Form 424B4 Tufin Software Technolog

TABLE OF CONTENTS

_____________

Neither we nor the underwriters, nor any of their respective agents, have authorized anyone to provide information different from that contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus prepared by us or on our behalf. Neither we nor the underwriters, nor any of their respective agents, take any responsibility for, and can provide no assurance as to the reliability of, any information other than the information in this prospectus and any free writing prospectus prepared by us or on our behalf. Neither the delivery of this prospectus nor the sale of our ordinary shares means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy these ordinary shares in any circumstances under which such offer or solicitation is unlawful.

For investors outside of the United States: Neither we nor the underwriters, nor any of their respective agents, have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

References in this prospectus to the Global 2000 are to the world’s 2,000 largest public companies as published by Forbes on June 16, 2018.

SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before deciding to invest in our ordinary shares. You should read the entire prospectus carefully, including “Risk Factors” and our consolidated financial statements and notes to those consolidated financial statements, before making an investment decision. In this prospectus, the terms “Tufin,” “we,” “us,” “our” and “the company” refer to Tufin Software Technologies Ltd. and its subsidiaries.

Overview

We are pioneering a policy-centric approach to security and IT operations. We transform enterprises’ security operations by helping them visualize, define and enforce a unified security policy across complex, heterogeneous IT and cloud environments. Our products govern how individuals, systems and applications are permitted to communicate and provide policy-based security automation, enabling customers to reduce the time to implement complex network changes from days to minutes. Our solutions increase business agility, eliminate errors from manual processes and ensure continuous compliance through a single console. Since our inception, our solutions have been purchased by over 2,000 customers in over 70 countries, including approximately 15% of the Global 2000.

Cybersecurity is critical for enterprises of all sizes. As enterprises embrace digital transformation and adopt new technologies such as cloud-based services, software-defined networks, microservices and containers, the IT and cloud environments become increasingly complex and vulnerable to attack. In response to the heightened threat environment, lack of a defined network perimeter and a constantly changing attack surface, enterprises continue to implement additional firewalls, endpoint security, identity and access management and other security solutions. However, we believe most enterprises lack effective and comprehensive security policy management, which results in a trade-off between the necessary security posture and business requirements for speed, agility and innovation.

We believe a new approach to enterprise security is necessary: a data-driven framework centered on policy management and operationalized through policy-based automation, enhancing compliance and security while improving operational efficiency. To address this need, we have developed highly differentiated technology with four main pillars:

• | Policy-centric approach. We enable enterprises to visualize, define and enforce a unified security policy that acts as the foundation of governance and control, replacing ad-hoc configurations across fragmented networks. |

• | Automation of network changes. We automate the network change process across complex, heterogeneous environments, increasing business agility, enabling faster application deployment and reducing human error. |

• | Data-driven. Our approach draws data from across a customer’s IT and cloud environments, providing insights on connectivity and end-to-end visibility across the network. |

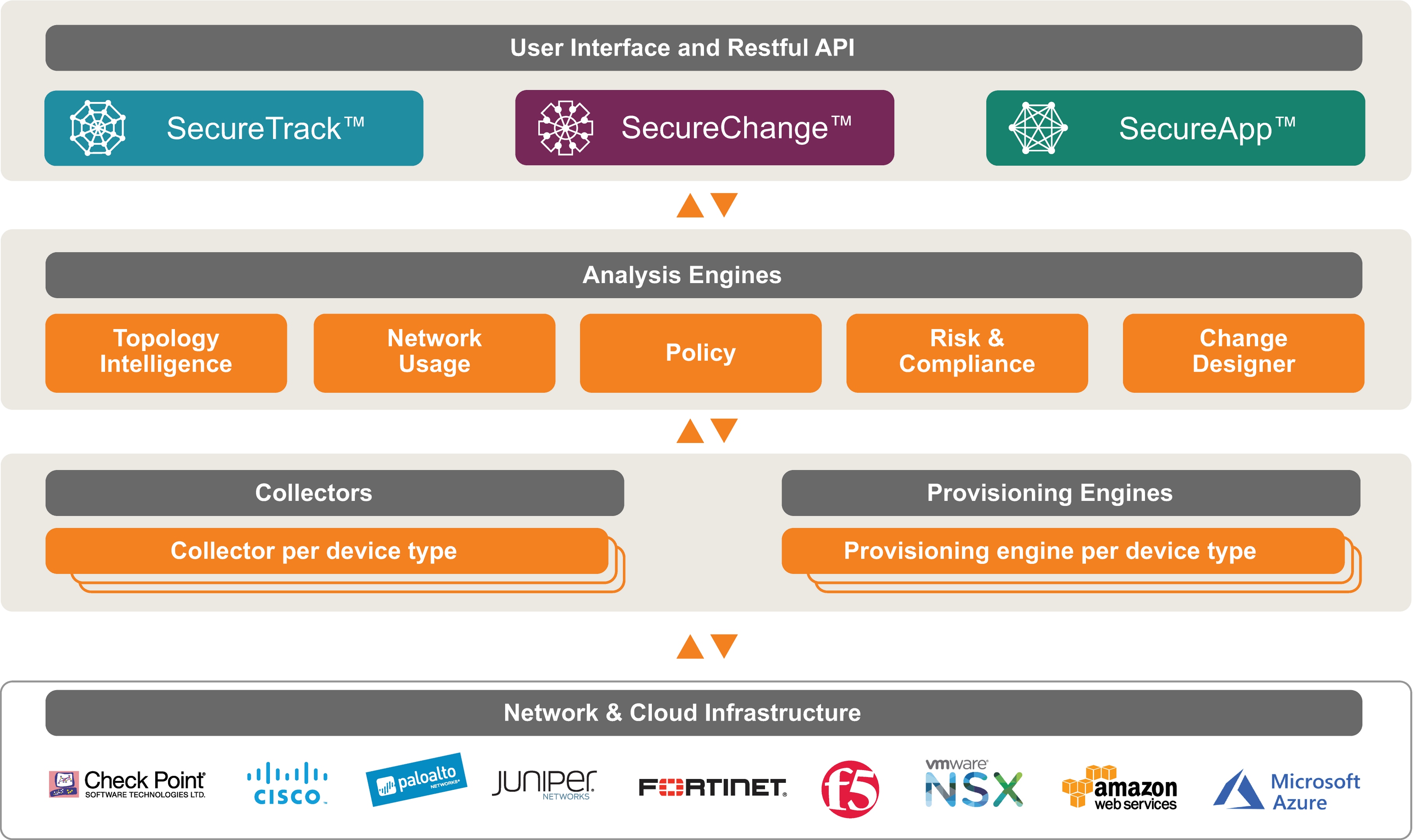

• | Open and extensible framework. Our open solutions serve as a centralized control layer for our customers’ networks and can connect to a wide range of third-party technologies through application program interfaces, or APIs. |

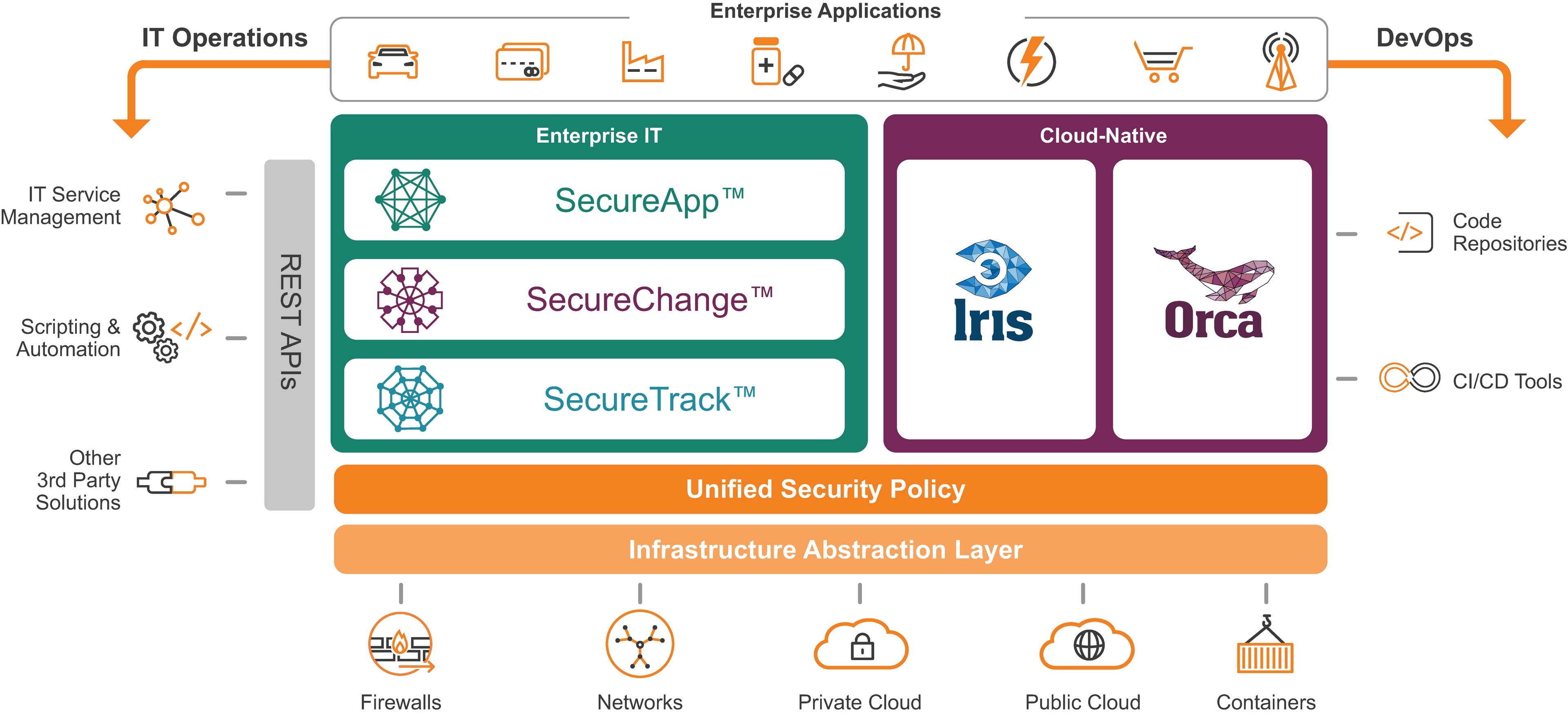

We offer five products that comprise the Tufin Orchestration Suite: SecureTrack, SecureChange, SecureApp and, most recently, Orca and Iris. SecureTrack, SecureChange and SecureApp enable enterprises to visualize, define and enforce their security policy across heterogeneous networks, both on premise and in the cloud. SecureTrack serves as the foundation of SecureChange and SecureApp. SecureTrack provides visibility across the network and helps organizations define a unified security policy and maintain compliance. SecureChange provides customers with the ability to automate changes across the network while maintaining compliance with policy and security standards. SecureApp provides

1

application connectivity management and streamlines communication between application developers and network engineers. Our newest products, Orca and Iris, provide cloud-based security automation solutions in response to the growth of containers and cloud-native environments.

We sell our products and services through our sales force, including our field sales team and our inside sales team, which works closely with our global network of approximately 140 active channel partners. Our channel partners include distributors and resellers, as well as service delivery partners that help customers successfully deploy, configure, customize and maintain our products and services.

We have experienced strong growth. For the years ended December 31, 2017 and 2018, our revenues were $64.5 million and $85.0 million, respectively, representing year-over-year growth of 31.7%. For the years ended December 31, 2017 and 2018, our net loss was $2.8 million and $4.3 million, respectively.

Industry Background

Enterprises that lack a comprehensive security policy are facing challenges in balancing the necessary security and risk posture with their business requirements, leaving security, network and compliance professionals overwhelmed. Several industry trends contribute to operational challenges in managing risk, as set forth below:

• | Increasing frequency and sophistication of cyberattacks. Enterprises worldwide are under constant security threat from both external cyberattackers and malicious insiders in search of sensitive information and vital systems. Cyberattackers are increasingly able to breach networks and locate and steal sensitive enterprise data. As a result, numerous enterprise boards are prioritizing and reshaping their cybersecurity approaches. |

• | Growing complexity of software-defined networks. Enterprises have been undergoing a digital transformation. They are rapidly shifting on-premise workloads to cloud environments to meet the changing demands of their markets and customers. To keep pace with this transformation, enterprises design scalable and flexible workloads and connections, which increase network complexity and the velocity of changes. The rise of technologies such as microservices and containers introduces additional complexity. The growing use of these dynamic technologies has raised business expectations on agility and increased the need for a unified security approach across networks and applications. |

• | Accelerating pace of application development and deployment. The accelerating pace of business and technological developments requires numerous and continuous application and infrastructure changes. The rise of the DevOps model, which is a set of software development practices that allows applications and features to be rapidly developed and deployed, has led to increased release velocity. Enterprises that use manual change processes struggle to keep pace and lack policy consistency, resulting in an ever-growing backlog of changes, delayed software releases and heightened security exposure. |

• | Evolving regulatory and compliance requirements. Global enterprises need to maintain compliance with a new wave of government regulations, corporate security policies and industry standards related to privacy and cybersecurity. Manual changes to network policy are difficult to track and are more likely to be non-compliant. As a result, enterprises seek cost-efficient security solutions to meet compliance requirements. |

• | Legacy security approaches can no longer address cybersecurity threats in the ever-changing IT and cloud environments. Traditional security policy management approaches address governance and control, but lack critical characteristics such as a unified security policy, automation, scalability, end-to-end visibility and extensibility. We believe a new approach to enterprise security is necessary: a data-driven framework centered on policy management and operationalized through automation. |

2

Benefits of Our Solutions

Our solutions enable our customers to visualize, define and enforce a security policy that dictates how users, systems and different organizational functions across the enterprise should be allowed to communicate. We automate our customers’ security policy management, allowing them to accelerate application deployment time without introducing non-compliant changes that could lead to vulnerabilities, and giving better visibility and control over all of their IT and cloud environments. This approach drives business agility and cost reduction while facilitating continuous compliance across hybrid, multi-vendor, multi-platform and heterogeneous environments. Our customers use our products to:

• | Accelerate business agility through end-to-end automation of security changes. Our automated solutions allow our customers to implement application changes onto their networks in minutes, not days. Our solutions accelerate security management processes, increase operational efficiency and reduce the traditional lag between software development and revenue-generating deployment. Increased efficiency frees up valuable IT resources to focus on higher-value tasks, all while remaining secure and compliant. |

• | Reduce security risk through adoption of a unified security policy and continuous compliance. We enable enterprises to create a unified security policy that acts as the foundation of their security decision making. Effective security policy governs how individuals, systems and applications communicate. A well-defined security policy forms the basis of our automation capabilities, guiding the change implementation logic and ensuring continuous compliance with corporate security policies, government regulations and industry standards. |

• | Navigate the complexity of hybrid and fragmented networks with a centralized control layer. We offer a centralized security management layer that analyzes, defines and implements enterprise-specific security policies. Our network abstraction layer allows for the automation of security changes across the network, including firewalls, traditional networks, public and private cloud environments, microservices and containers. Our solutions act as an independent third-party management layer, extending the security policy to every corner of the network, even as it grows, changes and adapts to new business demands and cybersecurity threats. |

• | Enhance visibility and control. Our solutions provide customers with complete visibility over their IT and cloud environments, and enable them to quickly view changes and their impact on security posture prior to deployment. Our solutions monitor, collect and record configuration changes across the enterprise. They verify the adherence of these changes to the unified security policy, helping customers visualize any resulting compliance gaps or related vulnerabilities. We use topology intelligence to map out resources and connections, even across fragmented, complex environments. Enterprises can use our products to centrally manage and enforce their security policy with significant improvements in speed and ease-of-use through a multi-environment, ‘single pane of glass’ interface to ensure compliance and control. |

Our Market Opportunity

We believe the majority of enterprises lack effective and comprehensive security policy management, which is critical to controlling network change. As digital transformation creates more complexity within IT and cloud environments, we believe our policy-centric, automated solutions will garner a growing share of enterprise security spend. In its September 14, 2018 publication Forecast Analysis: Information Security, Worldwide, 2Q18 Update, Gartner estimated that worldwide spending on information security products and services will reach more than $133 billion in 2019. In addition, 451 Research LLC’s VotE Information Security: Workloads and Key Projects 2018 study, covering 550 organizations of different sizes across 10 industry verticals, found that 83% of the companies surveyed did not have security automation and orchestration technologies in place, but 54% of those companies planned to deploy such technologies within the next 24 months. We believe increased security spending and adoption of security automation and orchestration technologies represent a significant opportunity for us.

3

We also believe our policy management and automation solutions overlap with several markets defined by IDC. IDC has estimated that:

• | the market for IT operations management, which improves user access to applications, business services and data sources on diverse platforms, will grow from $8.9 billion in 2018 to $11.7 billion by 2022, according to its Worldwide IT Operations Management Software Forecast for 2018-2022; |

• | the market for IT automation and configuration management, which supports DevOps automation and orchestration, digital enterprises, hybrid cloud architectures and microservices-based applications, will grow from $6.7 billion in 2018 to $8.4 billion in 2022, according to its Worldwide IT Automation and Configuration Management Software Forecast for 2018-2022; |

• | the market for policy and compliance (a sub-segment of security and vulnerability management), which enables enterprises to create, measure and report on security policy and regulatory compliance, will grow from $2.0 billion in 2018 to $3.1 billion in 2022, according to its Worldwide Security and Vulnerability Management Forecast for 2018-2022; and |

• | the market for vulnerability assessment (a sub-segment of security and vulnerability management), which scans networks and applications for security vulnerabilities, will grow from $2.2 billion in 2018 to $3.7 billion by 2022, according to its Worldwide Security and Vulnerability Management Forecast for 2018-2022. |

We believe that our solutions will attract a meaningful portion of these markets, resulting in a multi-billion dollar addressable market. As we continue to innovate and introduce new products, the use cases for our solutions will expand, which we expect will lead to incremental growth in our addressable market opportunity.

We believe our policy management and automation functionalities define a new market, and we are not aware of any third-party research that accurately defines the scope of our directly addressable opportunity. As such, we estimated the market size using third-party data and, when third-party data was not available, internal estimates. We segment enterprises based on estimates of their network infrastructure size and their need for our solutions across their networks, and apply an average annual billings figure per segment based on an estimated prior five years of inventory, resulting in an estimated directly addressable market of $10.3 billion, which includes on-premise firewalls, private cloud and public cloud orchestration segments, for the fiscal year ending December 31, 2019.

Our Competitive Strengths

We believe we have several competitive advantages, including:

• | Pioneer in security policy management. We are a pioneer in the security policy management market. We believe we were the first company to introduce security policy automation solutions with SecureChange and SecureApp, and we believe our position as a market leader reinforces our brand and supports our position as one of the most prominent players in an increasingly important segment. |

• | Advanced technology and ongoing innovation. We have over a decade of experience and believe our ability to innovate is the cornerstone of our position as a technology leader. Our comprehensive security policy management solutions rely on a set of proprietary technologies that provide a high level of security, scalability and performance. Our core technologies, which serve as the foundation of both our network and cloud-based products, include analysis engines, a provisioning engine, API integrations and infrastructure technology. |

• | Scalable, extensible enterprise-grade solutions. Our solutions scale up to the largest enterprises with thousands of network devices (e.g., firewalls and routers) through their distributed architecture and high availability offering. Our extensible API framework allows our customized solutions to interface with most IT management frameworks and systems, and is used by customers, partners |

4

and our professional services team who develop scripts and extensions on top of the Tufin Orchestration Suite.

• | Customer-first approach. Customer success has always been our priority. Since our inception, we have built a strong, customer-first approach and developed a powerful array of products and solutions to meet our customers’ needs and expectations. Our premium support services are available at all times to ensure that customers’ problems are addressed quickly. |

• | Automation-driven return on investment. Enterprises quickly realize value upon deployment of our solutions. Our policy-driven automation allows customers to implement accurate and compliant network changes within minutes rather than days, allowing them to introduce new business applications faster and redeploy IT resources into higher-value projects. |

Our Growth Strategy

• | Acquire new Global 2000 customers and mid-market customers. Since our inception, our solutions have been purchased by over 2,000 customers in over 70 countries, including approximately 15% of the Global 2000. Revenue generated from our Global 2000 customers, excluding maintenance renewals, represented an average of 65% of our total revenue over the fiscal years ended December 31, 2016 to 2018. We believe we have a significant growth opportunity with Global 2000 customers that currently lack a security policy management solution or that use a competing product that lacks automation. We also continue to pursue mid-market accounts with increasing need for security policy management solutions. |

• | Expand within our customer base through new use cases and larger deployments. We aim to drive policy management and automation across the entire enterprise to help our customers fully benefit from our solutions. Customers often contract with us for a portion of their IT and cloud environments or begin only with SecureTrack. Over time, customers often expand their network coverage or recognize the benefits of automated policy changes at the network and application levels and adopt our SecureChange and SecureApp solutions. Most recently, customers moving applications to the cloud have demonstrated interest in Orca and Iris. |

• | Extend security product leadership with innovative new products. We will continue to innovate in ways that enable frictionless collaboration between business and infrastructure teams. We intend to invest further in the Tufin Orchestration Suite to extend its functionality and features. We believe this will enhance our ability to generate revenue within our existing customer base and pursue new opportunities. We will also continue to introduce new products to broaden our appeal to customers and stay ahead of the market. |

• | Grow and cultivate our security partner ecosystem. We have built an extensive global channel partner ecosystem that extends our geographic coverage, drives awareness of our brand and accelerates usage and adoption of our products. We have also formed alliances with technology partners in the network security, security operations, incident response, vulnerability management and security compliance sectors. |

• | Democratize policy management across functions. Our customers continue to find new use cases for our policy management and automation products. For example, as enterprises continue to implement DevOps teams and practices, we believe they will need to introduce security measures earlier in the application development and deployment lifecycle. |

5

Risks Associated With Our Business

Investing in our ordinary shares involves risks. You should carefully consider the risks described in “Risk Factors” beginning on page 12 before making a decision to invest in our ordinary shares. If any of these risks actually occurs, our business, financial condition and results of operations would likely be materially adversely affected. In such case, the trading price of our ordinary shares would likely decline, and you may lose all or part of your investment. The following is a summary of some of the principal risks we face:

• | The security policy management market is rapidly evolving and difficult to predict. If the market does not evolve as we anticipate or if our target customers do not adopt our solutions, our revenues may not grow as expected and our share price may decline. |

• | If we are unable to acquire new customers, particularly large organizations, our future revenues and operating results will be harmed. |

• | Our business depends substantially on our ability to retain customers and expand our offerings to them, and our failure to do so could harm future results of operations. |

• | Our sales cycle is long and unpredictable, which may cause significant fluctuations in our quarterly results of operations. |

• | We face competition in the security policy management market in which we operate, and we may lack sufficient financial or other resources to maintain or improve our competitive position. |

• | Our revenue growth rate over the past year may not be indicative of our future performance. |

• | Our business could be adversely affected if we are unable to manage changes to our business model over time. |

• | Our business and operations have experienced rapid growth, and if we do not appropriately manage any future growth, our results of operations will be harmed. |

• | We have a history of losses, and we may not be able to generate sufficient revenues to achieve and sustain profitability. |

• | We have identified a material weakness in our internal control over financial reporting. If we fail to maintain effective internal control over financial reporting, we may be unable to report our financial results accurately or meet our reporting obligations. |

• | If third-party applications and network products change such that we do not or cannot maintain the compatibility of our platforms and solutions with these applications and products, or if we fail to provide integrations that our customers desire, demand for our solutions and platforms could decline. |

Corporate Information

We are incorporated under the laws of the State of Israel. Our principal executive offices are located at 5 HaShalom Road, ToHa Tower, Tel Aviv 6789205, Israel, and our telephone number is +972 (3) 612-8118. Our website address is www.tufin.com. Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus and is not incorporated by reference herein. We have included our website address in this prospectus solely for informational purposes. Our agent for service of process in the United States is Tufin Software North America, Inc., located at 2 Oliver Street, Suite 702, Boston, Massachusetts 02109-4901, and its telephone number is +1 (877) 270-7711.

Throughout this prospectus, we refer to various trademarks, service marks and trade names that we use in our business. The “Tufin” design logo is the property of Tufin Software Technologies Ltd. Tufin® is our registered trademark in the United States. We have several other trademarks, service marks and pending applications relating to our products. In particular, although we have omitted the “®” and “™” trademark designations in this prospectus from each reference to Unified Security Policy, Tufin Orchestration Suite,

6

SecureChange, SecureTrack and SecureApp, all rights to such trademarks are nevertheless reserved. Other trademarks and service marks appearing in this prospectus are the property of their respective holders.

7

THE OFFERING

Ordinary shares offered | 7,700,000 ordinary shares |

Ordinary shares to be outstanding after this offering | 32,436,501 ordinary shares |

Underwriters’ option | We have granted the underwriters an option to purchase up to 1,155,000 additional ordinary shares for a period of 30 days after the date of this prospectus. |

Use of proceeds | We intend to use the net proceeds we receive from this offering for working capital and other general corporate purposes. We expect to continue to invest in and to grow our research and development capabilities as well as expand our sales force and marketing team. See “Use of Proceeds.” |

Risk factors | See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our ordinary shares. |

Proposed NYSE symbol | TUFN |

The number of ordinary shares to be outstanding after this offering is based on 24,736,501 ordinary shares outstanding as of March 31, 2019. The number of ordinary shares to be outstanding after this offering excludes 9,652,267 ordinary shares reserved for issuance under our equity incentive plans, of which there were outstanding options to purchase 7,005,419 shares at a weighted average exercise price of $2.15 per share.

Unless otherwise indicated, this prospectus:

• | reflects the conversion of all outstanding preferred shares into 16,416,749 ordinary shares on a one-for-one basis, which will occur automatically immediately prior to the closing of this offering; |

• | gives effect to the exercise on a cashless basis of warrants to purchase 26,667 ordinary shares with an exercise price of $4.30 per share issued to an Israeli non-profit organization and the resulting issuance of 18,472 ordinary shares upon the closing of this offering; |

• | gives effect to the adoption of our amended and restated articles of association, which will become effective upon the closing of this offering and will replace our articles of association currently in effect; |

• | assumes no exercise of the underwriters’ option to purchase up to 1,155,000 additional ordinary shares; and |

• | reflects a 1.5:1 reverse share split effected on March 21, 2019. |

8

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables set forth our summary consolidated financial data. You should read the following summary consolidated financial data in conjunction with “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. Historical results are not necessarily indicative of the results that may be expected in the future. Our financial statements have been prepared in accordance with U.S. Generally Accepted Accounting Principles, or U.S. GAAP.

The summary consolidated statements of operations data for each of the years in the two-year period ended December 31, 2018 and the summary balance sheet data as of December 31, 2018 are derived from our audited consolidated financial statements appearing elsewhere in this prospectus.

Year ended December 31, | |||||||

2017 | 2018 | ||||||

(in thousands, except share and per share amounts) | |||||||

Consolidated Statements of Operations: | |||||||

Revenues: | |||||||

Product | $ | 30,855 | $ | 42,554 | |||

Maintenance and professional services | 33,685 | 42,427 | |||||

Total revenues | 64,540 | 84,981 | |||||

Cost of revenues: | |||||||

Product | 1,702 | 2,324 | |||||

Maintenance and professional services | 7,778 | 11,112 | |||||

Total cost of revenues(1) | 9,480 | 13,436 | |||||

Gross profit | 55,060 | 71,545 | |||||

Operating expenses: | |||||||

Research and development(1) | 17,672 | 21,363 | |||||

Sales and marketing(1) | 35,042 | 46,092 | |||||

General and administrative(1) | 4,608 | 6,022 | |||||

Total operating expenses | 57,322 | 73,477 | |||||

Operating loss | $ | (2,262 | ) | $ | (1,932 | ) | |

Financial income (loss), net | 267 | (1,047 | ) | ||||

Loss before taxes on income | $ | (1,995 | ) | $ | (2,979 | ) | |

Taxes on income | (797 | ) | (1,283 | ) | |||

Net loss | $ | (2,792 | ) | $ | (4,262 | ) | |

Basic and diluted net loss per ordinary share(2) | $ | (0.35 | ) | $ | (0.53 | ) | |

Weighted average number of ordinary shares used in computing basic and diluted net loss per ordinary share(2) | 7,872,545 | 8,045,647 | |||||

Basic pro forma net loss per ordinary share (unaudited)(3) | $ | (0.17 | ) | ||||

Weighted average number of shares used in computing pro forma basic and diluted net loss per ordinary share (unaudited)(3) | 24,462,397 | ||||||

9

As of December 31, 2018 | |||||||||||

Actual | Pro Forma(4) | Pro Forma As Adjusted(4) | |||||||||

(in thousands) | |||||||||||

Consolidated Balance Sheet Data: | |||||||||||

Cash and cash equivalents | $ | 15,248 | $ | 15,248 | $ | 113,397 | |||||

Working capital, excluding deferred revenue(5) | 17,781 | 17,781 | 115,930 | ||||||||

Deferred revenue, current and non-current | 31,464 | 31,464 | 31,464 | ||||||||

Total assets | 47,133 | 47,133 | 144,552 | ||||||||

Redeemable convertible preferred shares | 26,699 | — | — | ||||||||

Total shareholders’ equity (deficit) | (29,946 | ) | (3,247 | ) | 94,613 | ||||||

Year ended December 31, | |||||||

2017 | 2018 | ||||||

(in thousands) | |||||||

Supplemental Financial Data: | |||||||

Non-GAAP operating profit (loss)(6) | $ | (152 | ) | $ | 1,249 | ||

(1) | Includes share-based compensation expense as follows: |

Year ended December 31, | |||||||

2017 | 2018 | ||||||

(in thousands) | |||||||

Share-based Compensation Expense: | |||||||

Cost of revenues | $ | 332 | $ | 634 | |||

Research and development | 660 | 731 | |||||

Sales and marketing | 765 | 1,458 | |||||

General and administrative | 353 | 358 | |||||

Total share-based compensation expenses | $ | 2,110 | $ | 3,181 | |||

(2) | Basic and diluted net loss per ordinary share is computed based on the weighted average number of ordinary shares outstanding during each period. For additional information, see Note 2 to our consolidated financial statements included elsewhere in this prospectus. |

(3) | Pro forma basic and diluted net loss per ordinary share and pro forma weighted average shares outstanding assumes the conversion of all of our outstanding preferred shares into ordinary shares, which will occur immediately prior to the closing of this offering, but does not give effect to the issuance of shares in connection with this offering. For additional information on the conversion of the preferred shares, see Note 11 to our consolidated financial statements included elsewhere in this prospectus. |

(4) | Pro forma gives effect to the conversion of all of our outstanding preferred shares into ordinary shares, which will occur immediately prior to the closing of this offering. Pro forma as adjusted gives effect to (x) the same item as set forth in “pro forma,” (y) the exercise on a cashless basis of warrants to purchase 26,667 ordinary shares and the resulting issuance of 18,472 ordinary shares upon the closing of this offering and (z) the issuance and sale of ordinary shares in this offering at the initial public offering price of $14.00 per ordinary share after deducting underwriting discounts and estimated offering expenses payable by us. |

(5) | We define working capital as total current assets minus total current liabilities. |

10

(6) | Non-GAAP operating profit (loss) is a non-GAAP financial measure. We define non-GAAP operating profit (loss) as operating profit excluding share-based compensation expense. Because of varying available valuation methodologies, subjective assumptions and the variety of equity instruments that can impact a company’s non-cash expense, we believe that providing non-GAAP financial measures that exclude non-cash share-based compensation expense allows for more meaningful comparisons between our operating results from period to period. This non-GAAP financial measure is an important tool for financial and operational decision-making and for evaluating our operating results over different periods. The following table reconciles operating loss, the most directly comparable U.S. GAAP measure, to non-GAAP operating profit (loss) for the periods presented: |

Year ended December 31, | |||||||

2017 | 2018 | ||||||

(in thousands) | |||||||

Reconciliation of Operating Loss to Non-GAAP Operating Profit (Loss): | |||||||

Operating loss | $ | (2,262 | ) | $ | (1,932 | ) | |

Add: share-based compensation | $ | 2,110 | $ | 3,181 | |||

Non-GAAP operating profit (loss)(6) | $ | (152 | ) | $ | 1,249 | ||

For a description of how we use non-GAAP operating profit (loss) to evaluate our business, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Factors Affecting Our Performance.”

Other companies, including companies in our industry, may calculate non-GAAP operating profit (loss) differently or not at all, which reduces the usefulness of non-GAAP operating profit (loss) as a comparative measure. You should consider non-GAAP operating profit (loss) along with other financial performance measures, including operating profit, and our financial results presented in accordance with U.S. GAAP.

11

RISK FACTORS

This offering and an investment in our ordinary shares involve a high degree of risk. You should consider carefully the risks described below and all other information contained in this prospectus, including our financial statements and related notes thereto, before you decide to buy our ordinary shares. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our ordinary shares would likely decline, and you might lose all or part of your investment.

Risks Related to Our Business and Our Industry

The security policy management market is rapidly evolving and difficult to predict. If the market does not evolve as we anticipate or if our target customers do not adopt our solutions, our revenues may not grow as expected and our share price may decline.

We believe our future success depends in large part on growth in the security policy management market in which we compete. The security policy management market is relatively new and subject to rapid technological change, evolving industry standards, a shift in the enforcement or scope of regulations to which our customers are subject, as well as changing customer needs, requirements and preferences. As such, it is difficult to predict important market trends, including potential growth. For example, organizations that currently use home-grown tools may believe that they already have sufficient security policy management products. Therefore, such organizations may continue spending their network infrastructure budgets on other products and may not adopt our solutions in addition to or in lieu of other existing solutions. If the security policy management market does not evolve in the way we anticipate or if organizations do not recognize the benefits our solutions offer in addition to or in place of other existing solutions, then our revenues may not grow as expected and our share price could decline.

If we are unable to acquire new customers, particularly large organizations, our future revenues and operating results will be harmed.

Our growth strategy is dependent, in part, on our ability to acquire new customers, particularly large organizations. For example, in the year ended December 31, 2018, large organizations, which we define as those comprising the Global 2000, accounted for 68% of our revenues, excluding maintenance renewals. The size and number of customers that we add in a given period significantly and directly impacts both our short-term and long-term revenues. If we are unable to attract a sufficient number of new large organization customers or if we attract customers that place orders of an insufficient size, we may be unable to generate revenue growth at desired rates. The security policy management market is competitive and we cannot guarantee that we will out-perform our competitors. In addition, in many cases, our primary competition is in-house, manual, spreadsheet driven processes and homegrown approaches to security management. As a result, we may not be able to add new customers at the levels we expect, or may need to spend more than we budgeted on our efforts to do so. Competition in the marketplace may also result in us winning fewer new customers, lowering prices or offering sales incentives to new customers. These factors may have a material negative impact on our future revenues and operating results.

Sales to large organizations involve risks that may not be present (or that are present to a lesser extent) with sales to smaller entities. These risks include:

• | increased purchasing power and leverage held by large organizations in negotiating contractual arrangements with us, including, in certain cases, clauses that provide preferred pricing of configurations with similar specifications; |

• | the timing of individual large sales, which in some cases have occurred in a quarter subsequent to those we anticipated, or have not occurred at all; |

12

• | longer sales cycles and the associated risk that substantial time and resources may be spent on a potential customer that ultimately elects not to purchase our products or purchases fewer products than we anticipated; |

• | more stringent or costly requirements imposed upon us in our maintenance and professional services contracts with such customers, including stricter response times and penalties for any failure to meet maintenance and professional services requirements; |

• | more complicated and costly implementation processes and network infrastructure; and |

• | closer relationships with, and increased dependence upon, large technology companies who may offer competing products and have stronger brand recognition. |

If we are unable to increase sales of our solutions and products to large organizations while mitigating the risks associated with serving such customers, our business, results of operations, prospects and financial condition may suffer.

Our business depends substantially on our ability to retain customers and expand our offerings to them, and our failure to do so could harm future results of operations.

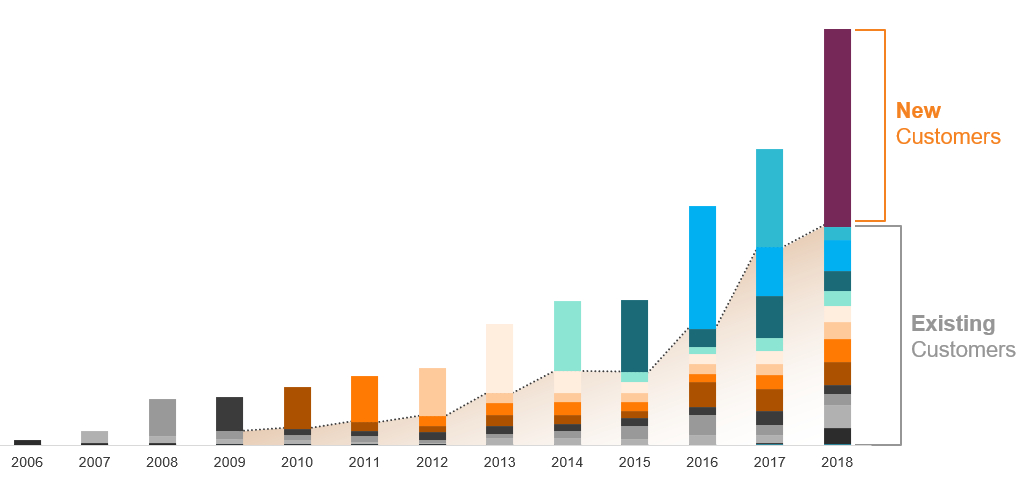

We generate a significant portion of our revenues from sales to existing customers and our business depends substantially on our ability to retain customers and expand our offerings to them. In 2017 and 2018, we generated over 75% and 70% of our revenues, respectively, from sales to existing customers, including renewals. Our Tufin Orchestration Suite is currently comprised of five products: SecureTrack, SecureChange, SecureApp and, most recently, Orca and Iris. The majority of our customers initially purchase SecureTrack to monitor part of their networks. Initial product deployments frequently expand across departments, divisions and geographies and result in the purchase of additional products, such as SecureChange and SecureApp. In addition, we expect an increasing portion of our revenues to be derived from additional sales to our customers of Orca and Iris, which allow for policy-driven automation and security management in cloud-native environments.

The rate at which our existing customers purchase additional products and services depends on a number of factors, including the perceived need for additional IT security, our customers’ IT budgets, the efficacy of our solutions, general economic conditions, our customers’ overall satisfaction with our products and services and the continued growth and economic health of our customer base. If our efforts to sell additional products and services to our customers are not successful, our future revenues and operating results will be harmed.

We devote significant efforts to developing and marketing product updates to existing customers and rely on these efforts for a portion of our revenues. This requires a significant investment in building and maintaining customer relationships, as well as significant research and development efforts in order to launch product updates and new products. Our future success depends, in part, on our ability to continue to expand sales of our current product offerings to existing customers, sell additional licenses for our current products to our existing customers and develop and sell new products to existing customers.

Our sales cycle is long and unpredictable, which may cause significant fluctuations in our quarterly results of operations.

The timing of our sales and related revenue recognition is difficult to predict because of the length and unpredictability of the sales cycle for our products. We and our channel partners often spend significant time and resources to better educate and familiarize potential customers with the value proposition of our products and platform. Our sales cycle usually lasts several months from proof of concept to purchase order from our customers, and it is often even longer, less predictable and more resource-intensive for larger transactions. Customers may also require additional internal approvals or seek to test our products for a longer trial basis before deciding to purchase our solutions. Furthermore, even if we close a large transaction during a given quarter, we may be unable to recognize the revenues derived from such a transaction due to our revenue recognition policy. See “Management’s Discussion and Analysis of

13

Financial Condition and Results of Operations—Application of Critical Accounting Policies and Estimates—Revenue Recognition.”

In addition, in the past, customers have deferred significant purchases to the last quarter of the year when they can determine what amount of their annual budget remains unused. As a result, the timing of individual sales can be difficult to predict. We generally expect an increase in business activity as we approach our fiscal year end in December, driven by our customers’ buying patterns. We believe that these seasonal trends will continue to affect our quarterly results. Large individual sales have, in some cases, occurred in quarters subsequent to those we anticipated or have not occurred at all. The loss or delay of one or more large transactions in a quarter could impact our anticipated results of operations for that quarter and future quarters for which revenue from that transaction is delayed. We may not be able to accurately predict or forecast the timing of sales, which could cause our results to vary significantly from our expectations and the expectations of market analysts. In addition, we might devote substantial time and effort to a particular unsuccessful sales effort, and as a result we could lose other sales opportunities or incur expenses that are not offset by an increase in revenue, which could harm our business.

We face competition in the security policy management market in which we operate, and we may lack sufficient financial or other resources to maintain or improve our competitive position.

We face competition in the security policy management market in which we operate. In many cases, our primary competition is in-house, manual, spreadsheet driven processes and homegrown approaches to security management, and we and our channel partners may not be successful in educating and familiarizing potential customers with the value associated with our products and services. Our direct competitors include vendors such as AlgoSec, Inc., FireMon, LLC and Skybox Security LLC that offer solutions that compete with all or some of our products or product features. We also indirectly compete with large IT companies that offer a broad array of traditional security management solutions, such as Symantec Corporation and Cisco Systems, Inc., for a share of enterprises’ IT security budgets. These large companies have the technical and financial resources and broad customer bases needed to bring products that are competitive with ours to market and already have existing relationships as a trusted vendor for other products. Such companies may use these advantages to offer products and services that are perceived to be as effective as ours at a lower price or for free as part of a larger product package or solely in consideration for maintenance and professional services fees. As the security policy management market grows, we expect competition to increase in the future from both existing competitors and new companies that may enter our markets. Some of our competitors may develop different products that compete with our current solutions and respond more quickly and effectively than we do to new or changing opportunities, technologies, standards or client requirements, including in cloud-native environments.

Organizations that use other products or home-grown tools may believe that these products or tools are sufficient to meet their security policy management needs or that our products only serve the needs of a portion of the enterprise security market. Accordingly, these organizations may continue allocating their information technology budgets for other products, and may not adopt our products. Further, many organizations have invested substantial personnel and financial resources to design and operate their networks and have established deep relationships with other providers of networking and security products. As a result, these organizations may prefer to purchase from their existing suppliers rather than add or switch to a new supplier, such as us, regardless of product performance, features, or greater services offerings or may be more willing to incrementally add solutions to their existing security infrastructure from existing suppliers than to replace it wholesale with our solutions.

Our current and potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their resources. Current or potential competitors may be acquired by third parties with greater available resources. As a result of such acquisitions, our current or potential competitors might be able to adapt more quickly to new technologies and customer needs, devote greater resources to the promotion or sale of their products and services, initiate or withstand

14

substantial price competition, take advantage of other opportunities more readily or develop and expand their product and service offerings more quickly than we do.

Our revenue growth rate over the past year may not be indicative of our future performance.

Our revenue growth rate in recent periods should not be viewed as an indication of our future performance. For the years ended December 31, 2017 and 2018, our revenues were $64.5 million and $85.0 million, respectively, representing year-over-year growth of 31.7%. We may not achieve similar revenue growth rates in future periods. Factors that could impact our ability to increase our revenue include our ability to increase the size or efficiency of our sales force, which has expanded rapidly in recent years, our ability to achieve repeat purchases by existing customers, our ability to successfully compete with other companies and the extent to which we are successful in securing large scale deployments, particularly among Global 2000 enterprises. If we are unable to maintain consistent revenue or revenue growth, our share price could experience volatility, and our ability to achieve and maintain profitability could be adversely affected.

Our business could be adversely affected if we are unable to manage changes to our business model over time.

We sell our software primarily through perpetual license agreements and, to a lesser extent, term-based license agreements rather than utilizing a Software-as-a-Service, or SaaS, model. SaaS is a model of software deployment in which a software provider typically licenses an application to customers for use as a service on demand through web browser technologies. While we do not currently earn any revenue from SaaS products, in the future, we plan to deploy certain of our new products as SaaS subscriptions to enable more customers to use our solutions beyond our existing on-premise offerings. A SaaS business model can require a vendor to undertake substantial capital investments and develop related sales and support resources and personnel. In recent years, companies have begun to expect that enterprise software solutions will be provided through a SaaS model. If customers were to require that we provide our products via a SaaS deployment, we would need to deploy resources to implement this alternative business model, which would negatively affect our results. In addition, if we shift to a subscription-based model or make other significant changes to our business model, we may fail to make such a transition in a timely manner or do so at a sustainable pace, either of which could have an adverse effect on our business, results of operations, financial condition and cash flows.

Our business and operations have experienced rapid growth, and if we do not appropriately manage any future growth, our results of operations will be harmed.

We have experienced rapid growth over the last several years, which has placed and will continue to place significant demands on our management, administrative, operational and financial infrastructure. For example, as of December 31, 2017, we had 325 employees and independent contractors compared to 424 as of December 31, 2018, and we expect to continue to expand our headcount. We expect to manage a more complex array of internal systems and processes as we scale aspects of our business in proportion to our growth, including an expanded sales force, additional customer service and research and development personnel, as well as more complex administrative systems related to managing increased headcount.

Our success will depend in part upon our ability to manage our growth effectively. To do so, we must continue to increase the productivity of our existing employees, particularly our sales force, and hire, train, and manage new employees and expand our network of channel partners. To manage the domestic and international growth of our operations and personnel, we will need to continue to improve our operational, financial, and management controls, as well as our reporting processes and procedures. In addition, we will hire additional personnel to support our financial reporting function.

These additional investments will increase our operating costs, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. We may not be able to successfully acquire or implement these or other improvements to our systems and processes in an

15

efficient or timely manner, or once implemented, we may discover deficiencies in their capabilities or effectiveness. We may experience difficulties in managing improvements to our systems and processes or in integrating with third-party technology. In addition, our systems and processes may fail to prevent or detect errors, omissions or fraud. Our failure to improve our systems and processes, or their failure to operate effectively and in the intended manner, may result in the disruption of our current operations and customer relationships, our inability to manage the growth of our business and our inability to accurately forecast and report our revenues, expenses and earnings, any of which may materially harm our business, results of operations, prospects and financial condition.

We have a history of losses, and we may not be able to generate sufficient revenues to achieve and sustain profitability.

We have incurred net losses in each period since our inception, including net losses of $2.8 million and $4.3 million for the years ended December 31, 2017 and 2018, respectively. As of December 31, 2018, our accumulated deficit was $40.3 million. We expect our operating expenses to increase significantly as we continue to expand our sales and marketing efforts, in part, by building our sales platforms, continue to invest in research and development and continue to expand our operations in existing and new geographies and vertical markets. We also expect to continue to devote significant research and development resources to our on-premise and cloud solutions. In addition, we expect to incur significant additional legal, accounting and other expenses related to being a public company upon the completion of this offering. While our revenues have grown in recent years, if our revenues decline or fail to grow at a rate faster than these increases in our operating expenses, we will not be able to achieve and maintain profitability in future periods. As a result, we may continue to generate losses. We cannot assure you that we will achieve profitability in the future or that, if we do become profitable, we will be able to sustain profitability.

We have identified a material weakness in our internal control over financial reporting. If we fail to maintain effective internal control over financial reporting, we may be unable to report our financial results accurately or meet our reporting obligations.

In connection with the issuance of our consolidated financial statements for each of the years ended December 31, 2017 and 2018, we identified a material weakness in our internal control over financial reporting as of December 31, 2017 and 2018. A “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

Specifically, we determined that we do not have sufficient finance staff to provide for effective control over our period-end financial reporting process. As a result of having insufficient staff, we were unable to adequately segregate duties in a manner consistent with control objectives for our period-end financial reporting process.

We have initiated actions toward remediating this material weakness by identifying our staffing requirements and commencing the process of hiring additional personnel for our finance team with the appropriate level of training and expertise. However, the implementation of these initiatives may not fully address this or any other material weakness or other deficiencies that we may have in our internal control over financial reporting.

We will assess our internal control environment and the potential remediation of this material weakness. If we are unable to certify that our internal control over financial reporting is effective pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we could lose investor confidence in the accuracy and completeness of our financial reports, which could harm our business, the price of our ordinary shares and our ability to access the capital markets.

16

If third-party applications and network products change such that we do not or cannot maintain the compatibility of our platforms and solutions with these applications and products, or if we fail to provide integrations that our customers desire, demand for our solutions and platforms could decline.

The attractiveness of our platforms depends, in part, on our ability to integrate with third-party applications and network products that our customers use or desire to use. Third-party providers may change the features of their applications and platforms or alter the terms governing use of their applications and platforms in an adverse manner. Further, third-party application providers may refuse to partner with us, or limit or restrict our access to their applications and platforms. Such changes could functionally limit or terminate our ability to use these third-party applications and systems with our platform, which could negatively impact our offerings and harm our business. If we fail to integrate our platforms with new third-party applications that our customers desire, or to adapt to the requirements of such third-party applications and platforms, we may not be able to offer the functionality that our customers expect, which would negatively impact our offerings and, as a result, harm our business.

If our products do not effectively interoperate with our customers’ existing or future IT infrastructures, deployments and integrations could be delayed or canceled, which would harm our business.

Our products must effectively interoperate with our customers’ existing or future IT infrastructure, which often has different specifications, utilizes multiple protocol standards, deploys products from multiple vendors and contains multiple generations of products that have been added over time. As a result, when problems occur in a network, it may be difficult to identify the sources of these problems. If we find errors in the existing software or defects in the hardware used in our customers’ infrastructure or problematic network configurations or settings, we may have to modify and improve our software so that our products will integrate with our customers’ infrastructure. In such cases, our products may be unable to support some of the configurations or protocols used in our customers’ infrastructure. These issues could cause longer deployment and integration times for our products and could cause order cancelations, either of which would adversely affect our business, results of operations and financial condition. Additionally, any changes in our customers’ IT infrastructure that degrade the functionality of our products or services, which are better supported by competitive software, could adversely affect the adoption and usage of our products.

Estimates of market opportunity and forecasts of market growth included in this prospectus may prove to be inaccurate.

Growth forecasts included in this prospectus relating to our market opportunity and the expected growth in the security policy management market, which are subject to significant uncertainty, may prove to be inaccurate. We believe our policy management and automation functionalities define a new market, and we are not aware of any third-party research that accurately defines the scope of our directly addressable opportunity. As such, we estimated the market size using third-party data and, when third-party data was not available, internal estimates. We segment enterprises based on estimates of their network infrastructure size and their need for our solutions across their networks, and apply an average annual billings figure per segment based on an estimated prior five years of inventory, resulting in an estimated directly addressable market of $10.3 billion, which includes on-premise firewalls, private cloud and public cloud orchestration segments, for the fiscal year ending December 31, 2019.

The addressable market we estimate may not materialize for many years. Even if the markets in which we compete meet the size estimates and growth forecast in this prospectus, our business could fail to grow at similar rates. Our growth is subject to many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties. Accordingly, the forecasts of market growth included in this prospectus are not indicative of our future growth.

17

Because we derive substantially all of our revenues from sales of licenses and maintenance for SecureTrack, SecureChange and SecureApp, which belong to a single platform of products – the Tufin Orchestration Suite – the failure of these products to satisfy customers or to achieve increased market acceptance would adversely affect our business.

In 2018, we generated substantially all of our revenues from sales of licenses and maintenance for SecureTrack, SecureChange and SecureApp. We recently introduced Orca and Iris to market, and have not yet derived revenues from the sale of these products. We expect to continue to derive a majority of our revenues from license and maintenance sales relating to the Tufin Orchestration Suite in the future. As such, market acceptance of this platform of products is critical to our continued success. Demand for licenses for the Tufin Orchestration Suite is affected by a number of factors, some of which are outside of our control, including continued market acceptance of our software by our customers and potential customers, the viability of existing and new use cases, technological change and growth or contraction in our market. If we are unable to continue to meet customer demands or to achieve more widespread market acceptance of our software, our business, operations, financial results and growth prospects will be materially and adversely affected.

If we are unable to increase market awareness of our company and our solutions, or fail to successfully promote or protect our brand, our competitive market position and revenues may not continue to grow or may decline.

We believe that improved awareness of our brand and the value proposition of our solutions will be essential to our continued growth and our success. Many factors, some of which are beyond our control, are important to maintaining and enhancing our brand, including our ability to increase awareness among existing and potential channels partners through various means of marketing and promotional activities. If our marketing efforts are unsuccessful in improving market awareness of our brand and our solutions, then our business, results of operations, prospects, and financial condition will be adversely affected, and we will not be able to achieve sustained growth.

Moreover, due to the intensely competitive nature of our market, we believe that building and maintaining our brand and reputation is critical to our success and that the importance of positive brand recognition will increase as competition in our market further intensifies. While we believe that we are successfully building a well-established brand and have invested and expect to continue to invest substantial resources to promote and maintain our brand, both domestically and internationally, there can be no assurances that our brand development strategies will enhance our reputation or brand recognition or lead to increased revenue.

Furthermore, an increasing number of independent industry analysts and researchers, such as Gartner, IDC and 451 Research LLC, regularly evaluate, compare and publish reviews regarding the functionality of security products and services, including our solutions. These reviews may significantly influence the market perception of our solutions. We do not have any control over the content of these independent industry analysts and researchers’ reports, and our reputation and brand could be harmed if they publish negative reviews of our solutions or do not view us as a market leader. The strength of our brand may also be negatively impacted by our competitors’ marketing efforts, which may include incomplete, inaccurate and misleading statements about our business, products and services. If we are unable to maintain a strong brand and reputation, sales to new and existing customers could be adversely affected, and our financial performance could be harmed.

Our business and reputation could be harmed based on real or perceived shortcomings, defects or vulnerabilities in our solutions or the failure of our solutions to meet customers’ expectations.

Our customers face increasingly sophisticated and targeted cyberthreats. If we fail to update our products to detect or prevent such threats, our business and reputation will suffer. Moreover, as our solutions are adopted by an increasing number of enterprises and governmental entities, cyberattackers may focus on finding ways to defeat our solutions. The data stored in our products’ database is highly sensitive, and includes our customers’ current enterprise-wide network configuration and security policies. If our

18

products’ security configuration is breached, this data could be used by malicious actors, including external hackers and rogue employees within our customers’ organizations, to plan how they could effectively traverse our customers’ networks and gain unauthorized access to critical systems and data. A breach or theft of our customers’ sensitive business data, regardless of whether the breach or theft is attributable to the failure of our products, could adversely affect the market’s perception of the efficacy of our solutions and current or potential customers may look to our competitors for alternatives to our solutions. The failure of our products may also subject us to lawsuits and financial losses stemming from indemnification of our partners and other third parties, as well as the expenditure of significant financial resources to analyze, correct or eliminate any vulnerabilities. Although we seek to limit our financial exposure in such circumstances through caps on our indemnification obligations, customers may litigate the enforceability of such caps and it is possible that such litigation may be successful in certain circumstances. Any such event could also cause us to suffer reputational harm, lose existing customers or deter them from purchasing additional products and services and prevent new customers from purchasing our solutions.

Our business and reputation could be harmed if cybersecurity risks materialize.

Cybersecurity threats are a growing and evolving risk, and often are difficult or impossible to detect for long periods of time or to successfully defend against. Successful attacks, whether through external or internal actors, could harm the confidentiality, integrity and availability of personal data and other sensitive information, as well as the integrity and availability of our systems, products and services in a manner that could materially and adversely affect our business. Because techniques used to obtain unauthorized access or sabotage systems change frequently and generally are not identified until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, such a security breach could impair our ability to operate our business, including our ability to provide maintenance and support services to our customers. If this happens, our revenues could decline and our business could suffer. In addition, if we suffer a highly publicized security breach, even if our platform and solutions perform effectively, such a breach could cause us to suffer reputational harm, lose existing commercial relationships and customers or deter customers from purchasing additional solutions and prevent new customers from purchasing our solutions.

We are subject to data privacy laws, the breach of which could subject us to fines and harm our reputation.

We are subject to an expanding number of domestic, international and contractual legal requirements regarding privacy, personal data rights and cybersecurity. These laws, rules and regulations continue to evolve and address a range of issues, including restrictions or technological requirements regarding the collection, use, storage, protection, retention or transfer of data. Violation of these requirements could result in substantial fines, penalties and related defense costs. For example, the GDPR provides for penalties that could reach the greater of 20 million Euros or 4% of a company’s worldwide annual turnover. In addition, because we operate in a number of jurisdictions, we may be subject to a variety of local data privacy laws, which can change frequently and potentially conflict with our existing obligations. These legal requirements may be interpreted and enforced in a manner that is inconsistent with our existing practices or the features of our products and services. We may also be subject to claims of liability or responsibility for the actions of third parties with whom we interact or upon whom we rely in relation to various products and services, including but not limited to our channel partners. In addition to the possibility of our being subject to enforcement actions, fines, lawsuits and other claims, we could be required to fundamentally change our business activities and practices or modify our products and services, which could have an adverse effect on our business. Any inability to adequately address customer privacy and data protection concerns, even if unfounded, or to comply with applicable privacy and data protection laws, regulations and policies, could result in additional cost and liability to us, damage our reputation, inhibit sales and adversely affect our business.

19

If we do not effectively expand, train and retain our sales force, we may be unable to acquire new customers or sell additional products and services to existing customers, and our business will suffer.

Our future success depends, in part, on our ability to continue to expand, train and retain our sales force. Our inability to attract or retain qualified personnel or delays in hiring required sales personnel may seriously harm our business, financial condition and results of operations. Any of our employees may terminate their employment at any time, subject to certain notice requirements. Our ability to continue to attract and retain highly skilled personnel is critical to our future success. During 2018, we increased the number of our sales and marketing personnel from 128 to 166. We expect to continue to expand our sales and marketing personnel significantly and face a number of challenges in achieving our hiring and integration goals. There is intense competition for individuals with sales training and experience. In addition, the training and integration of a large number of sales and marketing personnel in a short time requires the allocation of significant internal resources. We invest significant time and resources in training new sales force personnel to understand our solutions and growth strategy. However, there is no guarantee that our recent hires and planned new hires will become as productive as we expect or require, and we may be unable to hire or retain sufficient numbers of qualified individuals in the future in the markets in which we currently operate or where we seek to conduct business. Our failure to hire a sufficient number of qualified sales force members and train them to operate at target performance levels may materially and adversely impact our projected growth rate.

Our ability to enhance our products may be harmed if we are unable to attract and retain sufficient research and development personnel, and if we are unable to generate an adequate return on our investment in research and development.

Our ability to enhance our products may be harmed if we are unable to attract and retain sufficient engineers and research and development personnel. Our principal research and development activities are conducted from our headquarters in Israel, and we face significant competition for suitably skilled engineers and research and development personnel in this region, where the availability of such personnel is limited. We also engage a number of developers in Bucharest, Romania as independent contractors in order to benefit from the significant pool of talent that is more readily available in this market. Larger companies may expend more resources than we do on employee recruitment and may be able to offer more favorable compensation and incentive packages than us. If we cannot attract or retain a sufficient number of skilled research and development employees, our business, prospects and results of operations could be adversely affected.

In order to remain competitive, we expect to continue to dedicate significant financial and other resources to develop new solutions, applications and enhancements to our existing products and platforms. For example, in 2018, we increased our dedicated research and development personnel by 33% compared to 2017. However, investing in research and development personnel, developing new products and enhancing existing products are expensive and time consuming, and there is no assurance that such activities will result in significant new marketable products or enhancements to our products, design improvements, cost savings, revenues or other expected benefits. If we delay releasing product enhancements and new solutions, or are otherwise unable to generate an adequate return on our investment, our business and results of operations may be materially and adversely affected.

If we fail to maintain successful relationships with our channel partners, or if our channel partners fail to perform, our ability to market, sell and distribute our solutions will be limited, and our business, financial position and results of operations will be harmed.

We sell our products and services through our sales force, including our field sales team and our inside sales team, which works closely with our global network of approximately 140 active channel partners. Our channel partners include distributors and resellers, as well as service delivery partners that help customers successfully deploy, configure, customize and maintain our products and services. Our channel partners fulfill orders constituting substantially all of our revenues. Certain of our new customer leads are generated by our channel partners. For the years ended December 31, 2017 and 2018, our two

20

largest channel partners accounted for 16% and 13% of our revenues and 13% and 10% of our revenues, respectively. Our agreements with these channel partners provide that each partner agrees to sell and distribute our products within certain territories for one year. These agreements are nonexclusive and non-transferable, and automatically renew unless terminated by either party after providing prior written notice. As of December 31, 2017, five of our channel partners accounted for 10% or more of our accounts receivable, accounting for an aggregate of 62% of our accounts receivable in 2017. As of December 31, 2018, three of our channel partners accounted for 10% of more of our accounts receivable, accounting for an aggregate of 36% of our accounts receivable in 2018. Our engagements with these channel partners are generally based on separate contractual relationships with different business units across multiple jurisdictions rather than on a single agreement.

As a result of this concentration, if a channel partner ceases to perform services for us, we may face disruptions in deploying solutions to our customers. Additionally, we are exposed to the credit risk of our channel partners in the event they become insolvent while owing us payment. If our channel partners do not effectively provide support to the satisfaction of our customers, we may be required to provide support to such customers, which would require us to invest in additional personnel and may require us to devote significant time and resources. If our channel partners do not effectively market and sell our solutions, or choose to use greater efforts to market and sell the products and services of our competitors, our ability to grow our business may be adversely affected.

Our relationships with channel partners have been, and could in the future be, terminated with little or no notice if they become subject to bankruptcy or other similar proceedings. The loss of our major channel partners, the inability to replace them or the failure to recruit additional channel partners could materially and adversely affect our results of operations. If we are unable to maintain our relationship with channel partners or otherwise develop and expand our sales channels, or if our channel partners fail to perform, our business, financial position and results of operations could be adversely affected.

Our increasing focus on expanding security policy management to cloud-native environments presents execution and competitive risks.