Form 40-F STANDARD LITHIUM LTD. For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

|

☐

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2021 Commission File Number 001-40569

Standard Lithium Ltd.

(Exact name of Registrant as specified in its charter)

| Canada | 2800 | Not Applicable | ||

|

(Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Suite 110, 375 Water Street

Vancouver, British Columbia, Canada

V6B 5C6

(604) 409-8154

(Address and telephone number of Registrant’s principal executive offices)

CT Corporation System

1015 15th Street N.W., Suite 1000

Washington, DC 20005

(202) 572-3133

(Name, address (including zip code) and telephone number (including area code) of

agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Shares, without par value | SLI | NYSE American LLC |

Securities

registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

| ☒ Annual information form | ☒ Audited annual financial statements |

Indicate the number of outstanding shares of each of the Registrant’s classes of capital or common stock as of the close of the period covered by this annual report:

The Registrant had 141,166,203 Common Shares issued and outstanding as of June 30, 2021.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company. ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

EXPLANATORY NOTE

Standard Lithium Ltd. (the “Company” or the “Registrant”) is a Canadian issuer that is permitted, under the multijurisdictional disclosure system adopted in the United States, to prepare this Annual Report on Form 40-F (this “Annual Report”) pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act and Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”). Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 thereunder.

PRINCIPAL DOCUMENTS

The following documents, filed as Exhibits 99.1, 99.2 and 99.3 hereto, are incorporated herein by reference into this Annual Report:

A. Annual Information Form of the Company for the year ended June 30, 2021 (the “AIF”).

B. Management’s Discussion and Analysis of the Company for the year ended June 30, 2021 (the “MD&A”).

C. Audited Consolidated Financial Statements of the Company for the year ended June 30, 2021 (the “Audited Financial Statements”).

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report are forward-looking statements under the provisions of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, Section 21E of the Exchange Act and forward-looking information within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). These statements relate to future events or the Company’s future performance. All statements, other than statements of historical fact, may be forward-looking statements. Statements concerning mineral resource and mineral reserve estimates also may be deemed to be forward-looking statements in that it reflects a prediction of mineralization that would be encountered if a mineral deposit were developed and mined. Forward-looking statements generally can be identified by the use of words such as “seek,” “anticipate,” “plan,” “continue,” “estimate,” “expect,” “may,” “will,” “project,” “predict,” “propose,” “potential,” “target,” “intend,” “could,” “might,” “should,” “believe,” “scheduled,” “implement” and similar words or expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

In particular, this Annual Report contains or incorporates by reference forward-looking statements, including, without limitation, with respect to the following matters or the Company’s expectations relating to such matters: the Company’s planned exploration and development programs (including, but not limited to, plans and expectations regarding advancement, testing and operation of the lithium extraction pilot plant), commercial opportunities for lithium products, expected results of exploration, accuracy of mineral or resource exploration activity, accuracy of mineral reserves or mineral resources estimates, including the ability to develop and realize on such estimates, whether mineral resources will ever be developed into mineral reserves, and information and underlying assumptions related thereto, budget estimates and expected expenditures by the Company on its properties, regulatory or government requirements or approvals, the reliability of third party information, continued access to mineral properties or infrastructure, payments and share issuances pursuant to property agreements, fluctuations in the market for lithium and its derivatives, expected timing of the expenditures, performance of the Company’s business and operations, changes in exploration costs and government regulation in Canada and the United States, competition for, among other things, capital, acquisitions, undeveloped lands and skilled personnel, changes in commodity prices and exchange rates, currency and interest rate fluctuations, the Company’s funding requirements and ability to raise capital, expectations and anticipated impact of the COVID-19 outbreak, including with regard to the health and safety of the Company’s workforce, COVID-19 protocols and their efficacy and impacts on timelines and budgets, and other factors or information.

| 1 |

Forward-looking statements do not take into account the effect of transactions or other items announced or occurring after the statements are made. Forward-looking statements are based upon a number of expectations and assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking statements. With respect to forward-looking statements listed above and incorporated by reference herein, the Company has made assumptions regarding, among other things: current technological trends; ability to fund, advance and develop the Company’s properties; the Company’s ability to operate in a safe and effective manner; uncertainties with respect to receiving, and maintaining, mining, exploration, environmental and other permits; pricing and demand for lithium, including that such demand is supported by growth in the electric vehicle market; impact of increasing competition; commodity prices, currency rates, interest rates and general economic conditions; the legislative, regulatory and community environments in the jurisdictions where the Company operates; impact of unknown financial contingencies; market prices for lithium products; budgets and estimates of capital and operating costs; estimates of mineral resources and mineral reserves; reliability of technical data; anticipated timing and results of operation and development; and the impact of COVID-19 on the Company and its business. Although the Company believes that the assumptions and expectations reflected in such forward-looking statements are reasonable, the Company can give no assurance that these assumptions and expectations will prove to be correct. Since forward-looking statements inherently involves risks and uncertainties, undue reliance should not be placed on such information.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, but are not limited to: general economic conditions in Canada, the United States and globally; industry conditions, including the state of the electric vehicle market; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services and to obtain capital, undeveloped lands, skilled personnel, equipment and inputs; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; uncertainties associated with estimating mineral resources and mineral reserves, including uncertainties relating to the assumptions underlying mineral resource and mineral reserve estimates; whether mineral resources will ever be converted into mineral reserves; uncertainties in estimating capital and operating costs, cash flows and other project economics; liabilities and risks, including environmental liabilities and risks inherent in mineral extraction operations; health and safety risks; risks related to unknown financial contingencies, including litigation costs, on the Company’s operations; unanticipated results of exploration activities; unpredictable weather conditions; unanticipated delays in preparing technical studies; inability to generate profitable operations; restrictive covenants in debt instruments; lack of availability of additional financing on terms acceptable to the Company; intellectual property risk; stock market volatility; volatility in market prices for commodities; liabilities inherent in the mining industry; the development of the COVID-19 global pandemic; changes in tax laws and incentive programs relating to the mining industry; other risks pertaining to the mining industry; conflicts of interest; dependency on key personnel; and fluctuations in currency and interest rates, as well as those factors discussed in the section entitled “Risk Factors” in the AIF and the MD&A. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Readers are cautioned that the foregoing lists of factors are not exhaustive. The forward-looking statements contained in or incorporated by reference in this Annual Report is expressly qualified by these cautionary statements. All forward-looking statements in this Annual Report or incorporated by reference in this Annual Report speaks as of the date of this Annual Report (or as of the date in the document incorporated by reference). The Company does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Additional information about these assumptions and risks and uncertainties is contained in the Company’s filings with securities regulators, including the AIF and MD&A, attached as Exhibits 99.1 and 99.2, respectively, to this Annual Report, in each case, incorporated by reference herein.

| 2 |

MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

The disclosure included in or incorporated by reference in this Annual Report uses mineral reserves and mineral resources classification terms that comply with reporting standards in Canada and are made in accordance with National Instrument 43-101—Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

These standards differ significantly from the requirements of the Securities and Exchange Commission (the “Commission” or the “SEC”) that are applicable to domestic United States reporting companies. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under SEC standards. Accordingly, information included in this Annual Report and the documents incorporated by reference herein that describes the Company’s mineral reserves and mineral resources estimates may not be comparable with information made public by United States companies subject to the SEC’s reporting and disclosure requirements.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its consolidated financial statements, which are filed with this Annual Report, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and which are not comparable to financial statements of United States companies.

CURRENCY

Unless otherwise indicated, all references to “$”, “C$” or “dollars” in this Annual Report refer to Canadian dollars. References to “US$” in this Annual Report refer to United States dollars. The exchange rate of Canadian dollars into United States dollars on June 30, 2020, based upon the daily average exchange rate as quoted by the Bank of Canada, was U.S.$1.00 = C$1.3628. The exchange rate of Canadian dollars into United States dollars, on June 30, 2021, based upon the daily average exchange rate as quoted by the Bank of Canada, was US$1.00 = C$1.2394.

DISCLOSURE CONTROLS AND PROCEDURES AND INTERNAL CONTROL OVER FINANCIAL REPORTING

A. Evaluation of disclosure controls and procedures. Disclosure controls and procedures are designed to ensure that (i) information required to be disclosed by the Company in reports that it files or submits to the SEC under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified in applicable rules and forms and (ii) material information required to be disclosed in the Company’s reports filed under the Exchange Act is accumulated and communicated to the Company’s management, including its Chief Executive Officer (“CEO”) and its Chief Financial Officer (“CFO”), as appropriate, to allow for timely decisions regarding required disclosure.

At the end of the period covered by this report, an evaluation was carried out under the supervision of and with the participation of the Company’s management, including the CEO and CFO, of the effectiveness of the design and operation of the Company’s disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Exchange Act). The evaluation included documentation review, enquiries and other procedures considered by management to be appropriate in the circumstances. Based on that evaluation, the Company’s CEO and CFO have concluded that, as of June 30, 2021, the Company’s disclosure controls and procedures were effective.

B. Management’s report on internal control over financial reporting. This Annual Report does not include a report of management’s assessment regarding internal control over financial reporting due to a transition period established by rules of the Commission for newly public companies.

C. Attestation report of the registered public accounting firm. This Annual Report does not include an attestation report of the Company’s registered public accounting firm due to a transition period established by rules of the Commission for newly public companies.

| 3 |

D. Changes in internal control over financial reporting. During the period covered by this Annual Report, no change occurred in the Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

The Company’s management, including the CEO and CFO, does not expect that its disclosure controls and procedures or internal controls and procedures will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

NOTICES PURSUANT TO REGULATION BTR

The Company was not required by Rule 104 of Regulation BTR to send any notices to any of its directors or executive officers during the fiscal year ended June 30, 2021.

AUDIT COMMITTEE FINANCIAL EXPERT

The Company’s board of directors (the “Board”) has determined that it has at least one audit committee financial expert serving on its audit and risk committee. The Board has determined that Jeffrey Barber is an audit committee financial expert and is independent, as that term is defined by the Exchange Act and the NYSE American’s corporate governance standards applicable to the Company.

The Commission has indicated that the designation of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose on such person any duties, obligations or liability that are greater than those imposed on such person as a member of the audit and risk committee and the Board in the absence of such designation and does not affect the duties, obligations or liability of any other member of the audit and risk committee or Board.

CODE OF ETHICS

The Board has adopted a written code of business conduct and ethics (the “Code”), by which it and all officers and employees of the Company, including the Company’s principal executive officer, principal financial officer and principal accounting officer or controller, abide. There were no waivers granted in respect of the Code during the fiscal year ended June 30, 2021. The Code is posted on the Company’s website at www.standardlithium.com. If there is an amendment to the Code, or if a waiver of the Code is granted to any of Company’s principal executive officer, principal financial officer, principal accounting officer or controller, the Company intends to disclose any such amendment or waiver by posting such information on the Company’s website. Unless and to the extent specifically referred to herein, the information on the Company’s website shall not be deemed to be incorporated by reference in this Annual Report. Except for the Code, and notwithstanding any reference to the Company’s website or other websites in this Annual Report or in the documents incorporated by reference herein or attached as Exhibits hereto, no information contained on the Company's website or any other site shall be incorporated by reference in this Annual Report or in the documents incorporated by reference herein or attached as Exhibits hereto.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Manning Elliot LLP acted as the Company’s independent registered public accounting firm for the fiscal year ended June 30, 2021. See the section “External Auditor Service Fee” in our AIF, which section is incorporated by reference herein, for the total amount billed to the Company by Manning Elliot LLP for services performed in the last two fiscal years by category of service (for audit fees, audit-related fees, tax fees and all other fees).

| 4 |

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

See the section “Pre-approval Policies and Procedures” in our AIF, which section is incorporated by reference herein. One hundred percent of the audit-related fees, tax fees and all other fees billed to the Company by Manning Elliot LLP were approved by the Company’s audit committee.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any “off-balance sheet arrangements” (as that term is defined in paragraph 11(ii) of General Instruction B to Form 40-F) that have or are reasonably likely to have a current or future effect on its financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The following is a summary of the Registrant’s contractual obligations as of June 30, 2021:

| Payments due by period (C$ in millions) | ||||||||||||||||||||

| Contractual Obligations | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||

| Property Payment Obligations | 11,750,000 | 2,250,000 | 4,000,000 | 3,000,000 | 2,500,000 | |||||||||||||||

IDENTIFICATION OF THE AUDIT COMMITTEE

The Board has a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act and satisfies the requirements of Exchange Act Rule 10A-3. As at June 30, 2021, the audit committee was comprised of Robert Mintak, Anthony Alvaro and Jeffrey Barber. Mr. Mintak and Mr. Alvaro resigned from the audit committee effective August 11, 2021 and, as such, the audit committee was reconstituted. As of August 11, 2021, the audit committee is comprised of Robert Cross, Volker Berl and Jeffrey Barber.

CORPORATE GOVERNANCE PRACTICES

As a Canadian corporation listed on the NYSE American, we are not required to comply with certain NYSE American corporate governance standards, so long as we comply with Canadian and TSXV corporate governance requirements. In order to claim such an exemption, however, Section 110 of the NYSE American Company Guide requires that we provide to NYSE American written certification from independent Canadian counsel that the non-complying practice is not prohibited by Canadian law. Any significant differences are described on the Company’s website at www.standardlithium.com. Information contained in or otherwise accessible through the Company’s website does not form part of this Form 40-F and is not incorporated into this Form 40-F by reference.

MINE SAFETY DISCLOSURE

During the period of this Annual Report, there were no mine safety violations or other regulatory matters required to be disclosed by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection or General Instruction B(16) of Form 40-F.

INCORPORATION BY REFERENCE

This Annual Report is incorporated by reference into the Company’s Registration Statement on Form F-10 (File No. 333-259442).

| 5 |

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

B. Consent to Service of Process

The Registrant has previously filed a Form F-X in connection with the class of securities in relation to which the obligation to file this report arises.

Any change to the name or address of the agent for service of process of the registrant shall be communicated promptly to the Commission by an amendment to the Form F-X referencing the file number of the Registrant.

| 6 |

EXHIBIT INDEX

*To be filed by amendment.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereto duly authorized.

| Date: October 28, 2021 | STANDARD LITHIUM LTD. | |

| By: | /s/ Robert Mintak | |

| Name: Robert Mintak | ||

| Title: CEO and Director | ||

Exhibit 99.1

STANDARD LITHIUM LTD.

ANNUAL INFORMATION FORM

for the Fiscal Year ended June 30, 2021

Dated October 28, 2021

CORPORATE OFFICE

Suite 110, 375 Water

Street

Vancouver, British Columbia, V6B 5C6

REGISTERED OFFICE

Suite 2200, 885 West

Georgia Street

Vancouver, British Columbia, V6C 3E8

TABLE OF CONTENTS

| PRELIMINARY NOTES AND CAUTIONARY STATEMENT | 3 |

| CORPORATE STRUCTURE | 7 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 8 |

| DESCRIPTION OF THE BUSINESS | 14 |

| MINERAL PROPERTIES | 18 |

| RISK FACTORS | 36 |

| DIVIDENDS AND DISTRIBUTIONS | 52 |

| CAPITAL STRUCTURE | 52 |

| MARKET FOR SECURITIES | 53 |

| ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTIONS ON TRANSFER | 55 |

| DIRECTORS AND OFFICERS | 55 |

| PROMOTERS | 57 |

| AUDIT COMMITTEE | 58 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 59 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 59 |

| AUDITORS, TRANSFER AGENT AND REGISTRAR | 60 |

| MATERIAL CONTRACTS | 60 |

| INTEREST OF EXPERTS | 60 |

| ADDITIONAL INFORMATION | 61 |

| SCHEDULE “A” Audit Committee Mandate | A-1 |

PRELIMINARY NOTES AND CAUTIONARY STATEMENT

Date of Information

All information in this Annual Information Form (“AIF”) is as of June 30, 2021, unless otherwise indicated.

Cautionary Notes to U.S. Investors Concerning Resource Estimates

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms “inferred mineral resources,” “indicated mineral resources,” “measured mineral resources” and “mineral resources” used or referenced in this AIF are Canadian mineral disclosure terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Standards for Mineral Resources and Mineral Reserves, Definitions and Guidelines, May 2014 (the “CIM Standards”). The CIM Standards differ significantly from standards in the United States included in U.S. Securities and Exchange Commission (the “SEC”) Industry Guide 7.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. Under the SEC Modernization Rules, the historical property disclosure requirements for mining registrants included in SEC Industry Guide 7 will be rescinded and replaced with disclosure requirements in subpart 1300 of SEC Regulation S-K. Following the transition period, as a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

As a result of the adoption of the SEC Modernization Rules, the SEC will recognize estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding definitions under the CIM Standards that are required under NI 43-101. Accordingly, during this period leading up to the compliance date of the SEC Modernization Rules, information regarding mineral resources or mineral reserves contained or referenced in this AIF may not be comparable to similar information made public by companies that report in accordance with U.S. standards. While the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

| 3 |

Currency

Except where otherwise indicated, all references to currency in this AIF are to Canadian Dollars (“$”).

Forward-Looking Information

Except for statements of historical fact, this AIF contains certain “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively referred to herein as “forward-looking information”). The statements relate to future events or the Company’s future performance. All statements, other than statements of historical fact, may be forward-looking information. Information concerning mineral resource and mineral reserve estimates also may be deemed to be forward-looking information in that it reflects a prediction of mineralization that would be encountered if a mineral deposit were developed and mined. Forward-looking information generally can be identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “propose”, “potential”, “target”, “intend”, “could”, “might”, “should”, “believe”, “scheduled”, “implement” and similar words or expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information.

In particular, this AIF contains forward-looking information, including, without limitation, with respect to the following matters or the Company’s expectations relating to such matters: the Company’s planned exploration and development programs (including, but not limited to, plans and expectations regarding advancement, testing and operation of the lithium extraction pilot plant), commercial opportunities for lithium products, expected results of exploration, accuracy of mineral or resource exploration activity, accuracy of mineral reserves or mineral resources estimates, including the ability to develop and realize on such estimates, whether mineral resources will ever be developed into mineral reserves, and information and underlying assumptions related thereto, budget estimates and expected expenditures by the Company on its properties, regulatory or government requirements or approvals, the reliability of third party information, continued access to mineral properties or infrastructure, payments and share issuances pursuant to property agreements, fluctuations in the market for lithium and its derivatives, expected timing of the expenditures, performance of the Company’s business and operations, changes in exploration costs and government regulation in Canada and the United States, competition for, among other things, capital, acquisitions, undeveloped lands and skilled personnel, changes in commodity prices and exchange rates, currency and interest rate fluctuations, the Company’s funding requirements and ability to raise capital, expectations and anticipated impact of the COVID-19 outbreak, including with regard to the health and safety of the Company’s workforce, COVID-19 protocols and their efficacy and impacts on timelines and budgets, and other factors or information.

| 4 |

Forward-looking statements do not take into account the effect of transactions or other items announced or occurring after the statements are made. Forward-looking information is based upon a number of expectations and assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. With respect to forward-looking information listed above, the Company has made assumptions regarding, among other things: current technological trends; ability to fund, advance and develop the Company’s properties; the Company’s ability to operate in a safe and effective manner; uncertainties with respect to receiving, and maintaining, mining, exploration, environmental and other permits; pricing and demand for lithium, including that such demand is supported by growth in the electric vehicle market; impact of increasing competition; commodity prices, currency rates, interest rates and general economic conditions; the legislative, regulatory and community environments in the jurisdictions where the Company operates; impact of unknown financial contingencies; market prices for lithium products; budgets and estimates of capital and operating costs; estimates of mineral resources and mineral reserves; reliability of technical data; anticipated timing and results of operation and development; and the impact of COVID-19 on the Company and its business. Although the Company believes that the assumptions and expectations reflected in such forward-looking statements are reasonable, the Company can give no assurance that these assumptions and expectations will prove to be correct. Since forward-looking information inherently involves risks and uncertainties, undue reliance should not be placed on such information.

Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, but are not limited to: general economic conditions in Canada, the United States and globally; industry conditions, including the state of the electric vehicle market; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services and to obtain capital, undeveloped lands, skilled personnel, equipment and inputs; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; uncertainties associated with estimating mineral resources and mineral reserves, including uncertainties relating to the assumptions underlying mineral resource and mineral reserve estimates; whether mineral resources will ever be converted into mineral reserves; uncertainties in estimating capital and operating costs, cash flows and other project economics; liabilities and risks, including environmental liabilities and risks inherent in mineral extraction operations; health and safety risks; risks related to unknown financial contingencies, including litigation costs, on the Company’s operations; unanticipated results of exploration activities; unpredictable weather conditions; unanticipated delays in preparing technical studies; inability to generate profitable operations; restrictive covenants in debt instruments; lack of availability of additional financing on terms acceptable to the Company; intellectual property risk; stock market volatility; volatility in market prices for commodities; liabilities inherent in the mining industry; the development of the COVID-19 global pandemic; changes in tax laws and incentive programs relating to the mining industry; other risks pertaining to the mining industry; conflicts of interest; dependency on key personnel; and fluctuations in currency and interest rates, as well as those factors discussed in the section entitled “Risk Factors” in this AIF.

| 5 |

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Readers are cautioned that the foregoing lists of factors are not exhaustive. All forward-looking information in this this AIF speaks as of the date of this AIF. The Company does not undertake any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law. All forward-looking information contained in this AIF is expressly qualified in its entirety by this cautionary statement. Additional information about these assumptions and risks and uncertainties is contained in the Company’s filings with securities regulators, including the Company’s most recent management’s discussion and analysis for our most recently completed financial year and, if applicable, interim financial period, which are available on SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Certain Other Information

The Company’s filings through SEDAR are not incorporated by reference in this AIF. Information contained on the Company’s website is also not incorporated by referenced in this AIF.

Certain information in this AIF is obtained from third party sources, including public sources, and there can be no assurance as to the accuracy or completeness of such information. Although believed to be reliable, management of the Company has not independently verified any of the data from third party sources nor ascertained the validity or accuracy of the underlying economic assumptions relied upon therein, and the Company does not make any representation as to the accuracy of such information.

The preliminary economic assessments (each, a “PEA”) included herein are preliminary in nature and include inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEAs will be realized. Additional work is required to upgrade the mineral resources to mineral reserves. In addition, the mineral resource estimates could be materially affected by environmental, geotechnical, permitting, legal, title, taxation, socio-political, marketing or other relevant factors.

| 6 |

CORPORATE STRUCTURE

Name, Address and Incorporation

Standard Lithium Ltd. (“Standard” or the “Company”) was incorporated under the laws of the Province of British Columbia on August 14, 1998 under the name “Patriot Petroleum Corp.” At its annual general meeting held on November 3, 2016, the shareholders of the Company approved the change of name of the Company to “Standard Lithium Ltd.” and to the continuance of the Company from the Business Corporations Act (British Columbia) to the Canada Business Corporations Act.

Standard is an innovative technology and lithium development company focused on the sustainable development of a portfolio of lithium-brine bearing properties in the United States utilizing proprietary Direct Lithium Extraction (“DLE”) and purification technologies.

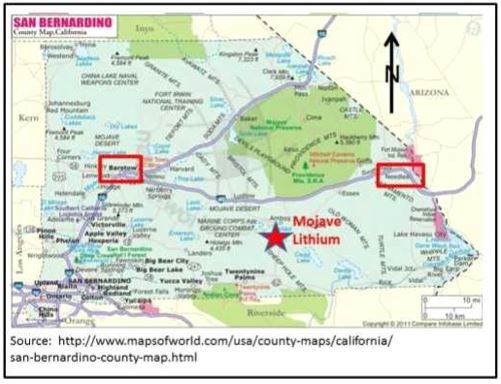

The Company’s flagship project is located in southern Arkansas, where it is engaged in the testing and proving of commercial viability of lithium extraction from over 150,000 acres of permitted brine operations (the “LANXESS Property”). The Company has commissioned its first industrial-scale direct lithium extraction demonstration plant (the “Demonstration Plant”) at LANXESS’ (as defined herein) south plant facility connected to existing LANXESS infrastructure. The Demonstration Plant utilizes the Company’s proprietary LiSTR technology to selectively extract lithium from brine that is a byproduct of existing bromine production facilities run by LANXESS. The Demonstration Plant is being used for proof-of-concept and commercial feasibility studies. The Company is also pursuing the resource development of over 27,000 acres of separate brine leases and deeds located in southwestern Arkansas (the “South-West Arkansas Project” (formerly known as the “TETRA Project”), and together with the LANXESS Property, the “Arkansas Lithium Project”). In addition, the Company has an interest in certain mineral leases located in the Mojave Desert in San Bernardino county, California.

Standard is listed on the TSX Venture Exchange (“TSXV”) and trades under the symbol “SLI”, on the NYSE American, LLC (the “NYSE American”) under the symbol “SLI” and on the Frankfurt Stock Exchange (“FRA”) under the symbol “S5L”. The Company is a reporting issuer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and files its continuous disclosure documents with the Canadian Securities Authorities in such provinces. Such documents are available on SEDAR at www.sedar.com.

The Company’s corporate office is located at Suite 110, 375 Water Street, Vancouver, British Columbia, V6B 5C6 and its registered office is located at Suite 2200, 885 West Georgia Street, Vancouver, British Columbia, V6C 3E8.

| 7 |

Intercorporate Relationships

Standard has six subsidiaries being, Arkansas Lithium Corp. (which operates the Demonstration Plant), California Lithium Ltd., Texas Lithium Corp. and 1093905 Nevada Corp., which are incorporated under the laws of Nevada, Texas Lithium Holdings Corp., which is incorporated under the laws of the Province of British Columbia and 1093905 LLC, which is incorporated under the laws of Delaware (the “Subsidiaries”). Each of the Subsidiaries are directly or indirectly wholly-owned by Standard.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

2018 - 2019 Developments

On February 21, 2018, the Company announced the implementation of a restricted share unit plan along with the grant of an aggregate of 2,100,000 restricted share units thereunder (the “RSUs”). The RSUs were to be granted to directors and officers of the Company, based on a common share value of $2.10, with vesting occurring in three equal tranches every four months for a period of twelve months. On October 25, 2018, the Company issued a news release clarifying that the board of directors of the Company (the “Board” or “Board of Directors”) ultimately elected not to implement a restricted share unit plan at that time and would not be granting the RSUs.

On May 9, 2018 the Company announced the signing of a memorandum of understanding (“LANXESS MOU”) with global specialty chemicals company LANXESS Corporation (“LANXESS”) and its US affiliate Great Lakes Chemical Corporation (“GLCC”), with the purpose of testing and proving the commercial viability of extraction of lithium from brine (“tail brine”) that is produced as part of LANXESS’s bromine extraction business at its three Southern Arkansas facilities.

The LANXESS MOU sets out the basis on which the parties have agreed to cooperate in a phased process towards developing commercial opportunities related to the production, marketing and sale of battery grade lithium products that may be extracted from tail brine and brine produced from the Smackover Formation. The LANXESS MOU forms the basis of what will become a definitive agreement and is binding until the execution of a more comprehensive agreement that the parties may execute on the completion of further development phases. The Company has paid an initial US$3,000,000 reservation fee to LANXESS to, locate and interconnect a lithium extraction pilot plant at one of LANXESS processing facilities in south Arkansas, secure access to tail brine produced as part of LANXESS bromine extraction business, and provide logistics and other support as may be required to operate the pilot plant with additional fees and obligations in the future subject to certain conditions.

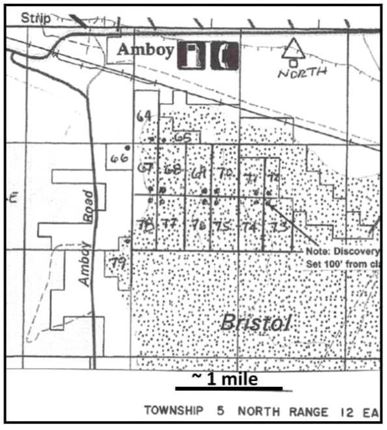

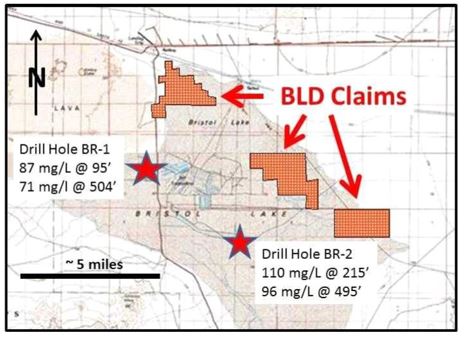

On May 15, 2018, the Company entered into a license, exploration and option agreement (the “TETRA 2nd Option Agreement”) with Tetra Technologies Inc. (“TETRA”), to formalise the memorandum of understanding originally signed on October 23, 2017 (the “MOU”), pursuant to which the Company has the rights to conduct lithium brine exploration activities on a total of approximately 23,940 acres of mineral claims located in the Bristol Dry Lake and Cadiz Dry Lake regions in San Bernardino County, California. The Company will initially acquire the right to conduct lithium exploration activities on the properties located in Bristol Dry Lake and Cadiz Dry Lake, in consideration for a series of cash payments and share issuances totaling US$2,700,000 and 3,400,000 Shares (which, for greater certainty, is in addition to the US$100,000 non-refundable deposit paid in connection with the MOU), to be completed over a sixty-month period. The cash payments and share issuances to be made to TETRA, are further described “Description of the Business – Arkansas Lithium Project” below.

| 8 |

On July 26, 2018, the Company changed its financial year-end from December 31 to June 30.

On September 4, 2018, the Company announced the appointment of Robert Cross to its Board of Directors as Non-Executive Chairman. Mr. Cross is an engineer with 25 years of experience as a financier and company builder in the mining and oil & gas sectors. He co-founded and serves as Chairman of B2Gold, a top performing growing gold producer which will achieve almost one million ounces of low-cost gold production in 2020. He was also co-founder and Chairman of Bankers Petroleum Ltd., co-founder and Chairman of Petrodorado Energy Ltd., and until October 2007, was the Non-Executive Chairman of Northern Orion Resources Inc. Between 1996 and 1998, Mr. Cross was Chairman and CEO of Yorkton Securities Inc. From 1987 to 1994, he was a Partner, Investment Banking with Gordon Capital Corporation in Toronto. Mr. Cross has an Engineering Degree from the University of Waterloo (1982) and received an MBA from Harvard in 1987.

On November 9, 2018, the Company signed a term sheet (the “LANXESS JV Term Sheet”) with LANXESS for a contemplated joint venture to coordinate in the commercial development of lithium extracted from the Smackover Formation. The Company is working with LANXESS in a phased approach as per terms of a binding memorandum of understanding, to develop commercial opportunities related to the production, marketing and sale of battery grade lithium products extracted from brine produced from the Smackover Formation.

Under the LANXESS JV Term Sheet, it is proposed that the parties would form a joint venture in which LANXESS would contribute lithium extraction rights and grant access to its existing infrastructure, and the Company would contribute existing rights and leases held in the Smackover Formation and the pilot plant being developed on LANXESS’ property, as well as its proprietary extraction processes including all relevant intellectual property rights. It is anticipated that, subject to completion of due diligence, the Company would initially hold a 30% equity interest in the joint venture, with the balance held by LANXESS. Subject to the satisfaction of certain conditions, the Company would have the option to increase its interest in the joint venture to 40%.

Upon proof of concept, LANXESS is prepared to provide funding to the joint venture to allow for commercial development of the future commercial project, and it is anticipated that the joint venture will include options for the Company to participate in project funding on similar terms. In connection with development of the joint venture, it is further contemplated that LANXESS will enter into a supply and distribution arrangement in which all merchant market sales of lithium derived from the joint venture will be distributed by LANXESS. The final terms of the joint venture and any funding and distribution arrangements remain subject to completion of due diligence, technical proof of concept, normal economic viability studies (e.g. Preliminary Feasibility Study, etc.) to confirm the technical feasibility and economic viability of the project, and the negotiation of definitive agreements between the parties.

| 9 |

On November 27, 2018, the Company entered into a share purchase agreement with Craig Johnstone Brown (“Brown”) to acquire all of the issued and outstanding share capital of 2661881 Ontario Limited, a company then-owned by Brown, which held the intellectual property rights to a process for the selective extraction of lithium from brine solutions (the “Brown SPA”). As consideration for the transaction, the Company completed a series of cash payments and Share issuances to Brown totaling $1,050,000 and 1,000,000 Shares; the acquisition completed on December 13, 2019.

On January 28, 2019, the Company announced a maiden resource estimate on the South-West Arkansas Project, 27,262 net brine acres located in Columbia and Lafayette Counties, Arkansas held pursuant to the TETRA 1st Option Agreement.

On February 28, 2019, the Company filed a technical report in respect of the South-West Arkansas Project on SEDAR.

On March 20, 2019, the Company engaged Advisian, the consulting arm of WorleyParsons Canada Services Ltd. (“Worley”) to complete a PEA of its LANXESS Property in the south-central region of Arkansas, USA.

On June 19, 2019, the Company announced the results of its PEA and updated Mineral Resource estimate on its LANXESS Property in the south-central region of Arkansas, USA. See “Mineral Properties – Arkansas Lithium Project”.

2019 - 2020 Developments

On October 15, 2019, the Company announced that the final modules of the Company’s “LiSTR” direct lithium extraction Demonstration Plant had been transported to and were currently being installed at the Arkansas Lithium Project.

On October 28, 2019, the Company agreed to accelerate the timeframe of completion of the payments and Share issuances detailed under the Brown SPA. Under the revised agreement, the Company will make (a) a cash payment of $250,000 on or before November 15, 2019 (paid); and (b) a further $250,000 (paid) and the issuance of 500,000 Shares (issued) on or before December 31, 2019. The Company completed the acquisition on December 13, 2019.

On December 2, 2019, the Company announced the successful installation of the Demonstration Plant at LANXESS’ South Plant facility in southern Arkansas and that the Company’s project team had also installed the site office/control room, the lithium-specific analytical laboratory, and a steel-framed, all-weather structure that allows year-round operation.

On March 9, 2020, the Company announced that it had produced its first >99.9% purity (also known as ‘three-nines’) battery quality lithium carbonate using the Company’s proprietary SiFT (“SiFT”) crystallisation technology.

On May 19, 2020, the Company announced the successful start-up of the Demonstration Plant which is now operating on a 24/7 basis, extracting lithium directly from LANXESS’ tail brine.

On June 9, 2020, the Company reported that it had completed the construction of its SiFT crystallization pilot plant.

| 10 |

2020 – 2021 Developments

On July 15, 2020, the Company announced that its SiFT crystallization pilot plant was beginning initial lithium carbonate crystallization work and that the commissioning phase of the plant had been successfully completed.

On September 9, 2020, the Company announced it had shipped its first large volume of lithium chloride product from the Demonstration Plant for final conversion to lithium carbonate.

On January 18, 2021, announced that its Board has developed a new long-term incentive plan (the “LTIP”) intended to enhance shareholder value and align management compensation with performance and the achievement of milestones in the development of the Company. Under the terms of the LTIP, the Board of Directors has granted an aggregate of 960,000 performance share units to certain officers and directors of the Company. Each restricted share unit represents the right to receive, once vested upon the achievement of performance milestones, one common share in the capital of the Company. Implementation of the LTIP remains subject to ratification by disinterested shareholders of the Company and approval of the TSX Venture Exchange.

On March 1, 2021, the Company announced that it successfully completed the conversion of its Arkansas-produced lithium chloride into 99.985% pure lithium carbonate using Original Equipment Manufacturers (“OEM”) technology. The Company also announced that it commenced work to assess the feasibility of directly converting LiCl produced by the Demonstration Plant into battery quality lithium hydroxide.

On April 5, 2021, the Company announced that the Honorable Francis R. Fannon has joined the company in the role of Strategic Advisor.

On May 17, 2021, the Company commenced work on a PEA on its South-West Arkansas Project. The Company engaged NORAM Engineering and Constructors Ltd. (“NORAM”) as the lead consultant, to prepare and coordinate the PEA. In carrying out the PEA, NORAM will be supported by Hunt, Guillot & Associates from Ruston, Louisiana in key areas such as brine supply, injection well and pipeline design and construction costs.

On June 14, 2021, the Company announced that LANXESS elected for the early conversion in full of the Loan (as defined herein).

In June 2021, the Company reorganized certain of its Canadian subsidiaries such that: 2661881 Ontario Limited (“2661881”), Moab Minerals Corp. and Vernal Minerals Corp. were continued under the Canada Business Corporations Act (resulting in 2661881 changing its name to 13075931 Canada Inc. (“13075931”)); these entities were combined into one entity, being 13075931, pursuant to a horizontal short-form amalgamation; and thereafter, the Company and 13075931 amalgamated pursuant to a vertical short-form amalgamation. The Company also incorporated a new direct wholly-owned subsidiary, Texas Lithium Holdings Corp. under the laws of British Columbia, and two indirect wholly-owned subsidiaries, Texas Lithium Corp. under the laws of Nevada, and 1093905 LLC under the laws of Delaware, and transferred ownership of 1093905 LLC to Texas Lithium Corp.

| 11 |

Subsequent Events to June 30, 2021

On July 13, 2021, the Company commenced trading of its Shares under the ticker symbol “SLI” on the NYSE American.

On July 15, 2021, the Company announced delivery of its SiFT lithium carbonate plant to the El Dorado Arkansas project site.

On July 20, 2021, the Company appointed Dr. Volker Berl as an independent director of the Company.

On October 12, 2021, the Company announced the results of a PEA and update of the inferred mineral resource at the Southwest Arkansas Project. Additionally, the Company’s project partner TETRA, has been involved in renewal of brine leases across the Southwest Arkansas Project, where appropriate.

Selected Financings

The Company has completed the following financings over the last three completed financial years:

On February 16, 2018, the Company closed a brokered private placement and issued 10,312,821 units of the Company (each, a “Unit”) at a price of $2.10 per Unit, for gross proceeds of $21,656,924. Each Unit consists of one Share and one-half of one Share purchase warrant (each whole warrant, a “Unit Warrant”. Each Unit Warrant was exercisable to acquire one Share at an exercise price of $2.60 for a period of two years. The Company paid finder’s fees of $2,165,692 in cash, issued 309,384 Shares and granted 721,897 compensation options which were exercisable for one Unit until February 16, 2020 at an exercise price of $2.10.

On March 21, 2019, the Company closed a bought-deal public offering by way of short form prospectus, comprising 11,390,500 Units at a price of $1.00 per Unit for gross proceeds of $11,390,500. Each Unit consists of one Share and one-half of one Unit Warrant. Each Unit Warrant is exercisable to acquire one Share at an exercise price of $1.30 per share, subject to adjustment in certain events, until March 21, 2022.

On April 15, 2019, the Company closed a private placement comprising 426,000 Units at a price of $1.00 per Unit for gross proceeds of $426,000. Each Unit consists of one Share and one-half of one Unit Warrant. Each Unit Warrant is exercisable to acquire one Share at an exercise price of $1.30 per share, subject to adjustment in certain events, for a period of three years.

On October 30, 2019, the Company entered into a $5,000,000 loan (the “Loan”) and guarantee agreement with LANXESS. US$3.75 million was advanced to the Company, based on an agreed exchange rate, and will be used in the ongoing development of the Demonstration Plant in southern Arkansas, for the demonstration of the Company’s proprietary process for the extraction of lithium from brine solutions.

The principal amount of the Loan will be convertible at the option of LANXESS at a rate such that for each $0.80 of principal converted, the Lender will receive one Common Share and one-half of a Warrant with an exercise price of $1.20 per Common Share and a term of three years. Assuming full conversion of the Loan principal, LANXESS would receive 6,251,250 Shares and 3,125,625 warrants to purchase Shares. All securities issued upon conversion of the Loan will be subject to four-month-and-one-day statutory hold period from the date the Loan was advanced.

| 12 |

The outstanding principal amount of the Loan will bear interest at an annual rate of 3.0%, subject to adjustments. In the event that the Company has a positive consolidated operating cash flow, as shown on its financial statements, the Company will pay a fee to the Lender of 4.5% per annum on the average daily outstanding principal amount of the Loan from the issuance date to the date that the consolidated operating cash flow of the Company is positive. From and after the date on which the consolidated operating cash flow of the Company is positive, the annual interest rate increases to 7.5%. Pre-payments are permitted with prior written approval of LANXESS and are subject to a prepayment fee of 3.0% on the portion of the Loan being prepaid.

The Loan is due and payable in full on the fifth anniversary, subject to the provision that at any time after second anniversary, LANXESS may elect an earlier maturity date on 60 days’ notice to the Company. The Loan was secured by a charge on the shares of Moab Minerals Corp., Vernal Minerals Corp., and 2661881, as well as by a security interest in the tangible and intangible property of the Company and the Subsidiaries.

On February 20, 2020, the Company closed a non-brokered public offering by way of special warrant (each, a “Special Warrant”), comprising 16,140,220 Special Warrants at a price of $0.75 per Special Warrant for gross proceeds of $12,105,165. Each Special Warrant entitles the holder to receive, upon voluntary or deemed exercise, and without payment of additional consideration, one unit of the Company (each, a “Conversion Unit”). Each Conversion Unit consists of one Share and one-half of one share purchase warrant (each, a “Unit Warrant”). Each Unit Warrant is exercisable to acquire one Share at an exercise price of $1.00 per Share, subject to adjustment in certain events, until February 20, 2022, subject to accelerated expiry in certain circumstances. Each Special Warrant would be deemed exercised on the date that is two business days following the earlier of: (i) the date that is four months and one day from issuance of the Special Warrants; or (ii) the date on which the Company obtains a receipt from the applicable securities regulatory authorities for a final prospectus qualifying distribution of the Conversion Units. All Special Warrants converted to Conversion Units on June 21, 2020.

On December 18, 2020, the Company closed a best efforts public offering by way of short form prospectus, comprising 15,697,500 Shares at a price of $2.20 per Share for aggregate gross proceeds of $34,534,500 (the “December 2020 Public Offering”). The Company paid aggregate cash commission of $2,267,815.

On June 14, 2021, LANXESS elected for the early conversion in full of the Loan. The Company issued 6,251,250 Shares, and 3,125,625 share purchase warrants to LANXESS in connection with the conversion of the outstanding Loan and has retired the principal of the Loan in the amount of US$3,750,000. Each warrant is exercisable to acquire one additional Share at a price of $1.20 until June 10, 2024.

| 13 |

DESCRIPTION OF THE BUSINESS

Background

The Company was incorporated under the laws of the Province of British Columbia on August 14, 1998 under the name “Patriot Petroleum Corp.” At its annual general meeting held on November 3, 2016, the shareholders of the Company approved the change of name of the Company to “Standard Lithium Ltd.” and to the continuance of the Company from the Business Corporations Act (British Columbia) to the Canada Business Corporations Act.

The shareholders also approved the consolidation of the Company’s Shares on the basis of one post-consolidation Share for five pre-consolidation Shares. All Share and per Share amounts in this AIF have been retroactively restated to reflect the share consolidation. The Company was formerly in the oil and gas business but changed its focus during the 2016 fiscal year. Standard is currently an innovative technology and lithium development company.

The Company’s flagship project is the Arkansas Lithium Project. In addition, the Company has an interest in certain mineral leases located in the Mojave Desert in San Bernardino county, California. These projects are summarized below

Arkansas Lithium Project

The Arkansas Lithium Project consists of two main areas of interest. The first is pursuant to the TETRA 1st Option Agreement to acquire certain rights to conduct brine exploration and production and lithium extraction activities on approximately 27,262 net acres of brine leases and deeds located in Columbia and Lafayette Counties, Arkansas. The terms and conditions of the TETRA 1st Option Agreement are set forth below. The second is pursuant to the LANXESS MOU and subsequent LANXESS JV Term Sheet regarding the testing and proving of commercial viability of lithium extraction from brine that is produced as part of LANXESS’ bromine extraction business at its three facilities in Union County, southern Arkansas. It is a matter of public record that LANXESS operates approximately 150,000 acres of brine leases in Southern Arkansas via three unitised areas. The terms and conditions of the LANXESS MOU and subsequent LANXESS JV Term Sheet described above in “General Development of the Business – Three Year History”.

The Company entered into an option agreement on December 29, 2017 (the “TETRA 1st Option Agreement”) with TETRA to acquire certain rights to conduct brine exploration and production and lithium extraction activities on approximately 27,262 brine acres located in Columbia and Lafayette Counties, Arkansas. Thereunder, the Company will be required to: pay TETRA US$500,00 by January 28, 2018 (paid), US$600,000 by December 29, 2018 (paid), US$700,000 by January 31, 2020 (paid) and US$750,000 by December 29, 2020 (paid); and pay additional annual payments of US$1,000,000 by each annual anniversary date beginning on the date that is 48 months following the date of the TETRA 1st Option Agreement, until the earlier of the expiration of the Exploratory Period (as defined therein) or, if the Company exercises the option, the Company beginning payment of the Royalty (as defined therein). During the Lease Period (as defined therein), at any time following the commencement of Commercial Production (as defined therein), the Company agreed to pay a royalty of 2.5% (minimum royalty US$1,000,000) to TETRA.

| 14 |

All of the Company’s activities in southern Arkansas relate to brine leases that overlie the Smackover Formation in a region with a long history of commercial scale brine processing. Historical published brine data and current unpublished brine data from within and adjacent to the Company’s area of activities lead the Company to believe that lithium-bearing brines are likely present throughout underlying the project area.

The lease area has been historically drilled for oil and gas exploration, and approximately 256 exploration and production wells have been completed in the Smackover Formation in or immediately adjacent to Company’s lease area. All of these 256 wells have geological logs, and all can be used to constrain the top of the Smackover Formation brine-bearing zone. In addition, a subset of 30 wells has full core reports that provide detailed data, and downhole geophysical logs that include formation resistivity and porosity data.

On August 28, 2018, the Company announced analysis from four brine samples recovered from two existing wells in the lease area showed lithium concentrations ranging between 347–461 mg/L lithium, with an average of 450 mg/L lithium in one of the wells, and 350 mg/L in the other. The brines were sampled from preexisting oil and gas wells that had been previously drilled into the Smackover Formation, and were completed at depths of approximately 9,300 ft (2,830 m) below ground level.

On November 14, 2018, the Company announced a maiden inferred resource of 802,000 tonnes lithium carbonate equivalent (“LCE”) at its LANXESS Property. The resource is defined across a total footprint of approximately 150,000 acres, which is comprised over 10,000 separate brine leases.

With respect to the LANXESS MOU and LANXESS JV Term Sheet, in Q1 2019 the Company undertook mini-pilot scale process work, using tail brine collected from operating facilities in Southern Arkansas. This work provided the engineering data for the design of a full-scale, continuously operated Demonstration Plant. The Company contracted Zeton Inc. (“Zeton”) to build the Demonstration Plant. The Demonstration Plant was constructed by Zeton in three phases and the final modules of the Company’s Demonstration Plant were transported to and installed at LANXESS’ South Plant facility in southern Arkansas. The Demonstration Plant is based on the Company’s proprietary LiSTR technology, that uses a solid sorbent material to selectively extract lithium from LANXESS’ tailbrine. The Company and their contractors completed initial installation of the Demonstration Plant at LANXESS’ South Plant facility in southern Arkansas. This installation was completed in mid-October 2019. During November and December 2019, a semi-permanent all-weather structure was installed to enclose the demonstration plant, and an office/control room and an analytical laboratory were also installed.

On January 28, 2019, the Corporation announced a maiden resource estimate on the South-West Arkansas Project, and on June 19, 2019, the Corporation announced the results of its preliminary economic assessment and updated Mineral Resource estimate on its LANXESS Property, and details regarding this are provided in the “Mineral Properties” section below.

On May 19, 2020, the Company announced full-time operation of the Demonstration Plant. The plant is designed to process up to 50 USGPM of brine, extract the lithium, with the aim of producing a high quality, concentrated lithium chloride intermediate product. This product can then be converted into battery quality lithium carbonate, either via conventional OEM processes, or via the proprietary SiFT technology the Company is developing. As of July 15, 2020, the Company’s SiFT pilot plant was operational and represents the next generation of lithium carbonate crystallisation, promising higher purities and more consistent product specifications; all requirements of the next generations of lithium ion batteries.

| 15 |

On March 1, 2021, the Company announced that it successfully completed the conversion of its Arkansas-produced lithium chloride into 99.985% pure lithium carbonate using OEM technology. The Company also announced that it commenced work to assess the feasibility of directly converting LiCl produced by the Demonstration Plant into battery quality lithium hydroxide.

On May 17, 2021, the Company commenced work on a PEA on its South-West Arkansas Project. The PEA will consider an integrated project including; brine supply and injection wells, pipelines and brine treatment infrastructure, a direct lithium extraction plant using the Company’s proprietary LiSTR technology, and a lithium chloride to lithium hydroxide conversion plant.

On June 14, 2021, the Company announced that LANXESS elected for the early conversion in full of the Loan.

On July 15, 2021, the Company announced delivery of its SiFT lithium carbonate plant to the El Dorado Arkansas project site.

See also “General Development of the Business – Three Year History – Subsequent Events to June 30, 2021.”

California Lithium Project

See “Mineral Properties – California Lithium Project” below for information on the California Lithium Project.

Lithium Brine Processing Project

The Company has formed a technical advisory group that is engaged in performing brine processing test and design work on bulk brine samples gathered from the Company’s projects. Work has been completed on five main fronts: (i) pre-treating the Company’s brines using modern filtration technologies; (ii) selectively extracting lithium from pre-treated brine(s) to produce a concentrated lithium salt solution; (iii) purifying and crystallisation of concentrated lithium solutions to produce battery-grade lithium products; (iv) de-risking the technology by designing, building and operating progressively larger pilot and pre-commercial plants; and (v) assisting in developing, refining and submitting patent applications and other intellectual property (IP) protections. The Company currently holds substantial IP and has filed full, non-provisional patent applications in several jurisdictions for its LiSTR (selective lithium extraction) technology, as well as a provisional application for its SiFT lithium carbonate crystallisation technology. This work is ongoing.

Other

The Company is continuing to review its options with respect to the current and other prospective properties.

| 16 |

Specialized Skills and Knowledge

Successful exploration, development and operation of the Company’s lithium projects will require access to personnel in a wide variety of disciplines, including geologists, geophysicists, engineers, drillers, managers, project managers, accounting, financial and administrative staff, and others. Since the project locations are also in jurisdictions familiar with and friendly to resource extraction, management believes that the Company’s access to the skills and experience needed for success is sufficient.

Competitive Conditions

The Company’s activities are directed towards the exploration, evaluation and development of mineral deposits. There is no certainty that the expenditures to be made by the Company will result in discoveries of commercial quantities of mineral deposits. There is aggressive competition within the mining industry for the discovery and acquisition of properties considered to have commercial potential. The Company will compete with other interests, many of which have greater financial resources than it will have, for the opportunity to participate in promising projects. Significant capital investment is required to achieve commercial production from successful exploration efforts, and the Company may not be able to successfully raise funds required for any such capital investment. See “Risk Factors – Competition” below.

Business Cycles

Mining is a cyclical industry and commodity prices fluctuate according to global economic trends and conditions. See “Risk Factors – Risk Related to the Cyclical Nature of the Mining Business” below.

Environmental Protection

Our exploration and development activities, as applicable, are subject to various levels of federal, state and local laws and regulations relating to the protection of the environment, including requirements for closure and reclamation of mining properties.

Employees

As of the date of this AIF, the Company did not have any employees and the services of CEO, CFO and President and COO were provided by contractors.

Reorganizations

Except as set forth above in “General Development of the Business – Three Year History”, there have been no corporate reorganizations within the three most recently completed financial years of the Company and there is no corporate reorganization completed during or proposed for the current financial year.

| 17 |

MINERAL PROPERTIES

Arkansas Lithium Project

The Arkansas Lithium Project consists of two main areas of interest: LANXESS Property and South-West Arkansas Project. Each property will be discussed below separately.

LANXESS Property

Please refer to the technical report titled “Preliminary Economic Assessment of LANXESS Smackover Project” dated August 1, 2019 (the “LANXESS PEA”), as filed on the Company’s SEDAR profile, for detailed disclosure relating to:

| · | Project Description, Location and Access; |

| · | History; |

| · | Geological Setting, Mineralization and Deposit Types; |

| · | Exploration; |

| · | Drilling; |

| · | Sample, Analysis and Data Verification; |

| · | Mineral Processing and Metallurgical Testing; |

| · | Mineral Resource and Mineral Reserve Estimates; |

| · | Mining Operations; |

| · | Processing and Recovery Methods; |

| · | Infrastructure, Permitting and Compliance Activities; |

| · | Capital and Operating Costs; |

| · | Exploration, Development and Production. |

The following is a summary of the LANXESS PEA, prepared by a multi-disciplinary team of Qualified Persons (“QPs”) that include geologists, hydrogeologists and chemical engineers with relevant experience in brine geology, brine resource modelling and estimation, and lithium-brine processing. The authors include Marek Dworzanowski, P.Eng., B.Sc. (Hons), FSAIMM, Roy Eccles M.Sc. P. Geol. of APEX Geoscience Ltd. (“APEX”), Stanislaw Kotowski, P.Eng, M.Sc. of Worley and Dr. Ron Molnar Ph.D. P. Eng. of METNETH2O.

The LANXESS PEA is incorporated by reference herein and for full technical details, the complete text of the LANXESS PEA should be consulted.

The following summary does not purport to be a complete summary of the LANXESS Property and is subject to all the assumptions, qualifications and procedures set out in the LANXESS PEA and is qualified in its entirety with reference to the full text of the LANXESS PEA. Readers should read this summary in conjunction with the LANXESS PEA.

Property Location and Description