Form 424B3 Li-Cycle Holdings Corp.

Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-267419

PROSPECTUS

Li-Cycle Holdings Corp.

Secondary Offering of

96,579,362 Common Shares

This prospectus relates to the offer and sale from time to time by the selling shareholders named in this prospectus or their permitted transferees (collectively, the “selling shareholders”) of up to 96,579,362 common shares, without par value (the “common shares”) of Li-Cycle Holdings Corp., an Ontario corporation (“we” or the “Company”). This prospectus covers any additional securities that may become issuable by reason of share splits, share dividends, and other events described herein.

The common shares covered by this prospectus that may be offered and sold by the selling shareholders include (i) 59,113,532 common shares issued to certain former shareholders and optionholders of Li-Cycle Corp., an Ontario corporation, at the closing of the business combination by and among the Company, Li-Cycle Corp., and Peridot Acquisition Corp., an Ontario corporation (“Peridot”), on August 10, 2021, as a result of which the Company became a new public company (the “Business Combination”), (ii) 7,500,000 common shares issued to Peridot Class B Holders (as defined herein) in connection with the Business Combination, (iii) 1,586,720 common shares issued following the exercise of private placement warrants (the “private placement warrants”) held by Peridot Acquisition Sponsor, LLC, a Delaware limited liability company (the “Sponsor”), (iv) 12,056,835 common shares issued to certain institutions and accredited investors in the PIPE Financing (as defined herein), (v) 11,021,923 common shares issuable upon conversion of outstanding unsecured convertible notes held by a selling shareholder (the “2021 Convertible Notes”) or pursuant to any other term of the 2021 Convertible Notes, including as a result of any of the payment-in-kind (“PIK”) provisions of the 2021 Convertible Notes, and (vi) 5,300,352 common shares issued pursuant to the LG Subscription (as defined herein).

We are registering the offer and sale of the common shares covered by this prospectus to satisfy certain registration rights we have granted to the selling shareholders. The selling shareholders may offer all or part of the common shares covered by this prospectus for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. These common shares are being registered to permit the selling shareholders to sell common shares from time to time, in amounts, at prices and on terms determined at the time of offering. The selling shareholders may sell these common shares through an underwritten offering, ordinary brokerage transactions, directly to market makers of our common shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of common shares offered hereunder, the selling shareholders and any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). If our common shares are sold through underwriters or broker-dealers, the selling shareholders will be responsible for underwriting discounts or commissions or agent’s commissions.

All of the common shares offered by the selling shareholders pursuant to this prospectus will be sold by the selling shareholders for their respective accounts. We will not receive any of the proceeds from these sales.

We will pay certain expenses associated with the registration of the common shares covered by this prospectus, as described in the section entitled “Plan of Distribution.”

Our common shares are currently listed on The New York Stock Exchange under the symbol “LICY”. On September 13, 2022, the last reported sale price of our common shares as reported on The New York Stock Exchange was $7.11 per common share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are currently an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, are subject to reduced public company reporting requirements. We are also a “foreign private issuer” and will report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies.

Our principal executive offices are located at 207 Queen’s Quay West, Suite 590, Toronto, Ontario , M5J 1A7, Canada.

Investing in our common shares involves a high degree of risk. Before buying any common shares, you should carefully read the discussion of material risks of investing in our common shares in the section entitled “Risk Factors” beginning on page 10 of this prospectus and the other information included or incorporated by reference in the prospectus and the applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these common shares or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated September 26, 2022

Table of Contents

| Page | ||||

| 1 | ||||

| 10 | ||||

| 33 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| DESCRIPTION OF AMENDED AND RESTATED COMPANY ORGANIZATIONAL DOCUMENTS |

43 | |||

| 48 | ||||

| 56 | ||||

| 61 | ||||

| 63 | ||||

| 67 | ||||

| 69 | ||||

| 69 | ||||

| 69 | ||||

| 69 | ||||

| 71 | ||||

| 72 | ||||

You should rely only on the information contained in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement. Neither we, nor the selling shareholders, have authorized any other person to provide you with different or additional information. Neither we, nor the selling shareholders, take responsibility for, nor can we provide assurance as to the reliability of, any other information that others may provide. The selling shareholders are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus, any applicable prospectus supplement or any documents incorporated by reference, is accurate only as of the date of the applicable document or such other date stated in the applicable document, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

Except as otherwise set forth in this prospectus, neither we nor the selling shareholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-3 that we filed with the United States Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. The selling shareholders named in this prospectus may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus includes important information about us, the common shares, the securities being offered by the selling shareholders and other information you should know before investing. Any prospectus supplement may also add, update, or change information in this prospectus. If there is any inconsistency between the information contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular prospectus supplement. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC.

Information on the website of the Company is not included or incorporated by reference in the registration statement of which this prospectus forms a part.

To the extent required, we and the selling shareholders, as applicable, will deliver a prospectus supplement with this prospectus to update the information contained in this prospectus. The prospectus supplement may also add, update or change information included in this prospectus. You should read both this prospectus and any applicable prospectus supplement, together with additional information described below under the captions “Where You Can Find More Information” and “Documents Incorporated by Reference.”

No offer of these securities will be made in any jurisdiction where the offer is not permitted.

BASIS OF PRESENTATION

Our fiscal year consists of twelve months ending October 31. Accordingly, references herein to “2019 fiscal year” relate to the twelve months ended October 31, 2019, references herein to “2020 fiscal year” relate to the twelve months ended October 31, 2020, references herein to “2021 fiscal year” relate to the twelve months ended October 31, 2021 and references herein to “2022 fiscal year” relate to the twelve months ended October 31, 2022. Our fiscal quarters consist of the three months ending on January 31, April 30, July 31 and October 31. References to any given year in this prospectus will be to a calendar year, and not a fiscal year, unless otherwise noted.

IMPORTANT INFORMATION ABOUT IFRS

Our financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and referred to in this prospectus as “IFRS.”

INDUSTRY AND MARKET DATA

In this prospectus, we rely on and refer to industry data, information and statistics regarding the markets in which we compete, as well as from publicly available information, industry and general publications and research and studies conducted by third parties. We have supplemented this information where necessary with our own internal estimates, considering publicly available information about other industry participants and our management’s best view as to information that is not publicly available. We have taken such care as we consider reasonable in the extraction and reproduction of information from such data from third party sources.

Industry publications, research, studies, forecasts and estimates generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts, estimates and other forward-looking information obtained from these

ii

Table of Contents

sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts, estimates and other forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under the section titled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the forecasts, estimates or other forward-looking information from independent third parties and us.

iii

Table of Contents

FREQUENTLY USED TERMS

As used in this prospectus, unless the context otherwise requires or indicates otherwise, references to “we,” “us,” “our,” “Li-Cycle” or the “Company” refer to Li-Cycle Holdings Corp., an Ontario corporation, and its consolidated subsidiaries.

In this document:

“2021 Convertible Notes” means the KSP Note together with any PIK Notes issued in satisfaction of interest due and payable thereon.

“Alabama Spoke” means Li-Cycle’s Spoke near Tuscaloosa, Alabama that is currently under development and construction.

“Amalgamation” means the amalgamation of Peridot Ontario and NewCo in accordance with the terms of the Arrangement.

“Arizona Spoke” means Li-Cycle’s operational Spoke in Gilbert, Arizona, which opened on May 17, 2022.

“Arrangement” means the plan of arrangement (including the Business Combination) in substantially the form attached as Annex C to the proxy statement/prospectus forming a part of the registration statement on Form F-4, filed by the Company with the SEC on July 6, 2021.

“black mass” means a powder-like substance, which contains a number of valuable metals, including nickel, cobalt and lithium.

“Business Combination” means the transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated as of February 15, 2021, as amended, by and among Peridot, Li-Cycle Corp. and NewCo.

“Closing Date” means the closing date of the Business Combination.

“common shares” means the common shares of the Company, without par value.

“Continuance” means the continuance of Peridot from the Cayman Islands under the Companies Act to the Province of Ontario, Canada as a corporation existing under the OBCA.

“EV” means electric vehicles.

“Germany Spoke” means Li-Cycle’s planned Spoke in Germany that is currently under development.

“Glencore” means Glencore Ltd.

“Glencore Convertible Note” means the unsecured convertible note due May 31, 2027 issued to Glencore. pursuant to the Glencore Note Purchase Agreement on May 31, 2022.

“Glencore Note Purchase Agreement” means the note purchase agreement, dated as of May 5, 2022, between the Company and Glencore Ltd.

“Glencore Warrants” means warrants to be issued by Li-Cycle to the holder of the Glencore Convertible Note in connection with an optional redemption of the Glencore Convertible Note that entitle the holder to

iv

Table of Contents

acquire, until the maturity date of the Glencore Convertible Note, a number of common shares equal to the principal amount of the Glencore Convertible Note being redeemed divided by the then applicable conversion price.

“Hub” means a centralized facility for large-scale production of specialty materials that achieves economies of scale in recycling. Our first commercial Hub will be located in Rochester, New York and is currently in the project execution phase.

“Incentive Plan” means the Company’s 2021 Incentive Award Plan.

“Investor Agreement” means the Investor and Registration Rights Agreement, dated as of August 10, 2021, by and among the Company, the Peridot Class B Holders and the Li-Cycle Holders.

“KSP Note” means the unsecured convertible note due September 29, 2026 originally issued to Spring Creek Capital, LLC pursuant to the KSP Note Purchase Agreement on September 29, 2021 and assigned on May 1, 2022, to Wood River Capital, LLC, as amended from time to time.

“KSP Note Purchase Agreement” means the Note Purchase Agreement, dated as of September 29, 2021, between the Company and Spring Creek Capital, LLC, and assigned on May 1, 2022, to Wood River Capital, LLC.

“LGC” means LG Chem, Ltd.

“LGES” means LG Energy Solution, Ltd.

“Li-Cycle Holders” means the prior shareholders of Li-Cycle Corp. that entered into the Li-Cycle Transaction Support Agreements in connection with the Business Combination.

“Li-Cycle Shares” means the issued and outstanding common shares of Li-Cycle Corp. prior to the Business Combination.

“Li-Cycle Transaction Support Agreements” means the Transaction Support Agreements, each dated as of February 15, 2021, among Peridot and the Li-Cycle Holders, entered into in connection with the Business Combination Agreement.

“NewCo” means Li-Cycle Holdings Corp. prior to the Amalgamation.

“New York Spoke” means Li-Cycle’s operational Spoke in Rochester, New York.

“Norway Spoke” means Li-Cycle’s planned Spoke in Norway that is currently under development.

“NYSE” means the New York Stock Exchange.

“OBCA” means the Ontario Business Corporations Act.

“OEM” means an original equipment manufacturer.

“Ohio Spoke” means Li-Cycle’s planned, co-located Spoke with Ultium near Warren, Ohio that is currently under development.

“Ontario Spoke” means Li-Cycle’s operational Spoke in Kingston, Ontario.

“Peridot” means, before the Continuance, Peridot Acquisition Corp., a Cayman Islands exempt company and, after the Continuance, Peridot Ontario.

v

Table of Contents

“Peridot Class B Holders” means the holders of Peridot Class B Shares immediately prior to the Business Combination.

“Peridot Class B Shares” means the Class B common shares of Peridot.

“Peridot Ontario” means Peridot as continued under the OBCA following the Continuance.

“PIK Notes” means the additional unsecured convertible notes that may be issued by Li-Cycle from time to time in satisfaction of the interest due and payable on the 2021 Convertible Notes.

“PIPE Financing” means the issuance and sale to the PIPE Investors, following the Amalgamation and prior to the closing date of the Business Combination, of an aggregate of 31,549,000 common shares for a purchase price of $10.00 per share, for aggregate gross proceeds of $315,490,000.

“PIPE Investors” means those certain investors, including an affiliate of Peridot’s Sponsor, who entered into Subscription Agreements to purchase common shares in the PIPE Financing.

“private placement warrants” means 8,000,000 warrants to purchase common shares that were issued to the Sponsor in exchange for outstanding warrants of Peridot in connection with the Business Combination, which were exercised or surrendered for common shares or redeemed on January 26, 2022 pursuant to the notice of redemption dated December 27, 2021.

“Product Recovery Percentage” means (a) the quantity of a given constituent in the feed lithium-ion battery materials (e.g., lithium, nickel, cobalt, other constituents) that is returned from the process and is available for sale after the process has taken place, divided by (b) the input quantity of the given constituent, measured as a percentage.

“public warrants” means 15,000,000 warrants to purchase common shares that were issued in exchange for outstanding warrants of Peridot that were issued in Peridot’s initial public offering, which were exercised or surrendered for common shares or redeemed on January 26, 2022 pursuant to the notice of redemption dated December 27, 2021.

“Recycling Efficiency Rate” means (a) the mass of recycled materials exiting the recycling process and returned to the economy, divided by (b) the mass of materials entering the recycling process, measured as a percentage.

“Rochester Hub” means Li-Cycle’s first commercial-scale Hub that is currently under construction in Rochester, New York.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Spoke” means a decentralized facility that mechanically processes batteries close to sources of supply and handles the preliminary processing of end-of-life batteries and battery scrap.

“Spoke Capital Projects” means the Spoke facilities presently under development and construction by Li-Cycle.

“Sponsor” means Peridot Acquisition Sponsor, LLC, a Delaware limited liability company.

“Subscription Agreements” means the subscription agreements entered into with the PIPE Investors, in connection with the PIPE Financing.

vi

Table of Contents

“Traxys” means Traxys North America LLC.

“Ultium” means Ultium Cells LLC.

“Warrant Redemption” means the redemption of all our outstanding warrants on January 26, 2022 as described in the notice of redemption dated December 27, 2021.

“warrants” means the public warrants and the private placement warrants.

References to “dollar,” “USD,” “US$” and “$” are to U.S. dollars and references to “CA$” and “Cdn. $” are to Canadian dollars.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus includes certain trademarks, service marks and trade names that we own or otherwise have the right to use, such as “Li-Cycle” and “Spoke & Hub Technologies” which are protected under applicable intellectual property laws and are our property. This prospectus also contains additional trademarks, tradenames, and service marks belonging to other parties, which are the property of their respective owners. Solely for convenience, our trademarks, service marks and trade names referred to in this prospectus may appear without the ® or ™ symbol, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names. We do not intend our use or display of other parties’ trademarks, tradenames, or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

vii

Table of Contents

This summary highlights selected information and does not contain all of the information you should consider before investing in our securities. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, any applicable prospectus supplement and the documents referred to in “Where You Can Find More Information” and “Documents Incorporated by Reference.” Some of the statements in this prospectus constitute forward-looking statements that involve significant risks and uncertainties. See “Forward-Looking Statements” for more information.

Our Company

Li-Cycle is an industry leader in lithium-ion battery resource recovery and the leading lithium-ion battery recycler in North America. When we refer to ourselves as the leading lithium-ion battery recycler in North America, we are referring to our status based on installed permitted capacity for lithium-ion battery recycling measured in tonnes per year. Our proprietary “Spoke & Hub” recycling and resource recovery process is designed (a) at our Spokes, to process battery manufacturing scrap and end-of-life batteries to produce “black mass” and other intermediate products, and (b) at our Hubs, to process black mass to produce critical battery materials, including lithium carbonate, nickel sulphate and cobalt sulphate. Our process enables an up to 95% Recycling Efficiency Rate, as compared to what we believe to be a 50% traditional industry average. Unlike the traditional revenue model for recycling that relies primarily on waste or tipping fees, our operating model is focused on generating revenue from sales of the raw materials we produce.

Li-Cycle was founded in 2016 by our chief executive officer, Ajay Kochhar, and executive chair, Tim Johnston, with the mission of solving the global disposal problem for end-of-life lithium-ion batteries and battery manufacturing scrap while simultaneously creating a secondary source of critical battery materials. By providing an “urban mining” solution, Li-Cycle seeks to offer an alternative to raw materials sourced through traditional global mining practices.

We pioneered what we believe to be an innovative and scalable metallurgical processing method with our Spoke & Hub Technologies. We expect to make a valuable contribution to the EV industry and the world’s transition to a circular economy by offering an environmentally friendly recycling solution to energy-intensive pyrometallurgical processing methods. We believe our production costs are on average lower than the mining and processing costs otherwise incurred by suppliers to produce these materials because we are able to produce multiple materials from a single process and because our process yields minimal waste and no displaced earth or tailings, as compared to traditional mining processes. By re-inserting critical materials back into the lithium-ion battery supply chain, we are able to effectively close the loop between the beginning and end-of-life manufacturing phases in both an environmentally and what we believe to be an economically sustainable manner.

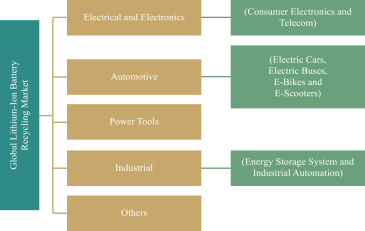

Lithium-ion batteries are increasingly powering products and solutions in a range of industries, including consumer electronics and EVs. Our sources of recycling feed are derived primarily from three key sources: 1) battery manufacturing scrap; 2) end-of-life lithium-ion batteries; and 3) damaged, defective, or recalled lithium-ion batteries.

1

Table of Contents

An overview of the industries in which lithium-ion batteries are utilized is set forth below:

Source: Expert Interviews, Secondary Research, and BIS Research Analysis

Our Strategy

Our goal is to be a leading global recycler of lithium-ion batteries and battery scrap and producer of key battery grade materials. Li-Cycle has developed a two-phased strategy, positioned to grow in lockstep with the electrification supply chain. In the first phase, Li-Cycle plans to expand its network in line with the manufacturing of lithium-ion batteries, by utilizing the resulting manufacturing scrap or yield loss as a key base-load of supply for Li-Cycle’s facilities. In the second phase, Li-Cycle plans to leverage its global network established predominantly on the basis of manufacturing scrap to position itself as the leader for the processing of end-of-life lithium-ion batteries. We are executing on our plan to construct a network of Spokes located at regionally optimized locations that reduce safety risk and costs associated with battery transport to our Spokes. We are also executing on our plan to construct centralized, large-scale Hubs to maximize economies of scale and efficiencies, with our first commercial Hub being under construction in Rochester New York. Our Hub facilities will process an intermediate product (black mass) from our Spokes, as this is significantly easier and safer to transport than batteries.

We are evaluating additional global opportunities to scale our operations with a range of potential partners and expansion opportunities that may include acquisitions, joint ventures or other commercial arrangements in North America, Europe and Asia Pacific. We seek to partner with multiple customers in each geography in connection with supply and off-take arrangements. Near to mid-term, our growth strategy is to focus on North America and Europe, aligning with leading global customer demand needs. During this period, we also expect to assess the potential for investments in the Asia Pacific region.

Our Competitive Strengths

Customer-Centric Solutions Provider

We provide sustainable and customer-centric solutions for each of our customers’ battery recycling needs. We provide the support necessary along each step of the process to ensure that our customers’ battery recycling experience is handled in a manner that is safe, professional, and economically viable. In particular,

| • | we work closely with a reliable network of logistics partners to support customers in transporting their batteries to our facilities; |

2

Table of Contents

| • | we offer our customers a home for the secure destruction of materials containing IP-sensitive design information, such as research and development batteries and battery materials. We have adopted procedures to protect the privacy and confidentiality of our customers’ trade secrets; and |

| • | in addition to providing advice on packaging and support with procurement, we provide spare battery storage, manage comprehensive battery replacement campaigns and customize programs and services to individual customers’ needs. |

Proprietary and Innovative Technology

We have established proprietary technology that we believe sets us apart from competitors because our technology has the ability to respond to changes in battery chemistries and adapt to change in inputs to the battery recycling process. Our process produces the fundamental building blocks of lithium-ion batteries — cathode precursor input chemicals, cathode input chemicals and raw materials that can be reused in batteries or the broader economy. By contrast, competitive emerging technologies such as cathode-to-cathode recycling produce end-products that have a higher risk of obsolescence due to continuous cathode technology advancement.

Leading Environmental Footprint

Due to our high recovery rates and sustainable, environmentally-friendly processes, we believe we are well-positioned to comply with heightened regulations applicable to us across the globe.

Unlike conventional pyrometallurgy processes, our hydrometallurgical process is designed for “best in class” environmental performance, with minimal solid waste streams to landfill, zero wastewater discharge, and relatively low air emissions. This has been a competitive advantage in terms of conforming to the requirements for municipal, state, and federal permitting processes associated with the development of our Spokes and Hub, as well as meeting our customers’ mandates for quality and sustainability.

In 2021, Li-Cycle received the 2021 Big Innovation Award presented by Business Intelligence Group, and it was named to the World Circular Economy Forum’s list of Circular Economy Solutions Inspiring the World. In addition, for three years in a row (2020, 2021 and 2022), Li-Cycle was named as a Global Cleantech 100 Company by the Cleantech Group and was also a finalist in the 10th Annual Business Green Leaders Awards.

Minimal Human Operating Risk

Unlike smelting, thermal pre-treatment refining, or cathode-to-cathode processes, our processes have minimal human operating risk. Our Spokes can safely process lithium-ion batteries at any state of charge, without any manual sorting, discharging, or dismantling required. In addition, our Spokes reduce the size of battery mass through an automated process, minimizing human operating risk.

Superior Recycling Recovery Rates and More Economical Supplier

Our wet-chemistry method is able to extract valuable battery-grade materials from black mass that are directly re-usable in the manufacturing of new battery technologies. In the short term, this increases the value that we derive from battery manufacturing scrap as well as end-of-life batteries and reduces waste.

We expect our production costs on average to be lower than the mining and processing costs otherwise incurred by suppliers to produce these battery-grade materials because we are able to produce multiple materials from a single process that yields minimal waste and no displaced earth or tailings, as compared to traditional mining processes.

3

Table of Contents

Investment by and Strategic Partnerships with Key Global Players

We believe that the investment by, and strategic partnerships we have established with, leading global players in the lithium-ion battery materials space, as described below, represent a strong validation of our business model:

Glencore

On May 5, 2022, the Company announced the entry into a global feedstock supply agreement with Glencore pursuant to which Glencore will supply manufacturing scrap and end-of-life lithium-ion batteries to the Company on a global basis. The Company also announced the entry into the Glencore Note Purchase Agreement pursuant to which the Company issued to Glencore on May 31, 2022, an unsecured convertible note in the aggregate principal amount of $200,000,000, in a transaction exempt from registration under the Securities Act of 1933, as amended.

On May 31, 2022, Li-Cycle entered into certain long-term commercial agreements with Glencore (the “Commercial Agreements”). Subject to existing commitments of the Company and other exceptions (including materials required for the Company’s operations), under the terms of the Commercial Agreements, Glencore will source and supply lithium-ion battery manufacturing scrap and other lithium-ion battery materials to the Company for use at the Company’s Spokes; Glencore will source and supply black mass to the Company for use at the Company’s Hubs; Glencore will purchase, for its internal consumption or on-sale to third party end customers, black mass, battery-grade end products and certain by-products produced at the Company’s Spokes and Hubs; and Glencore will supply sulfuric acid for use at the Company’s Hubs. Pursuant to the Commercial Agreements, Glencore will earn (i) sourcing fees on all feed flowing into the Company’s Spokes; (ii) sourcing fees on all third-party black mass flowing into the Company’s Hubs; (iii) marketing fees on all black mass flowing out of the Company’s Spokes and not flowing into the Company’s Hubs; and (iv) marketing fees on all end products flowing out of the Company’s Hubs or any third party processing sites that the Company may utilize. The term of the Amended and Restated Global Feed Sourcing Agreement commenced on May 4, 2022 and the term of the other Commercial Agreements commenced on August 1, 2022.

LG Chem and LG Energy Solution

In December 2021, Li-Cycle, LGC and LGES announced their intention to enter into a manufacturing scrap supply and nickel sulphate off-take agreement, pursuant to a non-binding letter of intent. On April 20, 2022, a subsidiary of the Company entered into a scrap offer agreement with LGES pursuant to which the Company will have the opportunity to recycle nickel-bearing lithium-ion battery manufacturing scrap and other lithium-ion battery material from LGES’s North American manufacturing sites. In addition, on April 20, 2022, a subsidiary of the Company entered into nickel sulphate offtake agreements with each of LGES and LGC pursuant to which the Company will allocate for sale, through its end-product offtake partner, Traxys, a combined initial allocation of 20,000 tonnes of nickel contained in nickel sulphate produced at the Company’s Hub facility currently under construction in Rochester, New York, to LGC and LGES over 10 years. These agreements will enable a closed-loop ecosystem for LGC and LGES for key materials in the lithium battery supply chain.

On December 13, 2021, Li-Cycle entered into subscription agreements with each of LGES and LGC, each of which were subsequently amended and restated on March 11, 2022 and April 21, 2022 (the “LG Subscription Agreements” and each, an “LG Subscription Agreement”), pursuant to which each of LGES and LGC agreed, subject to the satisfaction of certain conditions, to subscribe for an equal number of the Company’s common shares in transactions exempt from registration under the Securities Act (the “LG Subscription”). The LG Subscription was completed on May 11, 2022 and consisted of the issuance by the Company in accordance with the LG Subscription Agreements of (i) an initial tranche of 4,416,960 common shares, in the aggregate, at a price of $10.00 per share, for an aggregate initial tranche subscription price of approximately $44.2 million, and (ii) a second tranche of 883,392 common shares, in the aggregate, at a price of $6.60 per share (based on the volume-weighted average trading price of the Company’s common shares for the 5 trading days ending immediately prior to April 29, 2022), for an aggregate second tranche subscription price of approximately $5.8 million, for a total

4

Table of Contents

investment of $50.0 million. See “Description of Securities — Registration Rights — LG Subscription Agreements” for more information about the equity investment.

Koch Strategic Platforms (“KSP”)

KSP, a subsidiary of Koch Investments Group, through its affiliate, Wood River Capital, LLC, has invested $100 million in Li-Cycle pursuant to a convertible note to support the Company’s growth opportunities in North America, Europe and Asia Pacific. We believe this strategic investment by KSP will provide Li-Cycle with access to key industry expertise and commercial opportunities across the broader Koch Industries ecosystem.

Well Positioned for Governmental “Green” Financing Partnerships

With the emergence of government initiatives to accelerate the development of the circular economy and EV adoption, significant programs are underway to support the development of domestic critical material supply in the North American market. With our first mover technology and environmental advantages, we believe we are well positioned to explore various green financing opportunities from government or financial institutions supporting cleantech infrastructure in North America. Li-Cycle has also historically built strong relationships with various government agencies.

Emerging Growth Company and Foreign Private Issuer Status

We are currently an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of certain exemptions from specified disclosure and other requirements that are otherwise generally applicable to public companies. These exemptions include:

| • | not being required to comply with the auditor attestation requirements for the assessment of our internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002; |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | not being required to hold a nonbinding advisory vote on executive compensation or seek shareholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of (i) the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; (ii) the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; (iii) the issuance, in any three-year period, by our Company of more than $1.0 billion in non-convertible debt securities; and (iv) the last day of the fiscal year ending after the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement. We will no longer qualify as an “emerging growth company” on October 31, 2022. Consequently, the Company will be required to comply with the auditor attestation requirements for the assessment of its internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002, which would be included in the Company’s Annual Report on Form 20-F covering the fiscal year ended October 31, 2022.

We are also considered a “foreign private issuer” and will report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as a non-U.S. company with foreign private issuer status. This means that, even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

5

Table of Contents

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the Securities and Exchange Commission (the “SEC”) of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States, or (iii) our business is administered principally in the United States.

We may choose to take advantage of some but not all of these reduced burdens. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from our competitors that are public companies, or other public companies in which you have made an investment.

Summary of Risk Factors

Investing in our securities entails a high degree of risk as more fully described in the “Risk Factors” section of this prospectus beginning on page 10. You should carefully consider such risks before deciding to invest in our securities. These risks include but are not limited to the following:

Risks Relating to Li-Cycle’s Business

| • | Li-Cycle’s success will depend on its ability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third-party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries. |

| • | Li-Cycle may not be able to successfully implement its global growth strategy, on a timely basis or at all, and may be unable to manage future global growth effectively. Expanding internationally involves risks that could delay our expansion plans and/or prohibit us from entering markets in certain jurisdictions, which could have a material adverse effect on results of operations. |

| • | The development of Li-Cycle’s Rochester Hub, Spoke Capital Projects and other future projects is subject to risks and Li-Cycle cannot guarantee that these projects will be completed in a timely manner, that costs will not be significantly higher than estimated, or that the completed projects will meet expectations with respect to productivity or the specifications of their end products, among others. |

| • | Li-Cycle may engage in strategic transactions that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in the incurrence of debt or other liabilities, or prove not to be successful. |

| • | Failure to materially increase recycling capacity and efficiency could have a material adverse effect on Li-Cycle’s business, results of operations and financial condition. Li-Cycle is and will be dependent on its recycling facilities. If one or more of its current or future facilities become inoperative, capacity constrained or if operations are disrupted, Li-Cycle’s business, results of operations and financial condition could be materially adversely affected. |

6

Table of Contents

| • | Li-Cycle may in the future need to raise additional funds to meet its capital requirements and such funds may not be available to Li-Cycle on commercially reasonable terms or at all, which could materially adversely affect Li-Cycle’s business, results of operations and financial condition. |

| • | Li-Cycle has a history of losses and expects to incur significant expenses for the foreseeable future, and there is no guarantee it will achieve or sustain profitability. |

| • | Problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations could materially adversely affect Li-Cycle’s business, results of operations and financial condition. |

| • | Li-Cycle’s business is subject to operational and project development risks that could disrupt our business, some of which may not be insured or fully covered by insurance. |

| • | Li-Cycle’s revenue depends on maintaining and increasing feedstock supply commitments as well as securing new sources of supply. |

| • | Li-Cycle relies on a limited number of customers and the projected revenues for the Rochester Hub are derived significantly from a single customer. |

| • | A decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies, could materially harm Li-Cycle’s financial results and ability to grow its business. |

| • | Decreases in demand and fluctuations in benchmark prices for the metals contained in Li-Cycle’s products could significantly impact Li-Cycle’s costs, revenues and results of operations. In addition to commodity prices, Li-Cycle’s costs and revenues are primarily driven by the volume and composition of lithium-ion battery feedstock materials processed at its facilities (including manufacturing scrap, spent batteries and third-party purchased black mass) and changes in the volume or composition of feedstock processed could significantly impact Li-Cycle’s revenues and results of operations. |

| • | The development of an alternative chemical make-up of lithium-ion batteries or battery alternatives could materially adversely affect Li-Cycle’s revenues and results of operations. |

| • | Li-Cycle’s heavy reliance on the experience and expertise of its management may cause material adverse impacts on it if a management member departs. |

| • | Li-Cycle relies on third-party consultants for its regulatory compliance and Li-Cycle could be materially adversely impacted if the consultants do not correctly inform Li-Cycle of the legal changes. Further, Li-Cycle is subject to the risk of litigation or regulatory proceedings, which could materially adversely impact its financial results. |

| • | Li-Cycle may not be able to complete its recycling processes as quickly as customers may require, which could cause it to lose supply contracts and could harm its reputation. Li-Cycle operates in an emerging, competitive industry and if it is unable to compete successfully its revenue and profitability will be materially adversely affected. |

| • | Increases in income tax rates, changes in income tax laws or disagreements with tax authorities could materially adversely affect Li-Cycle’s business, results of operations and financial condition. |

| • | Li-Cycle’s operating and financial results may vary significantly from period to period due to fluctuations in its operating costs and other factors. |

| • | Fluctuations in foreign currency exchange rates could result in declines in reported sales and net earnings. |

| • | Unfavorable economic conditions, including the consequences of the global COVID-19 pandemic, disruptions in the global supply chain and inflation, could have a material adverse effect on Li-Cycle’s business, results of operations and financial condition. |

7

Table of Contents

| • | Natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, cyber incidents, boycotts and geo-political events could materially adversely affect Li-Cycle’s business, results of operations and financial condition. |

| • | Failure to protect or enforce Li-Cycle’s intellectual property could materially adversely affect its business, and Li-Cycle may be subject to intellectual property rights claims by third parties, which could be costly to defend, could require us to pay significant damages and could limit the Company’s ability to use certain technologies. |

| • | Li-Cycle has identified material weaknesses in its internal control over financial reporting. If its remediation of such material weaknesses is not effective, or if it fails to develop and maintain a proper and effective internal control over financial reporting, its ability to produce timely and accurate financial statements or comply with applicable laws and regulations could be impaired. |

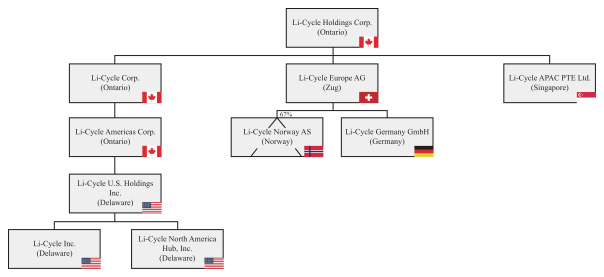

Corporate Structure

The following diagram depicts the organizational structure of the Company and its principal subsidiaries as of the date of this prospectus. All of the subsidiaries of the Company are directly or indirectly wholly-owned by the Company, except as otherwise indicated below.

Corporate Information

Li-Cycle Holdings Corp. was incorporated on February 12, 2021 under the laws of Ontario as a corporation solely for the purpose of effectuating the Business Combination, which was consummated on August 10, 2021. It is governed by Articles of Amalgamation dated August 10, 2021.

Our principal executive office is located 207 Queen’s Quay West, Suite 590, Toronto, Ontario, M5J 1A7, Canada and our phone number is (877) 542-9253. Our agent for service of process in the United States is Puglisi & Associates located at 850 Library Avenue, Suite 204, Newark, DE 19711.

Our principal website address is http://www.li-cycle.com. The information contained on our website does not form a part of, and is not incorporated by reference into, this prospectus.

8

Table of Contents

Summary Terms of the Offering

The summary below describes the principal terms of this offering. The “Description of Securities” section of this prospectus contains a more detailed description of our common shares.

| Common shares that may be offered and sold from time to time by the selling shareholders |

Up to 96,579,362 common shares, including up to 11,021,923 common shares issuable upon conversion of the 2021 Convertible Notes or pursuant to any other term of the 2021 Convertible Notes, including as a result of any of the PIK provisions of the 2021 Convertible Notes, which were originally issued in a transaction exempt from registration pursuant to Section 4(a)(2) of the Securities Act. |

| Offering prices |

The common shares offered by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the selling shareholders may determine. See “Plan of Distribution.” |

| Common shares issued and outstanding |

175,430,235 common shares (as of September 9, 2022). |

| Common shares outstanding after this offering |

186,452,158 common shares (as of September 9, 2022). |

| Dividend policy |

We have not paid any cash dividends on our common shares to date and do not intend to pay cash dividends for the foreseeable future. The payment of cash dividends in the future will be dependent upon our revenues and earnings, if any, capital requirements, any future debt agreements and general financial condition. The payment of any cash dividends will be within the discretion of our board of directors at such time. See “Dividend Policy.” |

| Use of proceeds |

All of the common shares offered by the selling shareholders pursuant to this prospectus will be sold by the selling shareholders for their respective accounts. We will not receive any of the proceeds from these sales. See “Use of Proceeds.” |

| Market for our common shares |

Our common shares are listed on The New York Stock Exchange under the symbol “LICY”. |

| Risk factors |

Investing in our securities involves substantial risks. See “Risk Factors” beginning on page 10 of this prospectus and other documents incorporated by reference herein, for a description of certain of the risks you should consider before investing in our common shares. |

9

Table of Contents

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks, all risk factors set forth in the applicable prospectus supplement and other information in or documents incorporated by reference in this prospectus, including our consolidated financial statements and related notes before you decide to purchase our securities. See “Documents Incorporated by Reference.” If any of these risks actually occur, our business and financial results could be materially adversely affected. This could cause the trading price of our securities to decline, perhaps significantly, and you therefore may lose all or part of your investment. These risks are not exhaustive and do not comprise all of the risks associated with an investment in the Company. Additional risks and uncertainties not currently known to us or which we currently deem immaterial may also have a material adverse effect on our business, financial condition and results of operations.

References in this section to “we,” “us” or “Li-Cycle” refer to Li-Cycle Corp. and its subsidiaries prior to the consummation of the Business Combination and the Company and its subsidiaries subsequent to the Business Combination, unless the context otherwise requires or indicates otherwise.

Summary of Risk Factors

The following summarizes some, but not all, of the risks provided below. Please carefully consider all of the information discussed in these “Risk Factors” for a more thorough description of these and other risks:

Risks Relating to Li-Cycle’s Business

| • | Li-Cycle’s success will depend on its ability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third-party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries. |

| • | Li-Cycle may not be able to successfully implement its global growth strategy, on a timely basis or at all, and may be unable to manage future global growth effectively. Expanding internationally involves risks that could delay our expansion plans and/or prohibit us from entering markets in certain jurisdictions, which could have a material adverse effect on results of operations. |

| • | The development of Li-Cycle’s Rochester Hub, Spoke Capital Projects and other future projects is subject to risks and Li-Cycle cannot guarantee that these projects will be completed in a timely manner, that costs will not be significantly higher than estimated, or that the completed projects will meet expectations with respect to productivity or the specifications of their end products, among others. |

| • | Li-Cycle may engage in strategic transactions that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in the incurrence of debt or other liabilities, or prove not to be successful. |

| • | Failure to materially increase recycling capacity and efficiency could have a material adverse effect on Li-Cycle’s business, results of operations and financial condition. Li-Cycle is and will be dependent on its recycling facilities. If one or more of its current or future facilities become inoperative, capacity constrained or if operations are disrupted, Li-Cycle’s business, results of operations and financial condition could be materially adversely affected. |

| • | Li-Cycle may in the future need to raise additional funds to meet its capital requirements and such funds may not be available to Li-Cycle on commercially reasonable terms or at all, which could materially adversely affect Li-Cycle’s business, results of operations and financial condition. |

| • | Li-Cycle has a history of losses and expects to incur significant expenses for the foreseeable future, and there is no guarantee it will achieve or sustain profitability. |

10

Table of Contents

| • | Problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations could materially adversely affect Li-Cycle’s business, results of operations and financial condition. |

| • | Li-Cycle’s business is subject to operational and project development risks that could disrupt our business, some of which may not be insured or fully covered by insurance. |

| • | Li-Cycle’s revenue depends on maintaining and increasing feedstock supply commitments as well as securing new sources of supply. |

| • | Li-Cycle relies on a limited number of customers and the projected revenues for the Rochester Hub are derived significantly from a single customer. |

| • | A decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies, could materially harm Li-Cycle’s financial results and ability to grow its business. |

| • | Decreases in demand and fluctuations in benchmark prices for the metals contained in Li-Cycle’s products could significantly impact Li-Cycle’s costs, revenues and results of operations. In addition to commodity prices, Li-Cycle’s costs and revenues are primarily driven by the volume and composition of lithium-ion battery feedstock materials processed at its facilities (including manufacturing scrap, spent batteries and third-party purchased black mass) and changes in the volume or composition of feedstock processed could significantly impact Li-Cycle’s revenues and results of operations. |

| • | The development of an alternative chemical make-up of lithium-ion batteries or battery alternatives could materially adversely affect Li-Cycle’s revenues and results of operations. |

| • | Li-Cycle’s heavy reliance on the experience and expertise of its management may cause material adverse impacts on it if a management member departs. |

| • | Li-Cycle relies on third-party consultants for its regulatory compliance and Li-Cycle could be materially adversely impacted if the consultants do not correctly inform Li-Cycle of the legal changes. Further, Li-Cycle is subject to the risk of litigation or regulatory proceedings, which could materially adversely impact its financial results. |

| • | Li-Cycle may not be able to complete its recycling processes as quickly as customers may require, which could cause it to lose supply contracts and could harm its reputation. Li-Cycle operates in an emerging, competitive industry and if it is unable to compete successfully its revenue and profitability will be materially adversely affected. |

| • | Increases in income tax rates, changes in income tax laws or disagreements with tax authorities could materially adversely affect Li-Cycle’s business, results of operations and financial condition. |

| • | Li-Cycle’s operating and financial results may vary significantly from period to period due to fluctuations in its operating costs and other factors. |

| • | Fluctuations in foreign currency exchange rates could result in declines in reported sales and net earnings. |

| • | Unfavorable economic conditions, including the consequences of the global COVID-19 pandemic, disruptions in the global supply chain and inflation, could have a material adverse effect on Li-Cycle’s business, results of operations and financial condition. |

| • | Natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, cyber incidents, boycotts and geo-political events could materially adversely affect Li-Cycle’s business, results of operations and financial condition. |

| • | Failure to protect or enforce Li-Cycle’s intellectual property could materially adversely affect its business, and Li-Cycle may be subject to intellectual property rights claims by third parties, which could be costly to defend, could require us to pay significant damages and could limit the Company’s ability to use certain technologies. |

11

Table of Contents

| • | Li-Cycle has identified material weaknesses in its internal control over financial reporting. If its remediation of such material weaknesses is not effective, or if it fails to develop and maintain a proper and effective internal control over financial reporting, its ability to produce timely and accurate financial statements or comply with applicable laws and regulations could be impaired. |

Risks Relating to this Offering and Ownership of Our Securities

| • | Our by-laws provide, subject to limited exceptions, that the Superior Court of Justice of the Province of Ontario and the appellate courts therefrom are the sole and exclusive forum for certain shareholder litigation matters, which could limit shareholders’ ability to obtain a favorable judicial forum for disputes. |

| • | Our common shares have only recently become publicly traded, and the market price of our common shares may be volatile. The trading price of our common shares could be subject to wide fluctuations. Sales of substantial amounts of our common shares after the expiration of applicable lock-up periods, or the perception that such sales will occur, could materially adversely affect the market price of our common shares. |

| • | The NYSE may delist our common shares, which could limit investors’ ability to engage in transactions in our common shares and subject us to additional trading restrictions. Because Li-Cycle has historically operated as a private company, we have limited experience complying with public company obligations and fulfilling these obligations is expensive and time consuming and may divert management’s attention from the day-to-day operation of our business. |

| • | As a “foreign private issuer” under the rules and regulations of the SEC, we are permitted to, and will, file less or different information with the SEC than a company incorporated in the United States or otherwise subject to these rules, and will follow certain home country corporate governance practices in lieu of certain NYSE requirements applicable to U.S. issuers. |

| • | Failure to develop and maintain effective internal control over financial reporting could have a material adverse effect on our business, results of operations and trading price of our common shares. |

| • | As an “emerging growth company,” the Company cannot be certain if reduced disclosure and governance requirements applicable to “emerging growth companies” will make its shares less attractive to investors. |

| • | We may issue additional shares or other equity securities without shareholder approval, which would dilute the ownership interests of existing shareholders and may depress the market price of our common shares. The issuance of our common shares in connection with the conversion of our outstanding convertible notes would cause substantial dilution, and could materially affect the trading price of our common shares. The Company becoming a “passive foreign investment company” could also have material adverse U.S. federal income tax consequences for U.S. Holders. We do not currently intend to pay dividends, which could affect your ability to achieve a return on your investment. |

| • | The Company’s ability to meet expectations and projections in any research or reports published by securities or industry analysts, or a lack of coverage by securities or industry analysts, could result in a depressed market price and limited liquidity for its shares. |

| • | The Company may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on its financial condition, results of operations and share price, which could cause you to lose some or all of your investment. |

12

Table of Contents

Risks Relating to Li-Cycle’s Business

Li-Cycle’s success will depend on its ability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third-party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries.

Li-Cycle’s future business depends in large part on its ability to economically and efficiently source, recycle and recover lithium-ion battery materials (including end-of-life batteries, manufacturing scrap and third-party black mass), and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries. Although it currently recycles and recovers lithium-ion battery materials at Spoke facilities in Ontario, New York State and Arizona, Li-Cycle will need to scale its recycling capacity in order to successfully implement its global growth strategy and plans to do so in the future by, among other things, successfully building and developing additional Spoke & Hub facilities, including its first commercial Hub facility in Rochester, New York; additional North American Spoke facilities near Tuscaloosa, Alabama and in Warren, Ohio; and the Company’s first European Spokes, in Norway and Germany.

Although Li-Cycle has experience in recycling lithium-ion materials in its existing facilities, such operations are currently conducted on a limited scale, and Li-Cycle has not yet developed or operated a Hub facility on a commercial scale to produce and sell end products. Li-Cycle does not know whether it will be able to develop efficient, automated, low-cost recycling capabilities and processes, or whether it will be able to secure reliable sources of supply, in each case that will enable it to meet the production standards, costs and volumes required to successfully recycle lithium-ion batteries and lithium-ion battery materials and meet its business objectives and customer needs. Even if Li-Cycle is successful in high-volume recycling in its current and future facilities, it does not know whether it will be able to do so in a manner that avoids significant delays and cost overruns, including as a result of factors beyond its control, such as problems with suppliers, or in time to meet the commercialization schedules of future recycling needs or to satisfy the requirements of its customers. Li-Cycle’s ability to effectively reduce its cost structure over time is limited by the fixed nature of many of its planned expenses in the near-term, and its ability to reduce long-term expenses is constrained by its need to continue investment in its global growth strategy. Any failure to develop and scale such manufacturing processes and capabilities within Li-Cycle’s projected costs and timelines could have a material adverse effect on its business, results of operations and financial condition.

Li-Cycle may not be able to successfully implement its global growth strategy, on a timely basis or at all.

Li-Cycle’s future global growth, results of operations and financial condition depend upon its ability to successfully implement its growth strategy, which, in turn, is dependent upon a number of factors, some of which are beyond Li-Cycle’s control, including its ability to:

| • | Economically recycle and recover lithium-ion batteries and lithium-ion battery materials and meet customers’ business needs; |

| • | Effectively introduce methods for higher recovery rates of lithium-ion batteries and solutions to recycling; |

| • | Complete the construction of its future facilities, including the Rochester Hub, and the Spoke Capital Projects at a reasonable cost on a timely basis; |

| • | Invest and keep pace in technology, research and development efforts, and the expansion and defense of its intellectual property portfolio; |

| • | Secure and maintain required strategic supply arrangements; |

| • | Secure and maintain leases for future Spoke & Hub facilities at competitive rates and in favorable locations; |

13

Table of Contents

| • | Apply for and obtain the permits necessary to operate Spoke & Hub facilities on a timely basis; |

| • | Effectively compete in the markets in which it operates; and |

| • | Attract and retain management or other employees who possess specialized knowledge and technical skills. |

There can be no assurance that Li-Cycle can successfully achieve any or all of the above initiatives in the manner or time period that it expects. Further, achieving these objectives will require investments that may result in both short-term and long-term costs without generating any current revenue and therefore may be dilutive to earnings. Li-Cycle cannot provide any assurance that it will realize, in full or in part, the anticipated benefits it expects to generate from its growth strategy. Failure to realize those benefits could have a material adverse effect on Li-Cycle’s business, results of operations and financial condition.

Li-Cycle may be unable to manage future global growth effectively.

Even if it can successfully implement its global growth strategy, any failure to manage its growth effectively could materially and adversely affect Li-Cycle’s business, results of operations and financial condition. Li-Cycle intends to expand its operations globally, which will require it to hire and train new employees in different countries; accurately forecast supply and demand, production and revenue; source and maintain supplies of lithium-ion batteries, lithium-ion battery manufacturing scrap and third-party black mass; control expenses and investments in anticipation of expanded operations; establish new or expand current design, production, and sales and service facilities; and implement and enhance administrative infrastructure, systems and processes. Future growth may also be tied to acquisitions, and Li-Cycle cannot guarantee that it will be able to effectively acquire other businesses or integrate businesses that it acquires. Failure to efficiently manage any of the above could have a material adverse effect on Li-Cycle’s business, results of operations and financial condition.

The development of Li-Cycle’s Rochester Hub, Spoke Capital Projects and other future projects is subject to risks, including with respect to engineering, permitting, procurement, construction, commissioning and ramp-up, and Li-Cycle cannot guarantee that these projects will be completed in a timely manner, that its costs will not be significantly higher than estimated, or that the completed projects will meet expectations with respect to their productivity or the specifications of their end products, among others.

Li-Cycle’s Rochester Hub, Spoke Capital Projects and other future projects are subject to development risks, including with respect to engineering, permitting, procurement, construction, commissioning and ramp-up. Because of the uncertainties inherent in estimating construction and labor costs, including as a result of unfavorable market conditions, and the potential for the scope of a project to change, it is relatively difficult to evaluate accurately the total funds that will be required to complete the Rochester Hub, Spoke Capital Projects or other future projects. Further, Li-Cycle’s estimates of the amount of time it will take to complete the Rochester Hub, Spoke Capital Projects or other future projects are based on assumptions about the timing of engineering studies, permitting, procurement, construction, commissioning and ramp-up, all of which can vary significantly from the time an estimate is made to the time of completion. Li-Cycle cannot guarantee that the costs of the Rochester Hub, Spoke Capital Projects or other future projects will not be higher than estimated, or that it will have sufficient capital to cover any increased costs, or that it will be able to complete the Rochester Hub, Spoke Capital Projects or other future projects within expected timeframes. Any such cost increases or delays could negatively affect Li-Cycle’s results of operations and ability to continue to grow, particularly if the Rochester Hub, Spoke Capital Projects or any other future project cannot be completed. Further, there can be no assurance that the Rochester Hub or the Spoke Capital Projects will perform at the expected production rates or unit costs, or that the end products will meet the intended specifications.

Failure to materially increase recycling capacity and efficiency could have a material adverse effect on Li-Cycle’s business, results of operations and financial condition.

Although Li-Cycle’s existing facilities in Ontario, New York State and Arizona currently have total processing capacity of 20,000 tonnes of lithium-ion batteries and lithium-ion battery materials per year, the

14

Table of Contents

future success of Li-Cycle’s business depends in part on its ability to significantly increase recycling capacity and efficiency as part of the incremental/additional facilities. Li-Cycle may be unable to expand its business, satisfy demand from its current and new customers, maintain its competitive position and achieve profitability if it is unable to build and operate any future facilities and otherwise allow for increases in scrapping output and speed. The construction of future global facilities will require significant cash investments and management resources and may not meet Li-Cycle’s expectations with respect to increasing capacity, efficiency and satisfying additional demand. For example, if there are delays in any future planned Hub, such as its current development

and construction of the Rochester Hub, construction of the Spoke Capital Projects and/or the future construction of other Spoke & Hub facilities, or if its facilities do not meet expected performance standards or are not able to produce materials that meet the quality standards Li-Cycle expects, Li-Cycle may not meet its target for adding capacity, which would limit its ability to increase sales and result in lower than expected sales and higher than expected costs and expenses. Failure to drastically increase recycling and processing capacity or otherwise satisfy customers’ demands may result in a loss of market share to competitors, damage Li-Cycle’s relationships with its key customers, a loss of business opportunities or otherwise materially adversely affect its business, results of operations and financial condition.

Li-Cycle may engage in strategic transactions, including acquisitions, that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in the incurrence of debt, or prove not to be successful.

From time to time, Li-Cycle may enter into transactions to acquire other businesses or technologies, to enter into joint ventures or to develop additional commercial relationships and its ability to do so successfully cannot be ensured. On January 26, 2022, Li-Cycle entered into a joint venture agreement with ECO STOR AS (“ECO STOR”) and Morrow Batteries AS (“Morrow”) to form Li-Cycle Norway AS through which it will construct the Norway Spoke. In January 2022, we announced that we would be developing a co-located Spoke with a strategic industry partner in Warren, Ohio, to enhance our ability to serve their recycling needs. In addition to these ventures, Li-Cycle is currently considering certain other joint ventures, strategic partnerships and acquisitions to support its growth strategy, including but not limited to the development of new Spoke & Hub facilities, but it does not currently have any binding commitments for such transactions other than as described herein. Li-Cycle will be dependent on its strategic partners with respect to the Norway Spoke, the Ohio Spoke and any other joint ventures. Conflicts or disagreements between Li-Cycle and its strategic partners, or failure of Li-Cycle’s strategic partners to commit sufficient resources to a joint venture may, among other things, delay or prevent the successful development or operation of the Norway Spoke, the Ohio Spoke or other joint ventures, which could have a material adverse effect on Li-Cycle’s business, financial condition, results of operations and prospects. Li-Cycle’s acquisitions or other strategic transactions could include the payment of the purchase price in whole or in part using Li-Cycle’s common shares, which would have a dilutive impact on existing shareholders. Li-Cycle may also decide to incur debt in connection with an acquisition or any other strategic transaction. Even if Li-Cycle identifies suitable opportunities for acquisitions, joint ventures or other strategic transactions, Li-Cycle may not be able to make such transactions on favorable terms or at all. Any strategic transactions Li-Cycle makes may not strengthen its competitive position, and these transactions may be viewed negatively by customers, suppliers or investors. Li-Cycle could incur losses resulting from undiscovered liabilities of an acquired business that we failed to or were unable to discover or were unable to quantify in the course of performing due diligence and that are not covered by any indemnification Li-Cycle may obtain from the seller. In addition, Li-Cycle may not be able to successfully integrate the acquired personnel, technologies and operations into its existing business in an effective, timely and non-disruptive manner. Strategic transactions may also divert management attention from day-to-day responsibilities, increase Li-Cycle’s expenses and reduce Li-Cycle’s cash available for operations and other uses. In addition, Li-Cycle may not be able to fully recover the costs of such acquisitions, joint ventures or other strategic transitions or be successful in leveraging any of them into increased business, revenue or profitability. Li-Cycle also cannot predict the number, timing or size of any future transactions or the effect that any such transactions might have on its results of operations. Accordingly, although there can be no assurance that Li-Cycle will undertake or successfully complete any acquisitions, joint ventures or other strategic transactions, any transactions that Li-Cycle does complete may be subject to the foregoing or

15

Table of Contents

other risks and may have a material adverse effect on Li-Cycle’s business, financial condition, results of operations and prospects.

Expanding internationally involves risks that could delay our expansion plans and/or prohibit us from entering markets in certain jurisdictions, which could have a material adverse effect on our results of operations.

International operations, such as those we intend to establish, are subject to certain risks inherent in doing business abroad, including:

| • | political, civil and economic instability; |

| • | risks of war and other hostilities; |

| • | corruption risks; |

| • | trade, customs and tax risks; |

| • | currency exchange rates and currency controls; |

| • | limitations on the repatriation of funds; |

| • | insufficient infrastructure; |

| • | economic sanctions; |