Form 425 Athene Holding Ltd Filed by: Athene Holding Ltd

Athene / Apollo Merger Summary of Employee Equity Treatment Filed by Athene Holding Ltd Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Athene Holding Ltd; Apollo Global Management, Inc.; Tango Holdings, Inc. (Commission File No. 001-37963)

Disclaimer The following pages summarize various aspects of awards made under the Athene Holding Ltd. equity incentive plans as an educational aid for broader understanding of the terms of the awards, as well as certain aspects of shares and warrants in Athene Holding Ltd. held by employees. The summary information is qualified in its entirety by reference to the actual terms of the plans, award agreements, warrant agreements and other agreements and instruments referred to in the presentation, including the Agreement and Plan of Merger, by and among Athene, Apollo Global Management, Inc., Tango Holdings, Inc., Blue Merger Sub, Ltd., and Green Merger Sub, Inc. All capitalized terms relating to awards under the equity incentive plans have the meanings set forth in the underlying equity incentive plan or the applicable award agreement. This information should not be considered complete and may not contain all of the information about the awards, plans and such other agreements and instruments that are important to you. We urge you to read carefully the award agreements and plans applicable to you as the terms of the awards are governed by the award agreements and plans and not by this summary. We also urge you to discuss your awards with your accounting, legal and tax advisors. Athene assumes no liability for any of the information provided in this presentation.

Merger impact and treatment of equity The following summarizes the handling of equity awards following closing of the merger. Please see the following page for an example. What will happen to Class A shares in Athene? Generally, the shares you own in Athene will be converted into shares of the combined company, which will be a publicly listed company, based on the exchange ratio in the merger. For each share of Athene, you will receive 1.149 shares of the new combined company. In addition, following the closing, employees who hold shares of Athene that are converted into shares of the combined company are expected to receive annual dividends initially set at a minimum of $1.60 per share. What will happen to my LTI awards? Time-based RSUs will convert into time-based RSUs of the combined company based on the exchange ratio in the merger (1.149). The vesting schedule will remain the same. Performance-based RSUs will convert into time-based RSUs of the combined company. The number of time-based RSUs that will be issued will be based on target level of the performance awards which will then be converted based on the exchange ratio in the merger. The new awards will vest on the same date as the original awards, i.e., on February 28 following the original 3-year performance period, subject to continued employment. Time-based options will convert into stock options of the combined company, with the number of options and strike prices to be adjusted based on the exchange ratio in the merger. The vesting schedule will remain the same. What will happen to my vested warrants? The treatment of warrants remains subject to further discussion between Apollo and Athene. More information will be provided to warrant holders prior to the closing of the transaction. What will happen to the ESPP shares and program going forward? The ESPP is expected to continue through the close of the transaction and will then be terminated. Further details about this will be communicated as we approach the closing. Any shares you purchase under the ESPP between now and the closing will be converted into shares of the new combined company based on the exchange ratio in the merger. Current eligibility rules will continue to apply for enrollment periods prior to the closing of the merger.

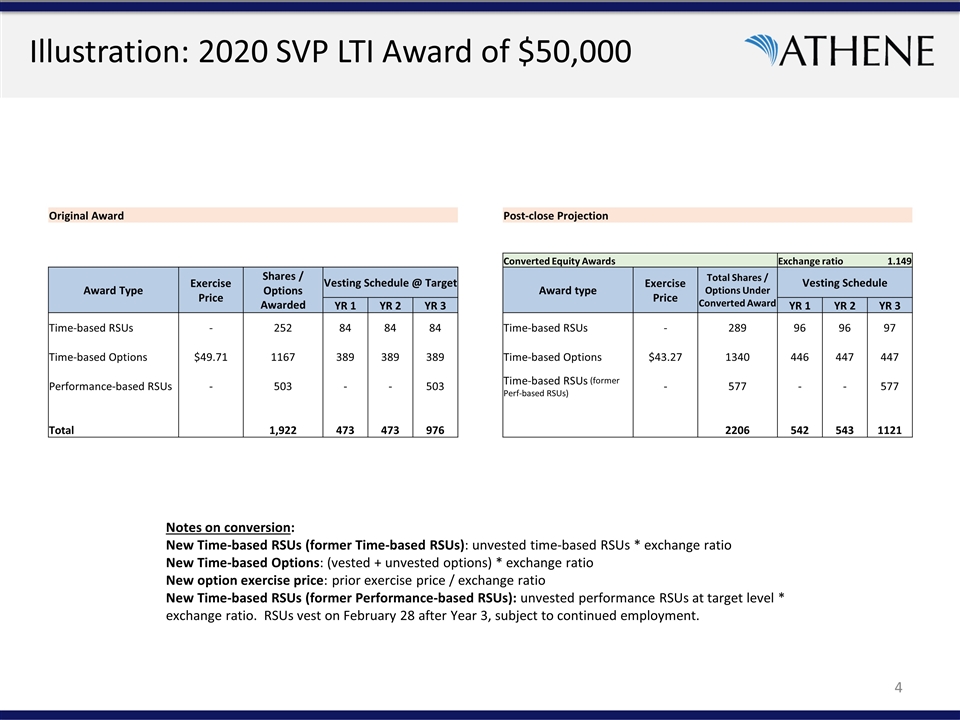

Illustration: 2020 SVP LTI Award of $50,000 Notes on conversion: New Time-based RSUs (former Time-based RSUs): unvested time-based RSUs * exchange ratio New Time-based Options: (vested + unvested options) * exchange ratio New option exercise price: prior exercise price / exchange ratio New Time-based RSUs (former Performance-based RSUs): unvested performance RSUs at target level * exchange ratio. RSUs vest on February 28 after Year 3, subject to continued employment. Original Award Post-close Projection Converted Equity Awards Exchange ratio 1.149 Award Type Exercise Price Shares / Options Awarded Vesting Schedule @ Target Award type Exercise Price Total Shares / Options Under Converted Award Vesting Schedule YR 1 YR 2 YR 3 YR 1 YR 2 YR 3 Time-based RSUs - 252 84 84 84 Time-based RSUs - 289 96 96 97 Time-based Options $49.71 1167 389 389 389 Time-based Options $43.27 1340 446 447 447 Performance-based RSUs - 503 - - 503 Time-based RSUs (former Perf-based RSUs) - 577 - - 577 Total 1,922 473 473 976 2206 542 543 1121

Tax Considerations* * The following summary is not intended to serve as individual tax advice. Each employee should consult his/her own tax advisor.

Tax Consequences of Stock Options and Restricted Share Units Tax Consequences of Stock, Stock Options and Restricted Stock Units in the Combined Company Tax Consequences for Vested Athene Stock that is Exchanged in the Merger Transaction The Merger is intended to qualify as a tax-free transaction for U.S. federal income tax purposes for Athene shareholders. The tax basis in your new shares in the combined company is expected to equal your tax basis in existing Athene shares that you surrender in the merger. The holding period for your new shares in the combined company is expected to include the period you held the exchanged Athene shares. Distributions that you receive from the new combined company are expected to be treated as “qualified dividends”, taxed at capital gains rates, for U.S. federal income tax purposes. Tax Consequences of Receipt of Unvested RSUs and Vested or Unvested Options in the Combined Company The receipt of unvested RSUs and vested or unvested options in the combined company as a result of the conversion of existing unvested AHL RSUs or vested or unvested AHL options is not expected to be a taxable event for Athene employees. Tax Consequences of the Subsequent Settlement of RSUs in the Combined Company Ordinary income is recognized upon the settlement of an RSU in an amount equal to the value of the shares that are transferred in settlement of the vested award. The tax basis of the shares of the combined company that are received is equal to the amount of compensation recognized, and the holding period for those shares commences on the day following the date on which the shares are transferred in settlement of the vested award. Any dividend equivalents paid on RSUs are included as compensation for U.S. federal income tax purposes when received. Tax Consequences of the Subsequent Exercise of an Option in the Combined Company Ordinary income is recognized upon the exercise of a stock option equal to the amount by which the fair market value of the shares in the combined company that are purchased pursuant to the option exceeds their purchase price. The tax basis of the purchased shares in the new combined company pursuant to the option is equal to the fair market value of those shares on the purchase date, and the holding period for those shares commences on the day following the date on which the shares are purchased pursuant to the option.

Legal Disclosure Additional Information Regarding the Transaction and Where to Find It This document is being made in respect of the proposed transaction involving Tango Holdings, Inc. (“HoldCo”), Apollo Global Management, Inc. (“AGM”), and Athene Holding Ltd. (the “Company”). The proposed transaction will be submitted to the stockholders of AGM and the shareholders of the Company for their respective consideration. In connection therewith, the parties intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a definitive proxy statement, which will be mailed to the stockholders of AGM and the shareholders of the Company. However, such documents are not currently available. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, AS APPLICABLE, INVESTORS AND SECURITY HOLDERS OF AGM AND THE COMPANY ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive joint proxy statement/prospectus, any amendments or supplements thereto and other documents containing important information about AGM and the Company, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by AGM will be available free of charge under the “Stockholders” section of AGM’s website located at http://www.apollo.com or by contacting AGM’s Investor Relations Department at (212) 822-0528 or [email protected]. Copies of the documents filed with the SEC by the Company will be available free of charge under the “Investors” section of the Company’s website located at http://www.athene.com or by contacting the Company’s Investor Relations Department at (441) 279-8531 or [email protected]. Participants in the Solicitation AGM, the Company, and HoldCo and their respective directors, executive officers, members of management and employees may, under the rules of the SEC, be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of AGM and HoldCo is set forth in AGM’s proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on August 20, 2020, its annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on February 19, 2021, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Information about the directors and executive officers of the Company is set forth in the Company’s proxy statement for its 2020 annual meeting of shareholders, which was filed with the SEC on April 21, 2020, its annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on February 19, 2021, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitations of the stockholders of AGM and the shareholders of the Company, and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC when they become available. No Offer or Solicitation This document is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Legal Disclosure (continued) Company Safe Harbor for Forward-Looking Statements This document contains, and certain oral statements made by the Company’s representatives from time to time may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are subject to risks and uncertainties that could cause actual results, events and developments to differ materially from those set forth in, or implied by, such statements. These statements are based on the beliefs and assumptions of the Company’s management and the management of the Company’s subsidiaries. Generally, forward-looking statements include actions, events, results, strategies and expectations and are often identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Forward looking statements within this document include, but are not limited to, statements regarding: the consummation of the proposed merger and the benefits to be derived therefrom; the future financial performance and growth prospects of the combined entity; the market environment in which the combined entity will operate; future capital allocation decisions, including the expected payment of dividends; the structure, governance and operation of the company post-merger; and the tax treatment of the proposed transaction. Factors that could cause actual results, events and developments to differ include, without limitation: the Company’s failure to obtain approval of the proposed transaction by its shareholders or regulators; the Company’s failure to recognize the benefits expected to be derived from the proposed transaction; unanticipated difficulties or expenditures relating to the proposed transaction; disruptions of the Company’s current plans, operations and relationships with customers, suppliers and other business partners caused by the announcement and pendency of the proposed transaction; legal proceedings, including those that may be instituted against the Company, the Company’s board of directors or special committee, the Company’s executive officers and others following announcement of the proposed transaction; the accuracy of the Company’s assumptions and estimates; the Company’s ability to maintain or improve financial strength ratings; the Company’s ability to manage its business in a highly regulated industry; regulatory changes or actions; the impact of the Company’s reinsurers failing to meet their assumed obligations; the impact of interest rate fluctuations; changes in the federal income tax laws and regulations; the accuracy of the Company’s interpretation of the Tax Cuts and Jobs Act, litigation (including class action litigation), enforcement investigations or regulatory scrutiny; the performance of third parties; the loss of key personnel; telecommunication, information technology and other operational systems failures; the continued availability of capital; new accounting rules or changes to existing accounting rules; general economic conditions; the Company’s ability to protect its intellectual property; the ability to maintain or obtain approval of the Delaware Department of Insurance, the Iowa Insurance Division and other regulatory authorities as required for the Company’s operations; and other factors discussed from time to time in the Company’s filings with the SEC, including its annual report on Form 10-K for the year ended December 31, 2020, which can be found at the SEC’s website www.sec.gov. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. The Company does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. The contents of any website referenced in this document are not incorporated by reference.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- BrightInsight Recognized Among Newsweek’s World’s Best Digital Health Companies 2024 List

- National Volunteer Week: Storyteller Shares the Joy of Reading with Kentucky Families

- Census is Now Available on Google Cloud Marketplace

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share