

“First Merger” has the meaning specified in Section 2.1(a).

“First Merger Closing” has the meaning specified in Section 2.3.

“First Merger Constituent Corporations” the meaning specified in Section 2.1(a).

“First Merger Effective Time” has the meaning specified in Section 2.3.

“Founder Shares” means certain shares of Monocle Common Stock held by Monocle Partners, LLC and Cowen Investments II LLC, pursuant to those certain Founder Shares Subscription Agreements, dated September 26, 2018, and as further described in the Founder Shares Agreement.

“Founder Shares Agreement” has the meaning specified in the Recitals.

“Fraud” means actual common law fraud (as opposed to any fraud claim based on constructive knowledge, negligent or reckless misrepresentation or a similar theory) under Delaware law with respect to the representations and warranties expressly set forth in this Agreement or in the other agreements entered into in connection with the transactions contemplated by this Agreement.

8

“Funded Debt” means, as of any date and without duplication, (i) all indebtedness of the Company and its Subsidiaries, whether or not contingent, for borrowed money or indebtedness issued or incurred in substitution or exchange for indebtedness for borrowed money (including the aggregate principal amount thereof, the aggregate amount of accrued but unpaid interest thereon and any premiums, prepayment penalties or similar contractual charges thereon), including indebtedness for borrowed money under the First Lien Credit Documents, (ii) amounts owing as deferred purchase price of property or services with respect to which the Company or any of its Subsidiaries is liable (other than ordinary course trade payables), including all obligations of the Company or any of its Subsidiaries resulting from any earn-out related to or arising out of any prior acquisition, business combination or similar transaction, (iii) indebtedness of the Company or any of its Subsidiaries evidenced by any note (including notes issued under the Senior Note Credit Documents), bond, debenture, mortgage or other debt instrument or debt security or similar instrument (but excluding performance, surety, statutory, appeal, customs or similar bonds), (iv) obligations of the Company or any of its Subsidiaries under any performance or surety bond, letter of credit, banker’s acceptance or bank guarantees or similar facilities, but in each case only to the extent drawn or called (and not paid in full or otherwise discharged) prior to the Closing, (v) all capitalized lease obligations of the Company or any of its Subsidiaries as determined under GAAP, (vi) all obligations in respect of interest rate or currency obligation swaps, caps, floors, hedges or similar arrangements of the Company or any of its Subsidiaries, (vii) with respect to any indebtedness of a type described in clauses (i) through (vi) above of any Person other than the Company and its Subsidiaries, any such indebtedness that is guaranteed by the Company or any of its Subsidiaries or that is secured by a Lien on any asset or property of the Company or any of its Subsidiaries, and (viii) for clauses (ii) through (vii) above, all accrued and unpaid interest thereon, if any, expense reimbursements or other fees, costs, expenses or other payment obligations associated with any required repayment of such indebtedness on the Closing Date or that would otherwise be payable or owed after any such required repayment. For the avoidance of doubt, Funded Debt shall not include any intercompany indebtedness solely between or among the Company or any of its Subsidiaries or the Debt Financing and any other indebtedness incurred, issued or otherwise obtained by or on behalf of or otherwise at the direction of Monocle in connection herewith.

“Funding Amount” has the meaning specified in Section 4.3(a)(iii).

“GAAP” means United States generally accepted accounting principles as in effect (i) with respect to financial information for periods on or after the Closing Date, as of the date of this Agreement and (ii) with respect to financial information for periods before the Closing Date, as of such applicable time.

“Governmental Authority” means any supra-national, federal, regional, state, provincial, municipal, local or foreign government, governmental authority, regulatory or administrative agency, governmental commission, department, agency or instrumentality, court, arbitral body or tribunal.

“Governmental Order” means any order, judgment, injunction, decree, writ, stipulation, determination or award, in each case, entered by or with any Governmental Authority.

“Hazardous Material” means material, substance or waste that is listed, regulated, or otherwise defined as “hazardous,” “toxic,” or “radioactive,” (or words of similar intent or meaning) under applicable Environmental Law, including but not limited to petroleum, petroleum by-products, asbestos or asbestos-containing material, polychlorinated biphenyls, flammable or explosive substances, or pesticides.

“Holder Representative” has the meaning specified in Section 12.1.

9

“Holders” means all Persons who hold one or more, Preferred Shares, Common Shares or SARs immediately prior to the Effective Time.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

“Information or Document Request” means any request or demand for the production, delivery or disclosure of documents or other evidence, or any request or demand for the production of witnesses for interviews or depositions or other oral or written testimony, by any Regulatory Consent Authority relating to the transactions contemplated hereby or by any third party challenging the transactions contemplated hereby, including any so called “second request” for additional information or documentary material or any civil investigative demand made or issued by the Antitrust Division of the United States Department of Justice or the United States Federal Trade Commission or any subpoena, interrogatory or deposition.

“Information Security Program” has the meaning specified in Section 5.23(e).

“In-the-Money SAR” means a SAR having a Per-SAR Consideration Amount as of immediately prior to the Effective Time greater than $0.

“Intellectual Property” means all intellectual property rights in any jurisdiction throughout the world, whether registered or unregistered, including all: (i) patents and patent applications, (ii) trademarks, service marks, trade dress, trade names, corporate names and logos, (iii) copyrights, (iv) Internet domain names, (v) trade secrets; and (vi) all registrations of and applications (whether provisional, pending or final) to register the foregoing, and all common law rights thereto.

“Intended Tax Treatment” has the meaning specified in the Recitals.

“Interim Financial Statements” has the meaning specified in Section 5.7(a).

“Interim Period” has the meaning specified in Section 7.1.

“L&W” has the meaning specified in Section 13.5.

“Labor Contract” has the meaning specified in Section 5.13(a)(ii).

“Law” means each provision of any statute, civil, criminal or common law, ordinance, rule, regulation, legislation, ordinance, order, code, treaty, ruling, directive, determination or decision, in each case, of any Governmental Authority or Governmental Order.

“Leased Real Property” means all real property and interests in real property leased, subleased or otherwise occupied or used but not owned by the Company or any of its Subsidiaries.

“Letter of Transmittal” means the letter of transmittal in substantially the form attached hereto as Annex E.

“LGP” means Leonard Green & Partners, L.P., a Delaware limited partnership.

10

“Lien” means any mortgage, deed of trust, pledge, hypothecation, encumbrance, security interest, claim, restriction or other lien of any kind.

“LLC Act” means the Limited Liability Company Act of the State of Delaware.

“Liquidation Preference” means, with respect to each Preferred Share, as determined on the date of the Second Merger, the Senior Liquidation Preference (as such term is defined in the Certificate of Designation).

“Liquidity Event” has the meaning specified in Section 4.8(h).

“Liquidity Event Consideration” has the meaning specified in Section 4.8(i).

“Lock-Up Agreement” has the meaning specified in the Recitals.

“Majority Holders” has the meaning specified in Section 12.1.

“Management Services Agreement” means the Management Services Agreement, dated as of July 11, 2010, by and among the Company, AerSale, Inc., a Florida corporation and LGP.

“Material Adverse Effect” means any effect, development, event, occurrence, fact, condition, circumstance or change that has had, or would reasonably be expected to have, a material adverse effect, individually or in the aggregate, on the business, results of operations, financial condition, assets or liabilities of the Company and its Subsidiaries, taken as a whole; provided, however, that no effect, development, event, occurrence, fact, condition, circumstances or change, to the extent resulting from any of the following, shall be deemed to constitute, or be taken into account in determining whether a “Material Adverse Effect” has occurred or would reasonably be expected to occur in respect of the Company and its Subsidiaries: (a) any change in applicable Laws, GAAP or regulatory policies or interpretations thereof or in accounting or reporting standards or principles or interpretations thereof to the extent that such change does not have a materially disproportionate impact on the Company and its Subsidiaries, taken as a whole, as compared to other participants in the same industry; (b) any change in interest rates or economic, political, business, financial, commodity, currency or market conditions generally to the extent that such change does not have a materially disproportionate impact on the Company and its Subsidiaries, taken as a whole, as compared to other participants in the same industry; (c) the announcement or the execution of this Agreement, the identity of Monocle, the pendency or consummation of the Second Merger or the performance of this Agreement (or the obligations hereunder), including the impact thereof on relationships, contractual or otherwise, with customers, vendors, licensors, distributors, partners, providers and employees; (d) any change generally affecting any of the industries or markets in which the Company or any of its Subsidiaries operates, including changes in any markets that supply materials to the Company or in which customers of the Company operate, or the economy as a whole to the extent that such change does not have a materially disproportionate impact on the Company and its Subsidiaries, taken as a whole, as compared to other participants in the same industry; (e) the taking of any action required by this Agreement or with the prior written consent of Monocle (including any actions set forth on Schedule 7.1); (f) any earthquake, hurricane, tsunami, tornado, flood, mudslide, wild fire or other natural disaster or act of God, and other force majeure event to the extent that such event does not have a materially disproportionate impact on the Company and its Subsidiaries, taken as a whole, as compared to other participants in the same industry; (g) any national or international political or social conditions in countries in which, or in the proximate geographic region of which, the Company or any of its Subsidiaries operates, including the engagement by the United States in hostilities or the escalation thereof, whether or not pursuant to the declaration of a national emergency or war, or the occurrence or the escalation of any military or terrorist attack upon the United States, or any United States territories, possessions, or diplomatic or consular offices or upon any United States military installation, equipment or personnel to the extent that such condition does not have a materially disproportionate impact on the Company and its Subsidiaries, taken as a whole, as compared to other participants in the same industry; or (h) in and of itself, the failure of the Company and its Subsidiaries, taken as a whole, to meet any projections, forecasts or budgets or estimates of revenues, earnings or other financial metrics for any period; provided, that this clause (h) shall not prevent a determination that any change or effect underlying such failure to meet projections, forecasts or budgets has resulted in a Material Adverse Effect (to the extent such change or effect is not otherwise excluded from this definition of Material Adverse Effect); provided, however that if the effects, developments, events, occurrences, facts, conditions, circumstances or changes set forth in clauses (a), (b), (d), (f) and (g) have a materially disproportionate impact on the Company and its Subsidiaries, taken as a whole, relative to other participants in the same industry, the extent to which such effects, developments, events, occurrences, facts, conditions, circumstances or changes are disproportionate may be taken into account in determining whether a Material Adverse Effect has occurred.

11

“Material Permits” has the meaning specified in Section 5.24.

“Maximum Target” has the meaning specified in Section 4.8(a)(ii).

“Maximum Target Earnout Shares” has the meaning specified in Section 4.8(a)(ii).

“Mergers” has the meaning specified in Section 3.1(a).

“Merger Consideration” means (i) in the event that Available Cash equals or exceeds Necessary Cash, the Aggregate Cash Consideration together with the Aggregate Common Stock Consideration or (ii) in the event that Necessary Cash exceeds Available Cash and the Available Cash Shortfall Amount equals or is less than $50,000,000, (x) the Aggregate Cash Consideration minus the Available Cash Shortfall Amount, together with (y) the Aggregate Common Stock Consideration and (z) the Aggregate Preferred Consideration.

“Merger Proposals” has the meaning specified in Section 9.4(a).

“Merger Sub 1” has the meaning specified in the preamble hereto.

“Merger Sub 2” has the meaning specified in the preamble hereto.

“Minimum Target” has the meaning specified in Section 4.8(a)(i).

“Minimum Target Earnout Shares” has the meaning specified in Section 4.8(a)(i).

“Monocle” has the meaning specified in the preamble hereto.

12

“Monocle Certificate(s)” means certificates representing Monocle Common Stock or Monocle Warrants.

“Monocle Certificate of Incorporation” has the meaning specified in the Recitals.

“Monocle Common Stock” has the meaning specified in the Recitals.

“Monocle Cure Period” has the meaning specified in Section 11.1(c)(i).

“Monocle Governing Documents” has the meaning specified in the Recitals.

“Monocle Parties” has the meaning specified in the preamble hereto.

“Monocle Share Redemption” means the election of an eligible (as determined in accordance with the Monocle Governing Documents) Pre-Closing Monocle Holder to exercise its Monocle Stockholder Redemption Right.

“Monocle Stockholder Approval” means the approval of the Merger Proposals set forth in clauses (B), (C), (D) and (E) of the definition thereof, in each case, by the requisite vote of the holders of Monocle Common Stock at the Monocle Stockholders’ Meeting in accordance with the Proxy Statement, the DGCL and the Monocle Governing Documents.

“Monocle Stockholder Redemption Right” means the Redemption Rights, as such term is defined in Section 9.1 of the Monocle Certificate of Incorporation.

“Monocle Stockholders’ Meeting” has the meaning specified in Section 9.4(a).

“Monocle Unit” means the units issued at the time of Monocle’s initial public offering consisting of one (1) share of Monocle Common Stock and one (1) Monocle Warrant.

“Monocle Warrant” means a warrant that represents the right to acquire shares of Monocle Common Stock.

“Nasdaq” has the meaning specified in the definition of Approved Stock Exchange.

“Necessary Cash” means an amount of cash equal to (a) the Aggregate Cash Consideration plus (b) the Company Transaction Expenses plus (c) Outstanding Monocle Expenses plus (d) the Funded Debt under the First Lien Credit Documents.

“NewCo” has the meaning specified in the preamble hereto.

“NewCo Certificate of Designation” means the Certificate of Designation of Preferences, Rights and Limitations of NewCo Convertible Preferred Stock in the form attached hereto as Annex F.

“NewCo Common Stock” means shares of NewCo’s common stock, par value $0.0001 per share.

13

“NewCo Common Stock Price” means, on any date after the Closing, the closing sale price per share of NewCo Common Stock reported as of 4:00 p.m., New York, New York time on such date by Bloomberg, or if not available on Bloomberg, as reported by Morningstar.

“NewCo Convertible Preferred Stock” means the 5.00% convertible preferred stock of NewCo, par value $0.0001 per share and a Stated Value (as defined in the NewCo Certificate of Designation) of one hundred dollars ($100.00) per share.

“NewCo Exchange Shares” has the meaning specified in Section 2.6(b)(i).

“NewCo Exchange Warrants” has the meaning specified in Section 2.6(b)(ii).

“NewCo Governing Documents” has the meaning specified in Section 2.4(b).

“NewCo Warrant” means a warrant representing the right to acquire NewCo Common Stock, in the same form and on the same terms and conditions (including the same “Warrant Price” and number of shares of common stock subject to such warrant) as the applicable Monocle Warrant surrendered and exchanged for such warrant as a result of the First Merger pursuant to Section 2.6(b)(ii).

“Offer Documents” has the meaning specified in Section 9.3(b).

“Out-of-the-Money SAR” means a SAR having a Per-SAR Consideration Amount as of immediately prior to the Effective Time equal to, or less than, $0.

“Outstanding Monocle Expenses” means the following fees and expenses incurred by Monocle in connection with the preparation, negotiation and execution of this Agreement and the consummation of the transactions contemplated hereby: (i) the fees and disbursements of outside counsel to Monocle or any of its Affiliates, (ii) the fees and expenses of any other agents, advisors, consultants, experts and financial advisors employed by Monocle or any of its Affiliates and (iii) solely to the extent not already reflected in “Outstanding Monocle Expenses”, all outstanding deferred, unpaid or contingent underwriting, broker’s, finders’ or similar fees, commissions or expenses owed by Monocle or any of its Affiliates (to the extent Monocle or any of its Subsidiaries is responsible for or obligated to reimburse or repay any such amounts).

“Parachute Payment Waiver” has the meaning specified in Section 7.10.

“Parent” has the meaning specified in the Recitals.

“Party” or “Parties” have the meaning specified in the preamble hereto.

“Patriot Act” means the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, as amended, and the rules and regulations promulgated thereunder.

“PCAOB” means the U.S. Public Company Accounting Oversight Board.

14

“Per-SAR Consideration Amount” with respect to any SAR, (x) the SAR Fair Market Value of such SAR (as determined in accordance with the SAR Plan), minus (y) the SAR Grant Date Value of such SAR (as set forth in the applicable SAR Award Agreement).

“Permits” means all permits, licenses, certificates of authority, authorizations, approvals, registrations, clearances, orders, variances, exceptions or exemptions and other similar consents issued by or obtained from a Governmental Authority.

“Permitted Liens” means (i) statutory or common law mechanics, materialmen, warehousemen, landlords, carriers, repairmen and construction contractors and other similar Liens that arise in the ordinary course of business consistent with past practice, (ii) pledges or deposits incurred in the ordinary course of business consistent with past practice (A) in connection with workers’ compensation, unemployment insurance and other social security legislation or (B) securing liability for reimbursement or indemnification obligations of insurance carriers providing property, casualty, liability or other insurance to the Company and its Subsidiaries or under self-insurance arrangements, as well as Liens on insurance policies and the proceeds thereof securing the financing of insurance premiums with respect thereto, (iii) Liens for Taxes not yet due and payable or which are being contested in good faith through appropriate Actions and with respect to which adequate reserves have been made in accordance with GAAP, (iv) Liens securing rental payments under capital lease agreements and purchase money obligations, (v) Liens on real property (including easements, covenants, rights of way and similar restrictions of record) that do not materially interfere with the present uses of such real property, (vi) Liens arising out of any license, sublicense or cross license of Intellectual Property, (vii) the interest of any lessor, sublessor, lessee or sublessee under any lease or sublease agreement in the ordinary course of business consistent with past practice, (viii) Liens that are customary contractual rights of setoff relating to deposit accounts or relating to purchase orders and other agreements entered into with customers in the ordinary course of business consistent with past practice, (ix) Liens arising out of conditional sale, title retention, consignment or similar arrangements for the sale of goods or equipment in the ordinary course of business consistent with past practice, (x) Liens only with regards to the pre-Closing period arising under the First Lien Credit Documents which, assuming the Monocle Parties’ compliance with Section 4.4, shall be released at Closing and (xi) Liens described on Schedule 1.1.

“Person” means any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, joint venture, joint stock company, governmental agency or instrumentality or other entity of any kind.

“Personal Information” means information that personally identifies a natural person including first and last name, contact details such as address, email address, or telephone number, social security number or tax identification number, or credit card number, bank account information and other financial account information, or account access codes and passwords.

“PMA” has the meaning specified in Section 5.12(a).

“Pre-Closing Monocle Holders” means the stockholders of Monocle at any time prior to the First Merger Effective Time.

15

“Preferred Consideration Percentage” means, solely to the extent that there is an Available Cash Shortfall Amount and such Available Cash Shortfall Amount equals or is less than $50,000,000, a fraction (expressed as a percentage), (i) the numerator of which is the Available Cash Shortfall Amount and (ii) the denominator of which is 400,000,000. For the avoidance of doubt, the Preferred Consideration Percentage shall only be applicable to the extent that there is an Available Cash Shortfall Amount and such Available Cash Shortfall Amount equals or is less than $50,000,000.

“Preferred Share” has the meaning specified in Section 4.1(a)(i).

“Preferred Stock” means the 8.65% Senior Cumulative Preferred Stock of the Company, par value $0.01.

“Preferred Stock Per Fully-Diluted Common Share” has the meaning specified in Section 4.1(c)(iv).

“Prospectus” has the meaning specified in Section 7.9.

“Proxy Statement” has the meaning specified in Section 9.3(a).

“Registered Intellectual Property” has the meaning specified in Section 5.23(a).

“Registration Statement” means the Registration Statement on Form S-4, or other appropriate form determined by the Parties, including any pre-effective or post-effective amendments or supplements thereto, to be filed with the SEC by Monocle or NewCo under the Securities Act with respect to the NewCo Common Stock to be issued to the Company Stockholders and holders of Monocle Common Stock pursuant to this Agreement.

“Regulatory Consent Authorities” means the Antitrust Division of the United States Department of Justice or the United States Federal Trade Commission, as applicable.

“Release” means any release, spill, emission, leaking, pumping, pouring, injection, escaping, deposit, disposal, discharge, dispersal, dumping, leaching or migration of any Hazardous Material into or through the indoor or outdoor environment.

“Remaining Cash Consideration” has the meaning specified in Section 4.1(b)(v).

“Remaining Common Stock Consideration” has the meaning specified in Section 4.1(b)(vii).

“Remaining Preferred Stock Consideration” has the meaning specified in Section 4.1(c)(v).

16