Form 425 FAST Acquisition Corp. Filed by: FAST Acquisition Corp.

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 30, 2021

FAST ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39462 | 85-1338207 | ||

| (State

or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS

Employer Identification No.) |

109 Old Branchville Rd.

Ridgefield, CT 06877

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (201) 956-1969

Not

Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one share of Class A common stock and one-half of one redeemable warrant | FST.U | The New York Stock Exchange | ||

| Class A common stock, par value $0.0001 per share | FST | The New York Stock Exchange | ||

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share | FST WS | The New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed, on February 1, 2021, FAST Acquisition Corp. (the “Company”) entered into an agreement and plan of merger (the “Merger Agreement”) with Fertitta Entertainment, Inc., a Texas corporation (“FEI”), FAST Merger Corp., a Texas corporation and direct subsidiary of the Company (“FAST Merger Corp.”) and FAST Merger Sub Inc., a Texas corporation and direct subsidiary of FAST Merger Corp. (“Merger Sub”), pursuant to which (i) the Company will change its jurisdiction of incorporation to Texas by merging with and into FAST Merger Corp., with FAST Merger Corp. surviving the merger (the “reincorporation”), and (ii) Merger Sub will merge with and into FEI with FEI surviving the merger (the “Merger”). Upon consummation of the transactions contemplated by the Merger Agreement (the “Business Combination”), FEI will become a wholly owned subsidiary of FAST Merger Corp., which is referred to herein as “New FEI.” The time of the closing of the Business Combination is referred to herein as the “Closing.”

On June 30, 2021, the Company, FEI, FAST Merger Corp. and Merger Sub entered into an Amendment No. 1 to the Merger Agreement (the “Amendment No. 1”). Among other things, the Amendment No. 1 amends the Merger Agreement to, among other things:

(i) increase the number of shares of Class A common stock of New FEI to be issued to the sole stockholder of FEI such that the value of the aggregate consideration to be received by the sole stockholder increased from approximately $1.97 billion to approximately $3.84 billion in consideration for the inclusion of certain high quality assets to New FEI including Mastro’s, Catch and Vic & Anthony’s restaurants; Cadillac Bar and Fish Tales casual concepts; and certain specialty entertainment assets including Fisherman’s Wharf and Pleasure Pier in Galveston and three aquariums; and

(ii) provide that the shares of Class B Units of Golden Nugget Online Gaming, Inc. (“GNOG”) issued in connection with the $2.2 million contribution made by LF LLC (a subsidiary of FEI) on March 31, 2021 and any additional shares acquired by LF LLC prior to the closing of the Business Combination as a result of contractually required contributions will be included as part of the transaction;

(iii) to extend the “Termination Date” under the Merger Agreement from November 1, 2021 to December 1, 2021.

The foregoing description of the Amendment No. 1, and the transactions and documents contemplated thereby, are not complete and are subject to and qualified in their entirety by reference to the Amendment No. 1, a copy of which is filed with this Current Report on Form 8-K as Exhibit 2.1 hereto, and the terms of which are incorporated by reference herein.

1

Item 7.01. Regulation FD Disclosure.

On June 30, 2021, the Company issued a press release announcing the execution of the Amendment No. 1. The press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Attached as Exhibit 99.2 hereto and incorporated by reference herein is the investor presentation that will be used by the Company with respect to the Business Combination.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information of the information in this Item 7.01, including Exhibits 99.1 and 99.2.

Important Information about the Business Combination and Where to Find It

In connection with the proposed Business Combination, the Company’s wholly owned subsidiary, FAST Merger Corp., intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “Registration Statement”), which will include a proxy statement/prospectus, and certain other related documents, which will be both the proxy statement to be distributed to holders of shares of the Company’s common stock in connection with its solicitation of proxies for the vote by the Company’s stockholders with respect to the Business Combination and other matters as may be described in the Registration Statement, as well as the prospectus relating to the offer and sale of the securities of FAST Merger Corp. to be issued in the Business Combination. The Company’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the Registration Statement and the amendments thereto and the definitive proxy statement/prospectus, as these materials will contain important information about the parties to the Merger Agreement, the Company and the Business Combination. After the Registration Statement is declared effective, the definitive proxy statement/prospectus will be mailed to stockholders of the Company as of a record date to be established for voting on the Business Combination and other matters as may be described in the Registration Statement. Stockholders will also be able to obtain copies of the proxy statement/prospectus and other documents filed with the SEC that will be incorporated by reference in the proxy statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: FAST Acquisition Corp., 109 Old Branchville Rd. Ridgefield, CT 06877, Attention: Sandy Beall, Chief Executive Officer.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed participants in the solicitation of proxies from the Company’s stockholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in the Company is contained in the Company’s final prospectus relating to its initial public offering dated August 20, 2020 and in the Company’s and FAST Merger Corp.’s subsequent filings with the SEC, including the Registration Statement relating to the Business Combination expected to be filed by FAST Merger Corp., and is available free of charge from the sources indicated above. Additional information regarding the interests of such participants will be contained in the Registration Statement when available.

FEI and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of the Company in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination will be contained in the Registration Statement when available.

2

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The Company’s and FEI’s actual results may differ from their expectations, estimates and projections and, consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s and FEI’s expectations with respect to future performance and anticipated financial impacts of the Business Combination, the satisfaction of the closing conditions to the Business Combination and the timing of the completion of the Business Combination. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company’s and FEI’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the risk that the Business Combination disrupts FEI’s current plans and operations; (2) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of FEI to grow and manage growth profitably and retain its key employees; (3) costs related to the Business Combination; (4) changes in applicable laws or regulations; (5) the possibility that FEI or the Company may be adversely affected by other economic, business, and/or competitive factors; (6) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; (7) the outcome of any legal proceedings that may be instituted against FEI or the Company following the announcement of the Merger Agreement; (8) the inability to complete the Business Combination, including due to failure to obtain approval of the stockholders of the Company, obtain certain regulatory approvals, including from certain gaming regulatory authorities, or satisfy other conditions to closing in the Merger Agreement; (9) the impact of COVID-19 on FEI’s business and/or the ability of the parties to complete the Business Combination; (10) the inability to obtain or maintain the listing of the combined company’s shares of common stock on the stock exchange following the Business Combination; or (11) other risks and uncertainties indicated from time to time in the Registration Statement relating to the Business Combination, including those under “Risk Factors” therein, and in the Company’s other filings with the SEC. Readers are cautioned not to place undue reliance upon any forward-looking statements in this Current Report on Form 8-K, which speak only as of the date made. Neither the Company nor FEI undertakes or accepts any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this Current Report on Form 8-K to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This Current Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

† Certain of the exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). The Registrant agrees to furnish a copy of all omitted exhibits and schedules to the SEC upon its request.

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FAST ACQUISITION CORP. | ||

| By: | /s/ Sandy Beall | |

| Name: Sandy Beall | ||

| Title: Chief Executive Officer | ||

| Dated: July 1, 2021 | ||

4

Exhibit 2.1

AMENDMENT NO. 1 TO AGREEMENT AND PLAN OF MERGER

This Amendment No. 1 to Agreement and Plan of Merger (this “Amendment”) is made and entered into as of July 1, 2021, by and among Fertitta Entertainment Inc., a Texas corporation (“Florida”), FAST Acquisition Corp., a Delaware corporation (“SPAC”), FAST Merger Corp., a Texas corporation and direct, wholly owned subsidiary of SPAC (“SPAC Newco”), and FAST Merger Sub Inc., a Texas corporation and direct, wholly owned subsidiary of SPAC (“Merger Sub” and, together with Florida, SPAC and SPAC Newco, the “Parties”). Except as otherwise indicated, capitalized terms used but not defined herein shall have the meanings given to such terms in the Merger Agreement (as defined below).

WHEREAS, the Parties entered into that certain Agreement and Plan of Merger (the “Merger Agreement”), dated as of February 1, 2021, pursuant to which, among other things, Merger Sub will merge with and into Florida, with Florida surviving such merger as a wholly owned subsidiary of SPAC Newco (the “Merger”), on the terms and subject to the conditions of the Merger Agreement;

WHEREAS, Section 10.06 of the Merger Agreement provides that the Merger Agreement may be amended or modified in whole or in part only by a duly authorized agreement in writing signed by the Parties and which makes reference to the Merger Agreement; and

WHEREAS, the parties hereto desire to amend the terms of the Merger Agreement as set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained in this Amendment and in the Merger Agreement and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties agree as follows:

1. Amendments. As of the date first written above, the Merger Agreement is hereby amended as follows:

(a) The following definitions will be added to Section 1.01 of the Merger Agreement:

“Additional Georgia Shares Value” means an amount equal to the product of (a) the number of Georgia Shares held by any Florida Entity at the time of calculation in excess of 31,494,175 Georgia Shares (subject to adjustment by reason of any stock dividend, subdivision, reclassification, reorganization, recapitalization, split, combination or exchange of shares, the issuance of shares to any Florida Entity in connection with interest payments paid on any Indebtedness of Georgia, or any other similar event between the date of this Agreement and the Closing), multiplied by (b) the Georgia Reference Price.

“Initial Execution Date” means February 1, 2021.

(b) The definition of “Aggregate Closing Date Transaction Value” set forth in Section 1.01 of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

“Aggregate Closing Date Transaction Value” means an amount equal to (a) $3,840,000,000 plus (b) Target Net Indebtedness, less (c) Closing Net Indebtedness, plus (d) Georgia Closing Amount, plus (e) Additional Georgia Shares Value less (f) Georgia Reference Amount.

(c) The definition of “Closing Cash” set forth in Section 1.01 of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

“Closing Cash” means the aggregate amount of all cash, cash equivalents, marketable securities and short-term investments (i) held by or on behalf of the Florida Entities as of the Effective Time, including (a) all cash on hand or otherwise in the possession of the Florida Entities as of the Effective Time, (b) money, currency or a credit balance in a deposit account at a financial institution, net of uncleared checks outstanding, plus processed credit card transactions for cash not yet received, (c) amounts held in escrow or earnest money deposits, and (d) checks, drafts and other similar instruments in transit that have been received by, but not deposited into the bank accounts of, the Florida Entities, or (ii) paid by any of the Florida Entities to any Person (other than another Florida Entity) between the Initial Execution Date and the Closing (x) in connection with the acquisition of any business, real property interest or other asset or assets or under any equity or other funding agreement or (y) as a premium, prepayment fee, or other penalty, fee, payment, cost or expense incurred in connection with the repayment or refinancing of any Indebtedness of the Florida Entities, including interest payments paid on any Indebtedness incurred in connection with such repayment or refinancing.

(d) The definition of “Closing Indebtedness” set forth in Section 1.01 of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

“Closing Indebtedness” means all Indebtedness of the Florida Entities as of the Effective Time, provided, however, that the calculation of Closing Indebtedness as of such time shall exclude (i) the Indebtedness set forth or described on Section 1.01(a) of the Florida Disclosure Letter, (ii) the amount of any assumed Indebtedness, seller financing or other Indebtedness used or incurred by the Florida Entities between the Initial Effective Date and the Closing in connection with the acquisition of any business, real property interest or other asset or assets and (iii) any premiums, prepayment fees, or other penalties, fees, costs or expenses incurred between the Initial Execution Date and the Closing in connection with the repayment or refinancing of any Indebtedness of the Florida Entities.

(e) The definition of “Georgia Closing Amount” set forth in Section 1.01 of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

“Georgia Closing Amount” means an amount equal to the product of (a) the Georgia Closing Price, multiplied by (b) 31,494,175 (subject to adjustment by reason of any stock dividend, subdivision, reclassification, reorganization, recapitalization, split, combination or exchange of shares, the issuance of shares to any Florida Entity in connection with interest payments paid on any Indebtedness of Georgia, or any other similar event between the date of this Agreement and the Closing).

2

(f) The definition of “Georgia Reference Amount” set forth in Section 1.01 of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

“Georgia Reference Amount” means an amount equal to the product of (a) the Georgia Reference Price, multiplied by (b) 31,494,175 (subject to adjustment by reason of any stock dividend, subdivision, reclassification, reorganization, recapitalization, split, combination or exchange of shares, the issuance of shares to any Florida Entity in connection with interest payments paid on any Indebtedness of Georgia, or any other similar event between the date of this Agreement and the Closing).

(g) The definition of “Georgia Reference Price” set forth in Section 1.01 of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

“Georgia Reference Price” means $13.00.

(h) Section 3.01(b) of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

(b) Merger Consideration. At the Effective Time, by virtue of the Merger and without any action on the part of SPAC, SPAC Newco, Merger Sub, Florida or the holders of Florida Common Stock, all shares of Florida Common Stock issued and outstanding immediately prior to the Effective Time (all such shares of Florida Common Stock collectively, the “Shares”) shall be canceled and converted into the right to receive the Merger Consideration in accordance with the Merger Consideration Calculation, and each holder of certificates or book-entry shares which immediately prior to the Effective Time represented such Shares shall thereafter cease to have any rights with respect thereto except the right to receive the Merger Consideration, in each case to be issued or paid, without interest, in consideration therefor as provided in the Merger Consideration Calculation. Prior to the Closing, the Florida Stockholder shall deliver to SPAC a duly completed and executed letter of transmittal, in form and substance reasonably acceptable to each of Florida and SPAC, and, if applicable, one or more certificates representing the shares of Florida Common Stock owned by the Florida Stockholder. Notwithstanding the foregoing, in no event shall the modification of the Merger Consideration or the effects of the adjustments set forth in Section 3.04 result in the holders of Florida Common Stock immediately prior to the Effective Time holding less than 50.1% of the outstanding SPAC Common Stock following the Effective Time after giving effect to the Transactions and the Split-Off.

3

(i) Section 4.19(f) of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

(f) To the Knowledge of Florida, there are no facts, circumstances or plans that, either alone or in combination, could reasonably be expected to prevent the Transactions or the Split-Off from qualifying for the Intended Tax Treatment.

(j) Section 5.14(h) of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

(h) To the Knowledge of SPAC and SPAC Newco, there are no facts, circumstances or plans that, either alone or in combination, could reasonably be expected to prevent the Transactions or the Split-Off from qualifying for the Intended Tax Treatment.

(k) Section 6.01(a) of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

(a) Except as set forth on Section 6.01 of the Florida Disclosure Letter, as expressly contemplated by this Agreement or the Ancillary Agreements, as consented to by SPAC in writing (which consent shall not be unreasonably conditioned, withheld or delayed), or as may be required by Law (including COVID-19 Measures), from the date of this Agreement and until the earlier of the Closing Date and the date on which this Agreement is terminated pursuant to Section 9.01 (the “Interim Period”), Florida shall, and shall cause the Florida Subsidiaries to, (i) use its commercially reasonable efforts to conduct and operate its business in the ordinary course consistent with past practice, (ii) use commercially reasonable efforts to preserve intact the current business organization and ongoing businesses of the Florida Entities, and maintain the existing relations and goodwill of the Florida Entities with customers, suppliers, joint venture partners, distributors and creditors of the Florida Entities, (iii) use commercially reasonable efforts to keep available the services of their present officers, (iv) use commercially reasonable efforts to maintain all insurance policies of the Florida Entities or substitutes therefor and (v) enter into an agreement to acquire, by merger or otherwise, up to 100 percent of all of the outstanding equity/membership interests in Top Shelf Holdings, LLC (a/k/a Catch Hospitality Group) and all subsidiaries (“Top Shelf”), including Catch Fertitta, LLC’s membership interest in Top Shelf, with the understanding that Catch Fertitta, LLC’s membership interest in Top Shelf is a SpinCo Asset and such interest in Top Shelf will be acquired/reacquired by Florida or a Florida Entity as part of such agreement; provided, that, in the case of each of the preceding clauses (i)-(iv), during any period of full or partial suspension of operations related to the coronavirus (COVID-19) pandemic, Florida may, in connection with the coronavirus (COVID-19) pandemic, take such actions as are reasonably necessary (A) to protect the health and safety of Florida’s and the Florida Subsidiaries’ employees and other individuals having business dealings with Florida or the Florida Subsidiaries or (B) to respond to third-party supply or service disruptions caused by the coronavirus (COVID-19) pandemic, including, but not limited to any reasonable actions and omissions taken as a result of COVID-19 and the COVID-19 Measures, and any such actions taken (or not taken) as a result of, in response to, or otherwise related to the coronavirus (COVID-19) pandemic shall be deemed to be taken in the “ordinary course of business” for all purposes of this Section 6.01 and not be considered a breach of this Section 6.01; provided, further, that following any such suspension, to the extent that Florida or any of the Florida Subsidiaries took any actions pursuant to the immediately preceding proviso that caused deviations from its business being conducted in the ordinary course of business consistent with past practice, to resume conducting its business in the ordinary course of business consistent with past practice in all material respects as soon as reasonably practicable.

4

(l) Section 9.01(a) of the Merger Agreement is hereby deleted in its entirety and replaced with the following:

(a) by either SPAC or Florida, if the Closing shall not have occurred by December 1, 2021 (the “Termination Date”) by giving written notice of such extension to the other party; provided, further, that the right to terminate this Agreement under this Section 9.01(a) shall not be available to any party hereto whose action or failure to fulfill any obligation under this Agreement or the Separation Agreement shall have been the primary cause of the failure of the Closing to occur on or prior to such date;

(m) The Florida Disclosure Letter is hereby amended and restated in its entirety in the form attached as Exhibit A hereto.

(n) In order to provide for the consummation of the Split-Off, (i) the form of SPAC Newco A&R Charter attached as Exhibit H shall be revised to permit a special distribution of 100% of the shares of SplitCo (as defined in the Split-Off Agreement) to the holders of SPAC Newco Class B Common Stock following the Effective Time (the “SplitCo Special Distribution”) and (ii) the form of Split-Off Agreement attached as Exhibit J shall be revised to provide that the Split-Off shall be effected pursuant to the SplitCo Special Distribution.

2. Effect of Amendment. This Amendment shall form a part of the Merger Agreement for all purposes, and each party thereto and hereto shall be bound hereby. From and after the execution of this Amendment by the parties hereto, each reference in the Merger Agreement to “this Agreement,” “hereof,” “hereunder,” “herein,” “hereby” or words of like import referring to the Merger Agreement shall mean and be a reference to the Merger Agreement as amended by this Amendment; provided, that for the avoidance of doubt, each reference in Article IV (Representations and Warranties of Florida) of the Merger Agreement to the phrase “the date of this Agreement” or “the date hereof” shall refer to the date of this Amendment, other than such reference in Section 4.19(b) of the Merger Agreement, which shall continue to refer to the Initial Execution Date.

3. Full Force and Effect. Except as expressly amended hereby, each term, provision, exhibit and schedule of the Merger Agreement is hereby ratified and confirmed and remains in full force and effect. This Amendment may not be amended except by an instrument in writing signed by the parties hereto.

5

4. Counterparts. This Amendment may be executed and delivered (including by facsimile or other means of electronic transmission, such as by electronic mail in “pdf” form) in two (2) or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. In the event that any signature is delivered by facsimile transmission or any other form of electronic delivery, such signature shall create a valid and binding obligation of the party executing this Agreement (or on whose behalf this Agreement is executed) with the same force and effect as if such signature page were an original thereof.

5. Governing Law; Waiver of Jury Trial. This Amendment, and all acts and claims or causes of action based upon, arising out of, or related to this Amendment or the transactions contemplated hereby, shall be governed by, and construed in accordance with, the Laws of the State of Texas, without giving effect to principles or rules of conflict of laws to the extent such principles or rules would require or permit the application of laws of another jurisdiction.

6. Additional Miscellaneous Terms. The provisions of Article X (General Provisions) of the Merger Agreement shall apply mutatis mutandis to this Amendment, and to the Merger Agreement as modified by this Amendment, taken together as a single agreement, reflecting the terms as modified hereby.

[Signature pages follow]

6

IN WITNESS WHEREOF, the Parties have caused this Amendment to be executed and delivered as of the date first above written.

| FERTITTA ENTERTAINMENT, INC. | ||

| /s/ Tilman J. Fertitta | ||

| Name: | Tilman J. Fertitta | |

| Title: | Chief Executive Officer | |

[Signature Page to Amendment No. 1 to Agreement and Plan of Merger]

IN WITNESS WHEREOF, the Parties have caused this Amendment to be executed and delivered as of the date first above written.

| FAST ACQUISITION CORP. | ||

| /s/ Sandy Beall | ||

| Name: | Sandy Beall | |

Title: |

Chief Executive Officer | |

| FAST MERGER CORP. | ||

| /s/ Sandy Beall | ||

| Name: | Sandy Beall | |

Title: |

President | |

| FAST MERGER SUB INC. | ||

| /s/ Sandy Beall | ||

| Name: | Sandy Beall | |

Title: |

President | |

[Signature Page to Amendment No. 1 to Agreement and Plan of Merger]

EXHIBIT A

Florida Disclosure Letter

[Intentionally Omitted]

Exhibit 99.1

Fertitta Entertainment, Inc. Announces Amendment to Merger Agreement with FAST Acquisition Corp.

Amended Transaction Values Golden Nugget/Landry’s at Enterprise Value of Approximately $8.6 Billion

HOUSTON, TX – June 30, 2021 – Fertitta Entertainment, Inc., the parent company of Golden Nugget/Landry’s (“Fertitta” or the “Company”), a leader in the gaming, restaurant, hospitality and entertainment industry, and FAST Acquisition Corp. (NYSE: FST) (“FAST”), a special purpose acquisition company co-headed by Doug Jacob and Sandy Beall, announced today that they have entered into an amendment to their previously announced Agreement and Plan of Merger entered into between the parties on February 1, 2021. According to the amendment, the Company has agreed to contribute certain operating businesses not originally included as part of the business combination with FAST for no additional debt. Businesses that will now be contributed to the public company include the Mastro’s brand, the Aquariums, the Pleasure Pier, Vic and Anthony’s, and a handful of smaller restaurant concepts, adding a total of 42 incremental, high-quality business assets. Also, the Company will enter into a transaction to acquire the Catch restaurants, including Catch Steak, which restaurant group is already 50% owned indirectly by Tilman J. Fertitta. In connection with the amendment, Mr. Fertitta, the Company’s owner, will receive additional equity in the NYSE public company which will increase his total equity stake post -closing of the transaction to approximately 72%.

Pro forma for the revised transaction, Fertitta Entertainment, Inc. will be one of the largest publicly-traded hospitality companies with 5 land-based casinos and substantial ownership of Golden Nugget Online Gaming, Inc. and over 500 restaurants, amusements, hotels, entertainment venues and other business units across 38 states, the District of Columbia, Puerto Rico, Hong Kong, mainland China, Mexico and Singapore, plus numerous licensed restaurants throughout the world.

In addition, the Company announced preliminary pro forma financial results for the quarter ended June 30, 2021. Including the additional assets and business units, pro forma net revenues for the three-month period are expected to be between $917 million and $920 million, with pro forma adjusted EBITDA estimated to be between $270 million and $275 million. For full year 2021, the Company believes that its pro forma adjusted EBITDA will exceed $800 million assuming the contribution or acquisition of all of the operating businesses by the Company was completed as of January 1, 2021. According to Tilman J. Fertitta, “the contribution of the new business assets greatly improves the Company’s operating cash flow, provides better assets for organic growth, and significantly deleverages the Company as no incremental debt is being incurred by the Company as part of the revised transaction. Since the rollout of covid vaccinations, the operating results of the incremental assets have been so strong, I decided that I should be focused all in on the Company as I see opportunities for a significant acquisition that would not otherwise be available to the Company without this revised transaction. We were a great company before and now even better today.”

1

“The addition of Mastro’s and the destination entertainment businesses provide tremendous cash flow and growth opportunities to the Company and we are excited that Tilman is contributing the new assets to the Company,” said Doug Jacob. “These brands create an even stronger portfolio to leverage for potential future acquisitions.”

Sandy Beall added: “We believe the new assets provide tremendous value to the public company and greatly strengthen the balance sheet for future growth.”

Amended Transaction Overview

The amended transaction implies an enterprise valuation for Golden Nugget/Landry’s of approximately $8.6 billion. This enterprise value includes the value of the GNOG equity to be contributed to the Company, based on an assumed per share trading price of approximately $13.00 for GNOG shares, which will be subject to adjustment based on the 60 day average price of the stock before closing. Estimated cash proceeds from the transaction are expected to consist of FAST’s $200 million of cash in trust, assuming no redemptions. In addition, shareholders have committed to invest approximately $1.24 billion in the form of a PIPE at a price of $10.00 per share of common stock of FAST immediately prior to the closing of the transaction.

The Company expects to use the proceeds from the transaction to accelerate the Company’s growth initiatives, general corporate purposes and reduce existing debt. In connection with the merger, the parties will undertake certain reorganizational transactions to exclude from the public company certain businesses and assets that Tilman J. Fertitta will continue to wholly own on a private basis.

The boards of directors of each of FAST and Fertitta have unanimously approved the amended transaction. The amended transaction will require the approval of the stockholders of FAST and is subject to other customary closing conditions, including the receipt of certain regulatory and gaming approvals. The SEC review process is expected to begin around the third week in July, and the transaction is now expected to close in the fourth quarter of 2021.

Fertitta Entertainment, Inc.

Fertitta Entertainment, Inc. is Tilman J. Fertitta’s holding company for substantially all of his assets, including all of the equity in Golden Nugget, LLC and Landry’s, LLC, approximately 31.494 million shares in Golden Nugget Online Gaming, Inc. (“GNOG”), hotels, real estate, and other investments. The business combination will only include all of its holdings in GNOG and the majority of the assets and businesses that comprise Golden Nugget, LLC and Landry’s, LLC. Golden Nugget/Landry’s is a multinational, diversified gaming, restaurant, hospitality, and entertainment company based in Houston, Texas. The Company’s gaming division includes the renowned Golden Nugget Hotel and Casino concept, with locations in Las Vegas and Laughlin, NV; Atlantic City, NJ; Biloxi, MS; and Lake Charles, LA. GNOG is a leading online gaming company that is considered a market leader by its peers and was first to bring Live Dealer and Live Casino Floor to the United States online gaming market. GNOG was the past recipient of 15 eGaming Review North America Awards, including the coveted “Operator of the Year” award in 2017, 2018, 2019 and 2020. Entertainment and hospitality divisions encompass popular destinations including the Kemah Boardwalk. The Company also operates more than 500 outlets, including over 400 high-end and casual dining establishments around the world, with well-known concepts such as Del Frisco’s, Landry’s Seafood House, Bubba Gump Shrimp Co., Rainforest Cafe, Morton’s The Steakhouse, The Oceanaire Seafood Room, McCormick & Schick’s Seafood, Chart House, Joe’s Crab Shack, and Saltgrass Steak House. Landry’s also operates the popular New York BR Guest Restaurants such as Dos Caminos, Strip House and Bill’s Bar & Burger.

2

FAST Acquisition Corp.

FAST is a hospitality-focused blank check company launched by the principals of &vestwhose business purpose is to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. FAST is led by founder Doug Jacob and CEO Sandy Beall. FAST raised $200,000,000 in its initial public offering on August 20, 2020 and is listed on NYSE under the ticker symbol "FST.”

Advisors

Latham & Watkins LLP is acting as legal advisor to Fertitta, and Jefferies LLC is acting as financial advisor and capital markets advisor to Fertitta. Jefferies LLC acted as lead placement agent on the PIPE. Both Winston & Strawn LLP and White & Case LLP are acting as legal advisors to FAST. Citigroup Global Markets Inc. is acting as sole financial advisor to FAST, and Citigroup Global Markets Inc. and UBS Investment Bank are jointly acting as capital markets advisor to FAST. Goodwin Procter LLP and Skadden, Arps, Slate, Meagher & Flom LLP are acting as legal advisors to Jefferies LLC.

Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures, including EBITDA and Pro forma Adjusted EBITDA. EBITDA is defined as net income plus interest expense, income tax expense, depreciation and amortization. Pro forma Adjusted EBITDA is defined as EBITDA, plus impairment expenses, pre-opening costs, and onetime non-recurring items, as if all of the businesses were owned as of January 1, 2021. These financial measures are not prepared in accordance with accounting principles generally accepted in the United States and may be different from non-GAAP financial measures used by other companies. FAST and the Company believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. These non-GAAP measures with comparable names should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP.

3

Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. The Company's and FAST’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company's and FAST's expectations with respect to future performance and anticipated financial impacts of the transactions contemplated by the merger (the “Business Combination”), the satisfaction of the closing conditions to the Business Combination and the timing of the completion of the Business Combination. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's and FAST's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the agreement and plan of merger for the Business Combination (the "Merger Agreement") or could otherwise cause the Business Combination to fail to close, (2) the outcome of any legal proceedings that may be instituted against the Company and FAST following the announcement of the Merger Agreement and the transactions contemplated therein; (3) the inability to complete the Business Combination, including due to failure to obtain approval of the stockholders of FAST or satisfy other conditions to closing in the Merger Agreement, including the failure to obtain gaming or other regulatory approvals; (4) the impact of COVID-19 on the Company’s business and/or the ability of the parties to complete the Business Combination; (5) the inability to obtain or maintain the listing of FAST's shares of common stock on the New York Stock Exchange following the Business Combination; (6) the risk that the Business Combination disrupts current plans and operations as a result of the announcement and consummation of the Business Combination; (7) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the Company to grow and manage growth profitably and retain its key employees; (8) costs related to the Business Combination; (9) changes in applicable laws or regulations; (10) the possibility that FAST or the Company may be adversely affected by other economic, business, and/or competitive factors; and (11) other risks and uncertainties indicated from time to time in the Registration Statement (as defined below) relating to the Business Combination, including those under "Risk Factors" therein, and in FAST's other filings with the SEC. The foregoing list of factors is not exclusive. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Neither FAST nor the Company undertakes or accepts any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction. This press release shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

4

Additional Information

In connection with the proposed Business Combination, FAST’s wholly owned subsidiary, FAST Merger Corp. (“FAST TX”) intends to file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 (the “Registration Statement”), which will include a proxy statement/prospectus, and certain other related documents, which will be both the proxy statement to be distributed to holders of shares of FAST’s common stock in connection with its solicitation of proxies for the vote by FAST’s stockholders with respect to the proposed Business Combination and other matters as may be described in the Registration Statement, as well as the prospectus relating to the offer and sale of the securities of FAST TX to be issued in the Business Combination. FAST’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the Registration Statement and the amendments thereto and the definitive proxy statement/prospectus, as these materials will contain important information about the parties to the Merger Agreement, FAST and the Business Combination. After the Registration Statement is declared effective, the definitive proxy statement/prospectus will be mailed to stockholders of FAST as of a record date established for voting on the Business Combination and other matters as may be described in the Registration Statement. Stockholders will also be able to obtain copies of the proxy statement/prospectus and other documents filed with the SEC that will be incorporated by reference in the proxy statement/prospectus, without charge, once available, at the SEC’s web site at www.sec.gov, or by directing a request to: FAST Acquisition Corp., 3 Minetta Street, New York, New York 10012, Attention: Sandy Beall, Chief Executive Officer.

Participants in the Solicitation

FAST and Fertitta and their respective directors and executive officers may be deemed participants in the solicitation of proxies from FAST’s stockholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in FAST are contained in FAST’s final prospectus dated August 20, 2020 relating to its initial public offering and in FAST’s subsequent filings with the SEC, and is available free of charge from the sources. Additional information regarding the interests of such participants will be contained in the Registration Statement when available.

Contacts:

Fertitta Entertainment, Inc.

Dancie Perugini Ware Public Relations:

713-224-9115

Dancie Perugini Ware [email protected]

Katelyn Roche Gosslee, [email protected]

Mary Ann Mason, [email protected]

Rick Liem [email protected] 713-386-7000

FAST Acquisition Corporation/&vest

Chris Cunningham

5

Exhibit 99.2

Deal Structure Update 1

DISCLAIMER 2 This presentation (the “presentation”) is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of FAST Acquisition Corp . (“FAST”) or Fertitta Entertainment, Inc . (“FEI”) or any of their respective affiliates . The presentation has been prepared to assist parties in making their own evaluation with respect to the proposed business combination (the "Business Combination") between FAST and FEI and for no other purpose . It is not intended to form the basis of any investment decision or any other decisions with respect of the Business Combination . No legally binding obligations will be created, implied, or inferred from this presentation or the information contained herein . No Representation or Warranty . No representation or warranty, express or implied, is or will be given by FAST or FEI or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of the Business Combination, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto . This presentation does not purport to contain all of the information that may be required to evaluate a possible investment decision with respect to FAST or FEI, and does not constitute investment, tax or legal advice . The recipient also acknowledges and agrees that the information contained in this presentation is preliminary in nature and is subject to change, and any such changes may be material . FAST and FEI disclaim any duty to update the information contained in this presentation . Any and all trademarks and trade names referred to in this presentation are the property of their respective owners . The only obligations of any such person shall be those of FAST and FEI as set forth in the definitive agreement previously executed by FAST and FEI (as the same may be amended, modified or supplemented from time to time) regarding the proposed transaction between FAST and FEI . The proposed Business Combination is subject to, among other things, the approval by FAST’s stockholders, satisfaction of the conditions set forth in the definitive agreement, and the negotiation and execution of any amendment, modification or supplement thereto and receipt of any necessary approvals or consents in connection therewith . Accordingly, there can be no assurance that the updated deal structure discussed in this presentation will be entered into or agreed, or that the proposed Business Combination will be consummated on the updated terms or at all . Forward looking statements . This presentation contains “forward looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995 . Forward looking statements include, without limitation, statements regarding the estimated future financial performance, financial position and financial impacts of the Business Combination as well as of FAST, FEI and the combined company following the Business Combination, the satisfaction of closing conditions to the Business Combination, the level of redemption by FAST's public stockholders and purchase price adjustments in connection with the Business Combination, the timing of the completion of the Business Combination, the anticipated pro forma enterprise value and projected revenue of the combined company following the Business Combination, anticipated ownership percentages of the combined company's stockholders following the potential transaction, and the business strategy, plans and objectives of management for future operations, including as they relate to the potential Business Combination . Such statements can be identified by the fact that they do not relate strictly to historical or current facts . When used in this presentation, words such as “pro forma,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “will”, “would” and similar expressions may identify forward looking statements, but the absence of these words does not mean that a statement is not forward looking . When FAST discusses its strategies or plans, including as they relate to the Business Combination, it is making projections, forecasts and forward looking statements . Such statements are based on the beliefs of, as well as assumptions made by and information currently available to, FAST's management . These forward looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results . Most of these factors are outside of FAST's and FEI's control and are difficult to predict . Factors that may cause such differences include, but are not limited to : ( 1 ) FAST's ability to complete the Business Combination or, if FAST does not complete the Business Combination, any other initial business combination ; ( 2 ) satisfaction or waiver (if applicable) of the conditions to the Business Combination, including with respect to the approval of the stockholders of FAST ; ( 3 ) the ability to maintain the listing of the combined company's securities on the New York Stock Exchange or another exchange ; ( 4 ) the risk that the Business Combination disrupts current plans and operations of FAST or FEI as a result of the announcement and consummation of the transaction described herein ; ( 5 ) the impact of COVID - 19 on FEI’s business and operations and/or the ability of the parties to complete the Business Combination ; ( 6 ) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees ; ( 7 ) costs related to the Business Combination ; ( 8 ) changes in applicable laws or regulations and delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals required to complete the Business Combination ; ( 9 ) the possibility that FAST and FEI may be adversely affected by other economic, business, and/or competitive factors ; ( 10 ) the outcome of any legal proceedings that may be instituted against FAST, FEI or any of their respective directors or officers following the announcement of the Business Combination ; ( 11 ) the failure to realize anticipated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions and purchase price and other adjustments ; and ( 12 ) other risks and uncertainties indicated from time to time in the Registration Statement (as defined below) related to the Business Combination, including those under “Risk Factors” therein, and other documents filed or to be filed with the Securities and Exchange Commission (“SEC”) by FAST TX (as defined below) or FEI . You are cautioned not to place undue reliance upon any forward looking statements . Forward looking statements included in this presentation speak only as of the date of this presentation . Neither FAST nor FEI undertakes any obligation to update its forward looking statements to reflect events or circumstances after the date hereof . Additional risks and uncertainties are identified and discussed in FAST’s and FEI’s reports filed or to be filed with the SEC . No Offer or Solicitation . This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination . This presentation does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, and otherwise in accordance with applicable law . Use of Projections . This presentation contains financial forecasts . Neither FAST's nor FEI's independent auditors have studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them has expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation . These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results . In this presentation, certain of the above mentioned projected information has been provided for purposes of providing comparisons with historical data . The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . Projections are inherently uncertain due to a number of factors outside of FAST's or FEI's control . Accordingly, there can be no assurance that the prospective results are indicative of future performance of FAST, FEI or the combined company after the Business Combination or that actual results will not differ materially from those presented in the prospective financial information . Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved . Industry and Market Data . In this presentation, we rely on and refer to information and statistics regarding market participants in the sectors in which FEI competes and other industry data . We obtained this information and statistics from third party sources, including reports by market research firms and company filings . Being in receipt of the presentation you agree you may be restricted from dealing in (or encouraging others to deal in) price sensitive securities . Non - GAAP Financial Matters . This presentation includes certain non GAAP financial measures, including EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, free cash flow and Return on Investment . EBITDA is defined as net income plus tax expense, interest expense and depreciation and amortization . Adjusted EBITDA is defined as EBITDA, less non - recurring expenses . Free cash flow is defined as Adjusted EBITDA less capital expenditures . Note that free cash flow does not represent residual cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations . Return on Investment is defined as EBITDA, divided by Total Investment . These financial measures are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and may be different from non - GAAP financial measures used by other companies . FAST and FEI believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends . These non - GAAP measures with comparable names should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP . See the footnotes on the slides where these measures are discussed for a description of these non - GAAP financial measures and reconciliations of such non - GAAP financial measures to the most comparable GAAP amounts can be found . This presentation includes certain forward looking non - GAAP financial measures . To the extent a reconciliation of these non - GAAP financial measures to the most directly comparable GAAP financial measures is not provided in this presentation, it is because neither FAST nor FEI is able to provide such reconciliation without unreasonable effort . Additional Information . In connection with the Business Combination, FAST's wholly owned subsidiary, FAST Merger Corp . (“FAST TX”), intends to file with the U . S . Securities and Exchange Commission (the “SEC”) a registration statement on Form S - 4 (the “Registration Statement”) which will include a proxy statement/prospectus, and certain other related documents, which will be both the proxy statement to be distributed to holders of shares of FAST’s common stock in connection with FAST's solicitation of proxies for the vote by its stockholders with respect to the Business Combination and other matters as may be described in the Registration Statement, as well as the prospectus relating to the offer and sale of the securities of FAST TX be issued in the Business Combination . FAST’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the Registration Statement and the amendments thereto and the definitive proxy statement/prospectus, as these materials will contain important information about the parties to the definitive agreement, FAST and the Business Combination . After the Registration Statement is declared effective, the definitive proxy statement/prospectus will be mailed to stockholders of FAST as of a record date to be established for voting on the Business Combination and other matters as may be described in the Registration Statement . Stockholders will also be able to obtain copies of the proxy statement/prospectus and other documents filed with the SEC that will be incorporated by reference in the proxy statement/prospectus, without charge, once available, at the SEC’s web site at www . sec . gov, or by directing a request to : FAST Acquisition Corp . , 3 Minetta Street, New York, New York 10012 , Attention : Sandy Beall, Chief Executive Officer . Participants in the Solicitation . FAST, FEI and their respective directors and officers may be deemed participants in the solicitation of proxies of FAST stockholders in connection with the Business Combination . FAST’s stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of FAST in FAST’s Registration Statement on Form S - 1 , which was initially filed with the SEC on August 4 , 2020 and is available at the SEC’s website at www . sec . gov or by directing a request to FAST at the address above . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to FAST stockholders in connection with the Business Combination and other matters to be voted upon at the Special Meeting will be set forth in the Registration Statement for the Business Combination when available . Additional information regarding the interests of participants in the solicitation of proxies in connection with the Business Combination will be included in the Registration Statement that FAST TX intends to file with the SEC . 2

UPDATE SUMMARY 3 3 • Given the strong operating performance of certain assets previously excluded from the transaction, Golden Nugget and FAST are contemplating amending the merger agreement to include these assets for stock consideration • The potential amendment contemplates adding 49 (1) high quality assets to the transaction, including: • Upscale Mastro’s, Catch and Vic & Anthony’s restaurant brands • Specialty assets including Fisherman’s Wharf, Pleasure Pier and three aquariums • Additional casual concepts including Cadillac Bar and Fish Tales • Pro forma for the new contributed assets and accelerated post - COVID reopening, Golden Nugget expects to achieve 2021E EBITDA of $790 million (2) • Based on the revised transaction terms, the deal has been significantly improved for FAST shareholders • TEV / 2021E EBITDA of 11.0x (vs. 11.9x in original deal structure) • Net Debt / 2021E EBITDA of 4.1x (vs. 5.6x in original deal structure) 1. 42 excluding Catch. 2. Includes Catch Hospitality pro forma at $25 million. Estimate updated to $800 million as of June 30 th , 2021.

SIMPLIFIES THE TRANSACTION 1 4 4 4 IMPROVES THE OVERALL OPERATING CASH FLOW 2 OPPORTUNITY FOR LARGE M&A 6 PROVIDES BETTER ASSETS FOR ORGANIC GROWTH 5 SIGNIFICANTLY DELEVERAGES THE COMPANY TJF ALL IN 7 3 ELIMINATES CONFLICTS RATIONALE FOR THE DEAL

5 Source: GN, LLC management. 1. Represents two licensed restaurants. 5 ( 1 ) SIGNIFICANT HIGH - QUALITY ASSETS

CATCH RESTAURANTS 6 6 CATCH ARIA CATCH NEW YORK CATCH LOS ANGELES CATCH STEAK

MASTRO'S RESTAURANTS 7 7 MASTRO'S NEW YORK CITY MASTRO'S OCEAN CLUB BOSTON MASTRO'S MALIBU MASTRO'S WASHINGTON D.C.

SPECIALTY ENTERTAINMENT CONCEPTS 8 8 DOWNTOWN HOUSTON AQUARIUM KEMAH BOARDWALK DOWNTOWN DENVER AQUARIUM GALVESTON PLEASURE PIER

9 CONSOLIDATED 1 ST QUARTER RESULTS Note: Excludes GNOG, actual results. Mar 2021 Mar 2019 Revenue $634,294 $826,138 Unit Level EBITDA $180,357 $176,085 % of Revenue 28.4% 21.3% Adjusted EBITDA $146,891 $139,521 % of Revenue 23.2% 16.9% SUBSTANTIAL MARGIN EXPANSION IN A CHALLENGING SALES ENVIRONMENT ($000’s) Quarter Ended 9

10 CONSOLIDATED 2021 REVENUE BY MONTH ($ in millions) 1. Excludes Catch Hospitality and GNOG. 10 Month Revenue (1) January $173.3 February $183.9 March $268.9 April $279.0

11 HISTORICAL PRO FORMA & MODEL PROJECTIONS SUMMARY (1) 1. Excludes GNOG. 2. Pro forma for acquired units in 2019 and the first quarter of 2020 as if in a full year. Pro forma for closed units through FY20. 3. Assumes normalization begins in Q2. 4. Estimate updated to $800 million as of June 30 th , 2021. FY19PF (2) FY20A FY21E (3) Revenue $3,851 $2,186 $3,345 Unit Level EBITDA $ 845 $ 395 $ 915 G&A & Other Expense ($ 145) ($ 115) ($ 125) EBITDA $ 700 $ 280 $ 790 (4) EBITDA % 18.2% 12.8% 23.6 % ($ in millions) 11

12 CONSOLIDATED PROJECTED FREE CASH FLOW (1) 1. Assumes no acquisitions or M&A. 2. Estimate updated to $800 million as of June 30 th , 2021. 3. Assumes transaction debt repayment occurs January 1 st , 2021. 2021E Adjusted EBITDA $790.0 (2) Less: Cash Interest Expense (3) (171.0) Capex (120.0) Cash Taxes (30.0) Free Cash Flow Before Debt Paydown $469.0 % Conversion 59% ($ in millions) 12

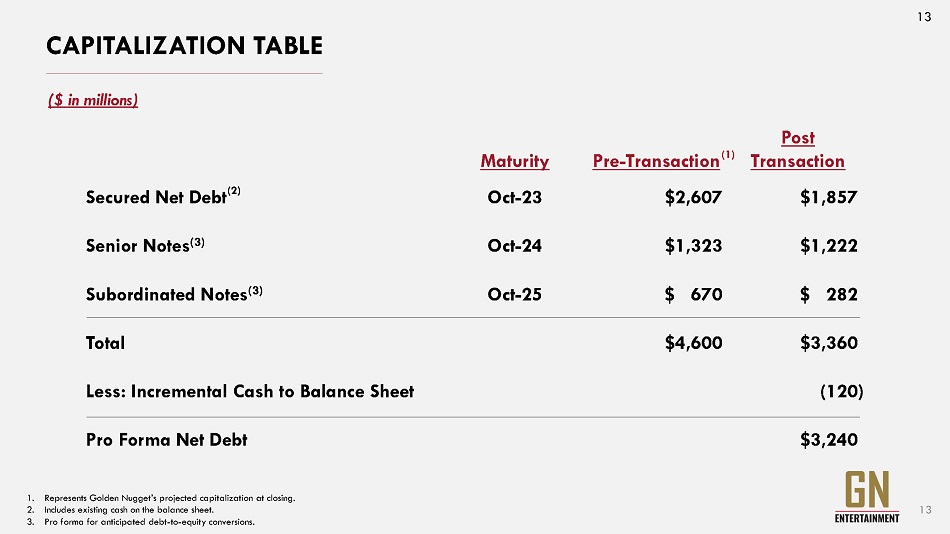

CAPITALIZATION TABLE ($ in millions) 1. Represents Golden Nugget’s projected capitalization at closing. 2. Includes existing cash on the balance sheet. 3. Pro forma for anticipated debt - to - equity conversions. Maturity Pre - Transaction (1) Post Transaction Secured Net Debt (2) Oct - 23 $2,607 $1,857 Senior Notes (3) Oct - 24 $1,323 $1,222 Subordinated Notes (3) Oct - 25 $ 670 $ 282 Total $4,600 $3,360 Less: Incremental Cash to Balance Sheet (120) Pro Forma Net Debt $3,240 13 13

UPDATED DEAL TERMS 14 Valuation Summary Pro Forma Basic Shares Outstanding Sources & Uses ($ in millions) • FAST Acquisition Corp. (“FAST”) is a publicly listed special purpose acquisition vehicle with over $200 million cash • Fertitta Entertainment, Inc., the parent company of Golden Nugget, Inc., (“Golden Nugget” or the “Company”) is a market - leading casino, online gaming and restaurant operator • FAST to combine with Fertitta Entertainment, Inc. – Includes $409 million of equity value associated with held shares of Golden Nugget Online Gaming (“GNOG”) (9) • $1,240 million raised through a private placement of public equity (“PIPE”) – Proceeds used to pay down debt 14 Note: $ in millions (except per share data). 1. Represents the projected Net Debt at closing for Golden Nugget. 2. Excludes Catch Hospitality. 3. Will be issued Class B shares with 10 - to - 1 voting rights which sunset when Tilman Fertitta’s economic ownership falls below 20%. 4. As s um e s n o r e d e m p t i o n s o f p u blic s h a re s by F AST s h a re h o ld ers. 7. 5. Excludes GNOG. Estimate updated to $800 million as of June 30, 8. 2021. 9. 6. Shares in millions. Catch Hospitality 50% owned by Fertitta Entertainment. FAST founders to forfeit 40% of their promote shares. GNOG contribution value calculated using a share price of $13.00. Sources Uses Golden Nugget Projected Net Debt (1) $4,600 Acquisition of Golden Nugget (2) $8,442 Equity Issued to Fertitta (3) 3,842 Paydown of Golden Nugget Debt 1,240 PIPE Proceeds 1,240 Incremental Cash to Balance Sheet 120 Cash Held in Trust (4) 200 Transaction Fees 80 Equity Consideration for Catch Hospitality 190 Purchase of Catch Hospitality 190 Total Sources $10,072 Total Uses $10,072 Illustrative Valuation ($ in millions, unless per share data) 2021E EBI T DA (5) $790 Transaction Multiple 10.4x Enterprise Value (Excluding GNOG) $8,223 Fertitta Owned GNOG Shares (6) 31.5 Share Price $13.00 GNOG Equity Value $409 Enterprise Value (Including GNOG and Catch) $8,632 70.1% 22.6% 3.6% 3.1% 0.5% Equity Issued to Fertitta PIPE Shareholders FAST Shareholders Catch Shareholders (7) FAST Promote (8)

11.9x 1 3 . 5 x 11.0x 20.1x 15.6x 14.7x 12.8x 15.7x 14.4x 1 1 . 6 x 8 . 2x 16.0x 14.1x 10.7x C urrent New Market Proposed C ae s ars C hurchi l l Downs Bally's Texas Darden Roadhouse Restaurants C ra c k e r Barrel Brinker Mo n ar c h R ed R o c k Resorts Boyd Gaming PUBLIC COMPARABLES – Enterprise Value / 2021E EBITDA 15 1. Includes contribution of GNOG at a share price of $23.00. 2. Based on EBITDA projections of $575mm in 2021 and current market price of FST shares @ $12.63. 3. Based on Pro Forma 2021 EBITDA of $790mm. Estimate updated to $800 million as of June 30, 2021. 4. Assumes the company's outstanding convertible notes are converted into common stock. Land Based Operators with Online Presence R estau r ants Regional Gaming Operators Va l ua t i on (2) S c e n ar i o (3) Penn Na t iona l (4) 15 Golden Nugget Source: Capital IQ, Wall Street research and company filings. Note: Trading data as of 6/4/2021. Original Deal @ Pricing (1) Average: 15.8x Average: 12.5x Average: 13.6x New Proposal: 11.0x

16 16 DRAMATICALLY IMPROVED CAPITAL POSITION 5.6x 4.1x Original Deal New Deal Net Debt to EBITDA Multiple • Estimated Free Cash Flow of $400+ million ($ in millions)

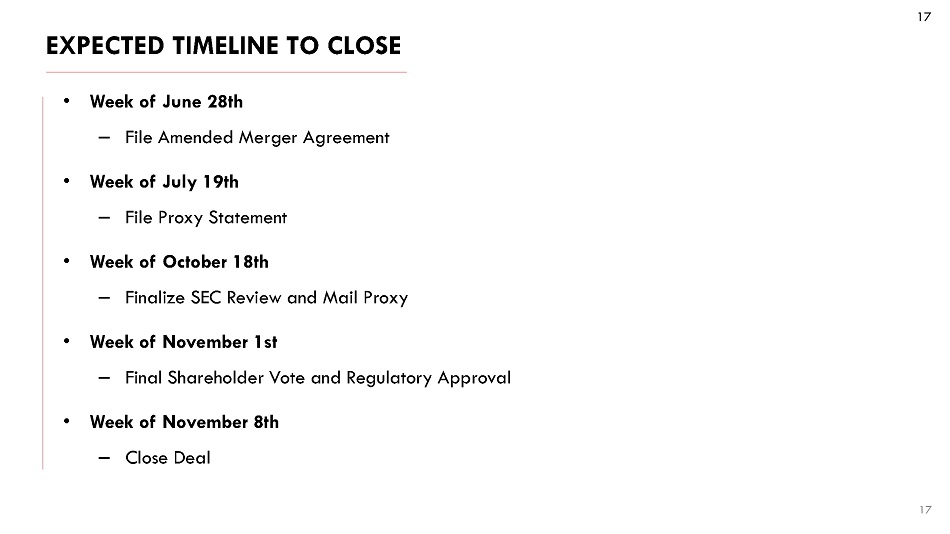

EXPECTED TIMELINE TO CLOSE 17 17 • Week of June 28th – File Amended Merger Agreement • Week of July 19th – File Proxy Statement • Week of October 18th – Finalize SEC Review and Mail Proxy • Week of November 1st – Final Shareholder Vote and Regulatory Approval • Week of November 8th – Close Deal

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Sony/Apollo bid for Paramount could be worth as much as $29 billion - Source

- Vail Resorts (MTN) Reports Certain Ski Season Metrics for the Season-to-Date Period Ended April 14

- Form 8.3 - Mattioli Woods plc

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share