Form 425 FIRST MID ILLINOIS BANCS Filed by: FIRST MID ILLINOIS BANCSHARES INC

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM 8-K |

| CURRENT REPORT |

| Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| Date of Report (Date of Earliest Event Reported): |

| June 12, 2018 |

| FIRST MID-ILLINOIS BANCSHARES, INC. |

| (Exact Name of Registrant as Specified in its Charter) |

| Delaware | 0-13368 | 37-1103704 |

| (State of Other Jurisdiction | (Commission File Number) | (IRS Employer |

| of Incorporation) | Identification No.) |

| 1421 CHARLESTON AVENUE | |

| MATTOON, IL | 61938 |

| (Address of Principal Executive Offices) | (Zip Code) |

| (217) 234-7454 |

| (Registrant’s Telephone Number, including Area Code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [X] | Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company [_]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[_]

| Item 1.01. | Entry into a Material Definitive Agreement |

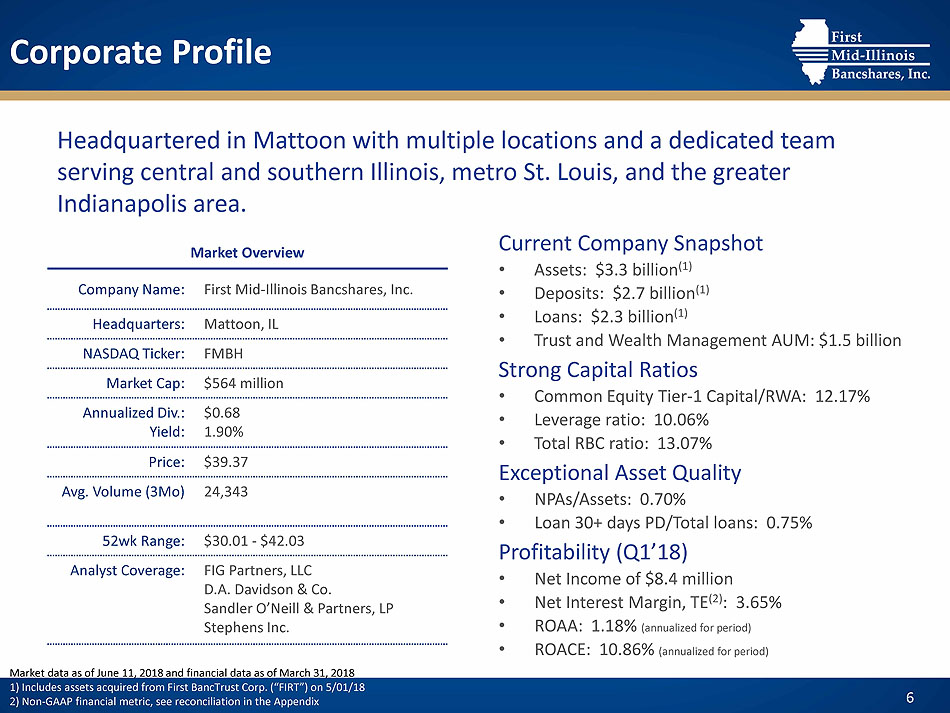

On June 12, 2018, First Mid-Illinois Bancshares, Inc. (the “Company”) and Project Almond Merger Sub LLC, a newly formed Illinois limited liability company and wholly-owned subsidiary of the Company (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with SCB Bancorp, Inc., an Illinois corporation (“SCB”), pursuant to which, among other things, the Company agreed to acquire 100% of the issued and outstanding shares of SCB pursuant to a business combination whereby SCB will merge with and into Merger Sub, whereupon the separate corporate existence of SCB will cease and Merger Sub will continue as the surviving company and a wholly-owned subsidiary of the Company (the “Merger”).

Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger, each share of common stock, par value $7.50 per share, of SCB issued and outstanding immediately prior to the effective time of the Merger (other than shares held in treasury by SCB and shares held by stockholders who have properly made and not withdrawn a demand for appraisal rights under Illinois law) will be converted into and become the right to receive, at the election of each stockholder, either $307.93 in cash or 8.0228 shares of common stock, par value $4.00 per share, of the Company and cash in lieu of fractional shares, less any applicable taxes required to be withheld and subject to certain potential adjustments. Overall elections are subject to proration such that, depending on the number of shares of SCB common stock electing shares of the Company’s common stock, between 19 and 32.5 percent of the SCB shares will be exchanged for cash, and between 67.5 and 81 percent will be exchanged for the Company’s common stock. Additionally, SCB’s outstanding stock options will be fully vested upon consummation of the Merger, and all outstanding SCB options that are unexercised prior to the effective time of the Merger will be cashed out. In addition, immediately prior to the closing of the proposed merger, SCB will pay a special dividend to its shareholders in the aggregate amount of $25 million.

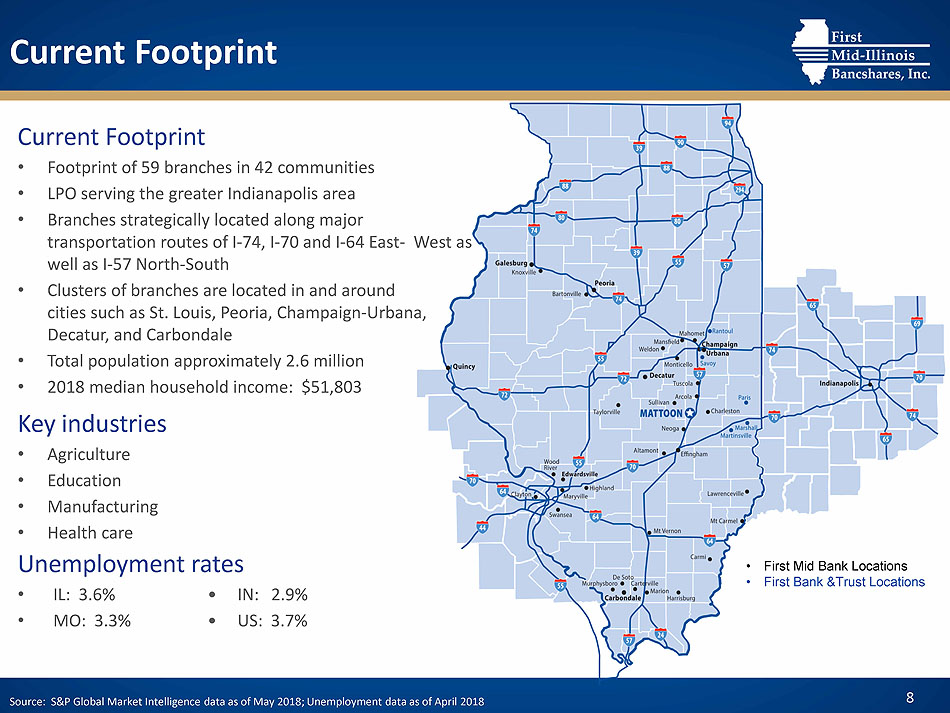

It is anticipated that SCB’s wholly-owned bank subsidiary, Soy Capital Bank and Trust Company (“Soy Capital Bank”), will be merged with and into the Company’s wholly-owned bank subsidiary First Mid-Illinois Bank & Trust, N.A. (“First Mid Bank”) at a date following completion of the Merger. At the time of the bank merger, Soy Capital Bank’s banking offices will become branches of First Mid Bank. As of March 31, 2018, Soy Capital Bank had total consolidated assets of $437 million, loans of $256 million and total deposits of $319 million.

The Merger Agreement contains customary representations and warranties of both parties and customary conditions to the parties’ obligations to close the transaction, as well as agreements to cooperate in the process of consummating the transaction. The Merger Agreement also contains provisions limiting the activities of SCB and Soy Capital Bank which are outside of the usual course of business, including restrictions on employee compensation, certain acquisitions and dispositions of assets and liabilities, and solicitations relating to alternative acquisition proposals, pending completion of the Merger.

The Merger is anticipated to be completed in late 2018, and is subject to the satisfaction of customary closing conditions in the Merger Agreement and the approval of the appropriate regulatory authorities and of the stockholders of SCB. The directors of SCB have executed a voting agreement in which they have agreed to vote their shares of SCB common stock in favor of approval of the Merger Agreement.

The information set forth above does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The representations, warranties and covenants of each party set forth in the Merger Agreement have been made only for purposes of, and were and are solely for the benefit of, the contracting parties, and are qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other time and investors should not rely on them as statements of fact. In addition, such representations and warranties (i) will not survive the consummation of the Merger and (ii) were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures. Accordingly, the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement and not to provide investors with any other factual information regarding the Company or SCB, their respective affiliates or their respective businesses. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding, the Company, SCB, their respective affiliates or their respective businesses, the Merger Agreement and the Merger that will be contained in, or incorporated by reference into the Registration Statement on Form S-4 that will include a proxy statement of SCB and a prospectus of the Company that the Company will file with the Securities Exchange Commission (“SEC”), as well as in the Forms 10-K, Forms 10-Q and other documents that the Company files with or furnishes to the SEC.

| Item 7.01. | Regulation FD Disclosure. |

In connection with the execution of the Merger Agreement discussed in Item 1.01 above, the Company and SCB issued a joint press release on June 12, 2018. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

| Item 8.01. | Other Events. |

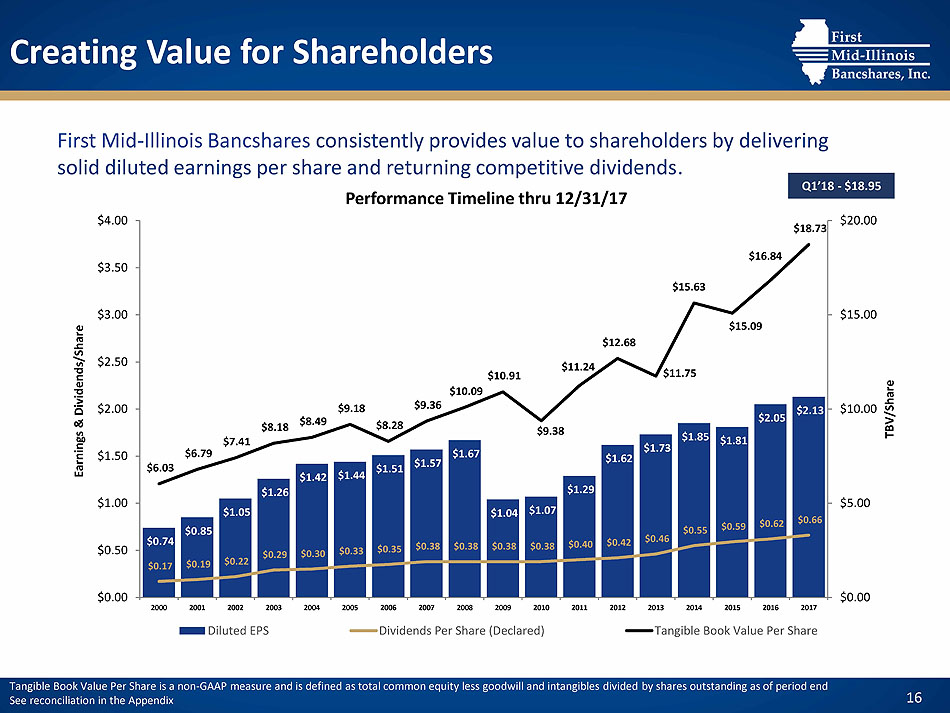

From time to time on and after June 12, 2018, the Company and SCB intend to provide supplemental information regarding the proposed transaction to analysts and investors in connection with certain presentations. A copy of the supplementary information is attached hereto as Exhibit 99.2 and incorporated herein by reference.

Forward Looking Statements

This document may contain certain forward-looking statements about First Mid-Illinois Bancshares, Inc. (“First Mid”) and SCB Bancorp, Inc., an Illinois corporation (“SCB”), such as discussions of First Mid’s and SCB’s pricing and fee trends, credit quality and outlook, liquidity, new business results, expansion plans, anticipated expenses and planned schedules. First Mid and SCB intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1955. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies and expectations of First Mid and SCB, are identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or similar expressions. Actual results could differ materially from the results indicated by these statements because the realization of those results is subject to many risks and uncertainties, including, among other things, the possibility that any of the anticipated benefits of the proposed transactions between First Mid and SCB will not be realized or will not be realized within the expected time period; the risk that integration of the operations of SCB with First Mid will be materially delayed or will be more costly or difficult than expected; the inability to complete the proposed transactions due to the failure to obtain the required stockholder approval; the failure to satisfy other conditions to completion of the proposed transactions, including receipt of required regulatory and other approvals; the failure of the proposed transactions to close for any other reason; the effect of the announcement of the transaction on customer relationships and operating results; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; changes in interest rates; general economic conditions and those in the market areas of First Mid and SCB; legislative/regulatory changes; monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; the quality or composition of First Mid’s and SCB’s loan or investment portfolios and the valuation of those investment portfolios; demand for loan products; deposit flows; competition, demand for financial services in the market areas of First Mid and SCB; and accounting principles, policies and guidelines. Additional information concerning First Mid, including additional factors and risks that could materially affect First Mid’s financial results, are included in First Mid’s filings with the Securities and Exchange Commission (the “SEC”), including its Annual Reports on Form 10-K. Forward-looking statements speak only as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the SEC, we do not undertake any obligation to update or review any forward-looking information, whether as a result of new information, future events or otherwise.

Important Information about the Merger and Additional Information

First Mid will file a registration statement on Form S-4 with the SEC in connection with the proposed transaction. The registration statement will include a proxy statement of SCB that also constitutes a prospectus of First Mid, which will be sent to the stockholders of SCB. Investors in SCB are urged to read the proxy statement/prospectus, which will contain important information, including detailed risk factors, when it becomes available. The proxy statement/prospectus and other documents which will be filed by First Mid with the SEC will be available free of charge at the SEC’s website, www.sec.gov, or by directing a request when such a filing is made to First Mid-Illinois Bancshares, P.O. Box 499, Mattoon, IL 61938, Attention: Investor Relations; or to SCB Bancorp, Inc., 455 North Main Street, Decatur, Illinois 62523, Attention: Investor Relations. A final proxy statement/prospectus will be mailed to the stockholders of SCB.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

Participants in the Solicitation

First Mid and SCB, and certain of their respective directors, executive officers and other members of management and employees are participants in the solicitation of proxies in connection with the proposed transactions. Information about the directors and executive officers of First Mid is set forth in the proxy statement for its 2018 annual meeting of stockholders, which was filed with the SEC on March 16, 2018. Investors may obtain additional information regarding the interests of such participants in the proposed transactions by reading the proxy statement/prospectus for such proposed transactions when it becomes available.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit Index

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| FIRST MID-ILLINOIS BANCSHARES, INC. | ||

| Dated: June 12, 2018 | By: | /s/ Joseph R. Dively |

| Joseph R. Dively | ||

| Chairman, President and Chief Executive Officer | ||

EXHIBIT 2.1

AGREEMENT AND PLAN OF MERGER

BY AND AMONG

FIRST MID-ILLINOIS BANCSHARES, INC.,

PROJECT ALMOND MERGER SUB LLC

AND

SCB BANCORP, INC.

Dated as of June 12, 2018

TABLE OF CONTENTS

| ARTICLE I THE MERGER | 1 | ||

| 1.1 | The Merger | 1 | |

| 1.2 | Effective Time | 1 | |

| 1.3 | Effects of the Merger. At and as of the Effective Time: | 2 | |

| 1.4 | Merger Consideration; Conversion of Shares. | 2 | |

| 1.5 | Company Options | 3 | |

| 1.6 | Cancellation of Treasury Shares | 4 | |

| 1.7 | Election Procedures. | 4 | |

| 1.8 | Proration and Redesignation Procedures. | 5 | |

| 1.9 | Exchange of Certificates. | 6 | |

| 1.10 | No Fractional Shares | 7 | |

| 1.11 | Dissenting Shares | 8 | |

| 1.12 | Withholding | 8 | |

| 1.13 | Closing. | 8 | |

| ARTICLE II REPRESENTATIONS AND WARRANTIES CONCERNING THE COMPANY | 8 | ||

| 2.1 | Organization. | 9 | |

| 2.2 | Organizational Documents; Minutes and Stock Records | 9 | |

| 2.3 | Capitalization. | 10 | |

| 2.4 | Authorization; No Violation. | 10 | |

| 2.5 | Consents and Approvals | 11 | |

| 2.6 | Financial Statements. | 11 | |

| 2.7 | No Undisclosed Liabilities | 12 | |

| 2.8 | Loans; Loan Loss Reserves. | 12 | |

| 2.9 | Properties and Assets. | 13 | |

| 2.10 | Material Contracts | 13 | |

| 2.11 | No Defaults | 15 | |

| 2.12 | Transactions with Affiliates | 15 | |

| 2.13 | Investments. | 15 | |

| 2.14 | Compliance with Laws; Legal Proceedings. | 16 | |

| 2.15 | Insurance | 16 | |

| 2.16 | Taxes. | 17 | |

| 2.17 | Environmental Laws and Regulations. | 19 | |

| 2.18 | Community Reinvestment Act Compliance. | 20 | |

| i |

| 2.19 | Company Regulatory Reports | 20 | |

| 2.20 | Employee Matters. | 21 | |

| 2.21 | Employee Benefit Plans. | 22 | |

| 2.22 | Technology and Intellectual Property. | 24 | |

| 2.23 | Absence of Certain Changes or Events | 25 | |

| 2.24 | Conduct of Business Since December 31, 2017 | 25 | |

| 2.25 | Change in Business Relationships. | 26 | |

| 2.26 | Trust Activities | 26 | |

| 2.27 | Insurance Activities. | 26 | |

| 2.28 | Agriculture Related Activities. | 27 | |

| 2.29 | Brokers’ and Finders’ Fees | 27 | |

| 2.30 | Opinion of Financial Advisor | 27 | |

| 2.31 | Information Supplied | 27 | |

| 2.32 | No Other Representations or Warranties | 28 | |

| ARTICLE III REPRESENTATIONS AND WARRANTIES CONCERNING PARENT AND MERGER SUB | 28 | ||

| 3.1 | Organization. | 28 | |

| 3.2 | Capitalization | 29 | |

| 3.3 | Authorization; No Violations. | 29 | |

| 3.4 | Consents and Approvals | 29 | |

| 3.5 | Parent SEC Filings and Financial Statements. | 30 | |

| 3.6 | Compliance with Laws; Legal Proceedings. | 31 | |

| 3.7 | Parent Regulatory Reports | 31 | |

| 3.8 | No Adverse Change | 31 | |

| 3.9 | Taxation of the Merger | 32 | |

| 3.10 | Brokers’ and Finders’ Fees | 32 | |

| 3.11 | Information Supplied | 32 | |

| 3.12 | Loans; Loan Loss Reserves. | 32 | |

| 3.13 | Financial Capability | 33 | |

| 3.14 | Community Reinvestment Act Compliance | 33 | |

| 3.15 | No Other Representations or Warranties | 33 | |

| ARTICLE IV AGREEMENTS AND COVENANTS | 33 | ||

| 4.1 | Conduct of the Company’s Business | 33 | |

| 4.2 | Conduct of Parent’s Business | 36 | |

| 4.3 | Access to Information and Premises. | 36 | |

| ii |

| 4.4 | Regulatory Filings of Parent | 37 | |

| 4.5 | SEC Filings | 37 | |

| 4.6 | Meeting | 38 | |

| 4.7 | Publicity | 38 | |

| 4.8 | No Conduct Inconsistent with this Agreement. | 39 | |

| 4.9 | Loan Charge-Off; Pre-Closing Loan Review. | 40 | |

| 4.10 | Director and Officer Insurance Coverage | 41 | |

| 4.11 | Interim Financial Statements | 41 | |

| 4.12 | Dissent Process | 41 | |

| 4.13 | Section 368(a) Reorganization | 41 | |

| 4.14 | Notice of Certain Events | 42 | |

| 4.15 | Reasonable and Diligent Efforts | 42 | |

| 4.16 | Stockholder Litigation | 42 | |

| 4.17 | Section 16 Matters | 42 | |

| 4.18 | Stock Exchange Listing | 42 | |

| 4.19 | Dividends. | 42 | |

| 4.20 | Takeover Statutes | 43 | |

| ARTICLE V EMPLOYEE BENEFIT MATTERS | 43 | ||

| 5.1 | Benefit Plans. | 43 | |

| 5.2 | No Rights or Remedies | 44 | |

| ARTICLE VI CONDITIONS PRECEDENT TO OBLIGATIONS OF PARENT AND MERGER SUB | 44 | ||

| 6.1 | Representations and Warranties | 44 | |

| 6.2 | Performance of Agreements. | 45 | |

| 6.3 | Closing Certificate | 45 | |

| 6.4 | Regulatory and Other Approvals | 45 | |

| 6.5 | Approval of Merger and Delivery of Articles of Merger | 45 | |

| 6.6 | No Injunctions or Restraints; Illegality | 45 | |

| 6.7 | No Adverse Changes | 45 | |

| 6.8 | Tax Opinion. | 45 | |

| 6.9 | Effectiveness of the Registration Statement | 46 | |

| 6.10 | Closing Balance Sheet | 46 | |

| 6.11 | Consents | 46 | |

| ARTICLE VII CONDITIONS PRECEDENT TO OBLIGATIONS OF THE COMPANY | 46 | ||

| 7.1 | Representations and Warranties; Performance of Agreements | 46 | |

| iii |

| 7.2 | Performance of Agreements | 46 | |

| 7.3 | Closing Certificate | 46 | |

| 7.4 | Regulatory and Other Approvals | 47 | |

| 7.5 | Approval of Merger and Delivery of Articles of Merger | 47 | |

| 7.6 | No Injunctions or Restraints; Illegality | 47 | |

| 7.7 | No Adverse Changes | 47 | |

| 7.8 | Tax Opinion | 47 | |

| 7.9 | Effectiveness of the Registration Statement | 47 | |

| ARTICLE VIII TERMINATION | 47 | ||

| 8.1 | Termination | 47 | |

| 8.2 | Effect of Termination. | 49 | |

| ARTICLE IX GENERAL | 51 | ||

| 9.1 | Confidential Information | 51 | |

| 9.2 | Non-Assignment | 51 | |

| 9.3 | Notices | 51 | |

| 9.4 | Knowledge | 52 | |

| 9.5 | Interpretation | 52 | |

| 9.6 | Entire Agreement | 52 | |

| 9.7 | Extension; Waiver | 52 | |

| 9.8 | Governing Law. | 53 | |

| 9.9 | Counterparts | 53 | |

| 9.10 | Severability | 53 | |

| iv |

INDEX OF DEFINED TERMS

| Term | Page |

| Acquisition Proposal | 39 |

| Agreement | 1 |

| Alternative Acquisition Agreement | 39 |

| Applicable Law | 9 |

| Articles of Merger | 1 |

| Bank | 9 |

| Bank Merger | 1 |

| BHCA | 9 |

| Borrower Affiliate | 34 |

| Business Day | 5 |

| Cash Consideration | 2 |

| Cash Electing Share | 2 |

| Cash Election | 2 |

| Cash Election Number | 6 |

| Closing | 8 |

| Closing Balance Sheet | 46 |

| Closing Date | 8 |

| Closing Parent Common Stock Price | 7 |

| Code | 1 |

| Commission | 11 |

| Company | 1 |

| Company Benefit Plans | 22 |

| Company Board | 11 |

| Company Common Stock | 2 |

| Company Disclosure Schedule | 8 |

| Company Financial Statements | 11 |

| Company Option | 3 |

| Company Recommendation | 38 |

| Company Stock Certificates | 2 |

| Company Stock Plans | 10 |

| Company Stockholder Approval | 11 |

| Company Stockholders Meeting | 38 |

| Company Subsidiaries | 9 |

| Confidentiality Agreement | 37 |

| Consolidated Stockholders’ Equity | 3 |

| Conversion Fund | 6 |

| Debenture Shares | 10 |

| Determination Date | 49 |

| Dissenting Shares | 8 |

| DOL | 22 |

| Effective Time | 1 |

| Election Deadline | 5 |

| Election Form | 4 |

| Employees | 21 |

| Encumbrances | 13 |

| Environmental Laws | 20 |

| ERISA Affiliate | 22 |

| v |

| ERISA Plans | 22 |

| Exchange Act | 30 |

| Exchange Agent | 5 |

| Exchange Ratio | 2 |

| Excluded Shares | 4 |

| Federal Reserve | 29 |

| Federal Reserve Application | 29 |

| Final Index Price | 49 |

| Fully Diluted Stock Amount | 4 |

| GAAP | 9 |

| Governmental Authority | 11 |

| Hazardous Materials | 20 |

| IBCA | 1 |

| IDFPR | 20 |

| IDFPR Application | 29 |

| IL SOS | 1 |

| ILLCA | 1 |

| Index | 49 |

| Index Ratio | 49 |

| Initial Index Price | 49 |

| Initial Parent Market Value | 49 |

| Injunction | 45 |

| Insurance Subsidiary | 9 |

| Intellectual Property | 24 |

| Interim Balance Sheet | 11 |

| Interim Financial Statements | 11 |

| Investment Securities | 15 |

| IRS | 22 |

| IT Assets | 24 |

| Knowledge | 52 |

| Licenses | 16 |

| Loans | 12 |

| Material Adverse Effect | 9 |

| Material Contracts | 13 |

| Maximum Cash Election Number | 4 |

| Maximum Stock Election Number | 4 |

| Merger | 1 |

| Merger Consideration | 2 |

| Minimum Adjusted Net Worth | 3 |

| Multiemployer Plan | 22 |

| Option Consideration | 4 |

| Ordinary Course of Business | 12 |

| OREO | 13 |

| Outside Date | 48 |

| Overage Stock Election Number | 5 |

| Parent | 1 |

| Parent Bank | 29 |

| Parent Board | 29 |

| Parent Common Stock | 2 |

| Parent Disclosure Schedule | 28 |

| Parent Financial Statements | 30 |

| vi |

| Parent Loans | 32 |

| Parent Market Value | 49 |

| Parent Regulatory Reports | 31 |

| Parent SEC Reports | 30 |

| Parent Stock Consideration | 2 |

| Parties | 1 |

| Party | 1 |

| PBGC | 22 |

| Permitted Encumbrances | 13 |

| Person | 9 |

| Prior Company Bidders | 40 |

| Proxy Statement | 37 |

| Qualifying Transaction | 50 |

| Real Property | 13 |

| Registration Statement | 11 |

| Regulatory Reports | 20 |

| Release | 20 |

| Representatives | 40 |

| Requisite Regulatory Approvals | 45 |

| Securities Act | 11 |

| Share Representatives | 4 |

| Special Dividend | 42 |

| Special Dividend Aggregate Amount | 42 |

| Special Dividend Per Share Amount | 42 |

| Stock Electing Share | 2 |

| Stock Election | 2 |

| Stock Election Cap Number | 5 |

| Stock Election Number | 5 |

| Superior Acquisition Proposal | 40 |

| Surviving Company | 1 |

| Tax | 17 |

| Tax Returns | 17 |

| Taxes | 17 |

| Termination Date | 47 |

| Termination Fee | 50 |

| Total Payments | 44 |

| Transaction Payment | 44 |

| Voting Agreement | 1 |

| vii |

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF MERGER (this “Agreement”), is entered into as of the 12th day of June, 2018, by and among First Mid-Illinois Bancshares, Inc., a Delaware corporation (“Parent”), Project Almond Merger Sub LLC, an Illinois limited liability company (“Merger Sub”), and SCB Bancorp, Inc., an Illinois corporation (the “Company”). Parent, Merger Sub and the Company are each referred to in this Agreement as a “Party” and collectively in this Agreement as the “Parties.”

RECITALS

WHEREAS, the Parent Board and the Company Board, and the sole member of Merger Sub, have each approved and declared it advisable and in the best interests of the Parties and their respective stockholders or unit holders to effect a reorganization, whereby the Company will merge with and into Merger Sub, in the manner and on the terms and subject to the conditions set forth in ARTICLE I (the “Merger”), as a result of which Merger Sub will be the Surviving Company;

WHEREAS, for federal income tax purposes the Parties desire and intend that the Merger qualify as a reorganization in accordance with Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and that this Agreement constitute a “plan of reorganization” for purposes of Section 368 of the Code; and

WHEREAS, certain stockholders of the Company have entered into a voting agreement by which they agree to vote in favor of this Agreement, the form of which is attached hereto as Exhibit A (the “Voting Agreement”).

NOW THEREFORE, in consideration of the premises and the mutual promises herein made, and in consideration of the representations, warranties and covenants herein contained, the Parties agree as follows:

ARTICLE I

THE MERGER

1.1 The Merger. Upon the terms and subject to the conditions of this Agreement, on the Closing Date and in accordance with the Business Corporation Act of 1983 of the State of Illinois, as amended (the “IBCA”), and the Limited Liability Company Act of the State of Illinois, as amended (the “ILLCA”), the Company shall be merged with and into Merger Sub, whereupon the separate corporate existence of the Company shall cease, and Merger Sub shall continue as the company surviving the Merger (the “Surviving Company”). The Parties will cooperate and use their reasonable best efforts to effect the merger of the Bank with and into the Parent Bank at a time to be determined following the Effective Time (the “Bank Merger”). At the effective time of the Bank Merger, the separate existence of the Bank will terminate. Parent Bank will be the surviving bank and will continue its existence under Applicable Law. The Bank Merger shall be accomplished pursuant to the bank merger agreement in form attached hereto as Exhibit B.

1.2 Effective Time. As of the Closing, the Parties will cause the articles of merger (the “Articles of Merger”) to be executed and filed with the Secretary of State of the State of Illinois (the “IL SOS”) as provided in the IBCA and ILLCA. The Merger shall become effective on the date and time (referred to as the “Effective Time”) at which the Articles of Merger is duly filed with the IL SOS, or at such other date and time as is agreed among the Parties and specified in the Articles of Merger.

1.3 Effects of the Merger. At and as of the Effective Time:

(a) as a result of the Merger, the articles of organization and limited liability company agreement of Merger Sub shall be the articles of organization and limited liability company agreement of the Surviving Company;

(b) the officers of the Surviving Company shall be the officers of Merger Sub serving immediately prior to the Effective Time, who shall continue in office for the terms provided in the limited liability company agreement of the Surviving Company and until their successors are duly elected or appointed and qualified; and

(c) the Merger shall have the effects set forth in the applicable provisions of the IBCA and ILLCA and, without limiting the generality of the foregoing, at the Effective Time, all of the property, rights, privileges, powers and franchises of the Company shall be vested in the Surviving Company, and all debts, liabilities and duties of the Company shall become the debts, liabilities and duties of Merger Sub.

1.4 Merger Consideration; Conversion of Shares.

(a) At the Effective Time, by virtue of the Merger and without any action on the part of the holder thereof, each share of common stock of the Company, $7.50 par value per share, issued and outstanding immediately prior to the Effective Time (“Company Common Stock”), other than Excluded Shares and Dissenting Shares, shall be converted into and become the right to receive the following consideration (and thereupon shall no longer be outstanding and shall automatically be cancelled and retired and shall cease to exist and shall thereafter represent only the right to receive, upon surrender of such certificate in accordance with Section 1.9(b), the following consideration) (the consideration described in clauses (i) and (ii) below, subject to adjustment in accordance with Section 1.4(d) and Section 8.3(c)(iii), the “Merger Consideration”):

(i) Each share of Company Common Stock with respect to which an election to receive cash (a “Cash Election”) has been properly made or deemed made in accordance with Section 1.7 (each a “Cash Electing Share”) shall be converted into the right to receive $307.93 in cash without interest (such per share amount is hereinafter referred to as the “Cash Consideration”); or

(ii) Each share of Company Common Stock with respect to which an election to receive stock consideration (a “Stock Election”) has been properly made or deemed made in accordance with Section 1.7 (each a “Stock Electing Share”) shall be converted into the right to receive (such per share amount, together with any cash in lieu of fractional shares of Parent Common Stock to be paid pursuant to Section 1.10, is hereinafter referred to as the “Parent Stock Consideration”) 8.0228 (the “Exchange Ratio”) validly issued, fully paid and nonassessable shares of common stock, par value $4.00 per share, of Parent (the “Parent Common Stock”).

(b) The holders of any certificates of Company Common Stock (“Company Stock Certificates”) previously evidencing such shares of Company Common Stock outstanding immediately prior to the Effective Time shall cease to have any rights with respect thereto except as otherwise provided in this Agreement or by law.

| 2 |

(c) If, between the date of this Agreement and the Effective Time, shares of Parent Common Stock shall be changed into a different number of shares or a different class of shares by reason of any reclassification, recapitalization, split-up, combination, exchange of shares or readjustment, or if a dividend in the form of Parent Common Stock shall be declared with a record date within such period, then the Exchange Ratio will be appropriately and proportionally adjusted so as to provide the holders of Company Common Stock with the same economic effect as contemplated by this Agreement prior to such event and as so adjusted shall, from and after the date of such event, be the Exchange Ratio.

(d) In the event the Closing Balance Sheet reflects Consolidated Stockholders’ Equity less than $71,161,583 (the “Minimum Adjusted Net Worth”), for every $50,000 shortfall thereof (and not, for the avoidance of doubt, any portion thereof), the Cash Consideration shall be reduced by $0.216. If the Closing Balance Sheet reflects Consolidated Stockholders’ Equity equal to or greater than the Minimum Adjusted Net Worth, then there will be no adjustment to the Merger Consideration. As used herein, the term “Consolidated Stockholders’ Equity ” shall mean the consolidated stockholders’ equity of the Company reflected on the Closing Balance Sheet; provided, however, that the following amounts shall be disregarded, and not be taken into account or otherwise reduce such consolidated stockholders’ equity: (i) any changes to the valuation of the Company’s investment portfolio attributed to ASC 320, whether upward or downward, from March 31, 2018 until the date of the Closing Balance Sheet, (ii) the aggregate fees and expenses of attorneys, accountants, consultants, financial advisors and other professional advisors incurred by the Company or any Company Subsidiary in connection with this Agreement or the transactions contemplated hereby, (iii) any amounts paid or payable to any director, officer or employee of the Company or any Company Subsidiary under any contract, severance arrangement, benefit plan or employment practice of the Company or any Company Subsidiary and all other payroll and non-payroll related costs and expenses incurred by the Company or any Company Subsidiary in connection with this Agreement or the transactions contemplated hereby, (iv) costs associated with the termination of the Company’s 401(k) Plan, any Company Stock Plan and any other employee benefit plan, (v) any costs associated with the termination of the Company’s data processing agreement (vi) any negative provisions for loan losses taken by the Company from the date of this Agreement until the date of the Closing Balance Sheet and (vii) any other expenses incurred solely in connection with the transactions contemplated hereby, in each case incurred or to be incurred by the Company or any Company Subsidiary through the Effective Time in connection with this Agreement and the transactions contemplated hereby.

(e) Notwithstanding anything to the contrary contained in this Agreement, before the Effective Time, the Parties may mutually agree to change the method of effecting the Merger if and to the extent that they deem such a change to be desirable; provided, that (i) any such change shall not affect the U.S. federal income tax consequences of the Merger to holders of Company Common Stock, and (ii) no such change shall alter or change the amount or kind of the consideration to be issued to holders of Company Common Stock as consideration in the Merger or require submission to or approval of the Company's stockholders after the Merger has been approved by the Company’s stockholders. If the Parties agree to make such a change, they shall execute appropriate documents to reflect the change. In addition, notwithstanding anything contained herein to the contrary, if an adjustment to (x) the Exchange Ratio pursuant to Section 1.4(d) or Section 8.3(c)(iii) or (y) to the Maximum Share Election Number pursuant to Section 1.7(d) would require Parent to issue more than 19.9% of the issued and outstanding shares of Parent Common Stock, as of the date hereof, as Parent Stock Consideration and in connection with Parent raising capital to finance all or a portion of the Cash Consideration, then Parent shall have the right to adjust the Exchange Ratio so that Parent would only be required to issue no more than 19.9% of Parent, and Parent shall increase the Cash Consideration to reflect, on a per share basis, the aggregate value of the total number of shares of Parent Common Stock that otherwise would have been issuable pursuant to the terms of this Agreement.

| 3 |

1.5 Company Options. As of the Effective Time, each option to purchase shares of Company Common Stock or other right to purchase Company Common Stock under any Company Stock Plan (each a “Company Option”), to the extent it is outstanding and unexercised immediately prior thereto, shall become fully vested as of the Effective Time and shall by virtue of the Merger and without any action on the part of any holder of any Company Option be automatically cancelled and the holder thereof will receive, as soon as reasonably practicable following the Effective Time a cash payment (without interest) with respect thereto equal to the product of (a) the excess, if any, of the Cash Consideration over the exercise price per share of such Company Option, as such exercise price per share is reduced immediately prior to Closing pursuant to Section 4.19(b), and (b) the number of shares of Company Common Stock issuable upon exercise of such Company Option (collectively, the “Option Consideration”). As used in this Agreement, “Equity Award Equivalent Shares” means the number of shares equal to (x) the aggregate amount of Option Consideration, divided by (y) the Cash Consideration. As of the Effective Time, all Company Options, whether or not vested or exercisable, shall no longer be outstanding and shall automatically cease to exist, and each holder of a Company Option shall cease to have any rights with respect thereto, except the right to receive the Option Consideration; provided that, if the exercise price of any such Company Option, as such exercise price per share is reduced immediately prior to Closing pursuant to Section 4.19(b), is equal or greater than the Cash Consideration, such Company Option shall be cancelled without any payment being made in respect thereof. The Option Consideration shall in all cases be paid in cash and shall not be subject to the proration contemplated by Section 1.8.

1.6 Cancellation of Treasury Shares. At the Effective Time, each share of Company Common Stock held as treasury stock or otherwise held by the Company, if any, immediately prior to the Effective Time shall automatically be cancelled and retired and cease to exist, and no Merger Consideration shall be exchanged therefor (collectively, the “Excluded Shares”).

1.7 Election Procedures.

(a) Subject to the proration and redesignation procedures set forth in Section 1.8, each holder of record of shares of Company Common Stock (other than Excluded Shares and Dissenting Shares) will be entitled to elect to receive for each such share the Cash Consideration and/or the Parent Stock Consideration. All such elections shall be made on an election form and letter of transmittal designed for that purpose in such form as Parent and the Company mutually agree (collectively, an “Election Form”). Holders of record of shares of Company Common Stock who hold such shares as nominees, trustees or in other representative capacities (“Share Representatives”) may submit multiple Election Forms, provided that such Share Representative certifies that each such Election Form covers all the shares of Company Common Stock held by each such Share Representative for a particular beneficial owner.

(b) Subject to adjustment in accordance with Section 1.7(d), the number of shares of Company Common Stock (other than Excluded Shares) plus the number of Equity Award Equivalent Shares (such number, the “Fully Diluted Stock Amount”) to be converted into the right to receive Cash Consideration for such shares shall be a number equal to 32.14% of the Fully Diluted Stock Amount outstanding immediately prior to the Effective Time (excluding Dissenting Shares) (the “Maximum Cash Election Number”).

(c) Subject to adjustment in accordance with Section 1.7(d), the number of shares of Company Common Stock (other than Excluded Shares) to be converted into the right to receive Parent Stock Consideration for such shares shall be a number equal to 67.86% of the Fully Diluted Stock Amount outstanding immediately prior to the Effective Time (excluding Dissenting Shares) (the “Maximum Stock Election Number”).

| 4 |

(d) Notwithstanding the provisions of Section 1.7(b) with regard to the Maximum Cash Election Number or Section 1.7(c) with regard to the Maximum Stock Election Number, if the number of Stock Electing Shares is (i) greater than the Maximum Stock Election Number set forth in Section 1.7(c) and (ii) equal to or less than a number equal to 81.43% of the Fully Diluted Stock Amount outstanding immediately prior to the Effective Time (excluding Dissenting Shares) (the “Stock Election Cap Number”, and any such number between the Maximum Stock Election Number set forth in Section 1.7(c) and up to the Stock Election Cap Number, the “Overage Stock Election Number”), then, for all purposes of this Agreement, the “Maximum Stock Election Number” shall be increased to be a number equal to such Overage Stock Election Number, and the “Maximum Cash Election Number” shall be reduced to be a number equal to the Fully Diluted Stock Amount outstanding immediately prior to the Effective Time (excluding Dissenting Shares) minus the Overage Stock Election Number; provided, for the avoidance of doubt, (x) the Overage Stock Election Number cannot be greater than a number equal to 81.43% of the Fully Diluted Stock Amount outstanding immediately prior to the Effective Time (excluding Dissenting Shares) even if the number of Stock Electing Shares is greater than the Stock Election Cap Number, (y) the Maximum Stock Election Number cannot be less than a number equal to 67.86% of the Fully Diluted Stock Amount outstanding immediately prior to the Effective Time (excluding Dissenting Shares), and (z) the Maximum Cash Election Number cannot be greater than a number equal to 32.14% of the Fully Diluted Stock Amount outstanding immediately prior to the Effective Time (excluding Dissenting Shares).

(e) The Election Form shall be mailed with the Proxy Statement to all holders of record of shares of Company Common Stock as of the record date of the Company Stockholders Meeting. Thereafter, the Company and Parent shall each use its reasonable and diligent efforts to mail or make available the Election Form to all persons who become holders of shares of Company Common Stock during the period between the record date for the Company Stockholders Meeting and the Election Deadline, and Parent shall provide Computershare Trust Company, N.A., Parent’s exchange agent (the “Exchange Agent”) with all information necessary for it to perform as specified herein. To be effective, an Election Form must be properly completed and received by the Exchange Agent on or before 5:00 p.m., Chicago Time, on the fifth Business Day prior to the Effective Time (the “Election Deadline”). Any Election Form may be revoked or modified by the person submitting such Election Form to the Exchange Agent by written notice to the Exchange Agent only if such notice of revocation or modification is actually received by the Exchange Agent at or prior to the Election Deadline. Subject to the terms of this Agreement and the Election Form, the Exchange Agent shall have reasonable discretion to determine whether any election, revocation or modification has been properly or timely made and to disregard immaterial defects in any Election Form, and any good faith decisions of the Exchange Agent regarding such matters shall be binding and conclusive. As used in this Agreement, “Business Day” means any day except Saturday, Sunday and any day on which banks in Mattoon, Illinois, or Decatur, Illinois, are authorized or required by law or other government action to close.

(f) Any Election Form received by the Exchange Agent after the Election Deadline shall be deemed to be a Stock Election and any holder of Company Common Stock not returning an effective Election Form to the Exchange Agent prior to the Election Deadline (including any holder of Dissenting Shares who has not returned an effective Election Form prior to the Election Deadline) shall be deemed to have made a Stock Election. In addition, if the Exchange Agent shall have determined that any purported Stock Election or Cash Election was not properly made, such purported Stock Election or Cash Election shall be deemed to be of no force and effect and the holder of shares of Company Common Stock making such purported Stock Election or Cash Election shall for all purposes hereof be deemed to have made a Stock Election.

| 5 |

1.8 Proration and Redesignation Procedures.

(a) If, after the results of the Election Forms are calculated, the number of Stock Electing Shares (the “Stock Election Number”) exceeds the Maximum Stock Election Number (as it may be adjusted pursuant to Section 1.7(d)), then all Cash Electing Shares shall be converted into the right to receive the Cash Consideration, and, subject to Section 1.10 hereof, each holder of Stock Electing Shares will be entitled to receive Parent Stock Consideration only with respect to that number of Stock Electing Shares held by such holder equal to the product obtained by multiplying (i) the number of Stock Electing Shares held by such holder by (ii) a fraction, the numerator of which is the Maximum Stock Election Number (as it may be adjusted pursuant to Section 1.7(d)), and the denominator is the Stock Electing Number, with the remaining number of such holder’s Stock Electing Shares being converted into Cash Electing Shares.

(b) If, after the results of the Election Forms are calculated, the number of Cash Electing Shares plus the number of Equity Award Equivalent Shares (the “Cash Election Number”) exceeds the Maximum Cash Election Number (as it may be adjusted pursuant to Section 1.7(d)), then all Stock Electing Shares shall be converted into the right to receive the Stock Consideration, all Equity Award Equivalent Shares shall be converted into the right to receive the Cash Consideration, and each holder of Cash Electing Shares will be entitled to Cash Consideration only with respect to the number of Cash Electing Shares held by such holder equal to the product obtained by multiplying (i) the number of Cash Electing Shares held by such holder by (ii) a fraction, the numerator of which is the Maximum Cash Election Number (as it may be adjusted pursuant to Section 1.7(d)) minus the number of Equity Award Equivalent Shares, and the denominator is the Cash Election Number minus the number of Equity Award Equivalent Shares, with the remaining number of such holder’s Cash Electing Shares being converted into Stock Electing Shares.

(c) After the redesignation procedures, if any, required by this Section 1.8 are completed, each Cash Electing Share and each Equity Award Equivalent Share shall be converted into the right to receive the Cash Consideration, and each Stock Election Share shall be converted into the right to receive the Parent Stock Consideration.

(d) No later than five Business Days after the Election Deadline, Parent shall cause the Exchange Agent to effect the allocation or redesignation procedures among the holders of Company Common Stock (excluding Excluded Shares and Dissenting Shares) or rights to receive Cash Consideration and Parent Stock Consideration as set forth in this Section 1.8.

1.9 Exchange of Certificates.

(a) At or prior to the Effective Time, Parent shall authorize the issuance of and shall make available to the Exchange Agent, for the benefit of the holders of Company Stock Certificates for exchange in accordance with this ARTICLE I, (i) a sufficient number of shares of Parent Common Stock, to be issued by book-entry transfer, for payment of the Parent Stock Consideration pursuant to Section 1.4(a)(ii), (ii) sufficient cash for payment of the Cash Consideration pursuant to Section 1.4(a)(i) and (iii) sufficient cash for payment of cash in lieu of any fractional shares of Parent Common Stock in accordance with Section 10. Such amount of cash and shares of Parent Common Stock, together with any dividends or distributions with respect thereto paid after the Effective Time, are referred to as the “Conversion Fund.” Parent shall be solely responsible for the payment of any fees and expenses of the Exchange Agent.

| 6 |

(b) Following the Effective Time, and upon proper surrender of a Company Stock Certificate for exchange to the Exchange Agent, together with a properly completed Exchange Form, duly executed, the holder of such Company Stock Certificate shall be entitled to receive in exchange therefor Cash Consideration and Parent Stock Consideration deliverable in respect of the shares of Company Common Stock represented by such Company Stock Certificate; thereupon such Company Stock Certificate shall forthwith be cancelled. No interest will be paid or accrued on the Merger Consideration deliverable upon surrender of a Company Stock Certificate.

(c) After the Effective Time, there shall be no transfers on the stock transfer books of the Company of the shares of Company Common Stock that were issued and outstanding immediately prior to the Effective Time.

(d) No dividends or other distributions declared with respect to Parent Common Stock and payable to the holders of record thereof after the Effective Time shall be paid to the holder of any unsurrendered Company Stock Certificate until the holder thereof shall surrender such Company Stock Certificate in accordance with this ARTICLE I. Promptly after the surrender of a Company Stock Certificate in accordance with this ARTICLE I, the record holder thereof shall be entitled to receive any such dividends or other distributions, without interest thereon, which theretofore had become payable with respect to shares of Parent Common Stock into which the shares of Company Common Stock represented by such Company Stock Certificate were converted at the Effective Time pursuant to Section 1.4. No holder of an unsurrendered Company Stock Certificate shall be entitled, until the surrender of such Company Stock Certificate, to vote the shares of Parent Common Stock into which such holder’s Company Common Stock shall have been converted.

(e) Any portion of the Conversion Fund that remains unclaimed by the stockholders of the Company twelve months after the Effective Time shall be paid to the Surviving Company, or its successors in interest. Any stockholders of the Company who have not theretofore complied with this ARTICLE I shall thereafter look only to the Surviving Company, or its successors in interest, for the issuance of the Cash Consideration, the payment of the Parent Stock Consideration and the payment of cash in lieu of any fractional shares deliverable in respect of such stockholders’ shares of Company Common Stock, as well as any accrued and unpaid dividends or distributions on such Parent Stock Consideration. Notwithstanding the foregoing, none of Parent, the Surviving Company, the Exchange Agent or any other Person shall be liable to any former holder of shares of Company Common Stock for any amount delivered in good faith to a public official pursuant to applicable abandoned property, escheat or similar laws.

(f) In the event any Company Stock Certificate shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the person claiming such Company Stock Certificate to be lost, stolen or destroyed and the posting by such person of a bond in such amount as the Exchange Agent may determine is reasonably necessary as indemnity against any claim that may be made against it with respect to such Company Stock Certificate, the Exchange Agent will issue in exchange for such lost, stolen or destroyed Company Stock Certificate, and in accordance with this ARTICLE I, the Cash Consideration or the Parent Stock Consideration and cash in lieu of any fractional shares deliverable in respect thereof pursuant to this Agreement, as applicable.

1.10 No Fractional Shares. Notwithstanding anything to the contrary contained in this Agreement, no fractional shares of Parent Common Stock shall be issued as Parent Stock Consideration in the Merger. Each holder of shares of Company Common Stock who would otherwise be entitled to receive a fractional share of Parent Common Stock pursuant to this ARTICLE I shall instead be entitled to receive an amount in cash (without interest) rounded to the nearest whole cent, determined by multiplying the Closing Parent Common Stock Price by the fractional share of Parent Common Stock to which such former holder would otherwise be entitled. “Closing Parent Common Stock Price” means the weighted average of the daily closing sales prices of a share of Parent Common Stock as reported on the NASDAQ Global Market for the ten consecutive trading days immediately preceding the Closing Date.

| 7 |

1.11 Dissenting Shares. Notwithstanding anything to the contrary contained in this Agreement, shares of Company Common Stock held by a holder who has made a demand for appraisal of such shares in accordance with the IBCA (any such shares being referred to as “Dissenting Shares” until such time as such holder fails to perfect or otherwise loses such holder’s appraisal rights under the IBCA with respect to such shares) shall not be converted into or represent the right to receive the Merger Consideration pursuant to this Agreement, but shall be entitled only to such rights as are granted by the IBCA to a holder of Dissenting Shares. At the Effective Time, the Dissenting Shares shall no longer be outstanding and shall automatically be canceled and shall cease to exist, and each holder of Dissenting Shares shall cease to have any rights with respect thereto, except the right to receive the fair value of such Dissenting Shares in accordance with the provisions of the IBCA. If any Dissenting Shares shall lose their status as such (through failure to perfect appraisal rights under the IBCA or otherwise), then, as of the later of the Effective Time or the date of loss of such status, such shares shall automatically be converted into and shall represent only the right to receive the Merger Consideration, without interest thereon, in exchange for each such share, upon surrender of the Company Stock Certificates that formerly evidenced such Dissenting Shares in the manner set forth in Section 1.9. The Company shall give Parent (a) prompt notice of any written demands for payment of fair value of any shares of Company Common Stock, attempted withdrawals of such demands and any other instruments served pursuant to the IBCA and received by the Company relating to stockholders’ dissenters’ rights, and (b) the opportunity to participate in all negotiations and proceedings with respect to demands under the IBCA consistent with the obligations of the Company thereunder. The Company shall not, except with the prior written consent of Parent, (i) make any payment with respect to such demand, (ii) offer to settle or settle any demand for payment of fair value or (iii) waive any failure to timely deliver a written demand for payment of fair value or timely take any other action to perfect payment of fair value rights in accordance with the IBCA.

1.12 Withholding. Parent or the Exchange Agent will be entitled to deduct and withhold from the Merger Consideration, the Option Consideration and any other amounts payable pursuant to this Agreement or the transactions contemplated hereby to any holder of Company Common Stock or Company Options such amounts as the Company, Parent, or any affiliate thereof, or the Exchange Agent are required to deduct and withhold with respect to the making of such payment under the Code, or any applicable provision of U.S. federal, state, local or non-U.S. tax law. To the extent that such amounts are properly withheld by Parent or the Exchange Agent and paid over to the appropriate taxing authority, such withheld amounts will be treated for all purposes of this Agreement as having been paid to the holder of the Company Common Stock or Company Option in respect of whom such deduction and withholding were made by Parent or the Exchange Agent.

1.13 Closing. The consummation of the transactions contemplated by this Agreement shall take place at a closing (the “Closing”) to be held on the fifth Business Day following the date on which all of the conditions set forth in ARTICLE VI and ARTICLE VII have been satisfied, or waived (other than those conditions that by their nature can only be satisfied at the Closing, but subject to the satisfaction or waiver thereof), or on such other date as the Parties may mutually agree (the “Closing Date”). The Closing shall take place at 10:00 a.m., local time, on the Closing Date at the offices of Schiff Hardin LLP, 233 S. Wacker Drive, Suite 7100, Chicago, Illinois, or at such other place and time upon which the Parties may agree.

| 8 |

ARTICLE II

REPRESENTATIONS AND WARRANTIES CONCERNING THE COMPANY

Except as disclosed in the disclosure schedule delivered by the Company to Parent and Merger Sub concurrently herewith (the “Company Disclosure Schedule”) (provided, that any disclosures made with respect to a section of this ARTICLE II shall be deemed to qualify any other section of this ARTICLE II specifically referenced or cross-referenced), the Company hereby represents and warrants to Parent as of the date hereof as follows:

2.1 Organization.

(a) The Company is duly registered as a bank holding company under the Bank Holding Company Act of 1956, as amended (the “BHCA”), is a corporation duly organized, validly existing and in good standing under the laws of the State of Illinois, and has the corporate power and authority to own its properties and to carry on its business as presently conducted. The Company is duly qualified and in good standing as a foreign corporation in each other jurisdiction where the location and character of its properties and the business conducted by it require such qualification, except where the failure to be so qualified would not have a Material Adverse Effect on the Company. As used in this Agreement, “Material Adverse Effect” shall mean changes, developments, occurrences or events (i) having a material adverse effect on the financial condition, assets, liabilities, business or results of operations of such Party or its subsidiaries, taken as a whole, or (ii) that materially impair the ability of such Party to perform its obligations under this Agreement or to consummate the transactions contemplated hereby on a timely basis; provided, however, that “Material Adverse Effect” shall not be deemed to include the effects of (A) changes after the date hereof in general United States or global business, political, economic or market (including capital or financial markets) conditions, (B) any outbreak, escalation or worsening of hostilities, declared or undeclared acts of war, sabotage, military action or terrorism, (C) changes or proposed changes after the date hereof in United States generally accepted accounting principles (“GAAP”) or authoritative interpretations thereof, (D) changes or proposed changes after the date hereof in any federal, state, local, municipal, foreign, international, multinational or other order, constitution, law, ordinance, regulation, rule, policy statement, directive, statute or treaty (“Applicable Law”), (E) the negotiation, execution or announcement of the Merger or this Agreement, or (F) any actions by the Parties as required or contemplated by this Agreement or taken with the consent of the other Parties.

(b) Soy Capital Bank and Trust Company, is an Illinois chartered bank, duly chartered and organized, validly existing and currently authorized to transact the business of banking under the laws of the State of Illinois (the “Bank”), and has the requisite power and authority to own its properties and to carry on its business as presently conducted. The Bank is a wholly owned subsidiary of the Company.

(c) J.L. Hubbard Insurance and Bonds Agency, Inc. (the “Insurance Subsidiary” and, together with the Bank, the “Company Subsidiaries”) is a corporation duly organized, validly existing and in good standing under the laws of the State of Illinois, has the corporate power and authority to own its properties and to carry on its business as presently conducted, and is a wholly owned subsidiary of the Bank.

(d) Other than (i) the Company Subsidiaries, (ii) investments in Investment Securities and (iii) securities owned in a fiduciary capacity, neither the Company nor any Company Subsidiary owns, directly or indirectly, any voting stock, equity securities or membership, partnership, joint venture or similar ownership interest in any individual, corporation, association, partnership, trust, limited liability company, unincorporated organization or other entity or group (any such individual or entity, a “Person”). Neither the Company nor any Company Subsidiary has any outstanding contractual obligations to provide funds to, or to make any investment (in the form of a loan, capital contribution or otherwise) in, any Person.

| 9 |

2.2 Organizational Documents; Minutes and Stock Records. The Company has furnished Parent with copies of the articles of incorporation and by-laws, or similar organizational documents, of the Company and each of the Company Subsidiaries, in each case as amended to the date hereof, and with such other documents as requested by Parent relating to the authority of the Company and the Company Subsidiaries to conduct their respective businesses. All such documents are complete and correct. The stock registers and minute books of the Company and each Company Subsidiary are each complete, correct and accurately reflect, in each case in all material respects, all meetings, consents, and other actions of the organizers, incorporators, stockholders, board of directors, and committees of the boards of directors of the Company and each Company Subsidiary, respectively, and all transactions in each such entity’s capital stock or equity ownership occurring since the applicable initial date of organization, incorporation or formation of the Company and each Company Subsidiary.

2.3 Capitalization.

(a) The Company. The authorized capital stock of the Company consists of (i) 600,000 shares of Company Common Stock, $7.50 par value per share, of which 225,825 shares are issued and outstanding as of the date of this Agreement and zero shares are held in treasury as of the date of this Agreement, and (ii) zero shares of preferred stock. The issued and outstanding shares of Company Common Stock have been duly and validly authorized and issued and are fully paid and non-assessable. None of the shares of Company Common Stock are subject to any preferences, qualifications, limitations, restrictions or special or relative rights under the Company’s articles of incorporation as in effect as of the date of this Agreement. Except pursuant to any exercise provisions of any Company Options or pursuant to the surrender of shares to the Company or the withholding of shares by the Company to cover tax withholding obligations under the Company’s stock plans and arrangements set forth on Schedule 2.3(a) (collectively, and in each case as the same may be amended to the date hereof, the “Company Stock Plans”), there are no options, warrants, agreements, contracts, or other rights in existence to purchase, acquire or receive from the Company any shares of capital stock of the Company, whether now or hereafter authorized or issued, except for that certain debenture issued by the Company which may be converted into 920 shares of Company Common Stock, as described on Schedule 2.3(a) (such shares of Company Common Stock that the debenture may be converted into, the “Debenture Shares”). Except for the Voting Agreement to be entered into concurrently with this Agreement, there are no voting trusts, voting agreements, proxies or other agreements, instruments or undertakings with respect to the voting of any interests in the Company. Schedule 2.3(a) sets forth a true, complete and correct list of the aggregate number of shares of Company Common Stock issuable upon the exercise of each stock option granted under the Company Stock Plans and the exercise price for each such stock option.

(b) The Company Subsidiaries. The authorized, issued and outstanding capital stock of each Company Subsidiary is set forth on Schedule 2.3(b), and all of such issued and outstanding capital stock is owned by the Company. The issued and outstanding shares of capital stock of each Company Subsidiary have been duly and validly authorized and issued and are fully paid and non-assessable and owned by the Company. There are no options, agreements, contracts, or other rights in existence to purchase or acquire from any Company Subsidiary any shares of capital stock of any Company Subsidiary, whether now or hereafter authorized or issued. Other than any Investment Securities held by the Bank, no Company Subsidiary owns, whether directly or indirectly, any voting stock, equity securities or membership, partnership, joint venture or similar ownership interest in any corporation, association, partnership, limited liability company or other entity.

| 10 |

2.4 Authorization; No Violation.

(a) The Company has full power and authority to execute and deliver this Agreement and to consummate the transactions contemplated hereby. The execution and delivery of this Agreement and the performance of the Company’s obligations hereunder have been duly and validly authorized unanimously by the Board of Directors of the Company (the “Company Board”), and do not violate or conflict with the Company’s articles of incorporation, by-laws, the IBCA, or any Applicable Law, court order or decree to which the Company or a Company Subsidiary is a party or subject, or by which the Company or a Company Subsidiary, or any of their respective properties are bound, and no other action on the part of the Company or a Company Subsidiary is necessary to authorize the execution and delivery by the Company of this Agreement and the consummation by it of the transactions contemplated hereby, other than the requisite approval of this Agreement and the Merger by the stockholders of the Company (the “Company Stockholder Approval”). This Agreement, when executed and delivered, and subject to the consents and regulatory approvals described in Section 2.5, will be a valid, binding and enforceable obligation of the Company, subject to applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting creditors generally and to general principles of equity. The only votes of holders of any class or series of Company capital stock necessary to approve this Agreement and the Merger are the holders of at least two-thirds of the outstanding shares of Company Common Stock. No state takeover statute or similar statute or regulation applies to this Agreement, the Voting Agreement or any of the transactions contemplated thereby and hereby.

(b) Subject to receipt of the consents or approvals set forth in Schedule 2.5, the execution and delivery of this Agreement and the performance of the Company’s obligations hereunder do not and will not result in any default or give rise to any right of termination, cancellation or acceleration under any Company Material Contract, except for such rights of termination, cancellation or acceleration that, either individually or in the aggregate, would not reasonably be expected to (i) materially interfere with the Ordinary Course of Business conducted by the Company, any Company Subsidiary or the Surviving Company or (ii) have a Material Adverse Effect on the Company.

2.5 Consents and Approvals. No consents or approvals of, or filings or registrations with, any court, administrative agency or commission or other governmental authority or instrumentality (each, a “Governmental Authority”) or with any third party are necessary in connection with the execution and delivery by the Company of this Agreement and the consummation by the Company of the Merger, except for (a) those third-party consents, approvals, filings or registrations set forth on Schedule 2.5, (b) the Federal Reserve Application and the IDFPR Application, (c) the filing of the Articles of Merger with the IL SOS under the IBCA and the ILLCA, (d) the Company Stockholder Approval and (e) the filing by Parent with the Securities and Exchange Commission (the “Commission”) of a registration statement on Form S-4 or other applicable form under the Securities Act of 1933, as amended (the “Securities Act”), covering the shares of Parent Common Stock to be issued pursuant to this Agreement, which shall include the Proxy Statement (the “Registration Statement”).

2.6 Financial Statements. Schedule 2.6 sets forth true and complete copies of the following financial statements (collectively, the “Company Financial Statements”): (a) the consolidated balance sheets of the Company and the Company Subsidiaries as of December 31, 2015, 2016 and 2017, and the related statements of income, changes in shareholders’ equity and cash flows for the fiscal years then ended; and (b) the consolidated interim balance sheet of the Company and the Company Subsidiaries as of March 31, 2018 (the “Interim Balance Sheet”) and the related statements of income and changes in shareholders’ equity for the three month period then ended (together with the Interim Balance Sheet, the “Interim Financial Statements”). The Company Financial Statements are complete and correct and have been prepared in conformance with GAAP applied on a consistent basis throughout the periods involved. Each balance sheet (including any related notes) included in the Company Financial Statements presents fairly the consolidated financial position of the Company and the Company Subsidiaries as of the date thereof, and each income statement (including any related notes) and statement of cash flow included in the Company Financial Statements presents fairly the consolidated results of operations and cash flow, respectively, of the Company and the Company Subsidiaries for the period set forth therein; provided, however, that the Interim Financial Statements contain all adjustments necessary for a fair presentation, subject to normal, recurring year-end adjustments (which adjustments will not be, individually or in the aggregate, material), and lack footnotes. The books, records and accounts of the Company and each Company Subsidiary accurately and fairly reflect, in reasonable detail, all transactions and all items of income and expense, assets and liabilities and accruals relating to the Company and the Company Subsidiaries, as applicable.

| 11 |

2.7 No Undisclosed Liabilities. Neither the Company nor any Company Subsidiary has any liabilities, whether accrued, absolute, contingent, or otherwise, existing or arising out of any transaction or state of facts existing on or prior to the date hereof, except (a) as and to the extent disclosed, reflected or reserved against in the Company Financial Statements, (b) as and to the extent arising under contracts, commitments, transactions, or circumstances identified in the Schedules provided for herein, excluding any liabilities for breaches thereunder by the Company or a Company Subsidiary, and (c) liabilities, not material in the aggregate and incurred in the Ordinary Course of Business, which, under GAAP, would not be required to be reflected on a balance sheet prepared as of the date hereof. An action taken in the “Ordinary Course of Business” shall mean an action taken in the ordinary course of business of the Company and each Company Subsidiary, as applicable, in conformity with past custom and practice (including with respect to quantity and frequency) and where for such action to be taken, no separate authorization by the Company Board, the board of directors of the Bank or the Insurance Subsidiary, as applicable, is required. Any liabilities incurred in connection with litigation or judicial, administrative or arbitration proceedings or claims against the Company or any Company Subsidiary shall not be deemed to be incurred in the Ordinary Course of Business.

2.8 Loans; Loan Loss Reserves.

(a) Each outstanding loan, loan agreement, note, lease or other borrowing agreement (including any overdraft protection extensions of credit), any participation therein and any guaranty, renewal or extension thereof (collectively, “Loans”) reflected on the books and records of the Bank is evidenced by appropriate and sufficient documentation and constitutes the legal, valid and binding obligation of the obligor named therein, enforceable in accordance with its terms, except to the extent such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights and remedies generally from time to time in effect and by Applicable Law which may affect the availability of equitable remedies. No obligor named in any Loan has provided notice (whether written or, to the Knowledge of the Company or any Company Subsidiary, oral) to the Company or any Company Subsidiary that such obligor intends to attempt to avoid the enforceability of any term of any Loan under any such laws or equitable remedies, and no Loan is subject to any valid defense, set-off, or counterclaim that has been threatened or asserted with respect to such Loan. All Loans that are secured, as evidenced by the appropriate and sufficient ancillary security documents, are so secured by valid and enforceable liens. Neither the Company nor any Company Subsidiary has entered into any loan repurchase agreements. There has been no default on, or forgiveness or waiver of, in whole or in part, any Loan made to an executive officer or director of the Company or any Company Subsidiary or an entity controlled by an executive officer or director during the three years immediately preceding the date hereof.

| 12 |

(b) The reserves and allowances for loan and lease losses shown on each of the balance sheets contained in the Company Financial Statements are adequate in the judgment of management, and consistent with the Bank’s internal policies, applicable regulatory standards and under GAAP, to provide for losses, net of recoveries relating to loans and leases previously charged off, on loans and leases outstanding (including accrued interest receivable) as of the applicable date of such balance sheet. The aggregate loan balances of the Bank in excess of such reserves, in each case as shown on Company Financial Statements, are, to the Knowledge of the Company and any Company Subsidiary, collectible in accordance with their terms.

2.9 Properties and Assets.

(a) Real Property. Schedule 2.9(a) sets forth a complete and correct description of all real property owned or leased by the Company or a Company Subsidiary or in which the Company or a Company Subsidiary has an interest (other than as a mortgagee) (the “Real Property”). No real property or improvements are carried on the Bank’s books and records as Other Real Estate Owned. The Company and the Company Subsidiaries own, or have a valid right to use or a leasehold interest in, all Real Property used by them in the conduct of their respective businesses as such businesses are presently conducted. The ownership or leasehold interest of the Company or the Company Subsidiaries in such Real Property is not subject to any mortgage, pledge, lien, option, conditional sale agreement, encumbrance, security interest, title exceptions or restrictions or claims or charges of any kind (collectively, “Encumbrances”), except for Permitted Encumbrances. As used in this Agreement, “Permitted Encumbrances” shall mean (i) Encumbrances arising under conditional sales contracts and equipment leases with third parties under which the Company or a Company Subsidiary is not delinquent or in default, (ii) carriers’, workers’, repairers’, materialmen’s, warehousemen liens’ and similar Encumbrances incurred in the Ordinary Course of Business, (iii) Encumbrances for taxes not yet due and payable or that are being contested in good faith and for which proper reserves have been established and reflected on the Company Financial Statements, (iv) minor exceptions or defects in title to real property or recorded easements, rights of way, building or use restrictions, covenants or conditions that in each case do not materially impair the intended use thereof, (v) zoning and similar restrictions on the use of real property, and (vi) in the case of any leased assets, (A) the rights of any lessor under the applicable lease agreement or any Encumbrance granted by any such lessor and (B) any statutory lien for amounts not yet due and payable, or that are being contested in good faith and for which proper reserves have been established and reflected on the Company Financial Statements. All material Licenses required for the lawful use and occupancy of any real property by the Company and the Company Subsidiaries, as the case may be, have been obtained and are in full force and effect. Neither the Company nor a Company Subsidiary is the lessor or lessee of any real property.

(b) Personal Property; Sufficiency of Assets. Schedule 2.9(b) sets forth a complete and correct description of all tangible personal property owned by the Company or a Company Subsidiary, or used by the Company or a Company Subsidiary and having book value reflected in the Company Financial Statements. The Company or a Company Subsidiary, as applicable, has good, valid and insurable title to, or a valid leasehold interest in, all tangible and intangible assets used, intended or required for use by the Company or a Company Subsidiary, as applicable, in the conduct of their businesses, free and clear of any Encumbrances, except for Permitted Encumbrances, and all such tangible personal property is in good working condition and repair, normal wear and tear excepted.

| 13 |

2.10 Material Contracts. Except for Contracts evidencing Company Loans made by the Bank in the Ordinary Course of Business, Schedule 2.10 lists all Material Contracts, true and complete copies of which have been delivered to Parent. “Material Contracts” means the following under which the Company or a Company Subsidiary is obligated on the date hereof (whether written or oral):

(a) all agreements for consulting, professional, advisory, and other professional services, including engagement letters, and including contracts pursuant to which the Company or a Company Subsidiary performs services for others, in each case exceeding $50,000;

(b) any leases for real property for which the Company or a Company Subsidiary is a tenant, and any leases of personal property, in each case exceeding $50,000;