Form 424B5 LAUREATE EDUCATION, INC.

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount To Be Registered |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

Class A common stock, par value $0.004 per share |

12,250,000 | $14.00 | $171,500,000 | $20,785.80 | ||||

|

||||||||

- (1)

- Calculated pursuant to Rule 457(a) based on the Amount To Be Registered multiplied by the Proposed Maximum Offering Price Per Share.

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-224405

PROSPECTUS SUPPLEMENT

(To Prospectus Dated April 23, 2018)

12,250,000 Shares

Class A Common Stock

The selling stockholder named in this prospectus supplement is offering 12,250,000 shares of our Class A common stock, par value $0.004 per share. We will not receive any of the proceeds from the sale of shares of our Class A common stock by the selling stockholder in this offering.

Our Class A common stock is listed on the Nasdaq Global Select Market under the symbol "LAUR." On November 15, 2018, the last reported sale price of our Class A common stock on the Nasdaq Global Select Market was $14.46 per share.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Public offering price |

$14.00 | $171,500,000 | ||

Underwriting discounts and commissions(1) |

$0.56 | $6,860,000 | ||

Proceeds, before expenses, to the selling stockholder |

$13.44 | $164,640,000 | ||

|

||||

- (1)

- We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See "Underwriting (Conflicts of Interest)."

The selling stockholder has granted the underwriters an option to purchase, within the 30-day period from the date of this prospectus supplement, up to an additional 1,837,500 shares of our Class A common stock at the public offering price less the underwriting discounts and commissions.

INVESTING IN OUR CLASS A COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY REVIEW THE RISKS AND UNCERTAINTIES REFERENCED UNDER THE HEADING "RISK FACTORS" BEGINNING ON PAGE S-21 OF THIS PROSPECTUS SUPPLEMENT, AS WELL AS THOSE CONTAINED IN THE ACCOMPANYING PROSPECTUS AND ANY DOCUMENTS THAT WE INCORPORATE BY REFERENCE HEREIN AND THEREIN.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement and the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our Class A common stock against payment in New York, New York on or about November 20, 2018.

Joint Book-Running Managers

| Credit Suisse | Barclays | BMO Capital Markets | Macquarie Capital |

| Citigroup | Goldman Sachs & Co. LLC | KKR |

Co-Managers

| Baird | Barrington Research | Piper Jaffray | Stifel |

The date of this prospectus supplement is November 15, 2018

Prospectus

LAUREATE, LAUREATE INTERNATIONAL UNIVERSITIES and the leaf symbol are trademarks of Laureate Education, Inc. in the United States and other countries. This prospectus supplement and any documents that we incorporate by reference herein also include other trademarks of Laureate and trademarks of other persons, which are properties of their respective owners.

We obtained the industry, market and competitive position data used throughout this prospectus supplement and any documents that we incorporate by reference herein from our own internal estimates and research as well as from industry publications and research, surveys and studies conducted by third-party sources. This prospectus supplement and any documents that we incorporate by reference herein also contains the results from a study by Kantar Vermeer, a leading third-party

S-i

market research organization. We commissioned the Kantar Vermeer study as part of our periodic evaluation of employment rates and starting salary information for our graduates.

Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We have not independently verified industry, market and competitive position data from third-party sources. While we believe our internal business estimates and research are reliable and the market definitions are appropriate, neither such estimates, research nor these definitions have been verified by any independent source.

S-ii

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the Securities and Exchange Commission (the "SEC") utilizing a "shelf" registration process. This prospectus supplement provides to you specific information about our Class A common stock that the selling stockholder is selling in this offering. Both this prospectus supplement and the accompanying prospectus include important information about us, the selling stockholder and other information that you should know before investing. Because the accompanying prospectus provides general information about us, some of the information therein may not apply to this offering. This prospectus supplement describes the specific details regarding the offering and adds to, updates and changes information contained in the accompanying prospectus. To the extent that the information in this prospectus supplement is different from that in the accompanying prospectus, you should rely on the information in this prospectus supplement. You should read both this prospectus supplement and the accompanying prospectus, together with the additional information described in the sections entitled "Information Incorporated by Reference" and "Where You Can Find More Information" of this prospectus supplement, before investing in our Class A common stock.

We are responsible for the information contained in this prospectus supplement, the accompanying prospectus, including the information incorporated by reference herein as described herein and therein, and any free writing prospectus prepared by or on behalf of us. None of the Company, the selling stockholder or the underwriters has authorized anyone to provide to you different information, and neither we, the selling stockholder nor the underwriters take responsibility for any other information that others may give you. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which they relate, and neither we, the selling stockholder nor the underwriters are making an offer to sell these securities in any jurisdiction in which the offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement and the accompanying prospectus is accurate as of any date other than its date.

As used in this prospectus supplement and the accompanying prospectus, unless otherwise stated or the context otherwise requires, references to "we," "us," "our," the "Company," "Laureate" and similar references refer collectively to Laureate Education, Inc. and its subsidiaries. Unless otherwise stated or the context requires, references to the Laureate International Universities network include Santa Fe University of Art and Design ("SFUAD"), which is owned by Wengen Alberta, Limited Partnership, an Alberta limited partnership ("Wengen"), our controlling stockholder. Laureate is affiliated with SFUAD, but does not own or control it and, accordingly, SFUAD is not included in the financial results of Laureate presented in this prospectus supplement and the accompanying prospectus.

As previously reported in our filings with the SEC, we have undertaken strategic reviews of our global portfolio and have announced plans to divest certain of our subsidiaries as part of a strategic shift. This strategic shift will have a significant effect on our operations and financial results. Accordingly, as of September 30, 2018, we will account for all of the divestitures that are currently part of this strategic shift as discontinued operations for all periods presented, including in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2018 filed with the SEC on November 8, 2018 and in our Current Report on Form 8-K filed with the SEC on November 13, 2018, in which we recast the financial information contained in our Annual Report on Form 10-K for the year ended December 31, 2017 (the "2017 10-K") to present the operations and financial position of these entities as discontinued operations. Unless otherwise indicated, the information in or incorporated by reference into this prospectus supplement, including our segment information, relates only to our continuing operations. We also announced on November 8, 2018 that we are considering various strategic options with respect to the portion of our business operated through our online

S-1

education program division known as Walden University ("Walden"). Because Walden does not meet the criteria to be classified as held for sale or a discontinued operation, it continues to be included in our continuing operations.

The information included in this prospectus supplement is presented in connection with the reporting changes described above and does not otherwise amend or restate our audited consolidated financial statements that were included in the 2017 10-K. Unaffected items and unaffected portions of our 2017 10-K have not been repeated in, and are not amended or modified by, this prospectus supplement. Our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2018 and June 30, 2018 have not been amended or restated in connection with the reporting changes described above.

S-2

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement and does not contain all of the information that you need to consider in making your investment decision. You should read carefully this entire prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, before making an investment decision to purchase our Class A common stock, especially the risks of investing in our Class A common stock discussed under the caption "Risk Factors" in this prospectus supplement and the information under the caption "Risk Factors" in our 2017 10-K, as revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form 8-K, as well as any amendments thereto, as filed with the SEC (all of which are incorporated by reference herein), as well as other risks described under the caption "Risk Factors" in the accompanying prospectus and any documents that we incorporate by reference herein and therein.

Our Beliefs

We believe in the power of education to transform lives, and the role that the Laureate network can play to benefit our students, the communities we serve and society. We believe that through innovation and operating leverage, we will be able to create superior experiences and outcomes for our students. In doing so, we employ a focused approach to operational excellence across all areas of our business and plan to invest future resources in markets and assets that we believe will continue to leverage the scale of our network to generate additional operating efficiencies, allowing us to continue to grow in a capital efficient manner while ensuring that academic quality and student experience remain a core priority.

Overview

As announced previously, we reviewed our global portfolio of institutions with the goals of simplifying and focusing our operations, reducing complexity, mitigating risks (such as political, regulatory, economic and currency), exiting smaller markets where our operations have less scale and maximizing our exposure to what we believe are the most attractive and scalable markets for our network. Following this strategic review, we determined to undertake a series of divestitures calculated to simplify and streamline our business. As reported in the 2017 10-K, in 2017, we announced the divestiture of certain subsidiaries in our Europe, Middle East, Africa and Asia Pacific ("EMEAA") and Central America & U.S. Campuses segments. On August 9, 2018, we announced that we plan to divest additional subsidiaries located in Europe, Asia and Central America, which are included in the EMEAA, Andean & Iberian, and Central America & U.S. Campuses segments. As of September 30, 2018, we will refer to the EMEAA segment as our "Rest of World" segment and to the Andean & Iberian segment as our "Andean" segment. We decided to focus principally on the Latin American markets where we operate large-scale platforms because we believe that these markets present the best opportunity for us to leverage network benefits by transitioning these institutions from decentralized, stand-alone units into an integrated and scaled network of institutions, enabled by a common operating model which we believe will leverage our competitive advantages in technology, intellectual property and curriculum design. In addition, we believe a more concentrated geographic footprint will allow us to further leverage scale and enable greater optimization of our cost structure.

After completing all of the announced divestitures, our remaining principal markets will be the core markets from which we draw approximately 80% of our students as of September 30, 2018—Brazil, Chile, Mexico and Peru (comprising our Brazil, Mexico and Andean segments), along with the Online & Partnerships segment and our institutions in Australia and New Zealand (comprising our Rest of World segment).

S-3

This strategic shift will have a significant effect on our operations and financial results. We expect that substantially all of the announced divestitures will be completed by mid-2019. We anticipate that the announced divestitures will enable us to focus on the integration of our platform and the creation of two scaled enterprises—one campus-based business primarily focused on emerging markets in Latin America, and one fully online platform in the U.S. We are currently evaluating the strategic fit of having these two scaled, but different, business units together in one organization. Accordingly, we are considering various strategic options for Walden with the goal of continuing to provide the best possible experience for Walden students, as well as ensuring the best position for Walden, for us and for our key stakeholders. To that end, we have had exploratory discussions with third parties regarding possible alternative transactions involving Walden. We are very proud of the quality and strength of Walden and we are very committed to maintaining that quality. Our conclusion following these discussions may be to decide to retain Walden within Laureate. At this time there is no assurance that we will engage in any transaction, or of the timing of any transaction, or that any proposed transaction, if it were to be announced, would be successfully consummated. Because Walden does not meet the criteria to be classified as held for sale or a discontinued operation, its results are reported within continuing operations for all periods presented.

General

We are the largest international network of degree-granting higher education institutions, primarily focused in Latin America, with more than 850,000 students enrolled at over 25 institutions with more than 150 campuses, which we collectively refer to as the Laureate International Universities network. The institutions in the Laureate International Universities network are leading brands in their respective markets and offer a broad range of undergraduate and graduate degrees through campus-based, online and hybrid programs. As of September 30, 2018, approximately 93% of our students attend traditional, campus-based institutions offering multi-year degrees, similar to leading private and public higher education institutions in developed markets such as the United States and Europe. Nearly two thirds of our students are enrolled in programs of four or more years in duration.

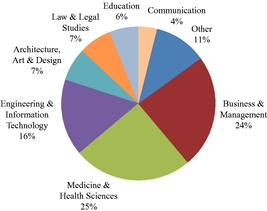

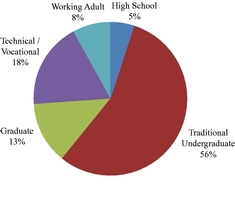

Our programs are designed with a distinct emphasis on applied, professional-oriented content for growing career fields and are focused on academic disciplines that we believe offer strong employment opportunities and high earnings potential for our students. We continually and proactively adapt our curriculum to the needs of the market. In particular, we emphasize science, technology, engineering and math (STEM) and business disciplines, areas in which we believe that there is large and growing demand, especially in developing countries. Since 2009, we have more than doubled our enrollment of students pursuing degrees in Medicine & Health Sciences, Engineering & Information Technology and Business & Management, our three largest disciplines. We believe the work of our graduates in these disciplines creates a positive impact on the communities we serve and strengthens our institutions' reputations within their respective markets. Our focus on private-pay and our track record for delivering high-quality outcomes to our students, while stressing affordability and accessibility, has been a key reason for our long record of success.

We believe the global higher education market presents an attractive long-term opportunity, primarily because of the large and growing imbalance between the supply and demand for affordable, quality higher education in many parts of the world. We believe the combination of the projected growth in the middle class, limited government resources dedicated to higher education, and a clear value proposition demonstrated by the higher earnings potential afforded by higher education, creates substantial opportunities for high-quality private institutions to meet this growing and unmet demand. By offering high-quality, outcome-focused education, we believe that we enable students to prosper and thrive in the dynamic and evolving knowledge economy.

We operate institutions that address regional, national and local supply and demand imbalances in higher education. As the international leader in higher education, we believe we are uniquely

S-4

positioned to deliver high-quality education across different brands and tuition levels in the markets in which we operate. In many developing markets, traditional higher education students (defined as 18-24 year olds) have historically been served by public universities, which have limited capacity and are often underfunded, resulting in an inability to meet growing student demands and employer requirements. Our institutions in these markets offer traditional higher education students a private education alternative, often with multiple brands and price points in each market, with innovative programs and strong career-driven outcomes. In many of these same markets, non-traditional students such as working adults and distance learners have limited options for pursuing higher education. Through targeted programs and multiple teaching modalities, we are able to serve the differentiated needs of this unique demographic.

Our program and level of study mix for 2017 was as follows:

| Program Mix | Level of Study Mix | |

|

|

|

| Based on 12/31/2017 total enrollments | Based on 12/31/2017 total enrollments High school students are primarily in Mexico |

The Laureate International Universities network enables us to educate our students locally while connecting them to an international community and offering them the advantages of our shared infrastructure, technology, curricula and operational best practices. For example, our students can take advantage of shared curricula, optional international programs and services, including English language instruction, dual-degree programs and other benefits offered by other institutions in our network. We believe that the benefits of the network translate into better career opportunities and higher earnings potential for our graduates.

Our Segments

We have five reportable segments, which are summarized in the table below. During the quarter ended September 30, 2018, a number of our subsidiaries met the requirements to be classified as discontinued operations. For more information about our discontinued operations and the effect on our segments, see "Basis of Presentation" and "—Overview." We group our institutions by geography in Brazil, Mexico, Andean and Rest of World for reporting purposes. Our Online & Partnerships segment includes our fully online universities. The following information for our segments is presented as of September 30, 2018, except where otherwise indicated.

S-5

| |

Brazil | Mexico | Andean | Rest of World# |

Online & Partnerships‡ |

Total | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Countries |

1 | 1 | 2 | 4 | 2 | 10 | |||||||||||||

Institutions |

13 | 2 | 8 | 12 | 3 | 38 | |||||||||||||

Enrollments (rounded to nearest hundred) |

273,000 | 210,200 | 314,800 | 19,100 | 62,000 | 879,100 | |||||||||||||

2018 YTD Revenues ($ in millions)* |

$ | 469.5 | $ | 463.9 | $ | 844.2 | $ | 170.2 | $ | 498.2 | $ | 2,436.5 | |||||||

% Contribution to 2018 YTD Revenues* |

19 | % | 19 | % | 35 | % | 7 | % | 20 | % | 100 | % | |||||||

- #

- Includes

eight licensed institutions in the Kingdom of Saudi Arabia that are managed under a contract that expires in 2019.

- ‡

- In

December 2017, we stopped accepting new enrollments at the University of Roehampton, an institution in our Online & Partnerships segment. We are

no longer accepting new enrollments at the University of Liverpool, another institution in our Online & Partnerships segment.

- *

- The elimination of intersegment revenues and amounts related to Corporate, which total $9.4 million, is not separately presented.

Our Industry

We operate in the international market for higher education, which is characterized by a significant imbalance between supply and demand, especially in developing economies. In many countries, demand for higher education is large and growing. GSV Advisors estimates that higher education institutions accounted for total revenues of approximately $1.5 trillion globally in 2015, with the higher education market expected to grow by approximately 5% per annum through 2020. Global growth in higher education is being fueled by several demographic and economic factors, including a growing middle class, global growth in services and technology-related industries and recognition of the significant personal and economic benefits gained by graduates of higher education institutions. At the same time, many governments have limited resources to devote to higher education, resulting in a diminished ability by the public sector to meet growing demand, and creating opportunities for private education providers to enter these markets and deliver high-quality education. As a result, the private sector plays a large and growing role in higher education globally. While the Laureate International Universities network is the largest international network of degree-granting higher education institutions in the world, our total enrollment at September 30, 2018 of more than 850,000 students represents only 0.4% of worldwide higher education students.

Large, Growing and Underpenetrated Population of Qualified Higher Education Students. According to United Nations Educational, Scientific and Cultural Organization ("UNESCO"), 217.5 million students worldwide were enrolled in higher education institutions in 2015, more than double the 100.2 million students enrolled in 2000, and approximately 90% of those students were enrolled at institutions outside of the United States. In many countries, including throughout Latin America and other developing regions, there is growing demand for higher education based on favorable demographics, increasing secondary completion rates and increasing higher education participation rates, resulting in continued growth in higher education enrollments. While global participation rates have increased for traditional higher education students (defined as 18-24 year olds), the market for higher education is still significantly underpenetrated, particularly in developing countries. For example, participation rates in Brazil and Mexico in 2015 were approximately 36% and approximately 23%, respectively, as compared to approximately 63% in the United States for the same period.

Strong Economic Incentives for Higher Education. According to the Brookings Institution, approximately 3.2 billion people in the world composed the middle class in 2016, a number that is

S-6

expected to be over five billion people by 2028. We believe that members of this large and growing group seek advanced education opportunities for themselves and their children in recognition of the vast differential in earnings potential with and without higher education. According to 2015 data from the Organization for Economic Co-operation and Development ("OECD"), in the United States and European Union countries that are members of the OECD, the earnings from employment for an adult completing higher education were approximately 74% and approximately 53% higher, respectively, than those of an adult with only an upper secondary education. This income gap is even more pronounced in many developing countries around the world, including a differential of approximately 149% in Brazil, and approximately 102% in Mexico. We believe the cumulative impact of favorable demographic and socio-economic trends, coupled with the superior earnings potential of higher education graduates, will continue to expand the market for private higher education.

Increasing Role of the Private Sector in Higher Education. In many of our markets, the private sector plays a meaningful role in higher education, bridging supply and demand imbalances created by a lack of capacity at public universities. In addition to capacity limitations, we believe that limited public resources, and the corresponding policy reforms to make higher education systems less dependent on the financial and operational support of local governments, have resulted in increased enrollments in private institutions relative to public institutions. For example, Brazil relies heavily upon private institutions to deliver quality higher education to students, with approximately 74% (in 2015) of higher education students in Brazil enrolled in private institutions.

Favorable Industry Dynamics in Key Latin American Markets. In the large Latin American markets in which we operate, many of the industry trends described above are even more prevalent, with strong growth in higher education over the past 15 years.

| |

|

# of Students ('000)‡ |

Participation Rate* |

|

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

% Private Sector# |

Wage Premium# |

|||||||||||||||||

| |

2000 | 2015 | 2000 | 2015 | |||||||||||||||

Brazil |

74 | % | 2,781 | 8,285 | 12 | % | 36 | % | 149 | % | |||||||||

Mexico |

30 | % | 1,963 | 3,515 | 15 | % | 23 | % | 102 | % | |||||||||

Peru |

N/A | 900 | 1,930 | 26 | % | 47 | % | N/A | |||||||||||

Chile |

73 | % | 452 | 1,222 | 27 | % | 61 | % | 137 | % | |||||||||

- #

- Based

on 2015 OECD data.

- ‡

- Based

on 2015 UNESCO data.

- *

- Based on 2015 UNESCO data; defined as 18-24 year olds.

Increasing Demand for Online Offerings. The acceptance of online learning in higher education is well-established, as evidenced by a survey conducted by the Babson Survey Research Group that reported that approximately 71% of academic leaders rated online learning outcomes as the same or superior to classroom learning in 2014. We believe that increasing student demand (for example, students taking at least one distance education course made up approximately 30% of all higher education enrollments in the United States as of the second half of 2015 according to the Distance Education Enrollment Report 2017), new instruction methodologies designed for the online medium, and growing employer and regulatory acceptance of degrees obtained through online and hybrid modalities will continue to drive online learning growth globally. Moreover, increasing the percentage of courses taught online in a hybrid educational model has significant cost and capital efficiency benefits as a greater number of students can be accommodated in existing physical campus space.

Growth in Outsourced Academic and Administrative Services. To adapt to changing student preferences and greater demand for online and distance learning solutions, university leaders are

S-7

refocusing their strategies around core academic functions, while seeking to outsource specialized technology functions and other administrative services. Private sector partners offering operational expertise and economies of scale are increasingly assisting universities through long-term relationships in areas such as online program management, technology support, facilities management, student services and procurement. According to a survey conducted by Inside Higher Ed in 2017, approximately 27% of college business officers in the United States believe that outsourcing more administrative services is a strategy they will implement in 2017-2018. We believe that these trends will increase opportunities for private sector partners to deploy their capabilities to traditional educational providers.

Our Strengths and Competitive Advantages

We believe our key competitive strengths that will enable us to execute our strategy include the following:

Scaled Platform Institutions Across Our Network. Our scale facilitates distinct advantages for our students and allows us to leverage our operating model across our network more efficiently. It would take a competitor considerable time and expense to establish a network of international universities of similar scale with the high-quality brands, intellectual property and accreditations that we possess.

Our network facilitates competitive advantages related to:

- •

- Curricula and Programs. We are able to leverage our curricula and resources

across our international network, allowing for the rapid deployment of new programs in our markets. Increasing amounts of our curricula are being standardized across our network, allowing us to lower

the cost of program development by reusing and sharing content, while improving the quality of our programs. For example, the resources and support of our international network enabled the rapid

expansion of our medicine and health sciences offerings, contributing to the opening of eight new medical schools since 2010 and increasing enrollment in the number of students pursuing degrees in the

fields of medicine and health sciences from approximately 50,000 students in 2009 to more than 200,000 students as of September 30, 2018. We are also able to utilize our network to provide

innovative offerings to our students, such as international joint and dual degree programs.

- •

- Best Practices. Through collaboration across our network, best practices

for key operational processes, such as campus design, faculty training, student services and recruitment are identified and then rolled out to the institutions in our network.

- •

- Unified Systems. Our scale also permits increased investment in unified technology systems and an opportunity to leverage standardization of processes, centralization of common services (such as information technology, finance and procurement) and intellectual property, and implementing a common operating model and platform for content development, digital campus experiences, student services, recruitment and administrative services across our network. We believe this operating leverage positions us well for enhanced growth in profitability and cash flow relative to our enrollments and revenue.

In particular, the scale of our business in the markets in Latin America in which we operate confers a competitive advantage, in that we are well-positioned to leverage our scale across these large markets that are relatively homogeneous in many ways (e.g., language, geography and regulatory environments). We are creating a common operating model for our network institutions that integrates multiple software components, including SaaS-based information technology capabilities, student information system, enterprise resource planning, learning management system ("LMS"), and customer relationship management, into a single unified platform. We anticipate that implementation of the common operating model in these markets will create additional operational leverage that can be

S-8

deployed not just at a brand or institution level, but more broadly across Brazil, Chile, Peru and Mexico.

Leading Intellectual Property and Technology. We have developed an extensive collection of intellectual property that has in part been enabled by investments in unified technology systems. We believe this collection of intellectual property, including online capabilities, campus management, faculty training, curriculum design and quality assurance, among other proprietary solutions, provides our students a truly differentiated learning experience and creates a significant competitive advantage for our institutions over competitors. We have made significant investments to create unified technology systems across our network. These systems will provide data and insights on a scale that we believe will allow us to improve student experience, retention rates and outcomes, while also enabling a more efficient and lower cost educational delivery model.

Long-Standing and Respected University Brands. We believe we have established a reputation for providing high-quality higher education in the countries in which we operate, and many of our institutions are among the most respected higher education brands in their local markets. Many of our institutions have over 50-year histories and are ranked among the best in their respective countries. For example, Universidade Anhembi Morumbi in Brazil is ranked by Guia do Estudante as one of São Paulo's top universities, UVM Mexico, the largest private university in Mexico, was ranked seventh among all public and private higher education institutions in that country by Guía Universitaria, an annual publication of Reader's Digest, Universidad Peruana de Ciencias Aplicadas ("UPC") recently attained a 4-Star Rating from QS Stars™, making it the only 4-Star Rated university in that country, and Universidad Andrés Bello in Chile is ranked by SCImago among the five best universities in the country.

Many of our institutions and programs have earned the highest accreditation available, which provides us with a strong competitive advantage in local markets. For example, medical school licenses are often the most difficult to obtain and are only granted to institutions that meet rigorous standards. We serve more than 200,000 students in the fields of medicine and health sciences across more than 100 campuses throughout the Laureate International Universities network, including 20 medical schools and 15 dental schools. We believe the existence of medical schools at many of our institutions further validates the quality of our institutions and programs and increases brand awareness.

Commitment to Academic Quality. We offer high-quality undergraduate, graduate and specialized programs in a wide range of disciplines that generate strong interest from students and provide attractive employment prospects. Our commitment to quality is demonstrated by, for example, the fact that our Brazilian institutions' IGC scores (an indicator used by the Brazilian Ministry of Education to evaluate the quality of higher education institutions) have increased by more than 26% on average from 2010 to 2016, placing three of our institutions in the top quarter, and approximately 98% of our students in Brazil enrolled in institutions ranked in the top third, of all private higher education institutions in the country. We focus on programs that prepare our students to become employed in high demand professions. Our curriculum development process includes employer surveys and ongoing research into business trends to determine the skills and knowledge base that will be required by those employers in the future. This information results in timely curriculum upgrades, which helps ensure that our graduates acquire the skills that will make them marketable to employers. We are also committed to continually evaluating our institutions to ensure we are providing the highest quality education to our students. Our proprietary management tool, the Laureate Education Assessment Framework ("LEAF"), is used to evaluate institutional performance based on 44 unique criteria across five different categories: Employability, Learning Experience, Personal Experience, Access & Outreach and Academic Excellence. LEAF, in conjunction with additional external assessment methodologies, such as QS Stars™, allows us to identify key areas for improvement in order to drive a culture of quality and continual innovation at our institutions.

S-9

Strong Student Outcomes. We track and measure our student outcomes to ensure we are delivering on our commitments to students and their families. In 2017, we commissioned a study by Kantar Vermeer, a leading third-party market research organization, of graduates at Laureate institutions representing over 65% of total Laureate enrollments. Graduates at 10 of our 12 surveyed international institutions achieved, on average, equal or higher employment rates within 12 months of graduation as compared to graduates of other institutions in the same markets. In addition, in 10 of the 12 institutions surveyed, graduates achieved equal or higher starting salaries as compared to graduates of other institutions in those same markets (salary premium to market benchmarks ranged from approximately 15% to approximately 47%). Furthermore, a joint study by Laureate and the IFC/World Bank Group in 2014 showed that graduates of Laureate institutions in Mexico experienced higher rates of social mobility, finding jobs, and moving up in socioeconomic status than their peers in non-Laureate institutions. In 2016, we conducted a similar study with the IFC in Peru for two of our network institutions, UPC and Cibertec, which showed that graduates from the larger programs of both institutions had higher salaries than their control group counterparts. Additionally, graduates from UPC were found to experience a larger positive change in their socioeconomic status than their peers who completed studies at non-Laureate institutions.

- •

- Private Pay Model. Approximately 70% of our total revenues for the year

ended December 31, 2017 were generated from private pay sources. We believe students' and families' willingness to allocate personal resources to fund higher education at our institutions

validates our strong value proposition.

- •

- Revenue Visibility Enhanced by Program Length and Strong Retention. The

length of our programs provides us with a high degree of revenue visibility. The majority of the academic programs offered by our institutions last between three and five years, and nearly two thirds

of our students were enrolled in programs of at least four years or more in duration as of December 31, 2017. Additionally, we actively monitor and manage student retention because of the

impact it has on student outcomes and our financial results. The historical annual student retention rate, which we define as the proportion of prior year students returning in the current year

(excluding graduating students), of over 80% has not varied by more than two percentage points in any one year over the last five years. Given our high degree of revenue visibility, we are able to

make attractive capital investments and execute other strategic initiatives to help drive sustainable growth in our business.

- •

- Attractive Margin Profile with Significant Operating Leverage. Our international network of universities provides significant advantages of scale, enabling us to operate efficiently with attractive margin levels by leveraging the scale of our network. In 2014, we launched our first Excellence in Process ("EiP") enterprise-wide initiative to optimize and standardize our processes to enable sustained growth and margin expansion. Our EiP programs have implemented vertical integration of procurement, information technology, finance, accounting, and human resources, enabling us to fully leverage the growing size and scope of our local operations while also enhancing our internal controls and have expanded to leveraging additional opportunities for efficiencies and savings related to the mid-office functions (including, for example, student information systems and the enrollment-to-graduation cycle) as well as general and administrative structure and certain student-facing activities.

Attractive Financial Model.

S-10

Our Strategy

The execution of our strategy will be enabled by the following initiatives:

Integration of Latin American Campus-Based Operations Through Common Operating Model. We anticipate that our focus on our core, scaled markets will allow us to integrate our campus-based operations in those markets. Our institutions in Latin America serve approximately 800,000 students in a relatively homogenous operating environment, creating a unique opportunity to harvest the benefits of scale. We believe that by implementing and optimizing our common operating model, we will be able to transition our institutions from operating as decentralized, stand-alone units to operating as an integrated and scaled network.

Tighter integration of our Latin American campus-based operations will also enable us to significantly reduce our cost structure and allow us to leverage the benefits of our scale across our more than 20 brands in these markets. By continuing to build on our success with the implementation of EiP, we believe that we can increase consistency and achieve scale with respect to back and mid-office functions, as well as certain front-office functions which impact the student from enrollment through graduation.

We anticipate that the common operating model will enable closer collaboration across our network and will facilitate network-wide innovation and improved student experiences, such as joint program development initiatives, global classrooms, increased sharing of best practices and additional coordinated investments in unified technology systems and new capabilities such as artificial intelligence and enhanced data analytics. We believe that this unification will enable us to be more nimble in our day-to-day operations and will allow us to extract valuable insights from more data across our network. We believe this will enable further innovation and efficiency in our academic model and operations. Further, we believe that this common operating system will enable us to lower the cost of delivery of education, which we believe should lead to improved margins and expanded market share. We plan to continue to centralize the development of certain curriculum, allowing us to build common teaching modules and courses at a lower cost and at higher quality, as compared to building modules and courses in each local market, as we can dedicate more resources to each course or module.

Leverage and Expand Existing Portfolio. We will continue to focus on opportunities to expand our programs and the type of students that we serve, as well as our capacity in our markets to meet local demand, leveraging our existing platform to execute on attractive organic growth opportunities. In particular, we intend to add new programs and course offerings, expand target student demographics and, where appropriate, increase capacity at existing campuses, open new campuses and enter new cities in existing markets. We believe these initiatives will drive growth and provide an attractive return on capital.

- •

- Add New Programs and Course Offerings. We will continue to develop new

programs and course offerings to address the changing needs in the markets. New programs and course offerings enable us to provide a high-quality education that we believe is desired by students and

prospective employers.

- •

- Expand Target Student Demographics. We use sophisticated analytical

techniques to identify opportunities to provide quality education to new or underserved student populations where market demand is not being met, such as non-traditional students (e.g., working

adults) who may value flexible scheduling options, as well as traditional students. Our ability to provide quality education to these underserved markets has provided additional growth opportunities

to our network and we intend to leverage our management capabilities and local knowledge to further capitalize on these opportunities in new and existing markets.

- •

- Increase Capacity at Existing and New Campus Locations. We will continue to make demand-driven investments in additional capacity throughout our network by expanding existing

S-11

campuses and opening new campuses, including in new cities. We employ a highly analytical process based on economic and demographic trends, and demand data for the local market to determine when and where to expand capacity. When opening a new campus or expanding existing facilities, we use best practices that we have developed over more than the past decade to cost-effectively expedite the opening and development of that location.

Expand Online and Hybrid Education Programs. We intend to increase the number of our students that receive their education through fully online or hybrid programs to meet the growing demands of students. Our online initiative is designed to not only provide students with access to innovative programs and modern digital experiences, but also to diversify our offerings, increase our enrollments and expand our digital solutions in a capital efficient manner, leveraging current infrastructure and improving classroom utilization.

For 2017, the percentage of student credit hours taken online in our campus-based institutions was approximately 20%, an increase from approximately 11% in 2015, and our goal is to increase that percentage of student credit hours to approximately 25% by the end of 2019. With a common LMS implemented throughout our network covering approximately 94% of our students as of September 30, 2018, we believe we have the scale to execute on this market opportunity, allowing us to differentiate ourselves further from our competitors.

We continue to accelerate the advancement of online education programs and technology-enabled solutions that deliver high-quality differentiated student experiences for our institutions at scale, including leveraging our network-wide launch of OneCampus® by Laureate, our global online campus. OneCampus® brings global connections, opportunities, courses, and workplace experiences to our students, who become "members" in the broader Laureate network of institutions and gain access to unique global opportunities online. Furthermore, it creates a channel for Laureate to manage online initiatives across the network and continually expand our portfolio of online offerings—reaching students, faculty, and alumni in the Laureate network and offering them a distinct market advantage.

Our strategy for the online opportunity includes the following components:

- •

- Hybrid Online Programs. Traditional 18-24 year old students

attending campus-based institutions are increasingly seeking digital learning experiences that are blended with in-person learning. We provide those students with a hybrid learning experience, mixing

face-to-face classroom experience with technology through our online platform, which we believe improves the student experience by providing them with a wide range of online courses, interactive

discussions, virtual experiences, digital resources, and simulations that enhance their learning experiences both within and outside the classroom.

- •

- Fully Online Programs. Many students require flexible learning modules to

accommodate work and personal responsibilities. Often, these students are working adults who are looking to either complete an undergraduate or post-graduate degree, or who want to gain a credential

to accelerate or change careers. Our fully online programs provide students with a high-quality curriculum experience to achieve their goals.

- •

- Distance Learning in Brazil. The Brazil market offers a unique opportunity to provide a quality and at-scale distance learning offering. The distance learning format reduces the need for on-site support, providing students with flexibility to plan their studies. With an established presence of over 450 learning centers as of September 30, 2018, we have continued to leverage our local brands in Brazil to capitalize on our investment in distance learning centers to support demand.

Selling Stockholder

The selling stockholder is Wengen Alberta, Limited Partnership. See "Selling Stockholder."

S-12

Corporate Information

Laureate is listed on the Nasdaq Global Select Market and is traded under the ticker symbol "LAUR".

Our principal executive offices are located at 650 S. Exeter Street, Baltimore, Maryland 21202. Our telephone number is (410) 843-6100. Our website is accessible through www.laureate.net. Information contained on, or accessible through, our website is not, and you must not consider the information to be, a part of this prospectus supplement or the accompanying prospectus or incorporated by reference herein or therein.

S-13

Issuer |

Laureate Education, Inc. | |

Class A common stock offered by the selling stockholder |

12,250,000 shares (or 14,087,500 shares if the underwriters exercise their option to purchase additional shares from the selling stockholder in full). |

|

Class A common stock outstanding after this offering |

103,904,217 shares. |

|

Use of proceeds |

We will not receive any of the proceeds from the sale of the shares of our Class A common stock by the selling stockholder. We will pay certain of the expenses of this offering in accordance with the terms of that certain Amended and Restated Registration Rights Agreement, dated as of February 6, 2017, by and among the Company, Wengen, Wengen Investments Limited and the other parties thereto (the "Wengen Registration Rights Agreement"). |

|

Dividend Policy |

We do not intend to pay dividends on shares of our Class A common stock following this offering. Any declaration and payment of future dividends to holders of shares of our Class A common stock may be limited by restrictive covenants in our debt agreements, and will be at the sole discretion of our board of directors and will depend on many factors, including our financial condition, earnings, capital requirements, level of indebtedness, statutory and contractual restrictions applicable to the payment of dividends and other considerations that our board of directors deems relevant. See "Dividend Policy." |

|

Risk Factors |

Investing in our Class A common stock involves risk. In particular, see the risks discussed under the caption "Risk Factors" in this prospectus supplement and the information under the caption "Risk Factors" in our 2017 10-K, as revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form 8-K, as well as any amendments thereto, as filed with the SEC (all of which are incorporated by reference herein), as well as other risks described under the caption "Risk Factors" in the accompanying prospectus, in any free writing prospectus prepared by or on behalf of us and any documents that we incorporate by reference herein and therein. |

S-14

Conflicts of Interest |

Affiliates of Kohlberg Kravis Roberts & Co. L.P. (together with its affiliates, "KKR") beneficially own (through their investment in Wengen) in excess of 10% of our issued and outstanding common stock. Because KKR Capital Markets LLC, an affiliate of KKR, is an underwriter and KKR's affiliates beneficially own in excess of 10% of our issued and outstanding common stock, KKR Capital Markets LLC is deemed to have a "conflict of interest" under Rule 5121 ("Rule 5121") of the Financial Industry Regulatory Authority, Inc. ("FINRA"). Accordingly, this offering is being made in compliance with the requirements of Rule 5121. Pursuant to that rule, the appointment of a "qualified independent underwriter" is not required in connection with this offering as the members primarily responsible for managing the public offering do not have a conflict of interest, are not affiliates of any member that has a conflict of interest and meet the requirements of paragraph (f)(12)(E) of Rule 5121. KKR Capital Markets LLC will not confirm sales of the securities to any account over which it exercises discretionary authority without the specific written approval of the account holder. See "Underwriting (Conflicts of Interest)." |

|

Nasdaq Global Select Market symbol |

"LAUR." |

Unless we indicate otherwise, all references in this prospectus supplement to the number and percentages of shares of our Class A common stock outstanding following this offering are based on 91,654,217 shares of our Class A common stock outstanding as of September 30, 2018, and do not give effect to:

- •

- 132,386,666 shares of our Class A common stock issuable upon the conversion of our Class B common stock outstanding as of

September 30, 2018;

- •

- 7,121,648 shares of our Class A common stock that would be issuable upon conversion of shares of our Class B common stock

issuable upon the exercise of total stock options outstanding as of September 30, 2018 at a weighted average exercise price of $19.27 per share;

- •

- 2,112,097 shares of our Class A common stock issuable upon the exercise of total stock options outstanding as of September 30,

2018 at a weighted average exercise price of $17.30 per share;

- •

- Approximately 2,600,000 shares of our Class A common stock available for additional grants under the Laureate Education, Inc.

2013 Long-Term Incentive Plan as of September 30, 2018;

- •

- 7,432 shares of our Class A common stock that would be issuable upon conversion of shares of our Class B common stock reserved

for issuance under the Laureate Education, Inc. Deferred Compensation Plan, as amended and restated effective January 1, 2009, outstanding as of September 30, 2018;

- •

- 62,629 shares of our Class A common stock that would be issuable upon conversion of shares of our Class B common stock issuable

upon the vesting of restricted stock units outstanding as of September 30, 2018;

- •

- 709,790 shares of our Class A common stock issuable upon the vesting of restricted stock units outstanding as of September 30, 2018;

S-15

- •

- 94,541 shares of our Class A common stock that would be issuable upon conversion of shares of our Class B common stock issuable

upon the vesting of performance share units outstanding as of September 30, 2018;

- •

- 1,405,718 shares of our Class A common stock issuable upon the vesting of performance share units outstanding as of September 30,

2018; and

- •

- any exercise of the underwriters' option to purchase additional shares of our Class A common stock from the selling stockholder.

S-16

SUMMARY CONSOLIDATED FINANCIAL DATA

Set forth below are summary consolidated financial and other data of Laureate Education, Inc., at the dates and for the periods indicated. The summary historical statements of operations data and statements of cash flows data for the fiscal years ended December 31, 2017, 2016 and 2015 and balance sheet data as of December 31, 2017 and 2016 have been derived from our historical audited consolidated financial statements included in our 2017 10-K (which report is incorporated by reference herein), as amended or affected by the recast audited consolidated financial statements included in our Current Report on Form 8-K filed with the SEC on November 13, 2018 and incorporated by reference herein. For more information about the recast financial information, see "Basis of Presentation". The unaudited consolidated statements of operations data for the nine months ended September 30, 2017 and 2018 and the unaudited consolidated balance sheet data as of September 30, 2018 are derived from our unaudited interim condensed consolidated financial statements incorporated by reference into this prospectus supplement. Our historical results are not necessarily indicative of our future results.

The historical consolidated financial and other data should be read in conjunction with (i) "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2018, (ii) our Current Report on Form 8-K filed with the SEC on November 13, 2018, and (iii) the consolidated financial statements and the related notes incorporated by reference into this prospectus supplement.

S-17

| |

Nine Months Ended September 30, |

Fiscal Year Ended December 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollar amounts in thousands) |

2018 | 2017 | 2017 | 2016 | 2015 | |||||||||||

| |

(unaudited) |

|

|

|

||||||||||||

Consolidated Statements of Operations: |

||||||||||||||||

Revenues |

$ | 2,436,514 | $ | 2,434,687 | $ | 3,385,876 | $ | 3,301,864 | $ | 3,399,774 | ||||||

Costs and expenses: |

||||||||||||||||

Direct costs |

2,081,125 | 2,110,901 | 2,821,291 | 2,788,691 | 2,946,016 | |||||||||||

General and administrative expenses |

194,184 | 221,909 | 315,471 | 222,496 | 194,686 | |||||||||||

Loss on impairment of assets |

10,030 | — | 7,121 | — | — | |||||||||||

| | | | | | | | | | | | | | | | | |

Operating income |

151,175 | 101,877 | 241,993 | 290,677 | 259,072 | |||||||||||

Interest income |

9,358 | 9,702 | 11,865 | 14,414 | 9,474 | |||||||||||

Interest expense |

(181,764 | ) | (256,677 | ) | (334,901 | ) | (390,391 | ) | (367,284 | ) | ||||||

Loss on debt extinguishment |

(7,481 | ) | (8,425 | ) | (8,392 | ) | (17,363 | ) | (1,263 | ) | ||||||

Gain (loss) on derivatives |

92,112 | 19,187 | 28,656 | (6,084 | ) | (2,607 | ) | |||||||||

Other income (expense), net |

10,815 | (568 | ) | (1,892 | ) | 457 | (423 | ) | ||||||||

Foreign currency exchange (loss) gain, net |

(43,942 | ) | (2,221 | ) | 2,539 | 77,299 | (128,299 | ) | ||||||||

(Loss) gain on sale of subsidiaries, net(1) |

— | — | (10,490 | ) | 398,081 | — | ||||||||||

| | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before income taxes and equity in net income of affiliates |

30,273 | (137,125 | ) | (70,622 | ) | 367,090 | (231,330 | ) | ||||||||

Income tax (expense) benefit |

(65,822 | ) | (13,668 | ) | 91,308 | (34,440 | ) | (95,364 | ) | |||||||

Equity in net income of affiliates, net of tax |

— | 1 | 152 | 90 | 2,495 | |||||||||||

| | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations |

(35,549 | ) | (150,792 | ) | 20,838 | 332,740 | (324,199 | ) | ||||||||

Income from discontinued operations, net of tax of $39,712, $15,125, $24,495, $30,561 and $22,366, respectively |

22,459 | 44,047 | 72,926 | 33,446 | 8,354 | |||||||||||

Gain on sales of discontinued operations, net of tax of $18,097, $0, $0, $0 and $0, respectively |

311,904 | — | — | — | — | |||||||||||

| | | | | | | | | | | | | | | | | |

Net income (loss) |

298,814 | (106,745 | ) | 93,764 | 366,186 | (315,845 | ) | |||||||||

Net (income) loss attributable to noncontrolling interests |

(315 | ) | 2,365 | (2,299 | ) | 5,661 | (403 | ) | ||||||||

| | | | | | | | | | | | | | | | | |

Net income (loss) attributable to Laureate Education, Inc. |

$ | 298,499 | $ | (104,380 | ) | $ | 91,465 | $ | 371,847 | $ | (316,248 | ) | ||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S-18

| |

Nine Months Ended September 30, |

Fiscal Year Ended December 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollar amounts in thousands) |

2018 | 2017 | 2017 | 2016 | 2015 | |||||||||||

| |

(unaudited) |

|

|

|

||||||||||||

Consolidated Statements of Cash Flows: |

||||||||||||||||

Net cash provided by operating activities |

$ | 356,370 | $ | 211,751 | $ | 130,756 | $ | 184,570 | $ | 170,486 | ||||||

Net cash provided by (used in) investing activities |

226,825 | (146,277 | ) | (324,530 | ) | 269,234 | (173,642 | ) | ||||||||

Net cash (used in) provided by financing activities |

(486,912 | ) | (11,406 | ) | 222,795 | (445,722 | ) | 34,424 | ||||||||

Business acquisitions, net of cash acquired |

— | (835 | ) | (835 | ) | — | (6,705 | ) | ||||||||

Segment Data: |

||||||||||||||||

Revenues: |

||||||||||||||||

Brazil |

$ | 469,480 | $ | 547,971 | $ | 765,746 | $ | 690,804 | $ | 672,917 | ||||||

Mexico |

463,868 | 451,993 | 646,154 | 626,011 | 678,193 | |||||||||||

Andean |

844,213 | 779,135 | 1,085,640 | 969,717 | 913,388 | |||||||||||

Rest of World |

170,164 | 149,156 | 214,720 | 330,423 | 452,937 | |||||||||||

Online & Partnerships |

498,207 | 520,982 | 690,374 | 704,976 | 707,998 | |||||||||||

Corporate |

(9,418 | ) | (14,550 | ) | (16,758 | ) | (20,067 | ) | (25,659 | ) | ||||||

| | | | | | | | | | | | | | | | | |

Total revenues |

$ | 2,436,514 | $ | 2,434,687 | $ | 3,385,876 | $ | 3,301,864 | $ | 3,399,774 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Other Data: |

||||||||||||||||

Total enrollments (rounded to the nearest hundred): |

||||||||||||||||

Brazil |

273,000 | 275,000 | 271,200 | 259,000 | 257,200 | |||||||||||

Mexico |

210,200 | 212,300 | 214,200 | 213,800 | 205,000 | |||||||||||

Andean |

314,800 | 307,400 | 299,100 | 286,600 | 270,700 | |||||||||||

Rest of World |

19,100 | 16,700 | 17,200 | 15,400 | 28,700 | |||||||||||

Online & Partnerships |

62,000 | 64,700 | 63,500 | 68,300 | 72,400 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total |

879,100 | 876,100 | 865,200 | 843,100 | 834,000 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

New enrollments (rounded to the nearest hundred): |

||||||||||||||||

Brazil |

157,100 | 143,700 | 149,900 | 134,500 | 142,300 | |||||||||||

Mexico |

107,400 | 105,800 | 107,300 | 108,400 | 101,000 | |||||||||||

Andean |

118,000 | 115,500 | 116,600 | 117,200 | 112,500 | |||||||||||

Rest of World |

12,100 | 11,400 | 12,000 | 14,100 | 19,400 | |||||||||||

Online & Partnerships |

27,000 | 27,700 | 35,000 | 39,300 | 39,500 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total |

421,600 | 404,100 | 420,800 | 413,500 | 414,700 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S-19

| |

|

As of December 31, | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

As of September 30, 2018 |

|||||||||

| (Dollar amounts in thousands) |

2017 | 2016 | ||||||||

Consolidated Balance Sheets: |

||||||||||

Cash and cash equivalents |

$ | 392,348 | $ | 320,567 | $ | 295,785 | ||||

Restricted cash and investments(2) |

196,790 | 212,215 | 178,552 | |||||||

Net working capital (deficit) (including cash and cash equivalents) |

(82,778 | ) | (85,895 | ) | (324,431 | ) | ||||

Property and equipment, net |

1,257,687 | 1,380,417 | 1,361,465 | |||||||

Goodwill |

1,709,586 | 1,828,365 | 1,786,554 | |||||||

Tradenames |

1,130,186 | 1,167,302 | 1,153,348 | |||||||

Other intangible assets, net |

25,455 | 35,779 | 46,035 | |||||||

Total assets |

6,990,536 | 7,391,285 | 7,062,534 | |||||||

Total debt, including due to shareholders of acquired companies |

2,653,110 | 3,167,051 | 3,635,261 | |||||||

Deferred compensation |

13,383 | 14,470 | 14,128 | |||||||

Total liabilities, excluding debt, due to shareholders of acquired companies and derivative instruments |

2,345,795 | 2,209,107 | 2,393,080 | |||||||

Convertible redeemable preferred stock |

— | 400,276 | 332,957 | |||||||

Redeemable noncontrolling interests and equity |

12,671 | 13,721 | 23,876 | |||||||

Total Laureate Education, Inc. stockholders' equity |

1,983,336 | 1,575,164 | 632,210 | |||||||

- (1)

- In

2016, represented a gain of approximately $249.4 million resulting from the Swiss institutions sale that closed on June 14, 2016 and a gain of

approximately $148.7 million, subject to certain adjustments, resulting from the French institutions sale that closed on July 20, 2016. In 2017, primarily represents a final purchase

price settlement related to the sale of the Swiss institutions.

- (2)

- Restricted cash and investments includes cash equivalents held to collateralize standby letters of credit in favor of the U.S. Department of Education (the "DOE") in order to allow our U.S. Institutions to participate in the Title IV program. In addition, we may have restricted cash in escrow pending potential acquisition transactions, or otherwise have cash that is not immediately available for use in current operations.

S-20

Investing in our Class A common stock involves a high degree of risk. Before deciding to invest in shares of our Class A common stock, you should consider carefully the risks set forth under "Risk Factors" in our 2017 10-K, as revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form 8-K, as well as any amendments thereto, as filed with the SEC (all of which are incorporated by reference herein), as well as other risks described under the caption "Risk Factors" in the accompanying prospectus and any free writing prospectus prepared by or on behalf of us. See "Information Incorporated by Reference" and "Where You Can Find More Information." These risks are not the only ones facing our company. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Each of these risk factors could materially and adversely affect our business, results of operations and financial condition and could result in you losing all or part of your investment in shares of our Class A common stock. See also "Forward-Looking Statements."

S-21

This prospectus supplement, the accompanying prospectus, any free writing prospectus prepared by or on behalf of us and any documents that we incorporate by reference herein and therein may contain "forward looking statements" within the meaning of the federal securities laws, which involve risks and uncertainties. You can identify forward looking statements because they contain words such as "believes," "expects," "may," "will," "should," "seeks," "approximately," "intends," "plans," "estimates" or "anticipates" or similar expressions that concern our strategy, plans or intentions. All statements we make relating to estimated and projected earnings, costs, expenditures, cash flows, growth rates, financial results and potential divestitures are forward looking statements. In addition, we, through our senior management, from time to time make forward looking public statements concerning our expected future operations and performance and other developments. All of these forward looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those we expected. We derive most of our forward looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results.

Important factors that could cause actual results to differ materially from our expectations include, but are not limited to, the information under the caption "Risk Factors" in our 2017 10-K, as revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form 8-K, as well as any amendments thereto, as filed with the SEC (all of which are incorporated by reference herein), as well as other risks described under the caption "Risk Factors" in the accompanying prospectus and any free writing prospectus prepared by or on behalf of us. All subsequent written and oral forward looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the factors discussed herein and therein. We undertake no obligation to publicly update or revise any forward looking statement as a result of new information, future events or otherwise, except as otherwise required by law. For any forward-looking statements contained in this prospectus supplement, the accompanying prospectus, any free writing prospectus prepared by or on behalf of us and any documents that we incorporate by reference herein and therein, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

S-22

We will not receive any of the proceeds from the sale of the shares of our Class A common stock by the selling stockholder. We will pay certain of the expenses of this offering in accordance with the terms of the Wengen Registration Rights Agreement.

S-23

MARKET PRICE OF OUR CLASS A COMMON STOCK

Our Class A common stock has traded on the Nasdaq Global Select Market under the symbol "LAUR" since February 1, 2017. Prior to that date, there was no public trading market for our Class A common stock. On November 15, 2018, the last reported sale price of our Class A common stock on the Nasdaq Global Select Market was $14.46.

There were 17 holders of record of our Class A common stock and 222 holders of record of our Class B common stock as of November 12, 2018. The number of beneficial owners of our Class A common stock is substantially greater than the number of record holders, because substantially all of our Class A common stock is held in "street name" by banks and brokers.

We currently do not anticipate paying any cash dividends on our Class A common stock or Class B common stock in the foreseeable future. We expect to retain our future earnings, if any, for use in the operation and expansion of our business. The terms of our senior secured credit agreement governing our senior secured credit facilities and the indenture governing our outstanding senior notes limit our ability to pay cash dividends in certain circumstances. Furthermore, if we are in default under the senior secured credit agreement governing our senior secured credit facilities or the indenture governing our outstanding senior notes, our ability to pay cash dividends will be limited in the absence of a waiver of that default or an amendment to such agreement or such indenture. In addition, our ability to pay cash dividends on shares of our Class A common stock may be limited by restrictions on our ability to obtain sufficient funds through dividends from our subsidiaries. Subject to the foregoing, the payment of cash dividends in the future, if any, will be at the discretion of our board of directors and will depend upon such factors as earnings levels, capital requirements, our overall financial condition and any other factors deemed relevant by our board of directors.

S-24

The following table sets forth information with respect to the current beneficial ownership of the selling stockholder, the number of shares of our Class A common stock being offered hereby by the selling stockholder and information with respect to shares to be beneficially owned by the selling stockholder after completion of this offering.

The number of shares and percentages of beneficial ownership set forth below are based on beneficial ownership as of November 12, 2018 and are based on the number of shares of our Class A common stock issued and outstanding as of November 12, 2018, prior to the consummation of this offering. The number of shares and percentages of beneficial ownership after this offering set forth below are based on the number of shares of our Class A common stock issued and outstanding immediately after the consummation of this offering, assuming the selling stockholder sells the number of shares set forth in the table below.

A person is a "beneficial owner" of a security if that person has or shares "voting power," which includes the power to vote or to direct the voting of the security, or "investment power," which includes the power to dispose of or to direct the disposition of the security or has the right to acquire such powers within 60 days. To our knowledge, unless otherwise noted in the footnotes to the following table, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to their beneficially owned common stock.

| |

|

|

|

|

Shares Beneficially Owned After this Offering | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Shares Beneficially Owned Prior to this Offering(1) |

|

Assuming No Exercise of the Underwriters' Option |

Assuming Full Exercise of the Underwriters' Option |

|||||||||||||||||||||||||||

Name of Beneficial Owner

|

Number | Percentage of Total Common Stock |

Percentage of Voting Power(2) |

Shares Being Sold in this Offering(3) |

Number | Percentage of Total Common Stock |

Percentage of Voting Power(1) |

Number | Percentage of Total Common Stock |

Percentage of Voting Power(1) |

|||||||||||||||||||||

Wengen Alberta, Limited Partnership |

126,189,616(4 | ) | 56.32 | % | 89.96 | % | 12,250,000(4 | ) | 113,939,616 | 50.86 | % | 88.16 | % | 112,102,116 | 50.04 | % | 87.86 | % | |||||||||||||

- (1)

- Except

as noted in the footnotes below, beneficial ownership of shares of Class A common stock reported in the table includes shares of our Class A

common stock and shares of our Class B common stock (which are convertible to shares of our Class A common stock), as a single class. The Class B common stock is convertible into

shares of Class A common stock on a share-for-share basis upon the election of the holder or upon transfer, subject to the terms of our amended and restated certificate of incorporation. The

Class A common stock and Class B common stock will automatically convert into a single class of common stock on the date on which the number of outstanding shares of Class B

common stock represents less than 15% of the aggregate combined number of outstanding shares of Class A common stock and Class B common stock.

- (2)

- Percentage

of voting power represents voting power with respect to all shares of our Class A common stock and Class B common stock, voting as a single

class. Holders of shares of our Class A common stock are entitled to one vote per share, and holders of shares of our Class B common stock are entitled to ten votes per share. Holders of

shares of our Class A common stock and Class B common stock vote together as a single class on all matters (including the election of directors) submitted to a vote of stockholders,

except as may otherwise be required by law or our amended and restated certificate of incorporation. Each share of our Class B common stock will convert automatically into one share of our

Class A common stock upon any transfer (including in connection with this offering), whether or not for value, except for certain transfers described in our amended and restated certificate of

incorporation.

- (3)

- The

underwriters of this offering have an option to purchase up to 1,837,500 additional shares of our Class A common stock from the selling stockholder.

- (4)