Form 425 FRANK'S INTERNATIONAL Filed by: FRANK'S INTERNATIONAL N.V.

Filed by Frank’s International N.V. Pursuant to Rule 425 of the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Frank’s International N.V. Commission File No.: 001-36053

Governance Materials March 15, 2021

Important Information No Offer or Solicitation This communication relates to a proposed merger and related transactions (the “Transactions”) between Frank’s International N.V. (“Frank’s”) and Expro Group Holdings International Limited (“Expro”). This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transactions or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Important Additional Information In connection with the Transactions, Frank’s intends to file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 (the “Registration Statement”), which will include a proxy statement/prospectus of Frank’s. After the Registration Statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the shareholders of the Frank’s and Expro. SHAREHOLDERS OF FRANK’S AND EXPRO ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE TRANSACTIONS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS. Such shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about Frank’s and Expro once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Additional information is available on the Frank’s website, www.franksinternational.com. Participants in the Solicitation Frank’s and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Frank’s in connection with the Transactions. Expro and its officers and directors may also be deemed participants in such solicitation. Information regarding Frank’s directors and executive officers is contained in the proxy statement for Frank’s 2020 Annual Meeting of Shareholders, which was filed with the SEC on April 28, 2020, Frank’s Annual Report on Form 10-K for the year ended December 31, 2020, which was filed with the SEC on March 1, 2021, and certain of its Current Reports on Form 8-K. You can obtain a free copy of these documents at the SEC’s website at http://www.sec.gov or by accessing Frank’s website at http://www.franksinternational.com. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. 1

Forward-Looking Statements 2 The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Expro or Frank’s expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance that convey the uncertainty of future events or outcomes identify the forward-looking statements, although not all forward-looking statements contain such identifying words. Without limiting the generality of the foregoing, forward-looking statements contained in this communication specifically include, but are not limited to, statements, estimates and projections regarding the Transactions, pro forma descriptions of the combined company, anticipated or expected revenues, EBITDA, synergies or cost-savings, operations, integration and transition plans, opportunities and anticipated future performance. These statements are based on certain assumptions made by Frank’s and Expro based on management’s experience, expectations and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. Forward-looking statements are not guarantees of performance. Although Frank’s and Expro believe the expectations reflected in these forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of Frank’s, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Such risks and uncertainties include the risk of the failure to obtain the required votes of Frank’s and Expro’s shareholders; the timing to consummate the Transactions; the risk that the conditions to closing of the Transactions may not be satisfied or that the closing of the Transactions otherwise does not occur; the failure to close the Transactions on the anticipated terms, including the anticipated tax treatment; the risk that a regulatory approval, consent or authorization that may be required for the Transactions is not obtained in a timely manner or at all, or is obtained subject to conditions that are not anticipated; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement relating to the Transactions; unanticipated difficulties or expenditures relating to the Transactions; the diversion of management time on Transactions-related matters; the ultimate timing, outcome and results of integrating the operations of Frank’s and Expro; the effects of the business combination of Frank’s and Expro following the consummation of the Transactions, including the combined company’s future financial condition, results of operations, strategy and plans; the risk that any announcements relating to the Transactions could have adverse effects on the market price of Frank’s common stock; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Transactions; expected synergies and other benefits from the Transactions; the potential for litigation related to the Transactions; results of litigation, settlements and investigations; actions by third parties, including governmental agencies; volatility in customer spending and in oil and natural gas prices, which could adversely affect demand for Frank’s and Expro’s services and their associated effect on rates, utilization, margins and planned capital expenditures; unique risks associated with offshore operations; global economic conditions; liabilities from operations; decline in, and ability to realize, backlog; equipment specialization and new technologies; adverse industry conditions; adverse credit and equity market conditions; difficulty in building and deploying new equipment; difficulty in integrating acquisitions; shortages, delays in delivery and interruptions of supply of equipment, supplies and materials; weather; loss of, or reduction in business with, key customers; legal proceedings; ability to effectively identify and enter new markets; governmental regulation, including legislative and regulatory initiatives addressing global climate change or other environmental concerns; investment in and development of competing or alternative energy sources; ability to retain and hire key personnel, including management and field personnel; the length of time it will take for the United States and the rest of the world to slow the spread of the COVID-19 virus to the point where applicable authorities ease current restrictions on various commercial and economic activities; and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond Expro’s or Frank’s control, including those detailed in Frank’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Frank’s website at http://www.franksinternational.com and on the SEC’s website at http://www.sec.gov. Any forward-looking statement speaks only as of the date on which such statement is made, and Expro and Frank’s undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements.

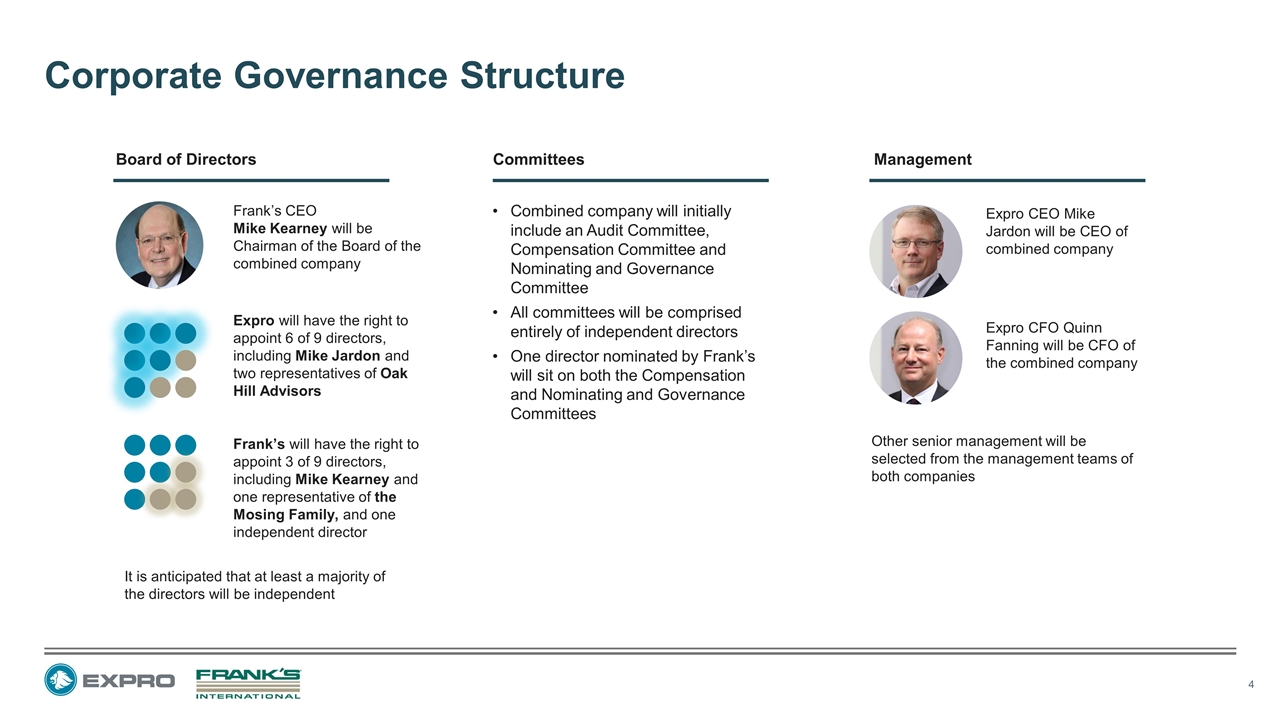

Corporate Governance Structure Board of Directors Committees Management Frank’s CEO Mike Kearney will be Chairman of the Board of the combined company Expro will have the right to appoint 6 of 9 directors, including Mike Jardon and two representatives of Oak Hill Advisors Frank’s will have the right to appoint 3 of 9 directors, including Mike Kearney and one representative of the Mosing Family, and one independent director It is anticipated that at least a majority of the directors will be independent Combined company will initially include an Audit Committee, Compensation Committee and Nominating and Governance Committee All committees will be comprised entirely of independent directors One director nominated by Frank’s will sit on both the Compensation and Nominating and Governance Committees Expro CEO Mike Jardon will be CEO of combined company Expro CFO Quinn Fanning will be CFO of the combined company Other senior management will be selected from the management teams of both companies

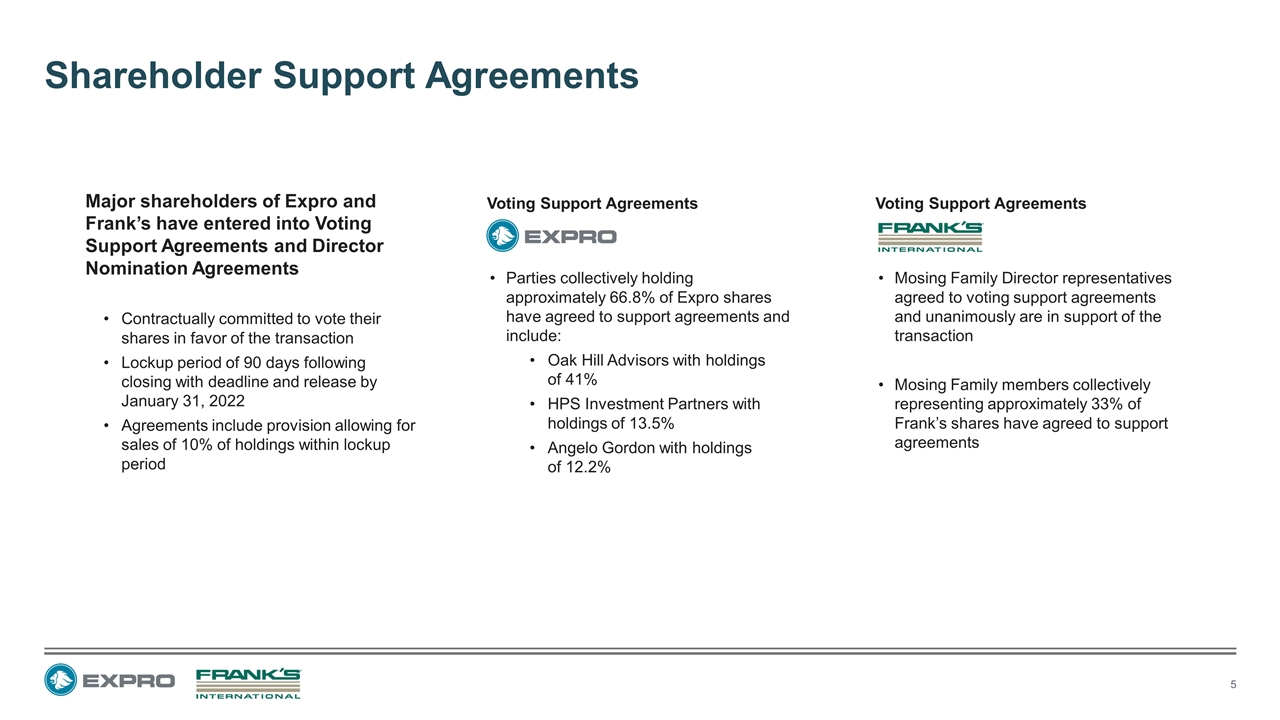

Voting Support Agreements Mosing Family Director representatives agreed to voting support agreements and unanimously are in support of the transaction Mosing Family members collectively representing approximately 33% of Frank’s shares have agreed to support agreements Major shareholders of Expro and Frank’s have entered into Voting Support Agreements and Director Nomination Agreements Contractually committed to vote their shares in favor of the transaction Lockup period of 90 days following closing with deadline and release by January 31, 2022 Agreements include provision allowing for sales of 10% of holdings within lockup period Shareholder Support Agreements Voting Support Agreements Parties collectively holding approximately 66.8% of Expro shares have agreed to support agreements and include: Oak Hill Advisors with holdings of 41% HPS Investment Partners with holdings of 13.5% Angelo Gordon with holdings of 12.2%

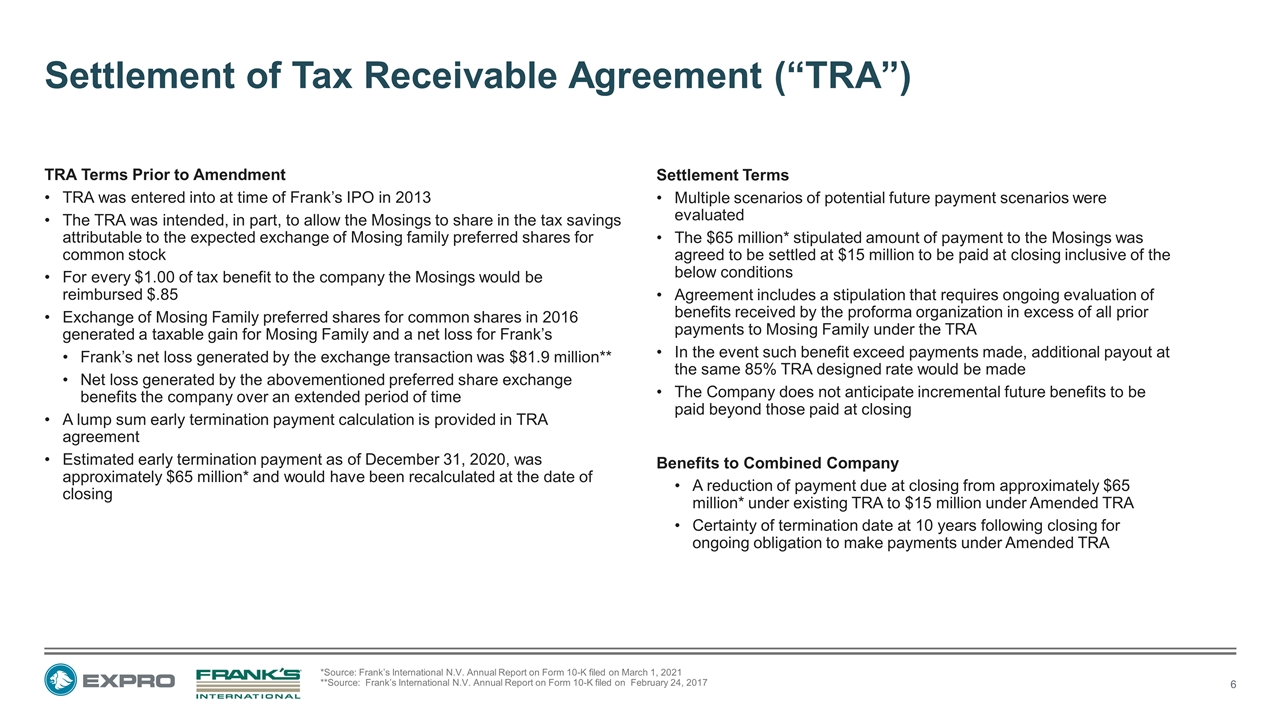

TRA Terms Prior to Amendment TRA was entered into at time of Frank’s IPO in 2013 The TRA was intended, in part, to allow the Mosings to share in the tax savings attributable to the expected exchange of Mosing family preferred shares for common stock For every $1.00 of tax benefit to the company the Mosings would be reimbursed $.85 Exchange of Mosing Family preferred shares for common shares in 2016 generated a taxable gain for Mosing Family and a net loss for Frank’s Frank’s net loss generated by the exchange transaction was $81.9 million** Net loss generated by the abovementioned preferred share exchange benefits the company over an extended period of time A lump sum early termination payment calculation is provided in TRA agreement Estimated early termination payment as of December 31, 2020, was approximately $65 million* and would have been recalculated at the date of closing Settlement of Tax Receivable Agreement (“TRA”) *Source: Frank’s International N.V. Annual Report on Form 10-K filed on March 1, 2021 **Source: Frank’s International N.V. Annual Report on Form 10-K filed on February 24, 2017 Settlement Terms Multiple scenarios of potential future payment scenarios were evaluated The $65 million* stipulated amount of payment to the Mosings was agreed to be settled at $15 million to be paid at closing inclusive of the below conditions Agreement includes a stipulation that requires ongoing evaluation of benefits received by the proforma organization in excess of all prior payments to Mosing Family under the TRA In the event such benefit exceed payments made, additional payout at the same 85% TRA designed rate would be made The Company does not anticipate incremental future benefits to be paid beyond those paid at closing Benefits to Combined Company A reduction of payment due at closing from approximately $65 million* under existing TRA to $15 million under Amended TRA Certainty of termination date at 10 years following closing for ongoing obligation to make payments under Amended TRA

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Fiserv (FI) PT Raised to $186 at Baird

- iManage to Present at ILTA EVOLVE Conference

- Silver Range Resources Ltd. to Present at Metals & Mining Virtual Investor Conference May 2nd

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share