Form 425 1Life Healthcare Inc Filed by: 1Life Healthcare Inc

Filed by 1Life Healthcare, Inc.

Pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Iora Health, Inc.

(Commission File No. 001-39203)

This filing relates to the proposed merger of Iora Health, Inc., a Delaware Corporation (“Iora Health”), with SB Merger Sub, Inc. (“Merger Sub”), a Delaware corporation and a wholly owned subsidiary of 1Life Healthcare, Inc., a Delaware corporation (“One Medical”), pursuant to the terms of that certain Agreement and Plan of Merger, dated as of June 6, 2021, by and among One Medical, Merger Sub, Iora and Fortis Advisors LLC, solely in its capacity as the representative of the stockholders of Iora. This filing under Rule 425 is being filed solely to amend a filing under Rule 425 on June 9, 2021 to reflect updates to the equity compensation information provided to Iora employees relating to the merger.

Equity Compensation Information for Iora Employees Related to One Medical Combination

Equity compensation is a benefit that many companies, especially startup companies like Iora Health, provide to their employees. Equity compensation provides employees with the opportunity to financially benefit from an increase in the financial value of a company over time. Prior to the announcement of the pending acquisition of Iora by One Medical, new Iora employees were offered some form of equity compensation when they joined Iora -- either Incentive Stock Options (ISOs) or Stock Appreciation Rights (SARs), sometimes referred to as phantom equity. You can read general information regarding Iora’s equity compensation on Canopy (ISOs info here; SARs info here).

Because Iora is being acquired by One Medical, holders of vested Iora equity compensation will have the opportunity to realize the financial value of their vested equity upon the closing of the acquisition. The purpose of this document is to help all Iora employees understand how equity compensation works, the potential financial value of their equity compensation (upon successful completion of the acquisition) and how employees who joined more recently will benefit financially from this event. This document is only a summary, and is subject in all respects to the provisions of the Iora equity plan and your award agreement, as well as the merger agreement pursuant to which Iora is being acquired by One Medical.

In connection with the closing of the acquisition of Iora by One Medical, 50% of each employee’s then-unvested ISOs and SARs will vest in accordance with the terms of the Iora equity plan. As discussed in greater detail below, each of your ISOs will be assumed by One Medical, will be adjusted to retain their intrinsic value using a conversion ratio and will continue as One Medical options and will generally be subject to the same terms, conditions and vesting schedule as currently apply to your ISOs. For holders of SARs, each of your vested SARs (including those that vest as a result of the 50% acceleration at closing) will be exchanged for a cash payment equal to spread value, and each of your unvested SARs will be converted into a cash payment equal to spread value and will generally be paid to you on the time-based vesting schedule applicable to the SARs and in accordance with the terms of the SARs.

As a preview of the detail that follows, here is a brief overview:

•The Iora Board of Directors last approved employee equity grants (either in the form of ISOs or SARs) in December 2020. All employees who started before that time have equity grants in the form of ISOs or SARs and this document provides instructions below for the steps those

employees can take to understand the potential value of the vested and unvested portions of those equity grants. Any Iora employee who falls into this group should follow the instructions below to log into your Carta account.

•Iora employees who started or received a written offer letter after the last Board approval of equity grants (in December 2020) and before June 7, 2021 have offer letters that reference equity compensation. Because the company was in the process of raising capital (and then subsequently entered conversations with One Medical regarding a possible acquisition), during that period, Iora’s Board has not been legally able to approve new equity grants since mid-December 2020. However, we are eager to ensure that this group of new Iora employees benefits from this event. As a result, each individual in this group will receive a cash award upon successful completion of the acquisition. Any employee who falls into this group should scroll to the last section of this document to understand next steps.

We will host multiple Equity Compensation Information Sessions between Friday, June 11 and Friday, June 18 in order to more fully explain Iora equity compensation and answer general questions. Please expect to receive a meeting invite to the sessions that are relevant to your type of equity compensation (ISO or SAR). There will be a separate session as well for employees who started between mid-December and June 7, 2021, during which time Iora’s Board was no longer able to approve grants.

STEP #1: Understand the details of your individual Iora equity compensation

Note: Employees who started or received a written offer letter after the last Board approval of equity grants (in December 2020) do not have a Carta account and should skip to the very last paragraph of this document.

Please log into Carta (link here), a web-based software platform that tracks each employee’s Iora equity compensation.

Use your Iora email address (or your personal email) as your login, follow the prompts to access your Carta account. Use the Activate Account function if you’ve never previously accessed Carta. If you have any issues accessing your Carta account, please submit a support request (support@iorahealth.com).

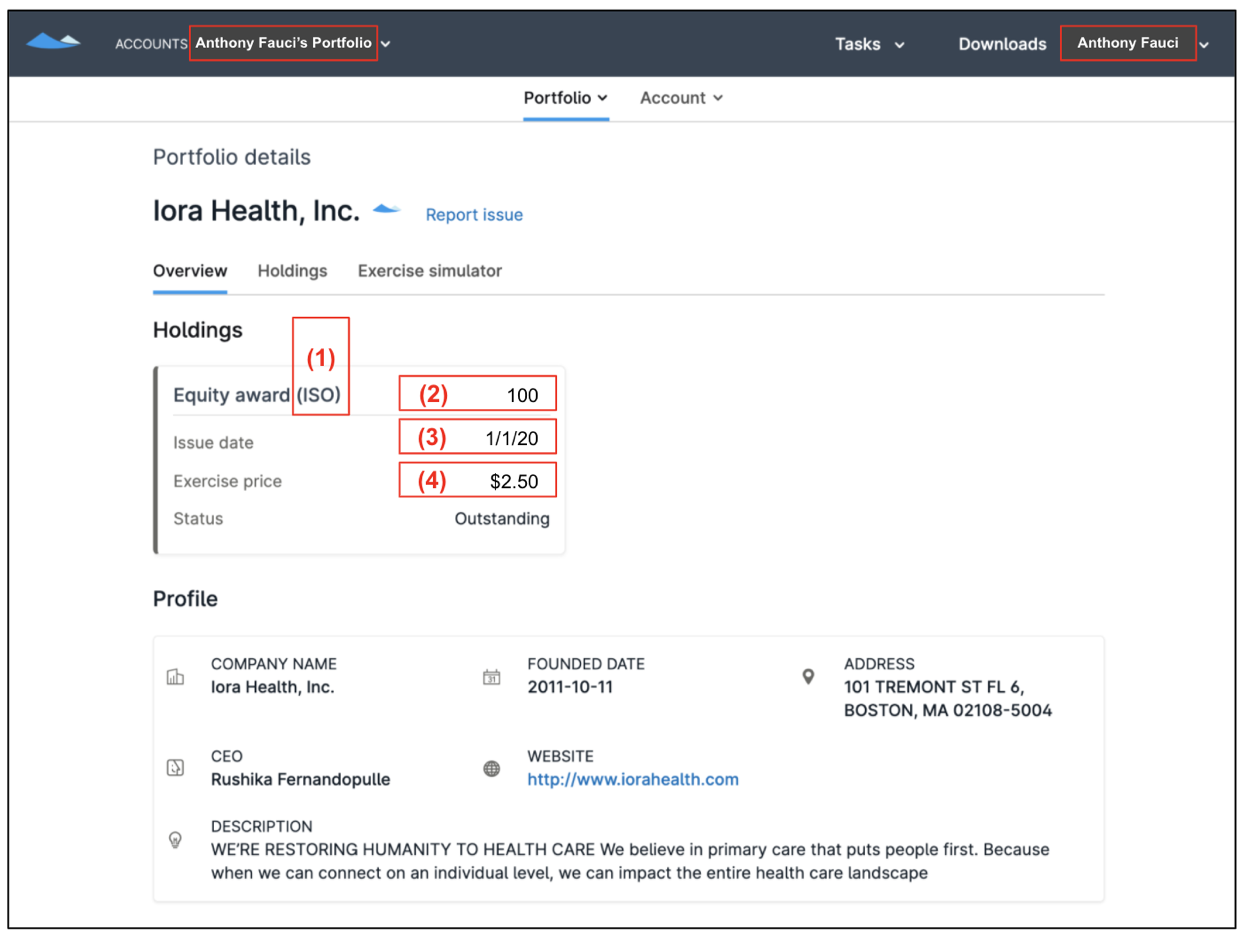

Once you’ve accessed your Carta account, you’ll arrive at the Portfolio Details page (screenshot below). You’ll want to identify the following 4 pieces of information for each Iora equity award you’ve received (see Carta screenshot below):

1.Type of Equity Compensation you received:

•Incentive Stock Options (ISOs) or

•Stock Appreciation Rights (SARs) - sometimes also referred to as phantom equity

2.Number of SARs or ISOs granted to you

3.Issue Date (sometimes also referred to as Grant Date)

4.Exercise Price

STEP #2: Understand the core terms & concepts of equity compensation at Iora

•please visit this page on Canopy to learn more about Incentive Stock Options (ISOs)

•please visit this page on Canopy to learn more about Stock Appreciation Rights (SARs), sometimes referred to as phantom equity

STEP #3: Refer to table below to estimate the potential financial value of your vested Iora equity

The table below estimates the pre-tax financial value of an Iora equity grant of 500 ISOs or 500 SARs assuming a hypothetical Acquisition Closing Date of 10/1/21 and a hypothetical One Medical stock price of $36.00/share. (Note: because One Medical shares are publicly traded the share price changes daily and may increase or decrease, the estimated financial value of your equity will fluctuate following the Acquisition Closing Date based on the One Medical share price in effect).

•Iora ISO holders will generally have their vested Iora ISOs automatically converted into One Medical incentive stock options upon closing at a conversion rate of 0.689 One Medical ISOs for each 1 Iora ISO. However, please note that some unvested ISOs which accelerate vesting upon the Acquisition Closing Date may convert to non-qualified stock options (NSOs), due to limitations under the Internal Revenue Code as to the maximum number of ISOs that may first become exercisable in a given year.

◦One Medical ISOs can then be held or exercised in accordance with their terms.

◦If exercised, the One Medical ISOs will be converted into One Medical stock.

◦Subject to applicable insider trading policies, One Medical stock can be sold in the public stock exchange and converted into cash.

◦The value of your new One Medical ISOs will change daily based on the company’s stock price.

•Iora SARs holders will have their vested Iora SARs automatically converted to a cash payment at closing. The methodology to determine this cash payment will be based on the same conversion rate of 0.689 One Medical units for each 1 Iora unit.

If you received:

•more than 500 ISOs or SARs from Iora, please extrapolate the number in the table to your grant (for example, if you received 1,000 ISOs, simply double the relevant amount in Column C)

•more than one equity compensation grant at different points in time, please extrapolate the number in the table to each grant

Please note: this table does NOT take into account if you exercised & sold vested equity compensation as part of Iora’s Tender Offer process in July 2018.

| Column A | Column B | Column C | ||||||

Approximate GRANT DATE of your Iora Equity Compensation grant | Approximate EXERCISE PRICE PER SHARE of your Iora Equity Compensation grant | ESTIMATED Post-Exercise, Pre-Tax and Assumed Vesting FINANCIAL VALUE of 500 Iora ISOs or 500 Iora SARs assuming a hypothetical Acquisition Closing Date of 10/1/21 and an estimated One Medical Stock Price of ~$36.00/share* | ||||||

| On or before 7/1/17 | $0.82 - $0.94 per share | $11,000 | ||||||

| On or around 1/1/18 | $2.14 per share | $10,000 | ||||||

| On or around 7/1/18 | $2.14 per share | $9,500 | ||||||

| On or around 1/1/19 | $2.14 per share | $9,000 | ||||||

| On or around 7/1/19 | $2.36 per share | $8,000 | ||||||

| On or around 1/1/20 | $2.50 per share | $7,500 | ||||||

| On or around 7/1/20 | $2.50 per share | $6,500 | ||||||

| Iora employees who started or received a written offer letter between the time that the Iora Board last approved option grants in December 2020 and June 7, 2021 | n/a | See below: Special Information for Employees Who Do Not Have a Board-Approved Grant | ||||||

*Note: because One Medical shares are publicly traded the share price changes daily and may increase or decrease, the estimated financial value of your equity will fluctuate based on the One Medical share price in effect.

STEP #4: Determine the potential financial value of your unvested Iora equity.

(Note: this step pertains only to Iora employees who joined Iora before the Iora Board’s last equity grant approval, in December 2020)

For ISO holders, after the Acquisition Closing Date each one of your unvested Iora ISOs will become 0.689 unvested One Medical ISOs in the equity management platform used by One Medical. (One Medical uses Shareworks instead of Carta.) Those ISOs will vest according to your previously

established vesting schedule. As those One Medical ISOs vest you may choose to exercise them, similar to your exercise rights at Iora. When you exercise a One Medical ISO it becomes a share of One Medical stock, which employees are eligible to sell in the public market subject to applicable insider trading policies. If you leave One Medical, you will generally forfeit any remaining unvested ISOs and you must exercise any vested shares within a time period defined in One Medical’s equity plan (similar to Iora).

For SARs holders, after the Acquisition Closing Date each of your unvested Iora SARs will be converted to cash which is held by One Medical and paid out according to your original Iora vesting schedule. If you leave One Medical before your vesting schedule is completed you will generally forfeit any remaining SARs related cash payments.

For ISO holders and SAR holders, if your employment with One Medical and Iora is terminated within 12 months following the Acquisition Closing Date by One Medical or Iora without cause, then each of your then-unvested ISOs will vest and become exercisable and each of your then-unvested SAR cash payments will vest and become payable to you, in either case, as of the date of your termination of employment.

================

Special Information for Employees Who Do Not Have a Board-Approved Grant

Note: Employees who fall into this category do not have a Carta account.

Iora employees who started or received a written offer letter between the time that the Iora Board last approved option grants (in December 2020) and June 7, 2021 whose offer letter from Iora referenced equity compensation (ISOs or SARs) will be eligible (upon successful completion of the acquisition) for a one-time cash award in lieu of an equity grant. This one-time cash award is anticipated to be approximately $5,000 for each 500 units of ISOs or SARs referenced in the employee’s offer letter. More details about eligibility for the cash award will be provided during the to-be-scheduled information session for individuals in this group.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Form 8.5 (EPT/RI) - musicMagpie Plc

- QuickHR Honours Women Leaders with the Annual Woman of Excellence Award

- Zero Knowledge Ventures Secures $7 Million to Propel Global Entrepreneurs into the US Market

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share