Form 424B4 Snow Lake Resources Ltd.

Filed Pursuant to Rule 424(b)(4)

Registration No. 333-254755

3,200,000 Common Shares

Snow Lake Resources Ltd.

This is the initial public offering of our common shares. We are offering 3,200,000 common shares. The initial public offering price of our common share is US$7.50 per share.

Prior to this offering, there was no public market for our common shares. We have been approved to list our common shares under the symbol “LITM” on the Nasdaq Capital Market. Our common shares will commence trading on November 19, 2021.

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, and as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

We expect be a “controlled company” under the rules of the Nasdaq Stock Market, immediately after consummation of this offering and we expect to avail ourselves of the corporate governance exemptions afforded to a “controlled company” under the rules of Nasdaq. See “Risk Factors—Risks Related to Our Common Shares and this Offering.”

Investing in our common shares involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of information that should be considered in connection with an investment in our common shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | US$ | 7.50 | US$ | 24,000,000 | ||||

| Underwriting discounts and commissions(1) | US$ | 0.5625 | US$ | 1,800,000 | ||||

| Proceeds to us, before expenses | US$ | 6.9375 | US$ | 22,200,000 | ||||

| (1) | Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the initial public offering price payable to the underwriters. We refer you to “Underwriting” beginning on page 107 for additional information regarding underwriters’ compensation. |

We have granted a 45 day option to the representative of the underwriters to purchase up to an additional 480,000 common shares at the public offering price less the underwriting discount and commissions.

The underwriters expect to deliver the common shares to purchasers on or about November 23, 2021.

ThinkEquity

The date of this prospectus is November 18, 2021

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, nor the underwriters have authorized anyone to provide you with different information. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any free writing prospectus, as the case may be, or any sale of common shares.

For investors outside the United States: Neither we, nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common shares and the distribution of this prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

i

SCIENTIFIC AND TECHNICAL INFORMATION

Cautionary Note Regarding Presentation of Mineral Reserve and Mineral Resource Estimates

The U.S. Securities and Exchange Commission, or the SEC, adopted final rules in 2018 to amend and modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Act of 1933, as amended, or the Securities Act, or the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act. These amendments, which we refer to as the SEC Mining Modernization Rules, became effective February 25, 2019, with compliance, following a transition period, required for the first fiscal year beginning on or after January 1, 2021. Under the SEC Mining Modernization Rules, following the transition period, the historical property disclosure requirements for mining registrants included in SEC Industry Guide 7 has been rescinded and replaced with disclosure requirements in subpart 1300 of SEC Regulation S-K, or S-K 1300. Domestic companies and foreign private issuers that file reports with the SEC are now required to disclose mineral resources, mineral reserves, and material exploration results for material mining operations in accordance with S-K 1300.

As a Canadian foreign private issuer that is not eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, we are required to provide disclosure on our mineral properties under the SEC Mining Modernization Rules beginning with our fiscal year starting July 1, 2021. We provide that disclosure in this prospectus.

As a result of the adoption of the SEC Mining Modernization Rules, the SEC now recognizes estimates of “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding definitions under the CIM Standards that are required under NI 43-101. Information regarding inferred mineral resources contained or referenced in this prospectus now complies with the SEC disclosure guidelines adopted under the SEC Mining Modernization Rules as codified in S-K 1300 and should be comparable to similar information made public by other companies that report in accordance with U.S. or Canadian standards.

We are still in the exploration stage and our planned commercial operations have not commenced. There is currently no commercial production at our Thompson Brothers Lithium Project sites, which we refer to herein as the TBL property. We have completed a technical report that, we believe, is in compliance with the SEC’s new S-K 1300 disclosure rules. We have not yet completed a preliminary economic Assessment, or PEA, or started a preliminary feasibility study, or PFS, of the TBL property. As such, our TBL property’s’ estimated proven or probable mineral reserves, expected mine life and lithium pricing cannot be determined at this time as the feasibility studies, drilling and pit design optimizations have not yet been undertaken.

Competent Person Statement

Some scientific and technical information contained herein with respect to the Thompson Brothers Lithium Project is derived from the report titled “Technical Report Summary and Resource Estimate, Thompson Brothers Lithium Project, Snow Lake Area, Herb Lake Mining Division, Manitoba, Canada” prepared for us with an effective date of June 7, 2021. We refer to this report herein as our S-K 1300 Report or our S-K 1300 compliant indicated and inferred mineral resource report. Canmine Consultants and Nuterra Geoscience have approved and verified the scientific and technical information related to the Thompson Brothers Lithium Project contained in the S-K 1300 Report and reproduced in this prospectus.

ii

GLOSSARY OF MINING TERMS

The following is a glossary of certain mining terms that may be used in this prospectus.

| Ag | Silver. |

| Alluvial | A placer formed by the action of running water, as in a stream channel or alluvial fan; also said of the valuable mineral (e.g. gold or diamond) associated with an alluvial placer. |

| Assay | A metallurgical analysis used to determine the quantity (or grade) of various metals in a sample. |

| Au | Gold. |

| Claim | A mining right that grants a holder the exclusive right to search and develop any mineral substance within a given area. |

|

CIM |

The Canadian Institute of Mining, Metallurgy and Petroleum. |

| CIM Standards | The CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council from time to time. |

| Concentrate | A clean product recovered in flotation, which has been upgraded sufficiently for downstream processing or sale. |

| Core drilling | A specifically designed hollow drill, known as a core drill, is used to remove a cylinder of material from the drill hole, much like a hole saw. The material left inside the drill bit is referred to as the core. In mineral exploration, cores removed from the core drill may be several hundred to several thousand feet in length. |

| Cu | Copper. |

|

Competent Person |

A Competent Person is a minerals industry professional responsible for the preparation and/or signing off reports on exploration results and mineral resources and reserves estimates and who is accountable for the prepared reports. A Competent Person has a minimum of five years’ relevant experience in the style of mineralization or type of deposit under consideration and in the activity which that person is undertaking. A Competent Person must hold acceptable qualification titles as listed in all Reporting Codes and Reporting Standards (NRO Recognized Professional Organizations with enforceable disciplinary processes including the powers to suspend or expel a member) and thus is recognized by governments, stock exchanges, international entities and regulators. |

| Cut-off grade | When determining economically viable mineral reserves, the lowest grade of mineralized material that can be mined and processed at a profit. |

| Deposit | An informal term for an accumulation of mineralization or other valuable earth material of any origin. |

| Dilational structure | Structures composed of mechanisms whose only degree of freedom corresponds to dilation. |

| Drift | A horizontal or nearly horizontal underground opening driven along a vein to gain access to the deposit. |

| Dyke | A long and relatively thin body of igneous rock that, while in the molten state, intruded a fissure in older rocks. |

iii

|

En-echelon |

Structures within rock caused by noncoaxial shear. |

| Exploration | Prospecting, sampling, mapping, diamond drilling and other work involved in searching for ore. |

| Flotation | A milling process in which valuable mineral particles are induced to become attached to bubbles and float as others sink. |

| FS | A Feasibility Study is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable Modifying Factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a Pre-Feasibility Study. |

| Grade | Term used to indicate the concentration of an economically desirable mineral or element in its host rock as a function of its relative mass. With gold, this term may be expressed as grams per tonne (g/t) or ounces per tonne (opt). |

| Greywacke | A variety of sandstone generally characterized by its hardness, dark color, and poorly sorted angular grains of quartz, feldspar, and small rock fragments set in a compact, clay-fine matrix. |

| Ha | Hectare - An area totaling 10,000 square meters or 2.47 acres. |

| Indicated Mineral Resource | Part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. |

| Inferred Mineral Resource | Part of a mineral resource for which quantity and grade or quality can be estimated on the basis of limited geological evidence and sampling and reasonably implied, but not verified, geological and grade continuity. |

| Km | Kilometre(s). Equal to 0.62 miles. |

| kMT | Kilo metric tonne. |

| LCE | Lithium Carbonate Equivalent - Trade in lithium is largely centered around key lithium raw materials and chemicals such as spodumene concentrate, lithium carbonate and lithium hydroxide, which vary significantly in their lithium content. To normalize this varied lithium content data, market participants will often also report data in terms of a “lithium carbonate equivalent,” or “LCE.” |

| Lithologic | The character of a rock formation, a rock formation having a particular set of characteristics. |

| M | Metre(s). Equal to 3.28 feet. |

| Mafic | Igneous rocks composed mostly of dark, iron- and magnesium-rich minerals. |

iv

|

Massive |

Said of a mineral deposit, especially of sulfides, characterized by a great concentration of mineralization in one place, as opposed to a disseminated or vein-like deposit. |

| Measured Mineral Resource | Part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| Metallurgy | The science and art of separating metals and metallic minerals from their ores by mechanical and chemical processes. |

| Mineral | A naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form. |

| Mineral Deposit | A mass of naturally occurring mineral material, e.g. metal ores or nonmetallic minerals, usually of economic value, without regard to mode of origin. |

| Mineralization | A natural occurrence in rocks or soil of one or more yielding minerals or metals. |

| Mineral Project | The term “mineral project” means any exploration, development or production activity, including a royalty or similar interest in these activities, in respect of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base, precious and rare metals, coal, and industrial minerals. |

| Mineral Reserve | The economically mineable part of a Measured and/or Indicated Mineral Resource. |

| Mineral Resource | A concentration or occurrence of diamonds, natural, solid, inorganic or fossilized organic material including base and precious metals, coal and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. |

| Net Smelter Royalty | The aggregate proceeds received from time to time from any arm’s length smelter or other arm’s length purchaser from the sale of any ores, concentrates, metals or other material of commercial value, net of expenses. |

| Modifying Factors | Considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. |

| Mt | Metric tonne. Metric measurement of weight equivalent to 1,000 kilograms or 2,204.6 pounds. |

| NI 43-101 | National Instrument 43-101 is a national instrument for the Standards of Disclosure for Mineral Projects within Canada. The Instrument is a codified set of rules and guidelines for reporting and displaying information related to mineral properties owned by, or explored by, companies which report these results on stock exchanges within Canada. issuers that are subject to Canadian securities laws. This includes Canadian entities as well as foreign-owned mining entities who have securities that trade on stock exchanges or Over The Counter (OTC) markets overseen by the Canadian Securities Administrators (CSA), even if they only trade on Over The Counter (OTC) derivatives or other instrumented securities. |

v

|

Ore |

Mineralized material that can be extracted and processed at a profit. |

| Ounce | A measure of weight in gold and other precious metals, correctly troy ounces, which weigh 31.2 grams as distinct from an imperial ounce which weigh 28.4 grams. |

| PEA | Preliminary economic assessment. A study, other than a pre-feasibility or feasibility study, that includes an economic analysis of the potential viability of mineral resources. |

| Pegmatite | An igneous rock, formed by slow crystallization at high temperature and pressure at depth, and exhibiting large interlocking crystals usually greater in size than 2.5 cm (1 in). |

| PFS | Preliminary feasibility study. A Preliminary Feasibility Study is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the Modifying Factors and the evaluation of any other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be converted to a Mineral Reserve at the time of reporting. A Pre-Feasibility Study is at a lower confidence level than a Feasibility Study. |

| Probable Mineral Reserve | The mineable part of an indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. |

| Proven Mineral Reserve | The term “proven mineral reserve” is the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. |

| Qualified Person | An individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development, production activities and project assessment, or any combination thereof, including experience relevant to the subject matter of the project or report and is a member in good standing of a self-regulating organization. |

| Reclamation | Restoration of mined land to original contour, use, or condition where possible. |

| Spodumene | A pyroxene mineral consisting of lithium aluminium inosilicate, LiAl(SiO3)2, and is a source of lithium. |

| Sedimentary | Said of rock formed at the Earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited, or chemically precipitated. |

| Strike | The direction, or bearing from true north, of a vein or rock formation measure on a horizontal surface. |

| Tenement | A mineral claim. |

| Tonne | A metric ton of 1,000 kilograms (2,205 pounds). |

| μm | Micrometer. |

| Zn | Zinc. |

vi

This summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common shares. You should carefully read the entire prospectus, including the risks associated with an investment in our company discussed in the “Risk Factors” section of this prospectus, before making an investment decision. Some of the statements in this prospectus are forward-looking statements. See the section titled “Cautionary Statement Regarding Forward-Looking Statements.”

In this prospectus, “we,” “us,” “our,” “our company,” “Snow Lake” and similar references refer to Snow Lake Resources Ltd. and its consolidated subsidiaries.

Our Company

Our Mission

Snow Lake is committed to being the first fully renewable energy powered electric mine in the world that can deliver a completely traceable, conflict free, net zero carbon, battery grade lithium to the electric vehicle, or EV, consumer market. We aspire to not only set the standard for responsible lithium battery manufacturing but we intend to be the first lithium producer in the world to achieve Certified B Corporation status in the process. As a Certified B Corporation (defined on page 3), we would hope to participate in accelerating the global culture shift to redefine success in business and help to build a more inclusive and sustainable economy.

Overview

We are an exploration stage mining company engaged in lithium exploration in the province of Manitoba, Canada.

On March 7, 2019, we and Nova Minerals, our parent company, entered into a share sale agreement, whereby, as part of a group restructuring, we acquired all of the outstanding capital stock of Thompson Bros (Lithium) Pty Ltd., a wholly owned subsidiary of Nova Minerals and owner of the Thompson Brothers Lithium Project discussed below.

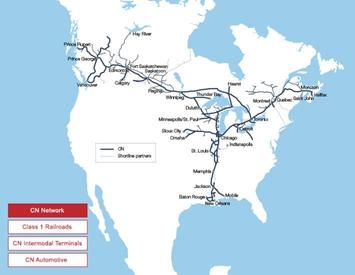

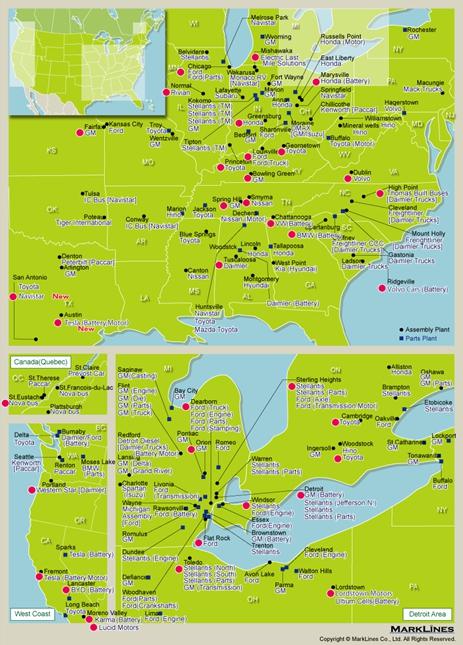

Our primary focus is currently conducting exploration for lithium at our 100% owned Thompson Brothers Lithium Project. See “Business – Our Mineral Project – Thompson Brothers Lithium Project.” Our objective is to develop a world-class lithium mine in Manitoba and to become the first fully energy renewable lithium hydroxide producer in North America, strategically located to supply the U.S. “Auto Alley,” from Michigan to the southern United States, and the European battery market via our nearby access to the Hudson Bay Railway and the Port of Churchill. With our commitment to the environment, corporate social responsibility and sustainability, we aim to derive substantial revenues from the sale of lithium hydroxide to the growing EV and battery storage markets in the U.S. and abroad. With access to renewable energy produced in Manitoba, we expect to become the first supplier in North America of lithium mined exclusively with the benefit of power produced from fully sustainable, local sources.

The Historical Setting for the Growth of Lithium Demand

The unprecedented prosperity of the 20th century is very much attributable to the discovery of oil in Western Pennsylvania in the mid-1800s and the subsequent invention of the internal combustion engine. The symbiotic relationship between oil and the internal combustion engine has been the underpinning of world economic growth, expansion and, most importantly, the empowerment of millions of people to whom mobility and freedom have become a way of life. The interstate highways that flourished in the United States over the past century have enabled commercial fluidity across the globe that capitalized exponentially on the gilded age of rail.

Until recently, a world without oil and the internal combustion engine was inconceivable and environmentalists protesting the high price being paid for our economic way of life, were brandished unrealistic luddites. The paradox of environmental sensitivity and the irreversible progress of a polluting population seemed permanently juxtaposed, until it wasn’t.

Today, we have reached the confluence where economic reality and social responsibility can finally meet. Thanks to technological innovation, through the development of the lithium battery we can now create an electric fleet of vehicles that not only delivers luxury and economy but is also ecologically friendly to our planet. We are now on the precipice of the next great economic age - preceded by the steam engine, the railroad, the combustion engine and the internet, we are now ready to be catapulted into the electric age. With the advent of the lithium battery, no longer will we have to rely on fossil fuel to power our economy or our cars as we embark into the next great age and, more importantly, we can limit and ultimately reverse the damage caused to our planet by the rapid economic expansion of the past century.

The Coming Commodity Supercycle and Growth in Lithium Demand

From our perspective, indications suggest that we are currently on the verge of a commodity supercycle fueled by pent up demand, infrastructure spending and post-COVID-19 economic exuberance. We expect that lithium, in particular, will benefit not only from a general rise in commodity demand but, specifically, from what we see as the tipping point for vehicle fleet electrification.

1

We believe that the journey now to the full electrification of our global automobile fleet has begun. Demand for EVs is being driven by conscious consumers who take the threat of global warming seriously and who have forced a universal commitment from the manufacturing industry to produce cars to match their environmentally conservative outlook. During the coming years, the achievement of this fleet conversion will be the primary challenge for the worldwide automobile industry and the determining factor will not be design or engineering, but batteries. Batteries will be the fuel and gold of the 21st century. Based on today’s predictions of the trajectory of future EV growth, the world will not have sufficient battery capacity to match growing demand. Today’s global fleet of approximately 1.4 billion automobiles includes 10 million plug in electric vehicles, an increase from only one million such EVs in 2015. Extrapolating the growth trajectory of EV demand, we believe that current industrial infrastructure is not scaled sufficiently to meet the coming demand.

Lithium is the key mineral ingredient in the power storage component of the EV revolution and the global demand growth curve for lithium consumption over the next decade is expected to be exponential. While normal commodity cycles are affected by incremental and organic growth, it is only once in a century that we witness new, previously nonexistent demand grow to accommodate a new economic, social and cultural reality.

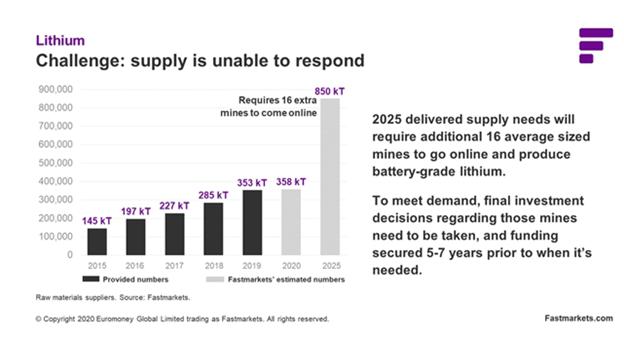

We believe that current global lithium production cannot cover a fraction of the projected exponential growth anticipated in the coming EV growth cycle and we intend to position our company to become a significant lithium supplier to the North American automotive industry and beyond.

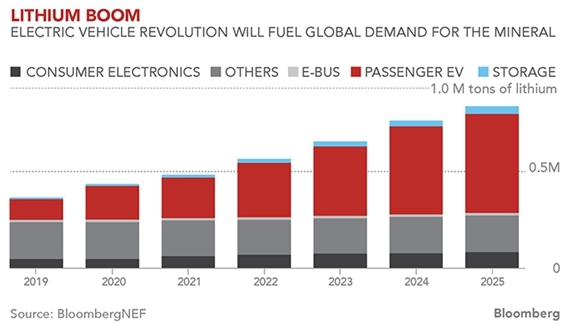

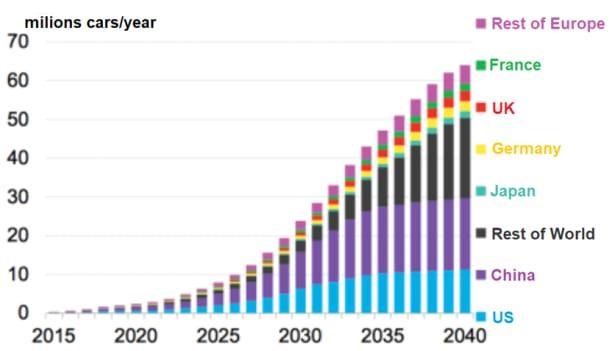

The table below shows the expected increase in lithium consumption through 2025.

As can be seen in this table, the leading driver for the growth in lithium consumption has been, and will continue to be, battery production for EVs. Fortune Business Insights has predicted that the EV market will exhibit a CAGR of 21.1% during the period from 2019 to 20261

Today, a large portion of the global lithium output is mined in diverse global locations such as Australia and Chile, transported great distances, primarily to China, for processing and then shipped again, back to the North American automobile industry. This is not a sustainable model and will not provide the necessary environmental or geopolitical comfort that will be required to electrify the global fleet of automobiles.

| 1 | https://www.globenewswire.com/news-release/2020/05/15/2034346/0/en/Electric-Vehicle-EV-Market-to-Rise-at-21-1- CAGR-till-2026-Product-Innovations-are-Leading-to-Wider-Adoption-says-Fortune-Business-Insights.html |

2

Our Corporate Strategy

Recently, EV auto makers have begun to face consumer scrutiny relating to the sourcing of materials, including lithium, that go into the makeup of electric vehicles. Additionally, in recent years, pressure has begun to be placed on EV auto makers by consumers and investors demanding that environmental, sustainability and governance, or ESG, standards be met in exchange for their investment dollars.

Extracting a natural resource to meet demand in an age old fashion similar to how other commodities are mined is not our approach. Today’s environmentally conscious consumers no longer want to be willfully ignorant of the sourcing and impact of the raw materials that are part of their everyday lives. Today’s conscious consumers of electric vehicles will not be satisfied by a pollution free means of transportation if the means to deliver that environmentally friendly car involve dubious mining ethics, pollutive extraction and processing, long distance logistics and general environmental damage in the process. It is understandable that consumers and investors who wish to see a sustainable future through EVs and sustainable lithium batteries would also care that their production does not put the environment, and their future, at unnecessary risk.

Snow Lake is committed to being the first, fully renewable energy powered electric mine in the world that can deliver fully traceable, conflict free, net zero carbon, battery grade lithium to the electric vehicle consumer market. We intend not only to set the standard for responsible battery manufacturing but also to become the first lithium producer in the world to achieve Certified B Corporation status in the process.

We intend to achieve our environmental, sustainability and governance friendly strategy through utilization and operation of the following initiatives and resources:

| ● | We have entered into a memorandum of understanding, or MOU, with Meglab Electronique Inc. for Meglab’s delivery to us of the first all electric lithium mine in the world. We have also entered into a MOU with CentrePort Canada Inc. to have CentrePort as the potential location to build our hydroxide plant. In April 2021, we entered into a MOU with IMG Investitions- und Marketinggesellschaft Sachsen-Anhalt mbH, the economic development agency for the state of Saxony-Anhalt, to consider investment in a lithium hydroxide plant in the Saxony-Anhalt region for final processing. We cannot guarantee, however, that the above nonbinding MOUs will lead to definitive agreements. |

| ● | Power to operate our future lithium mine is expected to be supplied by Manitoba Hydro on a 97% renewable basis; |

| ● | We are currently identifying sites within Manitoba for hydroxide processing of spodumene that will be powered by renewable energy sources; |

| ● | The Arctic Gateway Group’s Hudson Bay Railway lines are located within 30 kilometers of our TBL property will connect our lithium mining operations to the North American auto industry with a minimum carbon footprint, with total mine to manufacturer distance of less than 1,000 miles; and |

| ● | We intend to apply for “B Corporation” certification reflecting our corporate dedication to standards of social sustainability, environmental performance, accountability and transparency. A “Certified B Corporation” is a business that meets the highest standards of verified social and environmental performance, public transparency, and legal accountability to balance profit and purpose. We have begun the preliminary process to become a “pending” B corporation and expect to formally apply for B Corporation status approximately one year after we complete this offering and ramp up our operations. There can be no assurance at this time that we will receive “pending” B corporation status, that we will be able to apply for full B Corporation status within the time frame referenced above or that we will be successful in achieving B Corporation status. |

These factors will give us a competitive edge and first mover status in delivering a fully verifiable, environmentally friendly product to a rapid growth market that is consumer driven to demand a new level of transparency and responsibility.

Practical Steps

We have launched our PEA, which will include in depth metallurgy analysis, resource definition, engineering assessment and ore sorting optimization, among other studies, during the third calendar quarter of 2021. During the third or fourth quarter of 2021 we are planning to begin an additional drilling program to further expand our existing resource and a mag drone survey that will be partially financed by a grant from the Manitoba Government. In 2022 we intend to initiate our PFS with additional drilling exploration programs on the TBL property to survey historic drilling holes from Sherritt Gordon’s lithium discoveries more than 50 years ago, the records of which are intact. Also, we are beginning our environmental studies process during the later part of 2021 and sometime in 2022 we will begin the permitting for the start of our future mining operations. We are confident that we will confirm the historic mineralization assessments on the TBL property and be in a position to launch our mining operations during 2023.

3

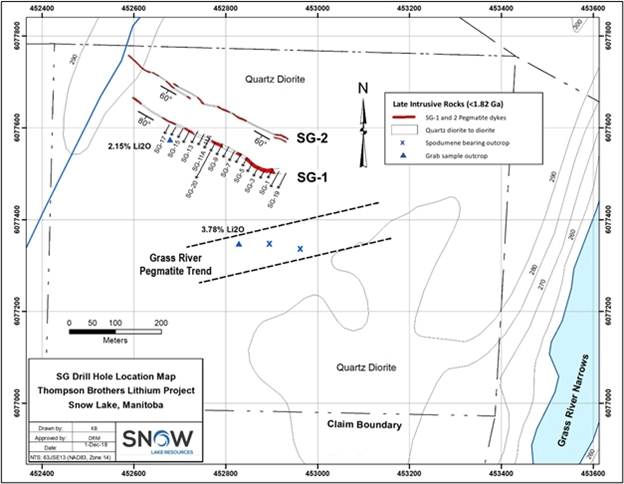

The Thompson Brothers Lithium Project

Our 100% owned Thompson Brothers Lithium Project consists of 38 contiguous mineral claims located on Crown land near Snow Lake, central Manitoba, Canada. We refer to this property as the Thompson Brothers Lithium property, or the TBL property. The TBL property encompasses two lithium-rich spodumene pegmatite clusters known as the Thompson Brothers and Sherritt Gordon, or SG, pegmatite dykes. A preliminary exploration program was conducted during 2017/2018 with respect to the Thompson Brothers dyke resulting in an S-K 1300 compliant updated estimate dated June 9, 2021 of an Indicated Resource of 9,082,600 tonnes of lithium bearing ore grading 1.00% Li2O, for 91,200 Li2O tonnes, and an Inferred Resource of 1,967,900 tonnes of lithium bearing ore grading 0.98% Li2O, for 19,300 Li2O tonnes. Further drilling will be required to determine whether the TBL property contains proven or probable mineral reserves, and then we will have to engage in economic modeling and analysis to determine the economic viability of the project. We expect that if the S-K 1300 compliant numbers are confirmed as probable or proven resources, a fully functioning lithium mine could provide 8 to10 years of producing 160k tonnes per annum of 6% lithium ore concentrate.

Our Opportunity

Our Thompson Brothers Lithium Project is strategically located in Manitoba, Canada, ideally situated to economically deliver mined and processed lithium products to the EV battery industry serving North America’s “Auto Alley” from Michigan to the southern United States. With direct rail access running north to the Port of Churchill, which supplies access to Europe by ship, we expect to be able to economically deliver our future lithium output to the markets of Europe as well. Preliminary exploration of our TBL property indicates a substantial S-K 1300 compliant indicated and inferred resource of lithium ore, and we have only explored 5% of the TBL property. We expect to prove this indicated and inferred resource in the near future through further exploration and technical analysis and reporting, although we can provide no guarantee that our indicated and inferred resource will be confirmed as proven or probable. With expected to be proven mineral resources and our prime location, and assuming we can raise the required capital (although this cannot be assured), successfully complete our preliminary economic assessment and preliminary feasibility study, obtain the required permitting and build a mine and ore concentrator, we expect to be able to produce economically significant amounts of marketable lithium ore concentrate in a socially responsible and environmentally friendly way utilizing renewable energy to power our mining operations. Assuming our successful execution of the required exploration and development steps and operating in accordance with our ESG corporate principals, we expect to be in a strong position to be able to exploit, through offtake agreements with OEM manufacturers, the anticipated rising demand for lithium hydroxide to meet the burgeoning needs of the EV battery and related markets in North America and beyond.

Our Competitive Strengths

We believe that the following competitive strengths contribute to our success and differentiate us from our competitors:

| ● | Our initial metallurgical test work yielded a spodumene concentrate grading 6.37% Li2O and our preliminary flotation tests indicate that a spodumene concentrate with +6.0% Li2O may be readily produced from the deposit. These preliminary findings suggest that our TBL property might contain lithium resources meeting industry and market specifications. For a discussion of this historical metallurgical test work, see “Business – Historical Mineral Processing and Metalurigcal Testing” below. |

| ● | Our TBL property is large, and we believe it is host to valuable lithium resources in commercial quantities. |

| ● | Access to Manitoba produced 97%+ renewable energy is expected to enable us to become the first supplier in North America of lithium mined exclusively with the benefit of fully renewable sources of energy. |

| ● | No significant technical challenges related to exploration and development of the deposits have been identified. |

| ● | We are strategically located in the North American market. |

| ● | Our operations are located in an exceptional mining friendly jurisdiction with excellent mining infrastructure. |

| ● | We have an experienced management team. |

| ● | The combination of the benefits of mining under a fully renewable energy ecosystem, location in a mining friendly jurisdiction, and strategic proximity to the major US EV manufacturing markets should make us an attractive source for offtake agreements with lithium battery and/or EV manufacturers who will need to secure their raw material supplies. |

4

Our Growth Strategies

We have developed a strategic plan for further exploration and development of the TBL property that includes the following milestones:

| ● | Complete resource update in accordance with the SEC’s new Mining Modernization Rules (field work completed) to expand and upgrade from Inferred to Indicated Resources. |

| ● | Complete Preliminary Economic Assessment, or PEA, study (began in the second quarter of 2021) to be followed by a Preliminary Feasibility Study, or PFS. |

| ● | Complete next stage of resource exploration drilling leading to resource upgrade to the Measured from Indicated level. |

| ● | Continue exploration of the TB1 dyke, which currently makes up our S-K 1300 compliant resource, to expand our known resource at this location. |

| ● | Restart exploration drilling at the Sherritt Gordon pegmatite dykes where preliminary exploration in the 1940s identified near surface spodumene deposits. Although no SG resources are included in our S-K 1300 compliant indicated and inferred mineral resource report, we expect that additional exploration of the SG dykes will result in the discovery of JORC reportable resources. |

| ● | Continue exploration of additional prospects located on our TBL property could add additional tonnage through further drilling. We also intend to explore for extensions to the existing mineral resources and other potential mineralization within the TBL property. |

Our Risks and Challenges

Our prospects should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

Risks Related to Our Business and Industry

Risks and uncertainties related to our business and industry include, but are not limited to, the following:

| ● | We have a limited operating history and have not yet generated any revenues; | |

| ● | Our financial statements have been prepared on a going concern basis and our financial status creates a doubt whether we will continue as a going concern; | |

| ● | If we do not obtain additional financing, our business may be at risk or execution of our business plan may be delayed; | |

| ● | The coronavirus pandemic may cause a material adverse effect on our business; | |

| ● | All of our business activities are now in the exploration stage and there can be no assurance that our exploration efforts will result in the commercial development of lithium hydroxide; | |

| ● | Our mineral resources described in our most recent S-K 1300 compliant indicated and inferred mineral resource report are only estimates and no assurance can be given that the anticipated tonnages and grades will be achieved, or that the indicated level of recovery will be realized. Although S-K 1300 compliant, there has been insufficient drilling on the TBL property to qualify our inferred resource under the SEC’s new Mining Modernization Rules. Further drilling will be required to determine whether the TBL property contains proven or probable mineral reserves and there can be no assurance that we will be successful in our efforts to prove our resource; |

5

| ● | Mineral exploration and development are subject to extraordinary operating risks. We currently do not insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which could have an adverse impact on us; | |

| ● | Our business operations are exposed to a high degree of risk associated with the mining industry; | |

| ● | We may not be able to obtain or renew licenses or permits that are necessary to our operations; | |

| ● | Our TBL Property may face indigenous land claims; | |

| ● | Volatility in lithium prices and lithium demand may make it commercially unfeasible for us to develop our Thompson Bros Lithium Project; | |

| ● | There can be no guarantee that our interest in the TBL property is free from any title defects; | |

| ● | Our mining operations are dependent on the adequate and timely supply of water, electricity or other power supply, chemicals and other critical supplies; | |

| ● | We currently report our financial results under IFRS, which differs in certain significant respect from U.S. generally accepted accounting principles; | |

| ● | Our directors and officers are engaged in other business activities and accordingly may not devote sufficient time to our business affairs, which may affect our ability to conduct operations and generate revenue; and | |

| ● | In the event that key personnel leave our company, we would be harmed since we are heavily dependent upon them for all aspects of our activities. |

Risks Related to This Offering and Ownership of Our Common Shares

Risks and uncertainties related to this offering and our Common Shares include, but are not limited to, the following:

| ● | We have considerable discretion as to the use of the net proceeds from this offering and we may use these proceeds in ways with which you may not agree; | |

| ● | If through additional drilling we are not able to prove our resource according to the SEC’s new Mining Modernization Rules, your investment in our common shares could become worthless; | |

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions against us or our management named in the prospectus based on foreign laws; | |

| ● | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies; | |

| ● | As a foreign private issuer, we are permitted to rely on exemptions from certain Nasdaq corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our shares; | |

| ● | Our parent company will own a majority of our outstanding common shares after this offering. As a result, it will have the ability to approve all matters submitted to our shareholders for approval; and | |

| ● | Future issuances of debt securities, which would rank senior to our common shares upon our bankruptcy or liquidation, and future issuances of preferred shares, which could rank senior to our common shares for the purposes of dividends and liquidating distributions, may adversely affect the level of return you may be able to achieve from an investment in our common shares. |

6

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of operations. You should consider the risks discussed in “Risk Factors” and elsewhere in this prospectus before investing in our common shares.

Our Corporate Structure

We were incorporated in the Province of Manitoba, Canada under The Corporations Act (Manitoba), or MCA, on May 25, 2018 by our parent company Nova Minerals Limited. Prior to this offering, Nova Minerals owned approximately 74% of our outstanding common shares. Nova Minerals has agreed to lock up its holdings of our common shares for a period of 180 days from the date of effectiveness of the registration statement of which this prospectus forms a part.

We have three wholly owned subsidiaries, Snow Lake Exploration Ltd., or Snow Lake Exploration, Snow Lake Crowduck Ltd., or Snow Lake Crowduck, and Thompson Bros (Lithium) PTY Ltd. (formerly Manitoba Minerals Pty Ltd), or Thompson Bros. Through a series of agreements between 2016 to 2019 we acquired a 100% interest in the TBL property. Our subsidiary, Thompson Bros, which owned our 20 Block A claims before they were transferred to Snow Lake Crowduck, has been deregistered in Australia and Manitoba.

Corporate Information

Our corporate address is 242 Hargrave St #1700, Winnipeg, MB R3C 0V1 Canada. Our company email address is [email protected].

Our registered office is located at 242 Hargrave St #1700, Winnipeg, MB R3C 0V1 Canada.

Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, N.Y. 10168.

Our website can be found at https://snowlakelithium.com. The information contained on our website is not a part of this prospectus, nor is such content incorporated by reference herein, and should not be relied upon in determining whether to make an investment in our common shares.

Implications of Being an Emerging Growth Company

Upon the completion of this offering, we will qualify as an “emerging growth company” under the Jumpstart Our Business Act of 2012, as amended, or the JOBS Act. As a result, we will be permitted to, and intend to, rely on exemptions from certain disclosure requirements. These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act of 2002 in the assessment of the emerging growth company’s internal control over financial reporting. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year during which we have total annual gross revenues of at least US$1.07 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (iii) the date on which we have, during the preceding three year period, issued more than US$1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which could occur if the market value of our common shares that are held by non-affiliates exceeds US$700 million as of the last business day of our most recently completed second fiscal quarter. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

7

Implications of Being a Foreign Private Issuer

Once the registration statement of which this prospectus is a part is declared effective by the SEC, we will become subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements we will file certain reports with the SEC. As a foreign private issuer, we will not be subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we will be subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, although we report our financial results on a quarterly basis, we will not be required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also will have four months after the end of each fiscal year to file our annual reports with the SEC and we will not be required to file current reports as frequently or promptly as U.S. domestic reporting companies. We also present our financial statements pursuant to International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, instead of pursuant to U.S. generally accepted accounting principles. Furthermore, our officers, directors and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we will also not be subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we will be permitted, and intend to follow certain home country corporate governance practices instead of those otherwise required under the listing rules of Nasdaq for domestic U.S. issuers. These exemptions and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable to a U.S. domestic reporting companies.

Notes on Prospectus Presentation

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. Certain market data and other statistical information contained in this prospectus are based on information from independent industry organizations, publications, surveys and forecasts. Some market data and statistical information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources listed above, our internal research and our knowledge of the Canadian mining industry. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

Our reporting currency and our functional currency is Canadian dollar. This prospectus contains translations of Canadian dollars into U.S. dollars at specific rates solely for the convenience of the reader. Unless otherwise noted, all translations from Canadian dollars into U.S. dollars in this prospectus were made at a rate of C$1.2404 per US$1.00, the noon buying rate as set forth in the H.10 statistical release of the U.S. Federal Reserve Board in effect as of June 30, 2021. On October 15, 2021, the noon buying rate for Canadian dollar was C$1.2387 per US$1.00. We make no representation that the Canadian dollar or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Canadian dollar, as the case may be, at any particular rate or at all.

All references in the prospectus to “U.S. dollars,” “dollars,” “US$” and “$” are to the legal currency of the United States and all references to “C$” are to the legal currency of Canada.

Annual Meeting of Shareholders

On September 17, 2021, we held our Annual Meeting of Shareholders via video conference on September 17, 2021 at 3:00 pm (EDT). A total of 10,740,424 (post consolidation) Class A common shares representing 82.5% of the aggregate shares outstanding and eligible to vote and constituting a quorum were represented in person or by valid proxies at the annual meeting.

The Shareholders of the Company approved the special resolutions to increase the range of number of Directors of our Company set out in Box 3 of the Articles of Incorporation from 1 to 5, to 1 to 9. In addition, the shareholders voted in favor of the 1-for-5 Reverse Split (as defined below). The share capital of our Company was streamlined by deleting each of the Class B Common, Class C Common, Class D Common, Class B Preference and Class C Preference classes of shares, and renaming the Class A Common and Class A Preference shares as common shares and preference shares, respectively. David Delaney and Allan David Engel were each elected as independent directors of our Company to serve until the next annual meeting of shareholders. De Visser Gray LLP were appointed as auditors of our Company until the next annual meeting of shareholders.

The Company filed the Articles of Amendment with the Companies Office, Province of Manitoba, on October 7, 2021.

On October 14, 2021, David Delaney submitted his resignation as a director of the Company and the directors appointed Hadassah Slater as an independent director of our Company to serve until the next annual meeting of shareholders.

Share Consolidation (a “Reverse Split”)

On October 7, 2021, we effectuated a one-for-five reverse stock split of our common shares, or the Reverse Split. The Reverse Split combined each five of our common shares into one common share. Fractional shares will not be issued to any existing shareholder in connection with the Reverse Split, but the Company will purchase from each existing shareholder the right to such fractional share that would have been issued, at a price based on the initial public offering price. The right to fractional shares which the Company will purchase resulting from the Reverse Split, in the aggregate, is less than ten (10) common shares. The historical audited financial statements included elsewhere in this prospectus have been adjusted for the Reverse Split. Unless otherwise indicated, all other share and per share data in this prospectus have been retroactively adjusted, where applicable, to reflect the Reverse Split as if it had occurred as at the June 30, 2019 fiscal year end. References to “post-consolidation” below are references to the number of our common shares after giving effect to this share consolidation.

8

The Offering

| Shares offered | 3,200,000 common shares at an initial public offering price of US$7.50 per share | |

| Common shares outstanding immediately before the offering | 13,010,176 (post-consolidation and subject to rounding of fractional shares) common shares. | |

| Common shares outstanding immediately after the offering | 16,210,176 common shares (or 16,690,176 common shares if the underwriters exercise the over-allotment option in full). | |

| Over-allotment option | We have granted to the underwriters a 45-day option to purchase from us up to an additional 480,000 shares at the initial public offering price, less the underwriting discounts and commissions. | |

| Use of proceeds |

We expect to receive net proceeds of approximately US$21.77 million from this offering, at an initial public offering price of US$7.50 per share and no exercise of the underwriters’ over-allotment option, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We plan to use the net proceeds of this offering for resource development activities including additional exploratory drilling, the preparation of a PEA, other technical studies and reports, possible strategic project acquisitions, and marketing and general corporate purposes. See “Use of Proceeds” for more information on the use of proceeds. | |

| Risk factors | Investing in our common shares involves a high degree of risk and purchasers of our common shares may lose part or all of their investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our common shares. | |

| Lock-up | We, all of our directors and officers and shareholders holding more than 97% of our outstanding common shares on a fully-diluted basis, have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our common shares or securities convertible into or exercisable or exchangeable for our common shares for a period of (i) 180 days after the closing of this offering in the case of our company, (ii) 12 months after the date of this prospectus in the case of our directors and officers, and (iii) 180 days after the date of this prospectus in the case of our shareholders, including our majority owner, Nova Minerals. See “Underwriting” for more information. | |

| Proposed trading market and symbol | Our Common Shares have been approved for listing on the Nasdaq Capital Market under the symbol “LITM.” |

The number of common shares outstanding immediately following this offering is based on 13,010,176 (post-consolidation and subject to rounding of fractional shares) shares outstanding as of November 18, 2021 and excludes (on a post-consolidation basis and subject to rounding of fractional shares, as applicable):

| ● | 820,000 common shares issuable upon the exercise of outstanding options under our Amended and Restated Stock Option Plan at a weighted average exercise price of C$2.50 (approximately US$2.02) per share; |

| ● | 1,586,732 additional common shares that are reserved for future issuance under our Amended and Restated Stock Option Plan; |

| ● | 864,525 common shares issuable upon the exercise of outstanding warrants at a weighted average exercise price of C$1.55 (approximately US$1.25) per share; |

| ● | 240,000 common shares reserved for issuance under a restricted stock award agreement with our Chief Executive Officer, Philip Gross; |

| ● | Approximately 751,163 common shares issuable upon the conversion of outstanding convertible debentures; and |

| ● | up to 184,000 common shares issuable upon exercise of the representative’s warrants issued in connection with this offering. |

9

Summary Consolidated Financial Information

The following selected historical financial information should be read in conjunction with our consolidated financial statements and related notes included elsewhere in the prospectus and the information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below.

The following summary consolidated financial data as of June 30, 2021 and 2020. This information is derived from our audited consolidated financial statements and our interim six-month consolidated financial statements included elsewhere in this prospectus.

Our financial statements are prepared and presented in accordance with IFRS. Our historical results for any period are not necessarily indicative of our future performance.

| Years Ended June 30, | ||||||||||||

| 2020 | 2021 | 2021 | ||||||||||

| Statements of Loss Data | C$ | C$ | US$ | |||||||||

| Total operating expenses | (247,364 | ) | (595,598 | ) | (480,166 | ) | ||||||

| Total other income (loss) | 65,248 | 43,162 | 34,797 | |||||||||

| Net loss | (182,116 | ) | (552,436 | ) | (445,369 | ) | ||||||

| Net loss per share – basic and diluted | (0.01 | ) | (0.04 | ) | (0.03 | ) | ||||||

| Weighted average shares outstanding – basic and diluted | 13,007,995 | 13,008,669 | 13,008,669 | |||||||||

| As of June 30, | ||||||||||||

| 2020 | 2021 | 2021 | ||||||||||

| Statements of Financial Position Data | C$ | C$ | US$ | |||||||||

| Cash | 143,089 | 318,844 | 257,049 | |||||||||

| Current assets | 154,480 | 397,461 | 320,430 | |||||||||

| Total assets | 5,551,359 | 6,127,685 | 4,940,088 | |||||||||

| Current liabilities | 343,734 | 1,374,819 | 1,108,367 | |||||||||

| Total liabilities | 343,734 | 1,374,819 | 1,108,367 | |||||||||

| Shareholders’ equity | 5,207,625 | 4,752,866 | 3,831,720 | |||||||||

| Total liabilities and shareholders’ equity | 5,551,359 | 6,127,685 | 4,940,088 | |||||||||

10

An investment in our common shares involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this prospectus, before purchasing our common shares. We have listed below (not necessarily in order of importance or probability of occurrence) what we believe to be the most significant risk factors applicable to us, but they do not constitute all of the risks that may be applicable to us. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section titled “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

We have a limited operating history and have not yet generated any revenues.

Our limited operating history makes evaluating our business and future prospects difficult, and may increase the risk of your investment. We were formed in May 2018 and we have not yet begun commercial production of lithium hydroxide. To date, we have no revenues. We are in the exploration stage of our development with the potential to establish commercial operations still an unknown. We intend to proceed with the development of the TBL property through to economic studies such as PEAs and PFSs and, provided the results are positive, through to mine development. We intend in the longer term to derive substantial revenues from becoming a strategic supplier of battery-grade lithium hydroxide to the growing electric vehicle and battery storage markets. Our company is in the exploration stage, and we do not expect to start generating revenues until the fourth quarter of 2024, at the earliest. Our planned exploration and development of mineral resources, primarily lithium, will require significant investment prior to commercial introduction and may never be successfully developed or commercially successful.

Our financial statements have been prepared on a going concern basis and our financial status creates a doubt whether we will continue as a going concern.

Our financial statements have been prepared on a going concern basis under which an entity is considered to be able to realize its assets and satisfy its liabilities in the ordinary course of business. Our future operations are dependent upon the identification and successful completion of equity or debt financing and the achievement of profitable operations at an indeterminate time in the future. There can be no assurances that we will be successful in completing an equity or debt financing or in achieving or maintaining profitability. The financial statements do not give effect to any adjustments relating to the carrying values and classification of assets and liabilities that would be necessary should we be unable to continue as a going concern.

If we do not obtain additional financing, our business may be at risk or execution of our business plan may be delayed.

We have limited assets upon which to commence our business operations and to rely otherwise. As of June 30, 2021, we had cash of C$318,844 (approximately US$ 257,049) and during the fiscal year ended June 30, 2021, and 2020, we had a net loss of C$552,436 (approximately US$445,369) and C$182,116, respectively. Given our net losses and with only these funds, we will need to seek additional funds in the future through equity or debt financings, or strategic alliances with third parties, either alone or in combination with equity financings to complete our lithium exploration initiative. Additional funding will be needed to implement our business plan that includes various expenses such as continuing our mining exploration program, legal, operational set-up, general and administrative, marketing, employee salaries and other related start-up expenses. Obtaining additional funding will be subject to various factors, including general market conditions, investor acceptance of our business plan and ongoing results from our exploration efforts. These financings could result in substantial dilution to the holders of our common shares, or require contractual or other restrictions on our operations or on alternatives that may be available to us. If we raise additional funds by issuing debt securities, these debt securities could impose significant restrictions on our operations. Any such required financing may not be available in amounts or on terms acceptable to us, and the failure to procure such required financing could have a material and adverse effect on our business, financial condition and results of operations, or threaten our ability to continue as a going concern.

We may not be able to acquire additional funds on acceptable terms, or at all. If we are unable to raise adequate funds, we may have to delay, reduce the scope of or eliminate some or all of our planned exploration programs. If we do not have, or are not able to obtain, sufficient funds, we may be required to delay further exploration, development or commercialization of our expected mineral resources, if and when verified. We also may have to reduce the resources devoted to our mining efforts or cease operations. Any of these factors could harm our operating results.

11

The coronavirus pandemic may cause a material adverse effect on our business.

In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China. The virus has since spread to more than 150 countries. On March 11, 2020, the World Health Organization declared the outbreak a pandemic. On March 11, 2020, the federal government of Canada announced a $1 billion package to help Canadians through the health crisis. To date, there have been a large number of temporary business closures, quarantines and a general reduction in consumer activity in Canada.

As a result of the measures adopted by the Province of Manitoba and the federal government of Canada, certain of our mining exploration activities have been delayed. The access to investor capital as well as the potential for a 14-day quarantine when travelling into the Province of Manitoba have discouraged us from engaging in certain exploration activities in the near term. As a result of these unexpected delays, we had placed our focus on completing lab work and technical report writing using the field data that we have previously compiled. In August 2021, members of our team made a site visit to Manitoba and conducted mapping and prospecting and in October 2021 additional members of our team visited the site. Subject to the consummation of this offering, we plan to undertake an exploratory core drilling program and test sampling beginning toward the end of December 2021 or during the first quarter of 2022.

The spread of the virus in many countries continues to adversely impact global economic activity and has contributed to significant volatility and negative pressure in financial markets and supply chains. The pandemic has had, and could have a significantly greater, material adverse effect on the Canadian economy as a whole, as well as the local economy where we conduct our operations. The pandemic has resulted, and may continue to result for an extended period, in significant disruption of global financial markets, which may reduce our ability to access capital in the future, which could negatively affect our liquidity.

If the current pace of the pandemic cannot be slowed and the spread of the virus is not contained, our business operations could be further delayed or interrupted. We expect that government and health authorities may announce new or extend existing restrictions, which could require us to make further adjustments to our operations in order to comply with any such restrictions. We may also experience limitations in employee resources. In addition, our operations could be disrupted if any of our employees were suspected of having the virus, which could require quarantine of some or all such employees or closure of our facilities for disinfection. We may also delay or reduce certain capital spending and related projects until the travel and logistical impacts of the pandemic are lifted, which will delay the completion of such projects. The duration of any business disruption cannot be reasonably estimated at this time but may materially affect our ability to operate our business and result in additional costs.

The extent to which the pandemic may impact our results will depend on future developments, which are highly uncertain and cannot be predicted as of the date of this prospectus, including new information that may emerge concerning the severity of the pandemic and steps taken to contain the pandemic or treat its impact, among others. Nevertheless, the pandemic and the current financial, economic and capital markets environment, and future developments in the global lithium mining and other areas present material uncertainty and risk with respect to our performance, financial condition, results of operations and cash flows.

Our business is subject to operational risks that are generally outside of our control and could adversely affect our business.

Mineral mining sites, like the sites where our TBL property is located, by their nature are subject to many operational risks and factors that are generally outside of our control and could adversely affect our business, operating results and cash flows. These operational risks and factors include the following:

| ● | unanticipated ground and water conditions; |

| ● | adverse claims to water rights and shortages of water to which we have rights; |

| ● | adjacent land ownership that results in constraints on current or future operations; |

| ● | geological problems, including earthquakes and other natural disasters; |

| ● | metallurgical and other processing problems; |

| ● | the occurrence of unusual weather or operating conditions and other force majeure events; |

12

| ● | lower than expected ore grades or recovery rates; |

| ● | accidents; |

| ● | delays in the receipt of or failure to receive necessary government permits; |

| ● | the results of litigation, including appeals of agency decisions; |

| ● | uncertainty of exploration and development; |

| ● | delays in transportation; |

| ● | interruption of energy supply; |

| ● | labor disputes; |

| ● | inability to obtain satisfactory insurance coverage; and |

| ● | the failure of equipment or processes to operate in accordance with specifications or expectations. |

Any one or more of these factors or other risks could cause us not to realize the anticipated benefits of an acquisition of properties or companies and could have a material adverse effect on our financial condition.

All of our business activities are now in the exploration stage and there can be no assurance that our exploration efforts will result in the commercial development of lithium hydroxide.

All of our operations are at the exploration stage and there is no guarantee that any such activity will result in commercial production of lithium mineral deposits. Very limited drilling has been conducted on our TBL property to date, which makes the extrapolation of an S-K 1300 compliant indicated or inferred resource to an S-K 1300 probable or proven reserve and to commercial viability impossible without further drilling. We intend to engage in that additional exploratory drilling with proceeds from this offering but we can provide no assurance of future success from our planned additional drilling program. The exploration for lithium deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to locate and establish proven mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration programs planned by us or any future development programs will result in a profitable commercial mining operation. There is no assurance that our mineral exploration activities will result in any discoveries of commercial quantities of lithium. There is also no assurance that, even if commercial quantities of ore are discovered, a mineral property will be brought into commercial production. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure, metal prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted. Our long-term profitability will be in part directly related to the cost and success of our exploration programs and any subsequent development programs.

Our mineral resources or reserves may be significantly lower than expected.

We are in the exploration stage and our planned principal operations have not commenced. There is currently no commercial production on the TBL property and we have not yet completed a preliminary economic assessment or a preliminary feasibility study. As such, our estimated proven or probable mineral reserves, expected mine life and lithium pricing cannot be determined as the exploration program, drilling, economic assessment and feasibility studies and pit (or mine) design optimizations have not yet been undertaken, and the actual mineral reserves may be significantly lower than expected. You should not rely on the S-K 1300 compliant technical report, PEAs or PFSs, if and when completed and published, as indications that we will have successful commercial operations in the future. Even if we prove reserves on the TBL property, we cannot guarantee that we will be able to develop and market them, or that such production will be profitable.

13

The estimation of lithium reserves is not an exact science and depends upon a number of subjective factors. Any indicated or inferred resource figures presented in this prospectus are estimates from the written reports of technical personnel and mining consultants who were contracted to assess the mining prospects. Resource estimates are a function of geological and engineering analyses that require us to forecast production costs, recoveries, and metals prices. The accuracy of such estimates depends on the quality of available data and of engineering and geological interpretation, judgment, and experience. Estimated indicated or inferred lithium resources may not be upgraded to indicated or measured or to probable or proved reserves, and any reserves may not be realized in actual production and our operating results may be negatively affected by inaccurate estimates. Additionally, resource estimates do not determine the economics of a mining project and, although we have begun to prepare a preliminary economic assessment, even once the PEA is produced we cannot guarantee that it will reflect positive economics for our mining resources or that we will be able to execute our plans to create an economically viable mining operation.

Our mineral resources described in our most recent S-K 1300 compliant indicated and inferred mineral resource report are only estimates and no assurance can be given that the anticipated tonnages and grades will be achieved, or that the indicated level of recovery will be realized.