Form 425 BB&T CORP Filed by: SUNTRUST BANKS INC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

February 7, 2019

Date of Report (Date of earliest event reported)

SunTrust Banks, Inc.

(Exact name of registrant as specified in its charter)

| Georgia | 001-08918 | 58-1575035 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 303 Peachtree Street, N.E. Atlanta, Georgia |

30308 | |

| (Address of principal executive offices) | (Zip Code) |

(800) 786-8787

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01. Other Events.

On February 7, 2019, BB&T Corporation (“BB&T”) and SunTrust Banks, Inc. (“SunTrust”) issued a joint press release announcing the execution of an Agreement and Plan of Merger, dated as of February 7, 2019 (the “Merger Agreement”), providing for the merger of BB&T and SunTrust. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

In connection with the announcement of the Merger Agreement, BB&T and SunTrust intend to provide supplemental information regarding the proposed transaction in connection with presentations to analysts and investors. The slides that will be made available in connection with the presentations are attached hereto as Exhibit 99.2 and are incorporated herein by reference.

ITEM 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

Description of Exhibit | |

| 99.1 | Joint Press Release, dated February 7, 2019 | |

| 99.2 | Investor Presentation, dated February 7, 2019 | |

Forward Looking Statements

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of BB&T and SunTrust. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on BB&T’s and SunTrust’s current expectations and assumptions regarding BB&T’s and SunTrust’s businesses, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect BB&T’s or SunTrust’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between BB&T and SunTrust, the outcome of any legal proceedings that may be instituted against BB&T or SunTrust, delays in completing the transaction, the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction) and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all, the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where BB&T and SunTrust do business, the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, diversion of management’s attention from ongoing business operations and opportunities, potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction, the ability to complete the transaction and integration of BB&T and SunTrust successfully, and the dilution caused by BB&T’s issuance of additional shares of its capital stock in connection with the transaction. Except to the extent required by applicable law or regulation, each of BB&T and SunTrust disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding BB&T, SunTrust and factors which could affect the forward-looking statements contained herein can be found in BB&T’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, its Quarterly Reports on Form 10-Q for the three-month periods ended March 31, 2018, June 30, 2018 and September 30, 2018, and its other filings with the Securities and Exchange Commission (“SEC”), and in SunTrust’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, its Quarterly Reports on Form 10-Q for the three-month periods ended March 31, 2018, June 30, 2018 and September 30, 2018, and its other filings with the SEC.

Additional Information about the Merger and Where to Find It

In connection with the proposed merger with SunTrust, BB&T will file with the SEC a registration statement on Form S-4 to register the shares of BB&T’s capital stock to be issued in connection with the merger. The registration statement will include a joint proxy statement/prospectus which will be sent to the shareholders of BB&T and SunTrust seeking their approval of the proposed transaction.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THESE DOCUMENTS DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT BB&T, SUNTRUST, AND THE PROPOSED TRANSACTION.

Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from BB&T at its website, www.bbt.com, or from SunTrust at its website, www.suntrust.com. Documents filed with the SEC by BB&T will be available free of charge by accessing BB&T’s website at http://bbt.com/ under the tab “About BB&T” and then under the heading “Investor Relations” or, alternatively, by directing a request by telephone or mail to BB&T Corporation, 200 West Second Street, Winston-Salem, North Carolina, (336) 733-3065, and documents filed with the SEC by SunTrust will be available free of charge by accessing SunTrust’s website at http://suntrust.com/ under the tab “Investor Relations,” and then under the heading “Financial Information” or, alternatively, by directing a request by telephone or mail to SunTrust Banks, Inc., 303 Peachtree Street, N.E., Atlanta, Georgia 30308, (877) 930-8971.

Participants in the Solicitation

BB&T, SunTrust and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of BB&T and SunTrust in connection with the proposed transaction under the rules of the SEC. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about BB&T, and its directors and executive officers, may be found in the definitive proxy statement of BB&T relating to its 2018 Annual Meeting of Shareholders filed with the SEC on March 15, 2018, and other documents filed by BB&T with the SEC. Additional information about SunTrust, and its directors and executive officers, may be found in the definitive proxy statement of SunTrust relating to its 2018 Annual Meeting of Shareholders filed with the SEC on March 9, 2018, and other documents filed by SunTrust with the SEC. These documents can be obtained free of charge from the sources described above.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SunTrust Banks, Inc. | ||||||

| (Registrant) | ||||||

| By: | /s/ Curt Phillips | |||||

| Name: | Curt Phillips | |||||

| Title: | Senior Vice President, Assistant General Counsel and Assistant Corporate Secretary | |||||

Date: February 7, 2019

Exhibit 99.1

| BB&T Contacts: | SunTrust Contacts: | |||

| Media | Media | Media | ||

| Brian Davis | Sue Mallino | Tom Johnson | ||

| (336) 733-2542 | (404) 813-0463 | (212) 371-5999 | ||

| BB&T Corporate Communications | SunTrust Corporate Communications | Abernathy MacGregor Group | ||

| [email protected] | [email protected] | [email protected] | ||

| Investors | Investors | |||

| Richard Baytosh | Ankur Vyas | |||

| BB&T Investor Relations | Director of Investor Relations | |||

| (336) 733-0732 | (404) 827-6714 | |||

| [email protected] | [email protected] | |||

BB&T and SunTrust to Combine in Merger of Equals to Create the Premier Financial Institution

Combination of two iconic franchises creates sixth-largest U.S. bank holding company with 275 years of combined history and culture serving clients and communities in high-growth markets

Enhanced scale and financial strength will accelerate investment in transformative technology to embrace disruption and create a more distinctive client experience

Expanded fee income base will create opportunities to build scale in specialized businesses across a larger client base

Compelling value creation expected for both companies’ shareholders as demonstrated by double-digit earnings per share accretion by 2021

Estimated net cost synergies of at least $1.6 billion by 2022

Proven management teams with history of successful merger integrations, strong risk management skills and shared mission- and purpose-driven cultures

Combined company to operate under a new name and be headquartered in Charlotte, NC while maintaining significant operations and investment in Winston-Salem, NC and Atlanta, GA

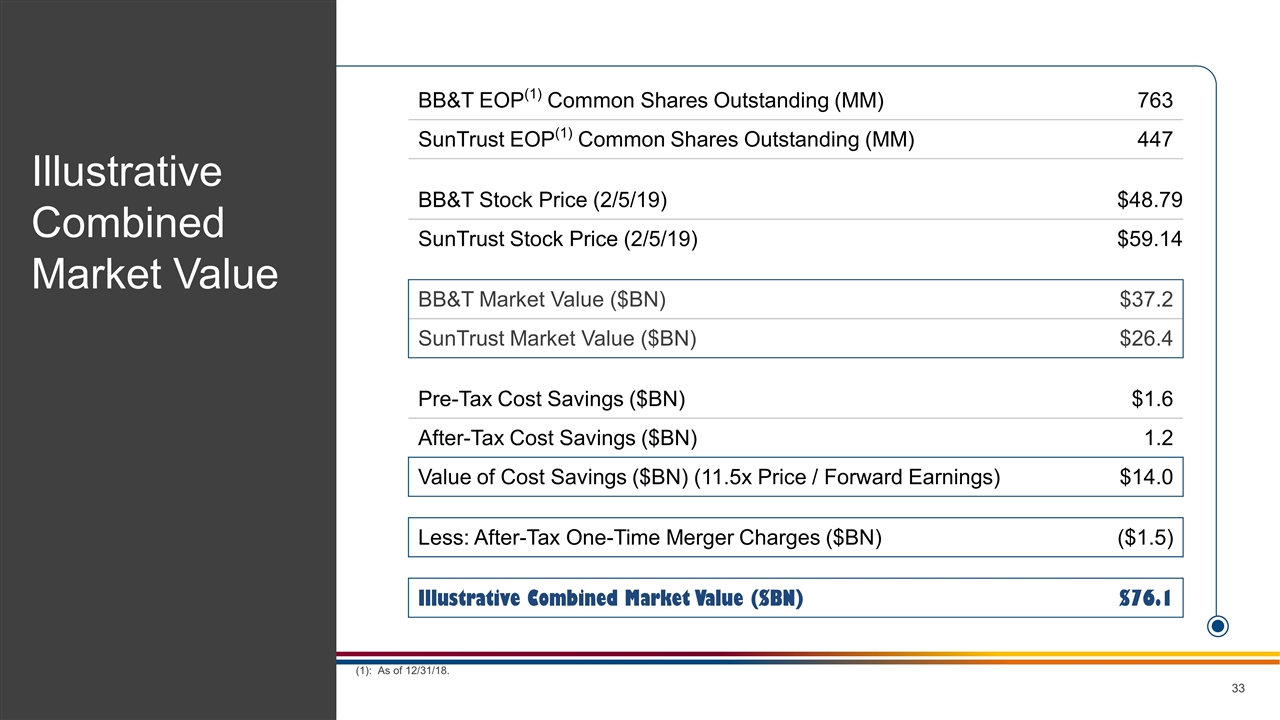

Atlanta, GA and Winston-Salem, NC, February 7, 2019 – SunTrust Banks, Inc. (NYSE: STI) and BB&T Corporation (NYSE: BBT) announced today that both companies’ boards of directors have unanimously approved a definitive agreement to combine in an all-stock merger of equals valued at approximately $66 billion. The combined company will be the sixth-largest U.S. bank based on assets and deposits.

The pro forma company will have approximately $442 billion in assets, $301 billion in loans, and $324 billion in deposits serving more than 10 million households in the United States, with leading market share in many of the most attractive, high-growth markets in the country. The incremental scale positions the new company to achieve industry-leading financial and operating metrics with the strongest return profile among its peers.

In a reflection of the equal contribution both banks bring to the new institution, the combined company will operate under a new name and brand, which will be determined prior to closing. The combined company’s board of directors and executive management team will be evenly split between the two

1

institutions. A new corporate headquarters will be established in Charlotte, NC, including an Innovation and Technology Center to drive digital transformation. In the current home markets for both companies, the combined company will maintain the Community Banking Center in Winston-Salem, NC and the Wholesale Banking Center in Atlanta, GA. This continued strong presence is also supported by the combined company’s commitment to increase the respective banks’ current levels of community investment.

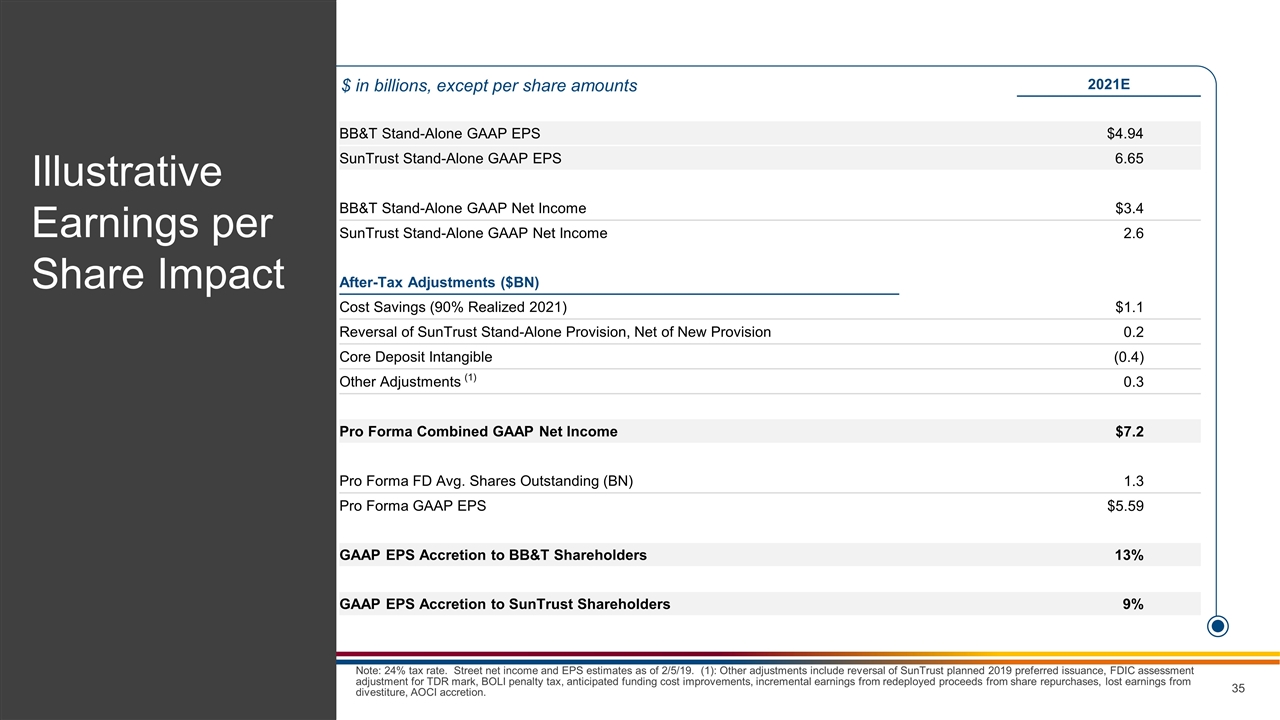

GAAP and Cash EPS accretion per BB&T share in 2021 is expected to be approximately 13% and 17%, respectively (based on Street estimates). GAAP and Cash EPS accretion per SunTrust share in 2021 is expected to be approximately 9% and 16%, respectively (based on Street estimates). SunTrust shareholders will receive a 5% increase in their dividend upon consummation of the transaction based upon each Company’s current dividend per share. Under the terms of the merger agreement, SunTrust shareholders will receive 1.295 shares of BB&T for each SunTrust share they own. BB&T shareholders will own approximately 57% and SunTrust shareholders will own approximately 43% of the combined company.

“This is a true merger of equals, combining the best of both companies to create the premier financial institution of the future,” said BB&T Chairman and Chief Executive Officer Kelly S. King. “It’s an extraordinarily attractive financial proposition that provides the scale needed to compete and win in the rapidly evolving world of financial services. Together with Bill’s leadership and our new SunTrust teammates, we’re going to bring the best of both companies forward to serve our clients and communities.”

William H. Rogers, Jr., Chairman and Chief Executive Officer of SunTrust, said, “By bringing together these two mission- and purpose-driven institutions, we will accelerate our capacity to invest in transformational technologies for our clients. Our shared culture embraces the disruption of technology and we will take this innovative mindset to expand our leadership in the next chapter of these historic brands. With our geographic position, enhanced scale and leading financial profile, these two companies will achieve substantially more for clients, teammates, associates, communities, and shareholders than we could alone. I have tremendous respect for Kelly, his leadership team and the BB&T associates. We will leverage our respective strengths as we focus together on the future.”

Strategic and Financial Benefits of the Proposed Merger

| • | Strong Cultural Alignment: The combined company will preserve and maintain the strong cultures of both BB&T and SunTrust to deliver superior client service and preserve the community bank model to maintain close ties to shared local communities. With its stronger position, it will also deliver a collective set of training, leadership, and development programs to attract and retain the industry’s top talent across its expanded career opportunities. |

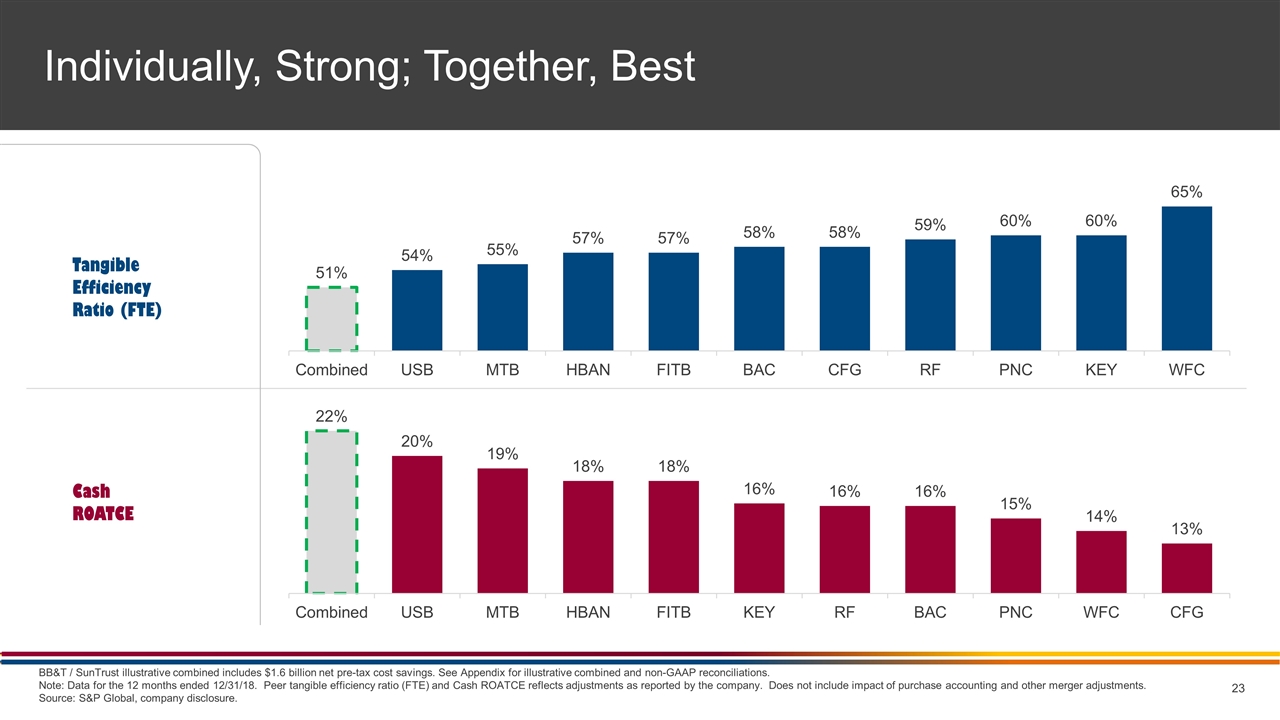

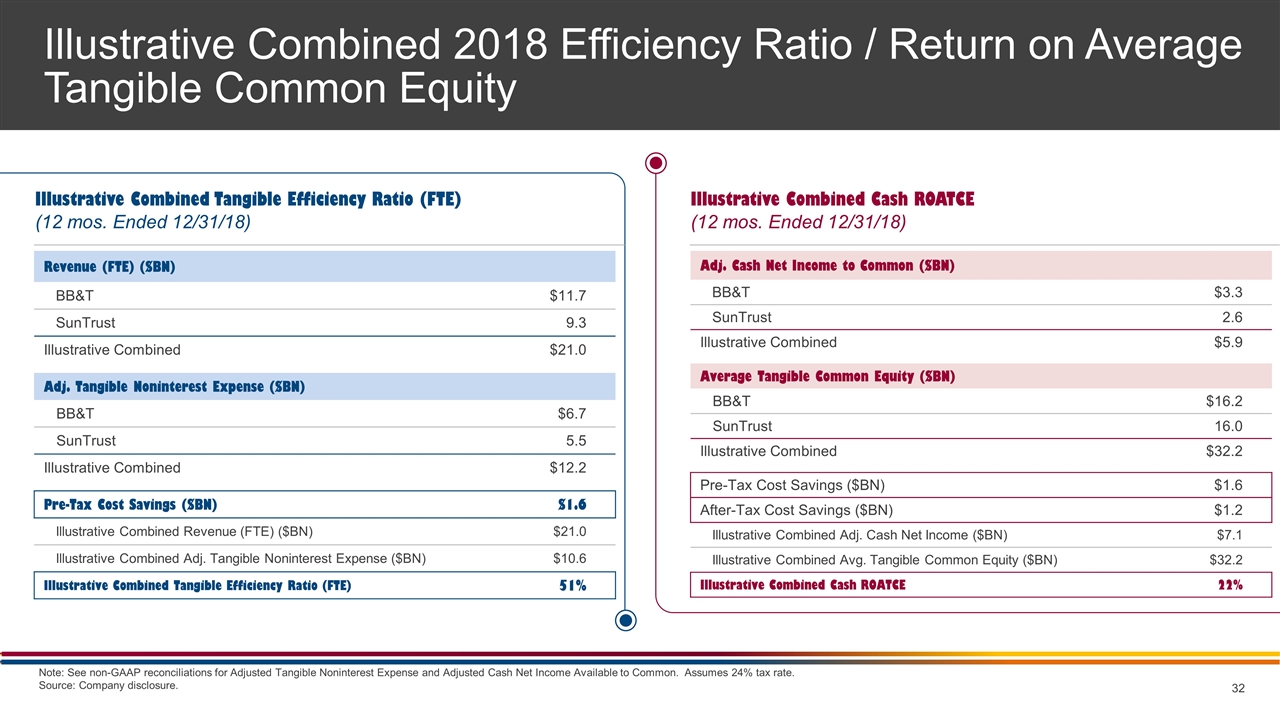

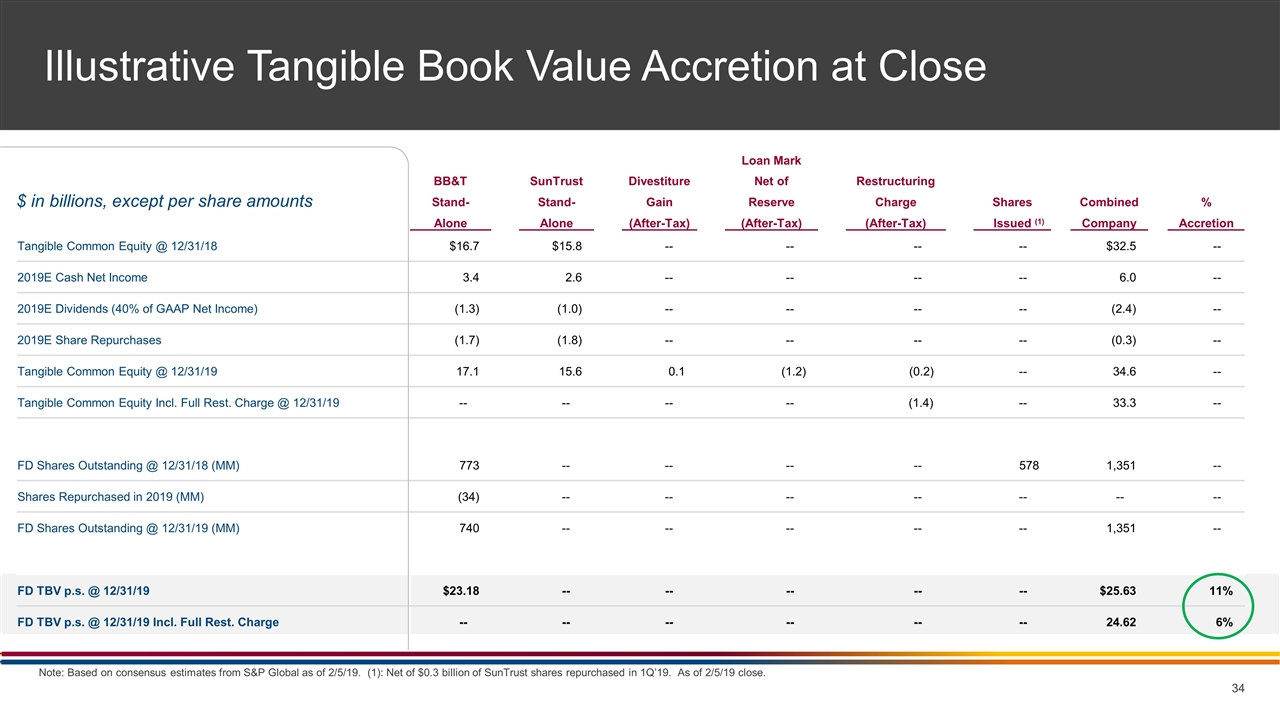

| • | Leading Financial Profile and Operating Metrics: The combined company will be well positioned to achieve industry-leading financial and operating metrics with the strongest return profile amongst its peers. The expected benefits of the transaction include a pro forma efficiency ratio of 51%, peer best ROATCE of 22% and projected tangible book value per share accretion at close for BB&T shareholders of approximately 11%, or 6% fully accounting for one-time merger charges. The merger is expected to generate an internal rate of return of approximately 18%. |

| • | Increased Profitability and Scale to Drive New Innovations: The combined company will take advantage of its enhanced scale to focus on selecting best of breed systems and processes and making significant investments in technology to create a sustainable competitive advantage in an increasingly digital-first world. |

2

| • | Revenue Growth Through Complementary Businesses: The combined company will leverage its complementary businesses to generate additional revenue opportunities through BB&T’s Community Banking and insurance operation and SunTrust’s leading middle market corporate & investment banking business and digital consumer lending platform. |

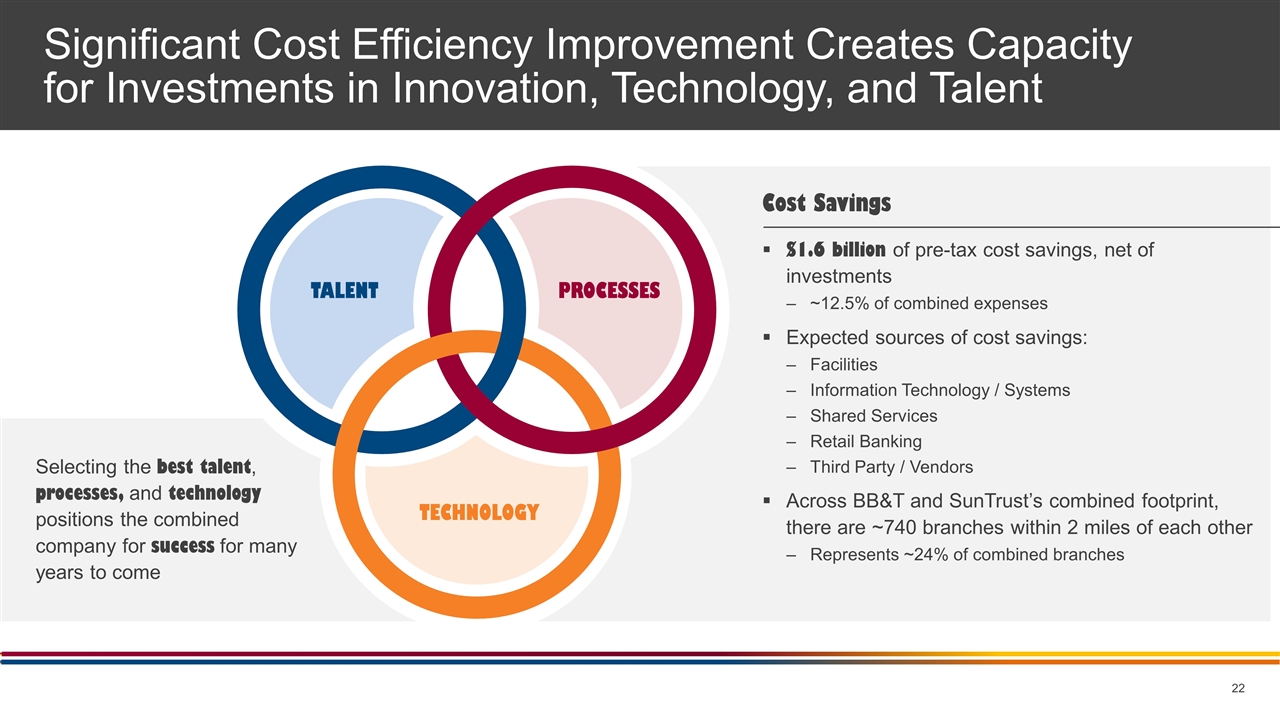

| • | Significant cost synergies: Expected to deliver approximately $1.6 billion in annual net cost synergies by 2022. The primary sources of cost savings are expected to be in facilities, information technology/systems, shared services, retail banking and third-party vendors. |

New Company Leadership Team, Succession Plan and Governance

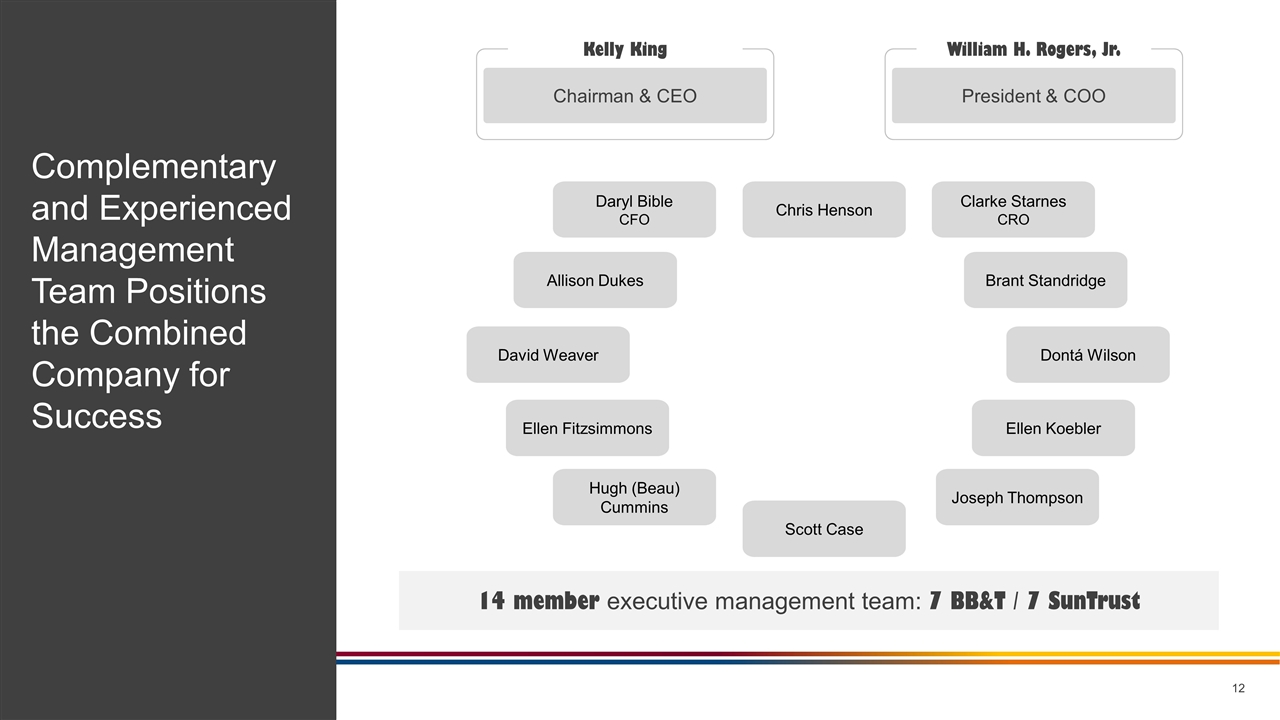

Kelly S. King, Chairman and Chief Executive Officer of BB&T and its bank subsidiary, will serve as Chairman and Chief Executive Officer of the combined company and its bank subsidiary until Sept. 12, 2021, after which time he will serve as Executive Chairman of both entities until March 12, 2022. King will continue to serve on the Board of Directors of the combined company until the end of 2023.

William H. Rogers, Jr., Chairman and Chief Executive Officer of SunTrust will serve as President and Chief Operating Officer of the combined company and its bank subsidiary until Sept. 12, 2021, at which time he will become Chief Executive Officer of the combined company and its bank subsidiary. He will also hold a seat on the combined company’s Board of Directors through his position as President and Chief Operating Officer and then Chief Executive Officer. On March 12, 2022, Rogers will also become Chairman and Chief Executive Officer of the combined company and its bank subsidiary.

Upon the closing of the transaction, the Board of Directors of the combined company will consist of members equally split between BB&T and SunTrust’s current Directors. David M. Ratcliffe, current Lead Director of SunTrust, will serve as Lead Director of the combined company until March 12, 2022 after which the Lead Director will be a legacy BB&T Director.

The combined company’s executive management team will be comprised equally from SunTrust and BB&T. They include Chris Henson, Clarke Starnes (Chief Risk Officer), Daryl Bible (Chief Financial Officer), Allison Dukes, Brant Standridge, David Weaver, Dontá Wilson, Ellen Fitzsimmons, Ellen Koebler, Hugh (Beau) Cummins, Joseph Thompson and Scott Case.

Timing and Approvals

The merger is expected to close in the fourth quarter of 2019, subject to satisfaction of customary closing conditions, including receipt of customary regulatory approvals and approval by the shareholders of each company.

Advisors

RBC Capital Markets served as financial advisor and Wachtell, Lipton, Rosen & Katz served as legal counsel to BB&T in this transaction. Goldman Sachs and SunTrust Robinson Humphrey served as financial advisors and Sullivan & Cromwell served as legal counsel to SunTrust in this transaction.

Investor Call

To listen to BB&T and SunTrust’s live conference call at 8:30 a.m. ET today, please call 888-599-8685 and enter the participant code 888 814. A presentation will be used during the earnings conference call and is available on BB&T’s website at https://bbt.investorroom.com/webcasts-and-presentations or SunTrust’s website at http://investors.suntrust.com/events-and-presentations. Replays of the conference call will be available for 30 days by dialing 888-203-1112 (access code 7188 590).

3

The presentation, including an appendix reconciling non-GAAP disclosures, is available at https://bbt.investorroom.com/webcasts-and-presentations or http://investors.suntrust.com/events-and-presentations.

Website

You can also hear from both CEOs and learn more about today’s announcement at: https://thepremierfinancialinstitution.com/.

About BB&T

BB&T is one of the largest financial services holding companies in the U.S. with $225.7 billion in assets and market capitalization of approximately $33.1 billion as of December 31, 2018. Building on a long tradition of excellence in community banking, BB&T offers a wide range of financial services including retail and commercial banking, investments, insurance, wealth management, asset management, mortgage, corporate banking, capital markets and specialized lending. Based in Winston-Salem, N.C., BB&T operates more than 1,800 financial centers in 15 states and Washington, D.C. and is consistently recognized for outstanding client service by Greenwich Associates for small business and middle market banking. More information about BB&T and its full line of products and services is available at www.BBT.com.

About SunTrust

SunTrust Banks, Inc. (NYSE: STI) is a purpose-driven company dedicated to Lighting the Way to Financial Well-Being for the people, businesses, and communities it serves. SunTrust leads onUp, a national movement inspiring Americans to build financial confidence. Headquartered in Atlanta, the Company has two business segments: Consumer and Wholesale. Its flagship subsidiary, SunTrust Bank, operates an extensive branch and ATM network throughout the high-growth Southeast and Mid-Atlantic states, along with 24-hour digital access. Certain business lines serve consumer, commercial, corporate, and institutional clients nationally. As of December 31, 2018, SunTrust had total assets of $216 billion and total deposits of $163 billion. The Company provides deposit, credit, trust, investment, mortgage, asset management, securities brokerage, and capital market services. Learn more at www.suntrust.com.

Forward Looking Statements

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of BB&T and SunTrust. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on BB&T’s and SunTrust’s current expectations and assumptions regarding BB&T’s and SunTrust’s businesses, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect BB&T’s or SunTrust’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between BB&T and SunTrust, the outcome of any legal proceedings that may be instituted against BB&T or SunTrust, delays in completing the transaction, the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction) and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all, the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where BB&T and SunTrust do business, the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, diversion of

4

management’s attention from ongoing business operations and opportunities, potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction, the ability to complete the transaction and integration of BB&T and SunTrust successfully, and the dilution caused by BB&T’s issuance of additional shares of its capital stock in connection with the transaction. Except to the extent required by applicable law or regulation, each of BB&T and SunTrust disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding BB&T, SunTrust and factors which could affect the forward-looking statements contained herein can be found in BB&T’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, its Quarterly Reports on Form 10-Q for the three-month periods ended March 31, 2018, June 30, 2018 and September 30, 2018, and its other filings with the Securities and Exchange Commission (“SEC”), and in SunTrust’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, its Quarterly Reports on Form 10-Q for the three-month periods ended March 31, 2018, June 30, 2018 and September 30, 2018, and its other filings with the SEC.

Additional Information and Where to Find It

In connection with the proposed merger with SunTrust, BB&T will file with the SEC a registration statement on Form S-4 to register the shares of BB&T’s capital stock to be issued in connection with the merger. The registration statement will include a joint proxy statement/prospectus which will be sent to the shareholders of BB&T and SunTrust seeking their approval of the proposed transaction.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THESE DOCUMENTS DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT BB&T, SUNTRUST, AND THE PROPOSED TRANSACTION.

Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from BB&T at its website, www.bbt.com, or from SunTrust at its website, www.suntrust.com. Documents filed with the SEC by BB&T will be available free of charge by accessing BB&T’s website at http://bbt.com/ under the tab “About BB&T” and then under the heading “Investor Relations” or, alternatively, by directing a request by telephone or mail to BB&T Corporation, 200 West Second Street, Winston-Salem, North Carolina, (336) 733-3065, and documents filed with the SEC by SunTrust will be available free of charge by accessing SunTrust’s website at http://suntrust.com/ under the tab “Investor Relations,” and then under the heading “Financial Information” or, alternatively, by directing a request by telephone or mail to SunTrust Banks, Inc., 303 Peachtree Street, N.E., Atlanta, Georgia 30308, (877) 930-8971.

Participants in the Solicitation

BB&T, SunTrust and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of BB&T and SunTrust in connection with the proposed transaction under the rules of the SEC. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about BB&T, and its directors and executive officers, may be found in the definitive proxy statement of BB&T relating to its 2018 Annual Meeting of Shareholders filed with the SEC on March 15, 2018, and other documents filed by BB&T with the SEC. Additional information about SunTrust, and its directors and executive officers, may be found in the definitive proxy statement of SunTrust relating to its 2018 Annual Meeting of Shareholders filed with the SEC on March 9, 2018, and other documents filed by SunTrust with the SEC. These documents can be obtained free of charge from the sources described above.

5

Transformational Merger of Equals to Create The Premier Financial Institution February 7, 2019 Exhibit 99.2

Introduction 6 Transaction Terms 11 Pro Forma Business Mix 14 Pro Forma Financial Profile and Impact 21 Conclusion 28 Agenda Presenters Kelly King Chairman & CEO, BB&T Corporation William H. Rogers, Jr. Chairman & CEO, SunTrust Banks, Inc. Allison Dukes CFO, SunTrust Banks, Inc. Daryl Bible CFO, BB&T Corporation William H. Rogers, Jr. Chairman & CEO, SunTrust Banks, Inc. I II III IV V Table of Contents

Forward-Looking / Non-GAAP Statements Cautionary Note Regarding Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of BB&T and SunTrust. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on BB&T’s and SunTrust’s current expectations and assumptions regarding BB&T’s and SunTrust’s businesses, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect BB&T’s or SunTrust’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between BB&T and SunTrust, the outcome of any legal proceedings that may be instituted against BB&T or SunTrust, delays in completing the transaction, the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction) and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all, the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where BB&T and SunTrust do business, the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, diversion of management’s attention from ongoing business operations and opportunities, potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction, the ability to complete the transaction and integration of BB&T and SunTrust successfully, and the dilution caused by BB&T’s issuance of additional shares of its capital stock in connection with the transaction. Except to the extent required by applicable law or regulation, each of BB&T and SunTrust disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding BB&T, SunTrust and factors which could affect the forward-looking statements contained herein can be found in BB&T’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, its Quarterly Reports on Form 10-Q for the three-month periods ended March 31, 2018, June 30, 2018 and September 30, 2018, and its other filings with the Securities and Exchange Commission (“SEC”), and in SunTrust’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, its Quarterly Reports on Form 10-Q for the three-month periods ended March 31, 2018, June 30, 2018 and September 30, 2018, and its other filings with the SEC. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures that are not in accordance with U.S. generally accepted accounting principles (GAAP). BB&T and SunTrust use certain non-GAAP financial measures to provide meaningful, supplemental information regarding their operational results and to enhance investors’ overall understanding of BB&T’s and SunTrust’s financial performance. The limitations associated with non-GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. These disclosures should not be considered an alternative to BB&T’s and SunTrust’s GAAP results.

Additional Statements Additional Information about the Merger and Where to Find It In connection with the proposed merger with SunTrust, BB&T will file with the SEC a registration statement on Form S-4 to register the shares of BB&T’s capital stock to be issued in connection with the merger. The registration statement will include a joint proxy statement/prospectus which will be sent to the shareholders of BB&T and SunTrust seeking their approval of the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THESE DOCUMENTS DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT BB&T, SUNTRUST, AND THE PROPOSED TRANSACTION. Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from BB&T at its website, www.bbt.com, or from SunTrust at its website, www.suntrust.com. Documents filed with the SEC by BB&T will be available free of charge by accessing BB&T’s website at http://bbt.com/ under the tab “About BB&T” and then under the heading “Investor Relations” or, alternatively, by directing a request by telephone or mail to BB&T Corporation, 200 West Second Street, Winston-Salem, North Carolina, (336) 733-3065, and documents filed with the SEC by SunTrust will be available free of charge by accessing SunTrust’s website at http://suntrust.com/ under the tab “Investor Relations,” and then under the heading “Financial Information” or, alternatively, by directing a request by telephone or mail to SunTrust Banks, Inc., 303 Peachtree Street, N.E., Atlanta, Georgia 30308, (877) 930-8971. Participants in the Solicitation BB&T, SunTrust and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of BB&T and SunTrust in connection with the proposed transaction under the rules of the SEC. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about BB&T, and its directors and executive officers, may be found in the definitive proxy statement of BB&T relating to its 2018 Annual Meeting of Shareholders filed with the SEC on March 15, 2018, and other documents filed by BB&T with the SEC. Additional information about SunTrust, and its directors and executive officers, may be found in the definitive proxy statement of SunTrust relating to its 2018 Annual Meeting of Shareholders filed with the SEC on March 9, 2018, and other documents filed by SunTrust with the SEC. These documents can be obtained free of charge from the sources described above.

Section I Introduction

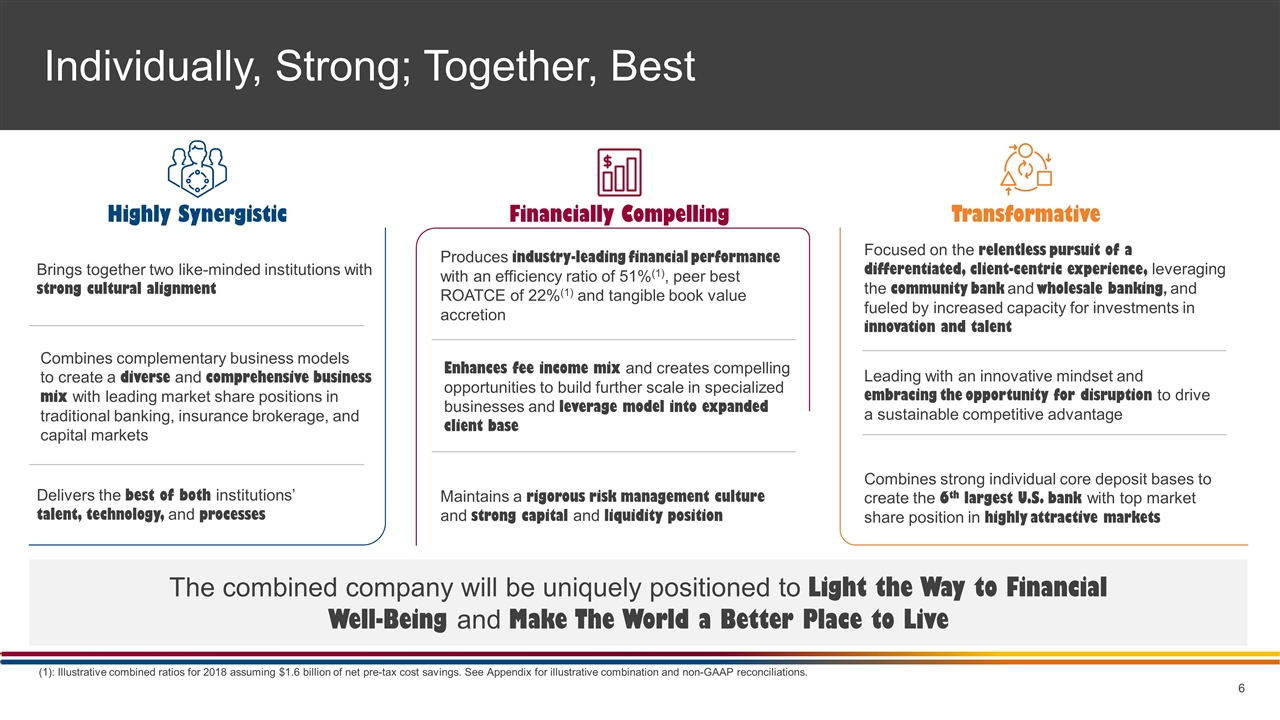

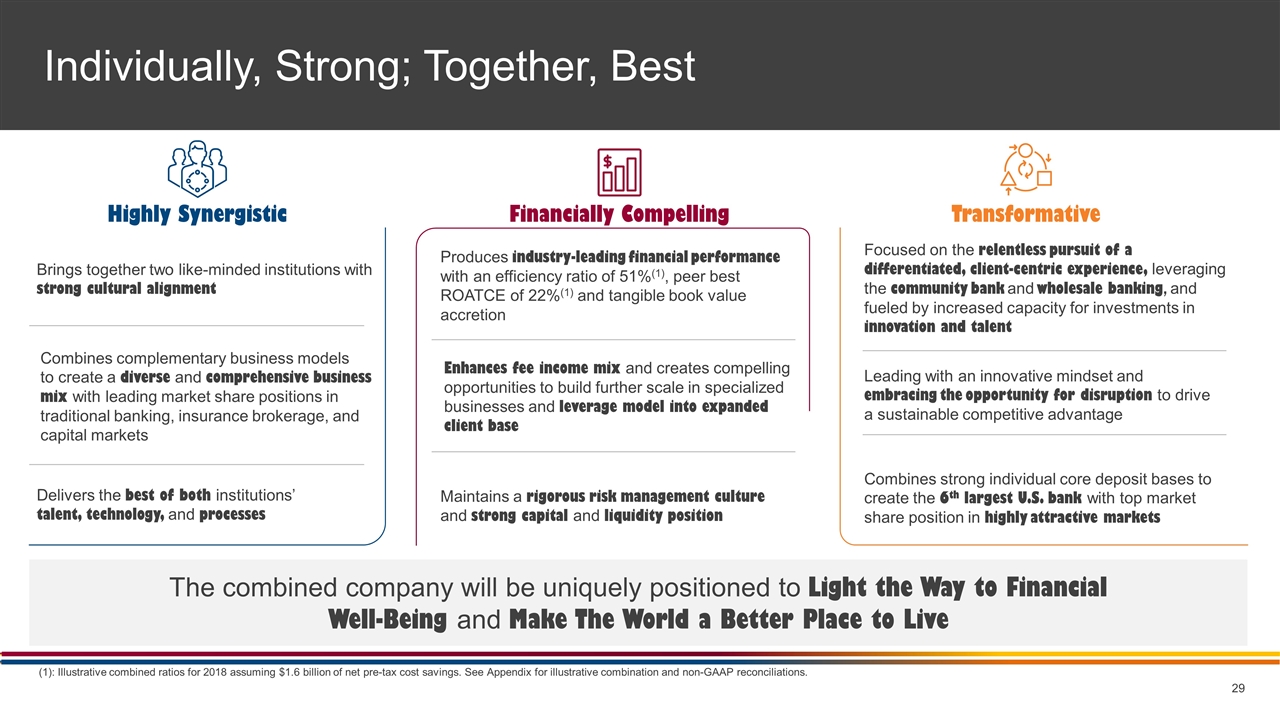

Individually, Strong; Together, Best Highly Synergistic Transformative Financially Compelling Brings together two like-minded institutions with strong cultural alignment Produces industry-leading financial performance with an efficiency ratio of 51%(1), peer best ROATCE of 22%(1) and tangible book value accretion Focused on the relentless pursuit of a differentiated, client-centric experience, leveraging the community bank and wholesale banking, and fueled by increased capacity for investments in innovation and talent Combines complementary business models to create a diverse and comprehensive business mix with leading market share positions in traditional banking, insurance brokerage, and capital markets Enhances fee income mix and creates compelling opportunities to build further scale in specialized businesses and leverage model into expanded client base Leading with an innovative mindset and embracing the opportunity for disruption to drive a sustainable competitive advantage Delivers the best of both institutions’ talent, technology, and processes Maintains a rigorous risk management culture and strong capital and liquidity position Combines strong individual core deposit bases to create the 6th largest U.S. bank with top market share position in highly attractive markets The combined company will be uniquely positioned to Light the Way to Financial Well-Being and Make The World a Better Place to Live (1): Illustrative combined ratios for 2018 assuming $1.6 billion of net pre-tax cost savings. See Appendix for illustrative combination and non-GAAP reconciliations.

This is not just a merger of two legacy institutions; we are combining two companies with strong foundations to create the premier financial institution Mission and purpose-driven culture will be enhanced when combined client relationships, top financial performance, leading the movement for financial well-being Culture Matters – The Optimal Foundation Two like-minded institutions with strong cultural alignment and a focus forward Helping our CLIENTS achieve economic success and financial security Creating a place where our ASSOCIATES can learn, grow and be fulfilled in their work Making the COMMUNITIES in which we work better places to be; and thereby: Optimizing the long-term return to our SHAREHOLDERS, while providing a safe and sound investment Our values: trust, passion to win, precision, courage Our principles: client first, one team, executional excellence, profitable growth Our performance promise: we will be the best financial services company through deepest client relationships, top financial performance, leading the movement for financial well-being Make the World A Better Place To Live Lighting the Way to Financial Well-Being

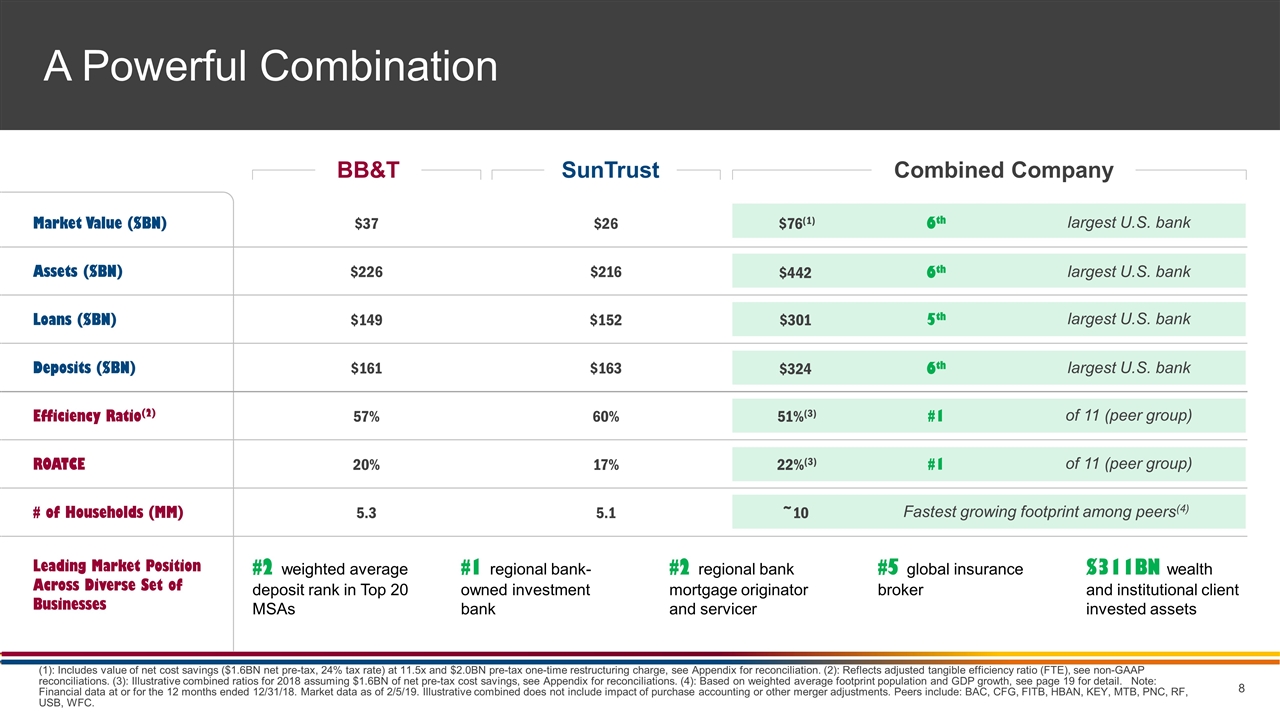

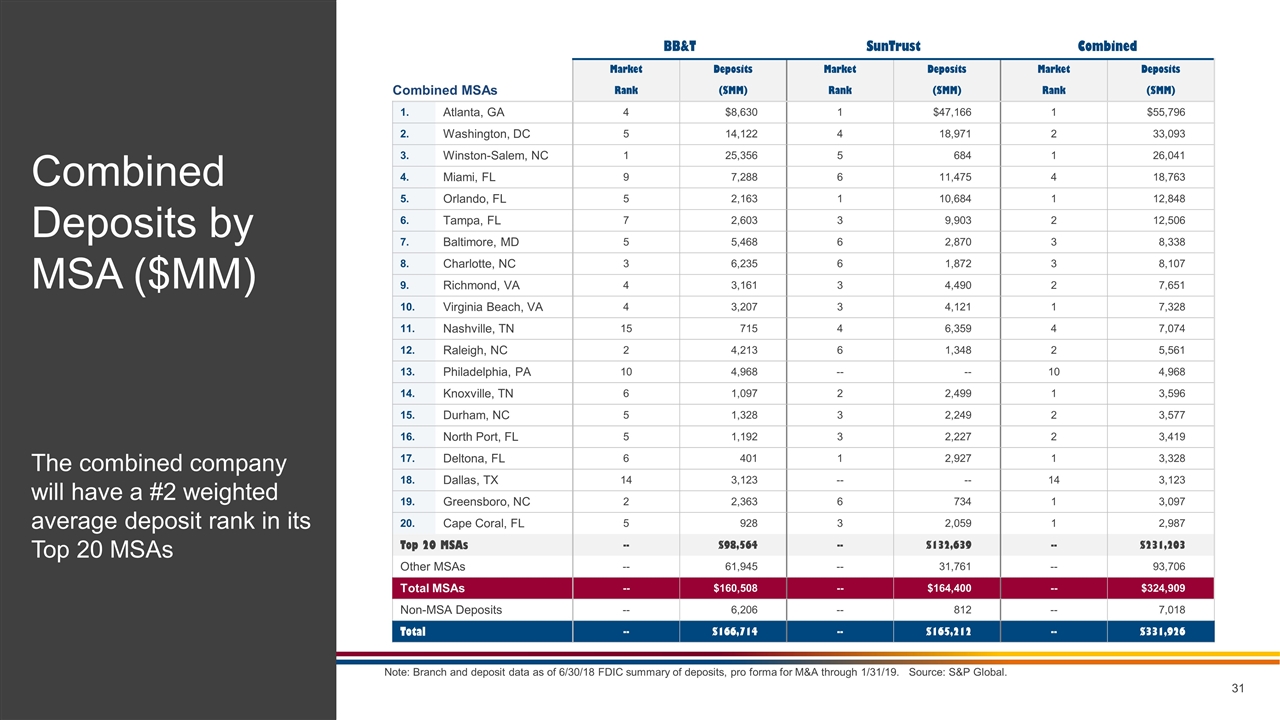

A Powerful Combination Efficiency Ratio(2) # of Households (MM) Leading Market Position Across Diverse Set of Businesses Market Value ($BN) Assets ($BN) Loans ($BN) Deposits ($BN) ROATCE Combined Company #2 weighted average deposit rank in Top 20 MSAs #1 regional bank-owned investment bank #2 regional bank mortgage originator and servicer #5 global insurance broker $311BN wealth and institutional client invested assets 57% 5.3 $37 $226 $149 $161 20% 60% 5.1 $26 $216 $152 $163 17% BB&T SunTrust (1): Includes value of net cost savings ($1.6BN net pre-tax, 24% tax rate) at 11.5x and $2.0BN pre-tax one-time restructuring charge, see Appendix for reconciliation. (2): Reflects adjusted tangible efficiency ratio (FTE), see non-GAAP reconciliations. (3): Illustrative combined ratios for 2018 assuming $1.6BN of net pre-tax cost savings, see Appendix for reconciliations. (4): Based on weighted average footprint population and GDP growth, see page 19 for detail. Note: Financial data at or for the 12 months ended 12/31/18. Market data as of 2/5/19. Illustrative combined does not include impact of purchase accounting or other merger adjustments. Peers include: BAC, CFG, FITB, HBAN, KEY, MTB, PNC, RF, USB, WFC. $76(1) 6th largest U.S. bank $442 6th largest U.S. bank $301 5th largest U.S. bank $324 6th largest U.S. bank 51%(3) #1 of 11 (peer group) 22%(3) #1 of 11 (peer group) ~10 Fastest growing footprint among peers(4)

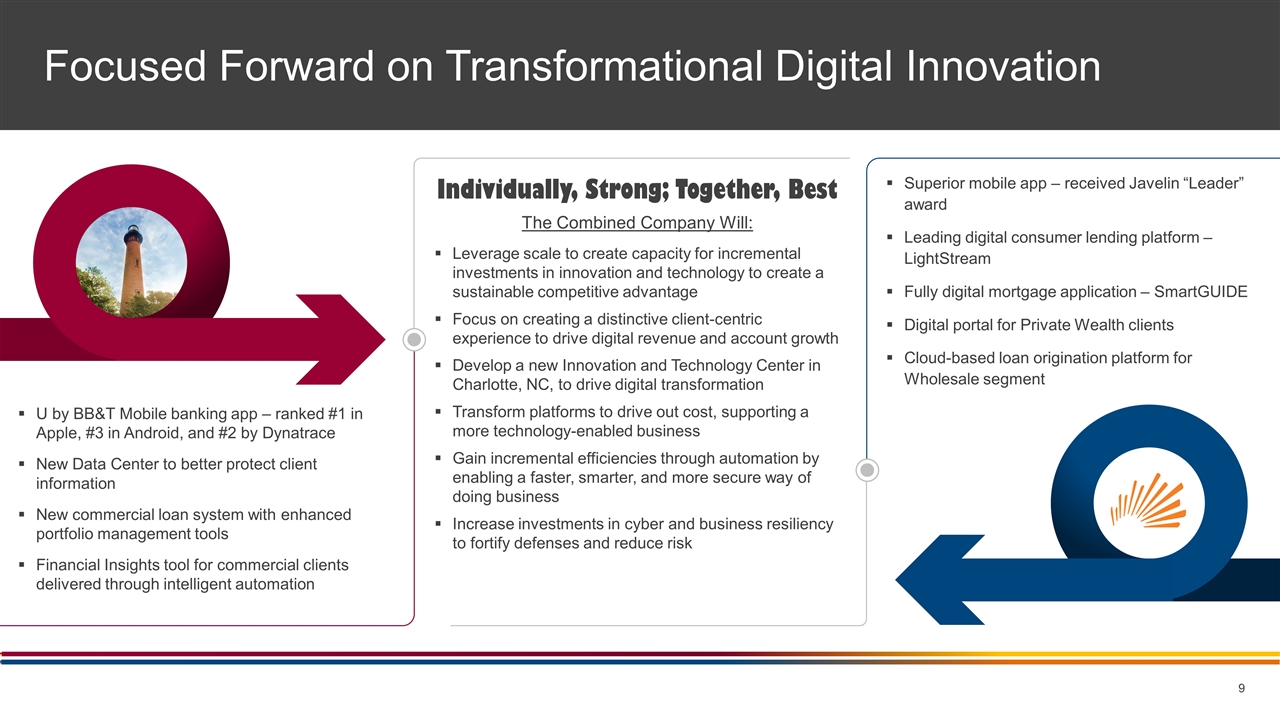

Focused Forward on Transformational Digital Innovation U by BB&T Mobile banking app – ranked #1 in Apple, #3 in Android, and #2 by Dynatrace New Data Center to better protect client information New commercial loan system with enhanced portfolio management tools Financial Insights tool for commercial clients delivered through intelligent automation Superior mobile app – received Javelin “Leader” award Leading digital consumer lending platform –LightStream Fully digital mortgage application – SmartGUIDE Digital portal for Private Wealth clients Cloud-based loan origination platform for Wholesale segment Individually, Strong; Together, Best The Combined Company Will: Leverage scale to create capacity for incremental investments in innovation and technology to create a sustainable competitive advantage Focus on creating a distinctive client-centric experience to drive digital revenue and account growth Develop a new Innovation and Technology Center in Charlotte, NC, to drive digital transformation Transform platforms to drive out cost, supporting a more technology-enabled business Gain incremental efficiencies through automation by enabling a faster, smarter, and more secure way of doing business Increase investments in cyber and business resiliency to fortify defenses and reduce risk

Section II Transaction Terms

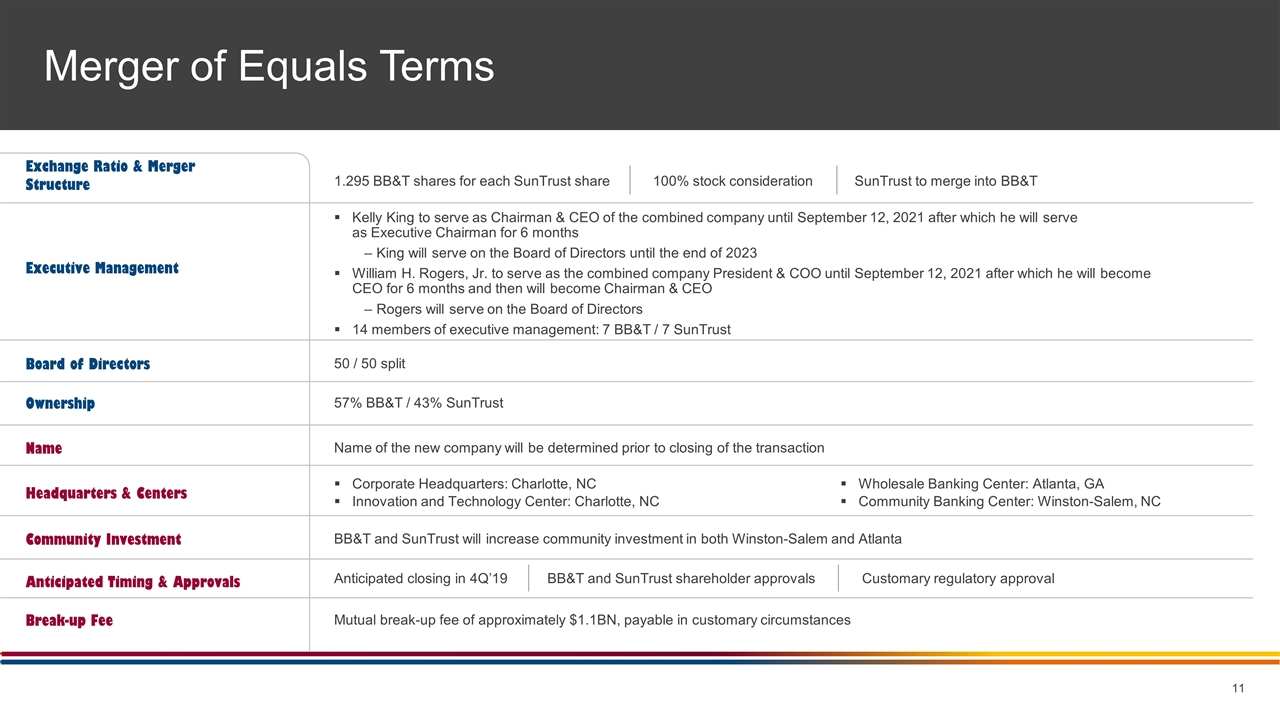

Merger of Equals Terms Name of the new company will be determined prior to closing of the transaction Name BB&T and SunTrust will increase community investment in both Winston-Salem and Atlanta Community Investment 50 / 50 split Board of Directors 57% BB&T / 43% SunTrust Ownership Break-up Fee Mutual break-up fee of approximately $1.1BN, payable in customary circumstances Exchange Ratio & Merger Structure 1.295 BB&T shares for each SunTrust share 100% stock consideration SunTrust to merge into BB&T Anticipated Timing & Approvals Anticipated closing in 4Q’19 BB&T and SunTrust shareholder approvals Corporate Headquarters: Charlotte, NC Innovation and Technology Center: Charlotte, NC Headquarters & Centers Wholesale Banking Center: Atlanta, GA Community Banking Center: Winston-Salem, NC Executive Management Kelly King to serve as Chairman & CEO of the combined company until September 12, 2021 after which he will serve as Executive Chairman for 6 months King will serve on the Board of Directors until the end of 2023 William H. Rogers, Jr. to serve as the combined company President & COO until September 12, 2021 after which he will become CEO for 6 months and then will become Chairman & CEO Rogers will serve on the Board of Directors 14 members of executive management: 7 BB&T / 7 SunTrust Customary regulatory approval

14 member executive management team: 7 BB&T / 7 SunTrust Kelly King Chairman & CEO William H. Rogers, Jr. President & COO Chris Henson Clarke Starnes CRO Brant Standridge Dontá Wilson Ellen Koebler Joseph Thompson Scott Case Hugh (Beau) Cummins Ellen Fitzsimmons David Weaver Allison Dukes Daryl Bible CFO Complementary and Experienced Management Team Positions the Combined Company for Success

Section III Pro Forma Business Mix

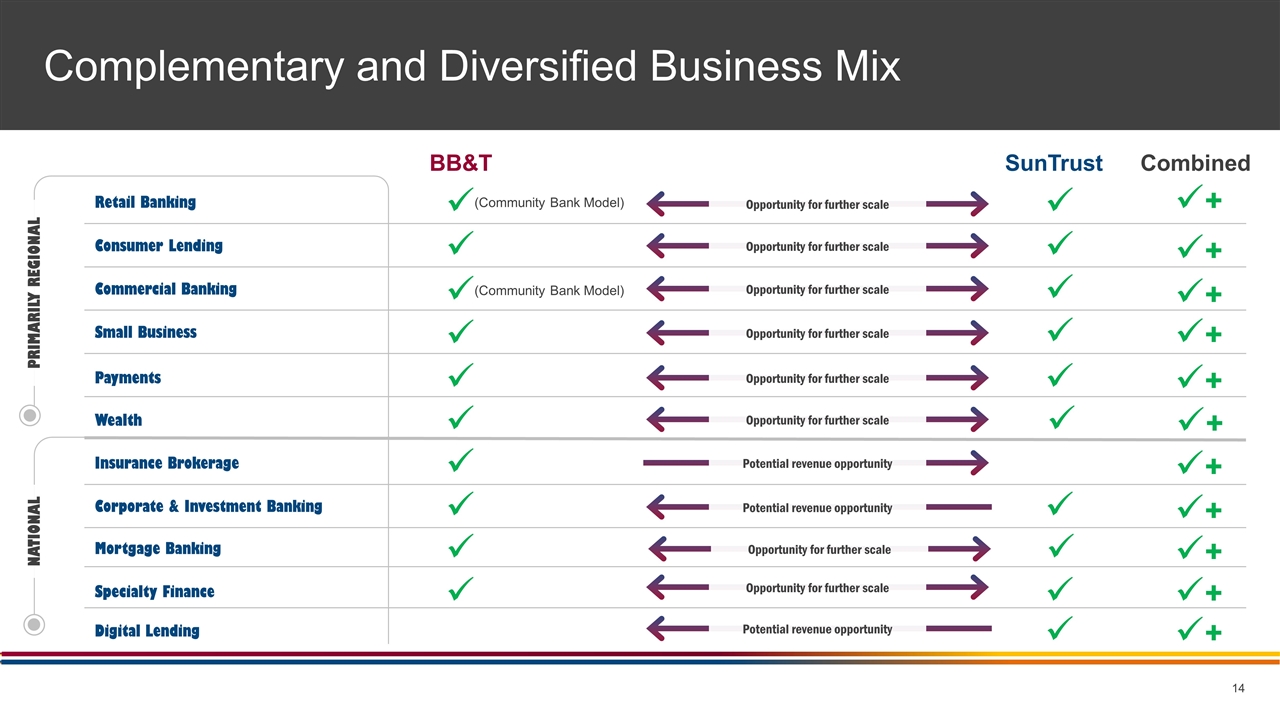

Complementary and Diversified Business Mix Retail Banking Consumer Lending Commercial Banking Small Business Payments Insurance Brokerage Corporate & Investment Banking BB&T ü ü ü ü ü ü SunTrust ü ü ü ü ü ü (Community Bank Model) (Community Bank Model) Specialty Finance ü ü ü Combined ü+ ü+ ü+ ü+ ü+ ü+ ü+ ü+ Potential revenue opportunity Opportunity for further scale Opportunity for further scale Opportunity for further scale Opportunity for further scale Wealth ü ü ü+ Opportunity for further scale Opportunity for further scale Opportunity for further scale PRIMARILY REGIONAL NATIONAL Mortgage Banking ü ü ü+ Opportunity for further scale Potential revenue opportunity Digital Lending ü ü+ Potential revenue opportunity

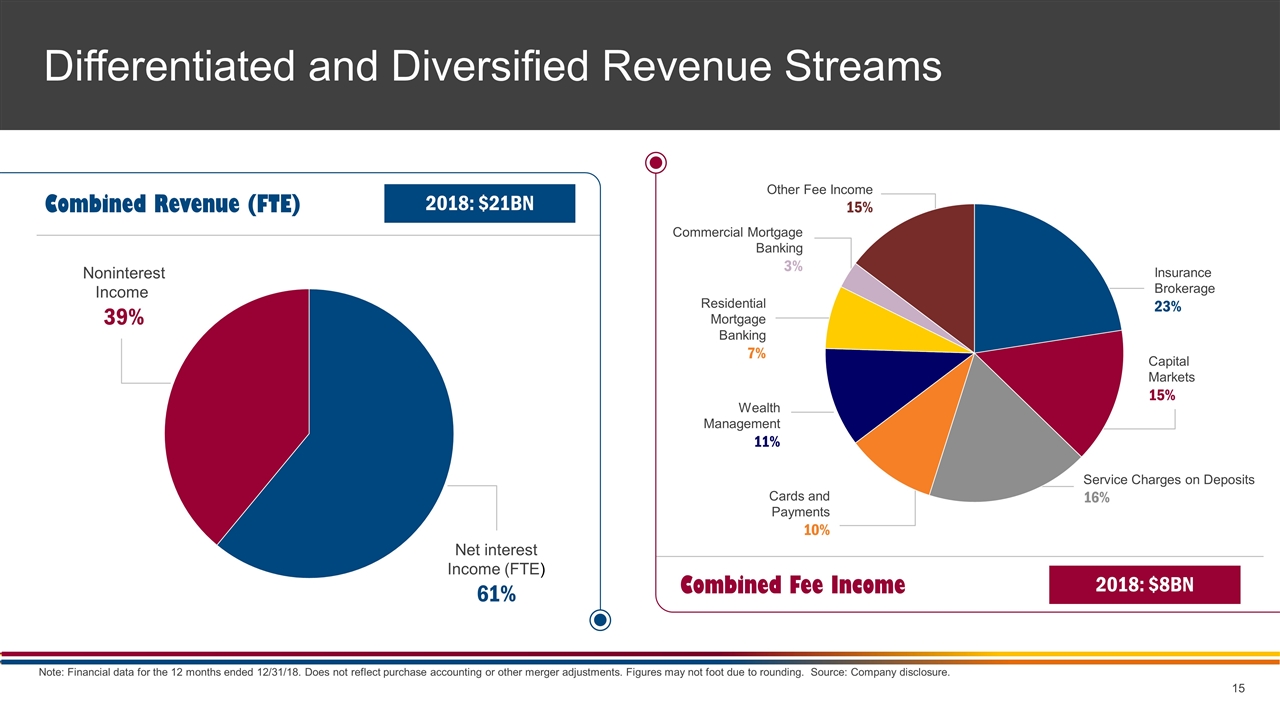

Differentiated and Diversified Revenue Streams Note: Financial data for the 12 months ended 12/31/18. Does not reflect purchase accounting or other merger adjustments. Figures may not foot due to rounding. Source: Company disclosure. Combined Revenue (FTE) Combined Fee Income Noninterest Income 39% Net interest Income (FTE) 61% Residential Mortgage Banking 7% Insurance Brokerage 23% Capital Markets 15% Service Charges on Deposits 16% Cards and Payments 10% Wealth Management 11% Commercial Mortgage Banking 3% Other Fee Income 15% 2018: $21BN 2018: $8BN

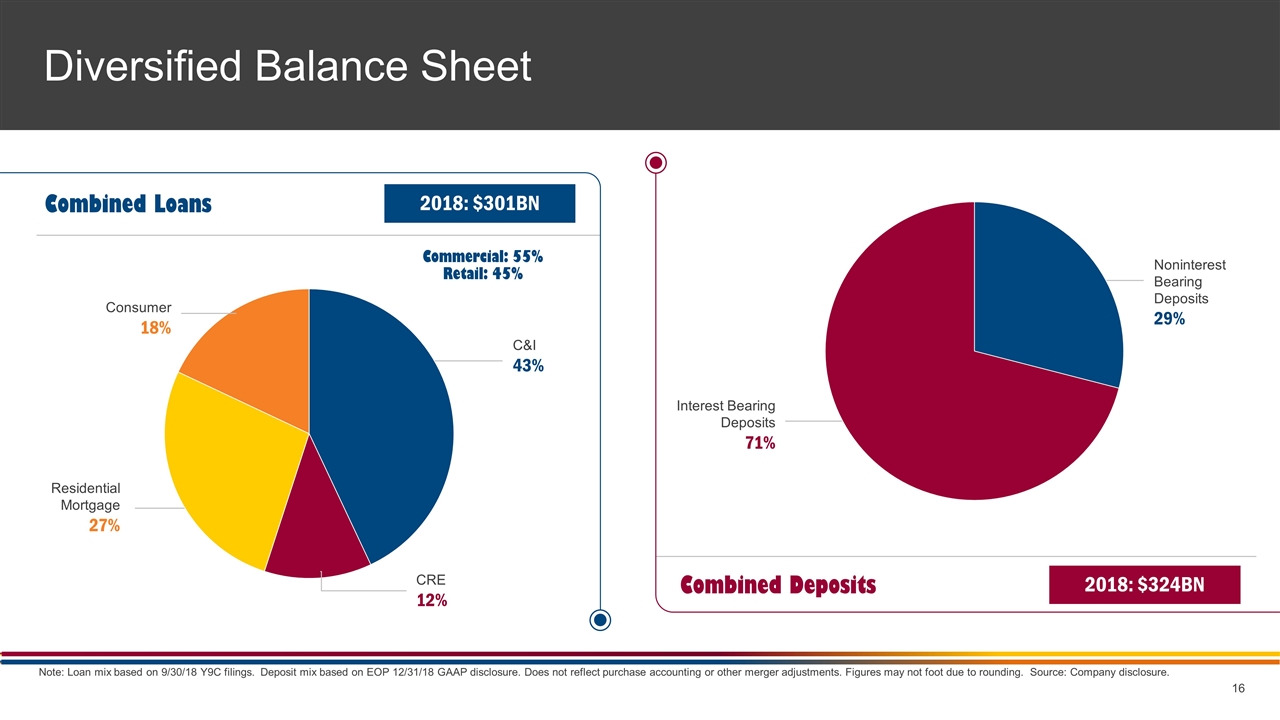

Diversified Balance Sheet Note: Loan mix based on 9/30/18 Y9C filings. Deposit mix based on EOP 12/31/18 GAAP disclosure. Does not reflect purchase accounting or other merger adjustments. Figures may not foot due to rounding. Source: Company disclosure. Noninterest Bearing Deposits 29% C&I 43% CRE 12% Residential Mortgage 27% Consumer 18% Interest Bearing Deposits 71% Commercial: 55% Retail: 45% Combined Loans 2018: $301BN Combined Deposits 2018: $324BN

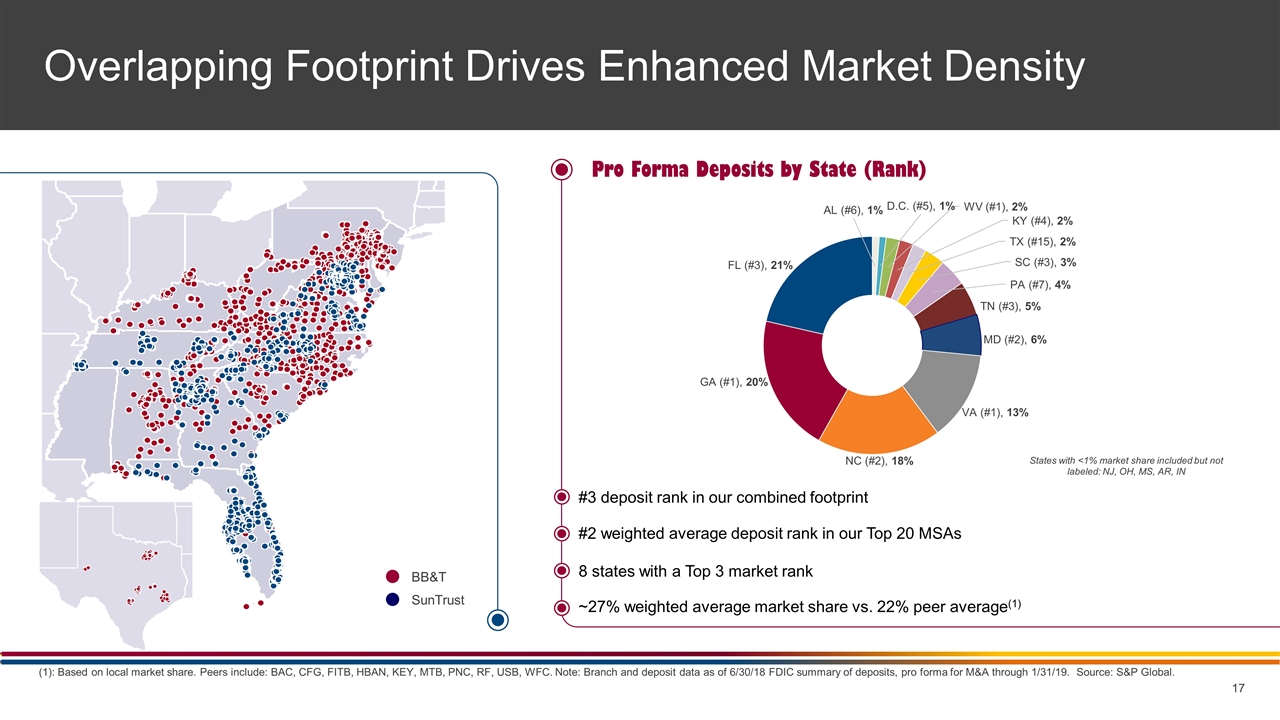

Overlapping Footprint Drives Enhanced Market Density (1): Based on local market share. Peers include: BAC, CFG, FITB, HBAN, KEY, MTB, PNC, RF, USB, WFC. Note: Branch and deposit data as of 6/30/18 FDIC summary of deposits, pro forma for M&A through 1/31/19. Source: S&P Global. BB&T SunTrust Pro Forma Deposits by State (Rank) States with <1% market share included but not labeled: NJ, OH, MS, AR, IN 8 states with a Top 3 market rank #2 weighted average deposit rank in our Top 20 MSAs ~27% weighted average market share vs. 22% peer average(1) #3 deposit rank in our combined footprint

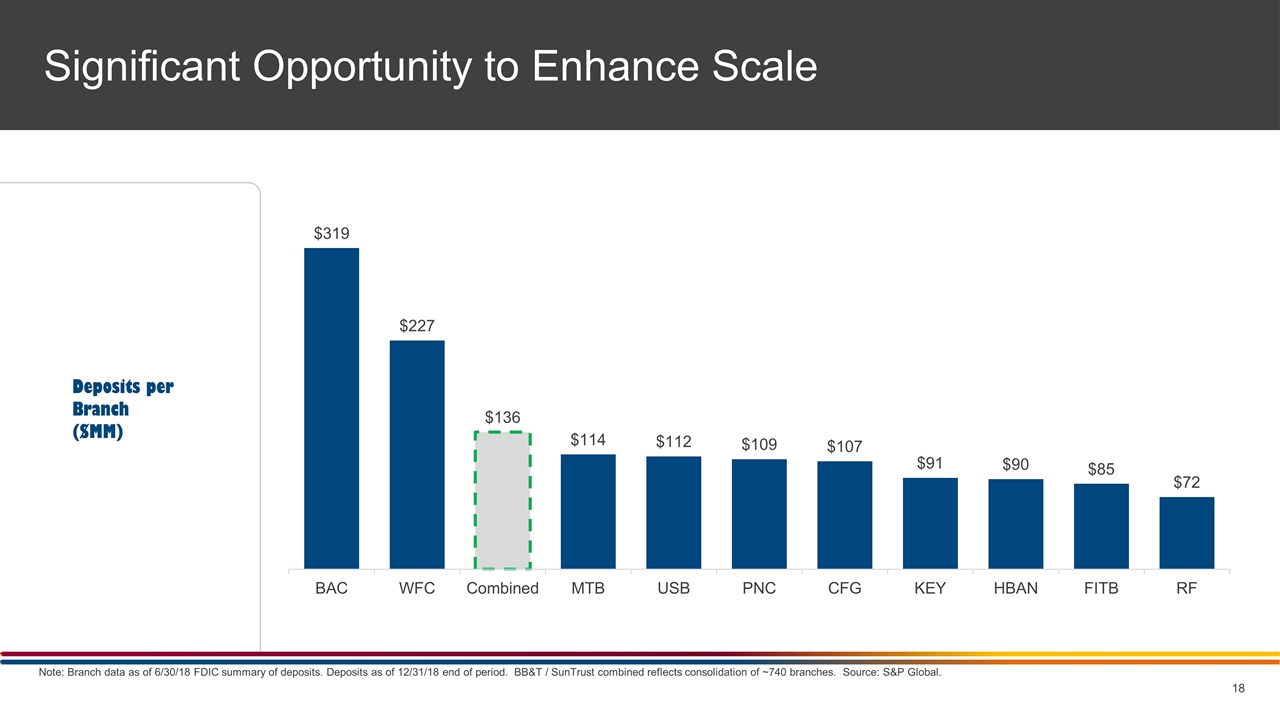

Significant Opportunity to Enhance Scale Note: Branch data as of 6/30/18 FDIC summary of deposits. Deposits as of 12/31/18 end of period. BB&T / SunTrust combined reflects consolidation of ~740 branches. Source: S&P Global. Deposits per Branch ($MM)

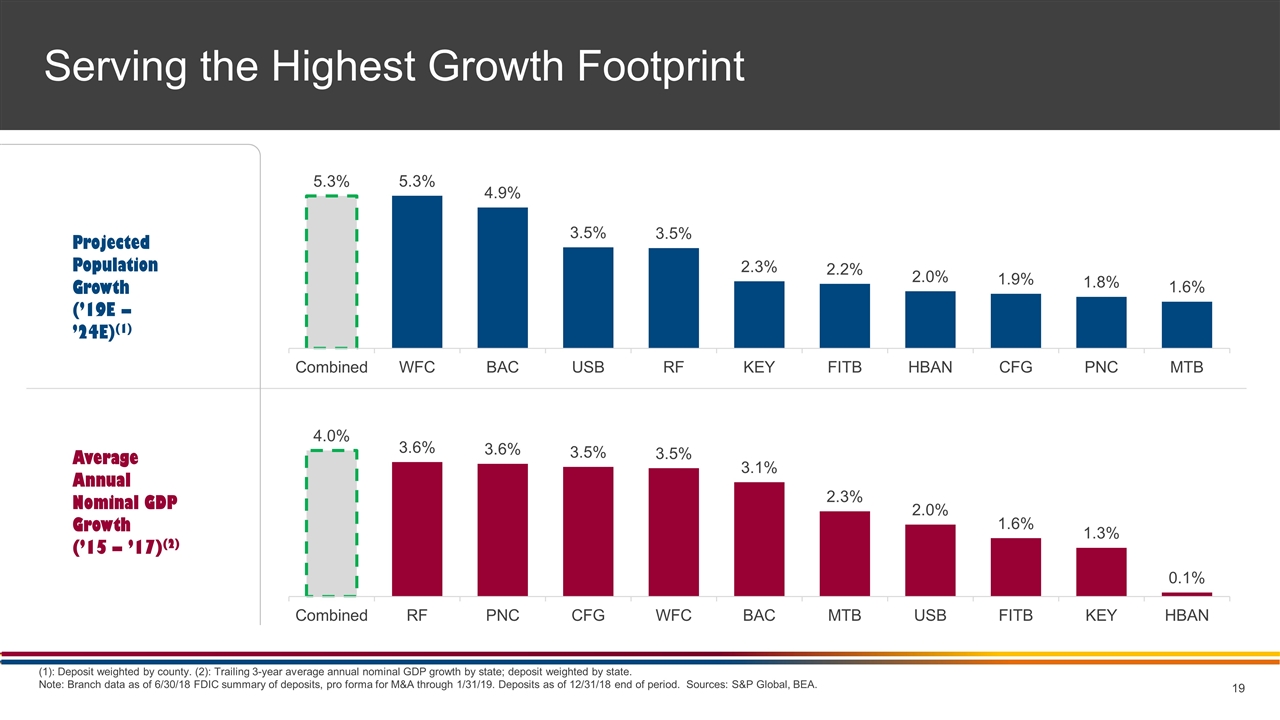

Serving the Highest Growth Footprint (1): Deposit weighted by county. (2): Trailing 3-year average annual nominal GDP growth by state; deposit weighted by state. Note: Branch data as of 6/30/18 FDIC summary of deposits, pro forma for M&A through 1/31/19. Deposits as of 12/31/18 end of period. Sources: S&P Global, BEA. Projected Population Growth (’19E – ’24E)(1) Average Annual Nominal GDP Growth (’15 – ’17)(2)

Section IV Pro Forma Financial Profile and Impact

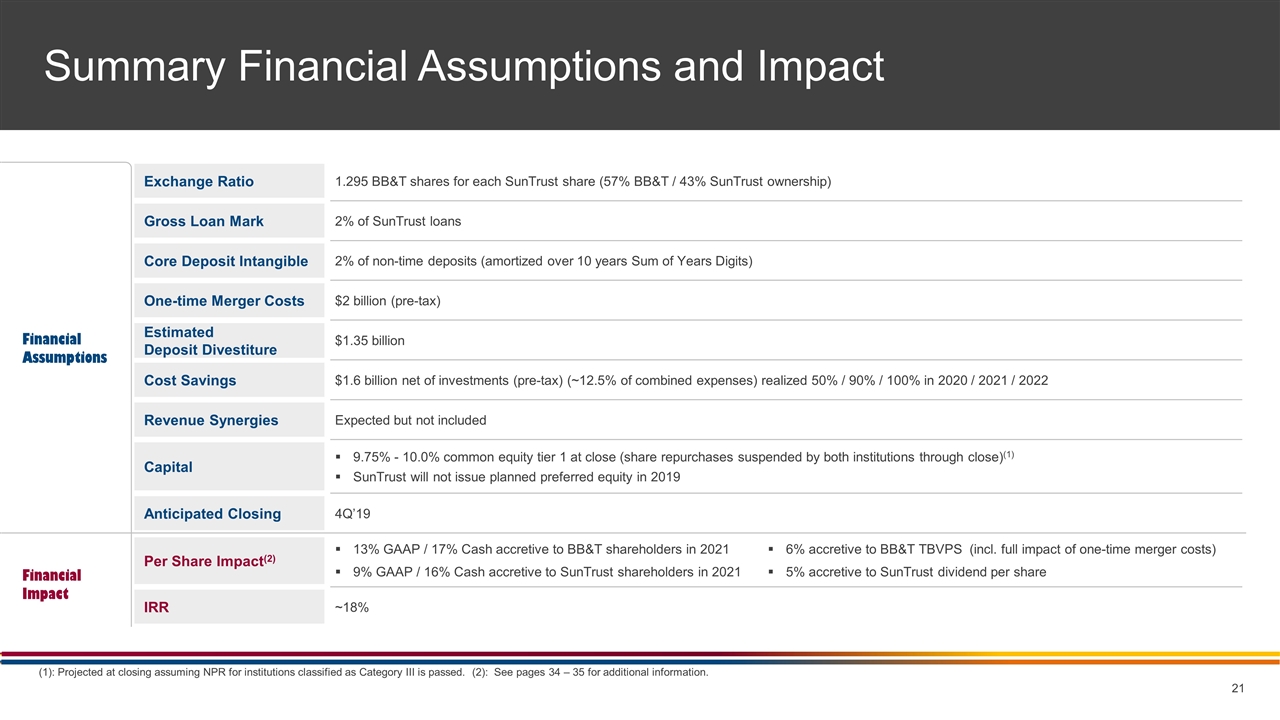

Capital Per Share Impact(2) Summary Financial Assumptions and Impact Financial Assumptions Estimated Deposit Divestiture Cost Savings Revenue Synergies Exchange Ratio Gross Loan Mark Core Deposit Intangible One-time Merger Costs Anticipated Closing IRR 9.75% - 10.0% common equity tier 1 at close (share repurchases suspended by both institutions through close)(1) SunTrust will not issue planned preferred equity in 2019 13% GAAP / 17% Cash accretive to BB&T shareholders in 2021 9% GAAP / 16% Cash accretive to SunTrust shareholders in 2021 $1.35 billion $1.6 billion net of investments (pre-tax) (~12.5% of combined expenses) realized 50% / 90% / 100% in 2020 / 2021 / 2022 Expected but not included 1.295 BB&T shares for each SunTrust share (57% BB&T / 43% SunTrust ownership) 2% of SunTrust loans 2% of non-time deposits (amortized over 10 years Sum of Years Digits) $2 billion (pre-tax) 4Q’19 ~18% 6% accretive to BB&T TBVPS (incl. full impact of one-time merger costs) 5% accretive to SunTrust dividend per share Financial Impact (1): Projected at closing assuming NPR for institutions classified as Category III is passed. (2): See pages 34 – 35 for additional information.

TALENT Selecting the best talent, processes, and technology positions the combined company for success for many years to come Significant Cost Efficiency Improvement Creates Capacity for Investments in Innovation, Technology, and Talent PROCESSES TECHNOLOGY Cost Savings $1.6 billion of pre-tax cost savings, net of investments ~12.5% of combined expenses Expected sources of cost savings: Facilities Information Technology / Systems Shared Services Retail Banking Third Party / Vendors Across BB&T and SunTrust’s combined footprint, there are ~740 branches within 2 miles of each other Represents ~24% of combined branches

Individually, Strong; Together, Best BB&T / SunTrust illustrative combined includes $1.6 billion net pre-tax cost savings. See Appendix for illustrative combined and non-GAAP reconciliations. Note: Data for the 12 months ended 12/31/18. Peer tangible efficiency ratio (FTE) and Cash ROATCE reflects adjustments as reported by the company. Does not include impact of purchase accounting and other merger adjustments. Source: S&P Global, company disclosure. Tangible Efficiency Ratio (FTE) Cash ROATCE

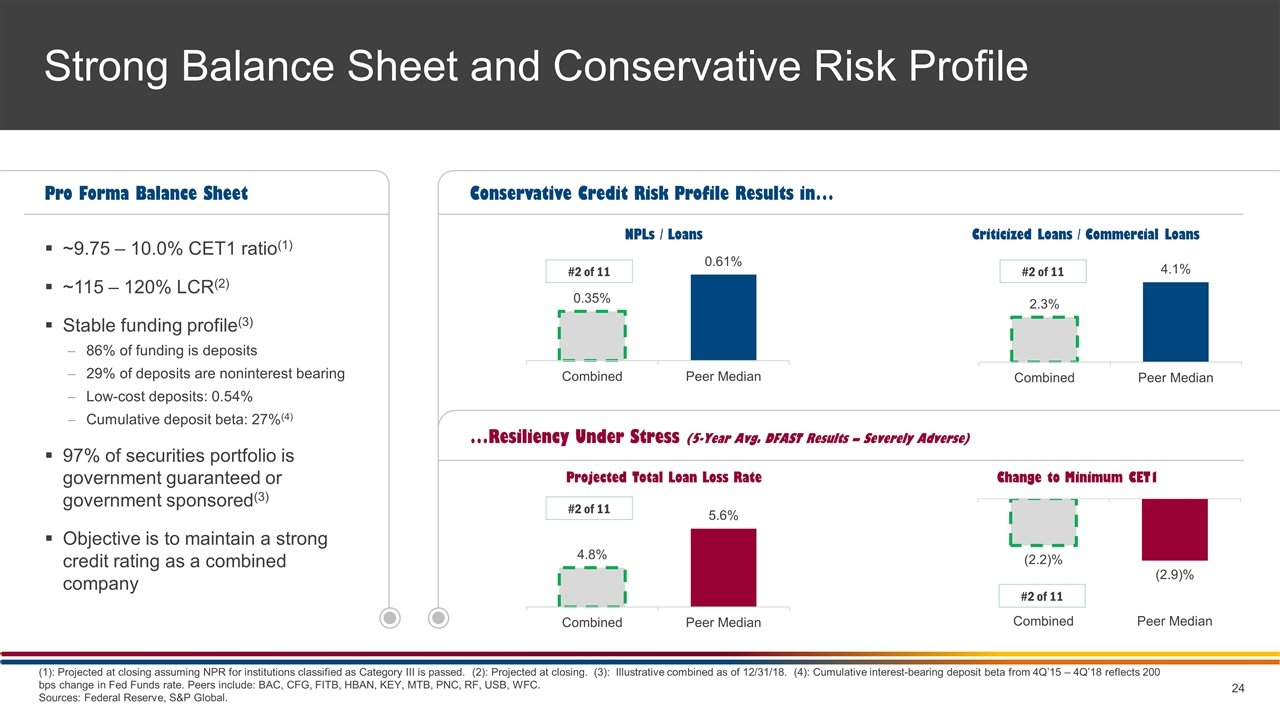

Strong Balance Sheet and Conservative Risk Profile (1): Projected at closing assuming NPR for institutions classified as Category III is passed. (2): Projected at closing. (3): Illustrative combined as of 12/31/18. (4): Cumulative interest-bearing deposit beta from 4Q’15 – 4Q’18 reflects 200 bps change in Fed Funds rate. Peers include: BAC, CFG, FITB, HBAN, KEY, MTB, PNC, RF, USB, WFC. Sources: Federal Reserve, S&P Global. ~9.75 – 10.0% CET1 ratio(1) ~115 – 120% LCR(2) Stable funding profile(3) 86% of funding is deposits 29% of deposits are noninterest bearing Low-cost deposits: 0.54% Cumulative deposit beta: 27%(4) 97% of securities portfolio is government guaranteed or government sponsored(3) Objective is to maintain a strong credit rating as a combined company Pro Forma Balance Sheet Conservative Credit Risk Profile Results in… NPLs / Loans Criticized Loans / Commercial Loans Projected Total Loan Loss Rate Change to Minimum CET1 #2 of 11 #2 of 11 #2 of 11 #2 of 11 …Resiliency Under Stress (5-Year Avg. DFAST Results – Severely Adverse)

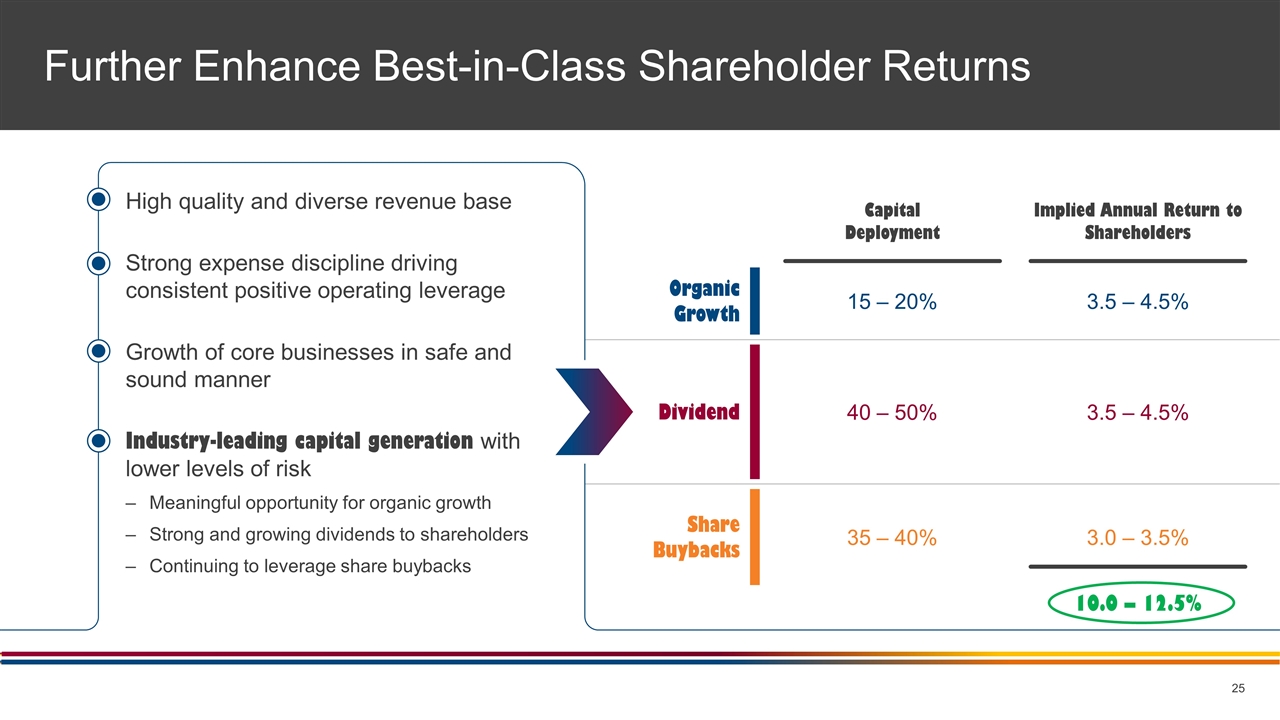

Further Enhance Best-in-Class Shareholder Returns High quality and diverse revenue base Capital Deployment 15 – 20% 40 – 50% 35 – 40% Implied Annual Return to Shareholders 3.5 – 4.5% 3.5 – 4.5% 3.0 – 3.5% Organic Growth Dividend Share Buybacks 10.0 – 12.5% Strong expense discipline driving consistent positive operating leverage Growth of core businesses in safe and sound manner Industry-leading capital generation with lower levels of risk Meaningful opportunity for organic growth Strong and growing dividends to shareholders Continuing to leverage share buybacks

Proven Track Record of Successfully Integrating Numerous Acquisitions Collectively integrated nearly 100 bank acquisitions successfully over the last 35 years Adhere to diligent planning and a strong governance process Incorporate the best talent, processes, and technology Complementary Geographies and Business Lines Strengthen differentiated and complementary business mix across lines of business, geographies, and clients Potential revenue opportunities as a result of the combination Leverage our combined strong understanding of our markets and business lines Create a high returning, diverse company with a low risk profile Unwavering Commitment to Serving Clients and Communities Preserve and maintain a strong culture and set of values as a combined company Create a distinctive client experience empowered by dynamic and innovative technology Preserve the community bank model to maintain close ties to our shared local communities Robust Risk Governance and Framework Continue to manage the company within a conservative risk appetite Maintain rigorous risk management and compliance programs Ensure successful integration and conversion through a robust governance process Alignment Drives Comprehensive and Thoughtful Integration Plan

Section V Conclusion

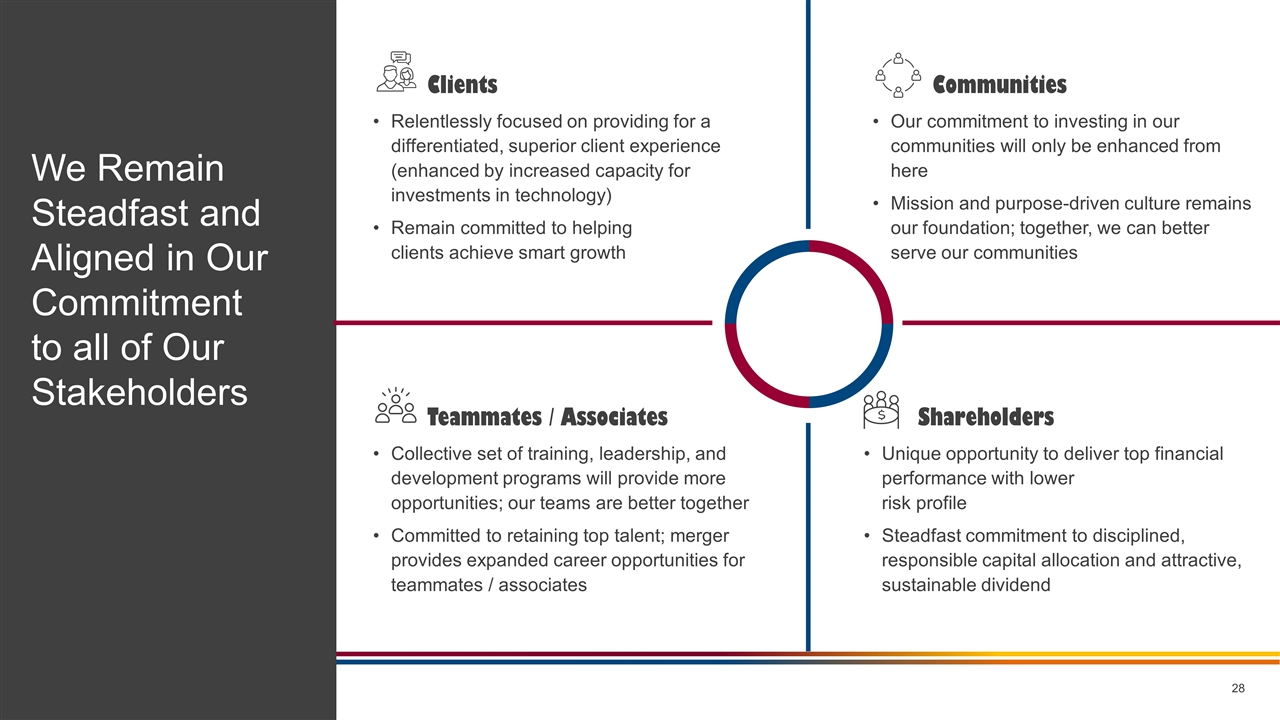

Clients Relentlessly focused on providing for a differentiated, superior client experience (enhanced by increased capacity for investments in technology) Remain committed to helping clients achieve smart growth Communities Our commitment to investing in our communities will only be enhanced from here Mission and purpose-driven culture remains our foundation; together, we can better serve our communities Teammates / Associates Collective set of training, leadership, and development programs will provide more opportunities; our teams are better together Committed to retaining top talent; merger provides expanded career opportunities for teammates / associates Shareholders Unique opportunity to deliver top financial performance with lower risk profile Steadfast commitment to disciplined, responsible capital allocation and attractive, sustainable dividend We Remain Steadfast and Aligned in Our Commitment to all of Our Stakeholders

Individually, Strong; Together, Best (1): Illustrative combined ratios for 2018 assuming $1.6 billion of net pre-tax cost savings. See Appendix for illustrative combination and non-GAAP reconciliations. Highly Synergistic Transformative Financially Compelling Brings together two like-minded institutions with strong cultural alignment Produces industry-leading financial performance with an efficiency ratio of 51%(1), peer best ROATCE of 22%(1) and tangible book value accretion Focused on the relentless pursuit of a differentiated, client-centric experience, leveraging the community bank and wholesale banking, and fueled by increased capacity for investments in innovation and talent Combines complementary business models to create a diverse and comprehensive business mix with leading market share positions in traditional banking, insurance brokerage, and capital markets Enhances fee income mix and creates compelling opportunities to build further scale in specialized businesses and leverage model into expanded client base Leading with an innovative mindset and embracing the opportunity for disruption to drive a sustainable competitive advantage Delivers the best of both institutions’ talent, technology, and processes Maintains a rigorous risk management culture and strong capital and liquidity position Combines strong individual core deposit bases to create the 6th largest U.S. bank with top market share position in highly attractive markets The combined company will be uniquely positioned to Light the Way to Financial Well-Being and Make The World a Better Place to Live

Appendix

Note: Branch and deposit data as of 6/30/18 FDIC summary of deposits, pro forma for M&A through 1/31/19. Source: S&P Global. Combined Deposits by MSA ($MM) BB&T SunTrust Combined Market Deposits Market Deposits Market Deposits Combined MSAs Rank ($MM) Rank ($MM) Rank ($MM) 1. Atlanta, GA 4 $8,630 1 $47,166 1 $55,796 2. Washington, DC 5 14,122 4 18,971 2 33,093 3. Winston-Salem, NC 1 25,356 5 684 1 26,041 4. Miami, FL 9 7,288 6 11,475 4 18,763 5. Orlando, FL 5 2,163 1 10,684 1 12,848 6. Tampa, FL 7 2,603 3 9,903 2 12,506 7. Baltimore, MD 5 5,468 6 2,870 3 8,338 8. Charlotte, NC 3 6,235 6 1,872 3 8,107 9. Richmond, VA 4 3,161 3 4,490 2 7,651 10. Virginia Beach, VA 4 3,207 3 4,121 1 7,328 11. Nashville, TN 15 715 4 6,359 4 7,074 12. Raleigh, NC 2 4,213 6 1,348 2 5,561 13. Philadelphia, PA 10 4,968 -- -- 10 4,968 14. Knoxville, TN 6 1,097 2 2,499 1 3,596 15. Durham, NC 5 1,328 3 2,249 2 3,577 16. North Port, FL 5 1,192 3 2,227 2 3,419 17. Deltona, FL 6 401 1 2,927 1 3,328 18. Dallas, TX 14 3,123 -- -- 14 3,123 19. Greensboro, NC 2 2,363 6 734 1 3,097 20. Cape Coral, FL 5 928 3 2,059 1 2,987 Top 20 MSAs -- $98,564 -- $132,639 -- $231,203 Other MSAs -- 61,945 -- 31,761 -- 93,706 Total MSAs -- $160,508 -- $164,400 -- $324,909 Non-MSA Deposits -- 6,206 -- 812 -- 7,018 Total -- $166,714 -- $165,212 -- $331,926 The combined company will have a #2 weighted average deposit rank in its Top 20 MSAs

Illustrative Combined 2018 Efficiency Ratio / Return on Average Tangible Common Equity Note: See non-GAAP reconciliations for Adjusted Tangible Noninterest Expense and Adjusted Cash Net Income Available to Common. Assumes 24% tax rate. Source: Company disclosure. Illustrative Combined Tangible Efficiency Ratio (FTE) (12 mos. Ended 12/31/18) Illustrative Combined Cash ROATCE (12 mos. Ended 12/31/18) Revenue (FTE) ($BN) BB&T $11.7 SunTrust 9.3 Illustrative Combined $21.0 Adj. Tangible Noninterest Expense ($BN) BB&T $6.7 SunTrust 5.5 Illustrative Combined $12.2 Pre-Tax Cost Savings ($BN) $1.6 Illustrative Combined Revenue (FTE) ($BN) $21.0 Illustrative Combined Adj. Tangible Noninterest Expense ($BN) $10.6 Illustrative Combined Tangible Efficiency Ratio (FTE) 51% Adj. Cash Net Income to Common ($BN) BB&T $3.3 SunTrust 2.6 Illustrative Combined $5.9 Average Tangible Common Equity ($BN) BB&T $16.2 SunTrust 16.0 Illustrative Combined $32.2 Pre-Tax Cost Savings ($BN) $1.6 After-Tax Cost Savings ($BN) $1.2 Illustrative Combined Adj. Cash Net Income ($BN) $7.1 Illustrative Combined Avg. Tangible Common Equity ($BN) $32.2 Illustrative Combined Cash ROATCE 22%

BB&T EOP(1) Common Shares Outstanding (MM) 763 SunTrust EOP(1) Common Shares Outstanding (MM) 447 BB&T Stock Price (2/5/19) $48.79 SunTrust Stock Price (2/5/19) $59.14 BB&T Market Value ($BN) $37.2 SunTrust Market Value ($BN) $26.4 Pre-Tax Cost Savings ($BN) $1.6 After-Tax Cost Savings ($BN) 1.2 Value of Cost Savings ($BN) (11.5x Price / Forward Earnings) $14.0 Less: After-Tax One-Time Merger Charges ($BN) ($1.5) Illustrative Combined Market Value ($BN) $76.1 Illustrative Combined Market Value (1): As of 12/31/18.

Loan Mark BB&T SunTrust Divestiture Net of Restructuring Stand- Stand- Gain Reserve Charge Shares Combined % Alone Alone (After-Tax) (After-Tax) (After-Tax) Issued (1) Company Accretion Tangible Common Equity @ 12/31/18 $16.7 $15.8 -- -- -- -- $32.5 -- 2019E Cash Net Income 3.4 2.6 -- -- -- -- 6.0 -- 2019E Dividends (40% of GAAP Net Income) (1.3) (1.0) -- -- -- -- (2.4) -- 2019E Share Repurchases (1.7) (1.8) -- -- -- -- (0.3) -- Tangible Common Equity @ 12/31/19 17.1 15.6 0.1 (1.2) (0.2) -- 34.6 -- Tangible Common Equity Incl. Full Rest. Charge @ 12/31/19 -- -- -- -- (1.4) -- 33.3 -- FD Shares Outstanding @ 12/31/18 (MM) 773 -- -- -- -- 578 1,351 -- Shares Repurchased in 2019 (MM) (34) -- -- -- -- -- -- -- FD Shares Outstanding @ 12/31/19 (MM) 740 -- -- -- -- -- 1,351 -- FD TBV p.s. @ 12/31/19 $23.18 -- -- -- -- -- $25.63 11% FD TBV p.s. @ 12/31/19 Incl. Full Rest. Charge -- -- -- -- -- -- 24.62 6% Illustrative Tangible Book Value Accretion at Close Note: Based on consensus estimates from S&P Global as of 2/5/19. (1): Net of $0.3 billion of SunTrust shares repurchased in 1Q’19. As of 2/5/19 close. $ in billions, except per share amounts

Illustrative Earnings per Share Impact 2021E BB&T Stand-Alone GAAP EPS $4.94 SunTrust Stand-Alone GAAP EPS 6.65 BB&T Stand-Alone GAAP Net Income $3.4 SunTrust Stand-Alone GAAP Net Income 2.6 After-Tax Adjustments ($BN) Cost Savings (90% Realized 2021) $1.1 Reversal of SunTrust Stand-Alone Provision, Net of New Provision 0.2 Core Deposit Intangible (0.4) Other Adjustments (1) 0.3 Pro Forma Combined GAAP Net Income $7.2 Pro Forma FD Avg. Shares Outstanding (BN) 1.3 Pro Forma GAAP EPS $5.59 GAAP EPS Accretion to BB&T Shareholders 13% GAAP EPS Accretion to SunTrust Shareholders 9% Note: 24% tax rate. Street net income and EPS estimates as of 2/5/19. (1): Other adjustments include reversal of SunTrust planned 2019 preferred issuance, FDIC assessment adjustment for TDR mark, BOLI penalty tax, anticipated funding cost improvements, incremental earnings from redeployed proceeds from share repurchases, lost earnings from divestiture, AOCI accretion. $ in billions, except per share amounts

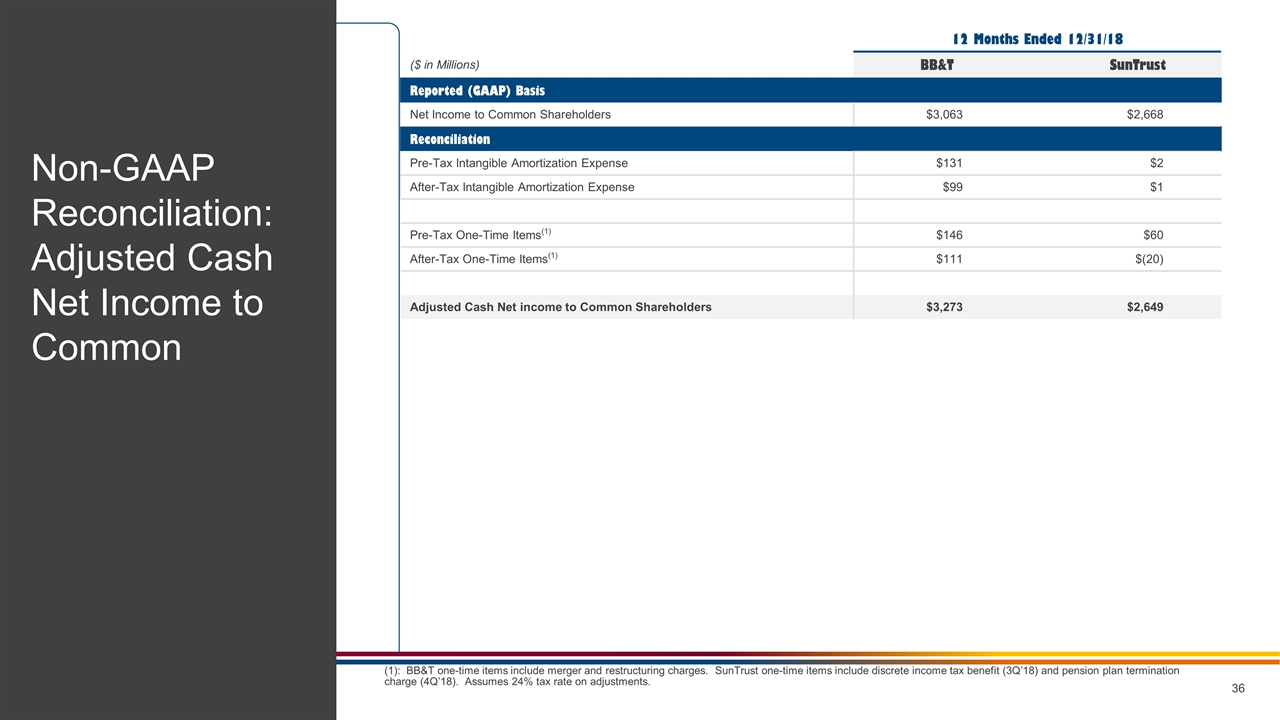

(1): BB&T one-time items include merger and restructuring charges. SunTrust one-time items include discrete income tax benefit (3Q’18) and pension plan termination charge (4Q’18). Assumes 24% tax rate on adjustments. Non-GAAP Reconciliation: Adjusted Cash Net Income to Common 12 Months Ended 12/31/18 ($ in Millions) BB&T SunTrust Reported (GAAP) Basis Net Income to Common Shareholders $3,063 $2,668 Reconciliation Pre-Tax Intangible Amortization Expense $131 $2 After-Tax Intangible Amortization Expense $99 $1 Pre-Tax One-Time Items(1) $146 $60 After-Tax One-Time Items(1) $111 $(20) Adjusted Cash Net income to Common Shareholders $3,273 $2,649

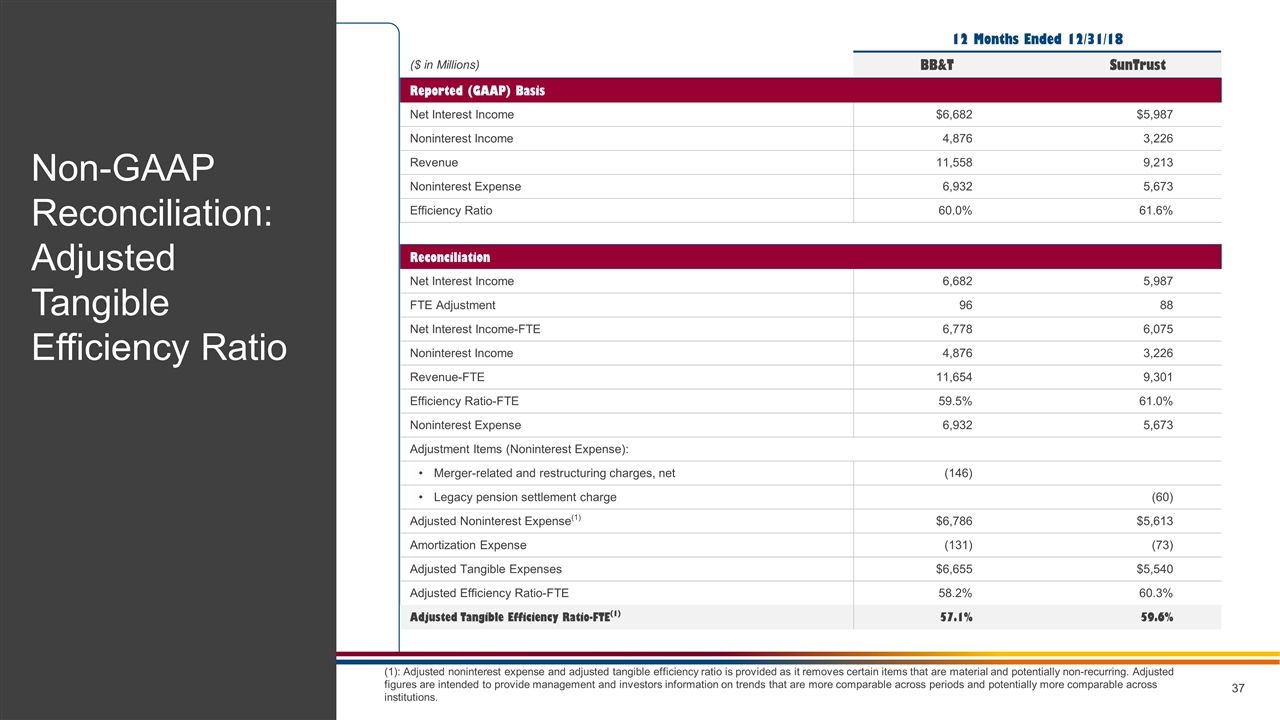

(1): Adjusted noninterest expense and adjusted tangible efficiency ratio is provided as it removes certain items that are material and potentially non-recurring. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions. Non-GAAP Reconciliation: Adjusted Tangible Efficiency Ratio 12 Months Ended 12/31/18 ($ in Millions) BB&T SunTrust Reported (GAAP) Basis Net Interest Income $6,682 $5,987 Noninterest Income 4,876 3,226 Revenue 11,558 9,213 Noninterest Expense 6,932 5,673 Efficiency Ratio 60.0% 61.6% Reconciliation Net Interest Income 6,682 5,987 FTE Adjustment 96 88 Net Interest Income-FTE 6,778 6,075 Noninterest Income 4,876 3,226 Revenue-FTE 11,654 9,301 Efficiency Ratio-FTE 59.5% 61.0% Noninterest Expense 6,932 5,673 Adjustment Items (Noninterest Expense): Merger-related and restructuring charges, net (146) Legacy pension settlement charge (60) Adjusted Noninterest Expense(1) $6,786 $5,613 Amortization Expense (131) (73) Adjusted Tangible Expenses $6,655 $5,540 Adjusted Efficiency Ratio-FTE 58.2% 60.3% Adjusted Tangible Efficiency Ratio-FTE(1) 57.1% 59.6%

Transformational Merger of Equals to Create The Premier Financial Institution www.thepremierfinancialinstitution.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Empowering Moms: Momcozy Unveils Its Perfect Wearable Pumping Solution for 2024

- Groupama Assurances Mutuelles calls for redemption of its undated subordinated bond (FR0011896513)

- ICE Announces Record Trading Activity in Murban Crude as ICE Futures Abu Dhabi Marks Third Anniversary

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share