Form 424B5 Fiverr International

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities nor does it seek an

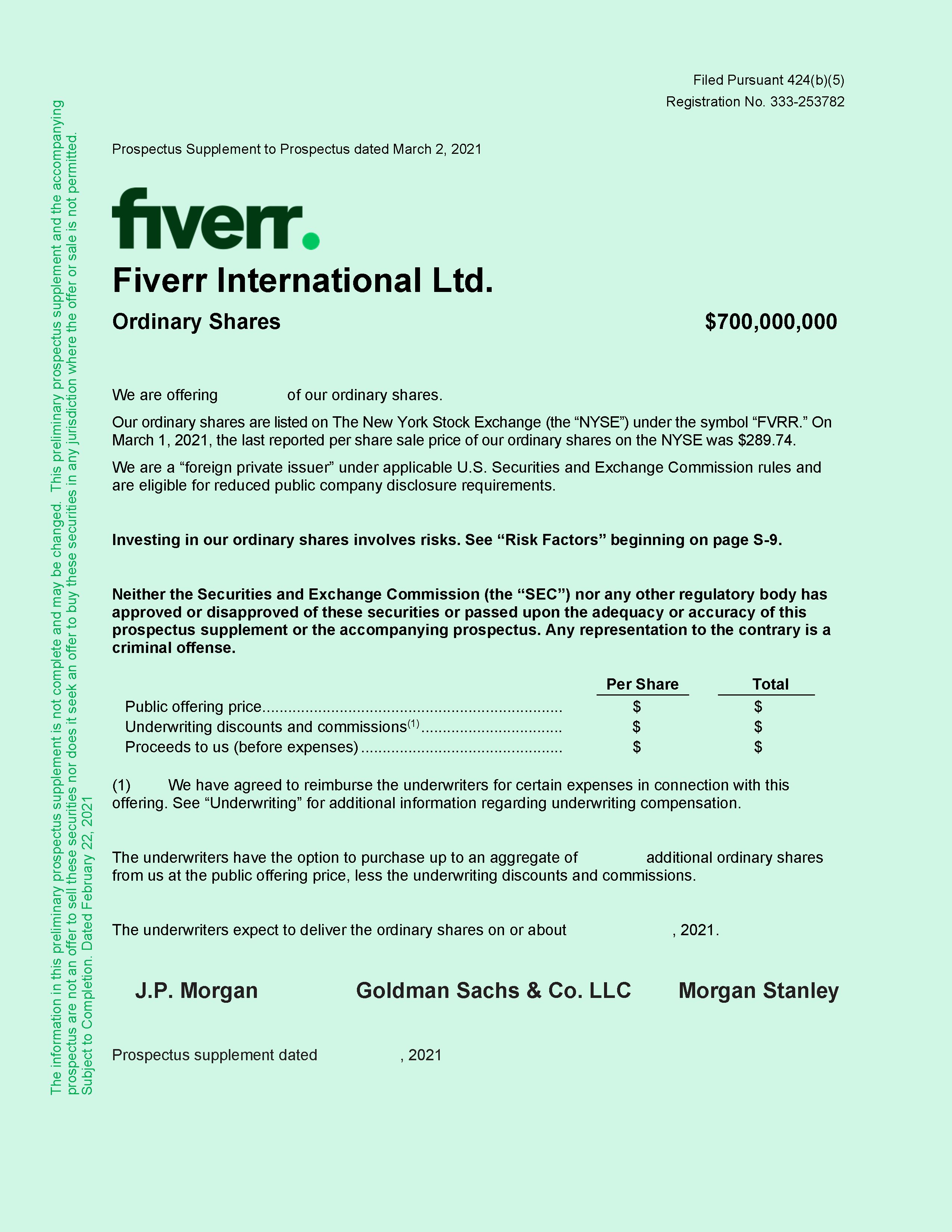

offer to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to Completion. Dated February 22, 2021 Filed Pursuant 424(b)(5) Registration No. 333-253782 Prospectus Supplement to Prospectus dated February 22,

2021 Fiverr International Ltd. $700,000,000 . Ordinary Shares We are offering of our ordinary shares. Our ordinary shares are listed on The New York Stock Exchange (the “NYSE”) under the symbol “FVRR.” On March 2,

2021, the last reported per share sale price of our ordinary shares on the NYSE was $289.74. We are a “foreign private issuer” under applicable U.S. Securities and Exchange Commission rules and are eligible for reduced public company disclosure

requirements. Investing in our ordinary shares involves risks. See “Risk Factors” beginnin on page S-9. Neither the Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense. Per Share Total Public offering price $ $ Underwriting discounts

and commissions(1) $ $ Proceeds to us (before expenses) $ $ (1) We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting” for additional information

regarding underwriting compensation. The underwriters have the option to purchase up to an aggregate of additional ordinary shares from us at the public offering price, less the underwriting discounts and commissions. The underwriters

expect to deliver the ordinary shares on or about , 2021. J.P. Morgan [__] Prospectus supplement dated , 2021

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

| Page |

|

| S-1 | |

| S-4 | |

| S-6 | |

| S-9 | |

| S-10 | |

| S-13 | |

| S-14 | |

| S-15 | |

| S-16 | |

| S-23 | |

| S-29 | |

| S-29 | |

| S-30 | |

| S-31 |

PROSPECTUS

| Page | |

|

ii

|

|

|

1

|

|

|

2

|

|

|

3

|

|

|

5

|

|

|

6

|

|

|

12

|

|

|

14

|

|

|

15

|

|

|

19

|

|

|

22

|

|

|

23

|

|

|

24

|

|

|

25

|

|

|

26

|

|

|

27

|

S - i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form F-3 that we filed with the Securities and Exchange Commission (the “SEC”),

utilizing an automatic shelf registration process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the offering contemplated hereby and also adds to and updates information contained

in the accompanying prospectus and the documents incorporated by reference therein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this

document combined. We urge you to carefully read this prospectus supplement and the accompanying prospectus, and the documents incorporated herein and therein before buying any of the securities being offered under this prospectus supplement. To the

extent that any statement that we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference therein, the statements made in this prospectus supplement will be

deemed to modify or supersede those statements made in the accompanying prospectus and documents incorporated by reference herein and therein.

Neither we nor the underwriters have authorized anyone to provide you with any information or to make any representations other than those contained in or incorporated by reference

into this prospectus supplement, the accompanying prospectus or in any free writing prospectuses we have prepared, and neither we nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other

information others may give you. We and the underwriters are not making an offer to sell, or seeking offers to buy, these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in

this prospectus supplement or the accompanying prospectus is accurate as of any date other than its date, regardless of the time of delivery of this prospectus supplement or of any sale of the ordinary shares.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus supplement

or the accompanying prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus supplement or the accompanying prospectus must

inform themselves about, and observe any restrictions relating to, the offering of our ordinary shares and the distribution of this prospectus supplement or the accompanying prospectus outside the United States.

Except where the context otherwise requires or where otherwise indicated in this prospectus supplement, the terms “Fiverr,” the “Company,” “we,” “us,” “our,” “our company” and “our

business” refer to Fiverr International Ltd., together with its consolidated subsidiaries as a consolidated entity.

All references in this prospectus supplement to “Israeli currency” and “NIS” refer to New Israeli Shekels, the terms “dollar,” “USD” or “$” refer to U.S. dollars and the terms “€” or

“euro” refer to the currency introduced at the start of the third stage of European economic and monetary union pursuant to the treaty establishing the European Community, as amended.

S - ii

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Our financial statements have been prepared in accordance with generally accepted accounting principles in the United States ("GAAP"). We present our consolidated financial

statements in U.S. dollars.

Our fiscal year ends on December 31 of each year. References to fiscal 2018 and 2018 are references to the fiscal year ended December 31, 2018, references to fiscal 2019 and 2019 are

references to the fiscal year ended December 31, 2019, and references to fiscal 2020 and 2020 are references to the fiscal year ended December 31, 2020. Some amounts in this prospectus supplement may not total due to rounding. All percentages have

been calculated using unrounded amounts.

Key Terms and Performance Indicators Used in this Prospectus Supplement

Throughout this prospectus supplement, we provide a number of key performance indicators used by our management and often used by competitors in our industry. These and other key

performance indicators are discussed in more detail in Item 5. “Operating and Financial Review and Prospects—Key Financial and Operating Metrics” in our Annual Report

on Form 20-F for the year ended December 31, 2020, which is incorporated by reference herein. We define certain terms used in this prospectus supplement as follows:

| ● |

“Active buyers” as of any given date means buyers who have ordered a Gig or other services on our platform within the last 12-month period, irrespective of cancellations.

|

| ● |

“Buyers” means users who order Gigs or other services on Fiverr.

|

| ● |

“Gig” or “Gigs” means the services offered on Fiverr.

|

| ● |

“Gross Merchandise Value” or “GMV” means the total value of transactions ordered through our platform, excluding value added tax, goods and services tax, service chargebacks and refunds.

|

| ● |

“Sellers” or “freelancers” means users who offer Gigs on our core platform.

|

| ● |

“Spend per buyer” as of any given date is calculated by dividing our GMV within the last 12-month period by the number of active buyers as of such date.

|

S - iii

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We have proprietary rights to trademarks used in this prospectus supplement that are important to our business, many of which are registered under applicable intellectual property

laws. Solely for convenience, trademarks and trade names referred to in this prospectus supplement may appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent

possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trademarks, trade names or service marks to imply a relationship with, or

endorsement or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this prospectus supplement is the property of its respective holder.

S - iv

This summary highlights information contained elsewhere in this prospectus supplement or the accompanying prospectus or incorporated by reference herein or therein. This summary does not contain all the information that you should

consider before deciding to invest in our ordinary shares. You should carefully read this entire prospectus supplement, the accompanying prospectus and any related free writing prospectus, including each of the documents incorporated

herein and therein by reference, before making an investment decision. You should carefully consider the information set forth under "Risk Factors" in this prospectus supplement, in the accompanying prospectus and in any related free

writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus supplement or the accompanying prospectus, including our Annual Report on Form 20-F for the year ended December

31, 2020. You should also carefully read the information incorporated by reference into the accompanying prospectus, including our financial statements, and the other information in the exhibits to the registration statement of which the

accompanying prospectus is a part.

Company Overview

Our mission is to change how the world works together. We started with the simple idea that people should be able to buy and sell digital services in the same fashion as physical goods on an e-commerce platform.

On that basis, we set out to design a digital marketplace that is built with a comprehensive SKU-like services catalog and an efficient search, find and order process that mirrors a typical e-commerce transaction.

We believe our model reduces friction and uncertainties for both buyers and sellers. At the foundation of our core platform, Fiverr.com, lies an expansive catalog with over 500 categories of

productized service listings, which we coined as Gigs. Each Gig has a clearly defined scope, duration and price, along with buyer-generated reviews. Using either our search or navigation tools, buyers can easily find and purchase productized

services, such as logo design, video creation and editing, website development and blog writing, with prices ranging from $5 to thousands of dollars. We call this the Service-as-a-Product (“SaaP”) model. Our approach fundamentally transforms

the traditional freelancer staffing model into an e-commerce-like experience.

Corporate Information

We were incorporated in Israel under the Israeli Companies Law, 5759 1999, and our principal executive office is located at 8 Eliezer Kaplan St., Tel Aviv 6473409, Israel. We are registered with the Israeli

Registrar of Companies. Our registration number is 51-444087-4. Our website address is www.fiverr.com, and our telephone number is +972-72-2280910. The information contained on, or that can be accessed through, our website is not a part of,

and shall not be incorporated by reference into, this prospectus supplement. We have included our website address as an inactive textual reference only.

Risk Factors

Investing in our ordinary shares involves risks. You should carefully consider all of the information in this prospectus supplement and the accompanying prospectus, including the

information incorporated by reference herein and therein. In particular, for a discussion of some specific factors you should consider before buying the shares, see “Risk Factors.” The following is a summary of some of the principal risks

we face:

| • |

a regional or global health pandemic, including COVID-19, could severely affect our business, results of operations and financial condition due to impacts on our buyer and seller base and consumer spending more broadly, as well

as impacts from remote work arrangements, actions taken to contain the disease or treat its impact and the speed and extent of the recovery;

|

S - 1

| • |

our growth depends on our ability to attract and retain a large community of buyers and freelancers, and the loss of our buyers and freelancers, or failure to attract new buyers and freelancers, could materially and adversely

affect our business;

|

| • |

we have incurred operating losses in the past, expect to incur operating losses in the future and may never achieve or maintain profitability;

|

| • |

if we fail to maintain and enhance our brand, our business, results of operations and prospects may be materially and adversely affected;

|

| • |

if the market for freelancers and the services they offer is not sustained or develops more slowly than we expect, our growth may slow or stall;

|

| • |

if user engagement on our website declines for any reason, our growth may slow or stall;

|

| • |

if we fail to maintain and improve the quality of our platform, we may not be able to attract and retain buyers and freelancers;

|

| • |

we face significant competition, which may cause us to suffer from a weakened market position that could materially and adversely affect our results of operations;

|

| • |

our business may suffer if we do not successfully manage our current and potential future growth;

|

| • |

our user growth and engagement on mobile devices depend upon effective operation with mobile operating systems, networks and standards that we do not control;

|

| • |

we or our third-party partners may experience a security breach, including unauthorized parties obtaining access to our users’ personal or other data, or any other data privacy or data protection compliance issue;

|

S - 2

| • |

changes in laws or regulations relating to consumer data privacy or data protection, or any actual or perceived failure by us to comply with such laws and regulations or our privacy policies, could materially and adversely

affect our business;

|

| • |

we have a limited operating history under our current platform and pricing model, which makes it difficult to evaluate our business and prospects and increases the risks associated with your investment, and any future changes

to our pricing model could materially and adversely affect our business;

|

| • |

errors, defects or disruptions in our platform could diminish our brand, subject us to liability, and materially and adversely affect our business, prospects, financial condition and results of operations;

|

| • |

our platform contains open source software components, and failure to comply with the terms of the underlying licenses could restrict our ability to market or operate our platform;

|

| • |

expansion into markets outside the United States is important to the growth of our business, and if we do not manage the business and economic risks of international expansion effectively, it could materially and adversely

affect our business and results of operations;

|

| • |

if we are unable to maintain and expand our scale of operations and generate a sufficient amount of revenue to offset the associated fixed and variable costs, our results of operations may be materially and adversely

affected;

|

| • |

our operating results may fluctuate from quarter to quarter, which makes our future results difficult to predict;

|

| • |

our business is subject to a variety of laws and regulations, both in the United States and internationally, many of which are evolving;

|

| • |

we depend upon talented employees, including our Chief Executive Officer, to grow, operate and improve our business, and if we are unable to retain and motivate our personnel and attract new talent, we may not be able to grow

effectively; and

|

| • |

if we fail to protect our intellectual property rights, our business, prospects, financial condition and results of operations could be materially and adversely affected.

|

S - 3

|

Ordinary shares offered by us

|

ordinary shares ( ordinary shares if the underwriters exercise their option to purchase additional ordinary shares in full).

|

|

Public offering price

|

$ per ordinary share.

|

|

Option to purchase additional shares

|

We have granted the underwriters an option for a period of 30 days after the date of this prospectus supplement to purchase up to additional ordinary shares.

|

|

Ordinary shares to be outstanding after this offering

|

ordinary shares ( ordinary shares if the underwriters exercise their

option to purchase additional ordinary shares in full).

|

|

Use of proceeds

|

We expect to receive net proceeds from this offering of approximately $ million, after deducting the underwriting discounts and commissions and offering

expenses payable by us.

We intend to use the net proceeds from this offering for working capital, to fund growth and for other general corporate purposes. See “Use of Proceeds.”

|

|

Dividend policy

|

We do not currently intend to pay cash dividends on our ordinary shares for the foreseeable future. However, if we do pay a cash dividend on our ordinary shares in the future, we will pay such dividend out

of our profits (subject to solvency requirements) as permitted under the laws of Israel. Our board of directors has complete discretion regarding the declaration and payment of dividends.

|

|

Risk factors

|

See “Risk Factors” and the other information included in this prospectus supplement and the accompanying prospectus for a discussion of factors you should consider before deciding to invest in our ordinary

shares.

|

|

NYSE trading symbol

|

“FVRR.”

|

S - 4

The number of our ordinary shares to be outstanding after this offering is based on 35,842,980 ordinary shares outstanding as of December 31, 2020. The number of ordinary shares to be outstanding after this

offering excludes:

| • |

3,223,443 ordinary shares issuable upon the exercise of options outstanding under our share option plans as of December 31, 2020, at a weighted average exercise price of $17.22 per share;

|

| • |

638,160 ordinary shares issuable upon the vesting of restricted share units under our share option plans as of December 31, 2020;

|

| • |

1,235,731 ordinary shares reserved for future issuance under our share option plans as described in Item 6.B. "Management—Share option plans" in our Annual Report on Form 20-F for the year

ended December 31, 2020, which is incorporated by reference herein; and

|

| • |

410,000 ordinary shares reserved for future issuance under our 2020 Employee Share Purchase Plan described in Item 6.B. "Management—Employee Share Purchase Plan" in our Annual Report on Form

20-F for the year ended December 31, 2020, which is incorporated by reference herein.

|

In addition, unless otherwise indicated, all information contained in this prospectus supplement assumes:

| • |

no exercise of the outstanding options described above after December 31, 2020;

|

| • |

no vesting of the restricted share units described above after December 31, 2020; and

|

| • |

no exercise by the underwriters of their option to purchase an additional ordinary shares from us in this offering.

|

S - 5

The following tables present our summary consolidated financial and other data. We prepare our consolidated financial statements in accordance with GAAP. We have derived the summary

consolidated statement of income data for the years ended December 31, 2020, 2019 and 2018 from our audited consolidated financial statements included in our Form 20-F for the year ended December 31, 2020 incorporated by reference herein.

Our historical results are not necessarily indicative of the results that may be expected in the future.

The financial data set forth below should be read in conjunction with, and

is qualified by reference to, Item 5. “Operating and Financial Review and Prospects” and the consolidated financial statements and notes

thereto included in our Annual Report on Form 20-F for the year ended December 31, 2020, which is incorporated by reference herein.

|

Year ended December 31,

|

||||||||||||

|

2020

|

2019

|

2018

|

||||||||||

|

(in thousands, except share and per share data)

|

||||||||||||

|

Consolidated Statement of Operations Data:

|

||||||||||||

|

Revenue

|

$

|

189,510

|

$

|

107,073

|

$

|

75,503

|

||||||

|

Cost of revenue(1)

|

33,188

|

22,224

|

15,621

|

|||||||||

|

Gross profit

|

156,322

|

84,849

|

59,882

|

|||||||||

|

Operating expenses:

|

||||||||||||

|

Research and development(1)

|

45,719

|

34,483

|

26,035

|

|||||||||

|

Sales and marketing(1)

|

94,379

|

62,750

|

49,720

|

|||||||||

|

General and administrative(1)

|

28,034

|

22,366

|

20,596

|

|||||||||

|

Total operating expenses

|

168,132

|

119,599

|

96,351

|

|||||||||

|

Operating loss

|

(11,810

|

)

|

(34,750

|

)

|

(36,469

|

)

|

||||||

|

Financial income (expenses), net

|

(2,800

|

)

|

1,371

|

408

|

||||||||

|

Loss before income taxes

|

(14,610

|

)

|

(33,379

|

)

|

(36,061

|

)

|

||||||

|

Income taxes

|

(200

|

)

|

(160

|

)

|

—

|

|||||||

|

Net loss

|

(14,810

|

)

|

$

|

(33,539

|

)

|

$

|

(36,061

|

)

|

||||

|

Deemed dividend to protected ordinary shareholder

|

—

|

(632

|

)

|

—

|

||||||||

|

Net loss attributable to ordinary shareholders

|

(14,810

|

)

|

(34,171

|

)

|

(36,061

|

)

|

||||||

|

Basic and diluted net loss per share attributable to ordinary shareholders

|

$

|

(0.46

|

)

|

$

|

(1.67

|

)

|

$

|

(5.42

|

)

|

|||

|

Basic and diluted weighted average ordinary shares outstanding

|

32,323,636

|

20,503,893

|

6,647,898

|

|||||||||

|

(1)

|

Amounts include share-based compensation expense as follows:

|

|

Year ended December 31,

|

||||||||||||

|

2020

|

2019

|

2018

|

||||||||||

|

Cost of revenue

|

$

|

384

|

$

|

142

|

$

|

12

|

||||||

|

Research and development

|

5,842

|

3,197

|

731

|

|||||||||

|

Sales and marketing

|

3,084

|

1,853

|

1,480

|

|||||||||

|

General and administrative

|

6,505

|

3,707

|

9,425

|

|||||||||

|

$

|

15,815

|

$

|

8,899

|

$

|

11,648

|

|||||||

S - 6

|

Years ended December 31,

|

||||||||||||

|

2020

|

2019

|

2018

|

||||||||||

|

(in thousands)

|

||||||||||||

|

Consolidated Statement of Cash Flows:

|

||||||||||||

|

Net cash provided by (used in) operating activities

|

$

|

17,135

|

$

|

(13,944

|

)

|

$

|

(51,676

|

)

|

||||

|

Net cash provided by (used in) investing activities

|

(326,357

|

)

|

(136,078

|

)

|

26,067

|

|||||||

|

Net cash provided by financing activities

|

551,813

|

117,993

|

53,888

|

|||||||||

|

Years ended December 31,

|

||||||||||||

|

2020

|

2019

|

2018

|

||||||||||

|

Selected Other Data(2):

|

||||||||||||

|

Active buyers (in thousands)

|

3,418

|

2,352

|

2,019

|

|||||||||

|

Spend per buyer

|

$

|

205

|

$

|

170

|

$

|

145

|

||||||

|

Adjusted EBITDA (in thousands)(3)

|

$

|

9,111

|

$

|

(17,991

|

)

|

$

|

(21,007

|

)

|

||||

|

As of December 31,

|

||||

|

2020

|

||||

|

Consolidated Balance Sheet Data:

|

(In thousands)

|

|||

|

Cash and cash equivalents

|

$

|

268,030

|

||

|

Total assets

|

861,202

|

|||

|

Total liabilities

|

515,799

|

|||

|

Share capital and additional paid-in capital

|

517,444

|

|||

|

Accumulated deficit

|

(172,573

|

)

|

||

|

Accumulated other comprehensive income

|

532

|

|||

|

Total shareholders' equity

|

345,403

|

|||

|

(2)

|

See the definitions of key operating and financial metrics in Item 5. “Operating and Financial Review and Prospects—Key Financial and Operating Metrics” in our Annual Report on Form 20-F

for the year ended December 31, 2020, which is incorporated by reference herein.

|

|

(3)

|

Adjusted EBITDA is a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. Adjusted EBITDA should not be considered as an alternative to net loss as a measure of financial

performance.

|

We define Adjusted EBITDA as net loss before financial income (expenses), net, income taxes, and depreciation and amortization, further

adjusted for share-based compensation expense, contingent consideration revaluation, acquisition-related costs and other IPO expenses. Adjusted EBITDA is included in this prospectus supplement because it is a key metric used by management and

our board of directors to assess our financial performance. Adjusted EBITDA is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Management believes that Adjusted EBITDA is an appropriate

measure of operating performance because it eliminates the impact of expenses that do not relate directly to the performance of the underlying business.

Adjusted EBITDA is not a GAAP measure of our financial performance or liquidity and should not be considered as an alternative to net loss

as a measure of financial performance, as an alternative to cash flows from operations as a measure of liquidity, or as an alternative to any other performance measure derived in accordance with GAAP. Adjusted EBITDA should not be construed as

an inference that our future results will be unaffected by unusual or other items. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not reflect our tax payments and

certain other cash costs that may recur in the future, including, among other things, cash requirements for costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in

addition to using Adjusted EBITDA as a supplemental measure. Our measure of Adjusted EBITDA is not necessarily comparable to similarly titled captions of other companies due to different methods of calculation.

S - 7

|

The following table reconciles Adjusted EBITDA to the most directly comparable GAAP financial performance measure, which is net loss:

|

|

Year ended December 31,

|

||||||||||||

|

2020

|

2019

|

2018

|

||||||||||

|

(in thousands)

|

||||||||||||

|

Net loss

|

$

|

(14,810

|

)

|

$

|

(33,539

|

)

|

$

|

(36,061

|

)

|

|||

|

Financial expenses (income), net

|

2,800

|

(1,371

|

)

|

(408

|

)

|

|||||||

|

Income taxes

|

200

|

160

|

—

|

|||||||||

|

Depreciation and amortization(a)

|

4,338

|

3,571

|

2,250

|

|||||||||

|

Share-based compensation(b)

|

15,815

|

8,899

|

11,648

|

|||||||||

|

Other initial public offering related expenses

|

—

|

416

|

—

|

|||||||||

|

Contingent consideration revaluation and acquisition related costs (c)

|

768

|

3,873

|

1,564

|

|||||||||

|

Adjusted EBITDA

|

9,111

|

$

|

(17,991

|

)

|

$

|

(21,007

|

)

|

|||||

|

(a)

|

The following table illustrates the breakdown of depreciation and amortization expense:

|

|

Year ended December 31,

|

||||||||||||

|

2020

|

2019

|

2018

|

||||||||||

|

Cost of revenue

|

$

|

1,962

|

$

|

1,728

|

$

|

1,119

|

||||||

|

Research and development

|

551

|

454

|

411

|

|||||||||

|

Sales and marketing

|

1,625

|

1,212

|

555

|

|||||||||

|

General and administrative

|

200

|

177

|

165

|

|||||||||

|

4,338

|

$

|

3,571

|

$

|

2,250

|

||||||||

|

(b)

|

Represents non-cash share-based compensation expense.

|

|

(c)

|

Acquisition related costs represent costs in connection with our acquisition of And Co. Ventures Inc. in January 2018 and ClearVoice Inc. in February 2019. These costs include compensation subject to continuing

employment, signing bonuses to certain employees and other acquisition-related costs.

|

|

The following table illustrates the breakdown of contingent consideration revaluation and acquisition related costs:

|

|

Year ended December 31,

|

||||||||||||

|

2020

|

2019

|

2018

|

||||||||||

|

Research and development

|

—

|

$

|

106

|

$

|

750

|

|||||||

|

Sales and marketing

|

121

|

1,436

|

750

|

|||||||||

|

General and administrative

|

647

|

2,331

|

65

|

|||||||||

|

$

|

768

|

$

|

3,873

|

$

|

1,564

|

|||||||

S - 8

Investing in our ordinary shares involves a high degree of risk. Our business, prospects, financial condition or operating results could be materially adversely

affected by the risks identified below, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our ordinary shares could decline due to any of these risks, and you may lose all or part of your

investment. Before deciding whether to invest in our ordinary shares, you should consider carefully the risk factors discussed below and those contained in the section entitled "Risk Factors" contained in our Annual Report on Form 20-F for the year

ended December 31, 2020, as filed with the SEC, which is incorporated herein by reference in its entirety, as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC.

Risks Relating to this Offering and Ownership of our Ordinary Shares

We have broad discretion over the use of proceeds we receive in this offering and may not apply the proceeds in ways that increase the value of your investment.

Our management will have broad discretion in the application of the net proceeds from this offering and, as a result, you will have to rely upon the judgment of our management with

respect to the use of these proceeds. Our management may spend a portion or all of the net proceeds in ways that not all shareholders approve of or that may not yield a favorable return. The failure by our management to apply these funds effectively

could harm our business.

S - 9

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein contain forward looking statements within the meaning of Section 27A of the

Securities Act. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future results of operations and financial position, business strategy and plans and our objectives for future

operations, are forward looking statements. In some cases, these forward-looking statements can be identified by words or phrases such as "may," "might," "will," "could," "would," "should," "expect," "plan," "anticipate," "intend," "seek," "believe,"

"estimate," "predict," "potential," "continue," "contemplate," "possible" or similar words. Statements regarding our future results of operations and financial position, growth strategy and plans and objectives of management for future operations,

including, among others, expansion in new and existing markets, are forward-looking statements.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates of future events and trends which affect or may affect our business, operations

and industry. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to numerous risks and uncertainties.

Forward-looking statements contained or incorporated in this prospectus supplement and the accompanying prospectus include, but are not limited to, statements about:

| • |

our future financial performance, including our revenue, operating expenses and our ability to maintain profitability and our future business and operating results;

|

| • |

our strategies, plans, objectives and goals;

|

| • |

our use of the net proceeds from the sale of ordinary shares by us in this offering; and

|

| • |

our expectations regarding the development of our industry, market size and the competitive environment in which we operate.

|

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our

current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without

limitation, the risk factors set forth in “Risk Factors,” including the following:

| ● |

a regional or global health pandemic, including COVID-19, could severely affect our business, results of operations and financial condition due to impacts on our buyer and seller base and consumer spending more broadly, as well as impacts

from remote work arrangements, actions taken to contain the disease or treat its impact and the speed and extent of the recovery;

|

| ● |

our growth depends on our ability to attract and retain a large community of buyers and freelancers, and the loss of our buyers and freelancers, or failure to attract new buyers and freelancers, could materially and adversely affect our

business;

|

| ● |

we have incurred operating losses in the past, expect to incur operating losses in the future and may never achieve or maintain profitability;

|

| ● |

if we fail to maintain and enhance our brand, our business, results of operations and prospects may be materially and adversely affected;

|

S - 10

| ● |

if the market for freelancers and the services they offer is not sustained or develops more slowly than we expect, our growth may slow or stall;

|

| ● |

if user engagement on our website declines for any reason, our growth may slow or stall;

|

| ● |

if we fail to maintain and improve the quality of our platform, we may not be able to attract and retain buyers and freelancers;

|

| ● |

we face significant competition, which may cause us to suffer from a weakened market position that could materially and adversely affect our results of operations;

|

| ● |

our business may suffer if we do not successfully manage our current and potential future growth;

|

| ● |

our user growth and engagement on mobile devices depend upon effective operation with mobile operating systems, networks and standards that we do not control;

|

| ● |

we or our third-party partners may experience a security breach, including unauthorized parties obtaining access to our users’ personal or other data, or any other data privacy or data protection compliance issue;

|

| ● |

changes in laws or regulations relating to consumer data privacy or data protection, or any actual or perceived failure by us to comply with such laws and regulations or our privacy policies, could materially and adversely affect our

business;

|

| ● |

we have a limited operating history under our current platform and pricing model, which makes it difficult to evaluate our business and prospects and increases the risks associated with your investment, and any future changes to our

pricing model could materially and adversely affect our business;

|

| ● |

errors, defects or disruptions in our platform could diminish our brand, subject us to liability, and materially and adversely affect our business, prospects, financial condition and results of operations;

|

| ● |

our platform contains open source software components, and failure to comply with the terms of the underlying licenses could restrict our ability to market or operate our platform;

|

| ● |

expansion into markets outside the United States is important to the growth of our business, and if we do not manage the business and economic risks of international expansion effectively, it could materially and adversely affect our

business and results of operations;

|

| ● |

if we are unable to maintain and expand our scale of operations and generate a sufficient amount of revenue to offset the associated fixed and variable costs, our results of operations may be materially and adversely affected;

|

| ● |

our operating results may fluctuate from quarter to quarter, which makes our future results difficult to predict;

|

| ● |

our business is subject to a variety of laws and regulations, both in the United States and internationally, many of which are evolving;

|

| ● |

we depend upon talented employees, including our Chief Executive Officer, to grow, operate and improve our business, and if we are unable to retain and motivate our personnel and attract new talent, we may

not be able to grow effectively; and

|

| ● |

if we fail to protect our intellectual property rights, our business, prospects, financial condition and results of operations could be materially and adversely affected.

|

S - 11

Many important factors, in addition to the factors described above and in other sections of this prospectus supplement, the accompanying prospectus and the documents incorporated by

reference herein, could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and

uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from estimates or forward-looking statements. We qualify all of our

estimates and forward-looking statements by these cautionary statements.

The estimates and forward-looking statements contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein speak only as of

the date thereof. Except as required by applicable law, we undertake no obligation to publicly update or revise any estimates or forward-looking statements whether as a result of new information, future events or otherwise, or to reflect the

occurrence of unanticipated events.

S - 12

We expect to receive net proceeds from this offering, after deducting underwriting discounts and commissions and offering expenses payable by us, of approximately $

million (or approximately $ million if the underwriters exercise their option to purchase additional ordinary shares from us in full).

We intend to use the net proceeds from this offering for working capital, to fund growth and for other general corporate purposes.

We will have broad discretion in the way that we use the net proceeds of this offering. Our use of the net proceeds from this offering will depend on a number of factors, including our

future revenue and cash generated by operations and the other factors described in “Risk factors.”

S - 13

The table below sets forth our cash and cash equivalents and capitalization as of December 31, 2020:

| • |

on an actual basis; and

|

| • |

on an as adjusted basis to reflect the issuance and sale of ordinary shares in this offering at the public offering price of $ per share after deducting underwriting discounts and commissions and offering expenses

payable by us.

|

Investors should read this table in conjunction with our audited financial statements and notes thereto incorporated by reference herein as well as “Use

of Proceeds” included elsewhere in this prospectus supplement and Item 5. “Operating and Financial Review and Prospects” in our Form 20-F for the year ended December 31, 2020, which is incorporated by

reference herein.

|

As of December 31, 2020

|

||||||||

|

Actual

|

As adjusted

|

|||||||

|

(in thousands, except share and per share data)

|

||||||||

|

Cash and cash equivalents

|

$

|

268,030

|

$

|

|||||

|

Bank deposits

|

90,000 |

90,000 |

||||||

|

Marketable securities

|

357,420 |

357,420 | ||||||

|

Long-term loan

|

$

|

2,707

|

$

|

2,707

|

||||

|

Convertible notes

|

352,034 |

352,034 |

||||||

|

Total debt

|

354,741 |

354,741 |

||||||

|

Ordinary shares, no par value: 75,000,000 shares authorized and 35,842,980 shares issued and outstanding, actual; 75,000,000 shares authorized and

shares issued and outstanding, as adjusted

|

–

|

–

|

||||||

|

Additional paid-in capital

|

517,444

|

|||||||

|

Accumulated deficit

|

(172,573

|

)

|

(172,573

|

)

|

||||

|

Accumulated other comprehensive income

|

532

|

532

|

||||||

|

Total shareholders’ equity

|

345,403

|

|||||||

|

Total capitalization

|

$

|

700,144

|

$

|

|||||

As adjusted shareholders' equity amounts shown in the table above exclude the impact of:

| • |

3,223,443 ordinary shares issuable upon the exercise of options outstanding under our share option plans as of December 31, 2020, at a weighted average exercise price of $17.22 per share;

|

| • |

638,160 ordinary shares issuable upon the vesting of restricted share units under our share option plans as of December 31, 2020;

|

| • |

1,235,731 ordinary shares reserved for future issuance under our share option plans as described in Item 6.B. "Management—Share option plans" in our Annual Report on Form 20-F for the year ended

December 31, 2020, which is incorporated by reference herein; and

|

| • |

410,000 ordinary shares reserved for future issuance under our 2020 Employee Share Purchase Plan described in Item 6.B. "Management—Employee Share Purchase Plan" in our Annual Report on Form 20-F

for the year ended December 31, 2020, which is incorporated by reference herein.

|

S - 14

If you invest in our ordinary shares in this offering, your ownership interest will be immediately diluted to the extent of the difference between the public

offering price per share and the net tangible book value per ordinary share after this offering. Our net tangible book value as of December 31, 2020 was $9.16 per ordinary share.

After giving effect to the sale of ordinary shares that we are offering at the public offering price of $ per share, after deducting underwriting

discounts and commissions and offering expenses payable by us, our net tangible book value on an adjusted basis as of December 31, 2020 would have been $ per ordinary share. This amount represents an immediate increase in net tangible book value of

$per ordinary share to our existing shareholders and an immediate dilution of $ per ordinary share to new investors purchasing ordinary shares in this offering. We determine dilution by subtracting the as adjusted net tangible book value per share

after this offering from the amount of cash that a new investor paid for an ordinary share.

The following table illustrates this dilution:

|

Public offering price per share

|

$

|

|||

|

As adjusted net tangible book value per share as of December 31, 2020

|

$ | |||

|

Increase per share attributable to this offering

|

||||

|

As adjusted net tangible book value per share after this offering

|

||||

|

Dilution per share to new investors in this offering

|

$

|

If the underwriters exercise in full their option to purchase additional ordinary shares from us in this offering, the as adjusted net tangible book value after

the offering would be $ per share, the increase in net tangible book value to existing shareholders would be $ per share, and the dilution to new investors would be $ per share, in each case based on the public offering price of

$ per share.

To the extent any of our outstanding options are exercised or restricted share units vest, there will be further dilution to new investors.

S - 15

The following description is not intended to constitute a complete analysis of all tax consequences relating to the acquisition, ownership and disposition of our

ordinary shares. You should consult your own tax advisor concerning the tax consequences of your particular situation, as well as any tax consequences that may arise under the laws of any state, local, foreign or other taxing jurisdiction.

Israeli tax considerations

Taxation of our shareholders

Capital gains taxes applicable to non-Israeli resident shareholders. A non-Israeli resident

who derives capital gains from the sale of shares in an Israeli resident company that were purchased after the company was listed for trading on a stock exchange outside of Israel, will be exempt from Israeli tax so long as the shares were not held

through a permanent establishment that the non-resident maintains in Israel. However, non-Israeli corporations will not be entitled to the foregoing exemption if Israeli residents: (i) have a controlling interest more than 25% in such non-Israeli

corporation or (ii) are the beneficiaries of, or are entitled to, 25% or more of the revenues or profits of such non-Israeli corporation, whether directly or indirectly. In addition, such exemption is not applicable to a person whose gains from

selling or otherwise disposing of the shares are deemed to be business income.

Additionally, a sale of securities by a non-Israeli resident may be exempt from Israeli capital gains tax under the provisions of an applicable tax treaty. For example, under

Convention Between the Government of the United States of America and the Government of the State of Israel with respect to Taxes on Income, as amended (the “United States Israel Tax Treaty”), the sale, exchange or other disposition of shares by a

shareholder who is a United States resident (for purposes of the treaty) holding the shares as a capital asset and is entitled to claim the benefits afforded to such a resident by the U.S. Israel Tax Treaty (a “Treaty U.S. Resident”) is generally

exempt from Israeli capital gains tax unless: (i) the capital gain arising from such sale, exchange or disposition is attributed to real estate located in Israel; (ii) the capital gain arising from such sale, exchange or disposition is attributed to

royalties; (iii) the capital gain arising from the such sale, exchange or disposition is attributed to a permanent establishment in Israel, under certain terms; (iv) such Treaty U.S. Resident holds, directly or indirectly, shares representing 10% or

more of the voting capital during any part of the 12 month period preceding the disposition, subject to certain conditions; or (v) such Treaty U.S. Resident is an individual and was present in Israel for 183 days or more during the relevant taxable

year.

In some instances where our shareholders may be liable for Israeli tax on the sale of their ordinary shares, the payment of the consideration may be subject to the withholding of

Israeli tax at source. Shareholders may be required to demonstrate that they are exempt from tax on their capital gains in order to avoid withholding at source at the time of sale (i.e., resident certificate or other documentation).

Taxation of non-Israeli shareholders on receipt of dividends. Non-Israeli residents (either

individuals or corporations) are generally subject to Israeli income tax on the receipt of dividends paid on our ordinary shares at the rate of 25%, which tax will be withheld at source, unless relief is provided in a treaty between Israel and the

shareholder’s country of residence (subject to the receipt in advance of a valid certificate from the ITA allowing for a reduced tax rate). With respect to a person who is a “substantial shareholder” at the time of receiving the dividend or on any

time during the preceding twelve months, the applicable tax rate is 30%. A “substantial shareholder” is generally a person who alone or together with such person’s relative or another person who collaborates with such person on a permanent basis,

holds, directly or indirectly, at least 10% of any of the “means of control” of the corporation. “Means of control” generally include the right to vote, receive profits, nominate a director or an executive officer, receive assets upon liquidation,

or order someone who holds any of the aforesaid rights how to act, regardless of the source of such right. Such dividends are generally subject to Israeli withholding tax at a rate of 25% so long as the shares are registered with a nominee company

(whether the recipient is a substantial shareholder or not) and, subject to the receipt in advance of a valid certificate from the ITA allowing for a reduced tax rate, 15% if the dividend is distributed from income attributed to an Approved

Enterprise or a Beneficiary Enterprise and 20% if the dividend is distributed from income attributed to a Preferred Enterprise or Preferred Technology Enterprise or such lower rate as may be provided in an applicable tax treaty. For example, under

the United States Israel Tax Treaty, the maximum rate of tax withheld at source in Israel on dividends paid to a holder of our ordinary shares who is a Treaty U.S. Resident is 25%. However, generally, the maximum rate of withholding tax on

dividends, not generated by a Preferred Enterprise or Beneficiary Enterprise, that are paid to a United States corporation holding 10% or more of the outstanding voting capital throughout the tax year in which the dividend is distributed as well as

during the previous tax year, is 12.5%, provided that not more than 25% of the gross income for such preceding year consists of certain types of dividends and interest. Notwithstanding the foregoing, dividends distributed from income attributed to

an Approved Enterprise, Beneficiary Enterprise or Preferred Enterprise are not entitled to such reduction under the tax treaty but are subject to a withholding tax rate of 15% for a shareholder that is a U.S. corporation, provided that the

conditions related to 10% or more holding and to our gross income for the previous year (as set forth in the previous sentence) is met. If the dividend is attributable partly to income derived from an Approved Enterprise, Benefited Enterprise or

Preferred Enterprise, and partly to other sources of income, the withholding rate will be a blended rate reflecting the relative portions of the two types of income. We cannot assure you that we will designate the profits that we may distribute in

a way that will reduce shareholders’ tax liability.

S - 16

A non-Israeli resident who receives dividends from which tax was withheld is generally exempt from the obligation to file tax returns in Israel with respect to such income, provided

that (i) such income was not generated from business conducted in Israel by the taxpayer, (ii) the taxpayer has no other taxable sources of income in Israel with respect to which a tax return is required to be filed, and (iii) the taxpayer is not

obligated to pay excess tax (as further explained below).

Surtax. Subject to the provisions of an applicable tax treaty, individuals who are subject

to tax in Israel (whether any such individual is an Israeli resident or non-Israeli resident) are also subject to an additional tax at a rate of 3% on annual income (including, but not limited to, dividends, interest and capital gain) exceeding NIS

647,640 for 2021, which amount is linked to the annual change in the Israeli consumer price index.

Estate and Gift Tax. Israeli law presently does not impose estate or gift taxes.

Material U.S. Federal Income Tax Considerations for U.S. Holders

The following is a description of the material U.S. federal income tax consequences of the acquisition, ownership and disposition of our ordinary shares. This description addresses

only the U.S. federal income tax consequences to U.S. Holders (as defined below) that are initial purchasers of our ordinary shares pursuant to the offering and that will hold such ordinary shares as capital assets within the meaning of Section 1221

of the Internal Revenue Code of 1986, as amended (the ‘‘Code’’), and that have the U.S. dollar as their functional currency. This discussion is based upon the Code, applicable U.S. Treasury regulations, administrative pronouncements and judicial

decisions, in each case as in effect on the date hereof, all of which are subject to change (possibly with retroactive effect). No ruling will be requested from the Internal Revenue Service (the ‘‘IRS’’) regarding the tax consequences of the

acquisition, ownership or disposition of the ordinary shares, and there can be no assurance that the IRS will agree with the discussion set out below. This summary does not address any U.S. tax consequences other than U.S. federal income tax

consequences (e.g., the estate and gift tax or the Medicare tax on net investment income) and does not address any state, local or non-U.S. tax consequences.

S - 17

This description does not address tax considerations applicable to holders that may be subject to special tax rules, including, without limitation:

| ● |

banks, financial institutions or insurance companies;

|

| ● |

real estate investment trusts or regulated investment companies;

|

| ● |

dealers or brokers;

|

| ● |

traders that elect to mark-to-market;

|

| ● |

tax exempt entities or organizations;

|

| ● |

‘‘individual retirement accounts’’ and other tax deferred accounts;

|

| ● |

certain former citizens or long-term residents of the United States;

|

| ● |

persons that are resident or ordinarily resident in or have a permanent establishment in a jurisdiction outside the United States;

|

| ● |

persons that acquired our ordinary shares pursuant to the exercise of any employee share option or otherwise as compensation for the performance of services;

|

| ● |

persons holding our ordinary shares as part of a ‘‘hedging,’’ ‘‘integrated’’ or ‘‘conversion’’ transaction or as a position in a ‘‘straddle’’ for U.S. federal income tax purposes;

|

| ● |

partnerships or other pass through entities and persons holding the ordinary shares through partnerships or other pass through entities; or

|

| ● |

holders that own directly, indirectly or through attribution 10% or more of the total voting power or value of all of our outstanding shares.

|

For purposes of this description, a ‘‘U.S. Holder’’ is a beneficial owner of our ordinary shares that, for U.S. federal income tax purposes, is:

| ● |

an individual who is a citizen or resident of the United States;

|

| ● |

a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States or any state thereof, including the District of Columbia;

|

| ● |

an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

|

| ● |

a trust if such trust has validly elected to be treated as a United States person for U.S. federal income tax purposes or if (1) a court within the United States is able to exercise primary supervision over its administration and (2) one

or more United States persons have the authority to control all of the substantial decisions of such trust.

|

If a partnership (or any other entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds our ordinary shares, the tax treatment of a partner in such

partnership will generally depend on the status of the partner and the activities of the partnership. Such a partner or partnership should consult its tax advisor as to the particular U.S. federal income tax consequences of acquiring, owning and

disposing of our ordinary shares in its particular circumstance.

You should consult your tax advisor with respect to the U.S. federal, state, local and foreign tax consequences of acquiring, owning and disposing of our ordinary shares.

S - 18

Distributions

Subject to the discussion under ‘‘—Passive Foreign Investment Company considerations’’ below, the gross amount of any distribution made to you with respect to our ordinary shares,

before reduction for any Israeli taxes withheld therefrom, generally will be includible in your income as dividend income on the date on which the dividends are actually or constructively received, to the extent such distribution is paid out of our

current or accumulated earnings and profits as determined under U.S. federal income tax principles. To the extent that the amount of any distribution by us exceeds our current and accumulated earnings and profits as determined under U.S. federal

income tax principles, it will be treated first as a tax-free return of your adjusted tax basis in our ordinary shares and thereafter as capital gain. However, we do not expect to maintain calculations of our earnings and profits under U.S. federal

income tax principles and, therefore, you should expect that the entire amount of any distribution generally will be reported as dividend income to you. If you are a non-corporate U.S. Holder, you may qualify for the lower rates of taxation with

respect to dividends on ordinary shares applicable to long-term capital gains (i.e., gains from the sale of capital assets held for more than one year), provided that we are not a PFIC (as discussed below under ‘‘—Passive Foreign Investment Company

considerations’’) with respect to you in our taxable year in which the dividend was paid or in the prior taxable year and certain other conditions are met, including certain holding period requirements and the absence of certain risk reduction

transactions. However, such dividends will not be eligible for the dividends received deduction generally allowed to corporate U.S. Holders.

Dividends paid to you with respect to our ordinary shares generally will be treated as foreign source income, which may be relevant in calculating your foreign tax credit limitation.

Subject to certain conditions and limitations, Israeli tax withheld on dividends may be credited against your U.S. federal income tax liability or, at your election, be deducted from your U.S. federal taxable income. Dividends that we distribute

generally should constitute ‘‘passive category income’’ for purposes of the foreign tax credit. A foreign tax credit for foreign taxes imposed on distributions may be denied if you do not satisfy certain minimum holding period requirements. The rules

relating to the determination of the foreign tax credit are complex, and you should consult your tax advisor to determine whether and to what extent you will be entitled to this credit.

Sale, exchange or other disposition of ordinary shares

Subject to the discussion under ‘‘Passive Foreign Investment Company considerations’’ below, you generally will recognize gain or loss on the sale, exchange or other disposition of our

ordinary shares equal to the difference between the amount realized on such sale, exchange or other disposition and your adjusted tax basis in our ordinary shares, and such gain or loss will be capital gain or loss. If you are a non-corporate U.S.

Holder, capital gain from the sale, exchange or other disposition of ordinary shares is generally eligible for a preferential rate of taxation applicable to capital gains, if your holding period for such ordinary shares exceeds one year (i.e., such

gain is long-term capital gain). The deductibility of capital losses for U.S. federal income tax purposes is subject to limitations under the Code. Any such gain or loss that a U.S. Holder recognizes generally will be treated as U.S. source income or

loss for foreign tax credit limitation purposes.

Passive foreign investment company considerations

If a non-U.S. company is classified as a PFIC in any taxable year, a U.S. Holder of such PFIC’s shares will be subject to special rules generally intended to reduce or eliminate any

benefits from the deferral of U.S. federal income tax that such U.S. Holder could derive from investing in a non-U.S. company that does not distribute all of its earnings on a current basis.

S - 19

In general, a non-U.S. corporation will be classified as a PFIC for any taxable year if at least (i) 75% of its gross income is classified as ‘‘passive income’’ or (ii) 50% of its

gross assets (generally determined on the basis of a quarterly average) produce or are held for the production of passive income (the ‘‘asset test’’). Passive income for this purpose generally includes dividends, interest, royalties, rents, gains

from commodities and securities transactions and the excess of gains over losses from the disposition of assets which produce passive income. For these purposes, cash and other assets readily convertible into cash are considered passive assets, and

goodwill and other unbooked intangibles are generally taken into account. In making this determination, the non-U.S. corporation is treated as earning its proportionate share of any income and owning its proportionate share of any assets of any

corporation in which it directly or indirectly holds 25% or more (by value) of the stock.

Based on the current and anticipated composition of our income and assets, operations and the value of our assets (including the value of our goodwill, going-concern value or any other

unbooked intangibles which may be determined based on the price of the ordinary shares), we do not expect to be treated as a PFIC for the current taxable year or in the foreseeable future. However, because PFIC status is based on our income, assets

and activities for the entire taxable year, it is not possible to determine whether we will be characterized as a PFIC for our current taxable year or future taxable years until after the close of the applicable taxable year. Moreover, we must

determine our PFIC status annually based on tests that are factual in nature, and our status in the current year and future years will depend on our income, assets and activities in each of those years and, as a result, cannot be predicted with

certainty as of the date hereof. Furthermore, fluctuations in the market price of our ordinary shares may cause our classification as a PFIC for the current or future taxable years to change because the aggregate value of our assets for purposes of

the asset test, including the value of our goodwill and unbooked intangibles, generally will be determined by reference to the market price of our shares from time to time (which may be volatile). We have a substantial balance of cash and other

liquid investments, which are passive assets for purposes of the PFIC determination, and the composition of our income and assets will be affected by how, and how quickly, we use our liquid assets and the cash raised in any equity offering.

Accordingly, if our market capitalization declines significantly, it may make our classification as a PFIC more likely for the current or future taxable years. The IRS or a court may disagree with our determinations, including the manner in which we

determine the value of our assets and the percentage of our assets that are passive assets under the PFIC rules. Therefore there can be no assurance that we will not be a PFIC for the current taxable year or for any future taxable year.

Under the PFIC rules, if we were considered a PFIC at any time that you hold our ordinary shares, we would continue to be treated as a PFIC with respect to your investment in all

succeeding years during which you own our ordinary shares (regardless of whether we continue to meet the tests described above) unless (i) we have ceased to be a PFIC and (ii) you have made a ‘‘deemed sale’’ election under the PFIC rules. If such

election is made, you will be deemed to have sold your ordinary shares at their fair market value on the last day of the last taxable year in which we were a PFIC, and any gain from the deemed sale would be subject to the rules described in the

following paragraph. After the deemed sale election, so long as we do not become a PFIC in a subsequent taxable year, the ordinary shares with respect to which such election was made will not be treated as shares in a PFIC. You should consult your

own tax advisor as to the possibility and consequences of making a deemed sale election.

S - 20

If we are considered a PFIC at any time that you hold ordinary shares, unless (i) we have ceased to be a PFIC and you have previously made the deemed sale election described above or

(ii) you make one of the elections described below, any gain recognized by you on a sale or other disposition of the ordinary shares, as well as the amount of any ‘‘excess distribution’’ (defined below) received by you, would be allocated ratably

over your holding period for the ordinary shares. The amounts allocated to the taxable year of the sale or other disposition (or the taxable year of receipt, in the case of an excess distribution) and to any year before we became a PFIC would be

taxed as ordinary income. The amount allocated to each other taxable year would be subject to tax at the highest rate in effect for individuals or corporations, as appropriate, for that taxable year, and an interest charge would be imposed. For

purposes of these rules, an excess distribution is the amount by which any distribution received by you on your ordinary shares in a taxable year exceeds 125% of the average of the annual distributions on the ordinary shares during the preceding

three taxable years or your holding period, whichever is shorter. Distributions below the 125% threshold are treated as dividends taxable in the year of receipt and are not subject to prior highest tax rates or the interest charge.

If we are treated as a PFIC with respect to you for any taxable year, you will be deemed to own shares in any entities in which we own equity that are also PFICs (“lower-tier PFIC”),

and you may be subject to the tax consequences described above with respect to the shares of such lower-tier PFIC you would be deemed to own.

Mark-to-market elections

If we are a PFIC for any taxable year during which you hold ordinary shares, then in lieu of being subject to the tax and interest charge rules discussed above, you may make an

election to include gain on the ordinary shares as ordinary income under a mark-to-market method, provided that such ordinary shares are ‘‘marketable.’’ The ordinary shares will be marketable if they are ‘‘regularly traded’’ on a qualified exchange

or other market, as defined in applicable U.S. Treasury regulations, such as the New York Stock Exchange (or on a foreign stock exchange that meets certain conditions). For these purposes, the ordinary shares will be considered regularly traded

during any calendar year during which they are traded, other than in de minimis quantities, on at least 15 days during each calendar quarter. Any trades that have as their principal purpose meeting this requirement will be disregarded. However,

because a mark-to-market election cannot be made for any lower-tier PFICs that we may own, you will generally continue to be subject to the PFIC rules discussed above with respect to your indirect interest in any investments we own that are treated

as an equity interest in a PFIC for U.S. federal income tax purposes. As a result, it is possible that any mark-to-market election with respect to the ordinary shares will be of limited benefit.

If you make an effective mark-to-market election, in each year that we are a PFIC, you will include in ordinary income the excess of the fair market value of your ordinary shares at

the end of the year over your adjusted tax basis in the ordinary shares. You will be entitled to deduct as an ordinary loss in each such year the excess of your adjusted tax basis in the ordinary shares over their fair market value at the end of the

year, but only to the extent of the net amount previously included in income as a result of the mark-to-market election. If you make an effective mark-to-market election, in each year that we are a PFIC, any gain that you recognize upon the sale or

other disposition of your ordinary shares will be treated as ordinary income and any loss will be treated as ordinary loss, but only to the extent of the net amount of previously included income as a result of the mark-to-market election.

Your adjusted tax basis in the ordinary shares will be increased by the amount of any income inclusion and decreased by the amount of any deductions under the mark-to-market rules

discussed above. If you make an effective mark-to-market election, it will be effective for the taxable year for which the election is made and all subsequent taxable years unless the ordinary shares are no longer regularly traded on a qualified

exchange or the IRS consents to the revocation of the election. You should consult your tax advisor about the availability of the mark-to-market election, and whether making the election would be advisable in your particular circumstances.

Qualified electing fund elections

In certain circumstances, a U.S. equity holder in a PFIC may avoid the adverse tax and interest-charge regime described above by making a ‘‘qualified electing fund’’ election to

include in income its share of the corporation’s income on a current basis. However, you may make a qualified electing fund election with respect to the ordinary shares only if we agree to furnish you annually with a PFIC annual information statement

as specified in the applicable U.S. Treasury regulations. We do not intend to provide the information necessary for you to make a qualified electing fund election if we are classified as a PFIC. Therefore, you should assume that you will not receive

such information from us and would therefore be unable to make a qualified electing fund election with respect to any of our ordinary shares were we to be or become a PFIC.

S - 21

Tax reporting

If you own ordinary shares during any year in which we are a PFIC and you recognize gain on a disposition of such ordinary shares or receive distributions with respect to such ordinary

shares, you generally will be required to file an IRS Form 8621 with respect to us, generally with your federal income tax return for that year. If we are a PFIC for a given taxable year, then you should consult your tax advisor concerning your

annual filing requirements.

You should consult your tax advisor regarding whether we are a PFIC as well as the potential U.S. federal income tax consequences of holding and disposing of our ordinary shares if we

are or become classified as a PFIC, including the possibility of making a mark-to-market election in your particular circumstances.

Backup withholding tax and information reporting requirements

Dividend payments on and proceeds paid from the sale or other taxable disposition of the ordinary shares may be subject to information reporting to the IRS. In addition, a U.S. Holder