Form 424B7 Hutchison China MediTech

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed pursuant to Rule 424(b)(7)

Registration No. 333-217101

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered(1) |

Amount to be Registered(1) |

Offering Price Per ADS |

Aggregate Offering Price(1) |

Amount of Registration Fee(2) |

||||

|---|---|---|---|---|---|---|---|---|

Ordinary Shares, US$0.10 par value(3) |

69,000,000 | US$24.00 | US$331,200,000 | US$40,141.44 | ||||

|

||||||||

- (1)

- Includes

9,000,000 ordinary shares, $0.10 par value, underlying 1,800,000 American depositary shares which may be purchased by the underwriter upon exercise of the

underwriter's option to purchase additional American depositary shares.

- (2)

- Calculated

in accordance with Rules 457(b) and 457(r) of the Securities Act of 1933, as amended, and relates to the registration statement on Form F-3

(File No. 333-217101) filed by the registrant on April 3, 2017.

- (3)

- These ordinary shares are represented by the registrant's American depositary shares each of which represents five ordinary shares of the registrant. Such American depositary shares issuable on deposit of the ordinary shares registered hereby have been registered under a separate registration statement on Form F-6 (File No. 333-209930).

PROSPECTUS SUPPLEMENT

(To prospectus dated April 3, 2017)

12,000,000 American Depositary Shares

(Representing 60,000,000 Ordinary Shares)

Hutchison China MediTech Limited

Hutchison Healthcare Holdings Limited, which we refer to as the selling shareholder or HHHL, is offering 12,000,000 of our American depositary shares, or ADSs, representing 60,000,000 of our ordinary shares, par value US$0.10 per share. Each ADS represents five ordinary shares. The selling shareholder will receive all of the proceeds from the sale of the ADSs in this offering.

Our ADSs are listed on the Nasdaq Global Select Market, and our ordinary shares are admitted to trading on the AIM market of the London Stock Exchange plc, or AIM, under the symbol "HCM." On June 26, 2019, the closing sale price of our ADSs on the Nasdaq Global Select Market was US$29.01 per ADS, and the closing sale price of our ordinary shares on AIM was £4.57 per share.

Investing in our ADSs involves a high degree of risk. See the "Risk Factors" section contained in this prospectus supplement beginning on page S-15.

PRICE: US$24.00 per ADS

|

||||

| |

Per ADS |

Total |

||

|---|---|---|---|---|

Public offering price |

US$24.00 | US$288,000,000 | ||

Underwriting discounts and commissions(1) |

US$0.51 | US$6,120,000 | ||

Proceeds, before expenses, to the selling shareholder |

US$23.49 | US$281,880,000 | ||

|

||||

- (1)

- We refer you to the "Underwriting" section of this prospectus supplement for additional information regarding total underwriting compensation payable by the selling shareholder.

The selling shareholder has granted the underwriter an option to purchase up to an aggregate of an additional 1,800,000 ADSs from it within 30 days of the date of this prospectus supplement at the public offering price, less underwriting discounts and commissions. See "Underwriting."

Neither the Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the ADSs against payment on or about July 2, 2019.

![]()

The date of this prospectus supplement is June 28, 2019.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is a part of a registration statement on Form F-3, or the accompanying prospectus, that we have filed with the SEC on April 3, 2017 (File No. 333-217101).

This prospectus supplement describes the terms of this offering of ADSs by the selling shareholder and also adds to and updates information contained in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in any document incorporated by reference into this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference into this prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier statement.

Before buying any of the ADSs that the selling shareholder is offering, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with additional information under the headings "Where You Can Find Additional Information" and "Incorporation of Certain Documents By Reference" for other information that you may need to make a decision to invest in the ADSs.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the ADSs or possession or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of the prospectus supplement and the accompanying prospectus applicable to that jurisdiction.

Neither we, the selling shareholder nor the underwriter have authorized anyone to provide you with different or additional information to that contained or incorporated by reference in this prospectus supplement or the accompanying prospectus or in any free writing prospectus prepared by us or on our behalf or to which we have referred you. Neither we, the selling shareholder nor the underwriter take any responsibility for, and cannot provide any assurance as to the reliability of, any other information that others may give you. This prospectus supplement and the accompanying prospectus may only be used where it is legal to sell these securities. You should not assume that the information contained in this prospectus supplement and the accompanying prospectus or the documents incorporated by reference, and any free writing prospectus that we have authorized for use in connection with this offering, is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement and the accompanying prospectus are the property of their respective owners.

Although we are responsible for all disclosure contained in this prospectus supplement and the accompanying prospectus, in some cases we have relied on certain market and industry data obtained from third-party sources that we believe to be reliable, a report prepared by Frost & Sullivan, an independent industry consultant, which was commissioned by us. Market estimates are calculated by using independent industry publications, government publications and third-party forecasts in conjunction with our assumptions about our markets. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings "Forward-Looking Statements" and "Risk Factors" in this prospectus supplement and the accompanying prospectus and

S-1

under similar headings in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

This prospectus supplement contains translations of certain foreign currency amounts into U.S. dollars for illustrative purposes only. Unless otherwise indicated, all translations of renminbi into U.S. dollars were made at RMB6.67 to US$1.00. We make no representation that the renminbi amounts referred to in this prospectus supplement could have been or could be converted into U.S. dollars at any particular rate or at all.

Effective as of May 30, 2019, each of our ordinary shares was subdivided into 10 ordinary shares and the par value was changed from US$1.00 per ordinary share to US$0.10 per ordinary share. We refer to this as the "Share Split." In connection with the Share Split, the ADS ratio was changed from one ADS representing one-half ordinary share to one ADS representing five ordinary shares. Unless otherwise indicated, all ordinary share and per share amounts presented in this prospectus supplement have been adjusted retroactively as if the Share Split and ADS ratio change were already effective.

In this prospectus supplement, unless otherwise indicated, references to the "company," "Chi-Med," "we," "us" and "our" refer to Hutchison China MediTech Limited and its consolidated subsidiaries and joint ventures. Unless otherwise indicated, references in this prospectus supplement to:

"ADSs" are to our American depositary shares, each of which represents five ordinary shares;

"China" or "PRC" are to the People's Republic of China, excluding, for the purposes of this prospectus supplement only, Taiwan and the special administrative regions of Hong Kong and Macau;

"CK Hutchison" are to CK Hutchison Holdings Limited, a company incorporated in the Cayman Islands and listed on The Stock Exchange of Hong Kong Limited, or the Hong Kong Stock Exchange, and the ultimate parent company of the selling shareholder;

"HHHL" are to Hutchison Healthcare Holdings Limited, the selling shareholder, a British Virgin Islands company and indirect wholly owned subsidiary of CK Hutchison;

"Hutchison Baiyunshan" are to Hutchison Whampoa Guangzhou Baiyunshan Chinese Medicine Company Limited, our non-consolidated joint venture with Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited, a leading China-based pharmaceutical company listed on the Shanghai Stock Exchange and the Hong Kong Stock Exchange. We have a 50% interest in Hutchison Baiyunshan through a holding company in which we have an 80% interest;

"Hutchison Sinopharm" are to Hutchison Whampoa Sinopharm Pharmaceuticals (Shanghai) Company Limited, our joint venture with Sinopharm Group Co. Ltd., a leading distributor of pharmaceutical and healthcare products and a leading supply chain service provider in China listed on the Hong Kong Stock Exchange. We have a 51% interest in Hutchison Sinopharm;

"Nutrition Science Partners" are to Nutrition Science Partners Limited, our non-consolidated joint venture with Nestlé Health Science S.A. in which we have a 50% interest;

"ordinary shares" or "shares" are to our ordinary shares, par value US$0.10 per share;

"Securities Act" are to the U.S. Securities Act of 1933, as amended;

"Shanghai Hutchison Pharmaceuticals" are to Shanghai Hutchison Pharmaceuticals Limited, our non-consolidated joint venture with Shanghai Pharmaceuticals Holding Co., Ltd., a leading pharmaceutical company in China listed on the Shanghai Stock Exchange and the Hong Kong Stock Exchange. We have a 50% interest in Shanghai Hutchison Pharmaceuticals;

"United States" or "U.S." are to the United States of America;

"US$" or "U.S. dollars" are to the legal currency of the United States; and

"£" are to the legal currency of the United Kingdom.

S-2

This prospectus supplement, the accompanying prospectus and the documents incorporated herein and therein by reference contain forward-looking statements made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The words "anticipate," "assume," "believe," "contemplate," "continue," "could," "estimate," "expect," "goal," "intend," "may," "might," "objective," "plan," "potential," "predict," "project," "positioned," "seek," "should," "target," "will," "would," or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We believe that these risks and uncertainties include, but are not limited to, those described in the "Risk Factors" sections of this prospectus supplement, the accompanying prospectus as well as in other documents incorporated by reference, which include, but are not limited to, the following:

- •

- the initiation, timing, progress and results of our or our collaboration partners' pre-clinical and clinical studies, and our research and

development programs;

- •

- our or our collaboration partners' ability to advance our drug candidates into, and/or successfully complete, clinical studies;

- •

- the timing of regulatory filings and the likelihood of favorable regulatory outcomes and approvals;

- •

- regulatory developments in China, the United States and other countries;

- •

- the adaptation of our Commercial Platform to market and sell our drug candidates and the commercialization of our drug candidates, if approved;

- •

- the pricing and reimbursement of our and our joint ventures' products and our drug candidates, if approved;

- •

- our ability to contract on commercially reasonable terms with contract research organizations, third-party suppliers and manufacturers;

- •

- the scope of protection we are able to establish and maintain for intellectual property rights covering our or our joint ventures' products and

our drug candidates;

- •

- the ability of third parties with whom we contract to successfully conduct, supervise and monitor clinical studies for our drug candidates;

- •

- estimates of our expenses, future revenue, capital requirements and need for additional financing;

- •

- our ability to obtain additional funding for our operations;

- •

- the potential benefits of our collaborations and our ability to enter into future collaboration arrangements;

- •

- the ability and willingness of our collaboration partners to actively pursue development activities under our collaboration agreements;

- •

- our receipt of milestone or royalty payments pursuant to our strategic alliances with AstraZeneca AB (publ), or AstraZeneca, and Lilly (Shanghai) Management Company Limited (formerly known as Eli Lilly Trading (Shanghai) Company Limited), or Eli Lilly;

S-3

- •

- the ability of our approved drug fruquintinib to achieve the same benefits for patients as those obtained during clinical trials and the

absence of unidentified side effects which could result in the Chinese regulators pulling fruquintinib from the market;

- •

- the rate and degree of market acceptance of our drug candidates;

- •

- our financial performance;

- •

- our ability to attract and retain key scientific and management personnel;

- •

- our relationship with our joint venture and collaboration partners;

- •

- developments relating to our competitors and our industry, including competing drug products;

- •

- changes in our tax status or the tax laws in the jurisdictions that we operate; and

- •

- development in our business strategies and business plans.

These factors should not be construed as exhaustive and should be read with the other cautionary statements in this prospectus supplement, the accompanying prospectus as well as in other documents incorporated by reference.

Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. As a result, any or all of our forward-looking statements in this prospectus supplement and the accompanying prospectus may turn out to be inaccurate. We have included important factors in the cautionary statements included in the "Risk Factors" sections of this prospectus supplement, the accompanying prospectus as well as in other documents incorporated by reference that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Moreover, we operate in a highly competitive and rapidly changing environment in which new risks often emerge. Our management may not be able to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make.

You should read this prospectus supplement, the accompanying prospectus and the other documents incorporated by reference herein or therein completely and with the understanding that our actual future results may be materially different from what we expect. The forward-looking statements contained in this prospectus supplement, the accompanying prospectus and any documents incorporated herein and therein are made as of the date of such statement, and we do not assume any obligation to update any forward-looking statements except as required by applicable law.

S-4

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference into this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our ADSs. For a more complete understanding of our company and this offering, we encourage you to read and consider carefully this entire prospectus supplement and the accompanying prospectus and the information incorporated by reference herein and therein, including our and our non-consolidated joint ventures' financial statements and the sections entitled "Item 3.D. Risk Factors" and "Item 5. Operating and Financial Review and Prospects" included in our annual report on Form 20-F filed with the SEC on March 11, 2019, as subsequently amended, or the 2018 Annual Report, and our current reports furnished on Form 6-K to the SEC on April 15, 2019 and June 6, 2019, respectively, and incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. Unless otherwise specified, market and industry data set out in this section are derived from a report prepared by Frost & Sullivan, an independent industry consultant, which was commissioned by us.

We are an innovative, commercial-stage biopharmaceutical company based in China aiming to become a global leader in the discovery, development and commercialization of targeted therapies and immunotherapies for the treatment of cancer and immunological diseases. Our mission is to leverage the highly specialized expertise of our fully integrated drug discovery division, known as our Innovation Platform, to develop and expand our drug candidate portfolio for the global market while also building on our first-mover advantage in the development and launch of novel cancer drugs in China. We also operate well-established and profitable Prescription Drug and Consumer Health businesses in China, known together as our Commercial Platform. Our commercial footprint in China gives us extensive infrastructure and know-how to market pharmaceutical products in the complex healthcare system in that country.

Our ordinary shares have been admitted to trading on AIM since 2006, and our ADSs have been listed on Nasdaq Global Select Market since 2016.

Innovation Platform

Focusing on both the global innovation and China oncology markets, our Innovation Platform is led by a team of over 440 scientists and staff. This team has an established track record of highly productive drug development over the last 17 years. Currently, we have eight self-discovered drug candidates in clinical trials, five of which are either in or about to start global clinical development. We plan to further establish and leverage this platform to produce and commercialize a stream of novel drug candidates with global potential.

Our Innovation Platform achieved an important milestone in its China oncology drug development with the commercial launch in late November 2018 of our self-discovered and developed drug fruquintinib, sold under the brand name Elunate, for the treatment of metastatic colorectal cancer. Fruquintinib is the first ever China-discovered and developed targeted oncology therapy to have received unconditional approval and be subsequently commercialized.

Our core research and development philosophy is to take a holistic approach to the treatment of cancer and immunological diseases, through multiple modalities and mechanisms, including targeted therapies, immunotherapies and other pathways. Our initial focus has been to design uniquely selective small molecule tyrosine kinase inhibitors deliberately engineered to improve drug efficacy and reduce known off-target toxicities. We recognized early on in our research and development that high selectivity is crucial in effectively treating patients with monotherapies as well as with combination therapies which we believe are needed to significantly improve treatment outcomes. We are designing these highly selective tyrosine kinase inhibitors against various targets with applications across multiple cancer and immunological indications.

S-5

We believe that our long track record of research and development in China will enable us to take advantage of the significant market opportunities in that country, which have been buoyed by the PRC government's recent policy reforms aimed at accelerating domestic innovative drug development and the expansion of access to world-class medicines for the people of China. The PRC government has enacted a series of policies to shorten the review and approval time for innovative drugs that address urgent medical needs and support innovative drug development by both domestic and multinational companies. In addition, national-, city- and provincial-level medical insurance reimbursement has been expanding rapidly, thereby reducing out-of-pocket treatment cost for patients. With these reforms, more advanced cancer treatments are being approved at an expedited pace and more patients will be able to afford such treatments. As a result, the China oncology market is expected to grow at a compound annual growth rate of 15.0% between 2018 and 2023 and 11.1% between 2023 and 2030.

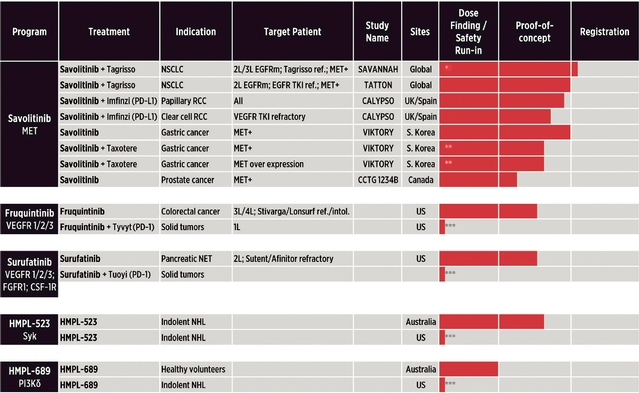

Global Clinical Drug Development

We believe our drug candidates in global development—savolitinib, fruquintinib, surufatinib (previously named sulfatinib), HMPL-523 and HMPL-689—are uniquely selective and/or differentiated and have the potential to be global first-in-class and/or best-in-class therapies. The following table summarizes the status of our global clinical drug portfolio's development as of the date of this prospectus supplement.

Our Global Clinical Development Pipeline

- Notes:

- Dose finding/safety run-in = Phase I/Ia studies; Proof-of-concept = Phase Ib, Ib/II or II studies; Registration = Phase II, II/III or III registration intent studies; NSCLC = non-small cell lung cancer; RCC = renal cell carcinoma; NHL = Non-Hodgkin's Lymphoma; * Phase II registration intent study subject to regulatory discussions; ** Further patient enrollment directed to savolitinib monotherapy arm due to the high efficacy observed; and *** In planning.

S-6

Over the next several years, we intend to accelerate development of our global clinical drug portfolio through existing partnerships such as that with AstraZeneca, as well as increasingly through our own clinical and regulatory operations in the United States and Europe.

- •

- Savolitinib—potential first-in-class selective MET inhibitor in late-stage clinical development as a monotherapy and in combination therapies in partnership with AstraZeneca

- •

- Fruquintinib—potential best-in-class selective VEGFR 1, 2 and 3 inhibitor

Savolitinib is a potent and selective inhibitor of the mesenchymal epithelial transition factor, or MET, receptor tyrosine kinase, an enzyme which has been shown to function abnormally in many types of solid tumors. We designed savolitinib through chemical structure modification to specifically address kidney toxicity, the primary issue that halted development of several other selective MET inhibitors. In clinical trials to date in over 900 patients globally, savolitinib has shown promising signs of clinical efficacy in patients with MET gene alterations in lung cancer, kidney cancer, gastric cancer and prostate cancer with an acceptable safety profile.

We are currently testing savolitinib in global partnership with AstraZeneca, both as a monotherapy and in combination with immunotherapy, targeted therapy and chemotherapy drugs. Specifically, we are currently progressing a global Phase II study, known as the SAVANNAH study, on savolitinib in combination with Tagrisso for treating epidermal growth factor receptor mutation, or EGFRm, non-small cell lung cancer with MET amplification, or MET+. We expect the primary data from the SAVANNAH study to become available in 2021 and are hopeful that such data will be enough to support regulatory approval for this combination therapy. We also anticipate announcing plans for further Phase II/III studies on savolitinib in lung cancer during 2019. Furthermore, proof-of-concept studies of savolitinib in kidney cancer (as a monotherapy as well as in combinations with programmed death-ligand 1, or PD-L1, inhibitors) and gastric cancer (as a monotherapy as well as in combinations with chemotherapy) are expected to be submitted for publication or presentation at scientific conferences in 2019 and, if the results of such studies are positive, they may lead to subsequent clinical development.

Fruquintinib is a highly selective and potent oral inhibitor of three vascular endothelial growth factor receptors, known as VEGFR 1, 2 and 3. We believe that fruquintinib has the potential to become the global best-in-class selective small molecule VEGFR 1, 2 and 3 inhibitor for many types of solid tumors, and we are currently studying fruquintinib in colorectal cancer, gastric cancer and lung cancer. Based on pre-clinical and clinical data to date, fruquintinib's kinase selectivity has been shown to reduce off-target toxicity. This allows for drug exposure that is able to fully inhibit VEGFR, a receptor tyrosine kinase which contributes to angiogenesis, the buildup of new blood vessels around a tumor, thereby contributing to the growth of tumors. Such selectivity also facilitates use in potential combinations with immunotherapy, targeted therapy and chemotherapy drugs. Fruquintinib has been approved for the treatment of third-line metastatic colorectal cancer in China.

Building on the data collected from our successful Phase III trial in China, known as the FRESCO study, which supported fruquintinib's approval in China, and the ongoing Phase Ib dose finding study of fruquintinib in the United States, we are planning to initiate a registration study of fruquintinib in the United States and Europe as a third/fourth-line treatment for metastatic colorectal cancer patients during 2019. We also intend to conduct global combination studies of fruquintinib with Tyvyt, a programmed cell death protein 1, or PD-1, monoclonal antibody developed by Innovent Biologics (Suzhou) Co. Ltd., or Innovent, and recently approved for clinical development in both China, where we are currently enrolling a Phase I/II study, and the United States, where a Phase I study is in planning and expected to be initiated in 2019.

S-7

- •

- Surufatinib—unique angio-immuno kinase inhibitor

- •

- HMPL-523—potential first-in-class selective Syk inhibitor for oncology

Surufatinib is an oral small molecule inhibitor targeting VEGFR 1, 2 and 3, fibroblast growth factor receptor 1, or FGFR 1, and colony stimulating factor-1 receptor, or CSF-1R, kinases that could simultaneously block tumor angiogenesis and immune evasion. This unique angio-immuno kinase profile seems to support surufatinib as an attractive candidate for exploration of possible combinations with checkpoint inhibitors against various cancers. Surufatinib is the first oncology candidate that we have taken through proof-of-concept in China and expanded globally ourselves.

We currently have various clinical trials of surufatinib ongoing as a single agent in patients with neuroendocrine tumors and biliary tract cancer and in combination with checkpoint inhibitors. The encouraging data from our Phase II study of surufatinib in pancreatic neuroendocrine tumor patients in China, and the ongoing Phase Ib study in the United States of surufatinib in pancreatic neuroendocrine tumor patients, is guiding our planning for a registration study in the United States and Europe in patients who have progressed on Sutent or Afinitor. Similar to fruquintinib, we intend to conduct a combination study of surufatinib with Tuoyi, a PD-1 monoclonal antibody being developed by Shanghai Junshi Biosciences Co. Ltd., or Junshi, in both China, where we are currently enrolling a Phase I study, and the United States, where a Phase I study is in planning and expected to be initiated in 2019. We believe surufatinib has potential in a number of other tumor types such as breast cancer with FGFR 1 activation.

- •

- HMPL-689—potential best-in-class selective PI3Kd inhibitor

HMPL-523 is a highly selective oral inhibitor targeting the spleen tyrosine kinase, or Syk, for the treatment of hematological cancers and certain chronic immune diseases, such as rheumatoid arthritis. HMPL-523 has a unique pharmacokinetic profile which provides for higher drug exposure in the tissue where rheumatoid arthritis and hematological cancer occur, rather than on a whole blood level.

We currently have various clinical trials of HMPL-523 ongoing. Based on emerging Phase I/Ib proof-of-concept clinical data in China and Australia on HMPL-523, we plan to initiate development in the United States and Europe in 2019, focusing on multiple sub-categories of indolent non-Hodgkin's lymphoma.

HMPL-689 is a novel, highly selective and potent small molecule inhibitor targeting the isoform PI3Kd. We have designed HMPL-689 with superior PI3Kd isoform selectivity, in particular to not inhibit other kinases so as to minimize the risk of serious infection caused by immune suppression. Its selectivity also makes it well suited for use in potential combination therapies. HMPL-689's strong potency, particularly at the whole blood level, also allows for reduced daily doses to minimize compound related toxicity.

We have early stage clinical trials of HMPL-689 ongoing. Based on emerging Phase I/Ib proof-of-concept clinical data in China and Australia on HMPL-689, we plan to initiate development of this drug candidate in the United States and Europe in 2019, focusing on multiple sub-categories of indolent non-Hodgkin's lymphoma.

In line with our strategy to expand clinical activities globally, we commenced operation of our U.S. subsidiary, Hutchison MediPharma (US) Inc., at our new office in New Jersey in early 2018. While we have been involved in clinical and non-clinical development in North America and Europe for over a decade, the activities conducted by this new U.S. office will support our growth strategy outside of China and significantly broaden and scale our non-Asian clinical development and international operations. We also

S-8

intend to significantly expand our U.S. clinical team to support our increasing clinical activities in the United States, Europe and other parts of the world.

China Oncology Drug Development

The Chinese oncology market, which comprises approximately a quarter of the global oncology patient population, represents a substantial and fast-growing market opportunity. Strong market growth is expected to be driven by gradually improving affordability for world-class novel oncology drugs and the PRC government's increasing emphasis on innovation combined with rapidly reforming regulatory infrastructure. We believe our established presence in China, combined with our ability to deliver global-quality innovation, positions us well to address the major unmet medical needs in the China oncology market.

With a deep and risk-balanced drug development pipeline focusing on both validated targets and novel targets, we currently have eight drug candidates in clinical development covering a dozen cancer targets, including savolitinib and surufatinib which are in late-stage development in China. Our other drug candidates are also uniquely selective and/or differentiated and have the potential to be first-in-class and/or best-in-class oncology therapies in China.

As the first mover to bring a self-discovered and developed innovative targeted cancer treatment to market in China with the launch of Elunate, we believe we are well positioned to take advantage of this significant market opportunity.

Driven by our strong expertise in molecular-targeted drugs and commitment to combination therapies of our tyrosine kinase inhibitors with various immunotherapies, we recently entered into multiple global and China-only collaboration agreements with Innovent, Junshi, Genor Biopharma Co. Ltd., or Genor, and Taizhou Hanzhong Pharmaceuticals, Inc., or Hanzhong, to evaluate the safety, tolerability and efficacy of fruquintinib and surufatinib in combination with various PD-1 inhibitors, which are important additions to our ongoing studies combining savolitinib with AstraZeneca's PD-L1 inhibitor Imfinzi.

S-9

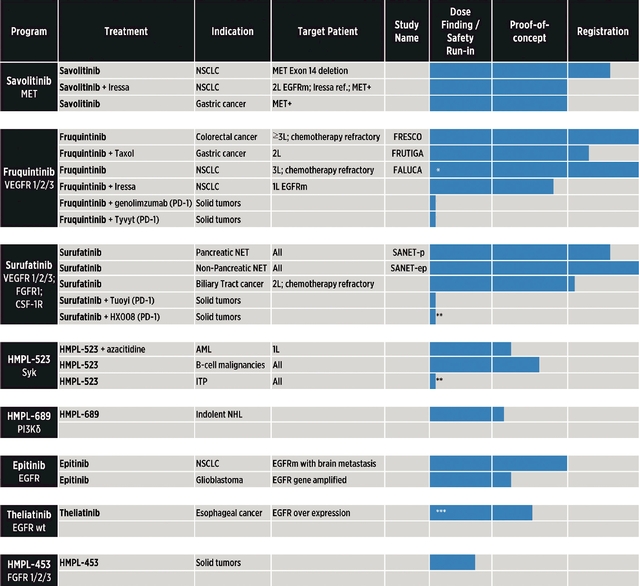

The following table summarizes the status of our China clinical programs as of the date of this prospectus supplement.

Our China Clinical Development Pipeline

- Notes:

- Dose finding/safety run-in = Phase I/Ia studies; Proof-of-concept = Phase Ib, Ib/II or II studies; Registration = Phase II, II/III or III registration intent studies; AML = acute myeloid leukemia; NSCLC = non-small cell lung cancer; NET = neuroendocrine tumors; NHL = non-Hodgkin's lymphoma; ref. or refractory = resistant to prior treatment; MET+ = MET-amplification; ITP = immune thrombocytopenia; * The trial did not meet the primary endpoint to demonstrate a statistically significant increase in overall survival compared to placebo. However, fruquintinib demonstrated a statistically significant improvement in all secondary endpoints including progression-free survival, objective response rate, disease control rate and duration of response as compared to the placebo; ** In planning; and *** Discontinued.

S-10

- •

- Savolitinib—potential first-in-class selective MET inhibitor in China

- •

- Fruquintinib—commercially launched in colorectal cancer in November 2018

We are currently conducting a Phase II registration study in China of savolitinib in non-small cell lung cancer patients with MET Exon 14 mutation/deletion who have failed prior systemic therapy, or are unwilling or unable to receive chemotherapy, which is expected to complete enrollment in mid-2019. If the results from this study are positive, we hope this would be sufficient to support an NDA submission in China. We believe MET Exon 14 mutation/deletion non-small cell lung cancer in China has the potential to be the first savolitinib indication approved.

- •

- Surufatinib—potential first-in-class inhibitor for all neuroendocrine tumors

In November 2018, we commenced commercial sales of Elunate, the brand name of fruquintinib capsules, targeting the more than 55,000 metastatic colorectal cancer third-line patients in China each year as of 2018. Elunate was launched with an initial retail price of approximately RMB22,000 (US$3,298) per cycle, on a four-week per cycle basis. Patients pay for three cycles of Elunate (cycles one, two and five) at the full price, and outside of these three cycles, Elunate is provided for free under Eli Lilly's patient access program. We expect an average usage of 5.5 cycles. In addition to this commercial launch, we have made progress with fruquintinib in partnership with Eli Lilly in various other cancer indications, including the initiation of the FRUTIGA study in China, a pivotal Phase III study to evaluate the efficacy and safety of fruquintinib in combination with Taxol compared with Taxol monotherapy for second-line treatment of advanced gastric cancer in patients who had failed first-line chemotherapy. We have also completed enrollment of a Phase II study in China of fruquintinib in combination with Iressa in first-line EGFR activating mutation non-small cell lung cancer, from which preliminary data has shown encouraging efficacy and safety profile and further development is being considered. Moreover, in addition to our global collaboration to evaluate the combination of fruquintinib with Innovent's PD-1 monoclonal antibody Tyvyt, we have entered into a collaboration in China to evaluate the combination of fruquintinib with genolimzumab, a PD-1 monoclonal antibody being developed by Genor.

Fruquintinib is currently our most advanced asset in China, and as a result we place high importance on gaining decision-making responsibilities in the life cycle development of fruquintinib. We believe that fruquintinib is a best-in-class VEGFR 1, 2 and 3 inhibitor and could be considered for development in China in many solid tumor indications in which VEGFR inhibitors have been approved globally. To this end, we recently amended our collaboration agreement with Eli Lilly with respect to fruquintinib, which gives us, among other things, all planning, execution and decision-making responsibilities for life cycle indication development of fruquintinib in China.

In June 2019, an interim analysis of our SANET-ep study, a Phase III trial in non-pancreatic neuroendocrine tumor patients in China, confirmed that the trial met its primary endpoint of progression-free survival. As a result, the study will be stopped, and we will discuss the preparation of an NDA for this indication with the NMPA. In addition, our Phase III study of surufatinib in pancreatic neuroendocrine tumor patients in China is set for interim analysis in late 2019. Subject to clinical outcome, we are hopeful that this interim analysis could support NDA submission during 2020. Based on encouraging Phase Ib data, a third registration study on surufatinib, a Phase IIb/III study in biliary tract cancer, has also recently begun enrollment in China. In addition to our global collaboration to evaluate the combination of surufatinib with Junshi's PD-1 monoclonal antibody Tuoyi, we have entered into a collaboration in China to evaluate the combination of surufatinib with HX008, a PD-1 monoclonal antibody being developed by Hanzhong.

S-11

- •

- HMPL-523—highly selective Syk inhibitor with potential in hematological cancer and immunological diseases

- •

- HMPL-689—highly selective PI3Kd inhibitor with potential in hematological cancer

- •

- Epitinib, theliatinib and HMPL-453—clinical-stage drug candidates for which we aim to establish proof-of-concept by 2021

Data from an extensive Phase I/Ib dose escalation and expansion study (covering more than 140 patients) on HMPL-523 has encouraged us to initiate exploratory studies in China on multiple indolent non-Hodgkin's lymphoma sub-categories, including chronic lymphocytic leukemia/small lymphocytic lymphoma, follicular lymphoma, marginal zone lymphoma, Waldenstrom's macroglobulinemia and mantle cell lymphoma. We plan to initiate registration studies in China late in 2019 in several of these indolent non-Hodgkin's lymphoma sub-categories.

Furthermore, we have initiated a Phase I study of HMPL-523, in combination with Vidaza, an approved hypomethylating agent, in elderly patients with acute myeloid leukemia in China. We are also considering immunology applications for HMPL-523 including for the treatment of immune thrombocytopenia in China.

Our Phase I dose escalation study on HMPL-689 in China is close to completion and expected to proceed into Phase Ib proof-of-concept expansion studies in 2019 in multiple sub-categories of indolent non-Hodgkin's lymphoma.

We have initiated a Phase Ib/II trial in China to study epitinib, our unique EGFR inhibitor that has demonstrated the ability to penetrate the blood-brain barrier, for the treatment of glioblastoma, a primary brain cancer that harbors high levels of EGFR gene amplification. We aim to establish proof-of-concept for epitinib as well as theliatinib, targeting EGFR wild-type, and HMPL-453, targeting FGFR 1, 2 and 3, by 2021.

Global-facing Discovery Engine

Leveraging the extensive and well-established drug discovery resources of our Innovation Platform, we are invested in continuing to create differentiated novel oncology and immunology treatments. These novel drug candidates reflect our core research and development philosophy in treating cancer and immunological diseases through multiple modalities and mechanisms. These include furthering our other pre-clinical programs for therapies addressing aberrant genetic drivers, inactivated T-cell response and insufficient T-cell response.

Commercial Platform

In addition to our Innovation Platform, we have established a profitable Commercial Platform in China. Many of the drugs sold by our Commercial Platform are household-name brands and/or have significant market share.

Our Commercial Platform has grown to a significant scale, with extensive manufacturing, marketing and distribution capabilities for prescription drugs and consumer health products. Our Commercial Platform has provided us the infrastructure and know-how in operating and marketing pharmaceutical products in the complex and evolving healthcare system in China. Additionally, cash flow from our Commercial Platform has provided an important source of funding for our Innovation Platform since our inception.

Our Prescription Drugs business joint ventures with Shanghai Pharmaceuticals Holding Co., Ltd. and Sinopharm Group Co. Ltd. operate a network of approximately 2,400 prescription drugs sales representatives covering over 24,900 hospitals in over 320 cities and towns in China as of March 31, 2019.

S-12

Leveraging this extensive network, these joint ventures, Shanghai Hutchison Pharmaceuticals and Hutchison Sinopharm, own or have distribution rights to a number of important prescription drugs in China, including She Xiang Bao Xin Pill, a nationally known oral vasodilator and pro-angiogenesis drug, and Concor (Bisoprolol tablets), one of the leading cardiac beta-1 receptor blockers in China.

Over the next several years, we will combine the marketing and sales experience and hospital access gained from our Commercial Platform's operations with our growing dedicated oncology-focused sales team to support the launch of products from our Innovation Platform if and when they are approved for use in China. Concurrent with this commercial team expansion, we also plan to increase our manufacturing capacity with a fully integrated active pharmaceutical ingredients or formulation manufacturing facility that is capable of supporting the manufacturing of our current and future commercial-stage oncology drugs.

Hutchison China MediTech Limited was incorporated in the Cayman Islands on December 18, 2000 as an exempted company with limited liability under the Companies Law, Cap 22 (Law 3 of 1961, as consolidated and revised) of the Cayman Islands. The address of our registered office in the Cayman Islands is P.O. Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. Our principal executive offices are located at Level 18, The Metropolis Tower, 10 Metropolis Drive, Hunghom, Kowloon, Hong Kong. Our telephone number at that address is +852 2121 8200. Our agent for service of process in the United States is Hutchison MediPharma (US) Inc., located at 25A Vreeland Road, Suite 304, Florham Park, New Jersey, 07932.

Our website address is www.chi-med.com. Our website and the information contained on our website do not constitute a part of this prospectus supplement.

S-13

ADSs Offered by the Selling Shareholder |

12,000,000 ADSs in this offering. | |

Ordinary Shares Outstanding Before and After This Offering |

666,577,450 ordinary shares. |

|

Option to Purchase Additional ADSs |

The selling shareholder has granted a 30-day option to the underwriter to purchase up to an aggregate of an additional 1,800,000 ADSs. |

|

American Depositary Shares: |

Each ADS represents five ordinary shares. You will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary and all holders and beneficial owners of ADSs issued thereunder. To better understand the terms of the ADSs, you should carefully read the section in the accompanying prospectus titled "Description of the Securities," which is incorporated by reference into this prospectus supplement, and the deposit agreement referred to therein. |

|

|

Investors in the ADSs will be able to trade our securities and receive distributions on them to the extent described in the section in the accompanying prospectus titled "Description of the Securities." |

|

Depositary |

Deutsche Bank Trust Company Americas |

|

Use of Proceeds |

The selling shareholder will receive all of the proceeds from the sale of the ADSs in this offering. For additional information, please see the "Use of Proceeds" section included elsewhere in the prospectus supplement. |

|

Risk Factors |

Investing in our ADSs involves significant risks. See "Risk Factors" on page S-15 of this prospectus supplement and the other information included in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus. |

|

Nasdaq Global Select Market Symbol |

The ADSs are listed on the Nasdaq Global Select Market under the symbol "HCM." |

Unless otherwise indicated, all information in this prospectus supplement, including information relating to the number of ordinary shares to be outstanding before and after the completion of this offering:

- •

- excludes 18,409,500 ordinary shares issuable upon exercise of outstanding options under our equity compensation plans, as of March 31,

2019;

- •

- excludes 23,130,970 ordinary shares reserved for further issuance under our equity compensation plans, as of March 31, 2019; and

- •

- assumes no exercise by the underwriter of the option to purchase up to 1,800,000 additional ADSs.

S-14

Investing in our ADSs involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described in this prospectus supplement and the accompanying prospectus, together with all of the other information incorporated by reference herein or therein, including those Item 3.D. "Risk Factors" in the 2018 Annual Report and those included in our current report furnished to the SEC on April 15, 2019, as well as other documents that we subsequently filed with the SEC that are incorporated by reference into this prospectus supplement. The risks and uncertainties described in that section and in the other documents incorporated by reference are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If negative events occur, our business, financial condition, results of operations, and prospects would suffer. In that event, the market price of our ADSs could decline, and you may lose all or part of your investment.

Risks Related to the American Depositary Shares and This Offering

The liquidity of our ADSs and ordinary shares may have an adverse effect on share price.

As of June 26, 2019, we had 666,577,450 ordinary shares outstanding. There is a risk that there may not be sufficient liquidity in the market to accommodate significant increases in selling activity or the sale of a large block of our securities.

Our ADSs are listed on Nasdaq, and our ordinary shares are admitted to trading on AIM. The dual listing of our ordinary shares and ADSs may dilute the liquidity of these securities in one or both markets and may adversely affect the development of an active trading market for the ADSs in the United States. The price of the ADSs could also be adversely affected by trading in our ordinary shares on AIM. Furthermore, our ordinary shares trade on AIM in the form of depository interests, each of which is an electronic book entry interest representing one of our ordinary shares. However, the ADSs are backed by physical ordinary share certificates, and the depositary bank for our ADS program is unable to accept depository interests into its custody in order to issue ADSs. As a result, if an ADS holder wishes to cancel its ADSs and instead hold depository interests for trading on AIM or vice versa, the issuance and cancellation process may be longer than if the depositary could accept such depository interests.

Although our ordinary shares continue to be admitted to trading on AIM, we may decide at some point in the future to propose to our ordinary shareholders to delist our ordinary shares from AIM, and our ordinary shareholders may approve such delisting. We cannot predict the effect such delisting of our ordinary shares on AIM would have on the market price of the ADSs on Nasdaq.

Substantial future sales or perceived potential sales of our ADSs in the public market may adversely affect the price of our ADSs.

In the future, we may sell our ADSs or our ordinary shares to raise capital, and our existing shareholders may sell substantial amounts of our ADSs or our ordinary shares in the public market. We cannot predict the size of such future issuance or the effect, if any, that they may have on the market price of our ADSs. Any future sales of a substantial amount of our ADSs or our ordinary shares in the public market, or the perception that such issuance and sale may occur, may adversely affect the price of our ADSs and impair our ability to raise capital through the sale of equity securities.

Upon completion of this offering, the selling shareholder who is also our largest shareholder will continue to own a significant percentage of our ordinary shares, which limits the ability of other shareholders to influence corporate matters.

As of June 26, 2019, HHHL owned approximately 60.2% of our ordinary shares, and HHHL's interest will decrease to approximately 51.2% of our ordinary shares immediately after the completion of this offering, assuming the underwriter does not exercise the option to purchase the additional 1,800,000 ADSs.

S-15

Accordingly, HHHL has and after this offering will have a significant influence over the management and strategic direction of our company. In addition, HHHL will retain a significant influence over the outcome of any corporate transaction or other matter submitted to shareholders for approval, and the interests of HHHL may differ from the interests of our other shareholders. Because we are incorporated in the Cayman Islands, certain matters, such as amendments to our memorandum and articles of association, require approval of at least two thirds of our shareholders by law subject to higher thresholds which we may set in our memorandum and articles of association. Therefore, HHHL's approval will be required to achieve any such threshold.

The market price for our ADSs may be volatile which could result in substantial loss to you.

The market price of our ADSs has been volatile. From March 17, 2016 to June 25, 2019, the closing sale price of our ADSs ranged from a high of US$41.14 to a low of US$11.26 per ADS. The market price for our ADSs is likely to be volatile and subject to wide fluctuations in response to factors, including the following:

- •

- announcements of competitive developments;

- •

- regulatory developments affecting us, our customers or our competitors;

- •

- announcements regarding our clinical trial results;

- •

- announcements regarding litigation or administrative proceedings involving us;

- •

- actual or anticipated fluctuations in our period-to-period operating results;

- •

- changes in financial estimates by securities research analysts;

- •

- additions or departures of our executive officers;

- •

- release or expiry of lock-up or other transfer restrictions on our outstanding ordinary shares or ADSs; and

- •

- sales or perceived sales of additional ordinary shares or ADSs.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. The market for equity securities of pharmaceutical companies, in particular, has at various times experienced extreme volatility. Prolonged global capital markets volatility may affect overall investor sentiment towards our ADSs, which would also negatively affect the market price for our ADSs.

Your right to participate in any future offerings may be limited, which may cause dilution to your holdings.

We may from time to time distribute rights to our shareholders, including rights to acquire our securities. However, we cannot make rights available to you in the United States unless we register the rights and the securities to which the rights relate under the Securities Act or an exemption from the registration requirements is available. Also, under the deposit agreement, the depositary bank will not make rights available to you unless either both the rights and any related securities are registered under the Securities Act, or the distribution of them to ADS holders is exempted from registration under the Securities Act. We are under no obligation to file a registration statement with respect to any such rights or securities or to endeavor to cause such a registration statement to be declared effective. Moreover, we may not be able to establish an exemption from registration under the Securities Act. If the depositary does not distribute the rights, it may, under the deposit agreement, either sell them, if possible, or allow them to lapse. Accordingly, you may be unable to participate in our rights offerings and may experience dilution in your holdings.

S-16

If we are classified as a passive foreign investment company, U.S. investors could be subject to adverse U.S. federal income tax consequences.

The rules governing passive foreign investment companies, or PFICs, can have adverse effects for U.S. investors for U.S. federal income tax purposes. The tests for determining PFIC status for a taxable year depend upon the relative values of certain categories of assets and the relative amounts of certain kinds of income. As discussed in "Taxation—Material U.S. Federal Income Tax Considerations," we do not expect to be a PFIC for our current taxable year. Notwithstanding the foregoing, the determination of whether we are a PFIC depends on particular facts and circumstances (such as the valuation of our assets, including goodwill and other intangible assets) and may also be affected by the application of the PFIC rules, which are subject to differing interpretations. The fair market value of our assets is expected to depend, in part, upon (1) the market price of our ordinary shares and ADSs and (2) the composition of our income and assets, which will be affected by how, and how quickly, we spend any cash that is raised in any financing transaction. In light of the foregoing, no assurance can be provided that we will not be a PFIC for our current or any future taxable year. Furthermore, if we are treated as a PFIC, then one or more of our subsidiaries may also be treated as PFICs.

If we are or become a PFIC, U.S. Holders (as defined below) of our ordinary shares and ADSs would be subject to adverse U.S. federal income tax consequences, such as ineligibility for any preferential tax rates on capital gains or on actual or deemed dividends, interest charges on certain taxes treated as deferred, and additional reporting requirements under U.S. federal income tax laws and regulations. Whether U.S. Holders of our ordinary shares or ADSs make (or are eligible to make) a timely qualified electing fund, or QEF, election or a mark-to-market election may affect the U.S. federal income tax consequences to U.S. Holders with respect to the acquisition, ownership and disposition of our ordinary shares and ADSs and any distributions such U.S. Holders may receive. We do not, however, expect to provide the information regarding our income that would be necessary in order for a U.S. Holder to make a QEF election if we are classified as a PFIC. Investors should consult their own tax advisors regarding all aspects of the application of the PFIC rules to our ordinary shares and ADSs.

S-17

The selling shareholder will receive all of the proceeds from the sale of the ADSs in this offering. We will not receive any of the proceeds from the sale of our ADSs by the selling shareholder. See "Selling Shareholder."

S-18

The following table and accompanying footnotes set forth information relating to the beneficial ownership of our ordinary shares and ADSs as of June 26, 2019 by the selling shareholder, before and after giving effect to this offering, assuming the underwriter does not exercise the option to purchase 1,800,000 additional ADSs. Beneficial ownership is determined in accordance with the rules and regulations of the SEC.

| |

Prior to this offering | |

After giving effect to this offering | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Number of ADSs offered in this offering |

|||||||||||||||||||||

| |

Number of ordinary shares held |

Number of ADSs held |

Percentage(1) | Number of ordinary shares held |

Number of ADSs held |

Percentage(1) | ||||||||||||||||

Hutchison Healthcare Holdings Limited(2) |

366,666,670 | 6,862,420 | 60.2 | % | 12,000,000 | 340,978,770 | 0 | 51.2 | % | |||||||||||||

(1) Approximate percentage of our total issued and outstanding share capital is based on 666,577,450 ordinary shares outstanding as of June 26, 2019.

(2) HHHL, a British Virgin Islands company, is an indirect wholly owned subsidiary of CK Hutchison, a company incorporated in the Cayman Islands and listed on The Stock Exchange of Hong Kong Limited. The registered address of HHHL is Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola VG1110, British Virgin Islands.

S-19

We have never declared or paid dividends on our ordinary shares or ADSs. We currently expect to retain all future earnings for use in the operation and expansion of our business and do not have any present plan to pay any dividends. The declaration and payment of any dividends in the future will be determined by our board of directors in its discretion, and will depend on a number of factors, including our earnings, capital requirements, overall financial condition and contractual restrictions.

S-20

The following is a general summary of certain major PRC, Hong Kong, Cayman Islands and U.S. federal income tax consequences relevant to an investment in our ADSs. The discussion is not intended to be, nor should it be construed as, legal or tax advice to any particular prospective purchaser. The discussion is based on laws and relevant interpretations thereof in effect as of the date of this prospectus supplement, all of which are subject to change or different interpretations, possibly with retroactive effect. The discussion does not address U.S. state or local tax laws, or tax laws of jurisdictions other than the PRC, Hong Kong, the Cayman Islands and the United States. You should consult your own tax advisors with respect to the consequences of acquisition, ownership and disposition of our ADSs.

PRC Enterprise Income Tax

Under the Enterprise Income Tax Law, or EIT Law, which was promulgated on March 16, 2007 and subsequently amended on February 24, 2017 and December 29, 2018, and its implementation rules which became effective on January 1, 2008, the standard tax rate of 25% applies to all enterprises incorporated in the PRC (including foreign-invested enterprises) with exceptions in special situations if relevant criteria are met and subject to the approval of the PRC tax authorities.

An enterprise incorporated outside of the PRC whose "de facto management bodies" are located in the PRC is considered a "resident enterprise" and will be subject to a uniform EIT rate of 25% on its global income. In April 2009, the State Administration of Taxation, or the SAT, in the Notice of the SAT on Issues Concerning the Determination of Chinese Controlled Enterprises Registered Overseas as Resident Enterprises on the Basis of Their De Facto Management Bodies, or Circular 82, specified certain criteria for the determination of what constitutes "de facto management bodies." If all of these criteria are met, the relevant foreign enterprise will be deemed to have its "de facto management bodies" located in the PRC and therefore be considered a resident enterprise in the PRC. These criteria include: (a) the enterprise's day to day operational management is primarily exercised in the PRC; (b) decisions relating to the enterprise's financial and human resource matters are made or subject to approval by organizations or personnel in the PRC; (c) the enterprise's primary assets, accounting books and records, company seals, and board and shareholders' meeting minutes are located or maintained in the PRC; and (d) 50% or more of voting board members or senior executives of the enterprise habitually reside in the PRC. In addition, an enterprise established outside the PRC which meets all of the aforesaid requirements is expected to make an application for the classification as a "resident enterprise" and this will ultimately be confirmed by the relevant tax authority. Although Circular 82 only applies to foreign enterprises that are majority owned and controlled by PRC enterprises, not those owned and controlled by foreign enterprises or individuals, the determining criteria set forth in Circular 82 may be adopted by the PRC tax authorities as the test for determining whether the enterprises are PRC tax residents, regardless of whether they are majority owned and controlled by PRC enterprises. However, it is not entirely clear how the PRC tax authorities will determine whether a non PRC entity (that has not already been notified of its status for EIT purposes) will be classified as a "resident enterprise" in practice.

Except for our PRC subsidiaries and joint ventures incorporated in China, we believe that none of our entities incorporated outside of China is a PRC resident enterprise for PRC tax purposes. However, the tax resident status of an enterprise is subject to determination by the PRC tax authorities, and uncertainties remain with respect to the interpretation of the term "de facto management body."

If a non-PRC enterprise is classified as a "resident enterprise" for EIT purposes, any dividends to be distributed by that enterprise to non-PRC resident shareholders or ADS holders or any gains realized by such investors from the transfer of shares or ADSs may be subject to PRC tax. If the PRC tax authorities determine that we should be considered a PRC resident enterprise for EIT purposes, any dividends payable by us to our non-PRC resident enterprise shareholders or ADS holders, as well as gains realized by

S-21

such investors from the transfer of our ordinary shares or ADSs may be subject to a 10% withholding tax, unless a reduced rate is available under an applicable tax treaty. Furthermore, if we are considered a PRC resident enterprise for EIT purposes, it is unclear whether our non-PRC individual shareholders (including our ADS holders) would be subject to any PRC tax on dividends or gains obtained by such non-PRC individual shareholders. If any PRC tax were to apply to dividends realized by non-PRC individuals, it would generally apply at a rate of up to 20% unless a reduced rate is available under an applicable tax treaty.

Profits Tax

Hong Kong tax residents are subject to Hong Kong profits tax in respect of profits arising in or derived from Hong Kong at the current rate of 16.5%. Dividend income earned by a Hong Kong tax resident is generally not subject to Hong Kong profits tax. Hutchison China MediTech Limited is a Hong Kong tax resident.

Hong Kong Tax on Shareholders and ADS Holders

No tax is payable in Hong Kong in respect of dividends paid by a Hong Kong tax resident to their shareholders, including our ADS holders.

Hong Kong profits tax will not be payable by our shareholders, including our ADS holders (other than shareholders/ADS holders carrying on a trade, profession or business in Hong Kong and holding the shares/ADSs for trading purposes), on any capital gains made on the sale or other disposal of the ADSs. Shareholders, including our ADS holders, should take advice from their own professional advisors as to their particular tax position.

No Hong Kong stamp duty is payable by our shareholders, including our ADS holders.

The Cayman Islands currently levies no taxes on individuals or corporations based upon profits, income, gains or appreciation, and there is no taxation in the nature of inheritance tax or estate duty. There are no other taxes likely to be material to us levied by the government of the Cayman Islands except for stamp duties which may be applicable on instruments executed in, or brought within the jurisdiction of the Cayman Islands. The Cayman Islands is a party to a double tax treaty entered into with the United Kingdom in 2010 but it is otherwise not a party to any double tax treaties that are applicable to any payments made to or by our company. There are no exchange control regulations or currency restrictions in the Cayman Islands. Payments of dividends and capital in respect of our ordinary shares or ADSs are not subject to taxation in the Cayman Islands and no withholding is required on the payment of a dividend or capital to any holder of our ordinary shares or ADSs, nor are gains derived from the disposal of our ordinary shares or ADSs subject to Cayman Islands income or corporation tax.

Pursuant to the Tax Concessions Law (Revised) of the Cayman Islands, Hutchison China MediTech Limited has obtained an undertaking from the Governor-in-Council: (a) that no law which is enacted in the Cayman Islands imposing any tax to be levied on profits or income or gains or appreciations shall apply to Hutchison China MediTech Limited or its operations; and (b) that the aforesaid tax or any tax in the nature of estate duty or inheritance tax shall not be payable on its shares, debentures or other obligations.

The undertaking is for a period of twenty years from January 9, 2001.

S-22

Material U.S. Federal Income Tax Considerations

The following summary, subject to the limitations set forth below, describes the material U.S. federal income tax consequences for a U.S. Holder (as defined below) of the acquisition, ownership and disposition of our ordinary shares and ADSs. This discussion is limited to U.S. Holders who hold such ordinary shares or ADSs as capital assets (generally, property held for investment). For purposes of this summary, a "U.S. Holder" is a beneficial owner of an ordinary share or ADS that is for U.S. federal income tax purposes:

- •

- a citizen or individual resident of the United States;

- •

- a corporation (or any other entity treated as a corporation for U.S. federal income tax purposes) organized in or under the laws of the United

States or any state thereof, or the District of Columbia;

- •

- an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

- •

- a trust if (i) it has a valid election in effect to be treated as a U.S. person for U.S. federal income tax purposes or (ii) a U.S. court can exercise primary supervision over its administration and one or more U.S. persons have the authority to control all of its substantial decisions.

Except as explicitly set forth below, this summary does not address aspects of U.S. federal income taxation that may be applicable to U.S. Holders subject to special rules, including:

- •

- banks or other financial institutions;

- •

- insurance companies;

- •

- real estate investment trusts;

- •

- regulated investment companies;

- •

- grantor trusts;

- •

- tax-exempt organizations;

- •

- persons holding our ordinary shares or ADSs through a partnership (including an entity or arrangement treated as a partnership for U.S. federal

income tax purposes) or S corporation;

- •

- dealers or traders in securities, commodities or currencies;

- •

- persons whose functional currency is not the U.S. dollar;

- •

- certain former citizens and former long-term residents of the United States;

- •

- persons holding our ordinary shares or ADSs as part of a position in a straddle or as part of a hedging, conversion or integrated transaction

for U.S. federal income tax purposes; or

- •

- direct, indirect or constructive owners of 10% or more of our equity (by vote or value).

In addition, this summary does not address the 3.8% Medicare contribution tax imposed on certain net investment income, any non-U.S. state or local tax laws, the U.S. federal estate and gift tax or the alternative minimum tax consequences of the acquisition, ownership and disposition of our ordinary shares or ADSs. We have not received nor do we expect to seek a ruling from the U.S. Internal Revenue Service, or the IRS, regarding any matter discussed herein. No assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of those set forth below. Each prospective investor should consult its own tax advisors with respect to the U.S. federal, state, local and non-U.S. tax consequences of acquiring, owning and disposing of our ordinary shares and ADSs.

This discussion is based on the U.S. Internal Revenue Code of 1986, as amended, or the Code, U.S. Treasury Regulations promulgated thereunder and administrative and judicial interpretations thereof, and

S-23

the income tax treaty between the PRC and the United States, or the U.S.-PRC Tax Treaty, each as available and in effect on the date hereof, all of which are subject to change or differing interpretations, possibly with retroactive effect, which could affect the tax consequences described herein. In addition, this summary is based, in part, upon representations made by the depositary to us and assumes that the deposit agreement, and all other related agreements, will be performed in accordance with their terms.

If an entity or arrangement treated as a partnership for U.S. federal income tax purposes holds our ordinary shares or ADSs, the tax treatment of the partnership and a partner in such partnership generally will depend on the status of the partner and the activities of the partnership. Such partner or partnership should consult its own tax advisors as to the U.S. federal income tax consequences of acquiring, owning and disposing of our ordinary shares or ADSs.

PROSPECTIVE INVESTORS SHOULD CONSULT THEIR OWN TAX ADVISORS WITH REGARD TO THE PARTICULAR TAX CONSEQUENCES APPLICABLE TO THEIR SITUATIONS AS WELL AS THE APPLICATION OF ANY U.S. FEDERAL, STATE, LOCAL, NON-U.S. OR OTHER TAX LAWS, INCLUDING GIFT AND ESTATE TAX LAWS.

ADSs

A U.S. Holder of ADSs will generally be treated, for U.S. federal income tax purposes, as the owner of the underlying ordinary shares that such ADSs represent. Accordingly, no gain or loss will be recognized if a U.S. Holder exchanges ADSs for the underlying shares represented by those ADSs.

The U.S. Treasury has expressed concern that parties to whom ADSs are released before shares are delivered to the depositary or intermediaries in the chain of ownership between holders and the issuer of the security underlying the ADSs, may be taking actions that are inconsistent with the claiming of foreign tax credits by U.S. Holders of ADSs. These actions would also be inconsistent with the claiming of the reduced rate of tax, described below, applicable to dividends received by certain non-corporate U.S. Holders. Accordingly, the creditability of non-U.S. withholding taxes (if any), and the availability of the reduced tax rate for dividends received by certain non-corporate U.S. Holders, each described below, could be affected by actions taken by such parties or intermediaries. For purposes of the discussion below, we assume that intermediaries in the chain of ownership between the holder of an ADS and us are acting consistently with the claim of U.S. foreign tax credits by U.S. Holders.

Taxation of Dividends

As described in "Dividend Policy" above, we do not currently anticipate paying any distributions on our ordinary shares or ADSs in the foreseeable future. However, to the extent there are any distributions made with respect to our ordinary shares or ADSs, and subject to the discussion under "—Passive Foreign Investment Company Considerations" below, the gross amount of any such distribution (including withheld taxes, if any) made out of our current or accumulated earnings and profits (as determined for U.S. federal income tax purposes) will generally be taxable to a U.S. Holder as ordinary dividend income on the date such distribution is actually or constructively received. Distributions in excess of our current and accumulated earnings and profits will be treated as a non-taxable return of capital to the extent of the U.S. Holder's adjusted tax basis in our ordinary shares or ADSs, as applicable, and thereafter as capital gain. However, because we do not maintain calculations of our earnings and profits in accordance with U.S. federal income tax accounting principles, U.S. Holders should expect to treat distributions paid with respect to our ordinary shares and ADSs as dividends. Dividends paid to corporate U.S. Holders generally will not qualify for the dividends received deduction that may otherwise be allowed under the Code. This discussion assumes that distributions made by us, if any, will be paid in U.S. dollars.

Dividends paid to a non-corporate U.S. Holder by a "qualified foreign corporation" may be subject to reduced rates of U.S. federal income taxation if certain holding period and other requirements are met. A qualified foreign corporation generally includes a foreign corporation (other than a PFIC) if (1) its

S-24

ordinary shares (or ADSs backed by ordinary shares) are readily tradable on an established securities market in the United States or (2) it is eligible for benefits under a comprehensive U.S. income tax treaty that includes an exchange of information program and which the U.S. Treasury Department has determined is satisfactory for these purposes.

IRS guidance indicates that our ADSs (which are listed on the Nasdaq Global Select Market) are readily tradable for purposes of satisfying the conditions required for these reduced tax rates. We do not expect, however, that our ordinary shares will be listed on an established securities market in the United States and therefore do not believe that any dividends paid on our ordinary shares that are not represented by ADSs currently meet the conditions required for these reduced tax rates. There can be no assurance that our ADSs will be considered readily tradable on an established securities market in subsequent years.

The United States does not have a comprehensive income tax treaty with the Cayman Islands. However, in the event that we were deemed to be a PRC resident enterprise under the EIT Law (see "—Taxation in the PRC" above), although no assurance can be given, we might be considered eligible for the benefits of the U.S.-PRC Tax Treaty for purposes of these rules. U.S. Holders should consult their own tax advisors regarding the availability of the reduced tax rates on dividends paid with respect to our ordinary shares or ADSs in light of their particular circumstances.

Non-corporate U.S. Holders will not be eligible for reduced rates of U.S. federal income taxation on any dividends received from us if we are a PFIC in the taxable year in which such dividends are paid, or in the preceding taxable year unless, under certain circumstances, the "deemed sale election," described below under "—Passive Foreign Investment Company Considerations—Status as a PFIC" has been made.