Form 20-F Seadrill Partners LLC For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

(Mark One)

¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001- 35704

(Exact Name of Registrant as Specified in Its Charter)

Republic of The Marshall Islands

(Jurisdiction of Incorporation or Organization)

2nd floor, Building 11, Chiswick Business Park, 566 Chiswick High Road, London,

W4 5YS, United Kingdom

Telephone: +44 20 8811 4700

(Address of Principal Executive Offices)

John Roche

2nd floor, Building 11, Chiswick Business Park, 566 Chiswick High Road, London,

W4 5YS, United Kingdom

Telephone: +44 20 8811 4700

E-mail: [email protected]

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading symbol | Name of Each Exchange on which Registered |

_ | _ | _ |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: Common units representing limited liability company interests

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

7,527,830 Common Units representing limited liability company interests

1,654,335 Subordinated Units representing limited liability company interests

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer ý | Emerging growth company o |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ý

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ý | International Financial Reporting Standards as Issued by the International Accounting Standards Board ¨ | Other ¨ |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

SEADRILL PARTNERS LLC

INDEX TO REPORT ON FORM 20-F

PART I | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

A. | ||

B. | ||

C. | ||

D. | ||

Item 4. | ||

A. | ||

B. | ||

C. | ||

D. | ||

Item 4A. | ||

Item 5. | ||

A. | ||

B. | ||

C. | ||

D. | ||

E. | ||

F. | ||

G. | ||

Item 6. | ||

A. | ||

B. | ||

C. | ||

D. | ||

E. | ||

Item 7. | ||

A. | ||

B. | ||

C. | ||

Item 8. | ||

A. | ||

B. | ||

Item 9. | ||

A. | ||

B. | ||

C. | ||

D. | ||

E. | ||

F. | ||

Item 10. | ||

A. | ||

B. | ||

C. | ||

D. | ||

E. | ||

F. | ||

G. | ||

H. | ||

I. | ||

Item 11. | ||

Item 12. | ||

PART II | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Item 16A. | ||

Item 16B. | ||

Item 16C. | ||

Item 16D. | ||

Item 16E. | ||

Item 16F. | ||

Item 16G. | ||

Item 16H. | ||

PART III | ||

Item 17. | ||

Item 18. | ||

Item 19. | ||

Presentation of Information in this Annual Report

This annual report on Form 20-F for the year ended December 31, 2019, ("the annual report"), should be read in conjunction with the Consolidated Financial Statements and accompanying notes included in this report. Unless the context otherwise requires, references in this annual report to "Seadrill Partners LLC," "Seadrill Partners," the "Company," "we," "our," "us" or similar terms refer to Seadrill Partners LLC, a Marshall Islands limited liability company, or any one or more of its subsidiaries (including OPCO, as defined below), or to all of such entities, and, for periods prior to the Company's initial public offering ("IPO") on October 24, 2012, the Company's combined entity. References to the Company's "combined entity" refer to the subsidiaries of Seadrill Limited that had interests in the drilling units in the Company's initial fleet prior to the Company's initial public offering, or in the case of drilling units subsequently acquired from Seadrill Limited in transactions between parties under common control, the subsidiaries of Seadrill Limited that had interests in the drilling units prior to the date of acquisition. References in this annual report to "Seadrill" or "Seadrill Limited" refer, depending on the context, to Seadrill Limited (NYSE: SDRL) and to any one or more of its direct and indirect subsidiaries. References to "Seadrill Management" refer to Seadrill Management Ltd, the entity that provides the Company with personnel and management, administrative, financial and other support services.

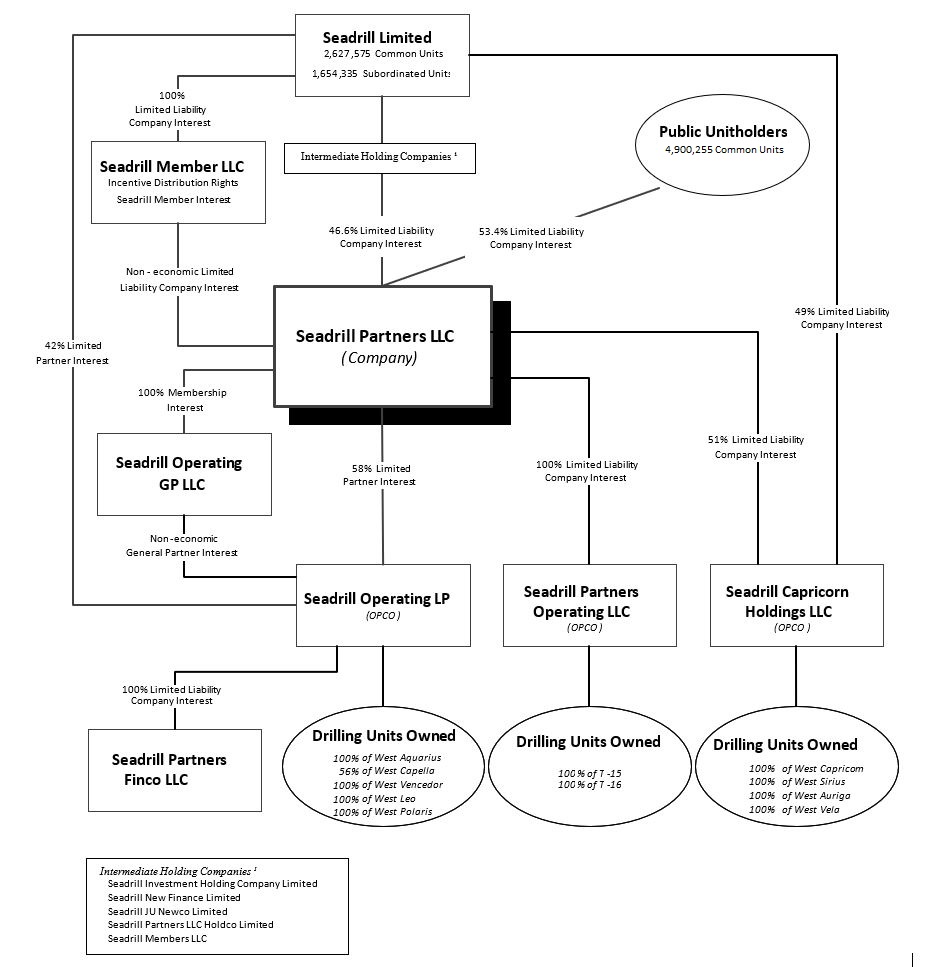

The Company owns (i) a 58% limited partner interest in Seadrill Operating LP, as well as the non-economic general partner interest in Seadrill Operating LP through the Company's 100% ownership of its general partner, Seadrill Operating GP LLC, (ii) a 51% limited liability company interest in Seadrill Capricorn Holdings LLC and (iii) a 100% interest in Seadrill Partners Operating LLC. Seadrill Operating LP owns: (i) a 100% interest in the entities that own and operate the West Aquarius, the West Vencedor, West Leo and the West Polaris (ii) an approximate 56% interest in the entity that owns and operates the West Capella and (iii) a 100% limited liability company interest in Seadrill Partners Finco LLC. Seadrill Capricorn Holdings LLC owns 100% of the entities that own and operate the West Capricorn, the West Sirius, the West Auriga, and the West Vela. Seadrill Partners Operating LLC owns 100% of the entities that own and operate the T-15 and T-16. Seadrill Operating LP, Seadrill Capricorn Holdings LLC and Seadrill Partners Operating LLC are collectively referred to as "OPCO."

All references in this annual report to "OPCO" when used in a historical context refer to OPCO's predecessor companies and their subsidiaries, and when used in the present tense or prospectively refer to OPCO and its subsidiaries, collectively, or to OPCO individually, as the context may require.

References in this annual report to "Seadrill Member" refer to the owner of the Seadrill Member interest, which is a non-economic limited liability company interest in Seadrill Partners and is currently held by Seadrill Member LLC, a wholly owned subsidiary of Seadrill. Certain references to the "Seadrill Member" refer to Seadrill Member LLC, as the context requires.

References in this annual report to "ExxonMobil", "Chevron", "BP", "Tullow", "Petronas", and "Hibernia" refer to subsidiaries of ExxonMobil Corporation, Chevron Corporation, BP Plc, Tullow Plc, Petroliam Nasional Berhad (PETRONAS), and Hibernia Management and Development Ltd. respectively, that are or were the Company's customers.

Important Information Regarding Forward Looking Statements

Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical or present facts or conditions.

This annual report and any other written or oral statements made by us or on our behalf may include forward-looking statements which reflect our current views with respect to future events and financial performance. The words "believe," "anticipate," "intend," "estimate," "forecast," "project," "plan," "potential," "may," "should," "expect" and similar expressions identify forward-looking statements.

The forward-looking statements in this annual report are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management's examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections.

i

In addition to these important factors and matters discussed elsewhere in this annual report, and in the documents incorporated by reference in this annual report, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include:

• | the impact of active negotiations and contingency planning efforts with respect to the refinancing of the Company's credit facilities; |

• | offshore drilling market conditions, including supply and demand; |

• | the Company's distribution policy and the Company's ability to make cash distributions on the Company's units or any resumption in such distributions and the amount of such distributions; |

• | the future financial condition, liquidity or results of operations of the Company or Seadrill; |

• | the repayment or refinancing of debt, including significant maturities on or prior to March 1, 2021; |

• | the ability of the Company and OPCO to comply with financing agreements and the effect of restrictive covenants in such agreements; |

• | the ability of the Company's drilling units to perform satisfactorily or to the Company's expectations; |

• | fluctuations in the price of oil; |

• | discoveries of new sources of oil that do not require deepwater drilling units; |

• | the development of alternative sources of fuel and energy; |

• | technological advances, including in production, refining and energy efficiency; |

• | weather events and natural disasters; |

• | the Company's ability to meet any future capital expenditure requirements; |

• | the Company's ability to maintain operating expenses at adequate and profitable levels; |

• | expected costs of maintenance or other work performed on the Company's drilling units and any estimates of downtime; |

• | the Company's ability to leverage Seadrill's relationship and reputation in the offshore drilling industry; |

• | the Company's ability to purchase drilling units in the future, including from Seadrill; |

• | increasing the Company's ownership interest in OPCO; |

• | customer contracts, including contract backlog, contract terminations and contract revenues; |

• | delay in payments by, or disputes with the Company's customers under its drilling contracts; |

• | termination of the Company's drilling contracts due to force majeure or other events; |

• | the financial condition of the Company's customers and their ability and willingness to fund oil exploration, development and production activity; |

• | the Company's ability to comply with, maintain, renew or extend its existing drilling contracts; |

• | the Company's ability to re-contract its drilling units upon conclusion of its existing drilling contracts at profitable dayrates; |

• | the Company's ability to respond to new technological requirements in the areas in which the Company operates; |

• | the occurrence of any accident involving the Company's drilling units or other drilling units in the industry; |

• | changes in governmental regulations that affect the Company and the interpretations of those regulations, particularly those that relate to environmental matters, export or import and economic sanctions or trade embargo matters, regulations applicable to the oil industry and tax and royalty legislation; |

• | competition in the offshore drilling industry and other actions of competitors, including decisions to deploy or scrap drilling units in the areas in which the Company currently operates; |

• | the availability on a timely basis of drilling units, supplies, personnel and oil field services in the areas in which the Company operates; |

• | general economic, political and business conditions globally, including global health threats, such as the Coronavirus, or COVID-19, outbreak on us, our customers and suppliers; |

• | military operations, terrorist acts, wars or embargoes; |

• | potential disruption of operations due to accidents, political events, piracy or acts by terrorists; |

• | the Company's ability to obtain financing in sufficient amounts and on adequate terms; |

• | workplace safety regulation and employee claims; |

• | the cost and availability of adequate insurance coverage; |

• | the Company's fees and expenses payable under the advisory, technical and administrative services agreements and the management and administrative services agreements; |

• | the taxation of the Company and distributions to the Company's unitholders; |

• | future sales of the Company's common units in the public market; |

• | acquisitions and divestitures of assets and businesses by Seadrill; and |

• | the Company's business strategy and other plans and objectives for future operations. |

We caution readers of this annual report not to place undue reliance on these forward-looking statements, which speak only as of their dates. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict all these factors. Further, we cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward looking statement.

ii

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. Selected Financial Data

The following table presents, in each case for the periods and as of the dates indicated, the Company's selected Consolidated and Combined Carve-Out financial and operating data. The following financial data should be read in conjunction with Item 5 - "Operating and Financial Review and Prospects" and the Company's historical Consolidated Financial Statements and the notes thereto included elsewhere in this annual report. We refer you to the notes to our Consolidated Financial Statements for a discussion of the basis on which our Consolidated Financial Statements are prepared, and we draw your attention to the statement regarding going concern as described in Note 1 - "General information" of the Consolidated Financial Statements included within this report.

Year Ended December 31, | ||||||||||||||||||||

2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

(in $ millions, except per unit data) | ||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Total operating revenues (1) | 750.0 | 1,038.2 | 1,128.4 | 1,600.3 | 1,741.6 | |||||||||||||||

Total other operating items (2) | 0.7 | (3.2 | ) | 90.7 | — | — | ||||||||||||||

Total operating expenses | (700.1 | ) | (678.0 | ) | (755.6 | ) | (782.2 | ) | (897.9 | ) | ||||||||||

Net operating income | 50.6 | 357.0 | 463.5 | 818.1 | 843.7 | |||||||||||||||

Total financial items | (273.9 | ) | (196.3 | ) | (187.9 | ) | (185.9 | ) | (254.7 | ) | ||||||||||

(Loss)/Income before income taxes | (223.3 | ) | 160.7 | 275.6 | 632.2 | 589.0 | ||||||||||||||

Income tax benefit/(expense) | 36.1 | (86.7 | ) | (40.3 | ) | (86.5 | ) | (100.6 | ) | |||||||||||

Net (loss)/income | (187.2 | ) | 74.0 | 235.3 | 545.7 | 488.4 | ||||||||||||||

(Loss)/ Earnings per unit (common and subordinated) | ||||||||||||||||||||

Common unitholders (U.S. dollar) (3) | $ | (10.12 | ) | $ | 7.45 | $ | 18.76 | $ | 31.97 | $ | 24.46 | |||||||||

Subordinated unitholders (U.S. dollar) (3) | $ | (10.12 | ) | — | — | $ | 22.85 | $ | 24.48 | |||||||||||

1. | Total operating revenues include amounts recognized as early termination fees under the offshore drilling contracts which have been terminated prior to the contract end date. |

2. | Total other operating items in 2018 are a result of a loss on impairment of goodwill. The gain in 2019 and 2017 primarily related to a decrease in the fair value of contingent liabilities to Seadrill for the purchase of the West Polaris in 2015. Refer to Note 8 - "Other operating items" for further information. |

3. | These amounts have been updated to reflect the 1 for 10 reverse stock split on July 2, 2019. |

As of December 31, | |||||||||||||||

2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||

(in $ millions) | |||||||||||||||

Balance Sheet Data (at end of period): | |||||||||||||||

Cash and cash equivalents | 560.0 | 841.6 | 848.6 | 767.6 | 319.0 | ||||||||||

Drilling units | 4,840.8 | 5,005.6 | 5,170.9 | 5,340.9 | 5,547.3 | ||||||||||

Total assets | 5,680.0 | 6,185.4 | 6,530.8 | 6,780.7 | 6,841.1 | ||||||||||

Total interest bearing debt | 2,878.2 | 3,059.1 | 3,367.8 | 3,600.6 | 3,840.2 | ||||||||||

Total equity | 2,523.7 | 2,714.2 | 2,701.8 | 2,535.8 | 2,097.4 | ||||||||||

Please also refer to Note 2 - "Accounting policies" to the Consolidated Financial Statements included in this annual report.

1

Year Ended December 31, | |||||||||||||||

2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||

(in $ millions, except fleet and unit data) | |||||||||||||||

Cash Flow Data: | |||||||||||||||

Net cash provided by operating activities | (26.0 | ) | 434.1 | 476.2 | 873.8 | 859.8 | |||||||||

Net cashflows from investing activities | (29.7 | ) | (23.4 | ) | (11.1 | ) | 97.6 | (376.3 | ) | ||||||

Net cashflows from financing activities | (225.9 | ) | (416.7 | ) | (384.9 | ) | (522.1 | ) | (407.6 | ) | |||||

Net (decrease)/increase in cash and cash equivalents | (281.6 | ) | (7.0 | ) | 81.0 | 448.6 | 76.3 | ||||||||

Fleet Data: | |||||||||||||||

Number of drilling units at end of period | 11 | 11 | 11 | 11 | 11 | ||||||||||

Average age of drilling units at end of period (years) | 8.7 | 7.7 | 6.7 | 5.7 | 4.7 | ||||||||||

Other Financial Data: | |||||||||||||||

Capital expenditures (1) | 111.1 | 115.0 | 121.6 | 61.1 | 68.4 | ||||||||||

Distributions declared per unit (2) (3) | 0.1200 | 3.1000 | 4.0000 | 5.5000 | 19.5250 | ||||||||||

Members Capital (at end of period): | |||||||||||||||

Total members capital (excluding non-controlling interest) | 1,235.0 | 1,329.7 | 1,303.7 | 1,192.6 | 964.3 | ||||||||||

Common Unitholders—units (3) | 7,527,830 | 7,527,830 | 7,527,830 | 7,527,830 | 7,527,830 | ||||||||||

Subordinated Unitholders—units (3) | 1,654,335 | 1,654,335 | 1,654,335 | 1,654,335 | 1,654,335 | ||||||||||

1. | Capital expenditures include long-term maintenance |

2. | Distributions attributable to the year. Distributions were declared only with respect to the common units in 2019, 2018 and 2017. |

3. | These amounts have been updated to reflect the 1 for 10 reverse stock split on July 2, 2019. |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our assets are primarily engaged in offshore contract drilling for the oil and gas industry in benign and harsh environments worldwide, including ultra-deepwater environments. The following summarizes risks that may materially affect our business, financial condition, results of operations, cash available for distributions or the trading price of our common units. The occurrence of any of the events described in this section could materially and negatively affect our business, financial condition, results of operations, cash available for the payment of distributions or the trading price of our common units. Unless otherwise indicated, all information concerning our business and our assets is as of December 31, 2019. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations.

Risks Relating to Our Indebtedness

We may not be able to refinance existing facilities or raise additional capital on acceptable terms, which may hinder or prevent us from meeting existing obligations and expanding our business.

As of December 31, 2019, we had $2.9 billion in principal amount of external interest-bearing debt secured by, among other things, liens on our drilling units. The debt will become due on or prior to February 2021, including our Term Loan B (approximately $2.6 billion outstanding due on or before February 2021), West Vela facility (approximately $151 million due on or before October 2020) and West Polaris facility (approximately $115 million due on or before July 2020).

In order to repay our indebtedness coming due in 2021, we will need to obtain new financing, sell assets, repay the debt with the proceeds from equity offerings or otherwise reach agreement with our lenders to extend such debt maturities or on other arrangements. Additional debt or equity financing may also not be available to us in the future for refinancing or repayment of existing indebtedness.

Our current indebtedness and potential future indebtedness could affect our performance, since a significant portion of our cash flow from operations will be dedicated to the payment of interest and principal on such debt and will not be available for other purposes.

2

We are in ongoing negotiations with our lenders and other stakeholders, which creates significant uncertainty, and may result in impairment, losses or substantial dilution for stakeholders.

To address our near-term maturities, we engaged with our secured lenders and Seadrill and have retained financial advisers and legal counsel in connection with these discussions. The Company aims to achieve a comprehensive and consensual solution that builds a sustainable capital structure and provides sufficient liquidity and maturity that reduces refinancing risk. Such a solution could involve amendments to the terms of our credit facilities, including a maturity extension. Alternatively, a deleveraging of our capital structure may be determined to be in the best interests of the Company, which may be accomplished on an out-of-court basis or an in-court basis, which could result in common unitholders experiencing substantial dilution in their voting and economic interests in the Company or receiving minimal or no recovery for their existing common units.

The outcome of these discussions is uncertain and could result in impairment, losses or substantial dilution for stakeholders, and may impair our ability to continue as a going concern.

There is a substantial doubt over our ability to continue as a going concern

Our consolidated financial statements as of December 31, 2019 were prepared under the assumption that we will continue as a going concern for the next twelve months. Our short-term liquidity requirements relate to servicing our debt repayments, interest payments, and funding working capital requirements. Historically, our main sources of liquidity included bank balances and contract and other revenues. To satisfy our debt maturities we expect additional liquidity to be required or we will need to otherwise negotiate maturity extensions or make other arrangements with our lenders. These conditions indicate the existence of substantial doubt about the Company's ability to continue as a going concern within the meaning of FASB's ASU 2014-15, Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern.

Our independent registered public accounting firm has issued an audit opinion that included an explanatory paragraph referring to our significant debt repayment due in the first quarter of 2021 and management's plan in this regard, and expressing substantial doubt in our ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The covenants in our credit facilities impose operating and financial restrictions on us, breach of which could result in a default under the terms of these agreements, which could accelerate the repayment of funds that we have borrowed.

Our debt agreements impose operating and financial restrictions on us. These restrictions may prohibit, or otherwise limit, our ability to undertake certain business activities without consent of the lending banks. These restrictions include:

• | executing other financing arrangements; |

• | incurring additional indebtedness; |

• | creating or permitting liens on our assets; |

• | selling our drilling units or the shares of our subsidiaries; |

• | making investments; |

• | changing the general nature of our business; |

• | paying distributions to our unitholders; |

• | changing the management and/or ownership of the drilling units; and |

• | making capital expenditures. |

Our lenders' interests may be different from ours and we may not be able to obtain our lenders' consent for requests that may be beneficial to our business. This may impact our performance.

In addition, several of our debt agreements require us to maintain certain specified financial ratios and to satisfy covenants, including ratios and covenants that pertain to, among other things, our liquidity and a net leverage ratio under our secured rig financing credit facilities.

In the future, to the extent our operating results indicate that we may not meet the net leverage ratio of our secured credit facilities, or a liquidity requirement, there are a number of actions available which are under management's control. We cannot provide any assurances that management's actions will resolve compliance with the leverage ratio, liquidity requirement or any other financial covenant. In the event that we fail to comply with the covenants in our credit facilities, we would be considered in default, after any applicable notice from our lenders, which would enable applicable lenders to accelerate the repayment of amounts outstanding and exercise remedies, subject to applicable cure or grace periods, and we would need to seek an amendment or waiver from the applicable lender groups.

Such amendments or waivers from our lenders may be subject to competing interests of the lending institutions. We cannot provide any assurances that we will be able to obtain such an amendment or waiver. If we are not able to obtain waivers or amendments, or if such waivers or amendments have onerous conditions attached, this may limit our ability to make decisions in the best interests of our business.

If we are unable to comply with any of the restrictions and covenants in our current or future debt financing agreements, and we are unable to obtain a waiver or amendment from our lenders for such noncompliance, a default could occur under the terms of those agreements. If a default occurs under these agreements, lenders could terminate their commitments to lend or accelerate the outstanding loans and declare all amounts borrowed due and payable. Our drilling units and equity interests in our subsidiaries serve as security for our secured indebtedness. If our lenders were to foreclose their liens on our drilling units or the equity interests in our subsidiaries in the event of a default, this would impair our ability to continue our operations.

3

Certain of our loan agreements contain cross-default provisions, meaning that if we are in default under one of our loan agreements, our other loan agreements also may be in default, which could result in amounts outstanding under those loan agreements to be accelerated and become due and payable. If any of these events occur, we cannot guarantee that our assets will be sufficient to repay in full all of our outstanding indebtedness, and we may be unable to find alternative financing. Even if we could obtain alternative financing, that financing might not be on terms that are favorable or acceptable. Any of these events would adversely affect our ability to make distributions to unitholders and cause a decline in the market price of our common units. For more information, please read Item 5 - "Operating and Financial Review and Prospects-Liquidity and Capital Resources."

Uncertainty regarding the London Interbank Offered Rate ("LIBOR") may adversely impact our indebtedness under our credit and loan facilities, which could have a material adverse effect on our business, financial condition and results of operations.

In July 2017, the U.K. Financial Conduct Authority announced that it would phase out LIBOR as a benchmark by the end of 2021. It is unclear whether new methods of calculating LIBOR will be established such that it continues to exist after 2021. Proposed alternative reference interest rates so far are based on overnight tenors only, while the most frequently used LIBOR rates are for one, three and six month tenors. Most of our credit and loan facilities are linked to LIBOR. When LIBOR ceases to exist, we may need to amend our credit and loan facilities based on a new standard that is established, if any. The basis of calculation of such standard is not yet agreed upon amongst market participants and as a result the cost of our borrowings may increase. In addition, any resulting differences in interest rate standards among our assets and our financing arrangements may result in interest rate mismatches between our assets and the borrowings used to fund such assets. There is no guarantee that a transition from LIBOR to an alternative reference interest rate will not result in financial market disruptions or significant increases in benchmark rates, or borrowing costs to borrowers, any of which could have an adverse effect on our business, financial condition and results of operations.

Risks Relating to Our Company and our Business

The success and growth of our business depends on the level of activity in the offshore oil and gas industry generally, and the drilling industry specifically, which are both highly competitive and cyclical, with intense price competition.

Our business depends on the level of oil and gas exploration, development and production in offshore areas worldwide that is influenced by oil and gas prices and market expectations of potential changes in these prices.

Oil and gas prices are extremely volatile and are affected by numerous factors beyond our control, including, but not limited to, the following:

• | worldwide production of, and demand for, oil and gas and geographical dislocations in supply and demand; |

• | the cost of exploring for, developing, producing and delivering oil and gas; |

• | expectations regarding future energy prices and production; |

• | advances in exploration, development and production technology; |

• | the ability of the Organization of Petroleum Exporting Countries or OPEC, and other non-member nations, including Russia, to set and maintain levels of production and pricing; |

• | the decision of OPEC or other non-member nations to abandon production quotas and/or member-country quota compliance within OPEC agreements; |

• | the level of production in non-OPEC countries; |

• | international sanctions on oil-producing countries, or the lifting of such sanctions; |

• | government regulations, including restrictions on offshore transportation of oil and natural gas; |

• | local and international political, economic and weather conditions; |

• | domestic and foreign tax policies; |

• | the development and exploitation of alternative fuels and unconventional hydrocarbon production, including shale; |

• | worldwide economic and financial problems and the corresponding decline in the demand for oil and gas and, consequently, our services; |

• | the policies of various governments regarding exploration and development of their oil and gas reserves, accidents, severe weather, natural disasters and other similar incidents relating to the oil and gas industry; and |

• | the worldwide political and military environment, including uncertainty or instability resulting from an escalation or additional outbreak of armed hostilities or other crises in the Middle East, Eastern Europe or other geographic areas or further acts of terrorism in the United States, Europe or elsewhere. |

Decreases in oil and gas prices for an extended period of time, or market expectations of potential decreases in these prices, have negatively affected and could continue to negatively affect our future performance. In March 2020, members of OPEC and Russia failed to reach an agreement to extend their previously agreed oil production cuts. Consequently, Saudi Arabia has announced a significant reduction in its export prices and Russia has announced that all agreed oil production cuts between members of OPEC and Russia will expire on April 1, 2020. As a result of these announcements, the price of oil fell approximately 20% on March 9, 2020. Later in April, OPEC and Russia had reached an agreement, however, due to the decrease in demand caused by COVID-19 pandemic oil prices have remained low. Even though oil prices have recovered during May, any perceived or actual further reduction in oil prices could have a material adverse effect on our business, financial condition and results of operations.

4

Continued periods of low demand can cause excess rig supply and intensify competition in our industry, which often results in drilling rigs, particularly older and less technologically-advanced drilling rigs, being idle for long periods of time. We cannot predict the future level of demand for drilling rigs or future conditions of the oil and gas industry with any degree of certainty. In response to the decrease in the prices of oil and gas, a number of our oil and gas company customers have announced significant decreases in budgeted expenditures for offshore drilling. Any future decrease in exploration, development or production expenditures by oil and gas companies could further reduce our revenues and materially harm our business.

In addition to oil and gas prices, the offshore drilling industry is influenced by additional factors, which could reduce demand for our services and adversely affect our business, including:

• | the availability and quality of competing offshore drilling units; |

• | the availability of debt financing on reasonable terms; |

• | the level of costs for associated offshore oilfield and construction services; |

• | oil and gas transportation costs; |

• | the level of rig operating costs, including crew and maintenance; |

• | the discovery of new oil and gas reserves; |

• | the political and military environment of oil and gas reserve jurisdictions; and |

• | regulatory restrictions on offshore drilling. |

The offshore drilling industry is highly competitive and fragmented and includes several large companies that compete in many of the markets we serve, as well as numerous small companies that compete with us on a local basis. Offshore drilling contracts are generally awarded on a competitive bid basis or through privately negotiated transactions. In determining which qualified drilling contractor is awarded a contract, the key factors are pricing, rig availability, rig location, the condition and integrity of equipment, the rig's and/or the drilling contractor's record of operating efficiency, including high operating uptime, technical specifications, safety performance record, crew experience, reputation, industry standing and customer relations. Our operations may be adversely affected if our current competitors or new market entrants introduce new drilling rigs with better features, performance, prices or other characteristics compared to our drilling rigs, or expand into service areas where we operate.

Competitive pressures and other factors may result in significant price competition, particularly during industry downturns, which could have a material adverse effect on our results of operations and financial condition.

The current downturn in activity in the oil and gas drilling industry has had and is likely to continue to have an adverse impact on our business and results of operations.

The oil and gas drilling industry is cyclical and is currently in a prolonged downcycle since 2014. As at December 31, 2019, the price of Brent crude was approximately $68 per barrel. After OPEC and Russia failed to agree on recent production cuts, however, Brent crude reached a low of $22 per barrel on March 30, 2020. Despite the fact that OPEC and Russia had reached a deal, Brent crude reached a low of $19 per barrel on April 21, 2020.

If we are unable to secure contracts for our drilling units upon the expiration of our existing contracts, we may idle or stack our units. When idled or stacked, drilling units do not earn revenues, but continue to require cash expenditures for crews, fuel, insurance, berthing and associated items.

As of December 31, 2019, we had six idle units, either "warm stacked," which means the rig is kept operational and ready for redeployment, and maintains most of its crew, or "cold stacked," which means the rig is stored in a harbor, shipyard or a designated offshore area, and the crew is reassigned to an active rig or dismissed. Without new drilling contracts or additional financing being available when needed or available only on unfavorable terms, we will be unable to meet our obligations as they come due or we may be unable to enhance our existing business, complete additional drilling unit acquisitions or otherwise take advantage of business opportunities as they arise.

In the current environment, our customers may also seek to cancel or renegotiate our contracts for various reasons, including adverse conditions, resulting in lower dayrates. Our inability, or the inability of our customers to perform, under our or their contractual obligations may have a material adverse effect on our financial position, results of operations and cash flows.

From time to time, we are approached by potential buyers for the outright purchase of some of our drilling units, businesses, or other fixed assets. We may determine that such a sale would be in our best interests and agree to sell certain drilling units or other assets. Such a sale could have an impact on short-term liquidity and net income. We may recognize a gain or loss on disposal depending on whether the fair value of the consideration received is higher or lower than the carrying value of the asset.

We do not know when the market for offshore drilling units may recover, or the nature or extent of any future recovery. There can be no assurance that the current demand for drilling rigs will not further decline in future periods. The continued or future decline in demand for drilling rigs would adversely affect our financial position, operating results and cash flows.

5

Our customers may seek to cancel or renegotiate their contracts to include unfavorable terms such as unprofitable rates, particularly in the circumstance that operations are suspended or interrupted

In the current market conditions, some of our customers may seek to terminate their agreements with us.

Some of our customers have the right to terminate their drilling contracts without cause upon the payment of an early termination fee. The general principle is that such early termination fee shall compensate us for lost revenues less operating expenses for the remaining contract period; however, in some cases, such payments may not fully compensate us for the loss of the drilling contract.

Under certain circumstances our contracts may permit customers to terminate contracts early without the payment of any termination fees, as a result of non-performance, periods of downtime or impaired performance caused by equipment or operational issues, or sustained periods of downtime due to force majeure events beyond our control. In addition, national oil company customers may have special termination rights by law. During periods of challenging market conditions, we may be subject to an increased risk of our customers seeking to repudiate their contracts, including through claims of non-performance.

Our customers may seek to renegotiate their contracts with us using various techniques, including threatening breaches of contract and applying commercial pressure, resulting in lower dayrates or the cancellation of contracts with or without any applicable early termination payments.

Reduced dayrates in our customer contracts and cancellation of drilling contracts (with or without early termination payments) may adversely affect our performance and lead to reduced revenues from operations.

Our contract backlog for our fleet of drilling units may not be realized.

As of May 31, 2020, our contract backlog was approximately $207.2 million.

The contract backlog presented in this annual report and our other public disclosures is only an estimate. The actual amount of revenues earned and the actual periods during which revenues are earned may be different from the contract backlog projections due to various factors, including shipyard and maintenance projects, downtime and other events within or beyond our control. In addition, we or our customers may seek to cancel or renegotiate our contracts for various reasons, including adverse conditions, such as the current environment, resulting in lower dayrates. In some instances, there is an option for a customer to terminate a drilling contract prematurely for convenience on payment of an early termination fee. However, this fee may not adequately compensate us for the loss of this drilling contract.

Our inability, or the inability of our customers, to perform under our or their contractual obligations may have a material adverse effect on our financial position, results of operations and cash flows.

We may not be able to renew or obtain new and favorable contracts for our drilling units whose contracts have expired or been terminated.

During the most recent period of high utilization and high dayrates, which we believe ended in early 2014, industry participants ordered the construction of new drilling units, which resulted in an over-supply and caused, in conjunction with deteriorating industry conditions, a decline in utilization and dayrates when the new drilling units entered the market. A relatively large number of the drilling units currently under construction have not been contracted for future work, and a number of units in the existing worldwide fleet are currently off-contract.

As of May 31, 2020, we have three drilling units on contract expiring in 2020. Our ability to renew these contracts or obtain new contracts will depend on our customers and prevailing market conditions, which may vary among different geographic regions and types of drilling units.

If we are unable to secure contracts for our drilling units we may continue to idle or stack our units. When idled or stacked, drilling units do not earn revenues, but continue to require cash expenditures for crews, fuel, insurance, berthing and associated items. As at December 31, 2019 we had six units either "warm stacked," which means the rig is kept operational and ready for redeployment, and maintains most of its crew, or "cold stacked," which means the rig is stored in a harbor, shipyard or a designated offshore area, and the crew is reassigned to an active rig or dismissed.

If we are not able to obtain new contracts in direct continuation of existing contracts, or if new contracts are entered into at dayrates substantially below the existing dayrates or on terms otherwise less favorable compared to existing contract terms, our revenues and profitability could be adversely affected. We may also be required to accept more risk in areas other than price to secure a contract and we may be unable to push this risk down to other contractors or be unable or unwilling at competitive prices to insure against this risk, which will mean the risk will have to be managed by applying other controls. This could lead to us being unable to meet our liabilities in the event of a catastrophic event on one of our rigs.

6

The market value of our drilling units may further decrease.

The market values of drilling units have declined as a result of the recent continued decline in the price of oil, which has been impacted by the spending plans of our customers. If the offshore contract drilling industry suffers further adverse developments in the future, the fair market value of our drilling units may decline further. The fair market value of the drilling units that we currently own, or may acquire in the future, may increase or decrease depending on a number of factors, including:

• | the general economic and market conditions affecting the offshore contract drilling industry, including competition from other offshore contract drilling companies; |

• | the types, sizes and ages of drilling units; |

• | the supply and demand for drilling units; |

• | the costs of newbuild drilling units; |

• | the prevailing level of drilling services contract dayrates; |

• | governmental or other regulations; and |

• | technological advances. |

If drilling unit values fall significantly, we may have to record an impairment adjustment in our Consolidated Financial Statements, which could adversely affect our financial results and condition. Additionally, if we sell one or more of our drilling units at a time when drilling unit prices have fallen, the sale price may be less than the drilling unit's carrying value in our Consolidated Financial Statements, resulting in a reduction in earnings.

Our business and operations involve numerous operating hazards, and in the current market we are increasingly required to take additional contractual risk in our customer contracts and we may not be able to procure insurance to adequately cover potential losses.

Our operations are subject to hazards inherent in the drilling industry, such as blowouts, reservoir damage, loss of production, loss of well control, lost or stuck drill strings, equipment defects, punch-throughs, cratering, fires, explosions and pollution. Contract drilling and well servicing requires the use of heavy equipment and exposure to hazardous conditions, which may subject us to liability claims by employees, customers and third parties. These hazards can cause personal injury or loss of life, severe damage to or destruction of property and equipment, pollution or environmental damage, claims by third parties or customers and suspension of operations. Our offshore fleet is also subject to hazards inherent in marine operations, either while on-site or during mobilization, such as capsizing, sinking, grounding, collision, damage from severe weather and marine life infestations. Operations may also be suspended because of machinery breakdowns, abnormal drilling conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. We customarily provide contract indemnity to our customers for claims that could be asserted by us relating to damage to or loss of our equipment, including rigs and claims that could be asserted by us or our employees relating to personal injury or loss of life.

Damage to the environment could also result from our operations, particularly through spillage of fuel, lubricants or other chemicals and substances used in drilling operations, or extensive uncontrolled fires. We may also be subject to property, environmental, personal injury and other damage claims by private parties, including oil and gas companies, as well as administrative, civil and criminal penalties or injunctions.

Our insurance policies and contractual rights to indemnity may not adequately cover losses, and we do not have insurance coverage or rights to indemnity for all risks. Consistent with standard industry practice, our customers generally assume, and indemnify us against, well control and subsurface risks under dayrate contracts. These are risks associated with the loss of control of a well, such as blowout or cratering, the cost to regain control of or re-drill the well and associated pollution. However, there can be no assurances that these customers will be willing or financially able to indemnify us against all these risks. Customers may seek to cap indemnities or narrow the scope of their coverage, reducing our level of contractual protection.

In addition, a court may decide that certain indemnities in our current or future contracts are not enforceable. For example, in a 2012 decision in a case related to the fire and explosion that took place on the unaffiliated Deepwater Horizon Mobile Offshore Drilling Unit in the Gulf of Mexico in April 2010, or the Deepwater Horizon Incident (to which we were not a party), the U.S. District Court for the Eastern District of Louisiana invalidated certain contractual indemnities for punitive damages and for civil penalties under the U.S. Clean Water Act under a drilling contract governed by U.S. maritime law as a matter of public policy. Further, pollution and environmental risks generally are not totally insurable. If a significant accident or other event occurs that is not fully covered by our insurance or an enforceable or recoverable indemnity from a customer, the occurrence could adversely affect our performance.

The amount recoverable under insurance may also be less than the related impact on enterprise value after a loss or not cover all potential consequences of an incident and include annual aggregate policy limits. As a result, we retain the risk through self-insurance for any losses in excess of these limits. Any such lack of reimbursement may cause us to incur substantial costs.

We could decide to retain more risk through self-insurance in the future. This self-insurance results in a higher risk of losses, which could be material, which are not covered by third-party insurance contracts. Specifically, we have at times in the past elected to self-insure for physical damage to rigs and equipment caused by named windstorms in the U.S. Gulf of Mexico due to the substantial costs associated with such coverage. Beginning on April 1, 2014, we have insured a limited part of this windstorm risk in a combined single limit annual aggregate policy. We elected to place an insurance policy for physical damage to rigs and equipment caused by named windstorms in the U.S. Gulf of Mexico with a combined single limit of $100 million in the annual aggregate, which includes loss of hire. If we elect to self-insure such risks again in the future and such windstorms cause significant damage to any rig and equipment we have in the U.S. Gulf of Mexico, it could have a material adverse effect on our financial position, results of operations or cash flows.

7

No assurance can be made that we will be able to maintain adequate insurance in the future at rates that we consider reasonable, or that we will be able to obtain insurance against certain risks.

We derive the majority of our revenue from a small number of customers, and the loss of any of these customers could result in a material loss of revenues and cash flow.

We are subject to the risks associated with having a limited number of customers for our services. We currently derive the majority of our revenues and cash flow from a small number of customers. For the year ended December 31, 2019, BP accounted for 67.6% and ExxonMobil accounted for 11.0% of our total revenues, respectively. Our results of operations could be materially adversely affected if any of our major customers fail to compensate us for our services, or cancel or re-negotiate our contracts.

We are subject to risk of loss resulting from non-payment or non-performance by our customers and certain other third parties. Some of these customers and other parties may be highly leveraged and subject to their own operating and regulatory risks. If any key customers or other parties default on their obligations to us, our financial results and condition could be adversely affected. Any material non-payment or non-performance by these entities, other key customers or certain other third parties could adversely affect our financial position, results of operations and cash flows.

Our drilling contracts contain fixed terms and day-rates, and consequently we may not fully recoup our costs in the event of a rise in expenses, including reactivation, operating and maintenance costs.

Our operating costs are generally related to the number of units in operation and the cost level in each country or region where the units are located. A significant portion of our operating costs may be fixed over the short term.

The majority of our contracts have dayrates that are fixed over the contract term. In order to mitigate the effects of inflation on revenues from term contracts, most of our long-term contracts include escalation provisions. These provisions allow us to adjust the dayrates based on stipulated cost increases, including wages, insurance and maintenance costs. However, actual cost increases may result from events or conditions that do not cause correlative changes to the applicable indices. Furthermore, certain indices are updated semiannually, and therefore may be outdated at the time of adjustment. The adjustments are typically performed on a semi-annual or annual basis. For these reasons, the timing and amount received as a result of such adjustments may differ from our actual cost increases, which could adversely affect our financial performance. In such contracts, the dayrate could be adjusted lower during a period when costs of operation rise, which could adversely affect our financial performance. Shorter-term contracts normally do not contain escalation provisions. In addition, our contracts typically contain provisions for either fixed or dayrate compensation during mobilization. These rates may not fully cover our costs of mobilization, and mobilization may be delayed, increasing our costs, without additional compensation from the customer, for reasons beyond our control.

In connection with new assignments, we might incur expenses relating to preparation for operations under a new contract. Expenses may vary based on a number of factors including the scope and length of such required preparations, whether the relevant unit is idle or stacked and reactivation is required and the duration of the contractual period over which such expenditures are amortized.

Equipment maintenance costs fluctuate depending upon the type of activity that the unit is performing and the age and condition of the equipment, as well as the applicable environmental, safety and maritime regulations and standards. Our operating expenses and maintenance costs depend on a variety of factors, including crew costs, provisions, equipment, insurance, maintenance and repairs, and shipyard costs, many of which are beyond our control.

In situations where our drilling units incur idle time between assignments, the opportunity to reduce the size of our crews on those drilling units is limited, as the crews will be engaged in preparing the unit for its next contract. When a unit faces longer idle periods, reductions in costs may not be immediate as some of the crew may be required to prepare drilling units for stacking and maintenance in the stacking period. Should units be idle for a longer period, we will seek to redeploy crew members, who are not required to maintain the drilling unit, to active rigs, to the extent possible. However, there can be no assurance that we will be successful in reducing our costs in such cases.

Operating and maintenance costs will not necessarily fluctuate in proportion to changes in operating revenues. Operating revenues may fluctuate as a function of changes in supply of offshore drilling units and demand for contract drilling services. Please see "The success and growth of our business depends on the level of activity in the offshore oil and gas industry generally, and the drilling industry specifically, which are both highly competitive and cyclical, with intense price competition", "Our customers may seek to cancel or renegotiate their contracts to include unfavorable terms such as unprofitable rates, particularly in the circumstance that operations are suspended or interrupted" and "We may not be able to renew or obtain new and favorable contracts for our drilling units whose contracts which have expired or been terminated". This could adversely affect our revenue from operations.

8

Consolidation and governmental regulation of suppliers may increase the cost of obtaining supplies or restrict our ability to obtain needed supplies

We rely on certain third parties to provide supplies and services necessary for our offshore drilling operations, including, but not limited to, drilling equipment suppliers, catering and machinery suppliers. Recent mergers have reduced the number of available suppliers, resulting in fewer alternatives for sourcing key supplies. With respect to certain items, such as blow-out preventers ("BOPs"), we are dependent on the original equipment manufacturer for repair and replacement of the item or its spare parts. Such consolidation, combined with a high volume of drilling units under construction, may result in a shortage of supplies and services, thereby increasing the cost of supplies and/or potentially inhibiting the ability of suppliers to deliver on time. These cost increases or delays could have a material adverse effect on our results of operations and result in rig downtime, and delays in the repair and maintenance of our drilling rigs.

We may be unable to obtain, maintain, and/or renew permits necessary for our operations or experience delays in obtaining such permits including the class certifications of rigs

The operation of our drilling units is subject to certain governmental approvals, the number and prerequisites of which cannot be determined until we identify the jurisdictions in which we will operate on securing contracts for the drilling units. Depending on the jurisdiction, these governmental approvals may involve public hearings and costly undertakings on our part. We may not obtain such approvals or such approvals may not be obtained in a timely manner. If we fail to timely secure the necessary approvals or permits, our customers may have the right to terminate or seek to renegotiate their drilling contracts to our detriment.

Every offshore drilling unit is a registered marine vessel and must be "classed" by a classification society to fly a flag. The classification society certifies that the drilling unit is "in-class," signifying that such drilling unit has been built and maintained in accordance with the rules of the classification society and complies with applicable rules and regulations of the drilling unit's country of registry and the international conventions of which that country is a member. In addition, where surveys are required by international conventions and corresponding laws and ordinances of a flag state, the classification society will undertake them on application or by official order, acting on behalf of the authorities concerned. Our drilling units are certified as being "in class" by the American Bureau of Shipping, or "ABS," Det Norske Veritas and Germanisher Lloyd, or "DNV GL," and the relevant national authorities in the countries in which our drilling units operate. If any drilling unit loses its flag, does not maintain its class and/or fails any periodical survey or special survey, the drilling unit will be unable to carry on operations and will be unemployable and uninsurable. Any such inability to carry on operations or be employed could have a material adverse impact on the results of operations.

The international nature of our operations involves additional risks including foreign government intervention in relevant markets.

We operate in various regions throughout the world. As a result of our international operations, we may be exposed to political and other uncertainties, particularly in less developed jurisdictions, including risks of:

• | terrorist acts, armed hostilities, war and civil disturbances; |

• | acts of piracy, which have historically affected ocean-going vessels; |

• | abduction, kidnapping and hostage situations; |

• | significant governmental influence over many aspects of local economies; |

• | the seizure, nationalization or expropriation of property or equipment; |

• | absence of laws or uncertainty of outcome in foreign court proceedings; |

• | the repudiation, nullification, modification or renegotiation of contracts; |

• | lack of cooperation with our due diligence or compliance practices; |

• | limitations on insurance coverage, such as war risk coverage, in certain areas; |

• | political unrest; |

• | foreign and U.S. monetary policy and foreign currency fluctuations and devaluations; |

• | the inability to repatriate income or capital; |

• | complications associated with repairing and replacing equipment in remote locations; |

• | import-export quotas, wage and price controls, and the imposition of trade barriers; |

• | U.S., European Union and other foreign sanctions or trade embargoes; |

• | anti-boycott regulations; |

• | compliance with various jurisdictional regulatory or financial requirements; |

• | compliance with and changes in taxation; |

• | other forms of government regulation and economic conditions that are beyond our control; and |

• | governmental corruption. |

In addition, international contract drilling operations are subject to various laws and regulations of the countries in which we operate, including laws and regulations relating to:

• | the equipping and operation of drilling units; |

• | exchange rates or exchange controls; |

• | the repatriation of foreign earnings; |

• | oil and gas exploration and development; |

• | the taxation of offshore earnings and the earnings of expatriate personnel; and |

• | the use and compensation of local employees and suppliers by foreign contractors. |

9

Some foreign governments favor or effectively require (i) the awarding of drilling contracts to local contractors or to drilling rigs owned by their own citizens, (ii) the use of a local agent or (iii) foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. These practices may adversely affect our ability to compete in those regions. It is difficult to predict what governmental regulations may be enacted in the future that could adversely affect the international drilling industry. The actions of foreign governments, including initiatives by OPEC, may adversely affect our ability to compete. Failure to comply with applicable laws and regulations, including those relating to sanctions and export restrictions, may subject us to criminal sanctions or civil remedies, including fines, the denial of export privileges, injunctions or seizures of assets.

Compliance with, and breach of, the complex laws and regulations governing international trade could be costly, expose us to liability and adversely affect our operations.

Our business in the offshore drilling industry is affected by laws and regulations relating to the energy industry and the environment in the geographic areas where we operate.

Accordingly, we are directly affected by the adoption of laws and regulations that, for economic, environmental or other policy reasons, curtail exploration and development drilling for oil and gas. We may be required to make significant capital expenditures or operational changes to comply with governmental laws and regulations. It is also possible that these laws and regulations may, in the future, add significantly to our operating costs or significantly limit drilling activity. Failure to comply with these laws and regulations could result in the occurrence of delays or restrictions in permitting or performance of projects or the assessment of administrative, civil and criminal penalties.

Import activities are governed by unique customs laws and regulations in each of the countries of operation. Moreover, many countries, including the United States, control the export and re-export of certain goods, services and technology and impose related export recordkeeping and reporting obligations.

The laws and regulations concerning import activity, export recordkeeping and reporting, export control and economic sanctions are complex and constantly changing. These laws and regulations may be enacted, amended, enforced or interpreted in a manner materially impacting our operations. Shipments can be delayed and denied export or entry for a variety of reasons, some of which are outside our control and some of which may result from the failure to comply with existing legal and regulatory regimes. Shipping delays or denials could cause unscheduled operational downtime. Any failure to comply with applicable legal and regulatory trading obligations could also result in criminal and civil penalties and sanctions, such as fines, imprisonment, debarment from government contracts, the seizure of shipments, and the loss of import and export privileges.

Offshore drilling in certain areas, including arctic areas and the U.S. Gulf of Mexico, has been curtailed and, in certain cases, prohibited because of concerns over protection of the environment. New laws or other governmental actions that prohibit or restrict offshore drilling or impose additional environmental protection requirements that result in increased costs to the oil and gas industry, in general, or to the offshore drilling industry, in particular, could adversely affect our performance.

The amendment or modification of existing laws and regulations or the adoption of new laws and regulations curtailing or further regulating exploratory or development drilling and production of oil and gas could have a material adverse effect on our business, results of operations or financial condition. Future earnings may be negatively affected by compliance with any such new legislation or regulations.

We are subject to complex environmental laws and regulations that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to numerous international, national, state and local laws and regulations, treaties and conventions in force in international waters and the jurisdictions in which our drilling units operate or are registered, which can significantly affect the ownership and operation of our drilling units. These requirements include, but are not limited to the conventions under the auspices of the United Nation's International Maritime Organization, or the "IMO," the International Convention for the Prevention of Pollution from Ships of 1973, as from time to time amended, or "MARPOL," including the designation of Emission Control Areas, or "ECAs" thereunder, the IMO International Convention on Civil Liability for Oil Pollution Damage of 1969, as from time to time amended, or the "CLC," the International Convention on Civil Liability for Bunker Oil Pollution Damage, or the "Bunker Convention," the International Convention for the Safety of Life at Sea of 1974, as from time to time amended, or "SOLAS," the International Safety Management Code for the Safe Operation of Ships and for Pollution Prevention, or the "ISM Code," the IMO International Convention on Load Lines in 1966, as from time to time amended, the International Convention for the Control and Management of Ships' Ballast Water and Sediments in February 2004 or the "BWM Convention," the U.S. Oil Pollution Act of 1990, or the "OPA," requirements of the U.S. Coast Guard, or the "USCG," the U.S. Environmental Protection Agency, or the "EPA," the U.S. Comprehensive Environmental Response, Compensation and Liability Act, or "CERCLA," the U.S. Maritime Transportation Security Act of 2002, or the "MTSA," the U.S. Outer Continental Shelf Lands Act, certain regulations of the European Union, and the laws and regulations of other countries in which we operate. Compliance with such laws, regulations and standards, where applicable, may require installation of costly equipment or implementation of operational changes and may affect the resale value or useful lifetime of our drilling units. These costs could have a material adverse effect on our business, results of operations, cash flows and financial condition. A failure to comply with applicable laws and regulations may result in administrative and civil penalties, criminal sanctions or the suspension or termination of our operations. Because such conventions, laws, and regulations are often revised, we cannot predict the ultimate cost of complying with them or the impact thereof on the resale prices or useful lives of our rigs. Additional conventions, laws and regulations may be adopted which could limit our ability to do business or increase the cost of our doing business and which may materially adversely affect our operations.

Certain environmental laws impose strict liability for the remediation of spills and releases of oil and hazardous substances, which could subject us to liability without regard to whether we were negligent or at fault. Under OPA, for example, owners, operators and bareboat charterers are jointly and severally strictly liable for the discharge of oil within the 200-mile exclusive economic zone around the United States. An oil or chemical spill for which we are deemed a responsible party could result in us incurring significant liability, including fines, penalties, criminal liability and remediation costs for natural resource damages under other federal, state and local laws, as well as third-party damages, which could

10

have a material adverse effect on our business, financial condition, results of operations and cash flows. Furthermore, the 2010 explosion of the Deepwater Horizon well and the subsequent release of oil into the Gulf of Mexico resulted in the substantial revision of safety regulations applicable to our industry; other similar events may result in further regulation of the shipping industry and modifications to statutory liability schemes, thus exposing us to further potential financial risk in the event of any such oil or chemical spill.

We are required by various governmental and quasi-governmental agencies to obtain certain permits, licenses and certificates with respect to our operations, and satisfy insurance and financial responsibility requirements for potential oil (including marine fuel) spills and other pollution incidents. Although we have arranged insurance to cover certain environmental risks, there can be no assurance that such insurance will be sufficient to cover all such risks or that any claims will not have a material adverse effect on our business, results of operations, cash flows and financial condition.

Although our drilling units are separately owned by our subsidiaries, under certain circumstances a parent company and all of the unit-owning affiliates in a group under common control engaged in a joint venture could be held liable for damages or debts owed by one of the affiliates, including liabilities for oil spills under OPA or other environmental laws. Therefore, it is possible that we could be subject to liability upon a judgment against us or any one of our subsidiaries.

Our drilling units could cause the release of oil or hazardous substances. Any releases may be large in quantity, above our permitted limits or occur in protected or sensitive areas where public interest groups or governmental authorities have special interests. Any releases of oil or hazardous substances could result in fines and other costs to us, such as costs to upgrade our drilling rigs, clean up the releases and comply with more stringent requirements in our discharge permits. Moreover, these releases may expose us to private litigation or result in our customers or governmental authorities suspending or terminating our operations in the affected area(s), which could have a material adverse effect on our business, results of operations and financial condition.

If we are able to obtain from our customers some degree of contractual indemnification against pollution and environmental damages in our contracts, such indemnification may not be enforceable in all instances or the customer may not be financially able to comply with its indemnity obligations in all cases, and we may not be able to obtain such indemnification agreements in the future. In addition, a court may decide that certain indemnities in our current or future contracts are not enforceable.

The insurance coverage we currently hold may not be available in the future, or we may not obtain certain insurance coverage. Furthermore, insurance costs may increase in the event of ongoing patterns of adverse changes in weather or climate. Even if insurance is available and we have obtained the coverage, it may not be adequate to cover our liabilities, or our insurance underwriters may be unable to pay compensation if a significant claim should occur. Any of these scenarios could have a material adverse effect on our business, results of operations and financial condition.

Failure to comply with international anti-corruption legislation, including the U.S. Foreign Corrupt Practices Act 1977 or the UK Bribery Act 2010, could result in fines, criminal penalties, damage to our reputation and drilling contract terminations.

We currently operate, and historically have operated, our drilling units in a number of countries throughout the world, including some with developing economies. We interact with government regulators, licensor's, port authorities and other government entities and officials. Also, our business interaction with national oil companies as well as state or government-owned shipbuilding enterprises and financing agencies puts us in contact with persons who may be considered to be "foreign officials" under the U.S. Foreign Corrupt Practices Act of 1977 (the "FCPA") and the Bribery Act 2010 of the United Kingdom (the "UK Bribery Act"). We are subject to the risk that we or our affiliated companies or their respective officers, directors, employees and agents may take actions determined to be in violation of anti-corruption laws, including the FCPA and the U.K. Bribery Act. Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties, curtailment of operations in certain jurisdictions, and might adversely affect our business, results of operations or financial condition. In addition, actual or alleged violations could damage our reputation and ability to do business. Detecting, investigating and resolving actual or alleged violations is expensive and can consume significant time and attention of our senior management.