Form 20-F Paysafe Ltd For: Mar 30

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: March 30, 2021

Commission File Number: 001-40302

PAYSAFE LIMITED

(Exact name of Registrant as specified in its charter)

| Not applicable | Bermuda | |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Paysafe Limited

Victoria Place

31 Victoria Street

Hamilton H10, Bermuda

(Address of Principal Executive Offices)

Elliott Wiseman

25 Canada Square, 27th Floor, London, United Kingdom E14 5LQ

+44 (0) 207 608 8460

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Shares | PSFE | New York Stock Exchange | ||

| Warrants | PSFE.WS | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report: 723,712,382 common shares and 53,901,025 warrants.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Emerging growth company | ☐ | |||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting over Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ☒ | International Financial Reporting Standards as issued | Other ☐ | ||||||

| by the International Accounting Standards Board | ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☐

Table of Contents

PAYSAFE LIMITED

| ii | ||||

| ii | ||||

| iii | ||||

| iii | ||||

| v | ||||

| 1 | ||||

| Item 1. Identity of Directors, Senior Management and Advisers |

1 | |||

| 1 | ||||

| 1 | ||||

| 48 | ||||

| 86 | ||||

| 86 | ||||

| 115 | ||||

| 123 | ||||

| 125 | ||||

| 136 | ||||

| 136 | ||||

| Item 11. Quantitative and Qualitative Disclosures About Market Risk |

138 | |||

| Item 12. Description of Securities Other than Equity Securities |

138 | |||

| 138 | ||||

| 138 | ||||

| 138 | ||||

| 138 | ||||

| 138 | ||||

| F-1 | ||||

Table of Contents

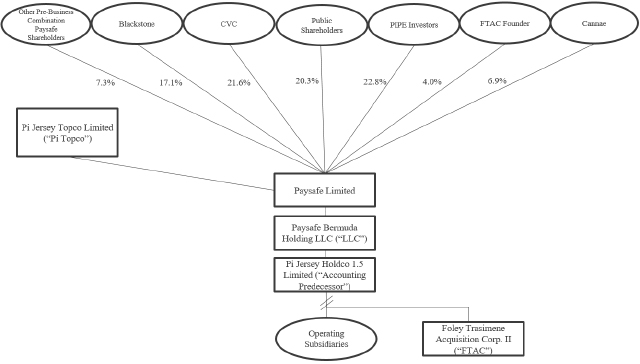

On December 7, 2020, Foley Trasimene Acquisition Corp. II, a Delaware corporation (“FTAC”), Paysafe Limited, an exempted limited company incorporated under the laws of Bermuda (“Paysafe Limited”), Merger Sub Inc., a Delaware corporation and direct, wholly owned subsidiary of Paysafe Limited (“Merger Sub”), Paysafe Bermuda Holding LLC, a Bermuda exempted limited liability company (the “LLC”), Pi Jersey Holdco 1.5 Limited, a private limited company incorporated under the laws of Jersey, Channel Islands (the “Accounting Predecessor”), and Paysafe Group Holdings Limited, a private limited company incorporated under the laws of England and Wales (“PGHL”), entered into the Agreement and Plan of Merger (the “Merger Agreement”). Pursuant to the Merger Agreement, among other things, (i) Merger Sub would merge with and into FTAC, with FTAC being the surviving corporation in the merger and an indirect subsidiary of Paysafe Limited (“Merger”) and each outstanding publicly traded share of FTAC Class A Common Stock and FTAC Class B Common Stock (other than certain excluded shares) would convert into the right to receive one common share, par value $0.001 per share, of Paysafe Limited (“Company Common Shares”), (ii) PGHL would transfer and contribute the Accounting Predecessor to the Company in exchange for Company Common Shares and cash and (iii) each of FTAC’s publicly traded warrants that are outstanding immediately prior to the effective time of the Merger would, pursuant to and in accordance with the warrant agreement covering such warrants, automatically and irrevocably be modified to provide that such warrant will no longer entitle the holder thereof to purchase the amount of share(s) of FTAC common stock set forth therein and in substitution thereof such warrant will entitle the holder thereof to acquire the same number of Company Common Shares per warrant on the same terms. The Business Combination was consummated on March 30, 2021, and on March 31, 2021 Paysafe Limited’s common shares and warrants began trading on the NYSE under the symbols “PSFE” and “PSFE.WS,” respectively.

FINANCIAL STATEMENT PRESENTATION

Paysafe Limited

Paysafe Limited was incorporated by PGHL under the laws of Bermuda on November 23, 2020 for the purpose of effectuating the Business Combination described herein. Prior to the Business Combination, Paysafe Limited had no material assets and did not operate any businesses. The Business Combination resulted in Paysafe Limited acquiring, and becoming the successor to, the Accounting Predecessor. Simultaneously, it completed the combination with the public shell company, FTAC, with an exchange of the shares and warrants issued by Paysafe Limited for those of FTAC. The Business Combination was accounted for as a capital reorganization followed by the combination with FTAC, which was treated as a recapitalization. Following the Business Combination, both the Accounting Predecessor and FTAC are indirect wholly owned subsidiaries of Paysafe Limited.

The Accounting Predecessor

As a result of the transaction being accounted for as a capital reorganization, Pi Jersey Holdco 1.5 Limited was deemed to be the Accounting Predecessor of Paysafe Limited. The Accounting Predecessor has a direct voting interest or a variable interest in the Group’s activities and operations that result in revenues, expenses, assets and liabilities. The financial statements for the Accounting Predecessor are included in this Report for the three years ended December 31, 2020.

ii

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report on Form 20-F (including information incorporated by reference herein, the “Report”) contains or may contain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “anticipate,” “appear,” “approximate,” “believe,” “continue,” “could,” “estimate,” “expect,” “foresee,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “would” and variations of such words and similar expressions (or the negative version of such words or expressions) may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in the section entitled “Item 3.D. Risk Factors” of this Report.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

In this Report, we present industry data, forecasts, information and statistics regarding the markets in which we compete as well as our analysis of statistics, data and other information that we have derived from third parties, including independent consultant reports, publicly available information, various industry publications and other published industry sources (including Mastercard’s investor presentation, eMarketer Inc.’s global eCommerce report dated June 2020 (referred to herein as “eMarketer”), the Strawhecker Group, Nilson, FIS, Newzoo, Eilers & Krejcik, H2 Gambling Capital, Allied Market Research,Glenbrook and Boston Consulting Group). Independent consultant reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable. Such information is supplemented where necessary with our own internal estimates and information obtained from discussions with our customers, taking into account publicly available information about other industry participants and our management’s judgment where information is not publicly available. This information appears in “Item 4.B. Information on the Company—Business Overview,” “Item 5. Operating and Financial Review and Prospects” and other sections of this Report.

Although we believe that these third-party sources are reliable, it does not guarantee the accuracy or completeness of this information, and we have not independently verified this information. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this Report. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Item 3.D. Risk Factors” of this Report. These and other factors could cause results to differ materially from those expressed in any forecasts or estimates. Some market data and statistical information are also based on our good faith estimates, which are derived from management’s knowledge of our industry and such independent sources referred to above. Certain market, ranking and industry data included elsewhere in this Report, including the size of certain markets and our size or position and the positions of our competitors within these markets, including its services relative to its competitors, are based on estimates by us. These estimates have been derived from management’s knowledge and experience in the markets in which we operate, as well as information obtained from surveys, reports by market research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate and have not been verified by independent sources. Unless otherwise noted, all of our market share and

iii

Table of Contents

market position information presented in this Report is an approximation. Our market share and market position in each of our business segments, unless otherwise noted, is based on our volume relative to the estimated volume in the markets served by each of our business segments. References herein to Paysafe being a leader in a market or product category refer to our belief that we have a leading market share position in each specified market, unless the context otherwise requires. As there are no publicly available sources supporting this belief, it is based solely on our internal analysis of our volume as compared to the estimated volume of our competitors. In addition, the discussion herein regarding our various end markets is based on how it defines the end markets for its products, which products may be either part of larger overall end markets or end markets that include other types of products and services.

Our internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and management’s understanding of industry conditions. Although we believe that such information is reliable, it has not had this information verified by any independent sources.

iv

Table of Contents

Unless otherwise stated or unless the context otherwise requires, all references to “we,” “us,” “our,” “Paysafe” or the “Company” refer to (i) Pi Jersey Holdco 1.5 Limited prior to the consummation of the Business Combination and to (ii) Paysafe Limited following the consummation of the Business Combination.

In addition, in this document:

“Accounting Predecessor” means Pi Jersey Holdco 1.5 Limited, a private limited company incorporated under the laws of Jersey, Channel Islands.

“Additional I/C Loans” means FTAC’s loans out of the Available Cash Amount, caused by the Company, to certain Subsidiaries of the Company following the FTAC Contribution.

“Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is controlled by, or is under common control with, such specified Person, through one or more intermediaries or otherwise; provided, except for the Company and its Subsidiaries, no Affiliate or portfolio company (as such term is commonly understood in the private equity industry) of funds advised by affiliates of CVC or Blackstone or any of their respective Affiliates shall be considered an Affiliate of the Company or any of its Subsidiaries.

“Available Cash Amount” means, as of immediately prior to Closing, all available Cash and Cash Equivalents of FTAC and its Subsidiaries, including (i) all amounts in the Trust Account (after reduction for the aggregate amount of payments required to be made in connection with FTAC Stockholder Redemption), (ii) the PIPE Investment Proceeds, and (iii) the aggregate amount of cash proceeds from the FTAC Financing.

“Blackstone” means The Blackstone Group Inc.

“Blackstone Investors” means certain funds affiliated with Blackstone.

“Brexit” means the United Kingdom (“UK”) leaving the EU.

“Business Combination” means the transactions contemplated by the Merger Agreement.

“Business Combination Proposal” means the proposal to adopt the Merger Agreement and approve the transactions contemplated thereby.

“CAGR” means compounded annual growth rate.

“Cannae” means Cannae Holdings and Cannae LLC.

“Cannae Holdings” means Cannae Holdings, Inc.

“Cannae LLC” means Cannae Holdings LLC, a wholly-owned subsidiary of Cannae Holdings.

“Cash and Cash Equivalents” means, for any Person, all cash and cash equivalents (including marketable securities, checks and bank deposits); provided, however that with respect to PGHL and its Subsidiaries, such amount shall (x) exclude segregated account funds and liquid assets as more fully described on Exhibit F-1 attached to the Merger Agreement and (y) include any costs, fees and expenses associated with refinancing or repricing the existing indebtedness of the Company (in accordance with the Merger Agreement) that have not been paid on or prior to the Closing Date.

“CBI” means the Central Bank of Ireland.

“Closing” means the closing of the transactions contemplated by the Merger Agreement and the PIPE Investment agreements.

v

Table of Contents

“Closing Date” means the date on which the Closing is completed.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Committee” means the compensation committee of the Company’s Board, or such other committee of the Company’s Board to which it has properly delegated power, or if no such committee or subcommittee exists, the Company’s Board which the Omnibus Incentive Plan will be administered by.

“Company Board” means the board of directors of the Company from time to time.

“Company Bye-laws” means the bye-laws of the Company to be amended and restated substantially in the form of Exhibit B attached to the Merger Agreement prior to the Effective Time.

“Company Common Share(s)” means the common shares, par value $0.001 per share, of Paysafe Limited and any successors thereto or other classes of common share of the Company created in any Pre-Closing Recapitalization.

“Company LLC Contribution” means the transfer and contribution of FTAC and the Accounting Predecessor by the Company to the LLC in exchange for LLC Interests immediately following the I/C Loan.

“Company Net Debt Amount” means, as of immediately prior to the Closing, an amount equal to (i) the aggregate indebtedness for borrowed money of PGHL and its Subsidiaries and indebtedness issued by PGHL and its Subsidiaries in substitution or exchange for borrowed money, excluding any items set forth on Exhibit F-1 attached to the Merger Agreement minus (ii) Cash and Cash Equivalents of PGHL and its Subsidiaries minus (iii) any costs, fees and expenses associated with refinancing or repricing the existing indebtedness of the Company (in accordance with the Merger Agreement) that have been paid on or prior to the Closing Date. An illustrative example of the Company Net Debt Amount is set forth on Exhibit F-2 attached to the Merger Agreement.

“Company Warrants” means warrants that will entitle the holder thereof to purchase for $11.50 per share one Company Common Share in lieu of one share of FTAC Class A Common Stock (subject to adjustment in accordance with the Warrant Agreement).

“COVID-19” means SARS-CoV-2 or COVID-19, and any evolutions thereof or any other epidemics, pandemics or disease outbreaks.

“CVC” means CVC Advisers Limited.

“CVC Investors” means Pi Holdings Jersey Limited and Pi Syndication LP.

“CVC Party” means Pi Holdings Jersey Limited.

“DGCL” means the Delaware General Corporation Law.

“Effective Time” has the meaning specified in Section 2.04 of the Merger Agreement.

“ERISA” means Employee Retirement Income Security Act of 1974.

“EU” means European Union.

“EUR” means Euro, the legal currency of the European Union.

“Executive Management” means members of the executive management of Paysafe.

“Existing Paysafe Shareholders” means CVC Investors, Blackstone Investors and Executive Management.

vi

Table of Contents

“FCA” means the UK Financial Conduct Authority and any successor authority thereto.

“Form F-4” means the Registration Statement on Form F-4 of Paysafe Limited filed on December 21, 2020 (file no. 333-251552), as amended on Form F-4/A on February 1, 2021 and on February 25, 2021.

“Forward Purchase Agreement” means the forward purchase agreement, dated as of July 31, 2020, between FTAC and Cannae Holdings, Inc.

“Founder” means Trasimene Capital FT, LP II.

“Founder LLC Contribution” means the contribution by Founder of FTAC Class C Common Stock to the LLC in exchange for exchangeable units.

“FTAC” means Foley Trasimene Acquisition Corp. II.

“FTAC Class A Common Stock” means the Class A common stock, par value $0.0001 per share, of FTAC.

“FTAC Class B Common Stock” means the Class B common stock, par value $0.0001 per share, of FTAC.

“FTAC Common Stock” means FTAC Class A Common Stock and FTAC Class B Common Stock.

“FTAC Contribution” means, immediately following the Company LLC Contribution, the transfer by the LLC to the Accounting Predecessor, or a Subsidiary of the Accounting Predecessor, of all of the stock of FTAC, consummated prior to the consummation to the Additional I/C Loans.

“FTAC Financing” means the equity financing to be provided pursuant to the Forward Purchase Agreement.

“FTAC Stockholders” means the holders of shares of FTAC Common Stock.

“GAAP” means generally accepted accounting principles in the United States.

“GDPR” means the EU’s General Data Protection Regulation 2016/679, as amended.

“Group” means, where appropriate, Paysafe and its subsidiaries.

“HMRC” means HM Revenue & Customs.

“I/C Loans” means the loans made by FTAC to the Company and the Accounting Predecessor out of the Available Cash Amount, made prior to the consummation of the Company LLC Contribution, FTAC Contribution and the Additional I/C Loans.

“Lien” means any mortgage, deed of trust, pledge, hypothecation, encumbrance, easement, license, option, right of first refusal, security interest or other lien of any kind.

“LLC” means, Paysafe Bermuda Holding LLC, a Bermuda exempted limited liability company.

“LLC Contribution” means, collectively, the Founder LLC Contribution and the Company LLC Contribution.

“LLC Interests” means the limited liability company interests in the LLC.

“Merger” means, immediately following the Founder LLC Contribution, on the terms and subject to the conditions of the Merger Agreement and in accordance with the DGCL and other applicable Laws, a business combination transaction by and among the Parties by which Merger Sub will merge with and into FTAC, with FTAC being the surviving corporation of the Merger, consummated prior to the consummation of the I/C Loans, the Company LLC Contribution, the FTAC Contribution and the Additional I/C Loans.

vii

Table of Contents

“Merger Agreement” means the agreement and plan of merger made and entered into as of December 7, 2020, by and among FTAC, the Company, Merger Sub, the LLC, the Accounting Predecessor and PGHL.

“Merger Sub” means Paysafe Merger Sub Inc., a Delaware corporation and direct, wholly owned subsidiary of the Company.

“NYSE” means the New York Stock Exchange.

“OECD” means the Organisation for Economic Co-operation and Development.

“Omnibus Incentive Plan” means the Paysafe Limited 2021 Omnibus Incentive Plan attached as Exhibit H to the Merger Agreement.

“Paysafe Consolidated Financial Statements” means the consolidated statements of financial position of Pi Jersey Holdco 1.5 Limited as of December 31, 2020 and 2019, the related consolidated statements of comprehensive loss, shareholder’s equity, and cash flows, for the years ended December 31, 2020, 2019 and 2018.

“Paysafe Limited” means Paysafe Limited, an exempted limited company incorporated under the laws of Bermuda.

“Paysafe Parties” means PGHL, the Accounting Predecessor, Merger Sub and the LLC.

“PCAOB” means the Public Company Accounting Oversight Board.

“PGHL” means Paysafe Group Holdings Limited, a private limited company incorporated under the laws of England and Wales.

“Pi Topco” means Pi Jersey Topco Limited, a company incorporated in Jersey.

“PIPE Investment” means the commitments obtained by FTAC from certain investors for a private placement of Company Common Shares pursuant to those certain Subscription Agreements.

“PIPE Investment Proceeds” mean the aggregate amount funded and paid to the Company by the PIPE Investors pursuant to their Subscription Agreements.

“PIPE Investor” means an investor party to a Subscription Agreement.

“POS” means point of sale.

“Pre-Closing Recapitalization” means the Company shall be permitted to adjust, split, combine, subdivide, recapitalize, reclassify or otherwise effect (including by merger) any change in respect of the then-outstanding Company Common Shares (including any such event that involves the creation of new classes of common shares of the Company, which may have varying voting rights on a per-share basis) as necessary or appropriate to facilitate the Transactions.

“Principal Shareholders” means, collectively, the Founder, Cannae LLC, the CVC Investors and the Blackstone Investors.

“Registration Rights Agreement” means the agreement entered into by the Company, Pi Topco, PGHL, Cannae LLC, the Founder, the CVC Party and the Blackstone Investors in connection with the consummation of the Merger, attached to the Merger Agreement as Exhibit D.

“Senior Facilities Agreement” means that certain Senior Facilities Agreement dated as of December 20, 2017, among Paysafe Group Holdings II Limited (formerly Pi UK Holdco II Limited), Paysafe Group Holdings III

viii

Table of Contents

Limited (formerly Pi UK Holdco III Limited), the Persons from time to time party thereto as TLB Borrowers, RCF Borrowers, and as Guarantors (in each case, as defined therein), the financial institutions from time to time party thereto as lenders, Credit Suisse AG, London Branch, as agent and as security agent, and the other Persons from time to time party thereto, as the same has been and may be further amended, restated, amended and restated, supplemented, replaced, refinanced, or otherwise modified from time to time in accordance with the terms thereof.

“Shareholders Agreement” means the agreement entered into by the Company, Pi Topco, PGHL and the Principal Shareholders in connection with the consummation of the Merger, attached to the Merger Agreement as Exhibit D.

“SMB” means small and medium-sized businesses.

“Subscription Agreement” means each individual subscription agreement entered into by each PIPE Investor.

“Transactions” means the transactions contemplated by the Merger Agreement, including the Merger, the Paysafe Contribution, the FTAC Contribution, the Founder LLC Contribution, the Company LLC Contribution and the Pre-Closing Recapitalization.

“Trasimene Capital” means Trasimene Capital Management, LLC, a financial advisory firm led by William P. Foley, II.

“Treasury Regulations” means the regulations, including proposed and temporary regulations, promulgated under the Code.

“U.S. dollar,” “USD,” “US$” and “$” mean the legal currency of the United States.

“VAT” means any: (a) tax imposed in compliance with the council directive of 28 November 2006 on the common system of value added tax (EC Directive 2006/112) (including, in relation to the UK, value added tax imposed by the Value Added Tax Act 1994 and legislation and regulations supplemental thereto); and (b) other tax of a similar nature (including, without limitation, sales tax, use tax, consumption tax and goods and services tax), whether imposed in a member state of the European Union in substitution for, or levied in addition to, such tax referred to in (a), or elsewhere.

“Warrant Agreement” means that certain Warrant Agreement, dated as of August 21, 2020, between FTAC and Continental Stock Transfer & Trust Company, a New York corporation.

ix

Table of Contents

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| A. | Directors and Senior Management |

Information regarding the directors and senior management of the Company following consummation of the Business Combination is set forth in “Item 6.A. Directors and Executive Officers” of this Report.

| B. | Advisors |

Simpson Thacher & Bartlett LLP, 900 G Street, N.W., Washington, D.C. 20001 and Wakefield Quin Limited, Victoria Place, 31 Victoria Street, Hamilton, HM10, Bermuda have acted as counsel for the Company and will act as counsel to the Company upon and following the consummation of the Business Combination.

| C. | Auditors |

Deloitte LLP acted as the independent auditor for Pi Jersey Holdco 1.5 Limited and subsidiaries for each of the three years in the period ended December 31, 2020.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| B. | Capitalization and Indebtedness |

Information pertaining to the indebtedness of Paysafe is set forth in the Form F-4, in the section entitled “Description of Certain Indebtedness,” which is incorporated herein by reference.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Summary

An investment in our shares involves substantial risks and uncertainties that may adversely affect our business, financial condition and results of operations and cash flows. Some of the more significant challenges and risks relating to an investment in our company include, among other things, the following:

| • | Cyberattacks and security vulnerabilities could result in loss of customer and merchant funds and personal data, including financial data, as well as serious harm to our reputation, business, and financial condition. |

| • | We must comply with money laundering regulations in Bermuda, the UK, Ireland, Switzerland, the United States, Canada and elsewhere, and any failure to do so could result in severe financial and legal penalties. |

| • | Our business is subject to extensive regulation and oversight in a variety of areas, all of which are subject to change and uncertain interpretation, including in such a way as to criminalize certain of our activities. |

| • | Our success depends on our relationships with banks, payment card networks, issuers and financial institutions. |

1

Table of Contents

| • | We generate a significant portion of our revenue by processing online payments for merchants and customers engaged in the online gambling and foreign exchange trading sectors. |

| • | Our focus on specialized and high-risk verticals can increase our risks relative to other companies in our industry. |

| • | We may become an unwitting party to fraud or be deemed to be handling proceeds of crimes being committed by customers. |

| • | We are vulnerable to the effects of chargebacks, merchant insolvency and consumer deposit settlement risk. |

| • | Our Integrated Processing Solutions business’s revenues from the sale of services to merchants that accept Visa cards and Mastercard cards are dependent on our continued financial institution sponsorship. |

| • | We may fail to hold, safeguard or account accurately for merchant or customer funds. |

| • | Our business and products are dependent on the availability, integrity and security of internal and external IT transaction processing systems and services. |

| • | We rely on third parties in many aspects of our business, which creates additional operational risk. |

| • | We are required to comply with payment card network operating rules. |

| • | We are subject to financial services regulatory risks. |

| • | We are subject to current and proposed regulations addressing both consumer and business privacy and data use, which could adversely affect our business, financial condition and results of operations. |

| • | We face substantial and increasingly intense competition worldwide in the global payments industry, including from businesses that are larger than we are, have a more dominant and secure position or offer other products and services to consumers and merchants that we do not offer. These competitors may act on business opportunities within our specialized industry verticals, which may reduce our ability to maintain or increase our market share. |

| • | The ongoing COVID-19 pandemic, including the resulting global economic uncertainty and measures taken in response to the pandemic, could materially impact our business and future results of operations and financial condition. |

| • | If we are unable to develop and maintain effective internal controls over financial reporting, we may not be able to produce timely and accurate financial statements, which could have a material adverse effect on our business. |

| • | If we fail to manage our growth effectively, our business could be harmed. |

| • | Our business depends on a strong and trusted brand, and any failure to maintain, protect and enhance our brand could materially harm our business. |

| • | If we cannot keep pace with rapid technological developments to provide new and innovative products and services, the use of our products and services and, consequently, our revenues could decline. |

| • | Our Principal Shareholders exercise significant influence over us and their interests may conflict with ours or yours in the future. |

2

Table of Contents

Risks Related to COVID-19

The ongoing COVID-19 pandemic, including the resulting global economic uncertainty and measures taken in response to the pandemic, could materially impact our business and future results of operations and financial condition.

The COVID-19 pandemic has disrupted the economy and put unprecedented strains on governments, health care systems, businesses and individuals around the world. The impact and duration of the COVID-19 pandemic are difficult to assess or predict. It is even more difficult to predict the impact on the global economic market, which will depend upon the actions taken by governments, businesses and other enterprises in response to the pandemic. The pandemic has already caused, and is likely to result in further, significant disruption of global financial markets and economic uncertainty. The pandemic has resulted in authorities implementing numerous measures to try to contain the COVID-19 pandemic, such as travel bans and restrictions, quarantines, shelter in place or total lock-down orders, and business limitations and shutdowns. Such measures have significantly contributed to rising unemployment and negatively impacted consumer and business spending. On March 17, 2020, as a precautionary measure in order to increase our cash position and preserve financial flexibility in light of uncertainty in the global markets resulting from the COVID-19 pandemic, we drew-down $216,000,000 under our revolving credit facility at an interest rate equal to 2.75% + USD LIBOR. We subsequently repaid all outstanding borrowings under our revolving credit facility during the period between August 17, 2020 and October 13, 2020. The extent to which COVID-19 impacts the Company’s financial results will depend on future developments, which are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of COVID-19 and the actions taken by governments to curtail or treat its impact, including shelter in place directives, business limitations and shutdowns, travel bans and restrictions, loan payment deferrals (whether government-mandated or voluntary), moratoriums on debt collection activities and other actions, which, if imposed or extended, may impact the economies in which the Company now or in the future operates in. Adverse market conditions resulting from the spread of COVID-19 could materially adversely affect our business and the value of our shares.

Our merchants, particularly in industries most impacted by the COVID-19 pandemic, including the retail, restaurant, hotel, hospitality, consumer discretionary and travel industries and companies whose customers operate in impacted industries, may reduce or delay their technology-driven transformation initiatives, which could materially and adversely impact our business. Further, as a result of the COVID-19 pandemic, we have experienced, and may continue to experience, slowed growth or decline in new demand for our products and services and lower demand from our existing merchants for expansion within our products and services, as well as existing and potential merchants reducing or delaying purchasing decisions. For example, while our Digital Wallet business is showing recovery as sporting events resume, if the COVID-19 pandemic continues and authorities implement measures to contain the pandemic that have the effect of decreasing or halting altogether sporting events, our Digital Wallet could be materially adversely affected. We have experienced, and may continue to experience, an increase in prospective merchants seeking lower prices or other more favorable contract terms and current merchants attempting to obtain concessions on the terms of existing contracts, including requests for early termination or waiver or delay of payment obligations, all of which has adversely affected and could materially adversely impact our business, results of operations and overall financial condition in future periods. Further, we may face increased competition due to changes to our competitors’ products or services, including modifications to their terms, conditions and pricing that could materially adversely impact our business, results of operations and overall financial condition in future periods.

The COVID-19 pandemic could cause our third-party service providers such as data center hosting facilities and cloud computing platform providers, which are critical to our infrastructure, to shut down their business, experience security incidents that impact our business, delay or disrupt performance or delivery of services or experience interference with the supply chain of hardware required by their systems and services, any of which could materially adversely affect our business. Further, the COVID-19 pandemic has resulted in our employees and those of many of our customers working from home and conducting work via the internet, and if the network and infrastructure of internet providers becomes overburdened by increased usage or is otherwise unreliable or unavailable, our employees’ and our customers’ employees’ access to the internet to conduct business could be negatively impacted. Limitations on access or disruptions to services or goods provided by or to some of our suppliers upon which our platform and business operations rely could interrupt our ability to provide our platform, decrease the productivity of our workforce and significantly harm our business operations, financial condition and results of operations. In addition, our technology platforms and the other systems or networks used in our business may experience an increase in attempted cyber-attacks, targeted intrusions, ransomware and phishing campaigns

3

Table of Contents

seeking to take advantage of shifts to employees working remotely using their household or personal internet networks as a result of the COVID-19 pandemic. The success of any of these unauthorized attempts could substantially impact our technology platforms, the proprietary and other confidential data contained therein or otherwise stored or processed in our operations, and ultimately our business. Any actual or perceived security incident also may cause us to incur increased expenses to improve our security controls and to remediate security vulnerabilities. Additionally, we may experience an increased volume of unanticipated customer requests for support (resulting in increased volume to our customer support and operations centers) and regulatory requests for information and support or additional regulatory requirements, which could require additional resources and costs to address.

While the current macroeconomic environment as a result of the COVID-19 outbreak has adversely impacted general consumer and merchant spending with a more pronounced impact on travel and events verticals, the spread of COVID-19 has also accelerated the shift from in-store shopping and traditional in-store payment methods (e.g., credit cards, debit cards, cash) towards e-commerce and digital payments and resulted in increased customer demand for safer payment and delivery solutions (e.g. contactless payment methods, buy online and pick up in store) and a significant increase in online spending in certain verticals that have historically had a strong in-store presence. Our eCash Solutions segment has benefited from these behavioral shifts, including a significant increase in net new active accounts and payments volume. To the extent that consumer preferences revert to pre-COVID-19 behaviors as mitigation measures to limit the spread of COVID-19 are lifted or relaxed, our business, financial condition, and results of operations could be adversely impacted.

The spread of COVID-19 has caused us to modify our business practices to help minimize the risk of the pandemic to our employees, our partners, our merchants and their customers, and the communities in which we participate, which could negatively impact our business. In response to the COVID-19 pandemic, we have enabled our employees to work remotely, implemented travel restrictions for all non-essential business and shifted company events to virtual-only experiences, and we may deem it advisable to similarly alter, postpone or cancel additional events in the future. There is no certainty that the measures we have taken will be sufficient to mitigate the risks posed by the pandemic. If the COVID-19 pandemic worsens, especially in regions where we have offices, our business activities originating from affected areas could be adversely affected. Disruptive activities could include additional business closures in impacted areas, further restrictions on our employees’ and service providers’ ability to travel, impacts to productivity if our employees or their family members experience health issues and potential delays in hiring and onboarding of new employees. We may take further actions that alter our business operations as may be required by local, provincial, state or federal authorities or that we determine are in the best interests of our employees. Such measures could negatively affect our sales and marketing efforts, sales cycles, employee productivity or customer retention, any of which could harm our financial condition and business operations.

Additionally, diversion of management focus to address the impacts of the COVID-19 pandemic could potentially disrupt our operating plans. The extent and continued impact of the COVID-19 pandemic on our business will depend on certain developments, including: the duration and spread of the outbreak; government responses to the pandemic; the impact on our customers and our sales cycles; the impact on customer, industry or employee events; and the effect on our partners, merchants and their customers, third-party service providers, customers and supply chains, all of which are uncertain and cannot be predicted. Because of our largely subscription-based business model, the effect of the COVID-19 pandemic may not be fully reflected in our results of operations and overall financial condition until future periods, if at all.

To the extent that the COVID-19 pandemic adversely affects our business and financial results, it may also have the effect of heightening many of the other risks described in this “Risk Factors” section.

Risks Related to Paysafe’s Business and Industry

Our focus on specialized and high-risk verticals can increase our risks relative to other companies in our industry.

We focus on specialized and high-risk verticals, including iGaming (which encompasses a broad selection of online betting related to sports, esports, fantasy sports, poker and other casino games) and Emerging Markets (which includes stock, FX and crypto trading, direct marketing, which can include nutraceuticals and multi-level marketing, travel and entertainment, integrated payments and digital goods. These revenue streams represented approximately $1.1 billion, or 74%, of our revenue for the year ended

4

Table of Contents

December 31, 2020. Although this focus distinguishes us from industry peers, it also increases risks inherent in our business and broader industry. For example:

| • | the industry verticals we serve are extensively regulated, and their regulation is evolving and subject to frequent change and uncertain interpretation. As a result of regulatory action, we have had to exit a market altogether, limit services we provide, or otherwise modify our business in ways that have adversely impacted profitability. We are also exposed to a higher risk of losses resulting from related investigations, regulatory actions and litigation. See “—Regulatory, Legal and Tax Risks—We generate a significant portion of our revenue by processing online payments for merchants and customers engaged in the online gambling and foreign exchange trading sectors”; |

| • | serving these high-risk industry verticals routinely creates greater operational complexity, including for our compliance, legal and risk functions; |

| • | with respect to certain industry verticals (such as iGaming), the laws related to, or the legal status of, such verticals vary significantly among the countries in which we operate and, in the U.S., from state to state, further adding operational complexity particularly in compliance and risk mitigation; |

| • | we may have difficulty obtaining or maintaining relationships with merchants and third-party service providers for our business, such as banks and payment card networks, including as a result of their assessment and appetite for the compliance, cost, government regulation, risk of consumer fraud or public pressure that can be associated with some of the specialized industry verticals that we operate in. For example, merchants may compel us to change our operations or add bespoke or enhanced internal controls in order to do business with them; and |

| • | from time to time, the industry verticals we serve (and we by association) are the subject of negative publicity, which can harm our brand and deter consumers and merchants from adopting our products and services and influence our third-party service providers’ assessment of our business. |

The enhanced risks resulting from our specialized focus can materialize suddenly and without warning, which may result in increased volatility in our results of operations compared with other companies in our industry that do not provide services to companies in high-risk industry verticals, and could result in a material adverse effect on our business, financial condition, results of operations and future prospects.

Cyberattacks and security vulnerabilities could result in loss of customer and merchant funds and personal data, including financial data, as well as serious harm to our reputation, business, and financial condition.

Our information technology (“IT”) security systems, software and networks and those of the customers and third parties with whom we interact may be vulnerable to unauthorized access (from within or by third parties), computer viruses or other malicious code, or other cybersecurity threats, which could result in the unauthorized access, loss, theft, changes to, unavailability, destruction or disclosure of confidential, proprietary, or personal information relating to merchants, customers and employees. Such access, loss, theft, changes to, unavailability, destruction or disclosure of confidential, proprietary, or personal information could result in identity theft, third party access to unique pin codes, the loss of card payment details that are stored on our system, and/or the loss of funds stored in customers’ wallets and prepaid cards or have other material impacts on our business. We, like other financial technology organizations, are routinely subject to cybersecurity threats and our technologies, IT systems and networks have been victims of cyberattacks in the past. Information security risks for payment and technology companies such as ours have significantly increased in recent years and in particular with the changes in ways of working driven by the pandemic, in part because of the proliferation of new technologies, the use of the internet and telecommunications technologies to conduct financial transactions, and the increased sophistication and activities of organized crime, hackers, terrorists and other external parties. Geopolitical events and resulting government activity could also lead to information security threats and attacks by affected jurisdictions and their sympathizers. Additionally, our ongoing migration of certain of our services to cloud computing platform providers, may introduce further, different security risks and potential attack paths to our businesses.

We are responsible for data security for ourselves and for third parties with whom we partner, including with respect to complying with rules and regulations established by the payment networks and card networks. These third

5

Table of Contents

parties include merchants, our distribution partners, our third-party payment processors and other third-party service providers and agents. We and other third parties collect, process, store and/or transmit personal information, such as names, contact details, addresses, social security numbers, credit or debit card numbers, expiration dates, driver’s license numbers, bank account numbers and bank routing information as well as certain information gathered during our Know Your Customer (“KYC”) procedures. We have ultimate liability to the payment networks and our partner banks for our failure or the failure of third parties with whom we contract to protect this data in accordance with payment network requirements. The loss, destruction or unauthorized modification of merchant or consumer data by us or our contracted third parties could result in significant fines, sanctions, proceedings or actions against us by governmental bodies, the payment networks, consumers, merchants or others, and could harm our business and reputation.

Certain of our products particular to our eCash Solutions business are identified by unique pin codes assigned to them at the point of sale when a customer uses the voucher on a merchant website. These active voucher pins are stored in our systems. Due to the anonymous nature of these pins, a theft and subsequent fraudulent utilization of pins from a server (either due to third-party hacking or due to internal fraud by an employee) could result in the original voucher holder’s inability to use his or her vouchers. While customer verification and fraud management procedures are in place to mitigate this risk, we would honor the payment by the original voucher holder from our own funds and therefore incur a loss. Our Digital Wallet business, on the other hand, could suffer from a loss of funds if a third-party hacker or an employee is successful in taking over one of our customer’s accounts as well as suffer the costs of any subsequent reimbursement to customers. Additionally, loss of payment card information would also lead us to incur card re-issuing costs, which depending on the size of the data breach could be significant. Significant losses incurred as a result of such activity would have a material adverse effect on our results of operations and, depending on the nature of such fraudulent attacks, we may be required to notify relevant regulators and other authorities such as law enforcement. Any adverse publicity as a result of such theft and fraudulent utilization could adversely affect our reputation and the demand for our products.

Despite various mitigation efforts that we undertake, there can be no assurance that we will be immune to these risks and not suffer material security incidents and resulting losses in the future, or that our insurance coverage would be sufficient to cover all related financial losses. The techniques used to obtain unauthorized, improper, or illegal access to our systems, our data (including our confidential business information and intellectual property rights) or our customers’ data, to disable or degrade our services, demand ransom or to sabotage our systems are constantly evolving and have become increasingly complex and sophisticated. These techniques may be difficult to detect quickly, and often are not recognized or detected until after they have been launched against a target. Threats to our IT systems and our associated third parties’ IT systems may result from human error, fraud or malice on the part of employees or third parties, including state-sponsored organizations with significant financial and technological resources, organized crime groups or from accidental technological failure. For example, certain of our employees require access to sensitive data that could be used to commit identity theft or fraud. While we have internal controls in place surrounding system access and segregation of duties, if unauthorized individuals gain access to this data, the risk of malfeasance is heightened. Concerns about security increase when we transmit information electronically, even though we encrypt certain communications and data to reduce this risk, because such transmissions can be subject to attack, interception or loss. Also, computer viruses can be distributed and spread rapidly over the internet and could infiltrate our systems or those of our contracted third parties. Denial of service, ransomware, or other attacks could be launched against us for a variety of purposes, including interfering with our services or to create a diversion for other malicious activities. These or similar types of actions and attacks could disrupt our delivery of services or make them unavailable. As cybersecurity threats continue to evolve, we may be required to expend significant additional resources to continue to modify or enhance our protective measures or to investigate and remediate any information security vulnerabilities. Any of the risks described above could materially adversely affect our overall business, financial condition and results of operations.

We have experienced and will likely continue to regularly experience denial-of-service and other cyberattacks and security events. In such circumstances, our data encryption practices and other protective measures have not always prevented and in the future may not prevent, as applicable, unauthorized access service disruption or system sabotage. For example, in November 2020, we discovered that we were the target of a cybersecurity attack that involved an outside actor attempting to exploit a potential vulnerability of a website used by part of our U.S. business. As a result of our investigation, we identified evidence of suspicious activity on the website that potentially impacted approximately 100,000 merchants and agents. Following the discovery of the cybersecurity

6

Table of Contents

incident, we began undertaking remediation efforts, took steps to prevent further unauthorized access and closed the website. We reported the data breach to the appropriate authorities. In addition, we provided the relevant individuals, at no cost to them, with two years of credit monitoring and identity protection services, and established a call center to respond to inquiries regarding the data breach.

Regardless of whether an actual or perceived breach is attributable to our products, such a breach could, among other things:

| • | interrupt our operations, |

| • | result in our systems or services being unavailable, |

| • | result in improper disclosure of data, |

| • | result in a demand for a ransom payment, |

| • | materially harm our reputation and brands, |

| • | result in significant regulatory scrutiny and legal and financial exposure, |

| • | cause us to incur significant remediation costs, |

| • | lead to loss of customer confidence in, or decreased use of, our products and services, |

| • | divert the attention of management from the operation of our business, |

| • | result in significant compensation or contractual penalties from us to our customers and their business partners as a result of losses to them or claims by them, and |

| • | adversely affect our business and results of operations. |

In addition, a significant cybersecurity breach of our systems or communications could result in payment networks prohibiting us from processing transactions on their networks or the loss of our sponsor banks that facilitate our participation in the payment networks, either of which could materially impede our ability to conduct our business. We may also be subject to liability for claims relating to misuse of personal information, such as unauthorized marketing, or violation of data privacy laws. In addition, our agreements with our sponsor banks and our third-party payment processors (as well as payment network requirements) require us to take certain protective measures to ensure the confidentiality of merchant and consumer data. Any failure to adequately comply with these protective measures could result in fees, penalties, litigation or termination of our sponsor bank agreements. Although we generally require that our agreements with distribution partners or our service providers who may have access to merchant or consumer data include confidentiality obligations that restrict these parties from using or disclosing any merchant or consumer data except as necessary to perform their services under the applicable agreements, we cannot guarantee that these contractual measures will be followed or will be adequate to prevent the unauthorized access, use, modification, destruction or disclosure of data or allow us to seek damages from the contracted party. In addition, many of our merchants are small and medium businesses that may have fewer resources dedicated to data security and may thus experience data breaches. Any unauthorized use, modification, destruction or disclosure of data could result in protracted and costly litigation, and cause us to incur significant losses.

We are vulnerable to the effects of chargebacks, merchant insolvency and consumer deposit settlement risk.

We are exposed to the effect of chargebacks and merchant insolvency in our Integrated Processing Solutions business. In that business, we are liable to various acquiring banks for chargebacks incurred by our merchants where the merchants are unable to meet liabilities arising as a result of those chargebacks. If the average chargeback rate on any of our merchant portfolios at any acquiring bank exceeds the maximum average chargeback rate permitted by the card agreements, we will be required to take steps to reduce the average chargeback rate so that it falls below the maximum permitted rate or risk losing our relationship with that acquiring bank. Those steps might include processing more transactions for merchants who have lower chargeback rates to produce a lower average chargeback rate for the portfolio as a whole or terminating relationships with merchants who have higher chargeback rates, which could in turn lead to a material loss of revenue for us. Chargebacks may arise as individual claims or as multiple claims relating to the same facts or circumstances. For example, the insolvency or cessation of

7

Table of Contents

a merchant doing business could cause numerous individual customers to bring claims at once which, either singly or in aggregate, could have a material adverse effect on our results of operations, financial condition and future prospects. Similarly, chargebacks or fraud related to our customers or merchants in our Digital Wallet business could cause the payment card schemes of which we are a member in Europe to require us to implement additional and potentially costly controls, and ultimately disqualify us from processing transactions if satisfactory controls are not maintained. Further, if any of the services we offer are deemed to have caused or contributed to illegal activity, customers, consumer protection agencies and regulatory firms could band together to initiate chargeback card payments or ACH reversals for transactions associated with the activity in question.

In our Digital Wallet business, we offer our merchants a “no chargeback policy.” A chargeback is the return of funds to a customer and in this context relates to a reversal of unauthorized charges to a customer’s credit card, for example, as a result of fraud or identity theft. Under our “no chargeback policy,” we agree to allow merchants who qualify under our vetting policy to retain all monies received from our NETELLER and Skrill digital wallet holders and undertake not to request reimbursement from such merchants in respect of chargebacks incurred. In such cases, the full amount of the disputed transaction is charged back to us and our credit card processor may levy additional fees against us unless we can successfully challenge the chargeback. We believe that our “no chargeback policy” is a key factor in a merchant’s decision to use our Digital Wallet services.

Our eCash Solutions business utilizes distribution partners and as such is exposed to credit risk in the event a distribution partner fails. This is managed through ongoing credit risk assessment with active exposure management including the use of credit limits, guarantees and insurance to limit overall exposure.

Our businesses are also subject to merchant credit risk in respect of non-payment for products provided and services rendered or non-reimbursement of costs incurred. The contracts we enter into may require significant expenditure prior to merchant payments and may expose us to potential credit risk or may require us to use our available bank facilities in order to meet payment obligations.

Additionally, we are exposed to risk associated with the settlement of consumer deposits. Digital Wallet deposits from financial institutions, such as bank accounts, are credited to customer accounts before settlement of funds is received. Thus, there is a risk that the funds may not be settled or may be recalled due to insufficient funds or fraud reasons, exposing us to the risk of negative customer wallet balances and bad debt. Further, Digital Wallet prepaid card deposits or transactions made by consumers may be charged back by consumers resulting in a negative balance and loss on our accounts. If we are unable to effectively manage and monitor these risks, they could have a material adverse effect on our results of operations, financial condition and future prospects.

Our success depends on our relationships with banks, payment card networks, issuers and financial institutions.

The nature of our business requires us to enter into numerous commercial and contractual relationships with banks, card networks, issuers and financial institutions. We depend on these relationships to operate on a day-to-day basis. If we are unsuccessful in establishing, renegotiating or maintaining mutually beneficial relationships with these parties, our business may be harmed. In addition, these relationships are subject to a number of risks, including the following:

| • | loss of banking relationships: we rely on the use of numerous bank accounts in the jurisdictions in which we operate for the efficient delivery of our services. A loss of any important banking relationship could have a material effect on our business and financial performance. For example, in the past, we have experienced the loss of three important banking relationships for our Digital Wallet business, which resulted in a higher concentration risk with our remaining banking partners; |

| • | new banking relationships: as we are considered a high risk customer for our banks and payment partners, there is a long lead time associated with establishing new or replacing banking and non-bank payment partner relationships due to the extensive level of compliance due diligence required by the banks and providers. See “—Risks Related to Paysafe’s Business and Industry—Our focus on specialized industry verticals can increase our risks relative to other companies in our industry; |

| • | loss of a banking product: many of our products rely on banks providing payments capability to us. We may lose that service although still maintain the banking relationship as the bank would, for example, continue to provide us with foreign exchange services. Such a loss of services from a bank (or banks) could have a material effect on our business and financial performance including on the geographies, customers and associated payment volumes which we are able to serve; |

8

Table of Contents

| • | loss of an alternative payment method: many of our products rely on processing relationships and connections to alternative or local payment methods, either direct or indirect via aggregators. Such a loss of payment methods or providers could have a material effect on our business and financial performance, including on the geographies, customers and associated payment volumes which we are able to serve; |

| • | downstream correspondent banking risk: if the correspondent banks of our banks (or the underlying banks of our non-bank payment providers) change their risk appetite, this could lead to restrictions with or rejections of our products’ payment flows which could have a material effect on our business and financial performance, including on the geographies, customers and associated payment volumes which we are able to serve; |

| • | failure of banks and financial institutions: across our businesses, we hold our own, merchants’ and customers’ funds on deposit at various banks and financial institutions. In our Digital Wallet and eCash Solutions businesses, we receive funds from our merchants and customers into a number of bank accounts operated by various banks in the countries in which we operate. We then transfer funds, from the various banks in the countries in which we operate, to multiple banks such that amounts equivalent to all merchant and customer funds are held in segregated accounts in accordance with applicable regulatory requirements. While we have controls in place intended to monitor and mitigate this risk, there can be no guarantee that the banks in which funds are held will not suffer any kind of financial difficulty or commence any insolvency or bankruptcy proceedings, or any moratorium, composition, arrangement or enforcement action or any other kind of analogous event in any jurisdiction that may result in the permanent loss of some or all of our own funds or the funds of merchants or customers, which could have a material adverse effect on our business and financial performance; |

| • | Visa and Mastercard operating rules: we are subject to the operating rules and regulations of Visa and Mastercard and changes to those operating rules and regulations could have a material adverse effect on our business. If a merchant or an independent sales organization (“ISO”) fails to comply with the applicable requirements of the card associations and networks, we or the merchant or ISO could be subject to a variety of fines or penalties that may be levied by the card associations or networks. If we cannot collect or pursue collection of such amounts from the applicable merchant or ISO, we may have to bear the cost of such fines or penalties, resulting in lower earnings for us. Policy changes by Visa and/or Mastercard could impact the merchant category code assignments to our business which can in turn impact our acceptance and authorization rates as well as our banking provider risk appetite assessment and costs. Policy changes can also impact our ability to acquire card transactions on a cross-border basis in particular markets, for example depending on the merchant country of registration; |

| • | fines and assessments: the payment card schemes and their processing service providers may pass on fines and assessments in respect of fraud or chargebacks related to our merchants or disqualify us from processing transactions if satisfactory controls are not maintained; |

| • | risk management policies: banks and financial institutions that provide us with services enabling us to operate our payments platform could reassess our risk profile due to the portfolio of products and services we offer and/or regard us as being non-compliant with certain laws or regulations (e.g., in relation to the regulation of e-money, cross border transactions or the provision of services to online gambling operators) that are applicable in their relevant jurisdictions or may regard our customers as being non-compliant. Banks and financial institutions may choose to withdraw from certain markets as a result of their internal risk management policies and may, in compliance with their regulatory obligations or internal risk and compliance policies, freeze the funds of our merchants and customers. In addition, consolidation in the banking sector may result in one of our banking providers being acquired by another bank, which may then prompt a change in our provider’s risk appetite and impacts our relationship with that provider; |

9

Table of Contents

| • | potential competitors: banks, payment card schemes, issuers and financial institutions may view us as being a competitor to their own business and may cease doing business with us as a result; and |

| • | fee increases: we are required to pay interchange and assessment fees, processing fees and bank settlement fees to third-party payment processors and financial institutions. From time to time, payment card networks have increased, and may increase in the future, the interchange fees and assessments that they charge for each transaction processed using their networks. Banks occasionally raise our fees in order to compensate for the increased risk, controls and anti-money laundering monitoring costs the bank may incur due to increased regulatory requirements or scrutiny. Additionally, if one of our banking providers cease to supply us services, that could lead to an increase in costs to continue to offer those services via alternative means, particularly where the service is provided in multiple currencies due to the incursion of additional foreign transaction fees. |

If, for any reason, any banks, payment card schemes, issuers or financial institutions cease to supply us with the services we require to conduct our business, or the terms on which such services are provided were to become less favorable or be cancelled, or a contractual claim made against us, it could impact our ability to provide our payment services, or the basis on which we are able to provide such services. This, and any of the factors set forth above, could result in a loss for us, which could have a material adverse effect on our results of operations, financial condition and future prospects.

We rely on third parties in many aspects of our business, which creates additional operational risk.

We rely on third parties in many aspects of our business, including the following:

| • | payment processing services from various service providers in order to allow us to process payments for merchants and customers and to properly code such transactions; |

| • | payment networks; |

| • | connectivity, routing and payment orchestration providers; |

| • | banks; |

| • | payment processors; |

| • | payment gateways that link us to the payment card and bank clearing networks to process transactions; |

| • | third parties that provide certain outsourced customer support functions, which are critical to our operations; and |

| • | third parties that provide IT-related services including data center facilities and cloud computing and compliance and risk functions. |

This reliance exposes us to increased operational risk. These third parties may be subject to financial, legal, regulatory and labor issues, cybersecurity incidents, privacy breaches, service terminations, disruptions or interruptions, or other problems, which may impose additional costs or requirements on us or prevent these third parties from providing services to us or our customers on our behalf, which could have a material adverse effect on our results of operations, financial condition and future prospects.

The European Banking Authority (“EBA”) published guidance on outsourcing arrangements that became effective on September 30, 2019 and is applicable to certain aspects of our businesses. These guidelines set out strict standards to follow when outsourcing critical or important functions that have a strong impact on a financial institution’s risk profile or on its internal control framework. Although we have implemented processes to ensure compliance with the required standards, a failure to meet these requirements could lead to regulatory challenge and require remediation and/or fines or penalties if we are found to be in noncompliance with the relevant regulation. Furthermore, any changes to our existing critical or important outsourced functions may be subject to regulatory approval, which, if not satisfied or obtained, may prevent us from initiating the change.

In addition, these third parties may breach their agreements with us, disagree with our interpretation of contract terms or applicable laws and regulations, refuse to continue or renew these agreements on commercially reasonable terms or at all, fail or refuse to process transactions or provide other services adequately, take actions that

10

Table of Contents

degrade the functionality of our services, impose additional costs or requirements on us or our customers, or give preferential treatment to competitive services. Some of these third party service providers are, or may become, owned by our competitors. There can be no assurance that third parties who provide services directly to us or our customers on our behalf will continue to do so on acceptable terms, or at all. If any third parties do not adequately or appropriately provide their services or perform their responsibilities to us or our customers on our behalf, we may be unable to procure alternatives from other third parties in a timely and efficient manner and on acceptable terms, or at all, and we may be subject to business disruptions, losses or costs to remediate any of the deficiencies, customer dissatisfaction, reputational damage, legal or regulatory proceedings, or other adverse consequences, any of which could have a material adverse effect on our results of operations, financial condition and future prospects.

Our Integrated Processing Solutions business’s revenues from the sale of services to merchants that accept Visa cards and Mastercard cards are dependent on our continued financial institution sponsorship.

Because we are not a bank, our North American Component of our Integrated Processing Solutions business is not eligible for membership in the card payment networks, and we are, therefore, unable to directly access these card payment networks, which are required to process transactions. These networks’ operating regulations require us to be sponsored by a member bank in order to process electronic payment transactions. Our various payment processing businesses are registered with the card networks through seven separate sponsor banks (who settle the transactions with our merchants).

Our sponsor banks may terminate their agreements with us if we materially breach the agreements and do not cure the breach within an established cure period, if we enter bankruptcy or file for bankruptcy, or if applicable laws or regulations, including Visa and/or Mastercard regulations, change to prevent either the applicable bank or us from performing services under the agreement. If these sponsorships are terminated and we are unable to secure a replacement sponsor bank within the applicable wind down period, we will not be able to process electronic payment transactions.